Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2011

TITAN IRON ORE CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

000-52917

|

98-0546715

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

3040 N. Campbell Ave., Suite 110, Tucson AZ 85719

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (520) 989-0020

4320 – 196 Street, S.W., #111, Lynwood, WA 98036-6754

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

TABLE OF CONTENTS

|

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

|

4

|

|

Item 1.01 - Entry into a Material Definitive Agreement.

|

5

|

|

Item 2.01 - Completion of Acquisition or Disposition of Assets

|

9

|

|

FORM 10 INFORMATION

|

9

|

|

BUSINESS

|

9

|

|

Overview

|

9

|

|

Wyoming Complex Project, Albany County, Wyoming

|

10

|

|

Our Current Business

|

11

|

|

RISK FACTORS

|

12

|

|

Risks Associated with Mining

|

12

|

|

Risks Related to Our Company

|

16

|

|

Risks Associated with Our Common Stock

|

17

|

|

Risks Relating to the Early Stage of our Company and Ability to Raise Capital

|

18

|

|

DESCRIPTION OF PROPERTIES

|

19

|

|

Principal Office

|

19

|

|

Mineral Properties

|

19

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

22

|

|

Overview

|

22

|

|

Results of Operations

|

23

|

|

Liquidity and Capital Resources

|

24

|

|

Going Concern

|

24

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

24

|

|

Changes in Control

|

25

|

|

DIRECTORS AND EXECUTIVE OFFICERS

|

25

|

|

Business Experience

|

25

|

|

Term of Office

|

27

|

|

Family Relationships

|

27

|

|

Involvement in Certain Legal Proceedings

|

27

|

|

EXECUTIVE COMPENSATION

|

28

|

|

Employment or Consulting Arrangements

|

29

|

|

Equity Awards

|

30

|

|

Director Compensation

|

30

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

|

30

|

|

Transactions with Related Persons, Promoters, and Certain Control Persons

|

30

|

|

Director Independence

|

30

|

|

LEGAL PROCEEDINGS

|

31

|

|

MARKET PRICE OF AND DIVIDENDS ON OUR COMMON STOCK AND RELATED STOCKHOLDER MATTERS

|

31

|

|

Market Information

|

31

|

|

Transfer Agent

|

31

|

|

Holders of Our Common Stock

|

31

|

|

Dividends

|

31

|

|

Securities Authorized for Issuance under Equity Compensation Plans

|

31

|

|

Recent Sales of Unregistered Securities

|

31

|

ii

|

DESCRIPTION OF SECURITIES

|

32

|

|

INDEMNIFICATION OF DIRECTORS AND OFFICERS

|

32

|

|

FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

|

33

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

33

|

|

Item 5.01 - Changes in Control of Registrant

|

33

|

|

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

34

|

|

Item 5.06 - Changes in Shell Company Status.

|

34

|

|

Item 9.01 Financial Statements and Exhibits.

|

35

|

|

SIGNATURES

|

36

|

iii

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for future operations. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this report include statements about:

|

|

·

|

Our future exploration programs and results;

|

|

|

·

|

Our future capital expenditures; and

|

|

|

·

|

Our future investments in and acquisitions of mineral resource properties.

|

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

|

|

·

|

risks and uncertainties relating to the interpretation of sampling results, the geology, grade and continuity of mineral deposits;

|

|

|

·

|

risks and uncertainties that results of initial sampling and mapping will not be consistent with our expectations;

|

|

|

·

|

risks and uncertainties that the mineral deposits will never constitute proven and probable reserves which can be developed and mined economically;

|

|

|

·

|

mining and development risks, including risks related to accidents, equipment breakdowns, labor disputes, permitting, or other unanticipated difficulties with or interruptions and delays in development and production;

|

|

|

·

|

the potential for delays in exploration activities; risks related to the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses in exploration, development and production which are beyond the capacity of our company to manage;

|

|

|

·

|

risks related to commodity price fluctuations;

|

|

|

·

|

the uncertainty of an unproven business plan and lack of. revenue generation and profitability based upon our limited history;

|

|

|

·

|

substantial risks inherent in the establishment of a new business venture since our company is at a very early stage

|

|

|

·

|

risks and uncertainties inherent in mineral exploration ventures which by their very nature face a high risk of business failure.

|

|

|

·

|

risks related to intense competition in the mineral exploration and exploitation industry which causes our company to have to compete with our company’s competitors for financing and for qualified managerial and technical employees.

|

|

|

·

|

risks related to the engagement of our company’s directors and officers in other business activities whereby they may not have sufficient time to attend to our company’s business affairs

|

|

|

·

|

risks related to failure to obtain adequate financing and additional capital on a timely basis and on acceptable terms for our planned exploration and development;

|

4

|

|

·

|

risks related to environmental regulation and liability, and the ability to secure governmental consents and approvals;

|

|

|

·

|

risks that the amounts reserved or allocated for environmental compliance, reclamation, post-closure control measures, monitoring and on-going maintenance may not be sufficient to cover such costs;

|

|

|

·

|

risks related to tax assessments;

|

|

|

·

|

political and regulatory risks associated with mining exploration, development and production ; and

|

|

|

·

|

the risks in the section entitled “Risk Factors”.

|

Any of these risks could cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by the forward-looking statements contained in this report.

While these forward-looking statements and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

In this report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this report, the terms “we”, “us”, “our” and the “our company” mean Titan Iron Ore Corp. unless the context clearly indicates otherwise.

Item 1.01 - Entry into a Material Definitive Agreement.

