Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BlackRock Inc. | d8k.htm |

| EX-99.1 - PRESS RELEASE DATED JULY 20, 2011 ISSUED BY THE COMPANY - BlackRock Inc. | dex991.htm |

Q2

2011 Earnings Press Release Supplement

July 20, 2011

Exhibit 99.2 |

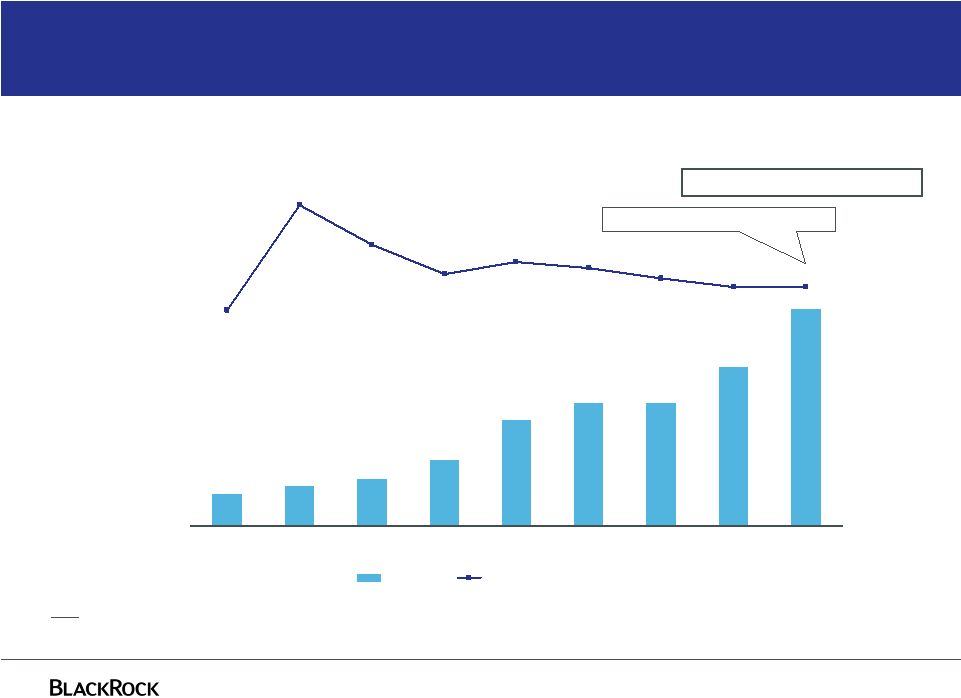

1

$727

$741

$737

$962

$819

$883

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

$578

$582

$670

$469

$463

$537

$2.40

$2.96

$3.00

$2.75

$3.42

$2.37

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Strong operating income drove earnings

Operating and Net Income, as Adjusted ($ in millions)

Diluted Earnings Per Share, as Adjusted

Reconciliation between GAAP and as Adjusted is provided in the appendix

Operating Income

Net Income

Second quarter EPS results were affected by volatility in non-operating. Q3

2011 will include full effect of Bank of America buy-back. |

2

Operating margin remained strong

Operating Margin, as Adjusted

For

further

information

and

reconciliation

between

GAAP

and

as

Adjusted,

see

note

(a)

in

the

current

earnings

release

as

well

as

the

2010

Form 10-K

and

first

quarter

2011

10-Q.

YTD 2011 = 39.4%

2011

year-to-date

margin

is

higher

than

the

full

year

and

second

quarter

2010

margins.

Full Year 2010 = 39.3%

BLK/BGI

Pro Forma |

3

Equity markets improved from 2010

800

900

1,000

1,100

1,200

1,300

1,400

S&P 500

Q1 2011 Spot to Spot

Q2 2011 Spot to Spot

Q1-11 Average: 1,303

Q2-11 Average: 1,318

Q2 2010 Spot to Spot

The S&P averaged approximately 1,300 in both the first and second quarter of

2011. Q2-10 Average: 1,135

4/30/10

5/31/10

6/30/10 12/31/10

2/28/11

3/31/11

4/30/11

5/31/11

6/30/11

3/31/10

1/31/11 |

Year-over-year

Q2 2011 vs. Q2 2010

4 |

5

27% year-over-year growth in EPS driven by operating EPS

Q2-11 Compared to Q2-10, as Adjusted

$2.46

$3.09

$0.63

($0.10)

