Attached files

| file | filename |

|---|---|

| EX-23.2 - EXHIBIT 23.2 - OxySure Therapeutics, Inc. | ex23-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1/A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(AMENDMENT NO. 8 )

OxySure® Systems, Inc.

|

Delaware

|

3841

|

71-0960725

|

||

|

(State or Other Jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

Incorporation or Organization)

|

Classification Code Number)

|

Identification No.)

|

OxySure Systems, Inc.

10880 John W. Elliot Drive, Suite 600

Frisco, Texas 75034

(972) 294-6450

(Address and telephone number of principal executive offices

and principal place of business)

Julian T. Ross

OxySure Systems, Inc.

10880 John W. Elliott Drive, Suite 600

Frisco, Texas 75034

(972) 294-6555

(Name, address and telephone number for agent for service)

______________________

Copies to

Oswald & Yap LLP

16148 Sand Canyon Avenue

Irvine, CA 92618

Telephone: (949) 788-8900

Facsimile (949) 788-8980

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post effective amendment filed under Rule 462(c) of the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If this Form is a post effective amendment filed under Rule 462(d) of the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. £

If delivery of the Prospectus is expected to be made pursuant to Rule 434, check the following box. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | o | Smaller reporting company | x |

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

CALCULATION OF REGISTRATION FEE

|

Proposed

|

Proposed

|

|||||||||||||||

|

Maximum

|

Maximum

|

Amount of

|

||||||||||||||

|

Title of Each Class of

|

Amount To Be

|

Offering Price

|

Aggregate

|

Registration

|

||||||||||||

|

Securities To Be Registered

|

Registered1

|

Per Share2

|

Offering Price

|

Fee

|

||||||||||||

|

Selling Security Holders Issued Common Stock, $0.0004 par value per share

|

1,534,8163 | $ | 1.00 | $ | 1,534,816 | $ | 178.19 | |||||||||

|

Common Stock, $0.0004 par value per share

|

5,000,0004 | $ | 1.00 | $ | 5,000,000 | $ | 580.50 | |||||||||

|

Underlying Shares for Convertible Preferred Stock, $0.0005 par value per share

|

2,380,7495 | $ | 1.00 | $ | 2,380,749 | $ | 276.40 | |||||||||

|

Total Registration Fee

|

8,915,565 | $ | 1.00 | $ | 8,915,565 | $ | 1,035.10 | |||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until the registration statement shall become effective on such dates as the Commission, acting pursuant to said Section 8(a), may determine.

PRELIMINARY PROSPECTUS

Subject to Completion, Dated__________

1 In accordance with Rule 416(a), the Registrant is also registering hereunder an indeterminate number of additional shares of common stock that shall be issuable pursuant to Rule 416 to prevent dilution resulting from stock splits, stock dividends or similar transactions.

2 Estimated pursuant to Rule 457(a) of the Securities Act, solely for the purpose of computing the amount of the registration fee. The selling price of our Common Stock was established arbitrarily.

3 Represents shares of the Registrant’s common stock being registered for resale that have been issued to the selling security holders named in the Prospectus or a Prospectus supplement.

4 Represents shares of the Registrant’s common stock being registered for sale in a direct public Offering by the Registrant.

5 Represents shares of the Registrant’s common stock being registered for resale that have been or may be acquired upon the conversion of convertible preferred stock that has been issued to the selling stockholders named in the Prospectus or a Prospectus supplement.

PRELIMINARY PROSPECTUS

8,915,565

Shares of Common Stock

OxySure® Systems, Inc.

This is our initial public offering. There is no public market for our common stock. It is our intention to seek quotation of our common stock by a market maker on an over-the-counter electronic quotation system such as the OTC Bulletin Board subsequent to the date of this Prospectus. The lack of a public market for our common stock may place purchasers of our shares at risk of having an illiquid security. There can be no assurance that any market maker will file the necessary documents with an OTC electronic quotation system, nor can there be any assurance that such an application for quotation will be approved.

Our existing shareholders are offering for sale, 1,534,816 shares of common stock. In addition, we are offering a total of 5,000,000 shares of our common stock in a direct public offering, without any involvement of underwriters or broker-dealers (the “Offering”). The offering price is $1.00 per share (the “Offering Price”) for both newly issued shares and those being sold by current shareholders. In addition, 2,380,749 shares of common stock are being registered for resale that have been or may be acquired upon the conversion of 1,951,434 shares of preferred stock (net of prior conversions), at a 1.22:1 ratio. The unaffiliated Selling Security Holders will sell at the specified fixed Offering Price of $1.00 per share until the shares are quoted on an OTC quotation system, after which the shares will sell at prevailing market prices or privately negotiated prices. We will not receive any proceeds from the sales by the Selling Security Holders. The Selling Security Holders named herein are deemed underwriters of the shares of common stock which they are offering.

This Offering is on a best efforts basis. The direct public Offering will terminate December 31, 2011, although we may close the Offering on any prior date if the Offering is fully subscribed or at the discretion of our Board of Directors. At our sole discretion, we may extend the Offering for an additional 90 days. The funds will be maintained in a separate bank account. There is no minimum amount of shares that we must sell in our direct public Offering, and therefore no minimum amount of proceeds will be raised.

The purchase of the securities involves a high degree of risk. See section entitled “Risk Factors” beginning on page 8.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of anyone’s investment in these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The Date of this Prospectus is: , 2011

SUBJECT TO COMPLETION

The information in this preliminary Prospectus may be changed. Existing shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary Prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

i

TABLE OF CONTENTS

| PROSPECTUS SUMMARY | 1 | |||

| RISK FACTORS | 7 | |||

| USE OF PROCEEDS | 23 | |||

| DILUTION | 26 | |||

| DIVIDEND POLICY | 27 | |||

| DETERMINATION OF OFFERING PRICE AND ADDITIONAL INFORMATION | 27 | |||

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 28 | |||

| SELLING SECURITY HOLDERS | 28 | |||

| SHARES ELIGIBLE FOR FUTURE SALE | 37 | |||

| PLAN OF DISTRUBUTION | 38 | |||

| MANAGEMENTS DISCUSSION AND ANALYSIS | 41 | |||

| DESCRIPTION OF BUSINESS | 53 | |||

| DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS | 76 | |||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 82 | |||

| DESCRIPTION OF SECURITIES | 85 | |||

| INTERESTS OF NAMED EXPERTS AND COUNSEL | 89 | |||

| DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION | 89 | |||

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 90 | |||

| MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 93 | |||

| AVAILABLE INFORMATION | 94 | |||

| CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING | 94 |

ii

Please read this Prospectus carefully. It describes our business, financial condition and results of operations. We have prepared this Prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this Prospectus. We have not authorized any other person to provide you with different information. This Prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this Prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date.

The terms “we,” “us,” and “our,” as used in this Prospectus refer to OxySure Systems, Inc.

iii

PROSPECTUS SUMMARY

Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read the more detailed information contained in this Prospectus, including our financial statements and related notes. Our business involves significant risks. You should carefully consider the information under the heading “Risk Factors” beginning on page 8.

