Attached files

| file | filename |

|---|---|

| EX-21.1 - LIST OF SUBSIDIARIES - Pershing Gold Corp. | sagebrushex211.htm |

| EX-23.1 - CONSENT OF J.H. COHN LLP - Pershing Gold Corp. | sagebrushex231.htm |

| EX-10.19 - UNANIMOUS SHAREHOLDER AGREEMENT, DATED APRIL 26, 2011 - Pershing Gold Corp. | sagebrushex1019.htm |

| EX-10.11 - FORM OF PROMISSORY NOTE - Pershing Gold Corp. | sagebrushex1011.htm |

| EX-10.21 - REVOLVING DEMAND LOAN ACKNOWLEDGMENT LETTER TO CII AND DENIS BENOIT, DATED APRIL 26, 2011 - Pershing Gold Corp. | sagebrushex1021.htm |

| EX-10.22 - REVOLVING DEMAND LOAN ACKNOWLEDGMENT LETTER TO CAPITAL HOEDOWN INC., DATED APRIL 26, 2011 - Pershing Gold Corp. | sagebrushex1022.htm |

| EX-10.20 - MANAGEMENT SERVICES AGREEMENT, DATED APRIL 26, 2011 - Pershing Gold Corp. | sagebrushex1020.htm |

| EX-10.17 - SEVERANCE AGREEMENT AND RELEASE - Pershing Gold Corp. | sagebrushex1017.htm |

As filed with the Securities and Exchange Commission on June 15, 2011

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SAGEBRUSH GOLD LTD.

(Exact name of registrant as specified in its charter)

|

Nevada

|

7990

|

26-0657736

|

|

(State or other jurisdiction

of incorporation or organization)

|

(Primary Standard Industrial

Classification Code Number)

|

(I.R.S. Employer

Identification Number)

|

1640 Terrace Way

Walnut Creek, California 94597

(925) 930-6338

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

|

Sheldon Finkel, Chief Executive Officer

110 Greene Street, Suite 403

New York, New York 10012

(212) 810-6193

|

David Rector, President

1640 Terrace Way

Walnut Creek, California 94597

(925) 930-6338

|

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Harvey J. Kesner, Esq.

61 Broadway, 32nd Floor

New York, New York 10006

Telephone: (212) 930-9700

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act of 1933 registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by a check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

|

Large Accelerated Filer ¨

|

Accelerated Filer ¨

|

|

Non-accelerated Filer ¨

|

Smaller Reporting Company x

|

|

Title of each class of

securities to be registered

|

Amount to be

Registered (1)

|

Proposed maximum

offering price per

share

|

Proposed maximum

aggregate offering

price

|

Amount of

registration fee

|

||||||||||

|

Primary Offering

|

||||||||||||||

|

Common stock, par value $0.0001 per share

|

(2)

|

$

|

25,000,000

|

$

|

2,902.50

|

|||||||||

|

Secondary Offering

|

||||||||||||||

|

Common stock, par value $0.0001 per share

|

(3)

|

|||||||||||||

|

Total

|

$

|

2,902.50

|

*

|

|||||||||||

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Act”), this registration statement shall be deemed to cover any additional number of shares of common stock as may be issued from time to time upon exercise of the warrants or options to prevent dilution as a result of stock splits, stock dividends or similar transactions. No additional consideration will be received for the common stock, and therefore no registration fee is required pursuant to Rule 457(i) under the Act.

|

|

(2)

|

Estimated solely for purposes of calculating the registration fee in accordance with Rule 457(o).

|

|

(3)

|

We intend to identify the shares to be offered by the selling stockholders through one or more amendments to be filed to this Registration Statement.

|

* $5,224.50 previously paid.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933 OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

1

EXPLANATORY NOTE

This Registration Statement contains two forms of prospectus: one to be used in connection with a public offering of shares of our common stock having an aggregate initial offering price of up to $25,000,000 (the "Prospectus") and one to be used in connection with the potential resale by certain selling stockholders of shares of our common stock (the "Selling Stockholder Prospectus"). We intend to identify the shares to be offered by the selling stockholders through one or more amendments to be filed to this Registration Statement. The Prospectus and Selling Stockholder Prospectus will be identical in all respects except for the alternate pages for the Selling Stockholder Prospectus included herein which are labeled "Alternate Page for Selling Stockholder Prospectus."

