Attached files

| file | filename |

|---|---|

| EX-5.1 - CONSENT OF CLARK WILSON LLP - ARGENTEX MINING CORP | exhibit5-1.htm |

| EX-23.1 - CONSENT OF MORGAN & COMPANY - ARGENTEX MINING CORP | exhibit23-1.htm |

Registration No. 333-164393

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM S-1/A

(Post-Effective Amendment No. 2)

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

ARGENTEX MINING CORPORATION

(Exact name of registrant as specified in its charter)

British Columbia

(State or other

jurisdiction of incorporation or organization)

1400

(Primary Standard Industrial

Classification Code Number)

71-0867623

(I.R.S. Employer

Identification Number)

Suite 835, 1100 Melville Street,

Vancouver, British

Columbia V6E 4A6, Canada.

Telephone (604) 568-2496

Fax (604) 568-1540

(Address, including

zip code, and telephone number,

including area code, of registrant’s

principal executive offices)

National Registered Agents, Inc. of NV

1000 East

William Street Suite 204

Carson City, Nevada 89701

Telephone: (800) 550-6724

(Name, address,

including zip code, and telephone number,

including area code, of agent for

service)

Copy of Communications To:

Clark Wilson LLP

Attention: Ethan Minsky

Suite 800 - 885 West Georgia

Street

Vancouver, British Columbia V6C 3H1, Canada

Telephone: (604) 643-3151

From time to time after the effective date of this

registration statement.

(Approximate date of commencement of

proposed sale to the public)

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Explanatory Note

On April 29, 2011, our shareholders approved the change of corporate jurisdiction of our company from the State of Delaware to the Province of British Columbia, Canada. On June 3, 2011, our company merged into its wholly-owned Nevada subsidiary (which was incorporated in the State of Nevada for this sole purpose) to change the corporate jurisdiction of our company from the State of Delaware to the State of Nevada. On June 8, 2011, our company was continued from the State of Nevada and into the Province of British Columbia, Canada.

We are filing this post-effective amendment no. 2 to our registration statement on Form S-1 (Registration No. 333-164393) (the “Registration Statement”) pursuant to Rule 414 under the Securities Act of 1933 to update the Registration Statement as a result of the completion of the change of corporate jurisdiction of our company from the State of Delaware to the Province of British Columbia, Canada.

In accordance with Rule 414(d) under the Securities Act of 1933, except as modified by this post-effective amendment no. 2, Argentex Mining Corporation, a British Columbia corporation, now as successor issuer to Argentex Mining Corporation, a Delaware corporation, hereby expressly adopts the Registration Statement as its own registration statement for all purposes of the Securities Act of 1933 and the Securities Exchange Act of 1934.

We are and expect to continue to be a foreign private issuer, as defined under Rule 405 promulgated under the Securities Act of 1933 and Rule 3b-4 promulgated under the Securities Exchange Act of 1934. As a foreign private issuer, we intend to file our annual reports each year with the Securities and Exchange Commission on Form 20-F. As a foreign private issuer, we are not required to file quarterly reports on Forms 10-Q. Instead, we intend to file with the Securities and Exchange Commission on a quarterly basis interim financial statements, together with management’s discussion and analysis in the form required under Canadian securities legislation. We intend to continue to prepare our financial statements in accordance with US GAAP.

- ii-

|

The information in this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

Subject to Completion, Dated ______________, 2011

Prospectus

2,980,407 Shares

Argentex Mining Corporation

Common Shares

_________________________________

The selling shareholders identified in this prospectus may offer and sell up to 2,980,407 common shares of our company that were issued or may be issued upon exercise of warrants. The warrants were acquired by the selling shareholders directly from our company in private placements that were exempt from the registration requirements of the Securities Act of 1933.

The selling shareholders may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or at negotiated prices.

Our common shares are quoted on Financial Industry Regulatory Authority’s OTC Bulletin Board under the symbol “AGXMF” and are listed on the TSX Venture Exchange under the symbol “ATX”. Prior to June 27, 2011, our common shares were quoted on Financial Industry Regulatory Authority’s OTC Bulletin Board under the symbol “AGXM”. On June 24, 2011, the closing price of our common shares on the OTC Bulletin Board was $0.79 per share and the closing price of our common shares on the TSX Venture Exchange was CDN$0.78.

We will not receive any proceeds from the sale of our common shares by the selling shareholders. We may, however, receive proceeds upon exercise of the warrants by the selling shareholders. We will pay for expenses of this offering, except that the selling shareholders will pay any broker discounts or commissions or equivalent expenses and expenses of their legal counsels applicable to the sale of their shares.

Investing in our common shares involves risks. See “Risk Factors” beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _____________, 2011.

Table of Contents

2

In this prospectus, unless otherwise specified, the terms “we”, “us” and “our” mean Argentex Mining Corporation, a British Columbia corporation, and/or our wholly owned subsidiary, SCRN Properties Ltd., a British Columbia corporation.

In this prospectus, we have converted sums paid or payable in foreign currency in to an "approximate" amount of U.S. dollars. References to these conversions into U.S. dollar amounts that are historic in nature have been converted at the exchange rate that was in effect at the date of the expenditure. Where we have converted any foreign currency amount on a forward-looking basis (ie, obligations that we have incurred but we have not yet paid) we have used a conversion rate of 1.0322 that was in effect on May 31, 2011 (and, in these cases, we have used the Bank of Canada's noon rate in effect on that date).

