Attached files

| file | filename |

|---|---|

| EX-21 - EXHIBIT 21 - T BAY HOLDINGS INC | ex21.htm |

| EX-31.1 - EXHIBIT 31.1 - T BAY HOLDINGS INC | ex31_1.htm |

| EX-31.2 - EXHIBIT 31.2 - T BAY HOLDINGS INC | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - T BAY HOLDINGS INC | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - T BAY HOLDINGS INC | ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

x

|

ANNUAL REPORT PURSUANT TO SECTION1 3 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended March 31, 2011

|

|

-OR-

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

|

|

For the transition period from to

|

|

Commission File Number 033-377099-S

T-BAY HOLDINGS, INC.

(Exact Name of registrant as specified in its charter)

|

NEVADA

|

|

91-1465664

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

Block 3 Qiao Xing Science Technological & Industrial

Zone,Tang Quan Huizhou, Guangdong, PRC

(Address of principal executive offices)

|

|

(Zip code)

|

Issuer’s telephone number, including area code: 86-752-6209699

(Former name, former address or former fiscal year, if changed since last report)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant: (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yesþ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yeso No þ

1

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer or smaller reporting company. ( See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act).

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rue 12b-2of the Exchange Act). Yes o No þ

As of March 31, 2011, the aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was $261,202 based on the closing sale price as reported on the Over-the-Counter Bulletin Board. As of 16 June 2011, there were 30,088,174 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None

2

T-Bay Holdings, Inc.

FORM 10-K

For the Year Ended March 31, 2011

|

PART I

|

|

|

|

|

ITEM 1.

|

|

5

|

|

|

ITEM 1A.

|

|

6

|

|

|

ITEM 1B.

|

7

|

||

|

ITEM 2.

|

|

7

|

|

|

ITEM 3.

|

|

7

|

|

|

ITEM 4.

|

|

7

|

|

|

PART II

|

|

|

8

|

|

ITEM 5.

|

8

|

||

|

ITEM 6.

|

9

|

||

|

ITEM 7.

|

|

10

|

|

|

ITEM 8.

|

|

14

|

|

|

ITEM 9.

|

|

33

|

|

|

ITEM 9A.

|

|

33

|

|

|

ITEM 9B.

|

34

|

||

|

|

|

|

|

|

PART III

|

|

|

35

|

|

ITEM 10.

|

|

35

|

|

|

ITEM 11.

|

|

36

|

|

|

ITEM 12.

|

|

39

|

|

|

ITEM 13.

|

|

40

|

|

|

ITEM 14.

|

|

40

|

|

|

|

|||

|

PART IV

|

|

||

|

ITEM 15

|

|

41

|

|

|

42

|

|

Exhibit 21

|

|

Exhibit 31.1

|

|

Exhibit 31.2

|

|

Exhibit 32.1

|

|

Exhibit 32.2

|

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements. These statements relate to future events or our future financial performance. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance, or achievements expressed or implied by forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "will," "should," "expect," "plan," "anticipate," "believe," "estimate," "predict," "potential" or "continue," the negative of such terms or other comparable terminology. These statements are only predictions. Actual events or results may differ materially.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. We undertake no duty to update any of the forward-looking statements after the date of this report to conform such statements to actual results or to changes in our expectations.

Readers are also urged to carefully review and consider the various disclosures made by us which attempt to advise interested parties of the factors which affect our business, including without limitation the disclosures made in PART I. ITEM 1A: Risk Factors and PART II. ITEM 6 "Management's Discussion and Analysis or Plan of Operation" included herein.

PART I.

|

Item 1.

|

Overview

The Company was incorporated under the laws of the State of Utah on August 8, 1984 with the name of "Sharus Corporation" with authorized common stock of 50,000,000 shares with par value of US$0.001 per share. On June 13, 1989, the domicile of the Company was changed to the state of Nevada in connection with a name change to "Golden Quest, Inc." On January 7, 2002, the name was changed to "T-Bay Holdings, Inc." as part of a reverse stock split of 400 shares of outstanding stock for one share. On January 17, 2005, the Company carried out a reverse stock split of 20 shares of outstanding stock for one share. After the reverse split, the Company has authorized common stock of 100,000,000 shares common stock and 10,000,000 shares of preferred stock both with par value of US$0.001.

On August 1, 2005, the Company entered into an Agreement and Plan of Reorganization (the “Agreement”) between Wise Target International Limited, (“Wise Target”), Amber Link International Limited (“Amber Link”), Ms. Meilian Li and Mr. Xiaofeng Li. Pursuant to the terms of the Agreement, following due diligence, the Company acquired all of the outstanding stock of Wise Target and Amber Link, making them wholly owned subsidiaries of the Company. Wise Target and Amber Link together own and control 95% of Shanghai Sunplus Communication Technology Co., Ltd., (“Sunplus”), a Sino-foreign joint venture. The Agreement required the Company to issue 18,550,000 shares of restricted common stock in exchange for all of the issued and outstanding shares of Wise Target and Amber Link. This transaction was subsequently completed on August 16, 2005.

In September 2010, we began to wind down the phone design services in our 95% owned subsidiary, Sunplus, a Sino-foreign joint venture established in China in 2002, as well as the sales of mobile phone components in our 100% owned subsidiary, Amber Link.

Corporate Structure

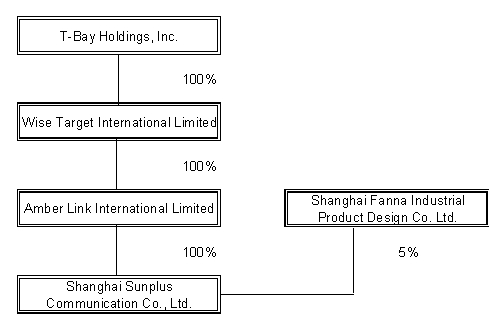

On August 16, 2005, T-Bay Holdings completed a reverse merger with Wise Target and Amber Link which made them wholly owned subsidiaries of the Company. Wise Target owned a 75% interest and Amber Link owned a 20% interest in Sunplus. The remaining 5% interest of Sunplus is owned by Shanghai Fanna Industrial Product Design Co., Ltd. (“Shanghai Fanna”). Wise Target and Amber Link are investment holding companies incorporated in the British Virgin Islands whereas Shanghai Fanna is a privately-owned company established in China in 2001. In March 2009, Wise Target transferred all its holdings (75%) in Sunplus to Amber Link for US$2,885,000 (HK$22,500,000). As a result of this transaction, Amber Link directly owned 95% of Sunplus and this transaction had no impact on the Company’s effective holdings of Sunplus. Shanghai Fanna Industrial Design Co., Ltd. continued to own the remaining 5% interest in Sunplus. On November 25, 2009, the Company transferred all its holdings (100%) in Amber Link to Wise Target for US$2,600. As a result of the transaction, the Company indirectly holds Amber Link and this transaction had no impact on the Company’s effective holdings of Amber Link and Sunplus.

In January 2007, Sunplus established Zhangzhou JiaXun Communication Facility Co.,Ltd. (“JiaXun”), a 100% owned subsidiary in Zhangzhou in Fujian province. In March 2007, JiaXun and Sunplus, respectively acquired 20% and 80% interest in Fujian QiaoXing Industry Co.,Ltd.(“Fujian QiaoXing”) for the construction of a technology park for long term development in the mobile telecommunication industry. Fujian QiaoXing was established on February 13, 2004, with a registered capital of RMB20,000,000 (US$2,590,000).

