Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Radius Health, Inc. | a2204572zex-23_1.htm |

| EX-10.67 - EX-10.67 - Radius Health, Inc. | a2204572zex-10_67.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS1

FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on June 23, 2011

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

Radius Health, Inc.

(Exact name of registrant as specified in its charter)

| Delaware (State or other jurisdiction of incorporation or organization) |

2834 (Primary Standard Industrial Classification Code Number) |

80-0145732 (I.R.S. Employer Identification Number) |

201 Broadway, 6th Floor

Cambridge, MA, 02139

(617) 551-4700

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

C. Richard Lyttle, Ph.D.

Chief Executive Officer

Radius Health, Inc.

201 Broadway, 6th Floor

Cambridge, MA, 02139

(617) 551-4700

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Julio E. Vega, Esq.

Matthew J. Cushing, Esq.

Bingham McCutchen LLP

One Federal Street

Boston, Massachusetts 02110

(617) 951-8000

Approximate date of commencement of proposed sale to the public:

Promptly after the effective date of this Registration Statement, subject to applicable contractual lock-up agreements.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price per Share |

Proposed Maximum Aggregate Offering Price(2) |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock, $0.0001 par value per share(3) |

555,594 | $8.14(4) | $4,523,647 | $526 | ||||

Common Stock, $0.0001 par value per share(5) |

15,491,300 | $8.14(4) | $126,130,165 | $14,644 | ||||

Common Stock, $0.0001 par value per share(6) |

266 | $15.00(7) | $3,990 | $1 | ||||

Common Stock, $0.0001 par value per share(8) |

38,880 | $8.14(9) | $316,561 | $37 | ||||

|

||||||||

- (1)

- This

Registration Statement covers the resale by our selling stockholders of up to 16,086,040 shares of our common stock.

- (2)

- Estimated

solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended.

- (3)

- Consists

of 555,594 shares of our currently issued common stock to be offered by the selling stockholders.

- (4)

- Our

common stock is not traded on any national exchange and in accordance with Rule 457; the offering price was determined based upon a per share

amount of $8.142, the negotiated conversion price of our convertible preferred stock and the minimum price at which certain selling stockholders may sell their shares of common stock until the common

stock is registered on a national securities exchange.

- (5)

- Consists

of 15,491,300 unissued shares of our common stock to be offered for resale by certain selling stockholders upon the conversion of 1,549,130

currently outstanding shares of our convertible preferred stock.

- (6)

- Consists

of 266 unissued shares of our common stock to be offered for resale by certain selling stockholders upon the exercise of outstanding common stock

purchase warrants.

- (7)

- Fee

is based on the exercise price of $15.00 per share applicable to shares issuable upon the exercise of common stock purchase warrants in accordance with

Rule 457(g) of the Securities Act of 1933, as amended.

- (8)

- Consists

of 38,880 unissued shares of our common stock to be offered for resale by certain selling stockholders upon the conversion of 3,880 shares of our

convertible preferred stock to be issued upon exercise of outstanding preferred stock purchase warrants.

- (9)

- Fee is based on the price of $8.142 which was determined in accordance with Rule 457(g) of the Securities Act of 1933, as amended, by dividing the exercise price of $81.42 per share of convertible preferred stock by ten, as each share of convertible preferred stock is convertible into ten shares of common stock.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(A) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE SECURITIES AND EXCHANGE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(A), MAY DETERMINE.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

OFFERING PROSPECTUS

SUBJECT TO COMPLETION, DATED JUNE 23, 2011

Radius Health, Inc.

16,086,040 Shares

Common Stock

The selling stockholders identified on pages 64 - 66 of this prospectus are offering on a resale basis a total of up to 16,086,040 shares of our Common Stock, $0.0001 par value per share ("Common Stock"), consisting of (i) 555,594 currently issued shares of our Common Stock to be offered for resale by certain selling stockholders, (ii) 15,491,300 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 1,549,130 outstanding shares of our convertible preferred stock, $0.0001 par value per share ("Preferred Stock") (iii) 266 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the exercise of outstanding common stock purchase warrants, and (iv) 38,880 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 3,880 shares of our Preferred Stock to be issued upon exercise of outstanding preferred stock purchase warrants

There is not currently, and there has never been, any market for any of our securities. Our securities are not eligible for trading on any national securities exchange, the Nasdaq or other over-the-counter markets, including the OTC Bulletin Board®. The selling stockholders identified herein have agreed not to sell the common stock (including shares of common stock issued upon conversion of preferred stock and exercise of warrants) registered hereunder for a price less than $8.142 per share until such time as such restriction is lifted and such securities are eligible for trading on a national securities exchange, the Nasdaq or the OTC Bulletin Board®. At and after such time that such securities are eligible for trading in such a manner, the selling stockholders may sell such securities at the prevailing market price or at a privately negotiated price.

The securities offered by this prospectus involve a high degree of risk.

See "Risk Factors" beginning on page 5.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined that this prospectus is truthful or complete. A representation to the contrary is a criminal offense.

The date of this Prospectus is , 2011.

TABLE OF CONTENTS

The following summary highlights selected information contained elsewhere in this Prospectus. This summary does not contain all the information that you should consider before investing in our securities. You should carefully read the entire Prospectus, paying particular attention to the risks referred to under the heading "Risk Factors."

About This Offering

This Prospectus relates to the resale of up to 16,086,040 shares of our Common Stock to be offered by the selling stockholders consisting of (i) 555,594 currently issued shares of our Common Stock to be offered for resale by certain selling stockholders. (ii) 15,491,300 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 1,549,130 outstanding shares of our Preferred Stock, (iii) 266 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the exercise of outstanding common stock purchase warrants, and (iv) 38,880 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 3,880 shares of our Preferred Stock to be issued upon exercise of outstanding preferred stock purchase warrants.

Summary of the Shares offered by the Selling Stockholders.

The following is a summary of the shares being offered by the selling stockholders:

| Securities Offered | 16,086,040 shares of our Common Stock to be offered by the selling stockholders consisting of: | |

(i) 555,594 currently issued shares of our Common Stock to be offered for resale by certain selling stockholders, |

||

(ii) 15,491,300 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 1,549,130 outstanding shares of our Preferred Stock, |

||

(iii) 266 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the exercise of outstanding common stock purchase warrants, and |

||

(iv) 38,880 unissued shares of our Common Stock to be offered for resale by certain selling stockholders upon the conversion of 3,880 shares of our Preferred Stock to be issued upon exercise of outstanding preferred stock purchase warrants. |

||

Use of Proceeds |

We will not receive any proceeds from the sale of the Common Stock offered by the selling stockholder. However, we will generate proceeds in the event of a cash exercise of the warrants by the selling stockholder. We intend to use those proceeds, if any, for general corporate purposes. |

|

Risk Factors |

The securities offered hereby involve a high degree of risk. See "Risk Factors" beginning on page 5. |

|

Offering Price |

All or part of the shares of Common Stock offered hereby may be sold from time to time in amounts and on terms to be determined by the selling stockholder at the time of sale. |

|

Market for Our Shares |

There is not now and never has been any market for our securities and an active market may never develop. |

1

The Company

We were incorporated in the state of Delaware on February 4, 2008 under the name MPM Acquisition Corp. In May 2011, we entered into a reverse merger transaction (the "Merger") with Radius Health, Inc., a Delaware corporation formed on October 3, 2003 (the "Target") pursuant to which Target became a wholly-owned subsidiary of ours. Immediately following the merger transaction, Target was merged with and into us, we assumed the business of Target and changed our name to "Radius Health, Inc."

