Attached files

| file | filename |

|---|---|

| EX-31.1 - Ranger Gold Corp. | form10k033111ex31-1.htm |

| EX-32.1 - Ranger Gold Corp. | form10k033111ex32-1.htm |

| EX-10.8 - Ranger Gold Corp. | form10k033111ex10-8.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

For the fiscal year ended March 31, 2011

Commission file number: 333-151419

RANGER GOLD CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

74-3206736

|

|

|

(State of incorporation)

|

(I.R.S. Employer Identification No.)

|

2533 N. Carson Street, Suite 5018

Carson City, Nevada, 89706

(Address of principal executive offices)

(775) 888-3133

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Exchange Act:

None

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, $0.0001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the average bid and asked price of such common equity as of September 30, 2010 was approximately $5,255,000.

The number of shares of the issuer’s common stock issued and outstanding as of June 28, 2011 was 46,020,000 shares.

Documents Incorporated By Reference: None

1

TABLE OF CONTENTS

|

Page

|

|||

|

Glossary of Mining Terms

|

3 | ||

|

PART I

|

|||

|

Item 1

|

Business

|

6 | |

|

Item 1A

|

Risk Factors

|

10 | |

|

Item 1B

|

Unresolved Staff Comments

|

15 | |

|

Item 2

|

Properties

|

15 | |

|

Item 3

|

Legal Proceedings

|

22 | |

|

Item 4

|

(Removed and Reserved)

|

22 | |

|

PART II

|

|||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

23 | |

|

Item 6

|

Selected Financial Data

|

25 | |

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

26 | |

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk.

|

32 | |

|

Item 8

|

Financial Statements and Supplementary Data.

|

32 | |

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

32 | |

|

Item 9A

|

Controls and Procedures

|

32 | |

|

Item 9B

|

Other Information

|

33 | |

|

PART III

|

|||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

34 | |

|

Item 11

|

Executive Compensation

|

36 | |

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

38 | |

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

39 | |

|

Item 14

|

Principal Accountant Fees and Services

|

39 | |

|

PART IV

|

|||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

40 | |

|

SIGNATURES

|

|||

2

Glossary of Mining Terms

Adit(s), Historic working driven horizontally, or nearly so into a hillside to explore for and exploit ore.

Adularia. A potassium-rich alteration mineral – a form of orthoclase.

Ag. Elemental symbol for silver.

Air track holes. Drill hole constructed with a small portable drill rig using an air-driven hammer.

Au. Elemental symbol for gold.

Core holes. A hole in the ground that is left after the process where a hollow drill bit with diamond chip teeth is used to drill into the ground. The center of the hollow drill fills with the core of the rock that is being drilled into, and when the drill is extracted, a hole is left in the ground.

Felsic Tertiary Volcanic Rocks. Quartz-rich rocks derived from volcanoes and deposited between two and sixty-five million years ago.

Geochemical sampling. Sample of soil, rock, silt, water or vegetation analyzed to detect the presence of valuable metals or other metals which may accompany them. For example, arsenic may indicate the presence of gold.

Geologic mapping. Producing a plan and sectional map of the rock types, structure and alteration of a property.

Geophysical survey. Electrical, magnetic, gravity and other means used to detect features, which may be associated with mineral deposits

Leaching. Leaching is a cost effective process where ore is subjected to a chemical liquid that dissolves the mineral component from ore, and then the liquid is collected and the metals extracted from it.

Level(s), Main underground passage driven along a level course to afford access to stopes or workings and provide ventilation and a haulageway for removal of ore.

Magnetic lows. An occurrence that may be indicative of a destruction of magnetic minerals by later hydrothermal (hot water) fluids that have come up along faults. These hydrothermal fluids may in turn have carried and deposited precious metals such as gold and/or silver.

Plug. A vertical pipe-like body of magma representing a volcanic vent similar to a dome.

Quartz Monzonite. A medium to coarse crystalline rock composed primarily of the minerals quartz, plagioclase and orthoclase.

Quartz Stockworks. A multi-directional system of quartz veinlets.

3

RC holes. Short form for Reverse Circulation Drill holes. These are holes left after the process of Reverse Circulation Drilling.

Resource. An estimate of the total tons and grade of a mineral deposit defined by surface sampling, drilling and occasionally underground sampling of historic diggings when available.

Reverse circulation drilling. A less expensive form of drilling than coring that does not allow for the recovery of a tube or core of rock. The material is brought up from depth as a series of small chips of rock that are then bagged and sent in for analysis. This is a quicker and cheaper method of drilling, but does not give as much information about the underlying rocks.

Scoping Study. A detailed study of the various possible methods to mine a deposit.

Sedimentation. The process of deposition of a solid material from a state of suspension or solution in a fluid (usually air or water).

Silicic dome. A convex landform created by extruding quartz-rich volcanic rocks

Stope(s), An excavation from which ore has been removed from sub-vertical openings above or below levels.

Tertiary. That portion of geologic time that includes abundant volcanism in the western U.S.

Trenching. A cost effective way of examining the structure and nature of mineral ores beneath gravel cover. It involves digging long usually shallow trenches in carefully selected areas to expose unweathered rock and allow sampling.

Tuffaceous. Pertaining to sediments which contain up to 50% tuff.

Volcanic center. Origin of major volcanic activity

Volcanoclastic. Coarse, unsorted sedimentary rock formed from erosion of volcanic debris.

4

Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking information. Forward-looking information includes statements relating to future actions, prospective products, future performance or results of current or anticipated products, sales and marketing efforts, costs and expenses, interest rates, outcome of contingencies, financial condition, results of operations, liquidity, business strategies, cost savings, objectives of management of Ranger Gold Corp. (the “Company”, “Ranger”, or “we”) and other matters. Forward-looking information may be included in this Annual Report on Form 10-K or may be incorporated by reference from other documents filed with the Securities and Exchange Commission (the “SEC”) by the Company. One can find many of these statements by looking for words including, for example, “believes,” “expects,” “anticipates,” “estimates” or similar expressions in this Annual Report on Form 10-K or in documents incorporated by reference in this Annual Report on Form 10-K. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or future events.

The Company has based the forward-looking statements relating to the Company’s operations on management’s current expectations, estimates and projections about the Company and the industry in which it operates. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that we cannot predict. In particular, we have based many of these forward-looking statements on assumptions about future events that may prove to be inaccurate. Accordingly, the Company’s actual results may differ materially from those contemplated by these forward-looking statements. Any differences could result from a variety of factors, including, but not limited to general economic and business conditions, competition, and other factors.

