Attached files

| file | filename |

|---|---|

| EX-32.2 - China Water Group, Inc. | v227308_ex32-2.htm |

| EX-32.1 - China Water Group, Inc. | v227308_ex32-1.htm |

| EX-31.2 - China Water Group, Inc. | v227308_ex31-2.htm |

| EX-31.1 - China Water Group, Inc. | v227308_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2009

|

|

¨

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission File No.: 000-26175

CHINA WATER GROUP, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

Nevada

|

88-0409151

|

|

|

(State or Other Jurisdiction of Incorporation

|

(I.R.S. Employer Identification No.)

|

|

|

or Organization)

|

|

SUITE 7A01, BAICHENG BUILDING

584 YINGBIN ROAD

DASHI, PANYU DISTRICT

GUANGZHOU, GUANGDONG, CHINA

(Address of Principal Executive Offices)

(86-20) 3479 9768

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (s 229.405) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company filer. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

Non-accelerated Filer ¨

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

Aggregate market value of the voting stock held by non-affiliates of the registrant, computed by reference to the closing price as of the last business day of the registrant’s most recently completed second fiscal quarter, March 31, 2011, was $3,599,888. The registrant has no non-voting common stock.

As of December 31, 2009, there were 139,383,450 shares of our common stock issued and outstanding.

INDEX TO FORM 10-K ANNUAL REPORT

|

Page

|

||

|

PART I

|

4

|

|

|

Item 1.

|

Business

|

4

|

|

Item 1A.

|

Risk Factors

|

21

|

|

Item 1B.

|

Unresolved Staff Comments

|

26

|

|

Item 2.

|

Properties

|

26

|

|

Item 3.

|

Legal Proceedings

|

28

|

|

Item 4.

|

Submission of Matters to a Vote of Security Holders

|

28

|

|

PART II

|

28

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

28

|

|

Item 6.

|

Selected Financial Data

|

29

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

30

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

36

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

36

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A(T)

|

Controls and Procedures

|

36

|

|

Item 9B

|

Other Information

|

44

|

|

PART III

|

44

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

44

|

|

Item 11.

|

Executive Compensation

|

46

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

49

|

|

Item 14.

|

Principal Accountant Fees and Services

|

50

|

|

PART IV

|

50

|

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

50

|

|

Signatures

|

53

|

|

|

Financial Statements

|

F-1

|

2

EXPLANATORY NOTE

We, China Water Group, Inc., is filing this Annual Report on Form 10-K for the year ended December 31, 2009 during calendar 2011, as a step towards becoming current in our filing obligations under the Securities Exchange Act of 1934. We will endeavor to file additional periodic reports to become current in our filings as expeditiously as the limited size of our staff allows.

Unless otherwise indicated, all references to our company include our wholly and majority owned subsidiaries.

All of our sales and nearly all our expenses are denominated in renminbi (“RMB”), the national currency of the People’s Republic of China (the “PRC”). For SEC reporting purposes, the balance sheet items are translated into US dollars using the exchange rate at the respective balance sheet dates. The capital and various reserves are translated at historical exchange rates prevailing at the time of the transactions while income and expenses items are translated at the average exchange rate for the period. All exchange differences are recorded within equity.

Statements contained in this Annual Report on Form 10-K, which are not historical facts, are forward-looking statements, as the term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements, whether expressed or implied, are subject to risks and uncertainties which can cause actual results to differ materially from those currently anticipated, due to a number of factors, which include, but are not limited to:

|

·

|

Competition within our industry;

|

|

·

|

Seasonality of our sales;

|

|

·

|

Success of our acquired businesses;

|

|

·

|

Our relationships with our major customers;

|

|

·

|

The popularity of our products;

|

|

·

|

Relationships with suppliers and cost of supplies;

|

|

·

|

Financial and economic conditions in Asia, Japan, Europe and the U.S.;

|

|

·

|

Anticipated effective tax rates in future years;

|

|

·

|

Regulatory requirements affecting our business;

|

|

·

|

Currency exchange rate fluctuations;

|

|

·

|

Our future financing needs; and

|

|

·

|

Our ability to attract additional investment capital on attractive terms.

|

Forward-looking statements also include the assumptions underlying or relating to any of the foregoing or other such statements. When used in this report, the words “may,” “will,” “should,” “could,” “expect,” “plan,” “anticipate,” “believe,” “estimate,” “predict,” “continue,” and similar expressions are generally intended to identify forward-looking statements.

Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date hereof. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements. Readers should carefully review the factors described in the Section of this report entitled “Risk Factors” and other documents we file from time to time with the Securities and Exchange Commission (‘SEC’), including the Quarterly Reports on Form 10-Q to be filed by us in the fiscal year 2010.

3

Part I

Item 1. Description of Business.

We are a bottled water company based in the PRC. We also continue to operate various waste water treatment facilities. Through our majority-owned subsidiaries, we were engaged in the design, construction, implementation and management of industrial and municipal waste water treatment facilities throughout the PRC. We are now seeking to dispose of those operations. We also provide high quality bottled water in China by using 9000-Year Old Glacier Spring Water. Our bottled water has been marketed in many big cities in China such as Shanghai, Beijing, Guangzhou, Chengdu and others.

We also previously provided turn-key waste water treatment engineering design and contracting. From 2000 through 2008, we completed the following turn-key projects: Yongji Development Zone Wastewater Treatment Plant (Phase 1), Guangdong Nanhai City Jinsha Town Wastewater Treatment Plant, Guangdong Sanshui Baini Wastewater Treatment Plant and Guangzhou Yantang Wastewater Treatment Plant, Tianjin City Meichang Town Wastewater Treatment Plant,Yongji Development Zone Wastewater Treatment Plant (Phase 2), China Environment Industrial Park Wastewater Treatment Plant, Huangzhuang Industrial Park Wastewater Treatment Plant and Tian Jin WuQing No.1 Waste Water Treatment Factory. We have left this business and no longer provide turn-key waste water services.

We hold 28.8%and 11.2%, respectively, of the equity interest in the following two water treatment facilities operated through build, operate and transfer (“BOT”) arrangements with the PRC government: (i) Tian Jin Shi Sheng Water Treatment Company Limited (“TianJin”), which commissioned water treatment in November 2003 and has a daily treatment capacity of approximately 10,000 tons; and (ii) Xin Le Sheng Mei Water Purifying Company Limited (“XinLe”), which also commissioned water treatment in November 2003 and has a daily treatment capacity of 40,000 tons. We have been retained as the manager to manage both TianJing and XinLe. The fees from XinLe and TianJing did not represent a significant portion of our revenue during 2008.

We also developed a BOT water treatment facility project in Hai Yang City under our subsidiary Hai Yang City Sheng Shi Environment Protection Company Limited (“HaiYang”) with capacity of 20,000 tons per day. We began construction of this project in April 2004 and completed the project and commenced water treatment in June 2005. We also developed another BOT water treatment facility project in Beijing under our subsidiary Bei Jing Hao Tai Shi Yuan Water Purifying Company Limited (“Beijing HaoTai”) with planned capacity of 20,000 tons per day. We began construction of this project in July 2004 completed approximately 90% till December, 2006. We retained a 90% interest in this facility until we disposed of it in December 2006 for a total consideration of US$1,442,567, and realized a gain of $44,872. In July 2005, we started construction of a BOT water treatment facility project for the Handan Fengfeng Mining Area in the Hebei Province under our subsidiary Han Dan Cheng Sheng Water Affairs Company Limited (“HanDan”) with capacity of 33,000 tons per day. The project was completed in December 2007. The fees from these projects are expected to increase our net sales in the future. We are in the process of discontinuing our waste water engineering operations to concentrate on our bottled water operations and the presentation of our financial statements reflects that these assets relate to our “discontinued division”.

