Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K 6/28/2011 - KITE REALTY GROUP TRUST | form8k_62711.htm |

Analysts and Investors

PRESENTED TO:

6.28.11

KITE HEADQUARTERS

Indianapolis, IN

KITE REALTY GROUP

2

DISCLAIMER

This presentation contains certain statements that are not historical fact and may constitute forward

-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors

which may cause the actual results of the Company to differ materially from historical results or

from any results expressed or implied by such forward-looking statements, including, without

limitation: national and local economic, business, real estate and other market conditions,

particularly in light of the current challenging economic conditions; financing risks, including the

availability of and costs associated with sources of liquidity; the Company’s ability to refinance, or

extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial

stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the

competitive environment in which the Company operates; acquisition, disposition, development and

joint venture risks; property ownership and management risks; the Company’s ability to maintain its

status as a real estate investment trust (“REIT”) for federal income tax purposes; potential

environmental and other liabilities; impairment in the value of real estate property the Company

owns; risks related to the geographical concentration of our properties in Indiana, Florida and

Texas; assumptions underlying our anticipated growth sources; and other factors affecting the real

estate industry generally. The Company refers you the documents filed by the Company from time

to time with the Securities and Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, which

discuss these and other factors that could adversely affect the Company’s results. The Company

undertakes no obligation to publicly update or revise these forward-looking statements (including

the FFO and net income estimates), whether as a result of new information, future events or

otherwise.

-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements involve known and unknown risks, uncertainties and other factors

which may cause the actual results of the Company to differ materially from historical results or

from any results expressed or implied by such forward-looking statements, including, without

limitation: national and local economic, business, real estate and other market conditions,

particularly in light of the current challenging economic conditions; financing risks, including the

availability of and costs associated with sources of liquidity; the Company’s ability to refinance, or

extend the maturity dates of, its indebtedness; the level and volatility of interest rates; the financial

stability of tenants, including their ability to pay rent and the risk of tenant bankruptcies; the

competitive environment in which the Company operates; acquisition, disposition, development and

joint venture risks; property ownership and management risks; the Company’s ability to maintain its

status as a real estate investment trust (“REIT”) for federal income tax purposes; potential

environmental and other liabilities; impairment in the value of real estate property the Company

owns; risks related to the geographical concentration of our properties in Indiana, Florida and

Texas; assumptions underlying our anticipated growth sources; and other factors affecting the real

estate industry generally. The Company refers you the documents filed by the Company from time

to time with the Securities and Exchange Commission, specifically the section titled “Risk Factors”

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, which

discuss these and other factors that could adversely affect the Company’s results. The Company

undertakes no obligation to publicly update or revise these forward-looking statements (including

the FFO and net income estimates), whether as a result of new information, future events or

otherwise.

KITE REALTY GROUP

3

TABLE OF CONTENTS

Welcome: John Kite, Chairman & Chief Executive Officer

Section 1 Technology Initiatives

MRI: Marin Updike, Controller, Real Estate

Lease Flow: Matthew Gabet, Director of Finance & Capital

Markets

Salesforce: Bradley Bisser, Vice President Asset Management

Spaceman: Chris Mulloy, Vice President Construction Services

MRI: Marin Updike, Controller, Real Estate

Lease Flow: Matthew Gabet, Director of Finance & Capital

Markets

Salesforce: Bradley Bisser, Vice President Asset Management

Spaceman: Chris Mulloy, Vice President Construction Services

Section 2 Leasing W.V. “Bud” Moll, Jr. Executive Vice President of

Leasing

Leasing

Section 3 Asset Management Bradley Bisser

Section 4 Construction Thomas McGowan, President & Chief Operating

Officer

Officer

Section 5 Development Thomas McGowan

Section 6 Finance Daniel Sink, Executive Vice President & Chief

Financial Officer

Wade Achenbach, Vice President, Finance &

Capital Markets

Financial Officer

Wade Achenbach, Vice President, Finance &

Capital Markets

Section 7 Biographies

TECHNOLOGY

INITIATIVES

INITIATIVES

KITE REALTY GROUP

5

OVERVIEW

Simple goals of the technology initiatives:

• Enable all Kite personnel to have access to critical information.

• Increase productivity.