5

PART I

Item 1. Description of Business.

We are engaged in natural resource exploration and anticipate acquiring, exploring, and if warranted and feasible, developing natural resource properties. Currently we are in the exploration state and are undertaking two exploration programs in Nevada.

History

Ranger Gold Corp. (formerly Fenario, Inc.) (the “Company”) was incorporated on May 11, 2007 under the laws of the State of Nevada. The Company’s business at that time was the development and licensing of proprietary software solutions for healthcare providers, health care professionals and health insurance companies. Due to the state of the economy, the Company did not conduct any significant operations other than organizational matters, filing its Registration Statement and filings of periodic reports with the SEC. The Company has since abandoned its original business plan and has entered the mineral exploration industry.

On October 28, 2009 the Company’s principal shareholder entered into a Stock Purchase Agreement which provided for the sale of 25,000,000 shares of common stock of the Company to Gurpartap Singh Basrai. Effective as of October 28, 2009, in connection with the share acquisition, Mr. Basrai was appointed President, Chief Executive Officer, Chief Financial Officer, Treasurer, Director, and Chairman of the Company.

On November 6, 2009 Paul Strobel was elected to the Board of Directors of the Company.

On November 9, 2009, Mr. Basrai, as the holder of 25,000,000 (at that time representing 55.5%) of the issued and outstanding shares of the Company’s common stock, provided the Company with written consent in lieu of a meeting of stockholders (the “Written Consent”) authorizing the Company to amend the Company’s Articles of Incorporation for the purpose of changing the name of the Company from “Fenario, Inc.” to “Ranger Gold Corp.” In connection with the change of the Company’s name to Ranger Gold Corp. the Company’s business was changed to mineral resource exploration. The change in name and business received its final approval by the regulatory authorities on January 7, 2010.

Also on November 9, 2009 as part of the Written Consent and in relation to the Company’s name and business change, the Written Consent adopted a resolution to implement a forward stock split the Company’s issued and outstanding shares of common stock. The Board of Directors subsequently approved a 5:1 forward stock split which became effective on January 21, 2010 and was payable to all shareholders of record as of January 15, 2010, the record date. All references to share and per share amounts have been restated in this 10-K and related financial statements to reflect the forward stock split.

On November 27, 2009 the Company executed a property option agreement with MinQuest, Inc. (“MinQuest”) granting the Company the right to acquire 100% of the mining interests of a mineral exploration property currently controlled by MinQuest. The property known as the CX Property is located in Nye County, Nevada and currently consists of 77 unpatented claims.

6

On January 25, 2010 the Company completed a private placement issuing 550,000 units at $0.15 per unit for total proceeds of $82,500. The units were offered by the Company pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended. Each unit consists of one common share of the Company and two non-transferable share purchase warrants, designated Class A and Class B. The Class A warrants are exercisable at a price of $0.25 per share and the Class B warrants are exercisable at a price of $0.50 per share. The Class A warrants are exercisable commencing January 25, 2011 and the Class B warrants are exercisable commencing January 25, 2012. Both the Class A and Class B warrants expire on January 25, 2015.

On February 3, 2010 the Company adopted its 2010 Stock Option Plan (the “2010 Plan”). The 2010 Plan provides for the granting of up to 5,000,000 stock options to key employees, directors and consultants, of common shares of the Company.

On March 10, 2010 the Company closed a private placement of 70,000 common shares at $0.15 per share for a total offering price of $10,500. The shares were offered by the Company pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended.

On March 16, 2010 Shelby Cave was elected to the Board of Directors of the Company.

On March 29, 2010, the Company executed a second property option agreement with MinQuest granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by MinQuest. The property known as the Truman Property is located in Mineral County, Nevada and currently consists of 98 unpatented claims.

On April 20, 2010, the Company completed a private placement of 400,000 common shares at $1.25 per share for a total offering price of $500,000. The shares were offered by the Company pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended.

Business Operations

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, developing natural resource properties. Our primary focus in the natural resource sector is gold. We are an exploration state company. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

7

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term. Therefore, we anticipate selling or partnering any ore bodies that we may discover to a major mining company. Many major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By selling or partnering a deposit found by us to these major mining companies, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the Company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have optioned in Nevada contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the selling or partnering of our properties, the purchase of small interests in producing properties, the purchase of properties where feasibility studies already exist or by the optioning of natural resource exploration and development projects. To date we have two properties under option, and are in the early stages of exploring these properties. There has been no indication as yet that any commercially viable mineral deposits exist on these properties, and there is no assurance that a commercially viable mineral deposit exists on any of our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

Financing

On January 25, 2010 the Company completed a private placement issuing 550,000 units at $0.15 per unit for total proceeds of $82,500. Each unit consists of one common share of the Company and two non-transferable share purchase warrants, designated Class A and Class B. The Class A warrants are exercisable at a price of $0.25 per share and the Class B warrants are exercisable at a price of $0.50 per share. The Class A warrants are exercisable commencing January 25, 2011 and the Class B warrants are exercisable commencing January 25, 2012. Both the Class A and Class B warrants expire on January 25, 2015.

On March 10, 2010 the Company closed a private placement of 70,000 common shares at $0.15 per share for a total offering price of $10,500 and on April 20, 2010, the Company completed a private placement of 400,000 common shares at $1.25 per share for a total offering price of $500,000.

8

The shares or units from these financings were offered by the Company pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended.

The Company expects that it will need approximately $421,000 to fund its operations during the next twelve months which will include property option payments, exploration of its properties as well as the costs associated with maintaining an office. The Company completed a financing on April 20, 2010 for total proceeds of $500,000. However, after incurring expenses since the financing, the cash from this financing is not sufficient to fund its planned operations for the next twelve months. In order to develop its properties, the Company will need to obtain additional financing. Management plans to seek additional capital through private placements and public offerings of its common stock. Although there are no assurances that management’s plans will be realized, management believes that the Company will be able to continue operations in the future.

Competition

The mineral exploration industry, in general, is intensively competitive and even if commercial quantities of ore are discovered, a ready market may not exist for sale of same. Numerous factors beyond our control may affect the marketability of any substances discovered. These factors include market fluctuations, the proximity and capacity of natural resource markets and processing equipment, government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in our not receiving an adequate return on invested capital.