Recent Developments

At the effective time of the Merger (the "Effective Time"), all of the shares of Target's common stock, par value $.01 per share (the "Target Common Stock"), and shares of Target's preferred stock, par value $.01 per share (the "Target Preferred Stock"), that were outstanding immediately prior to the Merger were cancelled and each outstanding share of Target Common Stock outstanding immediately prior to the Effective Time was automatically converted into the right to receive one share of our Common Stock and each outstanding share of Target Preferred Stock outstanding immediately prior to the Effective Time was automatically converted into the right to receive one-tenth of one share of our corresponding series of Preferred Stock as consideration for the Merger. In the Merger, we assumed all options and warrants of Target outstanding immediately prior to the Effective Time. Prior to the Merger, pursuant to the terms of a Redemption Agreement dated March 25, 2011, we completed the repurchase of all of our capital stock issued and outstanding immediately prior to the Merger. Upon completion of the Merger and the redemption, the former stockholders of Target held 100% of the outstanding shares of our capital stock. Pursuant to the Merger, we assumed all of the Target's obligations under its existing contracts, including those filed herewith as material contracts. In particular, we have assumed the obligations of Target under that certain Series A-1 Convertible Preferred Stock Purchase Agreement (the "Original Purchase Agreement") with certain investors listed therein (the "Investors") pursuant to which, among other things, Target agreed to issue and sell to the Investors up to an aggregate of 7,895,535 shares of Series A-1 Convertible Preferred Stock, par value $.01 per share, to be completed in three closings (the initial closing, the "Stage I Closing", the second closing, the "Stage II Closing" and the final closing, the "Stage III Closing") (collectively, the "Series A-1 Financing"). The Original Purchase Agreement was subsequently amended by Amendment No. 1 thereto to eliminate all closing conditions previously provided for in the Original Purchase Agreement (as so amended, the "Purchase Agreement"). Upon notice from us, the Investors are obligated to purchase, and we are obligated to issue, 263,178 shares of our Series A-1 Convertible Preferred Stock ("Series A-1 Preferred Stock") at the Stage II Closing and 263,180 shares of our Series A-1 Preferred Stock at the Stage III Closing, each at a purchase price per share of $81.42. There are no conditions to funding if we notify the Investors of any such closing.

The foregoing description of the Merger Agreement, the Redemption Agreement, Purchase Agreement and the transactions contemplated thereby do not purport to be complete and are qualified in their entireties by reference to the Merger Agreement and the Redemption Agreement, respectively.

On May 23, 2011, the Company entered into a Loan and Security Agreement with General Electric Capital Corporation ("GECC") as agent and a lender, and Oxford Finance LLC ("Oxford" and together with GECC, the "Lenders") as a lender, pursuant to which the lenders agreed to make available to the Company $25,000,000 in the aggregate over three term loans. The initial term loan was made on May 23, 2011 in an aggregate principal amount equal to $6,250,000 (the "Initial Term Loan") and is repayable over a term of 42 months, including a six month interest only period. The Initial Term Loan bears interest at 10%. Pursuant to the Agreement, the Company may request two (2) additional term loans, the first, which must be funded not later than November 23, 2011, in an aggregate principal amount equal to $6,250,000 (the "Second Term Loan") and the second, which must be funded not later than May 23, 2012, in an aggregate principal amount equal to $12,500,000 (the "Third Term Loan"). In

2

the event the Second Term Loan is not funded on or before November 23, 2011, the Lenders' commitment to make the Second Term Loan shall be terminated and the total commitment shall be reduced by $6,250,000. In the event the Third Term Loan is not funded on or before May 23, 2012, the Lenders' commitment to make the Third Term Loan shall be terminated and the total commitment shall be further reduced by $12,500,000. Pursunt to the agreement, the Company agreed to issue to the Lenders (or their respective affiliates or designees) stock purchase warrants (collectively, the "Warrants") to purchase in the aggregate a number of shares of our Series A-1 Preferred Stock equal to the quotient of (a) the product of (i) the amount of the applicable term loan multiplied by (ii) four percent (4%) divided by (b) the exercise price equal to $81.42 per share. The exercise period of each Warrant to be issued will expire ten (10) years from the date such Warrants are issued. On May 23, 2011, the Company issued a Warrant to each of GECC and Oxford for the purchase of 3,070 shares of Series A-1 Preferred stock.

Business Overview

Our business is focused on acquiring and developing new therapeutics for women's health, especially osteoporosis. Our lead product candidate is BA058 Injection for the prevention of fracture in women suffering from osteoporosis. BA058 Injection is a daily subcutaneous injection of our novel synthetic peptide analog of human parathyroid hormone-related protein ("hPTHrP"). In April 2011, we began dosing of patients in a pivotal, multinational Phase 3 clinical study and expect to report top-line data from the Phase 3 study by late 2013. Based on our clinical and preclinical results to date, we believe that BA058 stimulates the rapid formation of new high quality bone and may restore bone into the normal range in patients suffering from osteoporosis. In addition to BA058 Injection, we are developing BA058 Microneedle Patch, a short wear time, transdermal form of BA058 that is based on a microneedle technology from 3M Drug Delivery Systems ("3M") that is currently being studied in a Phase 1b clinical study which began in December 2010. The BA058 Microneedle Patch may eliminate the need for injections and lead to better treatment compliance for patients. We believe that development costs for the BA058 Microneedle Patch will be lower than the injectable version as it will not be necessary to conduct an additional fracture study for this follow-on product. As a result of the compressed pathway, we expect that marketing approval of the BA058 Microneedle Patch can occur soon after the BA058 Injection.

Osteoporosis is a disease characterized by low bone mass and structural deterioration of bone tissue, leading to an increase in fractures. The prevalence of osteoporosis is growing in developed nations with the aging of the populations. The National Osteoporosis Foundation ("NOF") has estimated that (i) 10 million people in the United States, comprising eight million women and two million are men, already have osteoporosis and another 34 million have low bone mass placing them at increased risk for osteoporosis and (ii) osteoporosis was responsible for more than 2 million fractures in the United States in 2005 resulting in an estimated $19 billion in costs.

In addition to BA058 Injection and BA058 Microneedle Patch, we are currently conducting one other clinical and one preclinical program. Our second clinical stage product candidate is RAD1901, a selective estrogen receptor modulator, or SERM, licensed from Eisai Co ("Eisai") in 2006 which has completed an initial Phase 2 clinical study for the treatment of vasomotor symptoms (hot flashes) in women entering menopause. Our third product candidate, RAD140, is a pre-IND discovery. RAD140 is a selective androgen receptor modular, or SARM, that is an orally-active androgen agonist on muscle and bone and is a potential treatment for age-related muscle loss, frailty, weight loss associated with cancer cachexia and osteoporosis.

3

As of June 23, 2011, we employed eight full-time employees and three part-time employees, five of whom held Ph.D. or M.D. degrees. Five of our employees were engaged in research and development activities and six were engaged in support administration, including business development, and finance. In addition, we intend to use clinical research organizations and third parties to perform our clinical studies and manufacturing.

Corporate Offices

Our executive offices are located at 201 Broadway, 6th Floor, Cambridge, MA 02139. Our telephone number is (617) 551-4700.