1

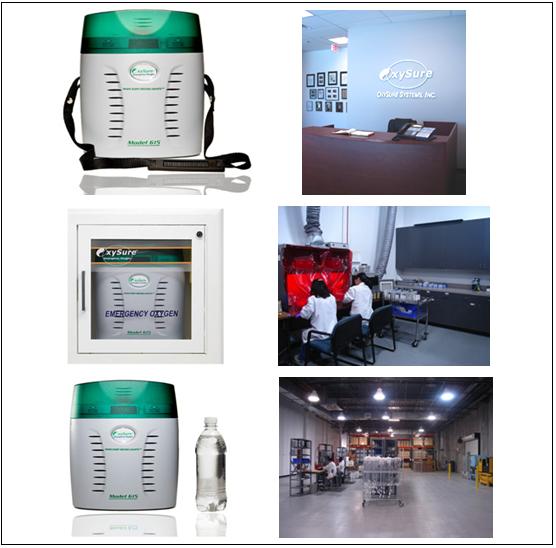

OxySure Systems, Inc. was formed on January 15, 2004 as a Delaware “C” Corporation for the purpose of developing products with the capability of generating medical grade oxygen “on demand,” without the necessity of storing oxygen in compressed tanks. We developed a unique technology that generates medically pure (USP) oxygen from two dry, inert powders. Other available chemical oxygen generating technologies contain hazards that we believe make them commercially unviable for broad-based emergency use by lay rescuers or the general public. Our launch product is the OxySure Model 615 portable emergency oxygen system. We believe that the OxySure Model 615 is currently the only product on the market that can be safely pre-positioned in public and private venues for emergency administration of medical oxygen by lay persons, without the need for training.

We were founded by our current Chairman, Chief Executive Officer, President, and Chief Financial Officer, Julian T. Ross, who conducted or managed all of the related research and development, a function Mr. Ross continues to oversee. In early 2004, Mr. Ross moved his research and development efforts into the North Texas Enterprise Center for Medical Technology (“NTEC”). NTEC is a Frisco, Texas based medical technology accelerator, and we were selected as an NTEC program company in early 2004, and we were the first program company to graduate from the accelerator program in November 2005. In December 2005, we received Food and Drug Administration (“FDA”) clearance for our Model 615 (510(K), Class II). The approval number for our FDA clearance is K052396, and Model 615 is cleared for over the counter sale, without the need for a prescription.

Upon graduation from NTEC, we proceeded with the development of our purpose-built production facility in Frisco, Texas, which also serves as our headquarters. The facility comprises 16,200 square feet of light industrial space, of which approximately 10,000 square feet is dedicated to production and warehousing. We received an economic incentive from the Frisco Economic Development Corporation (“FEDC”) in the amount of $243,000 in support of the development and build-out of the facility. This incentive was structured as a promissory note in the amount of $243,000 issued by us to FEDC. The promissory note is forgiven over a period of five years subject to us achieving targets such as headcount and square footage occupied in the city of Frisco. On August 5, 2008, the amount of $30,000 was forgiven for meeting the first year targets in the Performance Agreement with the FEDC. The performance targets for the second and third years have not been achieved. On March 22, 2011, we entered into an Amended and Restated Performance Agreement with the FEDC. The FEDC provided us with economic assistance in the form of a renewal and extension of the forgivable loan of $213,000 together with revised performance credits over five years, commencing on March 22, 2011 and ending on the earlier to occur of: (i) the full payment of the economic incentives; or (ii) March 31, 2016. In addition to the FEDC economic incentive, we received a further amount of $324,000 in the form of a Tenant Improvement Allowance from our landlord. Upon completion of the build-out, we moved into the facility in October 2007. We commenced commercial shipment of Model 615 during 2008.

We are still an early stage business with a history of losses, and only recently began generating revenues. To date, our sales have been minimal. As of March 31, 2011 and December 31, 2010, we have incurred net losses from operations and have stockholders’ deficits of $11,762,698 and $11,400,752, respectively. We have a working capital deficit of approximately $1,439,350 as of March 31, 2011 and $1,476,495 as of December 31, 2010. These factors raise substantial doubt about our ability to continue as a going concern. If 100% of the shares are sold in the direct public Offering, approximately $1,000,000 of the offering proceeds will be used for the repayment of debt we owe to our affiliates.

Common Stock

We are authorized to issue 100,000,000 shares of common stock, $0.0004 par value per share, of which 15,739,816 shares are issued and outstanding as of the date of this Prospectus. Each outstanding share of common stock is entitled to one vote, either in person or by proxy, on all matters that may be voted upon by their holders at meetings of the stockholders.

2

Preferred Stock

We are authorized to issue up to 25,000,000 shares of our preferred stock, par value $0.0005 per share, from time to time in one or more series. On March 31, 2006, we completed the issuance of 3,112,500 shares of our Series A Convertible Preferred Stock, par value $0.0005. We subsequently issued an additional 30,737 preferred shares pursuant to a lease agreement, increasing the total number of Series A preferred shares issued to 3,143,237 shares. As of the date of this Prospectus, there were 3,126,434 Series A preferred shares outstanding, net of conversions to common stock. The number of shares of common stock into which each share of Series A Convertible Preferred will convert is determined by dividing the original issue price by $0.82, resulting in each share of the Series A Convertible Preferred becoming 1.22 shares of common stock.

Our Board of Directors, without further approval of our stockholders, is authorized to fix the dividend rights and terms, conversion rights, voting rights, redemption rights, liquidation preferences and other rights and restrictions relating to any series of preferred stock. Issuances of shares of preferred stock, while providing flexibility in connection with possible financings, acquisitions and other corporate purposes, could, among other things, adversely affect the voting power of the holders of our common stock and prior series of preferred stock then outstanding.

Warrants

As of the date of this Prospectus, our warrant holders held an aggregate of 2,918,909 warrants to purchase shares of our common stock. All of the warrants are exercisable immediately. The following table sets out the warrants by groups, amounts and aggregate exercise prices:

|

Group

|

Total Number

of Warrants Outstanding

|

Aggregate

Exercise Price

|

Number of

Warrants

Exercisable Immediately

|

Number of

Warrants held

by Affiliates

and Promoters

|

Aggregate

Exercise

Price of

Warrants held

by Affiliates

and Promoters

|

|||||||||||||||

|

Licensing Agreements

|

551,200 | $ | 1.22 | 551,200 | - | - | ||||||||||||||

|

Financing

|

1,076,163 | $ | 0.32 | 1,076,163 | 976,163 | $ | 0.01 | |||||||||||||

|

Consultants

|

837,166 | $ | 0.43 | 837,166 | - | - | ||||||||||||||

|

Rent

|

429,380 | $ | 0.14 | 429,380 | - | - | ||||||||||||||

|

Community Grants

|

25,000 | $ | 1.00 | 25,000 | - | - | ||||||||||||||

|

Totals

|

2,918,909 | $ | 0.50 | 2,918,909 | 976,163 | $ | 0.01 | |||||||||||||

Options

As of the date of this Prospectus, we have granted options to acquire an aggregate of 2,180,604 shares (net of forfeitures and exercises ) of our common stock with an aggregate exercise price of $0.59 . The holders of common and preferred stock hold an aggregate of 406,787 options to purchase common stock (net of forfeitures and exercises ) with an aggregate exercise price of $0.88 per share. All other options are held by present and former employees, present and former Directors, Advisory Board members, and present and former consultants and other eligible persons who are not Selling Security Holders. Present and former employees, including some who are also stockholders, have been issued 1,976,924 options (net of forfeitures and exercises ) with an average weighted exercise price of $0.52 per share. Present and former Directors have been issued 32,000 options with an average weighted exercise price of $1.20 per share. This does not include any options issued to Mr. Ross, our CEO who also serves on the Board of Directors. Advisory Board members, including some who are also stockholders, have been issued 106,000 options (net of forfeitures) with an average weighted exercise price of $1.46 per share. Consultants and other eligible persons have been issued 72,930 options (net of forfeitures) with an average weighted exercise price of $1.07 per share.

3

Our shares of common stock are not traded on any exchange or other trading platform.

Our fiscal year end is December 31.

Our principal executive office is located at 10880 John W. Elliott Drive, Suite 600, Frisco, Texas 75034 and our telephone number is (972) 294-6450.

The Offering

|

Common stock offered by existing holders of common stock

|

1,534,816

|

|

|

Direct Public Offering

|

5,000,000

|

|

|

Common stock being registered for resale that have been or may be acquired upon the conversion of Series A Convertible Preferred Stock

|

2,380,749

|

|

|

Total common stock offered by Selling Security Holders and Direct Public Offering

|

8,915,565

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock by the Selling Security Holders. We will receive $5,000,000 in gross proceeds if we sell all of the shares being registered herein for our direct public Offering. Proceeds will be used for sales and marketing; payment of debt and accounts payable; administrative costs; costs associated with production; research and development; and offering expenses. See “Use of Proceeds.”

|

|

|

Risk factors

|

Investing in these securities involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 8.

|

4

SUMMARY FINANCIAL DATA

The following summary financial data should be read in conjunction with “Management’s Discussion and Analysis,” “Plan of Operation,” and the Financial Statements and Notes thereto, included elsewhere in this Prospectus. The statement of operations and balance sheet data are derived from our December 31, 2010 and 2009 audited financial statements. The data derived from our March 31, 2011 and 2010 financial statements are unaudited.

Statements of Operations

|

Three Months Ended

March 31, 2011

|

Three Months Ended

March 31, 2010

|

Fiscal Year Ended December 31, 2010

|

Fiscal Year Ended December 31, 2009

|

|||||||||||||

| (Restated) | ||||||||||||||||

|

REVENUE, net

|

$ | 51,825 | $ | 267,177 | $ | 356,013 | $ | 387,361 | ||||||||

|

COST OF SALES

|

$ | 37,194 | $ | 20,702 | $ | 54,781 | $ | 194,518 | ||||||||

|

GROSS PROFIT

|

$ | 14,631 | $ | 246,475 | $ | 301,232 | $ | 192,843 | ||||||||

|

OPERATING EXPENSES

|

||||||||||||||||

|

Selling, General & Administrative expenses

|

$ | 312,089 | $ | 276,183 | $ | 1,273,115 | $ | 2,193,853 | ||||||||

|

LOSS FROM OPERATING EXPENSES

|

$ | (297,458 | ) | $ | (29,708 | ) | $ | (971,883 | ) | $ | (2,001,010 | ) | ||||

|

OTHER INCOME / (EXPENSES)

|

$ | 33,751 | $ | 3,007 | $ | 6,046 | $ | (5,152 | ) | |||||||

|

INTEREST EXPENSE

|

$ | (98,239 | ) | $ | (57,558 | ) | $ | (328,277 | ) | $ | (261,899 | ) | ||||

|

Net loss

|

$ | (361,946 | ) | $ | (84,259 | ) | $ | (1,294,114 | ) | $ | (2,268,061 | ) | ||||

|

Accumulated deficit - beginning of the period

|

$ | (11,400,752 | ) | $ | (10,106,638 | ) | $ | (10,106,638 | ) | $ | (7,838,577 | ) | ||||

|

Accumulated deficit - end of the year

|

$ | (11,762,698 | ) | $ | (10,190,897 | ) | $ | (11,400,752 | ) | $ | (10,106,638 | ) | ||||

5

Balance Sheet Summaries

|

March 31, 2011

|

December 31, 2010

|

December 31, 2009

|

||||||||||

| (Restated) | ||||||||||||

|

ASSETS

|

||||||||||||

|

Current assets

|

||||||||||||

|

Cash and cash equivalents

|

$ | 335 | $ | 39,887 | $ | 73,077 | ||||||

|

Accounts receivable

|

$ | 10,862 | $ | 349 | $ | 36,365 | ||||||

|

Inventory

|

$ | 264,828 | $ | 227,692 | $ | 138,737 | ||||||

|

Prepaid Expenses

|

$ | 91,053 | $ | 40,666 | $ | 40,142 | ||||||

|

Total current assets

|

$ | 367,078 | $ | 308,594 | $ | 288,321 | ||||||

|

Property & Equipment, net

|

$ | 260,374 | $ | 304,737 | $ | 518,976 | ||||||

|

Intangible assets, net

|

$ | 467,493 | $ | 473,703 | $ | 502,624 | ||||||

|

Other Assets

|

$ | 175,611 | $ | 202,492 | $ | 13,132 | ||||||

|

TOTAL ASSETS

|

$ | 1,270,556 | $ | 1,289,526 | $ | 1,323,053 | ||||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||||||

|

Current liabilities

|

||||||||||||

|

Accounts payable and Accrued Liabilities

|

$ | 401,340 | $ | 388,937 | $ | 380,467 | ||||||

|

Capital leases - current

|

$ | 323,944 | $ | 332,640 | $ | 326,057 | ||||||

|

Notes payable - current

|

$ |

1,027,799

|

$ |

950,024

|

$ |

286,893

|

||||||

|

Deferred Revenue

|

$ | 239,820 | $ | 255,655 | - | |||||||

|

Total current liabilities

|

$ |

1,992,903

|

$ |

1,927,256

|

$ |

993,417

|

||||||

|

Long-term liabilities

|

||||||||||||

|

Capital leases

|

$ | 25,741 | $ | 25,741 | $ | 47,036 | ||||||

|

Notes payable

|

$ |

1,677,892

|

$ |

1,588,200

|

$ |

1,605,829

|

||||||

|

Total long-term liabilities

|

$ |

1,703,633

|

$ |

1,613,941

|

$ |

1,652,865

|

||||||

|

TOTAL LIABILITIES

|

$ | 3,696,536 | $ | 3,541,197 | $ | 2,646,282 | ||||||

|

STOCKHOLDERS’ EQUITY

|

||||||||||||

|

Preferred stock, par value $0.0005 per share, 25,000,000 shares authorized; 3,126,434 Series A convertible preferred shares issued and outstanding as of March 31, 2011, December 31, 2010 and December 31, 2009

|

$ | 1,563 | $ | 1,563 | $ | 1,563 | ||||||

|

Common stock, par value $0.0004 per share, 100,000,000 shares authorized; 15,739,816 shares of voting common stock issued and outstanding as of March 31, 2011 and 15,724,816 shares issued and outstanding as of December 31, 2010 and 2009.

