Attached files

| file | filename |

|---|---|

| EX-5.1 - EXHIBIT 5.1 - GREEN ENVIROTECH HOLDINGS CORP. | ex51.htm |

| EX-23.1 - EXHIBIT 23.1 - GREEN ENVIROTECH HOLDINGS CORP. | ex231.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GREEN ENVIROTECH HOLDINGS CORP.

Delaware

(State or Other Jurisdiction of Incorporation or Organization)

1000

(Primary Standard Industrial Classification Code Number)

32-0218005

(I.R.S. Employer Identification No.)

PO Box 692

5300 Claus Road

Riverbank, CA 95367

(209) 863-9000

(Address and telephone number of principal executive offices)

Gary DeLaurentiis

PO Box 692

5300 Claus Road

Riverbank, CA 95367

(Name, address and telephone number of agent for service

Copy to:

Andrea Cataneo, Esq.

Jeff Cahlon, Esq.

Sichenzia Ross Friedman Ference LLP

61 Broadway

New York, NY 10006

Telephone No.: (212) 930-9700

Fax No.: (212) 930-9725

Approximate Date of Proposed Sale to the Public: From time to time after the date this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [ x ]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [ x ]

|

|

(Do not check if a smaller

|

|

|

reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||

|

maximum

|

maximum

|

|||

|

offering price per

|

aggregate

|

Amount of

|

||

|

Title of class of securities to be registered

|

Amount to be registered (1)

|

share (3)

|

offering price (2)

|

registration fee

|

|

Common Stock, $.001 par value per share

|

14,606,826 shares(2)

|

$0.105 | $1,533,716.73 | $178.06 |

(1) In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions.

(2) Represents shares of common stock offered by the selling stockholder.

(3) Estimated in accordance with Rule 457 of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee and is based on the average of the high and low prices of our stock reported by the Over-the-Counter Bulletin Board (the “OTCBB”) on July 6, 2011, which was $0.105.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

2

THE INFORMATION CONTAINED IN THIS PRELIMINARY PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. THESE SECURITIES MAY NOT BE SOLD UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS DECLARED EFFECTIVE. THIS PRELIMINARY PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

SUBJECT TO COMPLETION, DATED JULY 8, 2011

PRELIMINARY PROSPECTUS

GREEN ENVIROTECH HOLDINGS CORP.

14,606,826 Shares of Common Stock

This prospectus relates to the resale of up to 14,606,826 shares of our common stock, par value $0.001 per share, by Centurion Private Equity, LLC (“Centurion” or “Selling Security Holder”), which includes (i) 290,641 shares issued to Centurion as a commitment fee pursuant to the terms of the investment agreement we entered into with Centurion on April 8, 2011 (the “Investment Agreement”), (ii) 31,250 shares issued to Centurion as a due diligence/legal and administrative fee in connection with the Investment Agreement, and (iii) 14,284,935 Put Shares that we will put to Centurion pursuant to the Investment Agreement.

The Investment Agreement with Centurion provides that Centurion is committed to purchase up to $5 million of our common stock (“Put Shares”). We may draw on the facility from time to time, as and when we determine appropriate in accordance with the terms and conditions of the Investment Agreement.

The 14,606,826 shares included in this prospectus represent a portion of the shares issuable to Selling Security Holder under the Investment Agreement. This portion was calculated as approximately one-third of the Company’s public float.

Centurion is an “underwriter” within the meaning of the Securities Act in connection with the resale of our common stock under the Investment Agreement. No other underwriter or person has been engaged to facilitate the sale of shares of our common stock in this offering. This offering will terminate on the earlier of (i) two years after the registration statement to which this prospectus is made a part is declared effective by the SEC, or (ii) thirty months from the date of the Investment Agreement.

When we put an amount of shares to Centurion (a “Put”), the per share purchase price that Centurion will pay to us in respect of such Put will be determined in accordance with a formula set forth in the Investment Agreement.

Generally, the price per share for each Put will be determined as follows: If the Market Price (defined below) for the Put is greater than $0.10, the purchase price for the Put Shares (the “Put Share Price”) sold in that Put shall equal 97% of the Market Price for such Put, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. If the Market Price for the Put is $0.10 or less, the purchase price for the Put Shares sold in that Put shall equal the lesser of (i) 97% of the Market Price for such Put or (ii) the Market Price for such Put minus $0.01, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. “Market Price” means the average of the three lowest daily volume weighted average prices published daily by Bloomberg LP for our common stock during the fifteen consecutive trading day period immediately following the date specified by us on which we intend to exercise the applicable Put. “Company Designated Minimum Put Share Price” means a minimum purchase price per Put share at which Centurion may purchase shares of common stock pursuant to the Company’s Put notice. The Company Designated Minimum Put Share Price shall be no greater than the lesser of (i) 80% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125 and shall be no less than the lesser of (i) 70% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125.

We will not receive any proceeds from the sale of these shares of common stock offered by Selling Security Holder. However, we will receive proceeds from the sale of our Put Shares under the Investment Agreement. The proceeds will be used for working capital or general corporate purposes. We will bear all costs associated with this registration.

Our common stock is quoted on the OTCBB under the symbol “GETH.” The closing price of our common stock on July 7, 2011 was $0.14. Centurion may sell our shares of common stock described in this prospectus at prevailing market prices or at privately negotiated prices

This investment involves a high degree of risk. You should purchase shares only if you can afford a complete loss. See “Risk Factors” beginning on page 6.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ________, 2011.

3

TABLE OF CONTENTS

|

|

Page

|

|

PROSPECTUS SUMMARY

|

6

|

|

RISK FACTORS

|

9

|

|

FORWARD-LOOKING STATEMENTS

|

14

|

|

USE OF PROCEEDS

|

14

|

|

BUSINESS

|

16

|

|

MARKET PRICE OF COMMON STOCK AND OTHER STOCKHOLDER MATTERS

|

20

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

21

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

25

|

|

EXECUTIVE COMPENSATION

|

28

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

31

|

|

SELLING STOCKHOLDERS

|

31

|

|

PLAN OF DISTRIBUTION

|

32

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

34

|

|

DESCRIPTION OF SECURITIES

|

34

|

|

EXPERTS

|

35

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

35

|

|

LEGAL MATTERS

|

36

|

|

WHERE YOU CAN FIND MORE INFORMATION

|

36

|

|

INDEX TO FINANCIAL STATEMENTS

|

37

|

|

PART II

|

53

|

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change in our affairs since the date of this prospectus is correct as of any time after its date.

4

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. You should read the entire prospectus carefully, including, the section entitled "Risk Factors" before deciding to invest in our common stock.

About Us

We are a development stage plastics recovery, separation, cleaning, and recycling company. We intend to supply recycled commercial plastics to industries such as the automotive and consumer products industries, and plan to construct large-scale plastics recycling facilities near automotive shredder locations nationwide. Operating with large national metal recycling partners, the Company, using a patent-pending process developed in conjunction with Thar Process, Inc., and Ergonomy LLC, will produce recycled commercial grade plastics ready to be re-introduced into commerce. Additionally, with other strategic partners, we will convert waste and scrap plastic (both from its own processing and from other sources) into high-value energy products, including synthetic oil.

