UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 16, 2010

LITHIUM EXPLORATION GROUP,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 333-137481 | 06-1781911 |

| (State or other jurisdiction of | (Commission File Number) | (I.R.S. Employer Identification |

| incorporation) | No.) |

3200 N. Hayden Road, Suite 300,

Scottsdale, AZ,

85251

(Address of principal executive offices)

480-641-4790

(Registrant’s telephone number,

including area code)

____________________________________________________

(Registrant’s former name, address and telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

Page

1

Item 1.01 Entry into Material Definitive Agreement

Item 2.01 Completion of Acquisition or Disposition of Assets.

As used in this Current Report on Form 8-K, unless otherwise stated, all references to the “Company”, “we,” “our” and “us” refer to Lithium Exploration Group, Inc.

Property Rights Acquisitions

Beginning on December 16, 2010, we started the process of acquiring lithium exploration properties and related technology. The following is a summary of these acquisitions. More detailed descriptions of each property are located in the section titled “Description of Property”.

On December 16, 2010, we entered into an assignment agreement with Lithium Exploration VIII Ltd., a Nevada company, in regards to the acquisition of an option interest in a prospective Lithium property in the Province of Alberta, Canada called the “Valleyview Property”.

First Lithium Resources Inc. and Lithium Exploration VIII had entered into an option agreement dated October 6, 2010, in regards to an option interest in certain mineral permits in Alberta, Canada, which option agreement and interest have been assigned to our company. Specifically, Lithium Exploration acquired an option to acquire a 100% interest in five mineral permits totaling 45,952 hectares in Alberta which we have assumed.

In regards to the option agreement for the property, our obligations for the property that we have assumed consist of:

-

Making payments in the aggregate amount of $500,000 in annual periodic payments escalating from $40,000 to $300,000, to January 1, 2014.

-

Complying with the net smelter royalty payments upon commercial production, which consists of 1% to First Lithium and certain underlying royalties payable to the original property vendor (a 3% net smelter return royalty and a 5% gross overriding royalty, which latter royalty is specific to diamond production).

The first cash payment of $40,000 has been made by Lithium Exploration VIII and in addition they also made a payment of $50,000 towards work assessment payments and for maintenance of the permits. In consideration for the assignment, we have agreed to pay Lithium Exploration VIII $90,000 in cash or the equivalent amount in shares of common stock.

The foregoing description of the assignment agreement is qualified entirely by reference to the copy of said agreement attached as an exhibit to this current report on Form 8-K.

On January 18, 2011 we entered into a purchase option agreement with Salta Water Co. (“Salta Water”).

Salta Water holds a 100% interest in certain mineral claims in Salta province, Argentina known as the Salta Agua claims.

We have acquired an option entitling us to acquire certain legal and beneficial interests in and to the Salta Agua claims, and to participate in the further exploration and, if deemed warranted, the development of the Salta Agua claims. Specifically, we have acquired a right and option to acquire undivided legal and beneficial interests of up to 100% in the Salta Agua claims free and clear of all liens, charges and claims of others.

2

In order for us to exercise the option and acquire an initial 60% interest, we are required to make the following payments to Salta Water and incur the expenses indicated, prior to the fifth anniversary of the date of the Option Agreement:

| (1) |

an initial payment of 25,000, which has been paid by us; | |

| (2) |

pay a further $50,000 no later than thirty days after the Effective Date and issue 250,000 restricted shares of common stock, which has been paid by us; | |

| (3) |

pay a further $100,000 on or before the first anniversary of the Effective Date and issue 250,000 restricted shares of common stock; | |

| (4) |

pay a further $100,000 on or before the second anniversary of the Effective Date and issue 250,000 restricted shares of common stock; | |

| (5) |

pay a further $100,000 on or before the third anniversary of the Effective Date and issue 250,000 restricted shares of common stock; and | |

| (6) |

incur or fund expenditures on the Property prior to the Option Deadline of not less than $4,000,000 on or before the fifth anniversary of the Effective Date. |

Once we have completed the foregoing conditions we will then have the further option to acquire the remaining 40% of the Salta Agua claims by paying $6,000,000 within 180 day or by paying $3,000,000 within 180 days and the balance of $3,000,000 within a further 12 months, which balance shall accrue interest at the rate of LIBOR plus 5%.

The foregoing description of the assignment agreement is qualified entirely by reference to the copy of said agreement attached as an exhibit to this current report on Form 8-K.

Technology Acquisition

On March 17, 2011, we entered into a letter agreement with Glottech-USA, LLC for the licensing of one (1) initial unit of certain proprietary and patented mechanical ultrasound technology for use in the water treatment in regards to our lithium operations in Alberta, Canada. Pursuant to the terms of the Agreement, Glottech-USA will assemble and ship to our company one (1) unit of the technology specifically designed for our water treatment purposes and will license the use of the technology. Furthermore, we have agreed that in the event that we have purchased a minimum of five (5) technology units within twelve (12) months from the date of execution, Glottech-USA has agreed that it will neither license nor lease the technology to any third party for use in the country of Canada.

In exchange for the acquisition of the technology, we have agreed to pay to Glottech-USA a Licensing & Technology Payment in the amount of US$800,000 as follows:

| (i) |

US$25,000 upon execution of the Agreement (the “Initial Payment”); | |

| (ii) |

US$75,000 within 180 days of the date of execution which shall serve as confirmation by the company of its intent to formally proceed with the intent of the Agreement (the “Confirmation Payment”); | |

| (iii) |

US$700,000 with 10 days of receipt of invoice from Glottech-USA to cover the cost of components and assembly for one (1) Technology unit (the “Closing Payment”); and | |

| (iv) |

monthly royalties, to be paid within fifteen (15) calendar days from the receipt of the invoice, in an amount of $2.00 per physical ton of water processed pursuant to the usage of the Technology following satisfactory delivery and physical setup of the Technology and continuing thereafter for as long as the Technology remains in our possession (the “Royalties”). |

3

Concurrent with the Confirmation Payment, in consideration of the preferential royalty payment structure and the territorial licensing and limited exclusivity provisions of the agreement, our CEO Alex Walsh, has pledged 2,000,000 shares to Glottech USA to be acquired as an option for the fee of $1 which can be exercised after the delivery of the operational unit to us.

We will adapt this technology for use on our Valleyview Property to evaluate its efficacy and efficiency. We do not, at this time, have plans to commercialize and distribute this technology beyond the scope of our own use.

The foregoing description of the letter agreement is qualified entirely by reference to the copy of said agreement attached as an exhibit to this current report on Form 8-K.

