Attached files

| file | filename |

|---|---|

| 8-K - CHINA FUND INC | v226549_8k.htm |

|

THE CHINA FUND, INC. (CHN)

MONTHLY INSIGHT

|

|

AT MAY 31, 2011

|

IN BRIEF

|

|

|

Net asset value per share

|

US$34.16

|

|

Market price

|

US$30.7

|

|

Premium/(discount)

|

(10.22%)

|

|

Fund size

|

US$778.3m

|

|

Source: State Street Bank and Trust Company.

|

|

|

At May 31, 2011

|

US$ return

|

|||

|

China Fund

NAV

|

MSCI Golden

Dragon*

|

|||

|

%

|

%

|

|||

|

One month

|

(3.0

|

)

|

0.2

|

|

|

Year to date

|

(3.3

|

) |

3.4

|

|

|

One year

|

25.1

|

28.0

|

||

|

Three years % pa

|

8.3

|

3.0

|

|

|

|

Past performance is not a guide to future returns.

Source: State Street Bank and Trust Company. NAV performance.

*Source for index data: MSCI.

|

||||

SHANGHAI TEAM

The Martin Currie Shanghai team

MANAGER’S COMMENTARY

In Shanghai today it is raining cats and dogs. As we have so far endured the driest year since 1873, this is a good thing. Stockmarket investors have developed an unusual interest in the weather as the drought in the lower Yangzi area reversed perceptions that the summer would bring a decline in food prices, easing inflationary pressure in the process. At the same time, the China bears latched onto signs of slowing growth (weaker PMI, decelerating import growth) as apparent proof that China was facing a ‘hard landing' (though this seems rather at odds with last week’s ‘China is overheating’ story). Worries about power shortages during the summer, caused by government suppression of electricity prices, added to the bearish mix. The reality, as we have witnessed in our constant company visiting around China, is that growth remains robust and somewhat higher than the government’s 7% target.

One additional problem, especially in the A-share market, has been the huge and constant supply of new equity. The government’s announcement of progress on the international board in Shanghai (the listing of foreign blue-chips in renminbi) was seen as a further draw on liquidity. A couple of state-owned enterprises, including Petrochina and Shenhua, have announced plans to buy back stock. A government announcement to curtail this, especially if it coincides with signs of a levelling-off of inflation late in the summer, could spark a sharp rally. Amid the bearishness, we should not lose sight of the strong liquidity flows resulting from negative real rates (try walking into a smart restaurant in Hong Kong or attending a Chinese fine-art auction...).

Small-cap stocks were harshly dealt with, especially those listed in New York, as accounting scandals, both real and imagined, caused a widespread sell-off. Although the quality of these smaller offshore listings is often questionable, there are some gems now available at bargain prices. We added to our holding in control-systems engineer Hollysys. The Fund’s worst-performing stock in May was Chaoda, which fell after a magazine article alleging accounting irregularities. We have now held this largescale vegetable producer for several years, and have discovered nothing untoward during our visits, including one last month. The stock now trades on less than 4 times prospective earnings, so we continue to hold.

In Taiwan, we are now well into the next presidential campaign, judging by the steady flow of government announcements designed to boost the economy. On June 1, 2011 a luxury tax to restrain property speculation came into force. But at the other end of the market, first-time buyers are to be helped with loan subsidies, lower mortgage rates and a higher loan ceiling. The Taiwanese government aims to build 10,000 units of affordable apartments for couples who have no property and a household income of less than NT$1.6 million per annum. From the end of June, Taiwan will open its doors for the first time to individual Chinese tourists. To meet the increasing demand, direct flights across the straits will increase from 370 per week to 500.

Taiwan’s GDP growth in quarter one was 6.6%, prompting the government to revise up its estimate for the whole year to over 5%. CPI was still only 1.3% in April, much lower than the mainland’s 5.3%; a number of companies have commented on the declining cost advantage of production in China. April’s unemployment rate dropped to 4.29%, its lowest in 31 months. And on July 1, 2011 the salary of government employees will rise by 3%.

