Attached files

| file | filename |

|---|---|

| 8-K - CROSS BORDER RESOURCES, INC. | v226657_8k.htm |

| EX-99.1 - CROSS BORDER RESOURCES, INC. | v226657_ex99-1.htm |

CROSS BORDER RESOURCES June 2011

Contacts, Forward-Looking Statements Cross Border Resources, Inc. 22610 U.S. Highway 281 North Suite 218 San Antonio, Texas 78258 Phone: (210) 226-6700 Fax: (210) 930-3967 www.xbres.com Corporate Everett Willard "Will" Gray II Chairman and CEO willg@xbres.com Mark Stark CFO and Treasurer marks@xbres.com Investor Relations Jon Cunningham RedChip Companies, Inc. (800) 733-2447 ext. 107 jon@redchip.com OTCQX: XBOR This document contains “forward-looking statements.” All statements other than statements of historical fact are “forward-looking statements” for purposes of federal and state securities laws, including, but not limited to, any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objections of management for future operations; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements or belief; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words “may,” “could,” “estimate,” “intend,” “continue,” “believe,” “expect” or “anticipate” or other similar words. These forward-looking statements present our estimates and assumptions only as of the date of this report. Except for our ongoing securities laws, we do not intend, and undertake no obligation, to update any forward-looking statement. Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any or our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and inherent risks and uncertainties. The factors impacting these risks and uncertainties include, but are not limited to:

Experienced Management Everett Willard “Will” Gray II, Chief Executive Officer – A seasoned executive who has been extensively involved in entrepreneurial ventures in oil field production as an angel investor and advisor/consultant to exploration and production start ups. Mr. Gray also has a diverse background gained from sales and marketing positions with a number of Fortune 500 companies, including Prudential Financial, Pharmacia Corp., Medtronic Inc., and Guidant Corporation. In April 2007, Mr. Gray founded WS Oil & Gas Limited, which provides merger and acquisition and capital raising consulting services to businesses in the energy sector. From August 2006 to March 2007, Mr. Gray was the CEO and President of Well Renewal Inc., a micro-cap exploration and production company quoted on the Pink Sheets. Mr. Gray was also a director of Well Renewal Inc. from April 2006 to March 2007. From July 2002 to July 2006, Mr. Gray worked as a sales representative for, in turn, Medtronic Inc., Guidant Corporation and FoxHollow Technologies Inc. Mr. Gray received his B.S. in Business Management from Texas State University. While attending Texas State, Mr. Gray was a member of the golf team, earning Southland Conference All-Academic Honors, as well as being a member of the Southland Conference Golf Championship team. Larry J. Risley, President and Chief Operating Officer – Over 30 years of energy experience in exploration, production, and operations with a particular focus in the Gulf Coast, East Texas, Appalachian, Illinois, and Permian basins. Mr. Risley served as the Chief Operating Officer of Pure Energy Group, focusing on deploying capital and compounding shareholder value primarily in Pure’s New Mexico position. From 2002 – 2004, Mr. Risley served as the Vice President of Exploration and Production for North Coast Energy whereas he focused on the growth of reserves, production and shareholder value via acquisition, development, and management of the company’s nearly 4,000 wells. From 1978 to 2002, Mr. Risley served in multiple roles for Chevron/Texaco. He received a B.S. in Geology and a Masters of Geology from State University of New York. P. Mark Stark, Chief Financial Officer – 25 years of experience at the CFO level in energy, agribusiness, commercial real estate and manufacturing/distribution. In-depth experience in the complete management of NYSE-listed and NASDAQ-listed company activities to include; preparation and execution of IPO, secondary equity, as well as, debt offerings. Duties and functions have included analyst guidance, disclosure policies, procedures, investor relations, SEC reporting, including SOX implementation. In addition to serving as CFO for TXCO Resources, Inc., he previously served as Chief Financial Officer of Alamo Water Refiners, Inc., Dawson Production Services Inc. (NYSE: DPS), and Venus Exploration Inc. (NASDAQ: VENX). During his tenure with Dawson, he managed the acquisition of 15 companies totaling approximately $200 million in revenues. Also highly experienced in cash management; debt management & banking relations; risk management & insurance; long range planning & forecasting; mergers, acquisitions & divestitures; financial reporting & general accounting; real estate; corporate & personal tax pension plan administration; financial & feasibility analysis; and budgeting & profit planning. He received a Bachelor of Business Administration from the University of Texas at Austin and a MBA from Southern Methodist University.

