Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - LINKEDIN CORP | d8k.htm |

Exhibit 99.1 |

Safe

harbor 2

This presentation contains forward-looking statements. All statements other than

statements of historical facts contained in this presentation,

including

statements

regarding

LinkedIn

Corporation’s

(“LinkedIn”

or

the

“Company”)

future

results

of

operations

and

financial

position,

including

preliminary financial results for the quarter ended March 31, 2011, financial

targets, business strategy, plans and objectives for future operations, are

forward-looking statements. The Company has based these forward-looking statements largely on its current estimates of its

financial results and its current expectations and projections about future events

and financial trends that it believes may affect its financial condition,

results of operations, business strategy, short term and long-term business operations and objectives, and financial needs as of the

date of this presentation. These forward-looking statements are subject to a

number of risks, uncertainties and assumptions, including those described

under the heading “Risk Factors” in the Company’s filings

with the Securities and Exchange Commission (the “SEC”). Moreover, the

Company operates

in

a

very

competitive

and

rapidly

changing

environment.

New

risks

emerge

from

time

to

time.

It

is

not

possible

for

Company

management

to

predict

all

risks,

nor

can

the

Company

assess

the

impact

of

all

factors

on

its

business

or

the

extent

to

which

any

factor,

or

combination of factors, may cause actual results to differ materially from those

contained in any forward-looking statements the Company may make. In

light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this presentation may

not occur and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. You

should

not

rely

upon

forward-looking

statements

as

predictions

of

future

events.

Although

the

Company

believes

that

the

expectations

reflected in the forward-looking statements are reasonable, the Company cannot

guarantee that the future results, levels of activity, performance or events

and circumstances reflected in the forward-looking statements will be achieved or occur. Moreover, neither the Company nor any

other person assumes responsibility for the accuracy and completeness of the

forward-looking statements. Except as required by law, the Company

undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this presentation, to

conform these statements to actual results or to changes in the Company’s

expectations. The Company’s filings with the Securities and Exchange

Commission are available to you and you should read the documents the Company

has filed with the SEC for more complete information about the Company. You

may get these documents for free by visiting EDGAR on the SEC Web site at

www.sec.gov. |

3

LinkedIn Overview |

What is the single most important driver of

long-term value creation within a company?

4 |

5 |

Jim Collins, “Good to Great”

“

Great talent builds great companies

6

If I were running a company

today, I would have one priority

above all others: to acquire as

many of the best people as

I could.