Prospectus Summary

Our Business

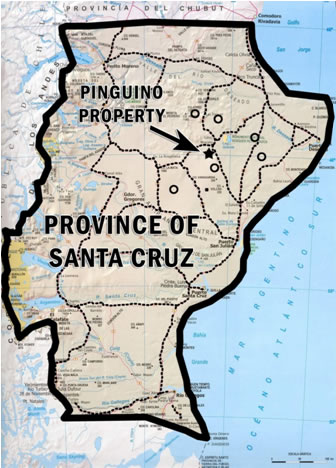

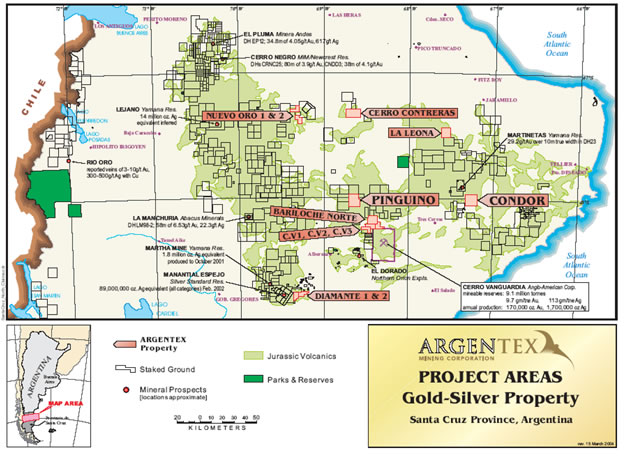

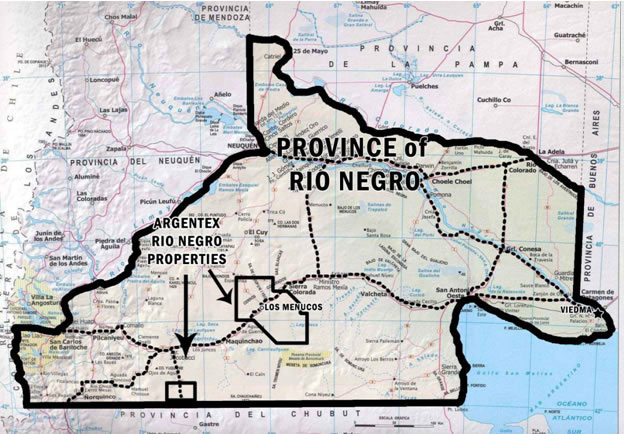

We are a junior exploration stage company that has not yet generated or realized any revenues from business operations. We currently hold interests in mineral properties located in the Rio Negro and Santa Cruz provinces of Argentina and in the Province of British Columbia, Canada. All of the surface rights and the mineral exploration licenses with respect to the Argentine claims are registered in the name of our subsidiary, SCRN Properties Ltd., while all of the mineral tenures with respect to our British Columbia claims are registered in the name of our company. One of the properties located in the Santa Cruz province of Argentina consists of surface rights and a group of claims that we refer to as the Pinguino property and we have concentrated the majority of our exploration efforts on this property. During the remainder of the year, we intend to continue to focus our efforts primarily on our Pinguino property and two of our other properties that are also located in the Santa Cruz province of Argentina – the Contreras property and the Condor property. We are continuing with targeted exploration in the form of geophysics, soil geochemistry, trenching and drilling on the Pinguino property in an effort to continue to test the limits of known mineralization and to identify new drill targets.

We have not determined whether any of our properties contain any mineral reserve. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/about/forms/industryguides.pdf) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

We have not begun significant operations and are considered an exploration stage company, as that term is defined in Industry Guide 7.

We have not generated any revenue from operations since our inception. We incurred a net loss of $5,164,198 during the year ended January 31, 2011 and a net loss of $3,405,546 during the three month period ended April 30, 2011. From inception through April 30, 2011, we have incurred a net loss of $25,648,674. We anticipate that we will continue to incur losses without generating any revenue from operations unless and until we are able to sell one or more of our resource properties or identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and build and operate a mine, and there can be no assurance that we will ever be able to do so. In their report on our financial statements for the year ended January 31, 2011, our independent auditors included an explanatory paragraph expressing concern about our ability to continue as a going concern.

On April 29, 2011, our shareholders approved the change of corporate jurisdiction of our company from the State of Delaware to the Province of British Columbia, Canada. We began filing the documents necessary to effect this change on June 3, 2011. On June 3, 2011, our subsidiary SCRN Properties was continued into the Province of British Columbia. On June 3, 2011, our company merged into its wholly-owned Nevada subsidiary (which was incorporated in the State of Nevada for this sole purpose) and, on June 8, 2011, our company was continued from the State of Nevada and into the Province of British Columbia, Canada.

Our principal offices are located at Suite 835, 1100 Melville Street, Vancouver, British Columbia V6E 4A6, Canada. Our telephone number at our principal offices is (604) 568-2496. Our fax number is (604) 568-1540.

3

Number of Shares Being Offered

This prospectus covers the resale by the selling shareholders named in this prospectus of up to 2,980,407 common shares of our company which were issued or may be issued upon the exercise of warrants that we issued in a private placement of units that was completed on November 27, 2009.

Number of Shares Outstanding

There were 61,347,545 common shares of our company issued and outstanding as at June 27, 2011.

Use of Proceeds

We will not receive any proceeds from the sale of any of our common shares by the selling shareholders. We may, however, receive proceeds upon exercise of the warrants by the selling shareholders. If we receive proceeds upon exercise of these warrants, we intend to use these proceeds to fund ongoing exploration programs at our properties in the Patagonia region of Argentina, for working capital and for general corporate purposes.

We will pay the expenses of this offering, except that the selling shareholders will pay any broker discounts or commissions or equivalent expenses and expenses of their legal counsel applicable to the sale of their shares.

Summary of Financial Data

The following information represents selected audited financial information for our company for the years ended January 31, 2011 and 2010 and selected unaudited financial information for our company for the three month periods ended April 30, 2011 and 2010. The summarized financial information presented below is derived from and should be read in conjunction with our audited and unaudited financial statements, as applicable, including the notes to those financial statements which are included elsewhere in this prospectus along with the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 57 of this prospectus.

Statements of Operations Data |

Three Month Period Ended April 30, 2011 |

Three Month Period Ended April 30, 2010 |

From December 21, 2001 (Inception) to April 30, 2011 |

| Total Revenues | Nil | Nil | Nil |

| Total Operating Expenses | (3,419,898) | (1,344,208) | (25,130,219) |

| Net Loss | (3,405,546) | (1,344,208) | (25,648,674) |

| Basic and Diluted Loss Per Share | (0.06) | (0.03) | - |

Statements of Operations Data |

Year Ended January 31, 2011 |

Year Ended January 31, 2010 |

| Total Revenues | Nil | Nil |

| Total Operating Expenses | (5,167,893) | (2,644,324) |

| Net Loss | (5,164,198) | (2,658,296) |

| Basic and Diluted Loss Per Share | (0.11) | (0.07) |

4

| Balance Sheets Data | At April 30, 2011 | At January 31, 2011 | At January 31, 2010 |

| Cash and Cash Equivalents | 1,924,897 | 5,959,362 | 3,209,786 |

| Working Capital | 3,358,958 | 5,316,067 | 2,877,702 |

| Total Assets | 6,161,207 | 6,963,168 | 3,372,176 |

| Total Liabilities | 1,871,860 | (718,220) | (441,940) |

| Total Stockholders’ Equity | 4,289,347 | 6,244,948 | 2,930,236 |

| Accumulated Deficit | (25,648,674) | (22,243,128) | (17,078,930) |

Please read this prospectus carefully. You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different information. You should not assume that the information provided by the prospectus is accurate as of any date other than the date on the front of this prospectus.

Risk Factors

An investment in our common shares involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in this prospectus in evaluating our company and our business before making any investment decision about our company. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. You should invest in our common shares only if you can afford to lose your entire investment.

Risks Relating to Our Change of Corporate Jurisdiction

We may still be treated as a U.S. corporation and taxed on our worldwide income after our change of corporate jurisdiction.

The change of our corporate jurisdiction from the State of Delaware to the Province of British Columbia, Canada is considered a migration of our company from the State of Delaware to the Province of British Columbia, Canada. Certain transactions whereby a U.S. corporation migrates to a foreign jurisdiction can be considered by the United States Congress to be an abuse of the U.S. tax rules because thereafter the foreign entity is not subject to U.S. tax on its worldwide income. Section 7874(b) of the Internal Revenue Code of 1986, as amended (the “Code”), was enacted in 2004 to address this potential abuse. Section 7874(b) of the Code provides generally that certain corporations that migrate from the United States will nonetheless remain subject to U.S. tax on their worldwide income unless the migrating entity has substantial business activities in the foreign country to which it is migrating when compared to its total business activities.

If Section 7874(b) of the Code applies to the migration of our company from the State of Delaware to the Province of British Columbia, Canada, our company would continue to be subject to United States federal income taxation on its worldwide income. Section 7874(b) of the Code could apply to our migration unless we have substantial business activities in Canada when compared to our total business activities.

We may be classified as a Passive Foreign Investment Company as a result of our change of corporate jurisdiction.