In December, 2008, Shanghai Sunplus, our 95%-owned Chinese subsidiary entered an agreement with Huizhou Liyin Electronics Co., Ltd. (“Huizhou Liyin”) to sell 100% of Sunplus’ interest in its wholly-owned subsidiary JiaXun for RMB5,000,000 and Eighty Percent (80%) of Sunplus’ interest in its subsidiary Fujian QiaoXing Industry for RMB84,000,000.

In March 2009, Sunplus terminated the agreement with Huizhou Liyin relating to sale of its interest in JiaXun and Fujian QiaoXing and entered into another agreement to sell those interests to QiaoXing Telecommunication Industry Company Limited to sell 100% of Sunplus’ interest in its wholly-owned subsidiary JiaXun for RMB5,000,000 and eighty percent (80%) of Sunplus’ interest in its subsidiary Fujian QiaoXing for RMB84,000,000. The transfers of Jia Xun and Fujian QiaoXing were completed on April 9 and March 20, 2009, respectively.

The current corporate structure of T-Bay Holdings is as follows:

Current Business Development

While we are winding down our phone design services, as well as the sales of mobile phone components, we continue to operate the administrative side of the business which is customer service, warranty claims, and the collection of receivables. We also continue to assess the mobile phone market for possibilities of transitioning our operations to a different segment(s) of the mobile phone industry, as well as exploring various acquisition opportunities. These activities occupied and continue to occupy three full-time employees. The Company hopes to complete the transition to a different segment or the mobile phone industry, or make an acquisition not later than December 31, 2011. In the interim, it will continue its present operations in a much reduced scope.

Employees

As of March 31, 2011, we had 3 full-time employees which constituted our administrative staff in China.

Web Site Access to Our Periodic SEC Reports

You may read and copy any public reports we filed with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site http://www.sec.gov that contains reports and information statements, and other information that we filed electronically.

|

Item 1A.

|

Set forth below is a description of factors that may affect our business, results of operations and share price from time to time.

The continuation of the Company will turn on a successful transition to a different segment of the mobile phone industry or the acquisition of another business. If these desired outcomes do not come to pass, the continuation of the Company would be in doubt.

While we are winding down our phone design services, as well as the sales of mobile phone components, we continue to assess the mobile phone market for possibilities of transitioning our operations to a different segment(s) of the mobile phone industry, as well as exploring various acquisition opportunities. These activities occupied and continue to occupy three full-time employees. The Company hopes to complete the transition to a different segment or the mobile phone industry, or make an acquisition not later than December 31, 2011. In the interim, it will continue its present operations in a much reduced scope. The continuation of the Company will turn on a successful transition to a different segment of the mobile phone industry or the acquisition of another business. If these desired outcomes do not come to pass, the continuation of the Company would be in doubt.

Our stock price has been historically volatile and may continue to be volatile, which may make it more difficult for you to resell shares when you want at prices you find attractive.

The trading price of our ordinary shares has been and may continue to be subject to considerable daily fluctuations. During the twelve months ended March 31, 2011, the closing sale prices of our ordinary shares on the Over-the-Counter Bulletin Board ranged from US$0.01 to US$0.25 per share and the closing sale price on June 16, 2011 was US$0.021 per share. Our stock price may fluctuate in response to a number of events and factors, such as quarterly variations in operating results, announcements of technological innovations or new products and media properties by us or our competitors, changes in financial estimates and recommendations by securities analysts, the operating and stock price performance of other companies that investors may deem comparable, new governmental restrictions or regulations and news reports relating to trends in our markets.

|

Item1B.

|

N/A.

|

Item 2.

|

As of March 31, 2011, we had an office in Huizhou, Guangdong, China.

|

Item 3.

|

We are not involved in any material pending legal proceedings at this time, and management is not aware of any contemplated proceeding by any governmental authority.

None.

PART II.

Our common stock is listed on the Pink sheetsunder the symbol “TBYH”. As of June 16, 2011, there were: (i) 319 shareholders of record, without giving effect to determining the number of shareholders who hold shares in "street name" or other nominee status; (ii) no outstanding options to purchase shares of our common stock; (iii) 30,088,174 outstanding shares of our common stock, of which 9,640,186 shares are either freely tradable or eligible for sale under Rule 144 or Rule 144K, and (v) no shares subject to registration rights.

The following table sets forth, for the fiscal quarters indicated, the high and low closing prices as reported by the Over-the-Counter Bulletin Board. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission, and may not represent actual transactions.

Sales Price

|

High

|

Low

|

|||||||||

|

Fiscal 2011

|

|

|

||||||||

|

First Quarter

|

US$

|

0.25 |

US$

|

0.10 | ||||||

|

Second Quarter

|

US$

|

0.24 |

US$

|

0.07 | ||||||

|

Third Quarter

|

US$

|

0.09 |

US$

|

0.03 | ||||||

|

Fourth Quarter

|

US$

|

0.04 |

US$

|

0.02 | ||||||

|

|

|

|||||||||

|

Fiscal 2010

|

|

|

||||||||

|

First Quarter

|

US$

|

1.01 |

US$

|

0.21 | ||||||

|

Second Quarter

|

US$

|

0.50 |

US$

|

0.11 | ||||||

|

Third Quarter

|

US$

|

0.45 |

US$

|

0.20 | ||||||

|

Fourth Quarter

|

US$

|

0.30 |

US$

|

0.05 | ||||||

Dividend Policy

We have never paid cash dividends and have no plans to do so in the foreseeable future. Our future dividend policy will be determined by our Board of Directors and will depend upon a number of factors, including our financial condition and performance, our cash needs and expansion plans, income tax consequences, and the restrictions that applicable laws and our credit arrangements then impose.

Recent Sales of Unregistered Securities

During the year ended March 31, 2011, we did not issue any securities that were not registered under the Securities Act of 1933, as amended (the “Securities Act”).

|

Item 6.

|

The following tables summarize the consolidated financial data of T-Bay Holdings, Inc. for the periods presented. You should read the following financial information together with the information under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes to these consolidated financial statements appearing elsewhere in this Form 10-K.

| Year Ended March 31 | ||||||||||||

|

In thousands, except share amounts

|

||||||||||||

|

2009 (1)

|

2010 (1)

|

2011

|

||||||||||

|

US$

|

US$

|

US$

|

||||||||||

|

General and administrative expenses

|

132 | 169 | 137 | |||||||||

|

Loss before income taxes and non-controlling interest

|

(132 | ) | (169 | ) | (137 | ) | ||||||

|

Non-controlling interests

|

429 | 427 | 588 | |||||||||

|

Net income attributable to common stockholder from continuing operations

|

297 | 258 | 451 | |||||||||

|

Loss from discontinued operations

|

(9,010 | ) | (6,766 | ) | (43,400 | ) | ||||||

|

Net loss

|

(8,713 | ) | (6,508 | ) | (42,949 | ) | ||||||

|

Loss per Share — basic

|

(0.29 | ) | (0.22 | ) | (1.43 | ) | ||||||

|

Loss per Share — diluted

|

(0.29 | ) | (0.22 | ) | (1.43 | ) | ||||||

|

|

As of March 31 | ||||||||

|

In thousands, except share amounts

|

|||||||||

|

|

2009 (1)

|

|

|

2010 (1)

|

2011 | ||||

|

|

US$

|

|

|

US$

|

US$ | ||||

|

Balance Sheet Data:

|

|||||||||

|

Cash and cash equivalents

|

3

|

-

|

1

|

||||||

|

Total current assets

|

3

|

-

|

1

|

||||||

|

Assets of discontinued operations

|

51,864

|

43,356

|

25

|

||||||

|

Total assets

|

51,867

|

43,356

|

26

|

||||||

|

Total current liabilities

|

441

|

554

|

705

|

||||||

|

Liabilities of discontinued operations

|

|

3,746

|

2,212

|

1,309

|

|||||

|

Long-term liabilities

|

3,483

|

3,483

|

4,255

|

||||||

|

Non-controlling interests

|

2,268

|

1,662

|

1,066

|

||||||

|

Total stockholders’ equity/(deficiency)

|

41,929

|

35,445

|

(7,309)

|

||||||

(1) The comparative figures have been reclassified to conform with the current year’ s presentation of discontinued operations.