4

Our predecessor in interest, Discovery Investments, Inc. (“Discovery”) was incorporated on September 10, 1996, under the laws of the State of Nevada to engage in any lawful corporate activity. Discovery had been in the development stage and was not active until October 26, 1999.

On December 10, 1999, Discovery entered into a Plan and Agreement of Reorganization (the “Plan”) with LLO-Gas, Inc. and John Castellucci. On October 26, 1999, LLO-Gas had acquired certain ARCO facilities and a so-called card lock facility and commenced operations. LLO-Gas was incorporated in July 1998 under the laws of the State of Delaware. On December 20, 1999, there was a closing under the Plan and LLO-Gas, Inc. became a wholly-owned subsidiary of Discovery and there was a change of control of Discovery. Between December 20, 1999 and August 10, 2000, differences of opinion as to matters of fact and as to matters of law had arisen by and between certain of the shareholders of Discovery, who were shareholders prior to the closing, and between Discovery, John Castellucci and LLO-Gas, Inc.

On June 7, 2000, LLO-Gas, Inc. filed a Voluntary Petition under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court, Central District of California, San Fernando Valley Division, case number SV 00-15398-AG. On December 1, 2000, the United States Bankruptcy Court converted the pending matter into a Chapter 7 liquidation. Said Chapter 7 effected LLO-Gas, Inc. and not Discovery.

On August 10, 2000, Discovery entered into a Mutual Rescission Agreement and Mutual Release with John Castellucci which provided, inter alia, that Discovery consented and agreed to rescind said Plan with John Castellucci consenting and agreeing to the rescission. The parties mutually agreed to forego all rights and benefits provided to each other thereunder.

On August 9, 2001, Discovery filed a voluntary petition under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court, District of Nevada, Case Number BK-S-01-18156-RCJ. On September 24, 2001, the Bankruptcy Court confirmed the Disclosure Statement and Plan of Reorganization submitted by Discovery and Discovery was thereafter released from Bankruptcy.

On April 29, 2002, Discovery entered into a Plan and Agreement of Reorganization with Bycom Media Inc., an Ontario, Canada corporation (“Bycom”). Pursuant to this agreement, Discovery acquired all the outstanding shares of Bycom for 4,800,000 shares of Common Stock. On October 5, 2002, Bycom became a wholly-owned subsidiary of Discovery and there was a change of control.

Bycom was engaged in multimedia applications for internet-based business. Utilizing business search tools and databases, Bycom intended to be able to locate and access global business information for a fee, or was to act as an “out-source provider” of information. Bycom currently is an inactive, wholly owned subsidiary of the Company.

On September 4, 2002, Discovery completed a transaction set out in a Plan and Agreement of Reorganization dated June 13, 2002, pursuant to which Discovery acquired all of the outstanding shares of Cavio Corporation, a Washington corporation, (“Cavio”) in exchange for 14 million share of Discovery common stock. Due to poor market conditions and Discovery’s inability to seek adequate financing from third parties to properly finance the operations of Cavio, on December 2, 2002 Discovery’s board of directors approved, subject to receiving the approval of a majority of the shareholders, to unwind the acquisition of Cavio in cancellation of the shares of common stock issued.

On December 2, 2002, Discovery unanimously approved the disposition of its interest in Cavio and thereafter received the consent of a majority of the outstanding shares of the company’s common stock. Discovery determined the effective date for the divestiture to be June 30, 2003.

5

For the two years prior to a reverse acquisition in September 2004, we had not generated significant revenues and were considered a development stage company as defined in Statement of Financial Accounting Standards No. 7. We were seeking business opportunities or potential business acquisitions. Pursuant to a securities purchase agreement and plan of reorganization dated September 9, 2004, as amended, between our company, Evergreen Asset Group Limited, an International Business Company organized under the laws of the British Virgin Islands (“Evergreen” or “EGAG”), and the stockholders of Evergreen, we acquired 100% of the issued and outstanding shares of Evergreen’s capital stock. We issued 83,500,000 shares of our common stock in exchange for all the 300 issued and outstanding shares of Evergreen capital stock which had an estimated value of $4.24 million at the time of such issuance, valued based on the fair market value of the net assets of Evergreen. Since the stockholders of Evergreen acquired approximately 83.5% of our outstanding shares and the Evergreen management team and board of directors became the management team and board of directors of our company, according to FASB Statement No. 141 - “ Business Combinations ”, this acquisition has been treated as a recapitalization for accounting purposes, in a manner similar to reverse acquisition accounting. In accounting for this transaction:

|

•

|

Evergreen is deemed to be the purchaser and surviving company for accounting purposes. Accordingly, its net assets are included in the balance sheet at their historical book values and the results of operations of Evergreen have been presented for the comparative prior period;

|

|

•

|

Control of the net assets and business of our company was acquired effective October 15, 2004. This transaction has been accounted for as a purchase of the assets and liabilities of our company by Evergreen. The historical cost of the net liabilities assumed was $0.00.

|

As a result of the transaction described above we changed our name from Discovery Investments, Inc. to China Evergreen Environmental Corporation.

Due to the reverse acquisition mentioned above, EGAG, pursuant to a group reorganization which was completed in July 2004, acquired 90% equity interests in each of XinXingmei, XianYang, HaiYang and BeijingHaoTai for cash consideration of RMB12,601,000 (approximately $1,521,860), RMB18,000,000 (approximately $2,173,913), RMB2,700,000 (approximately $326,087) and RMB1,800,000 (approximately $217,391), respectively, all of which are domestic incorporated companies established in the PRC with limited liability.

In March 2003, GDXS entered into a BOT agreement with Xian Yang City Environment Protection Bureau. The BOT agreement was later transferred to Xian Yang Bai Sheng Water Purifying Company Limited (“XianYang”), after XianYang was incorporated. The construction of the wastewater plant of XianYang started in the beginning of 2004. Due to the group reorganization in July 2004, 90% of GDXS’s interest in XianYang was transferred to EGAG. In October 2004, EGAG entered into a tri-party framework agreement with True Global Limited (“TGL”), an independent party and Guang Dong Xin Sheng Environmental Protection Company Limited (“GDXS”) for the disposal of its 90% interest in XianYang to TGL at a total consideration of $13,246,377. A gain on disposal of $5,220,299 was recorded in 2004 for the disposal of our entire 90% attributable interest in XianYang to TGL.The gain represents the difference between the disposal proceeds and our attributable share of net assets of XianYang at the date of disposal.