$0.40

$0.90

$1.40

$1.90

$2.40

$2.90

$3.40

Q2-10 EPS

Operating EPS

Q2-11 EPS

Increasing EPS

Non-Operating EPS

Operating EPS

Total EPS:

$3.00

Total EPS:

$2.37

Non-Operating :

($0.09)

Operating

EPS:

Operating

EPS:

For further information and reconciliation between GAAP and as Adjusted, see notes

(a) through (e) in the current earnings release Non-Operating :

($0.09) |

$741

$315

($173)

$883

Q2-10

Revenue

Expenses

Q2-11

$700

$900

6

19% year-over-year growth in operating income

$142 million

Q2-11 Compared to Q2-10, as Adjusted

$0

$1,100

For

further

information

and

reconciliation

between

GAAP

and

as

Adjusted,

see

note

(a)

in

the

current

earnings

release

as

well

as

the

2010

Form

10-K

and

first

quarter

2011

10-Q. |

$0

$1,800

$2,000

$2,200

$2,400

7

16% year-over-year revenue growth

Q2-11 Compared to Q2-10

Increasing Revenue

$315 million

Total Revenue

Q2-10

$2.03 billion

Q2-11

$2.35 billion

88%

2%

4%

6%

Base Fees

Performance Fees

BRS and Advisory

Other Revenue

90%

2%

5%

3%

Base Fees

Performance Fees

BRS and Advisory

Other Revenue |

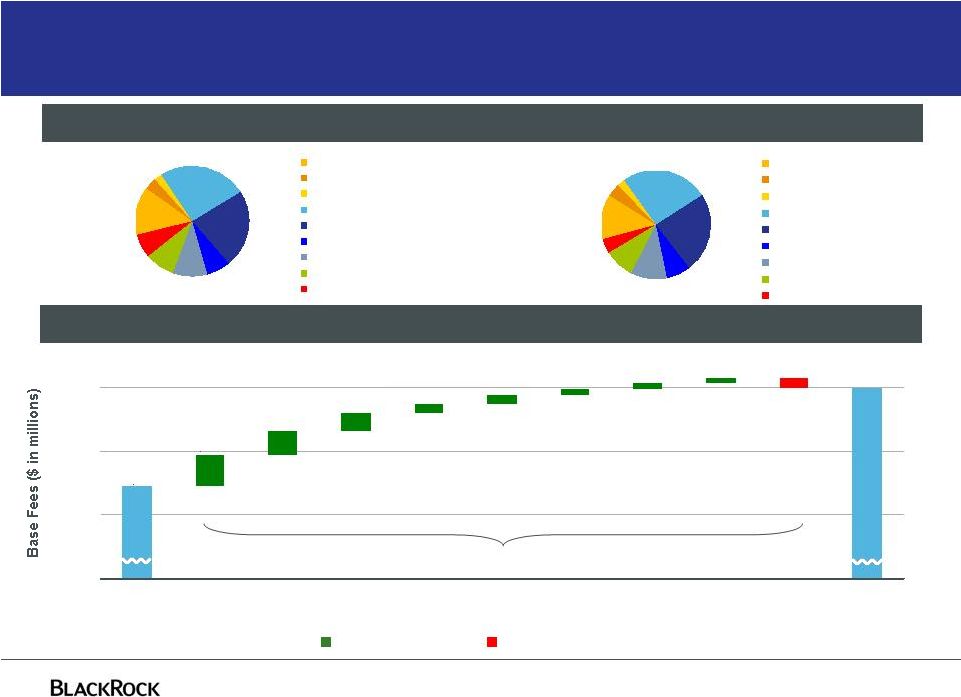

8

17% year-over-year base fee growth included higher fees in all long-term

asset classes Decreasing Base Fees

Increasing Base Fees

Q2-11 Compared to Q2-10

Q2-11

$2.10 billion

$308 million

Base fees

Q2-10

$1.79 billion

$0

$1,792

$2,100

$97

$76

$55

$30

$28

$19

$18

$15

($30)