The information in this discussion contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements involve risks and uncertainties, including statements regarding our capital needs, business strategy and expectations. Any statements contained herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may", "will", "should", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict", "potential" or "continue", the negative of such terms or other comparable terminology. Actual events or results may differ materially. We disclaim any obligation to publicly update these statements, or disclose any difference between its actual results and those reflected in these statements. The information constitutes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

The following review concerns the year ended March 31, 2011.

As a result of the change in consumer preference away from the types of mobile phone handsets to which our design service and our mobile phone components were suited, our business has been in decline for some time. Management finally concluded that this trend will not reverse, and therefore in September 2010 we began winding down our phone design services, as well as the sales of mobile phone components, while continuing to operate the administrative side of the business which is customer service, warranty claims, and the collection of receivables. We also continue to assess the mobile phone market for possibilities of transitioning our operations to a different segment(s) of the mobile phone industry, as well as exploring various acquisition opportunities. These activities occupied and continue to occupy three full-time employees. The Company hopes to complete the transition to a different segment or the mobile phone industry, or make an acquisition not later than December 31, 2011. In the interim, it will continue its present reduced scope of operations.

Loss from Discontinued Operations

The Company reported losses of US$43,400,000 and US$6,766,000 from discontinued operations for the years ended March 31, 2011 and 2010, respectively. Loss from discontinued operations for the years ended March 31, 2011 and 2010 consisted of revenue of US$9,643,000 and US$35,867,000, cost of revenue of US$9,385,000 and US$34,930,000, other income of US$238,000 and US$180,000, operating expenses of US$43,896,000 and US$7,919,000, gain on disposal of a subsidiary of US$NIL and US$43,000, respectively. We recorded losses on discontinued operations as the Company suspended operations in September 2010 and we increased our allowance for doubtful receivables.

Net loss attributable to common stockholders

As a result of the above item, net loss attributable to common stockholders was US$42,949,000 for the year ended March 31, 2011, as compared to US$6,508,000 for the year ended March 31, 2010. The increase of loss was mainly the result of the increase in allowance for doubtful receivables.

Loss per share attributable to common stockholders

We reported loss per share attributable to common stockholders of US$1.43, based on a weighted average number of shares outstanding of 30,088,174 for the year ended March 31, 2011, compared with a loss per share of US$0.22, based on the same weighted average number of shares for the year ended March 31, 2010. Our outstanding common stock was 30,088,174 shares as of March 31, 2011 and March 31, 2010. We do not have any preferred stock issued or outstanding warrants or options as of March 31, 2011 and March 31, 2010.

Assets

Cash and cash equivalents

|

As of March 31,

|

||||||||

|

(in thousands of US dollars)

|

||||||||

|

2010

|

2011

|

|||||||

|

US$

|

US$

|

|||||||

|

Cash and cash equivalents

|

- | 1 | ||||||

Cash and cash equivalents of continuing operations were US$1,000 as of March 31, 2011.

Assets of discontinued operations

|

As of March 31,

|

||||||||

|

(in thousands of US dollars)

|

||||||||

|

2010

|

2011

|

|||||||

|

US$

|

US$

|

|||||||

|

Assets of discontinued operations

|

43,356 | 25 | ||||||

Assets of discontinued operations were US$25,000 as of March 31, 2011. The decrease in assets of discontinued operations was mainly the result of the increase in allowance for doubtful receivables.

Liabilities

|

|

As of March 31,

|

|||||||

|

(in thousands of US dollars)

|

||||||||

| 2010 | 2011 | |||||||

| US$ | US$ | |||||||

|

Continuing operations

|

||||||||

|

Liabilities

|

4,037 | 4,960 | ||||||

|

Current liabilities

|

554 | 705 | ||||||

|

Long term liabilities

|

3,483 | 4,255 | ||||||

|

Discontinued operations

|

||||||||

|

Liabilities

|

2,212 | 1,309 | ||||||

|

Total Liabilities

|

6,249 | 6,269 | ||||||

Our total liabilities of continuing operations as of March 31, 2011 were US$4,960,000, which consisted of US$705,000 in current liabilities and US$4,255,000 in long-term liabilities.

Long-term liabilities of continuing operations amounted to US$4,255,000 as of March 31, 2011, all of which were liabilities due to shareholders.

Liabilities of discontinued operations amounted to US$1,309,000 as of March 31, 2011, most of which were other payables and accrued expenses.

Liquidity and Capital Resources

For the fiscal year ended March 31, 2011, we were winding down our provision of design solutions of wireless communication devices and sales of mobile phone components. We did not declare or pay dividends in the fiscal year ended March 31, 2011.

Cash and cash equivalents of continuing operations increased from US$Nil as of March 31, 2010 to US$1,000 as of March 31, 2011 and cash and cash equivalents of discontinued operations decreased from US$703,000 as of March 31, 2010 to US$25,000 as of March 31, 2011. The decrease was mainly attributed to the negative operating cash flows arising from the reduction in revenue and lack of receivables collected as our Company began to wind down the trading and production activities in September 2010.

As of March 31, 2011, we had capital commitments of US$40,000 in relation to acquisition of intangible assets.

We believe that cash advances from shareholders are necessary to support our limited operations for the next twelve months.

Going concern

We began to wind down our business in September 2010 and have accumulated losses from operations. The continuation of our Company as a going concern is dependent upon the Company generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities as and when they fall due. These financial statements do not include any adjustments relating to the recovery and classification of recorded asset amounts or the amount and classification of liabilities that might result from this uncertainty.

Critical Accounting Policies

The financial statements are prepared in accordance with accounting principles generally accepted in the U.S., which requires us to make estimates and assumptions in certain circumstances that affect amounts reported in the accompanying financial statements and related footnotes. In preparing these financial statements, management has made its best estimates and judgments of certain amounts included in the financial statements, giving consideration to materiality. We do not believe there is a great likelihood that materially different amounts would be reported related to the accounting policies described below. However, application of these accounting policies involves the exercise of judgment and use of assumptions as to future uncertainties and, as a result, actual results could differ from these estimates.

Revenue Recognition

Our revenues are mainly derived from design fees of mobile handset design services and sales of mobile phone components. We earn our revenue mainly through NRE fees, royalties, and sales of products.

NRE fee. NRE fees stands for Non Refundable Engineering fees, a fixed one-off fee after an agreement has been signed by both the customer and the Company. The NRE fees are no less than the total expenses of project design which normally includes the cost of market study, product concept identification, hardware designs, software designs, engineer expenses, mechanical engineering designs, testing and quality assurance, pilot production and production support. The NRE fees are recognized when payments are received.

Royalty. In addition to NRE fees, we also charge royalties to our customers. Royalty is calculated at an agreed rate for each unit manufactured or sold by our customers. The rate is variable based on volume of mobile handsets manufactured or sold. Royalty income is recognized when confirmation of manufacturing or selling volume is obtained from customers.