Sections 1291 to 1298 of the Code contain the Passive Foreign Investment Company (“PFIC”) rules. These rules generally provide for punitive treatment of “U.S. holders” of PFICs. A foreign corporation is classified as a PFIC if more than 75% of its gross income is passive income or more than 50% of its assets produce passive income or are held for the production of passive income.

Because most of our assets are cash or cash equivalents, short-term investments and shares of our wholly-owned subsidiary, SCRN Properties Ltd., we may be classified as a PFIC. If we are classified as a PFIC, then the holders of shares of our company who are U.S. taxpayers may be subject to PFIC provisions which may impose U.S. taxes, in addition to those normally applicable, on the sale of their shares of our company or on distribution from our company.

5

Now that we have completed the change of our corporate jurisdiction, we do not plan to file quarterly financial statements that have been reviewed by our independent auditors.

Although we have changed our corporate jurisdiction to the Province of British Columbia, Canada, we still have to comply with reporting requirements under United States securities laws. However, these requirements are reduced because we are no longer incorporated in a state of the United States.

We currently prepare our financial statements in accordance with United States generally accepted accounting principles (“US GAAP”). We have filed our audited annual financial statements with the Securities and Exchange Commission with our annual reports on Form 10-K and we have filed our unaudited interim financial statements with the Securities and Exchange Commission with our quarterly reports on Form 10-Q. Now that we have completed the change of our corporate jurisdiction, we meet the definition of a “foreign private issuer” under the Securities Exchange Act of 1934. As a foreign private issuer, we are eligible to file our annual reports each year with the Securities and Exchange Commission on Form 20-F. As a foreign private issuer filing annual reports on Form 20F, we are not required to file quarterly reports on Forms 10-Q. Instead, we plan to file with the Securities and Exchange Commission on a quarterly basis interim financial statements, which do not have to be reviewed by our auditors, together with management’s discussion and analysis in the form required under Canadian securities legislation. We anticipate that we will continue to prepare our financial statements in accordance with US GAAP despite the change of our corporate jurisdiction.

Because we meet the definition of a “foreign private issuer” under the Securities Exchange Act of 1934, insiders of our company are no longer required to file insider reports under Section 16(a) of the Securities Exchange Act of 1934 and they are no longer subject to the “short swing profit rule” of Section 16(b) of the Securities Exchange Act of 1934.

Now that we have become a foreign private issuer (as defined under the Securities Exchange Act of 1934) our directors, officers and shareholders owning more than 10% of our outstanding common shares are subject to the insider filing requirements imposed by Canadian securities laws but they are exempt from the insider requirements imposed by Section 16 of the Securities Exchange Act of 1934. The Canadian securities laws do not impose on insiders any equivalent of the “short swing profit rule” imposed by Section 16 and, since we qualify as a foreign private issuer, our insiders are no longer subject to liability for profits realized from any “short swing” trading transactions, or a purchase and sale, or a sale and purchase, of our equity securities within less than six months. As a result, our shareholders may not enjoy the same degree of protection against insider trading as they would under Section 16 of the Securities Exchange Act of 1934.

Because we meet the definition of a “foreign private issuer” under the Securities Exchange Act of 1934, our company will no longer be required to comply with Regulation FD.

Regulation FD, which was promulgated by the Securities and Exchange Commission under the Securities Exchange Act of 1934 to prevent certain selective disclosure by reporting companies, does not apply to foreign private issuers (as defined under the Securities Exchange Act, as amended) and does not apply to us as we have qualified as a foreign private issuer. As a result, our shareholders may not enjoy the same degree of protection against selective disclosure as they would under Section 16 of the Securities Exchange Act of 1934.

The market for shares of our company as a British Columbia corporation may differ from the market for shares of our company as a Delaware corporation.

Although we anticipate that our common shares will continue to be quoted or listed on both the Financial Industry Regulatory Authority’s OTC Bulletin Board and the TSX Venture Exchange now that we have completed the change of our corporate jurisdiction, the market prices, trading volume and volatility of the shares of our company as a British Columbia corporation could be different from those of the shares of our company as a Delaware corporation. We cannot predict what effect, if any, the change of our corporate jurisdiction will have on the market price prevailing from time to time or the liquidity of our common shares.

6

Risks Associated With Mining

All of our properties are in the exploration stage. There is no assurance that we can establish the existence of any mineral reserve on any of our properties. Unless and until we can do so, we cannot earn any revenues from operations and if we do not do so we may lose all of the funds that we have spent on exploration. If we do not discover any mineral reserve, our business may fail.

Despite exploration work on our mineral properties, we have not established that any of them contain any mineral reserve, nor can there be any assurance that we will be able to do so. If we do not, our business may fail. A mineral reserve is defined by the Securities and Exchange Commission in its Industry Guide 7 (which can be viewed over the Internet at http://www.sec.gov/about/forms/industryguides.pdf ) as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. The probability of an individual prospect ever having a “reserve” that meets the requirements of the Securities and Exchange Commission’s Industry Guide 7 is extremely remote; in all probability none of our mineral resource properties contains any ‘reserve’ and any funds that we spend on exploration will probably be lost.

The commercial viability of an established mineral deposit will depend on a number of factors including, by way of example, the size, grade and other attributes of the mineral deposit, the proximity of the resource to infrastructure such as a smelter, roads and a point for shipping, government regulation and market prices. Most of these factors will be beyond our control, and any of them could increase costs and make extraction of any identified mineral resource unprofitable.

Mineral operations are subject to applicable law and government regulation. Even if we discover a mineral resource in a commercially exploitable quantity, these laws and regulations could restrict or prohibit the exploitation of that mineral resource. If we cannot exploit any mineral resource that we discover on our properties, our business may fail.

Both mineral exploration and extraction require permits from various foreign, federal, state, provincial and local governmental authorities and are governed by laws and regulations, including those with respect to prospecting, mine development, mineral production, transport, export, taxation, labor standards, occupational health, waste disposal, toxic substances, land use, environmental protection, mine safety and other matters. There can be no assurance that we will be able to obtain or maintain any of the permits required for the continued exploration of our mineral properties or for the construction and operation of a mine on our properties at an economically viable cost. If we cannot accomplish these objectives, our business could fail. Although we believe that we are in compliance with all material laws and regulations that currently apply to our activities, we can give no assurance that we can continue to remain in compliance. Current laws and regulations could be amended and we might not be able to comply with them, as amended. Further, there can be no assurance that we will be able to obtain or maintain all permits necessary for our future operations, or that we will be able to obtain them on reasonable terms. To the extent such approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of our mineral properties.

If we establish the existence of a mineral reserve on any of our properties, we will require additional capital in order to develop the property into a producing mine. If we cannot raise this additional capital, we will not be able to exploit the reserve and our business could fail.

If we do discover a mineral reserve on any of our properties, we will be required to expend substantial sums of money to establish the extent of the reserve, develop processes to extract it and develop extraction and processing facilities and infrastructure. Although we may derive substantial benefits from the discovery of a reserve, there can be no assurance that any reserve established will be large enough to justify commercial operations, nor can there be any assurance that we will be able to raise the funds required for development on a timely basis. If we cannot raise the necessary capital or complete the necessary facilities and infrastructure, our business may fail.

Mineral exploration and development is subject to extraordinary operating risks. We do not currently insure against these risks. In the event of a cave-in or similar occurrence, our liability may exceed our resources, which would have an adverse impact on our company.

