Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Western Union CO | d8k.htm |

| EX-99.2 - PRESS RELEASE - Western Union CO | dex992.htm |

1

Western Union

Acquisition of

Travelex Global Business Payments

July 5, 2011

Exhibit 99.1 |

2

Safe Harbor

This presentation contains certain statements that are forward-looking within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are not guarantees of future

performance and involve certain risks, uncertainties and assumptions that are difficult to predict. Actual outcomes and results may differ

materially from those expressed in, or implied by, our forward-looking statements. Words such as

“expects,” “intends,” “anticipates,” “believes,” “estimates,” “guides,”

“provides guidance,” “provides outlook” and other similar expressions or future or

conditional verbs such as “will,” “should,” “would” and “could” are intended to

identify such forward-looking statements. Readers of this presentation by The Western Union

Company (the “Company,” “Western Union,” “we,” “our” or “us”) should

not rely solely on the forward-looking statements and should consider all uncertainties and risks

discussed in the Risk Factors section and throughout the Annual Report on Form 10-K for the

year ended December 31, 2010. The statements are only as of the date they are made, and the Company undertakes no obligation to

update any forward-looking statement.

Possible events or factors

that could cause results or performance to differ materially from those expressed in our forward-looking statements include the following:

changes in immigration laws, patterns and other factors related to migrants; our ability to adapt

technology in response to changing industry and consumer needs or trends; our failure to

develop and introduce new products, services and enhancements, and gain market acceptance of such products; the failure by us, our agents

or subagents to comply with our business and technology standards and contract requirements or

applicable laws and regulations, especially laws designed to prevent money laundering,

terrorist financing and anti-competitive behavior, and/or changing regulatory or enforcement interpretations of those laws; the impact on

our business of the Dodd-Frank Wall Street Reform and Consumer Protection Act and the rules

promulgated there-under; changes in United States or foreign laws, rules and regulations

including the Internal Revenue Code, and governmental or judicial interpretations thereof; changes in general economic conditions and

economic conditions in the regions and industries in which we operate; political conditions and

related actions in the United States and abroad which may adversely affect our businesses and

economic conditions as a whole; interruptions of United States government relations with countries in which we have or are implementing

material agent contracts; changes in, and failure to manage effectively exposure to, foreign exchange

rates, including the impact of the regulation of foreign exchange spreads on money transfers

and payment transactions; our ability to resolve tax matters with the Internal Revenue Service and other tax authorities

consistent with our reserves; failure to comply with the settlement agreement with the State of

Arizona; liabilities and unanticipated developments resulting from litigation and regulatory

investigations and similar matters, including costs, expenses, settlements and judgments; mergers, acquisitions and integration of acquired

businesses and technologies into our Company, and the realization of anticipated financial benefits

from these acquisitions; failure to maintain sufficient amounts or types of regulatory capital

to meet the changing requirements of our regulators worldwide; deterioration in consumers' and clients' confidence in our business, or in

money transfer providers generally; failure to manage credit and fraud risks presented by our agents,

clients and consumers or non-performance by our banks, lenders, other financial services

providers or insurers; any material breach of security of or interruptions in any of our systems; our ability to attract and retain

qualified key employees and to manage our workforce successfully; our ability to maintain our agent

network and business relationships under terms consistent with or more advantageous to us than

those currently in place; failure to implement agent contracts according to schedule; adverse rating actions by credit rating

agencies; failure to compete effectively in the money transfer industry with respect to global and

niche or corridor money transfer providers, banks and other money transfer services providers,

including telecommunications providers, card associations, card-based payment providers and electronic and internet providers; our

ability to protect our brands and our other intellectual property rights; our failure to manage the

potential both for patent protection and patent liability in the context of a rapidly developing

legal framework for intellectual property protection; cessation of various services provided to us by third-party vendors; adverse movements and

volatility in capital markets and other events which affect our liquidity, the liquidity of our agents

or clients, or the value of, or our ability to recover our investments or amounts payable to

us; decisions to downsize, sell or close units, or to transition operating activities from one location to another or to third parties, particularly

transitions from the United States to other countries; changes in industry standards affecting our

business; changes in accounting standards, rules and interpretations; significantly slower

growth or declines in the money transfer market and other markets in which we operate; adverse consequences from our spin-off

from First Data Corporation; decisions to change our business mix; catastrophic events; and

management's ability to identify and manage these and other risks. |

3

Western Union strategic growth areas

Moving Money for

Shareholder Value

Consumer

Money Transfer

Business

Payments

Stored

Value |

4

Western Union strategic growth areas

•

Approximately $400 billion principal cross-border remittance market

(Aite

Group)

