Attached files

| file | filename |

|---|---|

| EX-23.7 - FileWarden.com | sear_ex23-7.htm |

As filed with the Securities and Exchange Commission on July 26, 2011

Registration No. 333-167001

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

AMENDMENT #5

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_________________________

Success Exploration & Resources, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

1000

|

98-0232244

|

||

|

(State or other jurisdiction of

incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

21 SOURIQOUIS STREET

CHATHAM ONTARIO CANADA N7M 2T1

(519) 380-9992

(Address, including zip code and telephone number, including area code, of registrant’s principal executive offices)

EMPIRE STOCK TRANSFER INC.

1859 WHITNEY MESA DRIVE

HENDERSON, NEVADA 89014

(702) 818-5898

(Name including zip code and telephone number, including area code, of agent for service)With copies to:

Law Offices of John E. Dolkart, Jr.

1750 Kettner Blvd. Suite 416 San Diego, CA 92101

Telephone: (702) 275-2181 Fax: (619) 684-3512

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

Approximate date of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. [X] ____________________________

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ] _____________________________

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ] _________________________________________________

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ] _________________________________________________

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. [ ]

CALCULATION OF REGISTRATION FEE

|

Tile of each class of

securities to be registered

|

Dollar amount to

be registered

|

Proposed maximum

offering price per unit

|

Proposed maximum

aggregate offering price (1)

|

Amount of

registration fee

|

||||||||||||

|

Common Stock

9,626,000 shares(1)

|

$ | 2,000,000 | $ | 0.25 | (2) | $ | 2,000,000 | $ | 142.60 | |||||||

|

(1)

|

1,626,000 shares out of 9,626,000 shares eligible for sale are being sold by selling shareholders. These shares (as adjusted by a forward split) were sold to these shareholders in the Registrant's May 2007 private placement. The Registrant is offering for sale the remaining 8,000,000.

|

|

(2)

|

Represents the initial fixed price per share for the purpose of calculating the registration fee pursuant to Rule 457 under the Securities Act of 1933 (the "Act"). This is a bona fide estimate of the maximum offering price based, in part, on the last private sale of the Registrant's securities and calculations determined by management.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

2

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 26, 2011

9,626,000 Shares

SUCCESS EXPLORATION & RESOURCES, INC.

Common Stock

This prospectus relates to the public offering ("Offering") of: (1) 1,626,000 shares of our common stock (as adjusted subsequent to a forward split of 6 for 1) originally sold to certain selling shareholders at a forward-split adjusted price of $0.025 in a May 2007 private equity offering conducted in Canada believed to be exempt from registration pursuant to Regulation “S”; and (2) 8,000,000 shares to be offered by the Company for an aggregate of 9,626,000 shares of Common Stock (the "Shares"). The Shares will be offered from time to time for the account of the stockholders identified in the "Selling Stockholders" section of this prospectus as well as for the Company. We intend to seek a listing of our Common Stock on the Over-The-Counter Bulletin Board ("OTCBB"), which is maintained by the Financial Institutions National Regulatory Authority. Our shares may be sold at a fixed price of $0.25 per share, on a best-efforts basis, by our officers and directors. Selling shareholders will likewise offer their shares for sale at a fixed price of $0.25 per share. The Company will not receive any of the proceeds from the sale(s) of any selling shareholders’ shares. This offering shall commence once registration with the Securities and Exchange Commission is deemed effective and shall continue for a duration of one (1) year from the date of effectiveness unless terminated earlier by us. This is offering is bifurcated as follows: (1) the Company shall offer for sale 8,000,000 shares of common stock for which any proceeds resulting from sales shall be payable to the Company (the “Primary Offering”). The Primary Offering shall commence once registration is deemed effective and shall continue for a period of three (3) months or until such time as a post-effective amendment is filed terminating the Primary Offering; and (2) Selling Shareholders shall thereafter commence offering their shares for sale from the date of termination of the Primary Offering up until one (1) year from the date of effectiveness of the registration statement unless terminated earlier by us.

|

Offering Proceeds

|

$ | 2,000,000 | 100.0 | % | $ | 1,000,000 | 50.0 | % | ||||||||

|

Total Proceeds

|

2,000,000 | 100.0 | % | 1,000,000 | 50.0 | % | ||||||||||

|

Maximum Commissions(1)

|

200,000 | 10.0 | % | 100,000 | 10.0 | % | ||||||||||

|

Offering Expenses

|

30,000 | 1.50 | % | 30,000 | 3 | % | ||||||||||

|

Total Offering Expenses

|

230,000 | 11.50 | % | 130,000 | 13.00 | % | ||||||||||

|

Net Proceeds from Offering

|

$ | 1,770,000 | 88.5 | % | $ | 870,000 | 87.0 | % |

(1) We do not believe we will use broker/dealers or underwriters to facilitate our efforts in offering and selling our shares but to the extent that the rules and regulations might allow us to use a broker dealer; a broker/dealer is willing and able to participate in this offering on a best-efforts basis; and we are unable to raise sufficient funds on our own we have elected to cap any commissions that might be available to broker/dealers at ten (10%) percent. In any event, our officers and directors will not be receiving any commissions or remuneration in conjunction with the offer or sale of these securities. Our officers and directors are acting in reliance of the safe harbor provided for by Rule 3a4-1 of the Exchange Act.

These securities involve a high degree of risk and immediate substantial dilution and should be purchased only by persons who can afford the loss of their entire investment. See "Risk Factors" beginning on page 9.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

You should rely only on the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement. No one has been authorized to provide you with different information. The Shares are not being offered in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front of such documents. The information in this prospectus is not complete and may be changed. This prospectus is included in the Registration Statement that was filed by us with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the Registration Statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. Our agent for service of process in Nevada is Empire Stock Transfer, Inc. Their address for service is: 1859 Whitney Mesa Drive Henderson, NV 89014.

The date of this Prospectus is July 26, 2011

3

TABLE OF CONTENTS

4

ITEM 3 - SUMMARY INFORMATION AND RISK FACTORS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate only as of the date of the front cover regardless of the time of delivery of this prospectus or of any sale of shares. Except where the context requires otherwise, in this prospectus, the words “Company,” “we,” “us” and “our” refer to Success Exploration & Resources, Inc., a Nevada corporation.