Mineral exploration, development and production involve many risks which even a combination of experience, knowledge and careful evaluation may not be able to overcome. Our operations will be subject to all of the hazards and risks inherent in these activities and, if we discover a mineral reserve, our operations could be subject to all of the hazards and risks inherent in the development and production of a mineral reserve, including liability for pollution, cave-ins or similar

7

hazards against which we cannot insure or against which we may elect not to insure. Any such event could result in work stoppages and damage to property, including damage to the environment. We do not currently maintain any insurance coverage against these operating hazards. The payment of any liabilities that may arise from any such occurrence would likely have a material adverse impact on our company.

Mineral prices are subject to dramatic and unpredictable fluctuations and the economic viability of any of our exploration properties and projects cannot be accurately predicted.

We expect to derive revenues, if any, either from the sale of our mineral properties or from the extraction and sale of precious and base metals such as gold, silver, copper, zinc and indium. The price of these commodities has fluctuated widely in recent years and is affected by numerous factors beyond our control, including international, economic and political trends, expectations of inflation, currency exchange fluctuations, interest rates, global or regional consumptive patterns, speculative activities and increased production due to new extraction developments and improved extraction and production methods. The effect of these factors is based on the price of precious metals and therefore the economic viability of any of our exploration properties cannot accurately be predicted.

The mining industry is highly competitive and there is no assurance that we will continue to be successful in acquiring mineral claims. If we cannot continue to acquire properties to explore for mineral resources, we may be required to reduce or cease operations.

The mineral exploration, development, and production industry is largely unintegrated. We may compete with other exploration companies looking for mineral resource properties. Some of these other companies possess greater financial resources and technical facilities. This competition could adversely affect our ability to acquire suitable prospects for exploration in the future. Accordingly, there can be no assurance that we will acquire any interest in additional mineral resource properties that might yield reserves or result in commercial mining operations. While we may compete with other exploration companies in the effort to locate and acquire mineral resource properties, we do not believe that we will compete with them for the removal or sales of mineral products from our properties if we should eventually discover the presence of them in quantities sufficient to make production economically feasible. Readily available markets exist worldwide for the sale of mineral products. Therefore, we will likely be able to sell any mineral products that we identify and produce.

Risks Associated with Our Company

The fact that we have not earned any operating revenues since our incorporation raises substantial doubt about our ability to continue to explore our mineral properties as a going concern.

We have not generated any revenue from operations since our incorporation. During the year ended January 31, 2011, we incurred a net loss of $5,164,198 and during the quarter ended April 30, 2011, we incurred a net loss of $3,405,546. From inception through April 30, 2011 we have incurred an aggregate loss of $25,648,674. We anticipate that we will continue to incur operating expenses without revenues unless and until we are able to identify a mineral resource in a commercially exploitable quantity on one or more of our mineral properties and build and operate a mine or sell one or more of our resource properties. On May 31, 2011, we had cash and cash equivalents and short-term investments in the amount of approximately $3.6 million. We estimate our average monthly operating expenses will be approximately $200,000, excluding exploration but including general and administrative expenses, and we plan to spend approximately $15 million on the exploration of our mineral properties during this period. We believe that our cash on hand will not be sufficient to fund our currently budgeted operating requirements for the 12 month period ending May 31, 2012. In addition, our budget could increase during the balance of the year in response to matters that cannot be currently anticipated and we might find that we need to raise even more capital in order to properly address these items. As we cannot assure a lender that we will be able to successfully explore and develop our mineral properties, we will probably find it difficult to raise debt financing from traditional lending sources. We have traditionally raised our operating capital from sales of equity and debt securities, but there can be no assurance that we will continue to be able to do so. The unpredictable economy in the United States and the volatile public equity markets may make it more difficult for us to raise capital as and when we need it, and it is difficult for us to assess the impact this might have on our operations or liquidity and to determine whether the prices we might receive on the sale of minerals, if we discover any in commercially exploitable quantities, would exceed the cost of mineral exploitation and development. If we cannot raise the funds that we require to continue exploration of our mineral properties, we may be forced to delay, scale back, or eliminate our exploration activities. If any of these were to occur, there is a substantial risk that our business would fail.

8

We have a limited operating history on which to base an evaluation of our business and prospects and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

Although we have been in the business of exploring mineral resource properties since 2002, we have not yet located any mineral reserve and we have never had any revenues from our operations. In addition, our operating history has been restricted to the acquisition and exploration of our mineral properties and this does not provide a meaningful basis for an evaluation of our prospects if we ever determine that we have a mineral reserve and commence the construction and operation of a mine. We have no way to evaluate the likelihood of whether our mineral properties contain any mineral reserve or, if they do, that we will be able to build or operate a mine successfully. We anticipate that we will continue to incur operating costs without realizing any revenues during the period when we are exploring our properties. During the 12 month period ending May 31, 2012, we expect to spend approximately $17.5 million on the exploration of our mineral properties and on general and administrative expenses. We therefore expect to continue to incur significant losses into the foreseeable future. If we are unable to generate significant revenues from mining operations and any dispositions of our properties, we will not be able to earn profits or continue operations. At this early stage of our operation, we also expect to face the risks, uncertainties, expenses and difficulties frequently encountered by companies at the start up stage of their business development. We cannot be sure that we will be successful in addressing these risks and uncertainties and our failure to do so could have a materially adverse effect on our financial condition. There is no history upon which to base any assumption as to the likelihood that we will prove successful and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

Because all of our officers and directors are located outside of the United States, you may have no effective recourse against them for misconduct and you may not be able to enforce judgment and civil liabilities against them.

All of our directors and officers are nationals and/or residents of countries other than the United States and all or a substantial portion of their assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Our common shares are penny stock. Trading of our common shares may be restricted by the SEC’s penny stock regulations and the FINRA’s sales practice requirements, which may limit a shareholder’s ability to buy and sell our common shares.

Our common shares are penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the common shares that are subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in, and limit the marketability of, our common shares.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the Financial Industry Regulatory Authority has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain

9

information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the Financial Industry Regulatory Authority believes that there is a high probability that speculative low-priced securities will not be suitable for at least some customers. The Financial Industry Regulatory Authority requirements make it more difficult for broker-dealers to recommend that their customers buy our common shares, which may limit your ability to buy and sell our shares.

Forward-Looking Statements

This prospectus contains forward-looking statements. Forward-looking statements are projections of events, revenues, income, future economic performance or management’s plans and objectives for future operations. In some cases, you can identify forward-looking statements by the use of terminology such as “may”, “should”, “expect”, “plan”, “anticipate”, “believe”, “estimate”, “predict”, “potential” or “continue” or the negative of these terms or other comparable terminology. Examples of forward-looking statements made in this prospectus include statements about:

-

Our future exploration programs and results,

-

Our future capital expenditures, and

-

Our future investments in and acquisitions of mineral resource properties.