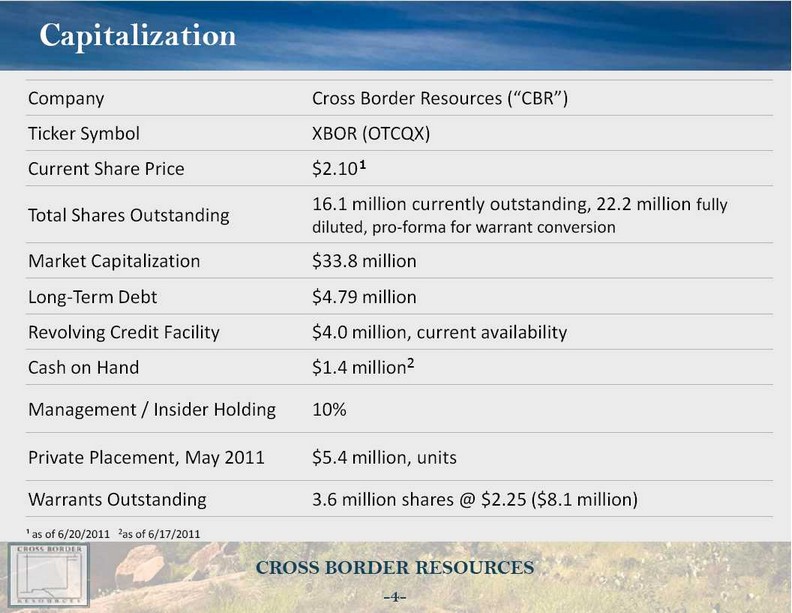

Capitalization Company Cross Border Resources (“CBR”) Ticker Symbol XBOR (OTCQX) Current Share Price $2.10¹ Total Shares Outstanding 16.1 million currently outstanding, 22.2 million fully diluted, pro-forma for warrant conversion Market Capitalization $33.8 million Long-Term Debt $4.79 million Revolving Credit Facility $4.0 million, current availability Cash on Hand $1.4 million2 Management / Insider Holding 10% Private Placement, May 2011 $5.4 million, units Warrants Outstanding 3.6 million shares @ $2.25 ($8.1 million) ¹ as of 6/20/2011 2as of 6/17/2011

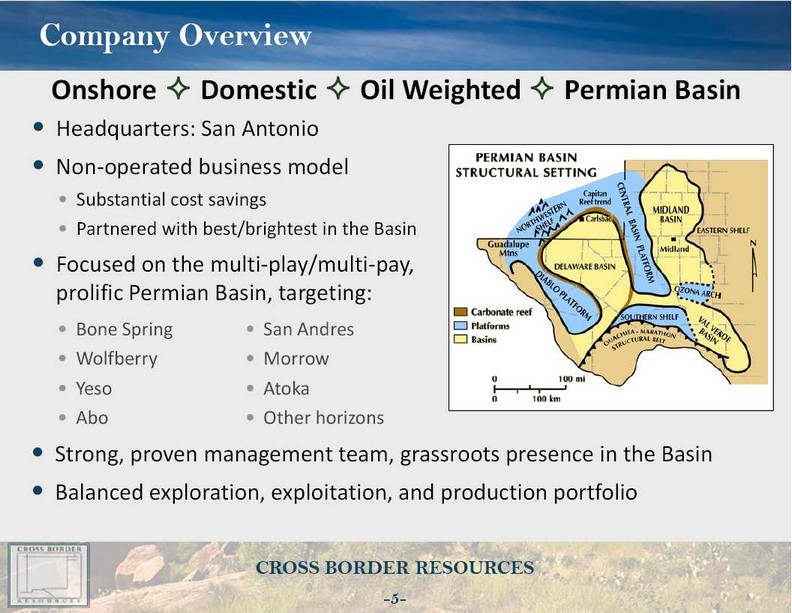

Company Overview Onshore ² Domestic ² Oil Weighted ² Permian Basin Headquarters: San Antonio Non-operated business model Substantial cost savings Partnered with best/brightest in the Basin Focused on the multi-play/multi-pay, prolific Permian Basin, targeting: Strong, proven management team, grassroots presence in the Basin Balanced exploration, exploitation, and production portfolio

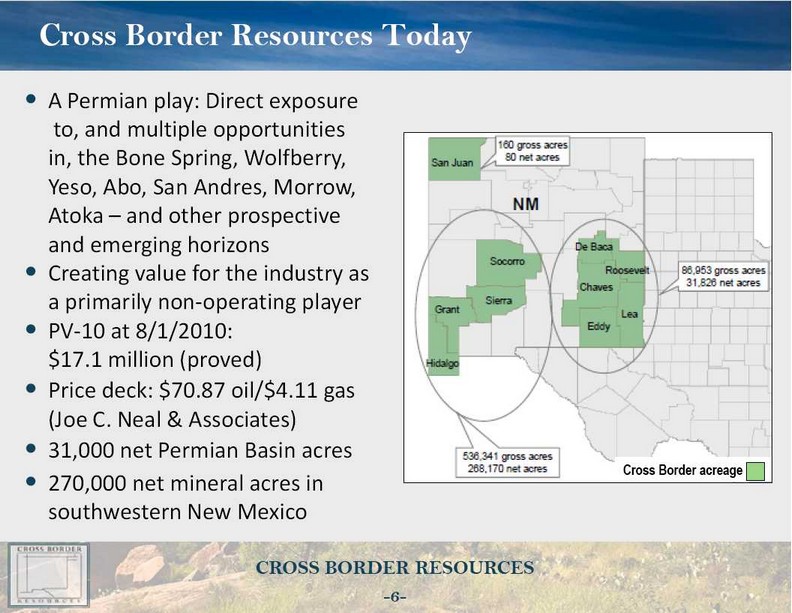

Cross Border Resources Today A Permian play: Direct exposure to, and multiple opportunities in, the Bone Spring, Wolfberry, Yeso, Abo, San Andres, Morrow, Atoka – and other prospective and emerging horizons Creating value for the industry as a primarily non-operating player PV-10 at 8/1/2010: $17.1 million (proved) Price deck: $70.87 oil/$4.11 gas (Joe C. Neal & Associates) 31,000 net Permian Basin acres 270,000 net mineral acres in southwestern New Mexico

