Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JONES LANG LASALLE INC | d8k.htm |

| EX-99.1 - PRESS RELEASE - JONES LANG LASALLE INC | dex991.htm |

Supplemental Information

Second Quarter

Earnings Call

2011

EXHIBIT 99.2 |

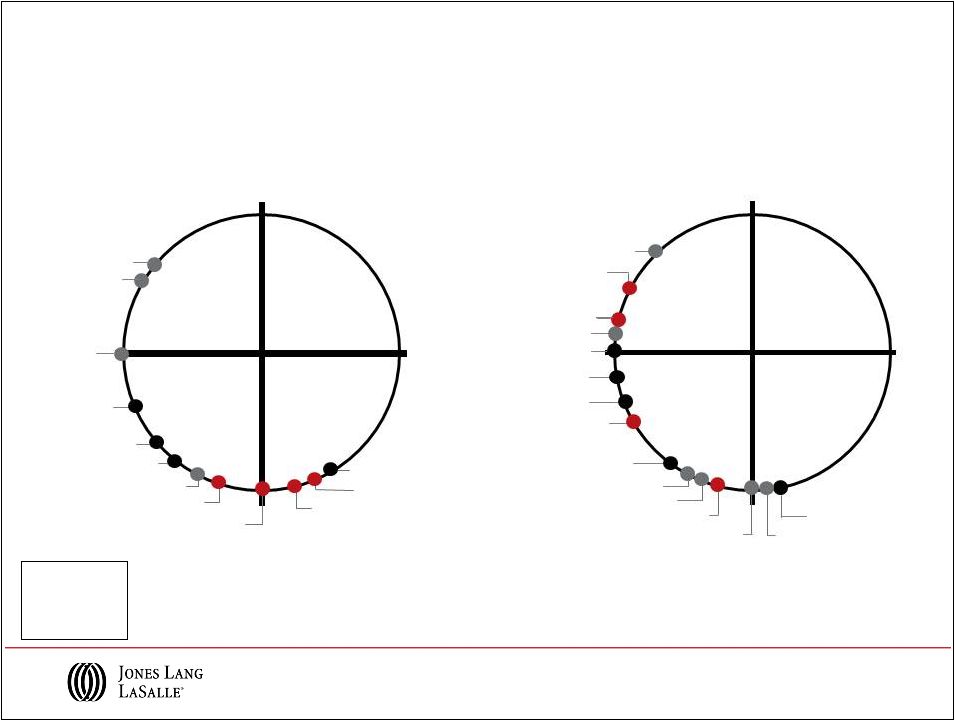

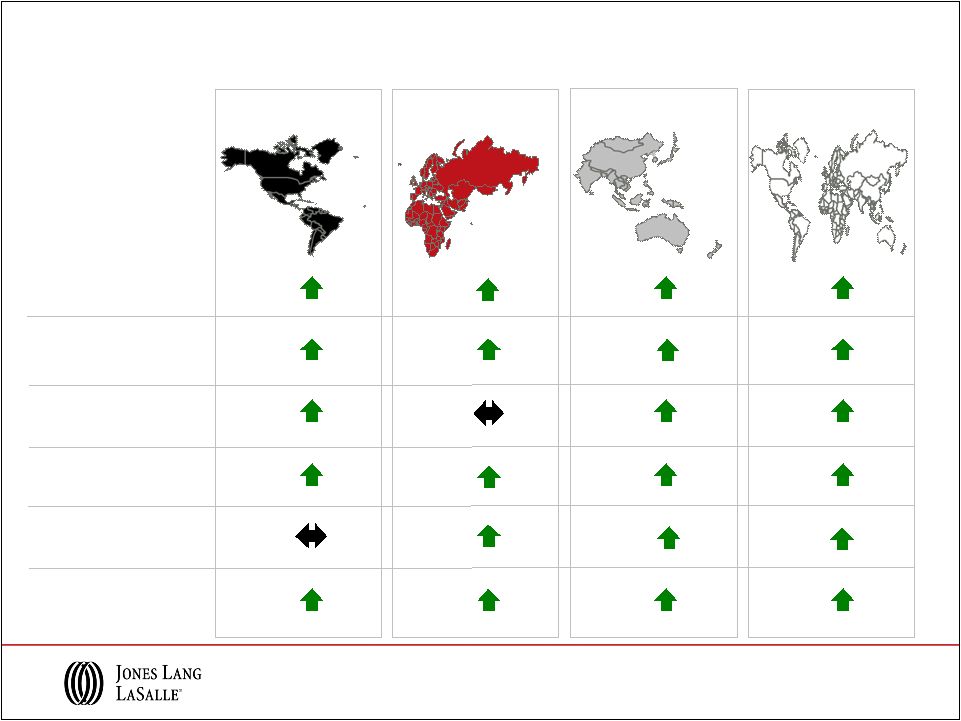

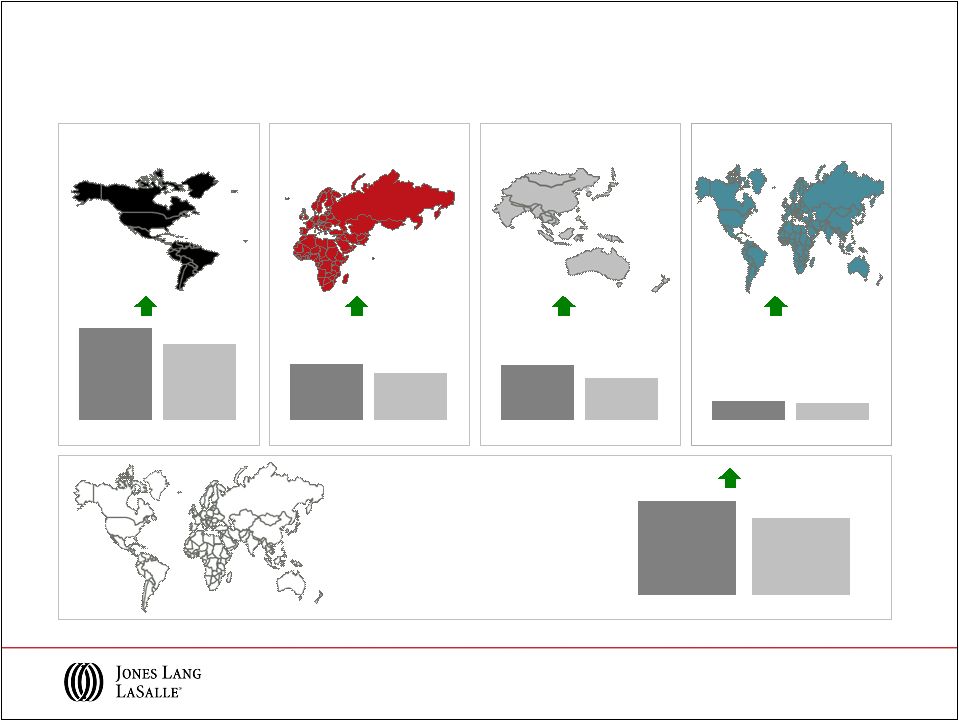

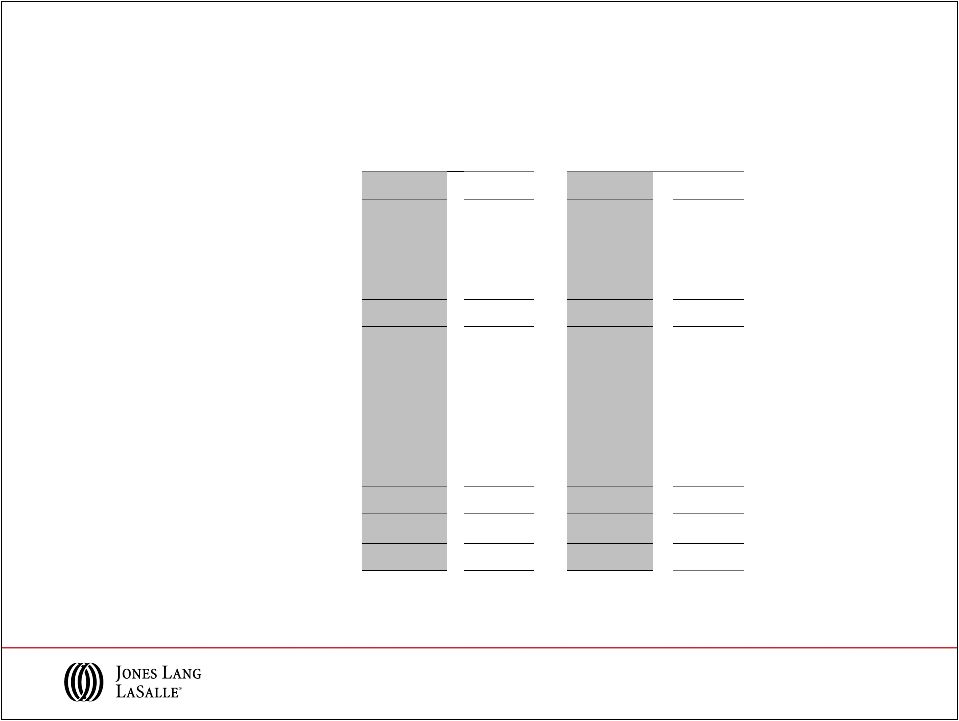

Market & Financial Overview |

Capital

Value growth slowing

Capital Value

growth

accelerating

Capital Value

bottoming out

Capital Value

falling

Capital Values

Q2 2011

As of Q2 2011

The

Jones

Lang

LaSalle

Property

Clocks

SM

Capital Value

growth slowing

Capital Value

growth

accelerating

Capital Value

bottoming out

Capital Value

falling

Q2 2010

Americas

EMEA

Asia Pacific

London

Washington DC

Toronto,

Seoul,

Singapore

Beijing

Hong Kong

Detroit,

Madrid

Atlanta,

Dallas,

Amsterdam

Brussels,

Stockholm

Mumbai,

Tokyo

Shanghai

Milan,

Sydney

New York, Sao Paulo

Moscow

Chicago, San Francisco

Berlin, Paris

Frankfurt