• Accelerate the leasing process which will accelerate rent commencement.

• Tenant retention.

KITE REALTY GROUP

6

MRI - OVERVIEW

MRI: An Enterprise Management System

Presenter: Marin Updike

Presenter: Marin Updike

• MRI Applications:

– MRI Commercial, AP and GL: Property Management and Financial Reporting

– Advanced Retail: Retail property sales and lease tracking

– Lease Flow: Track leasing process from contact to contract

– Work Flow: Automate business processes

– Job Cost: Track development budgets and contracts

– Recoveries: Estimate and bill tenant CAM, insurance and taxes

KITE REALTY GROUP

7

MRI - LEASE FLOW

Lease Flow

Presenter: Matthew Gabet

Presenter: Matthew Gabet

• Automated approval process for new and renewal leases.

• Comprehensive data base allows for more sophisticated reporting.

• Workflow between Leasing, Legal, Lease Administration and Accounting is defined.

• Notes, documents and lease terms are readily available to all approvers and other

individuals involved in the process from lease approval to rent commencement.

individuals involved in the process from lease approval to rent commencement.

• Lease language is contained in the MRI database and can be quickly queried.

SALESFORCE - DEMONSTRATION

Salesforce: A one-stop Customer Relations Management (CRM) database.

Presenter: Bradley Bisser

Presenter: Bradley Bisser

• Information for the entire company used primarily to connect with tenants/customers

in an organized fashion.

in an organized fashion.

• Creates a universal contact base for leasing agents, asset managers and executive

management. No longer does each person have their own contact list; the list is now

“owned” globally by the company and available to applicable departments.

management. No longer does each person have their own contact list; the list is now

“owned” globally by the company and available to applicable departments.

• Data is tied to each customer/tenant “Touch” with complete search and sort

capabilities.

capabilities.

• Leasing and Asset Management become symbiotic, sharing information on customers

instantly through salesforce.com.

instantly through salesforce.com.

• Assembles notes/conversations and sales information by tenant from broad sources

of information.

of information.

• Enables tracking of how often a tenant is “Touched” by landlord.

• Allows unprecedented clarity into each tenant’s current state of health, lease status,

notes and conversations logged.

notes and conversations logged.

KITE REALTY GROUP

8

KITE REALTY GROUP

9

PLAN DATA - SPACEMAN

Spaceman

Presenter: Chris Mulloy

Presenter: Chris Mulloy

• Displays MRI database information on a site plan.

• Provides a quick glance of lease information for any Kite shopping center.

• Enables Kite Leasing Agents to quickly access information on any tenant space in

the portfolio.

the portfolio.

• Kite employees have access to pertinent documents for shopping centers. Lease

Outline Drawing (LOD), Surveys, Building Plan, etc.

Outline Drawing (LOD), Surveys, Building Plan, etc.

• Allows for potential tenants/customers to view available spaces on a site plan and

obtain information about the space on a restricted basis.

obtain information about the space on a restricted basis.

W.V. “BUD” MOLL,

JR.

JR.

LEASING

LEASING - OVERVIEW

KITE REALTY GROUP

11

|

|

2011*

|

2010

|

2009

|

|

New Leases

|

9.1%

|

9.8%

|

4.4%

|

|

Renewals

|

<1.1%>

|

<3.5%>

|

<0.8%>

|

|

Weighted Total

|

5.8%

|

5.1%

|

2.1%

|

Leasing Results

Leasing Spread

* Through March 31, 2011

|

|

2011*

|

2010

|

2009

|

|

Total GLA Leased

|

194,276

|

1,151,682

|

793,471

|

|

Total Retail

Percentage Leased

|

92.3%

|

92.2%

|

90.1%

|

|

Shops (<10,000 SF)

|

78.2%

|

78.1%

|

76.6%

|

|

SSNOI

|

1.0%

|

<1.3%>

|

<2.7%>

|

LEASING - OVERVIEW

New Retail Relationships

• National Retailers: Nordstrom Rack / The Container Store / Arhaus Furniture /

Whole Foods / Fresh Market / Advanced Auto / Babies “R” Us and Toys “R” Us /

Ulta / Urban Outfitters / Vitamin Shoppe / buy buy Baby / Apricot Lane / Bobby

Chan / Chico’s / Dollar Tree / Goodwill

Whole Foods / Fresh Market / Advanced Auto / Babies “R” Us and Toys “R” Us /

Ulta / Urban Outfitters / Vitamin Shoppe / buy buy Baby / Apricot Lane / Bobby

Chan / Chico’s / Dollar Tree / Goodwill

KITE REALTY GROUP

12

LEASING - OVERVIEW

Leasing Department Management

• Personnel changes and upgrades.

