Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF GRANT THORNTON LLP - Great White Energy Services, Inc. | dex231.htm |

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on July 19, 2011

Registration No. 333-172174

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Great White Energy Services, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 1389 | 27-4397307 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

14201 Caliber Drive

Suite 300

Oklahoma City, Oklahoma 73134

(405) 285-5812

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

David W. Sparkman

Chief Financial Officer and Executive Vice President

Great White Energy Services, Inc.

14201 Caliber Drive

Suite 300

Oklahoma City, Oklahoma 73134

(405) 285-5812

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

| Seth R. Molay, P.C. | W. Mark Young | |

| Akin Gump Strauss Hauer & Feld LLP | Andrews Kurth LLP | |

| 1700 Pacific Avenue, Suite 4100 | 600 Travis, Suite 4200 | |

| Dallas, TX 75201 | Houston, TX 77002 | |

| (214) 969-4780 | (713) 220-4200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the “Securities Act”), check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated July 19, 2011.

PROSPECTUS

12,500,000 Shares

Great White Energy Services, Inc.

Common Stock

We are offering 1,250,000 shares of our common stock. This is our initial public offering and no public market currently exists for our common stock. The selling stockholders identified in this prospectus are offering, in the aggregate, an additional 11,250,000 shares of our common stock. We will not receive any of the proceeds from the sale of the shares by the selling stockholders.

We anticipate that the initial public offering price of our common stock will be between $19.00 and $21.00 per share. We have applied to have our common stock listed on The NASDAQ Global Market under the symbol “JAWS.”

The underwriters have an option to purchase an additional 1,875,000 shares of our common stock from the selling stockholders to cover any over-allotments.

Investing in our common stock involves a high degree of risk. Please read “Risk Factors” beginning on page 13.

| Per Share |

Total | |||||||

| Price to the public |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to Great White Energy Services, Inc. (before expenses) |

$ | $ | ||||||

| Proceeds to the selling stockholders (before expenses) |

$ | $ | ||||||

Delivery of the shares of common stock is expected to be made on or about , 2011.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Joint Book-Running Managers

| RAYMOND JAMES | JEFFERIES |

JOHNSON RICE & COMPANY L.L.C.

FEARNLEY FONDS

SIMMONS & COMPANY INTERNATIONAL

SUNTRUST ROBINSON HUMPHREY

The date of this prospectus is , 2011.

Table of Contents

Index to Financial Statements

Table of Contents

Index to Financial Statements

| 1 | ||||

| 13 | ||||

| 30 | ||||

| 31 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

39 | |||

| 54 | ||||

| 71 | ||||

| 91 | ||||

| 95 | ||||

| 97 | ||||

| 100 | ||||

| 102 | ||||

| 108 | ||||

| 110 | ||||

| 110 | ||||

| 110 | ||||

| 111 | ||||

| F-1 | ||||

Table of Contents

Index to Financial Statements

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not, and the selling stockholders and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We, the selling stockholders and the underwriters are only offering to sell, and only seeking offers to buy, the common stock in jurisdictions where offers and sales are permitted.

The information contained in this prospectus is accurate and complete only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock by us, the selling stockholders or the underwriters. Our business, financial condition, results of operations and prospectus may have changed since that date.

This prospectus includes market share and industry data and forecasts that we obtained from internal company surveys, publicly available information and industry publications and surveys. Our internal research and forecasts are based on management’s understanding of industry conditions, and such information has not been verified by independent sources. Industry publications and surveys generally state that the information contained therein has been obtained from sources believed to be reliable.

Unless the context otherwise requires, the information in the prospectus (other than in the historical financial statements) assumes that the underwriters will not exercise their over-allotment option.

Table of Contents

Index to Financial Statements

This summary contains basic information about us and the offering. Because it is a summary, it does not contain all the information that you should consider before investing in our common stock. You should read and carefully consider this entire prospectus before making an investment decision, especially the information presented under the heading “Risk Factors” beginning on page 13 and our combined financial statements and the accompanying notes included elsewhere in this prospectus. Please also read “Glossary of Oil and Natural Gas Terms” beginning on page 111 of this prospectus for definitions of certain terms that are commonly used in the oilfield services industry.

Great White Energy Services, Inc.

Overview

We are a diversified oilfield service company providing completion and production and horizontal and directional drilling services primarily in the U.S. onshore unconventional tight sands and shale oil and natural gas markets, commonly referred to as “unconventional resources.” These resources are called unconventional due to the different manner by which they are extracted as compared to the extraction of conventional resources. To extract unconventional resources, the wellbore is generally drilled to specific objectives within narrow parameters, often across long, horizontal intervals within narrow formations offering greater contact area with the producing formation. Typically, the well is then hydraulically fractured at multiple stages to optimize production. We use our equipment to drill and complete these horizontal wells.

We currently conduct our operations through two operating segments—completion and production services and horizontal and directional drilling services. We believe that our services are critical in increasing the ultimate recovery and present value of production streams for unconventional resources. Our complementary suite of drilling, completion and production related services provides us with the opportunity to cross sell our services and expand our customer base and geographic positioning.

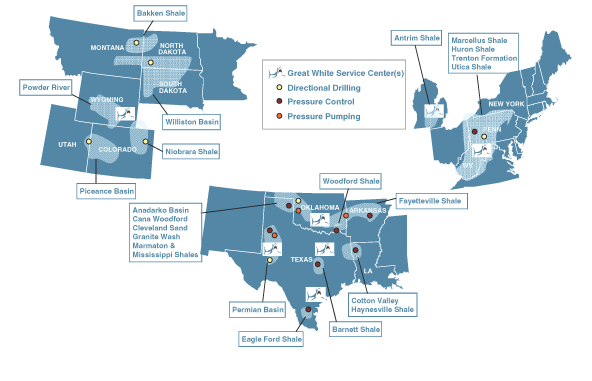

Our 13 service centers are strategically located in Michigan, Oklahoma, Texas, West Virginia and Wyoming primarily to serve the following resource plays:

| • | the Bakken Shale in Montana and North Dakota; |

| • | the Cana Woodford Shale and the Cleveland Sand in Oklahoma; |

| • | the Eagle Ford Shale in South Texas; |

| • | the Fayetteville Shale in Arkansas; |

| • | the Granite Wash in Oklahoma and Texas; |

| • | the Cotton Valley and the Haynesville Shale in Northwest Louisiana and East Texas; |

| • | the Marcellus Shale in West Virginia and Pennsylvania; |

| • | the Marmaton and Mississippi Shales in Oklahoma and Texas; |

| • | the Niobrara formation in Wyoming; |

| • | the Permian Basin in West Texas; |

| • | the Trenton formation in Michigan; |

| • | the Utica Shale in Ohio and Pennsylvania; and |

| • | the Woodford Shale in Southeastern Oklahoma. |

1

Table of Contents

Index to Financial Statements

Our operational division heads have an average of over 30 years of oilfield services experience and bring valuable basin-level expertise and long-term customer relationships to our business. We provide our completion and production and horizontal and directional drilling services to a diversified range of both public and private independent producers as well as integrated major companies. Our top five customers for the year ended December 31, 2010, representing 36% of our revenue, were SandRidge Energy, Inc., Windsor Permian LLC, Chesapeake Energy Corp., Continental Resources, Inc. and East Resources, Inc. Our top five customers for the three months ended March 31, 2011, representing 46% of our revenue, were SandRidge Energy, Inc., Unit Petroleum Company, Windsor Permian LLC, EOG Resources, Inc. and Continental Resources, Inc.

