Attached files

| file | filename |

|---|---|

| EX-4.8 - EMMAUS LIFE SCIENCES, INC. | ex-4_8.htm |

| EX-23.1 - EMMAUS LIFE SCIENCES, INC. | ex-23_1.htm |

| EX-10.28 - EMMAUS LIFE SCIENCES, INC. | ex-10_28.htm |

| As Filed with the Securities and Exchange Commission on July 11, 2011 | Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

________________

Emmaus Holdings, Inc.

(Name of Registrant As Specified in its Charter)

|

Delaware

|

2834

|

41-2254389

|

|

(State or Other Jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer Identification No.)

|

|

Incorporation

|

Classification Code Number)

|

|

|

or Organization)

|

20725 S. Western Avenue, Suite 136

Torrance, CA 90501

310-214-0065

(Address and Telephone Number of Principal Executive Offices)

________________

Corporation Service Company

2711 Centerville Road

Suite 400

Wilmington, DE 19808

800-222-2122

(Name, Address and Telephone Number of Agent for Service)

________________

Copies to

|

Katherine J. Blair, Esq.

Melissa A. Brown, Esq.

K&L Gates LLP

10100 Santa Monica Blvd., 7th Floor

Los Angeles, CA 90067

Telephone: (310) 552-5000

Facsimile: (310) 552-5001

|

Henry I. Rothman, Esq.

Joseph Walsh, Esq.

Troutman Sanders LLP

The Chrysler Building

405 Lexington Avenue

New York, NY 10174

Telephone: (212) 704-6000

Facsimile: (212) 704-6288

|

________________

Approximate Date of Proposed Sale to the Public: From time to time after the effective date of this Registration Statement

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.R

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement the same offering. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer £

|

Non-accelerated filer £

(Do not check if a smaller reporting company)

|

Smaller reporting company R

|

CALCULATION OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||||||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||||||

|

Title of Each Class of

|

Amount To Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities To Be Registered

|

Registered (1)

|

Per Share

|

Offering Price

|

Fee

|

||||||||||||

|

Common Stock, $0.001 par value per share

|

$ | 28,750,000 | (2) | $ | 3,337.88 | |||||||||||

|

Common Stock, $0.001 par value per share

|

2,672,250 | (3) | $ | 4.00 | (4) | $ | 10,689,000 | (4) | $ | 1,240.99 | ||||||

|

Underwriters’ Warrants to Purchase Common Stock

|

125,000 | (5) | N/A | N/A | N/A | (6) | ||||||||||

|

Common Stock Underlying Underwriters’ Warrants, $0.001 par value per share

|

125,000 | (7) | $ | 4.00 | (8) | $ | 500,000 | (8) | $ | 58.05 | ||||||

|

Total Registration Fee

|

$ | 4,636.92 | (9) | |||||||||||||

|

(1)

|

In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of additional shares of Common Stock that shall be issuable pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions.

|

|

(2)

|

The registration fee for securities to be offered by the Registrant is based on an estimate of the Proposed Maximum Aggregate Offering Price of the securities, and such estimate is solely for the purpose of calculating the registration fee pursuant to Rule 457(o). Includes shares that the Underwriters have the option to purchase from the Registrant to cover over-allotments, if any.

|

|

(3)

|

This Registration Statement also covers the resale under a separate resale prospectus (the “Resale Prospectus”) by selling securityholders of the Registrant of up to 2,672,250 shares of Common Stock previously issued to the selling securityholders as named in the Resale Prospectus.

|

|

(4)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457.

|

|

(5)

|

Represents the maximum number of warrants, each of which will be exercisable at a percentage of the per share offering price, to purchase the Registrant’s common stock to be issued to the Underwriters in connection with the public offering.

|

|

(6)

|

In accordance with Rule 457(g) under the Securities Act, because the shares of the Registrant’s common stock underlying the Underwriters’ warrants are registered hereby, no separate registration fee is required with respect to the warrants registered hereby.

|

|

(7)

|

Represents the maximum number of shares of the Registrant’s common stock issuable upon exercise of the Underwriters’ warrants.

|

|

(8)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(g) under the Securities Act, based on an estimated per share maximum exercise price.

|

|

(9)

|

Paid herewith.

|

________________

The Registrant amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall hereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains two prospectuses, as set forth below.

|

●

|

Public Offering Prospectus. A prospectus to be used for the public offering by the Registrant (the “Public Offering Prospectus”) of up to [_________] shares of the Registrant’s common stock (in addition to [_________] shares that may be sold upon exercise of the Underwriters’ over-allotment option, if any) through the Underwriters named on the cover page of the Public Offering Prospectus. We are also registering the warrants and shares of common stock underlying the warrants to be received by the Underwriters in this offering.

|

|

●

|

Resale Prospectus. A prospectus to be used for the resale by selling securityholders of up to 2,672,250 shares of the Registrant’s common stock (the “Resale Prospectus”).

|

The Resale Prospectus is substantively identical to the Public Offering Prospectus, except for the following principal points:

|

●

|

they contain different outside front covers;

|

|

●

|

they contain different Offering sections in the Prospectus Summary section beginning on page 3;

|

|

●

|

they contain different Use of Proceeds sections on page 26;

|

|

●

|

the Capitalization and Dilution sections on pages 28 and 29, respectively, of the Public Offering Prospectus are deleted from the Resale Prospectus;

|

|

●

|

a Selling Stockholder section is included in the Resale Prospectus beginning on page 77A;

|

|

●

|

references in the Public Offering Prospectus to the Resale Prospectus will be deleted from the Resale Prospectus;

|

|

●

|

the Underwriting section from the Public Offering Prospectus on page 77 is deleted from the Resale Prospectus and a Plan of Distribution is inserted in its place;

|

|

●

|

the Legal Matters section in the Resale Prospectus on page 81 deletes the reference to counsel for the Underwriters; and

|

|

●

|

the outside back cover of the Public Offering Prospectus is deleted from the Resale Prospectus.

|

The Registrant has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Resale Prospectus as compared to the Public Offering Prospectus.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | Subject To Completion | July 11, 2011 |

Shares

Emmaus Holdings, Inc.

Common Stock

This is a public offering of our common stock. We are a reporting company under Section 13 of the Securities Exchange Act of 1934, as amended. Our shares of common stock are not currently listed or quoted for trading on any national securities exchange or national quotation system. We intend to apply to have our shares of common stock listed on the Nasdaq Global Market under the symbol “[___]”. No assurance can be given that such listing will be approved.

The offering price to the public will be determined by negotiation between us and the underwriters.

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our common stock in “Risk Factors” beginning on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of anyone’s investment in these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Per Share

|

Total

|

|

|

Public offering price

|

$ [___]

|

$ [___]

|

|

Underwriting discounts and commissions

|

$ [___]

|

$ [___]

|

|

Proceeds, before expenses, to Emmaus Holdings, Inc.

|

$ [___]

|

$ [___]

|

The Underwriters have a 45-day option to purchase up to [_______] additional shares of common stock at the public offering price solely to cover over-allotments, if any, if the Underwriters sell more than [_______] shares of common stock in this offering (the “Over-allotment Shares”). If the Underwriters exercise this option in full, the total underwriting discounts and commissions will be $[__], and total proceeds, before expenses, will be $[__].