The Selling Stockholder Prospectus is substantively identical to the Prospectus, except for the following principal points:

|

•

|

they contain different outside and inside front covers;

|

|

•

|

they contain different Offering sections in the Prospectus Summary section on page 7;

|

|

•

|

they contain different Use of Proceeds sections on page 34; and

|

|

•

|

a Selling Stockholder section is included in the Selling Stockholder Prospectus beginning on page 48.

|

The Company has included in this Registration Statement, after the financial statements, a set of alternate pages to reflect the foregoing differences of the Selling Stockholder Prospectus as compared to the Prospectus.

2

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 15, 2011

PRELIMINARY PROSPECTUS

OFFERING UP TO ______ SHARES

Sagebrush Gold Ltd.

This prospectus relates to a public offering of _______ shares of our common stock, par value $0.0001 per share. We are not required to sell any specific dollar amount or number of shares of common stock but will use our best efforts to sell all of the shares of common stock being offered. The Company offering expires on the earlier of (i) the date upon which all of the shares of common stock being offered have been sold, or (ii) 24 months following the date of this prospectus.

We will bear all costs relating to the registration of these shares of our common stock.

Our common stock is quoted on the OTC Bulletin Board under the symbol “SAGE.OB” (formerly “EXCX.OB”). The last reported sale price of our common stock as reported by the OTC Bulletin Board on June 10, 2011 , was $1.44 per share.

Investing in our common stock is highly speculative and involves a high degree of risk. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 9 of this prospectus before making a decision to purchase our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

We intend to engage one or more placement agents in connection with this offering. The placement agents will not purchase or sell any of our securities, nor will they be required to arrange for the purchase and sale of any specific number or dollar amount of securities, other than to use their “best efforts” to arrange for the sale of securities by us. We have not arranged to place the funds in an escrow, trust or similar account.

|

|

Price to

Public

|

Placement

Agent Fees

|

Proceeds,

Before

Expenses, to

Us

|

|||||||||

|

Per Share

|

$

|

$

|

$

|

|||||||||

|

Total

|

$

|

$

|

$

|

|||||||||

We may amend or supplement this prospectus from time to time by filing amendments or supplements as required. You should read the entire prospectus and any amendments or supplements carefully before you make your investment decision.

The date of this prospectus is June *, 2011

3

TABLE OF CONTENTS

|

Page

|

|

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

4

The following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial statements and related notes included elsewhere in this prospectus. In this prospectus, unless otherwise noted, the terms “the Company,” “we,” “us,” and “our” refer to Sagebrush Gold Ltd., formerly known as The Empire Sports & Entertainment Holdings Co., and its subsidiary, The Empire Sports & Entertainment, Co.

Overview

We were formerly known as The Empire Sports & Entertainment Holdings Co. and changed our name to Sagebrush Gold Ltd. in order to reflect additional businesses to be pursued by us. Following the departure, in March 2011, of a senior executive officer responsible for developing our sports and entertainment projects, we evaluated several new business opportunities. During May 2011, we were presented with an opportunity to acquire, in consideration for the issuance of 21,000,000 shares of our common stock (which includes common stock underlying 8,000,000 shares of our Series B Convertible Preferred Stock), certain leases with the potential to pursue natural resource exploration, primarily precious metals, as a junior gold exploration company. As a result, our Board of Directors determined to pursue such acquisition. We appointed a new President, David Rector, with resource and exploration experience, and appointed a Chief Geologist. Our management conducted due diligence and management and their advisors concluded that the Nevada claims were conducive to exploration for gold. However, no deposits have been identified on the leased properties. We will, as a result, be engaged in two primary lines of business, through separate subsidiaries, consisting of resource exploration and sports and entertainment.