We commenced our operations in December 2005 with the acquisition of the assets of Quantum Drilling Motors, L.L.C., which we refer to as Quantum. We have since grown through acquisitions and organically by focusing on the growing needs of producers in unconventional resource plays. We had $80.4 million in revenue, $25.9 million in Adjusted EBITDA and net income of $19.3 million for the three months ended March 31, 2011, $206.7 million in revenue, $45.9 million in Adjusted EBITDA and net income of $20.9 million for the year ended December 31, 2010, $98.6 million in revenue, $5.7 million in Adjusted EBITDA and a net loss of $18.5 million for the year ended December 31, 2009, and $208.6 million in revenue, $61.6 million in Adjusted EBITDA and net income of $21.1 million for the year ended December 31, 2008. For a definition of Adjusted EBITDA, a reconciliation of Adjusted EBITDA to net income (loss) and a discussion of Adjusted EBITDA as a performance measure, please see “Selected Historical Financial Data” on page 36 of this prospectus.

Our Services

Completion and Production Services

Our completion and production services segment provides pressure pumping services and pressure control services. Our pressure pumping services include hydraulic fracturing and acidizing services. These services are primarily used in optimizing hydrocarbon flow paths during the completion phase of unconventional wellbores. We began providing pressure pumping services in September 2006 with 18,200 horsepower acquired in the acquisition of Acid Inc. As of March 31, 2011, we had grown our pressure pumping business to 98,800 horsepower, consisting of 42 quintuplex pumps. Our quintuplex pumps allow us to execute multi-stage fracture stimulation jobs, which are typically required for production enhancement of unconventional wells. Currently, we provide pressure pumping services in the Cana Woodford and Mississippi Shales in Oklahoma, the Marmaton Shale in Oklahoma and Texas and the Permian Basin in West Texas. Our completion and production segment was started in July 2006 through the hiring of an experienced senior management team. Since then, this team has developed our pressure control services through organic growth.

Our pressure control services equipment is tailored to the unconventional resources market with the ability to operate under high pressures without having to delay or cease production during completion operations. Ceasing or suppressing production in the completion phase of an unconventional well could result in formation damage impacting the overall recovery of reserves. As of March 31, 2010, our pressure control services were provided through our fleet of eight coiled tubing units, 19 snubbing units, six wireline units, 14 nitrogen pumping units, nine fluid pumping units and various well control assets. Based on our anticipated delivery schedule, we expect to have 12 coiled tubing units, 24 snubbing units, six wireline units, 16 nitrogen pumping units and 15 fluid pumping units by the end of 2011. We provide our pressure control services in the Fayetteville Shale in Arkansas, the Cana Woodford and Woodford Shales and the Cleveland Sand in Oklahoma, the Granite Wash and Mississippi Shale in Oklahoma and Texas, the Haynesville Shale in Northwest Louisiana and East Texas, the Barnett Shale in East Texas, the Permian Basin in West Texas and the Eagle Ford Shale in South Texas.

Our completion and production segment generated approximately $60.5 million, or 75.2% of our total revenue, for the three months ended March 31, 2011, $135.9 million, or 65.7% of our total revenue, for the year

2

Table of Contents

Index to Financial Statements

ended December 31, 2010, $55.8 million, or 56.6% of our total revenue, for the year ended December 31, 2009 and $103.5 million, or 49.6% of our total revenue, for the year ended December 31, 2008.

Horizontal and Directional Drilling Services

Our horizontal and directional drilling equipment is designed for efficient drilling and production of oil and natural gas from unconventional resource plays. Our horizontal and directional drilling services allow our customers to drill wellbores to specific objectives within narrow location parameters. The evolution of unconventional resource reserve recovery has increased the need for the precise placement of the wellbore. Wellbores are often drilled sideways across long-lateral intervals within narrow formations as thin as ten feet. Our personnel are involved in all aspects of the well from the initial planning to the management and execution of the horizontal or directional drilling operation. Our horizontal and directional drilling equipment includes drilling motors, measurement while drilling, or MWD, kits and electromagnetic, or EM, kits. As of March 31, 2011, we owned 39 MWD kits and six EM kits used in horizontal, vertical and directional drilling applications, 392 motors, four dedicated wireline units and an inventory of parts and other equipment. In addition, at June 20, 2011 we employed 76 directional drillers with significant industry experience to implement our services. We perform our horizontal and directional drilling services in the Piceance Basin in Colorado, the Cotton Valley and the Haynesville Shale in Northwest Louisiana and East Texas, the Bakken Shale in North Dakota and Montana, the Williston Basin in North Dakota and South Dakota, the Utica Shale in Ohio and Pennsylvania, the Granite Wash in Oklahoma and Texas, the Woodford Shale in Oklahoma, the Huron and Marcellus Shales in West Virginia and Pennsylvania, the Permian Basin in West Texas, the Powder River Basin and the Niobrara formation in Wyoming and the Trenton formation in Michigan.

We commenced our horizontal and directional drilling operations with the acquisition of the assets of Quantum in December 2005. We subsequently acquired the membership units of Directional Drilling Contractors L.L.C. in August 2007, and have since grown this business segment organically. Our horizontal and directional drilling services segment generated approximately $19.9 million, or 24.8% of our total revenue, for the three months ended March 31, 2011, $70.9 million, or 34.3% of our total revenue, for the year ended December 31, 2010, $42.7 million, or 43.4% of our total revenue, for the year ended December 31, 2009 and $105.1 million, or 50.4% of our total revenue, for the year ended December 31, 2008.

Our Industry

We believe that the following trends in our industry should benefit our operations:

| • | Increased fracturing and other well stimulation services required for horizontal wells. Multiple stages of hydraulic fracturing are typically required to enhance hydrocarbon production in horizontal wells. Water, sand and other additives are used in the fracturing process. The fractures created in the formation are held open through the use of sand and other proppants such as resin-coated and ceramic particles. The scope of these services for a horizontal well is greater than for a conventional well. It has been reported in the industry that the average horsepower, length of the lateral and number of fracture stages has increased since 2008. The total size of the global hydraulic fracturing market, based on revenue, was estimated to be approximately $10.5 billion in 2009 and $18.0 billion in 2010, based on data from a 2011 report by Spears & Associates. Fracturing revenue increased by $7.5 billion in 2010 as compared to 2009 primarily due to increased drilling activity, higher oil prices and a greater proportion of horizontal wells relative to vertical wells. |

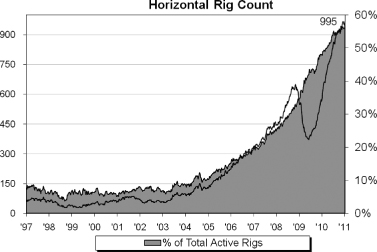

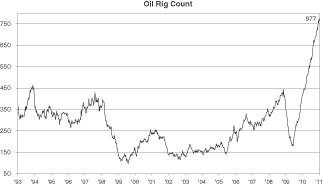

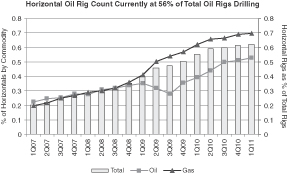

| • | Increased use of horizontal drilling to develop unconventional resource plays. According to the Baker Hughes rig count, the horizontal rig count on March 31, 2011 was 995, or 58% of the total U.S. onshore rig count. This compares to 650 horizontal rigs, equating to 34% of the total U.S. onshore rig count, in 2008, the previous peak of the horizontal rig count. For the twelve months ended March 31, 2011, horizontal rigs comprised on average 56% of the total U.S. onshore rig count. As a result of |