The Underwriters will also receive warrants to purchase a number of shares equal to 2% of the shares of our common stock sold in connection with this offering, or [______] shares, exercisable at a per share price equal to the public offering price of this offering.

The Underwriters are offering the common stock as set forth under “Underwriting.” Delivery of the shares will be made on or about [__________], 2011.

SUNRISE SECURITIES CORP.

The date of this Prospectus is ____________________, 2011

TABLE OF CONTENTS

|

PROSPECTUS SUMMARY

|

3

|

|

SUMMARY FINANCIAL DATA

|

8

|

|

RISK FACTORS

|

9

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

|

24

|

|

USE OF PROCEEDS

|

26

|

|

DIVIDEND POLICY

|

26

|

|

CAPITALIZATION

|

28

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

28

|

|

DILUTION

|

29

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

31

|

|

DESCRIPTION OF BUSINESS

|

40

|

|

MANAGEMENT

|

55

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

66

|

|

BENEFICIAL OWNERSHIP OF CERTAIN BENEFICIAL OWNERS, AND MANAGEMENT

|

68

|

|

DESCRIPTION OF SECURITIES

|

70

|

|

SHARES ELIGIBLE FOR FUTURE SALE

|

75

|

|

UNDERWRITING

|

77

|

|

LEGAL MATTERS

|

81

|

|

EXPERTS

|

81

|

|

ADDITIONAL INFORMATION

|

81

|

|

INDEX TO FINANCIAL STATEMENTS

|

F-1

|

|

PART II INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

II-1

|

|

SIGNATURES

|

II-8

|

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not, and the Underwriters have not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

PROSPECTUS SUMMARY

This summary highlights information contained throughout this prospectus and is qualified in its entirety by reference to the more detailed information and financial statements included elsewhere herein. Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read the more detailed information contained in this prospectus, including our financial statements and related notes. Our business involves significant risks. You should carefully consider the information under the heading “Risk Factors” beginning on page 9.

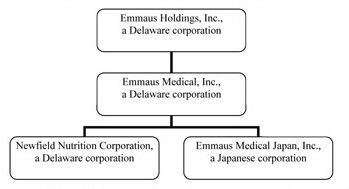

As used in this prospectus, unless otherwise indicated, the terms “we,” “our,” “us,” “Company” and “Emmaus” refer to Emmaus Holdings, Inc., a Delaware corporation, formerly known as AFH Acquisition IV, Inc., and its wholly-owned subsidiary, Emmaus Medical, Inc., a Delaware corporation (“Emmaus Medical”), and its wholly-owned subsidiaries, Newfield Nutrition Corporation, a Delaware corporation, and Emmaus Medical Japan, Inc., a Japanese corporation.

Company Overview

We are engaged in the discovery, development and commercialization of innovative and cost-effective treatments and therapies for rare diseases, areas that we believe have traditionally been underserved by large pharmaceutical companies. We believe that there are attractive niche markets and financial opportunities for companies such as ours that specialize in treatments for rare diseases. Over time, we plan to expand our business to include developing and marketing products to treat more common diseases. The primary focus of our business is the late-stage development of the amino acid L-glutamine as a prescription drug for the treatment of sickle cell disease (“SCD”). To a lesser extent, we are also engaged in the marketing and sale of NutreStore® [L-glutamine powder for oral solution] and promotion of Zorbtive® [somatropin (rDNA origin) for injection] as a treatment for short bowel syndrome (“SBS”) and the sale of L-glutamine as a nutritional supplement under the brand name AminoPure®. Since inception, we have generated minimal revenues from the sale of NutreStore® and AminoPure® and no revenues from the promotion of Zorbtive®.

Our goal is to be a specialty pharmaceutical company focused on the development and commercialization of proprietary branded products and product candidates to treat rare diseases. We intend to achieve this goal by:

|

●

|

Maximizing the value of our L-glutamine treatment for SCD. We are currently in phase III clinical trials of our L-glutamine treatment for SCD. We believe our treatment could have advantages over traditional treatments for SCD, including cost savings. We intend to undertake activities to prepare for the commercialization of this treatment. When and if this treatment is approved by the FDA, we intend to commercialize our L-glutamine SCD treatment.

|

|

●

|

Expanding our collaborative research arrangement with CellSeed. In April 2011, we entered into a Joint Research and Development Agreement (the “Research Agreement”) and an Individual Agreement (the “Individual Agreement”) with CellSeed, Inc. (“CellSeed”). Pursuant to the Research Agreement, the parties formed a relationship regarding the future research and development of cell sheet engineering regenerative medicine products and the future commercialization of such products. Pursuant to the Individual Agreement, CellSeed granted us the exclusive right to manufacture, sell, market and distribute Cultured Autologous Oral Mucosal Epithelial Cell-Sheets (“CAOMECS”) for the cornea in the United States. We intend to work on commercializing the CAOMECS for the cornea and to expand our relationship with CellSeed to develop cell sheets for other types of cells in the future.

|

|

●

|

Establishing strategic collaborations. We intend to seek opportunities to enter into strategic collaborations with leading pharmaceutical and biotechnology companies to commercialize our product candidates to drive growth and profitability. We believe that leveraging the capabilities of third parties will allow us to add efficiency to our operations and expand our commercial reach.

|

|

●

|

Pursuing acquisitions to broaden our drug candidates and product offerings. We will consider strategic acquisitions that will provide us with a broader range of drug candidates and product offerings. When evaluating potential acquisition targets, we will consider factors such as market position, growth potential and earnings prospects and strength and experience of management.

|

Risk Factors

Investing in our securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the section entitled “Risk Factors” immediately following this prospectus summary.

3

Corporate Information

We were incorporated in the state of Delaware on September 24, 2007. We were originally organized as a “blank check” shell company to investigate and acquire a target company or business seeking the perceived advantages of being a publicly held corporation. On May 3, 2011, we (i) closed a reverse merger transaction, described below, pursuant to which we became the 100% parent of Emmaus Medical, (ii) assumed the operations of Emmaus Medical and its subsidiaries, and (iii) changed our name from “AFH Acquisition IV, Inc.” to “Emmaus Holdings, Inc.”

Emmaus Medical, LLC was organized on December 20, 2000. In October 2003, Emmaus Medical, LLC conducted a reorganization and merged with Emmaus Medical, which was originally incorporated on September 12, 2003. Through this merger with Emmaus Medical, LLC into Emmaus Medical, Emmaus Medical acquired the exclusive patent rights for a treatment for SCD.

The corporate structure of the Company is illustrated as follows:

Our principal executive offices and corporate offices are located at 20725 S. Western Avenue, Ste. 136, Torrance, CA 90501-1884. Our telephone number is 310-214-0065.

We are a reporting company under Section 13 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our shares of common stock are not currently listed or quoted for trading on any national securities exchange or national quotation system. We intend to apply to have our shares of common stock listed on the Nasdaq Global Market under the symbol “[___]”.

