Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - GOLD RESOURCE CORP | d8k.htm |

6-21-11

2011 ANNUAL MEETING

2011 ANNUAL MEETING

Exhibit 99.1 |

This

brochure contains statements that plan for or anticipate the future.

Forward-looking statements include statements about the Company's ability

to develop and produce gold or other precious metals, statements

about

our future business plans and strategies, statements about future revenue

and the receipt of working capital, and most other statements that are not

historical in nature. Forward-looking statements are often identified by

words such as "anticipate," "plan," "believe," "expect,"

"estimate," and the like. Because forward-looking statements involve

future risks and uncertainties, there are factors that could cause actual

results to differ

materially from those expressed or implied, including those described in our

filings with the SEC. Prospective investors are urged not to put undue

reliance on these forward-looking statements.

This presentation is to be read in conjunction with the most current 10K

available at the Securities & Exchange Commission website

www.sec.gov. or

www.Goldresourcecorp.com

Forward Looking Statements

Forward Looking Statements |

High-Grade Asset Base with Significant Exploration Potential

High-Grade Asset Base with Significant Exploration Potential

Low Cost Gold Producer Focused on Growth

Low Cost Gold Producer Focused on Growth

Engineered To Maximize Shareholder Value

Engineered To Maximize Shareholder Value

Focused on Cash Flow and Dividends

Focused on Cash Flow and Dividends |

Delivering Shareholder Value

Delivering Shareholder Value |

Recent

events Recent events

Mine cleanup after rain /hail storm is

complete

Precautionary measures

Mine development continues

1

Stope (L4-L5) underway

Descending benches

Consider long hole stoping

Decline progressing ~6 meters

per day

Progressing towards Level 7

Ore blending program during cleanup

underground and open pit ore

Mill optimization continues

Cu/Au, Pb/Ag, Zn concentrates

Underground Au, Ag +90% recovery

st |

Recent

events Recent events

Overcame adversity

Optimizing operations

Foresee Q2

record

production, revenues

and earnings

Oaxaca Mining Unit Team

Oaxaca Mining Unit Team |

Aggressive Growth Profile

Aggressive Growth Profile

Calendar

Year-end

Production

Targets

Mill capacity as built = ~200,000 oz. Above targets do not include Company’s

remaining open pit ore stockpiles and stated long term goal of increasing mill capacity