• Leadership model:

– Goals - Challenging but concise to ensure understanding and maximum

production.

production.

– Coaching/Managing - Daily

– Accountability - Weekly/Quarterly/Annually

– Compensation Rewards

KITE REALTY GROUP

13

LEASING - OVERVIEW

Weekly KRG Real Estate Committee (REC)

• Participants - Executive Management / Leasing / Asset Management / Legal

/ Construction / Development

/ Construction / Development

Agenda

• Deal Presentations - Review of new deals and renewals.

• Legal Review - Update and track lease progress of negotiations.

• Weekly Leasing Reports - Review individual’s accomplishments from

previous week and goals for new week.

previous week and goals for new week.

• New Developments and Re-developments - Review lease tracking status

reports for Delray Beach, Florida; Holly Springs (Raleigh), North Carolina;

Wilmington, North Carolina and others.

reports for Delray Beach, Florida; Holly Springs (Raleigh), North Carolina;

Wilmington, North Carolina and others.

KITE REALTY GROUP

14

LEASING - OVERVIEW

2011 Leasing Production Goals

• Operating Centers - Increase to 93.5% leased by year-end.

– Boxes - 2 vacancies in operating portfolio (Lease in negotiation to occupy one of the

spaces).

spaces).

– Shops - Increase to 82% leased by 12/31/11 and 85% by 12/31/12.

• New Developments / Redevelopments (starts in 2011/first half of 2012)

– Delray Beach, Florida

• Key National Tenants Signed - Publix / Frank Theatres / Chase Bank / Apricot Lane /

Bobby Chan / Charming Charlie / Chico’s

Bobby Chan / Charming Charlie / Chico’s

– Holly Springs (Raleigh), North Carolina

• Key Box Tenants Signed - Dick’s Sporting Goods / Marshall’s

– Wilmington, North Carolina

• Key Box Tenant Signed - Whole Foods

KITE REALTY GROUP

15

LEASING - OVERVIEW

2011 Leasing Trends

• Box Tenants - Active

– Specialty Grocer - Fresh Market / Whole Foods / Trader Joe’s

– Other - Dick’s Sporting Goods / DSW / T.J. Maxx, Marshall’s, Home Goods / JC Penney /

Michael’s / PETCO / Petsmart / Toys "R" Us / Ulta / Ross Dress for Less

Michael’s / PETCO / Petsmart / Toys "R" Us / Ulta / Ross Dress for Less

• Box Tenants - Slowing

– Office Supply Stores - Downsizing

– Book Stores

• National Shops

– Most are active again including the “better” retailers.

– Deals are economically as tough as before but their “credit” remains strong.

• Local / Regional Shops

– Franchises are abundant and typically have the best chance to succeed.

– Other small retailers are doing some deals again but their credit and lack of significant

funding continues to be the biggest challenge.

funding continues to be the biggest challenge.

KITE REALTY GROUP

16

BRADLEY BISSER

ASSET MANAGEMENT

ASSET MANAGEMENT - INITIATIVES

KITE REALTY GROUP

18

Asset Management Strategy/Operating Property Coverage

• Team Overview - Regional Coverage

• Local, property level landlord reps in most of our markets.

Asset Managers Responsible for Property Level NOI

• Reduce expense structures through the analysis of property metrics, recoveries

and custom tailoring of expenses based on the individual needs of the centers.

and custom tailoring of expenses based on the individual needs of the centers.

• Reduce Expense Leakage

• Own all property level goals and objectives: Incentivized to manage centers with

specific parameters and promote onsite income-producing activities.

specific parameters and promote onsite income-producing activities.