I'd put off everything

else to fill my bus. |

The

LinkedIn opportunity Fundamentally transforming the way the world

works Fundamentally transforming the way the world works

Connect talent with opportunity at massive scale

7 |

Our mission

Connect the world’s professionals to make

them more productive and successful

8 |

The

value we bring to our members Identity

Connect, find and be found

LinkedIn Profile, Address Book, Search

Insights

Be great at what you do

Homepage, LinkedIn Today, Groups

Work wherever our members work

Everywhere

Mobile, APIs, Plug-Ins

Desktop

Rolodex, Resume,

Business Card

Newspapers,

Trade Magazines, Events

Opportunities that will transform the trajectory of your career

Opportunities that will transform the trajectory of your career

9 |

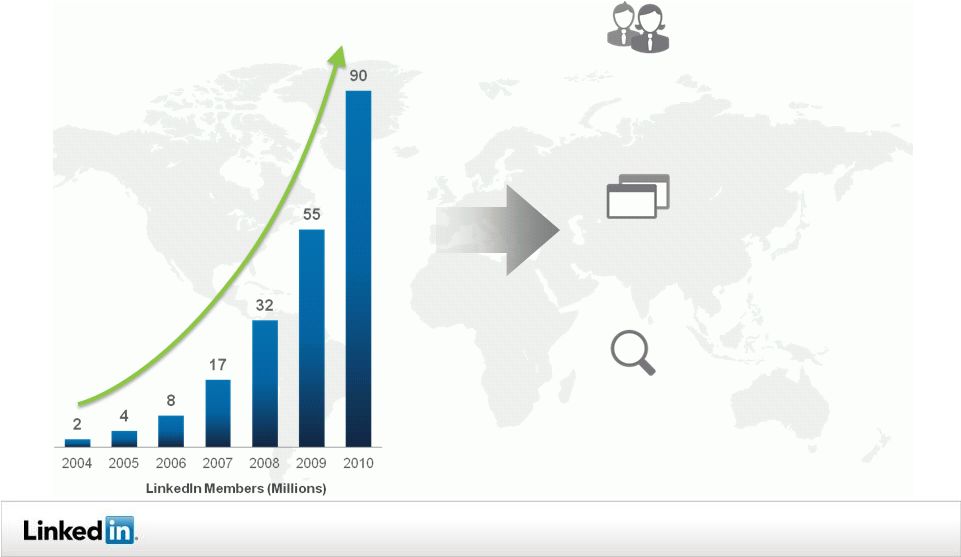

10

The power of LinkedIn’s network effects

Member growth

and engagement

Relevant and

valuable products

& services

Critical mass

of data

Technology

platform |

11

The world’s largest professional network

International now comprises over 50% of total membership

1 Internal data as of March 31, 2011; 2 comScore data as of March 31, 2011

1

75M

Avg Monthly Users in Q1’11

65% y/y growth

2

Page Views in Q1’11

96% y/y growth

7B+

2

Searches in Q1’11

70% y/y growth

~1B

1

100M+ |

Three diverse, scalable and growing business lines

2010

y/y growth

Providing passive recruiting at scale and adding

social relevancy to active job searches

Hiring Solutions

Delivering marketers targeted access to one of the most

influential, affluent and educated audiences on the web

Marketing Solutions

Enabling professionals to be more productive with

premium tools tailored by customer segment

Premium Subscriptions

182%

107%

35%

$102M

$79M

$62M

12

102%

$243M

Total |

Worldwide Labor Force

3,300M+

2

Huge global market opportunity in members

1 LinkedIn members as of March 31, 2011 | 2 Source: International

Planning & Research 13

Worldwide Professionals

640M+

2

LinkedIn Members

100M+

1 |

Huge

global market opportunity in monetization Worldwide talent acquisition

and staffing services

$85B

Worldwide Internet

advertising spend

14

$69B

Total

B2B

$25B

Addressable

Today

$27B

1

2

1

2

1 LinkedIn estimates 2 Source: IDC

Total |

Our

strategy Global Monetization

Professional Insights &

Knowledge Sharing

Professional Identity Ecosystem

Viral Growth Engine

15

Technology Infrastructure

Data |

Scale &

Redundancy

APIs

Professional

Graph

Security

Data

Infrastructure

Service

Infrastructure

Technology infrastructure

Building an industry-leading, global platform for developing scalable,

data-fueled professional networking applications

16 |

Technology infrastructure

Developing an open platform for third-party developers and publishers

17

Already generating as many API calls off LinkedIn as page views on LinkedIn

Already generating as many API calls off LinkedIn as page views on LinkedIn

|

Our

strategy Viral Growth Engine

Global Monetization

Professional Insights &

Knowledge Sharing

Professional Identity Ecosystem

18

Data |

Viral growth engine

Increasing the number of member invitations and connections

19

Weekly Member Invitations

6/1/09 9/1/09

12/1/09 3/1/10 6/1/10

9/1/10

12/1/10 3/1/11 |

Our

strategy Professional Identity Ecosystem

Viral Growth Engine

Global Monetization

Professional Insights &

Knowledge Sharing

20 |

Connect

Summary:

Career and

Professional

Highlights

Experience /

Education

Professional identity ecosystem

The professional profile of record

Professional

Details

Groups /

Associations

Recommendations

21 |

Professional identity ecosystem

The definitive professional search engine

22 |

Our

strategy Professional Insights &

Knowledge Sharing

Professional Identity Ecosystem

Viral Growth Engine

Global Monetization

23

Data |

Critical

Mass

Connections

Context

Data

Professional insights and knowledge sharing

Your professional dashboard

24 |

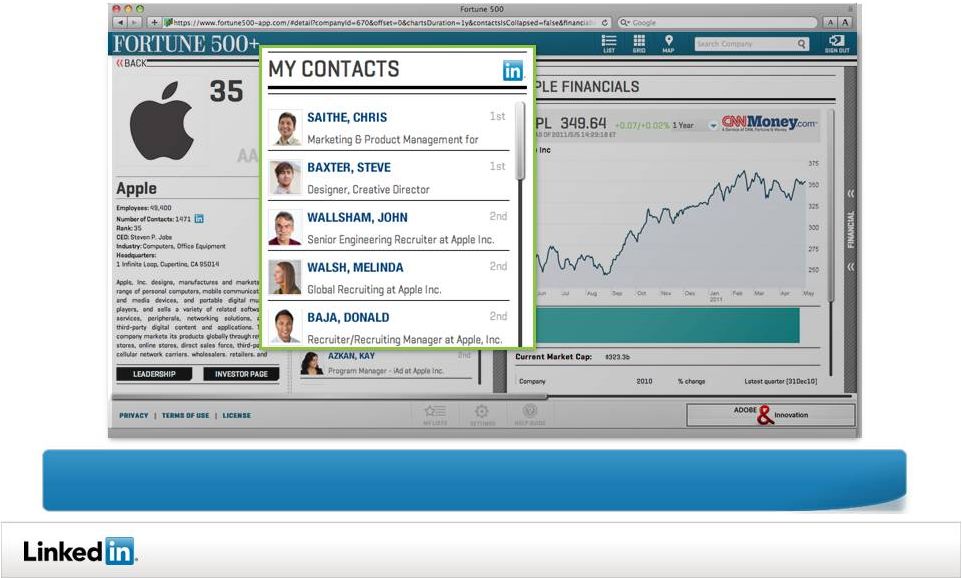

Context

Data

Connections

Professional insights and knowledge sharing

Your essential source for business intelligence

25

Critical Mass |

Our

strategy Professional Identity Ecosystem

Viral Growth Engine

26

Data |

Global monetization: Hiring Solutions

-

An unprecedented opportunity: passive recruiting at scale

-

73 of the Fortune 100 are using LinkedIn Hiring Solutions

27

Sherri Wang

Michael Cho

LinkedIn Recruiter: Search Results (113) Save

this search Keyword: (mergers OR arbitrage) -

Location: Hong Kong, China -

Industry: Financial Services |

Global monetization: Marketing Solutions

Targeting one of the most affluent and influential audiences on the web

28

Self-Service Platform

Custom groups / Sponsorship

LinkedIn Company Pages

Display / Social Ads |

Global monetization: Subscriptions

Premium tools tailored by customer segment

Subscription targeted to

member based on profile

data and activity

Recommended

subscription for

the individual

Product feature

list is presented

dynamically

29 |

Blue-chip enterprise companies and thousands of SMB

customers derive value from LinkedIn on a global basis

150K+

27%

International

Revenue

Small Business

Customers

TECHNOLOGY

30

PROFESSIONAL

SERVICES

CONSUMER

HEALTH CARE

FINANCIAL |

Our

strategy 31

Global Monetization

Professional Insights &

Knowledge Sharing

Professional Identity Ecosystem

Viral Growth Engine

Data |

Increasing investment for long-term growth

Scale hardware and

software to enhance site

performance and accelerate

development cycles

Execute robust product

roadmap to enhance growth,

engagement and

monetization

Infrastructure

Product Development

Expand global footprint by

launching new languages

and sales offices

International Growth

Meet increasing demand

across multiple business

lines

Sales Force

32 |

The

talent to make it happen Steve Cadigan

Vice President, People Operations

www.linkedin.com / in / cadigan

Mike Gamson

Senior Vice President,

Global Sales

www.linkedin.com/ in / mikegamson

Steve Sordello

Chief Financial Officer

www.linkedin.com / in / stevesordello

Deep Nishar

Senior Vice President, Products

and User Experience

www.linkedin.com/ in / deepnishar

Erika Rottenberg

Vice President, General Counsel

and Secretary

www.linkedin.com / in / erikarottenberg

David Henke

Senior Vice President, Operations

and Engineering

www.linkedin.com / in / drhenke

Nick Besbeas

Vice President, Marketing

http://www.linkedin.com / in / nickbesbeas

Jeff Weiner

Chief Executive Officer

www.linkedin.com / in / jeffweiner08

Robby Kwok

Head of Corporate Development

www.linkedin.com / in / robbykwok

33 |

Steve Sordello

Chief Financial Officer at LinkedIn

San Francisco Bay Area | Internet

34

Financial Overview

1st

Send Message

Send Message

View Profile |

Rapid growth in key metrics

Worldwide

35

1 At period end

2 Average monthly number over the three months ended

3 Over the three months ended

Source: comScore

(Millions)

(Millions)

(Billions)

Cumulative Registered Members

59% y/y growth

Average Monthly Unique Visitors

65% y/y growth

Total Page Views

96% y/y growth

2

1

3 |

($

millions) Quarterly Revenue

Accelerating revenue growth

Q1 2011

+110% y/y

2008: $79M

2009: $120M

+52%

2010: $243M

+102%

36 |

Payments

Platform Corporate Solutions

Recruiter

Jobs

Recruitment Media

Job Postings

Subscriptions

Talent Finder

Display Ads

LinkedIn Ads

Business Subscription

Hiring

Solutions

Premium

Subscriptions

Marketing

Solutions

SaaS business built on a consumer web platform

Online / offline mix results in monthly recurring revenue and high margin

self-serve business

37 |

Attractive financial model

Strong revenue growth

Diversified and proven revenue models

Visibility into future revenues

Significant operating leverage

Investing aggressively for growth

Strong balance sheet

38 |

Our vision

Create economic opportunity for every

professional in the world

39 |

|

Adjusted EBITDA and Non-GAAP Expenses

41

To provide investors with additional information regarding our financial results, we

