Attached files

| file | filename |

|---|---|

| 8-K - Comstock Mining Inc. | v227248_8k.htm |

| EX-10.1 - Comstock Mining Inc. | v227248_ex10-1.htm |

Annual Meeting of Shareholders Introduction & Welcome June 23, 2011

Forward Looking Statements This presentation has been prepared for introductory informational purposes only. This presentation is being made available on a confidential basis to a limited number of qualified recipients. This presentation may not be used for any other purpose. Any reproduction or distribution of this presentation, in whole or in part, or any disclosure of its contents, without the prior written consent of Comstock Mining Inc., is prohibited. Statements contained in this presentation, which are not historical facts, including statements about plans, goals and expectations regarding businesses and opportunities, new or existing business strategies, capital resources and future financial results, are "forward looking" as contemplated by the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, including, but not limited to, changes in government regulation, generally accepted accounting principles, taxation, competition, general economic conditions and geopolitical conditions. Accordingly, actual results may differ materially from those projected or implied in the forward-looking statements. This presentation does not constitute an offer or solicitation as to any securities. Any such offer shall be made only pursuant to definitive written private placement offering materials and in accordance with applicable securities laws. Any such securities will not be registered under the Securities Act of 1933 or any state securities law, will not be reviewed or approved by the Securities and Exchange Commission or any state securities law administrator, and will be not be offered or sold in any jurisdiction where it is unlawful to offer or sell such securities. Investors will need to conduct their own investigation thereof, including the merits and risks and the legality and tax consequences. Comstock Mining Inc. assumes no obligation to update or correct the information contained in this presentation or such discussions. NON_ GAAP FINANCIAL MEASURES The term "total cash cost" is a non_ GAAP financial measure and is used on a per ounce of gold basis. Total cash cost is equivalent to direct operating cost as found on the Consolidated Statements of Operations and includes by_ product credits for payable silver, lead, and zinc production. We have included total cash cost information to provide investors with information about the cost structure of our mining operations. This information differs from measures of performance determined in accordance with GAAP in Canada and in the United States and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. This measure is not necessarily indicative of operating profit or cash flow from operations as determined under GAAP and may not be comparable to similarly titled measures of other companies. CAUTIONARY NOTE TO US INVESTORS CONCERNING ESTIMATES OF MINERAL RESOURCES This presentation uses the terms “measured,” indicated,” and “inferred resources,” which are calculated in accordance with the Canadian National Instrument 43-101. The US Securities and Exchange Commission does not recognize these terms. The SEC permits U.S. mining companies to disclose only those mineral deposits that a company can economically and legally extract or produce. US investors are cautioned not to assume that any part or all of a measured, indicated or inferred resource exists or is economically or legally mineable. QUALIFIED PERSON Mr. Laurence G. Martin, AIPG Certified Professional Geologist #10985, a Qualified Person as defined under Canadian National Instrument 43-101, has reviewed and verified the technical contents of this report. All dollar amounts are in US dollars unless otherwise noted. 2

Comstock Mining Meeng Agenda Welcome to the Comstock Lode District 8:00 – 9:00 AM Check-in & Breakfast Buffet 9:30 – 10:15 AM Introducon & Company Overview – Hotel Great Room 10:30 – 11:30 AM Board Trolley and Mine Tour, Head Down the Lode 11:00 – 12:00 PM Operaons & Producon Exploraon & Resource Community Development Hotel Great Room Planning In the Gazebo Gold Hill Hall 11:45 – 1:00 PM Lunch Buffet in the Dining Room 12:45 - 1:45 PM Board Trolley for Mine Tour, Head Down the Lode 1:00– 2:00 PM Operaons & Producon Exploraon & Resource Community Development Hotel Great Room Planning Gold Hill Hall In the Gazebo 2:00 – 3:00 PM Operaons & Producon Exploraon & Resource Community Development Hotel Great Room Planning In the Gazebo Gold Hill Hall 3:00 – 4:00 PM Board Trolley for Mine Tour, Head Down the Lode 3:00 – 4:00 PM Operaons & Producon Exploraon & Resource Community Development Hotel Great Room Planning In the Gazebo Gold Hill Hall 4:30 – 5:00 PM Global Gold Industry in the Great Room 5:00 – 6:00 PM Happy Hour 6:00 – 8:00 PM Dinner and Entertainment with Mark Twain and Squeek on Piano 3

