Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - JACKSONVILLE BANCORP INC /FL/ | d8k.htm |

Jacksonville Bancorp, Inc.

Nasdaq: JAXB

Investor Presentation

June 27, 2011

Exhibit 99.1 |

Forward Looking

Statements The statements contained in this presentation, other than historical

information, are forward-looking statements. Forward looking statements

involve risks, assumptions, and uncertainties. This may cause actual

results to differ materially from forward looking statements as a result of a

variety of factors including (but not limited to): limited operating history,

economic and political conditions, competition, bank regulation,

legislation,

accounting principles and monetary policies, changes in the interest rate

environment, success in minimizing credit risk and nonperforming

assets,

and technological changes.

2 |

JAXB at a

Glance •

Founded

in

1999

and

is

a

publicly

traded,

Florida

state-chartered

commercial

bank

•

HQ in Jacksonville, FL (Duval County)

•

Primary markets in Northeast Florida

•

Asset size $624.6MM

•

Employee size 99

•

Eight full service branch offices and one virtual branch

•

Market cap $37.4 million

•

5.9 million shares outstanding; 41.4% public float

•

Insider ownership~ 52.3%; Institutional~24.5%

3 |

Market and Strategies

4 |

2010

Jacksonville Market Demographics Population

Total Population

859,030

0-14 Age Group

21%

15-34 Age Group

29%

35-54 Age Group

28%

55-69 Age Group

14%

70+ Age Group

7%

Median Age

35

FL Median Age

41

USA Median Age

37

Population 25+

w/Education

556,648

< 9th Grade

4%

Some High School

9%

High School Graduate

32%

Some College

22%

Associate Degree

9%

Bachelors Degree

17%

Graduate Degree

8%

Household

Total Households

337,036

Income

$0-25K

21%

$25-50K

28%

$50-100K

37%

$100K+

15%

Average Household Income

$63,480

Median Household Income

$51,156

FL Average Household Income

$64,516

USA Average Household Income

$70,713

Net Worth

$0-35K

42%

$35-100K

17%

$100-250K

18%

$250-500K

10%

$500K+

12%

Average Household Net Worth

$322,358

FL Average Household Net Worth

$398,087

USA Average Household Net Worth

$418,865

5 |

2010

Jacksonville Market Demographics cont’d Housing Market ~ Residential

Total Owner Occupied Housing Units

209,995

Housing Unit Value

$0-100K

37%

$100-200K

44%

$200-300K

12%

$300-500K

5%

$500K+

3%

Unemployment Rate

6

Jacksonville

9.7%

FL

11.2%

USA

10.1% |

Area of Northeast Florida currently

served by JAXB

5

3

2

4

1

6

7

8

1.

Ortega Office

2.

Downtown Office

3.

Intracoastal West Office

4.

Gate Parkway Office

5.

Mandarin Office

6.

Beach Boulevard Office

7.

Neptune Beach Office

8.

Jacksonville Beach Office

7 |

The Jacksonville Bank and

Oceanside Bank –

A Perfect Match

8 |

The

Jacksonville Bank and Oceanside Bank – Recent Timeline

•

Merger of Oceanside Bank with The Jacksonville

Bank

November 16, 2010

•

$35M

of

new

capital

raised

by

Bancorp

through

four

accredited

November

16,

2010

investors led by CapGen Capital Group IV LP ($33.6M was

down-streamed to the Bank)

•

Systems and branch

integration

December 6, 2010

•

Disposition of $40.3M of low quality assets

completed

February 11, 2011

•

Safety and Soundness

Examination

April 2011

9 |

Pro forma to

Current Comparison (in 000s) Actual as of

March 31, 2011

Pro forma as of

June 30, 2010

Variance

Inc/(Dec)

Cash and due from banks

$12,601

$89,741

($77,140)

Gross Loans

503,919

552,491

(48,572)

Allowance for loan losses

11,331

8,248

3,083

Loans, net of allowance for loan losses

492,588

(1)

544,243

(51,655)

Core deposit intangible

2,223

4,702

(2,479)

Goodwill

13,621

5,837

7,784

Total assets

624,643

752,927

(128,284)

Deposits:

DDA

78,959

74,744

4,215

MM/NOW/Savings

205,954

198,260

7,694

Time

244,870

365,776

(120,906)

Total deposits

529,783

638,780

(108,997)

Total liabilities

571,859

690,934

(119,075)

Capital

52,784

61,993

(9,209)

(1) Included in net loans is the discount on loans acquired in the acquisition of Oceanside

Bank in the amount of $18,448 10 |

Capital

11 |

Asset

Quality 12

*During the first quarter of 2011 the Company charged-off

$3.7 million on loans that were previously identified as impaired

with specific reserves recorded at December 31, 2010.

|

Management

Team Gilbert J. Pomar, III

Director of Bancorp and the Bank

since 1999. President and Chief

Executive Officer for the Bank and

President of Bancorp since March

1999. Mr. Pomar has more than 30

years of banking experience, is active

in various community efforts and is a

graduate of the University of Florida

where he earned his Bachelor of

Science degree in Finance.