Chris Ruffle, Martin Currie Inc*

* Martin Currie Ltd and Heartland Capital Management Ltd (‘HCML’) have established MC China Ltd (‘MCCL’), as a joint venture company, to provide investment advisory services to the range of China investment products managed by Martin Currie and its affiliates.

HCML has seconded both Chris Ruffle and Shifeng Ke to Martin Currie, Inc., and its affiliates, on a full-time basis.

MONTHLY INSIGHT

INVESTMENT STRATEGY

The Fund is 98.6% invested with holdings in 59 companies. Our weighting in A-shares is now 16.6% and in Taiwan 23.3%. Our direct portfolio now represents only 4.9% of the portfolio, and this should fall further as we expect to receive cash back from two investments in the next month.

We made little change to the portfolio in May, topping up A-share holdings Tangshan Jidong Cement and baijiu (white liquor) maker Wuliangye Yiban, as QFI quota became available. We added the unloved China Mobile, now cheap with a decent dividend yield, as a temporary home for cash, expecting it to be an early candidate for the international board in Shanghai. Our only sale was of Taiwanese distributor Synnex, which is looking rather expensive relative to other opportunities.

Chris Ruffle, Martin Currie Inc*

|

FUND DETAILS

|

|

Market cap

|

US$698.7m

|

|

Shares outstanding

|

22,781,762

|

|

Exchange listed

|

NYSE

|

|

Listing date

|

July 10, 1992

|

|

Listing and direct investment manager

|

Martin Currie Inc

|

|

Source: State Street Bank and Trust Company.

|

ASSET ALLOCATION

Source: State Street Bank and Trust Company

|

INDUSTRY ALLOCATION

|

||||||||

|

The China Fund, Inc %

|

MSCI Golden Dragon %

|

|||||||

|

Healthcare

|

23.2 | 0.4 | ||||||

|

Consumer discretionary

|

20.8 | 6.2 | ||||||

|

Consumer staples

|

17.5 | 3.0 | ||||||

|

Financials

|

13.8 | 35.9 | ||||||

|

Information technology

|

7.9 | 20.6 | ||||||

|

Industrials

|

5.5 | 7.2 | ||||||

|

Utilities

|

3.2 | 3.5 | ||||||

|

Telecommunications

|

3.1 | 6.6 | ||||||

|

Materials

|

2.8 | 7.5 | ||||||

|

Energy

|

0.8 | 9.1 | ||||||

|

Other assets & liabilities

|

1.4 | — | ||||||

|

Source: State Street Bank and Trust Company. Source for index data: MSCI

|

||||||||

|

PERFORMANCE

|

(US$ RETURNS) | |||||||

|

NAV %

|

Market price %

|

|||||||

|

One month

|

(3.0 | ) | (4.5 | ) | ||||

|

Year to date

|

(3.3 | ) | (5.6 | ) | ||||

|

Three years % pa

|

8.3 | 8.8 | ||||||

|

Past performance is not a guide to future returns.

|

||||||||

|

Three year returns are annualized.