$1,700

$1,900

$2,100

Q2-10

iShares/

ETP Equity

Active

Equity

Multi-Asset

Institutional

Index Equity

Alternatives

Active

Fixed

Income

Institutional

Index Fixed

Income

iShares/

ETP Fixed

Income

Cash

Q2-11

14%

3%

2%

26%

22%

7%

10%

9%

7%

Active Fixed Income

iShares/ ETP Fixed Income

Institutional Index Fixed Income

Active Equity

iShares/ ETP Equity

Institutional Index Equity

Multi-Asset

Alternatives

Cash

13%

4%

3%

25%

23%

11%

9%

5%

Active Fixed Income

iShares/ ETP Fixed Income

Institutional Index Fixed Income

Active Equity

iShares/ ETP Equity

Institutional Index Equity

Multi-Asset

Alternatives

Cash

7% |

$0

$1,200

$1,300

$1,400

$1,500

9

13% year-over-year expense growth driven by continued business expansion

Increasing Expenses

Decreasing Expenses

55%

10%

24%

3%

7%

1%

Employee Comp. & Benefits

Distribution & Servicing Costs

Amort. of Deferred Sales Commissions

Direct Fund Expenses

General & Administration

Amortization of Intangibles

$1.46 billion

Q2-11 Expense, as Adjusted, by Category

Q2-11 Compared to Q2-10, as Adjusted

For further information and reconciliation between GAAP and as Adjusted, see note

(a) in the current earnings release |

Sequential Quarters

Q2 2011 vs. Q1 2011

10 |

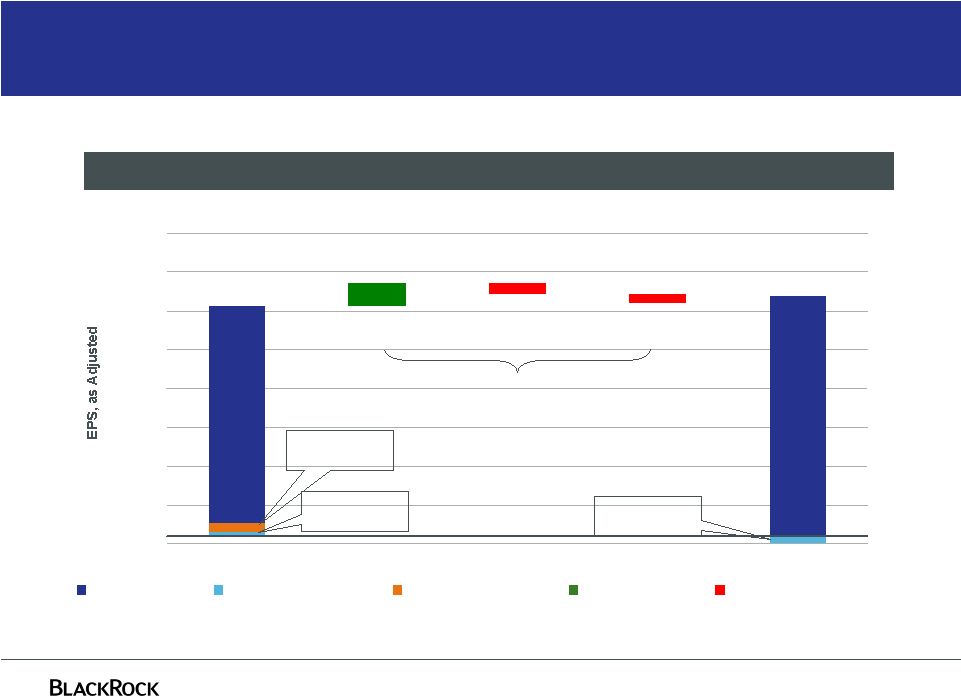

11

Sequential growth in operating income offset partially by lower mark-to-market

gains on investments ($0.10)