6

In April 2005, we conducted a private placement of 20 investment units, at $25,000 per unit, for gross proceeds of $500,000. Each unit consisted of (a) one 12% convertible debenture in the original principal amount of $25,000, convertible into shares of our common stock at the rate of the lesser of (i) $0.20 per share or (ii) a 10% discount to the price per share of common stock (or conversion price per share of common stock) of the next private placement conducted by us prior to any conversion of the debenture, and (b) 125,000 detachable warrants to purchase one share each of our common stock at an exercise price of $0.20 per share, expiring ten years from their date of issuance. The debentures were due and payable August 1, 2005. The debenture holders, however, extended the payment period to September 30, 2005. We granted the investors limited registration rights for the common shares underlying their debentures and warrants. Westminster Securities Corporation acted as placement agent for this offering on our behalf. All the debenture holders have converted the debentures into 3,703,701 shares of our common stock on October 1, 2005.

On September 14, 2005, we closed the private placement sale to accredited investors of units consisting of shares of our common stock and warrants to purchase shares of our common stock for aggregate gross proceeds of $4.83 million. Pursuant to the subscription agreements entered into with the investors, we issued to the investors 161 units at a price of $30,000 per unit. Each unit consisted of 200,000 shares of our common stock, priced at $0.15 per share, and warrants to purchase 200,000 shares of our common stock over a five-year period at an exercise price of $0.20 per share. Pursuant to the terms of the subscription agreements, we granted the investors limited registration rights for all common shares comprising the units, including the common shares issuable on exercise of the warrants.

On November 7, 2006, China Evergreen Environmental Corporation changed its name to China Water Group, Inc. to reflect its focus on China’s water treatment and supply needs and on build-operate-transfer(BOT), Transfer-operate-transfer(TOT), and turnkey wastewater treatment facilities in China, at the same time, bottled water is considered.

On December 29, 2007, we entered into an Equity Transfer Agreement, pursuant to which we transferred a 58% out of our 90% interest in our subsidiary Guangdong Xinxingmei Water Affairs Co, Ltd. (“GXWA”) to Wenning Pu, a 10% minority sharehoulder of GXWA for RBM7,308,600 (approximately $1,000,000). After the transaction, our ownership of GXWA was reduced from 90% to 32% and Wenning Pu’s ownership of GXWA was increased from 10% to 68%. The proceeds of the sale will be used for our working capital.

On December 31, 2007, China Water Group Inc. signed a contract with Fortune Luck Global International Limited to acquire 90 percent of the equity interest of Aba Xinchen Dagu Glacier Spring Co., Limited through its subsidiary Guangzhou Xinchen Water Company. The consideration for the acquisition is $13.45 million dollars, of which $7.5 million will be paid in cash, and the remaining $5.95 million will be paid in our common stock. As of November 20, 2009, we have paid a total of $ 7.5 million cash, but hadn’t issued any shares towards the purchase price. Acquiring this asset has allowed us to enter the bottled water business with our own high quality water source.

On December 30, 2008, we entered into an Equity Transfer Agreement, pursuant to which China Water Group Inc transferred 100% interest in Evergreen Asset Group Limited to Whole Treasure Investment Ltd. , a BVI company. The proceeds of the sale will be used for our working capital , mainly to develop the bottled water market and trademark building.

On February 26, 2009, Guangzhou Xinchen Water Company established a subsidiary, Chengdu Jiuqiannian Water Company, in the PRC as a wholly-owned limited liability company with registered capital of RMB 500,000 (approximately $73,250).

On August 24, 2009, Guangzhou Xinchen Water Company established a subsidiary, Beijing Jiuqiannian Trading Company Ltd., in the PRC as a wholly-owned limited liability company with registered capital of RMB 300,000 (approximately $43,971).

Our Corporate headquarters is located in Guangzhou, Guangdong, China

7

Our Business

General

We were a PRC based waste water engineering company and are engaged in repositioning ourselves to be a bottled water production, sales and marketing company . Through our majority-owned subsidiaries, we have been engaged in the design, construction, implementation and management of industrial and municipal waste water treatment facilities throughout the PRC. Starting in 2007 we repositioned our business focus to bottled water production, sales and distribution in the PRC.

Our waste water engineering business was originally established in 1999 by our Chairman, Mr. Chong Liang Pu, with a focus on developing innovative biochemical technologies and processes for waste water treatment. We have the exclusive rights to MHA biological treatment processes technologies (“MHA”) and GM Bio-carriers. Both are the subject of patents owned by our Chairman, Mr. Pu, and we have acquired the exclusive rights pursuant to a license agreement with Mr. Pu. Both technologies were developed to improve the efficiency and effectiveness of waste water treatment processes and reduce the initial investment and on-going operating cost of waste water treatment facilities.

We have applied biotechnological processes to waste water treatment and have developed relationships with the PRC environmental authorities at both national and provincial levels throughout the PRC. Since 2000, we have successfully completed the design and construction of over 15 waste water facilities across China with total daily capacity of over 130,000 tons (inclusive of five BOT waste water treatment facilities with daily capacity of 123,000 tons). Our customers include municipal governments, food processing and beverage companies and industrial companies.

As a result of these achievements, we have been recognized as a “Key Enterprise in Environmental Industry in the PRC” by the General Bureau of Environmental Protection of China and are viewed as a “High-Tech Enterprise” by the Bureau of Science and Technology of Guangzhou, PRC.

BOTTLED WATER OPERATIONS

In 2007 we entered into an agreement with Fortune Luck Global International Limited to secure a high quality source of natural drinking water from the Dagu glacier. During the calendar years 2007 and 2008 we conducted a limited test market of bottled water in Guangzhou. Management was satisfied with the results and intends to expand this business to make it the main business of the Company in the future. At the beginning of 2008, we started developing the bottled water business. The Company established development and branding strategies for the bottled water business, managed to set up four regional sales centers in the cities of Shanghai , Beijing, Chengdu and Guangzhou, as part of the strategy to promote our products in China’s major cities. The May 12th earthquake in Sichuan, however, had a severe impact on our marketing efforts, as the earthquake damaged the roads between Aba, where our production is located, and Chengdu. The roads did not reopen until November 2008. Nearly two years rebuilt after disaster of earthquake in Sichuang. The public infrastructures are recovered as well as we endeavor in sales promotion to bottled wate ,our sales are increased duing 2009.

8

The Global Industry for Bottled Water.

According to Datamonitor, the global bottled water market reached a value of $61.0 billion in 2006 and is forecasted to have a value of $86.4 billion in 2011, an increase of 41.6%. In 2006, global volume of bottled water was 115.4 billion liters and is expected to be 174.2 billion liters in 2011, an increase of 51.0%. On a consumption per capita basis, United Arab Emirates holds the leading position with 260 liters of bottled water consumption per capita in 2007, followed by Mexico and Italy. The global average consumption per capita is 29 liters, but China consumes only approximately 14 liters of bottled water per capita. If China's consumption per capita grew to the global average of 29 liters, it would represent a 110% increase (or an additional 20 billion liters) in consumption of bottled water. If China's consumption per capita grew to the average consumption per capita of the top 10 countries, it would represent over a 1,000% increase (or an additional 184 billion liters) in consumption of bottled water.

The Chinese Bottled Water Industry.