3

Table of Contents

Index to Financial Statements

| improvements in horizontal drilling and production-enhancement technologies, oil and natural gas companies are increasingly developing unconventional resources such as tight sands and shales. Successful and economic production of these unconventional resource plays frequently requires increased horizontal drilling, fracturing and stimulation services. Drilling related activity for unconventional resources is typically done on tighter acre-spacing and thus requires that more wells be drilled relative to conventional resources. We believe that all of these characteristics will drive the demand for our services. |

| • | New and emerging unconventional resource plays. In addition to the growth and development of existing unconventional resource plays such as the Barnett, Fayetteville, Haynesville, Marcellus and Woodford Shales, exploration and production companies continue to find new unconventional resources. These include oil and liquids-based shales in the Bakken, Cana Woodford, Eagle Ford, Granite Wash, Niobrara, Permian and Woodford resource plays. In certain cases, exploration and production companies have acquired vast acreage positions in these plays that require them to drill and produce hydrocarbons to hold the leased acreage. We believe these emerging resource plays will continue to drive demand for our services as they typically require the use of extended reach horizontal drilling, multiple stage fracture stimulation and high pressure completion capabilities. |

| • | Increased onshore focus from major integrated oil and natural gas companies. Major integrated exploration and production companies have increasingly been allocating capital and other resources to the U.S. onshore unconventional oil and natural gas tight sand and shale resource plays. Over the past two years, exploration and production companies such as ExxonMobil Corporation, BP p.l.c. and Chevron Corporation have made strategic acquisitions and/or formed joint ventures in unconventional resource plays. This onshore focus may intensify as regulatory scrutiny of offshore operations increases due to the blowout of BP p.l.c.’s Macondo well and the related oil spill in the Gulf of Mexico in 2010. |

| • | Need for additional drilling activity to maintain production levels. With the increased maturity of the onshore conventional and, in many cases, unconventional resource plays, oil and natural gas production may be characterized as having steeper initial decline curves. As a result, we believe that an increasing number of wells will need to be drilled to offset production declines. Given average decline rates and demand forecasts, we believe that the number of wells drilled is likely to continue to increase in coming years. Once a well has been drilled, it requires recurring production and completion services, which we believe will drive demand for our services. |

Our Strategy

Our strategy is to leverage our equipment and personnel to provide drilling, completion and production services in unconventional resource plays. These services optimize the ultimate recovery and present value of hydrocarbon reserves in the unconventional resource plays that we serve. We believe that our services provide cost efficiencies for our customers. Specifically, we intend to:

| • | Capitalize on the increased activity in the unconventional resource plays. Our equipment is tailored to provide drilling, completion and production services for unconventional wells and our operations are strategically located in major unconventional resource plays. We intend to continue capturing the anticipated growth in these markets and diversifying our operations across the different unconventional resource basins. Our core operations are focused in proven producing regions, primarily in the Bakken Shale in North Dakota and Montana, the Eagle Ford Shale in South Texas, the Fayetteville Shale in Arkansas, the Granite Wash in Oklahoma and Texas, the Cotton Valley and the Haynesville Shale in Northwest Louisiana and East Texas, the Marcellus Shale in West Virginia and Pennsylvania, the Marmaton and Mississippi Shales in Oklahoma and Texas, the Niobrara formation in Wyoming, the Permian Basin in West Texas, the Trenton formation in Michigan, the Utica Shale in Ohio and Pennsylvania and the Woodford Shale in Southeastern Oklahoma. We intend to continue to strategically |

4

Table of Contents

Index to Financial Statements

| deploy assets to these unconventional resource basins and will look to capture further growth in the emerging unconventional resource plays such as the Bakken, Cana Woodford, Eagle Ford and Niobrara. |

| • | Expand our completion and production services fleet. We have recently expanded and intend to continue to expand our fleet used to provide completion and production services. We acquired approximately $42.1 million of equipment during 2010 and currently expect to acquire approximately $88.1 million of equipment during 2011, including 18 quintuplex high-pressure pumps, six coiled tubing units, six snubbing units, seven fluid pumpers and two nitrogen units. |

| • | Leverage our broad range of services for unconventional wells. We offer a complementary suite of services relating to the drilling, completion and production of unconventional wells. Our completion and production segment provides production enhancement and completion services for unconventional wells and our horizontal and directional drilling segment assists in the drilling of these wells. These complementary services have provided us with opportunities to cross sell our services and expand our service offerings to existing customers, obtain new customers and expand our geographic presence. We intend to continue to expand our services in an effort to increase cross selling opportunities and create operational efficiencies for our customers. |

| • | Capitalize on organic growth opportunities. We intend to use our existing customer relationships, cross selling of services and operational track record to expand opportunistically to other geographic regions in which our customers have operations. In addition, we believe our reputation will allow us to successfully expand our customer base and geographic presence. |

| • | Expand through selected acquisitions. To complement our organic growth, we intend to pursue selected acquisitions that can meet our targeted returns on invested capital. We believe this strategy will facilitate the continued expansion of our customer base, geographic presence and service offerings. |

| • | Leverage our experienced operational management team and basin-level expertise. We seek to manage our business as close to our customer base as possible. Our operational division heads have an average of over 30 years of experience in the oilfield service business. These members of our management team have long-term customer relationships with our largest customers. We intend to leverage our operational management team’s basin-level expertise to deliver innovative, basin-specific services to our customers. |

Our Strengths

We believe that the following strengths position us well within our industry and will help us successfully execute our strategy:

| • | Quality equipment. Our service fleet is predominantly comprised of equipment that has been tailored to provide services for unconventional wells. Approximately 40% of our pressure pumping equipment has been built within the last year. Most of our pressure control equipment has been designed and built by us and is less than four years old. We believe that our equipment will allow us to provide a high level of service to our customers and capture future growth in the unconventional resource markets that we serve. |

| • | Experienced management and operating team. Our operational division heads have an extensive track record in the oilfield services business and an average of over 30 years of oilfield services experience. We believe their knowledge of our industry and business lines enhances our ability to provide a high level of customer service. In addition, our field managers have expertise in the geological basins in which they operate and understand the regional challenges that our customers face, which we believe strengthens our relationships with our customers. |

| • | Strategic geographic positioning. Currently, we operate 13 service centers to support our operations in major unconventional resource plays in the United States, including the Bakken Shale in North Dakota |

5

Table of Contents

Index to Financial Statements

| and Montana, the Cana Woodford Shale and the Cleveland Sand in Oklahoma, the Eagle Ford Shale in South Texas, the Fayetteville Shale in Arkansas, the Granite Wash in Oklahoma and Texas, the Cotton Valley and the Haynesville Shale in Northwest Louisiana and East Texas, the Marcellus Shale in West Virginia and Pennsylvania, the Niobrara formation in Wyoming, the Permian Basin in West Texas, the Trenton formation in Michigan, the Utica Shale in Ohio and Pennsylvania and the Woodford Shale in Southeastern Oklahoma. We expect to complete our fourteenth service center, located in Victoria, Texas, in the third quarter of 2011 to service our expanding activities in the Eagle Ford Shale. Our operations are focused in the growing oil and natural gas liquids resource plays, as well as natural gas resource plays. We believe our geographic positioning provides us with both a more stable revenue stream and access to the growth occurring in these unconventional resource plays. |

| • | Long-term, basin-level relationships with a stable customer base. Our operational division heads and field managers have formed long-term relationships with our customer base. We believe that these relationships will help provide us with a stable and growth-oriented client base in the unconventional shale markets that we serve. Our customers include large independent oil and natural gas exploration and production companies. Our top five customers for the year ended December 31, 2010, representing 36% of our revenue, were SandRidge Energy, Inc., Windsor Permian LLC, Chesapeake Energy Corp., Continental Resources, Inc. and East Resources, Inc. Our top five customers for the three months ended March 31, 2011, representing 46% of our revenue, were SandRidge Energy, Inc., Unit Petroleum Company, Windsor Permian LLC, EOG Resources, Inc. and Continental Resources, Inc. |