Government Regulation

The federal government and various state and local governments have adopted laws and regulations regarding the protection of natural resources, human health and the environment. We will be required to conduct all exploration activities in accordance with all applicable laws and regulations. These may include requiring working permits for any exploration work that results in physical disturbances to the land and locating claims, posting claims and reporting work performed on the mineral claims. The laws and regulations may tell us how and where we can explore for natural resources, as well as environmental matters relating to exploration and development. Because these laws and regulations change frequently, the costs of compliance with existing and future environmental regulations cannot be predicted with certainty.

Any exploration or production on United States Federal land will have to comply with the Federal Land Management Planning Act which has the effect generally of protecting the environment. Any exploration or production on private property, whether owned or leased, will have to comply with the Endangered Species Act and the Clean Water Act. The cost of complying with environmental concerns under any of these acts varies on a case-by-case basis. In many instances the cost can be prohibitive to development. Environmental costs associated with a particular project must be factored into the overall cost evaluation of whether to proceed with the project.

9

Other than the normal bonding requirements, there are no costs to us at the present time in connection with compliance with environmental laws. However, since we do anticipate engaging in natural resource projects, these costs could occur at any time. Costs could extend into the millions of dollars for which we could be liable. In the event of liability, we would be entitled to contribution from other owners so that our percentage share of a particular project would be the percentage share of our liability on that project. However, other owners may not be willing or able to share in the cost of the liability. Even if liability is limited to our percentage share, any significant liability would wipe out our assets and resources.

Employees

We have commenced only limited operations. Therefore, we have no full time employees. Our sole officer and three directors provide planning and organizational services for us on a part-time basis.

Subsidiaries

We do not have any subsidiaries and we are not part of a group.

Item 1A. Risk Factors

Factors that May Affect Future Results

1. We will require additional funds in the future to achieve our current business strategy and our inability to obtain funding will cause our business to fail.

Based upon current plans we expect to incur operating losses in future periods. This will happen because there are expenses associated with the acquisition and exploration of natural resource properties. We do not have sufficient cash on hand to fund our operating needs to March 31, 2012 and we will need to raise additional funds through public or private debt or equity sales in order to fund our future operations and fulfill contractual obligations. These financings may not be available when needed. Even if these financings are available, it may be on terms that we deem unacceptable or are materially adverse to your interests with respect to dilution of book value, dividend preferences, liquidation preferences, or other terms. Our inability to obtain financing would have an adverse effect on our ability to implement our current exploration in Arizona and Nevada, and as a result, could require us to diminish or suspend our operations and possibly cease our existence. Obtaining additional financing would be subject to a number of factors, including the market prices for the mineral property and silver and copper. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us.

10

2. If we do not complete the required option payments and capital expenditure requirements mandated in our respective agreements with MinQuest, Inc. (“MinQuest”) we will lose our interest in that respective property and our business may fail.

If we do not make all of the property payments to MinQuest or incur the required expenditures in accordance with the respective property option agreements we will lose our option to acquire the respective property for which we have not made the payments and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the properties.

3. Because of our reliance on MinQuest our operations would be severely impacted should our relationship with MinQuest be terminated for any reason.

Both of our properties have been acquired from MinQuest. In addition, to date all of our exploration activity on these properties has been undertaken by MinQuest. As a result, MinQuest has significant knowledge about our properties and it would be very difficult for us to replace MinQuest should our relationship with them be terminated for any reason. To date, there have not been any conflicts between the Company and MinQuest.

4. Because our Officer and Directors serve as Officers and Directors of other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

All of our Directors and Officers work for other mining and mineral exploration companies. Due to time demands placed on our Directors and Officers, and due to the competitive nature of the exploration business, the potential exists for conflicts of interest to occur from time to time that could adversely affect our ability to conduct our business. The Officers and Directors’ full-time employment with other entities limits the amount of time they can dedicate to us as a director or officer. Also, our Directors and Officers may have a conflict of interest in helping us identify and obtain the rights to mineral properties because they may also be considering the same properties. To mitigate these risks, we work with several geologists in order to ensure that we are not overly reliant on any one of our Directors to provide us with geological services. However, we cannot be certain that a conflict of interest will not arise in the future. To date, there have not been any conflicts of interest between any of our Directors or Officers and the Company.

5. Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have in Arizona and Nevada contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan.

11

6. Because we have not commenced business operations, we face a high risk of business failure due to our inability to predict the success of our business

We are in the initial stages of exploration of our mineral claims and thus have no way to evaluate the likelihood that we will be able to operate our business successfully. To date have been involved primarily in organizational activities, and the acquisition and exploration of the mineral claims. We have not earned any revenues as of the date of this report.

7. Because of the unique difficulties and uncertainties inherent in mineral exploration and the mining business, we face a high risk of business failure

Potential investors should be aware of the difficulties normally encountered by early-stage mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates.

In addition, the search for valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

8. Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. Therefore, we expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

9. Because access to our mineral claims is restricted by inclement weather we may be delayed in our exploration

Access to our mineral properties is restricted through some of the year due to weather in the

local area. As a result, any attempt to test or explore the property is largely limited to the times when weather permits such activities. These limitations can result in significant delays in exploration efforts. Such delays can have a significant negative effect on our results of operations.

12

10. Because our President has only agreed to provide his services on a part-time basis, he may not be able or willing to devote a sufficient amount of time to our business operations, causing our business to fail

Mr. Basrai, our sole officer, owns and operates several businesses. As a result of his duties and responsibilities with the other businesses Mr. Basrai provides his management services to a number of companies. Because we are in the early stages of our business, Mr. Basrai will not be spending all of his time working for the Company. Mr. Basrai will expend enough time to oversee the work programs that have been approved by the Company. Later, if the demands of our business require additional time from Mr. Basrai, he is prepared to adjust his timetable to devote more time to our business. However, it still may not be possible for Mr. Basrai to devote sufficient time to the management of our business, as and when needed, especially if the demands of Mr. Basrai’s other interests increase. Competing demands on Mr. Basrai’s time may lead to a divergence between his interests and the interests of our shareholders.

11. As we undertake exploration of our mineral claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our exploration programs

There are several governmental regulations that materially restrict mineral exploration. We will be subject to the federal, state and local laws of the United States and Nevada as we carry out our exploration programs. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the land in order to comply with these laws. While our planned exploration program budgets for regulatory compliance, there is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration programs.

12. Our auditors’ opinion on our March 31, 2011 and 2010 financial statements includes an explanatory paragraph in respect of there being substantial doubt about our ability to continue as a going concern.