2010 Achievements § Established a goal of 3.25 million g/e ounces and producon § Executed Reverse Stock Split (200 – 1) § Completed Consolidaon of Land Posion – almost 6,100 acres of connuous, mineralized trend § Reorganized Management & Built a Producon Ready Team – development, operaonal, regulatory and financial experience § Converted All Senior Debt for Equity § Raised over $35 million, fully funding our Business Plan § Listed on NYSE Amex Exchange § Expanded Resource Base and Exceponal Exploraon Rates 4

Our Focus 5

Our Near-Term Goal Safely commence Creating commercial mining and processing operaons in tremendous 2011 with annual producon rates of 20,000 near-term gold equivalent ounces and validate qualified resources value (at least measured and indicated) and reserves of 3.25 million gold equivalent ounces by 2013. 6

Team-based Incenves Dual Trigger for all intermediate objecves – 20%-1.0MM*g/e ounces and first gold pour No Annual Bonuses or – 20% - 1.5MM*g/e ounces and Guaranteed Payments produce 15,000 g/e oz.per No Individual Targets annum Team-based Profit Sharing – 20% - 2.0MM* g/e oz. per and from Generated Cash Flow produce 17,500 g/e oz. per annum – 40%-3.25 MM* g/e ounces and produe 20,000 g/e oz per annum Vest Only Upon Achievement of Both Objectives of Our Goal 7

Management Team Core Team Competencies & Experience Corrado De Gasperis § Chief Execuve Officer, President and Principal Financial Officer of Comstock Mining since April 2010 § Over 23 years of experience in manufacturing, metals and mining operaonal and financial management, construcon project management and capital markets Larry G. Marn, CPG § Vice President of Exploraon and Chief Geologist since 2008, Cerfied Professional Geologist (CPG) and designated Qualified Person (QP) § Over 31 years of successful precious metal exploraon, mine development and producon experience including with Peter Kiewet Sons and Houston Oil and Minerals. Supervised exploraon projects in Western U.S., Canada, Honduras, Liberia and Mexico Clifford Nelson, Jr. § Vice President of Operaons, Bachelors Degree in Metallurgical Engineering and Materials Science § Over 30 years of metallurgical and operaonal management experience with Inspiraon Resources BHP & St. Andrew Goldfields Michael N. Norred § Vice President of Strategic Resource Planning, Founder and President of TECHBASE Internaonal, direcng the Company’s strategic resource planning, data integrity and quality and resource aestaon § Over 31 years of mine planning, resource definion and esmaon and geological/stascal data management Stephen J. Russell § Senior Mine Geologist since 2010, Masters Degree, Geology, published on unique Western U.S. structural geology § Over 34 years in geology, mining, and exploraon with extensive Nevada mine planning and producon experience Dennis Anderson, CPG § Director of Perming and Environmental, Cerfied Professional Geologist (CPG); Designated Qualified Person (QP) § Over 31 years of natural resource-based engineering geology with industry experience and as a regulator in Nevada State Government, Project Manager and senior engineer on numerous mine projects, development, reclamaon plans and environmental assessments Randy Harris § Director of Safety,Cerfied by the Internaonal Society of Mine Safety Professionals, OSH Standards 1910 Level I&II, and internaonal Loss Control § Over 30 years in mine safety most recently he was the Safety Specialist for the State of Nevada Mine Safety Dr. Edouard Zoutomou § Process Manager , B.S. in Mining Engineering, M.S. in Metallurgical Engineering , Ph.D. in Mining Metallurgy § Over 30 years of project and operaons and metallurgical process engineering including management of a three-stage crushing operaon, a 10 million sq. . heap 8