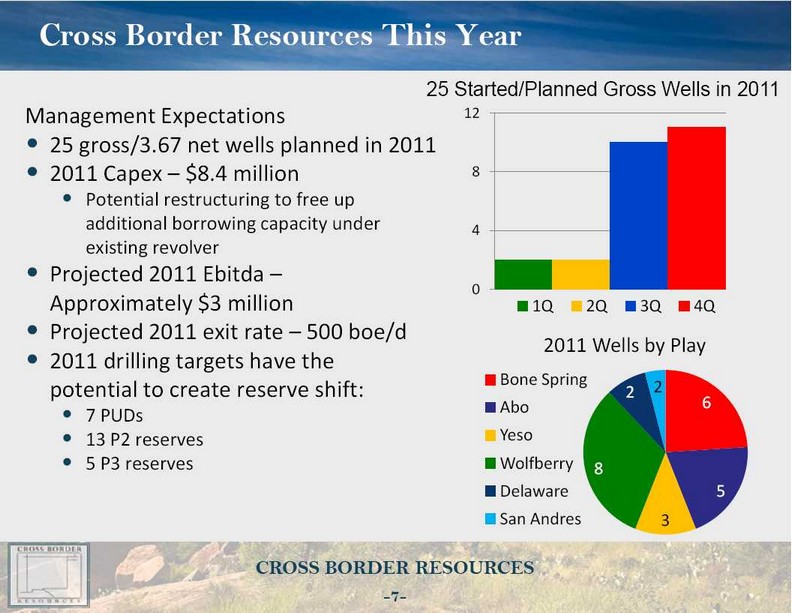

Cross Border Resources This Year Management Expectations 25 gross/3.67 net wells planned in 2011 2011 Capex – $8.4 million Potential restructuring to free up additional borrowing capacity under existing revolver Projected 2011 Ebitda – Approximately $3 million Projected 2011 exit rate – 500 boe/d 2011 drilling targets have the potential to create reserve shift: 7 PUDs 13 P2 reserves 5 P3 reserves 25 Started/Planned Gross Wells in 2011

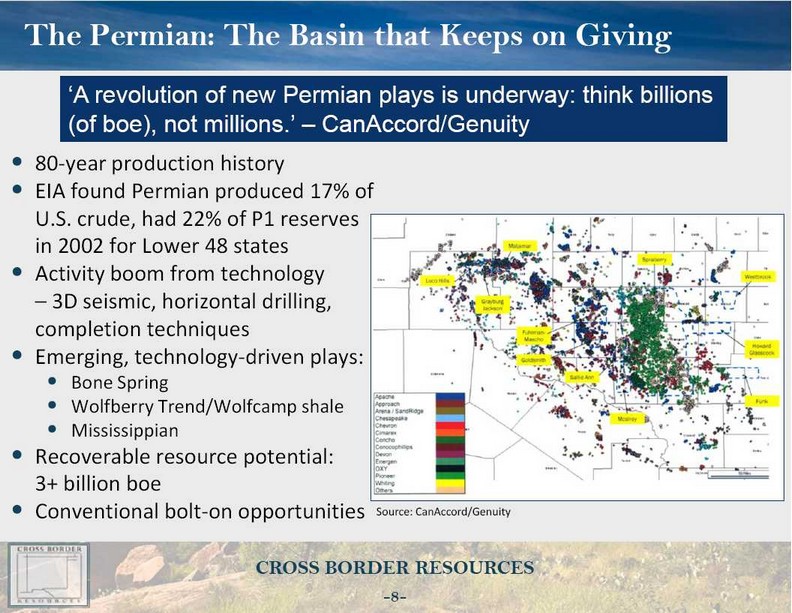

The Permian: The Basin that Keeps on Giving ‘A revolution of new Permian plays is underway: think billions (of boe), not millions.’ – CanAccord/Genuity 80-year production history EIA found Permian produced 17% of U.S. crude, had 22% of P1 reserves in 2002 for Lower 48 states Activity boom from technology – 3D seismic, horizontal drilling, completion techniques Emerging, technology-driven plays: Bone Spring Wolfberry Trend/Wolfcamp shale Mississippian Recoverable resource potential: 3+ billion boe Conventional bolt-on opportunities Source: CanAccord/Genuity