Risk Factors

Investing in our common stock involves risks that include the speculative nature of oil and natural gas operations, competition, volatile oil and natural gas prices and other material factors. You should read carefully the section of this prospectus entitled “Risk Factors” beginning on page 13 for an explanation of these risks before investing in our common stock. In particular, the following considerations may offset our competitive strengths or have a negative effect on our strategy, which could cause a decrease in the price of our common stock and a loss of all or part of your investment:

| • | We derive our revenues from companies in the oil and natural gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. |

| • | A material reduction in the levels of exploration and development activities in our market areas could affect our business. |

| • | We operate in a highly competitive industry in which price competition can be intense, which can force us to lower prices we charge for our services and, as a result, adversely affect our revenue and profitability. |

| • | We intend to grow our business and may be unable to secure equipment, raw materials (particularly sand and proppants) and crews to successfully execute our plans, and our hydraulic fracturing operations may be negatively impacted by shortages of water. |

| • | Competition for experienced oilfield service personnel is intense, and we face significant challenges in competing for crews and management with large and well-established competitors. |

| • | Our business depends upon our ability to obtain specialized equipment and parts from third party suppliers, and we may be vulnerable to delayed deliveries and future price increases. |

| • | Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could result in increased costs and additional operating restrictions or delays. |

| • | If our operations continue to grow, we will need to implement additional processes and procedures to accommodate this growth. There can be no assurance that we will be able to do so. |

6

Table of Contents

Index to Financial Statements

For a discussion of other considerations that could negatively affect us, see “Risk Factors” beginning on page 13 and “Cautionary Note Regarding Forward-Looking Statements” on page 30.

Our Equity Sponsor

Our equity sponsor, Wexford Capital LP, or Wexford, is a Greenwich, Connecticut-based SEC registered investment advisor with over $6.0 billion under management as of December 31, 2010. Wexford has made public and private equity investments in many different sectors with particular expertise in the energy and natural resources sector. Immediately prior to this offering, Wexford beneficially owned all of our outstanding common stock through GWES Holdings LLC, which we refer to as GWES Holdings, and Diamondback Holdings, LLC, which we refer to as Diamondback Holdings. Upon completion of this offering, Wexford will beneficially own approximately 72.2% of our common stock (approximately 68.1% if the over-allotment option is exercised in full). As a result, Wexford will continue to be able to exercise control over all matters requiring stockholder approval, including the election of directors, changes to our organizational documents and significant corporate transactions. Prior to the closing of this offering, we will enter into an advisory services agreement with Wexford under which Wexford will provide the Company with financial and strategic advisory services related to our business. Also, we have entered into certain other agreements with Wexford. For a description of the advisory services agreement and other agreements with Wexford, see “Related Party Transactions” beginning on page 91. Although management believes that the terms of these related party agreements are reasonable, it is possible that we could have negotiated more favorable terms for such transactions with unrelated third parties. The existence of these related party agreements may give Wexford the ability to further influence and maintain control over many matters affecting us.

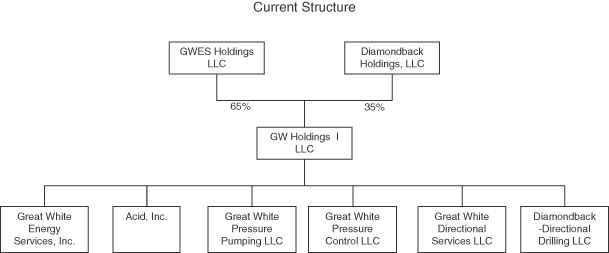

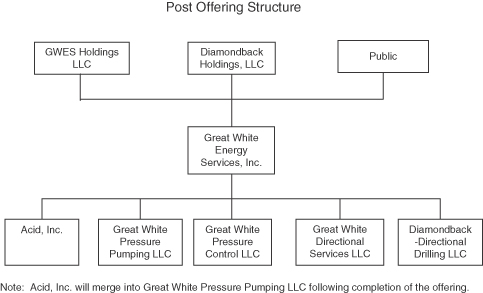

Our History

Great White Energy Services, Inc. was formed in December 2010 in Delaware and will not conduct any material business operations prior to the merger described below. We are currently a wholly-owned subsidiary of GW Holdings I LLC, which we refer to as GWH, and all of our assets and operations described in this prospectus are currently owned by GWH, which is an entity controlled by our equity sponsor, Wexford. Effective December 31, 2010, in transactions we refer to in this prospectus collectively as the “contribution,” GWES Holdings contributed to GWH its membership interests or common stock, as applicable, in three of its wholly-owned subsidiaries, Great White Pressure Control LLC, Great White Pressure Pumping LLC and Acid, Inc., and Diamondback Holdings contributed to GWH its membership interests in two of its wholly-owned subsidiaries, Great White Directional Services LLC (formerly Diamondback-Quantum LLC) and Diamondback-Directional Drilling LLC. Prior to the closing of this offering, we will merge with GWH and continue as the surviving corporation. In the merger, we will issue 28,456,554 shares of our common stock to GWES Holdings and 15,322,760 shares of our common stock to Diamondback Holdings. In this prospectus, we refer to Great White Pressure Control LLC, Great White Pressure Pumping LLC, Acid, Inc., Great White Directional Services LLC (formerly Diamondback-Quantum LLC) and Diamondback-Directional Drilling LLC as the contributed entities. As a result of the merger, the contributed entities will become our wholly-owned subsidiaries. Except as otherwise indicated or required by the context, all references in this prospectus to “Great White,” the “Company,” “we,” “us,” or “our” relate to Great White Energy Services, Inc. and its consolidated subsidiaries after giving effect to the contribution and the merger.

7

Table of Contents

Index to Financial Statements

The following organizational charts illustrate (a) our current organizational structure and (b) our organizational structure after giving effect to the merger described above and the offering:

Our Offices

Our principal executive offices are located at 14201 Caliber Drive, Suite 300, Oklahoma City, Oklahoma 73134, and our telephone number at that address is (405) 285-5812. Our website address is www.greatwhiteenergy.com. Information contained on our website does not constitute part of this prospectus.