Recent Events

Merger

Pursuant to an Agreement and Plan of Merger, dated April 21, 2011 (the “Merger Agreement”), by and among the Company, AFH Merger Sub, Inc., a wholly-owned subsidiary of the Company (“AFH Merger Sub”), AFH Holding and Advisory, LLC (“AFH Advisory”), and Emmaus Medical, Emmaus Medical merged with and into AFH Merger Sub with Emmaus Medical continuing as the surviving entity (the “Merger”). Upon the closing of the Merger, the Company changed its name from “AFH Acquisition IV, Inc.” to “Emmaus Holdings, Inc.”

Upon consummation of the Merger on May 3, 2011, (i) each outstanding share of Emmaus Medical common stock was exchanged for 29.48548924976 shares of our common stock, (ii) each outstanding Emmaus Medical option and warrant, which was exercisable for one share of Emmaus Medical common stock, was exchanged for an option or warrant, as applicable, exercisable for 29.48548924976 shares of our common stock; and (iii) each outstanding convertible note of Emmaus Medical, which was convertible for one share of Emmaus Medical common stock, was exchanged for a convertible note exercisable for 29.48548924976 shares of our common stock. As a result of the Merger, holders of Emmaus Medical common stock, options, warrants and convertible notes received 20,628,305 shares of our common stock (excluding 47,178 shares held by stockholders who exercised dissenters’ rights in connection with the Merger), options and warrants to purchase an aggregate of 326,508 shares of our common stock, and convertible notes to purchase an aggregate of 271,305 shares of our common stock. Securityholders of Emmaus Medical held 85% of our issued and outstanding common stock on a fully diluted basis upon the closing of the Merger. Immediately after the closing of the Merger, we had 24,378,305 (excluding 47,178 shares held by stockholders who exercised dissenters’ rights) shares of common stock, no shares of preferred stock, options to purchase 23,590 shares of common stock, warrants to purchase 302,918 shares of common stock and convertible notes exercisable for 271,305 shares of common stock issued and outstanding.

4

The Merger resulted in a change in control of our company from AFH Advisory, which is owned by Mr. Amir F. Heshmatpour, to the former securityholders of Emmaus Medical. In connection with the change in control, we appointed new persons to our Board of Directors and elected new officers of the Company. Mr. Heshmatpour, an officer and director of the Company prior to the consummation of the Merger, resigned from all of his officer positions with the Company at the time the transaction was consummated, but continues as a member of our Board of Directors. The appointments of the new officers and directors, as set forth below, were made on the closing of the Merger, except for Alfred E. Osborne, Jr., who was appointed to the board of directors on June 21, 2011.

|

Name

|

Position

|

|

Yutaka Niihara, M.D., MPH

|

President, Chief Executive Officer and Director

|

|

Willis C. Lee

|

Chief Operating Officer and Director

|

|

Lan T. Tran

|

Chief Administrative Officer and Corporate Secretary

|

|

Yasushi Nagasaki

|

Chief Financial Officer

|

|

Henry A. McKinnell, Jr., Ph.D.,

|

Chairman of the Board

|

|

Amir Heshmatpour

|

Director

|

|

Douglas W. Wilmore, M.D.

|

Director

|

|

Alfred E. Osborne, Jr., Ph.D.

|

Director

|

Prior to the closing of the Merger, AFH Advisory canceled an aggregate of 1,827,750 shares of AFH IV common stock pursuant to a Share Cancellation Agreement executed in connection with the Merger Agreement. AFH Advisory did not receive any consideration for the cancellation of the shares. The cancellation of the shares was accounted for as a contribution to capital. The number of shares cancelled was determined based on negotiations with AFH Advisory, the majority stockholder of AFH IV, and Emmaus Medical. Emmaus Medical and AFH Advisory negotiated an estimated value of Emmaus Medical and its subsidiaries, an estimated value of the shell company, and the mutually desired capitalization of the company resulting from the Merger. With respect to the determination of the amount of shares cancelled, the value of the shell company was derived primarily from its utility as a public company platform, including its good corporate standing and its timely public reporting status. We did not consider registering our own securities directly as a viable option for accessing the public markets. The services provided by AFH Advisory were not a consideration in determining this aspect of the transaction. Under these circumstances and based on these factors, Emmaus Medical and AFH Advisory agreed upon the number of shares to be cancelled.

Emmaus Medical agreed to reimburse AFH Advisory an aggregate of $900,000 (the “Total Shell Price”), consisting of $500,000 (the “Shell Cost”) for the identification of AFH IV and providing consulting services related to coordinating the Merger and managing the interrelationship of legal and accounting activities (the “Services”) and $400,000 for expenses incurred in connection with providing the Services, including, but not limited to, conducting a financial analysis of Emmaus Medical and conducting due diligence on Emmaus Medical and its subsidiaries. In addition, we agreed to pay all costs and expenses in connection with the Merger, including reasonable expenses of AFH Advisory and AFH IV, as well as all expenses of any future public offering of our securities we conduct, up to a maximum of $880,000 (the “Transaction Costs”). AFH Advisory agreed to advance all Transaction Costs on our behalf.

AFH Advisory is entitled, in its sole discretion, to either be reimbursed the Total Shell Price from the proceeds of this offering or convert such amount (or any portion thereof) into our common stock at a conversion price equal to 75% of the per share public offering price in such offering (the “Conversion Price”). AFH Advisory is entitled, in its sole discretion, to be reimbursed all advanced Transaction Costs from the proceeds of the Company’s next public offering of common stock, upon the consummation of any other financing conducted by the Company or to convert such amount (or any portion thereof) into shares of our common stock at the Conversion Price. Additionally, we have agreed to issue warrants to purchase shares of our common stock to AFH Advisory upon the closing of our next public offering. Such warrants will have a term of 5 years from the date of issuance and will have an exercise price equal to the Conversion Price. The number of shares underlying the warrants will be calculated by dividing the aggregate of Total Shell Price plus the amount of Transaction Costs actually advanced by the Conversion Price.

If this public offering is not consummated or we do not raise minimum gross proceeds of $5 million in this offering, then we must reimburse AFH Advisory an amount equal to 50% of the Shell Cost, or $250,000, and 50% of the Transaction Costs advanced by AFH Advisory on our behalf, or up to $440,000 based on the maximum amount of Transaction Costs which we have agreed to reimburse AFH Advisory. AFH Advisory, in its discretion, has the option to be reimbursed by us in cash or to convert such amounts (or any portion thereof) into our common stock at a conversion price equal to 75% of the per share price of the shares of common stock sold in our most recently completed private offering of common stock (the “Private Conversion Price”).

5

The Company granted AFH Advisory exclusive rights to act as its advisor in connection with all financings and mergers and acquisitions until November 10, 2012 and the right to appoint two board members to the Company’s board of directors upon the closing of the Merger.

The transactions contemplated by the Merger Agreement, as amended, were intended to be a “tax-free” contribution and/or reorganization pursuant to the provisions of Sections 351 and/or 368(a) of the Internal Revenue Code of 1986, as amended.