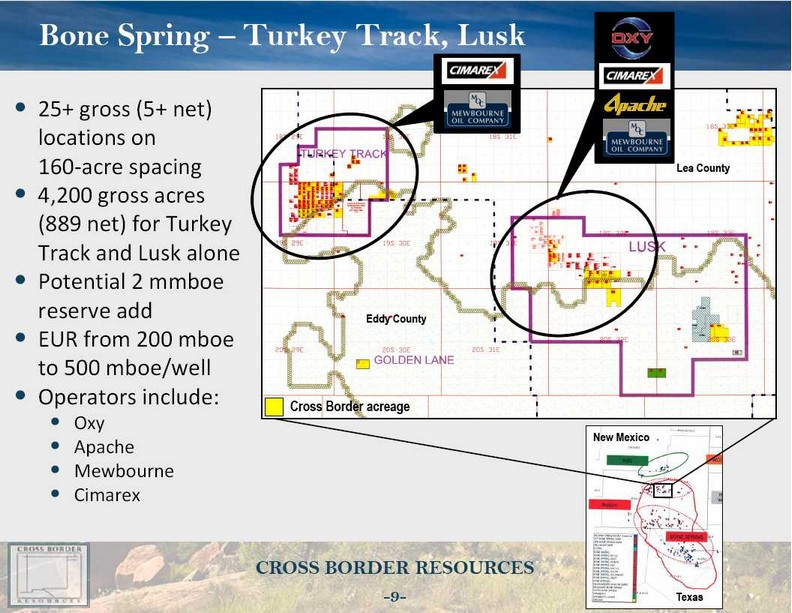

Bone Spring – Turkey Track, Lusk 25+ gross (5+ net) locations on 160-acre spacing 4,200 gross acres (889 net) for Turkey Track and Lusk alone Potential 2 mmboe reserve add EUR from 200 mboe to 500 mboe/well Operators include: Oxy Apache Mewbourne Cimarex Lea County Eddy County Cross Border acreage New Mexico Texas

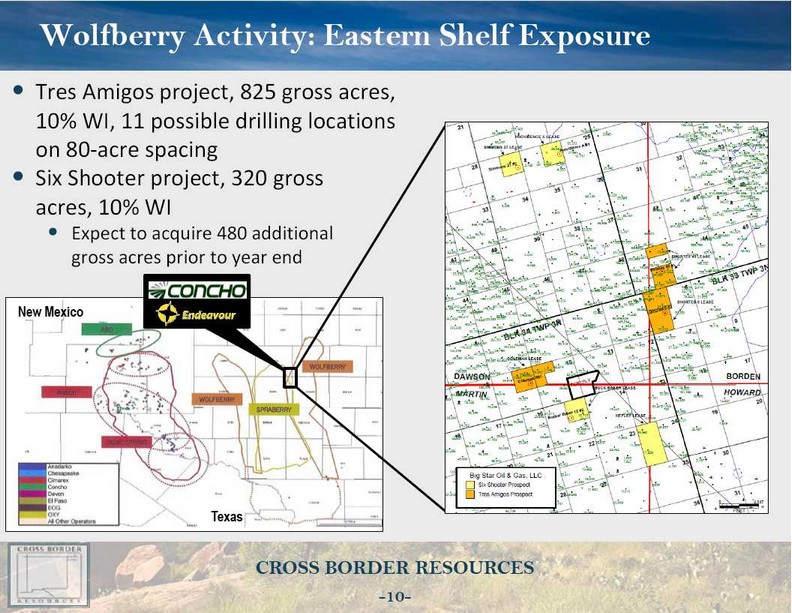

Wolfberry Activity: Eastern Shelf Exposure Tres Amigos project, 825 gross acres, 10% WI, 11 possible drilling locations on 80-acre spacing Six Shooter project, 320 gross acres, 10% WI Expect to acquire 480 additional gross acres prior to year end New Mexico Texas

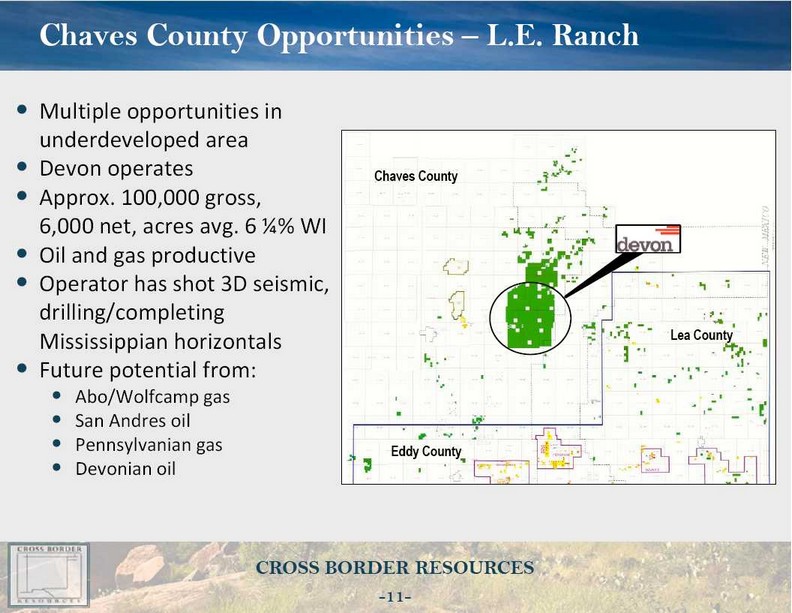

Chaves County Opportunities – L.E. Ranch Multiple opportunities in underdeveloped area Devon operates Approx. 100,000 gross, 6,000 net, acres avg. 6 ¼% WI Oil and gas productive Operator has shot 3D seismic, drilling/completing Mississippian horizontals Future potential from: Abo/Wolfcamp gas San Andres oil Pennsylvanian gas Devonian oil Chaves County Eddy County Lea County