Acquisition of Interest in Wyoming Complex Project, Albany County, Wyoming

Acquisition Agreement

Effective June 30, 2011 and in connection with the entry into an agreement (the “Acquisition Agreement”) with J2 Mining Ventures Ltd. (“J2 Mining”) dated June 13, 2011 and attached as Exhibit 10.1 to our Current Report on Form 8-K filed June 16, 2011, we completed the acquisition of a 100% right, title and interest in and to a property option agreement (the “Option Agreement”) from J2 Mining with respect to iron ore mineral properties located in Albany County, Wyoming (the “Wyoming Iron Complex”) by:

|

|

(a)

|

entering into an assignment of mineral property option agreement with J2 Mining and Wyomex LLC (the “Assignment Agreement”), whereby our company was assigned the 100% right, title and interest in and the Option Agreement from J2 Mining;

|

|

|

(b)

|

entering into an employment agreement with Andrew Brodkey as President and Chief Executive Officer of our company as described below;

|

|

|

(c)

|

entering into consulting agreements with Kriyah Consultants, LLC, Sage Associates, Inc. and J2 Mining as described below;

|

|

|

(d)

|

payment of $2,440 as reimbursement to J2 Mining for any direct out of pocket costs incurred by J2 Mining in acquiring the Option Agreement; and

|

5

|

|

(e)

|

causing our company’s affiliate shareholders to transfer a total of 18,000,000 fully-paid, non-assessable common shares in the capital of our company to J2 Mining and other persons as nominated by J2 pursuant to an affiliate stock purchase agreement described under Item 5.01 of this Current Report on Form 8-K.

|

The Option Agreement

The Option Agreement assigned to us from J2 Mining effective June 30, 2011, pursuant to the Assignment Agreement, was entered into on May 26, 2011 between J2 Mining and Wyomex LLC, pursuant to which Wyomex LLC, as optionor, granted to J2 Mining, as optionee, an exclusive right and option to acquire 100% undivided legal and beneficial interests in and to the Wyoming Iron Complex, consisting of certain unpatented lode mining claims, leased lands, and other interests in real property situated in Albany County, Wyoming. Pursuant to the Assignment Agreement, J2 Mining agreed to assign all its rights and interests in the property and the Option Agreement, and transfer all of its obligations under the Option Agreement to our company, and our company accepted and agreed to be bound by the terms of the Option Agreement.

The term of the option commenced on May 26, 2011 and initially extended until June 26, 2011, and may be extended for a maximum of six (6) successive one-month periods, at the sole election of our company, through notice to Wyomex LLC and tender of $5,000 from our company to Wyomex LLC for each of the first three (3) additional months and $15,000 for each additional month for months four (4) through six (6) as may be desired by us. The first $5,000 has been paid by us to Wyomex.

Subject to the terms and conditions of a definitive agreement to be executed by both our company and Wyomex LLC and prior to the date of termination of the sixth and final extension, our company may elect to exercise the option at any time during the option term by giving Wyomex LLC written notice of such election. Upon receipt of such notice, the parties shall execute an asset purchase agreement, which assets will include the unpatented mining claims, fee lands, mineral leases, any geological reports, data, laboratory information related thereto, buildings, mining equipment located within the property, water rights, accesses and rights-of-way, and generally all rights and appurtenances which are directly connected with the mining and business activities of Wyomex LLC related to the property, all of which shall be delivered free and clear of all liens or other encumbrances.

We may exercise the option by paying a total purchase price of $7,000,000, which shall consist of the following components:

|

|

(a)

|

payment at closing of $85,000 as an initial payment;

|

|

|

(b)

|

any monies or consideration previously paid by J2 Mining to Wyomex LLC;

|

|

|

(c)

|

commencing six (6) months from the date of closing and after receipt of the initial payment, and every six (6) months thereafter, we shall pay Wyomex LLC, as advance minimum royalty, $62,500, as adjusted under the Option Agreement, until the commencement of commercial production from the property; and

|

|

|

(d)

|

at the commencement of commercial production from the property, the semi-annual advance minimum royalty shall convert to a 4.5% gross metal value royalty on iron ore and/or other mineral materials produced and sold from the property and, except for events of force majeure, in no event shall the production royalty paid to Wyomex LLC be less than $150,000 in any given calendar year;

|

“commencement of commercial production” as used in the Option Agreement is defined as the first quarter of production in which 4.5% of the metal values or gross proceeds from the sales of mineral materials derived from the property exceed the amount of the minimum advance royalty. Thereafter, the semi-annual royalty payments shall be the larger of the amount of minimum advance royalty or 4.5% of gross metal value or gross proceeds from sales of all mineral materials derived from the property.

6

Subsequent to the payment to and receipt by Wyomex LLC of the foregoing $7,000,000, the production royalty shall be reduced, and our company shall pay Wyomex LLC a gross metal value royalty of 1.5% for all iron product and/or other mineral materials minded and sold from the property.

Employment and Consulting Agreements

Employment Agreement – Andrew A. Brodkey

Effective June 30, 2011, we entered into an employment agreement with Andrew A. Brodkey to serve as President and Chief Executive Officer of our company for a term of two years with automatic renewals for similar two year periods pursuant to the terms of the agreement. Mr. Brodkey’s duties shall include the duties and responsibilities for our company’s corporate and administration offices and positions as set forth in our company’s and such other duties and responsibilities as the board of directors may from time to time reasonably assign to Mr. Brodkey. Under the agreement, Mr. Brodkey receives monthly remuneration at a gross rate of $15,000 with such increases as our board of directors may approve. To the extent that benefit plans are implemented and made available to officers or employees of our company, Mr. Brodkey shall participate in employee incentive, bonus, pension, profit sharing, deferred compensation, stock appreciation or stock purchase, health, welfare and disability plans, or other benefit plans or other programs of our company, if any, to the extent that his position, tenure, salary, age, health and other qualifications make him eligible to participate. Our company may terminate Mr. Brodkey’s employment prior to the end of his employment period by giving the Mr. Brodkey 60 days’ advance notice in writing. If we terminate Mr. Brodkey’s employment prior to the end of his employment period for any reason other than cause or disability or if Mr. Brodkey terminates his employment for good reason, Mr. Brodkey shall be entitled to one (1) month’s severance pay for each one month of service up to a maximum of two (2) year’s wages, and we shall maintain all employee benefit plans and programs for the number of years remaining in the term of his employment in which he was entitled to immediately prior to the date of termination. If Mr. Brodkey, however, terminates his employment prior to the end of the employment period other than for good reason, Mr. Brodkey shall not be entitled to any severance and our company shall have no further liability to Mr. Brodkey. The employment agreement also contains a 12-month non-competition clause related to the iron ore exploration mining business and is construed and interpreted in accordance with the laws of the State of Arizona. He is also permitted under the terms of the employment agreement to pursue other business interests not in conflict with our company, including serving as CEO and a Director of the 3 other public companies identified in the following paragraph.