These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including:

-

General economic and business conditions,

-

Our ability to obtain additional financing,

-

Exposure to market risks in our financial instruments,

-

Fluctuations in worldwide prices and demand for minerals,

-

Fluctuations in the levels of our exploration and development activities,

-

Risks associated with mineral resource exploration and development activities,

-

Competition for resource properties and infrastructure in the mineral exploration industry,

-

Technological changes and developments in the mineral exploration and mining industry,

-

Regulatory uncertainties and potential environmental liabilities,

-

Political changes in Argentina, and

-

The risks in the section of this prospectus entitled “Risk Factors”,

any of which may cause our company’s or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements and any assumptions upon which they are based are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States and Canada, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

10

The Offering

This prospectus covers the resale by the selling shareholders named in this prospectus of up to 2,980,407 common shares of our company which were issued or may be issued upon the exercise of warrants. The warrants were acquired by the selling shareholders directly from our company in private placements that were completed on November 27, 2009.

On November 27, 2009, we sold 5,960,814 units at a price of CDN$0.70 (US$0.66) per unit to 49 selling shareholders for gross proceeds of CDN$4,172,569.80 (US$3,945,999). Each unit consisted of one common share of our company and one-half of one non-transferable warrant. Each whole warrant entitles the selling shareholder to purchase one additional common share of our company at a price of CDN$0.90 (US$0.93) until November 27, 2011, subject to early expiration in the event that our common shares trade on the TSX Venture Exchange in Canada or the OTC Bulletin Board in the United States with an average closing price greater than CDN$1.25 (US$1.29) for a period of 30 consecutive trading days. 48 of the selling shareholders were not U.S. persons, as that term is defined in Regulation S, and none of them was in the United States and for these selling shareholders we relied on the exemption from the registration requirements of the Securities Act of 1933 provided by Rule 903 of Regulation S. One of the selling shareholders was a U.S. person and an accredited investor and in issuing securities to this selling shareholder we relied on the exemption from the registration requirements of the Securities Act of 1933 provided by Rule 506 of Regulation D promulgated thereunder.

Pursuant to the subscription agreements that we entered into with the selling shareholders and the agency agreement with the agents who acted as our agents in connection with these private placements, we agreed to file a registration statement with the Securities and Exchange Commission to register for resale the common shares underlying the unit warrants.

Use of Proceeds

We will not receive any proceeds from the sale of our common shares by the selling shareholders. We may, however, receive proceeds upon exercise of the warrants by the selling shareholders. If we receive proceeds upon exercise of warrants issued in connection with the private placements that were completed on November 27, 2009, we intend to use these proceeds to fund ongoing exploration programs at our properties in the Patagonia region of Argentina, for working capital and for general corporate purposes.

We will pay for expenses of this offering, except that the selling shareholders will pay any broker discounts or commissions or equivalent expenses and expenses of their legal counsels applicable to the sale of their shares.

Selling Shareholders

The selling shareholders may offer and sell, from time to time, any or all of our common shares that were issued or may be issued upon exercise of the warrants.

The following table sets forth certain information regarding the beneficial ownership of our common shares by the selling shareholders as of June 27, 2011 and the number of our common shares being offered pursuant to this prospectus. Except as otherwise described below, we believe that the selling shareholders have sole voting and investment powers over their shares.

Because the selling shareholders may offer and sell all or only some portion of the 2,980,407 common shares of our company being offered pursuant to this prospectus, the numbers in the table below representing the amount and percentage of these common shares that will be held by the selling shareholders upon termination of the offering are only estimates based on the assumption that each selling shareholder will sell all of his or its common shares of our company being offered in the offering.

None of the selling shareholders had or have any position or office, or other material relationship with us or any of our affiliates over the past three years.

None of the selling shareholders is a registered broker-dealer or an affiliate of a registered broker-dealer. We may require the selling shareholders to suspend the sales of our common shares being offered pursuant to this prospectus upon the occurrence of any event that makes any statement in this prospectus or the related registration statement untrue in any material respect or that requires the changing of statements in those documents in order to make statements in those documents not misleading.

11

Name of Selling Shareholder |

Shares Owned by the Selling Shareholder before the Offering(1) |

Total Shares Offered in the Offering |

Number of Shares to Be Owned

by Selling Shareholder and Percent of Total Issued and Outstanding Shares After the Offering (1) |

|

| # of Shares(2) |

% of Class(2),(3) |

|||

| Dominion Employee Benefit Trustees Ltd. re Cheyne Trust A – David Treadwell FT(4) | 513,636(5) | 50,000 | 463,636 | * |

| Nassar Abdalla Alnassar | 877,272(6) | 50,000 | 827,272 | 1.33% |

| Gasland Investment SA(7) | 150,000(8) | 50,000 | 100,000 | * |

| Barnet Investments Ltd. (9) | 214,500(10) | 71,500 | 143,000 | * |

| Hinde Gold Fund(11) | 428,571(12) | 142,857 | 285,714 | * |

| Hambros (Guernsey Nominees) Limited(13) | 428,700(14) | 142,900 | 285,800 | * |

| TD Asset Management Inc.(15) | 1,277,100(16) | 285,700 | 991,400 | 1.59% |

| Samuel Belzberg | 150,000(17) | 50,000 | 100,000 | * |

| David Lyall | 537,000(18) | 179,000 | 358,000 | * |

| Grafton Capital Corporation(19) | 214,500(20) | 71,500 | 143,000 | * |

| Smith & Williamson Nominees Limited(21) | 428,700(22) | 142,900 | 285,800 | * |

| Greg Thompson | 53,700(23) | 17,900 | 35,800 | * |

| William Washington | 53,700(24) | 17,900 | 35,800 | * |

| Jag Holdings Ltd.(25) | 112,500(26) | 37,500 | 75,000 | * |

| Igor Mousasticoshvily | 37,500(27) | 12,500 | 25,000 | * |

| Benzion Schneider | 15,000(28) | 5,000 | 10,000 | * |

| John Horwood | 48,700(29) | 10,000 | 38,700 | * |

| Luke Norman | 300,000(30) | 100,000 | 200,000 | * |

| Richard Wyman | 210,000(31) | 70,000 | 140,000 | * |

| Brisco Capital Partners Corp.(32) | 150,000(33) | 50,000 | 100,000 | * |

| Darcy Higgs | 107,250(34) | 35,750 | 71,500 | * |

| Lorna Mjolsness | 75,000(35) | 25,000 | 50,000 | * |

| Barry Mjolsness | 75,000(36) | 25,000 | 50,000 | * |

| Klassic-Fore Investments Inc.(37) | 75,000(38) | 25,000 | 50,000 | * |

| Spangler Enterprises Ltd.(39) | 52,500(40) | 17,500 | 35,000 | * |

| Mark Hassett | 75,000(41) | 25,000 | 50,000 | * |

12

Name of Selling Shareholder |

Shares Owned by the Selling Shareholder before the Offering(1) |

Total Shares Offered in the Offering |

Number of Shares to Be Owned

by Selling Shareholder and Percent of Total Issued and Outstanding Shares After the Offering (1) |

