Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TESSERA TECHNOLOGIES INC | d8k.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 28, 2011 - TESSERA TECHNOLOGIES INC | dex991.htm |

Exhibit 99.2

Q2 2011 Earnings Prepared Remarks

Summary Results

Total revenue in the second quarter of 2011 for Tessera Technologies, Inc. (“the Company” or “we”) was $70.7 million, compared to total revenue of $74.6 million in the second quarter of 2010. Micro-electronics revenue for the second quarter of 2011 was $60.5 million, compared to $65.1 million in the prior year second quarter. Imaging & Optics total revenue was $10.2 million, up 8% compared to second quarter 2010 Imaging & Optics revenue of $9.5 million.

Second quarter of 2011 GAAP Net income was $11.6 million, or $0.23 per diluted share. Non-GAAP Net income was $21.4 million, or $0.41 per diluted share. Second quarter of 2010 GAAP Net income was $15.0 million, or $0.30 per diluted share. Second quarter of 2010 Non-GAAP Net income was $23.2 million, or $0.45 per diluted share.

Cash, cash equivalents, and investments at June 30, 2011, were $527.1 million, an increase of $27.6 million in the quarter.

Company Overview

Tessera Technologies, Inc. is comprised of two business segments: Micro-electronics and Imaging & Optics. The Company’s primary markets are computing, mobile, and consumer optics. Consumer devices such as notebooks, smartphones, and digital still cameras throughout the world contain patented semiconductor technology from our Micro-electronics patent portfolios as well as Imaging & Optics technologies.

There have been significant changes in the executive management and board of directors in the past six months. Today, Robert A. Young, Ph.D., leads Tessera Technologies, Inc. as its president and CEO. Dr. Young, a member of the Company’s board of directors since 1991, was appointed to this role in May 2011. Also in May 2011, Robert J. Boehlke, a member of the Company’s board of directors since 2004, was appointed chairman. In the first quarter of 2011, Kevin G. Rivette, who has extensive IP licensing experience, was appointed to the Company’s Board of Directors.

1

Each of our operating companies has new leadership as well. In March 2011, Bob Roohparvar, Ph.D., was appointed president of DigitalOptics Corporation, a wholly owned subsidiary of Tessera Technologies, Inc. DigitalOptics Corporation comprises the Company’s entire Imaging & Optics business. Dr. Roohparvar, previously with Flextronics, has a combination of technical, leadership and execution skills that will enable us to take our Imaging & Optics business to the next level.

In April 2011, we appointed Simon McElrea president of Invensas Corporation, a wholly owned subsidiary of Tessera Technologies, Inc., and part of our Micro-electronics reporting segment. Invensas develops, acquires and monetizes semiconductor technologies with a focus on circuitry design, memory modules, 3-D architecture, and advanced interconnect technologies. Mr. McElrea’s technical and business development experience will be an important contributing factor to the success of our Micro-electronics business.

In July 2011, we appointed Richard Chernicoff President of the Intellectual Property and Micro-electronics division of Tessera, Inc., a wholly owned subsidiary of Tessera Technologies, Inc. Mr. Chernicoff, previously with SanDisk Corporation, has extensive licensing expertise and experience, as well as deep customer and industry contacts, which will enable Tessera, Inc. to best meet the opportunities that lie ahead.

Segment Review

Micro-electronics

The Micro-electronics segment, which operates through two subsidiaries, develops, licenses and delivers advanced integrated circuit (IC) packaging solutions that are primarily used in the high growth mobile and memory markets. The segment’s revenue consists of per unit royalties paid for use of its patents and technologies under a Tessera Compliant Chip (TCC) license agreement, which typically provides licensees access to approximately 250 U.S. and foreign Tessera, Inc. patents. The last of these patents will expire in May 2027.