$0.40

$0.90

$1.40

$1.90

$2.40

$2.90

$3.40

$3.90

Q1-11 EPS

Operating EPS

Non-Operating EPS

Tax Adjustment

Q2-11 EPS

$0.04

Increasing EPS

For further information and reconciliation between GAAP and as Adjusted, see notes

(a) through (e) in the current earnings release Decreasing EPS

Q2-11 Compared to Q1-11, as Adjusted

Non-Operating EPS

Operating EPS

Total EPS:

$2.96

Total EPS:

$3.00

Operating

EPS:

Non-Operating:

$0.05

Non-Operating:

($0.09)

Operating

EPS:

Tax Adjustment:

$0.12

Tax Adjustment

$2.79

$3.09

$0.30

($0.14)

($0.12) |

12

8% sequential growth in operating income as a result of revenue growth

Q2-11 Compared to Q1-11, as Adjusted

$64 million

$0

$819

$883

($1)

$65

$700

$900

Q1-11

Revenue

Expenses

Q2-11

For

further

information

and

reconciliation

between

GAAP

and

as

Adjusted,

see

note

(a)

in

the

current

earnings

release

as

well

as

the

2010

Form

10-K

and

first

quarter

2011

10-Q. |

13

3% sequential revenue growth driven by base fees

$65 million

Decreasing Revenue

$0

Q2-11 Compared to Q1-11

Increasing Revenue

Total Revenue

Q1-11

$2.28 billion

Q2-11

$2.35 billion

86%

4%

4%

6%

Base Fees

Performance Fees

BRS and Advisory

Other Revenue

90%

2%

3%

5%

Base Fees

Performance Fees

BRS and Advisory

Other Revenue

$1,800

$2,000

$2,200

$2,400

$2,600 |

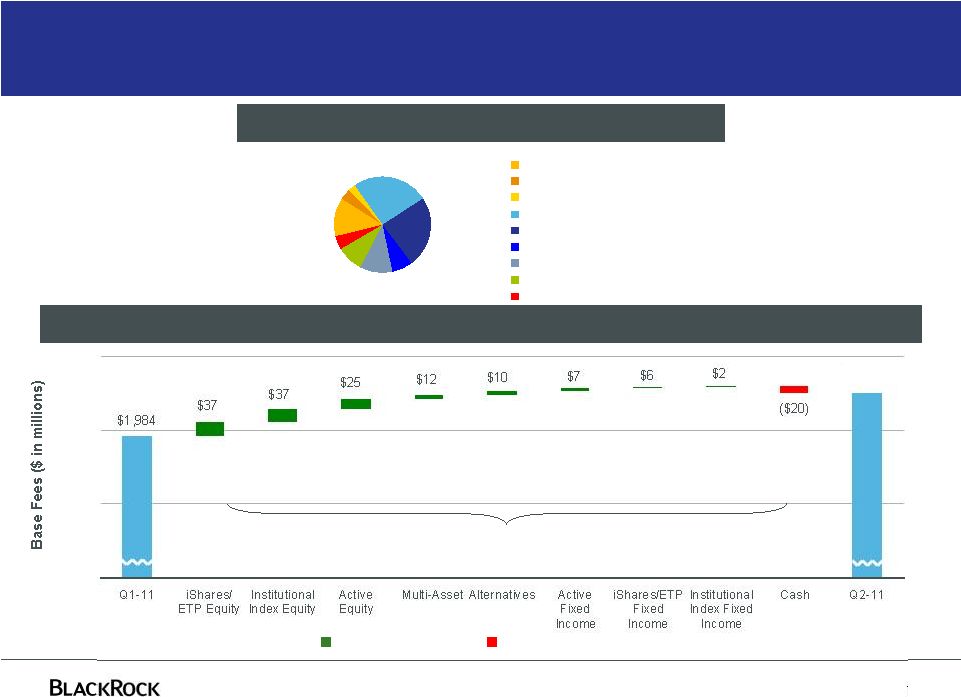

$0

$1,800

$2,000

$2,200

14

6% sequential base fee growth reflected higher fees in all long-term asset classes

