Attached files

Table of Contents

As filed with the Securities and Exchange Commission on July 14, 2011

Registration No. 333-170131

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PRE-EFFECTIVE AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

iSHARES® COPPER TRUST

(Exact name of registrant as specified in its charter)

| New York | 6799 | [—] | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

c/o BlackRock Asset Management International Inc.

400 Howard Street

San Francisco, CA 94105

Attn: Product Management Team

iShares Product Research & Development

(415) 670-2000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

c/o BlackRock Asset Management International Inc.

400 Howard Street

San Francisco, CA 94105

Attn: Product Research & Development Team,

(415) 670-2000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| David Yeres, Esq. Clifford Chance US LLP 31 West 52nd Street New York, NY 10019 |

Deepa Damre, Esq. BlackRock Institutional Trust Company, N.A. 400 Howard Street San Francisco, CA 94105 |

Approximate date of commencement of proposed sale to the public: As soon as practical after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated [ ], 20[ ]

12,120,000 Shares

iSHARES® COPPER TRUST

The iShares® Copper Trust issues shares (“Shares”) representing fractional undivided beneficial interests in its net assets. The objective of the trust is for the Shares to reflect, at any given time, the value of the assets owned by the trust less the trust’s expenses and liabilities at that time. The assets of the trust consist primarily of copper held by a custodian on behalf of the trust. The Shares are listed and traded on [ ] under the symbol “[ ]”. Market prices for the Shares may be different from the net asset value per Share. BlackRock Asset Management International Inc. is the sponsor of the trust, The Bank of New York Mellon is the trustee of the trust, and Metro International Trade Services LLC is the custodian of the trust. The trust is not an investment company registered under the Investment Company Act of 1940. The trust is not a commodity pool for purposes of the Commodity Exchange Act, and its sponsor is not subject to regulation by the Commodity Futures Trading Commission as a commodity pool operator or a commodity trading advisor.

Copper owned by the trust will be held by the custodian at locations within or outside the United States that are agreed from time to time by the custodian and the trustee.

The trust intends to issue Shares on a continuous basis. A block of 2,500 Shares is called a “Basket”. The trust issues and redeems Shares only in blocks of five or more Baskets. Only registered broker-dealers that become authorized participants by entering into a contract with the sponsor and the trustee may purchase or redeem Baskets. The trust issues Baskets in exchange for copper in physical form. Redemptions take place in exchange for copper transferred from the trust’s account to the redeeming authorized participant’s account with the trust’s custodian. See “Description of the Shares and the Trust Agreement—Redemption of Baskets; Withdrawal of Copper”.

Except when aggregated in blocks of five or more Baskets, Shares are not redeemable securities.

On [ ], 2011, the trust issued to [ ], as the Initial Purchaser, [ ] Baskets comprising [ ] Shares, which are referred to as the Initial Shares, in exchange for an in-kind per-Basket deposit with the custodian of 25 tonnes of copper (equivalent to a per-Share consideration of 10 kilograms of copper). The Initial Purchaser intends to offer the Initial Shares to the public.

The Initial Purchaser will, and the authorized participants may, offer to the public, from time to time, Shares from any Baskets they purchase from the trust (including the Initial Shares). Shares (including the Initial Shares) offered to the public by the Initial Purchaser or the authorized participants may be offered at a per-Share offering price that varies depending on, among other factors, the trading price of the Shares on [ ], the net asset value per Share and the supply of and demand for the Shares at the time of the offer. Shares initially comprising the same Basket but offered to the public at different times may have different offering prices. Neither the Initial Purchaser nor any authorized participant will receive from the trust, the sponsor or any of their affiliates, any fee or other compensation in connection with their sale of Shares to the public (including the Initial Shares); however, the sponsor may reimburse to the Initial Purchaser certain fees and expenses incurred in connection with the offering of the Initial Shares. The Initial Purchaser and the authorized participants may receive commissions or fees from investors who purchase Shares through their commission- or fee-based brokerage accounts.

Investing in the Shares involves significant risks. See “Risk Factors” starting on page 9.

Neither the Securities and Exchange Commission (SEC) nor any state securities commission has approved or disapproved of the securities offered in this prospectus, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Shares are not interests in or obligations of the sponsor or the trustee. The Shares are not insured by the Federal Deposit Insurance Corporation or any other governmental agency.

“iShares” is a registered trademark of BlackRock Institutional Trust Company, N.A.

The date of this prospectus is [ ], 20[ ].

Table of Contents

| Page | ||||

| 1 | ||||

| 1 | ||||

| 3 | ||||

| 4 | ||||

| 5 | ||||

| 8 | ||||

| 9 | ||||

| 9 | ||||

| 10 | ||||

| 13 | ||||

| 14 | ||||

| 17 | ||||

| 18 | ||||

| 18 | ||||

| 18 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| 25 | ||||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 26 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

34 | |||

| 34 | ||||

| 34 | ||||

| 35 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

i

Table of Contents

| Page | ||||

| 37 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 40 | ||||

| THE SECURITIES DEPOSITORY; BOOK-ENTRY-ONLY SYSTEM; GLOBAL SECURITY |

41 | |||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| Maximum 28% Long-Term Capital Gains Tax Rate for U.S. Shareholders Who Are Individuals |

49 | |||

| 3.8% Tax on Net Investment Income for Taxable Years Beginning After December 31, 2012 |

49 | |||

| 49 | ||||

| 49 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

ii

Table of Contents

Although the sponsor believes that this summary is materially complete, you should read the entire prospectus, including “Risk Factors” beginning on page 9, before making an investment decision about the Shares.

A glossary of defined terms appears beginning on page 53.

Trust Structure, the Sponsor, the Trustee and the Custodian

The trust was formed on [ ], 20[ ] when the sponsor and The Bank of New York Mellon (the “Trustee”) signed the Depositary Trust Agreement (“Trust Agreement”) and an initial deposit of copper was made in exchange for the issuance of [ ] Baskets. The purpose of the trust is to own copper transferred to the trust in exchange for Shares. Each Share represents a fractional undivided beneficial interest in the net assets of the trust. The assets of the trust consist primarily of copper held by the custodian on behalf of the trust. However, there may be situations where the trust will unexpectedly hold cash or other assets. For example, a claim may arise against a third party, which is settled in cash. In situations where the trust unexpectedly receives cash or other assets, no new Shares will be issued until after the record date for the distribution of such cash or other property has passed.

Copper transferred to the trust must meet, at the time it is transferred, the requirements (including in respect of brand, markings, bundling, shape, weight and size) of copper that may be delivered in settlement of a copper futures contract traded on the London Metal Exchange (the “LME”). Copper that meets such requirements may be represented by warehouse receipts called “Warrants” which are issued by LME-approved warehouses in compliance with LME rules and regulations. The trust intends to hold its copper in physical form and not represented by Warrants.

The trust issues and redeems Shares only in blocks of five or more Baskets. A Basket consists of 2,500 Shares. The trust issues Baskets in exchange for copper in physical form. Redemptions take place in exchange for copper transferred from the trust’s account to the redeeming authorized participant’s account with the trust’s custodian. See “Description of the Shares and the Trust Agreement—Redemption of Baskets; Withdrawal of Copper”.