Component sales. Revenue from sales of components including but not limited to PCBAs, PCBs and wireless modules is recognized when title passes to the customers, which is generally when products are delivered to them.

Allowance for doubtful receivables

The Group recognizes an allowance for doubtful receivables to ensure accounts and other receivable are not overstated due to uncollectibility. Allowance for doubtful receivables is maintained for all customers based on a variety of factors, including the length of time the receivables are past due, significant one-time events and historical experience. An additional allowance for individual accounts is recorded when the Group becomes aware of a customer’s or other debtor’s inability to meet its financial obligation, such as in the case of bankruptcy filings or deterioration in the customer’s or other debtor’s operating results or financial position. If circumstances related to customers or debtors change, estimates of the recoverability of receivables would be further adjusted.

The provision was made as follows: 5% of amounts due from 1 to 180 days; 50% of amounts due from 180 to 365 days and 100% of amounts due over 365 days.

Since the Group suspended its mobile phone business in September 2010, without the business relationship, the collection of accounts receivable became increasingly difficult. The Group determined that the accounts receivable were unlikely to be recovered, therefore, the accounts receivable were provided for in full for the year.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

|

|

|

Report of Independent Registered Public Accounting Firm

|

F-1

|

|

|

|

|

Consolidated Balance Sheets

|

F-2

|

|

|

|

|

Consolidated Statements of Operations and Comprehensive Income

|

F-3

|

|

|

|

|

Consolidated Statements of Changes in Stockholders’Equity

|

F-4

|

|

|

|

|

Consolidated Statements of Cash Flows

|

F-5

|

|

|

|

|

Notes to Consolidated Financial Statements

|

F-6 – F-18

|

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors and Stockholders of

T-Bay Holdings, Inc.

We have audited the accompanying consolidated balance sheets of T-Bay Holdings, Inc. and subsidiaries (the “Company”) as of March 31, 2011 and 2010, and the related consolidated statements of operations and comprehensive income, changes in stockholders’ equity, and cash flows for each of the two years in the period ended March 31, 2011. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purposes of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of March 31, 2011 and 2010 and the results of its operations and cash flows for each of the two years in the period then ended in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, the Company has incurred a loss of US$42,949,000 for the year ended March 31, 2011 and had net liabilities of US$6,243,000 as of March 31, 2011 that raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Certified Public Accountants

Hong Kong

June , 2011

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

March 31, 2011 and 2010

(In thousands of United States dollars)

|

MARCH 31,

|

||||||||||||

|

Note(s)

|

2011

|

2010

|

||||||||||

|

ASSETS

|

||||||||||||

|

CURRENT ASSETS

|

||||||||||||

|

Cash and cash equivalents

|

US$ | 1 | US$ | - | ||||||||

|

Total current assets

|

1 | - | ||||||||||

|

ASSETS OF DISCONTINUED OPERATIONS (including cash and cash equivalents of US$25,000 (2010: US$703,000))

|

9 | 25 | 43,356 | |||||||||

|

TOTAL ASSETS

|

US$ | 26 | US$ | 43,356 | ||||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

CURRENT LIABILITIES

|

||||||||||||

|

Accruals and other payables

|

||||||||||||

|

Related parties

|

8 | US$ | 617 | US$ | 437 | |||||||

|

Third parties

|

88 | 117 | ||||||||||

|

Total current liabilities

|

705 | 554 | ||||||||||

|

LONG-TERM LIABILITIES

|

||||||||||||

|

Due to shareholders

|

8 | 4,255 | 3,483 | |||||||||

|

LIABILITIES OF DISCONTINUED OPERATIONS

|

9 | 1,309 | 2,212 | |||||||||

|

Total liabilities

|

6,269 | 6,249 | ||||||||||

|

COMMITMENTS AND CONTINGENCIES

|

10 | |||||||||||

|

STOCKHOLDERS’ (DEFICIENCY)/EQUITY

|

||||||||||||

|

Preferred stock, authorized 10,000,000 shares, par value US$0.001, issued and outstanding Nil

|

3(q) | - | - | |||||||||

|

Common stock, authorized 100,000,000 shares, par value US$0.001, issued and outstanding 30,088,174

|

30 | 30 | ||||||||||

|

Additional paid-in capital

|

1,462 | 1,462 | ||||||||||

|

Public welfare fund

|

2,109 | 2,109 | ||||||||||

|

Statutory surplus fund

|

4,219 | 4,219 | ||||||||||

|

(Accumulated losses)/retained earnings

|

(21,154 | ) | 21,795 | |||||||||

|

Accumulated other comprehensive income

|

6,025 | 5,830 | ||||||||||

|

Total stockholders’ (deficiency)/equity

|

(7,309 | ) | 35,445 | |||||||||

|

NON-CONTROLLING INTEREST

|

1,066 | 1,662 | ||||||||||

|

TOTAL STOCKHOLDERS’ (DEFICIENCY)/EQUITY

|

2 | (6,243 | ) | 37,107 | ||||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ (DEFICIENCY)/EQUITY

|

US$ | 26 | US$ | 43,356 | ||||||||

The accompanying notes are an integral part of these consolidated financial statements.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

For the years ended March 31, 2011 and 2010

(In thousands of United States dollars, except per share data)

|

Note(s)

|

YEAR ENDED MARCH 31,

|

|||||||||||

|

2011

|

2010

|

|||||||||||

|

NET REVENUE

|

3(k) | US$ | - | US$ | - | |||||||

|

COST OF REVENUE

|

- | - | ||||||||||

|

GROSS PROFIT

|

- | - | ||||||||||

|

OPERATING EXPENSES

|

||||||||||||

|

General and administrative expenses

|

137 | 169 | ||||||||||

|

TOTAL OPERATING EXPENSES

|

137 | 169 | ||||||||||

|

LOSS FROM OPERATIONS AND BEFORE INCOME TAX

|

(137 | ) | (169 | ) | ||||||||

|

INCOME TAX

|

5 | - | - | |||||||||

|

NET LOSS FROM CONTINUING OPERATIONS

|

(137 | ) | (169 | ) | ||||||||

|

LESS: NET LOSS ATTRIBUTABLE TO NON-CONTROLLING INTEREST

|

588 | 427 | ||||||||||

|

NET PROFIT ATTRIBUTABLE TO COMMON STOCKHOLDERS FROM CONTINUING OPERATIONS

|

451 | 258 | ||||||||||

|

LOSS FROM DISCONTINUED OPERATIONS

|

9 | (43,400 | ) | (6,766 | ) | |||||||

|

NET LOSS

|

(42,949 | ) | (6,508 | ) | ||||||||

|

OTHER COMPREHENSIVE INCOME

|

||||||||||||

|

Foreign currency translation adjustment

|

195 | 24 | ||||||||||

|

COMPREHENSIVE LOSS

|

US$ | (42,754 | ) | US$ | (6,484 | ) | ||||||

|

WEIGHTED AVERAGE NUMBER OF SHARES (in thousands)

|

30,088 | 30,088 | ||||||||||

|

EARNINGS/(LOSS) PER SHARE ATTRIBUTABLE TO COMMON STOCKHOLDERS (in dollars)

|

3(o) | |||||||||||

|

- CONTINUING OPERATIONS

|

0.01 | 0.01 | ||||||||||

|

- DISCONTINUED OPERATIONS

|

(1.44 | ) | (0.23 | ) | ||||||||

| (1.43 | ) | (0.22 | ) | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the years ended March 31, 2011 and 2010