Private Placement

On April 19, 2011, we sold an aggregate of 577,750 shares of our common stock at a per share purchase price of $2.00 per share for gross proceeds of approximately $1.2 million (the “Private Placement”). The shares of our common stock sold in the Private Placement were not registered under the Securities Act of 1933, as amended (the “Securities Act”). These securities qualified for exemption under Rule 506 promulgated under Section 4(2) of the Securities Act since the issuance of securities by the Company did not involve a “public offering.” The issuance was not a public offering based upon the following factors: (i) a limited number of securities were issued to a limited number of offerees; (ii) there was no public solicitation; (iii) each offeree was an “accredited investor;” and (iv) the investment intent of the offerees.

Research Arrangements with CellSeed, Inc.

On April 8, 2011, Emmaus Medical entered into a Joint Research and Development Agreement (the “Research Agreement”) and an Individual Agreement (the “Individual Agreement”) with CellSeed, Inc. (“CellSeed”). Pursuant to the Research Agreement, the parties formed a relationship regarding the future research and development of cell sheet engineering regenerative medicine products (the “Products”), and the future commercialization of such Products. Pursuant to the Individual Agreement, CellSeed granted us an exclusive right to manufacture, sell, market and distribute Cultured Autologous Oral Mucosal Epithelial Cell-Sheets (“CAOMECS”) for the cornea in the United States. CellSeed will disclose its accumulated information package to us for the joint development of CAOMECS. Under the Research Agreement, we agreed to pay CellSeed $8,500,000 within 30 days of the completion of all of the following: (i) the execution of the Research Agreement; (ii) the execution of the Individual Agreement; and (iii) CellSeed’s delivery of the accumulated information package to us. Under the Individual Agreement, we agreed to pay CellSeed $1,500,000 within 30 days of CellSeed’s delivery of the accumulated information package to us and a royalty to be agreed upon by the parties. For additional information on the Research Agreement and the Individual Agreement see “Description of Business – Intellectual Property” on page 50 of this prospectus.

6

The Offering

|

Common stock we are offering

|

[________] shares (1)

|

|

Common stock included in Underwriters’ option to purchase shares from us to cover over-allotments, if any

|

[________] shares

|

|

Common stock outstanding after the offering

|

[________] shares (2)

|

|

Offering price

|

$[___] per share (estimate)

|

|

Use of proceeds

|

We intend to use the proceeds of this offering for [__________________]. See “Use of Proceeds” on page 26 for more information on the use of proceeds.

|

|

Risk factors

|

Investing in these securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 9.

|

|

Proposed symbol

|

We intend to apply to have our shares of common stock listed on the NASDAQ Global Market under the symbol “[___]” on or promptly after the date of this prospectus.

|

|

Concurrent resale registration

|

Upon the effectiveness of the Registration Statement of which this prospectus forms a part, 2,672,250 shares of our common stock will be registered for resale by the holders of such shares. None of these securities are being offered by us and we will not receive any proceeds from the sale of these shares. For additional information, see above under “Prospectus Summary — Recent Events.”

|

____________________

|

|

(1)

|

Excludes (i) up to [_____] shares of common stock underlying warrants to be received by the Underwriters in this offering, and (ii) 2,672,250 shares of our common stock held by the selling securityholders that are concurrently being registered with this offering for resale by such selling securityholders under a separate prospectus, and (iii) the [_____] shares of our common stock that we may issue upon the Underwriters’ over-allotment option exercise.

|

|

|

(2)

|

Based on 24,381,667 shares of common stock issued and outstanding as of the date of this prospectus and (ii) [_____] shares of common stock issued in the public offering. Excludes (i) Underwriters’ warrants to purchase a number of shares equal to 2% of the shares of common stock sold in this offering excluding the shares sold in the over-allotment option; (ii) 298,494 shares of common stock underlying warrants that are exercisable at $3.05; (iii) 23,590 shares of common stock underlying options that are exercisable at $3.05 per share; (iv) 271,305 shares of common stock underlying convertible notes convertible at $3.05 per share; and (v) 100,000 shares of common stock underlying convertible notes convertible at $3.60 per share. Also excludes [_____] shares of our common stock that we may issue upon the Underwriters’ over-allotment option exercise.

|

7

SUMMARY FINANCIAL DATA

The following summary financial information contains (i) consolidated statement of operations data for the three months ended March 31, 2011 and 2010 and the years ended December 31, 2010 and 2009 and since inception through March 31, 2011 and (ii) the consolidated balance sheet data as of March 31, 2011 and December 31, 2010 and 2009. The consolidated statement of operations data and balance sheet data as of and for the years ended December 31, 2010 and 2009 were derived from the audited consolidated financial statements included elsewhere in this prospectus. Such financial data should be read in conjunction with the consolidated financial statements and the notes to the consolidated financial statements starting on page F-1 and with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

Three Months Ended March 31,

|

Year Ended December 31,

|

From

December 20, 2000

(date of inception)

to March 31,

|

||||||||||||||||||

|

2011

|

2010

|

2010

|

2009

|

2011

|

||||||||||||||||

|

(unaudited)

|

(unaudited)

|

(unaudited)

|

||||||||||||||||||

|

(in thousands, except share and per share amounts)

|

||||||||||||||||||||

|

Revenues

|

$ | 59 | $ | 46 | $ | 139 | $ | 100 | $ | 403 | ||||||||||

|

Cost of goods sold, net of scrapped inventory

|

25 | 23 | 99 | 85 | 251 | |||||||||||||||

|

Scrapped inventory

|

- | - | 236 | - | 236 | |||||||||||||||

|

Total cost of goods sold

|

25 | 23 | 335 | 85 | 487 | |||||||||||||||

|

Gross profit

|

34 | 23 | (196 | ) | 15 | (83 | ) | |||||||||||||

|

Operating expenses

|

||||||||||||||||||||

|

Research and development

|

311 | 222 | 1,062 | 532 | 5,210 | |||||||||||||||

|

Selling

|

202 | 125 | 656 | 697 | 2,004 | |||||||||||||||

|

General and administrative

|

648 | 406 | 1,818 | 1,301 | 6,261 | |||||||||||||||

| 1,160 | 753 | 3,536 | 2,530 | 13,475 | ||||||||||||||||

|

Loss from operations

|

(1,126 | ) | (730 | ) | (3,732 | ) | (2,515 | ) | (13,558 | ) | ||||||||||

|

Other income (expense)

|

||||||||||||||||||||

|

Interest income

|

6 | 9 | 39 | 20 | 92 | |||||||||||||||

|

Interest expense

|

(12 | ) | (12 | ) | (60 | ) | (72 | ) | (402 | ) | ||||||||||

| (5 | ) | (3 | ) | (21 | ) | (52 | ) | (310 | ) | |||||||||||

|

Loss before income taxes

|

(1,131 | ) | (733 | ) | (3,753 | ) | (2,567 | ) | (13,868 | ) | ||||||||||

|

Income taxes

|

1 | 1 | 4 | 1 | 16 | |||||||||||||||

|

Net loss

|

(1,132 | ) | (734 | ) | (3,757 | ) | (2,568 | ) | (13,884 | ) | ||||||||||

|

Loss per share – basic and diluted

|

(0.06 | ) | (0.04 | ) | (0.19 | ) | (0.14 | ) | ||||||||||||

|

Weighted average shares outstanding – basic and diluted

|

20,519,383 | 19,288,138 | 19,661,306 | 18,813,759 | ||||||||||||||||

|

Consolidated Balance Sheets

|

As of March 31,

|

As of December 31,

|

||||||||||

|

2011

|

2010

|

2009

|

||||||||||

|

(unaudited)