to ~300,000 oz’s Internal Estimate, Not SEC Proven & Probable Reserves; see Risk

Factors in Company’s 10K Requires rapid stope

development and

Company will reevaluate

after Q2

10,493

90,000

155,000

200,000

0

25,000

50,000

75,000

100,000

125,000

150,000

175,000

200,000

225,000 |

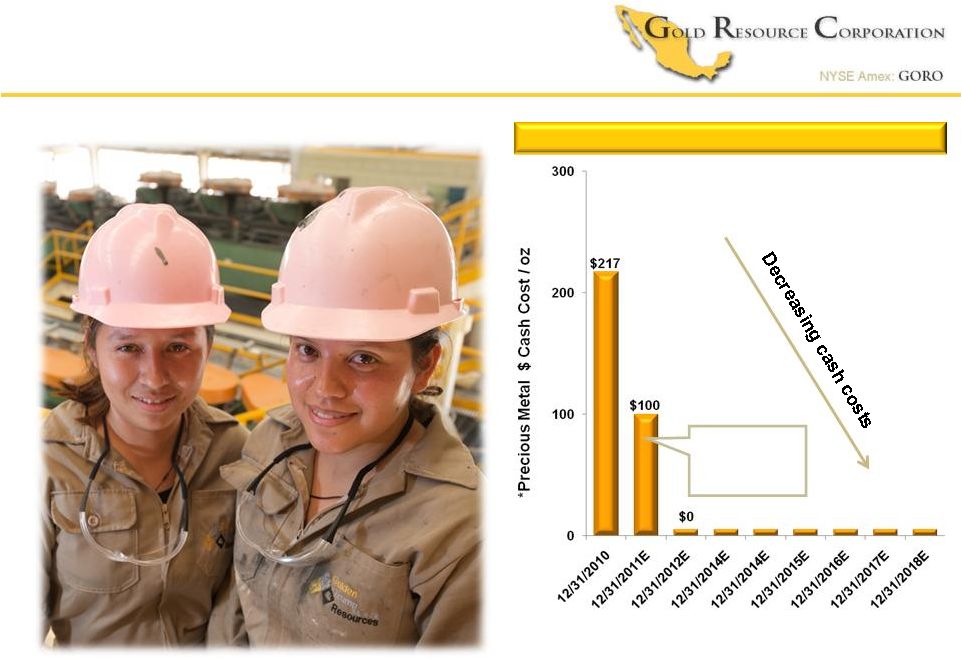

Continued Lower costs

Continued Lower costs

Cash Cost / Ounce Targets

Cash Cost / Ounce Targets

*Precious metals $0 cash cost / oz production targeted

using industry standard base metal by-product credits

of; Cu, Pb, Zn

Internal Estimate, Not SEC Proven & Probable Reserves; see Risk Factors in Company’s