|

||||||||

|

Source: State Street Bank and Trust Company

|

||||||||

|

15 LARGEST HOLDINGS (51.9%)

|

Fund %

|

||||

|

China Medical System Holdings

|

Healthcare

|

9.6 | |||

|

Huiyin Household Appliances

|

Consumer discretionary

|

4.9 | |||

|

Far Eastern Department Stores

|

Consumer discretionary

|

4.8 | |||

|

Ping An Insurance

|

Financials

|

3.7 | |||

|

Hsu Fu Chi International

|

Consumer staples

|

3.5 | |||

|

Hand Enterprise Solutions

|

Information technology

|

3.3 | |||

|

Shandong Weigao Group

|

Healthcare

|

3.1 | |||

|

Wumart Stores

|

Consumer staples

|

2.9 | |||

|

Sinopharm Group

|

Healthcare

|

2.8 | |||

|

FamilyMart

|

Consumer discretionary

|

2.7 | |||

|

Enn Energy

|

Utilities

|

2.2 | |||

|

Ruentex Development

|

Financials

|

2.2 | |||

|

China Fishery Group

|

Consumer staples

|

2.1 | |||

|

WuXi PharmaTech Cayman

|

Healthcare

|

2.1 | |||

|

Chinatrust Financial Holding

|

Financials

|

2.0 | |||

*Martin Currie Ltd and Heartland Capital Management Ltd (‘HCML’) have established MC China Ltd (‘MCCL’), as a joint venture company, to provide investment advisory services to the range of China investment products managed by Martin Currie and its affiliates.

|

DIRECT INVESTMENTS (4.9%)

|

|||||

|

Fund %

|

|||||

|

Zong Su Foods

|

Consumer staples

|

1.9 | |||

|

China Bright

|

Healthcare

|

1.9 | |||

|

Qingdao Bright Moon

|

Industrials

|

1.1 | |||

|

China Silicon

|

Information technology

|

0.0 | |||

|

Hand Enterprise Solutions (preferred)

|

Information technology

|

0.0 | |||

Source: State Street Bank and Trust Company.

|

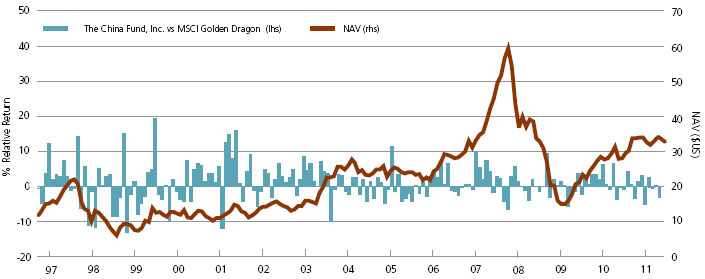

FUND PERFORMANCE (BASED ON NET ASSET VALUE)

|

(US$ returns)

|

|||||||||||||||||||||||||||

|

One month

|

Three months

|

Calendar year

|

One year

|

Three years

|

Five years

|

Since launch

|

||||||||||||||||||||||

|

%

|

%

|

to date %

|

%

|

% pa

|

% pa

|

% pa

|

||||||||||||||||||||||

|

The China Fund, Inc.

|

(3.0 | ) | 2.8 | (3.3 | ) | 25.1 | 8.3 | 20.3 | 12.5 | |||||||||||||||||||

|

MSCI Golden Dragon

|

0.2 | 6.9 | 3.4 | 28.0 | 3.0 | 11.8 | 10.9 | |||||||||||||||||||||

|

Hang Seng Chinese Enterprise

|

0.3 | 6.3 | 4.5 | 15.6 | (1.1 | ) | 14.7 | 19.3 | ||||||||||||||||||||

|

Shanghai Stock Exchange 180

|

(5.7 | ) | (3.9 | ) | (0.5 | ) | 12.1 | (5.5 | ) | 20.4 | n/a | |||||||||||||||||

Past performance is not a guide to future returns. Source: State Street Bank and Trust Company. Launch date July 10, 1992. Three, five year and since launch returns are all annualized. Source for index data: MSCI for the MSCI Golden Dragon and Copyright 2011 Bloomberg LP for the Hang Seng China Enterprise and the Shanghai Stock Exchange 180. For a full description of each index please see the index descriptions section.

PERFORMANCE IN PERSPECTIVE

Past performance is not a guide to future returns.

Source: Martin Currie Inc as at May 31, 2011.

MONTHLY INSIGHT

THE CHINA FUND INC. PREMIUM/DISCOUNT

Past performance is not a guide to future returns.

Source: Martin Currie Inc as at May 31, 2011.