Description of Business

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements. To the extent that any statements made in this report contain information that is not historical, these statements are essentially forward-looking. Forward-looking statements can be identified by the use of words such as “expects”, “plans”, “may,”, “anticipates”, “believes”, “should”, “intends”, “estimates”, and other words of similar meaning. These statements are subject to risks and uncertainties that cannot be predicted or quantified and, consequently, actual results may differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, without limitation, our ability to raise additional capital to finance our activities; the effectiveness, profitability and marketability of our products; legal and regulatory risks associated with the share exchange; the future trading of our common stock; our ability to operate as a public company; our ability to protect our proprietary information; general economic and business conditions; the volatility of our operating results and financial condition; our ability to attract or retain qualified senior management personnel and research and development staff; and other risks detailed from time to time in our filings with the Securities and Exchange Commission (the “SEC”), or otherwise.

Information regarding market and industry statistics contained in this report is included based on information available to us that we believe is accurate. It is generally based on industry and other publications that are not produced for purposes of securities offerings or economic analysis. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and the additional uncertainties accompanying any estimates of future market size, revenue and market acceptance of products and services. We do not undertake any obligation to publicly update any forward-looking statements. As a result, investors should not place undue reliance on these forward-looking statements.

Overview

We were incorporated in the State of Nevada on May 31, 2006. We were formed as an exploration stage company to be engaged in the search for mineral deposits or reserves. Effective November 30, 2010, we changed our name from “Mariposa Resources, Ltd.” to “Lithium Exploration Group, Inc.”, by way of a merger with our wholly owned subsidiary Lithium Exploration Group, Inc., which was formed solely for the change of name.

4

Current Business

We conducted preliminary exploration activities on the MRP Claims (lode mining claims), in Esmeralda County, Nevada. We returned these claims in June 2009. In December 16, 2010 we acquired rights to the Valleyview Property located in Alberta, Canada and on January 18, 2011 we acquired rights to the Salta Agua Claims in Argentina. On March 17, 2011 we acquired a license to a water treatment technology for use in our lithium operations on the Valleyview Property.

We are primarily engaged in the acquisition and exploration of early stage Lithium properties. The intended use of the technology acquired from Glottech-USA is to aid in the separation of lithium from oil and water based stock. We are only anticipating using this technology on our Valleyview Property and not distributing or commercializing it at this time.

What follows is a summary description of the Glottech-USA technology as well as a general description of our Lithium exploration business operations. More detailed description of our two Lithium properties can be found under the heading “Description of Property”.

Technology Description

Glottech-USA’s technology produces extremely high temperatures which destroy organic substances such as bacteria and other toxic agents. We believe that Glottech-USA's technology can provide lower costs of operation as well as reduced time for site clean-up than traditional methods of water treatment. We anticipate using this application to extract dissolved solids like lithium, potassium, and magnesium from oil field brine. The disposal of produced water (brine) from oil and gas production in Alberta is a significant environmental issue for the province and presents a considerable economic issue for producers. We intend to partner with the use of the technology on our Valleyview Property in Alberta, in cooperation with oil and gas producers, to treat and dispose of their produced water while monetizing the minerals that are contained within that produced water stream that is being brought to the surface during the oil and gas production process.

The technical process is based on the use of mechanical ultrasound generated through the production of a series of cavitations. Mechanical ultrasound is a machine-produced sound of a frequency above the upper limit of the normal range of human hearing. Cavitations are the rapid formation and collapse of bubbles in liquids, caused by the movement of something such as a propeller or by waves of high-frequency sound. The production of mechanical ultrasound allows Glottech-USA’s technology to distil the fluid stock. Using mechanical ultrasound for distillation has been attempted before, but the external energy requirement needed to produce the mechanical ultrasound was far too expensive to make it commercially viable. Glottech-USA’s technology uses the energy released during the cavitations in order to make it commercially viable from an economic perspective. During these cavitations, a millisecond of energy is released. During this release temperatures can reach 5000 degrees Centigrade. The technology is used to treat fluid stock that is either water or petroleum based. Glottech-USA has developed two separate units used for each particular application. Although the water and petroleum units have some different components, they both have the same basic design and are used similarly. Both models of the technology distill fluid stock. The petroleum unit has the ability to vary the internal temperature in order to derive a specific petroleum product such as aviation fuel, kerosene, diesel and gasoline. The water unit has pure distilled water as its output along with any inorganic substances coming out in the form of dry powder. Glottech-USA, through market feedback, has concluded that its water unit will represent the major portion of units placed in service over the ten year business plan life.

5

Market, Customers and Distribution Methods

Although there can be no assurance, large and well capitalized markets are readily available for all metals and precious metals throughout the world. A very sophisticated futures market for the pricing and delivery of future production also exists. The price for metals is affected by a number of global factors, including economic strength and resultant demand for metals for production, fluctuating supplies, mining activities and production by others in the industry, and new and or reduced uses for subject metals.

The mining industry is highly speculative and of a very high risk nature. As such, mining activities involve a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Few mining projects actually become operating mines.

The mining industry is subject to a number of factors, including intense industry competition, high susceptibility to economic conditions (such as price of metal, foreign currency exchange rates, and capital and operating costs), and political conditions (which could affect such things as import and export regulations, foreign ownership restrictions). Furthermore, the mining activities are subject to all hazards incidental to mineral exploration, development and production, as well as risk of damage from earthquakes, any of which could result in work stoppages, damage to or loss of property and equipment and possible environmental damage. Hazards such as unusual or unexpected geological formations and other conditions are also involved in mineral exploration and development.

Competition

The mineral exploration industry is highly competitive. We are a new exploration stage company and have a weak competitive position in the industry. We compete with junior and senior mineral exploration companies, independent producers and institutional and individual investors who are actively seeking to acquire mineral exploration properties throughout the world together with the equipment, labor and materials required to operate on those properties. Competition for the acquisition of mineral exploration interests is intense with many mineral exploration leases or concessions available in a competitive bidding process in which we may lack the technological information or expertise available to other bidders.

Many of the mineral exploration companies with which we compete for financing and for the acquisition of mineral exploration properties have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquiring mineral exploration interests of merit or on exploring or developing their mineral exploration properties. This advantage could enable our competitors to acquire mineral exploration properties of greater quality and interest to prospective investors who may choose to finance their additional exploration and development. Such competition could adversely impact our ability to attain the financing necessary for us to acquire further mineral exploration interests or explore and develop our current or future mineral exploration properties.

We also compete with other junior mineral exploration companies for financing from a limited number of investors that are prepared to invest in such companies. The presence of competing junior mineral exploration companies may impact our ability to raise additional capital in order to fund our acquisition or exploration programs if investors perceive that investments in our competitors are more attractive based on the merit of their mineral exploration properties or the price of the investment opportunity. In addition, we compete with both junior and senior mineral exploration companies for available resources, including, but not limited to, professional geologists, land specialists, engineers, camp staff, helicopters, float planes, mineral exploration supplies and drill rigs.

6

General competitive conditions may be substantially affected by various forms of energy legislation and/or regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including international political conditions, overall levels of supply and demand for mineral exploration.