Board of Directors Board of Competencies & Experience Directors John V. §Lead Investor, Chairman-elect, Comstock Mining Inc. Winfield §Chairman-of-the-Board, President and CEO if InterGroup Corporaon Inc. and Co.’s Extensive experience as CEO of public companies; an entrepreneur, investor and financier, investor in Comstock Mining Inc., since 2004 Robert A. § Director since 2008, Masters Degree in Mining Engineering: Colorado School Mines Reseigh §Over 40 years of experience in the mining and underground construcon industry (Peter Kiewit Sons, Atkinson Construcon and The Barnard Companies). Extensive experience in mine development, deep sha, drill and blast tunnel work William J. § Director since 2005, Chairman of the Audit and Compensaon Commiees; CPA Nance §Over 40 years of experience in most phases of real estate restructuring, development and financing, and M&A Sco H. §Director since 2008, holds A.S. in Automove Technology with further studies in Jolcover Technical Industrial Educaon §Over 30 years of Nevada mining experience, land and mine acquisions §General Manager of Plum Mining Co. LLC 9

World Class Advisory and Services Group MINERAL INDUSTRY ADVISORS FINANCIAL SERVICES Kenneth D. Moelis, Founder and CEO Behre Dolbear, Mineral Industry Advisors Mark W. Henkels, Managing Director, Metals and Mining GEOSTATISTICAL MODELING AUDITING AND ACCOUNTING TECHBase International, Ltd. Terry Neil, Head of North American Mining Pracce Michael Norred, Founder& President METALLURGY LEGAL SERVICES M. Ridgway Barker III, Partner, and Chair of the Corporate Finance and Gene McClelland, President and CEO McClelland Labs Securities Practice Group ASSAY INSURANCE SERVICES George Burke, President Nick Conca, Managing Principal & New York Office Leader STOCK EXCHANGE DESIGNATED MARKET MAKER Bruce Poignant, Managing Director 10

COMSTOCK LODE DISTRICT Underexplored, Producon Ready 11

The Historic Comstock District § World Class Historic Mineral District – Produced 8.2 million ounces of gold and 192 million ounces of silver – 33 bonanza discoveries in the 1800’s § Under-explored gold and silver district in terms of modern exploraon § Highly fragmented land posions, locally mined – Over 400 companies (130 publicly traded) working in the Comstock in the 1870’s 12

Reported Mineral Resource Result of Behre Dolbear Average Grade Contained Ounces 66.03(1) NI 43-101 report – August 2010 Tons Au Ag Au Ag Au Eq Oz (000’s) (oz/ton) (oz/ton) (ounces) (ounces) Measured 13,430 0.032 0.372 425,000 4,990,000 500,000 Indicated 18,080 0.026 0.310 474,000 5,600,000 560,000 Measured and Indicated 31,510 0.029 0.336 899,000 10,590,000 1,060,000 Inferred 13,870 0.023 0.256 322,000 3,550,000 380,000 Historical 2,460 0.053 1.472 131,000 3,620,000 190,000 (1) Au Eq Oz using August 31, 2010 London PM prices 1,630,000 Result of Behre Dolbear Average Grade Contained Ounces 63.67(2) NI 43-101 report – May 2010 Tons Au Ag Au Ag Au Eq Oz (000’s) (oz/ton) (oz/ton) (ounces) (ounces) Measured 12,761 0.030 0.384 383,000 4,900,000 460,000 Indicated 10,152 0.025 0.353 254,000 3,584,000 310,000 Measured and Indicated 22,913 0.028 0.370 637,000 8,484,000 770,000 Inferred 6,613 0.018 0.244 122,000 1,612,000 147,000 Historical 1,920 0.041 0.959 79,000 1,842,000 108,000 (2) Au Eq Oz using May 14, 2010 NY closing prices 1,025,000 Current technical report (excludes all drill results since August 2010) 13