(In thousands of United States dollars)

|

Common stock

|

Additional

paid-in

capital

|

Public

welfare

fund

|

Statutory

surplus

fund

|

Retained

earnings

/(accumulated

lossess)

|

Accumulated other comprehensive income

|

Total

stockholders’ equity/ (deficiency)

|

Non-

controlling interest

|

Total

|

||||||||||||||||||||||||||||||||

| No. of shares | US$ | US$ | US$ | US$ | US$ | US$ | US$ | US$ | ||||||||||||||||||||||||||||||||

|

Balance, March 31, 2009

|

30,088,174 | 30 | 1,462 | 2,109 | 4,219 | 28,303 | 5,806 | 41,929 | 2,268 | 44,197 | ||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (6,508 | ) | - | (6,508 | ) | (427 | ) | (6,935 | ) | ||||||||||||||||||||||||||

|

Disposal of a subsidiary

|

- | - | - | - | - | - | - | - | (36 | ) | (36 | ) | ||||||||||||||||||||||||||||

|

Repayment to minority shareholder

|

- | - | - | - | - | - | - | - | (10 | ) | (10 | ) | ||||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | 24 | 24 | (133 | ) | (109 | ) | ||||||||||||||||||||||||||||

|

Balance, March 31, 2010

|

30,088,174 | US$ | 30 | US$ | 1,462 | $ | 2,109 | US$ | 4,219 | US$ | 21,795 | US$ | 5,830 | US$ | 35,445 | US$ | 1,662 | US$ | 37,107 | |||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | (42,949 | ) | - | (42,949 | ) | (588 | ) | (43,537 | ) | ||||||||||||||||||||||||||

|

Foreign currency translation adjustment

|

- | - | - | - | - | - | 195 | 195 | (8 | ) | 187 | |||||||||||||||||||||||||||||

|

Balance, March 31, 2011

|

30,088,174 | US$ |

30

|

US$ |

1,462

|

US$ |

2,109

|

US$ |

4,219

|

US$ |

(21,154

|

) | US$ |

6,025

|

US$ |

(7,309

|

) | US$ |

1,066

|

US$ | (6,243 |

)

|

||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the years ended March 31, 2011 and 2010

(In thousands of United States dollars)

|

Note(s)

|

FOR THE YEAR ENDED

MARCH 31,

|

||||||||

|

2011

|

2010

|

||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|||||||||

|

Net loss from continuing operations

|

US$ | (137 | ) | $ | (169 | ) | |||

|

Decrease in accruals and other payables

|

(29 | ) | (39 | ) | |||||

|

Operating cash flows used in continuing operations

|

(166 | ) | (208 | ) | |||||

|

Operating cash flows used in discontinued operations

|

(684 | ) | (19,741 | ) | |||||

|

Net cash used in operating activities

|

(850 | ) | (19,949 | ) | |||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|||||||||

|

Net cash flows provided by investing activities of discontinued operations

|

- | 14 | |||||||

|

Net cash provided by investing activities

|

- | 14 | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|||||||||

|

Repayment of cash advance to the minority shareholder

|

(8 | ) | (10 | ) | |||||

|

Cash advance from shareholders

|

180 | 152 | |||||||

|

Net cash flows provided by financing activities

|

172 | 142 | |||||||

|

Effect of exchange rate changes on cash

|

1 | 3 | |||||||

|

Net decrease in cash and cash equivalents

|

(677 | ) | (19,790 | ) | |||||

|

Cash and cash equivalents at beginning of year

|

703 | 20,493 | |||||||

|

Cash and cash equivalents at end of year (including cash of continuing and discontinued operations of US$1,000 and US$25,000, respectively (2010: US$Nil and US$703,000, respectively))

|

US$ | 26 | US$ | 703 | |||||

|

SUPPLEMENTAL INFORMATION

|

|||||||||

|

Income taxes paid

|

US$ | - | US$ | 269 | |||||

The accompanying notes are an integral part of these consolidated financial statements.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

MARCH 31, 2011 and 2010

1. The Company and Subsidiaries

T-Bay Holdings, Inc. (the “Company” or T-Bay) was incorporated under the laws of the State of Utah on August 8, 1984 as “Sharus Corporation” with authorized common stock of 50,000,000 shares with a par value of US$0.001. On June 13, 1989, the domicile of the Company was changed to the state of Nevada in connection with a name change to “Golden Quest, Inc.”. On January 7, 2002, the name was changed to “T-Bay Holdings, Inc.” as part of a reverse stock split of 400 shares of outstanding stock for one share and on November 23, 2004, the Company increased the authorized common stock to 100,000,000 shares with a par value of US$0.001 as part of a reverse stock split of 20 outstanding shares for one share.

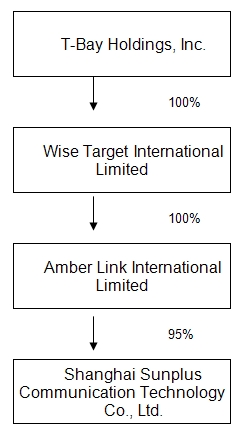

On August 16, 2005, pursuant to an Agreement and Plan of Reorganization, T-Bay issued 18,550,000 shares of its common stock for all of Amber Link International Limited’s (“Amber Link”) and Wise Target International Limited’s (“Wise Target”) outstanding shares of common stock (the “Merger”). Amber Link and Wise Target were two of the owners of Shanghai Sunplus Communication Technology Co., Ltd. (“Sunplus”). Wise Target owned a 75% interest and Amber Link owned a 20% interest in Sunplus. After the Merger, T-Bay indirectly owned a 95% interest in Sunplus. In March 2009, Wise Target transferred all its holdings (75%) in Sunplus to Amber Link for US$2,885,000 (HK$22,500,000). As a result of this transaction, Amber Link directly owned 95% of Sunplus and this transaction had no impact on the Company’s effective holdings of Sunplus. Shanghai Fanna Industrial Design Co., Ltd. owned the remaining 5% interest in Sunplus. On November 25, 2009, the Company transferred all its holdings (100%) in Amber Link to Wise Target for US$2,600. As a result of the transaction, the Company indirectly holds Amber Link and this transaction had no impact on the Company’s effective holdings of Amber Link and Sunplus.

Wise Target was incorporated on April 24, 2002 under the International Business Companies Act in the British Virgin Islands.

Amber Link was incorporated on May 10, 2002 under the International Business Companies Act in the British Virgin Islands. During the year ended March 31, 2007, Amber Link commenced the sales of mobile phones and components. In September 2010, Amber Link suspended operations.

Sunplus was established on October 17, 2002 under the laws of the People’s Republic of China (“PRC”) as a Sino-foreign joint venture specialized in the development, production and sales of electronic telecommunication devices. Sunplus commenced operations on May 1, 2003. In September 2010, Sunplus suspended operations. At March 31, 2011, Sunplus has 3 staff, which were administrative staff.

On February 12, 2007, Sunplus established a wholly-owned subsidiary, Zhangzhou JiaXun Communication Facility Co., Ltd. (“Zhangzhou JiaXun”) under the laws of the PRC. Zhangzhou JiaXun is an investment holding company.

On March 19, 2007, Sunplus and Zhangzhou JiaXun acquired 80% and 20%, respectively, of Fujian Qiaoxing Industry Co., Ltd. (“Fujian Qiaoxing”).

On March 20, 2009, Sunplus disposed of its 80% interest in Fujian Qiaoxing to Qiaoxing Telecommunication Industry Company Limited (“QiaoXing Telecom”), a third party, at a consideration of US$12,230,000 (RMB84,000,000).