|

$ | 6,296 | $ | 6,290 | $ | 6,290 | ||||||

|

Additional Paid-in Capital

|

$ | 9,328,859 | $ | 9,141,228 | $ | 8,775,556 | ||||||

|

Accumulated deficit

|

$ | (11,762,698 | ) | $ | (11,400,752 | ) | $ | (10,106,638 | ) | |||

|

TOTAL STOCKHOLDERS’ EQUITY AND COMPREHENSIVE INCOME

|

$ | (2,425,980 | ) | $ | (2,251,670 | ) | $ | (1,323,229 | ) | |||

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

|

$ | 1,270,556 | $ | 1,289,526 | $ | 1,323,053 | ||||||

6

RISK FACTORS

An investment in our common stock is highly speculative, involves a high degree of risk, and should be made only by investors who can afford a complete loss. You should carefully consider the following risk factors, together with the other information in this Prospectus, including our financial statements and the related notes, before you decide to buy our common stock. Our most significant risks and uncertainties are described below; however, they are not the only risks we face. If any of the following risks actually occur, our business, financial condition, or results of operations could be materially adversely affected, the trading of our common stock could decline, and you may lose all or part of your investment therein.

Risks Relating to the Early Stage of our Company

Because our auditors have issued a going concern opinion, there is substantial doubt that we can continue as an ongoing business for the next 12 months.

Our auditors have issued a going concern opinion. This means that there is substantial doubt that we can continue as an ongoing business for the next 12 months. The financial statements do not include any adjustments that might result from the uncertainty about our ability to continue in business. As such, we may have to cease operations and you could lose your investment.

We lack a long operating history and have losses that we expect to continue into the foreseeable future. There is no assurance our future operations will result in profitable revenues. If we cannot generate sufficient revenues to operate profitably, we may cease operations and you will lose your investment.

We were incorporated on January 15, 2004 and we do not have a long operating history or realized any substantial revenues. We do not have any sufficient operating history upon which an evaluation of our future success or failure can be made. Our net loss from inception through March 31, 2011 is $11,762,698 .

Our ability to achieve and maintain profitability and positive cash flow is dependent upon our ability to:

|

·

|

complete raising funds in our direct public Offering;

|

|

·

|

raise awareness and achieve market acceptance of our technology and our products;

|

|

·

|

identify and pursue channels and mediums through which we will be able to market and sell our products, including distributors and retailers;

|

|

·

|

attract and retain performing sales people;

|

|

·

|

lower our production costs significantly;

|

|

·

|

obtain any regulatory approvals where needed to market our products, including approvals in international markets;

|

|

·

|

procure and maintain on commercially reasonable terms relationships with third parties for the supply of services, parts and other manufacturing inputs; and

|

|

·

|

manage growth by managing administrative overhead.

|

7

Based upon current plans, we expect to incur operating losses in future periods because we will be incurring expenses and not generating sufficient revenues. We cannot guarantee that we will be successful in generating sufficient revenues in the future. Failure to generate sufficient revenues will cause you to lose your investment.

We are at a very early operational stage and our success is subject to the substantial risks inherent in the establishment of a new business venture.

The implementation of our business strategy is in a very early stage. We only produce one product, a portable emergency oxygen device, and the commercialization of this product is in its infancy. Our intended markets may not adopt this product, and it may not be commercially successful. We intend to develop additional product candidates but none have proven to be commercially viable or successful. Our business and operations should be considered to be in a very early stage and subject to all of the risks inherent in the establishment of a new business venture. Accordingly, our intended business and operations may not prove to be successful in the near future, if at all. Any future success that we might enjoy will depend upon many factors, several of which may be beyond our control, or which cannot be predicted at this time, and which could have a material adverse effect upon our financial condition, business prospects and operations and the value of an investment in our company.

We have a very limited operating history and our business plan is unproven and may not be successful.

Our company was formed in January 2004, but we only began commercial product shipment of our first product in earnest in early 2008 after we moved into our new, purpose built production facility. Since January 2004, our primary activities have been research and development, the obtainment of our FDA approval, the identification of collaborative partners, intellectual property protection such as patent applications and capital raising activities. We have not licensed or sold any substantial amount of products commercially and do not have any definitive agreements to do so. We have not proven that our business model will allow us to identify and develop commercially feasible products.

We have suffered operating losses since inception and we may not be able to achieve profitability.

We had an accumulated deficit of $11,762,698 and have an overall deficit of $2,425,980 in stockholders’ equity as of March 31, 2011 . We expect to continue to incur research and development expenses as well as significant expenses related to investment in sales and marketing and organizational growth in the foreseeable future related to the ongoing product development, completion of new development and commercialization of our products. As a result, we are sustaining substantial operating and net losses, and it is possible that we will never be able to sustain or develop the revenue levels necessary to attain profitability.

8

We have limited organizational and management resources.

Our management and organizational resources are limited, and this may adversely impact our ability to execute our business plan, successfully commercialize our portable emergency oxygen device, maintain regulatory compliance, or capitalize on market opportunities, if any. We have significant intellectual capital invested in our current employees and management, and any loss in organizational resources may have an adverse impact on our business. In particular, we have been, and we expect to continue to be reliant on, the experience and talents of our CEO and President, Mr. Ross.

We may have difficulty raising additional capital in addition to the direct public Offering, which could deprive us of necessary resources.

We expect to continue to devote significant capital resources to provide working capital, and to fund sales and marketing as well as research and development. In order to support the initiatives envisioned in our business plan, we will need to raise additional funds through the sale of assets, public or private debt or equity financing, collaborative relationships or other arrangements. Our ability to raise additional financing depends on many factors beyond our control, including the state of capital markets, the market price of our common stock and the development or prospects for development of competitive technology by others. Because our common stock is not and may never be listed on a stock exchange or any other trading system, many investors may not be willing to purchase it or may demand steep discounts. Sufficient additional financing may not be available to us or may be available only on terms that would result in further dilution to the current owners of our common stock.

We expect to raise additional capital during 2011 and 2012, but we do not have any firm commitments for additional funding. If we are unsuccessful in raising additional capital, or the terms of raising such capital are unacceptable, we may suffer liquidity issues that may have a material adverse impact on our ability to continue operations or we may have to modify our business plan and/or significantly curtail our planned activities and other operations.