In China, water resources per capita are only 28% of the world average. Compounding the lack of water resources, the State Environment Protection Administration of China estimated in 2007 that tap water in one-half of China's major cities was polluted by industrial chemicals and agriculture fertilizers. A large amount of wastewater is directly discharged into water bodies, and industrial wastewater treatment has not been completely established, resulting in serious water pollution problems. Safe drinking water is a priority in China, and given the lack of wastewater treatment plants, the drinking water issues are not likely to be solved in the near future. China's bottled water industry started to grow as drinking water quality in China began to deteriorate. The market grew at a compound rate of around 37% yearly from 1994 to 2005. According to the Beverage Marketing Corporation, China was the fastest growing consumer of bottled water in the world with a 17.5% compounded annual growth rate from 2002 to 2007, double the next fastest growing country, the United States. Although China was the fastest growing and third largest consumer of bottled water, it represented less than one-half of the world's per capita average of liters consumed and only 11% of the per capita average of liters consumed of the top 20 countries.

Industry Background

Waste Water Treatment Markets in the PRC . The waste water treatment business is in a developmental stage in China. Following decades of rapid industrialization and urbanization resulting from PRC’s breakneck economic expansion, demands for urban and industrial waste water treatment are immense. In 2002, total volume of municipal and industrial waste water produced reached 23 billion and 26 billion tons, respectively, of which only approximately 25% was treated in some form. The PRC government, which views environmental issues as a priority policy, has targeted a 90% treatment ratio by 2030. This targeted growth, combined with a policy of privatizing all existing government facilities, is resulting in extraordinarily high levels of expansion in an industry that did not effectively exist until the 1980s.

In order to promote investment in the waste water treatment industry, the central government has created incentives such as tax relief and higher throughput fees which can improve the profitability of certain municipal projects.

Under the tax regulations in the PRC, companies providing water purification are exempted from business tax on the collection of waste water treatment fees. The PRC government also gives tax relief in the form of reduction in or exemption from value-added tax and income tax to encourage treated water to be reused in residential, agricultural, commercial and industrial sectors.

The PRC government introduced a policy in relation to water supply tariff management methods for the water-resource system which became effective in January 2004. The new policy prescribes a water tariff approach, comprising of water production costs, expenses, profit, and tax. Pertinent pricing is expected to be in accord with local market demand.

9

Before the 1990s, water tariffs were extremely low, and there were no wastewater discharge fees. People were more concerned with water quality than with the price and quantity they used. As citizens now pay closer attention to water quality, they expect higher prices to accompany water quality improvements. Therefore, water tariff and wastewater treatment throughput fees, especially in the cities, are rising to levels that potentially allow our business to operate profitably.

Fresh Water Markets . Before 2003, the facilities for fresh water supply in the PRC were owned and operated by the agencies of local governments. As industrial, economic and population growth and chronic pollution have placed intense demands on the water supply in China, the fresh water supply has had serious shortages. Similar to the waste water treatment industry, the PRC government has opened up the fresh water supply business to private sector and international operators.

Bottled Water Markets . The bottled water industry in PRC is in the stage of rapid and continuous growth and development. Globally, according to recently published data from consultancy firm Beverage Marketing Corporation (BMC), from 2002 to 200 PRC was the fastest growing country in the world in terms of consumption of bottled water, showing a compound annual growth rate of 17.5%, doubling the next fastest growing country, the United States. With the growth in demand and addition of new industry participants offering new and varied bottled water products, management believes that the Chinese bottled water industry is posed for significant growth.

Our Business Waste Water Related Activities

There are different types and quantities of pollutants in water due to the environment, conditions and purpose for which the water is used. Municipal water has organic matters including nitrogen and phosphorus. The composition of such municipal wastewater is relatively stable. In contrast, pollutants in water discharged from industries include organic pollutants, inorganic matters, metal ions and salt ion. We adopt varying treatment processes for different industrial wastewater.

We provided turn-key engineering, equipment and chemical sales for industrial and municipal waste water treatment facilities in the PRC. We also invest in, manage and operate our own water treatment facilities through BOT arrangements in the PRC.

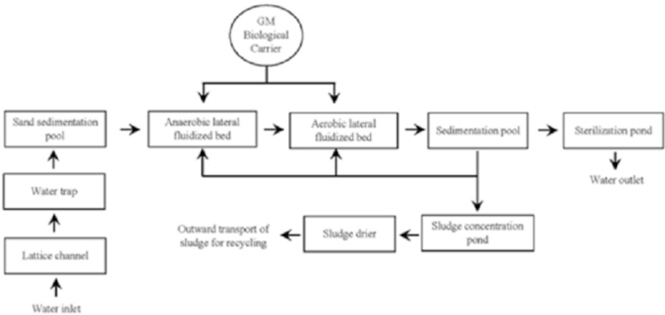

The following chart describes the waste water treatment process that we service:

10

Turn-Key Waste Water Engineering. We provide turn-key waste water treatment engineering services to both public and private sectors. Our public sector clients include municipal governments at the city, district and town levels. Our private sector clients include heavy industries, such as steel, car manufacturing, electronic; light industries, such as chemical, food and beverage, paper, printing and breweries; and others, including hospitals and the pharmaceutical industry. The industrial wastewater qualities differ due to the different industrial products and manufacturing processes.

These contracts are awarded either by public tender or by direct contract. A typical turn-key waste water treatment project can be classified into three phases; (1) survey and design, (2) construction and equipment installation, and (3) operation and management services. However, commencing in 2007, we discontinued initiating new turn-key projects.

From 2000 to 2007, we completed the following turn-key projects: Yongji Development Zone Wastewater Treatment Plant (Phase 1), Guangdong Nanhai City Jinsha Town Wastewater Treatment Plant, Guangdong Sanshui Baini Wastewater Treatment Plant and Guangzhou Yantang Wastewater Treatment Plant, Tianjin City Meichang Town Wastewater Treatment Plant,Yongji Development Zone Wastewater Treatment Plant (Phase 2), China Environment Industrial Park Wastewater Treatment Plant ,Huangzhuang Industrial Park Wastewater Treatment Plant and Tian Jin WuQing No.1 Waste Water Treatment Factory.

We financed our turn-key projects through progressive payments from our customers as stipulated in the agreements for these projects.

Investment in BOT Waste Water Treatment Facilities. We also invest in waste water treatment facilities through BOT arrangements. BOT projects provide us with a stable income source under a long-term (usually 20-30 year) contract granted by municipal governments to build and operate waste water plants. BOT project land is typically contributed by the municipal government with the operator providing investment and daily management. After the contract period, the project is transferred to the local government. After we secure a contract for a BOT project from a municipal government and the financing for such project is in place, we will proceed to construct the facility. After the completion of construction and testing and commissioning, we will operate the waste water treatment facility for a period of 20-25 years as stipulated in the BOT contract.

11

The following table sets forth the BOT projects which we have completed:

|

BOT Projects

|

Cost of

Investment

|

Capacity/

Per Day

|

Operation

Period

|

Date of

commencement of

operation

|

|||||

|

WWaste water treatment plant of TianJing

|

$

|

1.09 million

|

10,000 tons

|

20 years

|

November 2003

|

||||

|

WWaste water treatment plant of XinLe

|

$

|

4.11 million

|

40,000 tons

|

22 years

|

October 2003

|

||||

|

WWaste water treatment plant of HaiYang

|

$

|

3.62 million

|

20,000 tons

|

22 years

|

June 2005

|

||||

|

WWaste water treatment plant of HanDan

|

$

|

3.53 million

|

33,000 tons

|

22 years

|

December 2007

|

||||

As of December 31, 2008, the waste water treatment plants of TianJin, XinLe and HaiYang were operational and have been providing waste water treatment services. The HanDan waste water treatment plant began to operate during January 2008.