4

An investment in our Common Stock is very risky. You may lose the entire amount of your investment. Prior to making an investment decision, you should carefully review this entire prospectus and consider the following risk factors:

Risks Relating to our Securities

There is not now and never has been any market for our securities and an active market may never develop. You may therefore be unable to re-sell shares of our securities at times and prices that you believe are appropriate. There is no market—active or otherwise—for our Common Stock or our Preferred Stock and neither is eligible for listing or quotation on any securities exchange, automated quotation system (e.g., NASDAQ) or any other over-the-counter market, such as the OTC Bulletin Board® (the "OTCBB") or the Pink Sheets® (the "Pink Sheets"). Even if we are successful in obtaining approval to have our Common stock quoted on the OTCBB, it is unlikely that an active market for our Common Stock will develop any time soon thereafter. Accordingly, our Common Stock is highly illiquid. Because of this illiquidity, you will likely experience difficulty in re-selling such shares at times and prices that you may desire.

There is no assurance that our Common Stock will be listed on NASDAQ or any other securities exchange. We plan to seek listing of our Common Stock on NASDAQ or another national securities exchange or listed for quotation on the OTCBB, as soon as practicable. However, there is no assurance we will be able to meet the initial listing standards of either of those or any other stock exchange or automated quotation systems, or that we will be able to maintain a listing of our Common Stock on either of those or any other stock exchange or automated quotation system. We anticipate seeking a listing of our Common stock on the OTCBB, the Pink Sheets or another over-the-counter quotation system, before our Common Stock is listed on the NASDAQ or a national securities exchange. An investor may find it more difficult to dispose of shares or obtain accurate quotations as to the market value of our Common Stock while our Common Stock is listed on the OTCBB. If our Common Stock is listed on the OTCBB, we would be subject to an SEC rule that, if it failed to meet the criteria set forth in such rule, imposes various practice requirements on broker-dealers who sell securities governed by the rule to persons other than established customers and accredited investors. Consequently, such rule may deter broker-dealers from recommending or selling our Common Stock, which may further limit its liquidity. This would also make it more difficult for us to raise additional capital.

Shares of our Capital Stock issued in the Merger are not freely tradable under Securities Laws which will limit stockholders' ability to sell such shares of our Capital Stock. Shares of our Preferred Stock and our Common Stock issued as consideration in the Merger pursuant the Merger Agreement are deemed "Restricted Securities" under the federal securities laws, and consequently such shares may not be resold without registration under the Securities Act of 1933, as amended (the "Securities Act"), or without an exemption from the Securities Act. Further, Rule 144 covering resales of unregistered securities and promulgated under the Securities Act will not be available for resale of our capital stock unless or until one year following the date on which we file the information required by Form 10 as to the performance of our business. In addition, all shares of our Preferred Stock issued in the Merger will be subject to a lock-up provision set forth in the applicable stockholders' agreement. Each certificate evidencing shares of our capital stock to be issued pursuant to the Merger Agreement will bear a restrictive legend as to the nature of the restrictions on the transfer of such shares.

Because we became an operating company by means of a reverse merger, we may not be able to attract the attention of major brokerage firms. Additional risks may exist as a result of our becoming a public reporting operating company through a "reverse merger." Security analysts of major brokerage firms may not provide coverage of our capital stock or business. Because we became a public reporting operating company through a reverse merger, there is no incentive to brokerage firms to recommend

5

the purchase of our Common Stock. No assurance can be given that brokerage firms will want to provide analyst coverage of our capital stock or business in the future.

The resale of shares covered by a registration statement could adversely affect the market price of our Common Stock in the public market, should one develop, which result would in turn negatively affect our ability to raise additional equity capital. The sale, or availability for sale, of our Common Stock in the public market pursuant to a registration statement may adversely affect the prevailing market price of our Common Stock and may impair our ability to raise additional capital by selling equity or equity-linked securities. Once effective, a registration statement will register the resale of a significant number of shares of our Common Stock. The resale of a substantial number of shares of our Common Stock in the public market could adversely affect the market price for our Common Stock and make it more difficult for you to sell shares of our Common Stock at times and prices that you feel are appropriate. Furthermore, we expect that, because there will be a large number of shares registered pursuant to a registration statement, selling stockholders will continue to offer shares covered by such registration statement for a significant period of time, the precise duration of which cannot be predicted. Accordingly, the adverse market and price pressures resulting from an offering pursuant to a registration statement may continue for an extended period of time and continued negative pressure on the market price of our Common Stock could have a material adverse effect on our ability to raise additional equity capital.

We are or will be subject to Sarbanes-Oxley and the reporting requirements of federal securities laws, which can be expensive. As a public reporting company, we will be subject to the Sarbanes-Oxley Act of 2002, as well as the information and reporting requirements of the Securities Exchange Act of 1934, as amended, (the "Exchange Act") and other federal securities laws. The costs of compliance with the Sarbanes-Oxley Act and of preparing and filing annual and quarterly reports, proxy statements and other information with the SEC, and furnishing audited reports to stockholders, will cause our expenses to be higher than they would be if we were privately held.

For so long as shares of our Preferred Stock remain outstanding, if we are sold in a transaction yielding less than the liquidation preference payable in the aggregate to holders of outstanding Preferred Stock, holders of our Common Stock may not receive any proceeds from such transaction and may lose their investment entirely. As of May 20, 2011, we have 555,594 shares of Common Stock; 413,254 shares of Series A-1 Preferred Stock; 983,208 shares of Series A-2 Convertible Preferred Stock (the "Series A-2 Preferred Stock"); 142,227 shares of Series A-3 Convertible Preferred Stock (the "Series A-3 Preferred Stock"); 3,998 shares of Series Convertible A-4 Preferred Stock (the "Series A-4 Preferred Stock"); 6,443 shares of Series A-5 Convertible Preferred Stock (the "Series A-5 Preferred Stock"); and assumed warrants to acquire 818 shares of Series A-1 Preferred Stock. As more fully described herein and in our Certificate of Incorporation, shares of our Preferred Stock outstanding at the time of a sale or liquidation of the Company will have a right to receive proceeds, if any, from any such transactions, before any payments are made to holders of our Common Stock. In the event that there are not enough proceeds to satisfy the entire liquidation preference of our Preferred Stock, holders of our Common Stock will receive nothing in respect of their equity holdings in the Company.

Risks Related to our Business

We currently have no product revenues and will need to raise additional capital to operate our business. To date, we have generated no product revenues. Until, and unless, we receive approval from the U.S. Food and Drug Administration, or FDA, and other regulatory authorities for its product candidates, we cannot sell our drugs and will not have product revenues. Currently, our only product candidates are BA058, RAD1901, and RAD140, and none of these products is approved by the FDA for sale. Therefore, for the foreseeable future, we will have to fund our operations and capital expenditures from cash on hand, licensing fees and grants and potentially, future offerings of our Common Stock or

6

Preferred Stock. Currently, we believe that our cash on hand, which includes the $20.4 million in net proceeds received on May 17, 2011 from the first closing of the Series A-1 Financing, plus the proceeds of the two subsequent closings of the Series A-1 Financing which are available to us with no closing or other conditions, are sufficient to fund our operations into May 2012. However, changes may occur that would consume our available capital before that time, including changes in and progress of our development activities, acquisitions of additional candidates and changes in regulation.

We will need to seek additional sources of financing, which may not be available on favorable terms, if at all. Notwithstanding the expected completion of the subsequent two closings of the Series A-1 Financing, if we do not succeed in timely raising additional funds on acceptable terms, we may be unable to complete planned pre-clinical and clinical trials or obtain approval of any product candidates from the FDA and other regulatory authorities. In addition, we could be forced to discontinue product development, reduce or forego sales and marketing efforts and forego attractive business opportunities. Any additional sources of financing will likely involve the issuance of additional equity securities, which will have a dilutive effect on stockholders.