In the face of competition, we may not be successful in acquiring, exploring or developing profitable mineral properties or interests, and we cannot give any assurance that suitable oil and gas properties or interests will be available for our acquisition, exploration or development. Despite this, we hope to compete successfully in the mineral exploration industry by:

-

keeping our costs low;

-

relying on the strength of our management’s contacts; and

-

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

Intellectual Property

We have not filed for any protection of our trademark, and we do not have any other intellectual property.

Research and Development

We did not incur any research and development expenses during the period from May 31, 2006 (inception) to June 30, 2010.

Reports to Security Holders

We are subject to the reporting and other requirements of the Exchange Act and we intend to furnish our shareholders annual reports containing financial statements audited by our independent registered public accounting firm and to make available quarterly reports containing unaudited financial statements for each of the first three quarters of each year. We currently file Quarterly Reports on Form 10-Q, Annual Reports on Form 10-K and Current Reports on Form 8-K with the Securities and Exchange Commission in order to meet our timely and continuous disclosure requirements. We may also file additional documents with the Commission if they become necessary in the course of our company’s operations. The public may read and copy any materials that we file with the SEC at the SEC's Public Reference Room at 100 F Street, NE, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC. The address of that site is www.sec.gov.

Government Regulations

Any operations at our Lithium properties will be subject to various federal and state laws and regulations in Canada and Argentina which govern prospecting, development, mining, production, exports, taxes, labor standards, occupational health, waste disposal, protection of the environment, mine safety, hazardous substances and other matters. We will be required to obtain those licenses, permits or other authorizations currently required to conduct exploration and other programs. There are no current orders or directions relating to us or our Lithium properties with respect to the foregoing laws and regulations. Such compliance may include feasibility studies on the surface impact of our proposed operations, costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties. We are not presently aware of any specific material environmental constraints affecting our properties that would preclude the economic development or operation of property in Canada or Argentina.

7

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Employees

As of July 7, 2011 we did not have any employees. Alexander Walsh, our sole officer spends about 30 hours per week on our operations on a consulting basis. There are outside consultants that have been engaged for administrative duties and industry specialties. There are two other directors in the company, Jon Jazwinski and Brandon Colker, who spend approximately 15 hours per month on various company activities.

Description of Property

We currently rent an office totaling approximately 600 square feet located at 3200 N. Hayden Road, Suite 300, Scottsdale, AZ, 85251 for $600 a month. Our telephone number is 480-641-4790.

Valleyview Property

There are over 100 active oil or gas wells on our property. Oil and/or gas coexist within the same aquifers as our lithium and potassium-bearing brines. In recovering the oil and gas, brine is also drawn to the surface, but generally in much larger quantities.

The energy operator must process the brine and then separate it from the oil and/or gas. When this process is completed, the brine is returned to the aquifer. Given these circumstances, potential exists for a symbiotic relationship between us and other energy companies, with a result being that we may never have to even drill a hole to extract its own resource. Barrick Energy Inc, Paramount Resources, Signalta Resources Ltd, Penn West Petroleum Ltd and Canadian Natural Resources Ltd are among the companies actively operating wells on property for oil and gas deposits. We have rights to any minerals produced from their activity. In addition to lithium and potassium, other rare metals and minerals on the property include calcium, magnesium, iodine, and bromine. There can be no assurance that we will be able to locate and extract commercially viable amounts of lithium or any other minerals.

8

Location and Access

The property covers 5 townships just south and east of Valleyview, Alberta and covers approximately 113,500 acres. The townships it is located within include 68-21-W5, 69-21-W5, 67-22-W5, 68-22-W5, and 69-22-W5. Almost all of the property has paved roads and all year round access. Alberta Provincial Highway 43 runs north to south through the center of the property. The property is 1.5 hours driving from Grand Prairie, Alberta and 3.5 hours driving from Edmonton, Alberta.

Ownership Interest

On December 16, 2010, we entered into an assignment agreement with Lithium Exploration VIII Ltd., a Nevada company, in regards to the acquisition of an option interest in the Valleyview Property.

First Lithium Resources Inc. and Lithium Exploration VIII had entered into an option agreement dated October 6, 2010, in regards to an option interest in certain mineral permits in Alberta, Canada, which option agreement and interest have been assigned to our company. Specifically, Lithium Exploration acquired an option to acquire a 100% interest in five mineral permits totaling 45,952 hectares in Alberta, Nevada which we have assumed.

In regards to the option agreement for the property, our obligations for the property that we have assumed consist of:

-

Making payments in the aggregate amount of $500,000 in annual periodic payments escalating from $40,000 to $300,000, to January 1, 2014.

-

Complying with the net smelter royalty payments upon commercial production, which consists of 1% to First Lithium and certain underlying royalties payable to the original property vendor (a 3% net smelter return royalty and a 5% gross overriding royalty, which latter royalty is specific to diamond production).

9

The first cash payment of $40,000 has been made by Lithium Exploration VIII and in addition they also made a payment of $50,000 towards work assessment payments and for maintenance of the permits. In consideration for the assignment, we have agreed to pay Lithium Exploration VIII $90,000 in cash or the equivalent amount in shares of common stock.

The foregoing description of the assignment agreement is qualified entirely by reference to the copy of said agreement attached as an exhibit to this current report on Form 8-K.

History of Operations

A 1995 report authored by S. Bachu, M. Brulotte and L.P. Yuan of the Alberta Research Council, "Resource Estimates of Industrial Minerals in Alberta Formation Waters," discusses the area in which the Valleyview Property is located as having potential for resources of lithium within formation waters.

In the 1995 report, the Alberta Research Council provided a "historical resource estimate" of roughly 2.8 billion pounds of Li2O, based on 3,768 core analyses and 29 permeability studies. Of the more than 1,511 records in the AGS study, the well with the highest concentration of lithium (140mg/L or ppm) is located nearly in the center of the Valleyview Property, based on longitude and latitude coordinates. In addition, a second well in the top 50 is located approximately a mile from that well.

More recently, in January 2010, D.R. Eccles and G.M. Jean of the Alberta Geological Survey (AGS) published "Lithium Ground and Formation Water Geochemical Data," with the intention of enabling present and future companies to better evaluate their targets and characterize their resource estimates by being able to distinguish between background and anomalous concentrations of lithium throughout Alberta. The report, researched during 2009, is a compilation of ground- and formation-water geochemical lithium data from government sources and from AGS data holdings, resulting in 1511 records.

Current State and Plan of Operations

We completed a 12 week sample testing program in on May 31, 2011. We are initiating the process to complete the resource estimates for the Valleyview Project, and hope to have it completed by August 31, 2011. Immediate plans include conducting bulk sampling to be utilized in the design of a separation process to produce battery-grade lithium carbonate, potash (KCl), and magnesium hydroxide: Once the bulk sampling and separation process have been completed we will raise capital to build a pilot scale plant in Valleyview to begin the production of the outlined minerals.