SUMMARY

This summary highlights selected information from this prospectus. It does not contain all of the information that is important to you. We encourage you to carefully read this entire prospectus and the documents to which we refer you. The following summary is qualified in its entirety by reference to the detailed information appearing elsewhere in this registration statement.

Our Company

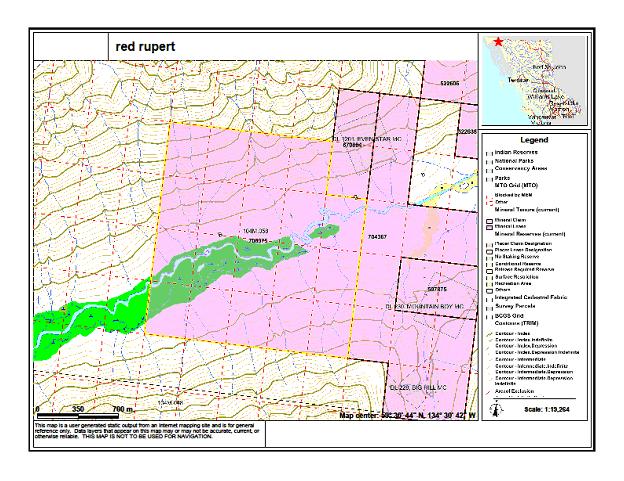

Exploration Stage Company. We are an exploration stage company engaged in the acquisition and exploration of mineral properties and mining tailing reprocessing projects. Our business is presently focused on our one mineral project in which we hold interests, the Red Rupert Mining Claim. This claim, initially acquired by our President and CEO, Alexander Long on February 23, 2010, was assigned to us on April 28, 2010. On April 1, 2011 Mr. Long renewed title to the claim then transferred ownership to the company to maintain interest in the Red Rupert property.

The Red Rupert Mining Claim involves exploration for precious metals on mining claims near British Columbia. Our Red Rupert Claims are comprised of non-patented hard rock load mining claims located on federal land administered by the British Columbia Government of Canada. Drilling and mining activities on the Red Rupert Mining Claims must be carried out in accordance with a Plan of Operations.

Corporate Information

Our principal executive offices are located at: 21 Sourquois Street, Chatham, Ontario Canada N7M2T1, Our telephone number is (519) 380-9992. Our Internet address is www.successexploration.com. Through a link on the “Recent Filings” section of our website, we shall make available the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the Securities and Exchange Commission (“SEC”): our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. All such filings are available free of charge. Information contained on our website or that is accessible through our website should not be considered to be part of this prospectus.

Shares Offered Hereby

This prospectus relates to the public offering ("Offering") of: (1) 1,626,000 shares of our common stock (as adjusted subsequent to a forward split of 6 for 1) originally sold to the selling shareholders at a forward-split adjusted price of $0.025 in a May 2007 private equity offering conducted in Canada believed to be exempt from registration pursuant to Regulation “S”; and (2) 8,000,000 shares to be offered by the Company for an aggregate of 9,626,000 shares of Common Stock (the "Shares"). This is the initial Registration Statement of the Company and is for the purpose of allowing non-affiliated selling stockholders who purchased shares in the Private Placement to resell their Shares at their own discretion and there are no past transactions of this kind. No founders' shares are being registered for resale. The selling stockholders are people known or related to the Company and its Management or people doing business with the Company. The principal reason that shares were sold to friends, business associates and relatives of the Company's founders is that those were the persons that such founders felt would be willing to make a nominal investment for their shares. The Company shall receive no consideration, directly or indirectly, in connection with the future sale of the Shares registered under this Registration Statement by selling stockholders. If we sell all of the 8,000,000 shares to be registered hereby, or more specifically all 8,000,000 shares being offered by the Company, at a selling price of $0.25 per share, then we expect to receive proceeds in the amount of $2,000,000. In order for the Company to receive proceeds, a current prospectus must be in effect. The costs of registering the Shares and other costs relating to the Offering are approximately $240,000 assuming a maximum amount of commissions of $200,000 is paid by the Company.

Summary Financial Information

The following summary financial information is derived from the more detailed audited financial statements and the notes to those statements appearing at the back of this prospectus. You should read those financial statements and notes for a further explanation of the financial data summarized below.

5

Balance Sheet Data

(As at May 31, 2011, May 31, 2010)

|

SUCCESS EXPLORATION & RESOURCES, INC.

|

||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||

|

BALANCE SHEETS

|

||||||||

|

(AUDITED)

|

||||||||

|

May 31,

|

||||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current assets:

|

||||||||

|

Cash

|

$

|

13,576

|

$

|

26,705

|

||||

|

Prepaid expenses

|

1,750

|

|||||||

|

Total current assets

|

15,326

|

$

|

26,705

|

|||||

|

Total assets

|

$

|

15,326

|

$

|

26,705

|

||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

|

||||||||

|

Current liabilities:

|

||||||||

|

Accounts payable

|

$

|

1,250

|

$

|

5819

|

||||

|

Notes payable - related party

|

25,489

|

10,093

|

||||||

|

Total current liabilities

|

26,739

|

15,912

|

||||||

|

Total liabilities

|

26,739

|

15,912

|

||||||

|

Stockholders' equity (deficit):

|

||||||||

|

Common stock, $0.001 par value, 75,000,000 shares

|

||||||||

|

authorized, 4,377,000 shares issued and outstanding

|

4,377

|

4,377

|

||||||

|

Additional paid-in capital

|

42,258

|

42,258

|

||||||

|

Deficit accumulated during development stage

|

(58,048)

|

(35,842

|

)

|

|||||

|

Total stockholders' equity (deficit)

|

(11,413)

|

10,793

|

||||||

|

Total liabilities and stockholders' equity (deficit)

|

$

|

15,326

|

26,705

|

|||||

6

Operations Data

(May 31, 2011 and 2010)

(Audited)

|

SUCCESS EXPLORATION & RESOURCES, INC.

