Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF ERNST & YOUNG LLP - Ryerson Holding Corp | dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 21, 2011.

Registration No 333-164484

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 12

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

RYERSON HOLDING CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 5051 | 26-1251524 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

2621 West 15th Place

Chicago, Illinois 60608

(773) 762-2121

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Terence R. Rogers

Chief Financial Officer

Ryerson Holding Corporation

2621 West 15th Place

Chicago, Illinois 60608

(773) 762-2121

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Cristopher Greer, Esq. | James J. Clark, Esq. William J. Miller, Esq. | |

| Willkie Farr & Gallagher LLP 787 Seventh Avenue New York, New York 10019 (212) 728-8000 Facsimile: (212) 728-9214 |

Cahill Gordon & Reindel LLP 80 Pine Street New York, New York 10005 (212) 701-3000 Facsimile: (212) 269-5420 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer x | Smaller reporting company ¨ | |

| (Do not check if a smaller reporting company) |

| Title of Each Class of Securities To Be Registered | Proposed Maximum Aggregate Offering |

Amount of Registration Fee(3) | ||

| Common Stock, par value $0.01 per share |

$300,000,000 | $34,830 | ||

| (1) | Estimated solely for purposes of determining the registration fee in accordance with Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes shares of common stock that may be purchased by the underwriters to cover over-allotments, if any. See “Underwriting.” |

| (3) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated , 2011

PROSPECTUS

Shares

Ryerson Holding Corporation

Common Stock

We are selling shares of our common stock. The selling stockholders identified in this prospectus have granted the underwriters an option to purchase up to additional shares of common stock to cover over-allotments. We will not receive any proceeds from the sale of shares by the selling stockholders.

This is the initial public offering of our common stock. We currently expect the initial public offering price to be between $ and $ per share. We have applied to have our common stock listed on the New York Stock Exchange under the symbol “RYI.”

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 16.

| Per Share | Total | |||

| Public Offering Price |

$ | $ | ||

| Underwriting Discount |

$ | $ | ||

| Proceeds, before expenses, to us. |

$ | $ |

The underwriters may also purchase up to an additional shares from the selling stockholders, at the public offering price, less the underwriting discount, within 30 days of the date of this prospectus to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2011.

| BofA Merrill Lynch |

J.P. Morgan | |||

The date of this prospectus is , 2011.

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus and any free writing prospectus we may specifically authorize to be delivered or made available to you. We have not, and the selling stockholders and the underwriters have not, authorized anyone to provide you with different information. We are not, and the selling stockholders and the underwriters are not, making an offer of these securities in any jurisdiction where the offer is not permitted. You should not assume that the information contained in this prospectus and any free writing prospectus we may specifically authorize to be delivered or made available to you is accurate as of any date other than the date on the front of this prospectus, regardless of its time of delivery or of any sale of shares of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

| Page | ||||

| 1 | ||||

| 16 | ||||

| 28 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

37 | |||

| 56 | ||||

| 71 | ||||

| 76 | ||||

| 83 | ||||

| 86 | ||||

| 87 | ||||

| 89 | ||||

| 91 | ||||

| 94 | ||||

| 101 | ||||

| 103 | ||||

| 105 | ||||

| 112 | ||||

| 112 | ||||

| 113 | ||||

| F-1 | ||||

Table of Contents

In this prospectus, we rely on and refer to information and statistics regarding the steel processing industry and our market share in the sectors in which we compete. We obtained this information and these statistics from sources other than us, which we have supplemented where necessary with information from publicly available sources, discussions with our customers and our own internal estimates. References in this prospectus to:

| • | The Institute of Supply Management refer to its April 2011 Manufacturing ISM Report on Business®; |

| • | The U.S. Congressional Budget Office refer to its January 2011 report entitled “The Budget and Economic Outlook: Fiscal Years 2011 to 2021”; |

| • | The Metals Service Center Institute (“MSCI”) refer to its April 2011 edition of “MSCI Metal Activity Report”; |

| • | The Economist Intelligence Unit refer to its March 2011 country report on China; and |

| • | CRU refers to projections featured in the February 2011 issue of “Stainless Steel Flat Products Quarterly Industry and Market Outlook” by CRU Group. |

We use these sources and estimates and believe them to be reliable, but we cannot give you any assurance that any of the projected results will be achieved.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully together with our consolidated financial statements and the related notes appearing elsewhere in this prospectus before making an investment decision. This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in such forward-looking statements as a result of certain factors, including those discussed in the “Risk Factors” and other sections of this prospectus.

Except as otherwise indicated herein or as the context otherwise requires, references in this prospectus to “Ryerson Holding,” “the Company,” “we,” “our,” and “us” refer to Ryerson Holding Corporation and its direct and indirect subsidiaries (including Ryerson Inc.). The term “Ryerson” refers to Ryerson Inc., a direct wholly owned subsidiary of Ryerson Holding, together with its subsidiaries on a consolidated basis. “Platinum” refers to Platinum Equity, LLC and its affiliated investment funds, certain of which are our principal stockholders, and “Platinum Advisors” refers to Platinum Equity Advisors, LLC. We refer to the issuance of our common stock being offered hereby as the “offering.”

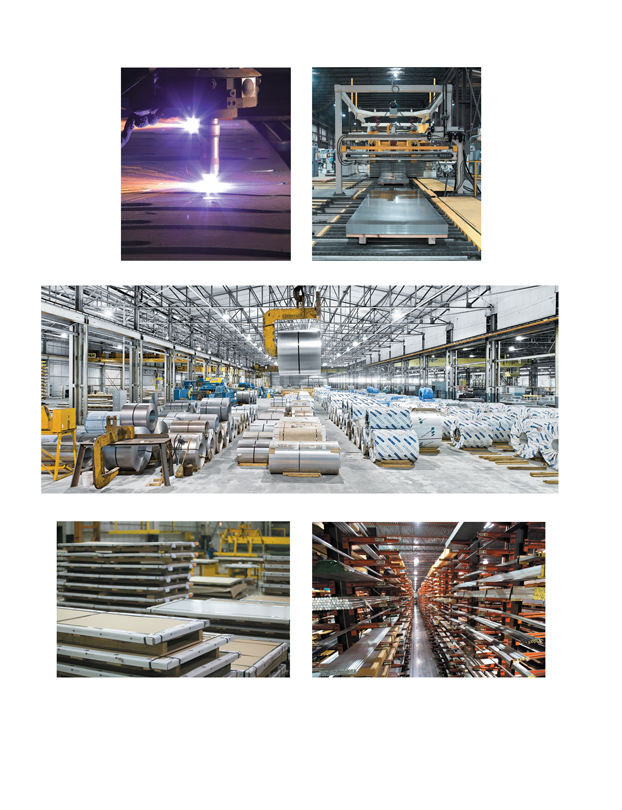

Our Company

We believe we are one of the largest processors and distributors of metals in North America measured in terms of sales, with operations in the United States, Canada, Mexico and an established and growing presence in China. Our customer base ranges from local, independently owned fabricators and machine shops to large, national original equipment manufacturers. We process and distribute a full line of over 75,000 products in stainless steel, aluminum, carbon steel and alloy steels, and a limited line of nickel and red metals. More than one-half of the products we sell are processed to meet customer requirements. We use various processing and fabricating techniques to process materials to a specified thickness, length, width, shape and surface quality pursuant to customer orders. For the year ended December 31, 2010, we purchased 2.4 million tons of materials from suppliers throughout the world. For the three months ended March 31, 2011, our net sales were $1.2 billion, Adjusted EBITDA, excluding LIFO expense, was $67.0 million and net loss was $1.6 million. See note 4 in “Summary Historical Consolidated Financial and Other Data” for a reconciliation of Adjusted EBITDA to net loss.