For the three months ended March 31, 2011 and 2010, we had revenue of $34,505 and $0, respectively, and net losses of $402,311 and $369,358, respectively. For the years ended December 31, 2010 and 2009, we had no revenues and net losses of $3,261,492 and $599,152, respectively.

In our auditors' report dated April 4, 2011, they have expressed substantial doubt about our ability to continue as a going concern.

About This Offering

This offering relates to the resale of up to 14,606,826 shares of our common stock by Selling Security Holder, which consists of (i) 290,641 shares issued to Selling Security Holder as a commitment fee, (ii) 31,250 shares issued to Selling Security Holder as a due diligence/legal and administrative fee, and (iii) 14,284,935 Put Shares that we will put to Centurion pursuant to the Investment Agreement. The 14,606,826 shares included in this prospectus represent a portion of the aggregate shares issuable to Selling Security Holder under the Investment Agreement. This portion was calculated as approximately one third of the Company’s public float.

On April 8, 2011, Company entered into an investment agreement with Centurion Private Equity, LLC (“Centurion” or “Selling Security Holder”). Pursuant to the Investment Agreement,

|

●

|

Centurion agreed to purchase from the Company, from time to time in the Company’s sole discretion (subject to the conditions set forth therein), for a period commencing on the effective date of the registration statement to be filed by the Company for resale of the shares of common stock issuable under the Investment Agreement, until the earlier of (i) two years after the registration statement to which this prospectus is made a part is declared effective by the SEC, or (ii) thirty months from the date of the Investment Agreement,

up to $5,000,000 in the Company’s common stock.

|

|

●

|

The Company issued to Centurion 290,641 shares of common stock as a commitment fee (the “Commitment Shares”) and 31,250 shares of common stock as a due diligence/legal and administrative fee (the “Fee Shares”).

|

|

●

|

Pursuant to a registration rights agreement between the Company and Centurion entered into in connection with the Investment Agreement, the Company agreed to file a registration statement for the resale of not less than the maximum number of shares of common stock allowable pursuant to Rule 415 under the Securities Act of 1933, as amended, issuable under the Investment Agreement (including the Commitment Shares and the Fee Shares).

|

|

●

|

Generally, the price per share for each Put will be determined as follows: If the Market Price (defined below) for the Put is greater than $0.10, the purchase price for the Put Shares (the “Put Share Price”) sold in that Put shall equal 97% of the Market Price for such Put, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. If the Market Price for the Put is $0.10 or less, the purchase price for the Put Shares sold in that Put shall equal the lesser of (i) 97% of the Market Price for such Put or (ii) the Market Price for such Put minus $0.01, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. “Market Price” means the average of the three lowest daily volume weighted average prices published daily by Bloomberg LP for our common stock during the fifteen consecutive trading day period immediately following the date specified by us on which we intend to exercise the applicable Put. “Company Designated Minimum Put Share Price” means a minimum purchase price per Put share at which Centurion may purchase shares of common stock pursuant to the Company’s Put notice. The Company Designated Minimum Put Share Price The Company Designated Minimum Put Share Price shall be no greater than the lesser of (i) 80% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125 and shall be no less than the lesser of (i) 70% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125.

|

|

●

|

The maximum amount of common stock that Centurion shall be obligated to purchase with respect to any single closing under the Investment Agreement will be the lesser of (i) 2,000,000 shares, (ii) 15% of the sum of the aggregate daily reported trading volume in the Company’s common stock for all Evaluation Days (as defined in the Investment Agreement) in the Pricing Period (as defined in the Investment Agreement), excluding any block trades that exceed 20,000 shares of common stock, (iii) the number of Put Shares (as defined in the Investment Agreement) which, when multiplied by their respective Put Share Prices (as defined in the Investment Agreement), equals the Maximum Put Dollar Amount (as defined in the Investment Agreement), and (iv) such amount which would cause Centurion’s beneficial ownership of the Company’s common stock to exceed 4.9%.

|

We relied on an exemption from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). The transaction does not does involve a private offering, Centurion is an “accredited investor” and Centurion has access to information about the Company and its investment.

At an assumed purchase price under the Investment Agreement of $0.1358 (equal to 97% of the closing price of our common stock of $0.14 on July 7, 2011), we will be able to receive up to $1,939,894 in gross proceeds, assuming the sale of the entire 14,284,935 Put Shares being registered hereunder pursuant to the Investment Agreement. At an assumed purchase price of $0.1358 under the Investment Agreement, we would be required to register 22,533,917 additional shares to obtain the balance of $5,000,000 under the Investment Agreement.

There are substantial risks to investors as a result of the issuance of shares of our common stock under the Investment Agreement. These risks include dilution of stockholders, significant decline in our stock price and our inability to draw sufficient funds when needed.

Centurion will periodically purchase our common stock under the Investment Agreement and will, in turn, sell such shares to investors in the market at the market price. This may cause our stock price to decline, which will require us to issue increasing numbers of common shares to Centurion to raise the same amount of funds, as our stock price declines.

Summary of the Shares offered by the Selling Security Holder

|

Common stock offered by Selling Security Holder

|

14,606,826 shares of common stock (including 321,891 previously issued shares and 14,284,935 shares issuable as Put Shares under the Investment Agreement).

|

|

|

Common stock outstanding before the offering

|

69,212,730, as of June 20, 2011

|

|

|

Common stock outstanding after the offering

|

83,497,665 shares.

|

|

|

Terms of the Offering

|

Selling Security Holder will determine when and how it will sell the common stock offered in this prospectus.

|

|

|

Termination of the Offering

|

Pursuant to the Investment Agreement, this offering will terminate on the earlier to occur of (i) two years after the registration statement to which this prospectus is made a part is declared effective by the SEC and (ii) 30 months from April 8, 2011).

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the shares of common stock offered by Selling Security Holder. However, we will receive proceeds from sale of our common stock under the Investment Agreement. The proceeds from the offering will be used for working capital and general corporate purpose. See “Use of Proceeds.”

|

|

|

Risk Factors

|

The common stock offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors” beginning on page 6.

|

|

|

OTCBB Symbol

|

GETH

|

5

RISK FACTORS

An investment in the Company’s common stock involves a high degree of risk. You should carefully consider the risks described below as well as other information provided to you in this prospectus. If any of the following risks actually occur, our business, financial condition or results of operations could be materially adversely affected, the value of our common stock could decline, and you may lose all or part of your investment.

Risk Factors related to our Business

We are currently not profitable and may never become profitable.

We have a history of losses totaling $4,588,092 through March 31, 2011 and we expect to incur additional substantial operating losses for the foreseeable future and we may never achieve or maintain profitability. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our Common Stock and investors would in all likelihood lose their entire investment.