|

||||||||||||

|

(AN EXPLORATION STAGE COMPANY)

|

||||||||||||

|

(AUDITED)

|

||||||||||||

|

Inception

|

||||||||||||

|

For the Years Ended

|

(November 29, 2005) to

|

|||||||||||

|

May 31,

|

May 31,

|

|||||||||||

|

2011

|

2010

|

2011

|

||||||||||

|

Revenue

|

$

|

-

|

$

|

-

|

$

|

-

|

||||||

|

Operating expenses:

|

||||||||||||

|

Professional fees

|

16,233

|

24,376

|

46,984

|

|||||||||

|

General and administrative

|

6,062

|

3,907

|

12,381

|

|||||||||

|

Total operating expenses

|

22,295

|

28,283

|

59,365

|

|||||||||

|

Other income:

|

||||||||||||

|

Interest income

|

89

|

290

|

1,317

|

|||||||||

|

Total other income

|

89

|

290

|

1,317

|

|||||||||

|

Net loss

|

$

|

(22,206

|

)

|

$

|

(27,993

|

)

|

$

|

(58,048

|

)

|

|||

|

Weighted average number of common shares outstanding - basic

|

4,377,000

|

4,377,000

|

||||||||||

|

Net loss per share - basic

|

$

|

(0.01

|

)

|

$

|

(0.01

|

)

|

||||||

7

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The safe harbor for forward-looking statements provided in the Private Securities Litigation Reform Act of 1995 does not apply to statements made in connection with an initial public offering.

This prospectus may contain forward-looking statements. The forward-looking statements are contained principally in, but not limited to, the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Forward-looking statements provide our current expectations or forecasts of future events. Forward-looking statements include statements about our expectations, beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts. Words or phrases such as “anticipate,” “believe,” “continue,” “ongoing,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project” or similar words or phrases, or the negatives of those words or phrases, may identify forward-looking statements, but the absence of these words does not necessarily mean that a statement is not forward-looking.

The risk factors referred to in this prospectus could materially and adversely affect our business, financial conditions and results of operations and cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us, and you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made and we do not undertake any obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. The risks and uncertainties described below are not the only ones we face. New factors emerge from time to time, and it is not possible for us to predict which will arise. There may be additional risks not presently known to us or that we currently believe are immaterial to our business. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, you may lose all or part of your investment.

The industry and market data contained in this prospectus are based either on our management’s own estimates or, where indicated, independent industry publications, reports by governmental agencies or market research firms or other published independent sources and, in each case, are believed by our management to be reasonable estimates. However, industry and market data is subject to change and cannot always be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey of market shares. We have not independently verified market and industry data from third-party sources. In addition, consumption patterns and customer preferences can and do change. As a result, you should be aware that market share, ranking and other similar data set forth herein, and estimates and beliefs based on such data, may not be verifiable or reliable.

RISK FACTORS

An investment in our common stock is very risky. Our financial condition is unsound. You should not invest in our common stock unless you can afford to lose your entire investment. You should carefully consider the risk factors described below, together with all other information in this prospectus, before making an investment decision. If an active market is ever established for our common stock, the trading price of our common stock could decline due to any of these risks, and you could lose all or part of your investment (whether or not a trading market for these securities is ever established) . You also should refer to the other information set forth in this prospectus, including our financial statements and the related notes.

Risks Relating to Our Business

We lack an operating history and have losses which we expect to continue into the future. As a result, we may have to suspend or cease exploration activities if we do not obtain additional financing, and our business will fail.

The report of our auditor accompanying our financial statements filed herewith includes a statement that the factors discussed below raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern will be dependent on our raising of additional capital and the success of our business plan.

We were incorporated on November 29, 2005. We have had little if any significant operating history and we are considered an exploration stage company. As a consequence there is limited practical historical data upon which we may make an evaluation of the future success or failure of our business plan.

We have a history of operating losses and have an accumulated deficit. We have not commenced our proposed mineral exploration or mining operations. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future.

We have not attained profitable operations and are dependent upon obtaining financing to pursue our plan of operation. Our ability to achieve and maintain profitability and positive cash flow will be dependent upon, among other things:

8

* our ability to locate a profitable mineral property;

* positive results from our feasibility studies on the Projects from the exploration of the Red Rupert Mining Claim;

* our ability to generate revenues.

We may not generate sufficient revenues from our proposed business plan in the future to achieve profitable operations. If we are not able to achieve profitable operations at some point in the future, we eventually may have insufficient working capital to maintain our operations as we presently intend to conduct them or to fund our plans to commence exploration of the Red Rupert Mining Claim. In addition, our losses may increase in the future if we expand our business plan. These losses, among other things, have had and will continue to have an adverse effect on our working capital, total assets and stockholders’ equity. If we are unable to achieve profitability, the market value of our common stock will decline and there would be a material adverse effect on our financial condition.

Our exploration and evaluation plan calls for exploration, testing and potential construction expenses in connection with the Red Rupert Mining Claim. At present this is are only claim or stake. Over the next twelve months, our management anticipates that the minimum cash requirements for funding our proposed exploration, testing and construction program and our continued operations will be approximately $80,000. On May 31, 2011, we had working capital deficit in the amount of approximately $(11,413).

This amount is less than the total expenditures that we have budgeted for the next 12 months by at least approximately $75,291. We estimate that our current financial resources are sufficient to allow us to meet the anticipated costs of this offering. Therefore we may be obliged to secure alternative sources of financing.

Obtaining additional financing is subject to a number of factors, including the market prices for the mineral property and base and precious metals. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. If adequate funds are not available or if they are not available on acceptable terms, our ability to fund our business plan could be significantly limited and we may be required to suspend our business operations. We cannot assure you that additional financing will be available on terms favorable to us, or at all. The failure to obtain such a financing would have a material, adverse effect on our business, results of operations and financial condition.

If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of current stockholders will be reduced and these securities may have rights and preferences superior to that of current stockholders. If we raise capital through debt financing, we may be forced to accept restrictions affecting our liquidity, including restrictions on our ability to incur additional indebtedness or pay dividends.

Actual capital costs, operating costs and economic returns may differ significantly from our estimates.

We are an exploration stage company and have only recently secured the Red Rupert Mining Claim. We do not have any historical mineral operations upon which to base our estimates of costs. Decisions about the exploration, testing and construction of our mineral properties will ultimately be based upon feasibility studies. Feasibility studies derive cost estimates based primarily upon:

· anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed;

· anticipated recovery rates of gold and other metals from the ore;

· cash operating costs of comparable facilities and equipment; and

· anticipated weather/climate conditions.

To date, we have not conducted an internal pre-feasibility study of the Red Rupert Mining Claim.