Individual Shares will not be redeemed by the trust, but will be listed and traded on [ ] under the symbol “[ ]”. The objective of the trust is for the value of the Shares to reflect, at any given time, the value of copper owned by the trust at that time less the trust’s expenses and liabilities. The material terms of the trust are discussed in greater detail in the section “Description of the Shares and the Trust Agreement”. The trust is not a registered investment company under the Investment Company Act of 1940, as amended, and is not required to register under such act.

The trust’s sponsor is BlackRock Asset Management International Inc., a Delaware corporation and a subsidiary of BlackRock, Inc. The Shares are not obligations of, and are not guaranteed by, BlackRock Asset Management International Inc. or any of its subsidiaries or affiliates.

The sponsor arranged for the creation of the trust and the listing of the Shares on [ ], and paid all the expenses of the registration of the Shares for their public offering in the United States, including the fees of the CPM Group (the independent commodities research firm responsible for the preparation of the section of this prospectus entitled “The Copper Industry”); the trust is not required to reimburse these amounts to the sponsor. The sponsor has agreed to assume the following administrative and marketing expenses incurred by the trust: the trustee’s fee, [ ]’s listing fees, SEC registration fees, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses. In

1

Table of Contents

addition, the sponsor has agreed to pay any fees due to J. Aron & Company (“J. Aron”), an international commodities dealer and subsidiary of The Goldman Sachs Group (which owns the custodian), in connection with its agreement to purchase copper from the trust as needed to cover trust expenses and to buy from or sell to certain authorized participants fractional amounts of copper transferred in connection with the issuance or redemption of Shares. The trust will be responsible for (and, therefore, the Shareholders will bear the burden of) trust expenses not assumed by the sponsor. These expenses include, primarily, the warehousing fees owed to the custodian and the sponsor’s fee. The following table summarizes the ordinary expenses to be incurred by the Trust, the party responsible for their payment and, in the case of expenses borne by the trust, their amount:

| Expense |

Amount |

Responsible Party | ||

| SEC Registration fees |

As needed | Sponsor | ||

| Auditing fees |

As needed | Sponsor | ||

| [ ] listing fees |

As needed | Sponsor | ||

| J. Aron & Company’s fees |

As needed | Sponsor | ||

| Legal fees |

Up to $100,000 per annum | Sponsor | ||

| Legal fees |

In excess of $100,000 per annum | Trust | ||

| Printing and mailing |

As needed | Sponsor | ||

| Sponsor fee |

[ ]% of adjusted net asset value per annum | Trust | ||

| Trustee fee |

As needed | Sponsor | ||

| Custodian fee |

$[ ] per tonne per day(1) |

Trust | ||

| (1) | As of the date of this prospectus, subject to adjustment as described under “The Custodian—The Custodian Fee.” Although the trust does not intend to hold any copper on Warrant, the custodian agreement provides that the warehousing fee due to the custodian in respect of any copper held on Warrant at a particular location will be the maximum LME-authorized per tonne per day fee for that location. |

The sponsor will not exercise day-to-day oversight over the trustee or the custodian. The sponsor may remove the trustee and appoint a successor trustee if the trustee ceases to meet certain objective requirements (including the requirement that it have capital, surplus and undivided profits of at least $150 million) or if, having received written notice of a material breach of its obligations under the Trust Agreement, the trustee has not cured the breach within thirty days. The sponsor also has the right to replace the trustee during the ninety days following any merger, consolidation or conversion in which the trustee is not the surviving entity or, in its discretion, on the fifth anniversary of the creation of the trust or on any subsequent third anniversary thereafter. The sponsor also has the right to select any new or additional custodian to be appointed by the trustee.

The trustee is The Bank of New York Mellon and the custodian is Metro International Trade Services LLC.

The trustee is responsible for the day-to-day administration of the trust. The responsibilities of the trustee include (1) processing orders for the creation and redemption of Baskets; (2) coordinating with the

2

Table of Contents

custodian the receipt or transfer of copper by the trust in connection with each issuance and redemption of Baskets; (3) calculating the net asset value and the adjusted net asset value of the trust on each business day; and (4) selling the trust’s copper as needed to cover the trust’s expenses. For a more detailed description of the role and responsibilities of the trustee see “Description of the Shares and the Trust Agreement” and “The Trustee.”

The custodian is selected by the sponsor and appointed by the trustee for the safekeeping of the copper owned by the trust and is responsible to the trustee only. The general role and responsibilities of the custodian are further described in “The Custodian.” Because the Shareholders are not parties to the custodian agreement, they will not have any claims against the custodian. The custodian’s obligation to accept delivery of copper on behalf of the trust is subject to certain capacity limits that the custodian may from time to time, in its discretion, increase by specified amounts as the total amount of copper that it holds for the trust exceeds 50% of the limit at the time in effect. If these limits are reached, it is anticipated that the sponsor will select and the trustee will retain one or more additional custodians. Each of the trustee and the custodian has the right to terminate the custodian agreement by written notice to the other party at least one year prior to the termination date; provided, that the trustee and the custodian have agreed that in the absence of a breach of the custodian agreement by the other party (or, in the case of the trustee, if the custodian chooses not to increase the warehousing capacity available to the trust after the 50% threshold referred to above has been reached), neither the trustee nor the custodian will exercise its right to terminate the agreement during the ten-year period ending on [ ], 202[ ]. Furthermore, the custodian has agreed that in the absence of a breach of the custodian agreement by the trustee, it will not knowingly provide warehousing services to any other publicly traded physical copper-based investment vehicle for as long as the Shares are primarily listed and publicly traded in the United States, the trust satisfies a minimum market share requirement and a termination date has not been specified. Similarly, the trustee has agreed that in the absence of a custodian’s breach and subject to capacity limits, it will not enter on behalf of the trust into any agreement with any other custodian for copper custodial or warehousing services.

Following the termination of the agreement with the custodian in effect as of the date of this prospectus, the trust will need to retain a new custodian. In addition, while the current agreement with the custodian remains in effect, the trust may need to retain additional custodians, for example, if it needs additional warehousing capacity that the custodian is not able or willing to provide. While the sponsor will seek any agreements with new or additional custodians to be at least as protective of the interests of the trust as the current agreement is, the actual terms and conditions of such agreements will only be negotiated at the time the new or additional custodians become necessary. Accordingly, the terms and conditions of any agreement with a new or additional custodian may be significantly different from the terms and conditions of the current arrangements with the custodian. For example, the duration of the agreement with a new or additional custodian, its fees, the maximum amount of copper that the new or additional custodian will hold on behalf of the trust, the scope of the new or additional custodian’s liability and the new or additional custodian’s standard of care may not be exactly the same as in or even similar to the current agreement with the custodian.

The objective of the trust is for the value of the Shares to reflect, at any given time, the value of copper owned by the trust at that time, less the trust’s expenses and liabilities. The trust is not actively managed. It does not engage in any activities designed to obtain a profit from, or to ameliorate losses caused by, changes in the price of copper. The trust receives copper deposited with it in exchange for the creation of Baskets, sells copper as necessary to cover the trust expenses and other liabilities and transfers copper to authorized participants in exchange for Baskets surrendered to it for redemption.