Our independent registered accounting firm has expressed doubt about our ability to continue as a going concern.

Because, as of December 31, 2010, we had not generated revenue since our inception, our independent registered accounting firm has included in their report for the years ended December 31, 2010 and 2009, an expression of uncertainty with respect to the Company’s ability to continue as a going concern.

Our independent registered accounting firm has expressed doubt about our ability to continue as a going concern.

Because, as of December 31, 2010, we had not generated revenue since our inception, our independent registered accounting firm has included in their report for the years ended December 31, 2010 and 2009, an expression of uncertainty with respect to the Company’s ability to continue as a going concern.

We may not be able to retain our interest in our Magic Bright subsidiary.

On March 30, 2011, we closed on the acquisition of all of the issued shares of Magic Bright Limited (“Magic Bright”). Our only revenues to date have been through our Magic Bright subsidiary. Under the terms of the purchase agreement pursuant to which we acquired all of the issued capital of Magic Bright, if the Company (i) does not obtain and allocate at least $2,000,000 of net proceeds from financings towards the business and operations of Magic Bright by way of interest free loans from the Company to Magic Bright on or before the date falling on the expiry of 12 months from the closing or (ii) does not obtain and allocate at least $3,000,000 in aggregate of such net proceeds towards the business and operations of Magic Bright by way of interest free loans from the Company to Magic Bright on or before the date falling on the expiry of 15 months from the closing or (iii) fails to pay all of the $1,000,000 in cash consideration for the acquisition by December 16, 2011, each seller shall have the option to re-purchase the Ordinary Shares sold by such seller to the Company, in exchange for the Magic Bright Acquisition Series Convertible Preferred Stock issued by the Company to such seller. In addition, three years from the closing, each seller will have a one-time ninety (90) day option to purchase back 50.1% of the Ordinary Shares sold by such seller to the Company, in exchange for the 50% of the Magic Bright Acquisition Series Convertible Preferred Stock issued by the Company to such seller (or the fair market equivalent in cash of such shares).

Our business is difficult to evaluate because we have a limited operating history and an uncertain future.

We have a limited operating history upon which to evaluate our present business and future prospects. We face risks and uncertainties relating to our ability to implement our business plan successfully. Our operations are subject to all of the risks inherent in the establishment of a new business enterprise generally. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered in connection with the formation of a new business, the commencement of operations and the competitive environment in which we operate. If we are unsuccessful in addressing these risks and uncertainties, our business, results of operations, financial condition and prospects will be materially harmed.

We will need significant additional capital, which we may be unable to obtain.

As of March 31, 2011, we had $76,300 in cash available. We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. Accordingly we need significant additional capital to fund our operations. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. If we are unable to raise substantial capital, investors will lose their entire investment.

If our strategy is unsuccessful, we will not be profitable and our stockholders could lose their investment.

We do not believe there are track records for companies pursuing our strategy, and there is no guarantee that our strategy will be successful or profitable. If our strategy is unsuccessful, we will fail to meet our objectives and not realize the revenues or profits from the business we pursue, which would cause the value of the Company to decrease, thereby potentially causing in all likelihood, our stockholders to lose their investment.

6

Our business will be dependent on a few large suppliers for feedstock and is vulnerable to changes in availability or supply of such feedstock.

We intend to derive our feedstock from suppliers who are operating large automotive shredders. Any substantial alteration or termination of our contracts or agreements with those particular suppliers may have a material adverse effect on our revenue as we may be unable to run our operation at capacity without a sufficient source of feedstock.

We will rely on several large customers for our product and are vulnerable to dramatic shifts in their industry.

We intend to focus on selling our product to the automotive industry initially, for use in production of new automobiles. Most of our customers and end users are subject to budgetary and political constraints which may delay or limit purchases of our products, and we will have no control over those decisions.

We may be unable to successfully execute any of our identified business opportunities or other business opportunities that we determine to pursue.

We currently have a limited corporate infrastructure. In order to pursue business opportunities, we will need to continue to build our infrastructure and operational capabilities. Our ability to do any of these successfully could be affected by any one or more of the following factors:

|

1.

|

Our ability to raise substantial additional capital to fund the implementation of our business plan

|

|

2.

|

Our ability to execute our business strategy

|

|

3.

|

The ability of our products and services to achieve market acceptance

|

|

4.

|

Our ability to manage the expansion of our operations and any acquisitions we may make, which could result in increased costs, high employee turnover or damage to customer relationships

|

|

5.

|

Our ability to attract and retain qualified personnel

|

|

6.

|

Our ability to manage our third party relationships effectively

|

|

7.

|

Our ability to accurately predict and respond to the rapid technological changes in our industry and the evolving demands of the markets we serve.

|

Our failure to adequately address any one or more of the above factors could have a significant impact on our ability to implement our business plan and our ability to pursue other opportunities that arise.

If we are unable to manage our intended growth, our prospects for future profitability will be adversely affected.

We intend to aggressively expand our marketing and sales program. Rapid expansion may strain our managerial, financial and other resources. If we are unable to manage our growth, our business, operating results and financial condition could be adversely affected. Our systems, procedures, controls and management resources also may not be adequate to support our future operations. We will need to continually improve our operational, financial and other internal systems to manage our growth effectively, and any failure to do so may lead to inefficiencies and redundancies, and result in reduced growth prospects and profitability.

Our insurance policies may be inadequate in a catastrophic situation and potentially expose us to unrecoverable risks.

We will have limited commercial insurance policies. Any significant claims against us would have a material adverse effect on our business, financial condition and results of operations. Insurance availability, coverage terms and pricing continue to vary with market conditions. We endeavor to obtain appropriate insurance coverage for insurable risks that we identify, however, we may fail to correctly anticipate or quantify insurable risks. We may not be able to obtain appropriate insurance coverage, and insurers may not respond as we intend to cover insurable events that may occur. We have observed rapidly changing conditions in the insurance markets relating to nearly all areas of traditional corporate insurance. Such conditions have resulted in higher premium costs, higher policy deductibles and lower coverage limits. For some risks, we may not have or maintain insurance coverage because of cost or availability.

We may become liable for damages for violations of environmental laws and regulations.

We are subject to various environmental laws and regulations enacted in the jurisdictions in which we operate which govern the manufacture, importation, handling and disposal of certain materials used in our operations. We are in the process of establishing procedures to address compliance with current environmental laws and regulations and we monitor our practices concerning the handling of environmentally hazardous materials. However, there can be no assurance that our procedures will prevent environmental damage occurring from spills of materials handled by the Company or that such damage has not already occurred. On occasion, substantial liabilities to third parties may be incurred. We may have the benefit of insurance maintained by the Company. However, the Company may become liable for damages against which it cannot adequately insure or against which it may elect not to insure because of high costs or other reasons.

We face intense competition and may not be able to successfully compete.