We have incurred net losses of $591,796 from May 11, 2007 (inception) to March 31, 2011. Our financial statements do not include any adjustments relating to the recoverability and classification of recorded assets, or the amounts of and classification of liabilities that might be necessary in the event the Company cannot continue in existence. We anticipate generating losses for at least the next 12 months. Therefore, there is substantial doubt about our ability to continue operations in the future as a going concern. We will need to obtain additional funds in the future. Our plans to deal with this cash requirement include loans from existing shareholders, raising additional capital from the public or private sale of equity or entering into a strategic arrangement with a third party. If we cannot continue as a viable entity, our shareholders may lose some or all of their investment in our company.

13

RISKS RELATING TO OUR COMMON SHARES

13. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorize the issuance of 500,000,000 common shares, of which 46,020,000 shares are issued and outstanding. The future issuance of our common shares may result in substantial dilution in the percentage of our common shares held by our then existing shareholders. We may value any common shares issued in the future on an arbitrary basis. The issuance of common shares for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common shares.

14. Our common shares are subject to the "Penny Stock" Rules of the SEC and we have no established market for our securities, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The Securities and Exchange Commission has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than USD $5.00 per share or with an exercise price of less than USD $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require:

|

·

|

that a broker or dealer approve a person’s account for transactions in penny stocks; and

|

|

·

|

the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased.

|

In order to approve a person's account for transactions in penny stocks, the broker or dealer must:

|

·

|

obtain financial information and investment experience objectives of the person; and

|

|

·

|

make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

|

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the Commission relating to the penny stock market, which, in highlight form:

|

·

|

sets forth the basis on which the broker or dealer made the suitability determination; and

|

|

·

|

that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

|

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common shares and cause a decline in the market value of our stock.

14

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

15. Because we do not intend to pay any cash dividends on our common shares, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common shares in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them.

Item 1B. Unresolved Staff Comments

There are no unresolved staff comments.

Item 2. Description of Properties.

We do not lease or own any real property. We currently maintain our corporate office on a one-year lease basis at 2533 N. Carson Street, Carson City, Suite 5018, Carson City, Nevada, 89706. Management believes that our office space is suitable for our current needs.

In the following discussion relating to our interests in real property, there are references to “patented” mining claims and “unpatented” mining claims. A patented mining claim is one for which the U.S. government has passed its title to the claimant, giving that person title to the land as well as the minerals and other resources above and below the surface. The patented claim is then treated like any other private land and is subject to local property taxes. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If one purchases an unpatented mining claim that is later declared invalid by the U.S. government, one could be evicted.

15

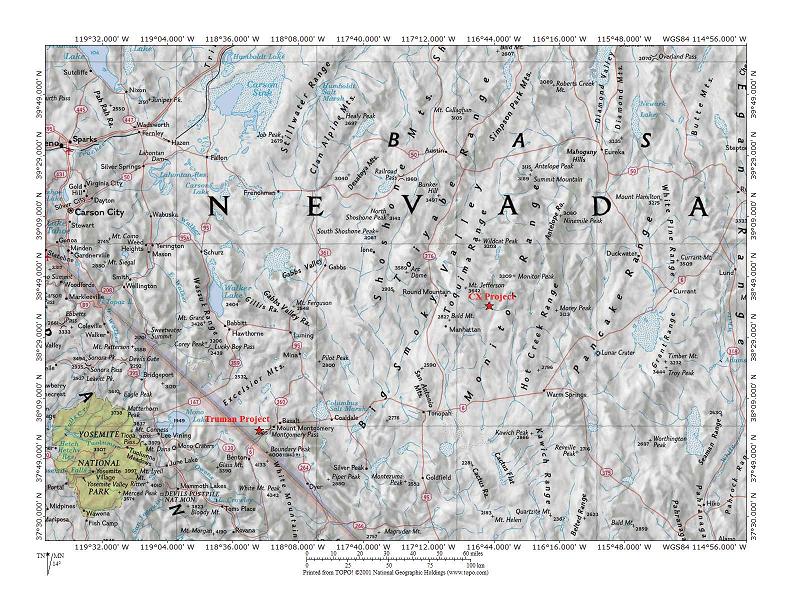

Map of our CX and Truman Properties located in Nevada.

16

CX Property

Acquisition of Interest

Pursuant to a Property Option Agreement, dated as of November 27, 2009 the Company executed a property option agreement with MinQuest, Inc. (“MinQuest”) granting the Company the right to acquire 100% of the mining interests of a mineral exploration property currently controlled by MinQuest. The property known as the CX Property is located in Nye County, Nevada and consisted of 72 unpatented claims (the ‘CX”) at the time of the option. The company has since added 5 additional unpatented claims to bring the total number of claims currently held to 77. Annual option payments and minimum annual exploration expenditures are as noted below:

|

Property

|

Work

|

|||

|

Payments

|

Expenditures

|

|||

|

Upon Execution of the Agreement

|

$

|

-

|

$

|

-

|

|

By February 25, 2010

|

20,000

|

-

|

||

|

By February 25, 2011

|

20,000

|

50,000

|

||

|

By February 25, 2012

|

20,000

|

150,000

|

||

|

By February 25, 2013

|

30,000

|

200,000

|

||

|

By February 25, 2014

|

40,000

|

350,000

|

||

|

By February 25, 2015

|

50,000

|

200,000

|

||

|

By February 25, 2016

|

50,000

|

200,000

|

||

|

By February 25, 2017

|

50,000

|

200,000

|

||

|

By February 25, 2018

|

50,000

|

200,000

|

||

|

By February 25, 2019

|

50,000

|

200,000

|

||

|

By February 25, 2020

|

100,000

|

750,000

|

||

|

$

|

480,000

|

$

|

2,500,000

|

|

Upon execution of the CX agreement, MinQuest accepted a 90-day, non-interest bearing promissory note from the Company for the initial $20,000 property option payment. On February 25, 2010 the Company paid the $20,000 balance of the note as well as reimbursed MinQuest for CX’s holding and related property costs in the amount of $23,512. On February 25, 2011, the Company made the second option payment of $20,000 to MinQuest.

Description and Location of the CX Property

The CX Property is located in Nye County, Nevada, 80 km north of Tonopah and currently consists of 77 unpatented claims.

Exploration History of the CX Property

Between 1970 and 1989, approximately 100 holes were drilled on the CX Property. Over 70 of these holes tested the main resource area while the rest tested the three remaining targets. Drill testing has been relatively shallow, with only 8 holes known to be deeper than 800 feet (240m) all located within the resource area.