|

| # of Shares(2) |

% of Class(2),(3) |

|||

| NuEnterprises Ltd.(42) | 75,000(43) | 25,000 | 50,000 | * |

| WCM Holdings Ltd.(44) | 52,500(45) | 17,500 | 35,000 | * |

| Riverspill Response Canada Ltd.(46) | 52,500(47) | 17,500 | 35,000 | * |

| Joma Enterprises Ltd.(48) | 52,500(49) | 17,500 | 35,000 | * |

| Alpha Capital(50) | 427,850(51) | 142,850 | 285,000 | * |

| Hansen Investments Ltd.(52) | 150,000(53) | 50,000 | 100,000 | * |

| Christian Klingebiel | 59,250(54) | 19,750 | 39,500 | * |

| 0820659 B.C. Ltd.(55) | 107,100(56) | 35,700 | 71,400 | * |

| Lu Ma | 85,650(57) | 28,550 | 57,100 | * |

| John Bowles | 53,550(58) | 17,850 | 35,700 | * |

| William Randall | 37,500(59) | 12,500 | 25,000 | * |

| Serge Vanry | 21,300(60) | 7,100 | 14,200 | * |

| Michel Mendenhall | 52,500(61) | 17,500 | 35,000 | * |

| Maria Burglehaus | 90,600(62) | 25,000 | 65,600 | * |

| Bradley Resources Canada Ltd.(63) | 107,100(64) | 35,700 | 71,400 | * |

| Frank Juriga | 30,000(65) | 10,000 | 20,000 | * |

| Peppy Holdings Ltd.(66) | 60,000(67) | 20,000 | 40,000 | * |

| Muse Global Master Fund Ltd.(68) | 217,500(69) | 72,500 | 145,000 | * |

| Aran Asset Management SA(70) | 427,500(71) | 142,500 | 285,000 | * |

| Morgan Stanley and Co.(72) | 645,000(73) | 215,000 | 430,000 | * |

| Dennis Brooks | 105,000(74) | 35,000 | 70,000 | * |

| Newgen Mining Fund SPC(75) | 600,000(76) | 200,000 | 400,000 | * |

| RAB Special Situations (Master) Fund Limited(77) | 315,000(78) | 105,000 | 210,000 | * |

| Totals | 10,485,729 | 2,980,407 | 7,505,322 | |

Notes

* Less than 1%.

13

| (1) |

Beneficial ownership is determined in accordance with Securities and Exchange Commission rules and generally includes voting or investment power with respect to common shares of our company. Common shares of our company subject to options, warrants and convertible preferred shares currently exercisable or convertible, or exercisable or convertible within 60 days, are counted as outstanding for computing the percentage of the person holding such options, warrants or convertible preferred shares but are not counted as outstanding for computing the percentage of any other person. | |

| (2) |

We have assumed that the selling shareholders will sell all of the shares being offered in this offering. | |

| (3) |

Based on 61,347,545 common shares of our company issued and outstanding as of June 27, 2011. Common shares of our company being offered pursuant to this prospectus by a selling shareholder are counted as outstanding for computing the percentage of that particular selling shareholder but are not counted as outstanding for computing the percentage of any other person. | |

| (4) |

David Treadwell exercises voting and dispositive power with respect to our common shares that are beneficially owned by Dominion Employee Benefit Trustees Ltd. re Cheyne Trust A – David Treadwell FT. | |

| (5) |

Consists of 463,636 common shares of our company and 50,000 common shares of our company issuable upon exercise of warrants. | |

| (6) |

Consists of 463,636 common shares of our company and 413,636 common shares of our company issuable upon exercise of warrants. | |

| (7) |

Alexis Poisson exercises voting and dispositive power with respect to our common shares that are beneficially owned by Gasland Investment SA. | |

| (8) |

Consists of 100,000 common shares of our company and 50,000 common shares of our company issuable upon exercise of warrants. | |

| (9) |

Sheena Artesga exercises voting and dispositive power with respect to our common shares that are beneficially owned by Barnet Investments Ltd. | |

| (10) |

Consists of 143,000 common shares of our company and 71,500 common shares of our company issuable upon exercise of warrants. | |

| (11) |

Ben Davies exercises voting and dispositive power with respect to our common shares that are beneficially owned by Hinde Gold Fund. | |

| (12) |

Consists of 428,571 common shares of our company. | |

| (13) |

Abydos Holdings Ltd. beneficially owns our common shares held by Hambros (Guernsey Nominees) Limited. The board of directors of Abyoos Holdings Ltd. exercises voting and dispositive power with respect to our common shares that are beneficially owned by Abydos Holdings Ltd. The board of directors is comprised of Joanne Sene, Rafael Jacob Benzaquen and Edward Frederick Naylor-Leyland. | |

| (14) |

Consists of 428,700 common shares of our company. | |

| (15) |

Margot Naudie exercises voting and dispositive power with respect to our common shares that are beneficially owned by TD Asset Management Inc. | |

| (16) |

Consists of 851,400 common shares of our company and 425,700 common shares of our company issuable upon exercise of warrants. | |

| (17) |

Consists of 100,000 common shares of our company and 50,000 common shares of our company issuable upon exercise of warrants. |

14

| (18) |

Consists of 358,000 common shares of our company and 179,000 common shares of our company issuable upon exercise of warrants. | |

| (19) |

Richard Grafton exercises voting and dispositive power with respect to our common shares that are beneficially owned by Grafton Capital Corporation. | |

| (20) |

Consists of 143,000 common shares of our company and 71,500 common shares of our company issuable upon exercise of warrants. | |

| (21) |

Nick Peppiatt exercises voting and dispositive power with respect to our common shares that are beneficially owned by Smith & Williamson Nominees Limited. | |

| (22) |

Consists of 285,800 common shares of our company and 142,900 common shares of our company issuable upon exercise of warrants. | |

| (23) |

Consists of 35,800 common shares of our company and 17,900 common shares of our company issuable upon exercise of warrants. | |

| (24) |

Consists of 35,800 common shares of our company and 17,900 common shares of our company issuable upon exercise of warrants. | |

| (25) |

John Greig exercises voting and dispositive power with respect to our common shares that are beneficially owned by Jag Holdings Ltd. | |

| (26) |

Consists of 112,500 common shares of our company. | |

| (27) |

Consists of 25,000 common shares of our company and 12,500 common shares of our company issuable upon exercise of warrants. | |

| (28) |

Consists of 15,000 common shares of our company. | |

| (29) |

Consists of 38,700 common shares of our company and 10,000 common shares of our company issuable upon exercise of warrants. | |

| (30) |

Consists of 300,000 common shares of our company. | |

| (31) |

Consists of 210,000 common shares of our company. | |

| (32) |

Scott Koyich exercises voting and dispositive power with respect to our common shares that are beneficially owned by Brisco Capital Partners Corp. | |

| (33) |

Consists of 100,000 common shares of our company and 50,000 common shares of our company issuable upon exercise of warrants. | |

| (34) |

Consists of 71,500 common shares of our company and 35,750 common shares of our company issuable upon exercise of warrants. | |

| (35) |

Consists of 50,000 common shares of our company and 25,000 common shares of our company issuable upon exercise of warrants. | |

| (36) |

Consists of 50,000 common shares of our company and 25,000 common shares of our company issuable upon exercise of warrants. | |

| (37) |

Bob Krahn exercises voting and dispositive power with respect to our common shares that are beneficially owned by Klassic-Fore Investments Inc. |