We have been financing the BOT projects of TianJing, XinLe and HaiYang through capital injectionsand funds generated from our operations. We will finance the remaining capital expenditure of HanDan of approximately $2 million through funds generated from our operations.

Our Production Process

Waste Water treatment Though the chemicals used for treating municipal and industrial wastewater qualities are different due to the different sources of wastewater for municipal wastewater treatment and different industrial product and manufacturing process for industrial wastewater treatment, the treatment processes are largely similar.

During the wastewater treatment process, the wastewater is first collected by a pipeline network system and then transported to a sand sedimentation pool. The wastewater will then go through the MHA waste water treatment process, which is a natural, chemical-free, biological and mineral-based process that facilitates the rapid growth of bacteria in order to improve the efficiency of degrading the micro-organism materials in the wastewater and for more efficient operation and reduced energy consumption. After the MHA waste water treatment process, the wastewater is then transported to the sedimentation pool to remove the fine particles in the wastewater. The wastewater will then be sterilized in the sterilization pool and be transported to the water outlet.

Bottled Water Raw water flows into water processing workshop through a stainless steel pipe. After sand filtration, carbon filtration, membrane filtration and ozone sterilizing, the water is placed into containers. Then the water will be poured into PET bottles automatically by an aseptic operation. Then these filled PET products are packed and transported to the market.

Our Project Management Process

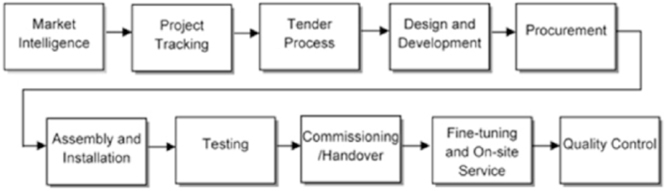

The following is the flow chart of our project management process for both turn-key wastewater engineering projects and BOT projects:

12

Market Intelligence . The starting point for all our projects was market intelligence so that our management was able to decide which projects they wished to secure for the benefit of the company. Our marketing personnel were in charge of market information on potential projects on a regular and ad-hoc basis. Our management was able to identify and decide on projects which we might potentially bid for.

Project Tracking . Based on the information gathered through market intelligence and the subsequent comprehensive analysis conducted on such information, our management decided which projects to pursue. We carried out internal evaluations which consist of three steps: initial evaluation, revaluation and valuation by professionals. We also engaged external advisors to carry out external evaluation. We then embarked on determining what the tender rules and conditions are and the capital requirements and technologies used for the project. Project tracking allowed us to plan ahead and make the necessary cost planning.

Tender Process . Once we decided to proceed to tender for a particular project, we formed a tender committee comprising marketing personnel and technical personnel, who were responsible for compiling the tender documents to be submitted for tender within the stipulated deadline. The tender committee compiled internal costing and budgetary estimates of labor and material costs based on quotations from the relevant suppliers and factor in a suitable profit margin in determining our tender pricing.

Design and Development. After signing of the contract, we appointed a project team to be responsible for the execution of the project, including an ad-hoc research and development team to handle the design and development of that particular project. The research and development team followed our overall guidelines to analyze, assess and determine the design and specifications of a system which ensured that all of our customers’ requirements were met. The design and development process included collection of information, site survey, key design concept, design specification, individual design, evaluation, revaluation and issue for construction. In addition to our own design and development capabilities, we have also entered into collaboration arrangements with other parties to test our equipment to ensure its suitability and effectiveness.

Procurement. After the necessary design and analysis, the specifications of the system were confirmed, and our procurement department proceeded to purchase all the materials and equipment required or appoint appropriate sub-contractors to carry out certain parts of the project.

Construction . The construction process included sub-contracting and site supervision. During construction, we sent site representatives to control and supervise the construction.

13

Assembly and Installation . We will carried out assembly and installation of equipment and/or system and coordinate the assembly and installation fully with the construction process to ensure all equipment and/or system were properly assembled and installed. We sent technical staff to assist and guide the assembly and installation.

Testing . After the equipment and/or system was assembled and installed, we tested the system in accordance with industrial and national rules and regulations formulated by the relevant PRC authorities.

Commissioning and Fine-Tuning . For turn-key projects, should the system pass all tests, we proceeded to hand over the system to our customers. 5%-10% of the total contract value was be treated as retention monies during the warranty period of up to 12 months requirement. Our technical personnel carried out fine-tuning and on-site services. After successful commissioning of the entire system, the retention monies were paid by our customers to us after the warranty period of up to 12 months. For BOT projects, the plant started operation after passing all tests. The technical team carried out fine-tuning and on-site services. The operation team followed the operational guidelines and monitor the quality of treated water.

Competition

We believe our main competitor in waste water treatment business was Beijing Capital Co., Ltd. (“Beijing Capital”), a subsidiary of Capital Group, which has identified investment, development, operation and management in the PRC water industry as its core business. Beijing Capital provides environment management services. We also competed with many other regional environmental and water treatment companies. We believe that we compete primarily on the basis of contract pricing and capital. Though many of our competitors offer similar but less cost-effective services, they may have greater financial resources and hence be able to secure contracts with reduced operating margins but more competitive pricing. However, we believed that as a result of our cost efficiency through our patented technologies, we were able to offer much more competitive pricing. In addition, having access to the capital markets in the United States through our public listing helped us to differentiate ourselves from our competitors. Another area of competition came from local protectionism where local governments wish to protect local environmental businesses. In order for us to overcome this kind of competition, we relied on our financial and technical resources.

We believe our main competitor in bottled water business is Evian, a French bottled water company which entered China more than 10 years ago and occupied the biggest share of the Chinese market for branded bottled water. Several other local brands of high level bottled water companies recently entered the market and have relatively small market shares. We believe that acquiring a 90% equity interest in a high quality water source within China will give us a competitive advantage in the bottled water business as we seek to expand this business.

Our Competitive Strengths

Key elements of our competitive strengths include:

Capital Resources On one hand, the threshold of capital requirements for entering the waste water treatment segment and the initial capital investment of waste water treatment facilities and projects, especially BOT projects, is relatively high. On the other hand, the bottled water business requires capital to build a marketing network and brand image in the targeted market. We believe we are capable of obtaining sufficient capital resources to fund our operation of an expanded bottled water business. We also believe that additional capital will be available to us on a time to time basis as we dispose of our remaining waste water treatment facilities..

14

We place great emphasis on high quality bottled water marketing and brand building also concentrate more on technical research and development, and typically set up research and development teams for specific projects to handle the design, development and improvement of such projects.

We are building our bottled water market network in China’s principal cities such as Beijing, Shanghai, Guangzhou and Chengdu, and have developed more than 300 distribution channels to sell our 9000-Year Old Glacier Spring Water, mainly luxury hotels, restaurants, chain stores and supermarkets, chambers of commerce, beauty parlors and other outlets.