17

Since 1989 work on the project has been limited to geologic mapping, rock chip sampling, geophysical surveys and reinterpretation of targets. Fieldwork by various groups identified mineralization with variable Ag:Au ratios. The rock-chip sampling confirmed the presence of gold mineralization with a low Ag:Au ratio peripheral to the known resource area. Previous limited shallow drilling in these two areas intersected gold mineralization. This Au-rich facies contains higher arsenic, antimony and mercury suggesting a separate gold mineralizing event.

A 3-dimensional drill model of the resource was reportedly completed by Bullion River Gold in 2004. The model suggests that gold-silver mineralization remains open along strike and at depth of the resource area.

Geology of the CX Property

The CX lies within a clustered group of calderas considered part of the Jefferson Mountain Caldera system. The project area is underlain by a Middle Tertiary (22-26Ma) caldera complex consisting of felsic ash-flow tuffs, tuffaceous sediments, and intrusions. The property lies along the margin of one of several nested calderas. Widespread alteration and mineralization coincides with a district-scale, northeast-trending structural zone coinciding with a caldera margin.

The CX is a volcanic-hosted, low-sulfidation, silver-gold, and epithermal system extending for more than 5.5 km along a northeast-trending structural zone defined by alteration, veining, gold-silver mineralization, faulting, and intrusions. Mineralization occurs in quartz-vein stockworks and breccias within sericitized, argillized and silicified volcanic rocks. Arsenic, molybdenum, mercury, thallium, and antimony are strongly elevated with gold and silver. Base-metal contents are low throughout the area. Strongly sericitized, alkali rhyolite stocks with quartz veinlets containing gold-silver-molybdenum mineralization are the likely source of mineralization.

Current State of Exploration

The CX claims presently do not have any mineral resources or reserves. The company has reviewed the results of the historic drilling and sampling. There is no mining plant or equipment located within the property boundaries. Currently, there is no power supply to the mineral claims. Our planned program includes compilation of all activities to the present with a follow-up reverse circulation drill program. However, this program is exploratory in nature and no minable reserves may ever be found.

18

Geological Exploration Program

In April 2010 our Board of Directors approved a $150,000 exploration program that will include 3,000 feet of reverse circulation drilling. Previous exploration mainly focused on a small core area where numerous drill holes were concentrated. The core area occurs near the center of the claim block. The outlying targets were tested with wide-spaced, shallow drill holes. Some of the targets had two episodes of drilling, both confirming the existence of gold and silver mineralization. These outlying targets were poorly understood, but remain attractive targets. Subsequent drilling added to the understanding of the model through detailed mapping, sampling and a geophysical survey. However, the program was prematurely truncated due to budget cuts. The various targets were further defined, but never tested by drilling.

Ranger has collected all of the data from the previous programs, confirmed the validity of the targets, prioritized the best ones and will test them with a drill program. Biological and cultural surveys were conducted on the CX in May and July of 2010 respectively.

The Company had intended on undertaking its planned drill program in the summer of 2010. Due to delays in receiving the permits for drilling, Ranger will now complete the field portion of the drill program in the summer of 2011. The Company has received approval of its drilling permit and bond calculation and has made the bond payment of $16,000 to the United States Forest Service. In addition, the Company has engaged a contract driller and will commence drilling once the last of the snow has melted and the roads have dried enough to allow access to the CX Property.

19

Truman Property

Acquisition of Interest

Pursuant to a Property Option Agreement dated March 29, 2010, the Company executed a second property option agreement with MinQuest granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by MinQuest. The property known as the Truman Property is located in Mineral County, Nevada and consisted of 52 unpatented claims (the “Truman”) at the time of acquisition. Subsequent to the option agreement, the Company has staked an additional 46 claims bringing the total number of claims at Truman to 98. Annual option payments and minimum annual exploration expenditures are as noted below:

|

Property

|

Work

|

|||

|

Payments

|

Expenditures

|

|||

|

Upon Execution of the Agreement

|

$

|

10,000

|

$

|

-

|

|

By March 29, 2011

|

10,000

|

50,000

|

||

|

By March 29, 2012

|

20,000

|

150,000

|

||

|

By March 29, 2013

|

30,000

|

200,000

|

||

|

By March 29, 2014

|

40,000

|

350,000

|

||

|

By March 29, 2015

|

50,000

|

200,000

|

||

|

By March 29, 2016

|

50,000

|

200,000

|

||

|

By March 29, 2017

|

50,000

|

200,000

|

||

|

By March 29, 2018

|

50,000

|

200,000

|

||

|

By March 29, 2019

|

50,000

|

200,000

|

||

|

By March 29, 2020

|

150,000

|

750,000

|

||

|

$

|

510,000

|

$

|

2,500,000

|

|

Upon execution of the Agreement the Company paid MinQuest $10,000 and well as reimbursed MinQuest for Truman’s holdings and related property costs in the amount of $7,859. On March 29, 2011, the Company made the $10,000 payment due to MinQuest under the option agreement.

Description and Location of the Truman Property

The Truman Property is located within the Buena Vista Mining District in southwestern Mineral County, Nevada, USA approximately 161 kilometers west of Tonopah, Nevada and 72.4 kilometers north-northeast of Bishop, California and currently consists of 98 unpatented claims.

Exploration History of the Truman Property

The project covers 8 epithermal gold and silver targets hosted within a sequence of Tertiary volcanics and Paleozoic sediments. These targets have been partially defined by previous exploration groups over a 25 year period. The historic efforts of five exploration groups have helped define high grade gold and silver values occurring in veins and low grade gold values occurring in bulk minable configurations.

20

Geology of the Truman Mineral Claims

The project covers 8 epithermal gold and silver targets hosted within a sequence of Tertiary volcanics and Paleozoic sediments. Regionally the Truman Property is located at the southwestern end of the Mina deflection within and adjacent to the Coaldale Fault Zone. To the south the White Mountains are made up of quartz monzonite of the Inyo Batholith containing roof pendants of highly metamorphosed Cambrian to Ordovician sediments. The east and north flanks of the White Mountains are composed predominantly of welded and non-welded ash flows, andesitic flows and breccias, quartz latite, basalt and tuffaceous volcanoclastics and sediments.