KITE REALTY GROUP

19

ANCILLARY INCOME - EXAMPLES

Daytona 500 Parking

International Speedway

Square

Square

Clothing Bins located in 28

Kite properties

Kite properties

PanAm Plaza, downtown Indianapolis

is used for a variety of events

is used for a variety of events

Temporary Leasing

Temporary fireworks stand set

-up in out-lot areas

-up in out-lot areas

Kick-off Concerts at Eddy

Street Commons

Street Commons

ASSET MANAGEMENT - INITIATIVES

Define long term strategies for each asset through regular asset reviews.

• Drive Tenant Retention

– Enhance direct communication with tenants.

– Enhance cross communication pertaining to customers with leasing and other

divisions within the company.

divisions within the company.

– Asset Managers’ compensation goals based upon “Tenant Touches” and ability to

retain customers.

retain customers.

– Salesforce: a tracking tool to enhance customer relations.

KITE REALTY GROUP

20

THOMAS MCGOWAN

CONSTRUCTION

KITE REALTY GROUP

22

CONSTRUCTION - OVERVIEW

• Completed “wind down” of the General Contracting (GC) department of Kite Realty

Construction in Q4 2010.

Construction in Q4 2010.

• Leverage an aggressive GC/CM market to secure favorable pricing.

• Reduced construction head count.

• Combined Estimating, Pre-construction, and Construction under one department,

Kite Construction Services, to streamline process and communication.

Kite Construction Services, to streamline process and communication.

• Implemented new sign-off processes to more aggressively control spending and

monitor budgets.

monitor budgets.

Modify strategy to move from Construction Management (CM) to

Owner’s Representation.

Owner’s Representation.

KITE REALTY GROUP

23

CONSTRUCTION - OVERVIEW

Goals and Objectives

• Support leasing with the objective of moving customers into space in a timely,

productive and cost efficient manner.

productive and cost efficient manner.

– Focused on addressing and assisting the tenants needs.

– Tenant Coordination is now overseeing “as-is” deals in order to streamline the process

and secure timely rent commencement.

and secure timely rent commencement.

• Execute on redevelopment initiatives.

– Stabilize and add value to current assets.

– Provide input on design scope, pricing and schedule.

– Coordinate the success of existing tenants during the redevelopment process.

• Prepare for the unexpected.

– Tenants have become more aggressive in the way they get reimbursed for construction

cost. We have implemented a new procedure for reviewing leases in order to protect us

from hidden costs inside the leases.

cost. We have implemented a new procedure for reviewing leases in order to protect us

from hidden costs inside the leases.

THOMAS MCGOWAN

DEVELOPMENT

KITE REALTY GROUP

25

COBBLESTONE PLAZA

Pembroke Pines, Florida

Pembroke Pines, Florida

In-process Development

• Foundations and walls are in place

for Whole Foods. The building will

be turned over to the tenant by the

end of August with an opening

expected in January, 2012.

for Whole Foods. The building will

be turned over to the tenant by the

end of August with an opening

expected in January, 2012.

• Construction on the Whole Foods

building has increased awareness of

the center. The project is 84%

leased or committed as of March 31,

2011and expected to be over 90%

leased by year-end.

building has increased awareness of

the center. The project is 84%

leased or committed as of March 31,

2011and expected to be over 90%

leased by year-end.

Whole Foods

KITE REALTY GROUP

26

SOUTH ELGIN COMMONS

South Elgin, Illinois

South Elgin, Illinois

In-process Development

• The combination 58,000 SF Toys “R”

Us/Babies “R” Us building pad was

turned over to the tenant on April 1, 2011

with opening scheduled for September,

2011.

Us/Babies “R” Us building pad was

turned over to the tenant on April 1, 2011

with opening scheduled for September,

2011.

• The additional building will be turned

over to the tenant in August with a store

opening scheduled for October, 2011.

over to the tenant in August with a store

opening scheduled for October, 2011.

Toys “R” Us/Babies “R” Us

KITE REALTY GROUP

27

OLEANDER SHOPPING CENTER

Wilmington, North Carolina

Wilmington, North Carolina

In-process Redevelopment

• Oleander Shopping Center,

Wilmington, NC, was acquired

by Kite on February 11, 2011 for

$3,450,000.

Wilmington, NC, was acquired

by Kite on February 11, 2011 for

$3,450,000.