Historically, the segment’s primary licensing program has been the TCC program, operated through Tessera, Inc., which encompasses semiconductor packaging technology and patents. More recently, Invensas Corporation created a program focused on technologies and patent classes such as DRAM circuitry design and memory modules. Invensas’s patent portfolio numbers approximately 400 patents and patent applications. The technologies described in the Invensas portfolio are not covered by a TCC

2

license agreement. These technologies will increase the value provided to licensees by bringing multiple levels of intellectual property innovation to electronic devices. In the aggregate, the Micro-electronics patent portfolios have nearly 1,375 patents and patent applications.

Continued innovation in memory and wireless technology has led to the development of a number of new solutions, such as the multi Face Down (xFD) platform, which enables multiple chips to be assembled in a chip-scale package (CSP) form factor, significantly increasing density, thermal and electrical performance advantages simultaneously. xFD, currently optimized for DDR3 DRAM chips, is a market-ready solution that addresses the current and future needs of key growth segments such as tablets, servers and mobile handsets. xFD is designed to be a bridge to 3 dimensional IC (3D-IC), requiring no major changes to existing manufacturing infrastructure, thereby facilitating rapid and low-risk adoption.

Finally, Tessera, Inc.’s innovative silent air cooling technology remains on track to be ready for high volume manufacturing in the fourth quarter of 2011, utilizing an outsourced manufacturing supply chain. Its first commercial product will be used in an ultra-thin elite laptop.

Imaging & Optics

The Imaging & Optics segment, which operates through DigitalOptics Corporation, offers solutions that include licensable technologies such as auto focus and zoom as well as Micro-Optics and Micro Electrical Mechanical Systems (MEMS) products. The primary end market for Imaging & Optics is camera phones, or, more specifically, the camera module market. The segment also licenses its imaging technologies into the digital still camera market and manufacture and sells optical products into special applications.

Today’s $9 billion mobile camera module market is a fragmented market with many suppliers. There are four main market components: image sensors; barrel and module integration; lenses; and auto focus technologies. We have begun to pursue a strategy that will enable us to capture more of the high value content of the camera module market. Our mission is to deliver, to the mobile and adjacent imaging markets, a new class of compact camera modules designs which enable greater features and functionality, thereby becoming a world-wide leader in supplying integrated imaging solutions.

3

Turning to the second quarter of 2011, royalties for EDoF Auto-Focus technology came in as expected. EDoF royalty growth is expected to generally track that of the overall EDoF market, which industry analyst Techno Systems Research forecasts will grow to more than 120 million camera phones with EDoF in 2011.

Royalties for zoom technology will begin to ramp in 2013, reflecting longer than anticipated qualification periods for licensees.

The MEMS Auto-Focus, this technology will be a ‘game changer’ as compared to the Voice Coil Motor (VCM) technology in use today. MEMS Auto-Focus is one order of magnitude faster and requires two orders of magnitude less power consumption than VCM. These advantages become even more significant as camera phones become thinner and replace the point and shoot camera. We expect to be manufacturing ready by the end of 2011. We believe MEMS Auto-Focus will be a significant growth driver for us in 2012 and beyond.

4

Patent Assets

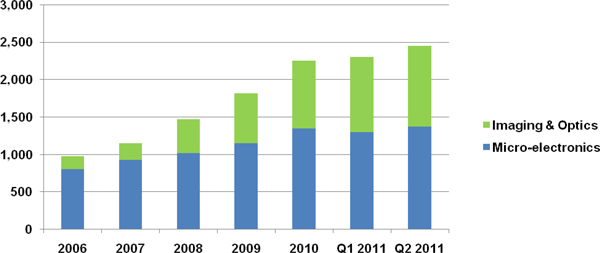

We foster innovation and dedicate significant resources to inventing and acquiring new technologies. High-quality patents are the international currency of innovation. As of June 30, 2011, Tessera Technologies, Inc. and its subsidiaries owned approximately 2,450 domestic and international patents and patent applications. Nearly 1,375 of these patents and patent applications are for technologies related to our Micro-electronics segment. Approximately 1,075 patents and patent applications are for technologies related to our Imaging & Optics segment. The last of the patents will expire in April 2030.