as a result of strong securities lending fees and AUM growth

$116 million

Decreasing Base Fees

Increasing Base Fees

13%

4%

3%

25%

23%

7%

11%

9%

5%

Active Fixed Income

iShares/ ETP Fixed Income

Institutional Index Fixed Income

Active Equity

iShares/ ETP Equity

Institutional Index Equity

Multi-Asset

Alternatives

Cash

Q2-11 Base Fees

Q2-11 Compared to Q1-11

$2.10 billion

$2,100 |

15

Sequential total expenses remained flat

Increasing Expenses

Decreasing Expenses

$0

$1.46 billion

Q2-11 Expense, as Adjusted, by Category

Q2-11 Compared to Q1-11, as Adjusted

For further information and reconciliation between GAAP and as Adjusted, see note

(a) in the current earnings release 55%

10%

24%

3%

7%

1%

Employee Comp. & Benefits

Distribution & Servicing Costs

Amort. of Deferred Sales Commissions

Direct Fund Expenses

General & Administration

Amortization of Intangibles

$1,300

$1,400

$1,500

$1,600

Q2-11

Q1-11

Direct Fund

Exp

G&A

Amort.–

Deferred

Commissions

Amort. –

Intangible

Assets

Compensation

& Benefits

Distribution &

Servicing

$1,463

$10

$5

($1)

($2)

($2)

($9)

$1,464 |

Non-operating and payout ratio

16 |

17

For

further

information

and

reconciliation

between

GAAP

and

as

Adjusted,

see

note

(b)

in

the

current

earnings

release

as

well

as

the

2010

Form 10-K

and

first

quarter

2011

10-Q.

Continued net investment gains offset by higher interest expense

$18

($13)

$2

$1

$2

($37)

($40)

($30)

($20)

($10)

$0

$10

$20

Private Equity

Real Estate

Distressed Credit/

Mortgage

Hedge Funds/

Funds of Hedge

Funds

Other Investments

Net Interest

Expense

Q2-11 $27 million Non-Operating Expense by Category, as Adjusted

Investment Losses/ Net Interest Expense

Investment Gain

$10 million Net Investment Gains |

18

Increase in payout ratio as a result of the $2.5 billion buyback

$4.00

$3.12

$3.12

$2.68

$1.68

$1.20

$1.00

$0.80

$5.50

33%

83%

64%

50%

56%

53%

48%

44%

44%

2011

2010

2009

2008

2007

2006

2005

2004

2003

Dividend (A)

Payout Ratio (B)

Notes:

(A) 2003 and 2011 dividends have been annualized

(B) Payout ratio = (dividends + share repurchases) / GAAP net income. 2011 ratio

includes Q1 & Q2 2011 data only. (C) Payout ratio = (YTD 2Q 2011 dividends

x 2) + share repurchases) / (YTD 2Q 2011 GAAP net income x 2). N/A

2/26/04

2/15/05

2/17/06

2/27/07

2/15/08

N/A

2/25/10

3/7/11

Dividend Change

Declared:

151% with $2.5 bn buyback

(C)