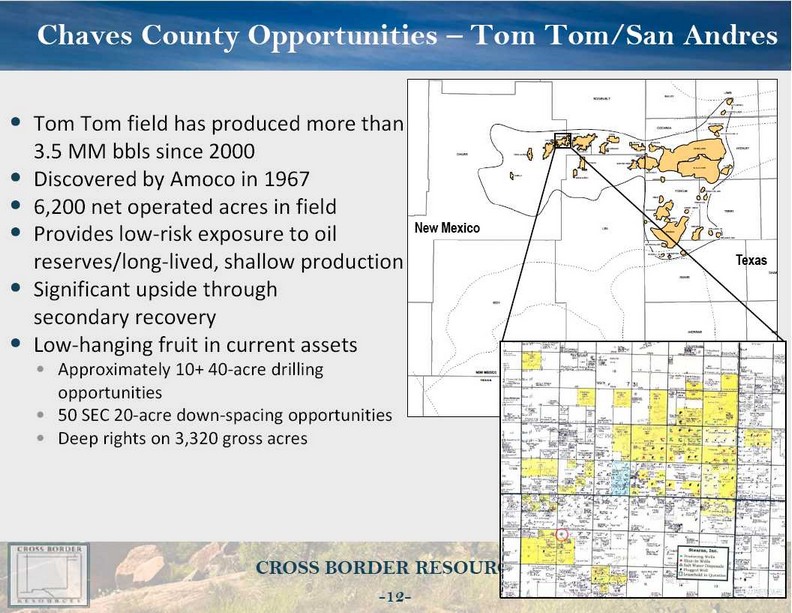

Chaves County Opportunities – Tom Tom/San Andres Tom Tom field has produced more than 3.5 MM bbls since 2000 Discovered by Amoco in 1967 6,200 net operated acres in field Provides low-risk exposure to oil reserves/long-lived, shallow production Significant upside through secondary recovery Low-hanging fruit in current assets Approximately 10+ 40-acre drilling opportunities 50 SEC 20-acre down-spacing opportunities Deep rights on 3,320 gross acres New Mexico Texas

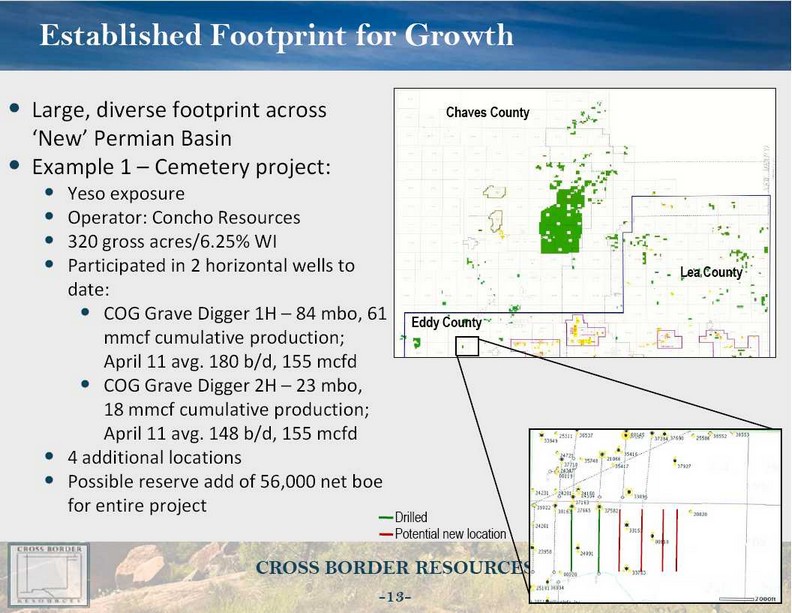

Established Footprint for Growth Large, diverse footprint across ‘New’ Permian Basin Example 1 – Cemetery project: Yeso exposure Operator: Concho Resources 320 gross acres/6.25% WI Participated in 2 horizontal wells to date: COG Grave Digger 1H – 84 mbo, 61 mmcf cumulative production; April 11 avg. 180 b/d, 155 mcfd COG Grave Digger 2H – 23 mbo, 18 mmcf cumulative production; April 11 avg. 148 b/d, 155 mcfd 4 additional locations Possible reserve add of 56,000 net boe for entire project Chaves County Lea County Eddy County Drilled Potential new location