Through our subsidiary “The Empire Sports & Entertainment, Co.”, we are engaged in the business of live entertainment as a promoter and producer of entertainment events such as concerts, music festivals, pay-per-view programming and other live events . Our goal is to become a leader in integrated promotion, production, and marketing for a broad variety of live events in sports and music . We promote or produce live music and entertainment shows and sporting events, such as professional boxing and mixed martial arts (MMA). We generate revenue primarily through promoter fees and sharing arrangements with performers and athletes and production of concerts and events. These revenues are expected to consist primarily of sponsorship, advertising and concession fees, ticket sales (“gate”), televised revenue (Pay-Per-View) and media distribution. We believe there may also be opportunities to integrate social media, interactive gaming and social networking technologies directly with our live events and derive additional revenue from our events. Our current operations are primarily focused on the entertainment line of our business and particularly in music festivals. For example, we have entered into a joint venture with respect to promotion of a summer music festival known as the Capital Hoedown to be held in Ottawa, Canada, which headlines Kenny Chesney and Carrie Underwood, on August 11-13, 2011.

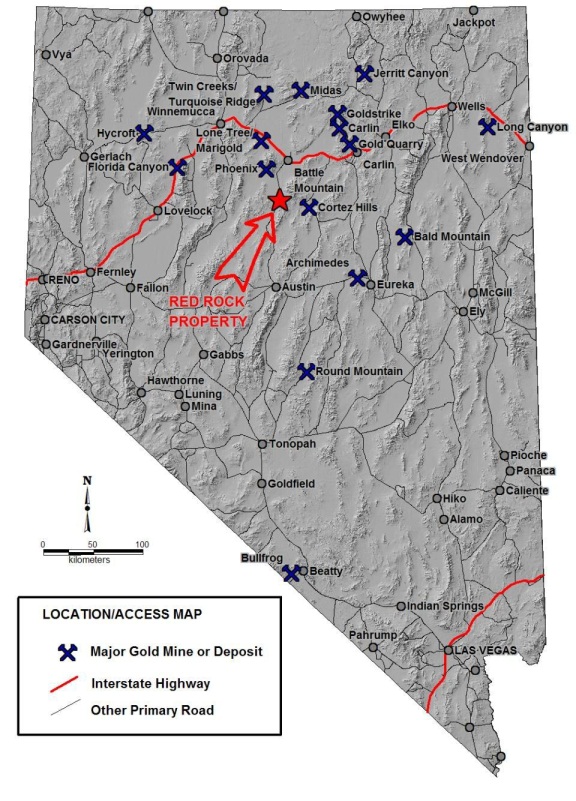

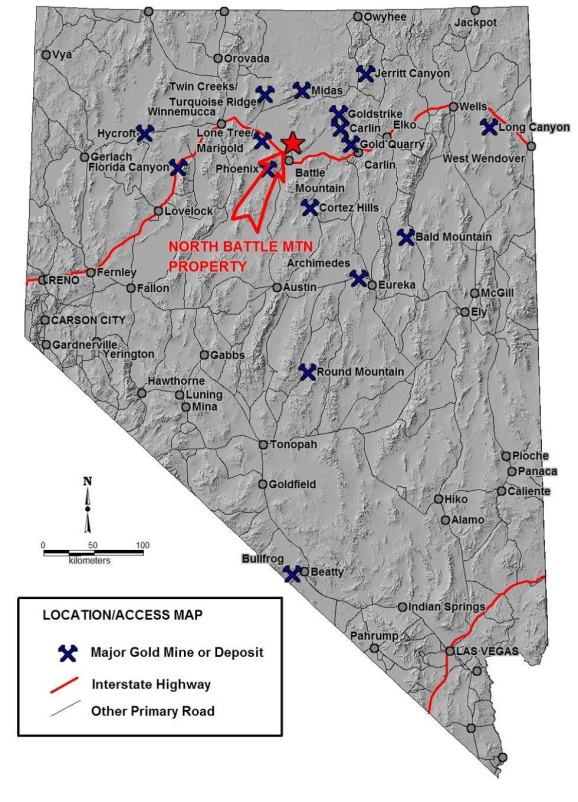

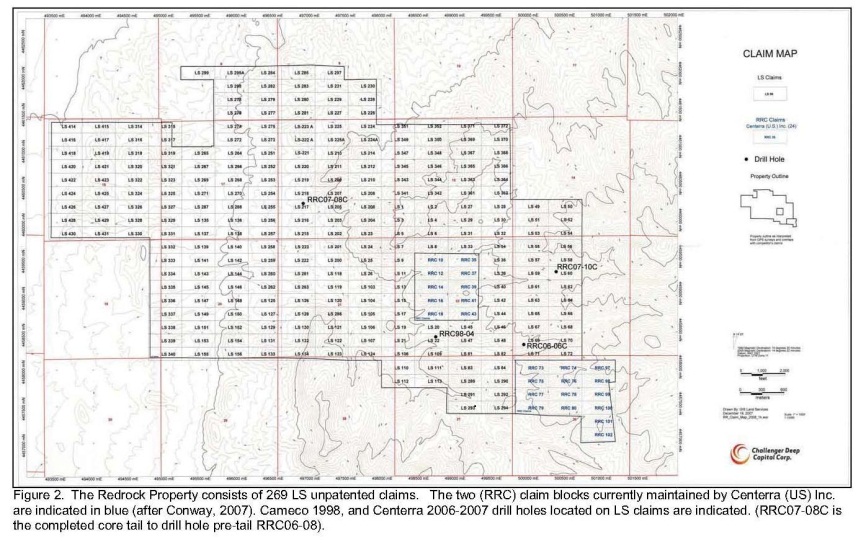

Through our subsidiary “Arttor Gold, LLC”, a Nevada limited liability company (“Arttor Gold”), we have the rights to explore on two properties, known as Red Rock and North Battle Mountain. The exploration rights to these properties are evidenced by leases between Arttor Gold and F.R.O.G. Consulting, LLC, a Nevada limited liability company (”FROG”)(an affiliate of Arthur Leger, our chief geologist), which acquired its rights to these properties from the Federal Bureau of Land Management by staking claims.

We plan to initially conduct exploration for gold at Red Rock. Our property currently has no known gold deposits. We have commenced planning for these initial exploration activities. We plan to seek to acquire additional exploration opportunities. Our exploration staff consists of our Chief Geologist, Arthur Leger, and the actual drilling and related activities will be outsourced. We plan to engage independent engineers, contractors and consultants on an as-needed basis. We cannot assure that any commercially exploitable gold deposit will be found on our properties or if found, will be of sufficient quality or quantity to justify removal and mining.