10 YEAR DIVIDEND HISTORY CHART

|

2000

|

2001

|

2002

|

2003

|

2004

|

2005

|

2006

|

2007

|

2008

|

2009

|

2010

|

||||||||||||||||||||||||||||||||||

|

Total

|

0.00 | 0.13 | 0.21 | 1.78 | 3.58 | 2.51 | 4.01 | 12.12 | 5.82 | 0.26 | 2.27 | |||||||||||||||||||||||||||||||||

|

Income

|

0.00 | 0.13 | 0.06 | 0.07 | 0.20 | 0.22 | 0.30 | 0.28 | 0.48 | 0.26 | 0.37 | |||||||||||||||||||||||||||||||||

|

Long-term capital

|

0.00 | 0.00 | 0.00 | 0.67 | 3.27 | 2.29 | 2.73 | 9.00 | 5.34 | 0.00 | 1.90 | |||||||||||||||||||||||||||||||||

|

Short-term capital

|

0.00 | 0.00 | 0.15 | 1.04 | 0.11 | 0.00 | 0.98 | 2.84 | 0.00 | 0.00 | 0.00 | |||||||||||||||||||||||||||||||||

Past performance is not a guide to future returns.

Source: State Street Bank and Trust Company.

|

Sector

|

Company (BBG ticker)

|

Price

|

Holding

|

Value US$

|

% of portfolio

|

||||

|

TAIWAN

|

23.3

|

||||||||

|

Far Eastern Department Stores

|

2903

|

TT

|

NT$54.5

|

19,543,604

|

$37,168,106

|

4.8

|

|||

|

FamilyMart

|

5903

|

TT

|

NT$134.0

|

4,501,652

|

$21,049,704

|

2.7

|

|||

|

Ruentex Development Co

|

9945

|

TT

|

NT$39.3

|

12,694,000

|

$17,386,310

|

2.2

|

|||

|

Chinatrust Financial

|

2891

|

TT

|

NT$25.5

|

17,527,288

|

$15,596,393

|

2.0

|

|||

|

Uni-President Enterprises Corp.

|

1216

|

TT

|

NT$41.3

|

10,023,901

|

$14,428,793

|

1.8

|

|||

|

Yuanta Financial Holdings

|

2885

|

TT

|

NT$19.8

|

17,683,593

|

$12,187,283

|

1.6

|

|||

|

China Metal Products

|

1532

|

TT

|

NT$29.6

|

11,500,347

|

$11,878,782

|

1.5

|

|||

|

WPG Holdings Co

|

3702

|

TT

|

NT$53.1

|

5,335,103

|

$9,885,681

|

1.3

|

|||

|

KGI Securities

|

6008

|

TT

|

NT$15.2

|

16,984,780

|

$8,979,287

|

1.1

|

|||

|

Fubon Financial Holdings

|

2881

|

TT

|

NT$41.9

|

5,195,134

|

$7,586,850

|

1.0

|

|||

|

Synnex Technology

|

2347

|

TT

|

NT$67.3

|

2,904,006

|

$6,819,961

|

0.9

|

|||

|

Test-Rite International

|

2908

|

TT

|

NT$22.9

|

8,457,000

|

$6,758,045

|

0.9

|

|||

|

Taiwan Life 4percent Conv Bond*

|

n/a

|

NT$94.9

|

200,000,000

|

$6,620,372

|

0.8

|

||||

|

Lien Hwa Industrial

|

1229

|

TT

|

NT$22.4

|

6,673,148

|

$5,216,126

|

0.7

|

|||

|

HONG KONG H

|

23.3

|

||||||||

|

China Medical System Holdings

|

867

|

HK

|

HK$8.0

|

72,353,760

|

$74,606,850

|

9.6

|

|||

|

Shandong Weigao Group Medical Polymer

|

8199

|

HK

|

HK$10.3

|

18,352,000

|

$24,539,175

|

3.2

|

|||

|

Wumart Stores

|

8277

|

HK

|

HK$17.9

|

9,810,750

|

$22,528,221

|

2.9

|

|||

|

Sinopharm Group

|

297

|

HK

|

HK$27.9

|

6,056,800

|

$21,648,672

|

2.8

|

|||

|

Boshiwa International Holding

|

1698

|

HK

|

HK$4.4

|

24,932,000

|

$14,200,514

|

1.8

|

|||

|

ZTE Corp.