5

Financial Discussion

Quarterly Revenue

| Q2 2011 | Q2 2010 | Y-o-Y % | Q1 2011 | Q-o-Q % | ||||||||||||||||

| Total Revenue |

$ | 70.7 | $ | 74.6 | (5 | %) | $ | 67.8 | 4 | % | ||||||||||

| Micro-electronics |

$ | 60.5 | $ | 65.1 | (7 | %) | $ | 53.6 | 13 | % | ||||||||||

| Imaging & Optics |

$ | 10.2 | $ | 9.5 | 8 | % | $ | 14.2 | (28 | %) | ||||||||||

| Imaging & Optics – Royalties |

$ | 3.7 | $ | 2.4 | 52 | % | $ | 4.9 | (25 | %) | ||||||||||

(in millions, except %)

Revenue for the second quarter of 2011 was $70.7 million, which was in line with our preannounced revenue of approximately $71 million.

Total Micro-electronics revenue was $60.5 million and included a $1.0 million license fee. Similar to prior years, in the second quarter we sequentially benefitted from the annual reset of the volume-based pricing incentives we have with two of our licensees. In 2011, this amount was approximately $13 million and was higher than the previously guided amount of $10 million to $12 million due to the better than anticipated first quarter of 2011 report of one of these licensees, which was in contrast to the industry’s first quarter as a whole. As a reminder, Tessera’s royalty revenue reflects the industry’s shipments on a one-quarter lag.

Offsetting the impact of the volume-based pricing incentives were two underlying industry trends unanticipated by industry analysts. First, unit DRAM shipments were down approximately 3% from Q4-10 to Q1-11*. Second, the transition from 1Gb DRAM to 2Gb DRAM occurred significantly faster than industry analysts forecasted. Unit shipments in the first quarter 2011 for 2Gb DRAM were up 108% sequentially according to Gartner, which was significantly higher than the forecast *.

* Gartner, Inc., “Forecast: DRAM Market Statistics, Worldwide, 2005-2015, 2Q11 Update” 13 June 2011 [ID: G00213844]

Relative to the prior year, second quarter 2011 Micro-electronics revenue was down $4.6 million, or 7%. Second quarter 2010 revenue benefitted from approximately $8.5 million in revenue from five licensees or former licensees who are in breach of contract or have not renewed their license agreements. Tessera, Inc. did not receive payment in the second quarter 2011 from these companies.

Imaging & Optics total revenue in the second quarter of 2011 was $10.2 million and consisted of royalties, license fees, and product and services revenue. Royalty and license revenue was $4.9 million, down 43% quarter-over-quarter, up, however, 51% year-over-year. Sequential royalty and license revenue decreased $3.8 million due primarily to one-time items in the first quarter of 2011, including

6

two license fees totalling $2.8 million, and a $0.6 million catch-up royalty payment for our embedded image enhancement technology. Royalties were $3.7 million, down 25% sequentially, largely due to the aforementioned one time catch-up royalty payment of $0.6 million, and up 52% year-over-year. Products and services revenue was $5.3 million, a decrease of $0.2 million, sequentially, related to slightly lower lithography sales in our Micro-Optics product line.

Quarterly GAAP Results

Total GAAP operating expenses in the second quarter of 2011 were $54.1 million, as follows:

| • | Cost of revenues: $5.3 million |

| • | R&D: $18.8 million |

| • | SG&A: $22.8 million and |

| • | Litigation expense: $7.2 million |

Included in the GAAP operating expenses above are the following:

| • | Stock-based compensation expense: $8.8 million and |

| • | Amortization of acquired intangibles: $4.2 million |

In addition, other income, net of expense, was $0.7 million, and GAAP tax expense was $5.7 million, representing a 33% effective tax rate for the quarter.

Second quarter total GAAP operating expenses were up 5% or $2.4 million quarter-over-quarter. The sequential increase was mainly due to higher litigation expense, up $1.2 million, and stock-based compensation expense, up $2.7 million, resulting from the departure of two executive members of the company’s management team in the second quarter. In the first quarter of 2011, we recognized a non-recurring reduction-in-workforce restructuring charge of $2.1 million.