8

Table of Contents

Index to Financial Statements

The Offering

| Common stock offered by us |

1,250,000 shares |

| Common stock offered by the selling stockholders |

11,250,000 shares (13,125,000 shares if the underwriters’ over-allotment option is exercised in full) |

| Common stock to be outstanding immediately after completion of this offering |

45,029,314 shares |

| Use of proceeds |

We will use all of the net proceeds of this offering to pay down outstanding borrowings under our revolving credit facility. Thereafter, we intend to use future borrowings under our revolving credit facility, together with cash flow from our operations and cash on hand, to fund our capital expenditures and for general corporate purposes. We will not receive any proceeds from the sale of shares by the selling stockholders. See “Use of Proceeds” on page 31 of this prospectus. |

| Conflict of interest |

An affiliate of SunTrust Robinson Humphrey, Inc., an underwriter of this offering, is the lender under our revolving credit facility. Since we will use the net proceeds of this offering to repay outstanding borrowings under our revolving credit facility, such affiliate will receive 5% or more of the net proceeds of this offering, not including underwriting compensation. As a result, this offering is being conducted in compliance with Rule 5121 of the Financial Industry Regulatory Authority, Inc., or FINRA. See “Underwriting—Conflict of Interest” on page 105 of this prospectus. |

| Dividend policy |

We currently anticipate that we will retain all future earnings, if any, to finance the growth and development of our business. We do not intend to pay cash dividends in the foreseeable future. |

| NASDAQ Global Market symbol |

“JAWS” |

Except as otherwise indicated, all information contained in this prospectus:

| • | assumes the underwriters do not exercise their over-allotment option; and |

| • | excludes 2,500,000 shares of common stock reserved for issuance under our equity incentive plan, including, based on an assumed public offering price of $20.00 per share (which is the midpoint of the range set forth on the cover of this prospectus): |

| • | 585,600 restricted stock units to be issued to certain employees following the closing of this offering under the terms of their employment agreements, which restricted stock units will not be subject to forfeiture and will have a settlement date that is 181 days after the closing of this offering; |

| • | 46,662 restricted stock units to be issued to our non-employee directors following the closing of this offering as part of their director compensation; and |

| • | options to purchase 935,819 shares of our common stock to be granted to our Chief Executive Officer following the closing of this offering under the terms of his employment agreement. |

9

Table of Contents

Index to Financial Statements

Summary Consolidated Financial Data

The following table sets forth our summary historical consolidated financial data as of the dates and for each of the periods indicated. The data as of December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008 are derived from our historical audited consolidated financial statements included elsewhere in this prospectus. The data as of and for the three months ended March 31, 2011 and 2010 are derived from our historical unaudited consolidated financial statements included elsewhere in this prospectus. The balance sheet data as of December 31, 2008 are derived from our audited balance sheet as of that date, which is not included in this prospectus. The unaudited pro forma financial data presented give effect to income taxes assuming that we operated as a taxable corporation throughout the periods presented. Operating results for the periods presented are not necessarily indicative of the results that may be expected for the entire year 2011 or any future periods. You should review this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Selected Historical Financial Data” and our historical consolidated financial statements and related notes included elsewhere in this prospectus.

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| (in thousands, except per share data) |

||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Completion and production services |

$ | 60,474 | $ | 21,321 | $ | 135,863 | $ | 55,841 | $ | 103,509 | ||||||||||

| Horizontal and directional drilling services |

19,890 | 14,521 | 70,867 | 42,732 | 105,106 | |||||||||||||||

| Total |

80,364 | 35,842 | 206,730 | 98,573 | 208,615 | |||||||||||||||

| Expenses: |

||||||||||||||||||||

| Cost of revenue, exclusive of depreciation, amortization and impairment: |

||||||||||||||||||||

| Completion and production services |

34,376 | 16,596 | 92,669 | 49,946 | 68,107 | |||||||||||||||

| Horizontal and directional drilling services |

15,213 | 11,403 | 53,098 | 32,801 | 63,507 | |||||||||||||||

| Selling, general and administrative |

4,908 | 3,371 | 15,102 | 10,332 | 15,896 | |||||||||||||||

| Depreciation and amortization |

6,554 | 5,450 | 23,419 | 22,367 | 20,673 | |||||||||||||||

| Impairment of goodwill and intangible assets |

— | — | — | — | 20,185 | |||||||||||||||

| Operating income (loss) |

19,313 | (978 | ) | 22,442 | (16,873 | ) | 20,247 | |||||||||||||

| Interest expense |

(29 | ) | (354 | ) | (1,346 | ) | (1,826 | ) | (2,110 | ) | ||||||||||

| Other income |

40 | 1 | 68 | 207 | 462 | |||||||||||||||

| Income (loss) before income taxes |

19,324 | (1,331 | ) | 21,164 | (18,492 | ) | 18,599 | |||||||||||||

| Provision (benefit) for income taxes |

33 | (33 | ) | 273 | 28 | (2,455 | ) | |||||||||||||

| Net income (loss) |

19,291 | (1,298 | ) | 20,891 | (18,520 | ) | 21,054 | |||||||||||||

| Income attributable to non-controlling interest in variable interest entities |

11 | 11 | 41 | 28 | 9 | |||||||||||||||

| Net income (loss) attributable to equity holders of the Company |

$19,280 | $ | (1,309 | ) | $ | 20,850 | $ | (18,548 | ) | $ | 21,045 | |||||||||

| Pro Forma C Corporation Data (unaudited):(1) |

||||||||||||||||||||

| Historical income (loss) before income taxes |

$19,324 | $ | (1,331 | ) | $ | 21,164 | $ | (18,492 | ) | $ | 18,599 | |||||||||

| Pro forma provision (benefit) for income taxes |

7,385 | (464 | ) | 8,160 | (6,928 | ) | 15,271 | |||||||||||||

| Pro forma net income (loss) |

$ | 11,939 | $ | (867 | ) | $ | 13,004 | $ | (11,564 | ) | $ | 3,328 | ||||||||

| Pro forma net income (loss) attributable to equity holders of the Company |

$ | 11,928 | $ | (878 | ) | $ | 12,963 | $ | (11,592 | ) | $ | 3,319 | ||||||||

| Pro forma income (loss) per common share—basic and diluted(2) |

$ | .27 | $ | .30 | ||||||||||||||||

| Weighted average pro forma shares outstanding—basic and diluted(2) |

43,779 | 43,779 | ||||||||||||||||||

10

Table of Contents

Index to Financial Statements

| Three Months Ended March 31, |

Year Ended December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Adjusted EBITDA (unaudited)(3) |

$ | 25,907 | $ | 4,473 | $ | 45,929 | $ | 5,701 | $ | 61,567 | ||||||||||

| Cash flows provided by operating activities |

16,252 | 377 | 29,931 | 22,479 | 38,657 | |||||||||||||||

| Cash flows used in investing activities |

(21,055 | ) | (2,706 | ) | (48,253 | ) | (5,871 | ) | (24,245 | ) | ||||||||||

| Cash flows provided by (used in) financing activities |

16,739 | 4,551 | 24,825 | (15,749 | ) | (16,056 | ) | |||||||||||||

| Cash capital expenditures: |

||||||||||||||||||||

| Property and equipment |

(21,846 | ) | (3,490 | ) | (52,569 | ) | (9,455 | ) | (32,848 | ) | ||||||||||

| As of March 31, | As of December 31, | |||||||||||||||||||

| 2011 | 2010 | 2010 | 2009 | 2008 | ||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Total current assets |