We currently operate over 100 facilities across North America and eight facilities in China. Our service centers are strategically located in close proximity to our customers, which allows us to quickly process and deliver our products and services, often within the same day or next day of receiving an order. We own, lease or contract a fleet of tractors and trailers, allowing us to efficiently meet our customers’ delivery demands. In addition, our scale enables us to maintain low operating costs. Our operating expenses as a percentage of sales for the years ended December 31, 2009 and 2010 were 16.2% and 13.3%, respectively.

We serve more than 40,000 customers across a wide range of manufacturing end markets. We believe the diverse end markets we serve reduce the volatility of our business in the aggregate. Our geographic network and broad range of products and services allow us to serve large, national manufacturing companies across multiple locations.

1

Table of Contents

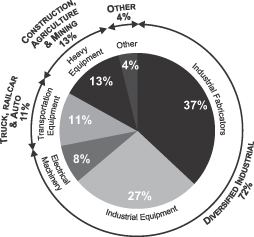

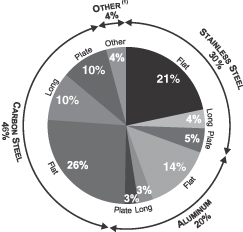

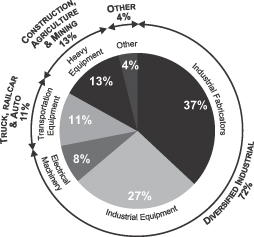

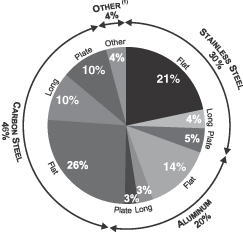

We are broadly diversified in our end markets and product lines in North America, as detailed below.

| North America Sales by End Market | North America Sales by Product | |

|

|

| |

| (1) Other includes copper, brass, nickel, pipe, valves and fittings. | ||

Industry Outlook

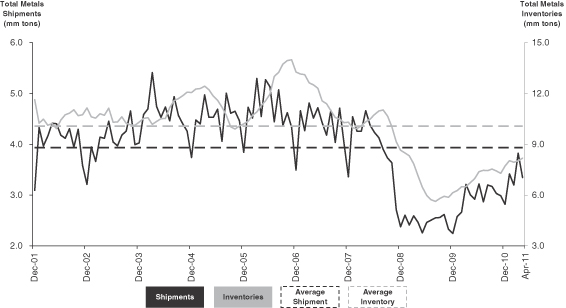

The U.S. manufacturing sector continues to recover from the economic downturn, which affected and may continue to affect our operating results. However, according to the Institute for Supply Management, the Purchasing Managers’ Index (“PMI”) was 60.4% in April 2011, marking the 21st consecutive month the reading was above 50%, which indicates that the manufacturing economy is generally expanding. The PMI measures the economic health of the manufacturing sector and is a composite index based on five indicators: new orders, inventory levels, production, supplier deliveries and the employment environment. PMI readings over 50% suggest growth in the manufacturing industry and if manufacturing is expanding, the general economy should similarly be expanding. As a result, PMI readings can be a good indicator of industry and general economic growth. Although there can be no guarantees on the timing of any overall improvements in the industry, since May 2009, total metal service center industry purchase orders have increased by 48.4%. Furthermore, the overall U.S. economy is expected to continue to grow as evidenced by the U.S. Congressional Budget Office’s forecasted GDP growth rates of 3.1% and 2.8% for 2011 and 2012, respectively.

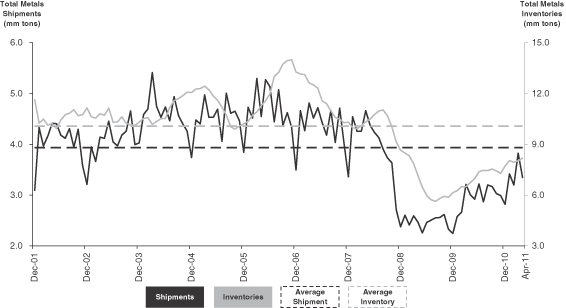

According to MSCI, total inventory levels of carbon and stainless steel at U.S. service centers reached a trough in August 2009 and bottomed at the lowest levels since the data series began in 1977. Although industry demand recovered in 2010 and into 2011, shipments and inventory are still well below historical averages, which we believe suggests long-term growth potential that may be realized if these metrics return to or exceed their historical averages.

2

Table of Contents

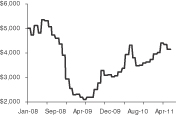

U.S. Metals Service Center Shipments & Inventories

| Source: | MSCI as of April 2011 |

China continues to be a key driver in the growth of global metals demand. According to The Economist Intelligence Unit, China’s GDP is projected to grow at 9.0% in 2011 while CRU is forecasting Chinese steel consumption growth of 11.8% (hot-rolled sheet) in the same period.

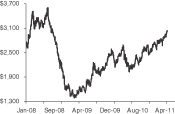

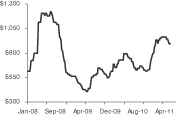

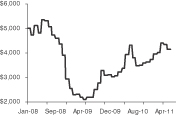

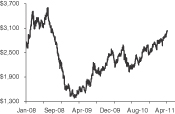

Metals prices have recovered significantly from the trough levels in 2009 as a result of growing demand and increased raw material costs, despite volume still well below historical levels.

The following charts show the historical mill cost of key metals.

| North American Midwest HRC ($/ton) |

USA CR Grade 304 Stainless Steel ($/ton) | Aluminum ($/ton) | ||

|

|

|

|

| Source: | Steel Business Briefing and Bloomberg. |

3

Table of Contents

Our Competitive Strengths

Leading Market Position with National Scale and Presence in China.

We believe we are one of the largest service center companies for stainless steel, one of the two largest service centers for aluminum, and one of the leading carbon products service center companies based on sales in the combined United States and Canada market. We also believe we are the second largest metals service center in the combined United States and Canada market based on sales. We have a broad geographic presence with over 100 locations in North America. We have leveraged our leadership in North America to establish sizable operations in China and we believe we are the only major global service center company whose activities in China generate a significant portion of our revenue relative to overall operations. Our China operations represented between 4% and 5% of our total revenues in 2010. In China, we have expanded from three metals service centers in 2006 to eight operating facilities currently with several more under consideration. We believe we are the only major North American service center whose activities in China represent a significant portion of overall operations in terms of revenue, making us a leading global service center company in China, which we believe positions us favorably in the largest metals market in the world. Although we maintain operations in China, conducting business in foreign countries has inherent risks and there can be no guarantee of our continued success abroad.

Our service centers are located near our customer locations, enabling us to provide timely delivery to customers across numerous geographic markets. Additionally, our widespread network of locations in the United States, Canada, Mexico and China utilize expertise that allow us to serve customers with complex supply chain requirements across multiple manufacturing locations. Our ability to transfer inventory among our facilities better enables us to timely and profitably source specialized items at regional locations throughout our network than if we were required to maintain inventory of all products at each location.

Diverse Customer Base, End Market and Geographic Focus.

We believe that our broad and diverse customer base in both geography and product provides a strong platform for growth in a recovering economy and helps to protect us from regional and industry-specific downturns. We serve more than 40,000 customers across a diverse range of industries, including metals fabrication, industrial machinery, commercial transportation, electrical equipment and appliances and heavy machinery and construction equipment. During the year ended December 31, 2010, no single customer accounted for more than 5% of our sales, and our top 10 customers accounted for less than 12% of sales. We continue to expand our customer base and added over 4,000 net new customers since December 31, 2009.

Extensive Breadth of Products and Services.

We carry a full range of over 75,000 products, including stainless steel, aluminum, carbon steel and alloy steels and a limited line of nickel and red metals. In addition, we provide a broad range of processing and fabrication services to meet the needs of our customers. We also provide supply chain solutions, including just-in-time delivery, and value-added components to many original equipment manufacturers. We believe our broad product mix, extensive geographic footprint and marketing approach provides customers a “one-stop shop” solution few other service center companies are able to offer.

Experienced Management Team with Diverse Backgrounds Focused on Profitability.

