Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - People's United Financial, Inc. | d8k.htm |

| EX-99.1 - EARNINGS PRESS RELEASE - People's United Financial, Inc. | dex991.htm |

EXHIBIT 99.2

Investor Presentation dated July 21, 2011

2nd

Quarter 2011 Earnings Conference Call July 21, 2011

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************

************************ |

1

Certain statements contained in this release are forward-looking in nature. These include all

statements about People's United Financial's plans, objectives, expectations and other

statements that are not historical facts, and usually use words such as "expect,"

"anticipate," "believe" and similar expressions. Such statements represent

management's current beliefs, based upon information available at the time the statements are

made, with regard to the matters addressed. All forward-looking statements are subject to

risks and uncertainties that could cause People's United Financial's actual results or financial condition

to differ materially from those expressed in or implied by such statements. Factors of particular

importance to People’s United Financial include, but are not limited to: (1) changes in

general, national or regional economic conditions; (2) changes in interest rates; (3) changes

in loan default and charge-off rates; (4) changes in deposit levels; (5) changes in levels

of income and expense in non-interest income and expense related activities; (6)

residential mortgage and secondary market activity; (7) changes in accounting and regulatory

guidance applicable to banks; (8) price levels and conditions in the public securities markets

generally; (9) competition and its effect on pricing, spending, third-party relationships

and revenues; (10) the successful integration of acquired companies; and (11) possible changes in

regulation resulting from or relating to recently enacted financial reform legislation.

People's United Financial does not undertake any obligation to update or revise any

forward-looking statements, whether as a result of new information, future events or

otherwise. Forward Looking Statement |

2

Second Quarter 2011 Results

Overview

Operating income of $57.3 million or $0.17 per share

Net interest margin of 4.13%; down 3 bps from 1Q 2011

Total loan growth of $164MM, 3.7% annualized

Total deposit growth of $168MM, 3.7% annualized

Operating efficiency ratio improved to 65.7% from 66.2% in 1Q 2011

NPAs

as a percentage of originated loans, REO and repossessed

assets increased to 2.05% up from 1.96% in 1Q 2011 as a result of a

single credit |

3

Danvers Bancorp transaction closed June 30

th

, effective July 1

st

. With

the transaction’s close, Kevin Bottomley has joined our Board of

Directors

Successfully completed Smithtown conversion the weekend of June

17

th

, which will result in run-rate cost reductions of $3MM

Announced $20MM in run-rate franchise-wide cost savings initiatives

Announced the expansion of asset-based lending with the closing of

the Danvers transaction. This unit will be led by Michael Maiorino,

who joined us earlier this month

In July, we announced the opening of 3 new Massachusetts branches

(2 in Boston, 1 in Lexington) and a new Connecticut branch

(New Fairfield)

Recent Initiatives |

4

0.02%

0.04%

0.03%

0.04%

(0.16%)

4.13%

4.16%

1Q 2011 Margin

1Q Accretable

Yield

Reassessment

2Q Accretable

Yield

Reassessment

Loan Yield &

Mix

Investment

Yield & Mix

Deposit/

Borrowing

Rates

2Q 2011 Margin

Total Impact of Decreased Loan Yields: (0.09%)

Net Interest Margin

Linked Quarter Change |

5

Net Interest Margin* (%)

Last Five Quarters

5

3.69

3.74

3.87

4.00

4.09

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

* Excluding the impact of accretable

yield reassessments |

6

Loans

Linked Quarter Change

(in $ millions)

6

Annualized

Linked Quarter Change:

18.7%

9.3%

(43.1%)

Originated Annualized

Linked Quarter Change:

12.2%

Total Annualized

Linked Quarter Change:

3.7%

17,687

(288)

239

213

17,523

Mar 31, 2011

Retail

Commercial

Banking

Acquired

Jun 30, 2011 |

7

Deposits

Linked Quarter Change

(in $ millions)

7

Annualized

Linked Quarter Change:

50.3%

(4.9%)