3

Table of Contents

Although the return, if any, on an investment in the Shares is subject to the additional expense of the sponsor’s fee and to other costs and expenses not assumed by the sponsor which would not be incurred in the case of a direct investment in copper, the Shares are intended to constitute a simple and cost-effective means of making an investment similar to an investment in copper. While the Shares are not the exact equivalent of an investment in copper, they provide investors with an alternative that allows a level of participation in the copper market through the securities market. An investment in Shares is:

Backed by copper held by the custodian on behalf of the trust.

The Shares are backed by copper held by the custodian on behalf of the trust at locations within or outside the United States that are agreed from time to time by the custodian and the trustee. As of the date of this prospectus, the custodian is authorized to hold copper owned by the trust at warehouses located in East Chicago (Indiana), Hull and Liverpool (England), Mobile (Alabama), New Orleans (Louisiana), Saint Louis (Missouri), Rotterdam (the Netherlands) and Antwerp (Belgium). Unless otherwise instructed by the trustee, no copper held by the custodian on behalf of the trust may be on Warrant.

As accessible and easy to handle as any other investment in shares.

Retail investors may purchase and sell Shares through traditional brokerage accounts at prices expected to be less than the amount required for currently existing means of investing in physical copper. Shares are eligible for margin accounts.

Listed.

Although there can be no assurance that an actively traded market in the Shares will develop or be maintained, the Shares are listed and traded on [ ] under the symbol “[ ]”.

Relatively cost efficient.

In spite of the additional expenses referred to above which would not be incurred in the case of a direct investment in copper, an investment in the Shares may represent a cost-efficient alternative for investors not in a position to participate directly in the market for physical copper, because the expenses of an investment in physical copper will be dispersed among all holders of Shares. See “Business of the Trust—Trust Objective”.

The sponsor’s office is located at 400 Howard Street, San Francisco, CA 94105; telephone number (415) 670-2000. The trustee has a trust office at 101 Barclay Street, Floor 6E, New York, New York 10286, telephone number (212) 815-6250. The custodian’s registered office is located at [ ]; its telephone number is [ ].

4

Table of Contents

| Offering |

The Shares represent units of fractional undivided beneficial interest in the net assets of the trust. | |

| Use of proceeds |

Proceeds received by the trust from the issuance of Baskets consist of copper deposits. Such copper is held by the custodian on behalf of the trust until (i) it is transferred to an authorized participant’s account at the trust’s custodian in exchange for Baskets surrendered for redemption or (ii) it is sold to pay the fees due to the custodian and the sponsor and other trust expenses or liabilities not assumed by the sponsor. | |

| [ ] symbol |

[ ] | |

| CUSIP |

46431Y107 | |

| Creation and redemption |

The trust issues and redeems Baskets on a continuous basis (a Basket equals 2,500 Shares). Baskets are only issued or redeemed in exchange for an amount of copper (transferred from the trust’s account to the redeeming authorized participant’s account at the custodian, in the case of redemptions) determined by the trustee on each day that [ ] is open for regular trading. No Shares are issued unless the custodian has received on behalf of the trust the corresponding amount of copper. On the day of creation of the trust, a Basket required delivery of 25 tonnes of copper. The amount of copper necessary for the creation of a Basket, or to be transferred to the redeeming authorized participant's account upon redemption of a Basket, will decrease over the life of the trust, due to the periodic sales of copper to raise the funds needed for the payment of fees and other expenses or liabilities owed by the trust. Baskets may be created or redeemed only by authorized participants, who must pay to the trustee and the custodian certain transaction fees in connection with each order to create or redeem Baskets. See “Description of the Shares and the Trust Agreement” for more details. | |

| Net Asset Value |

The net asset value of the trust is obtained by subtracting the trust’s accrued expenses and liabilities as of any day from the value of the copper owned by the trust on that day; the net asset value per Share, or NAV, is obtained by dividing the net asset value of the trust on a given day by the number of Shares outstanding on that date. On each day on which [ ] is open for regular trading, the trustee determines the NAV as promptly as practicable after 4:00 p.m. (New York time). The trustee values the trust’s copper at that day’s announced LME Bid Price. If there is no LME Bid Price on that day, the trustee is authorized to use the most recently announced LME Bid Price unless the sponsor determines that such price is inappropriate as a basis for evaluation (in which case the sponsor must select, and disclose to the Shareholders, the alternative basis for evaluation used by the trustee). See “Business of the Trust—Valuation of Copper; Computation of Net Asset Value.” | |

5

Table of Contents

| Trust expenses |

The trust’s main recurring expenses are expected to be the remuneration due to the sponsor (the “sponsor’s fee”) and the fees due to the custodian (the “custodian’s fee”). See “Prospectus Summary—Trust Structure, the Sponsor, the Trustee and the Custodian”, “Business of the Trust—Trust Expenses” and “Description of the Shares and the Trust Agreement—Trust Expenses and Copper Sales” for a description of all of the trust expenses. | |

| The sponsor’s fee is accrued daily and paid monthly in arrears at an annualized rate equal to [ ]% of the adjusted net asset value of the trust. In exchange for the sponsor’s fee, the sponsor has agreed to assume the following administrative and marketing expenses of the trust: the trustee’s fee, [ ] listing fees, SEC registration fees, printing and mailing costs, audit fees and expenses and up to $100,000 per annum in legal fees and expenses. In addition, the sponsor has agreed to pay any fees due to J. Aron in connection with its agreement to purchase copper from the trust as needed to cover trust expenses and to buy from or sell to certain authorized participants fractional amounts of copper transferred in connection with the issuance or redemption of Shares. The sponsor also paid the costs of the trust’s organization and the initial sale of the Shares, including the applicable SEC registration fees; the trust is not required to reimburse these amounts to the sponsor. | ||

| The custodian’s fee accrues daily and is payable monthly in arrears. As of the date of this prospectus, the custodian’s fee is $[ ] per tonne per day, subject to adjustment as described under “The Custodian—The Custodian’s Fee.” Although the trust does not intend to hold any copper on Warrant, the custodian agreement provides that the warehousing fee due to the custodian in respect of any copper held on Warrant at a particular location will be the maximum LME-authorized per tonne per day fee for that location. | ||

| The trustee will, on each day that the LME Bid Price is announced, sell copper in such quantity as may be necessary to permit payment of the sponsor’s fee, the custodian’s fee and of other trust expenses and liabilities not assumed by the sponsor. The trustee is authorized to sell copper at such times and in the smallest amounts required to permit such payments as they become due, it being the intention to avoid or minimize the trust’s holdings of cash. Accordingly, the amount of copper to be sold will vary from time to time depending on the level of the trust’s expenses and liabilities and the market price of copper. See “Business of the Trust—Trust Expenses” and “Description of the Shares and the Trust Agreement—Trust Expenses and Copper Sales.” | ||

| Tax Considerations |

Owners of Shares will be treated, for U.S. federal income tax purposes, as if they owned a corresponding share of the assets of the trust. They will also be viewed as if they directly received a corresponding share of any income of the trust, or as if they had incurred a corresponding share of the expenses of the trust. Consequently, each sale of copper by the trust will be a taxable event to Shareholders. See “United States Federal Income Tax Consequences—Taxation of U.S. Shareholders” and “ERISA and Related Considerations.” | |