We are not currently profitable and may never become profitable. We have a history of net losses and expect to incur substantial losses and negative operating cash flow for the foreseeable future, and may never achieve or maintain profitability. For the years ended December 31, 2010 and 2009, we had a net loss of $14.6 million and $15.1 million, respectively. As of March 31, 2011 we had an accumulated deficit of approximately $136.1 from the operations of Target. Even if we succeed in developing and commercializing one or more product candidates, we expect to incur substantial losses for the foreseeable future and may never become profitable. We also expect to continue to incur significant operating and capital expenditures and anticipate that our expenses will increase substantially in the foreseeable future as we:

- •

- continue to undertake pre-clinical development and clinical trials for product candidates;

- •

- seek regulatory approvals for product candidates;

- •

- implement additional internal systems and infrastructure; and

- •

- hire additional personnel.

We also expect to experience negative cash flow for the foreseeable future as we fund our operating losses and capital expenditures. As a result, we will need to generate significant revenues in order to achieve and maintain profitability. We may not be able to generate these revenues or achieve profitability in the future. Our failure to achieve or maintain profitability could negatively impact the value of our securities.

We have a limited operating history upon which to base an investment decision. We are a development-stage company and have not demonstrated an ability to perform the functions necessary for the successful commercialization of any product candidates. The successful commercialization of any product candidates will require us to perform a variety of functions, including:

- •

- continuing to undertake pre-clinical development and clinical trials;

- •

- participating in regulatory approval processes;

- •

- formulating and manufacturing products; and

- •

- conducting sales and marketing activities.

Our operations have been limited to organizing and staffing our company, acquiring, developing and securing its proprietary technology and undertaking pre-clinical and clinical trials of our product candidates. These operations provide a limited basis for you to assess our ability to commercialize our product candidates and the advisability of investing further in our securities.

7

We are heavily dependent on the success of the BA058 Injection, which is still under clinical development. We cannot be certain that BA058 Injection will receive regulatory approval or be successfully commercialized even if we receive regulatory approval. BA058 Injection is our only product candidate in late stage development, and our business currently depends heavily on its successful development, regulatory approval and commercialization. We have no drug products for sale currently and may never be able to develop marketable drug products. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of drug products are subject to extensive regulation by the FDA and other regulatory authorities in the United States and other countries, which regulations differ from country to country. We are not permitted to market BA058 Injection in the United States until it receives approval of a New Drug Application, or NDA, from the FDA, or in any foreign countries until it receives the requisite approval from such countries. In addition, the approval of BA058 Microneedle Patch as a follow-on product is dependent on an earlier approval of BA058 Injection. We have not submitted an NDA to the FDA or comparable applications to other regulatory authorities. Obtaining approval of an NDA is an extensive, lengthy, expensive and uncertain process, and the FDA may delay, limit or deny approval of BA058 Injection for many reasons, including:

- •

- we may not be able to demonstrate that BA058 is safe and effective as a treatment for osteoporosis to the satisfaction of

the FDA;

- •

- the results of its clinical studies may not meet the level of statistical or clinical significance required by the FDA for

marketing approval;

- •

- the FDA may disagree with the number, design, size, conduct or implementation of our clinical studies;

- •

- the clinical research organization, or CRO, that we retain to conduct clinical studies may take actions outside of our

control that materially adversely impact our clinical studies;

- •

- the FDA may not find the data from preclinical studies and clinical studies sufficient to demonstrate that BA058's

clinical and other benefits outweigh its safety risks;

- •

- the FDA may disagree with our interpretation of data from our preclinical studies and clinical studies or may require that

we conduct additional studies;

- •

- the FDA may not accept data generated at its clinical study sites;

- •

- if our NDA is reviewed by an advisory committee, the FDA may have difficulties scheduling an advisory committee meeting in

a timely manner or the advisory committee may recommend against approval of our application or may recommend that the FDA require, as a condition of approval, additional preclinical studies or

clinical studies, limitations on approved labeling or distribution and use restrictions;

- •

- the FDA may require development of a Risk Evaluation and Mitigation Strategy, or REMS, as a condition of approval;

- •

- the FDA may identify deficiencies in the manufacturing processes or facilities of our third-party manufacturers; or

- •

- the FDA may change its approval policies or adopt new regulations.

Before we submit an NDA to the FDA for BA058 as a treatment for osteoporosis, we must initiate and complete our pivotal Phase 3 study, a thorough QT study, a renal safety study, an osteosarcoma study in rats, and bone quality studies in rats and monkey. We have not commenced all of these required studies and the results of these studies will have an important bearing on the approval of BA058. In addition to fracture and BMD, our pivotal Phase 3 study will measure a number of other potential safety indicators, including anti-BA058 antibodies which will have an important bearing on the approval of BA058. In addition, the results from the rat carcinogenicity study, which includes

8

hPTH(1-34), as a comparator, may show that BA058 dosing results in more osteosarcomas than PTH which may have a material adverse bearing on approval of BA058.

If we do not obtain the necessary U.S. or worldwide regulatory approvals to commercialize any product candidate, we will not be able to sell our product candidates. We cannot assure you that we will receive the approvals necessary to commercialize any of our product candidates (BA058, RAD1901, and RAD140), or any product candidate we acquire or develop in the future. We will need FDA approval to commercialize our product candidates in the U.S. and approvals from the FDA-equivalent regulatory authorities in foreign jurisdictions to commercialize our product candidates in those jurisdictions. In order to obtain FDA approval of any product candidate, we must submit to the FDA an NDA demonstrating that the product candidate is safe for humans and effective for its intended use. This demonstration requires significant research and animal tests, which are referred to as pre-clinical studies, as well as human tests, which are referred to as clinical trials. Satisfaction of the FDA's regulatory requirements typically takes many years, depends upon the type, complexity and novelty of the product candidate and requires substantial resources for research, development and testing. We cannot predict whether our research and clinical approaches will result in drugs that the FDA considers safe for humans and effective for indicated uses. The FDA has substantial discretion in the drug approval process and may require us to conduct additional pre-clinical and clinical testing or to perform post-marketing studies. The approval process may also be delayed by changes in government regulation, future legislation or administrative action or changes in FDA policy that occur prior to or during its regulatory review. Delays in obtaining regulatory approvals may:

- •

- delay commercialization of, and our ability to derive product revenues from, our product candidate;

- •

- impose costly procedures on us; and

- •

- diminish any competitive advantages that we may otherwise enjoy.

Even if we comply with all FDA requests, the FDA may ultimately reject one or more of our NDAs. We may never obtain regulatory clearance for any of our product candidates (BA058, RAD1901, and RAD140). Failure to obtain FDA approval of any of our product candidates will severely undermine our business by leaving us without a saleable product, and therefore without any source of revenues, until another product candidate can be developed. There is no guarantee that we will ever be able to develop or acquire another product candidate.

In foreign jurisdictions, we must receive approval from the appropriate regulatory authorities before we can commercialize any drugs. Foreign regulatory approval processes generally include all of the risks associated with the FDA approval procedures described above. We cannot assure you that we will receive the approvals necessary to commercialize our product candidates for sale outside the United States.