• A 30,000 square foot Whole

Foods will replace the former

Lowes Food Store.

Foods will replace the former

Lowes Food Store.

• Kite will commence construction

of the new Whole Foods on July

15 with a turnover to the tenant

scheduled for November, 2011.

of the new Whole Foods on July

15 with a turnover to the tenant

scheduled for November, 2011.

KITE REALTY GROUP

28

RIVERS EDGE

Indianapolis, Indiana

Indianapolis, Indiana

In-process Redevelopment

• The Rivers Edge redevelopment

is proceeding on schedule. New

anchor tenants include Nordstrom

Rack, The Container Store, buy

buy Baby and Arhaus Furniture.

is proceeding on schedule. New

anchor tenants include Nordstrom

Rack, The Container Store, buy

buy Baby and Arhaus Furniture.

• Nordstrom Rack was turned over

to the tenant on April 15, 2011,

The Container Store will be

turned over on August 11, 2011

and buy buy Baby is expected to

be delivered on October 31,

2011.

to the tenant on April 15, 2011,

The Container Store will be

turned over on August 11, 2011

and buy buy Baby is expected to

be delivered on October 31,

2011.

• Phase II of the project is under

way and will include a new

18,000 SF BGI building and a

renovated space for Arhaus

Furniture.

way and will include a new

18,000 SF BGI building and a

renovated space for Arhaus

Furniture.

• The center is 98.6% leased and

is expected to be partially

operational this fall.

is expected to be partially

operational this fall.

KITE REALTY GROUP

29

DELRAY MARKETPLACE

Delray Beach, Florida

Delray Beach, Florida

Future Development

• Offsite improvements for our portion

of the Lyons Road expansion

project are underway at a cost of

approximately $800,000.

of the Lyons Road expansion

project are underway at a cost of

approximately $800,000.

• Including anchors Publix and Frank

Theatres, we currently have 17

executed leases. The center is

approximately 60% pre-leased.

Theatres, we currently have 17

executed leases. The center is

approximately 60% pre-leased.

• The project is scheduled to open in

fall, 2012.

fall, 2012.

KITE REALTY GROUP

30

NEW HILL PLACE

Holly Springs, North Carolina

Holly Springs, North Carolina

Future Development

• The following junior box leases are

executed:

executed:

– Dick’s Sporting Goods - 40,000 SF

– Marshall’s - 25,000 SF

• Leases pending:

– 21,000 SF out for signature

– 12,000 SF out for signature

– 25,000 SF pending final approval from

tenants real estate committee

tenants real estate committee

• Phase I of New Hill Place is

scheduled to commence

construction in spring, 2012 pending

Target’s opening slot.

scheduled to commence

construction in spring, 2012 pending

Target’s opening slot.

DANIEL SINK & WADE

ACHENBACH

ACHENBACH

FINANCING

KITE REALTY GROUP

32

DEBT AND CAPITAL MARKETS UPDATE

Market Overview

• Permanent Loan Market - CMBS/Insurance

• Construction Loan Market

Significant Debt Transactions

• Closed on $200M Unsecured Credit Facility

• Executed term sheet on $85.7M of secured financing for 10 years at 5.25% (1)

2011 Maturities

• Only remaining 2011 maturity will be Gateway Marysville ($20.6 million) at the

completion of the secured financing. This loan has a one-year extension

option.

completion of the secured financing. This loan has a one-year extension

option.

(1) Subject to normal and customary due diligence and closing.

KITE REALTY GROUP

33

DEBT AND CAPITAL MARKETS UPDATE

Primary Debt Capital Market Initiatives

• Extend duration of maturities.

• Manage fixed to floating ratio to a goal of 80/20 (w/construction loan debt).

• Capitalize on low long term interest rate environment.

• Delevering in process through NOI growth.

• Continue to stagger debt maturities.