10K Q1 2011

$87 |

Company’s First Profit

Company’s First Profit

Flotation

Agitated leach

Two mill circuits

Q1 2011 First Company Profit |

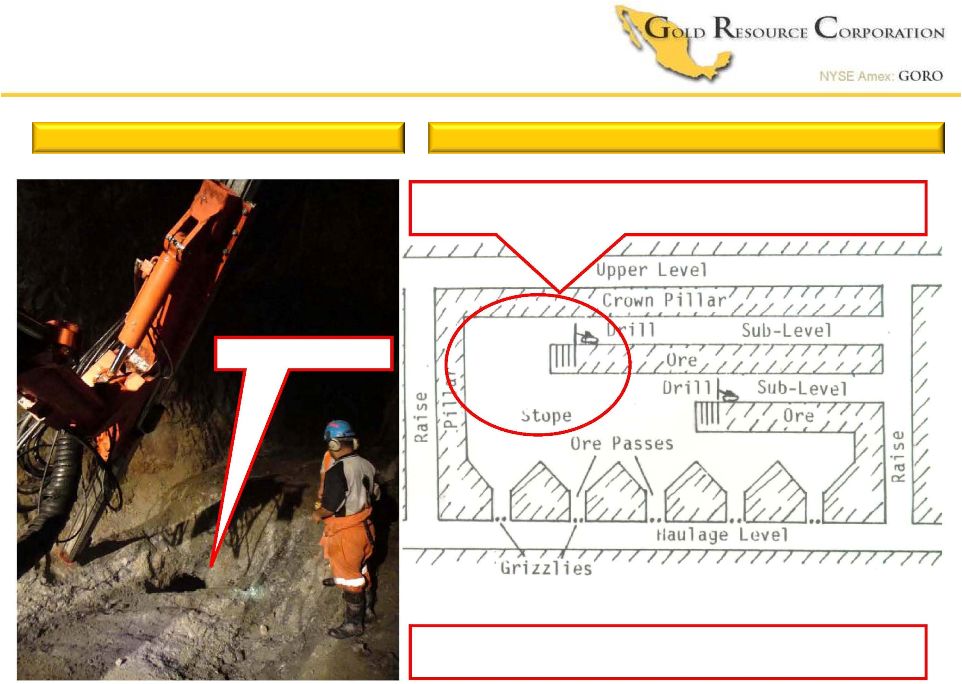

Descending Benches

Descending Benches

Schematic of Mine Development

Schematic of Mine Development

Arista Underground Mine development

Arista Underground Mine development

Currently stoping between levels 4 and 5

L4

L 5

~450-650 nominal tonnes per day

Ore Pass |

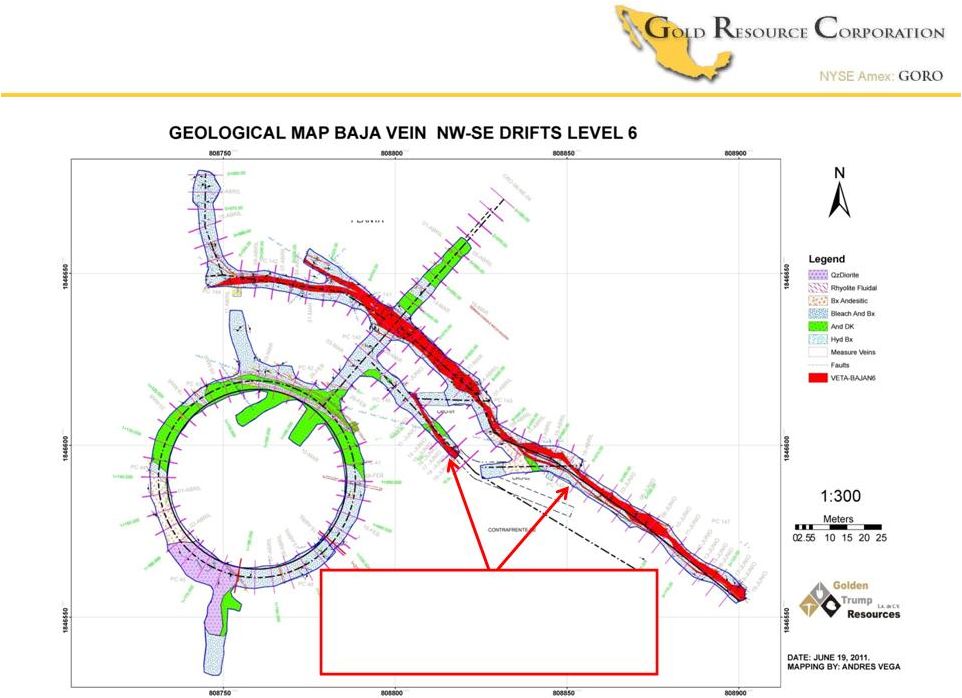

Arista Underground Mine development

Arista Underground Mine development

Level 6 development:

Multiple veins being mined |

1

st

Stope

L4

L 5

Hole #

from

Meters

Au g/t

Ag g/t

Cu%

Pb%

Zn% (weighted avg. not true width)