We will need to complete feasibility studies that address the economic viability of the Claim. Capital and operating costs and economic returns, and other estimates contained in our feasibility studies may differ significantly from our current estimates. There is no assurance that our actual capital and operating costs will not exceed our current estimates. In addition, delays to exploration or construction schedules may negatively impact the net present value and internal rates of return for our mineral properties. There are no assurances that actual recoveries of base and precious metals or other minerals processed from our mineral projects including the Red Rupert Mining Claim will be economically feasible or that actual costs will match any pre-feasibility estimates. Feasibility estimates typically underestimate future capital needs and operating costs. Our projected operating and capital cost estimates are in preliminary stages and may be subject to significant, upward adjustment based on future events, including the results of any final feasibility study which we may develop.

9

If the results from any feasibility studies and the results from the operation of the Red Rupert Mining Claim are not sufficiently positive for us to proceed we will have to scale back or abandon our proposed operations with respect to this claim.

We intend to explore, test and commence production Red Rupert Mining Claim, eventually resulting in both full scale production and processing. However, if the results of our feasibility studies on the claim are not positive, we will have to scale back or abandon our proposed operations of the Red Rupert Mining Claim. There is no assurance that actual recoveries of base and precious metals or other minerals re-processed from the slag pile will be economically feasible. If metal recoveries are less than projected, then our metal sales will be less than anticipated and may not equal or exceed the cost of mining and recovery. In such event, we will have difficulty in raising additional capital to maintain operations and that would result in a material adverse effect on our operating results, financial condition and our ability to remain in business.

If we are unable to achieve projected mineral recoveries from our proposed exploration and mining activities at the Red Rupert Mining Claim then our financial condition will be adversely affected.

As we have not established any reserves on the Red Rupert Mining Claim to date, there is no assurance that actual recoveries of minerals from material mined during exploration mining activities will equal or exceed our exploration costs on our mineral properties. Even if the feasibility study results in a positive outcome, there is no assurance that if we move to production scale from pilot plant scale that our actual results will match feasibility estimates. If mineral recoveries are less than projected, then our sales of minerals will be less than anticipated and may not equal or exceed the cost of exploration and recovery, in which case our operating results and financial condition will be materially, adversely affected.

We have no known mineral reserves and if we cannot find any, we will have to cease operations.

We have no known mineral reserves. Mineral exploration is highly speculative. It involves many risks and is often non-productive. Even if we are able to find mineral reserves on our property our production capability is subject to further risks including:

· costs of bringing the property into production including exploration work, preparation of production feasibility studies, and construction of production facilities;

· availability and costs of financing;

· ongoing costs of production; and

· environmental compliance regulations and restraints.

The marketability of any minerals acquired or discovered may be affected by numerous factors which are beyond our control and which cannot be accurately predicted, such as market fluctuations, the lack of milling facilities and processing equipment near the Red Rupert Mining Claim, the success of our drilling and sampling activities on the claim and such other factors as government regulations, including regulations relating to allowable production, exporting of minerals, and environmental protection. If we do not find a mineral reserve or if we cannot explore the mineral reserve because we do not have the money to do so or because it will not be economically feasible to do so, we will have to cease operations.

Our rights under the Red Rupert Mining Claim or any future claims we might acquire, may be difficult to retain and may not apply to all metals and minerals located on the property.

Because title to unpatented mining claims is subject to inherent uncertainties, it is difficult to determine conclusively the ownership of such claims. These uncertainties relate to such things as sufficiency of mineral discovery, proper posting and marking of boundaries and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining in the Canada now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry.

The present status of our unpatented mining claims located on public lands allows us the exclusive right to mine and remove valuable metals, such as precious and base metals, which are in lode form. We also are allowed to use the surface of the land solely for purposes related to mining and processing the metal-bearing ores. However, legal ownership of the land remains with the land owner. Lode mining claims include classic veins or lodes having well defined boundaries and with respect to which we would have legal rights to within the property that is the subject of the Red Rupert Mining Claim.

Our industry is highly competitive, mineral lands are scarce and we may not be able to obtain quality properties.

In addition to us, many companies and individuals engage in the mining business, including large, established mining companies with substantial capabilities and long earnings records. There is a limited supply of desirable mineral lands available for claim staking, lease, or acquisition in Canada or the United States and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mining properties since we must compete with these individuals and companies, many of which have greater financial resources and larger technical staffs. Mineral properties in specific areas which may be of interest or of strategic importance to us may be unavailable for exploration or acquisition due to their high cost or they may be controlled by other companies who may not want to sell or option their interests at reasonable prices. In addition, the Red Rupert Mining Claim is a finite, depleting asset. Therefore, the life of the claim if viable will be finite, if it is ever developed to the point of economic feasibility. Our long-term viability depends upon finding and acquiring new resources from different sites or properties. There can be no assurances that the Red Rupert Mining Claim will become economically viable and if so, that we will achieve or obtain additional successful economic opportunities.

10

We are subject to compliance with government regulation that may increase the anticipated cost of our exploration program.

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the laws of the Canadian Province of British Columbia and applicable national laws in Canada, (and to the extent that we may acquire claims in the United States, similar state and federal laws) as we carry out our business plan with respect to the Red Rupert Mining Claim or other claims. We are required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. Further, to the extent that we might acquire claims in the United States, the U.S. Congress is actively considering amendment of the federal mining laws. Among the amendments being considered are (1) the imposition of significant royalties payable to the United States; and (2) more stringent environmental and reclamation standards, either of which would increase the cost of operations of mining projects within the United States. While our present and planned claims are likely to be within Canada and we endeavor to budget for regulatory compliance, there is a risk that new regulations, whether in Canada or the U.S., could increase our costs of doing business and prevent us from carrying out our exploration program.

With respect to the Red Rupert Mining Claim in British Columbia, the main agency that governs the exploration of minerals in the Province of British Columbia, Canada, is the Ministry of Energy and Mines.

The Ministry of Energy and Mines manages the development of British Columbia's mineral resources, and implements policies and programs respecting their development while protecting the environment. In addition, the Ministry regulates and inspects the exploration and mineral production industries in British Columbia to protect workers, the public and the environment.

The material legislation applicable to us is the Mineral Tenure Act R.S.B.C. 1996 Chapter 292, as amended, and administered by the Mineral Titles Branch of the Ministry of Energy and Mines, and the Mines Act, RSBC 1996 Chapter 293, as amended, as well as the Health, Safety and Reclamation Code, 2003, as amended.