6

Table of Contents

| Voting Rights |

Owners of Shares do not have the kind of voting rights traditionally associated with the ownership of shares, but 75% of the outstanding Shares of the trust will have the right to terminate the trust at any time, and 25% of the outstanding Shares will have the right to require the trustee to cure any material breach of the Trust Agreement. See “Risk Factors—Risks Related to the Shares—As an owner of Shares, you will not have the rights normally associated with ownership of other types of shares” and “Description of the Shares and the Trust Agreement—Voting Rights.” | |

| Suspension of Issuance, Transfers and Redemptions |

The trustee may suspend the delivery or registration of transfers of Shares, or may refuse a particular deposit or transfer at any time, if the trustee or the sponsor thinks it advisable for any reason. See “Description of the Shares and the Trust Agreement—Requirements for Trustee Actions.” Redemptions may be suspended only (i) during any period in which regular trading on [ ] is suspended or restricted, or the exchange is closed, (ii) during an emergency that makes it reasonably impracticable for the custodian to deliver Warrants, warehouse receipts and physical copper. | |

| Limitation on Liability |

The sponsor and the trustee:

• are only obligated to take the actions specifically set forth in the Trust Agreement without negligence or bad faith;

• are not liable for the exercise of discretion permitted under the Trust Agreement; and

• have no obligation to prosecute any lawsuit or other proceeding on behalf of the Shareholders or any other person.

See “Description of the Shares and the Trust Agreement—Limitations on Obligations and Liability.” | |

| Termination events |

The trustee will terminate the Trust Agreement if:

• the trustee is notified that the Shares are delisted from [ ] and are not approved for listing on another national securities exchange within five business days of their delisting;

• holders of at least 75% of the outstanding Shares notify the trustee that they elect to terminate the trust;

• 60 days have elapsed since the trustee notified the sponsor of the trustee’s election to resign and a successor trustee has not been appointed and accepted its appointment;

• the SEC determines that the trust is an investment company under the Investment Company Act of 1940, as amended, and the trustee has actual knowledge of that determination;

• the aggregate market capitalization of the trust, based on the closing price for the

Shares, was less than $[ ] for five consecutive trading days and the trustee receives, within | |

7

Table of Contents

| • the CFTC determines that the trust is a commodity pool under the Commodity Exchange Act and the trustee has actual knowledge of that determination;

• the trust fails to qualify for treatment, or ceases to be treated, as a grantor trust for United States federal income tax purposes and the trustee receives notice that the sponsor has determined that the termination of the trust is advisable; or

• if the law governing the trust limits its maximum duration, upon the expiration of 21 years after the death of the last survivor of all the descendants of Elizabeth II, Queen of England, living on the date of the Trust Agreement.

After termination of the trust, the trustee will deliver trust property upon surrender and cancellation of Shares and, ninety days after termination, will sell any remaining trust property in a private or public sale, and hold the proceeds, uninvested and in a non-interest bearing account, for the benefit of the holders who have not surrendered their Shares for cancellation. See “Description of the Shares and the Trust Agreement—Amendment and Termination.” | ||

| Authorized Participants |

Baskets may be created or redeemed only by authorized participants. Each authorized participant must be a registered broker-dealer, a participant in DTC, have entered into an agreement with the trustee (the authorized participant agreement) and be in a position to transfer copper to, and take delivery of copper from, the custodian through one or more copper accounts. The authorized participant agreement provides the procedures for the creation and redemption of Baskets and for the transfers of property that take place in connection with such transactions. A list of the current authorized participants can be obtained from the trustee or the sponsor. | |

| Clearance and settlement |

The Shares are issued in book-entry form only. Transactions in Shares clear through the facilities of DTC. Investors may hold their Shares through DTC, if they are participants in DTC, or indirectly through entities that are participants in DTC. | |

As of the close of business on [ ], 20[ ], the net asset value of the trust was $[ ] and the NAV was $[ ]. See the financial statements included in this prospectus.

8

Table of Contents

Before making an investment decision, you should consider carefully the risks described below, as well as the other information included in this prospectus.

Risks Related to the Copper Markets

Because the Shares are created to reflect the price of the copper held by the trust, the market price of the Shares will be as unpredictable as the price of copper has historically been. This creates the potential for losses, regardless of whether you hold Shares for a short-, mid- or long-term.

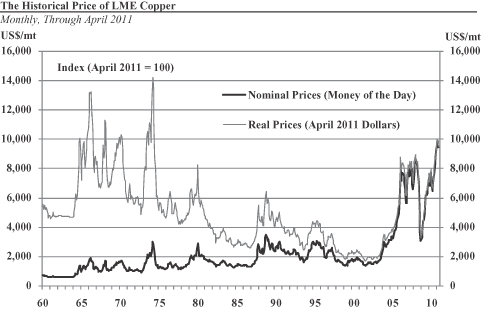

Shares are created to reflect, at any given time, the value of the copper owned by the trust at that time less the trust’s expenses and liabilities. Because the value of Shares depends to a large extent on the price of copper, it is subject to fluctuations similar to those affecting copper prices. The price of copper has fluctuated widely over the past several years. According to Bloomberg, between May of 1986 (when the current copper futures contract started trading on the LME) and April 30, 2011, the 30-day volatility of the LME Settlement Price has ranged from 6.5% to 92.4%. If copper markets continue to be characterized by the wide fluctuations that they have shown in the past several years, the price of the Shares will change widely and in an unpredictable manner. This exposes your investment in Shares to potential losses if you need to sell your Shares at a time when the price of copper is lower than it was when you made your investment in Shares. Even if you are able to hold Shares for the mid- or long-term you may never realize a profit, because copper markets have historically experienced extended periods of flat or declining prices.

Following an investment in Shares, several factors may have the effect of causing a decline in the prices of copper and a corresponding decline in the price of Shares. Among them:

| • | A change in economic conditions, such as a recession, can adversely affect the price of copper. In recent years, demand from China has been a significant factor in the overall market for copper and, therefore, copper price levels. Were such demand to decline due to a reduction in the rate of growth of the Chinese economy, or for other reasons, copper prices and, consequently, the price of the Shares could decline as well. |

| • | Copper is used in a wide range of industrial applications. Technological changes and the substitution of other materials in lieu of copper (for example, aluminium in copper transmission lines, PVCs in copper tubing, and optical fibers for copper cable in telecommunications lines) could have a negative impact on its demand and, consequently, its price and the price of the Shares. |

| • | A change in the attitude of speculators and investors towards copper. Should the speculative community take a negative view towards copper, a decline in world copper prices could occur, negatively impacting the price of the Shares. |

| • | A significant increase in copper price hedging activity by copper producers or industrial users. Should there be an increase in the level of hedge activity of copper mining companies or industrial users of copper, it could cause a decline in world copper prices, adversely affecting the price of the Shares. |

Conversely, several factors may trigger a temporary increase in the price of copper prior to your investment in the Shares. If that is the case, you will be buying Shares at prices affected by the temporarily high prices of copper, and you may incur losses when the causes for the temporary increase disappear.