Customers, Sales and Marketing

Many of our principal customers in our waste water treatment business were local governments, food and beverage processing companies and industrial companies that used our technologies to treat their waste water. In our bottled water business, the main customers are the retail stores our wholesale distributors and our ultimate customers are middle class, and wealthy families, large companies and government offices as they are more sensitive to and will pay a premium for food and water that is perceived to be safer.

Two major customers accounted for approximately 61% of the net revenue for the whole year ended December 31, 2009. The source of revenue from these customers is the sales of bottled water. One major customer, Guangzhou ShengRen Water Co. Ltd, accounted for approximately 23% of the net revenue. The other major customer, Shanghai KeKejia Water Ltd, accounted for approximately 38% of the net revenue. These two major customers are our authorized regional distributors.

Research and Development

Waste Water treatment Our research and development efforts were directed toward enhancing our existing technology and products and developing our next generation of technology. We are no longer engaged in Research and Development with respect to waste water treatment.

Bottled Water Given high market demand for bottled water, we have established an R&D department responsible for expanding product lines and putting in market a series of products to meet different demands of market segments so as to increase the market coverage.

Quality Control

In connection with our waste water treatment business, our quality control department was headed by Luo Huizhong, who has more than 16 years of relevant experience. Mr. Luo has been a chief engineer at several companies, and vice general engineer of our company, and he is familiar with resource allocation, quality control and environmental facility management control. We no longer have a quality control department for waste water treatment.

15

Quality Control during production for bottled water . We have established at the factory a department and laboratory facilities to ensure the high quality of our products. Specific procedures include testing at each stage such as water source, water treatment, bottling, packaging, and finished products to ensure our products are meeting all healthy water standards and the expectations of our customers.

Cooperative Partners and Suppliers for Waste Water Treatment

We outsourced the design and construction of our subsystems to a number of cooperative partners and key suppliers and maintain close relationships with them. Our cooperative partners include North-Eastern Environmental Protection Design Institute, Guangdong Province Environmental Protection Design Institute, and the 20 Group of China Railway Company. We have signed cooperative agreements with these cooperative partners. North-Eastern Environmental Protection Design Institute provides technical support in the design of waste water treatment facilities and preparation for the tendering of projects, 20 th Group of China Railway Company evaluates all documents and information required for tendering while Guangdong Province Environmental Protection Design Institute evaluates feasibility and acceptability of the blue prints of the facilities. Compensation for our cooperative partners were based on amount of work done.

North-Eastern Environmental Protection Design Institute was established in 1961 in the city of Changchun. The institute focuses on design of, research in and provision of consultancy services for municipal infrastructure construction works including water supply, waste water treatment, waste treatment, energy supply, construction of road and bridges, public transport and reforestation of cities etc. The institute also provides other services in relation to civil construction works for municipal projects like feasibility studies for projects, evaluation of projects, project management and project supervision.

The Guangdong Province Environmental Protection Design Institute was established in 1990. Over the years, the institute has gained experiences in the design, management, treatment and turn-key engineering of waste water, air pollution, noise pollution and waste residue. The institute has achieved remarkable results especially in waste water treatment for the printing and dyeing, electroplating, brewing, pharmaceutical, chemical and food & beverages industries.

The 20 th Group of China Railway is a large-scale construction company in the PRC. The history of the 20 th Group of China Railway dated back to the year 1949. The company has enormous experience in the construction of railway systems in the PRC and related infrastructure including road construction, water supply, energy supply, waste water treatment, urban and rural planning, municipal projects etc. The company is also involved in many large scale construction projects overseas.

There are three main types of equipment for our waste water treatment and potable water projects: (i) electrical equipment which includes various types of sewage pumps, slush pumps and other water pumps, separators, sludge scrapers, mixers, air compressors, filters, dehydrators, blow fans, etc; (ii) automated control systems and electrical parts; and (iii) various test, analysis, detection and monitoring instruments. All purchases from foreign companies are made through their authorized dealers/agents in the PRC. We adhere closely to the principles of total quality management. Our customers, suppliers and employees are encouraged to provide feedback and suggestions for improvements in products and services.

The following table sets forth our major suppliers of equipment and materials in waste water treatment:

16

|

Component, Raw Materials and

Equipment

|

Our Major Suppliers

|

|

|

Waste water treatment analytical instruments

|

Hach Company

|

|

|

Blow fan systems

|

HV-Turbo A/S

|

|

|

Sewage pumps, slush pumps, other water pumps and mixers

|

Nanjing Airs Pump Industry Group

|

|

|

PLC automated control systems

|

Mitsubishi Electric

|

|

|

Electrical parts

|

Schneider Electric Low Voltage (Tianjin) Co.

|

|

|

Automated systems

|

GuangZhou SaiDi Automated Engineering Company

|

The following table sets forth our major suppliers of equipment and materials in bottled water:

|

Component, Raw Materials and

Equipment

|

Our Major Suppliers

|

|

|

Bottle blowing machine

|

Fogang Guozhu Blowing Equipment Co., Ltd

|

|

|

Racking machine

|

Jiangsu XinMeixin Water Purifying Equipment Co.,Ltd

|

|

|

Air compressor

|

Nanjing Hengda Compressor Co.,Ltd

|

|

|

Packing machinery

|

Jiangsu XinMeichen Packing Machinery Co.,Ltd

|

|

|

Water treating equipment

|

Zhejiang Deqing Water Treating Co.,Ltd

|

|

|

Bottle base, top

|

Yibing PuLaisi Packing Material Co.,Ltd

|

|

|

Bottle bag, label

|

Guangzhou Rongshun Packing Co.,Ltd

|

Bottled Water

We have entered into a 50-year exclusive contract to use the glacier spring water at the Aba area with the Aba Municipal Government of Sichuan province. According to the contract, during the first 10 years, we have the right to exclude any competitor for the water source. Currently, we have established a bottling facility in the area, primarily for 350 ML and 500 ML bottled water. A 3L facility is under construction with expected completion the end of 2010. Our current production capacity is 120 tons per day. We intend to increase the capacity to 200 tons per day in the future. In addition to Aba, we are in the process of exploring new water sources.

17

Intellectual Property

Waste Water treatment We seek to protect our intellectual property by way of our license rights to patents on proprietary features of our advanced bio-chemical treatment technology and processing systems for waste water treatment and by challenging third parties that we believe infringe on our licensed patents. We have obtained the exclusive right to use two patents owned by our Chairman, Mr. Pu, for our MHA and GM Bio-carriers technologies. We also protect our intellectual property rights with nondisclosure and confidentiality agreements with employees, consultants and key customers.

Specifically, we have registered the following patents with the State Intellectual Property Office of the PRC:

|

|

•

|

MHA biological treatment process technology (PRC Patent No. ZL 01 1 07637.2) applied on March 14, 2001, declared effective on March 3, 2004 with a duration of 20 years from the date of application; and

|

|

|

•

|

GM Bio carriers (PRC Patent No. ZL 01 1 07624.0) applied on March 8, 2001, declared effective on September 10, 2003 with a duration of 20 years from the date of application.

|

Bottled water We are the only bottled water company in China that has registered with the State Industrial and Commercial Bureau our “9000-year” trade mark

Employees

As of December 31, 2008, we had 78 employees, of whom 31 were in bottled water operations of whom 28 were engaged in sales, marketing and services, the others in accounting and administration. We also had no employees in our waste water treatment at the end of 2009 None of our employees is represented by a collective bargaining agreement, and we believe that we have satisfactory relations with our employees.