Atlanta, Dallas

Chicago, Toronto

Beijing

Sao Paulo, Washington DC

Amsterdam

New

York, Moscow

Singapore

San Francisco

Detroit

Berlin, Stockholm

Shanghai

Hong Kong

Brussels,

Seoul

Madrid,

Tokyo

Paris,

Sydney

Mumbai

London

Frankfurt, Milan

3 |

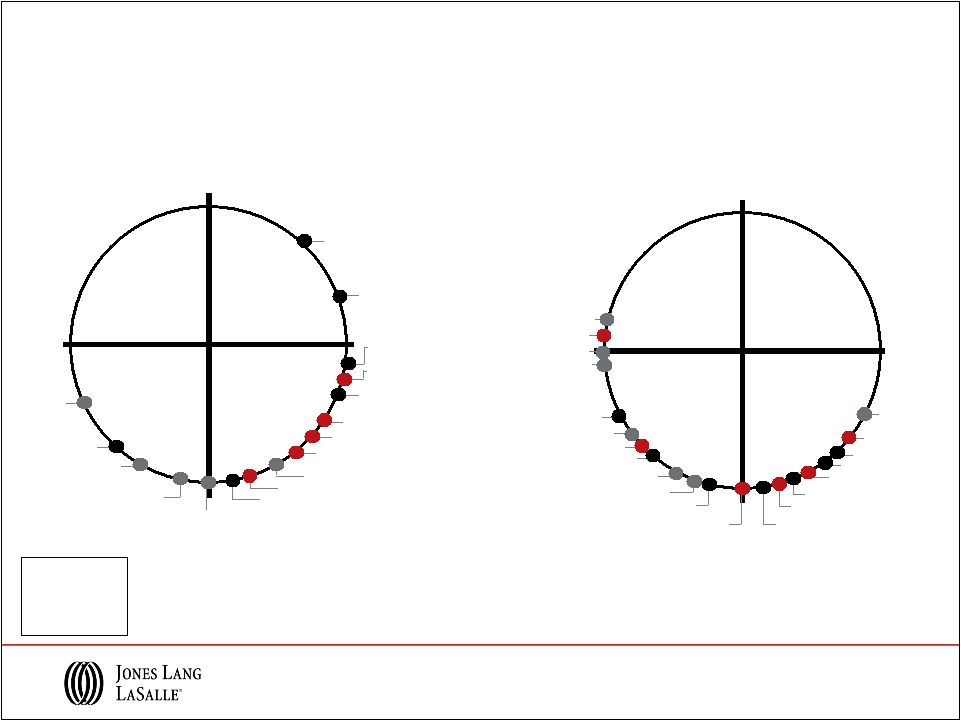

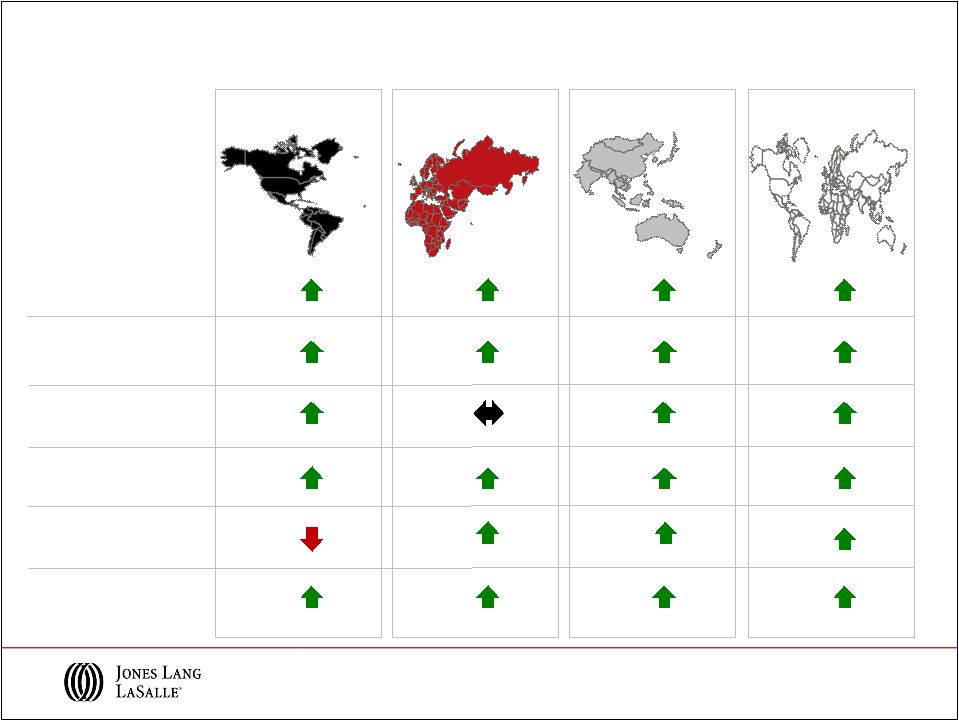

Leasing Market Fundamentals

Q2 2011

As of Q2 2011

The

Jones

Lang

LaSalle

Property

Clocks

SM

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Q2 2010

Rental Value

growth slowing

Rental Value

growth

accelerating

Rental Values

bottoming out

Rental Values

falling

Americas

EMEA

Asia Pacific

Paris, Beijing

Hong

Kong

Sao Paulo

Shanghai

Washington DC

Dallas, Toronto

Rome,

Seoul

Detroit

Atlanta, Chicago

Los Angeles

New York

Stockholm, Tokyo

Brussels, Frankfurt, Milan

Berlin, Moscow

Mumbai, Sydney

London,

Singapore

Mexico City

Madrid

Dubai

Johannesburg

Amsterdam,

San Francisco

Dubai

Dallas

Frankfurt, Milan

Johannesburg

Detroit

San Francisco

New York, Beijing

Washington DC