The Company currently does not have direct competitors in the capacity range we target. However, there can be no assurance that: (i) the Company will not have direct competition in the future, (ii) that such competitors will not substantially increase the resources devoted to the development and marketing of their products and services that compete with those of the Company, or (iii) that new or existing competitors will not enter the market in which the Company is active.

We rely on key personnel and, if we are unable to retain or motivate key personnel or hire qualified personnel, we may not be able to grow effectively.

Our success depends in large part upon the abilities and continued service of our executive officers and other key employees, particularly Mr. Gary DeLaurentiis, our Chief Executive Officer, and Wong Kwok Wing, Tony, the President of our Magic Bright subsidiary. There can be no assurance that we will be able to retain the services of such officers and employees. Our failure to retain the services of our key personnel could have a material adverse effect on the Company. In order to support our projected growth, we will be required to effectively recruit, hire, train and retain additional qualified management personnel. Our inability to attract and retain the necessary personnel could have a material adverse effect on the Company. We have no “key man” insurance on any of our key employees.

7

The People’s Republic of China’s economic policies and conditions could affect our business.

The principal market and operations of our Magic Bright subsidiary are in the PRC. Accordingly, our results of operations and prospects are subject, to a significant extent, to economic, political and legal developments in the PRC. While the PRC’s economy has experienced significant growth in the past 20 years, such growth has been uneven geographically and among various sectors of the economy. The Chinese government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall economy of the PRC, but some measures may have a negative effect on us. For example, our operating results and financial condition may be adversely affected by changes relating import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC’s political, economic and social life.

Risks Relating to the Offering

We are registering an aggregate of 14,606,826 shares of common stock issued or issuable under the Investment Agreement. The sale of such shares could depress the market price of our common stock.

We are registering an aggregate of 14,606,826 shares of common stock under the registration statement of which this prospectus forms a part, including (i) 290,641 shares issued to Centurion as a commitment fee pursuant to the terms of the Investment Agreement, (ii) 31,250 shares issued to Centurion as a due diligence/legal and administrative fee in connection with the Investment Agreement, and (iii) 14,284,935 Put Shares that we will put to Centurion pursuant to the Investment Agreement. The 14,606,826 shares of our common stock represent approximately 33% of our public float. The sale of these shares into the public market by Centurion could depress the market price of our common stock.

The Company may not have access to the full amount available under the Investment Agreement.

We have not drawn down funds and have not issued Put Shares under the Investment Agreement with Centurion. Our ability to draw down funds and sell shares under the Investment Agreement requires that the registration statement, of which this prospectus is a part, be declared effective by the SEC, and that this registration statement continue to be effective. In addition, the registration statement of which this prospectus is a part registers 14,606,826 total shares (including 14,284,935 Put Shares) of our common stock issued or issuable under the Investment Agreement, and our ability to access the Investment Agreement to sell any remaining shares issuable under the Investment Agreement is subject to our ability to prepare and file one or more additional registration statements registering the resale of these shares, which we may not file until the later of 60 days after Centurion and its affiliates have resold substantially all of the common stock registered for resale under the registration statement of which this prospectus is a part, or six months after the effective date of the registration statement of which this prospectus is a part. These subsequent registration statements may be subject to review and comment by the Staff of the SEC, and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these subsequent registration statements cannot be assured. The effectiveness of these subsequent registration statements is a condition precedent to our ability to sell the shares of common stock subject to these subsequent registration statements to Centurion under the Investment Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or all of the shares issuable under the Investment Agreement to be declared effective by the SEC in a timely manner, we will not be able to sell shares under the Investment Agreement unless certain other conditions are met. Accordingly, because our ability to draw down amounts under the Investment Agreement is subject to a number of conditions, there is no guarantee that we will be able to draw down any portion or all of the $5 million available to us under the Investment Agreement.

Because Centurion will be paying less than the then-prevailing market price for our common stock, your ownership interest may be diluted and the value of our common stock may decline by exercising the put right pursuant to the Investment Agreement.

Generally, the price per share for each Put will be determined as follows: If the Market Price (defined below) for the Put is greater than $0.10, the purchase price for the Put Shares (the “Put Share Price”) sold in that Put shall equal 97% of the Market Price for such Put, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. If the Market Price for the Put is $0.10 or less, the purchase price for the Put Shares sold in that Put shall equal the lesser of (i) 97% of the Market Price for such Put or (ii) the Market Price for such Put minus $0.01, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. “Market Price” means the average of the three lowest daily volume weighted average prices published daily by Bloomberg LP for our common stock during the fifteen consecutive trading day period immediately following the date specified by us on which we intend to exercise the applicable Put. “Company Designated Minimum Put Share Price” means a minimum purchase price per Put share at which Centurion may purchase shares of common stock pursuant to the Company’s Put notice. The Company Designated Minimum Put Share Price The Company Designated Minimum Put Share Price shall be no greater than the lesser of (i) 80% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125 and shall be no less than the lesser of (i) 70% of the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice, or (ii) the closing bid price of the Company’s common stock on the trading day immediately preceding the date of the Company’s Put notice minus $0.0125. Because the put price is lower than the prevailing market price of our common stock, to the extent that the put right is exercised, your ownership interest may be diluted. Centurion has a financial incentive to sell our common stock immediately upon receiving the shares to realize the profit equal to the difference between the discounted price and the market price. If Centurion sells the shares, the price of our common stock could decrease. If our stock price decreases, Centurion may have a further incentive to sell the shares of our common stock that it holds. These sales may have a further impact on our stock price.

The Investment Agreement’s pricing structure may result in dilution to our stockholders.

Pursuant to the Investment Agreement, Centurion committed to purchase, subject to certain conditions, up to $5 million of our common stock over a period commencing on the effective date of the registration statement of which this prospectus forms a part and terminating on the earlier of (i) two years after the registration statement to which this prospectus is made a part is declared effective by the SEC, or (ii) thirty months from the date of the Investment Agreement. If we sell shares to Centurion under the Investment Agreement, it will have a dilutive effect on the holdings of our current stockholders, and may result in downward pressure on the price of our common stock. If we draw down amounts under the Investment Agreement, we will issue shares to Centurion at purchase price per share determined as follows: If the Market Price for the Put is greater than $0.10, the purchase price for the Put Shares (the “Put Share Price”) sold in that Put shall equal 97% of the Market Price for such Put, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. If the Market Price for the Put is $0.10 or less, the purchase price for the Put Shares sold in that Put shall equal the lesser of (i) 97% of the Market Price for such Put or (ii) the Market Price for such Put minus $0.01, but shall in no event be less than the Company Designated Minimum Put Share Price for such Put, if applicable. If we draw down amounts under the Investment Agreement when our share price is decreasing, we will need to issue more shares to raise the same amount than if our stock price was higher. Issuances in the face of a declining share price will have an even greater dilutive effect than if our share price were stable or increasing, and may further decrease our share price.

Risks Relating to our Common Stock

There is a limited trading market for the Common Stock.