On April 9, 2009, Sunplus disposed of Zhangzhou JiaXun to QiaoXing Telecom at a consideration of US$731,000 (RMB5,000,000).

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

1. The Company and Subsidiaries (continued)

As of March 31, 2011, the Group structure is as follows:-

2. Going concern

These financial statements have been prepared on a going concern basis which assumes the Company and its subsidiaries (collectively referred to as the “Group”) will be able to realize its assets and discharge its liabilities in the normal course of business for the foreseeable future. The Group suspended operations in September 2010 with a view to minimize future losses. As of March 31, 2011, the Group’s continuing and discontinued operations had net liabilities of US$6,243,000 and incurred a net loss of US$42,949,000 for the year. This raises substantial doubt about the Group’s ability to continue as a going concern. These financial statements do not include any adjustments that may result from this uncertainty. The Group’s ability to continue as a going concern is dependent upon the Group generating profitable operations in the future and/or obtaining the necessary financing to meet its obligations and repay its liabilities as and when they fall due. Management intends to look for new business opportunities and to finance operating costs over the next twelve months with existing cash on hand and advances from shareholders. The Company is currently in search for potential new business but no contracts or agreements have been signed or concluded. The Company is also in negotiation to complete the disposal of the mobile phone design operations, comprising Amber Link and Sunplus. The management continues to operate the administrative side of the business which is customer service, warranty claims and the collection of receivables.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

3. Summary of Significant Accounting Policies

(a) Basis of Preparation

The consolidated financial statements as of and for the two years ended March 31, 2011 and 2010 included the financial statements of T-Bay and its subsidiaries (hereinafter, referred to collectively as the “Group”) and are prepared in conformity with accounting principles generally accepted in the United States of America (US GAAP). All significant inter-company balances and transactions have been eliminated on consolidation.

(b) Basis of Consolidation

The consolidated balance sheets as of March 31, 2011 and 2010 and the consolidated statements of operations and comprehensive income for the years ended March 31, 2011 and 2010 included T-Bay, Wise Target, Amber Link and Sunplus.

Non-controlling interest represents minority shareholder’s interest in the results and net assets of Sunplus.

As mentioned in Note 1, AmberLink and Sunplus suspended operations in September 2010, therefore, the financial position and results of operations of AmberLink and Sunplus have been presented as discontinued operations for all periods shown in the accompanying consolidated financial statements (see note 9).

(c) Reclassifications

Certain reclassifications were made to conform prior years’ financial statements to the current presentation.

(d) Use of Estimates

In preparing financial statements in conformity with US GAAP, management is required to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported periods. Significant estimates include useful lives of depreciable and amortizable assets and allowance for doubtful receivables. Actual results could differ from those estimates.

(e) Cash and Cash Equivalents

The Group considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents. As of March 31, 2011 and 2010, the Group did not have any cash equivalents.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

3. Summary of Significant Accounting Policies (continued)

(f) Allowance for Doubtful Receivables (continued)

The Group recognizes an allowance for doubtful receivables to ensure accounts and other receivable are not overstated due to uncollectibility. Allowance for doubtful receivables is maintained for all customers based on a variety of factors, including the length of time the receivables are past due, significant one-time events and historical experience. An additional allowance for individual accounts is recorded when the Group becomes aware of a customer’s or other debtor’s inability to meet its financial obligation, such as in the case of bankruptcy filings or deterioration in the customer’s or other debtor’s operating results or financial position. If circumstances related to customers or debtors change, estimates of the recoverability of receivables would be further adjusted.

The provision was made as follows: 5% of amounts due from 1 to 180 days; 50% of amounts due from 180 to 365 days and 100% of amounts due over 365 days.

Since the Group suspended its mobile phone business in September 2010, without the business relationship, the collection of accounts receivable became increasingly difficult. The Group determined that the accounts receivable were unlikely to be recovered, therefore, the accounts receivable were provided for in full for the year.

(g) Property, Plant and Equipment

Property, plant and equipment is stated at cost. Depreciation is provided principally by use of the straight-line method over the estimated useful lives of the related assets. Expenditure for maintenance and repairs, which does not improve or extend the expected useful life of the assets, is expensed to operations while major repairs are capitalized.

Management estimates that property, plant and equipment have a 10% residual value. The estimated useful lives are as follows:

|

Machinery

|

5 years

|

|

Office equipment

|

5 years

|

|

Motor vehicles

|

5 years

|

The gain or loss on disposal of property, plant and equipment is the difference between the net sales proceeds and the carrying amount of the relevant assets, and, if any, is recognized in the statement of operations and comprehensive income.

(h) Intangible Assets

Intangible assets consist of software and patents and are amortized using the straight-line method over their estimated useful life of 5 years.

(i) Impairment of Long-Lived Assets

In accordance with Financial Accounting Standards Board Accounting Standards Codification (“FASB ASC”) No. 360-10-35, the Group evaluates its long-lived assets to determine whether later events and circumstances warrant revised estimates of useful lives or a reduction in carrying value due to impairment. If indicators of impairment exist and if the value of the assets is impaired, an impairment loss would be recognized. For the year ended March 31, 2011, an impairment loss of US$47,000 (2010: US$Nil) has been recognized, which is included in loss from discontinued operations.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

3. Summary of Significant Accounting Policies (continued)

(j) Income Taxes

The Group accounts for income taxes under FASB ASC No. 740. Under FASB ASC No. 740, deferred tax assets and liabilities are recognized for the future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. Under FASB ASC No. 740, the effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date.

The Group reviews the differences between the tax bases under PRC tax laws and financial reporting under US GAAP. As of March 31, 2011 and 2010, no material differences were found; therefore, there were no material deferred tax assets or liabilities arising from the operations of the subsidiaries in the PRC.

FASB ASC No 740 clarifies the accounting for uncertainty in income taxes recognized in an enterprise’s financial statements and it prescribes a recognition threshold and measurement attributable for the financial statements recognition and measurement of a tax position taken or expected to be taken in a tax return. FASB ASC No. 740 also provides guidance on derecognizing, classification, interest and penalties, accounting in interim periods, disclosures and transitions. Interest and penalties from tax assessments, if any, are included in general and administrative expenses in the consolidated statements of operations and comprehensive income.

The Group recognizes that virtually all tax positions in the PRC are not free of some degree of uncertainty due to tax law and policy changes by the PRC government. However, the Group cannot reasonably quantify political risk factors and thus must depend on guidance issued by current PRC government officials.

Based on all known facts and circumstances and current tax law, the Group believes that the total amount of unrecognized tax benefits as of March 31, 2011 and 2010 is not material to its results of operations, financial condition or cash flows. The Group also believes that the total amount of unrecognized tax benefits as of March 31, 2011 and 2010, if recognized, would not have a material effect on its effective tax rate. The Group further believes that there are no tax positions for which it is reasonably possible, based on current Chinese tax law and policy, that the unrecognized tax benefits will significantly increase or decrease over the next twelve months producing, individually or in the aggregate, a material effect on the Group’s results of operations, financial condition or cash flows.

Under current PRC tax laws, no tax is imposed in respect to distributions paid to owners except individual income tax.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

3. Summary of Significant Accounting Policies (continued)

(k) Revenue Recognition

Revenue from goods sold is recognized when title has passed to the purchaser, which generally is at the time of delivery. Revenue from design services is recognized when earned on the basis of the terms specified in the underlying contractual agreements.