Atlanta, Chicago

Rome, Tokyo

Los Angeles, Brussels

Sao Paulo,

Moscow

Mumbai

Mexico City

Hong Kong

Singapore

Shanghai

Sydney,

Berlin, Paris

Seoul

London

Madrid

Amsterdam

Stockholm

Toronto

4 |

Q2 Selected Business Wins and Expansions

5

–

Apollo Group

–

8.5M sf

–

Pinchal

&

Company

portfolio

–

$240M

–

Bella

Vista

at

Hilltop,

Richmond

CA

–

$140M

–

Morgans

and

Royalton

Hotels,

New

York

–

$140M

–

Skadden

Arps,

Washington

DC

–

400K

sf

Americas

EMEA

Asia Pacific

–

Doosan Power Systems Limited

–

2.5M sf

–

Suomi Life Assurance, Helsinki

–

€122M

–

Mubarak Al Hassawi Medical City, UAE

–

€175M

–

Businesspark Kienberg, Berlin

–

1.1M sf

–

Magelan

Shopping

Centre,

Ukraine

–

1M

sf

–

DIISR,

Australia

–

1M

sf

–

Northland

Centre,

Melbourne

–

481M

–

Mafatlal

Industries,

Mumbai

–

$136M

–

Ayers Rock Resort, Australia

–

$325M

–

Waterfront

Place/Eagle

Street

Pier,

Brisbane

–

$248M

–

Morgan

Stanley,

Tokyo

–

350K

sf

–

Credit Suisse, Singapore

–

300K sf

–

Rialto

Complex,