|

||||||||||||

|

(in thousands)

|

||||||||||||

|

Total Current Assets

|

$ | 2,515 | $ | 2,097 | $ | 1,780 | ||||||

|

Total Assets

|

4,418 | 2,692 | 2,303 | |||||||||

|

Total Current Liabilities

|

791 | 897 | 624 | |||||||||

|

Total Liabilities

|

1,915 | 1,081 | 907 | |||||||||

|

Total Stockholders' Equity

|

2,503 | 1,611 | 1,396 | |||||||||

The acquisition of Emmaus Medical by us on May 3, 2011 pursuant to the Merger was accounted for as a recapitalization by us. The recapitalization was, at the time of the Merger, the merger of a private operating company (Emmaus Medical) into a non-operating public shell corporation (us) with nominal net assets and as such is treated as a capital recapitalization, rather than a business combination. As a result, the assets of the operating company are recorded at historical cost. The transaction is the equivalent to the issuance of stock by the private company for the net monetary assets of the shell corporation. The pre-acquisition financial statements of Emmaus Medical are treated as the historical financial statements of the consolidated companies. The financial statements presented will reflect the change in capitalization for all periods presented, therefore the capital structure of the consolidated enterprise, being the capital structure of the legal parent, is different from that appearing in the financial statements of Emmaus Medical in earlier periods due to this recapitalization.

8

RISK FACTORS

Any investment in our common stock involves a high degree of risk. Investors should carefully consider the risks described below and all of the information contained in this prospectus before deciding whether to purchase our common stock. Our business, financial condition or results of operations could be materially adversely affected by these risks if any of them actually occur. Our shares of common stock are not currently listed or quoted for trading on any national securities exchange or national quotation system. If and when our shares of common stock are traded, the trading price could decline due to any of these risks, and an investor may lose all or part of his or her investment. Some of these factors have affected our financial condition and operating results in the past or are currently affecting our company. This prospectus also contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including the risks we face as described below and elsewhere in this prospectus.

RISKS RELATED TO OUR OPERATIONS

We have incurred losses since inception, have limited cash resources and anticipate that we will continue to incur substantial losses for the foreseeable future.

Emmaus Medical is still in the development stage. As of March 31, 2011, we had an accumulated deficit of $13.9 million since our inception in 2000. Our net losses were $3.8 million and $2.6 million for the years ended December 31, 2010 and 2009, respectively, and $1.1 million and $0.7 million for the three months ended March 31, 2011 and 2010, respectively. These losses resulted principally from costs incurred in our research and development programs and from our general and administrative expenses. We have had limited revenue, have sustained significant operating losses, and are likely to sustain operating losses in the foreseeable future. Since inception, we have funded our operations through the private placement of equity securities, convertible notes and loans from stockholders and expect that we will continue to fund our operations through public or private equity or debt financings or other sources, such as strategic partnerships. Such financings may not be available in amounts or on terms acceptable to us, if at all. Our failure to raise capital as and when needed would inhibit our ability to continue operations and implement our business strategies.

We expect to continue to incur significant and increasing negative cash flow and operating losses as we continue our research activities, conduct clinical trials, and seek regulatory approvals for our L-glutamine treatment for SCD. These losses, among other things, have had and will continue to have an adverse effect on our stockholders’ equity, total assets and working capital. Because of the numerous risks and uncertainties associated with drug development, we are unable to predict the extent of any future losses, whether or when we will be able to commercialize our L-glutamine treatment for SCD, or when we will become profitable, if at all. Even if we do achieve profitability, we may not be able to sustain or increase profitability on a quarterly or annual basis.

Our recurring operating losses have raised substantial doubt regarding our ability to continue as a going concern.

Our recurring operating losses raise substantial doubt about our ability to continue as a going concern. As a result, our independent registered public accounting firm included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2010 with respect to this uncertainty. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could result in the loss of confidence by investors, suppliers and employees.

We will require substantial additional funding and may be unable to raise capital when needed, which could force us to delay, reduce or eliminate planned activities or result in our inability to continue as a going concern.

We will require additional capital to pursue planned clinical trials and regulatory approvals, as well as further research and development and marketing efforts for our products and potential products.Our future capital requirements will depend on, and could increase significantly as a result of, many factors, including:

|

●

|

the duration and results of the clinical trials for our various products going forward;

|

|

●

|

unexpected delays or developments in seeking regulatory approvals;

|

|

●

|

the time and cost in preparing, filing, prosecuting, maintaining and enforcing patent claims;

|

9

|

●

|

other unexpected developments encountered in implementing our business development and commercialization strategies; and

|

|

●

|

the outcome of litigation, if any, and further arrangements, if any, with collaborators.

|

We may attempt to raise additional funds through public or private financings, collaborations with other pharmaceutical companies or financing from other sources. Additional funding may not be available on terms which are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our product development programs or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable for equity securities, the issuance of those securities could result in dilution to our stockholders. Moreover, the incurrence of debt financing could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness and could impose restrictions on our operations. This could render us more vulnerable to competitive pressures and economic downturns.

In addition, if we do not meet our payment obligations to third parties as they come due, we may be subject to litigation claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to management, and may result in unfavorable results that could further adversely impact our financial condition.

Raising additional capital may cause dilution to our existing stockholders, restrict our operations or require us to relinquish rights.

We may seek additional capital through a combination of private and public equity offerings, debt financings and collaborations and strategic and licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest in us will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a stockholder. Debt financing, if available, would result in increased fixed payment obligations and may involve agreements that include covenants limiting or restricting our ability to take specific actions such as incurring debt, making capital expenditures or declaring dividends. If we raise additional funds through collaboration, strategic alliance and licensing arrangements with third parties, we may have to relinquish valuable rights to our technologies, future revenue streams or product candidates, or grant licenses on terms that are not favorable to us.

Our business is subject to extensive government regulation, which could cause delays in the development and commercialization of our drug products, impose significant costs on us or provide advantages to our larger competitors.

The FDA and similar agencies in foreign countries impose substantial requirements upon the development, manufacture and marketing of drugs. They require laboratory and clinical testing procedures, manufacturing, labeling, registration, notification, clearance or approval, marketing, distribution, recordkeeping, reporting and promotion, and other costly and time-consuming procedures. Satisfaction of clearance or approval requirements typically takes several years or more and varies substantially from country to country as well as upon the type, complexity and novelty of the therapeutic product.