5110004 79.47

33.81

18.49

1853

1.59

1.76

5.21

L 6

Safety ramp

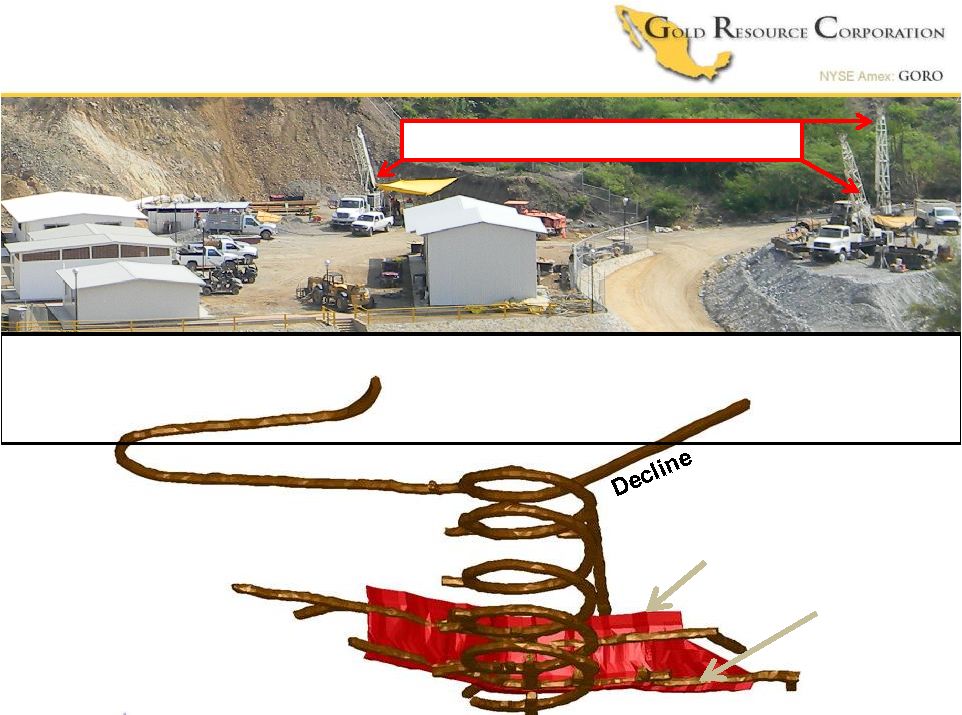

Arista Mine Development

Arista Mine Development

3 drills assisting development work

Hole 5110004 |

Arista Mine Development

Arista Mine Development

2011 Arista Drilling focus has been

mine development

NI-43-101 support

Underground development intercepts include (weighted avg. not true

width): Hole

#

from

Meters

Au g/t

Ag g/t

Cu%

Pb%

Zn%

5110004

79.47

33.81

18.49

1853

1.59

1.76

5.21

5110005

60.55

11.90

5.14

546

0.48

1.47

4.50

5110006

67.89

2.91

28.01

455

0.76

3.02

7.45

5110006

73.76

7.28

6.18

496

0.76

1.38

7.79

5110007

93.93

8.42

2.97

122

0.35

2.77

3.95

5110008

60.65

2.00

6.35

685

0.63

6.16

8.34

5110008

104.6

2.00

7.50

43

0.17

0.38

1.28

5110009

64.57

5.45

3.34

646

0.53

1.54

3.60

5110012

89.11

6.19

4.71

583

0.44

0.78

0.78

5110013

27.86

4.37

5.33

466

0.68

2.53

4.11

5110014

16.04

6.44

8.95

11116

0.54

1.55

2.51

2011 Arista Drilling focus going forward

Continued mine development

NI-43-101 support

Arista expansion drilling |

Strategy

Strategy

Decisions based on financial performance

Payback CAPEX less than 1 year/ IRR >100%

Production at earliest possible date

Build company with cash flow

Limit shareholder dilution

Distribute meaningful dividend

(Disciplined

Cap

Structure)