KITE REALTY GROUP

34

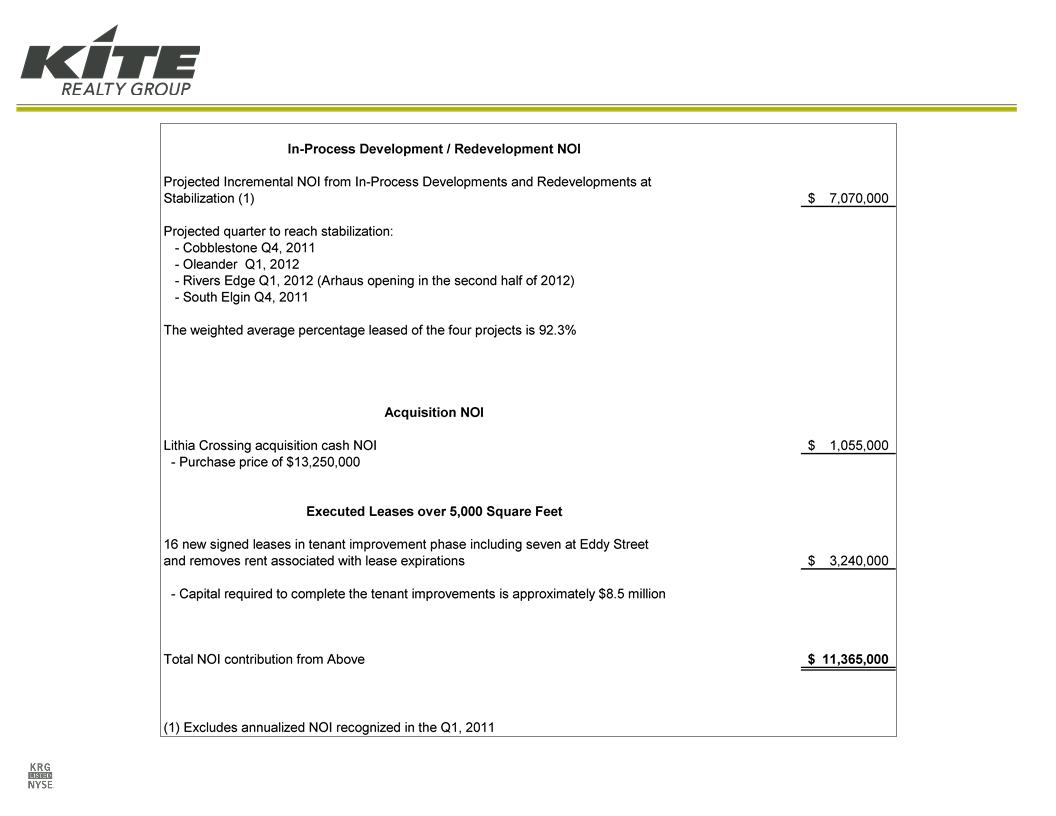

INCREMENTAL NOI ANALYSIS ON AN

ANNUALIZED BASIS

ANNUALIZED BASIS

PRESENTER BIOGRAPHIES

KITE REALTY GROUP

36

ABOUT THE TEAM - BIOGRAPHIES

John A. Kite

Chairman and Chief Executive Officer

John Kite is President and Chief Executive Officer of Kite Realty Group. Kite Realty Group is

a public company listed on the New York Stock Exchange with approximately $1 billion of

total market capitalization. Mr. Kite is responsible for the strategic direction and operating

results of the company. He serves as the head of the company’s capital allocation

committee which is responsible for major capital transactions. Mr. Kite led the senior

management team in structuring the company’s $240 million initial public offering in August

of 2004 and its secondary public offering of $150 million in October of 2005. Prior to

becoming Chief Executive Officer, Mr. Kite was President of Kite Companies from 1997-

2004. In 1994 he was named President of KMI Realty Advisors an affiliate of the Kite

Companies. Mr. Kite joined the Kite organization as Chief Financial Officer of Kite

Development in 1990. Mr. Kite was a Business Development Officer in the Commercial

Lending Department of Harris Trust and Savings Bank in Chicago, IL from 1987-1990. Mr.