The Mineral Tenure Act and its regulations govern the procedures involved in the location, recording and maintenance of mineral titles in British Columbia. The Mineral Tenure Act also governs the issuance of leases which are long term entitlements to minerals, designed as production tenures. The Mineral Tenure Act does not apply to minerals held by crown grant or by freehold tenure.

All mineral exploration activities carried out on the property underlying our mineral claim interest must be in compliance with the Mines Act. The Mines Act applies to all mines during exploration, development, construction, production, closure, reclamation and abandonment. It outlines the powers of the Chief Inspector of Mines, to inspect mines, the procedures for obtaining permits to commence work in, on or about a mine and other procedures to be observed at a mine. Additionally, the provisions of the Health, Safety and Reclamation Code for mines in British Columbia contain standards for employment, occupational health and safety, accident investigation, work place conditions, protective equipment, training programs, and site supervision.

Additional approvals and authorizations may be required from other government agencies, depending upon the nature and scope of the proposed exploration program. If the exploration activities require the falling of timber, then either a free use permit or a license to cut must be issued by the Ministry of Forests. Items such as waste approvals may be required from the Ministry of Environment, Lands and Parks if the proposed exploration activities are significantly large enough to warrant them. Waste approvals refer to the disposal of rock materials removed from the earth which must be reclaimed. An environmental impact statement may be required.

British Columbia law requires that a holder of title to the claims must spend at least U.S. $0.40 per hectare per year in order to keep the property in good standing. Thus, the annual cost of compliance with the Mineral Tenure Act with respect of the claims is presently approximately CDN $250 per year. The Red Rupert Mining Claim is in good standing with the Province of British Columbia until April 1, 2012 (Tenure Number: 850457 thru 850459). Exploration work with a minimum value of CDN $125 for the property is required before April 1, 2012. If we do not complete this minimum amount of exploration work by this time, we will (on behalf of the claim owner) be required to pay a fee in lieu of exploration work in the amount of CDN$250 to the Province of British Columbia. If we fail to meet these requirements on a timely basis, our mineral claim will lapse. Accordingly, you could lose all or part of your investment in our common stock.

We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. Because there is presently no information on the size, tenor, or quality of any resource or reserve at this time, it is impossible to assess the impact of any capital expenditures on earnings, our competitive position or on us in the event a potentially economic deposit is discovered.

Prior to undertaking mineral exploration activities, we must make application under the Mines Act for a permit, if we anticipate disturbing land. A permit is issued within 45 days of a complete and satisfactory application. We do not anticipate any difficulties in obtaining a permit, if needed. The initial exploration activities on the property underlying our mineral claim interest are not expected to involve ground disturbance and as a result do not require a work permit. Any follow-up trenching and/or drilling will require permits, applications for which will be submitted well in advance of the planned work.

11

If we enter the production phase, the cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

* water discharge will have to meet drinking water standards;

* dust generation will have to be minimal or otherwise re-mediated;

* dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

* an assessment of all material to be left on the surface will need to be environmentally benign;

* ground water will have to be monitored for any potential contaminants;

* the socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be re-mediated; and

* there will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible.

We must comply with complex environmental regulations which are increasing and costly.

Our exploration operations are regulated by various environmental laws that relate to the protection of air and water quality, hazardous waste management and mine reclamation. These regulations will impose operating costs on us. If the regulatory environment for our operations changes in a manner that increases the costs of compliance and reclamation, then our operating expenses may increase. This would result in an adverse effect on our financial condition and operating results.

Compliance with environmental quality requirements and reclamation laws imposed by authorities may:

* require significant capital outlays;

* materially affect the economics of a given property;

* cause material changes or delays in our intended activities; and

* expose us to lawsuits.

These authorities may require us to prepare and present data pertaining to the effect or impact that any proposed exploration for or production of minerals may have upon the environment. The requirements imposed by any such authorities may be costly, time consuming, and may delay operations. Future legislation and regulations designed to protect the environment, as well as future interpretations of existing laws and regulations, may require substantial increases in equipment and operating costs and delays, interruptions, or a termination of operations. We cannot accurately predict or estimate the impact of any such future laws or regulations, or future interpretations of existing laws and regulations, on our operations.

Affiliates of our management and our principal stockholders have conflicts of interest which may differ from those of the company and other shareholders.

We may have ongoing business relationships with affiliates of our management and principal stockholders. These persons are subject to a fiduciary duty to exercise good faith and integrity in handling our affairs. However, the existence of these continuing obligations may create a conflict of interest between us and our board members and executive management, and any disputes between us and such persons over the terms and conditions of these agreements that may arise in the future may raise the risk that the negotiations over such disputes may not be subject to being resolved in an arms’ length manner. Although our management intends to avoid situations involving conflicts of interest and is subject to a Code of Ethics, there may be situations in which our interests may conflict with the interests of those of our management or their affiliates. These could include:

* competing for the time and attention of management;

* potential interests of management in competing investment ventures; and

* the lack of independent representation of the interests of the other stockholders in connection with potential disputes or negotiations over ongoing business relationships.

We may suffer adverse consequences as a result of our reliance on outside contractors to conduct our operations.

A significant portion of our planned operations will be conducted by outside contractors. As a result, our operations will be subject to a number of risks, some of which are outside our control, including:

* negotiating agreements with contractors on acceptable terms;

* the inability to replace a contractor and its operating equipment in the event that either party terminates the agreement;

* reduced control over those aspects of operations which are the responsibility of the contractor;

* failure of a contractor to perform under its agreement with us;

* interruption of operations in the event that a contractor ceases its business due to insolvency or other unforeseen events;

12

* failure of a contractor to comply with applicable legal and regulatory requirements, to the extent it is responsible for such compliance; and

* problems of a contractor with managing its workforce, labor unrest or other employment issues.

In addition, we may incur liability to third parties as a result of the actions of our contractors. The occurrence of one or more of these risks could have a material adverse effect on our business, results of operations and financial condition.

Because our management does not have formal technical training related to mineral exploration, there may be a higher risk that our business will fail.

Our executive officers and directors do not have any formal training as geologists or in the technical aspects of management of a mineral exploration company. With no direct training or experience in these areas, our management may not be fully aware of the specific requirements related to working within this industry. Our management's decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, our operations, earnings, and ultimate financial success could suffer irreparable harm due to management's lack of experience in this industry.