Our senior management team has extensive industry and operational experience and has been instrumental in optimizing and implementing our transformation since Platinum’s acquisition of Ryerson in 2007. Our senior management has an average of more than 21 years of experience in the metals or service center industries. The senior executive team’s extensive experience in international markets and outside the service center industry provides perspective to drive profitable growth. Our CEO, Mr. Michael Arnold, joined the Company in January

4

Table of Contents

2011 and has 32 years of diversified industrial experience. After fully implementing Platinum’s acquisition plan to transform our operating and cost structure in 2009, we have increased our focus on growing and enhancing profitability driven by providing customized solutions to diversified industrial customers who value these services.

Broad-Based Product and Geographic Platform Provides Multiple Opportunities for Profitable Growth.

While we expect the service center industry to benefit from improving general economic conditions, several end-markets where we have meaningful exposure (including the heavy and medium truck/transportation, machinery, industrial equipment and appliance sectors) have begun and we believe will continue to experience stronger shipment growth compared to overall industrial growth. In addition, although there can be no guarantee of growth, we believe a number of our other strategies, such as upgrading our sales talent and growing our large national network and diverse operating capabilities, will provide us with growth opportunities.

Strong Relationships with Suppliers.

We are among the largest purchasers of metals in North America. We believe we are frequently one of the largest customers of our suppliers and that concentrating our orders among a core group of suppliers is an effective method for obtaining favorable pricing and service. We believe we have the opportunity to further leverage this strength. Suppliers worldwide are consolidating and large, geographically diversified customers, such as Ryerson, are desirable partners for these larger suppliers. We have long-term relationships with our suppliers and take advantage of purchasing opportunities abroad.

Transformed Decentralized Operating Model.

We have transformed our operating model by decentralizing our operations and reducing our cost base. Decentralization improved our customer service by moving key operational functions such as procurement, credit and operations support to our field operations. From October 2007 through the end of 2009, we reduced annual expenses by $280 million, approximately 61% of which are permanent cost reductions. The cost reductions included a headcount reduction of approximately 1,700, representing 33% of our workforce, and the closure of 14 redundant or underperforming facilities in North America. We have also focused on process improvements in inventory management. Our inventory days improved from an average of 100 days in 2006 to 71 days in 2010. These organizational and operating changes improved our operating structure, working capital management and efficiency. As a result of our initiatives, we believe that we have increased our financial flexibility and have a favorable cost structure compared to many of our peers. We continue to seek out opportunities to improve efficiency and increase cost savings.

Our Strategy

Expand Our Industry Leadership in Selected Products and Diversified Industrial Markets.

We are selective regarding which products, end markets and customers we serve. We believe we are currently the industry leader in stainless steel, and a leader in aluminum and long products. We are constantly evaluating attractive opportunities focused on geographies, end-markets and customers that will allow us to grow the fastest, maximize our margins, leverage our global procurement capabilities and achieve leadership positions. We have increased our focus on higher margin diversified industrial customers that value our customized processing services and are less price sensitive than large volume buyers. We added over 4,000 net new customers since December 31, 2009 across a diverse set of industrial manufacturers.

Additionally, we see significant opportunities to improve our product mix by increasing the amount of long products supplied to our customers. We have established regional product inventory to provide a broad line of

5

Table of Contents

stainless, aluminum, carbon and alloy long products as well as the necessary processing equipment to meet demanding requirements of these customers. For the year ended December 31, 2010, we generated $622 million of revenue from long products, which represents an increase of 33% over 2009.

We seek to grow revenue by continuing to complement our standard products with first stage manufacturing and other processing capabilities that add value for our customers. Additionally, for certain customers we have assumed the management and responsibility for complex supply chains involving numerous suppliers, fabricators and processors. For the year ended December 31, 2010, we generated $283 million of revenue from our fabrication operations, which represents an increase of 58% over 2009.

Drive to Industry Leading Financial Performance.

Continue to Improve Margins. We seek to improve our margins through value-based pricing, superior service, improved product mix and improvements in procurement. We leverage our capabilities to deliver the highest value proposition to our customers by providing a wide breadth of competitive products and services, superior customer service and product quality, and responsiveness.

Continue to Improve Our Operating Efficiencies. We are committed to improving our operating capabilities through continuous business improvements and cost reductions. We have made and continue to make improvements in a variety of areas, including working capital management, operations, delivery and administration expenses.

Focus on Profitable Global Growth.

We are focused on increasing our sales to existing customers, as well as expanding our customer base globally. We expect to continue increasing total revenue through a variety of sales initiatives and by targeting attractive markets.

Continue to Revitalize Sales Talent. Since 2008, we have upgraded our talent and believe we have revitalized our North American sales force, as well as adjusted our incentive plans to be consistent with our profitability goals.

Continue to Expand our Customer Base. We will continue expanding our customer base in diversified industrial end markets with an increased focus on transactional business. We will simultaneously continue to serve and opportunistically seek to expand our larger national and global customers.

Continue Expansion in Attractive Markets. We have also opened facilities in several new regions globally, where we identified a geographic or product market opportunity.

| • | North America. We have expanded and continue to expand in markets where we observe select products, services and end markets are underserved. For example, we have broadened our reach in long and plate products in Texas, California, Utah and Mexico. We continue to pursue sales in the Mexican market through our locations along the U.S.-Mexico border as well as new locations in Mexico. |

| • | China. We believe we are the most established U.S. based service center in China. We have grown our operations in China substantially and continue to enhance the size and quality of the sales talent in our operations, pursue more value-added processing with higher margins, and broaden our product line. Our China operations represented between 4% and 5% of our total revenues in 2010. |

| • | Emerging Markets. We expect to leverage our expertise in North America and experience in China to grow our business in high growth emerging markets, including Asia and Latin America and with particular focus on India and Brazil. |

6

Table of Contents

Continue to Execute Value-Accretive Acquisitions.

The metals service center industry is highly fragmented with the largest player accounting for only 6% of the total market share and a vast majority of our other competitors operating from a single location or being regionally focused. We believe our significant geographic presence provides a strong platform to capitalize on this fragmentation through acquisitions. In the last fifteen months, we completed four strategic acquisitions: Texas Steel Processing Inc.; assets of Cutting Edge Metals Processing Inc.; SFI-Gray Steel Inc. and Singer Steel Company. These acquisitions have provided various opportunities for long-term value creation through the expansion of our product and service capabilities, geographic reach, operational distribution network, end markets diversification, cross-selling opportunities and the addition of transactional-based customers. We continually evaluate potential acquisitions of service center companies that complement our existing customer base and product offerings, and plan to continue pursuing our disciplined approach to such acquisitions.

Maintain Flexible Capital Structure and Strong Liquidity Profile.

Our management team is focused on maintaining a strong level of liquidity that will facilitate our plans to execute our various growth strategies. Throughout the economic downturn, we maintained liquidity in excess of $350 million. Availability under Ryerson’s senior secured $1.35 billion asset-based revolving credit facility (as amended, the “Ryerson Credit Facility”) at March 31, 2011 was approximately $302 million and we had cash-on-hand of $41.9 million. On March 14, 2011, we amended and extended the maturity date of the Ryerson Credit Facility until the earliest of (i) March 2016, (ii) 90 days prior to the scheduled maturity date of Ryerson Inc.’s Floating Rate Senior Secured Notes due November 1, 2014 (the “2014 Notes”), if any 2014 Notes are then outstanding and (iii) 90 days prior to the scheduled maturity date of Ryerson Inc.’s Senior Secured Notes due November 1, 2015 (the “2015 Notes” and together with the 2014 Notes, the ”Ryerson Notes”), if any 2015 Notes are then outstanding. We have no financial maintenance covenants on our debt unless availability under the Ryerson Credit Facility falls below $125 million. In addition, there are no other significant debt maturities until 2014.