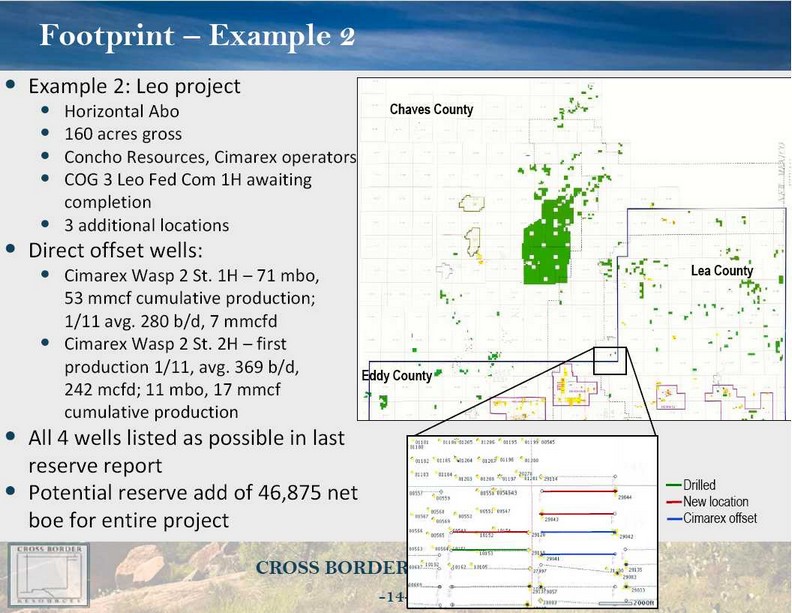

Footprint – Example 2 Example 2: Leo project Horizontal Abo 160 acres gross Concho Resources, Cimarex operators COG 3 Leo Fed Com 1H awaiting completion 3 additional locations Direct offset wells: Cimarex Wasp 2 St. 1H – 71 mbo, 53 mmcf cumulative production; 1/11 avg. 280 b/d, 7 mmcfd Cimarex Wasp 2 St. 2H – first production 1/11, avg. 369 b/d, 242 mcfd; 11 mbo, 17 mmcf cumulative production All 4 wells listed as possible in last reserve report Potential reserve add of 46,875 net boe for entire project Chaves County Eddy County Lea County Drilled New location Cimarex offset

Conclusion: The Cross Border Opportunity Cross Border Resources offers direct, high-impact exposure to ‘The New Permian’ Current production from 80-plus wellbores offers a balanced E&P investment The established, non-operated business model yields tremendous value to shareholders Clean balance sheet offers the financial flexibility to compound growth Recent listing on OTCQX improves market liquidity, seeking listing on major exchange Sound management team with a grassroots presence in the Permian Basin Multiple acquisitions in consideration Skilled in identifying and maximizing assets Partnered with the best and the brightest operators in the Permian

Appendix

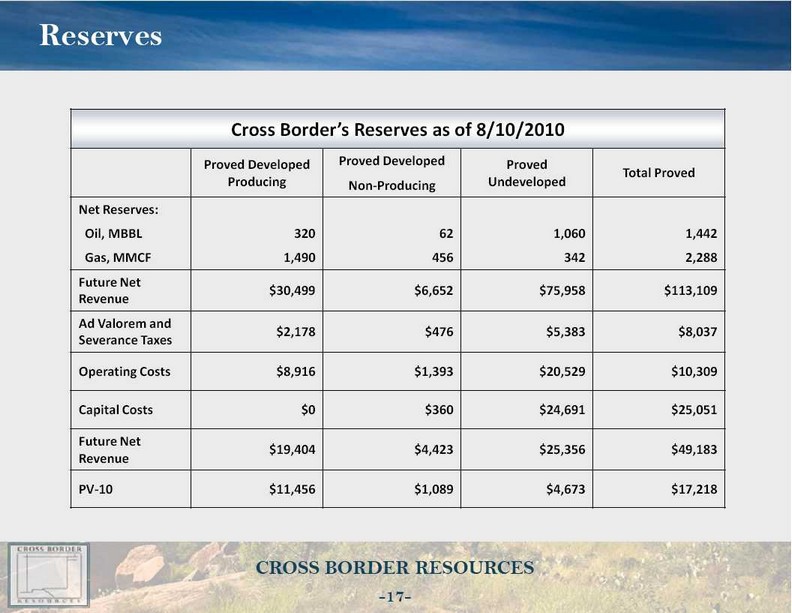

Reserves Cross Border’s Reserves as of 8/10/2010 Proved Developed Producing Proved Developed Non-Producing Proved Undeveloped Total Proved Net Reserves: Oil, MBBL Gas, MMCF 320 1,490 62 456 1,060 342 1,442 2,288 Future Net Revenue $30,499 $6,652 $75,958 $113,109 Ad Valorem and Severance Taxes $2,178 $476 $5,383 $8,037 Operating Costs $8,916 $1,393 $20,529 $10,309 Capital Costs $0 $360 $24,691 $25,051 Future Net Revenue $19,404 $4,423 $25,356 $49,183 PV-10 $11,456 $1,089 $4,673 $17,218