|

763

|

HK

|

HK$27.7

|

2,250,826

|

$7,987,194

|

1.0

|

|||

|

Fook Woo

|

923

|

HK

|

HK$2.4

|

25,314,000

|

$7,778,609

|

1.0

|

|||

|

Asian Citrus Holdings

|

73

|

HK

|

HK$8.6

|

6,677,000

|

$7,657,543

|

1.0

|

|||

|

HONG KONG

|

19.7

|

||||||||

|

Huiyin Household Appliances

|

1280

|

HK

|

HK$1.8

|

160,413,750

|

$37,949,202

|

4.9

|

|||

|

Enn Energy

|

2688

|

HK

|

HK$27.1

|

5,084,000

|

$17,517,961

|

2.3

|

|||

|

China Mobile

|

941

|

HK

|

HK$71.1

|

1,636,500

|

$14,980,946

|

1.9

|

|||

|

Ports Design

|

589

|

HK

|

HK$20.0

|

4,549,500

|

$11,686,982

|

1.5

|

|||

|

Natural Beauty Bio-Technology

|

157

|

HK

|

HK$1.6

|

47,710,000

|

$9,630,577

|

1.2

|

|||

|

Intime Department Store Group

|

1833

|

HK

|

HK$13.8

|

5,278,629

|

$9,202,886

|

1.2

|

|||

|

Shangri-La Asia

|

69

|

HK

|

HK$20.3

|

3,316,683

|

$8,699,161

|

1.1

|

|||

|

Tencent Holdings

|

700

|

HK

|

HK$223.8

|

291,000

|

$8,380,776

|

1.1

|

|||

|

China Water Affairs

|

855

|

HK

|

HK$2.9

|

19,976,000

|

$7,422,490

|

1.0

|

|||

|

China Shineway Pharmaceutical Group

|

2877

|

HK

|

HK$18.4

|

3,041,000

|

$7,256,674

|

0.9

|

|||

|

Chaoda Modern Agriculture (Holdings)

|

682

|

HK

|

HK$3.8

|

13,999,357

|

$6,875,664

|

0.9

|

|||

|

SYSCAN Technology Holdings

|

8083

|

HK

|

HK$0.4

|

146,000,000

|

$6,569,981

|

0.8

|

|||

|

Golden Meditech Co

|

801

|

HK

|

HK$1.4

|

35,040,000

|

$6,126,977

|

0.8

|

|||

|

Yorkey Optical International Cayman

|

2788

|

HK

|

HK$1.2

|

4,862,926

|

$769,035

|

0.1

|

|||

|

FUJI Food & Catering Services

|

1175

|

HK

|

HK$0.0

|

5,462,000

|

$0

|

0.0

|

|||

|

EQUITY LINKED SECURITIES (‘A’ SHARES)