The Cambrian Polleta Formation, a coarse grained marble to recrystallized limestone, is the oldest formation known in the area. The thickness within the project area is at least 320 meters. The Harkless Formation lies conformably above the Polleta Formation. The Harkless is composed of a red to brown phyllite which produces slaty to pencil like shards when weathered. The Harkless ranges from 30 to 100 meters thick.

The Cambrian formations are intruded by a group of felsic to intermediate stocks ranging from Jurassic to Miocene (Crowder, et al, 1972). A possible Jurassic age adamellite is mapped in sections 2 and 3. Mineralization peripheral to the intrusive bodies include quartz-calcite vein fillings within faults containing gold and silver. A luecogranite near the center boundary of sections 10 and 11 is fault bounded and difficult to determine the relationships with either the ash fall tuffs or the Paleozoic sediments. A porphyrytic rhyolite stock occurring along the range front adjacent to the Pediment Target in the central part of section 11 is believed to be Tertiary in age (Crowder, et al, 1972). The porphyrytic rhyolite has been altered to a quartz-sericite-pyrite matrix with stockwork quartz veining along the north and east margins. Contact type alteration and mineralization are exposed in several areas around the stock in Section 11. At least three distinct dike generations cut the Paleozoic, intrusive and volcanic country rocks. These dikes are intermediate to basic ranging from andesitic to diabase in nature.

Current State of Exploration

The Truman claims presently do not have any mineral resources or reserves. The property that is the subject of our mineral claims is undeveloped and does not contain any open-pits. No reported historic production is noted for the property. There is no mining plant or equipment located on the property that is the subject of the mineral claim. Currently, there is no power supply to the mineral claims. Our planned exploration program is exploratory in nature and no mineral reserves may ever be found. Although drill holes are present within the property boundary, there is no drilled resource on our claims.

Geological Exploration Program

In April 2010 our Board of Directors approved a $150,000 exploration program that will include 3,000 feet of reverse circulation drilling. The project covers 8 epithermal gold and silver targets hosted within a sequence of Tertiary volcanics and Paleozoic sediments. These targets have been partially defined by previous exploration groups over a 25 year period. The historic efforts of five exploration groups have helped define high grade gold and silver values occurring in veins and low grade gold values occurring in bulk minable configurations.

21

The company intends to concentrate on three previously identified mineralized zones. Although the various targets were previously discovered by others, they remain poorly explored because of past property disputes or a lack of understanding of the geology and an ore model. Recent breakthroughs in geologic concepts in the immediate area and ore models typified by the aforementioned targets coupled with the historic results collected from the work of others provides an opportunity for Ranger.

A mapping and sampling program was initiated on the Truman in mid-October, 2010. An extensive evaluation of underground workings was carried out throughout the project area. This evaluation resulted in the survey, underground mapping and sampling of approximately 4,200 feet of historic adits and stopes. Surface mapping and sampling was also carried out in the western portion of the property. This mapping was intended to follow up on silver in soil samples from historic sampling carried out by Noranda in the early 1990’s. A total of 118 underground samples and 8 surface samples were collected during this exercise. The underground samples were continuous chip samples collected over widths ranging from 3 to 50 feet and averaging 20 feet. The results of this work identified several mineralized structures.

As with the CX, the Company had intended on undertaking its planned drill program in the summer of 2010. Due to delays in receiving the permits for drilling, Ranger will now complete the field portion of the drill program in the summer of 2011. Ranger has mapped the target areas and defined the targets with additional underground sampling and mapping carried out during the fall of 2010. The biological and cultural surveys have been initiated for the Truman project in April, 2011.

Item 3. Legal Proceedings.

There are no pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s properties are not the subject of any pending legal proceedings.

Item 4. (Removed and Reserved)

22

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

Market Information.

Our common stock is traded on the Financial Industry Regulatory Authority Over The Counter Bulletin Board (“OTCBB”) under the symbol “RNGC.” The OTCBB does not have any quantitative or qualitative standards such as those required for companies listed on Nasdaq. The following table sets forth the range of quarterly high and low closing bid prices of the common stock as reported on http://finance.yahoo.com during the years ending March 31, 2011 and March 31, 2010:

|

Financial Quarter

|

Bid Price Information*

|

||

|

Year

|

Quarter

|

High Bid Price

|

Low Bid Price

|

|

2011

|

Fourth Quarter

|

$0.50

|

$0.16

|

|

Third Quarter

|

$0.48

|

$0.17

|

|

|

Second Quarter

|

$1.05

|

$0.175

|

|

|

First Quarter

|

$1.92

|

$0.41

|

|

|

2010

|

Fourth Quarter

|

$1.10

|

$0.15

|

|

Third Quarter

|

$0.03

|

$0.03

|

|

|

Second Quarter

|

$0.03

|

$0.03

|

|

|

First Quarter

|

$0.03

|

$0.03

|

|

*The quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not represent actual transactions.

Holders.

On June 27, 2011, there were approximately thirty-one (31) holders of record of the Company’s common stock.

Dividends.

The Company has not declared or paid any cash dividends on its common stock nor does it anticipate paying any in the foreseeable future. Furthermore, the Company expects to retain any future earnings to finance its operations and expansion. The payment of cash dividends in the future will be at the discretion of its Board of Directors and will depend upon its earnings levels, capital requirements, any restrictive loan covenants and other factors the Board considers relevant.

Warrants or Options.

At March 31, 2011 the Company had 1,400,000 common stock options and 1,100,000 common share purchase warrants outstanding. Each common stock option and warrant is convertible into one share of common stock of the Company.

23

Securities Authorized for Issuance under Equity Compensation Plans

We do not have any equity compensation plans that were approved by our shareholders. Set forth below is certain information as of March 31, 2011, the end of our most recently completed fiscal year, regarding equity compensation plans that have not been approved by our stockholders.

|

Equity compensation plans not approved by stockholders – as of March 31, 2011

|

||||||||

|

Plan Category

|

Number of securities to be

issued upon exercise of

outstanding options, warrants and rights

|

Weighted average exercise

price of outstanding options,

warrants and rights

|

Number of securities

remaining available for

future issuance

|

|||||

|

Equity compensation plans approved by security holders(1)

|

5,000,000

|

$0.68

|

3,600,000

|

|||||

|

Equity compensation plans not approved by security holders (2)

|

1,100,000

|

$0.38

|

N/A

|

|||||

|

(1)

|

As of March 31, 2011, there were a total of 1,400,000 options granted under the 2010 Plan with exercise prices ranging from $0.50 per share to $1.00 per share. Of these options, 1,100,000 options have vested with the remaining options vesting over two years.