Andrew Brodkey is a mining engineer and a lawyer. He graduated with distinction with a B.S. in Mining Engineering from the University of Arizona in 1979. Mr. Brodkey earned a law degree, cum laude, from Creighton University in 1982. He worked at the Denver, Colorado law firm of Gorsuch, Kirgis, Campbell, Walker and Grover as an associate specializing in natural resources and environmental law from 1982 until 1987. Subsequently, Mr. Brodkey joined Magma Copper Company, a NYSE-traded mining company in 1987, where he held various positions, eventually succeeding to the role of Vice President and General Counsel in 1992. Following Magma’s acquisition by BHP in 1996, he remained in a senior legal position with BHP Copper Inc., and in 2000 moved to the position of Vice President, Business Development for BHP Copper. Following his departure from BHP in 2002, Mr. Brodkey held the position of Managing Director of the International Mining & Metals Group of CB Richard Ellis, Inc (“CBRE”), where he was responsible for creating and building the mining property practice of CBRE. Currently, Mr. Brodkey is the President, CEO and Director of Pacific Copper Corp, President, CEO and Director of Pan American Lithium Corp. and President and Director of Zoro Mining Corp. His is also the Manager of Kriyah Consultants LLC, which has a contractual relationship with our company as discussed below.

Consulting and Payroll Agreements with Kriyah Consultants LLC

Effective June 30, 2011, we entered into consulting agreements with Kriyah Consultants LLC, a company managed by Andrew Brodkey, whereby Kriyah will be paid a consulting fee of $2,500 per month to:

|

|

(e)

|

provide office space, office equipment, utilities, phones and furniture;

|

|

|

(f)

|

employ secretarial, bookkeeping, accounting, recordkeeping, legal compliance and related personnel;

|

|

|

(g)

|

advise our company regarding financial planning, corporate development, and corporate governance;

|

7

|

|

(h)

|

provide instructions and directions to our company’s legal counsel, accountants and auditors; and

|

|

|

(i)

|

ensure that all accounting records are maintained to meet generally accept accounting principals and quarterly and annual reports are prepared and filed to meet regulatory requirements.

|

The Kriyah agreement also provides that our company will reimburse Kriyah for its proportionate share of all expenses incurred with respect to the operation of the administration of our company, including but not limited to, our company’s allocable share of Kriyah’s office rent, office equipment, employee and contractor wages and benefits, phones and other office operational costs (such allocable share to be determined according to the number of like clients being serviced by Kriyah at its Tucson location). Also under this agreement, Kriyah will provide the services of Frank Garcia as CFO and Jodi Henderson as Corporate Secretary.

Frank Garcia from 2007 to the present has worked as Accounting Manager for Kriyah Consultants LLC providing accounting services for mining exploration companies. From 1997 to 2006, Mr. Garcia was employed in senior management positions by Misys PLC, a global software and solutions company serving customers in international banking and securities, international healthcare, and UK retail financial services. Prior to 1997 Mr. Garcia held executive positions with CEMEX, a world leader in the construction materials industry. Mr. Garcia is currently the CFO of two publicly-traded mining companies-- Zoro Mining Corp. (OTCBB: ZORM) and Pan American Lithium Corp. (OTCBB: PALTF; TSX-V: PL). Mr. Garcia received his Bachelor of Science –Business Administration—Major in Accounting from the University of Arizona in 1981.

Jodi Henderson is currently the Director of Operations for Kriyah Consultants, LLC an administration company that manages publicly held mining exploration companies. Prior to her September 2007 appointment to Kriyah she managed the administration and marketing for the International Mining & Metals Group of CB Richard Ellis, Inc. After she received her degree in Applied Mathematics from the Indiana State University she gained 10 years of board, administration and finance management experience which included a tenure as a Director for the Tucson Museum of Art from 2002 to 2005. Currently, Ms. Henderson is the Secretary and Treasurer for Zoro Mining Corp. (OTCBB: ZORM) and Secretary of Pacific Copper Corp. (OTCBB: PPFP) and Pan American Lithium Corp. (OTCBB: PALTF; TSX-V: PL).

In addition to the consulting agreement, our company entered into a payroll services agreement with Kriyah, whereby Kriyah agrees to administer the payroll health insurance benefits to be provided by our company to Mr. Brodkey as contemplated in the employment agreement with Mr. Brodkey. Such payroll services include administering payroll deductions, unemployment compensation, social security taxes and workers compensation and any other withholdings or payroll related payments required under applicable law.

Consulting Agreement - Sage Associates, Inc.

Effective June 30, 2011, we entered into a consulting agreement with Sage Associates, Inc. whereby Sage through its owner, Dr. David Hackman, will serve as our company’s Vice President, Exploration, and will provide and perform for the benefit of our company certain geological advisory services as may be requested by our company. Under the agreement, Sage receives monthly compensation at a gross rate of $6,000. In addition to any fees that may be payable to Sage under the agreement, we agreed to promptly reimburse Sage within thirty (30) days of receipt of detailed invoice, for all reasonable travel and other out-of-pocket expenses incurred in performing the services under the agreement, which are approved by our company. The term of the agreement is expected to continue through the end of the 2011 calendar year and shall automatically renew from year to year unless terminated. If our company exercises its right to terminate the agreement, we shall only be obligated to pay Sage for the fees actually earned by Sage in performing the services up to the time that such right of termination is exercised and effective.

Dr. David Hackman is a geologist and a registered professional engineer with over 35 years international experience specializing in the evaluation of leachable and other metal deposits. Dr. Hackman has worked as a geologist for Mobil Oil Company and ALCOA. From 1990 to 1995, Dr. Hackman was the president, of Liximin, Inc., a mineral exploration and mine development company based in Tucson, Arizona. From 1996 to 2000, Dr. Hackman was an officer and director of Silver Eagle Resources Ltd. Currently, Dr. Hackman is the V.P of Exploration and a Director of Zoro Mining Corp. (OTCBB: ZORM) and Pacific Copper Corp. (OTCBB: PPFP), and is also the V.P. of Exploration for Pan American Lithium Corp. (OTCBB: PALTF; TSX-V: PL).