Our Common Stock is eligible for quotation on the Over-the-Counter Bulletin Board, or OTCBB. However, to date there has been a limited trading market for the Common Stock, and we cannot give assurance that a more active trading market will develop. The lack of an active, or any, trading market will impair a stockholder’s ability to sell his shares at the time he wishes to sell them or at a price that he considers reasonable. An inactive market will also impair our ability to raise capital by selling shares of capital stock and will impair our ability to acquire other companies or assets by using common stock as consideration.

8

Stockholders may have difficulty trading and obtaining quotations for our Common Stock.

There has been limited trading market for our Common Stock, and the bid and asked prices for our Common Stock on the Over-the-Counter Bulletin Board may fluctuate widely in the future. As a result, investors may find it difficult to dispose of, or to obtain accurate quotations of the price of, our securities. This severely limits the liquidity of our Common Stock, and would likely reduce the market price of our Common Stock and hamper our ability to raise additional capital.

The market price of our Common Stock is likely to be highly volatile and subject to wide fluctuations.

Dramatic fluctuations in the price of our Common Stock may make it difficult to sell our Common Stock. The market price of our Common Stock is likely to be highly volatile and could be subject to wide fluctuations in response to a number of factors that are beyond our control, including:

|

●

|

dilution caused by our issuance of additional shares of Common Stock and other forms of equity securities in connection with (i) future capital financings to fund our operations and growth, and (ii) attracting and retaining valuable personnel and in connection with future strategic partnerships with other companies;

|

| ● |

variations in our quarterly operating results;

|

| ● |

announcements that our revenue or income are below or that costs or losses are greater than analysts’ expectations;

|

| ● |

the general economic slowdown;

|

| ● |

sales of large blocks of our Common Stock;

|

| ● |

announcements by us or our competitors of significant contracts, acquisitions, strategic partnerships, joint ventures or capital commitments; and

|

| ● |

Fluctuations stock market prices and volumes.

|

These and other factors are largely beyond our control, and the impact of these risks, singly or in the aggregate, may result in material adverse changes to the market price of our Common Stock and/or our results of operations and financial condition.

The ownership of our Common Stock is highly concentrated in our officers.

Based on the 69,212,730 shares of Common Stock outstanding as of June 23, 2011, Gary DeLaurentiis our Chief Executive Officer beneficially owns approximately 23% of our outstanding Common Stock. As a result, Mr. DeLaurentiis has the ability to exercise a significant degree of control over our business by, among other items, his voting power with respect to the election of directors and all other matters requiring action by stockholders. Such concentration of share ownership may have the effect of discouraging, delaying or preventing, among other items, a change in control of the Company.

Our founders received their shares of our Common Stock at a price of $.01 per share.

Our founders received their shares of our Common Stock at a price of $.01 per share. The low purchase price for such shares may make it more likely that the shares will be sold at lower trading prices. The sale of such shares into the market could have a depressive effect on the trading price of our Common Stock, if then traded.

The Common Stock is subject to the “penny stock” rules of the SEC, which may make it more difficult for stockholders to sell the Common Stock.

The United States Securities and Exchange Commission (the “Commission”) has adopted Rule 15g-9 which establishes the definition of a "penny stock" for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

1.

|

That a broker or dealer approve a person's account for transactions in penny stocks; and

|

|

2.

|

The broker or dealer receives from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

9

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

1.

|

Obtain financial information and investment experience objectives of the person; and

|

|

2.

|

Obtain financial information and investment experience objectives of the person; and

|

|

3.

|

Make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks

|

|

4.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

5.

|

That the broker or dealer received a signed, written agreement from the investor prior to the transaction

|

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

The regulations applicable to penny stocks may severely affect the market liquidity for the Common Stock and could limit an investor’s ability to sell the Common Stock in the secondary market.

As an issuer of “penny stock,” the protection provided by the federal securities laws relating to forward looking statements does not apply to the Company.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to issuers of penny stocks. As a result, the Company will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by the Company contained a material misstatement of fact or was misleading in any material respect because of the Company’s failure to include any statements necessary to make the statements not misleading. Such an action could adversely affect our financial condition.

The Company has not paid dividends in the past and does not expect to pay dividends for the foreseeable future. Any return on investment may be limited to the value of the Common Stock.

No cash dividends have been paid on the Common Stock. We expect that any income received from operations will be devoted to our future operations and growth. The Company does not expect to pay cash dividends in the near future. Payment of dividends would depend upon our profitability at the time, cash available for those dividends, and other factors as the Company’s board of directors may consider relevant. If the Company does not pay dividends, the Common Stock may be less valuable because a return on an investor’s investment will only occur if the Company’s stock price appreciates.

The rights of the holders of common stock have been impaired by the issuance of preferred stock and may be further impaired by the potential future issuance of preferred stock.

We are authorized to issue up to 25,000,000 shares of blank check preferred stock of which 1,000,000 shares have been designated as Magic Bright Acquisition Series Convertible Preferred Stock (“Magic Bright Preferred Stock”). Holders of Magic Bright Preferred Stock will be entitled to dividends when, as and if declared by the board of directors, and on an-converted basis with the respect to dividends declared on the common stock. The Magic Bright Preferred Stock will entitle holders to a liquidation preference equal to the stated value of $5.00 per share (plus accrued but unpaid dividends). Holders of Magic Bright Preferred Stock are entitled to 5 votes for each share of Magic Bright Preferred Stock held by such holder. Beginning 12 months from the date of issuance of the Magic Bright Preferred Stock (which issuance occurred on March 30, 2011), the Magic Bright Preferred Stock may be converted into common stock, at a rate of 5 shares of common stock for each share of Magic Bright Preferred Stock. A holder of Magic Bright Preferred Stock may not convert any shares of Magic Bright Preferred Stock to common stock unless such holder converts all of such Magic Bright Preferred Stock held by such holder into common stock. The conversion rate will be subject to a one-time adjustment, if, at the time conversion, the 20 day average closing price of the common stock, is less than $1.00 per share, such that the holder would receive a sufficient number of shares of common stock to equal $5,000,000 (assuming the conversion of all 1,000,000 issued shares of Magic Bright Preferred Stock).

Furthermore, our board of directors has the right, without stockholder approval, to issue additional preferred stock with voting, dividend, conversion, liquidation or other rights which could adversely affect the voting power and equity interest of the holders of common stock, which could be issued with the right to more than one vote per share, and could be utilized as a method of discouraging, delaying or preventing a change of control. The possible negative impact on takeover attempts could adversely affect the price of our common stock. Although we have no present intention to issue any additional shares of preferred stock or to create any additional series of preferred stock, we may issue such shares in the future.

10

FORWARD-LOOKING STATEMENTS

This document contains forward-looking statements, which reflect the views of our management with respect to future events and financial performance. These forward-looking statements are subject to a number of uncertainties and other factors that could cause actual results to differ materially from such statements. Forward-looking statements are identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “projects,” “targets ” and similar expressions. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on the information available to management at this time and which speak only as of this date. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under “Risk Factors” beginning on page 9.