Excludes $2.5 bn share buyback |

Appendix

19 |

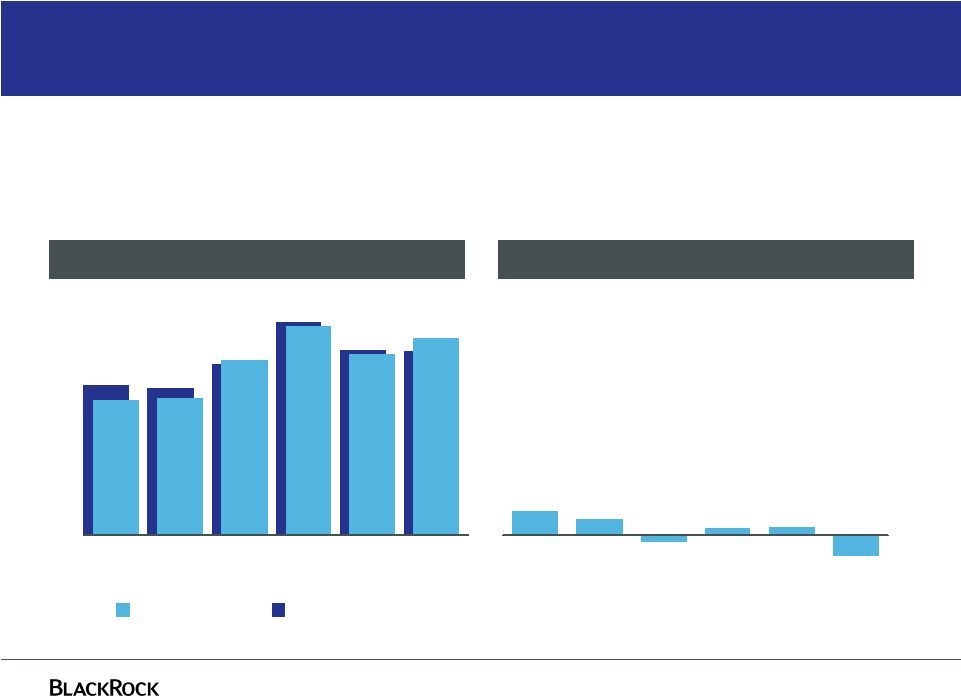

20

$883

$962

$737

$741

$727

$819

$654

$697

$707

$940

$798

$866

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

GAAP

As Adjusted

Quarterly operating income –

GAAP and As Adjusted

Operating Income ($ in millions)

Non-GAAP Adjustments ($ in millions)

Non-GAAP

adjustments

include

BGI

integration

costs,

PNC

LTIP

funding

obligation,

Merrill

Lynch

compensation

contribution, and compensation related to appreciation (depreciation) on certain

deferred compensation plans $17

$21

$22

$30

$73

$44

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

For further information and reconciliation between GAAP and as Adjusted, see note (a) in the current

earnings release as well as previously filed Form 10-Qs |

21

$578

$582

$670

$469

$463

$537

$432

$551

$657

$568

$619

$423

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Quarterly net income –

GAAP and As Adjusted

($41)

$14

$13

$46

$31

($14)

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Net Income ($ in millions)

Non-GAAP Adjustments ($ in millions)

GAAP

As Adjusted

For further information and reconciliation between GAAP and as Adjusted, see notes

(c) and (d) in the current earnings release as well as previously filed Form 10-Qs

Non-GAAP adjustments include BGI integration costs, PNC LTIP funding obligation, Merrill Lynch

compensation contribution, and income tax law changes

|

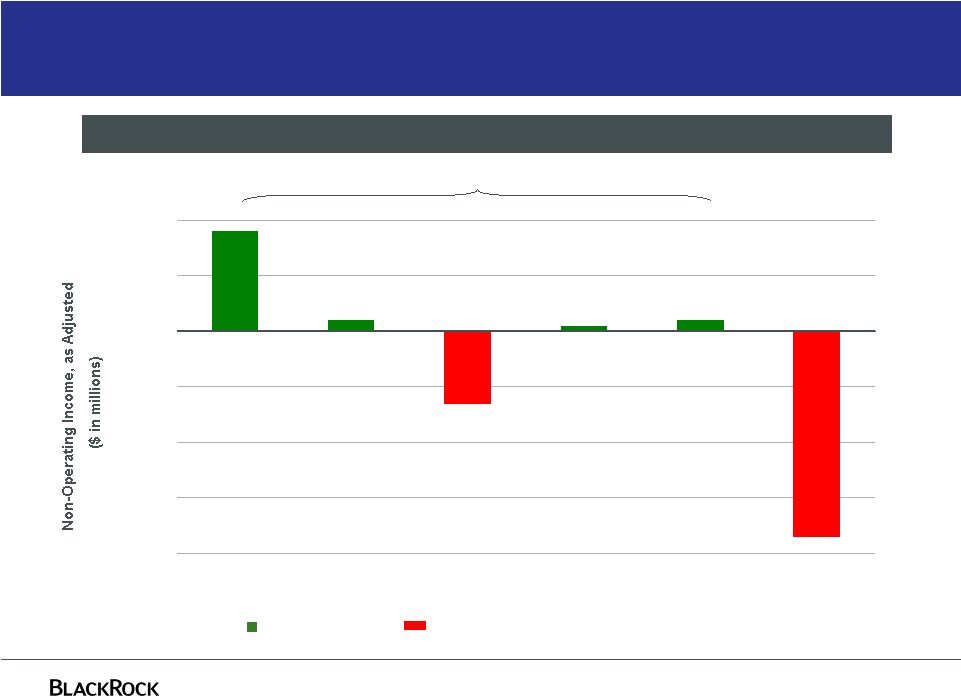

22

$78

$18

$15

($27)