8

Consulting Agreement - J2 Mining Ventures Ltd.

Effective June 30, 2011, we entered into a consulting agreement with J2 Mining Ventures Ltd. whereby J2 Mining will provide and perform for the benefit of our company certain geological, engineering, marketing and project management services as may be requested by our company. Under the agreement, J2 Mining receives monthly compensation at a gross rate of $8,000. In addition to any fees that may be payable to J2 Mining under the agreement, we agreed to promptly reimburse J2 Mining within thirty (30) days of receipt of detailed invoice, for all reasonable travel and other out-of-pocket expenses incurred in performing the services under the agreement, which are approved by our company. The term of the agreement is expected to continue through the end of the 2011 calendar year and shall automatically renew from year to year unless terminated. If our company exercises its right to terminate the agreement, we shall only be obligated to pay J2 Mining for the fees actually earned by J2 Mining in performing the services up to the time that such right of termination is exercised and effective.

The Assignment Agreement is attached as exhibit 10.1, the Andrew Brodkey Employment Agreement is attached as exhibit 10.2 and the Consulting Agreements with Kriyah, Sage and J2 Mining are attached as exhibit 10.3, 10.4 and 10.5 this current report on Form 8-K and are hereby incorporated by reference.

Item 2.01 - Completion of Acquisition or Disposition of Assets

The information set forth under Item 1.01 of this Current Report on Form 8-K is also responsive to this item and is hereby incorporated into this Item 2.01 by reference.

FORM 10 INFORMATION

Business

Overview

We were incorporated in the State of Nevada on June 5, 2007. Our plan after our inception on June 5, 2007 was to produce user-friendly software that creates interactive digital yearbook software for schools and allows them to create and burn their own interactive digital yearbooks on CD/DVD.

Effective June 15, 2011, we completed a merger with our subsidiary, Titan Iron Ore Corp., a Nevada corporation, which was incorporated solely to effect a change in our name from “Digital Yearbook Inc.” to “Titan Iron Ore Corp.”

Also effective June 15, 2011, we effected a 37 to one forward stock split of our authorized and issued and outstanding common and preferred stock. As a result, our authorized capital increased from 100,000,000 shares of common stock with a par value of $0.0001 to 3,700,000,000 shares of common stock with a par value of $0.0001 of which 5,151,000 shares of common stock outstanding increased to 190,587,000 shares of common stock. Subsequently, on June 20, 2011, we issued 2,100,000 common shares pursuant to a private placement unit offering, increasing the number of shares of common stock outstanding to 192,687,000.

Effective June 30, 2011 and in connection with the closing of the Acquisition Agreement, Ohad David, Ruth Navon and Service Merchant Corp., as vendors, entered into an affiliate stock purchase agreement, whereby, among other things, the vendors surrendered 142,950,000 shares of common stock of our company for cancellation, decreasing the number of shares of common stock outstanding to the current number of 49,737,000. As at the date of this 8-K, the transfer and cancellation was still in process.

We are a development stage company. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. We have not made any significant purchase or sale of assets, nor has our company been involved in any mergers, acquisitions or consolidations. We are not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, since we have a specific business plan or purpose. Neither we nor our officers, directors, promoters or affiliates, have had preliminary contact or discussions with, nor do we have any present plans, proposals, arrangements or understandings with any representatives of the owners of any business or company regarding the possibility of an acquisition or merger.

9

Wyoming Iron Complex Project, Albany County, Wyoming

Effective June 30, 2011 and in connection with the entry into an agreement (the “Acquisition Agreement”) with J2 Mining Ventures Ltd. (“J2 Mining”) dated June 13, 2011 and attached as Exhibit 10.1 to our Current Report on Form 8-K filed June 16, 2011, we completed the acquisition of a 100% right, title and interest in and to a properties (Strong Creek and Iron Mountain) option agreement (the “Option Agreement”) from J2 Mining with respect to an iron ore mineral property located in Albany County, Wyoming and entered into an assignment of mineral property option agreement with J2 Mining and Wyomex LLC (the “Assignment Agreement”), whereby our company was assigned the 100% right, title and interest in and the Option Agreement from J2 Mining;

The Option Agreement assigned to us from J2 Mining on June 30, 2011, pursuant to the Assignment Agreement, was entered into on May 26, 2011 between J2 Mining and Wyomex LLC, pursuant to which Wyomex LLC, as optionor, granted to J2 Mining, as optionee, an exclusive right and option to acquire 100% undivided legal and beneficial interests in and to certain unpatented lode mining claims, fee lands, leased lands, and other interests in real property situated in Albany County, Wyoming (the “Wyoming Iron Complex”). Pursuant to the Assignment Agreement, J2 Mining agreed to assign all its rights and interests in the property and the Option Agreement, and transfer all of its obligations under the Option Agreement, to our company, and our company accepted and agreed to be bound by the terms of the Option Agreement.

The term of the option commenced on May 26, 2011 and initially extended until July 27, 2011 and may be extended for a maximum of six (6) successive one-month periods, at the sole election of our company, through notice to Wyomex LLC and tender of $5,000 from our company to Wyomex LLC for each of the first three (3) additional months and $15,000 for each additional month for months four (4) through six (6) as may be desired by us. The first payment of $5,000 has been made.

Subject to the terms and conditions of a definitive agreement to be executed by both our company and Wyomex LLC and prior to the date of termination of the sixth and final extension, our company may elect to exercise the option at any time during the option term by giving Wyomex LLC written notice of such election. Upon receipt of such notice, the parties shall execute an asset purchase agreement, which assets will include the unpatented mining claims, fee lands, mineral leases, any geological reports, data, laboratory information related thereto, buildings, mining equipment located within the property, water rights, accesses and rights-of-way, and generally all rights and appurtenances which are directly connected with the mining and business activities of Wyomex LLC related to the property, all of which shall be delivered free and clear of all liens or other encumbrances.