7

Quarterly GAAP Net Income and EPS

| Q2 2011 | Q2 2010 | Y-o-Y % | Q1 2011 | Q-o-Q % | ||||||||||||||||

| GAAP Net Income |

$ | 11.6 | $ | 15.0 | (23 | %) | $ | 11.2 | 3 | % | ||||||||||

| GAAP EPS |

$ | 0.23 | $ | 0.30 | $ | 0.22 | ||||||||||||||

| Fully Diluted Shares |

51,442 | 50,260 | 51,267 | |||||||||||||||||

(in millions, except per share and % data)

Quarterly Non-GAAP Results

Total Non-GAAP operating expenses in the second quarter of 2011 were $41.1 million as follows:

| • | Cost of revenues: $3.5 million |

| • | R&D: $15.6 million |

| • | SG&A: $14.8 million and |

| • | Litigation expense: $7.2 million |

Second quarter total Non-GAAP operating expenses were down $0.4 million or 1% quarter-over-quarter primarily related to the aforementioned $2.1 million reduction-in-work force charge recognized in the first quarter of 2011. This was non-recurring in the second quarter of 2011 and offset by higher litigation expenses and costs related to the executive departures. Cost of revenues was down $0.2 million or 4% quarter-over-quarter, due to the decrease in product sales. R&D expense was up $0.2 million or 1% quarter-over-quarter. SG&A expenses were up $0.5 million or 3% quarter-over-quarter related to the previously mentioned departure of two executive employees.

Non-GAAP results exclude stock-based compensation, charges for acquired in-process research and development, acquired intangibles amortization, impairment charges on long-lived assets, and related tax effects. We have included a detailed reconciliation between our GAAP and Non-GAAP net income in both our earnings release and on our web site for your convenient reference.

8

Quarterly Non-GAAP Net Income and EPS

Tax adjustments in the second quarter of 2011 for Non-GAAP items were approximately $3.2 million.

| Q2 2011 | Q2 2010 | Y-o-Y % | Q1 2011 | Q-o-Q % | ||||||||||||||||

| Non-GAAP Net Income |

$ | 21.4 | $ | 23.2 | (8 | %) | $ | 19.0 | 12 | % | ||||||||||

| Non-GAAP EPS |

$ | 0.41 | $ | 0.45 | $ | 0.36 | ||||||||||||||

| Fully Diluted Shares |

52,525 | 51,190 | 52,548 | |||||||||||||||||

(in millions, except per share and % data)

Balance Sheet Metrics

We ended the quarter with $527.1 million in cash, cash equivalents, and investments, a $27.6 million increase over the prior quarter. Net cash provided by operations for the quarter was $28.5 million.

Third Quarter 2011 Guidance

We have adjusted our guidance practice and, starting with the third quarter of 2011, will provide quarterly financial guidance after the second month of a quarter. We believe that providing guidance at this later point in the quarter will provide greater visibility to investors because we will typically have received and reviewed the majority of our royalty reports before guidance is provided.

Litigation Review

On July 7, 2011, Tessera, Inc. filed a request for rehearing of the U.S. Court of Appeals for the Federal Circuit’s ruling in the ITC 630 DRAM case that affirmed that U.S. Patent No. 5,663,106 was valid, infringed as to the accused µBGA products, but not infringed as to the accused wBGA products. The Court also affirmed that Tessera, Inc.’s patent rights were exhausted as to certain accused products purchased from Tessera, Inc. licensees.

On July 27, 2011, the respondents in Tessera, Inc.’s ITC 605 Wireless case petitioned the U.S. Supreme Court for a writ of certiorari. With regard to both the ITC 605 and ITC 630 cases, Tessera, Inc. intends to pursue the related district court actions after the stays currently in effect in those cases are lifted, which is expected to occur once the appellate process is completed.

On May 4, 2011, oral argument was held before the U.S. Court of Appeals for the Federal Circuit in the Powertech Technology Inc. v. Tessera, Inc. case, in which PTI’s request for a declaratory judgment of

9

noninfringement and invalidity of Tessera’s U.S. Patent No. 5,663,106 was dismissed by the district court for lack of subject matter jurisdiction. The Court of Appeals has not yet issued a ruling.