Most of our product candidates are in early stages of clinical trials. Except for BA058, each of our other product candidates (RAD1901 and RAD140), are in early stages of development and requires extensive pre-clinical and clinical testing. We cannot predict with any certainty if or when we might submit an NDA for regulatory approval for any of our product candidates or whether any such NDA will be accepted.

Clinical trials are very expensive, time-consuming and difficult to design and implement. Human clinical trials are very expensive and difficult to design and implement, in part because they are subject to rigorous regulatory requirements. A substantial portion of our BA058 development costs are denominated in euro and any adverse movement in the dollar/euro exchange rate will result in increased costs and require us to raise additional capital to complete the development of our products. The clinical trial process is also time consuming. We estimate that clinical trials of BA058 Injection will

9

take at least three years to complete. Furthermore, failure can occur at any stage of the trials, and we could encounter problems that cause us to abandon or repeat clinical trials. The commencement and completion of clinical trials may be delayed by several factors, including:

- •

- unforeseen safety issues;

- •

- determination of dosing issues;

- •

- lack of effectiveness during clinical trials;

- •

- slower than expected rates of patient recruitment;

- •

- inability to monitor patients adequately during or after treatment; and

- •

- inability or unwillingness of medical investigators to follow our clinical protocols.

In addition, we or the FDA may suspend our clinical trials at any time if it appears that we are exposing participants to unacceptable health risks or if the FDA finds deficiencies in our Investigational New Drug, or IND, submissions or the conduct of these trials. Therefore, we cannot predict with any certainty the schedule for future clinical trials.

The results of our clinical trials may not support its product candidate claims. Even if our clinical trials are completed as planned, we cannot be certain that the results will support our product candidate claims. Success in pre-clinical testing and early clinical trials does not ensure that later clinical trials will be successful, and we cannot be sure that the results of later clinical trials will replicate the results of prior clinical trials and pre-clinical testing. Our Phase 3 study of BA058 Injection for fracture prevention may not replicate the positive efficacy results for BMD from our Phase 2 study. The clinical trial process may fail to demonstrate that our product candidates are safe for humans and effective for indicated uses. This failure would cause us to abandon a product candidate and may delay development of other product candidates. Any delay in, or termination of, our clinical trials will delay the filing of our NDAs with the FDA and, ultimately, our ability to commercialize our product candidates and generate product revenues. In addition, our clinical trials to date involve a small patient population. Because of the small sample size, the results of these clinical trials may not be indicative of future results.

Physicians and patients may not accept and use our drugs. Even if the FDA approves one or more of our product candidates, physicians and patients may not accept and use it. Acceptance and use of our product will depend upon a number of factors including:

- •

- perceptions by members of the health care community, including physicians, about the safety and effectiveness of our drug;

- •

- cost-effectiveness of our product relative to competing products;

- •

- availability of reimbursement for our product from government or other healthcare payers; and

- •

- effectiveness of marketing and distribution efforts by us and its licensees and distributors, if any.

Because we expect sales of our current product candidates, if approved, to generate substantially all of its product revenues for the foreseeable future, the failure of these drugs to find market acceptance would harm our business and could require us to seek additional financing.

Our drug-development program depends upon third-party researcher, investigators and collaborators who are outside our control. We depend upon independent researchers, investigators and collaborators, such as Nordic Bioscience Clinical Development VII A/S ("Nordic"), to conduct our pre-clinical and clinical trials under agreements with us. These third parties are not our employees and we cannot control the amount or timing of resources that they devote to our programs. These third parties may not assign as great a priority to our programs or pursue them as diligently as we would if we were undertaking such

10

programs ourselves. If outside collaborators fail to devote sufficient time and resources to our drug-development programs, or if their performance is substandard, the approval of our FDA applications, if any, and our introduction of new drugs, if any, will be delayed. These collaborators may also have relationships with other commercial entities, some of whom may compete with us. If our collaborators assist competitors at our expense, our competitive position would be harmed.

We will rely exclusively on third parties to formulate and manufacture our product candidate. We have no experience in drug formulation or manufacturing and do not intend to establish our own manufacturing facilities. We lack the resources and expertise to formulate or manufacture our own product candidates. We have entered into agreements with contract manufacturers to manufacture BA058 Injection for use in clinical trial activities. These contract manufacturers are currently our only source for the production and formulation of BA058. We currently do not have sufficient clinical supplies of BA058 to complete the planned Phase 3 study for BA058 Injection but believe that our contract manufacturers will be able to produce sufficient supply of BA058 to complete all of the planned BA058 clinical studies. However, if our contract manufacturers are unable to produce, in a timely manner, adequate clinical supplies to meet the needs of our clinical studies, we would be required to seek new contract manufacturers that may require us to modify our finished product formulation and modify or terminate our clinical studies for BA058. Any modification of our finished product or modification or termination of our Phase 3 clinical study could adversely affect our ability to obtain necessary regulatory approvals and significantly delay or prevent the commercial launch of the product, which would materially harm our business and impair our ability to raise capital.

We depend on a number of single source contract manufacturers to supply key components of BA058. For instance, we depend on Lonza Group Ltd. ("Lonza"), which produces supplies of bulk drug product of BA058 to support the BA058 Injection and BA058 Microneedle Patch clinical studies and potential commercial launch. We also depend on VETTER Pharma Fertigung GmbH & Co ("Vetter") and 3M for the production of finished supplies of BA058 Injection and BA058 Microneedle Patch, respectively. Because of our dependence on Vetter for the "fill and finish" part of the manufacturing process for BA058 Injection, we are subject to the risk that Vetter may not have the capacity from time to time to produce sufficient quantities of BA058 to meet the needs of our clinical studies or be able to scale to commercial production of BA058. Because the manufacturing process for BA058 Microneedle Patch requires the use of 3M's proprietary technology, 3M is our sole source for finished supplies of BA058 Microneedle Patch.

While we are currently in discussions, to date, we have not entered into a long-term agreement with Lonza, Vetter or 3M, who each currently produces BA058 product on a purchase order basis for us. Accordingly, Lonza, Vetter and 3M could terminate our relationship at any time and for any reason. If our relationship with any of these contract manufacturers is terminated, or if they are unable to produce BA058 in required quantities, on a timely basis or at all, our business and financial condition would be materially harmed. If any of our current product candidates or any product candidates we may develop or acquire in the future receive FDA approval, we will rely on one or more third-party contractors to manufacture its drugs. Our anticipated future reliance on a limited number of third-party manufacturers exposes us to the following risks:

- •

- We may be unable to identify manufacturers on acceptable terms or at all because the number of potential manufacturers is

limited and the FDA must approve any replacement contractor. This approval would require new testing and compliance inspections. In addition, a new manufacturer would have to be educated in, or

develop substantially equivalent processes for, production of our products after receipt of FDA approval, if any.

- •

- Our third-party manufacturers might be unable to formulate and manufacture our drugs in the volume and of the quality required to meet our clinical needs and commercial needs, if any.

11

- •

- Our future contract manufacturers may not perform as agreed or may not remain in the contract manufacturing business for

the time required to supply our clinical trials or to successfully produce, store and distribute its products.

- •

- Drug manufacturers are subject to ongoing periodic unannounced inspection by the FDA, the Drug Enforcement Administration,

and corresponding state agencies to ensure strict compliance with good manufacturing practice and other government regulations and corresponding foreign standards. We does not have control over

third-party manufacturers' compliance with these regulations and standards.

- •

- If any third-party manufacturer makes improvements in the manufacturing process for our products, we may not own, or may have to share, the intellectual property rights to the innovation.