have disclosed adjusted EBITDA, a non-GAAP financial measure, and

certain expenses on a non-GAAP basis. We have provided below a reconciliation of adjusted EBITDA to net income (loss), the

most directly comparable GAAP financial measure, and a reconciliation of these

non-GAAP expenses to their most directly comparable GAAP financial

measure. We have included these non-GAAP financial measures because they

are key measures used by our management and board of directors to

understand

and

evaluate

our

core

operating

performance

and

trends,

to

prepare

and

approve

our

annual

budget

and

to

develop

short-

and

long-

term operational plans. In particular, the exclusion of certain expenses in

calculating adjusted EBITDA and these non-GAAP expenses can provide a

useful measure for period-to-period comparisons of our core business. Additionally, adjusted EBITDA is a key financial measure used

by the compensation committee of our board of directors in connection with the

payment of bonuses to our executive officers. Accordingly, we believe that

adjusted EBITDA and these non-GAAP operating expenses provide useful information to investors and others in understanding and

evaluating our operating results in the same manner as our management and board of

directors. Our use of adjusted EBITDA and non-GAAP expenses has

limitations as an analytical tool, and you should not consider it in isolation or as a

substitute for analysis of our results as reported under GAAP. Some of these

limitations are: •although depreciation and amortization are

non-cash charges, the assets being depreciated and amortized may have to be replaced in the

future, and adjusted EBITDA does not reflect cash capital expenditure requirements

for such replacements or for new capital expenditure requirements;

•adjusted EBITDA does not reflect changes in, or cash requirements for, our

working capital needs; •adjusted

EBITDA

and

non-GAAP

expenses

do

not

consider

the

potentially

dilutive

impact

of

equity-based

compensation.

Equity-based

compensation expenses are recurring and, for the foreseeable future, will continue

to be a significant recurring expense in our business as it represents

an

important

part

of

our

employees’

compensation

and

impacts

their

performance;

•adjusted

EBITDA

does

not

reflect

tax

payments

that

may

represent

a

reduction

in

cash

available

to

us;

and

•other companies, including companies in our industry, may calculate adjusted

EBITDA and non-GAAP expenses differently, which reduces their usefulness

as a comparative measure. Because of these limitations, you should consider

adjusted EBITDA and non-GAAP expenses alongside other financial performance measures,

including various cash flow metrics, net income (loss) and our other GAAP

results. |

2007

2008

2009

2010

Q1'11

Revenue

$32.5

$78.8

$120.1

$243.1

$93.9

Cost of Revenue (GAAP)

7.4

18.6

25.9

44.8

16.8

SBC included in cost of revenue

0.1

0.3

0.4

0.4

0.2

Cost of revenue (Non-GAAP)

7.3

18.3

25.5

44.4

16.6

Gross margin % (Non-GAAP)

78%

77%

79%

82%

82%

Sales and marketing (GAAP)

5.0

17.0

26.8

59.0

29.4

SBC included in sales and marketing

0.2

0.5

0.7

1.2

1.1

Sales and marketing (Non-GAAP)

4.9

16.5

26.2

57.8

28.3

Sales and marketing as a % of revenue (Non-GAAP)

15%

21%

22%

24%

30%

Research and development (GAAP)

11.6

29.4

39.4

65.1

24.7

SBC included in research and development

0.6

1.2

2.3

3.2

1.6

Research and development (Non-GAAP)

11.0

28.2

37.1

61.9

23.1

Research and development as a % of revenue (Non-GAAP)

34%

36%

31%

25%

25%

General and administrative (GAAP)

6.8

13.0

19.5

35.1

13.6

SBC included in general and administrative

1.0

2.6

2.8

3.9

1.0

General and administrative (Non-GAAP)

5.9

10.4

16.7

31.1

12.7

General and administrative as a % of revenue (Non-GAAP)

18%

13%

14%

13%

13%

Reconciliation of GAAP to Non-GAAP expenses

42

($ millions) |

$ millions)

2007

2008

2009

2010

Q1'11

Net income (loss)

$0.3

($4.5)

($4.0)

$15.4

$2.1

Provision (benefit) for income taxes

0.0

0.3

0.8

3.6

(0.3)

Other (income) expense, net

(0.8)

(1.3)

(0.2)

0.6

(0.4)

Depreciation and amortization

2.1

6.4

11.9

19.6

8.2

Stock-based compensation

1.8

4.6

6.2

8.8

3.8

Adjusted EBITDA

3.5

5.5

14.7

48.0

13.3

Reconciliation of Adjusted EBITDA

43

($ millions) |