Nothing in this discussion should be understood as implying that changes in the price of the Shares will in all cases mirror the changes in the price of copper. As the remaining risk factors included in this section of the prospectus make clear, there is a large number of other factors that can have an adverse

9

Table of Contents

effect on the price of the Shares and that are not related to variations in copper prices. The occurrence of one or more of the events described in such risk factors may result in substantial losses in your investment in the Shares, even if you held them during a period of sustained increases in the price of copper.

An increase in the demand for copper, driven by the success of the trust or of similar investment vehicles, could result in increases in the price of copper that are otherwise unrelated to other factors affecting the global copper markets.

Because there is no limit to the number of Shares that the trust can issue, a very enthusiastic reception of the Shares by the market, or the proliferation of similar investment vehicles that issue shares backed by physical copper, could result in purchases of copper for deposit into the trust or such similar investment vehicles that are large enough to result in an increase in the price of physical copper. If that were the case, the price of the Shares would be expected to reflect that increase. It is impossible to predict whether, or at what point, the demand for copper-backed investment instruments like the Shares would eventually stabilize and, if it does, whether the price of copper would remain stable or return to historical levels. An investor purchasing Shares at a time when they reflect a temporarily inflated price of copper will sustain losses upon the sale of such Shares after the effect of events causing such inflated prices has ceased and the price of copper has returned to a deflated level.

Neither the sponsor nor the trustee has experience with a trust the only assets of which are copper.

None of the sponsor, the trustee or their respective management have experience with an investment vehicle such as the trust that only invests in copper. While there have been other similar exchange traded investment vehicles that invest in precious metals and with which the sponsor and the trustee have been involved, none of them invested in copper. If this lack of experience with a copper-based investment vehicle like the trust results in losses or operational difficulties, the value of the Shares may be adversely affected and you may sustain a loss in your investment.

The trust is a passive investment vehicle. This means that the value of your Shares may be adversely affected by trust losses that, if the trust had been actively managed, might have been avoided.

The trustee does not actively manage the copper held by the trust. This means that the trustee does not sell copper at times when its price is high, or acquire copper at low prices in the expectation of future price increases. It also means that the trustee does not make use of any of the hedging techniques available to professional copper investors to attempt to reduce the risks of losses resulting from price decreases or high price volatility. Any losses sustained by the trust will adversely affect the value of your Shares.

The performance of your Shares will be adversely affected by an increase in the expenses of the trust.

The trust will be responsible for the payment of the sponsor’s fee and all other expenses not assumed by the sponsor. While most of the anticipated ordinary expenses of the trust have been assumed by the sponsor, warehousing fees are the responsibility of the trust. The amount of the warehousing fee as of the date of this prospectus is set forth under “Prospectus Summary—Trust Structure, the Sponsor, the Trustee and the Custodian”. This fee is subject to annual adjustments to reflect changes in the maximum fee from time to time authorized by the LME and is, therefore, subject to increases beyond the trustee’s or the sponsor’s control. In addition, the obligation of the custodian to accept delivery of copper on behalf of the

10

Table of Contents

trust is not unlimited. If the custodian agreement terminates and the trust needs to negotiate a new agreement with a different custodian, or if the trust is required to obtain the services of additional warehousing companies to store copper in excess of the amount that the custodian is required to warehouse, the amount of the fees to be paid by the trust in connection with such new arrangements is impossible to predict. It will depend on the market conditions prevailing at the time, the relative strength of the trust’s bargaining position and other factors outside of the trust’s or the sponsor’s control. In any event, an increase in warehousing fees will require additional sales of copper to cover such fees and will result in a corresponding decrease in the return, if any, on your investment in the Shares.

Copper warehousing fees are usually structured in terms of a fixed dollar amount per tonne per day, irrespective of the market value of the copper. Accordingly, in times of depressed copper prices, the trust will need to sell higher amounts of copper to cover periodic storage fees. This will result in a more accelerated decrease in the amount of copper represented by each Share and a corresponding decrease in the value of the Share. For a comparison of the warehousing costs of copper and certain precious metals, please see “Operation of the Copper Market—Warehousing Costs”.

A determination by the taxing authorities in one or more of the several relevant jurisdictions that the warehousing of copper is, or that transfers of copper to or from the trust in connection with issuances and redemptions of Baskets are, subject to sales or other taxes could have an adverse effect on the trust and the value of your Shares.

Transfers of copper to or from the trust in connection with the issuance or redemption of Baskets take place in different jurisdictions, each with its own tax laws and regulations. The Trust Agreement provides that an authorized participant acquiring or redeeming Baskets in exchange for copper is responsible for the payment of all federal, state, local and other taxes and governmental charges and fees payable in connection with the transaction (including any applicable sales, use, value added or similar taxes). Accordingly, under normal circumstances, the trust would not expect to be responsible for any such amounts. It is possible, however, that a final determination by the relevant authorities as to the application of a tax, fee or governmental charge (including any applicable sales, use, value added or similar taxes) may not occur until sometime after the transaction with the relevant authorized participant has been concluded. If as a result of such final determination a taxing or other authority were to seek a payment from the trust in respect of amounts that should have been paid by an authorized participant at the time of a past transaction with the trust, and the authorized participant is unwilling or unable to honor its payment obligation under the Trust Agreement, the trust may be left with a liability for which it may not be able to seek recovery from any person. Alternatively, a taxing authority may determine that the warehousing of the trust’s copper in the jurisdiction is subject to tax. In any of such circumstances, the value of the assets of the trust will decrease to reflect any sales of copper needed to pay the past due taxes or other amounts and any applicable penalties, and the value of the Shares will be adversely affected.

The liquidation of the trust may occur at a time when the disposition of the trust’s copper will result in losses to investors in Shares.

Although the trust does not have a fixed duration, if certain events occur, at any time, the trustee will have to terminate the trust. See “Description of the Shares and the Trust Agreement—Amendment and Termination” for more information about the termination of the trust, including when events outside the control of the sponsor, the trustee or the Shareholders may prompt the trust’s termination.

Upon termination of the trust, the trustee will sell copper in the amount necessary to cover all expenses of liquidation, and to pay any outstanding liabilities of the trust. The remaining copper will be distributed among investors surrendering Shares. Any copper remaining in the possession of the trustee after 90 days will be sold by the trustee and the proceeds of the sale will be held by the trustee until claimed by any remaining holders of Shares. Sales of copper in connection with the liquidation of the trust at a time of low prices will likely result in losses, or adversely affect your gains, on your investment in Shares.

11

Table of Contents

Investors with large holdings may choose to terminate the trust.

Holders of 75% of the Shares have the power to terminate the trust. This power may be exercised by a relatively small number of holders. If it is so exercised, investors who wished to continue to invest in copper through the vehicle of the trust will have to find another vehicle, and may not be able to find another vehicle that offers the same features as the trust.

The value of the Shares will be adversely affected if copper owned by the trust is lost or damaged in circumstances in which the trust is not in a position to recover the corresponding loss.