Melbourne

–

904K

sf

–

Aviva Tower, London

–

£288M

–

Piccadilly

Estates,

London

–

£130M

–

Wells Fargo, Chicago

–

293K sf

–

Twitter, San Francisco

–

215K sf |

Financial Information |

7

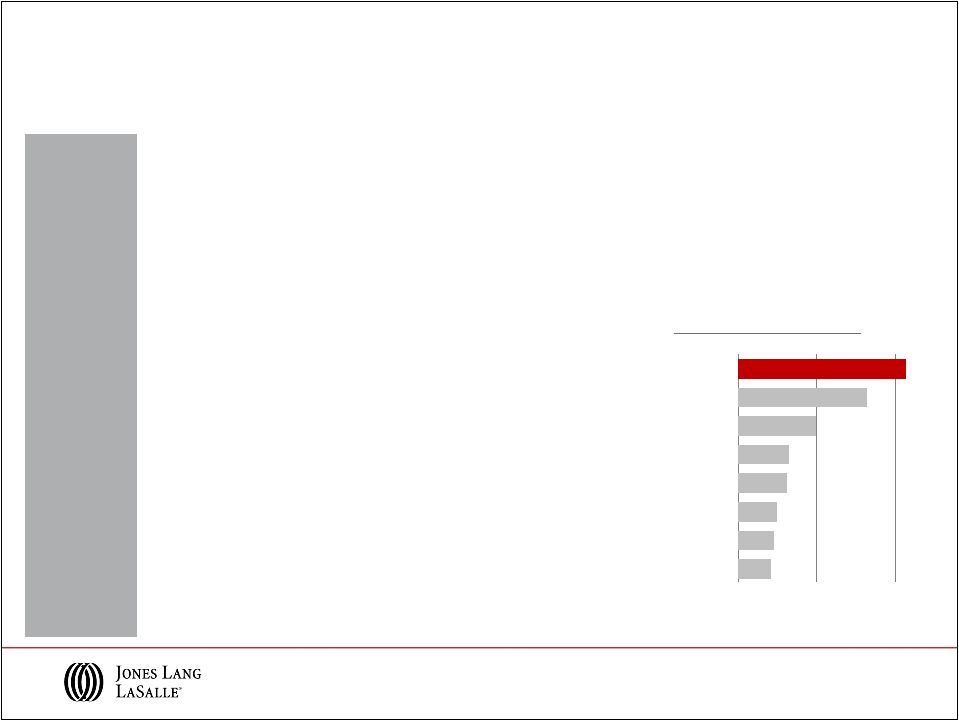

Q2 2011 Revenue Performance

Note: Equity earnings (losses) of $4.2M and ($2.8M) in 2011 and 2010, respectively,

are included in segment results, however, are excluded from Consolidated

totals. Americas

EMEA

Asia Pacific

Consolidated

($ in millions, % change in USD)

LIM

18%

28%

39%

21%

24% |

Asia

Pacific 8

Q2 2011 Real Estate Services Revenue

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$171.7

$31.7

$74.2

$40.8

$28.0

$346.4

13%

122%

19%

6%

(3%)

17%

$60.5

$38.1

$34.4

$46.2

$39.0

$218.2

29%

19%

(2%)

67%

34%

28%

$49.2

$33.8

$88.8

$20.2

$22.4

$214.4

36%

95%

25%

37%

44%

39%

$281.4

$103.6

$197.4

$107.2

$89.4

$779.0

20%

63%

17%

33%

25%

Total RES

Revenue

21%

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). ($ in millions; % change in USD )