$2

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

$39

($28)

($6)

$20

$14

GAAP

As Adjusted

Quarterly non-operating income –

GAAP and As Adjusted

Non-Operating Income ($ in millions)

Non-GAAP Adjustments ($ in millions)

Non-GAAP adjustments include net income (loss) attributable to

non-controlling interests, and compensation expense related to

(appreciation) depreciation on certain deferred compensation plans $47

($8)

($39)

$2

($1)

$0

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

($75)

As Adjusted:

($27)

For further information and reconciliation between GAAP and as Adjusted, see note (b) in the current

earnings release as well as previously filed Form 10-Qs |

23

Forward-looking statements

This

presentation,

and

other

statements

that

BlackRock

may

make,

may

contain

forward-looking

statements

within

the meaning of the Private Securities Litigation Reform Act, with respect to

BlackRock’s future financial or business performance, strategies or

expectations. Forward-looking statements are typically identified by words or

phrases such as “trend,”

“potential,”

“opportunity,”

“pipeline,”

“believe,”

“comfortable,”

“expect,”

“anticipate,”

“current,”

“intention,”

“estimate,”

“position,”

“assume,”

“outlook,”

“continue,”

“remain,”

“maintain,”

“sustain,”

“seek,”

“achieve,”

and

similar

expressions,

or

future

or

conditional

verbs

such

as

“will,”

“would,”

“should,”

“could,”

“may”

or

similar expressions.

BlackRock cautions that forward-looking statements are subject to numerous

assumptions, risks and uncertainties, which change over time.

Forward-looking statements speak only as of the date they are made, and BlackRock

assumes no duty to and does not undertake to update forward-looking

statements. Actual results could differ materially from those

anticipated in forward-looking statements and future results could differ materially from

historical performance. |

24

Forward-looking statements

In addition to risk factors previously disclosed in BlackRock’s Securities and Exchange

Commission (“SEC”) reports and those identified elsewhere in this presentation the

following factors, among others, could cause actual results to differ materially from

forward-looking statements or historical performance: (1) the introduction, withdrawal,

success and timing of business initiatives and strategies; (2) changes and volatility in political,

economic or industry conditions, the interest rate environment, foreign exchange rates or financial

and capital markets, which could result in changes in demand for products or services or in the

value of assets under management; (3) the relative and absolute investment performance of

BlackRock’s investment products; (4) the impact of increased competition; (5) the impact

of capital improvement projects; (6) the impact of future acquisitions or divestitures; (7) the

unfavorable resolution of legal proceedings; (8) the extent and timing of any share

repurchases; (9) the impact, extent and timing of technological changes and the adequacy of intellectual

property and information security protection; (10) the impact of legislative and regulatory actions

and reforms, including the Dodd-Frank Wall Street Reform and Consumer Protection Act, and

regulatory, supervisory or enforcement actions of government agencies relating to BlackRock,

Barclays Bank PLC or The PNC Financial Services Group, Inc.; (11) terrorist activities,

international hostilities and natural disasters, which may adversely affect the general

economy, domestic and local financial and capital markets, specific industries or BlackRock;

(12) the ability to attract and retain highly talented professionals; (13) fluctuations in the

carrying value of BlackRock’s economic investments; (14) the impact of changes to tax

legislation and, generally, the tax position of the Company; (15) BlackRock’s success in

maintaining the distribution of its products; (16) the impact of BlackRock electing to provide

support to its products from time to time; (17) the impact of problems at other financial

institutions or the failure or negative performance of products at other financial institutions; and (18) the

ability of BlackRock to complete the integration of the operations of Barclays Global Investors.

|

|