|

13.1

|

||||||||

|

Ping An Insurance

|

n/a

|

US$7.5

|

3,775,759

|

$28,386,227

|

3.7

|

||||

|

Wuliangye Yibin

|

n/a

|

US$5.1

|

2,334,507

|

$11,893,947

|

1.5

|

||||

|

Shanghai Qiangsheng

|

n/a

|

US$1.0

|

10,482,652

|

$10,807,687

|

1.4

|

||||

|

Tangshan Jidong Cement

|

n/a

|

US$3.7

|

2,837,087

|

$10,409,633

|

1.3

|

||||

|

Zhejiang China Commodities City Group

|

n/a

|

US$3.6

|

2,771,970

|

$10,058,343

|

1.3

|

||||

|

Suning Appliance

|

n/a

|

US$1.9

|

4,311,019

|

$8,097,590

|

1.0

|

||||

|

Shanghai Yuyuan Tourist

|

n/a

|

US$1.7

|

429,303,600

|

$7,434,345

|

1.0

|

||||

|

Jiangsu Yuyue Medical Equipment

|

n/a

|

US$3.6

|

1,936,000

|

$7,042,879

|

0.9

|

||||

|

China Railway Construction Group

|

n/a

|

US$0.9

|

6,582,600

|

$6,207,603

|

0.8

|

||||

|

Qinghai Salt Lake Potash

|

n/a

|

US$8.3

|

178,729

|

$1,491,270

|

0.2

|

||||

*This is an unlisted convertible bond. Shares in Taiwan Life are listed on the Taiwan Stock Exchange.

MONTHLY INSIGHT

|

Sector

|

Company (BBG ticker)

|

Price

|

Holding

|

Value US$

|

% of portfolio

|

||||

|

SINGAPORE

|

6.0

|

||||||||

|

Hsu Fu Chi International

|

HFCI SP

|

SG$3.9

|

8,485,084

|

$27,084,078

|

3.5

|

||||

|

China Fishery Group

|

CFG SP

|

SG$1.5

|

13,594,872

|

$16,630,823

|

2.1

|

||||

|

CDW Holding

|

CDW SP

|

SG$0.1

|

48,208,000

|

$2,929,153

|

0.4

|

||||

|

USA

|

5.0

|

||||||||

|

WuXi PharmaTech Cayman

|

WX US

|

US$18.3

|

883,490

|

$16,123,692

|

2.1

|

||||

|

Mindray Medical International

|

MR US

|

US$29.1

|

291,700

|

$8,473,885

|

1.1

|

||||

|

Hollysys Automation Technologies

|

HOLI US

|

US$8.8

|

925,700

|

$8,146,160

|

1.0

|

||||

|

Far East Energy

|

FEEC US

|

US$0.4

|

16,392,823

|

$6,207,962

|

0.8

|

||||

|

DIRECT

|

4.9

|

||||||||

|

Zong Su Foods

|

n/a

|

US$5,603.0

|

2,677

|

$15,000,034

|

1.9

|

||||

|

China Bright

|

n/a

|

HK$7.9

|

14,665,617

|

$14,971,457

|

1.9

|

||||

|

Qingdao Bright Moon

|

n/a

|

US$0.3

|

31,827,172

|

$8,561,510

|

1.1

|

||||

|

China Silicon Corp.

|

n/a

|

US$0.0

|

2,329,281

|

$0

|

0.0

|

||||

|

Hand Enterprise Solutions (preferred)

|

n/a

|

US$0.0

|

500,000

|

$0

|

0.0

|

||||

|

CHINA ‘A’ SHARE

|

3.3

|

||||||||

|

Hand Enterprise Solutions

|

300170

|

CH

|

Rmb15.0

|

11,238,137

|

$26,035,165

|

3.3

|

|||

|

OTHER ASSETS & LIABILITIES

|

$10,688,037

|

1.4

|

INDEX DESCRIPTIONS

MSCI Golden Dragon Index

The MSCI Golden Dragon is a free float-adjusted market capitalization index that is designed to measure equity market performance in the China region. As of May 2005 the MSCI Golden Dragon Index consisted of the following country indices: China, Hong Kong and Taiwan.

Hang Seng China Enterprise Index

The Hang Seng China Enterprise Index is a capitalization-weighted index comprised of state-owned Chinese companies (H-shares) listed on the Hong Kong Stock Exchange and included in Hans Seng Mainland China index.

Shanghai Stock Exchange 180 Index

The Shanghai Stock Exchange 180 ‘A’ Share Index is a capitalization-weighted index. The index tracks the daily price performance of the 180 most representative ‘A’ share stocks listed on the Shanghai Stock Exchange.