|

9

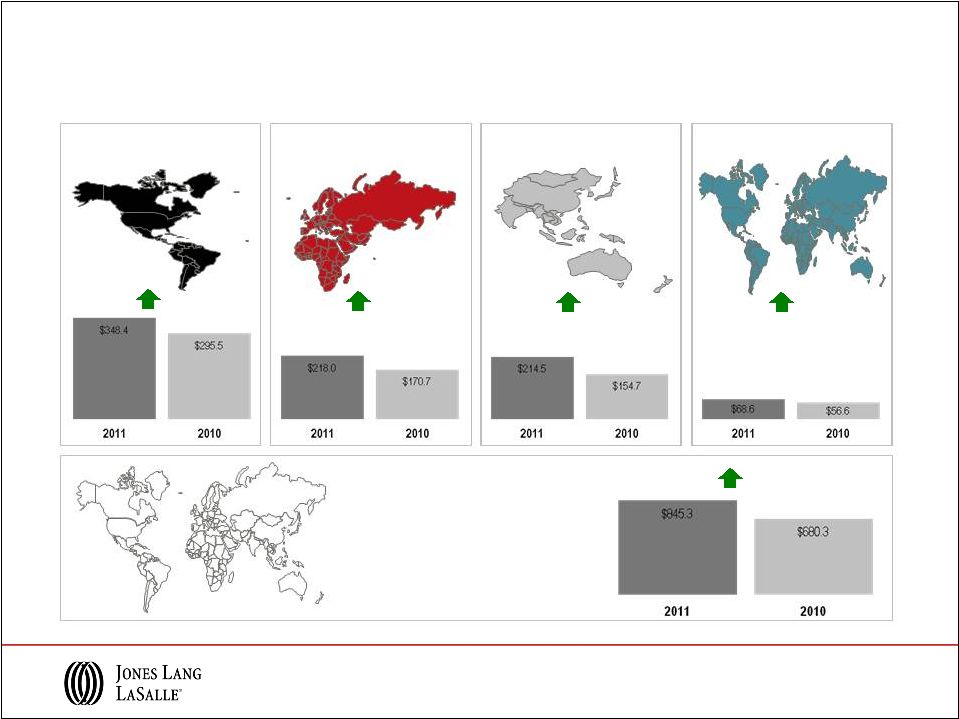

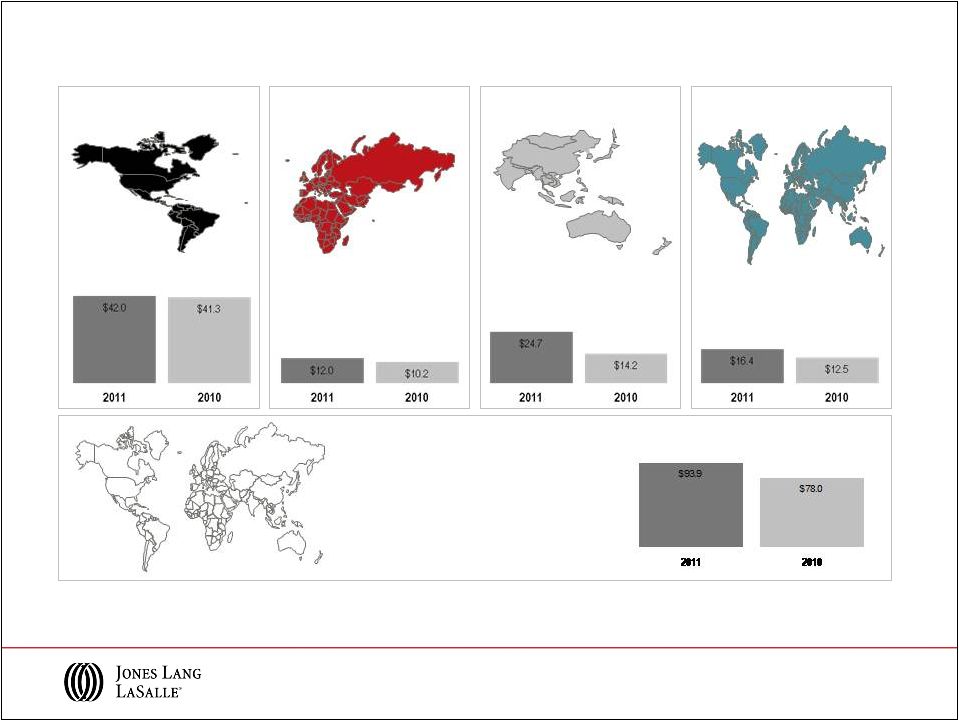

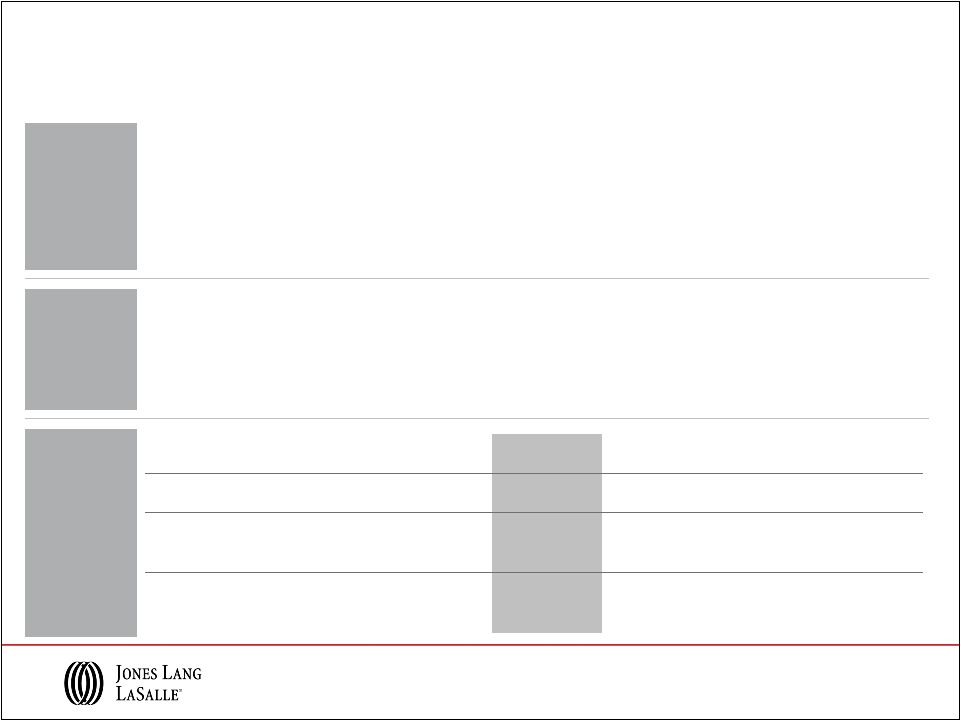

YTD 2011 Revenue Performance

Note: Equity earnings (losses) of $2.1M and ($8.9M) in 2011 and 2010, respectively,

are included in segment results, however, are excluded from Consolidated

totals. Americas

EMEA

Asia Pacific

LIM

$636.5

$523.9

2011

2010

Consolidated

$1,533.2

$1,261.0

2011

2010

22%

($ in millions; % change in USD )