•

Underserved consumers, migrants

•

Western Union (WU) brand, agent network, regulatory and compliance

expertise, range of send and delivery options, consumer relationships

•

17% cross-border market share

•

C2C revenue 6% CAGR 2006-2010

•

$1.8 trillion total global principal market for all prepaid (Mercator

Advisory), rapid growth projected

•

Underserved consumers

•

WU brand, infrastructure, agent network, consumer relationships

•

Early stage development: over 1 million cards-in-force in the U.S.

•$24

billion revenue SME cross-border market (McKinsey & Co)

•Underserved

customers: SMEs, mid-sized

corporates, financial

institutions

•WU

brand, financial institution relationships, agent network, global

licenses

•Approximately

$400 million combined Western Union Business Solutions

(WUBS)/Travelex Global Business Payments (TGBP) revenues in 2012, a

leading specialist provider of international business payments

Consumer

Money

Transfer

Stored

Value

Business-

to-Business

Payments |

5

Western Union growth strategies

•

Agent location expansion

•

Strategic marketing

•

New consumer opportunities through electronic channels:

westernunion.com, account based money transfer (on-line

banking), mobile

Continued share gains in long-term growth market

•

Leverage brand, consumer relationships, global agent network

•

Build awareness, expand distribution over time in U.S.

•

International expansion plans in progress

Build position in rapidly developing market

•

Custom House acquisition in 2009 provided an entry

•

Acquisition of TGBP gives immediate scale, further reach, and

added capabilities

Combined resources set stage for growth in large and

growing underserved market

Consumer

Money

Transfer

Stored

Value

Business-

to-Business

Payments |

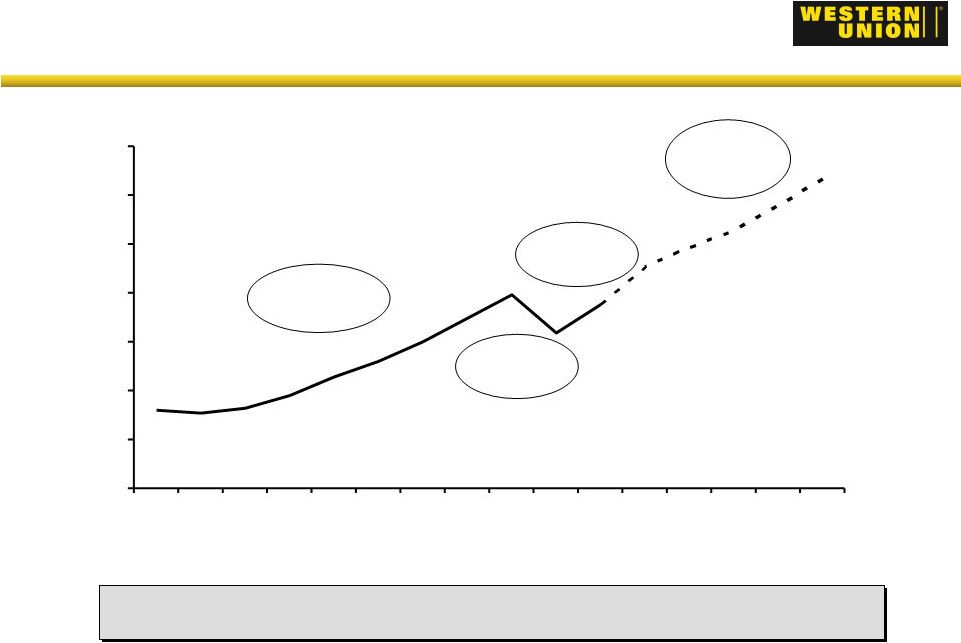

6

2008-2009

-21%

Global Trade (total merchandise and service exports)