We may exercise the option by paying a total purchase price of $7,000,000, which shall consist of the following components:

|

|

(j)

|

payment at closing of $85,000 as an initial payment;

|

|

|

(k)

|

any monies or consideration previously paid by J2 Mining to Wyomex LLC;

|

|

|

(l)

|

commencing six (6) months from the date of closing and after receipt of the initial payment, and every six (6) months thereafter, we shall pay Wyomex LLC, as advance minimum royalty, $62,500, as adjusted under the Option Agreement, until the commencement of commercial production from the property;

|

|

|

(m)

|

at the commencement of commercial production from the property, the semi-annual advance minimum royalty shall convert to a 4.5% gross metal value royalty on iron ore and/or other mineral materials produced and sold from the property and, except for events of force majeure, in no event shall the production royalty paid to Wyomex LLC be less than $150,000 in any given calendar year;

|

“commencement of commercial production” as used in the Option Agreement is defined as the first quarter of production in which 4.5% of the metal values or gross proceeds from the sales of mineral materials derived from the property exceed the amount of the minimum advance royalty. Thereafter, the semi-annual royalty payments shall be the larger of the amount of minimum advance royalty or 4.5% of gross metal value or gross proceeds from sales of all mineral materials derived from the property.

10

Subsequent to the payment to and receipt by Wyomex LLC of the foregoing $7,000,000, the production royalty shall be reduced, and our company shall remit to Wyomex LLC a gross metal value royalty of 1.5% for all iron product and/or other mineral materials minded and sold from the property.

Our Current Business

With the entry into the Assignment Agreement with respect to the Wyoming Iron Complex, we abandoned our efforts as an interactive software developer, and we are focusing our efforts in the mineral exploration. Our business plan is to proceed with the exploration of the Wyoming Iron Complex consisting of mineral leases on 320 acres and 23 unpatented mining claims aggregating approximately 463 acres located in the county of Albany, Wyoming, USA. The proposed work program for the first year is as follows:

The initial phase is expected to take up to three months and entail an expenditure of approximately $75,000. We anticipate that the specific work to be undertaken will include:

|

|

·

|

Compilation of all existing geological data into one comprehensive data base for each of the Strong Creek and Iron Mountain Deposits

|

|

|

·

|

Completion of the equivalent of a NI 43-101Technical Report for the Wyoming Complex as a whole.

|

|

|

·

|

Development of an additional work program for the properties.

|

The second phase is expected to take a further three to four months and entail an overall expenditure of approximately $100,000. We anticipate that the specific work to be undertaken will include Confirmation Drilling of existing drill targets to validate historic data (2000 feet).

The third phase will be contingent on the results of the phases 1 & 2 and would likely involve expansion and Infill Drilling to expand the resource on the Strong Creek deposit (8000 feet) to upgrade and enhance the quality the resource data base, Bulk testing of Iron Mountain Ores to confirm the validity of the Krupp Renn Process, Bench scale tests on the Strong Creek ores to validate the Hazen /USBM results, and the initiation of a prefeasibility study based on historic and current data. This work program is expected to take six to eight months and entail an aggregate expenditure of approximately $2,300,000.

Mineral property exploration is typically conducted in phases. We have not yet commenced the initial phase of exploration on our Wyoming Iron Complex. Once we complete each phase of exploration, we will make a decision as to whether or not and how we proceed with each successive phase based upon the analysis of the results of that program.

Our plan of operation is to carry out exploration work on our Wyoming Complex in order to ascertain whether it possesses commercially exploitable quantities of iron ore and other metals. We intend to primarily explore for iron ore but if we discover that our mineral property holds potential for other minerals that our management determines are worth exploring further, then we intend to explore for those other minerals. We will not be able to determine whether or not the property contains a commercially exploitable mineral deposit, or reserve, until appropriate exploratory work is done and an economic evaluation based on that work indicates economic viability.

We have generated minimal revenues and have incurred losses since inception. Furthermore, we have been issued a going concern opinion by our auditors and rely upon the sale of our securities as well as borrowings to fund operations. Accordingly, we will be dependent on future additional financing in order to seek other business opportunities in the mining industry or new business opportunities. We are considered an exploration stage company as we are involved in the examination and investigation of the mineral property that we believe may contain valuable minerals, for the purpose of discovering the presence of ore, if any, and its extent. Since we are an exploration stage company, there is no assurance that a commercially viable mineral deposit exists on our property, and a great deal of further exploration will be required before a final evaluation as to the economic and legal feasibility for our exploration is determined. We have no known reserves of any type of mineral. To date, we have not discovered an economically viable mineral deposit on the mineral property, and there is no assurance that we will discover one.

11

Competition

We are a mineral resource exploration company. We compete with other mineral resource exploration companies for financing and for the acquisition of new mineral properties. Many of the mineral resource exploration companies with whom we compete have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on acquisitions of mineral properties of merit, on exploration of their mineral properties and on development of their mineral properties. In addition, they may be able to afford more geological expertise in the targeting and exploration of mineral properties. This competition could result in competitors having mineral properties of greater quality and interest to prospective investors who may finance additional exploration and development. This competition could adversely impact on our ability to achieve the financing necessary for us to conduct further exploration of our mineral properties.

We also compete with other mineral resource exploration companies for financing from a limited number of investors that are prepared to make investments in mineral resource exploration companies. The presence of competing mineral resource exploration companies may impact on our ability to raise additional capital in order to fund our exploration programs if investors are of the view that investments in competitors are more attractive based on the merit of the mineral properties under investigation and the price of the investment offered to investors. We also compete with other mineral resource exploration companies for available resources, including, but not limited to, professional geologists, camp staff, helicopter or float planes, mineral exploration supplies and drill rigs.

Employees and Key Consultants

To become competitive in the mineral exploration market, our company entered into an employment agreement with Andrew Brodkey and appointed employees and key consultants as described under Item 1.01 of this Current Report.

Intellectual Property

We do not own, either legally or beneficially, any patents or trademarks.