(Approx.1/3

Cash

Flow) |

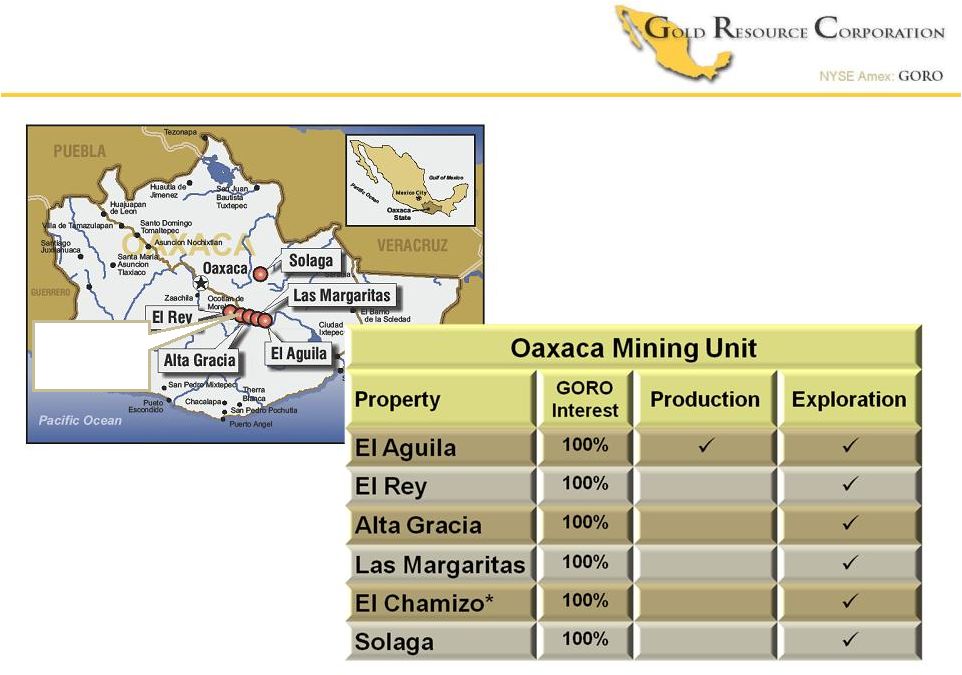

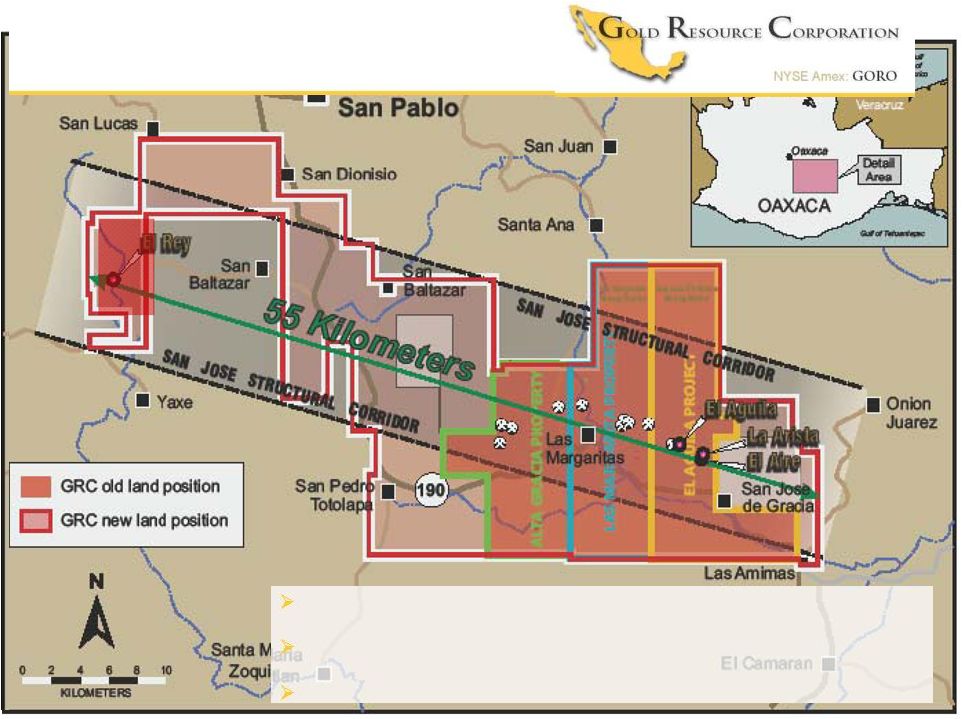

Exploration; 6 property acquired

Exploration; 6 property acquired

New land acquisition*

48 kilometers on trend

+200sq miles

New

Property

*

th |

Exploration; New Land Acquisition

Exploration; New Land Acquisition

Oaxaca Mining Unit expansion

Dominant land position

5 properties on N70W regional structural corridor |

Exploration; Drill Rigs

Exploration; Drill Rigs

Two drill companies currently contracted

GeoDrill and Alta Drilling

Additional drills being evaluated

* The Company currently targets adding these drills subject to drill availability

and / or order timeframes |

Advancing Exploration

Advancing Exploration

The El Rey Property

Discovered high-grade gold vein system

Exploration / development underground

Mineralization

within 100 meters of the surface

Vein

drill

intercepts

include

(5

holes)

(1)

:

1 m of 132.5 g/t Au

1.4 m of 55.3 g/t Au

9 m of 19.4 g/t Au including

1 m of 66.4 g/t Au

1 m of 31.8 g/t Au

1 m of 30.3 g/t Au

1 m of 29.1 g/t Au

1 m of 23.7 g/t Au

Refurbish & extend existing shaft

Drive 2 development drifts along veins

Development Exploration

Development Exploration |

Advanced Exploration

Advanced Exploration

Alta Gracia Property

Developed many high-grade targets

High up in the system

May be above boiling point

Old workings utilized for new exploration

Surface samples (rock chip) include:

#

Meter

Ag g/t

Au g/t

101814

0.3

2590

4.75

101815

1.2

604

1.32

101817

0.3

431

1.08

101820

0.3

801

1.69

101828

0.5

356

0.39

101837

1.0

287

2.08

101841

0.3

560

0.36

101793

0.3

926

2.10

Development Exploration

Development Exploration

Alta Gracia Property |

Advanced Exploration

Advanced Exploration

Drill rig

Pad for mine works

exploration

Old workings |

Overcame Adversity

Overcame Adversity

Typical day at the mill |

Overcame Adversity

Overcame Adversity

Freak hail storm |

Overcame Adversity

Overcame Adversity

Gold Resource Corporation

2886 Carriage Manor Point

Colorado Springs, CO. 80906 USA

Office: (303) 320-7708

Fax: (303) 320-7835

Email: gregpatterson@goldresourcecorp.com

Website: www.goldresourcecorp.com

10”

of rain and hail in three hours |

Overcame Adversity

Overcame Adversity

Mill remained

operational

No serious

injuries |

Overcame Adversity

Overcame Adversity

Flood cleanup complete

Mine development continues

First stope underway |

Overcame Adversity

Overcame Adversity

Production continued

Record production forecasted Q2 |

Overcame Adversity

Overcame Adversity |

Gold

Market / Equities pullback Gold Market / Equities pullback

|

Gold

Market Gold Market

“While the party continues for gold bullion prices,

stocks of gold companies have been a no-show.”

Frank Holmes June 2011

“Gold equities underperformed gold bullion in 2000 and 2008 during times

of extreme market negativity and uncertainty. These previous instances

have been merely temporary setbacks and markets generally

reverted back

to

their

long-term

trends.”