$ Trillions

Source: World Trade Organization. Global Insights, June 2011

Globalization is driving rapid growth in

cross-border trade

2000-2009

CAGR +8%

2011-2015

CAGR +9%

2009-2010

+19%

0

5

10

15

20

25

30

35

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

Global trade creates a need for B2B cross-border payments and FX

|

7

The market is significant and market

dynamics present opportunities

Global SME cross-border payments revenue estimated at

$24 billion and growing

-

Similar size as consumer cross-border remittance market

Industry is fragmented

-

Largely served by local banks

Customers are underserved

-

Service, speed, accuracy, product offerings, price |

8

Overview of Travelex Global Business

Payments

•

A leading provider of international business-to-business payments

-

Over 35,000 customers across 14 countries

-

Headquartered in London

-

Differentiated from traditional bank business-to-business payments due to

strong

value

proposition:

global

reach,

high

service,

accuracy,

product

capabilities; competitive pricing

•

Business clients:

-

Small

&

Medium

Enterprises

(SME)

–

small

business

owners

(55%

of

revenues)

-

Corporations –

primarily mid-sized, typically up to £100 million of revenues

(24% of revenues)

-

Distribution

partners

–

including

financial

institutions,

universities

and

law

firms

(21% of revenues)

•

Current principal geographic markets are the UK, U.S. and Australia

(75% of revenues)

•

2011 estimated revenues of approximately £150 million

•

2011 normalized EBITDA margin of approximately 30% |

9

Financial Highlights –TGBP Acquisition

Acquisition Price

The Global Business Payments division will be acquired from

Travelex Holdings Limited for £606 million in cash, primarily

international cash.

Closing

The transaction is expected to close in late 2011, subject to

regulatory approvals and closing conditions.

Revenues

WUBS/TGBP combined revenues in 2012 are expected to be

approximately $400 million.

Revenue growth

Combined revenues are expected to grow at an approximate

10% CAGR over the next 3 years. Incremental growth once

strategies are fully implemented and integration activities are

completed.

Integration Costs

Approximately $70 million over 2 years (at current FX rate).

Synergies

Significant annual synergies of $30 million are expected

following integration.

Non-Cash Intangible Amort.

Approximately $40 million annually beginning 2012.

EPS

Dilutive to GAAP EPS by approximately $0.02 in 2011 and

approximately $0.04 in 2012 due to deal and integration

costs and non-cash acquisition related amortization (cash

accretive in 2012).