Total Annualized

Linked Quarter Change:

3.7%

3.7%

(30)

56

142

18,278

18,110

Mar 31, 2011

Legacy

De Novo

Acquired

Jun 30, 2011 |

8

Non-Interest Income

1.7

(1.3)

(2.0)

1.7

1.9

76.6

74.6

1Q 2011

Bank Service

Charges

Gain on

Smithtown Loan

Sales

Gain on

Residential Loan

Sales

Insurance

Other

2Q 2011 |

9

Non-Interest Expense

Non-operating

increase from 1Q

202.8

3.3

2.8

(2.9)

(2.2)

1.5

1.7

207.0

1Q 2011

Merger

Related

Executive

Separation

Comp &

benefits

Occupancy &

Equipment

Professional &

Outside Svc

Other

2Q 2011 |

10

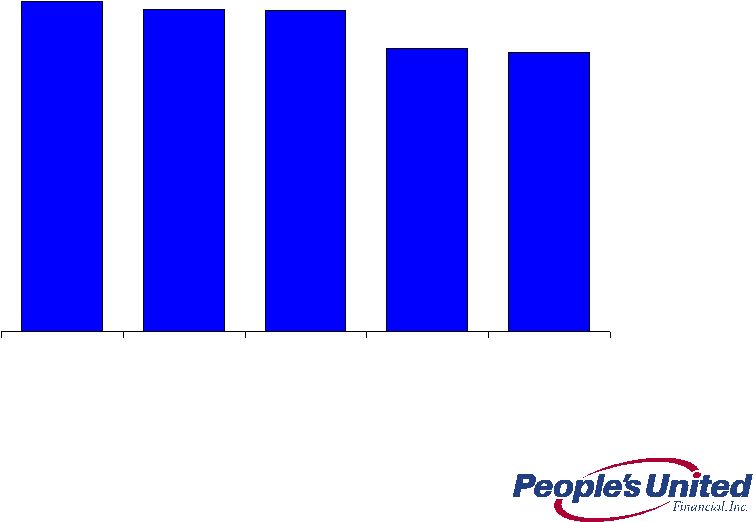

Efficiency Ratio (%)

Last Five Quarters

10

72.2%

71.2%

71.1%

66.2%

65.7%

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011 |

11

Last Five Quarters

2.05

1.96

3.34

3.61

0.00

1.00

2.00

3.00

4.00

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

PBCT

Peer Group Median

Top 50 Banks by Assets

Asset Quality

NPAs / Loans & REO* (%)

*

Non-performing

assets

(excluding

acquired

non-performing

loans)

as

a

percentage

of

originated

loans

plus

all

REO

and

repossessed

assets;

acquired

non-performing

loans

excluded

as

risk

of

loss

has

been

considered

by

virtue

of

our

estimate

of

acquisition-date fair value and/or the existence of an FDIC loss sharing

agreement Source: SNL Financial and Company filings

|

12

Last Five Quarters

0.35

0.22

1.02

1.41

0.00

0.50

1.00

1.50

2.00

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

PBCT

Peer Group Mean

Top 50 Banks

Asset Quality

Net Charge-Offs / Avg. Loans (%)

Source: SNL Financial and Company filings |

13

Acquired Smithtown Portfolio

Workout Progress

(in $ millions)

Non-Performing Loans at Closing (11/30/2010)

$268.7

New Non-Performing Loans

130.4

Sales, Settlements & Payoffs

(125.3)

Charge-Offs

(74.9)

Return to Accrual

(20.4)

Paydowns

(9.4)

Non-Performing Loans as of June 30, 2011

$169.1

Remaining

Non-Accretable

Difference

(credit

mark)

$296.6 |

14

Allowance for Loan Losses

Originated Portfolio Coverage Detail

(in $ millions)