Failure to effectively manage our growth could place strains on our managerial, operational, and financial resources and could adversely affect our business and operating results.

Our growth has placed, and is expected to continue to place, a strain on our managerial, operational and financial resources. Further, we will be required to manage those multiple relationships. Any further growth by us or an increase in the number of our distributors, strategic relationships or alliances will increase this strain on our managerial, operational and financial resources. This strain may inhibit our ability to achieve the rapid execution necessary to implement our business plan, and could have a material adverse effect upon our financial condition, business prospects and operations and the value of an investment in our company.

9

Our success is dependent on key personnel.

Our ability to succeed is substantially dependent on the performance of our officers and directors. Our success also depends on our ability to attract, hire, retain and motivate future officers and key employees. The loss of the services of any of these executive officers or other key employees could have a material adverse effect on our business, prospects, financial condition and results of operations. We have entered into employment agreements with our executive officers and key employees. We currently have no “Key Person” life insurance policies. Our future success may also depend on our ability to identify, attract, hire, train, retain and motivate other highly skilled technical, managerial, sales, marketing and customer service personnel. We have been, and we expect to continue to be reliant on, the experience and talents of our CEO and President, Mr. Ross.

Competition for such personnel is intense, and there can be no assurance that we will be able to successfully attract, assimilate or retain sufficiently qualified personnel. The failure to attract and retain the necessary technical, managerial, sales, marketing and customer service personnel could have a material adverse effect on our business, prospects, and financial condition.

Risks Relating to our Research and Development Business

There are substantial inherent risks in attempting to commercialize new technological applications, and, as a result, we may not be able to successfully develop products or technology for commercial use.

We conduct ongoing development on our portable emergency oxygen device, and we conduct research and development of products in various vertical markets and industries. Our product development team has worked on developing technology and products in various stages. However, commercial feasibility and acceptance of such product candidates are unknown. Scientific research and development requires significant amounts of capital and takes an extremely long time to reach commercial viability, if at all. Other than our portable emergency oxygen device, to date, our research and development projects have not produced commercially viable applications, and may never do so. Even our portable emergency oxygen device may not prove to be commercially viable in the long term. During the research and development process, we may experience technological barriers that we may be unable to overcome. Because of these uncertainties, it is possible that none of our product candidates will be successfully developed. If our portable emergency oxygen device fails to achieve commercial success, or we are unable to successfully develop new products or technology for commercial use, we will be unable to generate revenue or build a sustainable or profitable business.

We will need to achieve commercial acceptance of our applications to generate revenues and achieve profitability.

While we began shipping our portable emergency oxygen device in earnest during 2008, there can be no assurance that there will be market acceptance for our portable emergency oxygen device, its need, or its use, and there can be no assurance of its commercial acceptance or profitability. While we intend to develop additional products, even if our research and development yields technologically feasible applications, we may not successfully develop commercial products, and even if we do, we may not do so on a timely basis. If our research efforts are successful on the technology side, it could take at least several years before this technology will be commercially viable. During this period, superior competitive technologies may be introduced or customer needs may change, which will diminish or extinguish the commercial uses for our applications. We cannot predict when significant commercial market acceptance for our portable emergency oxygen device or any of our potential new products will develop, if at all, and we cannot reliably estimate the projected size of any such potential market. If markets fail to accept our portable emergency oxygen device or any new products we may develop, we may not be able to generate revenues from the commercial application of our products and technologies. Our revenue growth and achievement of profitability will depend substantially on our ability to have our portable emergency oxygen device and any new products we may introduce be accepted by customers. If we are unable to cost-effectively achieve acceptance of our products and technology by customers, or if the associated products do not achieve wide market acceptance, our business will be materially and adversely affected.

10

We will need to establish relationships with collaborative and development partners to fully develop and market our existing and new products.

We do not possess all of the resources necessary to develop and commercialize existing and new products on a mass scale resulting from or that may result from our technologies. Unless we expand our product development capacity and enhance our internal marketing capability, we will need to make appropriate arrangements with collaborative partners to develop and commercialize current and future products.

If we do not find appropriate partners, our ability to develop and commercialize products could be adversely affected. Even if we are able to find collaborative partners, the overall success of the development and commercialization of product candidates in those programs will depend largely on the efforts of other parties and is beyond our control. In addition, in the event we pursue our commercialization strategy through collaboration, there are a variety of attendant technical, business and legal risks, including:

|

●

|

a development partner would likely gain access to our proprietary information; potentially enabling the partner to develop products without us or design around our intellectual property;

|

|

●

|

we may not be able to control the amount and timing of resources that our collaborators may be willing or able to devote to the development or commercialization of our product candidates or to their marketing and distribution; and

|

|

●

|

disputes may arise between us and our collaborators that result in the delay or termination of the research, development or commercialization of our products and product candidates or that result in costly litigation or arbitration that diverts our resources.

|

The occurrence of any of the above risks could impair our ability to generate revenues and harm our business and financial condition.

11

We rely on third parties to manufacture our product parts and subassemblies and new product candidates and our business will suffer if they do not perform.

Our production activity is primarily focused on the final assembly of our portable emergency oxygen device, and we outsource the manufacturing of most of the parts, components or subassemblies. We expect to continue to utilize this manufacturing model for this product as well as for new product candidates. As a result, we do not expect to manufacture many of our products and product inputs and will engage third party contractors, molders and packagers to provide manufacturing or production services. If our contractors do not operate in accordance with regulatory requirements and quality standards, our business will suffer. We expect to use or rely on components and services that are provided by sole source suppliers. The qualification of additional or replacement vendors is time consuming and costly. If a sole source supplier has significant problems supplying our products, our sales and revenues will be hurt until we find a new source of supply.

Our production process is very labor intensive.

Due to resource constraints and current limitations in our production process, our production process is very labor intensive. We hope in the future to increase the level of automation in our process, and if we do, there is no assurance that we will be able to realize any production efficiencies through such automation. If we are not able to automate our processes or do not realize any production efficiencies though automation, we may need a larger production force, and if we do, our production costs may rise. Furthermore, if our production process stays labor intensive then our production process time may be slower which will not allow us to quickly and effectively respond to large orders if any. We may elect to outsource some or all of our production process in an effort reduce costs and increase production capacity. If we do, we may experience quality issues and long production lead times, which will adversely impact customer satisfaction and sales. In addition, quality issues may lead to enforcement action by the FDA.

Moving to higher production volumes could be accompanied by quality problems.

To date, we have produced and shipped limited quantities of our first product, the portable emergency oxygen device. In the event that demand for this product increases, we will have to accommodate such increases in demand by increasing our production throughput. There can be no assurance that we would be successful in increasing our production throughput in response to any increases in demand, or that we would not suffer losses in product quality. Any upward pressure on production capacity requirements may have an adverse impact on quality, production cost and delivery times. Furthermore, we may seek to outsource some, part or all of our production process to meet demand. Any such outsourcing of production may have an adverse impact on quality, production cost and delivery times.