Mineral, and base and precious metal prices are volatile and declines may have an adverse effect on our share price and business plan.

The market price of minerals is extremely volatile and beyond our control. Basic supply/demand fundamentals generally influence gold prices. The market dynamics of supply/demand can be heavily influenced by economic policy. Fluctuating metal prices will have a significant impact on our results of operations and operating cash flow. Furthermore, if the price of a mineral should drop dramatically, the value of our properties which are being explored or developed for that mineral could also drop dramatically and we might not be able to recover our investment in those properties. The decision and investment necessary to put a mine into production must be made long before the first revenues from production will be received. Price fluctuations between the time that we make such a decision and the commencement of production can completely change the economics of the mine. Although it is possible for us to protect against some price fluctuations by entering into derivative contracts (hedging) in certain circumstances, the volatility of mineral prices represents a substantial risk which no amount of planning or technical expertise can eliminate.

If the price of base and precious metals declines, our financial condition and ability to obtain future financings will be impaired.

The price of base and precious metals is affected by numerous factors, all of which are beyond our control. Factors that tend to cause the price of base and precious metals to decrease include the following:

* sales or leasing of base and precious metals by governments and central banks;

* a low rate of inflation and a strong U.S. dollar;

* speculative trading;

* decreased demand for base and precious metals in industrial, jewelry and investment uses;

* high supply of base and precious metals from production, disinvestment, scrap and hedging;

* sales by base and precious metals producers, foreign transactions and other hedging transactions; and

* devaluing local currencies (relative to base and precious metals prices in U.S. dollars) leading to lower production costs and higher production in certain major base and precious metals producing regions.

Our business is dependent on the price of base and precious metals. We have not undertaken hedging transactions in order to protect us from a decline in the price of base and precious metals. A decline in the price of base and precious metals may also decrease our ability to obtain future financings to fund our planned exploration programs.

We have identified material weaknesses in our internal control over financial reporting and concluded that such controls may not be sufficiently effective. If we fail to maintain effective internal control over financial reporting, we may not be able to accurately report our financial results. We can provide no assurance that we will at all times in the future be able to report that our internal control is effective.

As a registrant under the Exchange Act and a public company, and under Section 404 of the Sarbanes-Oxley Act of 2002, we are required to include a management report of our internal controls over financial reporting in our annual report, which contains management’s assessment of the effectiveness of the company’s internal controls over financial reporting. We are required to report, among other things, control deficiencies that constitute material weaknesses or changes in internal control that, or that are reasonably likely to, materially affect internal control over financial reporting. A “material weakness” is a significant deficiency or combination of significant deficiencies that results in more than a remote likelihood that a material misstatement of the annual or interim financial statements will not be prevented or detected. If we fail to comply with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 or report a material weakness, we might be subject to regulatory sanction and investors may lose confidence in our financial statements, which may be inaccurate if we fail to remedy such material weakness.

13

Our independent registered public accounting firm is required to attest to and report on management’s assessment of the effectiveness of the company’s internal controls over financial reporting. Our management may conclude that our internal controls over our financial reporting are not effective. Moreover, even if our management concludes that our internal controls over financial reporting are effective, our independent registered public accounting firm may still decline to attest to our management’s assessment or may issue a report that is qualified if it is not satisfied with our controls or the level at which our controls are documented, designed, operated, or reviewed, or if it interprets the relevant requirements differently from us. Our reporting obligations as a public company will place a significant strain on our management, operational, and financial resources and systems for the foreseeable future. Effective internal controls, particularly those related to revenue recognition, are necessary for us to produce reliable financial reports and are important to help prevent fraud. As a result, our failure to achieve and maintain effective internal controls over financial reporting could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our stock. Furthermore, we anticipate that we will incur considerable costs and use significant management time and other resources in an effort to comply with Section 404 and other requirements of the Sarbanes-Oxley Act.

Our system of internal control over financial reporting may be impaired as a consequence of our lack of financial resources and suitably experienced personnel. Management had identified internal control deficiencies which, in management’s judgment, represent material weakness in internal control over financial reporting. The control deficiencies generally related to controls over the accounting for complex transactions to ensure such transactions are recorded as necessary to permit preparation of financial statements and disclosure in accordance with generally accepted accounting principles. Such complex transactions included capital asset acquisitions and accounting for income taxes. At this time, management has endeavored to address any potential deficiencies in internal controls which, in management’s judgment, may result in a material weakness in internal control over financial reporting. We can provide no assurance that we will at all times in the future be able to report that our internal control over financial reporting is effective. If we fail to maintain an effective system of internal controls, we may not be able to accurately report our financial results or prevent fraud.

Reliance upon key personnel and necessity of additional personnel

The Company is largely dependent upon the personal efforts and abilities of existing management and staff. The success of the Company will also be largely dependent upon the ability of the Company to continue to attract quality management and employees to help operate the Company as its operations may grow. The loss of any key personnel, as well as the inability to attract experienced individuals as required in the future, could have a material adverse effect on our future results of operations.

Our stock is a penny stock. Trading of our stock may be restricted by SEC penny stock regulations and FINRA sales practice requirements, which may limit a stockholder's ability to buy and sell our stock. There is no public trading market for our securities, and the prospective market for our securities is likely to be limited and be sporadic and highly volatile.

There is currently no public market for our common stock. If a trading market does develop for our stock, it is likely we will be subject to the regulations applicable to "Penny Stock." The regulations of the SEC promulgated under the Exchange Act that require additional disclosure relating to the market for penny stocks in connection with trades in any stock defined as a penny stock. The SEC regulations define penny stocks to be any non-NASDAQ equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Unless an exception is available, those regulations require the broker-dealer to deliver, prior to any transaction involving a penny stock, a standardized risk disclosure schedule prepared by the SEC, to provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction, monthly account statements showing the market value of each penny stock held in the customers account, to make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity, if any, in the secondary market for a stock that becomes subject to the penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage market investor interest in and limit the marketability of our common stock.

In addition to the "penny stock" rules promulgated by the Securities and Exchange Commission, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Our management owns a significant amount of our outstanding common stock

The officers, directors, and control persons of the Company, as a group, own much of our outstanding common stock and can exercise substantial control over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. This concentration of ownership significantly limits the power to exercise control by the minority shareholders who purchase Shares in this Offering.