Risk Factors

An investment in our common stock is subject to substantial risks and uncertainties. Before investing in our common stock, you should carefully consider the following, as well as the more detailed discussion of risk factors and other information included in this prospectus:

| • | although the financial markets are in a state of recovery, the economic downturn reduced both demand for our products and metals prices; |

| • | the global financial and banking crises have caused a lack of credit availability that has limited and may continue to limit the ability of our customers to purchase our products or to pay us in a timely manner; |

| • | the metals distribution business is very competitive and increased competition could reduce our gross margins and net income; |

| • | we may not be able to sustain the annual cost savings realized as part of our recent cost reduction initiatives; and |

| • | we may not be able to successfully consummate and complete the integration of future acquisitions, and if we are unable to do so, we may be unable to increase our growth rates. |

7

Table of Contents

Recent Developments

Stock Split

On , 2011, our Board of Directors approved a for 1.00 stock split of the Company’s common stock to be effected prior to the closing of this offering. Our consolidated financial statements as of December 31, 2010 and 2009 and for the years ended December 31, 2010, 2009 and 2008 give retroactive effect to the stock split.

The Sponsor

Platinum is a global acquisition firm headquartered in Beverly Hills, California with principal offices in Boston, New York and London. Since its founding in 1995, Platinum has acquired more than 100 businesses in a broad range of market sectors including technology, industrials, logistics, distribution, maintenance and service. Platinum’s current portfolio includes 33 companies in a variety of different industries that serve customers around the world. The firm has a diversified capital base that includes the assets of its portfolio companies, which generated more than $11.0 billion in revenue in 2010, as well as capital commitments from institutional investors in private equity funds managed by the firm. Platinum’s Mergers & Acquisitions & Operations (“M&A&O®”) approach to investing focuses on acquiring businesses that need operational support to realize their full potential and can benefit from Platinum’s expertise in transition, integration and operations.

JT Ryerson, one of our subsidiaries, is party to a corporate advisory services agreement (the “Services Agreement”) with Platinum Advisors, an affiliate of Platinum. In connection with this offering, Platinum Advisors and JT Ryerson intend to terminate the Services Agreement, pursuant to which JT Ryerson will pay Platinum Advisors $ million as consideration for terminating the Services Agreement. We refer to this as the “Services Agreement Termination.” See “Certain Relationships and Related Party Transactions—Services Agreement.”

8

Table of Contents

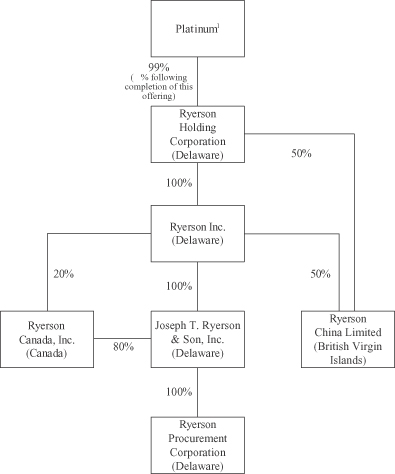

Corporate Structure

Our current corporate structure is made up as follows: Ryerson Holding, the issuer of the common stock offered hereby, owns all of the common stock of Ryerson Inc. and all of the membership interests of Rhombus JV Holdings, LLC. Ryerson Inc. owns, directly or indirectly, all of the common stock of the following entities: JT Ryerson; Ryerson Americas, Inc.; Ryerson International, Inc.; Ryerson Pan-Pacific LLC; J.M. Tull Metals Company, Inc.; RdM Holdings, Inc.; RCJV Holdings, Inc.; Ryerson Procurement Corporation; Ryerson International Material Management Services, Inc.; Ryerson International Trading, Inc.; Ryerson (China) Limited; Ryerson Canada, Inc.; Ryerson Metals de Mexico, S. de R.L. de C.V.; 862809 Ontario, Inc.; Leets Assurance, Ltd.; Integris Metals Mexicana, S.A. de C.V.; Servicios Empresariales Ryerson Tull, S.A. de C.V.; Servicios Corporativos RIM, S.A. de C.V.; and Ryerson Holdings (India) Pte Ltd. Platinum currently owns 99% of the capital stock of Ryerson Holding and will own approximately % of the capital stock following this offering. The chart below illustrates in summary form our material operating subsidiaries.

| 1 | Platinum refers to the following entities: Platinum Equity Capital Partners, L.P.; Platinum Equity Capital Partners-PF, L.P.; Platinum Equity Capital Partners-A, L.P.; Platinum Equity Capital Partners II, L.P.; Platinum Equity Capital Partners-PF II, L.P.; Platinum Equity Capital Partners-A II, L.P.; and Platinum Rhombus Principals, LLC. For additional detail regarding ownership by Platinum, see “Principal and Selling Stockholders.” |

9

Table of Contents

Corporate Information

Ryerson Holding and Ryerson Inc. are each incorporated under the laws of the State of Delaware. Ryerson Holding was formed in July 2007. Our principal executive offices are located at 2621 West 15th Place, Chicago, Illinois 60608. Our telephone number is (773) 762-2121.

On January 1, 2006, Ryerson Inc. changed its name from Ryerson Tull, Inc. to Ryerson Inc. On January 4, 2010, Ryerson Holding changed its name from Rhombus Holding Corporation to Ryerson Holding Corporation. Our website is located at www.ryerson.com. Our website and the information contained on the website or connected thereto will not be deemed to be incorporated into this prospectus and you should not rely on any such information in making your decision whether to purchase our securities.

10

Table of Contents

The Offering

| Issuer |

Ryerson Holding Corporation. |

| Common stock offered by us |

shares. |

| Underwriters’ over-allotment option to purchase additional common stock from the selling stockholders |

Up to shares. |

| Common stock outstanding before this offering |

5,000,000 shares. |

| Common stock to be outstanding immediately following this offering |

shares. |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million. If the over-allotment is exercised, we will not receive any proceeds from the sale of our common stock by the selling stockholders. |

| We intend to use the net proceeds from the sale of shares of our common stock offered pursuant to this prospectus and the net proceeds from the exercise, if any, of the underwriters’ over-allotment option (i) to redeem in full our $483 million aggregate principal amount at maturity 14 1/2% Senior Discount Notes due 2015 (the “Ryerson Holding Notes”), plus pay accrued and unpaid interest and additional interest, if any, up to, but not including, the redemption date, (ii) with respect to 50% of any remaining net proceeds following the redemption described in clause (i), subject to certain exceptions, to make an offer to purchase the 2015 Notes at par, (iii) to repay outstanding indebtedness under the Ryerson Credit Facility and (iv) to pay related fees and expenses. See “Use of Proceeds.” |

| This prospectus is not an offer to purchase, a solicitation of an offer to purchase or a solicitation of a consent with respect to the Ryerson Holding Notes or the 2015 Notes. |

| Risk factors |

See “Risk Factors” on page 16 of this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

| Dividend policy |

We do not anticipate declaring or paying any regular cash dividends on our common stock in the foreseeable future. Any payment of cash dividends on our common stock in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, earnings, capital requirements, financial condition, future prospects, contractual restrictions, including under the Ryerson Credit Facility and the Ryerson Notes, and other factors deemed relevant by our Board of Directors. |

11

Table of Contents

| Proposed New York Stock Exchange symbol |

“RYI.” |

The number of shares to be outstanding after this offering is based on 5,000,000 shares of common stock outstanding immediately before this offering and the shares of common stock being sold by us in this offering, and assumes no exercise by the underwriters of their option to purchase shares of our common stock in this offering to cover over-allotments, if any. The number of shares to be outstanding after this offering excludes shares of common stock reserved for future grants under our stock incentive plan assuming such plan is adopted in connection with this offering.