(l) Research and Development Costs

Research and development costs consist of expenditure incurred during the course of planned research and investigation aimed at discovery of new knowledge which will be useful for developing new products or significantly enhancing existing products, and the implementation of such through design and testing of product alternatives. All expenses incurred in connection with the Group’s research and development activities are charged to current income. During the two years ended March 31, 2011 and 2010, no research and development costs were charged to the statement of operations and comprehensive income.

(m) Foreign Currency Translation and Transactions

The functional currencies of the Group are U.S. dollars, Hong Kong dollars and Renminbi, and its reporting currency is U.S. dollars. The Group’s balance sheet accounts are translated into U.S. dollars at the year-end exchange rates and all revenue and expenses are translated into U.S. dollars at the average exchange rates prevailing during the periods in which these items arise. Translation gains and losses are deferred and accumulated as a component of other comprehensive income in stockholders’ equity. Transaction gains and losses that arise from exchange rate fluctuations from transactions denominated in a currency other than the functional currency are included in the consolidated statement of operations as incurred.

The PRC government imposes significant exchange restrictions on fund transfers out of the PRC that are not related to business operations. These restrictions have not had a material impact on the Group because it has not engaged in any significant transactions that are subject to the restrictions.

(n) Fair Value of Financial Instruments

FASB ASC No. 825 “Financial Instruments” requires disclosing fair value to the extent practicable for financial instruments that are recognized or unrecognized in the balance sheet. The fair value of the financial instruments disclosed herein is not necessarily representative of the amount that could be realized or settled, nor does the fair value amount consider the tax consequences of realization or settlement.

For certain financial instruments, including cash, accounts, notes and other receivables, accounts payable, accruals and other payables, it was assumed that the carrying amounts approximate fair value because of the near term maturities of such obligations.

The long-term accounts receivable are discounted based on the future contractual cash flows at the current market interest rate that is available to the Group for similar financial instruments of 5%. US$473,000 (2010: US$1,425,000) was debited to revenue accordingly.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

3. Summary of Significant Accounting Policies (continued)

(n) Fair Value of Financial Instruments (continued)

The Group complies with FASB ASC No. 820 “Fair Value Measurements and Disclosures”. FASB ASC No. 820 clarifies the definition of fair value, prescribes methods for measuring fair value and establishes a fair value hierarchy to classify the inputs used in measuring fair value as follows:

Level 1-Inputs are unadjusted quoted prices in active markets for identical assets or liabilities available at the measurement date.

Level 2-Inputs are unadjusted quoted prices for similar assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, inputs other then quoted prices that are observable, and inputs derived from or corroborated by observable market data.

Level 3-Inputs are unobservable inputs which reflect the reporting entity's own assumptions on what assumptions the market participants would use in pricing the asset or liability based on the best available information.

The Group currently does not have any balance sheet components deemed financial assets, and we do not have any nonfinancial assets or liabilities of our continuing operations that have been marked to fair value, however, our financial statements in the future may be impacted by this standard.

(o) Earnings/Loss Per Share

Basic earnings/loss per share is computed by dividing the loss for the year by the weighted average number of common shares outstanding for the year.

(p) Profit Appropriation

In accordance with PRC regulations, the PRC subsidiaries are required to make appropriations to the statutory surplus reserve, based on after-tax net income determined in accordance with PRC GAAP. Appropriation to the statutory surplus reserve should be at least 10% of the after-tax net income determined in accordance with PRC GAAP until the reserve is equal to 50% of the entity’s registered capital. Appropriations to the statutory public welfare fund and discretionary surplus reserve fund are made on the same basis as statutory surplus fund, normally at 5%-10% or higher rates and are generally optional at the discretion of the Board of Directors. Statutory surplus reserve is non-distributable other than in liquidation.

(q) Preferred Stock

No shares of preferred stock have been issued or are outstanding. Dividends, voting rights and other terms, rights and preferences of the preferred shares have not been designated but may be designated by our board of directors from time to time.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

4. Allowance for Doubtful Receivables

|

MARCH 31,

2011

|

MARCH 31,

2010

|

|||||||

| US$’000 | US$’000 | |||||||

|

Balance, beginning of year

|

$ | 15,429 | $ | 9,202 | ||||

|

Additions

|

43,342 | 6,227 | ||||||

|

Written off

|

(10,543 | ) | - | |||||

| $ | 48,228 | $ | 15,429 | |||||

5. Income Tax

Amber Link and Wise Target are not subject to income taxes in any tax jurisdiction.

No provision for current income tax for T-Bay has been made as it incurred a loss for each of the years ended March 31, 2011 and 2010, respectively.

Sunplus is subject to PRC Income Tax. Pursuant to the PRC Income Tax Laws, the prevailing statutory rate of enterprise income tax is 25%.

|

YEAR ENDED MARCH 31,

|

||||||||

|

2011

|

2010

|

|||||||

| US$’000 | US$’000 | |||||||

|

Loss before income tax

|

$ | (137 | ) | $ | (169 | ) | ||

|

Income benefit on pretax loss at statutory rate

|

(34 | ) | (42 | ) | ||||

|

Effect of different tax rates of Group company operating in other jurisdictions

|

(12 | ) | (11 | ) | ||||

|

Tax effect of non-deductible expenses

|

2,722 | 862 | ||||||

|

Change in valuation allowance

|

(2,676 | ) | (809 | ) | ||||

|

Income tax expense

|

$ | - | $ | - | ||||

As of March 31, 2011, T-Bay had accumulated net operating loss carryforwards for United States federal tax purposes of approximately US$2,044,000, that are available to offset future taxable income. As of March 31, 2011, Sunplus had net operating loss carryforwards of approximately US$912,000 that are available to offset future taxable income up to 2015. Realization of the net operating loss carryforwards is dependent upon future profitable operations. In addition, T-Bay’s carryforwards may be limited upon a change of control in accordance with Internal Revenue Code Section 382, as amended. Accordingly, management has recorded a valuation allowance to reduce deferred tax assets associated with the net operating loss carryforwards to zero at March 31, 2011. T-Bay’s net operating loss carryforwards expire in years 2012 through 2031.

As of March 31, 2011, deferred tax assets consist of:-

|

MARCH 31, 2011

|

MARCH 31, 2010

|

|||||||

| US$’000 | US$’000 | |||||||

|

Net operating loss carryforwards

|

$ | 923 | $ | 2,300 | ||||

|

Less: valuation allowance

|

(923 | ) | (2,300 | ) | ||||

| $ | - | $ | - | |||||

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

5. Income Tax (continued)

The U.S. Federal income tax returns of T-Bay for 2005 – 2007 have been filed but are subject to examination by the Internal Revenue Service.

6. Concentrations and Credit Risk

The Group operates principally in the PRC (including Hong Kong) and grants credit to its customers in this geographic region. Although the PRC is economically stable, it is always possible that unanticipated events in foreign countries could disrupt the Group’s operations.

Financial instruments that potentially subject the Group to a concentration of credit risk consist of cash, accounts receivable and other receivables.

As of March 31, 2011 and 2010, the Group had credit risk exposure of uninsured cash in banks of approximately US$26,000 and US$703,000, respectively.

As of March 31, 2011 and 2010, the Group had credit risk exposure of sales proceeds receivable from QiaoXing Telecom of approximately US$Nil and US$11,928,000, respectively (See Note 1).