Kite graduated from DePauw University with a B.A. in Economics in 1987.

a public company listed on the New York Stock Exchange with approximately $1 billion of

total market capitalization. Mr. Kite is responsible for the strategic direction and operating

results of the company. He serves as the head of the company’s capital allocation

committee which is responsible for major capital transactions. Mr. Kite led the senior

management team in structuring the company’s $240 million initial public offering in August

of 2004 and its secondary public offering of $150 million in October of 2005. Prior to

becoming Chief Executive Officer, Mr. Kite was President of Kite Companies from 1997-

2004. In 1994 he was named President of KMI Realty Advisors an affiliate of the Kite

Companies. Mr. Kite joined the Kite organization as Chief Financial Officer of Kite

Development in 1990. Mr. Kite was a Business Development Officer in the Commercial

Lending Department of Harris Trust and Savings Bank in Chicago, IL from 1987-1990. Mr.

Kite graduated from DePauw University with a B.A. in Economics in 1987.

KITE REALTY GROUP

37

ABOUT THE TEAM - BIOGRAPHIES

Thomas K. McGowan

President and Chief Operating Officer

Tom McGowan is primarily responsible for new project development, general operational

and organizational functions of the development, construction and asset management

groups. Before joining Kite Companies, Mr. McGowan worked for Mansur Development

Corporation. In his 24 years in the real estate development business, Mr. McGowan has

coordinated the development of shopping centers, Class A office buildings, medical facilities,

industrial buildings, planned unit developments, and full service hotels. Mr. McGowan was a

partner of Kite Companies prior to taking the company public in August of 2004. Mr.

McGowan graduated from Indiana University with a B.A. in Political Science in 1987.

and organizational functions of the development, construction and asset management

groups. Before joining Kite Companies, Mr. McGowan worked for Mansur Development

Corporation. In his 24 years in the real estate development business, Mr. McGowan has

coordinated the development of shopping centers, Class A office buildings, medical facilities,

industrial buildings, planned unit developments, and full service hotels. Mr. McGowan was a

partner of Kite Companies prior to taking the company public in August of 2004. Mr.

McGowan graduated from Indiana University with a B.A. in Political Science in 1987.

Daniel R. Sink

Executive Vice President and Chief Financial Officer

Daniel Sink is Executive Vice President and Chief Financial Officer for Kite Realty Group

and oversees the real estate finance area, all corporate accounting functions, corporate tax

planning, overall company financial budgeting, and corporate operations and administration.

Mr. Sink has been the Chief Financial Officer of Kite Companies since 1999. From 1989

through 1999, Mr. Sink was employed by Olive, LLP (subsequently merged into BKD LLP),

one of the fifteen largest accounting firms in the country, acting as a tax specialist in charge

of the tax consulting for the central Indiana real estate/construction group. Mr. Sink is a

Certified Public Accountant and earned his B.S. in Accounting from Indiana University.

and oversees the real estate finance area, all corporate accounting functions, corporate tax

planning, overall company financial budgeting, and corporate operations and administration.

Mr. Sink has been the Chief Financial Officer of Kite Companies since 1999. From 1989

through 1999, Mr. Sink was employed by Olive, LLP (subsequently merged into BKD LLP),

one of the fifteen largest accounting firms in the country, acting as a tax specialist in charge

of the tax consulting for the central Indiana real estate/construction group. Mr. Sink is a

Certified Public Accountant and earned his B.S. in Accounting from Indiana University.

KITE REALTY GROUP

38

ABOUT THE TEAM - BIOGRAPHIES

W.V. (BUD) Moll, Jr.

Executive Vice President of Leasing

Executive Vice President of Leasing

Bud Moll leads the Kite Realty Group Leasing department. Responsible for leasing the KRG

retail portfolio, Mr. Moll’s team handles all aspects of the leasing process for over sixty KRG

assets. Prior to joining Kite, Mr. Moll was a partner at Poag & McEwen in Memphis, Tennessee

for nine years where he developed one of the premier leasing teams in the retail real estate

industry. Mr. Moll was responsible for leasing over ten new ground-up Lifestyle Centers and

creating lasting relationships with the preeminent retailers in the business. Mr. Moll also worked

for The Pyramid Companies in New York for ten years. Pyramid is widely recognized for

educating dozens of the most successful real estate professionals in the industry. While a

member of the Pyramid team, he was consistently one of the firm’s top producers. Mr. Moll

began his professional career in sales and later in management at IBM in Chicago. Mr. Moll

earned his BA degree from Valparaiso University and later obtained an MBA from Marquette

University.