Risk Factors

In addition to other information in this report, the following risk factors should be carefully considered in evaluating our business because such factors may have a significant impact on our business, operating results, liquidity and financial condition. As a result of the risk factors set forth below, actual results could differ materially from those projected in any forward-looking statements. Additional risks and uncertainties not presently known to us, or that we currently consider to be immaterial, may also impact our business, operating results, liquidity and financial condition. If any such risks occur, our business, operating results, liquidity and financial condition could be materially affected in an adverse manner. Under such circumstances, the trading price of our securities could decline, and you may lose all or part of your investment.

Risks Associated with Mining

All of our mineral properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral resource on any of our properties in commercially exploitable quantities. Until we can do so, we cannot earn any revenues from operations and if we do not do so we will lose all of the funds that we expend on exploration. If we do not discover any mineral resource in a commercially exploitable quantity, our business could fail.

We have not established that our mineral properties contain any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business could fail.

A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/divisions/corpfin/forms/industry.htm#secguide7) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote; in all probability our mineral resource property does not contain any ‘reserve’ and any funds that we spend on exploration will probably be lost.

12

Even if we do eventually discover a mineral reserve on one or more of our properties, there can be no assurance that we will be able to develop our properties into producing mines and extract those resources. Both mineral exploration and development involve a high degree of risk and few properties which are explored are ultimately developed into producing mines.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we might discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labour standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at economically viable costs. If we cannot accomplish these objectives, our business could fail.

There can be no assurance that we can comply with all material laws and regulations that apply to our activities. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

Exploration development and exploitation activities are subject to comprehensive regulation and permitting which may cause substantial delays or require capital outlays in excess of those anticipated causing a material adverse effect on us.

Exploration, development and exploitation activities are subject to federal, provincial, state and local laws, regulations and policies, including laws regulating permitting and the removal of natural resources from the ground and the discharge of materials into the environment. Exploration, development and exploitation activities are also subject to federal, provincial, state and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment and other operational activities.

Environmental and other legal standards imposed by federal, provincial, state or local authorities may be changed and any such changes may prevent us from conducting planned activities or may increase our costs of doing so, which could have material adverse effects on our business. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing a material adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages that we may not be able to or elect not to insure against due to prohibitive premium costs and other reasons. Any laws, regulations or policies of any government body or regulatory agency may be changed, applied or interpreted in a manner which could materially alter and negatively affect our ability to carry on our business.

13

If we establish the existence of a mineral resource on any of our properties in a commercially exploitable quantity, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the resource, and our business could fail.

If we do discover mineral resources in commercially exploitable quantities on any of our properties, we will be required to expend substantial sums of money to establish the extent of the resource, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a major deposit, there can be no assurance that such a resource will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involves many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all the hazards and risks inherent in the exploration for mineral resources and, if we discover a mineral resource in commercially exploitable quantity, our operations could be subject to all of the hazards and risks inherent in the development and production of resources, including liability for pollution, cave-ins or similar hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that arise from any such occurrence would have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations.

We expect to derive revenues, if any, either from the sale of our mineral resource properties or from the extraction and sale of iron ore. The price of those commodities has fluctuated widely in recent years, and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors on the price of base and precious metals, and therefore the economic viability of any of our exploration properties and projects, cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will be successful in acquiring mineral claims. If we cannot acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely un-integrated. We compete with other exploration companies looking for mineral resource properties. While we compete with other exploration companies in the effort to locate and acquire mineral resource properties, we will not compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

In identifying and acquiring mineral resource properties, we compete with many companies possessing greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations.

14

Our competition includes large established mining companies with substantial capabilities and with greater financial and technical resources than us. As a result of this competition, we may have to compete for financing and may be unable to acquire financing on terms we consider acceptable. We may also have to compete with the other mining companies for the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration programs may be slowed down or suspended, which may cause us to cease operations as a company.

If our costs of exploration are greater than anticipated, then we may not be able to complete the exploration program for our Wyoming Iron Complex without additional financing, of which there is no assurance that we would be able to obtain.

We are proceeding with the initial stages of exploration on our Wyoming Iron Complex. Our exploration program outlines a budget for completion of the program. However, there is no assurance that our actual costs will not exceed the budgeted costs. Factors that could cause actual costs to exceed budgeted costs include increased prices due to competition for personnel and supplies during the exploration season, unanticipated problems in completing the exploration program and delays experienced in completing the exploration program. Increases in exploration costs could result in our not being able to carry out our exploration program without additional financing. There is no assurance that we would be able to obtain additional financing in this event.

Because of the speculative nature of exploration of mining properties, there is substantial risk that no commercially exploitable minerals will be found and our business will fail.

We have not commenced the initial stage of exploration of our mineral property, and thus have no way to evaluate the likelihood that we will be successful in establishing commercially exploitable reserves of iron ore or other valuable minerals on our Wyoming Iron Complex. The search for valuable minerals as a business is extremely risky. We may not find commercially exploitable reserves of iron ore or other valuable minerals in our mineral property. Exploration for minerals is a speculative venture necessarily involving substantial risk. The expenditures to be made by us on our exploration program may not result in the discovery of commercial quantities of ore. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The search for valuable minerals involves numerous hazards. In the course of carrying out exploration of our Wyoming Iron Complex, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. We currently have no such insurance nor do we expect to get such insurance for the foreseeable future. If a hazard were to occur, the costs of rectifying the hazard may exceed our asset value and cause us to liquidate all of our assets, resulting in the loss of your entire investment in this offering.

Because access to our mineral property is often restricted by inclement weather, we may be delayed in our exploration and any future mining efforts.

Access to the mineral property may be restricted during the period between October and April of each year because the period between these months can typically feature heavy snow cover which makes it difficult if not impossible to carry out exploration and other activities at the Wyoming Iron Complex. We can attempt to visit, test or explore our mineral property only when weather permits such activities. These limitations can result in significant delays in exploration efforts, as well as in mining and production in the event that commercial amounts of minerals are found. Such delays can cause our business to fail.

15

Because our executive officer has other business interests, he may not be able or willing to devote a sufficient amount of time to our business operation, causing our business to fail.

Our President and CEO will devote approximately 25% of his working time on providing management services to us. If the demands on our executive officer from his other obligations increase, he may no longer be able to devote sufficient time to the management of our business. This could negatively impact our business development.