12

We rely on third parties for the worldwide marketing and distribution of our product candidates, who may not be successful in selling our products.

We currently do not have adequate resources to market and distribute any products outside of the U.S. and engage third party marketing and distribution companies to perform these tasks. We also do not have adequate resources to market and distribute products in the U.S. While we believe that distribution partners will be available, we cannot assure you that the distribution partners, if any, will succeed in marketing our products on a global basis. We may not be able to maintain satisfactory arrangements with our marketing and distribution partners, who may not devote adequate resources to selling our products. If this happens, we may not be able to successfully market our products, which would decrease or eliminate our ability to generate revenues.

We may not be successful at marketing and selling our technology or products.

We began commercializing our first product, our portable emergency oxygen device, in earnest in early 2008. We also intend to develop additional products and technologies for various vertical market applications. We may not be able to market and sell our technology or products and any financial or research efforts we exert to develop, commercialize or promote such products may not result in revenue or earnings.

We may not be able to compete with better-established competitors.

While our portable emergency oxygen device is a medical device, it is targeted at commercial, education and government markets, as well as consumer markets. In addition, our intended future products are targeted at various commercial, education, government and consumer markets. The industries in which we operate, which include, but are not limited to, the medical device and biotechnology industries, are intensely competitive. Most of our competitors have significantly greater financial, technical, manufacturing, marketing and distribution resources as well as greater industry experience than we have. The particular medical conditions, illnesses or diseases our portable emergency oxygen device and future product lines are intended to address can also be addressed by other medical devices, products, procedures or drugs. Many of these alternatives are widely accepted by physicians and our target customers and have a long history of use. Physicians and target customers may use our competitors’ products and/or our products may not be competitive with other technologies. If these things happen, our sales and revenues will be adversely impacted. In addition, our current and potential competitors may establish cooperative relationships with large medical equipment companies or companies with competitive technologies to gain access to greater research and development or marketing resources. Competition may result in price reductions, reduced gross margins and loss of market share.

Our products may be displaced by newer technology.

The medical device and biotechnology industries are undergoing rapid and significant technological change. Third parties may succeed in developing or marketing technologies and products that are more effective than those developed or marketed by us, or that would make our technology and products obsolete or non-competitive. Additionally, researchers and engineers could develop new technologies and products that replace or reduce the importance of our technologies and products. Accordingly, our success will depend, in part, on our ability to respond quickly to medical and technological changes through the development and introduction of new products. We may not have the resources to do this. If our product candidates become obsolete and our efforts to develop new products do not result in any commercially successful products, our sales and revenues will suffer.

13

We may not have sufficient legal protection against infringement or loss of our intellectual property and we may lose rights to our licensed intellectual property if diligence requirements are not met.

Our success depends, in part, on our ability to secure and maintain patent protection, to preserve our trade secrets, and to operate without infringing on the patents of third parties. While we intend to protect our proprietary positions by filing United States and foreign patent applications for our important inventions and improvements, domestic and foreign patent offices may not issue these patents.

To date we have filed various patents with respect to our technology and product candidates. Some of these applications include applications for provisional patents which are not reviewed by the United States Patent and Trademark Office (“PTO”) and will not result in the issuance of a patent, unless a regular patent application is filed within one year after the filing of the provisional patent application. Generally, our provisional patent applications do not contain all of the detailed design and other information required by a regular patent application. As a result, it may be uncertain whether the description of the invention in a provisional patent meets the “best mode and enablement” requirements for issuance of a patent. Failure to adequately describe the invention may result in the loss of certain claims. Although we intend to file regular patent applications with respect to any of our provisional patent applications, such filings require substantial expenditures of management time and legal fees. If we do not have the funds or resources to prepare, file and maintain patent applications, we could lose proprietary rights to our technology.

Even if we file patent applications and patents are issued, third parties may challenge, invalidate, or circumvent our patents or patent applications in the future. Competitors, many of which have significantly more resources than we have and have made substantial investments in competing technologies, may apply for and obtain patents that will prevent, limit, or interfere with our ability to make, use, or sell our products either in the United States or abroad.

In the United States, patent applications are secret until patents are issued, and in foreign countries, patent applications are secret for a time after filing. Publications of discoveries tend to significantly lag the actual discoveries and the filing of related patent applications. Third parties may have already filed applications for patents for products or processes that will make our products obsolete or will limit our patents or invalidate our patent applications.

We require our employees, consultants, advisers and suppliers to execute confidentiality and assignment of invention agreements in connection with their employment, consulting, advisory, or supply relationships with us. They may breach these agreements and we may not obtain an adequate remedy for breach. Further, third parties may gain access to our trade secrets or independently develop or acquire the same or equivalent information.

14

We could be damaged by product liability claims.

Our portable emergency oxygen device is intended for use by laypersons, without any training requirements. If one of our products malfunctions or a person misuses it and injury results to a user or operator, the injured party could assert a product liability claim against our company. While we currently carry a limited amount of product liability insurance, it may not sufficiently shield us from any potential product liability claims, and we might not have sufficient funds available to pay any claims over the limits of our insurance. Furthermore, any potential product liability claim may lead to our product liability insurance being cancelled, or we may not be able to obtain such insurance at a rate that is acceptable to us or at all. Because personal injury claims based on product liability may be very large, an underinsured or an uninsured claim could financially damage our company.

We may encounter unforeseen costs in supplying products.

Our estimates of the costs and time to be consumed in receiving components or input products supplied by outside vendors or third party companies may not be accurate. There can be no assurance that we will not experience supply chain issues such as supply interruptions, fluctuations in supply or demand, or fluctuations in shipping costs caused by fluctuations in fuel costs. If we were to experience such supply issues, they may have a material adverse effect on our business and operations. We may not be able to transfer any adverse cost variations to our customers.

Risks Relating to the Regulatory Environment

We may have compliance issues with the FDA which could prevent or delay our ability to generate revenues.

Our primary product, the portable emergency oxygen device is considered a Class II medical device by the FDA.

The FDA regulations govern the following activities that we perform, or that are performed on our behalf, to ensure that medical devices distributed domestically or exported internationally are safe and effective for their intended uses:

|

·

|

product design, development and manufacture;

|

|

·

|

product safety, testing, labeling and storage;

|

|

·

|

pre-marketing clearance or approval;

|

|

·

|

record keeping procedures;

|

|

·

|

product marketing, sales and distribution; and

|

|

·

|

post-marketing surveillance, complaint handling, medical device reporting, reporting of deaths or serious injuries and repair or recall of products.

|

15

Failure to comply with applicable regulatory requirements can result in enforcement action by the FDA, which may include any of the following sanctions:

|

·

|

warning letters, untitled letters, fines, injunctions, consent decrees, and civil penalties;

|

|

·

|

repair, replacement, refunds, recall, or seizure of our products;

|

|

·

|

operating restrictions, partial suspension or total shutdown of production;

|

|

·

|

refusing our requests for 510(k) clearance or Pre-market Approval (“PMA”) of new products, new intended uses or modifications to existing products;

|

|

·

|

withdrawing 510(k) clearance or PMA approvals that have already been granted; and

|

|

·

|

criminal prosecution.

|

We may face problems related to the Department of Transportation regarding the shipment of our product which could potentially increase our shipping costs and limit our revenue potential.