15

| (38) |

Consists of 50,000 common shares of our company and 25,000 common shares of our company issuable upon exercise of warrants. | |

| (39) |

Craig Spangler and Huan Spangler exercise voting and dispositive power with respect to our common shares that are beneficially owned by Spangler Enterprises Ltd.. | |

| (40) |

Consists of 35,000 common shares of our company and 17,500 common shares of our company issuable upon exercise of warrants. | |

| (41) |

Consists of 50,000 common shares of our company and 25,000 common shares of our company issuable upon exercise of warrants. | |

| (42) |

Naresh Desai exercises voting and dispositive power with respect to our common shares that are beneficially owned by NuEnterprises Ltd. | |

| (43) |

Consists of 50,000 common shares of our company and 25,000 common shares of our company issuable upon exercise of warrants. | |

| (44) |

Wesley Martin exercises voting and dispositive power with respect to our common shares that are beneficially owned by WCM Holdings Ltd. | |

| (45) |

Consists of 35,000 common shares of our company and 17,500 common shares of our company issuable upon exercise of warrants. | |

| (46) |

John Lambton exercises voting and dispositive power with respect to our common shares that are beneficially owned by Riverspill Response Canada Ltd. | |

| (47) |

Consists of 35,000 common shares of our company and 17,500 common shares of our company issuable upon exercise of warrants. | |

| (48) |

John Webb exercises voting and dispositive power with respect to our common shares that are beneficially owned by Joma Enterprises Ltd. | |

| (49) |

Consists of 35,000 common shares of our company and 17,500 common shares of our company issuable upon exercise of warrants. | |

| (50) |

Peter Grut exercises voting and dispositive power with respect to our common shares that are beneficially owned by Alpha Capital. | |

| (51) |

Consists of 427,850 common shares of our company. | |

| (52) |

Peter Grut exercises voting and dispositive power with respect to our common shares that are beneficially owned by Hansen Investments Ltd. | |

| (53) |

Consists of 150,000 common shares of our company. | |

| (54) |

Consists of 59,250 common shares of our company. | |

| (55) |

Michael Waldkirch exercises voting and dispositive power with respect to our common shares that are beneficially owned by 0820659 B.C. Ltd. | |

| (56) |

Consists of 71,400 common shares of our company and 35,700 common shares of our company issuable upon exercise of warrants. | |

| (57) |

Consists of 85,650 common shares of our company. |

16

| (58) |

Consists of 35,700 common shares of our company and 17,850 common shares of our company issuable upon exercise of warrants. | |

| (59) |

Consists of 37,500 common shares of our company. | |

| (60) |

Consists of 21,300 common shares of our company. | |

| (61) |

Consists of 35,000 common shares of our company and 17,500 common shares of our company issuable upon exercise of warrants. | |

| (62) |

Consists of 90,600 common shares of our company. | |

| (63) |

George Holbrooke exercises voting and dispositive power with respect to our common shares that are beneficially owned by Bradley Resources Canada Ltd. | |

| (64) |

Consists of 71,400 common shares of our company and 35,700 common shares of our company issuable upon exercise of warrants. | |

| (65) |

Consists of 20,000 common shares of our company and 10,000 common shares of our company issuable upon exercise of warrants. | |

| (66) |

David Steed exercises voting and dispositive power with respect to our common shares that are beneficially owned by Peppy Holdings Ltd. | |

| (67) |

Consists of 40,000 common shares of our company and 20,000 common shares of our company issuable upon exercise of warrants. | |

| (68) |

Richard Hazelwood exercises voting and dispositive power with respect to our common shares that are beneficially owned by Muse Global Master Fund Ltd. | |

| (69) |

Consists of 145,000 common shares of our company and 72,500 common shares of our company issuable upon exercise of warrants. | |

| (70) |

Michael Thalmann exercises voting and dispositive power with respect to our common shares that are beneficially owned by Aran Asset Management SA. | |

| (71) |

Consists of 357,500 common shares of our company and 70,000 common shares of our company issuable upon exercise of warrants. | |

| (72) |

CD Capital (UK) Ltd. beneficially owns our common shares held by Morgan Stanley and Co. Carmel Daniel exercises voting and dispositive power with respect to our common shares that are beneficially owned by CD Capital (UK) Ltd. | |

| (73) |

Consists of 430,000 common shares of our company and 215,000 common shares of our company issuable upon exercise of warrants. | |

| (74) |

Consists of 70,000 common shares of our company and 35,000 common shares of our company issuable upon exercise of warrants. | |

| (75) |

David Dattels exercises voting and dispositive power with respect to our common shares that are beneficially owned by Newgen Mining Fund SPC. | |

| (76) |

Consists of 600,000 common shares of our company. | |

| (77) |

Philipp Richard exercises voting and dispositive power with respect to our common shares that are beneficially owned by RAB Special Situations (Master) Fund Limited. |

17

| (78) |

Consists of 210,000 common shares of our company and 105,000 common shares of our company issuable upon exercise of warrants. |

Plan of Distribution

The selling shareholders may, from time to time, sell all or a portion of our common shares on any market upon which our common shares may be listed or quoted (currently Financial Industry Regulatory Authority’s OTC Bulletin Board in the United States and the TSX Venture Exchange in Canada and the Frankfurt Stock Exchange in Germany), in privately negotiated transactions or otherwise. Such sales may be at fixed prices prevailing at the time of sale, at prices related to the market prices or at negotiated prices. The common shares of our company being offered for resale pursuant to this prospectus may be sold by the selling shareholders by one or more of the following methods, without limitation:

| 1. |

block trades in which the broker or dealer so engaged will attempt to sell our common shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| 2. |

purchases by broker or dealer as principal and resale by the broker or dealer for its account pursuant to this prospectus; | |

| 3. |

an exchange distribution in accordance with the rules of the exchange or quotation system; | |

| 4. |

ordinary brokerage transactions and transactions in which the broker solicits purchasers; | |

| 5. |

privately negotiated transactions; | |

| 6. |

market sales (both long and short to the extent permitted under the federal securities laws); | |

| 7. |

at the market to or through market makers or into an existing market for the shares; | |

| 8. |

through transactions in options, swaps or other derivatives (whether exchange listed or otherwise); and | |

| 9. |

a combination of any aforementioned methods of sale. |

In the event of the transfer by any of the selling shareholders of his, her or its common shares of our company or warrants to any pledgee, donee or other transferee, we will amend this prospectus and the registration statement of which this prospectus forms a part by the filing of a prospectus supplement or, if necessary, a post-effective amendment in order to have the pledgee, donee or other transferee in place of the selling shareholder who has transferred his, her or its shares.

In effecting sales, brokers and dealers engaged by the selling shareholders may arrange for other brokers or dealers to participate. Brokers or dealers may receive commissions or discounts from a selling shareholder or, if any of the broker-dealers act as an agent for the purchaser of such shares, from a purchaser in amounts to be negotiated which are not expected to exceed those customary in the types of transactions involved. Broker-dealers may agree with a selling shareholder to sell a specified number of our common shares at a stipulated price per share. Such an agreement may also require the broker-dealer to purchase as principal any unsold common shares of our company at the price required to fulfill the broker-dealer commitment to the selling shareholder if such broker-dealer is unable to sell the shares on behalf of the selling shareholder. Broker-dealers who acquire our common shares as principal may thereafter resell our common shares from time to time in transactions which may involve block transactions and sales to and through other broker-dealers, including transactions of the nature described above. Such sales by a broker-dealer could be at prices and on terms then prevailing at the time of sale, at prices related to the then-current market price or in negotiated transactions. In connection with such resale, the broker-dealer may pay to or receive from the purchasers of the shares commissions as described above.

The selling shareholders and any broker-dealers or agents that participate with the selling shareholders in the sale of our common shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933 in connection with these sales. In that event, any commissions received by the broker-dealers or agents and any profit on the resale of the common shares of our company purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933.