Geology

In 1993, a data set comprising nearly 130 000 formation water analyses from the Alberta Basin was reviewed for potential economic industrial mineral interest (Hitchon, B., Underschultz, J.R. and Bachu, S. 1993: Industrial mineral potential of Alberta formation waters. Alberta Research Council, Alberta Geological Survey, Open File Report 1993-15, 85 p). The study identified anomalous values of certain elements in Devonian formation waters associated with producing oil and gas wells in the Valleyview and Swan Hills areas of west-central Alberta including brines with up to 140 mg/L lithium. This value is significant considering the median values of lithium in Alberta formation waters is 0.2 mg/L (based on 1,511 analyses; Eccles, D.R. and Berhane, H. (2011): Geological introduction to lithium-rich formation water in Alberta, west-central Alberta; Energy Resources Conservation Board, ERCB/AGS Open FileReport, 36 p.). Further modeling by in 1995 (Bachu, S. Yuan, L.P. and Brulotte, M. (1995): Resource estimates of industrial minerals in Alberta formation waters. Alberta Research Council, Alberta Geological Survey, Open File Report 1995-01, 59 p.) calculated a historical resource estimate of 515 000 tonnes for Devonian formation waters in west-central Alberta. This estimate is distributed over a cumulative area of 3,980 km2 at prospective depths of between 2700 and 4000 m depth. The high-lithium brines also contain elevated potassium (up to 8,000 mg/L), boron (up to 270 mg/L) and bromine (up to 410 mg/L).

10

The Li-rich formation waters appear to be associated with carbonate build-ups of the Leduc Formation (both Leduc north and south) in the Woodbend Group and the Swan Hills Formation of the Beaverhill Lake Group. The Woodbend Group carbonates, including the Leduc and Cooking Lake formations, reach thicknesses of >300 m in places, while the Beaverhill Lake carbonate platform varies in thickness from >150 m in the southern reef portion to around 50 m in the northwest. However, in the Swan Hills area the carbonate platform of the Cooking Lake Formation and the reefs of the Leduc Formation (both of Woodbend Group) directly overlie the Beaverhill Lake Group carbonates, such that it is likely difficult to differentiate between the various formation waters.

Recent (2011) Devonian oilfield formation water sampling by our company shows that a large area of their property comprises Lithium-enriched formation waters. Some 40 wells have >60 mg/L Li with about 15 of those wells containing between 70 and 85 mg/L Li. The consistency of the dataset indicates a fairly homogenous Devonian source of Lithium-enriched formation waters. Other minerals of interest include calcium (up to 28,100 gm/L), magnesium (up to 4,630 mg/L), iodine (up to 27 mg/L), bromine (up to 4,000 mg/L), and potassium (6,500 mg/L).

The source of lithium in oil field waters remains subject to debate. Explanations generally conform with those for Li-rich brine solutions and include recycling of earlier deposits/salars, mixing with pre-existing subsurface brines, weathering of volcanic and/or basement rocks, and transport from hydrothermal volcanic activity, but none of these hypotheses has clearly pointed to the ultimate source for the anomalous values of Lithium. However, in a recent isotopic study, Eccles and Berhane (2011) suggested that any viable lithium source model in northwestern Alberta should invoke direct contact between Devonian formation water and the crystalline basement or with immature siliciclastics deposited above the basement (basal Cambrian sandstone, Granite Wash or the Gilwood Member), and mobilization of silicate-bearing fluids to the aquifer.

Salta Agua Claims

Location and Access

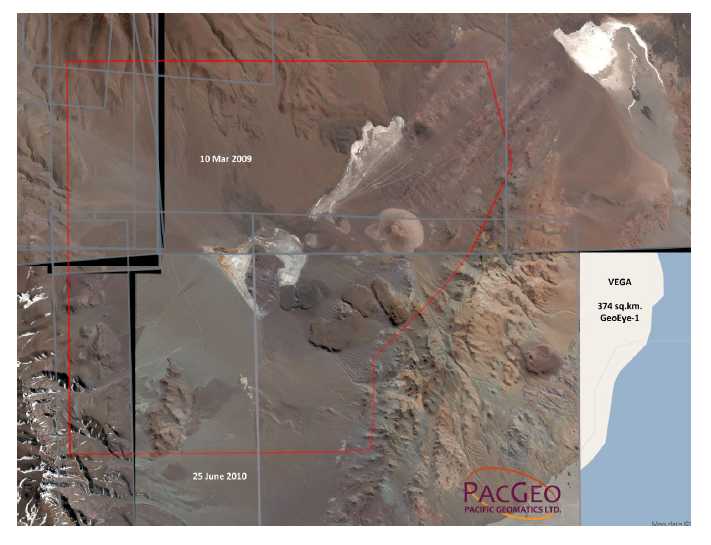

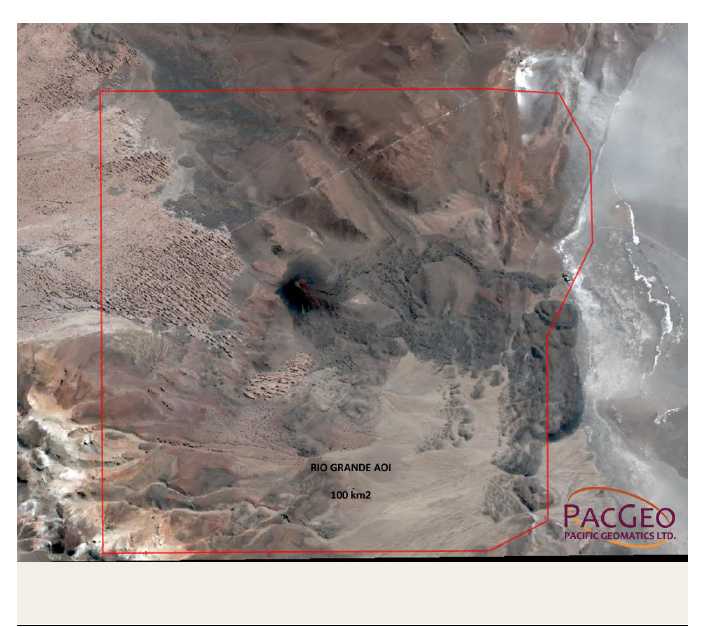

These properties, totaling just over 42,000 hectares, are located in northwestern Argentina, at the foothills of the Andes Mountains. They are made up of 5 separate mining concessions. The 5 mining concessions Rio Grande (9,758 hectares), Vega Sur (9,585 hectares), Vega Oeste (9,686 hectares), Vega Cono (7897 hectares), and Vega Este (5,487 hectares). There is year round road access to a majority of the claims.

11

12

Ownership Interest

On January 18, 2011 we entered into a purchase option agreement with Salta Water. Salta Water holds 100% interest in the Salta Agua claims.