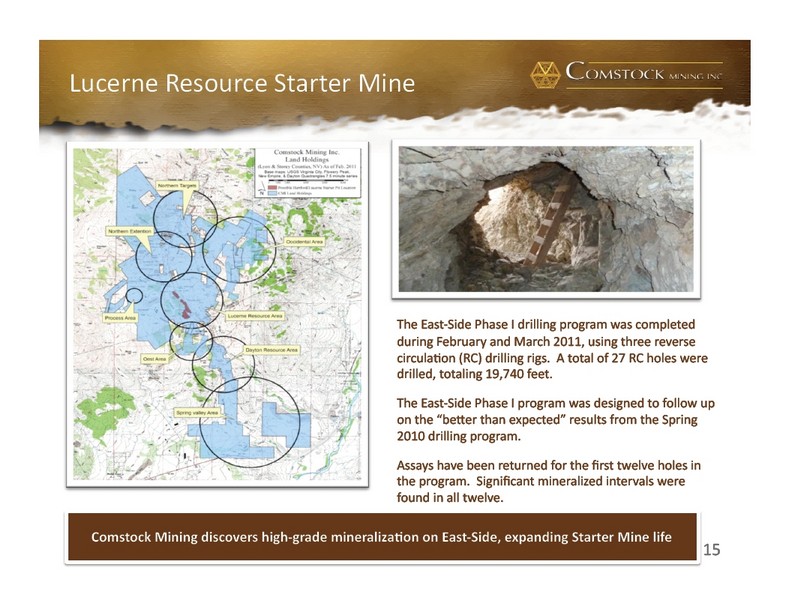

Two Near-Term Gold Projects Lucerne Resource Area Dayton Resource Area 1.2 million g/e oz. 0.2 million g/e oz. – 2011 Starter Mine 4+ years – Near surface <230 – Near surface, <500 – Oxide ores – Oxide ores – Low Strip rao – Low Strip rao – Persistent, high grades – Persistent, high grades – Open on West. South and – Excellent Infrastructure Northern borders and depth – Open on East and Northern borders and depth 14

Lucerne Resource Starter Mine The East-Side Phase I drilling program was completed during February and March 2011, using three reverse circulaon (RC) drilling rigs. A total of 27 RC holes were drilled, totaling 19,740 feet. The East-Side Phase I program was designed to follow up on the “beer than expected” results from the Spring 2010 drilling program. Assays have been returned for the first twelve holes in the program. Significant mineralized intervals were found in all twelve. Comstock Mining discovers high-grade mineralizaon on East-Side, expanding Starter Mine life 15

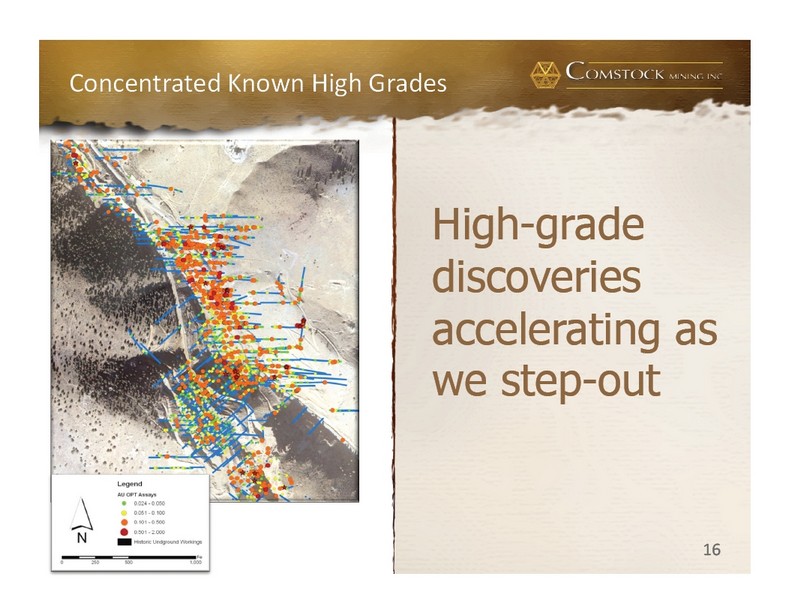

Concentrated Known High Grades High-grade discoveries accelerating as we step-out 16