Unless we specifically state otherwise, the information in this prospectus assumes:

| • | an initial public offering price of $ per share, the mid-point of the offering range set forth on the cover page of this prospectus; |

| • | the underwriters do not exercise their over-allotment option; and |

| • | a for 1.00 stock split that will occur prior to the closing of this offering. |

12

Table of Contents

Summary Historical Consolidated Financial and Other Data

The following table presents our summary historical consolidated financial data, as of the dates and for the periods indicated. Our summary historical consolidated statements of operations data for the years ended December 31, 2008, 2009 and 2010 and the summary historical balance sheet data as of December 31, 2009 and 2010 have been derived from our audited consolidated financial statements included elsewhere in this prospectus.

You should read the summary financial and other data set forth below along with the sections in this prospectus entitled “Use of Proceeds,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and related notes included elsewhere in this prospectus. The share and per share information presented below has been adjusted to give effect to the for 1.00 stock split that will occur immediately prior to the closing of this offering.

| Year Ended December 31, | Three Months Ended March 31, | |||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| ($ in millions) | ||||||||||||||||||||

| Statements of Operations Data: |

||||||||||||||||||||

| Net sales |

$ | 5,309.8 | $ | 3,066.1 | $ | 3,895.5 | $ | 871.5 | $ | 1,187.0 | ||||||||||

| Cost of materials sold |

4,596.9 | 2,610.0 | 3,355.7 | 737.7 | 1,030.3 | |||||||||||||||

| Gross profit (1) |

712.9 | 456.1 | 539.8 | 133.8 | 156.7 | |||||||||||||||

| Warehousing, selling, general and administrative |

586.1 | 483.8 | 506.9 | 118.8 | 135.2 | |||||||||||||||

| Restructuring and other charges |

— | — | 12.0 | — | 0.3 | |||||||||||||||

| Gain on insurance settlement |

— | — | (2.6 | ) | — | — | ||||||||||||||

| Gain on sale of assets |

— | (3.3 | ) | — | — | — | ||||||||||||||

| Impairment charge on fixed assets |

— | 19.3 | 1.4 | — | — | |||||||||||||||

| Pension and other postretirement benefits curtailment (gain) loss |

— | (2.0 | ) | 2.0 | — | — | ||||||||||||||

| Operating profit (loss) |

126.8 | (41.7 | ) | 20.1 | 15.0 | 21.2 | ||||||||||||||

| Other income and (expense), net (2) |

29.2 | (10.1 | ) | (3.2 | ) | (2.5 | ) | 5.7 | ||||||||||||

| Interest and other expense on debt |

(109.9 | ) | (72.9 | ) | (107.5 | ) | (24.7 | ) | (29.7 | ) | ||||||||||

| Income (loss) before income taxes |

46.1 | (124.7 | ) | (90.6 | ) | (12.2 | ) | (2.8 | ) | |||||||||||

| Provision (benefit) for income taxes (3) |

14.8 | 67.5 | 13.1 | 2.6 | (1.2 | ) | ||||||||||||||

| Net income (loss) |

31.3 | (192.2 | ) | (103.7 | ) | (14.8 | ) | (1.6 | ) | |||||||||||

| Less: Net income (loss) attributable to noncontrolling interest |

(1.2 | ) | (1.5 | ) | 0.3 | (0.1 | ) | 0.1 | ||||||||||||

| Net income (loss) attributable to Ryerson Holding Corporation |

$ | 32.5 | $ | (190.7 | ) | $ | (104.0 | ) | $ | (14.7 | ) | $ | (1.7 | ) | ||||||

13

Table of Contents

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| ($ in millions, except per share data) | ||||||||||||||||||||

| Earnings (loss) per share of common stock: |

||||||||||||||||||||

| Basic earnings (loss) per share |

$ | 6.50 | $ | (38.14 | ) | $ | (20.80 | ) | $ | (2.94 | ) | $ | (0.34 | ) | ||||||

| Diluted earnings (loss) per share |

$ | 6.50 | $ | (38.14 | ) | $ | (20.80 | ) | $ | (2.94 | ) | $ | (0.34 | ) | ||||||

| Weighted average shares outstanding — Basic (in millions) |

5.0 | 5.0 | 5.0 | 5.0 | 5.0 | |||||||||||||||

| Weighted average shares outstanding — Diluted (in millions) |

5.0 | 5.0 | 5.0 | 5.0 | 5.0 | |||||||||||||||

| Pro forma — basic and diluted earnings (loss) per share of common stock — adjusted for dividends (4) |

$ | $ | ||||||||||||||||||

| Pro forma — weighted average shares outstanding — adjusted for dividends (in millions) (4) |

||||||||||||||||||||

| Balance Sheet Data (at period end): |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 130.4 | $ | 115.0 | $ | 62.6 | $ | 121.6 | $ | 41.9 | ||||||||||

| Restricted cash |

7.0 | 19.5 | 15.6 | 12.8 | 15.1 | |||||||||||||||

| Inventory |

819.5 | 601.7 | 783.4 | 684.0 | 856.7 | |||||||||||||||

| Working capital |

1,084.2 | 750.4 | 858.8 | 805.0 | 916.4 | |||||||||||||||

| Property, plant and equipment, net |

547.7 | 477.5 | 479.2 | 476.1 | 484.4 | |||||||||||||||

| Total assets |

2,281.9 | 1,775.8 | 2,053.5 | 1,983.6 | 2,269.2 | |||||||||||||||

| Long-term debt, including current maturities |

1,030.3 | 754.2 | 1,211.3 | 1,026.7 | 1,307.7 | |||||||||||||||

| Other Financial Data: |

||||||||||||||||||||

| Cash flows provided by (used in) operations |

$ | 280.5 | $ | 284.9 | $ | (198.7 | ) | $ | (51.9 | ) | $ | (103.8 | ) | |||||||

| Cash flows provided by (used in) investing activities |

19.3 | 32.1 | (44.4 | ) | 2.0 | (15.7 | ) | |||||||||||||

| Cash flows provided by (used in) financing activities |

(197.0 | ) | (342.4 | ) | 185.1 | 54.0 | 98.4 | |||||||||||||

| Capital expenditures |

30.1 | 22.8 | 27.0 | 5.3 | 6.4 | |||||||||||||||

| Depreciation and amortization |

37.6 | 36.9 | 38.4 | 9.1 | 10.4 | |||||||||||||||

| EBITDA (5) |

194.8 | (13.4 | ) | 55.0 | 21.7 | 37.2 | ||||||||||||||

| Adjusted EBITDA (5) |

185.9 | 37.5 | 81.1 | 28.2 | 33.7 | |||||||||||||||

| Adjusted EBITDA, excluding LIFO (5) |

277.4 | (136.7 | ) | 133.5 | 40.7 | 67.0 | ||||||||||||||

| Ratio of Tangible Assets to Total Net Debt (6) |

2.1x | 2.3x | 1.5x | 1.8x | 1.6x | |||||||||||||||

| Volume and Per Ton Data: |

||||||||||||||||||||

| Tons shipped (000) |

2,505 | 1,881 | 2,252 | 527 | 645 | |||||||||||||||

| Average number of employees |

4,663 | 4,192 | 4,126 | 4,099 | 4,178 | |||||||||||||||

| Tons shipped per employee |

537 | 449 | 546 | 129 | 154 | |||||||||||||||

| Average selling price per ton |

$ | 2,120 | $ | 1,630 | $ | 1,730 | $ | 1,654 | $ | 1,840 | ||||||||||

| Gross profit per ton |

285 | 242 | 240 | 254 | 243 | |||||||||||||||

| Operating profit (loss) per ton |

51 | (22 | ) | 9 | 28 | 33 | ||||||||||||||

| (1) | The year ended December 31, 2008 includes a LIFO liquidation gain of $15.6 million, or $9.9 million after-tax. |

| (2) | The year ended December 31, 2008 included a $18.2 million gain on the retirement of debt as well as a $6.7 million gain on the sale of corporate bonds. The year ended December 31, 2009 included $11.8 million of foreign exchange losses related to short-term loans from our Canadian operations, offset by the recognition of a $2.7 million gain on the retirement of debt. The year ended December 31, 2010 included $2.6 million of foreign exchange losses related to the repayment of a long-term loan to our Canadian operations. The three months ended March 31, 2011 included a $6.3 million gain on bargain purchase related to our Singer Steel acquisition. |

| (3) | The year ended December 31, 2009 includes a $92.7 million tax expense related to the establishment of a valuation allowance against the Company’s US deferred tax assets and a $14.5 million income tax charge on the sale of our joint venture in India. |