|

|

(2)

|

Represents share purchase warrants granted as part of a private placement previously completed by the Company. Each warrant is exercisable into one common share. Half of the warrants have vested and the balance vest January 25, 2012.

|

The following discussion describes material terms of grants made pursuant to the stock option plans:

On February 3, 2010 the Company adopted its 2010 Stock Option Plan (“the 2010 Plan”). The 2010 Plan provides for the granting of up to 5,000,000 stock options to key employees, directors and consultants, of common shares of the Company. Under the 2010 Plan, the granting of stock options, the exercise prices, and the option terms are determined by the Company's Option Committee, a committee designated to administer the 2010 Plan by the Board of Directors. For incentive options, the exercise price shall not be less than the fair market value of the Company's common stock on the grant date. (In the case of options granted to an employee who owns stock possessing more than 10% of the voting power of all classes of the Company's stock on the date of grant, the option price must not be less than 110% of the fair market value of common stock on the grant date.). Options granted are not to exceed terms beyond five years. No stock options have been granted under the 2010 Plan.

24

In order to exercise an option granted under the Plan, the optionee must pay the full exercise price of the shares being purchased. Payment may be made either: (i) in cash; or (ii) at the discretion of the Committee, by delivering shares of common stock already owned by the optionee that have a fair market value equal to the applicable exercise price; or (iii) with the approval of the Committee, with monies borrowed from us.

Subject to the foregoing, the Committee has broad discretion to describe the terms and conditions applicable to options granted under the Plan. The Committee may at any time discontinue granting options under the Plan or otherwise suspend, amend or terminate the Plan and may, with the consent of an optionee, make such modification of the terms and conditions of such optionee’s option as the Committee shall deem advisable.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities.

On January 25, 2010 the Company completed a private placement issuing 550,000 units at $0.15 per unit for total proceeds of $82,500. Each unit consists of one common share of the Company and two non-transferable share purchase warrants, designated Class A and Class B. The Class A warrants are exercisable at a price of $0.25 per share and the Class B warrants are exercisable at a price of $0.50 per share. The Class A warrants are exercisable commencing January 25, 2011 and the Class B warrants are exercisable commencing January 25, 2012. Both the Class A and Class B warrants expire on January 25, 2015.

On March 10, 2010 the Company closed a private placement of 70,000 common shares at $0.15 per share for a total offering price of $10,500.

On April 20, 2010, the Company completed a private placement of 400,000 common shares at $1.25 per share for a total offering price of $500,000.

All of the above transactions were offered by the Company pursuant to an exemption from registration under Regulation S of the Securities Act of 1933, as amended.

Purchases of Equity Securities by the Company and Affiliated Purchasers.

None.

Item 6. Selected Financial Data

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

25

Item 7. Management’s Discussion and Analysis or Plan of Operation.

Overview

We are a natural resource exploration company with an objective of acquiring, exploring, and if warranted and feasible, exploiting natural resource properties. Our primary focus in the natural resource sector is gold. We do not consider ourselves a “blank check” company required to comply with Rule 419 of the Securities and Exchange Commission, because we were not organized for the purpose of effecting, and our business plan is not to effect, a merger with or acquisition of an unidentified company or companies, or other entity or person. We do not intend to merge with or acquire another company in the next 12 months.

Though we have the expertise on our board of directors to take a resource property that hosts a viable ore deposit into mining production, the costs and time frame for doing so are considerable, and the subsequent return on investment for our shareholders would be very long term indeed. We therefore anticipate optioning or selling any ore bodies that we may discover to a major mining company. Most major mining companies obtain their ore reserves through the purchase of ore bodies found by junior exploration companies. Although these major mining companies do some exploration work themselves, many of them rely on the junior resource exploration companies to provide them with future deposits for them to mine. By optioning or selling a deposit found by us to these major mining companies, it would provide an immediate return to our shareholders without the long time frame and cost of putting a mine into operation ourselves, and it would also provide future capital for the company to continue operations.

The search for valuable natural resources as a business is extremely risky. We can provide investors with no assurance that the properties we have in Nevada contain commercially exploitable reserves. Exploration for natural reserves is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing commercially feasible reserves. Problems such as unusual or unexpected geological formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to complete our business plan and any money spent on exploration would be lost.

Natural resource exploration and development requires significant capital and our assets and resources are limited. Therefore, we anticipate participating in the natural resource industry through the purchase or option of early stage properties. To date we have two properties under option. We have not yet conducted exploration on the properties but we have initiated an exploration program that will include mapping, sampling, surveying and drilling on each of our two properties. There has been no indication as yet that any mineral deposits exist on the properties, and there is no assurance that a commercially viable mineral deposit exists on our properties. Further exploration will be required before a final evaluation as to the economic and legal feasibility is determined.

26

In the following discussion, there are references to “unpatented” mining claims. An unpatented mining claim on U.S. government lands establishes a claim to the locatable minerals (also referred to as stakeable minerals) on the land and the right of possession solely for mining purposes. No title to the land passes to the claimant. If a proven economic mineral deposit is developed, provisions of federal mining laws permit owners of unpatented mining claims to patent (to obtain title to) the claim. If you purchase an unpatented mining claim that is later declared invalid by the U.S. government, you could be evicted.

Plan of Operation

During the twelve-month period ending March 31, 2012, our objective is to continue to explore the properties subject to our mineral claims. The funds in our treasury are not sufficient to meet all planned activities as outlined below. The Company expects that it will need approximately $421,000 to fund its operations during the next twelve months which will include property option payments, exploration of its properties as well as the costs associated with maintaining an office. The Company completed a financing on April 20, 2010 for total proceeds of $500,000. However, the cash from this financing is not sufficient to fund its planned operations for the next twelve months. In order to develop its properties, the Company will need to obtain additional financing. Management plans to seek additional capital through private placements and public offerings of its common stock. Although there are no assurances that management’s plans will be realized, management believes that the Company will be able to continue operations in the future.

We continue to run our operations with the use of contract operators, and as such do not anticipate a change to our company staffing levels. We remain focused on keeping the staff compliment, which currently consists of our three directors and one investor relations person, at a minimum to conserve capital. Our staffing in no way hinders our operations, as outsourcing of necessary operations continues to be the most cost effective and efficient manner of conducting the business of the Company.

We do not anticipate any equipment purchases in the twelve months ending March 31, 2012.