The identification in this document of factors that may affect future performance and the accuracy of forward-looking statements is meant to be illustrative and by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. You may rely only on the information contained in this prospectus.

We have not authorized anyone to provide information different from that contained in this prospectus. Neither the delivery of this prospectus nor the sale of common stock means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy these securities in any circumstances under which the offer or solicitation is unlawful.

USE OF PROCEEDS

We will not receive any proceeds from the resale of the common stock offered by Centurion pursuant to this prospectus. All proceeds from the resale of such shares will be for the account of Centurion. However, we will receive proceeds from the sale of the Put Shares to Centurion pursuant to the Investment Agreement. We intend to use the net proceeds from the sale of the Put Shares under the Investment Agreement for working capital or general corporate needs.

DESCRIPTION OF BUSINESS

Corporate History

Green EnviroTech Holdings Corp. (the “Company”) was incorporated in the State of Delaware on June 26, 2007 under the name Wolfe Creek Mining, Inc. On November 20, 2009, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Green EnviroTech Acquisition Corp., a Nevada corporation, and Green EnviroTech Corp. (“Green EnviroTech”), a plastics recovery, separation, cleaning, and recycling company. Green EnviroTech is a Nevada corporation formed on October 6, 2008 under the name EnviroPlastics Corporation. On October 21, 2009, Enviroplastics Corporation changed its name to Green EnviroTech Corp. and on July 20, 2010, the Company changed its name to Green EnviroTech Holdings Corp.

Pursuant to the Merger Agreement, on November 20, 2009 (the “Closing Date”), Green EnviroTech Acquisition Corp. merged with and into Green EnviroTech, resulting in Green EnviroTech becoming a wholly-owned subsidiary of the Company (the “Merger”). As a result of the consummation of the Merger Agreement, the Company issued approximately 45,000,000 shares of its common stock to the shareholders of Green EnviroTech, representing approximately 45% of the issued and outstanding common stock of the Company following the closing of the Merger. Further, the outstanding shares of common stock of Green EnviroTech were cancelled. The acquisition of Green EnviroTech is treated as a reverse acquisition, and the business of Green EnviroTech became the business of the Company. Immediately prior to the reverse acquisition, Wolfe Creek was not engaged in any active business.

Our common stock (“Common Stock”) is quoted on the Over-the-Counter Bulletin Board under the symbol “GETH”. There has been limited trading to date in the Common Stock. We have a total of 250,000,000 authorized common shares with a par value of $0.001 per share and 25,000,000 authorized preferred shares. On March 11, 2010, the Company effected a 14-to-1 stock dividend, pursuant to which each stockholder of the Company was issued 14 additional shares of common stock for each share of common stock held by such shareholder as of the record date for the stock dividend of March 11, 2010. As a result of this stock dividend, the number of shares of the Company’s common stock issued and outstanding increased from approximately 4,000,000 to 60,000,000. As of May 18, 2011, there are 67,047,447 shares of Common Stock issued and outstanding. All shares amounts in this prospectus reflect the stock dividend unless the context suggests otherwise.

References in this prospectus to “Green EnviroTech”, “we”, “us”, “our” and similar words refer to the Company and its wholly-owned subsidiaries, unless the context otherwise requires. Prior to the effectiveness of the reverse acquisition, these terms refer to Green EnviroTech Corp. References to “Wolfe Creek” refer to the Company and its business prior to the reverse acquisition

Our Principal Offices

Our executive offices are located at 5300 Claus Road, Riverbank, CA 95367, and our phone number at this address is (209) 863-9000.

Overview of Our Business

The Company is a converter of waste plastic material into products useable in industrial applications. These applications are primarily base plastic pellet material used by the plastic extrusion industry and crude petroleum used by the major oil refineries.

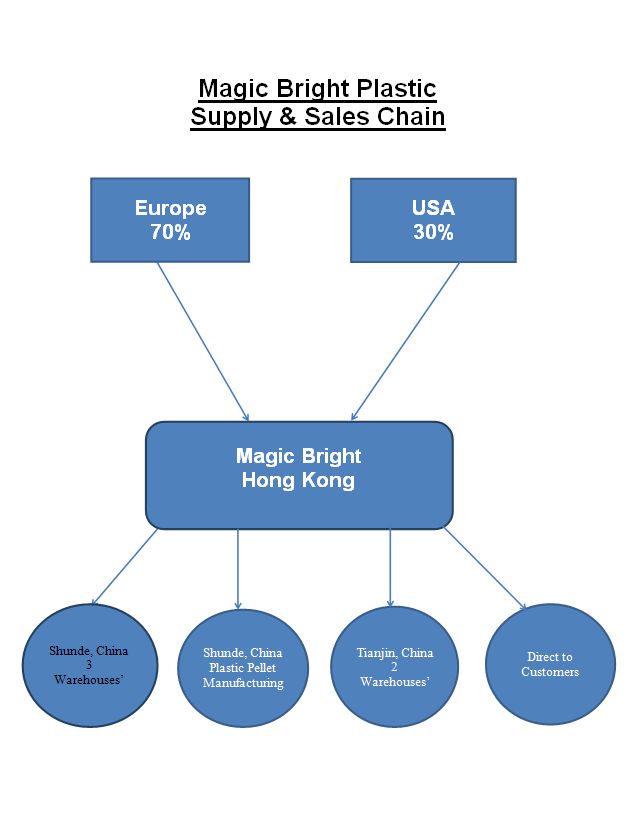

On March 30, 2011, the Company completed the acquisition of Magic Bright Limited (“Magic Bright”), which is currently the Company’s sole source of revenue. Magic Bright is a global trader and distributor of waste plastic materials. The principal outlet for its products is in the People’s Republic of China (the “PRC”). Magic Bright’s main office is located in the Lokuille Commercial Building, Unit B/18F, 27 Lock Road, Tsimshatusi, Kowloon, Hong Kong. Magic Bright acquires product from primarily the US and Europe and transports it to Hong Kong and into mainland China. Its primary customers are small to mid size companies, who purchase the waste plastic in smaller quantities and further process the waste material for re-sale to plastic product manufacturers or are pellet manufacturers themselves.

11

Magic Bright has been in operation since 2000 and focuses on plastic recycling waste streams from the US and Europe with a majority of the materials coming from Europe. Magic Bright also trades from time to time in paper and metal products. Magic Bright purchases plastic materials from the post-consumer and industrial waste streams. Recycling programs in communities collect plastic bottles and film plastic, bale the materials and offer them for sale. Magic Bright uses these sources for a majority of its trading. Additional supplies come from manufacturing processes that have produced scrap and offer it for sale.