14

Table of Contents

| (4) | Pro forma earnings per share – as adjusted for dividends in excess of earnings includes million and million additional shares that represent, in accordance with Staff Accounting Bulletin Topic 1.B.3, the number of shares sold in this offering, the proceeds of which are assumed for purposes of this calculation to have been used to fund a termination payment to the principal stockholder in excess of earnings during the year ended December 31, 2010 and the three months ended March 31, 2011, respectively. The calculation assumes an initial offering price of $ per share, the mid-point of the price range on the cover page of this prospectus. These assumed number of additional shares issued to fund the termination payment in excess of earnings for the year ended December 31, 2010 and the three months ended March 31, 2011 are as follows: |

| December 31, 2010 |

March 31, 2011 |

|||||||

| Dividends paid: |

||||||||

| During the period (in millions) |

$ | 213.8 | $ | — | ||||

| Termination payment to principal stockholder (in millions) |

$ | $ | ||||||

| Dividends in excess of earnings (in millions) |

$ | $ | ||||||

| Assumed initial offering price per share |

$ | $ | ||||||

| Assumed additional number of shares issued to fund dividends in excess of earnings (in millions) |

||||||||

| (5) | EBITDA, for the period presented below, represents net income before interest and other expense on debt, provision for income taxes, depreciation and amortization. Adjusted EBITDA gives further effect to, among other things, gain on the sale of assets, reorganization expenses and the payment of management fees. We believe that EBITDA and Adjusted EBITDA provide additional information for measuring our performance and are measures frequently used by securities analysts and investors. EBITDA and Adjusted EBITDA do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA nor Adjusted EBITDA is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. Our definitions of EBITDA and Adjusted EBITDA may differ from that of other companies. Set forth below is the reconciliation of net income to EBITDA, as further adjusted to Adjusted EBITDA and Adjusted EBITDA, excluding LIFO. |

| Year Ended December 31, | Three Months Ended March 31, |

|||||||||||||||||||

| 2008 | 2009 | 2010 | 2010 | 2011 | ||||||||||||||||

| ($ in millions) | ||||||||||||||||||||

| Net income (loss) attributable to Ryerson Holding |

$ | 32.5 | $ | (190.7 | ) | $ | (104.0 | ) | $ | (14.7 | ) | $ | (1.7 | ) | ||||||

| Interest and other expense on debt |

109.9 | 72.9 | 107.5 | 24.7 | 29.7 | |||||||||||||||

| Provision (benefit) for income taxes |

14.8 | 67.5 | 13.1 | 2.6 | (1.2 | ) | ||||||||||||||

| Depreciation and amortization |

37.6 | 36.9 | 38.4 | 9.1 | 10.4 | |||||||||||||||

| EBITDA |

$ | 194.8 | $ | (13.4 | ) | $ | 55.0 | $ | 21.7 | $ | 37.2 | |||||||||

| Gain on sale of assets |

— | (3.3 | ) | — | — | — | ||||||||||||||

| Reorganization |

15.3 | 19.9 | 19.1 | 2.2 | 0.9 | |||||||||||||||

| Advisory service fee |

5.0 | 5.0 | 5.0 | 1.3 | 1.3 | |||||||||||||||

| Foreign currency transaction (gains) losses |

(1.0 | ) | 14.8 | 2.7 | 2.7 | 0.8 | ||||||||||||||

| Debt retirement gains |

(18.2 | ) | (2.7 | ) | (2.6 | ) | — | — | ||||||||||||

| Gain on bond investment sale |

(6.7 | ) | — | — | — | — | ||||||||||||||

| Impairment charge on fixed assets |

— | 19.3 | 1.4 | 0.5 | — | |||||||||||||||

| Gain on bargain purchase |

— | — | — | — | (6.3 | ) | ||||||||||||||

| Other adjustments |

(3.3 | ) | (2.1 | ) | 0.5 | (0.2 | ) | (0.2 | ) | |||||||||||

| Adjusted EBITDA |

185.9 | 37.5 | 81.1 | 28.2 | 33.7 | |||||||||||||||

| LIFO expense (income) |

91.5 | (174.2 | ) | 52.4 | 12.5 | 33.3 | ||||||||||||||

| Adjusted EBITDA, excluding LIFO expense (income) |

$ | 277.4 | $ | (136.7 | ) | $ | 133.5 | $ | 40.7 | $ | 67.0 | |||||||||

| (6) | Tangible Assets are defined as accounts receivable, inventories, assets held for sale and property, plant and equipment, net of any reserves and of accumulated depreciation. |

15

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with the other information contained in this prospectus, before making your decision to invest in shares of our common stock. We cannot assure you that any of the events discussed in the risk factors below will not occur. These risks could have a material and adverse impact on our business, results of operations, financial condition and cash flows. If that were to happen, the trading price of our common stock could decline, and you could lose all or part of your investment.

Risks Relating to Our Business

We service industries that are highly cyclical, and any downturn in our customers’ industries could reduce our sales and profitability. The economic downturn has reduced demand for our products and may continue to reduce demand until an economic recovery.

Many of our products are sold to industries that experience significant fluctuations in demand based on economic conditions, energy prices, seasonality, consumer demand and other factors beyond our control. These industries include manufacturing, electrical products and transportation. We do not expect the cyclical nature of our industry to change.

The U.S. economy entered an economic recession in December 2007, which spread to many global markets in 2008 and 2009 and affected Ryerson and other metals service centers. Beginning in late 2008 and continuing through 2010, the metals industry, including Ryerson and other service centers, felt additional effects of the global economic crisis and recovery thereto and the impact of the credit market disruption. These events contributed to a rapid decline in both demand for our products and pricing levels for those products. The Company has implemented a number of actions to conserve cash, reduce costs and strengthen its competitiveness, including curtailing non-critical capital expenditures, initiating headcount reductions and reductions of certain employee benefits, among other actions. However, there can be no assurance that these actions, or any others that the Company may take in response to further deterioration in economic and financial conditions, will be sufficient.

The global financial and banking crises have caused a lack of credit availability that has limited and may continue to limit the ability of our customers to purchase our products or to pay us in a timely manner.

In climates of global financial and banking crises, such as those from which we are currently recovering, the ability of our customers to maintain credit availability has become more challenging. In particular, the financial viability of many of our customers is threatened, which may impact their ability to pay us amounts due, further affecting our financial condition and results of operations.

The metals distribution business is very competitive and increased competition could reduce our gross margins and net income.

The principal markets that we serve are highly competitive. The metals distribution industry is fragmented and competitive, consisting of a large number of small companies and a few relatively large companies. Competition is based principally on price, service, quality, production capabilities, inventory availability and timely delivery. Competition in the various markets in which we participate comes from companies of various sizes, some of which have greater financial resources than we have and some of which have more established brand names in the local markets served by us. Increased competition could force us to lower our prices or to offer increased services at a higher cost, which could reduce our profitability.

16

Table of Contents

The economic downturn has reduced metals prices. Though prices have risen since the onset of the economic downturn, we cannot assure you that prices will continue to rise. Changing metals prices may have a significant impact on our liquidity, net sales, gross margins, operating income and net income.

The metals industry as a whole is cyclical and, at times, pricing and availability of metal can be volatile due to numerous factors beyond our control, including general domestic and international economic conditions, labor costs, sales levels, competition, levels of inventory held by other metals service centers, consolidation of metals producers, higher raw material costs for the producers of metals, import duties and tariffs and currency exchange rates. This volatility can significantly affect the availability and cost of materials for us.