The trial on Phase II of the Tessera, Inc. arbitration against Amkor Technology, Inc. is scheduled to begin on August 12, 2011. As a reminder, the previous Amkor Technology arbitration took approximately three years before being resolved in Tessera’s favor. On May 26, 2011, Tessera, Inc. filed an additional request for arbitration against Amkor before the International Chamber of Commerce.

Tessera, Inc.’s antitrust lawsuit against Hynix Semiconductor Inc., filed in 2006, is now before the California Superior Court in San Francisco. The final remaining aspects of the pretrial phase of the case are progressing, but the Court has not yet set a trial date.

In addition, Tessera, Inc. continues to pursue the lawsuit it initiated against UTAC Taiwan Corporation in the U.S. District Court for the Northern District of California for breach of contract and breach of the covenant of good faith and fair dealing. Tessera, Inc. continues to pursue the patent infringement lawsuit it initiated against Sony Corporation, Sony Electronics, Inc. and Renesas Electronics Corporation in the U.S. District Court for the District of Delaware. Tessera, Inc. continues to pursue the patent infringement lawsuit it initiated against Sony in California Superior Court in Santa Clara for breach of contract and breach of the covenant of good faith and fair dealing. Invensas Corporation continues to pursue the patent infringement lawsuit it initiated against Renesas in the U.S. District Court for the District of Delaware. All of these cases are in their early stages.

10

Safe Harbor Statement

This document contains forward-looking statements, which are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties that could cause actual results to differ significantly from those projected, particularly with respect to the company’s financial results, the impact of changes to executive management and the board of directors, growth of the company’s served markets, industry and technology trends, use of the company’s technology in additional applications, impact of volume pricing adjustments in our Micro-electronics segment and revenue growth in our Imaging & Optics segment, future investment and development resources, the expansion of the company’s intellectual property portfolios, and the company’s IP protection efforts, including litigation. Material factors that may cause results to differ from the statements made include changes to the company’s plans or operations relating to its businesses and groups, market or industry conditions; delays, setbacks or losses relating to our intellectual property or intellectual property litigations, or any invalidation or limitation of our key patents; fluctuations in our operating results due to the timing of new license agreements and royalties, or due to legal costs; changes in patent laws, regulation or enforcement, or other factors that might affect our ability to protect our intellectual property; the risk of a decline in demand for semiconductor products; failure by the industry to adopt our technologies; competing technologies; the future expiration of our patents; the future expiration of our license agreements and the cessation of related royalty income; the failure or refusal of licensees to pay royalties; failure to identify or complete a favorable transaction with respect to the Imaging & Optics business; failure to achieve the growth prospects and synergies expected from acquisition transactions; and delays and challenges associated with integrating acquired companies with our existing businesses. You are cautioned not to place undue reliance on the forward-looking statements, which speak only as of the date of these prepared remarks. Tessera’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the year ended Dec. 31, 2010, and Form 10-Q for the period ended March 31, 2011, include more information about factors that could affect the company’s financial results. Tessera assumes no obligation to update information contained in these remarks. Although these remarks may remain available on Tessera’s website or elsewhere, its continued availability does not indicate that Tessera is

11

reaffirming or confirming any of the information contained herein.

Non-GAAP Financial Measures

In addition to disclosing financial results calculated in accordance with U.S. generally accepted accounting principles (GAAP), this document contains non-GAAP financial measures adjusted for either one-time or ongoing non-cash acquired intangibles amortization charges, acquired in-process research and development, all forms of stock-based compensation, impairment charges on long-lived assets, and related tax effects. The non-GAAP financial measures also exclude the effects of FASB Accounting Standards Codification Topic 718 – Stock Compensation upon the number of diluted shares used in calculating non-GAAP earnings per share. Management believes that the non-GAAP measures used in these remarks provide investors with important perspectives into the company’s ongoing business performance. The non-GAAP financial measures disclosed by the company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. The non-GAAP financial measures used by the company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies.

12