The effect of government regulation may be to delay marketing of products for a considerable or indefinite period of time, to impose costly procedures upon our activities and to furnish a competitive advantage to larger companies that compete with us. There can be no assurance that the FDA or other regulatory clearance or approval for any products developed by us will be granted on a timely basis, if at all, or, once granted, that clearances or approvals will not be withdrawn or other regulatory actions taken which might limit our ability to market our proposed products. Any such delay in obtaining or failure to obtain such clearance or approvals would adversely affect us, the manufacturing and marketing of the products we intend to develop and our ability to generate product revenue.

We cannot assure you that we will be able to complete our clinical trial programs successfully within any specific time period, or if such clinical trials take longer to complete than we project, our ability to execute our current business strategy will be adversely affected.

We do not know if our current clinical trials for our L-glutamine treatment for SCD will be completed on schedule or at all. Even if completed, we do not know if these trials will produce clinically meaningful results sufficient to support an application for marketing approval. Whether or not and how quickly we complete clinical trials is dependent in part upon the rate at which we are able to obtain regulatory clearance to commence clinical trials, engage clinical trial sites and medical investigators, reach agreement on acceptable clinical trial agreement terms or clinical trial protocols with medical investigators or clinical trial sites or institutional review boards and, thereafter, the rate of enrollment of patients, and the rate to collect, clean, lock and analyze the clinical trial database.

10

Patient enrollment is a function of many factors, including the design of the protocol, the size of the patient population, the proximity of patients to and availability of clinical sites, the eligibility criteria for the study, the perceived risks and benefits of the drug under study and of the control drug, if any, the efforts to facilitate timely enrollment in clinical trials, the patient referral practices of physicians, the existence of competitive clinical trials, and whether existing or new drugs are approved for the indication. If we experience delays in identifying and contracting with sites and/or in patient enrollment/completion in our clinical trial programs, we may incur additional costs and delays in our development programs, and may not be able to complete our clinical trials on a cost-effective or timely basis. Accordingly, we may not be able to complete the clinical trials within an acceptable time frame, if at all. If we or any third party have difficulty obtaining clinical drug materials or enrolling a sufficient number of patients to conduct its clinical trials as planned, or if enrolled patients do not complete the trial as planned, we or a third party may need to delay or terminate ongoing clinical trials, which could negatively affect our business.

Clinical trials often require the enrollment of large numbers of patients, and suitable patients may be difficult to identify and recruit. Our ability to enroll sufficient numbers of patients in our clinical trials depends on many factors, including the size of the patient population, the nature and design of the protocol, the proximity of patients to clinical sites, the eligibility criteria for the trial, competing clinical trials and the availability of approved effective drugs. In addition, patients may withdraw from a clinical trial or be unwilling to follow our clinical trial protocols for a variety of reasons. If we fail to enroll and maintain the number of patients for which the clinical trial was designed, the statistical power of that clinical trial may be reduced which would make it harder to demonstrate that the product candidate being tested in such clinical trial is safe and effective. Additionally, we may not be able to enroll a sufficient number of qualified patients in a timely or cost-effective manner.

The drug development process to obtain FDA approval is very costly and time consuming and if we cannot complete our clinical trials in a cost-effective manner, our results of operations may be adversely affected.

Even with the granting of orphan drug status and fast track designation, the cost associated with the successful development of the L-glutamine treatment for SCD is uncertain. Costs of clinical trials may vary significantly over the life of a project owing but not limited to the following:

|

●

|

the duration of the clinical trial;

|

|

●

|

the number of sites included in the trials;

|

|

●

|

the countries in which the trial is conducted;

|

|

●

|

the length of time required to enroll eligible patients;

|

|

●

|

the number of patients that participate in the trials;

|

|

●

|

the number of doses that patients receive;

|

|

●

|

the drop-out or discontinuation rates of patients;

|

|

●

|

per patient trial costs;

|

|

●

|

potential additional safety monitoring or other studies requested by regulatory agencies;

|

|

●

|

the duration of patient follow-up;

|

|

●

|

the efficacy and safety profile of the product candidate;

|

|

●

|

the costs and timing of obtaining regulatory approvals; and

|

|

●

|

the costs involved in enforcing or defending patent claims or other intellectual property rights.

|

If we are unable to control the costs of our clinical trials and conduct our trials in a cost-effective manner, our results of operations may be adversely affected.

We may be required to suspend, repeat or terminate our clinical trials if they do not meet regulatory requirements, the results are negative or inconclusive or adversely affect the necessary human subject protections, or if the trials are not well designed, which may result in significant negative repercussions on our business and financial condition.

11

We must be evaluated in light of the uncertainties and complexities affecting a development stage company. Our L-glutamine treatment for SCD, which is currently our only product in development, has not yet received regulatory approval for its intended commercial sale. We cannot market a pharmaceutical product in any jurisdiction until it has completed rigorous preclinical testing and clinical trials and passed such jurisdiction’s extensive regulatory approval process. Pre-clinical testing and clinical development are long, expensive and uncertain processes. Data obtained from pre-clinical and clinical tests can be interpreted in different ways, which could delay, limit or prevent regulatory approval. It may take us many years to complete the testing of our products and failure can occur at any stage of this process. We cannot provide assurance that our authorized clinical testing will be completed successfully within any specified time period by us, or without significant additional resources or expertise to those originally expected to be necessary. We cannot provide assurance that such testing will show potential products to be safe and efficacious or that any such product will be approved for a specific indication. Results from early clinical trials may not be indicative of the results that will be obtained in later-stage clinical trials. In addition, negative or inconclusive results from the clinical trials we conduct or adverse medical events could cause us to have to suspend, repeat or terminate the clinical trials. Clinical trials are subject to continuing oversight by governmental regulatory authorities and institutional review boards and must meet the requirements of these authorities and requirements for informed consent and good clinical practices and we cannot guarantee that we will be able to comply with such requirements. We will rely on third parties, such as contract research organizations and/or co-operative groups, to assist us in overseeing and monitoring clinical trials as well as to process the clinical results and manage test requests, which may result in delays or failure to complete trials, if the third parties fail to perform or to meet the applicable standards. A failure by us or such third parties to keep to the terms of a product development program for any particular product candidate or to complete the clinical trials for a product candidate in the envisaged time frame could have a significant negative effect on our business and financial condition.

There are known adverse side effects to our Zorbtive® and Nutrestore® products.

We market and/or sell two prescription pharmaceutical products that have received FDA approval: NutreStore® [L-glutamine powder for oral solution] and Zorbtive® [somatropin (rDNA origin) for injection], as a treatment for SBS. Reported side effects of NutreStore® include, but are not limited to, the urge to empty bowels, gas, abdominal pain, vomiting and hemorrhoids. Common side effects of Zorbtive® include, but are not limited to, muscle and joint pain and fluid retention or swelling. Zorbtive® may also cause serious side effects such as inflammation of the pancreas (pancreatitis), diabetes or other blood sugar problems, pain, numbness or tingling in the wrist and hand, or increased blood pressure in the brain. Any of these known side effects and any associated warning statements or labeling requirements may limit the commercial profile of these products and prevent us from achieving or maintaining market acceptance of such products.