We, like many other metals service centers, maintain substantial inventories of metal to accommodate the short lead times and just-in-time delivery requirements of our customers. Accordingly, we purchase metals in an effort to maintain our inventory at levels that we believe to be appropriate to satisfy the anticipated needs of our customers based upon historic buying practices, contracts with customers and market conditions. When metals prices decline, as they did in 2008 and 2009, customer demands for lower prices and our competitors’ responses to those demands could result in lower sale prices and, consequently, lower margins as we use existing metals inventory. Notwithstanding recent price increases, metals prices may decline in 2011, and declines in those prices or further reductions in sales volumes could adversely impact our ability to maintain our liquidity and to remain in compliance with certain financial covenants under the Ryerson Credit Facility, as well as result in us incurring inventory or goodwill impairment charges. Changing metals prices therefore could significantly impact our liquidity, net sales, gross margins, operating income and net income.

We have a substantial amount of indebtedness, which could adversely affect our financial position and prevent us from fulfilling our financial obligations.

We currently have a substantial amount of indebtedness and may incur additional indebtedness in the future. As of March 31, 2011, after giving effect to this offering and the application of net proceeds from this offering, our total indebtedness would have been approximately $ million and we would have had approximately $ million of unused capacity under the Ryerson Credit Facility. Our substantial indebtedness may:

| • | make it difficult for us to satisfy our financial obligations, including making scheduled principal and interest payments on the notes and our other indebtedness; |

| • | limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions and general corporate and other purposes; |

| • | limit our ability to use our cash flow or obtain additional financing for future working capital, capital expenditures, acquisitions or other general corporate purposes; |

| • | require us to use a substantial portion of our cash flow from operations to make debt service payments; |

| • | limit our flexibility to plan for, or react to, changes in our business and industry; |

| • | place us at a competitive disadvantage compared to our less leveraged competitors; and |

| • | increase our vulnerability to the impact of adverse economic and industry conditions. |

We may be able to incur substantial additional indebtedness in the future. The terms of the Ryerson Credit Facility and the indentures governing our outstanding notes restrict but do not prohibit us from doing so. If new indebtedness is added to our current debt levels, the related risks that we now face could intensify.

17

Table of Contents

The covenants in the Ryerson Credit Facility and the indentures governing our notes impose, and covenants contained in agreements governing indebtedness that we incur in the future may impose, restrictions that may limit our operating and financial flexibility.

The Ryerson Credit Facility and the indentures governing our notes contain a number of significant restrictions and covenants that limit our ability and the ability of our restricted subsidiaries, including Ryerson Inc., to:

| • | incur additional debt; |

| • | pay dividends on our capital stock or repurchase our capital stock; |

| • | make certain investments or other restricted payments; |

| • | create liens or use assets as security in other transactions; |

| • | merge, consolidate or transfer or dispose of substantially all of our assets; and |

| • | engage in transactions with affiliates. |

The terms of the Ryerson Credit Facility require that, in the event availability under the facility declines to a certain level, we maintain a minimum fixed charge coverage ratio at the end of each fiscal quarter. Total credit availability is limited by the amount of eligible accounts receivable and inventory pledged as collateral under the agreement insofar as the Company is subject to a borrowing base comprised of the aggregate of these two amounts, less applicable reserves. As of March 31, 2011, total credit availability was $302 million based upon eligible accounts receivable and inventory pledged as collateral.

Additionally, subject to certain exceptions, the indenture governing Ryerson’s notes restricts Ryerson’s ability to pay us dividends to the extent of 50% of future net income, once prior losses are offset. Future net income is defined in the indenture governing the notes as net income adjusted for, among other things, the inclusion of dividends from joint ventures actually received in cash by Ryerson, and the exclusion of: (i) all extraordinary gains or losses; (ii) a certain portion of net income allocable to minority interest in unconsolidated persons or investments in unrestricted subsidiaries; (iii) gains or losses in respect of any asset sale on an after tax basis; (iv) the net income from any disposed or discontinued operations or any net gains or losses on disposed or discontinued operations, on an after-tax basis; (v) any gain or loss realized as a result of the cumulative effect of a change in accounting principles; (vi) any fees and expenses paid in connection with the issuance of Ryerson’s notes; (vii) non-cash compensation expense incurred with any issuance of equity interest to an employee; and (viii) any net after-tax gains or losses attributable to the early extinguishment of debt. Our future indebtedness may contain covenants more restrictive in certain respects than the restrictions contained in the Ryerson Credit Facility and the indentures governing our notes. Operating results below current levels or other adverse factors, including a significant increase in interest rates, could result in our being unable to comply with financial covenants that are contained in the Ryerson Credit Facility or that may be contained in any future indebtedness. In addition, complying with these covenants may also cause us to take actions that are not favorable to holders of our notes and may make it more difficult for us to successfully execute our business strategy and compete against companies that are not subject to such restrictions.

We may not be able to generate sufficient cash to service all of our indebtedness.

Our ability to make payments on our indebtedness depends on our ability to generate cash in the future. Our outstanding notes, the Ryerson Credit Facility and our other outstanding indebtedness are expected to account for significant cash interest expenses. Accordingly, we will have to generate significant cash flows from operations to meet our debt service requirements. If we do not generate sufficient cash flow to meet our debt service and working capital requirements, we may be required to sell assets, seek additional capital, reduce capital expenditures, restructure or refinance all or a portion of our existing indebtedness, or seek additional financing. Moreover, insufficient cash flow may make it more difficult for us to obtain financing on terms that are

18

Table of Contents

acceptable to us, or at all. Furthermore, Platinum has no obligation to provide us with debt or equity financing and we therefore may be unable to generate sufficient cash to service all of our indebtedness.

Because a substantial portion of our indebtedness bears interest at rates that fluctuate with changes in certain prevailing short-term interest rates, we are vulnerable to interest rate increases.

A substantial portion of our indebtedness, including the Ryerson Credit Facility and the 2014 Notes, bears interest at rates that fluctuate with changes in certain short-term prevailing interest rates. As of March 31, 2011, Ryerson Holding’s subsidiaries had approximately $102.9 million of floating rate debt under the 2014 Notes and approximately $533.9 million of outstanding borrowings under the Ryerson Credit Facility, with an additional $302 million available for borrowing under such facility. Assuming a consistent level of debt, a 100 basis point change in the interest rate on our floating rate debt effective from the beginning of the year would increase or decrease our fiscal 2011 interest expense under the Ryerson Credit Facility and the 2014 Notes by approximately $5.9 million on an annual basis. We use derivative financial instruments to manage a portion of the potential impact of our interest rate risk. To some extent, derivative financial instruments can protect against increases in interest rates, but they do not provide complete protection over the long term. If interest rates increase dramatically, we could be unable to service our debt.

We may not be able to successfully consummate and complete the integration of future acquisitions, and if we are unable to do so, we may be unable to increase our growth rates.

We have grown through a combination of internal expansion, acquisitions and joint ventures. We intend to continue to grow through selective acquisitions, but we may not be able to identify appropriate acquisition candidates, obtain financing on satisfactory terms, consummate acquisitions or integrate acquired businesses effectively and profitably into our existing operations. Restrictions contained in the agreements governing our notes, the Ryerson Credit Facility or our other existing or future debt may also inhibit our ability to make certain investments, including acquisitions and participations in joint ventures.

Our future success will depend on our ability to complete the integration of these future acquisitions successfully into our operations. After any acquisition, customers may choose to diversify their supply chains to reduce reliance on a single supplier for a portion of their metals needs. We may not be able to retain all of our and an acquisition’s customers, which may adversely affect our business and sales. Integrating acquisitions, particularly large acquisitions, requires us to enhance our operational and financial systems and employ additional qualified personnel, management and financial resources, and may adversely affect our business by diverting management away from day-to-day operations. Further, failure to successfully integrate acquisitions may adversely affect our profitability by creating significant operating inefficiencies that could increase our operating expenses as a percentage of sales and reduce our operating income. In addition, we may not realize expected cost savings from acquisitions, which may also adversely affect our profitability.