Magic Bright suppliers prepare the material for shipping by compressing it into a bale, boxed or put into super sacks and loaded into an export container, which then are delivered to the port. The shipper normally handles this part of the process. Each container load is a minimum of 40,000 pounds. Once the material is purchased, Magic Bright decides which one of its warehouses to ship to or has it shipped directly to a customer. Magic Bright maintains three warehouses in the city of Shunde in southern China and two in the northern city of Tianjin. Both locations have a sales force. Magic Bright employs four sales persons in Shunda and three in Tianjin, who deal with the buyers of the scrap plastics. Most of the buyers have been purchasing materials from Magic Bright for several years. In addition to the warehouses in Shunde, Magic Bright maintains a plant in Shunde that takes film plastic, washes and converts the film to pellets. These pellets are sold regionally to manufactures who consume the raw materials in their process.

Magic Bright also owns, through a subsidiary, property in Shunde that consists of approximately 10 acres with a 20,000 square foot building. In addition there is a structure that is 25% complete that is 30,000 square feet. The Company has developed plans of completing the building in 2012 for approximately $ 500,000 USD. The property is currently leased to a furniture company for $10,000 per month. The Company intends to use the property for an additional plant that will take film plastic, washe and convert the film to pellets.

Apart from Magic Bright, we are a development stage company that intends to supply recycled commercial plastics to industries such as the automotive and consumer products industries, and plan to construct large-scale plastics recycling facilities near automotive shredder locations nationwide. Operating with large national metal recycling partners, the Company, using a patent-pending process developed in conjunction with Thar Process, Inc., and Ergonomy LLC, will produce recycled commercial grade plastics ready to be re-introduced into commerce. Additionally, with other strategic partners, we will convert waste and scrap plastic (both from its own processing and from other sources) into high-value energy products, including synthetic oil.

Each year, millions of tons of automotive shredder residue (“Shredder Residue”) containing reusable and recyclable plastics are unnecessarily disposed of in landfills. We believe this is because, while national and global demand for recycled plastic has increased dramatically over the past decade, the technology to efficiently and effectively recycle plastic material from this residue stream has lagged behind. This has resulted in tremendous waste and created a market for recycled commercial plastics, creating an opportunity for someone with a cost-effective recovery process.

We now have such a process. We were formed to capitalize on the growing market to supply recycled commercial plastic to businesses which currently use or want to use recycled plastics in their products, such as the automotive and consumer products industries. Working with our metal shredder/recycling partners, we intend to utilize our proprietary cleaning technology to take the Shredder Residue headed to landfills tainted with contaminants and convert it into two streams of recyclable material with no remaining trace of contaminants. Using our process, plastics, rubber, and foam, can be recovered from the shedder waste. We will use our proprietary technology to process the plastic stream, removing the contaminants and creating recycled commercial plastic material ready to be re-introduced into commerce.

Our plastic recovery process is both highly cost effective and efficient, and it dramatically reduces the amount of Shredder Residue going to landfills. Our process is environmentally responsible on multiple levels, and it will assist our customers in reducing their carbon footprint by allowing them to utilize a greater percentage of recycled material in their products.

The recovered plastics by us will be our main source of revenue. Automotive parts manufacturers are our primary target market. However, the use of our recycled materials isn’t limited to automotive parts. Numerous other durable goods manufacturers utilize plastics, and recycled plastic will work in many applications. As a result, we believe there is significant demand in both domestic and international markets for these materials, and we have identified multiple targets for our output stream of recycled material, beginning with a large multi-national supplier to the automotive industry worldwide. We believe that our customers will be able to utilize a larger percentage of highly cost-effective recycled plastic in the manufacturing process of their products and create dramatic savings over the cost of using only virgin plastic (tied to the cost of petroleum).

Automotive Parts---Our Largest Market Prospect

The automotive industry uses plastic for its durability, corrosion resistance, ease of coloring and finishing, resiliency, cost, energy efficiency, and lightweight characteristics. Utilizing lightweight manufacturing products translates directly into improved fuel usage experience and lowered costs to the consumer as well as lower costs to the manufacturer. And, the use of plastics in car bodies, along with improvements in coating technology, contribute to automobiles lasting much longer than vehicles did before the widespread use of plastics in fender liners, quarter panels, and other body parts.

According to the U.S. Department of Labor, despite news of plant closures and unemployed autoworkers, the motor vehicle and parts manufacturing industry continues to be one of the largest employers in the country and a major contributor to the US economy.

In 2006, it was determined by the automotive industry that approximately 9,200 establishments manufactured motor vehicles and motor vehicle parts. We believe the number of such establishments has since declined due to the economic down turn. The exact number of establishments that have closed has not been determined. However, a number of the establishments have down sized and merged. Such establishments include small parts plants with a few workers to huge assembly plants that employ thousands; the largest sector of this industry is motor vehicle parts manufacturing. This industry includes electrical and electronic equipment, engines and transmissions, brake systems, seating and interior trim, steering and suspension components, air-conditioners, and motor vehicle stampings, such as fenders, tops, body parts, trim, and molding. Plastics are a large and growing part of many of these products.

12

In 2001, Chrysler Motors created the “Care Car II” program to demonstrate the usage of recycled plastics in automotive design, manufacturing and materials certification. It was thought that use of recycled plastic in vehicles would reduce costs (from the cost of virgin plastic), reduce the carbon foot print ‘created’ in production, and improve the life cycle analysis results on each vehicle. The key objectives of the “Care Car II” program were to:

|

1.

|

Obtain recycled plastics;

|

|

2.

|

Work with the supplier base responsible for the production molding of many parts and components;

|

|

3.

|

Allow suppliers to manufacture these parts using recycled plastics, and process them using the same procedures used in manufacturing parts from virgin plastic; and

|

|

4.

|

Demonstrate recovery technology that made plastic recycling more cost effective.

|

To demonstrate the “Care Car II” program, plastics were recovered from shredder residue including PP/PE (Polypropylene/Polyethylene), ABS (Acrylonitrile butadiene styrene), PUR ( Polyurethane) as well as foam and rubber. These materials were then used to create over 150 pounds of recycled plastic that could replace virgin plastics in a new vehicle. The program vehicles’ parts (molded from recycled plastics) were then subjected to accelerated durability testing and met all Chrysler’s performance and material specifications. The vehicles were subsequently shown at the following technical and public events in 2002:

· New York Auto Show;

· Paris Auto Show;

· GPEC International Plastics Convention, Detroit, MI;

· Automotive Reporters Review, New York, NY;

· Washington, DC (Received Environmental Award for the Year);

· Senior Management- DaimlerChrysler, Auburn Hills, MI. and Stuttgart Germany; and

· Ford Motor Company, GM, Mercedes and Porsche.

This demonstration program received numerous write-ups in technical magazines, SAE (Society of Automotive Engineers) Papers, newspapers and proved that substantial cost savings were available to automotive manufacturers through the use of recycled plastic material. It was determined that 100-150 pounds of recycled plastic could be implemented into automotive plastics components for both the interior and exterior parts of new vehicles. However, at the time in 2001, the necessary production, recovery, and cleaning technologies (removal of PCB’s (Polychlorinated biphenyls)) for recycling plastics from waste were lacking, thus making large-scale operations unfeasible.