Frank

Holmes

June

2011

Gold Market / Equities Pullback

Gold Market / Equities Pullback |

Where

We Are Going Where We Are Going

Development of Expanded Oaxaca Mining Unit

Development of Expanded Oaxaca Mining Unit

Increase Shareholder Value

Increase Shareholder Value

Continue “Mainstream”

Continue “Mainstream”

Thrust for Institutional Investors

Thrust for Institutional Investors

Focused on Production and Increasing Cash Flow

Focused on Production and Increasing Cash Flow

Position GORO as “GO TO”

Position GORO as “GO TO”

Gold Investment

Gold Investment |

Mainstream Exposure

Mainstream Exposure |

Mainstream Thrust

Mainstream Thrust

Formal Resource Report

Formal Resource Report

NYSE Amex Listing

NYSE Amex Listing

“Mainstream”

“Mainstream”

for Institutional Investors

for Institutional Investors

Coverage

Coverage

TSX Secondary Listing

TSX Secondary Listing

2010

2011 |

Strike a

balance between ~Company Growth

~Return to Owners

Measurement

~Cash balance for near term growth

~Cash generated by Mine Gross Profit

Mine Gross Profit

Dividends

7/1/2010-3/30/2011

$18 million

$13 million

SPECIAL CASH DIVIDENDS

SPECIAL CASH DIVIDENDS

GORO; Unique Gold Investment

GORO; Unique Gold Investment

New

Generated

Cash

~Future project expectations |

Cash

flow (Mine Gross Profit) and dividend focused. Company long term

estimate:

~1/3

cash flow for taxes

~1/3

cash flow targeted for growth

~1/3

cash flow targeted to be paid

back to shareholders as dividends

SPECIAL CASH DIVIDENDS

SPECIAL CASH DIVIDENDS

Special

dividend

declared

Payable to

shareholders

of record as of

Special

dividend

amount

Total Special

Dividends Returned to

shareholders

Jul.–

Dec.

2010

$0.18

$0.35

Jan. 31

Feb. 14, 2011

$0.03

Feb. 28

Mar. 18, 2011

$0.03

Mar. 31

April 15, 2011

$0.03

Apr. 28

May 13, 2011

$0.04

May. 27

June 13, 2011

$0.04

Special dividends should not be considered a prediction or guarantee of future

dividends. Potential special dividends may vary in amount and

consistency or be discontinued at management’s discretion depending on

variables including but not limited to operational cash flows, Company

development requirements and strategies, spot gold and silver prices,

taxation, general market conditions and other factors described in the

Company’s public filings. GORO; Unique Gold Investment

GORO; Unique Gold Investment

(GRC targets, performance not guaranteed, see Risk Factors in Company’s

10K) |

Company

Annual Dividend

Estimate

Yield

%

Share Price Close

6/20/2011

Agnico Eagle

U.S.$0.65

1.1%

U.S.$60.98

Barrick

U.S.$0.49

1.1%

U.S.$43.17

Goldcorp

U.S.$0.42

0.9%

U.S.$47.35

Kinross

U.S.$0.10

0.7%

U.S.$14.88

Newmont

U.S.$0.80

0.8%

U.S.$51.82

Yamana

U.S.$0.12

1.1%

U.S.$11.32

Royal Gold

U.S.$0.44

0.8%

U.S.$56.39

PEER AVERAGE

0.9%

Hypothetical*

Gold Resource

U.S.$0.48*

2.0%

U.S.$24.30

Source: Based on each company’s annual public filing and Bloomberg.

*Hypothetical

special dividend distribution, NOT GUARANTEED Dividend &

Yields Dividend & Yields |

Cash

Flow Cash Flow

Become the “Go To”

Become the “Go To”

Gold Investment

Gold Investment

Dividends

Dividends

Dividends

Dividends

“In Kind”

“In Kind”

Treasury %

Treasury %

in Physical

in Physical

Adding Ounces

Adding Ounces

Capitalize on

Capitalize on

Opportunities

Opportunities

Low Cost

Low Cost

Producer

Producer

The “Go To”

The “Go To”

Gold Company

Gold Company

(GRC targets, performance not guaranteed, see Risk Factors in Company’s

10K) Growth

Growth |

Conclusion

Conclusion

Exploration of High-Grade Asset Base

Exploration of High-Grade Asset Base

Low Cost Gold Producer

Low Cost Gold Producer

Increasing Production Profile

Increasing Production Profile |