18

From time to time, any of the selling shareholders may pledge our common shares pursuant to the margin provisions of customer agreements with brokers. Upon a default by a selling shareholder, his, her or its broker may offer and sell the pledged our common shares from time to time. Upon a sale of our common shares, we believe that the selling shareholders will satisfy the prospectus delivery requirements under the Securities Act of 1933. We will file any amendments or other necessary documents in compliance with the Securities Act of 1933 which may be required in the event any of the selling shareholders defaults under any customer agreement with brokers.

To the extent required under the Securities Act of 1933, a prospectus supplement or, if necessary, a post-effective amendment to the registration statement of which this prospectus forms a part will be filed disclosing the name of any broker-dealers, the number of our common shares involved, the price at which our common shares are to be sold, the commissions paid or discounts or concessions allowed to such broker-dealers, where applicable, that such broker-dealers did not conduct any investigation to verify the information set out or incorporated by reference in this prospectus and other facts material to the transaction.

We and the selling shareholders will be subject to applicable provisions of the Securities Exchange Act of 1934 and the rules and regulations under it, including, without limitation, Rule 10b-5 and, insofar as a selling shareholder is a distribution participant and we, under certain circumstances, may be a distribution participant, under Regulation M. All of the foregoing may affect the marketability of our common shares.

All expenses for the prospectus and related registration statement including legal, accounting, printing and mailing fees are and will be borne by us. Any commissions, discounts or other fees payable to brokers or dealers in connection with any sale of our common shares will be borne by the selling shareholders, the purchasers participating in such transaction, or both.

Any common shares of our company being offered pursuant to this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act of 1933, may be sold under Rule 144 rather than pursuant to this prospectus.

Description of Securities

General

We are authorized to issue an unlimited number of common shares without par value and an unlimited number of preferred shares without par value. As of June 27 2011, there were 61,347,545 common shares of our company outstanding and no preferred shares outstanding.

Common Shares

The holders of our common shares are entitled to dividends, if, as and when declared by the board of directors of our company, entitled to one vote per share at meetings of shareholders or our company and, upon dissolution, entitled to share equally in such assets of our company as are distributable to the holders of our common shares and subject to the rights of the holders of our preferred shares.

Preferred Shares

Our company is authorized to issue preferred shares in one or more series. Subject to the Business Corporations Act (British Columbia), the directors of our company may, by resolution, if none of the shares of any particular series are issued, alter articles of our company and authorize the alteration of the notice of articles of our company, as the case may be, to do one or more of the following:

- determine the maximum number of shares of that series that our company is authorized to issue, determine that there is no such maximum number, or alter any such determination;

- create an identifying name for the shares of that series, or alter any such identifying name; and

- attach special rights or restrictions to the shares of that series, or alter any such special rights or restrictions.

The holders of our preferred shares are entitled, on the liquidation or dissolution of our company, whether voluntary or involuntary, or on any other distribution of the assets of our company among shareholders of our company for the purpose of winding up its affairs, to receive, before any distribution is made to the holders of our common shares or any other shares of our company ranking junior to our preferred shares with respect to the repayment of capital on the liquidation or

19

dissolution of our company, whether voluntary or involuntary, or on any other distribution of the assets of our company among shareholders of our company for the purpose of winding up its affairs, the amount paid up with respect to each preferred share held by them, together with the fixed premium (if any) thereon, all accrued and unpaid cumulative dividends (if any and if preferential) thereon, which for such purpose will be calculated as if such dividends were accruing on a day-to-day basis up to the date of such distribution, whether or not earned or declared, and all declared and unpaid non-cumulative dividends (if any and if preferential) thereon. After payment to the holders of our preferred shares of the amounts so payable to them, they will not, as such, be entitled to share in any further distribution of the property or assets of our company, except as specifically provided in the special rights and restrictions attached to any particular series. All assets remaining after payment to the holders of our preferred shares as aforesaid will be distributed rateably among the holders of our common shares.

Except for such rights relating to the election of directors on a default in payment of dividends as may be attached to any series of the preferred shares by the directors, holders of our preferred shares are not entitled, as such, to receive notice of, or to attend or vote at, any general meeting of shareholders of our company

Change in Control

There are no provisions in our articles that would delay, defer or prevent a change in control of our company and that would operate only with respect to an extraordinary corporate transaction involving our company or subsidiary, such as merger, reorganization, tender offer, sale or transfer of substantially all of our assets, or liquidation.

Experts and Counsel

The financial statements of our company included in this prospectus have been audited by Morgan & Company, Chartered Accountants, to the extent and for the period set forth in their report (which contains an explanatory paragraph regarding our ability to continue as a going concern) appearing elsewhere in the prospectus, and are included in reliance upon such report given upon the authority of said firm as experts in auditing and accounting.

Clark Wilson LLP, of Suite 800 – 885 West Georgia Street, Vancouver, British Columbia, Canada has provided an opinion on the validity of our common shares being offered pursuant to this prospectus.

Interest of Named Experts and Counsel

No expert named in the registration statement of which this prospectus forms a part as having prepared or certified any part thereof (or is named as having prepared or certified a report or valuation for use in connection with such registration statement) or counsel named in this prospectus as having given an opinion upon the validity of the securities being offered pursuant to this prospectus or upon other legal matters in connection with the registration or offering such securities was employed for such purpose on a contingency basis. Also at the time of such preparation, certification or opinion or at any time thereafter, through the date of effectiveness of such registration statement or that part of such registration statement to which such preparation, certification or opinion relates, no such person had, or is to receive, in connection with the offering, a substantial interest, direct or indirect, in our company or any of its parents or subsidiaries. Nor was any such person connected with our company or any of its parents or subsidiaries as a promoter, managing or principal underwriter, voting trustee, director, officer or employee.

Information with respect to Our Company

Description of Business

Corporate History

We were incorporated in the State of Nevada on December 21, 2001 under the name “Delbrook Corporation” with authorized capital of 100,000,000 shares of common stock with a par value of $0.001 and 100,000,000 shares of preferred stock with a par value of $0.001. On March 15, 2004, we changed our name to “Argentex Mining Corporation”. We effected this name change by merging with our wholly owned subsidiary, “Argentex Mining Corporation”, a Nevada corporation that we formed specifically for this purpose. Our company was the surviving company in the merger. On November 5, 2007, we moved our state of domicile from Nevada to Delaware. This re-domicile was effected by merging with our wholly owned subsidiary “Argentex Mining Corporation”, a Delaware corporation that we formed specifically for

20

this purpose. Our subsidiary was the surviving entity upon completion of the merger. On April 29, 2011, our shareholders approved the change of corporate jurisdiction of our company from the State of Delaware to the Province of British Columbia, Canada. We began filing the documents necessary to effect this change on June 3, 2011. On June 3, 2011, our subsidiary SCRN Properties was continued into the Province of British Columbia. On June 3, 2011, our company merged into its wholly-owned Nevada subsidiary (which was incorporated in the State of Nevada for this sole purpose) and, on June 8, 2011, our company was continued from the State of Nevada and into the Province of British Columbia, Canada.

Subsidiary

We have one wholly-owned subsidiary, SCRN Properties Ltd., a British Columbia corporation, which we formed on February 13, 2004 for the purpose of acquiring and exploring natural resource properties in Argentina.

Our Business