We have acquired an option entitling us to acquire certain legal and beneficial interests in and to the Salta Agua claims, and to participate in the further exploration and, if deemed warranted, the development of the Salta Agua claims. Specifically, we have acquired a right and option to acquire undivided legal and beneficial interests of up to 100% in the Salta Agua claims free and clear of all liens, charges and claims of others.

In order for us to exercise the option and acquire an initial 60% interest, we are required to make the following payments to Salta Water and incur the expenses indicated, prior to the fifth anniversary of the date of the Option Agreement:

| (1) |

an initial payment of 25,000, which has been paid by us; | |

| (2) |

pay a further $50,000 no later than thirty days after the Effective Date and issue 250,000 restricted shares of common stock; |

13

| (3) |

pay a further $100,000 on or before the first anniversary of the Effective Date and issue 250,000 restricted shares of common stock; | |

| (4) |

pay a further $100,000 on or before the second anniversary of the Effective Date and issue 250,000 restricted shares of common stock; | |

| (5) |

pay a further $100,000 on or before the third anniversary of the Effective Date and issue 250,000 restricted shares of common stock; and | |

| (6) |

incur or fund expenditures on the Property prior to the Option Deadline of not less than $4,000,000 on or before the fifth anniversary of the Effective Date. |

Once we have completed the foregoing conditions, we will then have the further option to acquire the remaining 40% of the Salta Agua claims by paying $6,000,000 within 180 day or by paying $3,000,000 within 180 days and the balance of $3,000,000 within a further 12 months, which balance shall accrue interest of the rate of LIBOR plus 5%.

The foregoing description of the assignment agreement is qualified entirely by reference to the copy of said agreement attached as an exhibit to this current report on Form 8-K.

History of Operations

In November of 2009 a report was completed on the Salta Agua Claims outlining the geological formation of the property which collected some surface water samples from alluvial fans and compiled data collected by other projects in close proximity to these claims. The report outlined the needs for future exploration including trenching and drilling efforts that could produce a resource estimate for lithium and potassium.

We have recently engaged an imaging firm to get high resolution imaging for all 5 claims to serve as the map of the property to identify road access and potential pooling of surface water that could assist in the future exploration efforts. Once this imaging is complete we intend to send a team out to each of the 5 claims to do some trenching and take some samples of the minerals 3 – 4 meters underground. This trench testing will assist us in identifying the next steps in our exploration of these assets.

We are not aware of any other history of operations on the Salta Agua Claims.

Plan of Exploration

We anticipate undertaking an exploration program which will include drilling, detailed geologic mapping and geophysical surveys. We anticipate that drilling will consist of completing 20 to 30 widely spaced drill holes for a total of 3,000 meters. Drill depths are expected to range between 50 and 300 meters. Each drill hole will be drilled using a reverse-circulation rotary method, sampling sediment every 1 meter for stratigraphic analysis and sampling brines separately. Resistivity, and possibly seismic surveys, are planned to delineate the salt-body geometry. Pumping tests are planned for those drill holes with better lithium-brine grades. Once the initial steps are completed, we anticipate that a pre-feasibility study will be performed on the most favorable targets. It will include a detailed description of infrastructure, logistics and resources.

14

Geology

The Altiplano-Puna plateau comprises numerous salt pans, known as salars that contain high concentrations of Lithium, Potassium and Boron. The salars occur at a variety of elevations ranging from a 1000 m to more than 4000 m. They typically form in closed topographic depressions, most likely related to structural events that created initial accommodation space. There are many variations in salar development owing to continual deviations associated with tectonism, sediment supply, basin asymmetry and climate change. In general, the salars represent the end product of a basin infill process that can include deposition of colluvial talus and gravel fans, grading upwards into sheet sands, and playa silts and clays (Alonso, R.N., Jordan, R.E., Tebbutt, K.T. and Vandervoort, D.S. 1991. Giant evaporite belts of the Neogene central Andes. Geology, v. 19, p. 401-404.). The origin of the high-Lithium brines remains speculative, but they are considered intimately linked to volcanism because the Lithium-bearing brine region roughly coincides with the Altiplano-Puna magma body (de Silva, S.L., Zandt, G., Trumball, R., Viramonte, J.G., Salas, G. and Jimenez, N. 2006. Large imbrignite eruptions and volcano-tectonic depressions in the Central Andes: A thermomechanical perspective. In: C. Troise, G. de Natale and C.R.J. Kilburn (eds), Mechanisms of Activity and Unrest at Large Calderas, Geological Society, London, Special Publication, No. 269, p. 47-63.). Volcanism also plays a significant role in basin infill and basin closure and isolation. Lastly, the Altiplano-Puna climate has been dominated by hyper-arid conditions since the Andes reached their current elevation (about 6 million years ago) causing evaporation and precipitation of a variety of evaporite deposits.

The Salta Agua Claims, which are located within the Puna Plateau on the eastern slope of the Andes Mountains, Argentina, encompasses two large salars: Salar Rio Grande (~10,000 Ha) and Salar Arizaro (~32,500 Ha; Ebisch, J.F. 2009. Salta Agua Claims, NI 43-101 Compliant Technical Report, 56 p). The better documented of the two salars, the Salar de Arizaro represents a mature salar, which are typically characterized by a relatively uniform and thick sequence of halite deposited under varying subaqueous to subaerial conditions (Bobst, A.L., Lowenstein, T.K., Jordan, T.E. Godfrey, L.V., Ku, T.L. and Luo, S. 2001. A 106 ka paleoclimate record from drill core of the Salar de Atacama, northern Chile. Paleogeography, Palaeoclimatology, Palaeoecology, v. 173, p. 21-42). It is hosted in a mid to Late Tertiary andesitic volcanic complex. The Salar del Rio Grande is associated with intense volcanic activity as evidenced by numerous sulphur deposits near the western edge of the salar. The Salar del Rio Grande is filled by clastic and evaporitic sediments characterized by at least three zones: a central zone rich in sulphate, and northern and southern zones comprised of Ordovician and Tertiary sediments, respectively (Ebisch, 2009).

The Salta Agua Claims is in the infancy stages of exploration. Sampling to date has only focused on surface waters and well water at the top of the water column. Near-surface samples from Arizaro yielded up to 19 mg/L Li while Rio Grande returned up to 32 mg/L Li (Ebisch, 2009). Importantly, Ebisch (2009) also collected samples from water wells in the region surrounding the Salta Agua Claims and reported several high Li values (e.g., 261, 171, 119 and 823 mg/L), including high K (6854 and 8531 mg/L) and B (524 and 531 mg/L). Complete brine characterization is particularly important because multiple brine types are apparent in even large mature salars suggesting hydrochemical variation. Variation in brine type occurs not only during salar formation associated with changes in volcanism, sediment supply, basin asymmetry and climate change, but might also be influenced by continuing processes.