$386.1

$322.2

2011

2010

$379.9

$290.3

2011

2010

$132.8

$115.7

2011

2010

21%

20%

31%

15% |

Asia

Pacific 10

YTD 2011 Real Estate Services Revenue

($ in millions; % change in USD )

Americas

EMEA

Leasing

Capital Markets &

Hotels

Property & Facility

Management

Project &

Development Services

Advisory, Consulting

& Other

Total RES

Operating Revenue

$314.8

$51.5

$141.0

$78.0

$48.6

$633.9

22%

116%

17%

11%

(6%)

21%

$97.6

$66.7

$70.3

$84.6

$67.2

$386.4

14%

15%

1%

58%

22%

20%

$78.8

$51.5

$172.5

$38.3

$38.7

$379.8

28%

52%

24%

51%

26%

31%

$491.2

$169.7

$383.8

$200.9

$154.5

$1,400.1

21%

46%

17%

35%

12%

23%

Total RES

Revenue

Note: Segment and Consolidated Real Estate Services (“RES”) operating

revenue exclude Equity earnings (losses). |

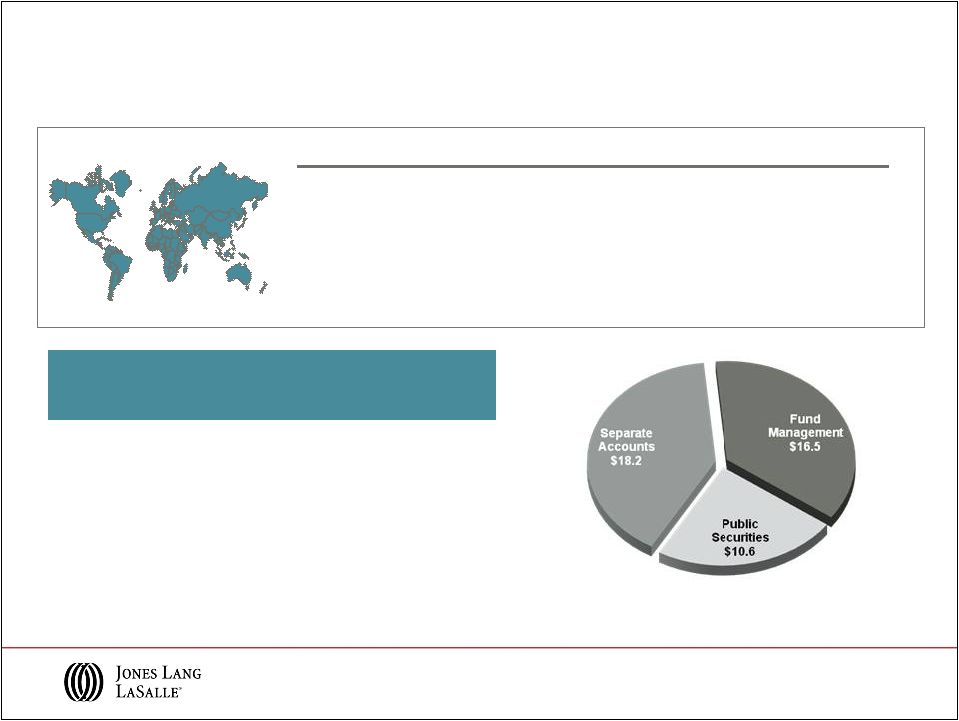

•

$2.3 billion of net new capital commitments in Q2 2011, primarily in

Public Securities

•

$3.8 billion of net new capital commitments raised YTD 2011

•

Announced acquisition of Trinity Funds Management, an Australian

property fund manager with ~$690 million of assets under management

2011 YTD Highlights

Product

Assets Under

Management

($ in billions)

Average

Performance

Private Equity

U.K.

$12.2

Above benchmark

Continental Europe

$4.4

Return: >1x equity

North America

$10.5

Above benchmark

Asia Pacific

$7.6

Return: >1x equity

Public Securities

$10.6

Above benchmark

Total Q2 2011 AUM

$45.3 B

AUM by Fund type

Note: AUM data reported on a one-quarter lag

($ in billions)

11

A premier global investment manager

LaSalle Investment Management |

Solid Cash Flows and Balance Sheet Position

•

Funded King Sturge acquisition on

May 31, 2011

-

Total Purchase Price of ~$319 million;

$160 million paid upfront with

remainder paid over five years

•

Amended $1.1 billion credit facility

-

Pricing reset to LIBOR + 1.625%

-

Maturity extended to June 2016

-

EBITDA add backs for acquisition

related expenses

•

Investment grade ratings:

Standard & Poor’s:

BBB-

(Outlook: Stable)

Moody’s Investor Services:

Baa2

(Outlook:

Stable)

Cash Flows

Q2 2011

YTD

Q2 2010

YTD

Cash from Earnings

$123

$120

Working Capital

(259)

