Attached files

| file | filename |

|---|---|

| 8-K - 8-K - ACCURIDE CORP | acw11-8kq2.htm |

| EX-99.1 - 99.1 PRESS RELEASE, DATED JULY 26, 2011, ENTITLED ?ACCURIDE CORPORATION REPORTS SECOND QUARTER RESULTS FOR 2011?. - ACCURIDE CORP | acw11-99d1.htm |

Page | 1

Second Quarter 2011

Earnings Call

Earnings Call

Page | 2

Statements contained in this news release that are not purely historical are forward-

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2009. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

looking statements within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,

including statements regarding Accuride’s expectations, hopes, beliefs and

intentions with respect to future results. Such statements are subject to the impact

on Accuride’s business and prospects generally of, among other factors, market

demand in the commercial vehicle industry, general economic, business and

financing conditions, labor relations, governmental action, competitor pricing activity,

expense volatility and other risks detailed from time to time in Accuride’s Securities

and Exchange Commission filings, including those described in Item 1A of

Accuride’s Annual Report on Form 10-K for the fiscal year ended December 31,

2009. Any forward-looking statement reflects only Accuride’s belief at the time the

statement is made. Although Accuride believes that the expectations reflected in

these forward-looking statements are reasonable, it cannot guarantee its future

results, levels of activity, performance or achievements. Except as required by law,

Accuride undertakes no obligation to update any forward-looking statements to

reflect events or developments after the date of this news release.

Forward Looking Statements

Page | 3

Second Quarter 2011 Earnings

Ø Opening Comments

• CEO Update

• Industry Highlights

• Focused Priorities

Ø Financial Information

• Second Quarter Results

• 2011 Outlook

Ø Q&A

Ø Closing Comments

Rick Dauch

President & CEO

Jim Woodward

Senior Vice President &

Chief Financial Officer

Chief Financial Officer

Rick Dauch

Jim Woodward

Rick Dauch

Page | 4

Page | 5

Quarter Highlights

Opportunities / Good Things

• Strong customer volumes: Class 8, Trailer, Improving 5-7

• Acquisition of Camden operation

• Completion of raw material “pass through” agreements for 2011

• CEO orientation complete:

• Core vs. non-core analysis complete - activity underway

• Gunite turnaround plan developed & initiated

• North American wheel capacity / CAPEX analysis complete

• Gunite AM price increases: AM + 16%; OEM in negotiations

• Critical leadership team and skill-set additions

Challenges / Bad Things

• Continued rise in raw materials:

• Steel: up 25% vs. prior year

• Aluminum: up 13% vs. prior year

• Gunite demand continues to exceed current machining capacity

Page | 6

Page | 7

Source: Cass Freight &Ceridian-UCLA Pulse of Commerce Index

• June expenditures up 26%

year-over-year

year-over-year

• June shipments up 5.3%

year-over-year

year-over-year

• Positive freight movement

trend continues

trend continues

Increasing Freight & Utilization

• Diesel fuel consumption

increased 2.0% year-

over-year in June

increased 2.0% year-

over-year in June

• Higher fleet utilization

is driving replacement

demand

is driving replacement

demand

Page | 8

• More loads needing to

be hauled than trucks

available

be hauled than trucks

available

• Current level is

approximately 3 loads

per 1 truck

approximately 3 loads

per 1 truck

• Industry experts

expect capacity to

remain tight

expect capacity to

remain tight

Source: TransCore, FTR & ACT

Freight & Truck Demand

• Capacity is anticipated

to remain tight

to remain tight

• Increased truckload

profitability allows

fleets to invest in new

equipment

profitability allows

fleets to invest in new

equipment

Page | 9

• Price gap between

new & used trucks

continues to shrink

new & used trucks

continues to shrink

• Used truck

inventories remain

tight

inventories remain

tight

Source: ACT, FTR, Transport Fundamentals & Transport Capital Partners, LLC

Used Truck Market

• Financing is only

challenging for high

risk fleets

challenging for high

risk fleets

• Credit availability is

expected to continue

to improve

expected to continue

to improve

• Capital is available;