15

Index of Geologic Terms

| TERM | DEFINITION |

| Andesitic |

a fine-grained grayish volcanic rock characterized by feldspar minerals |

| Basal |

at or forming the bottom of something |

| Basin |

a broad area of land drained by a single river and its tributaries, or draining into a lake |

| Brine |

water containing a significant amount of salt, used for curing, preserving, and developing flavor in |

| Cambrian |

the period of geologic time, 570 million to 500 million years ago, during which invertebrate animal life, including trilobites, appeared, and marine algae developed |

| Carbonate |

a salt or ester of carbonic acid |

| Cenozoic |

the most recent era of geologic time, beginning about 65 million years ago, during which modern plants and animals evolved |

| Colluvial talus |

loose rock and soil at the base of a cliff or steep slope |

| Crystalline |

relating to, made of, containing, or resembling crystals |

| Devonian |

Is a geologic period and system of the Paleozoic era spanning from 416 to 359.2 million years ago, where rocks from this period were first studied. During this period the pectoral and pelvic fins of lobe-finned fish evolved into legs as they started to walk on land as tetrapods around 397 Ma. |

| Entrada Sandstone |

a formation that is spread across the U.S. states of Wyoming, Colorado, northwest New Mexico, northeast Arizona and southeast Utah. Part of the Colorado Plateau, this formation was deposited during the Jurassic period sometime between 180 and 140 million years ago in various environments, including: tidal mudflats, beaches and sand dunes |

| Evaporite |

Water-soluble mineral sediments that result from the evaporation from an aqueous solution and has been concentrated by evaporation. There are two types of evaporate deposits, marine which can also be described as ocean deposits, and non-marine which are found in standing bodies of water such as lakes. Evaporites are considered sedimentary rocks. |

| Halite |

a colorless or white crystalline mineral consisting of sodium chloride. Use: table salt, source of chlorine. |

| Hydrochemical |

a chemical characteristic of water |

| Playa silts |

a fine-grained sediment, especially of mud or clay particles at the lower part of an inland desert drainage basin |

16

|

Sandstone |

a sedimentary rock made up of particles of sand bound together with a mineral cement. Use: building material |

|

Sediment |

material, originally suspended in a liquid, that settles at the bottom of the liquid when it is left standing for a long time |

|

Sheet sands |

flat, gently undulating sandy plots of sand surfaced by grains that may be too large for saltation Sand sheets exist where grain size is too large, or wind velocities too low, for dunes to form |

|

Siliciclastics |

rocks formed by inorganic processes or deposited through some mechanical process, such as stream deposits that are |

|

Subaerial |

used in geology to describe events or structures that are located at the earth’s surface |

|

Subaqueous |

living, found, or formed under water |

|

Tectonism |

is the faulting or folding or other deformation of the outer layer of a planet caused by heat loss |

|

Tertiary |

the period of geologic time, 65 million to 1.6 million years ago, during which mammals became dominant and modern plants evolved |

|

Thermomechanical |

A technique used in thermal analysis, a branch |

Risk Factors

Risks Related to Our Business

We have a limited operating history and as a result there is no assurance we can operate on a profitable basis.

We have a limited operating history. Our company's operations will be subject to all the uncertainties arising from the absence of a significant operating history. Potential investors should be aware of the difficulties normally encountered by resource exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of our properties may not result in the discovery of reserves. Problems such as unusual or unexpected formations of rock or land and other conditions are involved in resource exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial reserves, we may decide to abandon our claims and acquire new claims for new exploration or cease operations. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. There can be no assurance that we will be able to operate on a profitable basis.

17

If we do not obtain additional financing, our business will fail and our investors could lose their investment.

We had cash in the amount of $42,937 and working capital deficiency of $68,876 as of the period ended March 31, 2011. We currently do not generate any revenues from our operations. Any direct acquisition of a claim under lease or option is subject to our ability to obtain the financing necessary for us to fund and carry out exploration programs on potential properties. The requirements are substantial. Obtaining additional financing would be subject to a number of factors, including market prices for resources, investor acceptance of our properties and investor sentiment. These factors may negatively affect the timing, amount, terms or conditions of any additional financing available to us. The most likely source of future funds presently available to us is through the sale of equity capital and loans. Any sale of share capital will result in dilution to existing shareholders.

Because of the speculative nature of exploration of mineral properties, we may never discover a commercially exploitable quantity of minerals, our business may fail and investors may lose their entire investment.

We are in the very early exploration stage and cannot guarantee that our exploration work will be successful, or that any minerals will be found, or that any production of minerals will be realized. The search for valuable minerals as a business is extremely risky. We can provide investors with no assurance that exploration on our properties will establish that commercially exploitable reserves of minerals exist on our property. Additional potential problems that may prevent us from discovering any reserves of minerals on our property include, but are not limited to, unanticipated problems relating to exploration and additional costs and expenses that may exceed current estimates. If we are unable to establish the presence of commercially exploitable reserves of minerals on our property our ability to fund future exploration activities will be impeded, we will not be able to operate profitably and investors may lose all of their investment in our company.

We have no known mineral reserves and we may not find any lithium and even if we find lithium it may not be in economic quantities. If we fail to find any lithium or if we are unable to find lithium in economic quantities, we will have to suspend operations.

We have no known mineral reserves. Even if we find lithium, it may not be of sufficient quantity so as to warrant recovery. Additionally, even if we find lithium in sufficient quantity to warrant recovery it ultimately may not be recoverable. Finally, even if any lithium is recoverable, we do not know that this can be done at a profit. Failure to locate lithium in economically recoverable quantities will cause us to suspend operations.

Supplies needed for exploration may not always be available. If we are unable to secure exploration supplies we may have to delay our anticipated business operations.

Competition and unforeseen limited sources of supplies needed for our proposed exploration work could result in occasional spot shortages of supplies of certain products, equipment or materials. There is no guarantee we will be able to obtain certain products, equipment and/or materials as and when needed, without interruption, or on favorable terms. Such delays could affect our anticipated business operations and increase our expenses.

Because of the unique difficulties and uncertainties inherent in mineral exploration ventures, we face a high risk of business failure.

Potential investors should be aware of the difficulties normally encountered by new mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claim may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims. If this happens, our business will likely fail.

18

The marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include market fluctuations in lithium pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of mineral resources and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

Exploration and production activities are subject to certain environmental regulations which may prevent or delay the commencement or continuation of our operations.

In general, our exploration and production activities are subject to certain federal, state and local laws and regulations relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuation of a given operation. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. In addition, legislation has been enacted which requires well and facility sites to be abandoned and reclaimed to the satisfaction of state authorities. However, such laws and regulations are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry.

Any change to government regulation/administrative practices may have a negative impact on our ability to operate and our profitability.