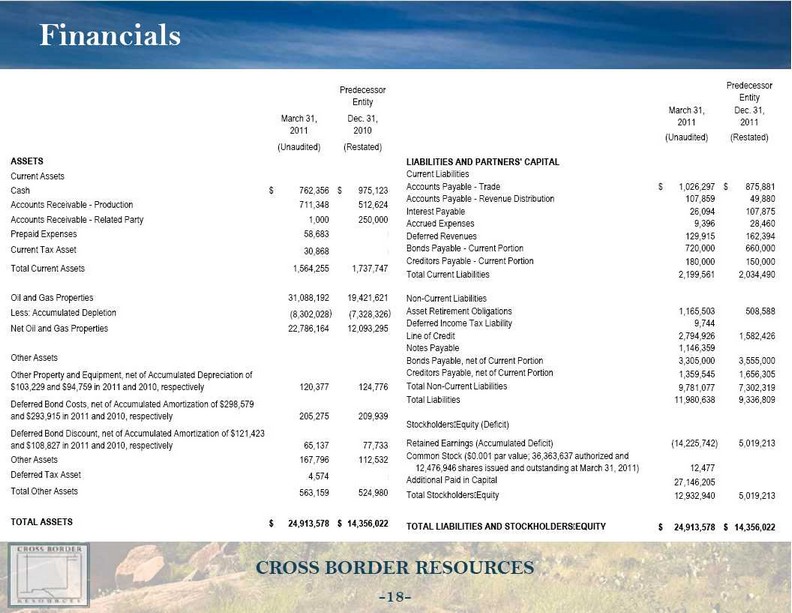

Financials Predecessor Entity March 31, 2011 Dec. 31, 2010 (Unaudited) (Restated) ASSETS Current Assets Cash $ 762,356 $ 975,123 Accounts Receivable - Production 711,348 512,624 Accounts Receivable - Related Party 1,000 250,000 Prepaid Expenses 58,683 — Current Tax Asset 30,868 — Total Current Assets 1,564,255 1,737,747 Oil and Gas Properties 31,088,192 19,421,621 Less: Accumulated Depletion (8,302,028) (7,328,326) Net Oil and Gas Properties 22,786,164 12,093,295 Other Assets Other Property and Equipment, net of Accumulated Depreciation of $103,229 and $94,759 in 2011 and 2010, respectively 120,377 124,776 Deferred Bond Costs, net of Accumulated Amortization of $298,579 and $293,915 in 2011 and 2010, respectively 205,275 209,939 Deferred Bond Discount, net of Accumulated Amortization of $121,423 and $108,827 in 2011 and 2010, respectively 65,137 77,733 Other Assets 167,796 112,532 Deferred Tax Asset 4,574 — Total Other Assets 563,159 524,980 TOTAL ASSETS $ 24,913,578 $ 14,356,022 Predecessor Entity March 31, 2011 Dec. 31, 2011 (Unaudited) (Restated) LIABILITIES AND PARTNERS' CAPITAL Current Liabilities Accounts Payable - Trade $ 1,026,297 $ 875,881 Accounts Payable - Revenue Distribution 107,859 49,880 Interest Payable 26,094 107,875 Accrued Expenses 9,396 28,460 Deferred Revenues 129,915 162,394 Bonds Payable - Current Portion 720,000 660,000 Creditors Payable - Current Portion 180,000 150,000 Total Current Liabilities 2,199,561 2,034,490 Non-Current Liabilities Asset Retirement Obligations 1,165,503 508,588Deferred Income Tax Liability 9,744 — Line of Credit 2,794,926 1,582,426 Notes Payable 1,146,359 — Bonds Payable, net of Current Portion 3,305,000 3,555,000 Creditors Payable, net of Current Portion 1,359,545 1,656,305 Total Non-Current Liabilities 9,781,077 7,302,319 Total Liabilities 11,980,638 9,336,809 Stockholders’ Equity (Deficit) Retained Earnings (Accumulated Deficit) (14,225,742) 5,019,213 Common Stock ($0.001 par value; 36,363,637 authorized and 12,476,946 shares issued and outstanding at March 31, 2011) 12,477 — Additional Paid in Capital 27,146,205 — Total Stockholders’ Equity 12,932,940 5,019,213 TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY $ 24,913,578 $ 14,356,022