Environmental Regulation

One of our core values is protecting the environment in which we operate and the environment in which our equipment operates. Compliance with laws and regulations regarding the discharge of materials into the environment, or otherwise relating to the protection of the environment, has not had any material effect on our capital expenditures, earnings or competitive position. We do not anticipate any material capital expenditures for environmental control facilities in 2009.

Regulation

The PRC’s numerous ongoing water reforms are moving toward a user-pay, market-driven sector. Legislation serves as the basis to regulate and enforce these reforms. The Water Resource Law, amended and put into effect on October 1, 2002, significantly changes water resource management systems, water resource protection, water conservation, and legal responsibilities.

Environmental Laws and Regulations

In the PRC, environmental laws and regulations are stipulated and implemented through legislation and through administrative authorities at various levels of government. Current environmental laws and regulations can be classified into two categories: environmental management and environmental pollution prevention and control. All environmental laws and regulations are stipulated on the basis of the Environmental Protection Law (EPL). EPL, effective in December 1989, sets the framework for environmental management and pollution control legislation in the PRC.

18

Environmental Management Laws and Regulations. The PRC’s environmental management measures include environmental impact assessment (EIA), the Three Synchronies Policy, permitting requirements, and reporting requirements. Each of these is described below:

|

1.

|

Environmental impact assessment . The 1989 Environmental Impact Assessment Law was revised in October 2002. These revisions became effective in September 2003 and apply to all construction projects that may negatively impact the environment. An EIA must be prepared during the project feasibility stage to assess the project’s environmental impact. EIA approval is necessary to secure a construction and operating permit.

|

|

2.

|

Three Synchronies Policy . Article 26 of the EPL defines the Three Synchronies Policy as the installation of pollution prevention and control facilities in a construction project to be undertaken concurrently with the main construction phase. The pollution prevention and control facilities are to be installed and commissioned only after they are inspected and approved by the Environmental Protection Bureau (EPB).

|

|

3.

|

Permitting requirements . Pollution discharges in the PRC are subject to registration and permitting requirements. The EPL defines requirements for pollution discharge registration and permits. Pollution discharges must be registered with the relevant environmental authority. A pollution discharge permit is issued after registration. The Management Regulation on the Registration of Discharged Pollutants, issued by the State Environmental Protection Administration (SEPA), effective Oct. 1, 1992, details requirements for pollution discharge registration. At the state level, the Department of Pollution Control under SEPA implements pollution discharge registration and permitting policies. Pollution control departments under local EPBs are in charge of the registration procedures and issue a pollution discharge permit.

|

|

4.

|

Reporting requirements. According to Article 31 of the EPL, any organization that causes or has a potential to cause an accident resulting in environmental pollution must promptly take measures to prevent and control the pollution hazard and notify the relevant authorities. In addition, enterprises and institutions that have a greater likelihood to cause severe pollution accidents must adopt effective pollution prevention measures.

|

Environmental Pollution Laws and Regulations. Environmental pollution prevention and control measures in the PRC apply to various environmental media, including water, water supply, wastewater discharge, air emissions, hazardous waste management, noise, and soil and groundwater. In November 2004, the management rules regarding environmental pollution prevention facilities operation permit was enacted and it set forth the requirements for getting a permit and how the facilities must be operated.

The following is a summary of environmental pollution laws and regulations regarding water, water supply and waste water discharge in the PRC:

Three laws apply to the water sector:

|

1.

|

The Water Resources Law emphasizes the uniform management of river basins and the macro-management of water distribution and consumption. In addition, the law identifies a water quality management system.

|

19

|

2.

|

The 1984 Water Pollution Prevention and Control Law (WPL) applies to discharges to rivers, lakes, canals, reservoirs, and groundwater. The WPL contains sections pertaining to water quality and discharge standards, pollution prevention, surface water, and groundwater. Amendments in 1996 introduced further controls on river basins, including requirements for cities and towns to establish central sewage treatment plants and to set treatment fees, mass-loading controls, provisions for strengthening the supervision and management of water pollution, and non-point-source pollution controls.

|

|

3.

|

The Implementation Regulation of Water Pollution Prevention and Control Law was enacted on March 20, 2000. This law regulates the supervision and management of surface and ground water pollution, prevention, and control measures.

|

Water supply. In urban areas, water is usually supplied by the municipal water utility companies, which are responsible for ensuring that water quality complies with the National Drinking Water Standard (GB5749-85). A groundwater abstraction permit is required if any company intends to use groundwater directly. In the northern part of the PRC, however, the use of groundwater is strictly controlled because of significant water shortages and ground settlement issues. Users must apply to provincial or higher level administrative committees for a groundwater abstraction permit.

Wastewater discharge. Two types of wastewater discharge systems are defined in the PRC: (1) polluted wastewater discharges (typically industrial and domestic wastewater) and (2) non-polluted wastewater discharges (for example, storm water). Separate drainage systems for polluted and non-polluted discharges are required for a facility in which a municipal sewer system is available.

Bottled water sales For a company to sell bottled water products, the company must obtain a State issued certificate for water source, and meets the State QA standard and State requirements of the Food Safety Law and Drinking Natural Mineral Water Standard. We have obtained the necessary certificates and believe that we meet all standards.

Environmental Enforcement

In the PRC, methods of enforcing environmental legislation include discharge fees, surcharge fees, fines, and administrative sanctions. Pollutant discharge activity is subject to a discharge permit, which must be registered and obtained before the pollutants are generated.

In major pollution control areas, such as Shanghai and Beijing, mass-loading targets are established and allocated to major emission facilities by the local EPB. In some pilot locations, emission quotas can be traded among facilities.

In areas with significant pollution problems, such as those impacted by sulfur dioxide emissions, acid rain, and water quality deterioration, specific discharge limitations are adopted to prevent further degradation.

There are specific items within the Constitution of the People’s Republic of China and the PRC Criminal Law to strengthen the enforcement of environmental legislation by disciplinary sanction, civil liability, and even criminal liability. Disciplinary sanctions may come in the form of a warning, a fine, a requirement to install environmental protection equipment, or a requirement to cease operations. Criminal liability can also be passed on to the legal representative of an enterprise if the polluting activity caused severe damage to property, health, or interests of the state or its citizens. In these cases, the individual deemed responsible may be prosecuted. Civil liability also exists and is aimed at activities that may result in civil disputes. Generally, the dispute may be settled through financial compensation by the facility that caused the damage.

20

Currently, the industry of waste water treatment is facing more intense competition. The industry itself requires large investment in capital coupled with low rates of return over long periods. We have determined that we lack the available capital resources and support to expand our business in waste water treatment. Management believes it is in the shareholders’ interest to switch our business line from waste water treatment to bottled water mining, distribution and sales as there is currently no premium national bottled glacier water brand in the PRC creating a market opportunity for the Company.

Our transition from a waste water treatment company with a BOT model to a premium bottled water production, distribution and marketing company will occur over several years as our BOT operations are disposed of from time to time as opportunities present themselves to us and our capital resources and efforts are devoted to expanding bottled water operations.

Item 1A. Risk Factors.