14

Management has broad discretion with respect to the application of the net proceeds from the Offering

Although a portion of the net proceeds of this Offering are for specific uses, the balance will be available for working capital and general corporate purposes. See “Use of Proceeds” on page 21. Therefore, the application of the net proceeds of this Offering is substantially within the discretion of management. Investors will be relying on the Company's management and their business judgment based solely on limited information. No assurance can be given that the application of the net proceeds of this Offering will result in the Company achieving its financial and strategic objectives.

The price of our shares in this offering was arbitrarily determined by us and may not reflect the actual market price for the securities.

The offering price of $0.25 per share of common stock was arbitrarily determined by the Company and is unrelated to any specific investment criteria, such as the assets or past results of the Company’s operations. In determining the Offering price, the Company considered such factors as the prospects, if any, of similar companies, the previous experience of management, and the Company's anticipated results of operations and the likelihood of acceptance of this Offering. Prior to purchasing shares, prospective investors are urged to review all financial and other information contained in this Offering with qualified persons to determine whether the investment is suitable.

The initial public offering price of the common stock was determined by us arbitrarily. The price is not specifically based on our financial condition and prospects, market prices of similar securities of comparable publicly traded companies, certain financial and operating information of companies engaged in similar activities to ours, or general conditions of the securities market. The price may not be indicative of the market price, if any, for the common stock in the trading market after this offering. The market price of the securities offered herein, if any, may decline below the initial public offering price. The stock market has experienced extreme price and volume fluctuations. In the past, securities class action litigation has often been instituted against a company following periods of volatility in the market price of its securities. If instituted against us, regardless of the outcome, such litigation could result in substantial costs and a diversion of management's attention and resources, which would increase our operating expenses and affect our financial condition and business operations.

The Company does not plan to pay dividends in the foreseeable future, thus investors will need to sell the Shares purchased in the Offering to realize a return on their investment.

The Company intends to retain any future earnings to finance the operation and expansion of its business and does not anticipate paying any cash dividends in the foreseeable future. As a result, stockholders will need to sell shares of common stock in order to realize a return on their investment, if any.

The shares being offered directly by us are offered without any requirement for a minimum amount of shares to be sold. Accordingly, there is no guarantee that we will be successful at raising enough funds to effectuate our business with the proceeds of this offering.

There is no assurance that we will be successful at raising the maximum amount of this offering. This is especially true in light of the fact that no underwriter is being utilized, and that we are not experienced in the sale of securities. If we only raise a portion of the offering, we will be limited in our ability to achieve our objectives. Furthermore, there will be a greater likelihood that investors will lose their entire investment.

Investors will experience immediate and substantial dilution in the net tangible book value per share of the common stock they purchase.

Since the price per share of our common stock being offered is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. Based on an offering price of $0.25 per share if you purchase shares of our common stock in this offering, you will suffer immediate and substantial dilution of approximately 35.21%. See the section entitled “Dilution” below for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

Future financings could adversely affect common stock ownership interest and rights in comparison with those of other security holders.

Our board of directors has the power to issue additional shares of common stock without stockholder approval. If additional funds are raised through the issuance of equity or convertible debt securities, the percentage ownership of our existing stockholders will be reduced, and these newly issued securities may have rights, preferences or privileges senior to those of existing stockholders. If we issue any additional common stock or securities convertible into common stock, such issuance will reduce the proportionate ownership and voting power of each other stockholder. In addition, such stock issuances might result in a reduction of the per share book value of our common stock.

15

Our anti-takeover provisions or provisions of Nevada law, in our articles of incorporation and bylaws and the common share purchase rights that accompany shares of our common stock could prevent or delay a change in control of us, even if a change of control would benefit our stockholders.

Provisions of our articles of incorporation and bylaws, as well as provisions of Nevada law, could discourage, delay or prevent a merger, acquisition or other change in control of us, even if a change in control would benefit our stockholders. These provisions:

* classify our board of directors so that only one-third of the directors are elected each year and require the vote of 66 2/3% of the outstanding stock entitled to vote in the election of directors to amend these provisions;

* prohibit stockholder action by written consent and require that all stockholder actions be taken at a meeting of our stockholders; and

* establish advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon by stockholders at stockholder meetings and require the vote of 66 2/3% of the outstanding stock entitled to vote in the election of directors to amend these provisions,

In addition, the Nevada Revised Statutes contain provisions governing the acquisition of a controlling interest in certain publicly held Nevada corporations. These laws provide generally that any person that acquires 20% or more of the outstanding voting shares of certain publicly held Nevada corporations, such as us, in the secondary public or private market must follow certain formalities before such acquisition or they may be denied voting rights, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights in whole or in part. These laws provide that a person acquires a "controlling interest" whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the Nevada Revised Statutes, would enable that person to exercise (1) one-fifth or more, but less than one-third, (2) one-third or more, but less than a majority or (3) a majority or more, of all of the voting power of the corporation in the election of directors. The Control Share Acquisition Statute generally applies only to Nevada corporations with at least 200 stockholders, including at least 100 stockholders of record who are Nevada residents, and which conduct business directly or indirectly in Nevada. Our Bylaws provide that the provisions of the Nevada Revised Statutes, known as the “Control Share Acquisition Statute” apply to the acquisition of a controlling interest in us, irrespective of whether we have 200 or more stockholders of record, or whether at least 100 of our stockholders have addresses in the State of Nevada appearing on our stock ledger. These laws may have a chilling effect on certain transactions if our articles of incorporation or bylaws are not amended to provide that these provisions do not apply to us or to an acquisition of a controlling interest, or if our disinterested stockholders do not confer voting rights in the control shares.

A substantial number of our shares will be available for sale in the public market and sales of those shares could adversely affect our stock price.

Sales of a substantial number of shares of common stock into the public market, or the perception that such sales could occur, could substantially reduce our stock price in the public market for our common stock, and could impair our ability to obtain capital through a subsequent sale of our securities.