Copper owned by the trust will not be insured against any kind of risks. In addition, the custodian is not required to physically segregate the trust’s copper, so as to prevent it from being commingled with other customers’ copper, and is responsible to the trust for loss or damage to the trust’s copper only under limited circumstances. Even when it is responsible to the trust, the custodian has no obligation to replace any copper lost. Any insurance maintained by the custodian is for its own benefit, and neither the trustee nor any Shareholder will have any claim under any insurance maintained by the custodian. The custodian’s liability to the trust, if any, will be limited to the value of any copper lost at the time of the custodian’s acts or omissions giving rise to the claim for indemnification. Accordingly, even if the custodian were liable to the trust and indemnified the trust for any losses attributable to it, there is no assurance that such indemnification would suffice to place the trust and its Shareholders in the same situation as they would have been in the absence of the circumstances giving rise to such losses.

Any loss of copper owned by the trust will result in a corresponding reduction in the NAV and it is reasonable to expect that such loss will also result in a decrease in the value at which the Shares are traded on [ ].

Copper transferred to the trust in connection with the creation of Baskets may not be of the quality required under the Trust Agreement. The trust will sustain a loss if the trustee issues Shares in exchange for copper of inferior quality, and that loss will adversely affect the value of all existing Shares.

The procedures agreed to with the custodian contemplate that the custodian must undertake certain tasks in connection with the inspection of copper delivered by authorized participants in exchange for Baskets. The custodian’s inspection includes procedures that the sponsor believes are consistent with industry practice, but does not include any chemical or other tests designed to verify that the copper received does, in fact, meet the requirements referred to in the Trust Agreement. Accordingly, such inspection procedures may not prevent the deposit of copper that fails to meet these standards. Each person that deposits copper in the trust is liable to the trust if that copper does not meet the requirements of the Trust Agreement. The custodian will not be responsible or liable to the trust or to any investor in the event any copper otherwise properly inspected by it does not meet the requirements contained in the Trust Agreement. To the extent that Baskets are issued in exchange for copper of inferior quality and the trust is not able to recover damages from the person that deposited that copper, the total value of the assets of the trust will be adversely affected and, with it, the NAV. In these circumstances, it is reasonable to expect that the value at which the Shares trade on [ ] will also be adversely affected.

The value of the Shares will be adversely affected if the trust is required to indemnify the sponsor, the trustee and certain related parties or the custodian as contemplated in the Trust Agreement and the custodian agreement.

Under the Trust Agreement, the sponsor and certain parties related to the sponsor (such as its shareholders, officers or directors) have a right to be indemnified from the trust for any liability or expense incurred in connection with the discharge of their obligation under the Trust Agreement and without

12

Table of Contents

negligence, bad faith, willful misconduct or reckless disregard on their part. The Trust Agreement also provides that the trustee and certain parties related to the trustee (such as directors, employees and agents) have the right to be indemnified by the sponsor for certain losses or liabilities incurred in connection with the performance of their obligations thereunder without negligence, bad faith, willful misconduct or willful malfeasance, and that any amounts for which the sponsor fails to indemnify the trustee and such related parties will be claims against the trust assets that will have priority over the rights of the sponsor, the Shareholders and any other person. Similarly, the custodian agreement provides for the indemnification of the custodian by the trust under certain circumstances. This means that it may be necessary to sell assets of the trust in order to cover losses or liability suffered by the persons entitled to indemnification pursuant to the foregoing provisions. Any sale of that kind would reduce the net asset value of the trust and the value of the Shares.

The sponsor, the trustee and their respective affiliates may engage in activities that present conflicts with the interests of the trust and holders of the Shares.

Each of the sponsor and the trustee may, from time to time, have conflicting demands in respect of its respective obligations to the trust. For example, if the trust is not as successful as the sponsor expects, or its operations result in losses to the sponsor, the sponsor may find it in its interest to terminate the trust, in compliance with the Trust Agreement, at a time when such termination may not necessarily be in the interest of the trust or its Shareholders. The sponsor and the trustee may agree to increases in their respective fees or other amendments to the Trust Agreement that are not consistent with the interests of the Shareholders (for example, because they increase the rights of the sponsor or dilute the duties of the trustee). According to the Trust Agreement, any such amendment will become effective, and be binding on all Shareholders who continue to own Shares, 30 days after public notice of the amendment has been given.

Similarly, the sponsor and the trustee may be involved in the creation or operation of other investment vehicles that compete with the trust and that, if more successful than the trust, could lead to the decision to dissolve and liquidate the trust at a time not consistent with the interests of existing Shareholders.

In addition, the sponsor, the trustee or any of their respective affiliates may engage in trading activities relating to copper that are not for the account of, or on behalf of, the trust or the Shareholders. They can also trade in the Shares in a way that is contrary to the interests of owners of Shares (for example, by taking short positions in the Shares or entering into derivative transactions the return on which is inversely related to the performance of the Shares). All of these, and similar, activities may present a conflict between the Shareholders’ interest in the Shares and the interest of the sponsor or the trustee and its affiliates in their proprietary accounts and could be adverse to the interests of the Shareholders.

Risks Related to The London Metal Exchange

Although the trust is not affiliated with, or endorsed or in any way supported by, The London Metal Exchange, it relies on prices and standards disseminated by the LME that are widely accepted in the copper world markets and, in connection with the delivery of Warrants by the custodian following a redemption of Baskets, on the availability of certain systems and arrangements developed and put in place by the LME. As a result, several actions or omissions of the LME, over which none of the trust, the sponsor or the trustee will have any control, may have an adverse effect on the value of the Shares and may result in losses on your investment in Shares. For example:

A failure of the systems or procedures developed by the LME for the transfer of Warrants may delay or impede timely redemptions of Baskets and prevent the trading price of the Shares from converging with the price of copper.

As explained elsewhere in this prospectus, in connection with a redemption of Shares the custodian will generally issue Warrants to the redeeming authorized participant. Pursuant to the LME Rulebook,

13

Table of Contents

Warrants are transferred via an electronic system called the LMEsword System, operated by the LME. None of the trust, the trustee, the custodian or any of their affiliates has any control over the operation or availability of the LMEsword System. Should the LMEsword System become unavailable at the time a redemption occurs, the custodian will not be able to deliver the corresponding Warrants. In that situation, while it may be possible for the custodian to arrange for the delivery of a warehouse receipt or for the physical delivery of copper, there is no assurance that such delivery could take place at the time anticipated by the redeeming authorized participant, and a delay may result.

To the extent that the delays described in the paragraph above occur at a time when the trading price of the Shares has deviated from the price of copper, they may result in authorized participants not being able or willing to take advantage of the arbitrage opportunities that would otherwise operate to close the disparity and cause both prices to converge. If that is the case, the price of your Shares may fall or fluctuate erratically and you may sustain a loss in your investment. See “Risk Factors—Risks Relating to the Shares—If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical copper, or for other reasons, the possibility for arbitrage transactions by authorized participants, intended to keep the price of the Shares closely linked to the price of copper, may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.”

The copper held by the trust may cease to be eligible under applicable standards of The London Metal Exchange and such a change may adversely affect the value of your investment in the Shares.

According to the Trust Agreement, only copper that meets the requirements to be delivered in settlement of copper futures contracts traded on the LME may be delivered to the trust in exchange for Baskets. This requirement seeks to ensure that the trust owns copper of such quality and specifications as are widely acceptable in the market. There is no assurance, however, that the LME will not change its specifications, or that copper held by the custodian will not cease to meet the specifications required to be delivered in settlement of copper futures contracts traded on the LME. As a result, copper owned by the trust may become less marketable and lose value. If that were the case, the value of your investment in the Shares would be adversely affected.