Changes in regulatory requirements and guidance or unanticipated events during our clinical trials may occur, which may result in necessary changes to clinical trial protocols, which could result in increased costs to us, delay our development timeline or reduce the likelihood of successful completion of the clinical trial.

Changes in regulatory requirements and guidance or unanticipated events during our clinical trials may occur, as a result of which we may need to amend clinical trial protocols. If we experience delays in completion of, or if we terminate, any of our clinical trials, the commercial prospects for our L-glutamine treatment for SCD may be harmed and our ability to generate product revenue will be delayed, possibly materially.

Even if we are able to develop our L-glutamine treatment for SCD, we may not be able to receive regulatory approval, or if approved, we may not be able to generate significant revenues or successfully commercialize our L-glutamine treatment for SCD, which would adversely affect our financial results and financial condition.

Although our L-glutamine treatment for SCD is in Phase III clinical trials, it will still require regulatory approval before we can market it. We cannot predict the outcome of our Phase III clinical trial of this product and cannot assure you that we will obtain the necessary regulatory approvals. There are many reasons that we may fail in our efforts to develop and commercialize our L-glutamine treatment for SCD and other drug product candidates, including:

|

●

|

the chance that our preclinical testing or clinical trials could show that our L-glutamine treatment for SCD or other drug product candidates are ineffective an/or cause harmful side effects;

|

|

●

|

the failure of our drug product candidates to receive necessary regulatory approvals from the FDA or foreign regulatory authorities in a timely manner, or at all;

|

|

●

|

the failure of our drug product candidates, once approved, to be produced in commercial quantities or at reasonable costs;

|

|

●

|

physicians’ reluctance to switch from existing treatment methods, including traditional therapy agents, to our products;

|

12

|

●

|

the failure of our drug product candidates, once approved, to achieve commercial acceptance;

|

|

●

|

the introduction of products by our competitors that are more effective or have a different safety profile than our products;

|

|

●

|

the application of restrictions to our drug product candidates by regulatory or governmental authorities;

|

|

●

|

the proprietary rights of other parties preventing us or our potential collaborative partners from marketing our drug product candidates;

|

|

●

|

the possibility that we may not be able to maintain the orphan drug designation or obtain orphan drug exclusivity for our product; and

|

|

●

|

the possibility that our fast track designation may not actually lead to a faster development or regulatory review or approval process.

|

Even if the FDA and other regulatory authorities approve our L-glutamine treatment for SCD or any of our products, the manufacture, packaging, labeling, distribution, marketing and sale of such products will be subject to strict and ongoing regulation. Compliance with such regulation will be expensive and consume substantial financial and management resources. The FDA has the authority to regulate the claims we make in marketing our prescription drug products to ensure that such claims are true, not misleading, supported by scientific evidence and consistent with the labeled use of the drug. Failure to comply with FDA requirements in this regard could result in, among other things, warning letters, suspensions of approvals, seizures or recalls of products, injunctions against a product's manufacture, distribution, sales and marketing, operating restrictions, civil penalties and criminal prosecutions. Additionally, an approval for a product may be conditioned on our agreement to conduct costly post-marketing follow-up studies to monitor the safety or efficacy of the products. In addition, as a clinical experience with a drug expands after approval because the drug is used by a greater number and more diverse group of patients than during clinical trials, side effects or other problems may be observed after approval that were not observed or anticipated during pre-approval clinical trials. In such a case, a regulatory authority could restrict the indications for which the product may be sold or restrict the distribution channels or revoke the product’s regulatory approval, which could hinder our ability to generate revenues from our products. If we fail to develop and commercialize our drug product candidates as planned, our financial results and financial condition will be adversely affected, we will have to delay or terminate some or all of our research product development programs and may be forced to cease operations.

We are subject to various regulations pertaining to healthcare fraud and abuse, violations of which could have a material adverse affect on our business.

We are subject to various federal and state laws pertaining to healthcare fraud and abuse, including inducing, facilitating or encouraging submission of false claims to government programs and prohibitions on the offer or payment or acceptance of kickbacks or other remuneration for the purchase of our products. Specifically, these anti-kickback laws make it illegal for a prescription drug manufacturer to solicit, offer, or pay any remuneration in exchange for purchasing, leasing or ordering any service or items including the purchase or prescribing of a particular drug for which payment may be made under a federal healthcare program. Because of the sweeping language of the federal anti-kickback statute, many potentially beneficial business arrangements would be prohibited if the statute were strictly applied. To avoid this outcome, the Department of Health and Human Services has published regulations, known as “safe harbors,” that identify exceptions or exemptions to the statute’s prohibitions. Arrangements that do not fit within the safe harbors are not automatically deemed to be illegal, but must be evaluated on a case by case basis for compliance with the statute. We seek to comply with anti-kickback statutes and if necessary to fit within one of the defined "safe harbors"; we are unaware of any violations of these laws. However, due to the breadth of the statutory provisions and the absence of uniform guidance in the form of regulations or court decisions, there can be no assurance that our practices will not be challenged under anti-kickback or similar laws. Violations of such restrictions may be punishable by civil or criminal sanctions, including fines and civil monetary penalties, as well as the possibility of exclusion from U.S. federal healthcare programs (including Medicaid and Medicare). Any such violations could have a material adverse effect on our business, financial condition, results or operations and cash flows.

In addition, the FDA has the authority to regulate the claims we make in marketing our prescription drug products to ensure that such claims are true, not misleading, supported by scientific evidence and consistent with the labeled use of the drug. Failure to comply with FDA requirements in this regard could result in, among other things, warning letters, suspensions of approvals, seizures or recalls of products, injunctions against a product's manufacture, distribution, sales and marketing, operating restrictions, civil penalties and criminal prosecutions. Any of these FDA actions could negatively impact our product sales and profitability.

13

If the manufacturers upon whom we rely fail to produce in the volumes and quality that we require on a timely basis, or to comply with stringent regulations applicable to pharmaceutical manufacturers, we may face delays in the development and commercialization of, or be unable to meet demand for, our products, if any, and may lose potential revenues.

We do not currently have or intend to develop our own manufacturing capabilities. We intend to enter into various arrangements with contract manufacturers and others to manufacture our products and, thus, will significantly depend upon the subsequent success of these outside parties in performing their manufacturing responsibilities. The manufacture of pharmaceutical products requires significant expertise and capital investment, including the development of advanced manufacturing techniques and process controls. Manufacturers of pharmaceutical products may encounter difficulties in production, including problems with quality control, quality assurance testing, shortages of qualified personnel, and compliance with strictly enforced federal, state and foreign regulations. Our third-party manufacturers and key suppliers may experience manufacturing difficulties due to resource constraints or as a result of labor disputes, unstable political environments at foreign facilities or financial difficulties. If these manufacturers or key suppliers were to encounter any of these difficulties, or otherwise fail to comply with their contractual obligations, our ability to timely launch any potential product candidate, if approved, would be jeopardized.

We currently obtain our pharmaceutical grade L-glutamine from two Japanese companies, which together produce the vast majority of pharmaceutical grade L-glutamine approved for sale in the U.S., and obtain all of our L-glutamine for our NutreStore product from one of these companies. If these suppliers were to experience any manufacturing or production difficulties producing pharmaceutical grade L-glutamine, our ability to complete our clinical trials, to commercialize L-glutamine for the treatment of SCD and to continue to sell NutreStore would be harmed.