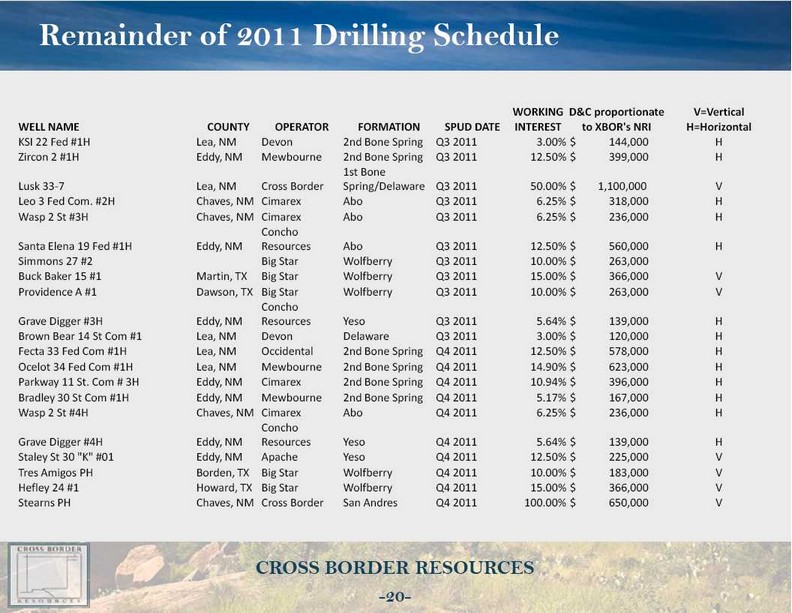

Remainder of 2011 Drilling Schedule WELL NAME COUNTY OPERATOR FORMATION SPUD DATE WORKING INTEREST D&C proportionate to XBOR's NRI V=Vertical H=Horizontal KSI 22 Fed #1H Lea, NM Devon 2nd Bone Spring Q3 2011 3.00% $ 144,000 H Zircon 2 #1H Eddy, NM Mewbourne 2nd Bone Spring Q3 2011 12.50% $ 399,000 H Lusk 33-7 Lea, NM Cross Border 1st Bone Spring/Delaware Q3 2011 50.00% $ 1,100,000 V Leo 3 Fed Com. #2H Chaves, NM Cimarex Abo Q3 2011 6.25% $ 318,000 H Wasp 2 St #3H Chaves, NM Cimarex Abo Q3 2011 6.25% $ 236,000 H Santa Elena 19 Fed #1H Eddy, NM Concho Resources Abo Q3 2011 12.50% $ 560,000 H Simmons 27 #2 Big Star Wolfberry Q3 2011 10.00% $ 263,000 Buck Baker 15 #1 Martin, TX Big Star Wolfberry Q3 2011 15.00% $ 366,000 V Providence A #1 Dawson, TX Big Star Wolfberry Q3 2011 10.00% $ 263,000 V Grave Digger #3H Eddy, NM Concho Resources Yeso Q3 2011 5.64% $ 139,000 H Brown Bear 14 St Com #1 Lea, NM Devon Delaware Q3 2011 3.00% $ 120,000 H Fecta 33 Fed Com #1H Lea, NM Occidental 2nd Bone Spring Q4 2011 12.50% $ 578,000 H Ocelot 34 Fed Com #1H Lea, NM Mewbourne 2nd Bone Spring Q4 2011 14.90% $ 623,000 H Parkway 11 St. Com # 3H Eddy, NM Cimarex 2nd Bone Spring Q4 2011 10.94% $ 396,000 H Bradley 30 St Com #1H Eddy, NM Mewbourne 2nd Bone Spring Q4 2011 5.17% $ 167,000 H Wasp 2 St #4H Chaves, NM Cimarex Abo Q4 2011 6.25% $ 236,000 H Grave Digger #4H Eddy, NM Concho Resources Yeso Q4 2011 5.64% $ 139,000 H Staley St 30 "K" #01 Eddy, NM Apache Yeso Q4 2011 12.50% $ 225,000 V Tres Amigos PH Borden, TX Big Star Wolfberry Q4 2011 10.00% $ 183,000 V Hefley 24 #1 Howard, TX Big Star Wolfberry Q4 2011 15.00% $ 366,000 V Stearns PH Chaves, NM Cross Border San Andres Q4 2011 100.00% $ 650,000V

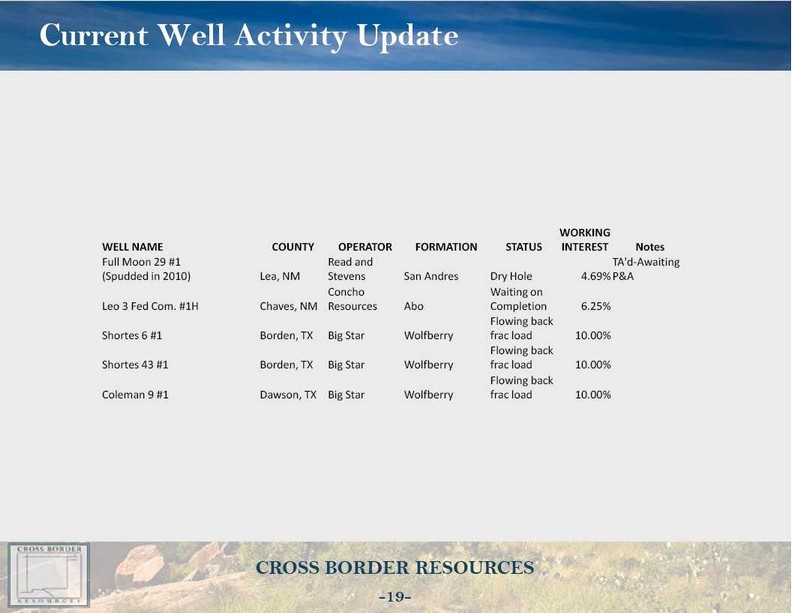

Current Well Activity UpdateWELL NAME COUNTY OPERATOR FORMATION STATUS WORKING INTEREST NotesFull Moon 29 #1(Spudded in 2010) Lea, NM Read and Stevens San Andres Dry Hole 4.69% TA'd-Awaiting P&ALeo 3 Fed Com. #1H Chaves, NM Concho Resources Abo Waiting on Completion 6.25% Shortes 6 #1 Borden, TX Big Star Wolfberry Flowing back frac load 10.00% Shortes 43 #1 Borden, TX Big Star Wolfberry Flowing back frac load 10.00% Coleman 9 #1 Dawson, TX Big Star Wolfberry Flowing back frac load 10.00%