$ | 79,672 | $ | 33,800 | $ | 54,066 | $ | 24,948 | $ | 45,364 | ||||||||||

| Total assets |

261,260 | 157,284 | 213,506 | 150,449 | 185,783 | |||||||||||||||

| Advances from Great White Energy Services LLC |

5,043 | |

10,334 |

|

638 | 10,464 | 9,948 | |||||||||||||

| Total current liabilities |

47,299 | 27,952 | 31,921 | 24,451 | 30,016 | |||||||||||||||

| Capital lease obligations, net of current portion |

6,252 | 6,519 | 6,457 | 6,614 | 6,481 | |||||||||||||||

| Long-term debt, net of current portion |

19,497 | — | 6,012 | |

— |

|

— | |||||||||||||

| Total liabilities |

74,054 | 35,901 | 45,552 | 32,572 | 38,213 | |||||||||||||||

| Non-controlling interest in variable interest entities |

611 | 679 | 639 | 668 | 690 | |||||||||||||||

| Total equity |

187,206 | 121,383 | 167,955 | 117,878 | 147,570 | |||||||||||||||

| (1) | Great White Energy Services, Inc. was formed as a Delaware corporation in December 2010 and will not conduct any material business operations prior to the merger described below. We are currently a wholly-owned subsidiary of GW Holdings I LLC, or GWH, and all of our assets and operations described in this prospectus are currently owned by GWH, which is an entity controlled by our equity sponsor, Wexford. Effective December 31, 2010, GWES Holdings LLC, which we refer to as GWES Holdings, contributed to GWH its membership interests or common stock, as applicable, in three of its wholly-owned subsidiaries, Great White Pressure Control LLC, Great White Pressure Pumping LLC and Acid, Inc., and Diamondback Holdings, LLC, which we refer to as Diamondback Holdings, contributed to GWH its membership interests in two of its wholly-owned subsidiaries, Great White Directional Services LLC (formerly Diamondback-Quantum LLC) and Diamondback-Directional Drilling LLC. In connection with its contribution to GWH, Diamondback Holdings extinguished all indebtedness owed to it by the contributed entities under a revolving credit agreement. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—Credit Facilities.” Prior to the closing of this offering, we will merge with GWH and continue as the surviving corporation. In the merger, we will issue 28,456,554 shares of our common stock to GWES Holdings and 15,322,760 shares of our common stock to Diamondback Holdings. In this prospectus, Great White Pressure Control LLC, Great White Pressure Pumping LLC, Acid, Inc., Great White Directional Services LLC (formerly Diamondback-Quantum LLC) and Diamondback-Directional Drilling LLC are referred to as the contributed entities. As a result of the merger, the contributed entities will become our wholly-owned subsidiaries. Our historical consolidated financial statements were prepared on a consolidated basis and represent the consolidated assets, liabilities, revenues and expenses of GWH. See “Note A—Nature of Operations and Summary of Significant Accounting Policies” to our historical consolidated financial statements appearing elsewhere in this prospectus for additional information regarding the basis upon which our financial statements have been prepared. Each of the contributed entities other than Acid, Inc. was treated as a partnership for federal income tax purposes. As a result, essentially all of our taxable earnings and losses were passed through to Wexford, and we did not pay federal income taxes at the entity level. For comparative purposes, we have |

11

Table of Contents

Index to Financial Statements

| included a pro forma provision (benefit) for income taxes assuming we had been taxed as a C corporation in all periods prior to the merger. The unaudited pro forma data are presented for informational purposes only, and do not purport to project our results of operations for any future period or our financial position as of any future date. |

| (2) | The pro forma earnings per share data have been presented for the latest fiscal year and interim period and has been calculated as if the merger discussed in note 1 above had been consummated and the shares of common stock were issued to GWES Holdings and Diamondback Holdings in the merger at the beginning of such period. |

| (3) | For a definition of Adjusted EBITDA and reconciliation of Adjusted EBITDA to net income (loss) attributable to the equity holders of the Company, the most comparable measure calculated in accordance with U.S. Generally Accepted Accounting Principles, or GAAP, see “Selected Historical Financial Data” on page 36 of this prospectus. |

12

Table of Contents

Index to Financial Statements

An investment in our common stock involves a high degree of risk. The following is a description of material risks that are presently known to us. You should carefully consider these risks and all of the other information contained in this prospectus before deciding to invest in our common stock. Additional risks not presently known to us or which we currently consider immaterial also may adversely affect our company.

Risks Related to Our Business and Our Industry

Our business depends on the oil and natural gas industry and particularly on the level of exploration and production activity within the United States, which may be adversely impacted by industry conditions that are beyond our control.

We depend on our customers’ willingness and ability to make operating and capital expenditures to explore for, develop and produce oil and natural gas in the United States. If these expenditures decline, our business will suffer. Our customers’ willingness to explore, develop and produce depends largely upon prevailing industry conditions that are influenced by numerous factors over which we have no control, such as:

| • | the supply of and demand for oil and natural gas; |

| • | the level of prices, and expectations about future prices, of oil and natural gas; |

| • | the cost of exploring for, developing, producing and delivering oil and natural gas; |

| • | the expected decline rates of current production; |

| • | the discovery rates of new oil and natural gas reserves; |

| • | contractions in the credit market; |

| • | available pipeline and other transportation capacity; |

| • | weather conditions, including hurricanes that can affect oil and natural gas operations over a wide area and other natural disasters; |

| • | political instability in oil and natural gas producing countries; |

| • | governmental approvals and regulatory requirements and conditions; |

| • | the continued threat of terrorism and the impact of military and other action, including military action in the Middle East; |

| • | technical advances affecting energy consumption; |

| • | the price and availability of alternative fuels; |

| • | the ability of oil and natural gas producers to raise equity capital and debt financing; |

| • | merger and divestiture activity among oil and natural gas producers; and |

| • | domestic and worldwide economic conditions. |

Any of the above factors could impact the level of oil and natural gas exploration and production activity and could ultimately have a material adverse effect on our business, financial condition, results of operations and cash flows.

The cyclicality of the oil and natural gas industry in the United States may cause our operating results to fluctuate.

We derive our revenues from companies in the oil and natural gas exploration and production industry, a historically cyclical industry with levels of activity that are significantly affected by the levels and volatility of oil and natural gas prices. We may experience significant fluctuations in operating results as a result of the

13

Table of Contents

Index to Financial Statements

reactions of our customers to changes in oil and natural gas prices. For example, in 2009, declines in prices for oil and natural gas, combined with adverse changes in the capital and credit markets, caused many exploration and production companies to reduce their capital budgets and drilling activity. This resulted in a significant decline in demand for our services, had an adverse impact on our prices and utilization, and adversely affected our results of operations.

In addition, substantially all of the service revenue we earn is based upon a charge for a relatively short period of time (e.g., an hour, a day, a week) for the actual period of time the service is provided to our customers. By contracting services on a short-term basis, we are exposed to the risks of a rapid reduction in market prices and utilization, with resulting volatility in our revenues.

Our business is difficult to evaluate because we have a limited operating history.

We commenced operations in December 2005. All of our assets and operations described in this prospectus were acquired by us since that time. As a result, there is only limited historical financial and operating information available on which to base your evaluation of our performance.

We may have difficulty managing growth in our business, which could adversely affect our financial condition and results of operations.

The growth of our company in accordance with our business plan, if achieved, will place a significant strain on our financial, technical, operational and management resources. As we expand our activities through both organic growth and acquisitions, there will be additional demands on our financial, technical, operational and management resources. These demands may be increased as our geographic coverage expands. The failure to continue to upgrade our technical, administrative, operating and financial control systems or the occurrences of unexpected expansion difficulties, including the failure to recruit and retain experienced managers, engineers and other professionals in the oil and natural gas services industry, could have a material adverse effect on our business, financial condition and results of operations and our ability to timely execute our business plan.

If our intended expansion of our business is not successful, our financial condition, profitability and results of operations could be adversely affected, and we may not achieve increases in revenue and profitability that we hope to realize.