Scott M. Hall

Executive Vice President of Bancorp

and the Bank since February 2008 and

was named Chief Credit Office of both

in April 2010. Mr. Hall has over 20

years of experience in the financial

service industry, is active in various

community activities and is a graduate

of the University of North Florida

where he earned his Bachelor of

Business Administration degree in

Finance.

Valerie A. Kendall

Executive Vice President and Chief

Financial officer of Bancorp and the

Bank. Ms. Kendall has more than 20

years of banking experience, is a

Certified Public Accountant and is a

graduate of Florida Southern College

where she earned her Bachelor of

Science degree in Accounting.

Price W. Schwenck

Director of Bancorp and the bank since

1999. Chairman of the Board of Directors

for the Bank since 1999 and elected as

Executive Chairman on May 5, 2010.

Formerly served as Chief Executive Officer

of Bancorp from 1999 until April 26, 2000

and re-elected in May 2010. Mr. Schwenck

received his Bachelors degree and M.B.A

from the University of South Florida and his

M.S. from the University of Miami after four

years of extended study and application in

the field of quality management and

leadership.

13 |

Strategic

Objectives •

Well defined NE FL focus

•

Management of low quality assets

•

Serving our community as the largest community bank in

Jacksonville

•

Organized to focus on relationship gathering and retention

•

Strong commitment to risk management and organizational

efficiencies

14 |

Performance Drivers

15 |

Net Interest

Margin 16

* includes adjustments for loan accretion, non-

accrual and other interest adjustments |

Summary

Balance Sheet (in 000s) March 31,

2011

December 31,

2010

March 31,

2010

Gross loans

$ 503,919

$ 512,765

$ 390,601

Allowance for loan losses

11,331

13,069

7,618

Net loans

492,588

(1)

499,696

382,983

Core deposit intangible

2,223

2,376

--

Goodwill

13,621

12,498

--

Total assets

624,643

651,833

452,375

Total deposits

529,783

562,187

385,944

Total liabilities

571,859

599,974

426,164

Capital

52,784

51,859

26,211

(1) Included in net loans is the discount on loans acquired in the acquisition of Oceanside

Bank in the amount of $18,448 17 |

Loan

Composition (in 000s) March 31, 2011

December 31, 2010*

18 |

March 31, 2011

Deposit Mix (in 000s)

December 31, 2010

19 |

Financial Highlights

20 |

Loan and

Deposit History (in 000s) 21

|

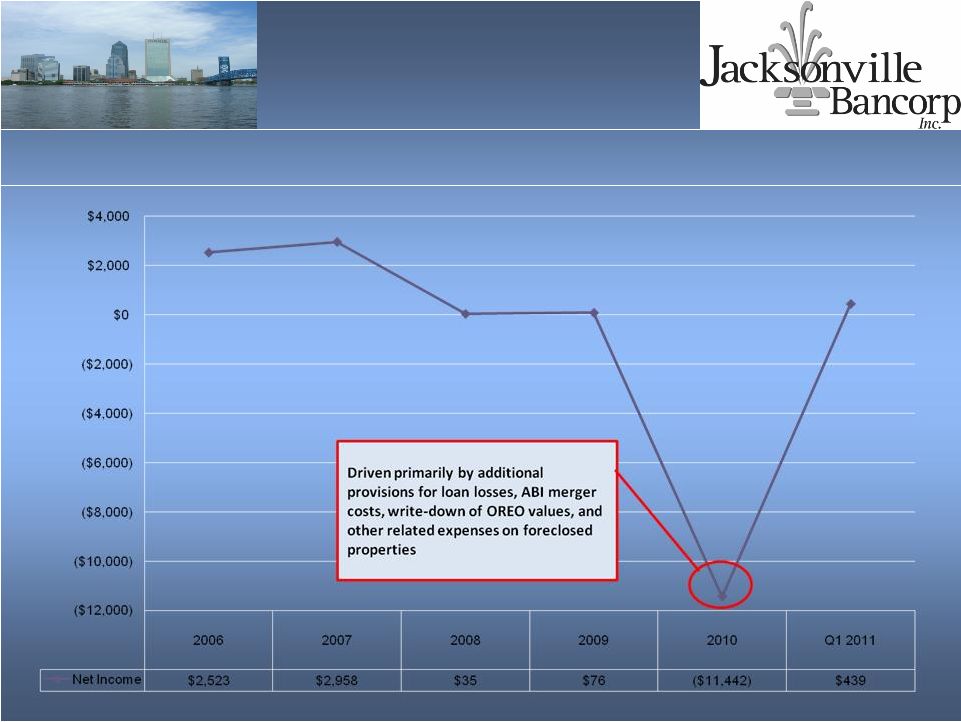

Net Income (in 000s) 22 |

Summary

Operating Results (in 000s) Q1 2011

Q4 2010

Q3 2010

Q2 2010

Q1 2010

Interest Income

$7,740

$6,752

$5,666

$5,749

$5,795

Interest expense

1,864

1,914

1,926

2,222

2,220

Net interest income

5,876

4,838

3,740

3,527

3,575

Provision for loan losses

1,929

11,894

799

1,920

2,375

Net interest income after

provision for loan losses

3,947

(7,056)