Risks Related to Our Company

We have a limited operating history on which to base an evaluation of our business and prospects.

We have been in the business of exploring mineral resource properties only since June 2011 and we have not yet located or identified any mineral reserves. As a result, we have never had any revenues from our mining operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserve or, if they do that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. We therefore expect to continue to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

The fact that we have not earned any significant operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any significant revenue from operations since our incorporation and we anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and we build and operate a mine. At March 31, 2011, we had working capital deficit of $17,631. We incurred a net loss of $66 for the three months ended March 31, $9,485 for the year ended December 31, 2010, and $75,581 since inception. We will require additional financing to sustain our business operations if we are not successful in earning revenues once exploration is complete. If our exploration programs are successful in discovering reserves of commercial tonnage and grade, we will require significant additional funds in order to place the Wyoming Iron Complex into commercial production. Should the results of our planned exploration require us to increase our current operating budget, we may have to raise additional funds to meet our currently budgeted operating requirements for the next 12 months. As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. If we cannot raise the money that we need to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

These circumstances lead our independent registered public accounting firm, in their report dated May 18, 2011, to comment about our company’s ability to continue as a going concern. When an auditor issues a going concern opinion, the auditor has substantial doubt that our company will continue to operate indefinitely and not go out of business and liquidate its assets. These conditions raise substantial doubt about our company’s ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event our company cannot continue in existence. We continue to experience net operating losses.

16

Risks Associated with Our Common Stock

If we issue additional shares in the future, it will result in the dilution of our existing shareholders.

Our articles of incorporation authorize the issuance of up to 3,700,000,000 shares of common stock with a par value of $0.0001 per share. Our board of directors may choose to issue some or all of such shares to acquire one or more companies or properties and to fund our overhead and general operating requirements. The issuance of any such shares will reduce the book value per share and may contribute to a reduction in the market price of the outstanding shares of our common stock. If we issue any such additional shares, such issuance will reduce the proportionate ownership and voting power of all current shareholders. Further, such issuance may result in a change of control of our corporation.

Our common stock is illiquid and the price of our common stock may be negatively impacted by factors which are unrelated to our operations.

Although our common stock is currently quoted on the OTC Bulletin Board, our common stock has not traded. Even when an active market is established, trading through the OTC Bulletin Board is frequently thin and highly volatile. There is no assurance that a sufficient market will develop in our stock, in which case it could be difficult for shareholders to sell their stock. The market price of our common stock could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of our competitors, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting our competitors or us. In addition, the stock market is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

We do not intend to pay cash dividends on any investment in the shares of stock of our company.

We have never paid any cash dividends and currently do not intend to pay any cash dividends for the foreseeable future. Because we do not intend to declare cash dividends, any gain on an investment in our company will need to come through an increase in the stock’s price. This may never happen and investors may lose all of their investment in our company.

Trading of our stock is restricted by the Securities Exchange Commission’s penny stock regulations, which may limit a stockholder’s ability to buy and sell our common stock.

The Securities and Exchange Commission has adopted regulations which generally define “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the Securities and Exchange Commission, which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

17

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.\

Risks Relating to the Early Stage of our Company and Ability to Raise Capital

We are at a very early stage and our success is subject to the substantial risks inherent in the establishment of a new business venture.

The implementation of our business strategy is in a very early stage and subject to all of the risks inherent in the establishment of a new business venture. Accordingly, our intended business and prospective operations may not prove to be successful in the near future, if at all. Any future success that we might enjoy will depend upon many factors, many of which are beyond our control, or which cannot be predicted at this time, and which could have a material adverse effect upon our financial condition, business prospects and operations and the value of an investment in our company.

We have no operating history and our business plan is unproven and may not be successful.

We have no commercial operations. None of our projects have proven or provable reserves, are built, or are in production. We have not licensed or sold any mineral products commercially and do not have any definitive agreements to do so. We have not proven that our business model will allow us to generate a profit.

We expect to suffer continued operating losses and we may not be able to achieve profitability.

We expect to continue to incur significant discovery and development expenses in the foreseeable future related to exploration and the completion of feasibility, development and commercialization of our projects. As a result, we will be sustaining substantial operating and net losses, and it is possible that we will never be able to sustain or develop the revenue levels necessary to attain profitability.

We may have difficulty raising additional capital, which could deprive us of necessary resources.

We expect to continue to devote significant capital resources to fund exploration and development of our properties. In order to support the initiatives envisioned in our business plan, we will need to raise additional funds through public or private debt or equity financing, collaborative relationships or other arrangements. Our ability to raise additional financing depends on many factors beyond our control, including the state of capital markets, the market price of our common stock, the market price for commodities, and the development or prospects for development of competitive technology or competitive projects by others. Because our common stock is not listed on a major stock market, many investors may not be willing or allowed to purchase our common shares or may demand steep discounts. Sufficient additional financing may not be available to us or may be available only on terms that would result in further dilution to the current owners of our common stock.

We expect to raise additional capital during 2011-2012 and have, as of June 30, 2011, closed a private placement financing in the gross amount of $1,050,000, but we do not have any firm commitments for funding beyond this recent placement. If we are unsuccessful in raising additional capital, or the terms of raising such capital are unacceptable, we may have to modify our business plan and/or significantly curtail our planned activities. If we are successful raising additional capital through the issuance of additional equity, our investor’s interests will be diluted.

18

There are substantial doubts about our ability to continue as a going concern and if we are unable to continue our business, our shares may have little or no value.

Our ability to become a profitable operating company is dependent upon our ability to generate revenues and/or obtain financing adequate to explore and develop our properties. Achieving a level of revenues adequate to support our cost structure has raised substantial doubts about our ability to continue as a going concern. We plan to attempt to raise additional equity capital by issuing shares covered and, if necessary through one or more private placement or public offerings. However, the doubts raised relating to our ability to continue as a going concern may make our shares an unattractive investment for potential investors. These factors, among others, may make it difficult to raise any additional capital.

Failure to effectively manage our growth could place additional strains on our managerial, operational and financial resources and could adversely affect our business and prospective operating results.