retail portfolio, Mr. Moll’s team handles all aspects of the leasing process for over sixty KRG

assets. Prior to joining Kite, Mr. Moll was a partner at Poag & McEwen in Memphis, Tennessee

for nine years where he developed one of the premier leasing teams in the retail real estate

industry. Mr. Moll was responsible for leasing over ten new ground-up Lifestyle Centers and

creating lasting relationships with the preeminent retailers in the business. Mr. Moll also worked

for The Pyramid Companies in New York for ten years. Pyramid is widely recognized for

educating dozens of the most successful real estate professionals in the industry. While a

member of the Pyramid team, he was consistently one of the firm’s top producers. Mr. Moll

began his professional career in sales and later in management at IBM in Chicago. Mr. Moll

earned his BA degree from Valparaiso University and later obtained an MBA from Marquette

University.

Bradley H. Bisser

Vice President of Asset Management

Brad Bisser oversees sixty-two Kite Realty Group operating properties and maintains strong

relationships with tenants and vendors. Mr. Bisser ensures all assets operate in a first class

manner while controlling costs. Prior to joining Kite, Mr. Bisser was with Developers Diversified

Realty, managing a portfolio of 110 retail properties in the Southeast and has over eighteen

years experience in property management. Mr. Bisser graduated from Southern Illinois

University with a major in German and International Business.

relationships with tenants and vendors. Mr. Bisser ensures all assets operate in a first class

manner while controlling costs. Prior to joining Kite, Mr. Bisser was with Developers Diversified

Realty, managing a portfolio of 110 retail properties in the Southeast and has over eighteen

years experience in property management. Mr. Bisser graduated from Southern Illinois

University with a major in German and International Business.

KITE REALTY GROUP

39

ABOUT THE TEAM - BIOGRAPHIES

Wade Achenbach

Vice President, Finance and Capital Markets

Wade Achenbach is Vice President of Finance and Capital Markets and is responsible for all aspects

of debt and equity capital markets, as well as overseeing the profitability of all capital spend

throughout the company. While at Kite, Mr. Achenbach has completed over $2 billion in capital

markets transactions and worked on over 3 million square feet of retail and mixed-use developments

and redevelopments in eight states. Prior to joining Kite, he was in the mergers and acquisitions

group at Plexus Corporate, a publicly traded global contract electronics manufacturing company. Mr.

Achenbach earned his bachelor’s degree from Indiana University with a major in Finance and a minor

in Economics.

of debt and equity capital markets, as well as overseeing the profitability of all capital spend

throughout the company. While at Kite, Mr. Achenbach has completed over $2 billion in capital

markets transactions and worked on over 3 million square feet of retail and mixed-use developments

and redevelopments in eight states. Prior to joining Kite, he was in the mergers and acquisitions

group at Plexus Corporate, a publicly traded global contract electronics manufacturing company. Mr.

Achenbach earned his bachelor’s degree from Indiana University with a major in Finance and a minor

in Economics.

Chris Mulloy

Vice President, Construction Services

Chris Mulloy is Vice President of Construction Services and is primarily responsible for overseeing

pre-development, estimating, and construction of all new project development, site assessment and

re-development of existing company assets. Mr. Mulloy has been actively involved in development,

pre-construction, and construction in the development of community shopping centers, retail projects,

Class A office buildings, mixed-use developments, community shopping centers, retail projects,

industrial, and medical facilities in his fifteen years of real estate, construction, and architectural

experience. Mr. Mulloy graduated from the University of Illinois at Champaign-Urbana with a B.S. in

Architecture.

pre-development, estimating, and construction of all new project development, site assessment and

re-development of existing company assets. Mr. Mulloy has been actively involved in development,

pre-construction, and construction in the development of community shopping centers, retail projects,

Class A office buildings, mixed-use developments, community shopping centers, retail projects,

industrial, and medical facilities in his fifteen years of real estate, construction, and architectural

experience. Mr. Mulloy graduated from the University of Illinois at Champaign-Urbana with a B.S. in

Architecture.

KITE REALTY GROUP

40

ABOUT THE TEAM - BIOGRAPHIES

Matthew G. Gabet

Director of Finance and Capital Markets

Marin C. Updike

Controller, Real Estate