OBJECTIVE

The investment objective of the Fund is to achieve long term capital appreciation. The Fund seeks to achieve its objective through investment in the equity securities of companies and other entities with significant assets, investments, production activities, trading or other business interests in China or which derive a significant part of their revenue from China.

The Fund has an operating policy that the Fund will invest at least 80% of its assets in China companies. For this purpose, ‘China companies’ are (i) companies for which the principal securities trading market is in China; (ii) companies for which the principal securities trading market is outside of China or in companies organized outside of China, that in both cases derive at least 50% of their revenues from goods or services sold or produced, or have a least 50% of their assets in China; or (iii) companies organized in China. Under the policy, China will mean the People’s Republic of China, including Hong Kong, and Taiwan. The Fund will provide its stockholders with at least 60 days’ prior notice of any change to this policy.

CONTACTS

The China Fund, Inc.

c/o State Street Bank and Trust Company

2 Avenue de Lafayette

PO Box 5049

PO Box 5049

Boston, MA 02206-5049

Tel: (1) 888 CHN-CALL (246 2255)

www.chinafundinc.com

|

IMPORTANT INFORMATION

This document is issued and approved by Martin Currie Inc (MC Inc), as investment adviser of The China Fund Inc (the Fund). MC Inc is authorised and regulated by the Financial Services Authority (FSA) and incorporated under limited liability in New York, USA. Registered in Scotland (No BR2575), registered address Saltire Court, 20 Castle Terrace, Edinburgh, EH1 2ES. Information herein is believed to be reliable but has not been verified by MC Inc. MC Inc makes no representation or warranty and does not accept any responsibility in relation to such information or for opinion or conclusion which the reader may draw from the newsletter.

Martin Currie Ltd and Heartland Capital Management Ltd (‘HCML’) have established MC China Ltd (‘MCCL’), as a joint venture company, to provide investment advisory services to the range of China investment products managed by Martin Currie and its affiliates. HCML has seconded both Chris Ruffle and Shifeng Ke to Martin Currie, Inc., and its affiliates, on a full-time basis. Heartland Capital Investment Consulting Ltd (‘HCIC’) is a wholly owned subsidiary of MC China Ltd. Research is undertaken by HCIC for MC China Ltd and provided to Martin Currie Investment Management Ltd, an affiliate of the investment manager, Martin Currie Inc, for The China Fund Inc. HCIC may change its opinions and views without prior notice. It does not constitute investment advice nor is it an invitation to invest in this company.

The Fund is classified as a ‘non-diversified’ investment company under the US Investment Company Act of 1940 as amended. It meets the criteria of a closed ended US mutual fund and its shares are listed on the New York Stock Exchange. MC Inc has been appointed investment adviser to the Fund.

Investors are advised that they will not generally benefit from the rules and regulations of the United Kingdom Financial Services and Markets Act 2000 and the FSA for the protection of investors, nor benefit from the United Kingdom Financial Services Compensation Scheme, nor have access to the Financial Services Ombudsman in the event of a dispute. Investors will also have no rights of cancellation under the FSA's Conduct of Business Sourcebook of the United Kingdom.

This newsletter does not constitute an offer of shares. MC Inc, its ultimate and intermediate holding companies, subsidiaries, affiliates, clients, directors or staff may, at any time, have a position in the market referred to herein, and may buy or sell securities, currencies, or any other financial instruments in such markets. The information or opinion expressed in this newsletter should not be construed to be a recommendation to buy or sell the securities, commodities, currencies or financial instruments referred to herein.

The information provided in this report should not be considered a recommendation to purchase or sell any particular security. There is no assurance that any securities discussed herein will remain in an account’s portfolio at the time you receive this report or that securities sold have not been repurchased.

It should not be assumed that any of the securities transactions or holdings discussed here were or will prove to be profitable, or that the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein.