Accretive to GAAP EPS by approximately $0.04 in 2013. |

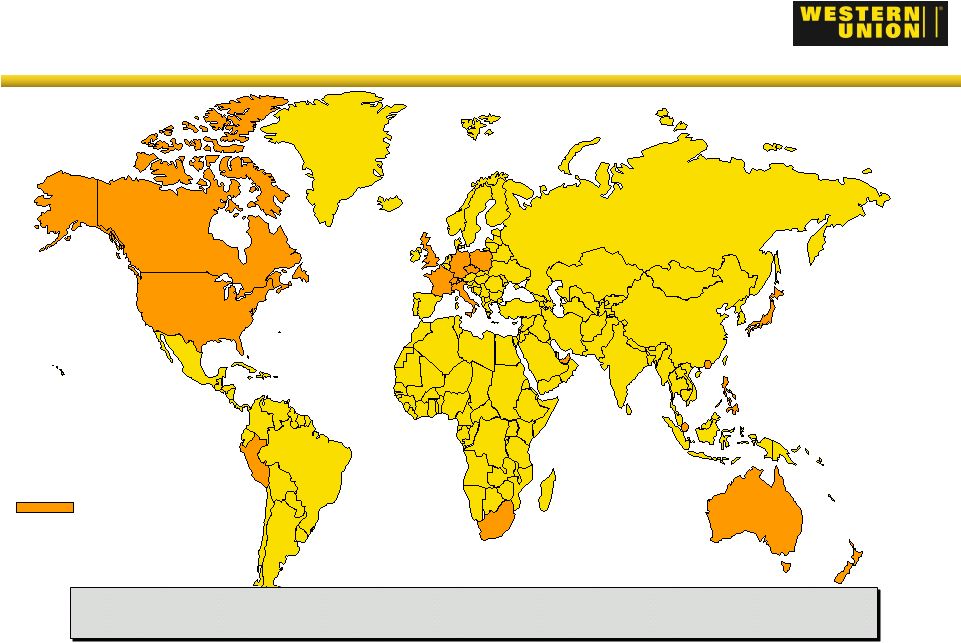

10

The acquisition provides immediate

scale and expanded reach

Canada

United

States

United

Kingdom

Italy

Germany

France

Czech Republic

Switzerland

Poland

Malta

South

Africa

Japan

Hong Kong

Singapore

Australia

New Zealand

Philippines*

WUBS & TGBP Combined

Peru*

* Additional countries recently signed by Western Union for agent distribution.

UAE*

TGBP and WUBS combined will have immediate presence in 16 countries,

representing over 50% of the revenue opportunity |

11

TGBP-WUBS combination creates a

strong B2B foundation

•

A leading specialist provider of international business payments

-

Proven leadership and talent

-

Combined sales force of 450 people

-

Presence in 16 countries

•

Strong product and functionality capabilities

•

Extensive banking relationships and local payments networks

•

Western Union complementary assets

-

Strong global brand

-

Financial strength

-

Global licenses |

12

The combined company accelerates the

business growth strategy

•

Geographic expansion

-

Combine WU licenses, brand strength, with TGBP capabilities to enter new

markets

-

Utilize WU agent network in certain countries

•

Product expansion to existing customers

-

Combined business offers more capabilities, enhanced product features

•

New distribution opportunities

-

Leverage

TGBP

capabilities

and

expertise

with

3

party

distributors

(financial

institutions, law firms, universities) in new markets

-

Capitalize on WU’s more than 1,000 financial institution relationships

-

Gain access to new customers due to WU strong financial profile

rd |

WUBS-TGBP

GBP Leadership Raj Agrawal

General Manager, Western Union Business Solutions

Raj Agrawal is General Manager for Western Union Business Solutions (WUBS), a trusted global

leader in foreign exchange and international business payments with clients operating

in markets around the world. Agrawal is responsible for leading the continued growth

and expansion of all WUBS products and services worldwide. Previously, he was

responsible for regional global financial planning and analysis for Western

Union. Agrawal has been with the company since 2006 and has held roles of increasing

responsibility including

treasurer

and

senior

vice

president

for

Finance

in

the

EMEA/APAC

region.

Prior

to

joining

Western

Union, he was in the dual role of treasurer and vice president of Investor Relations for

Deluxe Corporation. Agrawal started his career in the automotive industry at

General Motors Corporation in Michigan, USA, as Senior Manufacturing Engineer. He later

joined Chrysler Corporation, serving as Senior Financial Analyst and General Mills,

Inc., where he held a variety of positions including Assistant Treasurer. Agrawal holds an MBA

in Finance from Columbia University.

David Sear

Divisional Managing Director, Travelex Global Business Payments

David Sear is Divisional Managing Director for Travelex Global Business Payments. He has full

responsibility for the division worldwide, which specializes in international and

domestic payment and receipt processing services and solutions. Before moving to his

current role, Sear was divisional managing director for the outsourcing division during

which time his team substantially increased profitability and made Travelex the

world-leader in the issuance of pre-paid currency cards for consumers and corporates.

He joined Travelex in March 2006 from Voca Ltd (previously BACS), where he helped to

transform the company at the centre of the UK's payments industry. Prior to Voca, Sear

was chief operating officer at WorldPay Group plc. He ran the company's operations as

it established its position as a major global player in the adoption and development of

e-Commerce. Sear also spent seven years as European managing director at Equifax

Cheque Services, the world's largest cheque guarantee company, and worked in retail operations

for the WH Smith Group for five years.

13 |