The following is an overview of the project work to date, as well as anticipated work for the next twelve months. Specific dates when work will begin, and how long it will take to complete each step is subject to change due to the variables of weather, availability of work crews for a particular type of work, and the results of work that is planned, the outcome of which will determine what the next step on that project will be.

27

CX Property

Pursuant to a Property Option Agreement, dated as of November 27, 2009 the Company executed a property option agreement with MinQuest, Inc. (“MinQuest”) granting the Company the right to acquire 100% of the mining interests of a mineral exploration property currently controlled by MinQuest. The property known as the CX Property is located in Nye County, Nevada and currently consists of 77 unpatented claims (the ‘CX”). To earn a 100% interest in the CX, the Company must make certain annual option payments totaling $480,000 and incur certain annual exploration expenditures totaling $2,500,000 to February 25, 2020. Upon execution of the CX agreement, MinQuest accepted a 90-day, non-interest bearing promissory note from the Company for the initial $20,000 property option payment. On February 25, 2010 the Company paid the $20,000 balance of the note as well as reimbursed MinQuest for CX’s holding and related property costs in the amount of $23,512. On February 25, 2011 the Company made the second property option payment of $20,000 required under the CX agreement. As a result of the CX property not containing any known resources, the Company has written down its property option payments made to March 31, 2011 in the statements of operations and comprehensive loss at March 31, 2011 and 2010 respectively.

In April 2010 our Board of Directors approved a $150,000 exploration program that will include 3,000 feet of reverse circulation drilling. Previous exploration mainly focused on a small core area where numerous drill holes were concentrated. The core area occurs near the center of the claim block. The outlying targets were tested with wide-spaced, shallow drill holes. Some of the targets had two episodes of drilling, both confirming the existence of significant gold and silver mineralization over substantial widths. These outlying targets were poorly understood, but remain attractive targets. Subsequent drilling added to the understanding of the model through detailed mapping, sampling and a geophysical survey. However, the program was prematurely truncated due to budget cuts. The various targets were further defined, but never tested by drilling.

Ranger has collected all of the data from the previous programs, confirmed the validity of the targets, prioritized the best ones and will test them with a drill program. Biological and cultural surveys were conducted on the CX in May and July of 2010 respectively.

The Company had intended on undertaking its planned drill program in the summer of 2010. Due to delays in receiving the permits for drilling, Ranger will now complete the field portion of the drill program in the summer of 2011. The Company has received approval of its drilling permit and bond calculation and has made the bond payment of $16,000 to the United States Forest Service. In addition, the Company has engaged a contract driller and will commence drilling once the last of the snow has melted and the roads have dried enough to allow access to the CX Property.

28

Truman Property

Pursuant to a Property Option Agreement dated March 29, 2010, the Company executed a second property option agreement with MinQuest granting the Company the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by MinQuest. The property known as the Truman Property is located in Mineral County, Nevada and currently consists of 98 unpatented claims (the “Truman”). To earn a 100% interest in the Truman the Company must make certain annual option payments totaling $510,000 and incur certain annual exploration expenditures totaling $2,500,000 to March 29, 2020. Upon execution of the Agreement the Company paid MinQuest $10,000 and well as reimbursed MinQuest for Truman’s holdings and related property costs in the amount of $7,859. On March 29, 2011 the Company made the second property option payment of $10,000 required under the Truman agreement. As a result of the Truman property not containing any known resources, the Company has written down its property option payments made to March 31, 2011 in the statements of operations and comprehensive loss at March 31, 2011 and 2010 respectively.

In April 2010 our Board of Directors approved a $150,000 exploration program that will include 3,000 feet of reverse circulation drilling. The project covers 8 epithermal gold and silver targets hosted within a sequence of Tertiary volcanics and Paleozoic sediments. These targets have been partially defined by previous exploration groups over a 25 year period. The historic efforts of five exploration groups have helped define high grade gold and silver values occurring in veins and low grade gold values occurring in bulk minable configurations.

The company intends to concentrate on three previously identified mineralized zones. Although the various targets were previously discovered by others, they remain poorly explored because of past property disputes or a lack of understanding of the geology and an ore model. Recent breakthroughs in geologic concepts in the immediate area and ore models typified by the aforementioned targets coupled with the historic results collected from others work provides an opportunity for Ranger.

A mapping and sampling program was initiated on the Truman in mid-October, 2010. An extensive evaluation of underground workings was carried out throughout the project area. This evaluation resulted in the survey, underground mapping and sampling of approximately 4,200 feet of historic adits and stopes. Surface mapping and sampling was also carried out in the western portion of the property. This mapping was intended to follow up on silver in soil samples from historic sampling carried out by Noranda in the early 1990’s. A total of 118 underground samples and 8 surface samples were collected during this exercise. The underground samples were continuous chip samples collected over widths ranging from 3 to 50 feet and averaging 20 feet. The results of this work identified several mineralized structures.

As with the CX, the Company had intended on undertaking its planned drill program in the summer of 2010. Due to delays in receiving the permits for drilling, Ranger will now complete the field portion of the drill program in the summer of 2011. Ranger has mapped the target areas and defined the targets with additional underground sampling mapping was carried out during the fall of 2010. The biological and cultural surveys have been initiated for the Truman project in April, 2011.

29

Results of Operations

The Year Ended March 31, 2011 compared to the Year Ended March 31, 2010

We did not earn any revenues during the years ended March 31, 2011 or 2010. We do not anticipate earning revenues until such time as we have entered into commercial production of our mineral properties. We are presently in the exploration stage of our business and we can provide no assurance that we will discover commercially exploitable levels of mineral resources on our properties, or if such resources are discovered, that we will enter into commercial production of our mineral properties.

For the year ended March 31, 2011 we had a net loss of $347,063 compared to $187,903 in the corresponding period in 2010. The increase in the net loss was largely due to the initiation of the exploration programs at the CX and Truman properties and higher general and administration costs. Mineral property exploration costs increased to $159,420 in 2011 compared to $53,071 in 2010. The CX and Truman properties were optioned from MinQuest in the fourth quarter of fiscal 2010. As a result, we incurred minimal exploration expenses in 2010 compared to 2011. Mineral exploration costs incurred in fiscal 2011 related to mapping, sampling, and the preparation of the drilling permit applications for both properties. In addition, stock-based compensation expense included in mineral exploration expenses increased to $39,448 in 2011 from $7,710 in 2010. Property option payments were an aggregate $30,000 in both 2011 and 2010.