Pursuant to the agreement signed between Sunplus and QiaoXing Telecom in respect of the disposal of Fujian Qiaoxing to QiaoXing Telecom in March 2009, QiaoXing Telecom was to settle this outstanding balance by June 2009. However, QiaoXing Telecom was unable to obtain approval from the local governmental bureau in Zhangzhou to develop the land held by Fujian Qiaoxing. This was due to the delay in development by Fujian Qiaoxing. When the Zhangzhou local government granted the land use right to Fujian Qiaoxing in 2006, Fujian Qiaoxing was required to develop the land within three years. However, the land had not been developed prior to the disposal to QiaoXing Telecom and the local authorities refused to approve the development plans submitted by QiaoXing Telecom. Since March 2010, management had actively liaised with the Zhangzhou local governmental bureau to apply for an extension of the land development.

Despite various discussions and negotiations held with the Zhangzhou local authority, the effort failed, and the local authorities took back the land by forced resumption. In view of this, full allowance has been made in respect of the sales proceeds receivable from QiaoXing Telecom of US$10,543,000 and charged to the statement of operations and comprehensive income in the first quarter in the year ended March 31, 2011, which is included in loss from discontinued operations.

On August 31, 2010, an agreement was signed between Sunplus and QiaoXing Telecom for settlement. As Zhangzhou local government had taken back the land, QiaoXing Telecom can no longer use the land for any purpose. It was mutually agreed that Sunplus will not request QiaoXing Telecom to repay the outstanding balance of US$10,543,000 while the deposit paid by QiaoXing Telecom will not be refunded back to QiaoXing Telecom. In view of this, Sunplus wrote off the allowance made.

A substantial portion of revenue was generated from one group of customers for the years ended March 31, 2011 and 2010.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2010 and 2009

6. Concentrations and Credit Risk (continued)

The net sales to customers representing at least 10% of net total sales are as follows:-

|

YEAR ENDED MARCH 31,

|

||||||||||||||||

|

2011

|

2010

|

|||||||||||||||

| US$’000 | US$’000 | US$’000 |

%

|

|||||||||||||

|

Customer A

|

1,881 | 20 | 7,453 | 21 | ||||||||||||

|

Customer B

|

1,667 | 17 | 5,710 | 16 | ||||||||||||

|

Customer C

|

850 | 9 | 4,501 | 13 | ||||||||||||

|

Customer D*

|

1,203 | 12 | 4,066 | 11 | ||||||||||||

|

Customer E*

|

1,135 | 12 | 3,816 | 11 | ||||||||||||

|

Customer F

|

1,667 | 17 | 3,898 | 11 | ||||||||||||

|

Customer G

|

505 | 5 | 3,721 | 10 | ||||||||||||

|

Customer Group A*

|

2,339 | 24 | 7,882 | 22 | ||||||||||||

The following customers had balances greater than 10% of the total accounts receivable as of March 31, 2011 and March 31, 2010:-

|

MARCH 31, 2011

|

MARCH 31, 2010

|

|||||||||||||||

| US$’000 |

%

|

US$’000 |

%

|

|||||||||||||

|

Customer A

|

9,001 | 19 | 8,248 | 19 | ||||||||||||

|

Customer B

|

7,824 | 17 | 6,846 | 16 | ||||||||||||

|

Customer E*

|

5,343 | 11 | 4,731 | 11 | ||||||||||||

|

Customer G

|

4,632 | 10 | 4,497 | 11 | ||||||||||||

|

Customer group A*

|

9,180 | 20 | 8,499 | 20 | ||||||||||||

* Customer Group A includes customers D and E.

*At March 31, 2011 and March 31, 2010, this group of customers accounted for 20% and 20%, respectively, of accounts receivable. The accounts receivable that have repayment terms of not more than twelve months that have been discounted. The Group does not require collateral to support financial instruments that are subject to credit risk.

As of March 31, 2011 and 2010, the Group had credit risk exposure of accounts receivable of approximately US$Nil and US$28,493,000, respectively.

7. Retirement and Welfare Benefits

The full-time employees of the PRC subsidiaries are entitled to staff welfare benefits including medical care, casualty, housing benefits, education benefits, unemployment insurance and pension benefits through a PRC government-mandated multi-employer defined contribution plan. The PRC subsidiaries are required to accrue the employer-portion for these benefits based on certain percentages of the employees’ salaries. The total provision for such employee benefits was US$57,000 and US$164,000 for the years ended March 31, 2011 and 2010, respectively. The PRC subsidiaries are required to make contributions to the plans out of the amounts accrued for all staff welfare benefits except for education benefits. The PRC government is responsible for the staff welfare benefits including medical care, casualty, housing benefits, unemployment insurance and pension benefits to be paid to these employees.

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

8. Related Party Transactions

The Group engages in business transactions with the following related parties:

a. Li Xiaofeng, a director and stockholder of T-Bay.

b. Li Meilian, a stockholder of T-Bay.

The Group has the following transactions and balances with related parties:-

|

MARCH 31, 2011

|

MARCH 31, 2010

|

|||||||

| US$’000 | US$’000 | |||||||

|

Other payable – Li Meilian

|

$ | 617 | $ | 437 | ||||

|

Long-term liabilities

|

||||||||

|

Other payable – Li Meilian

|

$ | 3,482 | $ | 3,482 | ||||

|

Other payable – Li Xiaofeng

|

773 | 773 | ||||||

| $ | 4,255 | $ | 4,255 | |||||

The balances have no stated terms for repayment, are not interest bearing, and are the result of a loan and cash advances from related parties and the repayment thereof. Those payables to Li Meilian and Li Xiaofeng which are classified as long-term liabilities are not repayable within the next twelve months.

9. Discontinued Operations

In September 2010, the operations of Amber Link and Sunplus were suspended.

The following table summarises the result of these discontinued operations, net of income taxes, for the years ended March 31, 2011 and 2010.

|

MARCH 31, 2011

|

MARCH 31, 2010

|

|||||||

| US$’000 | US$’000 | |||||||

|

NET REVENUE

|

$ | 9,643 | $ | 35,867 | ||||

|

COST OF REVENUE

|

(9,385 | ) | (34,930 | ) | ||||

|

GROSS PROFIT

|

258 | 937 | ||||||

|

OPERATING EXPENSES

|

||||||||

|

Selling expenses

|

(34 | ) | (129 | ) | ||||

|

General and administrative expenses

|

(43,862 | ) | (7,790 | ) | ||||

|

TOTAL OPERATING EXPENSES

|

(43,896 | ) | (7,919 | ) | ||||

|

LOSS FROM OPERATIONS

|

(43,638 | ) | (6,982 | ) | ||||

|

OTHER INCOME

|

238 | 180 | ||||||

|

GAIN ON DISPOSAL OF SUBSIDIARY

|

- | 43 | ||||||

|

LOSS BEFORE INCOME TAX

|

(43,400 | ) | (6,759 | ) | ||||

|

INCOME TAX

|

- | (7 | ) | |||||

|

NET LOSS

|

$ | (43,400 | ) | $ | (6,766 | ) | ||

T-BAY HOLDINGS, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

MARCH 31, 2011 and 2010

9. Discontinued Operations (continued)

The assets of discontinued operations of Amber Link and Sunplus as at March 31, 2011 and March 31, 2010 were as follows:

|

MARCH 31, 2011

|

MARCH 31, 2010

|

|||||||

|

US$’000

|

US$’000

|

|||||||

|

Property, plant and equipment

|

$ | - | $ | 1,591 | ||||

|

Accounts receivable - long term (See notes 4 and 6)

|

- | 28,493 | ||||||

|

Intangible assets

|

- | 42 | ||||||

|

Other receivables and prepayment (See notes 4 and 6)

|

- | 12,517 | ||||||

|

Notes receivable

|

- | 10 | ||||||

|

Cash and bank balances

|