We may not be able to retain or expand our customer base if the North American manufacturing industry continues to erode through moving offshore or through acquisition and merger or consolidation activity in our customers’ industries.

Our customer base primarily includes manufacturing and industrial firms. Some of our customers operate in industries that are undergoing consolidation through acquisition and merger activity; some are considering or have considered relocating production operations overseas or outsourcing particular functions overseas; and some customers have closed as they were unable to compete successfully with overseas competitors. Our facilities are predominately located in the United States and Canada. To the extent that our customers cease U.S. operations, relocate or move operations overseas to regions in which we do not have a presence, we could lose their business. Acquirers of manufacturing and industrial firms may have suppliers of choice that do not include us, which could impact our customer base and market share.

19

Table of Contents

Certain of our operations are located outside of the United States, which subjects us to risks associated with international activities.

Certain of our operations are located outside of the United States, primarily in Canada, Mexico and China. We are subject to the Foreign Corrupt Practices Act (“FCPA”), which generally prohibits U.S. companies and their intermediaries from making corrupt payments or otherwise corruptly giving any other thing of value to foreign officials for the purpose of obtaining or keeping business or otherwise obtaining favorable treatment, and requires companies to maintain adequate record-keeping and internal accounting practices. The FCPA applies to covered companies, individual directors, officers, employees and agents. Under the FCPA, U.S. companies may be held liable for actions taken by strategic or local partners or representatives. If we or our intermediaries fail to comply with the requirements of the FCPA, governmental authorities in the United States could seek to impose civil and/or criminal penalties.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities, particularly with regards to the land our facilities are located on.

The Chinese government has exercised and continues to exercise substantial control over the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and other matters. We believe that our operations in China are in material compliance with all applicable legal and regulatory requirements. However, the central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Moreover, the Chinese court system does not provide the same property and contract right guarantees as do courts in the United States and, accordingly, disputes may be protracted and resolution of claims may result in significant economic loss.

Additionally, although in recent years the Chinese government has implemented measures emphasizing the utilization of market forces for economic reform, there is no private ownership of land in China and all land ownership is held by the government of China, its agencies, and collectives, which issue land use rights that are generally renewable. We lease the land where our Chinese facilities are located from the Chinese government. Although we believe our relationship with the Chinese government is sound, if the Chinese government decided to terminate our land use rights agreements, our assets could become impaired and our ability to meet customer orders could be impacted.

Operating results may experience seasonal fluctuations.

A portion of our customers experience seasonal slowdowns. Our sales in the months of July, November and December traditionally have been lower than in other months because of a reduced number of shipping days and holiday or vacation closures for some customers. Consequently, our sales in the first two quarters of the year are usually higher than in the third and fourth quarters.

Damage to our information technology infrastructure could harm our business.

The unavailability of any of our computer-based systems for any significant period of time could have a material adverse effect on our operations. In particular, our ability to manage inventory levels successfully largely depends on the efficient operation of our computer hardware and software systems. We use management information systems to track inventory information at individual facilities, communicate customer information and aggregate daily sales, margin and promotional information. Difficulties associated with upgrades, installations of major software or hardware, and integration with new systems could have a material adverse effect on results of operations. We will be required to expend substantial resources to integrate our information systems with the systems of companies we have acquired. The integration of these systems may disrupt our business or lead to operating inefficiencies. In addition, these systems are vulnerable to, among other things, damage or interruption

20

Table of Contents

from fire, flood, tornado and other natural disasters, power loss, computer system and network failures, operator negligence, physical and electronic loss of data, or security breaches and computer viruses.

Any significant work stoppages can harm our business.

As of March 31, 2011, we employed approximately 3,700 persons in North America and 500 persons in China. Our North American workforce was comprised of approximately 1,900 office employees and approximately 1,800 plant employees. Forty percent of our plant employees were members of various unions, including the United Steel Workers and the International Brotherhood of Teamsters unions. Our relationship with the various unions has generally been good. There has been one work stoppage over the last five years.

Six collective bargaining agreements expired in 2008, a year in which we reached agreement on the renewal of four contracts covering 53 employees. Two contracts covering 52 employees were extended into 2009. We reached agreement in 2009 on one of the extended contracts covering 45 employees and the single remaining contract from 2008, covering approximately five persons, remains on an extension. In addition, negotiations over a new collective bargaining agreement at a newly certified location employing four persons began in late 2008 and concluded in 2009. Nine contracts covering 339 persons were scheduled to expire in 2009. We reached agreement on the renewal of eight contracts covering approximately 258 persons and one contract covering approximately 89 persons was extended. During 2010, the parties to this extended contract covering two Chicago area facilities agreed to sever the bargaining unit between the two facilities and bargaining was concluded for one facility, which covers approximately 59 employees. This new contract expires on December 31, 2011. The other facility’s contract, which covers approximately 30 employees, remains on extension. Seven contracts covering approximately 85 persons were scheduled to expire in 2010. We reached agreement on the renewal of all seven contracts. Ten contracts covering approximately 312 persons are scheduled to expire in 2011. One of these contracts, which covers 59 employees, will not be renewed due to facility closure. We may not be able to negotiate extensions of these agreements or new agreements prior to their expiration date. As a result, we may experience additional labor disruptions in the future.

Certain employee retirement benefit plans are underfunded and the actual cost of those benefits could exceed current estimates, which would require us to fund the shortfall.

As of December 31, 2010, our pension plan had an unfunded liability of $306 million. Our actual costs for benefits required to be paid may exceed those projected and future actuarial assessments to the extent that those costs exceed the current assessment. Under those circumstances, the adjustments required to be made to our recorded liability for these benefits could have a material adverse effect on our results of operations and financial condition and cash payments to fund these plans could have a material adverse effect on our cash flows. We may be required to make substantial future contributions to improve the plan’s funded status.

Future funding for postretirement employee benefits other than pensions also may require substantial payments from current cash flow.

We provide postretirement life insurance and medical benefits to eligible retired employees. Our unfunded postretirement benefit obligation as of December 31, 2010 was $176 million. Our actual costs for benefits required to be paid may exceed those projected and future actuarial assessments to the extent that those costs exceed the current assessment. Under those circumstances, adjustments will be required to be made to our recorded liability for these benefits.

Any prolonged disruption of our processing centers could harm our business.

We have dedicated processing centers that permit us to produce standardized products in large volumes while maintaining low operating costs. We may suffer prolonged disruption in the operations of any of these facilities, whether due to labor or technical difficulties, destruction or damage to any of the facilities or otherwise.

21

Table of Contents

If we are unable to retain and attract management and key personnel, it may adversely affect our business.

We believe that our success is due, in part, to our experienced management team. Losing the services of one or more members of our management team could adversely affect our business and possibly prevent us from improving our operational, financial and information management systems and controls. In the future, we may need to retain and hire additional qualified sales, marketing, administrative, operating and technical personnel, and to train and manage new personnel. Our ability to implement our business plan is dependent on our ability to retain and hire a large number of qualified employees each year.

Our existing international operations and potential joint ventures may cause us to incur costs and risks that may distract management from effectively operating our North American business, and such operations or joint ventures may not be profitable.

We maintain foreign operations in Canada, China and Mexico. International operations are subject to certain risks inherent in conducting business in, and with, foreign countries, including price controls, exchange controls, export controls, economic sanctions, duties, tariffs, limitations on participation in local enterprises, nationalization, expropriation and other governmental action, and changes in currency exchange rates. While we believe that our current arrangements with local partners provide us with experienced business partners in foreign countries, events or issues, including disagreements with our partners, may occur that require attention of our senior executives and may result in expenses or losses that erode the profitability of our foreign operations or cause our capital investments abroad to be unprofitable.

Lead time and the cost of our products could increase if we were to lose one of our primary suppliers.