Errors or omissions in information disseminated by The London Metal Exchange may have an adverse effect on the value of your Shares.

The trust values its assets using the Official Price (cash, buyer) announced by the LME on the date on which the valuation takes place. Should the LME fail to announce an Official Price (cash, buyer) on a date when such announcement is expected, the trustee is authorized to use the most recently announced LME Official Price (cash, buyer) unless the sponsor determines that such a price is inappropriate as a basis for evaluation. Similarly, the LME may announce on a date as Official Price (cash, buyer) an erroneous price. It is not possible to anticipate the effect, if any, that such a change in the price used in the valuation of the trust’s assets, or the announcement of an erroneous price (even if subsequently corrected by the LME) may have on the price of the Shares, but it is conceivable that such impact could be negative and material. If that is the case and you were to sell your Shares at a time while such negative impact is still affecting their market price, you may sustain a loss on your investment in the Shares.

The amount of copper represented by the Shares will decrease over the life of the trust due to the sales necessary to pay trust expenses. Without increases in the price of copper sufficient to compensate for that decrease, the price of the Shares will also decline and you will lose money on your investment in Shares.

Because the trust does not have any income, it needs to sell copper to cover the sponsor’s fee, the custodian’s fee and other expenses not assumed by the sponsor. Although the sponsor has agreed to

14

Table of Contents

assume all organizational and certain ordinary administrative and marketing expenses incurred by the trust, not all trust expenses have been assumed by the sponsor. For example, warehousing fees and any taxes and other governmental charges that may be imposed on the trust’s property will not be paid by the sponsor. Legal fees and expenses in excess of $100,000.00 per annum will also be the responsibility of the trust.

The trust may also be subject to other liabilities (for example, as a result of litigation) which have not been assumed by the sponsor. The only source of funds to cover those liabilities will be sales of copper held by the trust. Even if there were no expenses other than the sponsor’s and the custodian’s fees, and there were no other liabilities of the trust, the trustee would still need to sell copper to pay the custodian’s fee and the sponsor’s fee. The result of these sales is a decrease in the amount of copper represented by each Share. New deposits of copper, received in exchange for new Shares issued by the trust, do not reverse this trend.

A decrease in the amount of copper represented by each Share results in a decrease in its price even if the price of copper has not changed. To retain the Share’s original price, the price of copper has to increase. Without that increase, the lower amount of copper represented by each Share will have a correspondingly lower price. If these increases do not occur, or are not sufficient to counter the lower amount of copper represented by each Share, you will sustain losses on your investment in Shares.

The price received upon the sale of Shares may be less that the value of the copper represented by them.

The result obtained by subtracting the trust’s accrued expenses and liabilities as of any day from the price of the copper owned by the trust on that day is the net asset value of the trust which, when divided by the number of Shares outstanding on that date, results in the net asset value per Share, or NAV.

Shares may trade at, above or below their NAV. The NAV of Shares will fluctuate with changes in the market value of the trust’s assets. The trading prices of Shares will fluctuate in accordance with changes in their NAVs as well as market supply and demand. The amount of the discount or premium in the trading price relative to the NAV per Share may be influenced by non-concurrent trading hours between the major copper markets and [ ]. While the Shares will trade on [ ] until [ : ] p.m. New York time, liquidity in the market for copper will be reduced after the close of the major world copper markets, including the LME and the COMEX. As a result, during this time, trading spreads, and the resulting premium or discount on Shares, may widen.

There may be situations where an authorized participant is unable to redeem a Basket. To the extent the value of copper decreases, these delays may result in a decrease in the value of the copper the authorized participant will receive when the redemption occurs, as well as a reduction in liquidity for all shareholders in the secondary market.

Although Shares may be surrendered for redemption by authorized participants in blocks of five or more Baskets, redemptions may be suspended during any period while regular trading on [ ] is suspended or restricted, or the exchange is closed, or if an emergency exists that makes it reasonably impracticable for the custodian to deliver Warrants, warehouse receipts and physical copper. If any of these events occurs at a time when an authorized participant intends to redeem Shares, and the price of copper decreases before such authorized participant is able again to surrender for redemption Baskets, such authorized participant will sustain a loss with respect to the amount that it would have been able to obtain in exchange for the copper received from the trust upon the redemption of its Shares, had the redemption taken place when such authorized participant originally intended it to occur. As a consequence, authorized participants may reduce their trading in Shares during times when redemptions are suspended, decreasing the number of potential buyers of Shares in the secondary market and, therefore, the price a Shareholder may receive upon sale.

15

Table of Contents

The liquidity of the Shares may also be affected by the withdrawal from participation of authorized participants.

Authorized participants may withdraw from participation at any time. In the event that one or more authorized participants which have substantial interests in Shares withdraw from participation, the liquidity of the Shares will likely decrease which could adversely affect the market price of the Shares and result in your incurring a loss on your investment.

The lack of an active trading market for the Shares may result in losses on your investment at the time of disposition of your Shares.

Although Shares are listed for trading on [ ], you should not assume that an active trading market for the Shares will develop or be maintained. If you need to sell your Shares at a time when no active market for them exists, such lack of an active market will most likely adversely affect the price you receive for your Shares (assuming you are able to sell them).

If the process of creation and redemption of Baskets encounters any unanticipated difficulties or is materially restricted due to any illiquidity in the market for physical copper, or for other reasons, the possibility for arbitrage transactions by authorized participants, intended to keep the price of the Shares closely linked to the price of copper, may not exist and, as a result, the price of the Shares may fall or otherwise diverge from NAV.

The ability of authorized participants to create and redeem Baskets in a predictable and timely manner is intended to ensure that they will stand ready to take advantage of any arbitrage opportunities arising from temporary discrepancies between the trading price of the Shares and the price of the copper represented by the Shares. At times when the Shares are trading at a premium (that is, they can be sold at a price higher than the price of the underlying amount of copper held by the trust, as measured by the NAV), authorized participants will have an incentive to purchase and deposit copper into the trust in exchange for new Baskets that can then be sold at a profit. Such purchases of copper and sales of Shares should cause their respective prices to converge. Conversely, when the Shares are trading at a discount (that is, they can be purchased at a price lower than the price of the underlying amount of copper held by the trust, as measured by the NAV), authorized participants will have an incentive to purchase Shares and redeem them in exchange for the corresponding amounts of copper that can then be sold at a profit. Such purchases of Shares and sales of copper should cause their respective prices to converge. In either case, the activities of the authorized participants should cause the trading price of the Shares to reflect the price of the copper they represent.

If the processes of creation and redemption of Shares encounter any unanticipated difficulties, authorized participants and their customers, who would otherwise be willing to purchase or redeem Baskets to take advantage of any arbitrage opportunities described above, may not take the risk that, as a result of those difficulties, they may not be able to realize the profit they expect. Such difficulties may arise, for example, due to shortages in the availability of physical copper to be delivered in connection with a creation of new Baskets, if such copper is only available at locations from which it would not be cost-efficient for the authorized participant to transfer it to the trust’s account at the custodian, or if limitations in the custodian’s ability to promptly take or make delivery of copper were to dissuade authorized participants or their customers from attempting to capitalize on otherwise available arbitrage opportunities. If this is the case, the liquidity of the Shares may decline and the price of the Shares may fluctuate independently of the price of copper and may fall.