Dayton Resource Area The Dayton phase one drilling program: – completed between December 2010 and February 2011 – Total of 42 RC holes were drilled, totaling 19,476 feet – Designed as north, middle, and south east-west “drill fences”, or rows of drill holes, spaced approx 750 feet apart – Goals to confirm mineralizaon extended to greater depths and also to validate the company’s exploraon in the Dayton area – Geology was logged on 5-foot intervals from the RC chips, providing the informaon for geological interpretaon on each of the drill fences 17

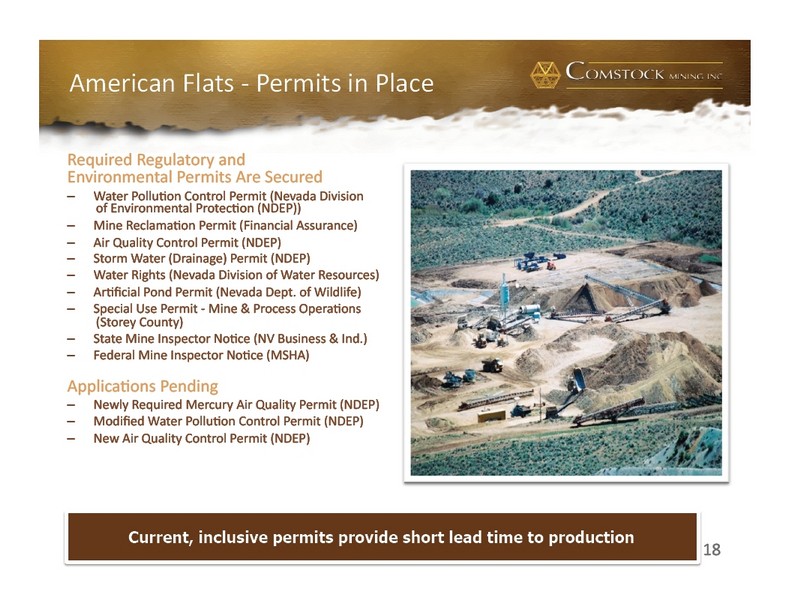

American Flats - Permits in Place Required Regulatory and Environmental Permits Are Secured – Water Polluon Control Permit (Nevada Division of Environmental Protecon (NDEP)) – Mine Reclamaon Permit (Financial Assurance) – Air Quality Control Permit (NDEP) – Storm Water (Drainage) Permit (NDEP) – Water Rights (Nevada Division of Water Resources) – Arficial Pond Permit (Nevada Dept. of Wildlife) – Special Use Permit - Mine & Process Operaons (Storey County) – State Mine Inspector Noce (NV Business & Ind.) – Federal Mine Inspector Noce (MSHA) Applicaons Pending – Newly Required Mercury Air Quality Permit (NDEP) – Modified Water Polluon Control Permit (NDEP) – New Air Quality Control Permit (NDEP) Current, inclusive permits provide short lead time to production 18

2011 Achievements and Objecves Lucern Project Q1 Q2 Q3/Q4 Updated drill results – East-side Phase I Completed Dayton Phase I Drill Program Connue East-Side Phase II Drill Program NYSE AMEX lisng “LODE” Mercury Permit East side, Dayton Drilling Updated Updated NI 43-101 Report Air Quality Permit Commence Producon Acvies 19