(200)

Cash used in Operations

($136)

($80)

Primary Uses

Capital Expenses

(1)

(36)

(14)

Acquisitions & Deferred Payment Obligations

(235)

(33)

Co-Investment

-

(11)

Dividends

(7)

(4)

Net Cash Outflows

($278)

($62)

Net Share Activity & Other Financing

(6)

(5)

Net Bank Debt (Borrowings) / Repayments

($420)

($147)

Balance Sheet

Q2 2011

Q2 2010

Cash

$96

$55

Short Term Borrowings

45

64

Credit Facility

444

268

Net Bank Debt

$393

$277

Deferred Business Obligations

439

371

Total Net Debt

$832

$648

($ in millions)

(1)

Year-to-date capital expenditures for June 30, 2011 and 2010, net of tenant

improvement allowances received, were $34 million and $12 million,

respectively. Q2 2011 Highlights

12 |

Appendix |

14

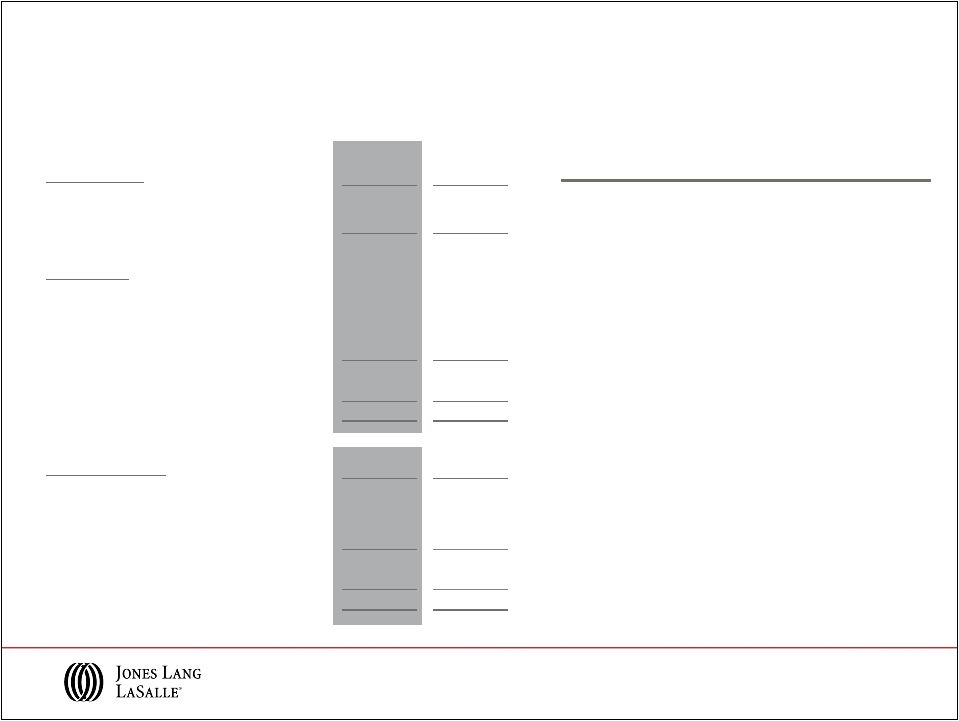

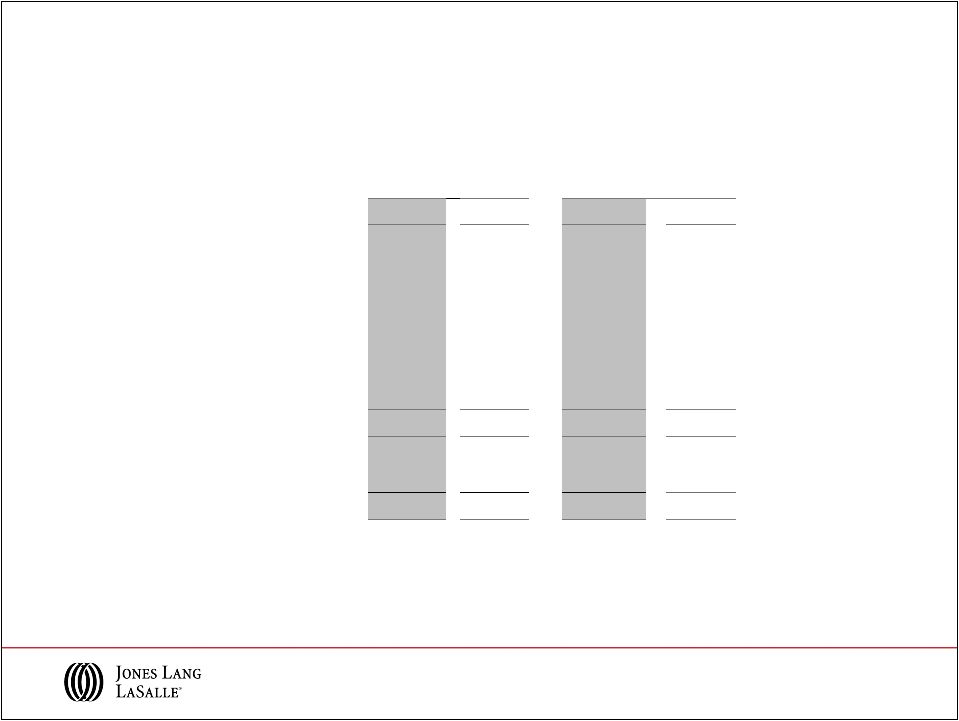

Q2 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

Consolidated

* Refer

to

slide

16

for

Reconciliation

of

GAAP

Net

Income

to

adjusted

EBITDA

for

the

three

months

ended

June

30,

2011,

and

2010,

for

details

relative

to

these

adjusted

EBITDA

calculations. Segment EBITDA is calculated by adding the segment’s Depreciation

and amortization to its reported Operating income, which excludes Restructuring and

acquisition charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four

segments less net income attributable to non-controlling interests and dividends on

unvested common stock.