lenders are being

selective

lenders are being

selective

Page | 10

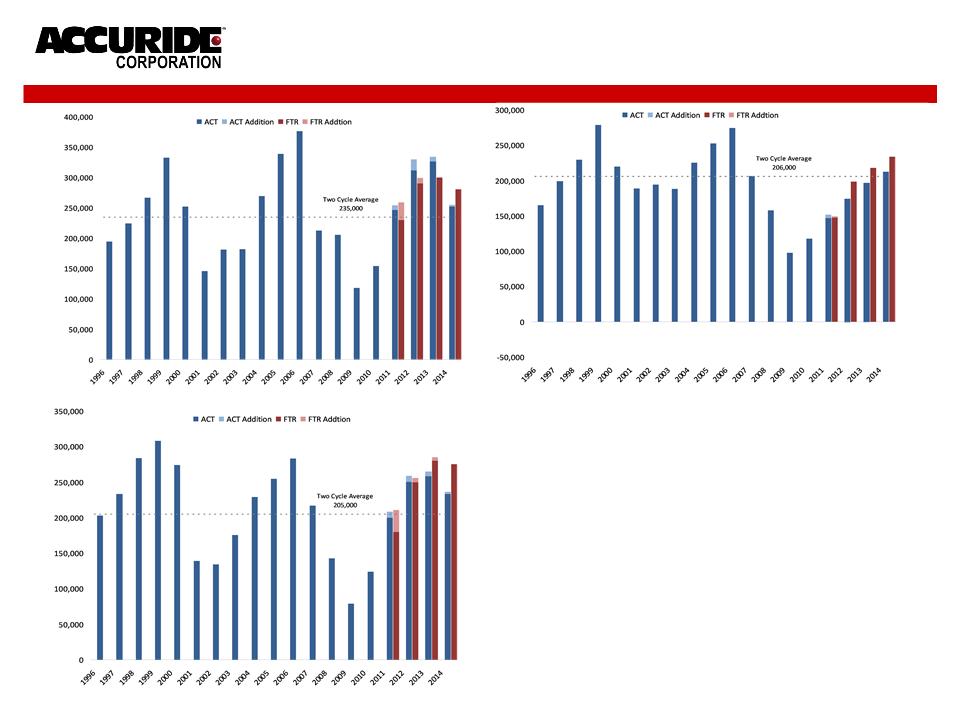

Source: ACT & FTR

Build Levels

• Class 8 continues to strengthen

• Recovery in the medium-duty

segment of the market is 18 to 24

months behind

segment of the market is 18 to 24

months behind

• Trailer builds remain strong

Page | 11

Raw Material Trends

Page | 12

Raw Material Recovery / Pricing

§ Our existing mechanisms are working and will pass through the higher raw

material costs experienced in the first half of the year to our customers.

material costs experienced in the first half of the year to our customers.

§ Negotiations are underway with OEM customers for non-material price increases

on our Gunite product; material increases are being passed through

on our Gunite product; material increases are being passed through

§ Changes in raw material costs (increases or decreases) are passed through to

customers using a three to six month lag.

customers using a three to six month lag.

|

Business Unit

|

OEM

|

Aftermarket

|

|

Steel Wheels

|

|

|

|

Aluminum Wheels

|

|

|

|

Gunite

|

|

|

|

Brillion

|

|

|

|

Imperial

|

|

|

|

Fabco

|

|

|

ü

ü

ü

ü

ü

ü

ü

ü

ü

ü

ü

ü

Page | 13

Page | 14

Strategic Objectives

Ø #1-2 globally in wheel-end systems

Ø ROIC > 20% through a cycle

Ø >80% of products from CORE products

Ø Balanced geographical revenues:

• 40% North America

• 30% Asia

• 20% Europe

• 10% South America

Ø >95% retention of personnel

Ø Maximize ACW share price

Share

Price

Grow Globally

Create a Competitive

Cost Structure &

LEAN Operating Culture

Divest Non-Core Assets

Fix Core Business & Operations

Customer Centric, Technology Leadership

Ethical People, Selfless Leaders, Team Oriented

Accuride Vision: Accuride will be the premier supplier of wheel-end system

solutions to the global commercial vehicle industry

solutions to the global commercial vehicle industry

Page | 15

Fix & Grow Accuride

“Fix” (6-12 months):

• Invest to catch up

• Clean and organize

• Close or fix uncompetitive operations

• Rationalize / consolidate capacity

• Divest non-core assets

• Reassign, release, reduce

• Upgrade from outside

• Standardize

• Understand LEAN

“Grow” (12-18 months):

• Invest to leapfrog

• World class standards

• Open new facilities

• Build and expand

• Acquire “core” assets

• Add and expand

• Promote from within

• Benchmark

• Operate LEAN

Page | 16

Top Five Priorities

1. Strengthen Organization

2. Fix Gunite Business

3. Improve Steel Wheel Business

4. Grow Aluminum Wheel Business

5. Pursue Strategic Opportunities

Page | 17

• Fill critical staffing gaps:

• Technical (Product, Process Engineering)

• Quality Leadership

• Operations (Plant Staff, Supply Chain)

• Change structure to create P&L focus, accountability:

• Wheels, Gunite & Brillion, Imperial, Fabco

• Direct reporting responsibility of Functional Support Staff

• Streamline Sales & Marketing:

• Added aftermarket resources

• Cleaner reporting structure

• Establish leadership development program:

• Grow next generation of leaders

• More P&L focus and developmental assignments

Priority 1: Strengthen Organization

Page | 18

Action Plan to Fix Gunite

Near Term

(<3-6 months)

|

• Aftermarket and OE price increases are in place

• OEM non-material price increases - in negotiations

• Additional price adjustments will be made as raw material prices warrant

|

|

• Stabilize & upgrade organization and leadership team

• Improve daily & weekly operational throughput

• Fix scheduling & quality systems

• Critical CAPEX to repair or replace key process equipment ($6.8M)

|

|

• Major CAPEX to establish adequate capacity for drum machining & slack

adjuster assembly ($20 -$25M) • Consolidation of machining operations from three to one manufacturing location

|

|

• Explore strategic options for casting

• Significant product R&D initiatives underway:

• Development of Air-Disc Brake components and systems

• Aluminum and Austempered Ductile Hubs

• Add capacity in Mexico

|

Mid-Term

(12-18 months)

Long Term

(>18 months)

Priority 2: Fix Gunite Business

Pricing

(Ongoing)

Gunite = >25% revenue and is a CORE business at Accuride

and will be competitive and profitable in 2012

Page | 19

Current State

• Money losing operation

• Customer Demand > Capacity > Operational Capability:

• Machining operations are a major bottleneck

• Flawed launch of new equipment at Rockford (2009-2010)

• Dysfunctional scheduling system across 3 operating sites

• Quality system improvements needed

• Poor operational leadership and performance:

• Excess labor / overtime

• Excess scrap, tooling

• Excess freight

• Inadequate CAPEX investment over 20-30 years

Priority 2: Fix Gunite Business

Future State

|

Machining

|

$ 9.0

|

$21.0

|

TBD

|

|

Foundry/Other

|

3.0

|

4.5

|

TBD

|

|

Total

|

$12.0

|

$26.0

|

TBD

|

Note: Investment in millions

Adjusted EBITDA

Note: Does not include corporate charges

Page | 20

Priority 3: Improve Steel Wheel Business

“Re-deploy and Renew”

• Consolidate from 3 to 2 NAFTA heavy truck steel wheel

plants

plants

• Convert Canada to a competitive light wheel only facility or close

operation

operation

• Re-deploy commercial heavy truck process equipment to

Henderson and Monterrey facilities

Henderson and Monterrey facilities

• CAPEX investment of $10-20M over the next 2-3 years to:

• Upgrade Monterrey facility and process capability

• Invest in new technology to ensure state of the art

manufacturing in all processes (i.e. coatings, welding)

manufacturing in all processes (i.e. coatings, welding)

• Implement LEAN manufacturing system (2011-13)

Page | 21

Priority 4: Grow Aluminum Wheel Business

“Expand and Grow”

• Execute Phase 1 capacity expansion:

• Line 4 Launch in Mexico (2Q11) - complete

• New Mega-Line at Erie (3Q11) - on schedule

• Acquire, integrate and expand Camden, SC operation to increase

aluminum wheel capacity (1Q 2012) - on schedule

aluminum wheel capacity (1Q 2012) - on schedule

• Exploring additional capacity expansion in Mexico:

• Machining capacity (2012)

• Expand plant and add forging capacity (2013 - 2014)

• Gain market share:

• NA: Truck & trailer manufacturers

• MX: Truck & trailer manufacturers, Brazil

• Expand globally through strategic activity (Asia, Europe)

Page | 22

Ø Accuride has executed on a series of strategic maneuvers to focus on its core operations, which

will strengthen its long-term growth prospects and enhance its ability to serve the leading

commercial vehicle OEMs

will strengthen its long-term growth prospects and enhance its ability to serve the leading

commercial vehicle OEMs

|

Ø November 2010 - Announced the sale of Brillion Farm Equipment division to Landoll Corporation

Ø Brillion Farm Equipment manufactures a full line of tillage, seedbed preparation and seeding equipments

made to be durable, long lasting and productive in a wide range of environments Ø Accuride originally acquired the business as a part of its 2005 purchase of Transportation Technologies

Ø The divestiture is in direct support of Accuride’s strategic focus on the commercial vehicle market

|

|

|

Ø January 2011 - Announced the sale of Bostrom Seating division to CVGI

Ø Bostrom manufactures a full line of seats for the heavy truck market. It’s products are sold to original

equipment manufactures and to aftermarket distributors. Ø Accuride originally acquired the business as a part of its 2005 purchase of Transportation Technologies

Ø The divestiture is in direct support of Accuride’s strategic focus on core products

|

|

|

|

|

Divested

Bostrom

Seating

Acquired

Forgitron

Divested

Brillion Farm

Equipment

Equipment

Additional

Actions

Priority 5: Pursue Strategic Opportunities

Ø Provides manufacturing flexibility & opportunity to optimize aluminum wheel production