The U.S. Department of Transportation (“DOT”) issued an interpretation letter on October 3, 2008 determining that our primary product, the portable emergency oxygen device, should be classified as “Oxygen Generator, Chemical, UN3356” for the purposes of shipment. As a result of this interpretation, we are required to maintain at least one certified shipping personnel on staff to conduct shipping from our warehouse. This DOT interpretation also requires us to put certain hazardous materials labeling on our packages upon shipment.

Furthermore, delivery and logistics providers such as United Parcel Service (“UPS”) and Federal Express typically charge a hazardous materials fee (“hazmat fee”) for products shipped with a UN3356 designation. These issues have caused us to experience problems related to shipping, including the following:

| ● | To date, we have typically passed any shipping hazmat fees on to our customers, but we have experienced customer resistance to these fees. |

| ● | During the period that we are shipping under the UN3356 shipping designation, the OxySure Model 615 can be transported by all modalities, including rail, road, ocean, and air. However, when transported by air it has to be: (i) transported on cargo aircraft; (ii) appropriately labeled; and (iii) no more than 25 kilograms gross in weight. However, several air cargo transporters have declined to transport “chemical oxygen generators,” especially internationally. This has caused problems for us in shipping limited quantities of products by air to international destinations. |

During the period that we are shipping under the UN3356 shipping designation, we may not be able to continue to pass the hazmat fees on to our customers. If we elect to absorb these hazmat fees, it may significantly increase our shipping costs. If we continue to pass these hazmat fees on to our customers, it may limit our revenue potential. Further, during the period that we are shipping under the UN3356 shipping designation we could suffer a temporary or permanent suspension of our ability to ship our products if we were to fail to comply with the applicable shipping requirements, which could result in a total loss or large decrease in the sales of our product. A permanent suspension of our ability to ship could result from, without limitation, repeated, gross violations of applicable regulations that have remained uncured, while we are shipping under the UN3356 shipping designation.

16

While the FDA has deemed the Model 615 sufficiently safe for over the counter purchase by lay persons, and while we have obtained independent, third party validation of the non-hazardous nature of Model 615, we are required, for shipment purposes, to comply with requirements of this interpretation letter until we can obtain a Special Permit or other similar relief, removing these shipping requirements. There can be no assurance that we will be able to obtain such a Special Permit or that we will be able to obtain some other, similar relief from DOT. If we are able to obtain such a Special Permit or other similar relief, there can be no assurance that it won’t take a very long time to achieve. Any delay or inability to obtain such a Special Permit or other, similar relief could have a material adverse impact on the marketability of our product, which in turn could limit our revenue potential.

We are subject to regulations and limitations set forth by the Federal Aviation Administration which could limit our ability to generate revenues.

The Federal Aviation Administration (“FAA”) maintains control over any oxygen devices that are carried by commercial aircraft, either as commercial cargo, passenger luggage or as passenger on-board items. The DOT interpretation letter dated October 3, 2008 determined that our primary product, the portable emergency oxygen device should be classified as “Oxygen Generator, Chemical, UN3356” for the purposes of shipment. This means, in part, that the product can only be shipped on cargo aircraft and cannot be carried on board commercial aircraft unless the FAA grants us specific approval for our product to be allowed on commercial aircraft. Currently, we have not sought approval from the FAA for passengers to carry our portable emergency oxygen device on board commercial aircraft. We plan to seek approval by the FAA for passengers to be allowed to carry our portable emergency oxygen device on board commercial aircraft. There can be no assurance that we will be able to obtain such approval. If we are able to obtain such approval, there can be no assurance that it won’t take a long time to obtain. Any delay or inability to obtain such FAA approval could have a material adverse impact on the marketability of our product and could limit our revenue potential.

We may face problems obtaining regulatory approval in international markets which could prevent or delay our ability to generate revenues.

As a medical device, our product is highly regulated. We anticipate that most of the international markets we expect to operate in will require some sort of regulatory approval. There can be no assurance that we will be able to obtain the regulatory approvals we will need to operate in our intended markets.

17

Risks Relating to our Stock

Our common stock is not listed or quoted on any exchange or electronic quotation system and shareholders may not be able to resell their shares.

Currently our common stock is not listed or quoted on any exchange or automated quotation system. There can be no assurance that our common stock will ever be listed or quoted on any exchange or quotation system. If our common stock is ever publicly traded, an active public market for our shares may never develop. There can be no assurance that purchaser of our shares will be able to resell their shares at their original purchase price, if at all.

Our common stock is expected to be traded over the counter, which may deprive stockholders of the full value of their shares.

We anticipate that our common stock will be quoted via an over-the-counter electronic quotation system, such as the OTC Bulletin Board (“OTCBB”). If quoted on the OTCBB, our common stock is expected to have fewer market makers, lower trading volumes and larger spreads between bid and asked prices than securities listed on an exchange such as the New York Stock Exchange or the NASDAQ Stock Market. These factors may result in higher price volatility and less market liquidity for the common stock.

If our stock price drops significantly, we may become subject to securities litigation that could result in a harmful diversion of our resources.

In the past, following periods of volatility in the market price of a particular company’s stock, securities class action litigation has been brought against such companies. Any litigation arising from the volatility in the price of our common stock could have an adverse effect upon our business, financial condition, and results of operations.

The determination of the existing shareholder selling price does not bear any relationship to our book value.

The Offering Price of our common stock does not bear any direct relationship to the value of our physical assets, our book value, or any other general accepted criteria of valuation. The Offering Price is not necessarily an indication of the actual value of such securities at the time of this Offering. Additionally, the market price for our securities following this Offering may be highly volatile as has been the case with the securities of other companies in emerging businesses. Factors such as our financial results, the introduction of new products or services, the strength of our competitors, and various factors affecting our industry generally, may have a significant impact on the market price of our securities. In recent years, the stock market has experienced a high level of price and volume volatility. Market prices for the securities of many companies, particularly of small and emerging growth companies like ours whose common stock is traded in the over-the-counter market, have experienced wide price fluctuations which have not necessarily been related to the operating performance of these companies.

18

A low market price would severely limit the potential market for our common stock.

Our common stock is expected to trade at a price substantially below $5.00 per share, subjecting trading in the stock to certain Securities and Exchange Commission (“SEC”) rules requiring additional disclosures by broker-dealers. These rules generally apply to any non-NASDAQ equity security that has a market price per share of less than $5.00 per share, subject to certain exceptions (a “penny stock”). Such rules require the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and the risks associated therewith and impose various sales practice requirements on broker-dealers who sell penny stocks to persons other than established customers and institutional or wealthy investors. For these types of transactions, the broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the sale. The broker-dealer also must disclose the commissions payable to the broker-dealer, current bid and offer quotations for the penny stock and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Such information must be provided to the customer orally or in writing before or with the written confirmation of trade sent to the customer. Monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. The additional burdens imposed upon broker-dealers by such requirements could discourage broker-dealers from effecting transactions in our common stock.