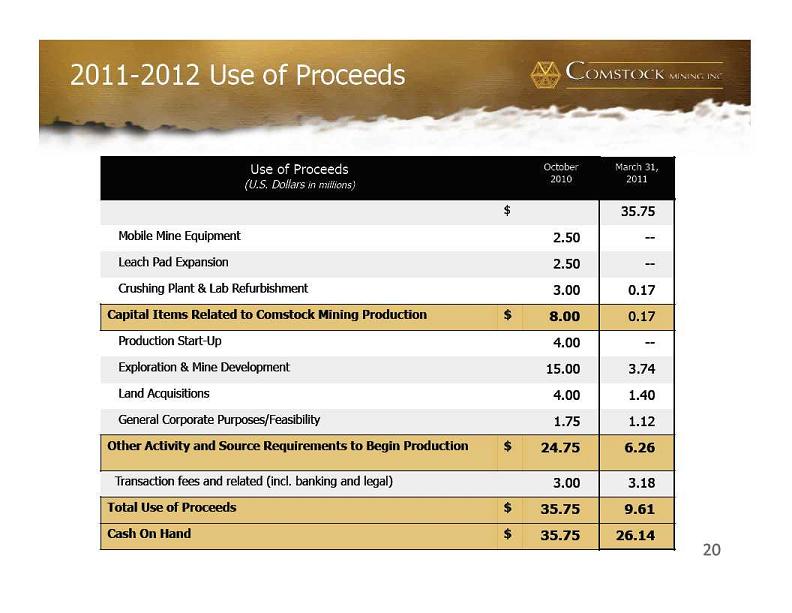

2011-2012 Use of Proceeds Use of Proceeds October March 31, (U.S. Dollars in millions) 2010 2011 $ 35.75 Mobile Mine Equipment 2.50 -- Leach Pad Expansion 2.50 -- Crushing Plant & Lab Refurbishment 3.00 0.17 Capital Items Related to Comstock Mining Production $ 8.00 0.17 Production Start-Up 4.00 -- Exploration & Mine Development 15.00 3.74 Land Acquisitions 4.00 1.40 General Corporate Purposes/Feasibility 1.75 1.12 Other Activity and Source Requirements to Begin Production $ 24.75 6.26 Transaction fees and related (incl. banking and legal) 3.00 3.18 Total Use of Proceeds $ 35.75 9.61 Cash On Hand $ 35.75 26.14 20

Expanding Investor Base § Expanded instuonal investor base § Listed on NYSE AMEX; further expanding the base § Planned TSX lisng for Q3 2011 § Retained Terre Partners for investor relaons § Ancipang Expanded Research Coverage – Sean Weiss, Weiss Research (exisng) – Roger Wiegand, Trader Tracks (exisng) – Doug Thomas, JET Independent Research (exisng) – Alka Singh, Jennings Capital (site visited, pending) – Ron Stewart, Dundee Capital Securies (visits pending) – Adam Graf, Dahlman Rose (visits pending) 21

Investment Highlights § Nevada's historically richest mining district and underexplored by modern methods § Low risk jurisdicon § 6,099 acres of connuous mineralized trend § Permied, producon-ready § Near term gold producon and cash flow § Robust development pipeline of high grade mul-ounce gold and silver deposits § Strong management team with development, operaonal, regulatory and financial experience § Well-capitalized balance sheet and significant near-term upside 22

Frank’s 5 M’s 23

Relave Valuaons § Strong management team with development, operaonal, regulatory and financial experience § Control substanally all of Nevada’s historically richest mining district and underexplored by modern methods – 30+ Years of Projected Mine Life § NYSE Amex, stable, liquid valuaon, near term upside § Well capitalized, strong cash posion – Fully funding our stated objecves, Crical Chain Dedicates Burn Rate § 6,099 acres of connuous mineralized trend § Robust development pipeline of high grade mul-ounce gold and silver deposits. § It’s The Comstock, STUPID!!! 24

Poised for Producon Revaluaon 25

Annual Meeting of Shareholders June 23, 2011