The business of mineral exploration and development is subject to substantial regulation under various countries laws relating to the exploration for, and the development, upgrading, marketing, pricing, taxation, and transportation of mineral resources and related products and other matters. Amendments to current laws and regulations governing operations and activities of mineral exploration and development operations could have a material adverse impact on our business. In addition, there can be no assurance that income tax laws, royalty regulations and government incentive programs related to the properties mineral exploration industry generally will not be changed in a manner which may adversely affect our progress and cause delays, inability to explore and develop or abandonment of these interests.

Permits, leases, licenses, and approvals are required from a variety of regulatory authorities at various stages of exploration and development. There can be no assurance that the various government permits, leases, licenses and approvals sought will be granted in respect of our activities or, if granted, will not be cancelled or will be renewed upon expiry. There is no assurance that such permits, leases, licenses, and approvals will not contain terms and provisions which may adversely affect our exploration and development activities.

19

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is largely dependent on our ability to hire highly qualified personnel. This is particularly true in highly technical businesses such as resource exploration. These individuals are in high demand and we may not be able to attract the personnel we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

Our independent certified public accounting firm, in the notes to the audited financial statements for the year ended June 30, 2010 states that there is a substantial doubt that we will be able to continue as a going concern.

As at June 30, 2010, we have experienced significant losses since inception. Failure to arrange adequate financing on acceptable terms and to achieve profitability would have an adverse effect on our financial position, results of operations, cash flows and prospects. Accordingly, there is substantial doubt that we will be able to continue as a going concern.

Risks Associated with Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the Financial Industry Regulatory Authority. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like Amex. Accordingly, shareholders may have difficulty reselling any of the shares.

Penny stock rules will limit the ability of our stockholders to sell their stock.

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

20

The Financial Industry Regulatory Authority, or FINRA, has adopted sales practice requirements which may also limit a shareholder's ability to buy and sell our stock.

In addition to the "penny stock" rules described above, FINRA has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer's financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for its shares.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make a gain on your investment.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any gain on your investment will need to result from an appreciation in the price of our common stock. There will therefore be fewer ways in which you are able to make a gain on your investment.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) which imposes additional sales practice requirements on brokers-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement prior from you to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Our compliance with the Sarbanes-Oxley Act and SEC rules concerning internal controls will be time-consuming, difficult, and costly.

Under Section 404 of the Sarbanes-Oxley Act and current SEC regulations, we will be required to furnish a report by our management on our internal control over financial reporting beginning with our Annual Report on Form 10-K for our fiscal year ending June 30, 2011. We will soon begin the process of documenting and testing our internal control procedures in order to satisfy these requirements, which is likely to result in increased general and administrative expenses and may shift management’s time and attention from revenue-generating activities to compliance activities. While we expect to expend significant resources to complete this important project, we may not be able to achieve our objective on a timely basis. It will be time-consuming, difficult and costly for us to develop and implement the internal controls, processes and reporting procedures required by the Sarbanes-Oxley Act. We may need to hire additional personnel to do so, and if we are unable to comply with the requirements of the legislation we may not be able to assess our internal controls over financial reporting to be effective in compliance with the Sarbanes-Oxley Act.

21

Financial Information

Management's Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with the financial statements of Lithium Exploration Group Inc., including the notes thereto, appearing elsewhere in this report. The discussion of results, causes and trends should not be construed to imply any conclusion that these results or trends will necessarily continue into the future. All references to currency in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section are to U.S. dollars, unless otherwise noted.

Results of Operations for the Three and Nine months Ended March 31, 2011

We have generated no revenues since inception and have incurred $204,691 and $306,218, respectively, in expenses for the three and nine month periods ended March 31, 2011.

The following provides selected financial data about our company for the three and nine month periods ended March 31, 2011 and 2010.

Three months ended March 31, 2011 and 2010.

| Three months | Three months | |||||

| ended | ended | |||||

| March 31, 2011 | March 31, 2010 | |||||

| Revenue | $ | Nil | $ | Nil | ||

| Operating Expenses | $ | 204,691 | $ | 3,293 | ||

| Net Loss | $ | (204,691 | ) | $ | (3,293 | ) |

Operating expenses for the three months ended March 31, 2011 increased as a result of an increase in our operating expenses including $5,828 in advertising expenses, $9,000 in consulting fees, $5,782 in general and administrative expenses, $22,500 in management fees, $135,000 in mining expenses, $18,965 in professional fees, $1,450 in transfer agent fees and $6,166 in travel expenses.

Nine months ended March 31, 2011 and 2010.

| Nine months | Nine months | |||||

| ended | ended | |||||

| March 31, 2011 | March 31, 2010 | |||||

| Revenue | $ | Nil | $ | Nil | ||

| Operating Expenses | $ | 306,218 | $ | 17,401 | ||

| Net Loss | $ | (306,218 | ) | $ | (17,401 | ) |

Operating expenses for the nine months ended March 31, 2011 increased as a result of an increase in our operating expenses including $5,828 in advertising expenses, $9,000 in consulting fees, $5,782 in general and administrative expenses, $22,500 in management fees, $225,000 in mining expenses, $29,648 in professional fees, $2,148 in transfer agent fees and $6,166 in travel expenses.

22

Liquidity and Capital Resources for the Three and Nine months Ended March 31, 2011

The following table provides selected financial data about our company as of March 31, 2011, and June 30, 2010, respectively.

| As at | As at | |||||

| March 31, 2011 | June 30, 2010 | |||||

| Total assets | 78,505 | 641 | ||||

| Total liabilities | 147,381 | 38,299 | ||||

| Stockholders’ deficit | (68,876 | ) | (37,658 | ) |

Cash Flows

| Nine Months | Nine Months | |||||

| ended | ended | |||||

| March 31, 2011 | March 31, 2010 | |||||

| Net cash used in operating activities | (218,242 | ) | (20,297 | ) | ||

| Net cash used in investing activities | Nil | Nil | ||||

| Net cash provided by financing activities | 260,738 | 22,154 | ||||

| Increase (Decrease) in cash | 42,496 | 1,857 |

We had cash of $42,937 as of March 31, 2011 as compared to cash of $441 as of June 30, 2010. We had a working capital deficit of $68,876 as of March 31, 2011 compared to a working capital deficit of $37,658 as June 30, 2010.

Results of Operations for the Years ended June 30, 2010 and 2009

We have generated no revenues since inception and have incurred $137,158 in expenses through June 30, 2010.

The following table provides selected financial data about our company for the year ended June 30, 2010, and 2009, respectively.

| BALANCE SHEET DATA | ||

| June 30, 2010 | June 30, 2009 | |

| Cash | $441 | $132 |

| Total Assets | $641 | $132 |

| Total Liabilities | $38,299 | $17,151 |

| Stockholders’ deficit | ($37,658) | ($17,019) |

23

Liquidity and Capital Resources for the Years ended June 30, 2010 and 2009

The report of our auditors on our audited financial statements for the fiscal year ended June 30, 2010, contains a going concern qualification as we have suffered losses since our inception. We have minimal assets and have achieved no operating revenues since our inception. We have depended on loans and sales of equity securities to conduct operations. Unless and until we commence material operations and achieve material revenues, we will remain dependent on financings to continue our operations.