FINRA sales practice requirements may also limit a stockholder’s ability to buy and sell our stock.

In addition to the penny stock rules promulgated by the SEC, which are discussed in the immediately preceding risk factor, Financial Industry Regulatory Authority (“FINRA”) rules require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit the ability to buy and sell our stock and have an adverse effect on the market value for our shares.

An investor’s ability to trade our common stock may be limited by trading volume.

A consistently active trading market for our common stock may not occur on an OTC electronic quotation system. A limited trading volume may prevent our shareholders from selling shares at such times or in such amounts as they may otherwise desire.

19

We have a concentration of stock ownership and control, which may have the effect of delaying, preventing, or deterring a change of control.

Our common stock ownership is highly concentrated. Through their ownership of shares of our common stock and preferred stock, two individuals, our President, Julian T. Ross and Donald Reed, a member of our Board of Directors, beneficially own 92.01% of our total outstanding shares of common stock and preferred stock before this Offering. This amount includes warrants, options, and convertible notes held by JTR Investments, Limited and Agave Resources, LLC. As a result of the concentrated ownership of the stock, these two stockholders, acting together, will be able to control all matters requiring stockholder approval, including the election of directors and approval of mergers and other significant corporate transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change in control of our company. It could also deprive our stockholders of an opportunity to receive a premium for their shares as part of a sale of our company and it may affect the market price of our common stock.

We have not voluntarily implemented various corporate governance measures, in the absence of which, shareholders may have more limited protections against interested director transactions, conflicts of interest and similar matters.

Recent federal legislation, including the Sarbanes-Oxley Act of 2002, has resulted in the adoption of various corporate governance measures designed to promote the integrity of the corporate management and the securities markets. Some of these measures have been adopted in response to legal requirements. Others have been adopted by companies in response to the requirements of national securities exchanges, such as the NYSE or The NASDAQ Stock Market, on which their securities are listed. Among the corporate governance measures that are required under the rules of national securities exchanges and NASDAQ are those that address board of directors’ independence, audit committee oversight and the adoption of a code of ethics. While our Board of Directors has adopted a Code of Ethics and Business Conduct, we have not yet adopted any of these corporate governance measures and, since our securities are not listed on a national securities exchange, we are not required to do so. It is possible that if we were to adopt some or all of these corporate governance measures, shareholders would benefit from somewhat greater assurances that internal corporate decisions were being made by disinterested directors and that policies had been implemented to define responsible conduct. For example, in the absence of audit, nominating and compensation committees comprised of at least a majority of independent directors, decisions concerning matters such as compensation packages to our senior officers and recommendations for director nominees may be made by a majority of directors who have an interest in the outcome of the matters being decided. Prospective investors should bear in mind our current lack of corporate governance measures in formulating their investment decisions.

20

Failure to design, implement and maintain effective internal controls could have a material adverse effect on our business and stock price.

As a public company, we will have significant requirements for enhanced financial reporting and internal controls. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations on a timely basis, result in material misstatements in our financial statements and harm our operating results. In addition, we will be required, pursuant to Section 404 of the Sarbanes-Oxley Act, to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting for the first fiscal year beginning after the effective date of this offering. This assessment will need to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting, as well as a statement that our auditors have issued an attestation report on effectiveness of our internal controls. Testing and maintaining internal controls may divert our management’s attention from other matters that are important to our business. We may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 or our independent registered public accounting firm may not issue a favorable assessment. If either we are unable to conclude that we have effective internal control over financial reporting or our independent registered public accounting firm are unable to provide us with an unqualified report, investors could lose confidence in our reported financial information, which could have a negative effect on the trading price of our stock.

Our lack of sufficient personnel creates a material weakness in our internal controls. If we fail to implement a remediation plan to cure our lack of internal controls over our financial reporting, we may lose credibility with investors and the market price of our common stock may be adversely impacted.

While there were internal controls and procedures in place that relate to financial reporting and the prevention and detection of material misstatements, it was our management’s opinion that the a material weakness in the financial reporting process resulted from insufficient personnel. We are currently working to improve our internal financial reporting controls. We plan to continue to assess our internal controls and procedures and intend to take further action as necessary or appropriate to address our material weaknesses, including to effect compliance with Section 404 of the Sarbanes-Oxley Act of 2002 when we are required to make an assessment of our internal controls under Section 404 which is anticipated to be for fiscal year 2011. The existence of a material weakness is an indication that there is a more than remote likelihood that a material misstatement of our financial statements will not be prevented or detected in a future period while that material weakness continues to exist. The process of designing and implementing effective internal controls and procedures is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company. We cannot assure you that additional material weaknesses or significant deficiencies in our internal controls will not be discovered in the future. In the event that we cannot implement a remediation plan in a timely manner, investors and others may lose confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our stock.

Our board of directors has the authority to issue shares of “blank check” preferred stock, which may make an acquisition of our company by another company more difficult.

We may in the future adopt certain measures that may have the effect of delaying, deferring or preventing a takeover or other change in control of our company that a holder of our common stock might consider in its best interest. Specifically, our board of directors, without further action by our stockholders, currently has the authority to issue shares of preferred stock and to fix the rights (including voting rights), preferences and privileges of these shares (“blank check” preferred). Such preferred stock may have rights, including economic rights, senior to our common stock. As a result, the issuance of the preferred stock could have a material adverse effect on the price of our common stock and could make it more difficult for a third party to acquire a majority of our outstanding common stock.

Because we will not pay dividends in the foreseeable future, stockholders will only benefit from owning common stock if it appreciates.

We have never paid dividends on our common stock and we do not intend to do so in the foreseeable future. We intend to retain any future earnings to finance our growth. Accordingly, any potential investor who anticipates the need for current dividends from his investment should not purchase our common stock.

21

Selling Security Holders will be able to sell their shares at less than the fixed price that applies to our sales.

Selling Security Holders will be able to sell their shares at less than the fixed price that applies to our sales, which may limit our ability to raise capital through this Prospectus.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This document contains “forward-looking statements.” These statements are subject to risks and uncertainties and are based on the beliefs and assumptions of management and information currently available to management. The use of words such as “believes,” “expects,” “anticipates,” “intends,” “plans,” “estimates,” “should,” “likely,” or similar expressions, indicates a forward-looking statement. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future results may differ materially from those expressed in the forward-looking statements. Many of the factors that will determine these results are beyond our ability to control or predict. Stockholders are cautioned not to put undue reliance on any forward-looking statements, which speak only to the date made. For a discussion of some of the factors that may cause actual results to differ materially from those suggested by the forward-looking statements, please read carefully the information under “Risk Factors.”