($ in millions) |

15

YTD 2011 Adjusted EBITDA* Performance

Americas

EMEA

Asia Pacific

LIM

$60.6

$59.3

2011

2010

Consolidated

$122.2

$115.0

2011

2010

* Refer to slide 16 for Reconciliation of GAAP Net Income to adjusted EBITDA for the

six months ended June 30, 2011, and 2010, for details relative to these adjusted EBITDA

calculations. Segment EBITDA is calculated by adding the segment’s Depreciation

and amortization to its reported Operating income, which excludes Restructuring and acquisition

charges. Consolidated adjusted EBITDA is the sum of the EBITDA of the four segments

less net income attributable to non-controlling interest and, dividends on unvested

common stock.

($ in millions)

$3.8

$5.3

2011

2010

$33.1

$22.8

2011

2010

$26.0

$28.1

2011

2010 |

16

($ in millions)

Reconciliation of GAAP Net Income to Adjusted EBITDA

Three Months Ended

June 30,

Six Months Ended

June 30,

2011

2010

2011

2010

Net income attributable to common

shareholders

$43.9

$31.8

$45.3

$32.0

Add:

Interest expense, net of interest income

9.6

12.9

17.5

24.3

Provision for income taxes

15.0

9.6

15.6

9.7

Depreciation and amortization

19.3

17.5

37.7

35.2

EBITDA

$ 87.8

$ 71.8

$ 116.1

$ 101.2

Restructuring and acquisition charges

6.1

4.0

6.1

5.1

Non-cash co-investment charges

-

2.2

-

8.7

Adjusted EBITDA

$ 93.9

$ 78.0

$ 122.2

$ 115.0

|

17

($ in millions)

Reconciliation of GAAP Net Income to Adjusted Net Income

Three Months Ended

June 30,

Six Months Ended

June 30,

2011

2010

2011

2010

GAAP Net income attributable to common

shareholders

$ 43.9

$ 31.8

$ 45.3

$ 32.0

Shares (in 000s)

44,473

44,250

44,391

44,085

GAAP earnings per share

$ 0.99

$ 0.72

$ 1.02

$ 0.73

GAAP Net income attributable to common

shareholders

$ 43.9

$ 31.8

$ 45.3

$ 32.0

Restructuring and acquisition charges, net

4.6

3.1

4.6

3.9

Intangible amortization, net

1.2

-

1.2

-

Non-cash co-investment charges, net

-

1.7

-

6.7

Adjusted net income

$ 49.7

$ 36.6

$ 51.1

$ 42.6

Shares (in 000s)

44,473

44,250

44,391

44,085

Adjusted earnings per share

$ 1.12

$ 0.83

$ 1.15

$ 0.97 |

•

Strengthens JLL’s leading position in both the UK and EMEA markets

-

London

is

a

mature

and

highly

transparent

market;

#1

destination

of

international

capital

the

last

two years

•

Complementary service offerings; each firm brings important strengths

-

Clients benefit from powerful combined Capital

Markets team with access to JLL’s global platform

-

Depth and scale added to services including

industrial, global logistics, and retail

-

King Sturge’s Advisory and Property Management

businesses complement JLL and increase

EMEA’s resiliency to economic cycles

-

King Sturge's strong high-end London residential

platform gains access to JLL's market leading

Asian network

Source: PropertyEU Research, PropertyEU Magazine May 2011

Based on European investment transactions in excess of €20 million in 2010.

Strategic

Rationale

-

King Sturge was Property Week’s U.K. Investment Agency of the Year; Jones Lang

LaSalle was Property Week’s U.K. Office Agent of the Year

4.2

4.6

4.9

6.2

6.4

9.8

16.4

21.4

€ 0

€ 10

€ 20

Jones Lang LaSalle /

King Sturge

CB Richard Ellis

Cushman & Wakefield

Savills

Catela Property Group

Colliers International

BNP Paribas

DTZ

European Investment Volume

(€

in billions)

18

Local and Regional Services

King Sturge secures market leadership |

•

JLL and King Sturge merged operations on May 31, 2011

•

Purchase price £197 million ($319 million) with a five-year deferred payment

structure •

Operating margins, ex-transaction related charges, strongly accretive to the

higher end of JLL EMEA’s medium-term Operating Income Margin target of

8-10% Transaction

Highlights

Note: Assumes GBP/USD conversion rate of 1.62

King Sturge

Overview

•

King Sturge is a market-leading London-based mixed property services

business -

Over 85 partners and approximately 1,600 employees, over 1,300 U.K. based

•

Client focused, strong team ethic and highly respected in the market

•

Annual revenue approximately £160 million ($259 million)

-

U.K. revenue over 85%

19

King Sturge Overview

A merger of equals in EMEA

Total Forecast

Q2 2011

Approximate Timing

Integration Expense

$25 million

$3 million

Majority in the first 12 months

Retention Cost

$25 million

$3 million

2/3 in the first twelve months;

1/3 in the following twelve months

Intangible Amortization

$32 million

$2 million

$15 million in the first 12 months;

$2 million/ year thereafter

Anticipated

Transaction

Costs |