Today, our cleaning technologies can provide a viable stream of recycled plastics into commerce. We intend to take advantage of the increasing market for recycled goods, starting with automotive parts, and to assist companies facing growing mandates to utilize recyclable material in their products. With our strategic partners, we will focus on industries faced with rising material costs and searching for ways to apply and introduce “green” technology and materials to their products. Our technology will allow these industries to reduce manufacturing costs and decrease the carbon footprint of their products.

Ironically, the automotive recyclers will supply the Shredder Residue used by Green EnviroTech to create commercially recycled plastics from the shredding of old vehicles. Currently, about 15,000,000 automobiles are shredded every year in the US alone. According to the Institute for Scrap Recycling Industries (ISRI) and US Car data, each vehicle contains roughly 300 pounds of plastics (recyclable potential: 4.5 billon pounds per year) that can be recycled by our process. Therefore, we create a virtuous circle of recycling: Shredder Residue from old vehicles creating recycled plastics then sold to major automotive manufacturers for use in new vehicles.

The Green EnviroTech Separation Process

Our recycling process begins by receiving Shredder Residue generated by metal recycling companies. The Shredder Residue is separated into four (4) distinct streams of material: plastics, foam, rubber, and waste. The automated separation of shredder residue is a mechanical process developed by one of our strategic partners and shareholder, Central Manufacturing located in Groveland, IL.

Once the plastics are separated from the shredder residue, they are ground into inch-long pieces and the cleaning process starts. With our patent pending, proprietary technology we then remove any contaminants from the plastics stream using a single step process consisting of a combination of two liquefied gases under pressure. This innovative cleaning system is effective and extremely cost efficient.

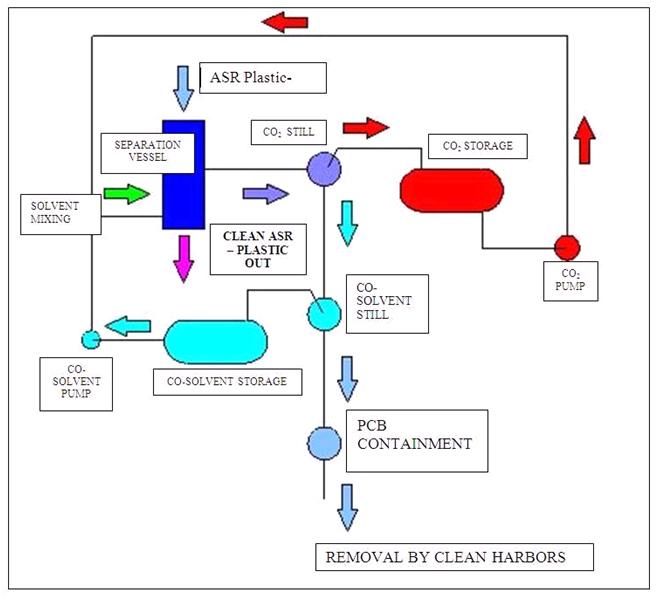

Plastic resin which has been surface contaminated is submerged in a liquefied gas mixture. The gas mixture works to remove the contaminants in a unique way. A propane component of the mixture dissolves the heavy "oils" and "waxes" because of its high solvent capability. A carbon dioxide component provides light oil removal, a small molecule to reach deep into the material, and a safety blanket for the propane. Throughout the system, the plastic resin is contacted with the gas or liquid stream of the mixture and agitated to ensure complete removal of the contaminants. The liquid mixture is then distilled for reuse while the contaminants are safely collected. The entire process is illustrated below.

13

Once cleaned, the plastic stream is then separated into three (3) separate streams using sink float technology. The separated streams are then sent through a metal detector and are ready for market—either packaged, or sent into a rail car or bulk truck ready for use by our compounding partner. The three (3) output streams offered for sale will include a PP/PE mix, an ABS / HIPS mix, and mixed plastics. Rubber and foam waste streams will be disposed of, and any plastic waste will be utilized in the P2Ffuel conversion process wherever possible.

We plan to combine our proprietary technology and the experience of our management team to further streamline and improve this process over time. Our on-going research and development efforts will be focused on continually improving the characteristics and quality of the recycled plastics, thus allowing our customers to use increased percentages of recycled material in their end products. We plan to provide plastics parts manufacturing industries with increasing cost savings, production efficiencies, and environmentally friendly methods, which will allow them to integrate commercially recycled plastics into the production of new products too.

Compounding After Cleaning and Separation

The Modern Plastics Encyclopedia (1995) defines “plastics compounding” as: the incorporation of additional ingredients to base plastic types needed for processing to create optimal properties in the finished material. These ingredients may include additives to improve a polymer's physical properties, stability or process ability.

Compounding is usually required for recycled materials for the following reasons:

|

1.

|

It allows virgin materials to be mixed with recycled materials to meet material specifications for performance and recycled material content (minimum: 25%) targets;

|

|

2.

|

It allows additives to be compounded into the recycled material to meet target application requirements;

|

|

3.

|

Recycled materials are typically ground from parts that produce flakes. The compounding process turns them into pellets that can be more easily handled by traditional plastics processing equipment; and

|

|

4.

|

It provides a very important homogenization step. Recycled materials are usually a mix of many different grades of the same basic material. Even though the materials might be from the same family, differences in molecular weight, copolymer ratios, etc. can lead to a mixed material having poor homogeneity. The intensive physical mixing in a molten polymer that is achieved during extrusion can homogenize different grades of materials.

|

Facilities Locations Reduce Transportation Costs

We keep our own production costs to a minimum by locating our recycling facilities in close proximity to metal shredders, and thus our shredder residue source material. Over thirty (30) potential sites nationally (and one hundred forty (140) sites internationally) have been identified with the assistance of one of our strategic partners, Sadoff & Rudoy Metals. Additionally, we project to have one facility on the same site as our plastics compounding partner, which will dramatically reduce our shipping costs and (necessary) price mark-ups to end user customers. At these sites, we intend to build or lease its facilities to minimize transportation costs, to potentially reduce land and plant costs, and to help create and foster relationships with our various partners’ industries. This location strategy will continually benefit both our suppliers and customers.

Facilities Development Plan

On December 4, 2009, the Company formed Green EnviroTech Wisconsin, Inc., (“GET WISC”) a Wisconsin corporation, in anticipation of opening a plant in Wisconsin.

The Company had previously announced it was exploring the idea of opening a plant in Fond du Lac, Wisconsin. However, we have since decided to locate the plant in another city in Wisconsin. There were no incentives offered by Fond du Lac other than to offer to sell land suitable for plant construction when no building for lease was found suitable for the Company’s needs. The Industrial Park location appeared to be suitable and the Company started design work at the location. The site called for a rail spur which was turned down by the railroad for lack of enough space to meet their requirements. The Company looked elsewhere and decided to direct its efforts to Sheboygan where the city has offered incentives and the city has commercial building space available suitable for the needs of the plant. The area also has a pool of experienced work force available to compliment the employee requirements needed for the plant.