Our anticipated growth is expected to continue to place a strain on our managerial, operational and financial resources. Further, as we acquire interests in more properties or subsidiaries and other entities, we will be required to manage multiple relationships. Any further growth by us, or an increase in the number of our strategic relationships will increase this strain on our managerial, operational and financial resources. This strain may inhibit our ability to achieve the rapid execution necessary to implement our business plan, and could have a material adverse effect upon our financial condition, business prospects and prospective operations and the value of an investment in our company.

Description of Properties

Principal Office

As of the date of this report, our executive offices consist of 800 square feet are located at 3040 North Campbell Ave, Suite 110 Tucson, Arizona 85719. The office lease costs $2,100 per month, which, along with utilities and related expenses, is allocated proportionally among our company and several other junior mining companies which are administered by Kriyah Consultants LLC out of the same location. We believe that our office space and facilities are sufficient to meet our present needs and do not anticipate any difficulty securing alternative or additional space, as needed, on terms acceptable to us.

Mineral Properties

As of the date of this report on Form 8-K, we have the option to acquire 100% interest in the Wyoming Iron Complex properties pursuant to the terms of the Option Agreement assigned to our company on June 30, 2011 by J2 Mining Ventures Ltd. The mineral concessions and rights that form the Wyoming Iron Complex property consist of 23 unpatented US mining claims (Strong Creek Claims) located under the Mining Law of 1872, comprising approximately 463 acres, and 2 mineral leases (Iron Mountain Leases) totalling approximately 320 acres. The claims were staked by Wyomex LLC, a duly incorporated limited liability company under the laws of Wyoming., and are registered with the Office of the Registrar Albany County, Wyoming and with the US Bureau of Land Management located in Cheyenne Wyoming and registered in the name of Wyomex LLC in accordance with the requirements of the Mining Law of 1872. Costs of maintaining the claims in 2010 were $140 per claim payable annually by August 31st. Wyomex is also the lessee under the two aforementioned mineral leases.

Technical Reports

We intend to commission a comprehensive technical report on the Wyoming Iron Complex property which will conform substantially to the requirements of National Instrument 43-101 Standards of Disclosure for Mineral Projects, adopted by the Canadian Securities Administrators (“NI 43-101”). All Reports completed prior to January 2002 are considered to be “historic in nature” and are not compliant with NI 43-101 or SEC Guide 7, and therefore can not be relied upon. In August 2005, a due diligence program was undertaken by Radar Acquisitions Corp. in which 10 rotary air blast drill holes were completed on a selected area that exhibited higher grade titanium grades. A technical report compliant with NI 43-101 was produced for this area but its content is not considered to be applicable to the planned work program.

19

Description of Property, Location, Means and Access

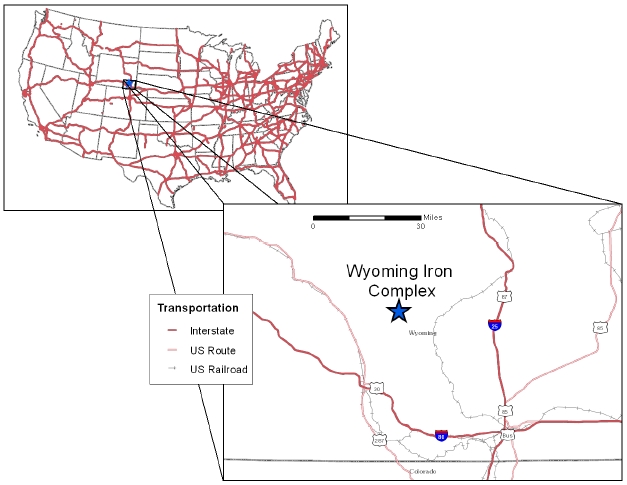

The Wyoming Iron Complex is located approximately 30 miles north-northeast of the city Laramie in southeastern Wyoming, (See Figure 1 below). The Strong Creek Claims are located in the central portion of the Laramie Anorthosite Complex (LAC), approximately a one hour drive north from Laramie, along Hwy 287 to 34 and then secondary roads from the Greaser Ranch. The Iron Mountain Leases are located approximately 2 miles to the east of Strong Creek and are accessible by secondary roads. The Wyoming Iron Complex also lies 15 miles to the east of the main rail line of the Union Pacific. Power and water are available at the property.

The closest major town to the Wyoming Iron Complex is Laramie, Wyoming, a city of approximately 25,000 people. It has an elevation of 7,200 feet, resulting in a varied, but semi-arid climate. Laramie is located along the I-40 corridor and is on the main rail line of the Union Pacific. Laramie is a full-service city which hosts all amenities, and is the home of the University of Wyoming.

Figure 1 Wyoming Iron Complex

Climate, Local Resources, Infrastructure and Physiography

Albany County, population 27,204 (US Census Bureau, 2003), is located in the high plains region of south-eastern Wyoming. Most of the county is located in a cool and arid basin (<12 inches of precipitation annually) containing the Laramie River watershed, a major tributary to the North Platte River system. The county is flanked on the west by the Medicine Bow Mountains and on the east by the Laramie Range.

20

Due to its elevation, Wyoming has a relatively cool climate. Above the 6,000 foot level, the temperature rarely exceeds 100 F. Summer nights are usually cool, though daytime readings may be quite high. Away from the mountains, low July temperatures range from 50 to 60 F. A typical winter would see freezing temperatures from December through March with most accumulation of snow occurring in March.

History of Exploration

Since the earliest geological investigations of the area by Stansbury in 1851, and Hayden in 1871, Fe-Ti oxide deposits have been known in Albany County. There have been numerous economic evaluations of these deposits by Ball, 1907; Singewald, 1913; Frey, 1946 and Hild, 1953.

From the completion of the railway until 1975 the property was owned by Union Pacific Resources (“UPR”) a wholly owned subsidiary of Union Pacific. From the mid 1950’s through 1972 the properties were drilled and evaluated which produced a resource estimate (non-compliant with SEC Guide 7 or Canadian NI 43-101) for contained iron, titanium dioxide and vanadium.