Each of these risks could delay our clinical trials, the approval, if any, of our product candidates by the FDA or the commercialization of our product candidates or result in higher costs or deprive us of potential product revenues.

We have no experience selling, marketing or distributing products and no internal capability to do so. We currently have no sales, marketing or distribution capabilities. We do not anticipate having the resources in the foreseeable future to allocate to the sales and marketing of our proposed products. Our future success depends, in part, on our ability to enter into and maintain collaborative relationships for such capabilities, the collaborator's strategic interest in the products under development and such collaborator's ability to successfully market and sell any such products. We intend to pursue collaborative arrangements regarding the sales and marketing of our products, however, there can be no assurance that we will be able to establish or maintain such collaborative arrangements, or if able to do so, that they will have effective sales forces. To the extent that we decide not to, or are unable to, enter into collaborative arrangements with respect to the sales and marketing of our proposed products, significant capital expenditures, management resources and time will be required to establish and develop an in-house marketing and sales force with technical expertise. There can also be no assurance that we will be able to establish or maintain relationships with third party collaborators or develop in-house sales and distribution capabilities. To the extent that we depend on third parties for marketing and distribution, any revenues we receive will depend upon the efforts of such third parties, and there can be no assurance that such efforts will be successful. In addition, there can also be no assurance that we will be able to market and sell our products in the United States or overseas.

If we cannot compete successfully for market share against other drug companies, we may not achieve sufficient product revenues and our business will suffer. The market for our product candidates is characterized by intense competition and rapid technological advances. If any of our product candidates receives FDA approval, it will compete with a number of existing and future drugs and therapies developed, manufactured and marketed by others. If we fail to develop BA058 Microneedle Patch, our commercial opportunity for BA058 will be limited. Existing or future competing products may provide greater therapeutic convenience or clinical or other benefits for a specific indication than our products, or may offer comparable performance at a lower cost. If our products fail to capture and maintain market share, we may not achieve sufficient product revenues and our business will suffer.

We will compete against fully integrated pharmaceutical companies and smaller companies that are collaborating with larger pharmaceutical companies, academic institutions, government agencies and other public and private research organizations. Many of these competitors have oncology compounds already approved or in development. In addition, many of these competitors, either alone or together

12

with their collaborative partners, operate larger research and development programs or have substantially greater financial resources than we does, as well as significantly greater experience in:

- •

- developing drugs;

- •

- undertaking pre-clinical testing and human clinical trials;

- •

- obtaining FDA and other regulatory approvals of drugs;

- •

- formulating and manufacturing drugs; and

- •

- launching, marketing and selling drugs.

Developments by competitors may render our products or technologies obsolete or non-competitive. The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. Some of the drugs that we are attempting to develop, such as BA058, RAD1901 and RAD140 will have to compete with existing therapies. In addition, a large number of companies are pursuing the development of pharmaceuticals that target the same diseases and conditions that we is targeting. We faces competition from pharmaceutical and biotechnology companies in the United States and abroad. In addition, companies pursuing different but related fields represent substantial competition. Many of these organizations competing with us have substantially greater capital resources, larger research and development staffs and facilities, longer drug development history in obtaining regulatory approvals and greater manufacturing and marketing capabilities than we do. These organizations also compete with us to attract qualified personnel and parties for acquisitions, joint ventures or other collaborations, and therefore, we may not be able to hire or retain qualified personnel to run all facets of our business.

If our efforts to protect our intellectual property related to BA058, RAD1901 and/or RAD140 fail to adequately protect these assets, we may suffer the loss of the ability to license or successfully commercialize one or more of these candidates. Our commercial success is significantly dependent on intellectual property related to that product portfolio. We are either the licensee or assignee of numerous issued and pending patent applications that cover various aspects of our assets including BA058, RAD1901 and RAD140.

Patents covering BA058 as a composition of matter have been issued in the United States (US patent No. 5,969,095), Europe and several additional countries. Because the BA058 composition of matter case was filed in 1996, it is expected to have a normal expiry of approximately 2016 in the United States (this date does not include the possibility of Hatch-Waxman extension) and additional countries where it has issued. Because of this, it is possible that the data exclusivity provisions as applied to new molecular entities may run longer than the issued composition of matter patents.

We and Ipsen Pharma S.A.S (Ipsen) are also coassignees to US patent No. 7,803,770 that we believe provides exclusivity until 2027 in the United States (absent any extensions) for the method of treating osteoporosis with the intended therapeutic dose. Because patents are both highly technical and legal documents that are frequently subject to intense litigation pressure, there is risk that one or more of the issued patents that are believed to cover BA058 when marketed will be found to be invalid, unenforceable and/or not infringed. In the absence of product exclusivity in the market, there is a high likelihood of multiple competitors selling the same product with a corresponding drop in pricing power and/or sales volume.

13

Currently, additional intellectual property covering the BA058 Microneedle Patch is the subject of a US provisional patent application with a priority date of 2011 and any issued claims resulting from this application will expire no earlier than 2031. However, pending patent applications in the United States and elsewhere may not issue since the interpretation of the legal requirements of patentability in view claimed inventions are not always predictable. Additional intellectual property covering the BA058 Microneedle Patch technology exists in the form of proprietary information contained by trade secrets. These can be accidentally disclosed to, independently derived by or misappropriated by competitors, possibly reducing or eliminating the exclusivity advantages of this form of intellectual property, thereby allowing those competitors more rapid entry into the market place with a competitive product thus reducing our marketing advantage of the BA058 Microneedle Patch. In addition, trade secrets may in some instances become publicly available required disclosures in regulatory files. Alternatively, competitors may sometimes reverse engineer a product once it becomes available on the market. Even where a competitor does not use an identical technology for the delivery of BA058, it is possible that they could achieve an equivalent or even superior result using another technology. Such occurrences could lead to either one or more alternative competitor products available on the market and/or one or more generic competitor products on the market with a corresponding decrease in market share and/or price for the BA058 Microneedle Patch.

Patents covering RAD1901 as a composition of matter have been issued in the United States, Australia and is pending in Europe and several additional countries. The RAD1901 composition of matter patent in the United States expires in 2025 (not including any Hatch-Waxman extension). Additional patent applications relating to methods of treating vasomotor symptoms, clinical dosage strengths and combination treatment modalities all covering RAD1901 have been filed. Since patents are both highly technical and legal documents that are frequently subject to intense litigation pressure, there is risk that one or more of the issued patents that are believed to cover RAD1901 when marketed will be found to be invalid, unenforceable and/or not infringed when subject to said litigation. In the absence of product exclusivity in the market, there is a high likelihood of multiple competitors selling the same product with a corresponding drop in pricing power and/or sales volume. Pending patent applications in the United States and elsewhere may not issue since the interpretation of the legal requirements of patentability in view of any claimed invention before that patent office are not always predictable. As a result, we Health could encounter challenges or difficulties in building, maintaining and/or defending its intellectual property rights protecting and defending our intellectual property both in the United States and abroad.

Patent applications covering RAD140 and other SARM compounds that are part of the SARM portfolio have been filed in the United States and elsewhere. Since the RAD140 composition of matter case was effectively filed in 2009, if issued, it is expected to have a normal expiry of approximately 2029 in the United States (this does not include the possibility of USPTO patent term adjustment or Hatch-Waxman extension) and additional countries if/when it issues. Since patents are both highly technical and legal documents that are frequently subject to intense litigation pressure, there is risk that even if one or more RAD140 patents does issue and is asserted that the patent(s) will be found invalid, unenforceable and/or not infringed when subject to said litigation. Finally, the intellectual property laws and practices can vary considerably from one country to another and also can change with time. As a result, we Health could encounter challenges or difficulties in building, maintaining and/or defending its intellectual property rights protecting and defending our intellectual property both in the United States and abroad.