2,941

1,607

1,200

Noninterest income

396

341

299

286

248

Noninterest expense:

Salaries and employee benefits

1,708

1,479

1,399

1,281

1,237

Occupancy and equipment

660

698

416

412

406

Data processing

398

320

266

250

245

Regulatory assessment

322

266

232

251

260

OREO

252

2,270

308

379

464

M&A expense

25

917

760

353

--

Other

885

780

484

517

474

Total noninterest expense

4,250

6,730

3,865

3,443

3,086

Income (loss) before income taxes

93

(13,445)

(625)

(1,550)

(1,638)

Income tax expense (benefit)

(346)

(4,331)

(276)

(558)

(650)

Net income (loss)

$439

($9,114)

($349)

($992)

($988)

Capital ratios:

Tier 1 Leverage Ratio

7.29%

9.09%

7.27%

7.31%

7.72%

Tier 1 Risk-Based Capital Ratio

8.70%

9.13%

8.30%

8.63%

8.87%

Total Risk-Based Capital Ratio

10.54%

10.40%

11.22%

11.51%

11.63%

23 |

Summary

Operating Results cont’d: GAAP to Non-GAAP Comparison (in 000s)

Q1 2011

Q4 2010

Q3 2010

Q2 2010

Q1 2010

Net income (loss)

$439

($9,114)

($349)

($992)

($988)

Plus: Total provision for

loan losses

1,929

11,894

799

1,920

2,375

Expense:

Other real estate

owned *

243

2,236

278

171

464

Merger and

acquisition

25

917

760

353

--

Income tax benefit

(346)

(4,331)

(276)

(558)

(650)

Pre-provision, pre-OREO,

pre-merger and pre-tax

earnings

$2,290

$1,602

$1,212

$894

$1,201

*balance is net of income

24 |

Key

Ratios Q1 2011

Q4 2010

Q3 2010

Q2 2010

Q1 2010

EPS

$0.07

($2.42)

($0.20)

($0.57)

($0.56)

Book Value per share

8.96

8.81

14.07

14.30

14.98

Tangible Book Value per

share

6.27

6.28

14.07

14.30

14.98

ROAA

0.28%

(6.54%)

(0.32%)

(0.88%)

(0.89%)

ROAE

3.40%

(83.81%)

(5.49%)

(15.20%)

(14.64%)

Efficiency Ratio

67.76%

129.95%

95.69%

90.30%

80.72%

25 |

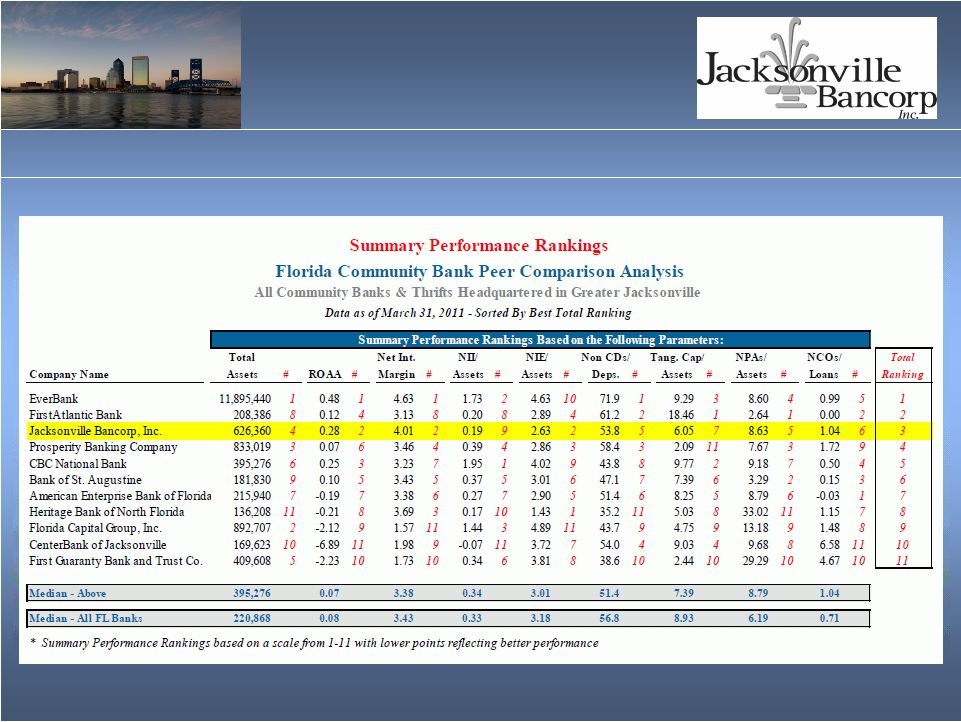

Peer

Analysis 26 |