ITEM 4 - USE OF PROCEEDS

The gross proceeds to the Company are estimated to be $2,000,000 for the Maximum Offering. If we raise only half of the gross proceeds we would have raised $1,000,000. The allocations set forth in the table below are the estimates of management as to how the proceeds of this Offering will generally be allocated. We also provide an example of the intended use of proceeds for a situation in which the company raises only 50% of the total amount offered in this offering. There is no assurance that the estimates set forth below will correspond with the actual expenditures of the Company during the next twelve months or thereafter, or that the results of this Offering and the allocations set forth below will be sufficient to maintain the Company’s operations without additional financing in the future.

|

Offering Proceeds

|

$ | 2,000,000 | 100.0 | % | $ | 1,000,000 | 50.0 | % | ||||||||

|

Total Proceeds

|

2,000,000 | 100.0 | % | 1,000,000 | 50.0 | % | ||||||||||

|

Maximum Commissions(1)

|

200,000 | 10.0 | % | 100,000 | 10.0 | % | ||||||||||

|

Offering Expenses

|

30,000 | 1.50 | % | 30,000 | 3 | % | ||||||||||

|

Total Offering Expenses

|

230,000 | 11.50 | % | 130,000 | 13.00 | % | ||||||||||

|

Net Proceeds from Offering

|

$ | 1,770,000 | 88.5 | % | $ | 870,000 | 87.0 | % |

16

USE OF NET PROCEEDS

|

Phase 1(a) - Preliminary Work - Review of Regional Database

|

1,600

|

0.09

|

%

|

1,600

|

0.18

|

%

|

||||||||||

|

Website development

|

5,000

|

0.29

|

%

|

5,000

|

0.57

|

%

|

||||||||||

|

Phase 1(b) - Field Work

|

16,200

|

0.94

|

%

|

16,200

|

1.86

|

%

|

||||||||||

|

Phase 2 Field Studies

|

75,000

|

4.32

|

%

|

50,000

|

5.76

|

%

|

||||||||||

|

Unscheduled expenses related to Phase(s) 1 and 2

|

5,000

|

0.29

|

%

|

5,000

|

0.57

|

%

|

||||||||||

|

Phase 3 Field Work

|

125,000

|

7.20

|

%

|

125,000

|

14.37

|

%

|

||||||||||

|

Purchase New Claims apart of Red Rupert

|

530.770

|

30.

|

%

|

185,000

|

21.3

|

%

|

||||||||||

|

Exploration of new claims

|

308,440

|

17.4

|

%

|

74,700

|

8.6

|

%

|

||||||||||

|

Drilling Sampling of all claims

|

77,110

|

4.4

|

%

|

43,500

|

5.0

|

%

|

||||||||||

|

Geo Physics /Geo Chemistry of new claims and all phases of Red Rupert

|

77,110

|

4.4

|

%

|

43,500

|

5.0

|

%

|

||||||||||

|

Feasibility Studies of new claims and Red Rupert all phases

|

231,330

|

13.1

|

%

|

130,500

|

15.0

|

%

|

||||||||||

|

Developmental Cost Analysis of Red Rupert Claim all Phases

|

70,110

|

4..0

|

%

|

45,000

|

5.2

|

%

|

||||||||||

|

Equipment leasing all claims

|

154,220

|

08.7

|

%

|

87,000

|

10.0

|

%

|

||||||||||

|

Travel all claims

|

77,110

|

4.4

|

%

|

40,000

|

4.6

|

%

|

||||||||||

|

Total Use of Net Proceeds

|

$

|

1,770,000

|

100.00

|

%

|

$

|

870,000

|

100.0

|

%

|

(1) We may have to pay up to a 10% commission with respect to the shares being offered for sale by the Company. These commissions may be payable to broker/dealers, or other duly licensed institutions or individuals or otherwise as may be applicable pursuant to state and federal law.

(2) Percentage or Proceeds calculated on the premise that only 50% of amount offered is actually raised by the Company.

(3) Phase 1(a) Breakdown of anticipated Expenditures:

|

Allowance for purchase of maps, air photographs, publications

|

$

|

200.00

|

||

|

Review files at Geological Survey Branch, Victoria and Vancouver, allow for travel and living expenses

|

400.00

|

|||

|

Wages

|

1,000.00

|

|||

|

Total

|

1,600.00

|

(4) Phase 1(b) Breakdown of Proposed Expenditures:

|

Two person prospecting crew, two weeks in the field, helicopter supported:

|

||||

|

mobilization and travel costs, allowance

|

$

|

2,000.00

|

||

|

prospecting and camping gear

|

3,000.00

|

|||

|

groceries, and other supplies

|

1,200.00

|

|||

|

helicopter service - expect four hours @ $1500/hr $6,000.00 analytical costs, including freight, 20 rock samples, 50 soil and stream sediment samples

|

10,000.00

|

|||

|

TOTAL ( two persons for fourteen days @ $200/person/day)

|

16,200.00

|

|||

|

Anticipated Cost of Preliminary Review and Field Work

|

$

|

18,000.00

|

||

|

Allowance for unscheduled expenses

|

$

|

5,000.00

|

||

|

Total Anticipated Cost of Preliminary Review and Field Work

|

$

|

23,000.00

|

Depending upon the results of our initial feasibility studies we may elect to proceed with further studies and eventual development of the Red Rupert Claim. If so, Phase 2 and 3 would include the following:

17

Phase 2 - Follow-up Work

Two person crew to prospect, sample and, possibly trench and conduct geophysical surveys. We project that this would require two weeks of helicopter transport services. The total cost of Phase 2 should our initial feasibility studies result in the decision to move forward with the claim would range between $50,000-75,000.

Phase 3 - More surveys, followed by diamond drilling

Selected target areas will have to be more carefully detailed in order to identify drill sites. Geophysical surveys, either of a different method or on a more dense grid, should clarify the type of structure being investigated and will ensure that diamond drill holes are placed in the most prospective areas. Speculatively, an initial drill program of 1000 meters is likely to be required. The approximate costs of Phase 3 will be between $100,000 and $125,000. The Phase 3 program is wholly speculative, depending upon the location and configuration of the mineral zones. It is possible that further geophysical surveys with different techniques or more densely spaced observations, may be required to assist in designing a program of diamond drill holes to test the deeper potential of the "best" parts of the area. Costs are difficult to estimate but in a somewhat remote area they are likely to be fairly high. The lack of local roads severely restricts ingress and egress to the site. Phase 3 should be expected to cost at least $100,000.

ITEM 5 - DETERMINATION OF OFFERING PRICE

The offering price of the common stock has been arbitrarily determined and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value, historical earnings or net worth. In determining the offering price, management considered such factors as the prospects, if any, for similar companies, anticipated results of operations, present financial resources and the likelihood of acceptance of this offering.

ITEM 6 – DILUTION