Ø Non-union facility located in the southeastern US

Ø Facility is close to several OEM assembly plants

Ø Operations were modified over the past 30 days & are now producing Accuride quality

product

product

Ø Plant #1 in Portland, TN will be consolidated to our

TX & VA plants by year end 2011 moving us closer to

our key customers & optimizing capacity & logistics

TX & VA plants by year end 2011 moving us closer to

our key customers & optimizing capacity & logistics

Ø Core metal Bumper production processes will be

consolidated at our TN chrome plating operation

(owned facility) by 2011 year end

consolidated at our TN chrome plating operation

(owned facility) by 2011 year end

Ø Transfer heavy duty wheel capacity from our

London, Ontario facility to our Monterrey, Mexico

facility as demand continues to shift to Mexico and

the Southwestern United States

London, Ontario facility to our Monterrey, Mexico

facility as demand continues to shift to Mexico and

the Southwestern United States

Page | 23

Page | 24

Summary Income Statement

Page | 25

Segment Reporting

Page | 26

Net Sales & Adjusted EBITDA

Page | 27

Trade Working Capital

Page | 28

Customer Receivables - Net

Page | 29

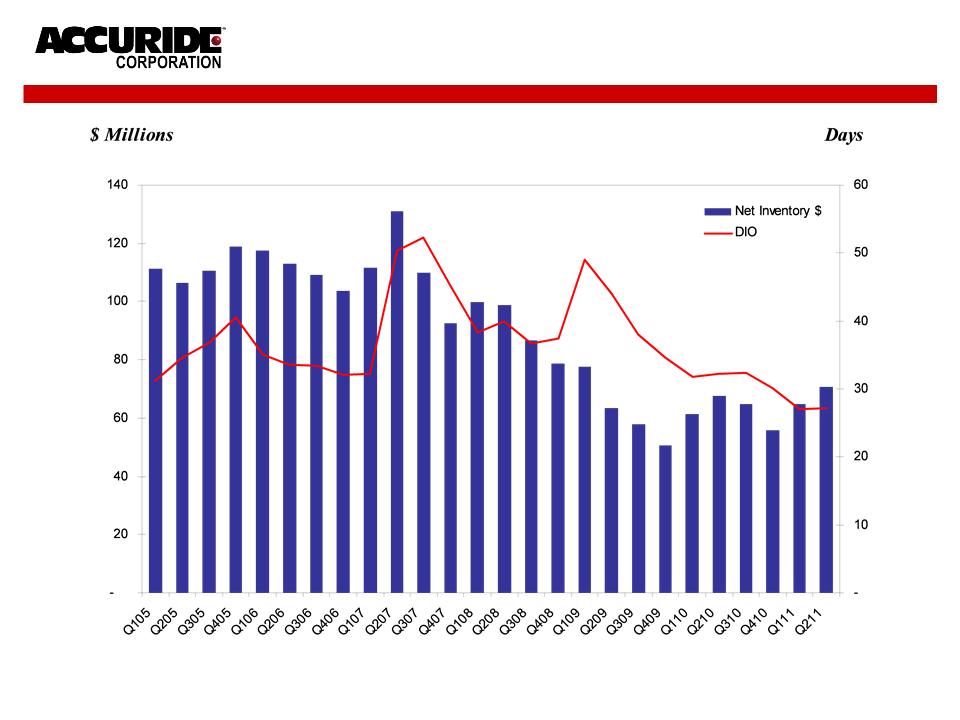

Inventories - Net

Page | 30

Accounts Payable

Page | 31

Net Income To EBITDA Reconciliation

Page | 32

Free Cash Flow

Page | 33

Net Debt & Liquidity

Page | 34

Summary Income Statement

Page | 35

Full Year Guidance

Net Sales $950.0 to $1,000.0

Adjusted EBITDA $110.0 to $115.0

EPS - Diluted $0.40 to $0.50

Depreciation & Amortization $50.0

Capital Expenditures $67.0

Cash Interest Expense $30.0

Excess Pension Contributions $15.0

Trade Working Capital Use of Cash $15.0

Tax Rate for Book 15%

Free Cash Flow ($17.0) to ($12.0)

Page | 36

• Focus on fixing our “core” assets:

• Accuride Wheels, Gunite

• Operational excellence - manufacturing & supply chain

• Make strategic investments:

• Organizational skill set improvements

• CAPEX - process capability, capacity footprint

• Research & Development - future products

• 100% commitment to:

• Fix what is not working today

• Divest non-core assets

• Expand globally to support our customers’ needs

• Southern US and Mexico

• Asia

• South America

• Europe

Summary

Page | 37

Page | 38

Page | 39

Segment EBITDA Reconciliation