A key element of our business strategy involves the expansion of our services, geographic presence and customer base. These aspects of our strategy are subject to numerous risks and uncertainties, including:

| • | inability to retain or hire experienced crews and other personnel; |

| • | lack of customer demand for the services we intend to provide; |

| • | inability to secure necessary equipment, raw materials (particularly sand and other proppants) or technology to successfully execute our expansion plans; |

| • | shortages of water used in our hydraulic fracturing operations; |

| • | unanticipated delays that could limit or defer the provision of services by us and jeopardize our relationships with existing customers and adversely affect our ability to obtain new customers for such services; and |

| • | competition from new and existing services providers. |

Encountering any of these or any unforeseen problems in implementing our planned expansion could have a material adverse impact on our business, financial condition, results of operations and cash flows, and could prevent us from achieving the increases in revenues and profitability that we hope to realize.

14

Table of Contents

Index to Financial Statements

Our business depends upon our ability to obtain specialized equipment and parts from third party suppliers, and we may be vulnerable to delayed deliveries and future price increases.

We purchase specialized equipment and parts from third party suppliers and affiliates, including companies controlled by Wexford. Currently, there is a high demand for hydraulic fracturing, coiled tubing and other oil field services and extended lead times to obtain equipment needed to provide these services. Further, there are a limited number of suppliers that manufacture the equipment we use. Should our current suppliers be unable or unwilling to provide the necessary equipment and parts or otherwise fail to deliver the products timely and in the quantities required, any resulting delays in the provision of our services could have a material adverse effect on our business, financial condition, results of operations and cash flows. In addition, future price increases for this type of equipment and parts could negatively impact our ability to purchase new equipment to update or expand our existing fleet or to timely repair equipment in our existing fleet.

The loss of or interruption in operations of one or more of our key raw material suppliers and shortages of water could have a material adverse effect on our operations.

Our reliance on outside suppliers for some of the key raw materials we use in providing our services involves several risks, including limited control over the price, timely delivery and quality of such materials or equipment. We rely on a limited number of suppliers for certain raw materials, particularly sand and other proppants, which are critical for certain of our operations. In the past we have experienced a shortage of sand and if we were to again have a problem sourcing this or other raw materials or transporting these materials from these suppliers, our ability to provide services would be limited. We do not have commitments with our suppliers to ensure the continued supply of raw materials. Historically, we have placed orders with our suppliers that meet our expected raw material demands for short periods of time. Any changes in our suppliers could cause material delays in our operations and increase our costs. In addition, our suppliers may not be able to meet our future demands as to volume, quality or timeliness. Our inability to obtain timely delivery of key raw materials of acceptable quality or any significant increases in prices of such materials could result in material operational delays, increase our operating costs, limit our ability to service our customers’ wells or otherwise materially and adversely affect our business and operating results. Further, our hydraulic fracturing operations require significant amounts of water and may be negatively impacted by shortages of water, due to droughts or otherwise, in the areas in which we operate. Our fracturing operations in certain shales are more water intensive due to the peculiar geology of such shales, and competition for water in such shales is growing.

We rely on a few key employees whose absence or loss could adversely affect our business.

Many key responsibilities within our business have been assigned to a small number of key employees. Our key employees include John Jordan, our chief executive officer, Ronnie Roles, our senior vice president of pressure control services, William Hailey, senior vice president of pressure pumping services, and Danny Ward, senior vice president of directional drilling services. The loss of their services could adversely affect our business. Our key employees may voluntarily terminate their employment at any time. The loss of one or more of our key employees could have a material adverse impact on our business. Also, we do not maintain “key person” life insurance policies on any of our employees. As a result, we are not insured against any losses resulting from the death of our key employees.

If we are unable to employ a sufficient number of skilled and qualified workers, our capacity and profitability could be diminished and our growth potential could be impaired.

The delivery of our products and services requires skilled and qualified workers with specialized skills and experience who can perform physically demanding work. As a result of the volatility of the oilfield services industry and the demanding nature of the work, workers may choose to pursue employment in fields that offer a more desirable work environment at wage rates that are competitive. Our ability to be productive and profitable will depend upon our ability to employ and retain skilled workers. In addition, our ability to expand our

15

Table of Contents

Index to Financial Statements

operations depends in part on our ability to increase the size of our skilled labor force. The demand for skilled workers is high, and the supply is limited. As a result, competition for experienced oilfield service personnel is intense, and we face significant challenges in competing for crews and management with large and well-established competitors. A significant increase in the wages paid by competing employers could result in a reduction of our skilled labor force, increases in the wage rates that we must pay, or both. If either of these events were to occur, our capacity and profitability could be diminished and our growth potential could be impaired.

Unionization efforts could increase our costs or limit our flexibility.

Presently, none of our employees work under collective bargaining agreements. Unionization efforts have been made from time to time within our industry, to varying degrees of success. Any such unionization could increase our costs or limit our flexibility.

Advancements in technology could have a material adverse effect on our business, financial condition and results of operations and cash flows.

As new horizontal and directional drilling, pressure pumping, pressure control and other well service technologies develop, we may be placed at a competitive disadvantage, and competitive pressure may force us to implement new technologies at a substantial cost. We may not be able to successfully acquire or use new technologies. New technologies could render our current products and services obsolete or significantly reduce demand for our current products and services. As a result, new advancements in technology could have a material adverse effect on our business, financial condition and results of operations and cash flows.

Our operations require substantial capital and we may be unable to obtain needed capital or financing on satisfactory terms, which could limit our ability to grow.

The oilfield services industry is capital intensive. In conducting our business and operations, we make, and expect to continue to make, substantial capital expenditures. Our capital acquisitions were approximately $28.8 million for the three months ended March 31, 2011, $55.5 million for the year ended December 31, 2010, $8.1 million for the year ended December 31, 2009 and $35.5 million for the year ended December 31, 2008. The decrease in 2009 was due to the economic downturn in late 2008 and 2009. Our capital expenditures for 2011 are estimated to be approximately $99.7 million. To date, we have financed capital expenditures primarily with funding from our equity sponsor, cash generated by operations and borrowings under our credit facilities. We will pay down outstanding indebtedness with the net proceeds of this offering. Following the completion of this offering and the application of the net proceeds thereafter, we intend to finance our capital expenditures primarily with cash on hand, cash flow from operations and borrowings under our revolving credit facility. We may be unable to generate sufficient cash from operations and other capital resources to maintain planned or future levels of capital expenditures which, among other things, may prevent us from acquiring new equipment or properly maintaining our existing equipment. This could put us at a competitive disadvantage or interfere with our growth plans. Further, our actual capital expenditures for 2011 could exceed our capital expenditure budget. In the event our capital expenditure requirements at any time are greater than the amount we have available, we could be required to seek additional sources of capital, which may include debt financing, joint venture partnerships, sales of assets, offerings of debt or equity securities or other means. We may not be able to obtain any such alternative source of capital or, if we can obtain alternative sources of capital, the terms of such alternative may not be favorable to us. In particular, the terms of any debt financing may include covenants that significantly restrict our operations. Our inability to grow as planned may reduce our chances of maintaining and improving profitability.

Our acquisitions may expose us to various risks, including those relating to difficulties in identifying suitable acquisition opportunities and integrating businesses, assets and personnel, as well as difficulties in obtaining financing for targeted acquisitions and the potential for increased leverage or debt service requirements.