Payments, fees, submissions and various additional requirements must be met in order for pending patent applications to advance in prosecution and issued patents to be maintained. Rigorous compliance with these requirements is essential to procurement and maintenance of patents integral to the product portfolio. Periodic maintenance fees, renewal fees, annuity fees and various other governmental fees on patents and/or applications will come due for payment periodically throughout the lifecycle of patent

14

applications and issued patents. In order to help ensure that we comply with any required fee payment, documentary and/or procedural requirements as they might relate to any patents for which we is an assignee or co-assignee, we employ competent legal help and related professionals as needed to comply with those requirements. Our outside patent counsel uses Computer Packages, Inc. for patent annuity payments. Failure to meet a required fee payment, document production of procedural requirement can result in the abandonment of a pending patent application or the lapse of an issued patent. In some instances the defect can be cured through late compliance but there are situations where the failure to meet the required event cannot be cured. Such an occurrence could compromise the intellectual property protection around a our preclinical or clinical candidate and possibly weaken or eliminate our ability to protect our eventual market share for that product.

If we infringe the rights of third parties we could be prevented from selling products, forced to pay damages, and defend against litigation. If our products, methods, processes and other technologies infringe the proprietary rights of other parties, we could incur substantial costs and may have to:

- •

- obtain licenses, which may not be available on commercially reasonable terms, if at all;

- •

- abandon an infringing drug candidate;

- •

- redesign its products or processes to avoid infringement;

- •

- stop using the subject matter claimed in the patents held by others;

- •

- pay damages; or

- •

- defend litigation or administrative proceedings which may be costly whether we wins or loses, and which could result in a substantial diversion of its financial and management resources.

Our ability to generate product revenues will be diminished if our drugs sell for inadequate prices or patients are unable to obtain adequate levels of reimbursement. Our ability to commercialize its drugs, alone or with collaborators, will depend in part on the extent to which reimbursement will be available from:

- •

- government and health administration authorities;

- •

- private health maintenance organizations and health insurers; and

- •

- other healthcare payers.

Significant uncertainty exists as to the reimbursement status of newly approved healthcare products. Healthcare payers, including Medicare, are challenging the prices charged for medical products and services. Government and other healthcare payers increasingly attempt to contain healthcare costs by limiting both coverage and the level of reimbursement for drugs. Even if one of our product candidates is approved by the FDA, insurance coverage may not be available, and reimbursement levels may be inadequate, to cover such drug. If government and other healthcare payers do not provide adequate coverage and reimbursement levels for one of our products, once approved, market acceptance of such product could be reduced.

We may not successfully manage our growth. Our success will depend upon the expansion of our operations and the effective management of its growth, which will place a significant strain on our management and on administrative, operational and financial resources. To manage this growth, we may be required to expand our facilities, augment our operational, financial and management systems and hire and train additional qualified personnel. If we are unable to manage this growth effectively, our business would be harmed.

15

We may be exposed to liability claims associated with the use of hazardous materials and chemicals. Our research and development activities may involve the controlled use of hazardous materials and chemicals. Although we believe that our safety procedures for using, storing, handling and disposing of these materials comply with federal, state and local laws and regulations, we cannot completely eliminate the risk of accidental injury or contamination from these materials. In the event of such an accident, we could be held liable for any resulting damages and any liability could materially adversely affect its business, financial condition and results of operations. In addition, the federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous or radioactive materials and waste products may require us to incur substantial compliance costs that could materially adversely affect its business, financial condition and results of operations.

We rely on key executive officers and scientific and medical advisors, and their knowledge of our business and technical expertise would be difficult to replace. We are highly dependent on its principal scientific, regulatory and medical advisors. We do not have "key person" life policies for any of our officers. The loss of the technical knowledge and management and industry expertise of any of our key personnel could result in delays in product development, loss of customers and sales and diversion of management resources, which could adversely affect our operating results.

If we are unable to hire additional qualified personnel, our ability to grow our business may be harmed. We will need to hire additional qualified personnel with expertise in pre-clinical testing, clinical research and testing, government regulation, formulation and manufacturing and sales and marketing. We compete for qualified individuals with numerous biopharmaceutical companies, universities and other research institutions. Competition for such individuals is intense, and we cannot be certain that our search for such personnel will be successful. Attracting and retaining qualified personnel will be critical to our success.

We may incur substantial liabilities and may be required to limit commercialization of our products in response to product liability lawsuits. The testing and marketing of medical products entail an inherent risk of product liability. If we cannot successfully defend our self against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our products. Our inability to obtain sufficient product liability insurance at an acceptable cost to protect against potential product liability claims could prevent or inhibit the commercialization of pharmaceutical products we develop, alone or with collaborators.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus that are forward-looking in nature are based on the current beliefs of our management as well as assumptions made by and information currently available to management, including statements related to the markets for our products, general trends in our operations or financial results, plans, expectations, estimates and beliefs. In addition, when used in this prospectus, the words "may," "could," "should," "anticipate," "believe," "estimate," "expect," "intend," "plan," "predict" and similar expressions and their variants, as they relate to us or our management, may identify forward-looking statements. These statements reflect our judgment as of the date of this prospectus with respect to future events, the outcome of which is subject to risks, which may have a significant impact on our business, operating results or financial condition. You are cautioned that these forward-looking statements are inherently uncertain. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results or outcomes may vary materially from those described herein. We undertake no obligation to update forward-looking statements. The risks identified under the heading "Risk Factors" in this prospectus, among others, may impact forward-looking statements contained in this prospectus.

16

DESCRIPTION OF THE BUSINESS OF RADIUS HEALTH, INC.

Overview

We are a pharmaceutical company focused on acquiring and developing new therapeutics for osteoporosis and women's health. Our lead candidate is BA058 Injection for the prevention of fracture in women suffering from osteoporosis. BA058 Injection is a daily subcutaneous injection of our novel synthetic peptide analog of hPTHrP. In April 2011, we began dosing of patients in a pivotal, multinational Phase 3 clinical study and expect to report top-line data from the Phase 3 study by late 2013. Based on our clinical and preclinical results to date, we believe that BA058 stimulates the rapid formation of new high quality bone and may restore bone into the normal range in patients suffering from osteoporosis. In addition to BA058 Injection, we are developing BA058 Microneedle Patch, a short wear time, transdermal form of BA058 that is based on a microneedle technology from 3M that is currently being studied in a Phase 1b clinical study which began in December 2010. The BA058 Microneedle Patch may eliminate the need for injections and lead to better treatment compliance for patients. We believe that development costs for the BA058 Microneedle Patch will be lower than the injectable version as it will not be necessary to conduct an additional fracture study for this follow-on product. As a result of the compressed pathway, we expect that marketing approval of the BA058 Microneedle Patch can occur soon after the BA058 Injection.