We intend to enter into long term supply agreements with one or more manufacturers for our products. There can be no assurance that we will be successful in entering into such long term supply contracts, or that such contracts will be at prices that are acceptable to us. Our manufacturing partners may not be able to expand capacity or to produce additional product requirements for us in the event that demand for our products increases. There can be no assurance that we or our manufacturers will be able to continue purchasing products from current suppliers or any other supplier on terms similar to current terms or at all. Any interruption in the availability of certain raw materials or ingredients, or significant increases in the prices paid by us for them, could have a material adverse effect on its business, financial condition, liquidity and operating results.

In addition, all manufacturers and suppliers of pharmaceutical products must comply with applicable current good manufacturing practice (“cGMP”) regulations for the manufacture of our products, which are enforced by the FDA through its facilities inspection program. The FDA is likely to conduct inspections of our third party manufacturer and key supplier facilities as part of the Agency’s review of any of our NDAs and its ongoing compliance programs. If our third party manufacturers and key suppliers are not in compliance with cGMP requirements, it may result in a delay of approval for products undergoing regulatory review or the inability to meet market demands for approved, marketed products, particularly if these sites are supplying single source ingredients required for the manufacture of any potential product. These cGMP requirements include quality control, quality assurance and the maintenance of records and documentation, among other items. Furthermore, regulatory qualifications of manufacturing facilities are applied on the basis of the specific facility being used to produce supplies. As a result, if one of the manufacturers that we rely on shifts production from one facility to another, the new facility must go through a complete regulatory qualification and be approved by regulatory authorities prior to being used for commercial supply. Our manufacturers may be unable to comply with these cGMP requirements and with other FDA, state and foreign regulatory requirements. A failure to comply with these requirements may result in fines, product recalls or seizures and related publicity requirements, injunctions, total or partial suspension of production, civil penalties, suspension or withdrawals of previously granted regulatory approvals, warning or untitled letters, refusal to approve pending applications for marketing approval of new products or of supplements to approved applications, import or export bans or restrictions, and criminal prosecution and penalties. Any of these penalties could delay or prevent the promotion, marketing or sale of our products. If the safety of any quantities supplied is compromised due to a third party manufacturer’s or key supplier’s failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize our products.

The failure of our products to gain market acceptance will hinder our ability to generate revenues from the sale of our products.

Even if our products are approved for commercialization, they may not be successful in the marketplace. Market acceptance of any of our products will depend on a number of factors including, but not limited to:

14

|

●

|

demonstration of clinical efficacy and safety;

|

|

●

|

the prevalence and severity of any adverse side effects;

|

|

●

|

limitations or warnings contained in the product’s approved labeling; availability of alternative treatments for the indications;

|

|

●

|

the advantages and disadvantages of our products relative to current or alternative treatments;

|

|

●

|

the availability of acceptable pricing and adequate third-party reimbursement; and

|

|

●

|

the effectiveness of marketing and distribution methods for the products.

|

If our products do not gain market acceptance among physicians, patients, treatment centers, healthcare payors and others in the medical community, which may not accept or utilize our products, our ability to generate significant revenues from its products would be limited and our financial conditions will be materially adversely affected. In addition, if we fail to successfully penetrate our core markets and successfully expand our business into new markets, the growth in sales of our products, along with its operating results, could be negatively impacted.

Our ability to successfully penetrate our core markets in which we compete or to successfully expand our business into additional countries in Africa, Europe, Asia or elsewhere is subject to numerous factors, many of which are beyond our control. Our products, if successfully developed, may compete with a number of drugs and therapies currently manufactured and marketed by major pharmaceutical companies. Our products may also compete with new products currently under development by others or with products which may be less expensive than our products. There is no assurance that our efforts to increase market penetration in our core markets and existing geographic markets will be successful. Our failure to do so could have an adverse effect on our operating results.

We lack experience in commercializing products, which may have an adverse effect on our business.

We will need to transition from a company with a development focus to a company capable of supporting commercial activities. We may not be successful in such a transition. We have not yet demonstrated an ability to obtain marketing approval for product candidates and have limited experience in commercializing products. As a result, we may not be as successful as companies that have previously obtained marketing approval for drug candidates and have more experience commercially launching drugs.

We are required to make significant payments to CellSeed pursuant to the Research Agreement and the Individual Agreement, and if we cannot make such payments when due, CellSeed may terminate the agreements which will negatively impact our financial condition and our ability to implement our business strategies.

In April 2011, Emmaus Medical entered into the Research Agreement and the Individual Agreement with CellSeed. Pursuant to the Research Agreement, the Company and CellSeed formed a relationship regarding the future research and development of cell sheet engineering regenerative medicine products, and the future commercialization of such products. Pursuant to the Individual Agreement, CellSeed granted us the exclusive right to manufacture, sell, market and distribute CAOMECS for the cornea in the United States and agreed to disclose its accumulated information package for the joint development of CAOMECS to us. Under the Research Agreement, we agreed to pay CellSeed $8,500,000 within 30 days of the completion of all of the following: (i) the execution of the Research Agreement; (ii) the execution of the Individual Agreement; and (iii) CellSeed’s delivery of the accumulated information package to Emmaus. Under the Individual Agreement, we agreed to pay CellSeed $1,500,000 within 30 days of CellSeed’s delivery of the accumulated information package to us and a royalty to be agreed upon by the parties. We have had limited revenue, have sustained significant operating losses, and are likely to sustain operating losses in the foreseeable future. As of March 31, 2011, we had cash and cash equivalents of approximately $1.1 million. We anticipate that we will continue to fund our operations through public or private equity or debt financings or other sources, such as strategic partnership agreements. Such financings may not be available in amounts or terms acceptable to us, if at all. Our failure to raise capital as and when needed could impact our ability to pay the amounts required under the Research Agreement and Individual Agreement to CellSeed. If we are unable to pay the amounts required, CellSeed could terminate the agreements which would negatively impact on our ability to pursue our business strategies.

There are various uncertainties related to the research, development and commercialization of cell sheet engineering regenerative medicine products pursuant to the Research Agreement and Individual Agreement which could negatively affect our ability to commercialize such products.

We have historically focused on the research and development of our L-glutamine treatment for SCD and have no experience in the research, development or commercialization of cell sheet regenerative medicine products. Such products would require FDA approval, however, it is uncertain what type of approval the FDA would require for such products or what

15

type of scientific data would be required to provide the safety and efficacy of such products. Such uncertainties could delay our ability to obtain FDA approval for and to commercialize such products. In addition, the research and commercialization of cell sheet regenerative medicine products could be hindered if third party manufacturers of such products are out of compliance with cGMP regulations. Any delay in obtaining FDA approval or the occurrence of problems with third party manufacturers of cell sheet regenerative medicine products would negatively affect our ability to commercialize such products.

Failure to obtain acceptable prices or adequate reimbursement for our products may cause an adverse impact on our results of operations.