As a component of our business strategy, we have pursued and intend to continue to pursue selected acquisitions of complementary assets, businesses and technologies. Since our commencement of operations in

16

Table of Contents

Index to Financial Statements

December 2005, we have completed three acquisitions for an aggregate consideration of approximately $78.5 million. Acquisitions involve numerous risks, including:

| • | unanticipated costs and assumption of liabilities and exposure to unforeseen liabilities of acquired businesses, including but not limited to environmental liabilities; |

| • | difficulties in integrating the operations and assets of the acquired business and the acquired personnel; |

| • | limitations on our ability to properly assess and maintain an effective internal control environment over an acquired business, in order to comply with public reporting requirements; |

| • | potential losses of key employees and customers of the acquired businesses; |

| • | inability to commercially develop acquired technologies; |

| • | risks of entering markets in which we have limited prior experience; and |

| • | increases in our expenses and working capital requirements. |

The process of integrating an acquired business may involve unforeseen costs and delays or other operational, technical and financial difficulties and may require a disproportionate amount of management attention and financial and other resources. Our failure to achieve consolidation savings, to incorporate the acquired businesses and assets into our existing operations successfully or to minimize any unforeseen operational difficulties could have a material adverse effect on our financial condition and results of operations. Furthermore, there is intense competition for acquisition opportunities in our industry. Competition for acquisitions may increase the cost of, or cause us to refrain from, completing acquisitions.

In addition, we may not have sufficient capital resources to complete additional acquisitions. Historically, we have financed capital expenditures primarily with funding from our equity sponsor, cash generated by operations and borrowings under our credit facilities. We may incur substantial indebtedness to finance future acquisitions and also may issue equity, debt or convertible securities in connection with such acquisitions. Debt service requirements could represent a significant burden on our results of operations and financial condition and the issuance of additional equity or convertible securities could be dilutive to our existing stockholders. Furthermore, we may not be able to obtain additional financing on satisfactory terms. Even if we have access to the necessary capital, we may be unable to continue to identify additional suitable acquisition opportunities, negotiate acceptable terms or successfully acquire identified targets.

Our ability to grow through acquisitions and manage growth will require us to continue to invest in operational, financial and management information systems and to attract, retain, motivate and effectively manage our employees. The inability to effectively manage the integration of acquisitions could reduce our focus on subsequent acquisitions and current operations, which, in turn, could negatively impact our earnings and growth. Our financial position and results of operations may fluctuate significantly from period to period, based on whether or not significant acquisitions are completed in particular periods.

Our customer base is concentrated and the loss of one or more of our significant customers could cause our revenue to decline substantially.

Our top five customers accounted for approximately 46%, 36%, 26% and 30% of our revenue for the three months ended March 31, 2011 and for the years ended December 31, 2010, 2009 and 2008, respectively. Our largest customer accounted for approximately 15%, 18%, 11% and 13% of our revenue for the three months ended March 31, 2011 and for the years ended December 31, 2010, 2009 and 2008, respectively. It is likely that we will continue to derive a significant portion of our revenue from a relatively small number of customers in the future. If a major customer decided not to continue to use our services, our revenue would decline and our operating results and financial condition could be harmed.

17

Table of Contents

Index to Financial Statements

Many of our customers’ activity levels, spending for our services and payment patterns have been and may continue to be impacted by the credit markets.

Many of our customers finance their activities through cash flow from operations, the incurrence of debt or the issuance of equity. During 2008 there was a significant decline in the credit and equity markets, adversely impacting the availability of capital. We believe that since March 2009, the credit and equity markets have improved. However, uncertainty regarding any continued improvement or the actual deterioration of these markets could have a material adverse impact on our customers’ willingness or ability to spend for our services. Such reduction in spending could have a material adverse effect on our operations.

In addition, while historically our customer base has not presented significant credit risks, the same factors that may lead to a reduction in our customers’ spending also may increase our exposure to the risks of nonpayment and nonperformance by our customers. A significant reduction in our customers’ liquidity may result in a decrease in their ability to pay or otherwise perform on their obligations to us. Any increase in the nonpayment of and nonperformance by our counterparties, either as a result of recent changes in financial and economic conditions or otherwise, could have an adverse impact on our operating results and could adversely affect our liquidity.

Our indebtedness and liquidity needs could restrict our operations and make us more vulnerable to adverse economic conditions.

Our existing and future indebtedness, whether incurred in connection with acquisitions, operations or otherwise, may adversely affect our operations and limit our growth, and we may have difficulty making debt service payments on such indebtedness as payments become due. Our level of indebtedness may affect our operations in several ways, including the following:

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | the covenants that are contained in the agreements that govern our indebtedness could limit our ability to borrow funds, dispose of assets, pay dividends and make certain investments; |

| • | our debt covenants could also affect our flexibility in planning for, and reacting to, changes in the economy and in our industry; |

| • | any failure to comply with the financial or other covenants of our debt could result in an event of default, which could result in some or all of our indebtedness becoming immediately due and payable; |

| • | our level of debt could impair our ability to obtain additional financing in the future for working capital, capital expenditures, acquisitions or other general corporate purposes; and |

| • | our business may not generate sufficient cash flow from operations to enable us to meet our obligations under our indebtedness. |

Our revolving credit facility imposes restrictions on us that may affect our ability to successfully operate our business.

Our revolving credit facility limits our ability to take various actions, such as:

| • | incurring additional indebtedness; |

| • | paying dividends; |

| • | creating certain additional liens on our assets; |

| • | entering into sale and leaseback transactions; |

| • | making investments; |

| • | entering into transactions with affiliates; |

18

Table of Contents

Index to Financial Statements

| • | making material changes to the type of business we conduct or our business structure; |

| • | making guarantees; |

| • | disposing of assets in excess of certain permitted amounts; |

| • | merging or consolidating with other entities; and |

| • | selling all or substantially all of our assets. |

In addition, our revolving credit facility requires us to maintain certain financial ratios and to satisfy certain financial conditions, which may require us to reduce our debt or take some other action in order to comply with each of them. These restrictions could also limit our ability to obtain future financings, make needed capital expenditures, withstand a downturn in our business or the economy in general, or otherwise conduct necessary corporate activities. We also may be prevented from taking advantage of business opportunities that arise because of the limitations imposed on us by the restrictive covenants under our revolving credit facility.

We may not be able to provide services that meet the specific needs of oil and natural gas exploration and production companies at competitive prices.

The markets in which we operate are generally highly competitive and have relatively few barriers to entry. The principal competitive factors in our markets are price, product and service quality and availability, responsiveness, experience, technology, equipment quality and reputation for safety. We compete with large national and multi-national companies that have longer operating histories, greater financial, technical and other resources and greater name recognition than we do. Several of our competitors provide a broader array of services and have a stronger presence in more geographic markets. In addition, we compete with several smaller companies capable of competing effectively on a regional or local basis. Our competitors may be able to respond more quickly to new or emerging technologies and services and changes in customer requirements. Some contracts are awarded on a bid basis, which further increases competition based on price. Pricing is often the primary factor in determining which qualified contractor is awarded a job. The competitive environment has intensified as recent mergers among oil and natural gas companies have reduced the number of available customers. As a result of competition, we may lose market share or be unable to maintain or increase prices for our present services or to acquire additional business opportunities, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

In addition, some exploration and production companies have begun performing hydraulic fracturing and directional drilling on their wells using their own equipment and personnel. Any increase in the development and utilization of in-house fracturing and directional drilling capabilities by our customers could decrease the demand for our services and have a material adverse impact on our business.

Severe weather could have a material adverse impact on our business.

Our business could be materially and adversely affected by severe weather. Repercussions of severe weather conditions may include:

| • | curtailment of services; |

| • | weather-related damage to equipment resulting in suspension of operations; |

| • | weather-related damage to our facilities; |

| • | inability to deliver equipment and materials to jobsites in accordance with contract schedules; and |

| • | loss of productivity. |