Plan of Operation

You should read the following discussion of our financial condition and results of operations together with our unaudited financial statements and the notes thereto included elsewhere in this filing. Our unaudited financial statements have been prepared in accordance with accounting principles generally accepted in the United States. This discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those anticipated in these forward-looking statements.

Anticipated Cash Requirements

We estimate that our expenses over the next 12 months will be approximately $189,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

| Description |

Estimated Completion Date |

Estimated Expenses ($) |

| General and administrative | 12 months | 24,000 |

| Mining expenses | 12 months | 160,000 |

| Professional fees | 12 months | 5,000 |

| Total | $189,000 |

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any such financings on terms that will be acceptable to us.

We were incorporated in the State of Nevada on May 31, 2006. We were formed to engage in the search for mineral deposits or reserves. We conducted preliminary exploration activities on certain properties in Esmeralda County, Nevada on which we held certain mining claims. On September 25, 2009, amended June 24, 2010, we were granted an option to acquire an undivided 50% interest in eight mineral claims located in the Clinton Mining District of British Columbia, Canada, representing 3,900 hectares. On February 14, 2011 we sent notice to Beeston to terminate the option agreement related to the mineral claims located in the Clinton Mining District. On December 16, 2010, we entered into an assignment agreement to acquire an undivided 100% right, title and interest in and to certain mineral permits located in the Province of Alberta, Canada.

On January 18, 2011, we entered into a purchase option agreement with Salta Water Co. and we have acquired a 60% interest on the Salta Aqua claims in Salta Province, Argentina. We have a further option to acquire the remaining 40% interest from Salta Water.

On March 17, 2011, we entered into a letter agreement with Glottech-USA, LLC for an acquisition of one initial unit of certain proprietary and patented mechanical ultrasound technology for use in the water treatment in regards to our lithium operations in Alberta, Canada. In exchange for the acquisition of the technology, we have agreed to pay to Glottech-USA a licensing and technology payment in the aggregate amount of $800,000 which includes a confirmation payment of $75,000. Concurrent with the Confirmation Payment, in consideration of the preferential royalty payment structure and the territorial licensing and limited exclusivity provisions of the agreement, our CEO Alex Walsh, has pledged 2,000,000 shares to Glottech USA to be acquired as an option for the fee of $1 which can be exercised after the delivery of the operational unit to us. As a result of the acquisitions the Company has changed its business direction and is focused on the development of the Lithium assets.

24

Because of our limited cash in the bank, we will be required to raise additional capital over the next twelve months to meet our ongoing expenses, including our costs related to the remaining required payments under the assignment agreement, as entered into on December 16, 2010 and the purchase option agreement, as entered into on January 18, 2011.

On June 29, 2011 we entered into a convertible debenture agreement in the amount of $1,500,000. The agreement includes registration rights and we are required to file a Registration Form on S-1 within 30 days of the closing of the financing. We received an initial amount of $1,000,000 upon closing and will receive the remaining $500,000 once the Registration Statement is declared effective by the SEC. The convertible debenture carries an interest rate of 12% and may be converted at $0.83 per share. Along with the convertible debenture, we also issued warrants to acquire 1,204,819 shares of our common stock for a period of five years, at a price of $0.913 per share. The warrant also includes cashless exercise provisions.

Further, we may raise capital in connection with or in anticipation of possible acquisition transactions. We do not currently engage in any product research and development and have no plans to do so in the foreseeable future. We have no present plans to purchase or sell any plant or significant equipment. We also have no present plans to add employees, although we may do so in the future if we engage in any merger or acquisition transactions.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in our financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to our stockholders.

Inflation

The effect of inflation on our revenues and operating results has not been significant.

Critical Accounting Policies

Our financial statements are affected by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete listing of these policies is included in Note 2 of the notes to our financial statements for the years ended June 30, 2010 and 2009. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows, and which require the application of significant judgment by management.

25

Use of Estimates

The preparation of financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amount of revenues and expenses during the reporting period. Actual results could differ from those estimates. Our periodic filings with the Securities and Exchange Commission include, where applicable, disclosures of estimates, assumptions, uncertainties and markets that could affect our financial statements and future operations.

Net Income or (Loss) per Share of Common Stock

We have adopted FASC Topic No. 260, “Earnings Per Share,” (“EPS”) which requires presentation of basic and diluted EPS on the face of the income statement for all entities with complex capital structures and requires a reconciliation of the numerator and denominator of the basic EPS computation to the numerator and denominator of the diluted EPS computation. In the accompanying financial statements, basic earnings (loss) per share is computed by dividing net income/loss by the weighted average number of shares of common stock outstanding during the period.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth the ownership, as of July 7, 2011, of our common stock by each of our directors, by all of our executive officers and directors as a group and by each person known to us who is the beneficial owner of more than 5% of any class of our securities. As of July 7, 2011, there were 50,815,476 shares of our common stock issued and outstanding. All persons named have sole or shared voting and investment control with respect to the shares, except as otherwise noted. The number of shares described below includes shares which the beneficial owner described has the right to acquire within 60 days of the date of this Form 8-K.

| Title of Class | Name and Address

of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percent of

Class (1) |

| Common Stock |

Alexander Walsh (2) 320 E. Fairmont Dr., Tempe, AZ, 85282 |

27,000,000 | 53% |

| Common Stock |

Jonathan Jazwinski (3) 3200 North Hayden Road, Suite 300 Scottsdale, AZ, 85251 |

150,000 (5) | 0% |

| Common Stock |

Brandon Colker (4) 3200 North Hayden Road, Suite 300 Scottsdale, AZ, 85251 |

150,000 (5) | 0% |

| All Officers and Directors as a Group | 27,300,000 | 53% | |

26

| (1) | Based on 50,815,476 issued and outstanding shares of our common stock as of July 7, 2011. |

| (2) |

Alexander Walsh is our President, Chief Executive Officer, Chief Financial Officer, Principal Accounting Officer, Secretary, Treasurer and one of our directors. |

| (3) |

Jonathan Jazwinski is one of our directors |

| (4) |

Brandon Colker is one of our directors. |

| (5) |

On April 27, 2011 Brandon Colker and Jonathan Jazwinski agreed to compensation of 450,000 shares each for acting on our board of directors. The shares vest annually at 150,000 share per year for a total of 3 years. |

Changes in Control

As of July 7, 2011 we had no pension plans or compensatory plans or other arrangements which provide compensation in the event of termination of employment or a change in our control.

Directors and Executive Officers