Investing in the Fund involves certain considerations in addition to the risks normally associated with making investments in securities. The value of the shares issued by the Fund, and the income from them, may go down as well as up and there can be no assurance that upon sale, or otherwise, investors will receive back the amount originally invested. There can be no assurance that you will receive comparable performance returns, or that investments will reflect the performance of the stock examples contained in this document. Movements in foreign exchange rates may have a separate effect, unfavorable as well as favorable, on the gain or loss otherwise experienced on an investment. Past performance is not a guide to future returns. Accordingly, the Fund is only suitable for investment by investors who are able and willing to withstand the total loss of their investment. In particular, prospective investors should consider the following risks:

|

à

|

The companies quoted on Greater Chinese stock exchanges are exposed to the risks of political, social and religious instability, expropriation of assets or nationalisation, rapid rates of inflation, high interest rates, currency depreciation and fluctuations and changes in taxation, which may affect income and the value of investments.

|

|

à

|

At present, the securities market and the regulatory framework for the securities industry in China is at an early stage of development. The China Securities Regulatory Commission (CSRC) is responsible for supervising the national securities markets and producing relevant regulations. The Investment Regulations, under which the Fund invests in the People's Republic of China (PRC) and which regulate repatriation and currency conversion, are new. The Investment Regulations give CSRC and State Administration of Foreign Exchange (SAFE) wide discretions and there is no precedent or certainty as to how these discretions might be exercised, either now or in the future. The Fund may, from time to time, obtain access to the securities markets in China via Access Products. Such products carry additional risk and may be less liquid than the underlying securities which they represent.

|

|

à

|

During the past 15 years, the PRC government has been reforming the economic and political systems of the PRC, and these reforms are expected to continue, as evidenced by the recently announced changes. The Fund's operations and financial results could be adversely affected by adjustments in the PRC's state plans, political, economic and social conditions, changes in the policies of the PRC government such as changes in laws and regulations (or the interpretation thereof), measures which may be introduced to control inflation, changes in the rate or method of taxation, imposition of additional restrictions on currency conversion and the imposition of additional import restrictions.

|

|

à

|

PRC’s disclosure and regulatory standards are in many respects less stringent than standards in certain Organisation for Economic Co-operation and Development (OECD) countries, and there may be less publicly available or less reliable information about PRC companies than is regularly published by or about companies from OECD countries.

|

|

à

|

The Shanghai Stock Exchange and Shenzhen Stock Exchange have lower trading volumes than most OECD exchanges and the market capitalisations of listed companies are small compared to those on more developed exchanges in developed markets. The listed equity securities of many companies in the PRC are accordingly materially less liquid, subject to greater dealing spreads and experience materially greater volatility than those of OECD countries. These factors could negatively affect the Fund’s NAV.

|

|

à

|

The Fund invests primarily in securities denominated in other currencies but its NAV will be quoted in US dollars. Accordingly, a change in the value of such securities against US dollars will result in a corresponding change in the US dollar NAV.

|

|

à

|

The marketability of quoted shares may be limited due to foreign investment restrictions, wide dealing spreads, exchange controls, foreign ownership restrictions, the restricted opening of stock exchanges and a narrow range of investors. Trading volume may be lower than on more developed stockmarkets, and equities are less liquid. Volatility of prices can also be greater than in more developed stockmarkets. The infrastructure for clearing, settlement and registration on the primary and secondary markets may be underdeveloped. Under certain circumstances, there may be delays in settling transactions in some of the markets.

|

Martin Currie Inc, registered in Scotland (no BR2575)

Registered office: Saltire Court, 20 Castle Terrace, Edinburgh EH1 2ES

Tel: 44 (0) 131 229 5252 Fax: 44 (0) 131 228 5959 www.martincurrie.com/china

North American office: 1350 Avenue of the Americas, Suite 3010, New York, NY 10019, USA Tel: (1) 212 258 1900 Fax: (1) 212 258 1919

Authorised and registered by the Financial Services Authority and incorporated with limited liability in New York, USA.

Please note: calls to the above numbers may be recorded.