You should carefully consider the risks described below, which constitute the material risks facing us. If any of the following risks actually occur, our business could be harmed. You should also refer to the other information about us contained in this Form 10-K, including our financial statements and related notes.

Risks Related to Our Business

We are dependent on economic conditions in the PRC’s as all of our business is conducted in the PRC. All of our business operations are conducted in the PRC and all of our customers are also located in the PRC. We operate our new bottled water business internally in the PRC. Accordingly, any significant slowdown in the PRC economy may cause the waste water treatment industry to reduce expenditure or delay the building of new facilities or projects for waste water treatment. This may in turn lead to a decline in the demand for our BOT products and services, and may reduce our profitability and the return on your investment. Also, a general economic slowdown has is currently underway may reduce demand for premium bottled water and limit the growth of those operations.

Failure to retain services of key personnel will affect our operations and results. Our success to date has been largely due to the contributions of our executive officers. The continued success of our business is very much dependent on the goodwill that they have developed in the industry over the past several years.

Our continued success is dependent, to a large extent, on our ability to retain the services of our executive officers. The loss of any of our executive officers’ services due to resignation, retirement, illness or otherwise without suitable replacement or the inability to attract and retain qualified personnel would affect our operations and may reduce our profitability and the return on your investment.

We may not be able to protect our processes, technologies and systems against claims by other parties. Although we have two registered patents in respect of the processes, technologies and systems we use frequently in our systems, we have not purchased or applied for any patents other than these as we are of the view that it may not be cost-effective to do so. For such other processes, technologies and systems for which we have not applied for or purchased or been licensed to use patents, we may have no legal recourse to protect our rights in the event that they are replicated by other parties. If our competitors are able to replicate our processes, technologies and systems at lower costs, we may lose our competitive edge and our profitability may be reduced.

21

We may face claims for infringement of third-party intellectual property rights. We may face claims from third parties in respect of the infringement of any intellectual property rights owned by such third parties. There is no assurance that third parties will not assert claims to our processes, technologies and systems. In such an event, we may need to acquire licenses to, or to contest the validity of, issued or pending patents or claims of third parties. There can be no assurance that any license acquired under such patents would be made available to us on acceptable terms, if at all, or that we would prevail in any such contest. In addition, we would incur substantial costs and spend substantial amounts of time in defending ourselves in or contesting suits brought against us for alleged infringement of another party’s patent rights. As such, our operations and business may be adversely affected by such civil actions.

We rely on trade secrets, technology and know-how, which we seek to protect, in part, by confidentiality provisions in contracts with our customers and our employees. There can be no assurance that these agreements will not be breached, or that we will have adequate remedies for any breach, or that other parties may not obtain knowledge of our trade secrets and processes, technology and systems. Should these events occur, our business would be affected and hence, our profitability, may be reduced.

We may require additional funding for our future growth. Our future growth will depend, to a large extent, on our ability to establish our bottled water products through advertising and to develop a manufacturing and distribution network which requires a high amount of capital investment. In order to obtain additional capital to develop these growth opportunities, we may issue additional shares of our equity securities. If new shares placed to new and/or existing shareholders are issued, they may be priced at a discount to the then prevailing market price of our shares, in which case, existing shareholders’ equity interests may be diluted. If we fail to utilize the new equity to generate a commensurate increase in earnings, our earnings per share will be diluted, and this could lead to a decline in our share price. Any additional debt financing may, apart from increasing interest expense, contain restrictive covenants with respect to dividends, future fund-raising exercises and other financial and operational matters.

Our customers may make claims against us and/or terminate our services, in whole or in part, prematurely should we fail to implement projects that fully satisfy their requirements and expectations. Failure to implement projects that fully satisfy the requirements and expectations of our customers or defective system structure or products as a result of design or workmanship or due to acts of nature may lead to claims against us and/or termination of our services, in whole or in part, prematurely. This may arise from a variety of factors including unsatisfactory design or implementation, staff turnover, human errors or misinterpretation of and failure to adhere to regulations and procedures. This may adversely affect our reputation and may reduce our profitability.

Our Waste Water Treatment Operations rely on a few major suppliers. We are dependent on our major suppliers for the timely delivery of materials and equipment that we require for the waste water treatment systems we operate. Should our major suppliers fail to deliver the materials and equipment on time, and if we are unable to source these materials and equipment from alternative suppliers on a timely basis, our operations could be adversely affected. This, in turn, would adversely affect our reputation if our customers lose confidence in our services and as a result, reduce our revenue and profitability.

22

BOT projects require high capital commitments. We have invested capital in BOT projects which require high up-front capital expenditures. Our returns from BOT projects are derived from fees paid by the PRC and other governmental customers and such BOT projects are able to generate a steady and recurring source of income for us over a sustained period of time between 20 and 25 years. However, our BOT projects are exposed to risks such as the occurrence of natural disasters or the imposition of more stringent government regulations, which may result in the disruption of our BOT projects. Our investment returns from these BOT projects may thus be reduced should any of such risks materialize.

We rely on subcontractors for our BOT projects. As we may, from time to time, subcontract some parts of our projects to subcontractors, such as engineering, assembly and integration works, we face the risk of unreliability of work performed by our subcontractors. Should our subcontractors default on their contractual obligations and work specifications, our ability to deliver the end product or service to our customers in accordance with quality and/or timing specifications may, in turn, be compromised. Furthermore, if we are unable to secure competitive rates from our subcontractors, our profitability may be reduced.

We are subject to foreign exchange risks. Our dominant transactional currency is the Chinese RMB, including the cost of materials which are imported by our suppliers. With costs mainly denominated in RMB, our transactional foreign exchange exposure for the past few years has been insignificant. However, as our suppliers take into account the fluctuations in foreign exchange rates when they price the imported materials which we procure from them, such fluctuations in foreign exchange rates may result in changes in the purchase price of imported materials. Any future significant fluctuations in foreign exchange rates may have a material impact on our financial performance in the event that we are unable to transfer the increased costs to our customers.

Since our subsidiaries, operations and significant assets are located in the PRC, shareholders may find it difficult to enforce a U.S. judgment against the assets of our company, our directors and executive officers. Our subsidiaries’ operations and significant assets are located in the PRC. In addition, all of our executive officers and our directors are non-residents of the U.S., and substantially all the assets of these persons are located outside the U.S. As a result, it could be difficult for investors to effect service of process in the U.S., or to enforce a judgment obtained in the U.S. against us or any of these persons.

Our operations could be adversely affected by changes in the political and economic conditions in the PRC. The PRC is our main market and accounted for all of our revenue in 2006. Therefore, we face risks related to conducting business in the PRC. Changes in the social, economic and political conditions of the PRC may adversely affect our business. Unfavorable changes in government policies, political unrest and economic developments may also have a negative impact on our operations.

Since the adoption of the “open door policy” in 1978 and the “socialist market economy” in 1993, the PRC government has been reforming and is expected to continue to reform its economic and political systems. Any changes in the political and economic policies of the PRC government may lead to changes in the laws and regulations or the interpretation of the same, as well as changes in the foreign exchange regulations, taxation and import and export restrictions, which may, in turn, adversely affect our financial performance. While the current policy of the PRC government seems to be one of imposing economic reform policies to encourage foreign investments and greater economic decentralization, there is no assurance that such a policy will continue to prevail in the future.

23