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Commercial

Banking

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Retail Banking

Commercial ALLL -

$163.9 million

91% of Commercial NPLs

Retail ALLL -

$12.1 million

15% of Retail NPLs

Total ALLL -

$176.0 million

68% of Total NPLs

0.00%

0.50%

1.00%

1.50%

2.00%

NPLs:Loans

ALLL:Loans

Total |

15

Operating ROAA Progress

Last Five Quarters

0.58

0.50

0.64

0.87

0.92

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011 |

16

Loans

Deposits

Growing Future Earnings Per Share

Loans and Deposits per Share

* Pro forma for FIF acquisition

* *Pro forma for SMTB & LSBX acquisitions

**

*Pro

forma

for

DNBK

acquisition

$12.0

$14.0

$16.0

$18.0

$20.0

$22.0

2009Q2

2009Q4*

2010Q2**

2010Q4***

2010Q2***

$40.00

$42.50

$45.00

$47.50

$50.00

$52.50

$55.00

$57.50

Deposits ($Bn)

Deposits per share

$12.5

$14.0

$15.5

$17.0

$18.5

$20.0

2009Q2

2009Q4*

2010Q2**

2010Q4***

2011Q2***

$35.00

$40.00

$45.00

$50.00

$55.00

Gross Loans ($Bn)

Loans per share |

17

Summary

Premium brand built over 169 years

High quality Northeast footprint characterized by wealth, density and

commercial activity

Strengthened leadership team

Low cost of deposits

Strong net interest margin

Superior asset quality

Focus on relationship-based banking

Growing

loans

and

deposits

within

footprint

-

in

two

of

the

largest

MSAs

in

the country (New York City, #1 and Boston, #10)

Significantly more asset sensitive than peers

Pro forma tangible common equity ratio of 13% (with Danvers)

Sustainable Competitive Advantage |

| Q & A

****************************************

****************************************

****************************************

****************************************

****************************************

***************************************

************************

************************

************************

************************

************************

************************

************************

************************ |

| Appendix

************************

************************

************************

************************

************************

************************

************************ |

20

Acquired Loan Portfolio

Actual Credit Experience vs. Expectations

Acquired loans initially recorded at fair value (inclusive of related credit mark)

without carryover of historical ALLL

Accounting model is cash-flow based:

Contractual

cash flows (principal & interest) less Expected

cash flows

(principal &

interest)

=

non-accretable

difference

(utilized

to

absorb

actual

portfolio

losses)

Expected

cash

flows

(principal

&

interest)

less

fair

value

=

accretable

yield

Cash flows are both acquisition and pool specific

Expected cash flows are regularly reassessed and compared to actual cash

collections Better

than

expected

credit

experience

results

in

reclass

of

non-accretable

difference

to

accretable yield (prospective yield adjustment over the life of the loans)

As of 6/30/2011

(in $ millions)

Carrying

Amount

Remaining

Accretable

Yield

Remaining

Non-Accretable

Difference

NPLs

a

Remaining

Non-Accretable

Difference/NPLs

Charge-offs

Incurred Since

Acquisition

FinFed (2/18/10)

$485.4

$53.7

$21.1

$55.5

38.0%

$9.8

Butler (4/16/10)

88.3

28.3

30.6

16.2

188.9%

3.3

RiverBank (11/30/10)

454.2

117.1

15.0

9.6

156.3%

1.8

Smithtown (11/30/10)

b

1,359.3

702.7

296.6

169.1

175.4%

81.1

Total

$2,387.2

$901.8

$363.3

$250.4

(a)

Represent contractual amounts; loans meet People’s United Financial’s

definition of a non-performing loan but are not subject to

classification as non-accrual in the same manner as originated loans. Rather, these loans are considered to be accruing

loans

because

their

interest

income

relates

to

the

accretable

yield

recognized

at

the

pool

level

and

not

to

contractual

interest

payments at the loan level.