16

Table of Contents

An investor buying or selling Shares may be affected by concurrent activities of authorized participants (both in the copper markets and in the market for the Shares) as a result of which the prices of copper and the Shares may move in opposite direction to the investor’s interests.

An investor that purchases Shares at a time when they are trading at a premium (that is, their trading price is higher than the price of the underlying amount of copper held by the trust, as measured by the NAV) is subject to the risk that authorized participants are contemporaneously selling Shares to take advantage of the existing arbitrage opportunity as described above. If that is the case, and the authorized participants’ activities result in a reduction of the price of the Shares, the value of the investor’s Shares will be adversely affected and any sale at the new price will result in a loss on the investment.

Conversely, an investor that sells Shares at a time when they are trading at a discount (that is, their price is less than the price of the underlying amount of copper held by the trust, as measured by the NAV), will lose the opportunity to benefit from an increase in the price of the Shares resulting from authorized participants’ purchases for the purposes of redeeming the Shares and taking advantage of the comparatively higher price of the copper received in exchange.

As an owner of Shares, you will not have the rights normally associated with ownership of other types of shares.

Shares are not entitled to the same rights as shares issued by a corporation. By acquiring Shares, you are not acquiring the right to elect directors, to receive dividends, to vote on certain matters regarding the issuer of your Shares or to take other actions normally associated with the ownership of shares. You will only have the limited rights described under “Description of the Shares and the Trust Agreement”.

As an owner of Shares, you will not have the protections normally associated with ownership of shares in an investment company registered under the Investment Company Act of 1940, or the protections afforded by the Commodity Exchange Act.

The trust is not registered as an investment company for purposes of United States federal securities laws, and is not subject to regulation by the SEC as an investment company. Consequently, the owners of Shares do not have the regulatory protections provided to investors in investment companies. For example, the provisions of the Investment Company Act that limit transactions with affiliates, prohibit the suspension of redemptions (except under certain limited circumstances) or limit sales loads do not apply to the trust.

The trust does not hold or trade in commodity interests regulated by the Commodity Exchange Act (CEA), as administered by the Commodity Futures Trading Commission (CFTC). Furthermore, the trust is not a commodity pool for purposes of the CEA, and neither the sponsor nor the trustee is subject to regulation by the CFTC as a commodity pool operator, or a commodity trading advisor. Consequently, the owner of Shares does not have the regulatory protections provided to investors in CEA-regulated instruments or commodity pools, and does not receive the disclosure document and certified annual report required to be delivered by a commodity pool operator.

STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes statements which relate to future events or future performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “should,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “potential” or the negative of these terms or other comparable terminology. All statements (other than statements of historical fact) included in this prospectus that address activities, events or developments that may occur in the future, including such

17

Table of Contents

matters as changes in market conditions (for copper and the Shares), the trust’s operations, the sponsor’s plans and references to the trust’s future success and other similar matters are forward-looking statements. These statements are only predictions. Actual events or results may differ materially. These statements are based upon certain assumptions and analyses made by the sponsor on the basis of its perception of historical trends, current conditions and expected future developments, as well as other factors it believes are appropriate in the circumstances. Whether actual results and developments will conform to the sponsor’s expectations and predictions, however, is subject to a number of risks and uncertainties, including the special considerations discussed in this prospectus, general economic, market and business conditions, changes in laws or regulations, including those concerning taxes, made by governmental authorities or regulatory bodies, and other world economic and political developments. See “Risk Factors.” Consequently, all the forward-looking statements made in this prospectus are qualified by these cautionary statements, and there can be no assurance that the actual results or developments the sponsor anticipates will be realized or, even if substantially realized, that they will result in the expected consequences to, or have the expected effects on, the trust’s operations or the value of the Shares. Moreover, neither the sponsor, nor any other person assumes responsibility for the accuracy or completeness of the forward-looking statements. Neither the trust nor the sponsor is under a duty to update any of the forward-looking statements to conform such statements to actual results or to a change in the sponsor’s expectations or predictions.

Proceeds received by the trust from the issuance and sale of Baskets consist of copper deposits. Such copper is held by the custodian on behalf of the trust until (i) it is transferred from the trust’s account to the account of authorized participants in connection with redemptions of Baskets or (ii) it is sold to pay fees due to the sponsor and trust expenses and liabilities not assumed by the sponsor. See “Business of the Trust—Trust Expenses”.

The information in this section was prepared by CPM Group, an independent commodities research firm retained by the sponsor.

Copper is a major base metal. It has been one of the largest commodities markets for centuries and, according to the U.S. Geological Survey, a scientific agency of the United States government, the copper market is the third largest metals market in terms of physical volume. Much of the copper traded in the world is traded across organized exchanges, with the major exchanges located in London, Shanghai, and New York. There also is an active dealer market that trades physical and forward copper off of the exchanges, as well as non-exchange traded options. The price of copper generally reflects copper supply and demand, underlying production costs, cumulative levels of copper inventories, and investor sentiment toward copper market prospects and broader economic trends, as well as actual economic conditions such as industrial production, real manufacturing output, inflation, and exchange rates.

Copper mine supplies are concentrated on a regional basis, while demand is more geographically dispersed, as is typical in extractive industries. The copper supply chain—from raw copper concentrated ore from mines to upgraded copper products—is highly dependent on global trade. According to CPM Group, a commodities market research firm, the majority of copper mine production is in the Americas, accounting for roughly 56% of global output in 2010, while roughly 45% and 38% of refined and semi-manufactured production is performed in Asia, respectively. Final end use varies regionally. Copper is ductile, corrosion resistant, malleable and an excellent conductor of heat and electricity. In fact, copper is considered the best non-precious metal conductor of electricity, encountering much less resistance

18

Table of Contents

compared to other commonly used metals. As such, copper is widely employed in cable, wire, and electrical products for both the electrical and building industries. Globally, International Copper Study Group estimates that in 2008, prior to the decline in construction activity during the recession, the building construction and infrastructure sectors were the largest consumers of refined copper, demanding roughly 40% of world supplies, and that the electrical and electronic sector comprised approximately 20% of total usage, while the industrial machinery and equipment (19%), transportation equipment (13%), and consumer and general products (8%) sectors accounted for the remainder of demand. Geographically, according to CPM Group research, China is the largest consumer (39%) of refined copper, followed by the European Union and United States, which consumed roughly 18% and 9% of global refined copper supplies in 2010, respectively. It should be noted that the products made in these manufacturing locations using copper then are exported, sold, and used worldwide, so that while manufacturing demand for copper is distributed along these lines, the demand for copper is distributed more broadly by end-user demand in many countries around the world.

The copper market includes a diversified group of market participants. Both the physical and financial copper markets consist of primary and secondary producers, fabricators, manufacturers and end-use consumers, physical traders and merchants, the banking sector, and the investment community.

Primary and Secondary Producers