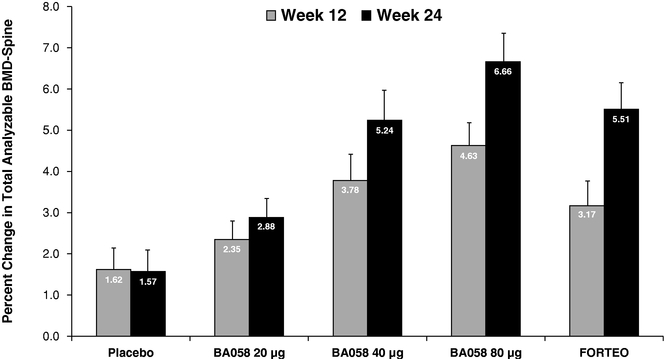

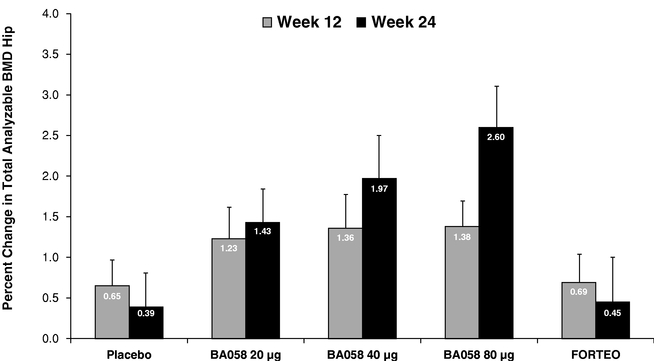

While there are a number of drugs that help to reduce the rate of bone loss, there are few that are able to build bone. The only approved therapy in the United States that increases bone mineral density ("BMD") into the normal range is Forteo®, a daily subcutaneous injection of recombinant human parathyroid hormone (rhPTH(1-34)). The product is marketed by Eli Lilly and had reported worldwide sales of $830 million in 2010. We believe that BA058 may offer a number of important advantages over Forteo®, including greater efficacy, a faster benefit, a shorter course of therapy, no need to store BA058 Injection under refrigeration, and an improved safety profile. We believe, if approved, the BA058 Injection and the BA058 Microneedle Patch will offer an attractive bone anabolic treatment option for prescribing physicians and women with compelling advantages in safety, efficacy and delivery over Forteo®.

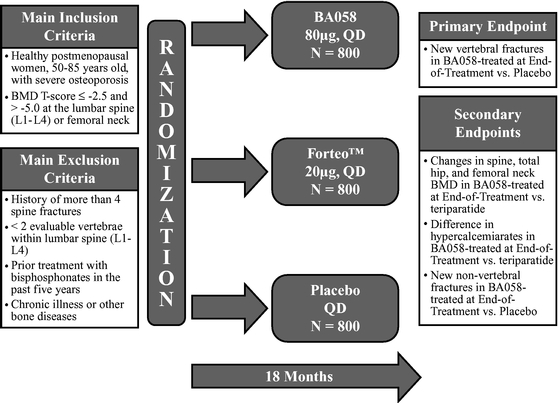

Based upon guidance we have received from the United States Food and Drug Administration ("FDA") and the European Medicines Agency ("EMA"), we believe that a single pivotal placebo-controlled, comparative Phase 3 study will be sufficient to support registration of BA058 Injection for the treatment of osteoporosis in both the United States and the European Union. Our planned study will enroll a total of 2,400 patients to be randomized equally to receive daily doses of one of the following: 80 micrograms (µg) of BA058, a matching placebo, or the approved dose of 20 µg of Forteo® for 18 months. The study will be powered to show that BA058 is superior to (i) placebo for fracture and (ii) Forteo® for greater BMD improvement at major skeletal sites and for a lower occurrence of hypercalcemia, a condition in which the calcium level in a patient's blood is above normal. We believe that the study will also show that BMD gains for BA058 patients will be earlier than for Forteo® patients.

Market Opportunity for BA058

Osteoporosis is a disease characterized by low bone mass and structural deterioration of bone tissue, leading to an increase in fractures. The prevalence of osteoporosis is growing in developed nations with the aging of the populations. NOF has estimated that (i) 10 million people in the United States, comprising eight million women and two million are men, already have osteoporosis and another 34 million have low bone mass placing them at increased risk for osteoporosis and (ii) osteoporosis was responsible for more than 2 million fractures in the United States in 2005 resulting in an estimated $19 billion in costs.

17

In 2011, Cowen and Company ("Cowen"), an investment banking firm, estimated that total worldwide sales of osteoporosis products was $7.6 billion in 2010. There are two main types of osteoporosis drugs now available in the United States: (i) anti-resorptive agents such as bisphosphonates including Actonel®, Boniva® or Reclast®, and Prolia® (a nuclear factor kB ligand ("RANKL") inhibitor marketed by Amgen), as well as calcitonins and selective estrogen receptor modulators such as Evista® marketed by Lilly; and (ii) anabolic agents, with Forteo® being the only approved drug of this type. Anti-resorptive agents act to prevent further bone loss by inhibiting the breakdown of bone whereas anabolic agents stimulate bone formation to build high quality, new bone. The use of bisphosphonates have been associated with infrequent but serious adverse events such as osteonecrosis of the jaw, atrial fibrillation and anomalous fractures resulting from "frozen bone" that have created increasing concern with physicians and patients. Many physicians are seeking alternatives to current anti-resorptive therapies and we believe this will drive greater demand for bone anabolic agents in the future. We believe that there is a significant opportunity for a new anabolic agent such as BA058 that will increase bone mineral density to a greater degree and at a faster rate than Forteo® with added advantages in convenience and safety.

Our Strategy

We plan to build a pharmaceutical company focused on acquiring and developing new therapeutics for osteoporosis and women's health by:

- •

- Completing the single, pivotal Phase 3 clinical trial of BA058 Injection for the treatment of osteoporosis by the

end of 2013;

- •

- Pursuing the clinical development of BA058 Microneedle Patch as a follow-on product for the treatment of

osteoporosis; Obtaining regulatory approval of BA058 Injection and BA058 Microneedle Patch for the treatment of osteoporosis, initially in the United States and subsequently in the European Union;

- •

- Collaborating with third parties for the worldwide commercialization of BA058; and

- •

- Collaborating with third parties for the further development and commercialization of RAD1901 and RAD140 on a worldwide basis.

To execute on our strategy, we have built a strong management team and Board of Directors with significant pharmaceutical development, regulatory and commercial experience.

Our Solution

In addition to BA058 Injection and BA058 Microneedle Patch, we are currently conducting one other clinical and one preclinical program. Our second clinical stage product candidate is RAD1901, a selective estrogen receptor modulator, or SERM, licensed from Eisai in 2006 which has completed an initial Phase 2 clinical study for the treatment of vasomotor symptoms (hot flashes) in women entering menopause. Our third product candidate, RAD140, is a pre-IND discovery. RAD140 is a selective androgen receptor modular, or SARM, that is an orally-active androgen agonist on muscle and bone and is a potential treatment for age-related muscle loss, frailty, weight loss associated with cancer cachexia and osteoporosis.

18

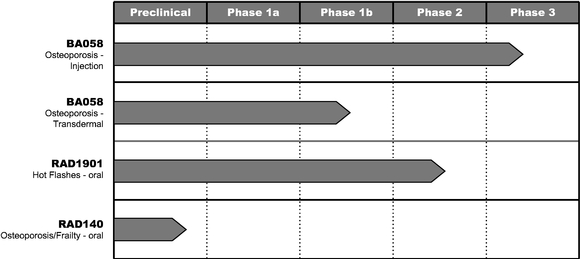

The following table summarizes the target indications, dosage forms, and stages of development for our product candidates.

Radius Product Pipeline

BA058