(b)

Smithtown charge-offs include $8.2M and $17.7M incurred upon sale of acquired

loans in Q211 and Q111, respectively. |

21

Capital Ratios

2Q 2010

3Q 2010

4Q 2010

1Q 2011

2Q 2011

2Q 2011

Pro Forma

PEOPLE’S UNITED FINANCIAL

Tang. Com. Equity/Tang. Assets

18.0%

17.8%

14.1%

13.9%

13.9%

13.0%

Leverage Ratio

2, 6

18.2%

18.0%

14.5%

14.6%

14.3%

13.1%

Tier

1

Common

3

22.1%

22.3%

17.0%

17.2%

17.0%

15.5%

Tier 1 Risk-Based Capital

4, 6

22.5%

22.7%

17.5%

17.7%

17.6%

16.2%

Total Risk-Based Capital

5, 6

23.4%

23.6%

19.3%

19.4%

19.1%

17.6%

PEOPLE’S UNITED BANK

Leverage Ratio

2, 6

12.8%

13.0%

11.4%

11.5%

11.6%

10.3%

Tier 1 Risk-Based Capital

4, 6

15.7%

15.4%

13.6%

13.9%

14.2%

12.8%

Total Risk-Based Capital

5, 6

16.6%

16.4%

14.5%

14.8%

15.0%

13.6%

Notes:

1.

Pro forma for Danvers acquisition

2.

Leverage

(core)

Capital

represents

Tier

1

Capital

(total

stockholder’s

equity,

excluding:

(i)

after-tax

net

unrealized

gains

(losses)

on

certain

securities

classified

as

available

for

sale;

(ii)

goodwill

and

other

acquisition-related

intangibles;

and

(iii)

the

amount

recorded

in

accumulated

other

comprehensive

income

(loss)

relating

to

pension

and

other

postretirement benefits), divided by Adjusted Total Assets (period end total assets

less goodwill and other acquisition-related intangibles) 3.

Tier 1 Common represents total stockholder’s equity, excluding goodwill and

other acquisition-related intangibles, divided by Total Risk-Weighted Assets

4.

Tier 1 Risk-Based Capital represents Tier 1 Capital divided by Total

Risk-Weighted Assets 5.

Total

Risk-Based

Capital

represents

Tier

1

Capital

plus

subordinated

notes

and

debentures,

up

to

certain

limits,

and

the

allowance

for

loan

losses,

up

to

1.25%

of

total

risk

weighted assets, divided by Total Risk-Weighted Assets

6.

Well capitalized limits for the Bank are: Leverage Ratio, 5%; Tier 1 Risk-Based

Capital, 6%; and Total Risk Based Capital, 10%. |

22

We do not expect short-term interest rates to rise in 2011, however, we do expect

Fed tightening to begin in 2012

Given short-term interest rates are very low and are expected to remain low for

the near term, we have continued to hold securities

For

Q1

2011

we

were

4.5x

–

5.0x

as

asset

sensitive

as

the

estimated

median

of

our

peers

depending on scenario

For an immediate parallel increase of 100bps, our net interest income is projected to

increase by ~$40MM on an annualized basis

Yield curve twist scenarios confirm that we are reasonably well protected from bull

flattener (short rates are unchanged, long rates fall) and benefit

considerably from bear flattener environments (short rates rise, long rates

are unchanged) Notes:

1.

Analysis is as of 3/31/11 filings

2.

Data as of 3/31/11 SEC filings, where exact +100bps shock up scenario data was not

provided PBCT interpolated based on data disclosed 3.

Data as of 3/31/11 filings, where exact +200bps shock up scenario data was

not provided PBCT interpolated based on data disclosed Current Asset

Sensitivity Net

Interest

Income

at

Risk

1

Analysis involves PBCT estimates, see notes below

Change in Net Interest Income

Scenario

Lowest

Amongst Peers

Highest

Amongst Peers

Peer Median

PBCT Multiple to

Peer Median

Shock Up

100bps ²

-0.6%

5.6%

0.9%

5.0x

Shock Up

200bps ³

-0.1%

11.2%

2.5%

4.5x |

For

more information, investors may contact: Peter Goulding, CFA

203-338-6799

peter.goulding@peoples.com

************************

************************

************************

************************

************************

***********************

******* |