Our History

We were incorporated under the laws of the State of Nevada on August 2, 2007 to be a web-based service provider and consulting company. On November 28, 2007, we entered into a license agreement with a third party to use their software on a non-exclusive basis. We later determined that we were unable to implement the software with clients. As a result, on December 29, 2009, we entered into a termination agreement. On September 27, 2010, we amended and restated our Articles of Incorporation in order to, among other things, change our name to The Empire Sports & Entertainment Holdings Co.

5

Our wholly-owned subsidiary, The Empire Sports & Entertainment, Co. (“Empire”) began operations in 2009. Certain of our assets were acquired from Golden Empire, LLC (“Golden Empire”), a New Jersey limited liability company and as a result our financial statements and results of operations includes certain information regarding the operations of Golden Empire, although we did not acquire Golden Empire. In May 2010, Empire entered into a series of assignment and assumption agreements with Golden Empire, pursuant to which Golden Empire assigned all of its rights, title and interest in certain promotion rights agreements with various professional boxers to Empire. As of December 31, 2010, we had total assets of $2,777,672. For the period from February 10, 2010 (Inception) through December 31, 2010, we recorded a net loss of $2,022,497.

On September 29, 2010, we entered into a Share Exchange Agreement (the “Exchange Agreement”) with Empire and the shareholders of Empire. Upon closing of the transaction contemplated under the Exchange Agreement (the “Share Exchange”), the Empire Shareholders transferred all of the issued and outstanding capital stock of Empire to us in exchange for shares of our common stock. Such Share Exchange caused Empire to become a wholly-owned subsidiary of the Company. Following the Share Exchange, we succeeded to the business of Empire as our sole line of business.

At the closing of the Share Exchange, each share of Empire’s common stock issued and outstanding immediately prior to the closing of the Share Exchange was exchanged for the right to receive one share of our common stock. Accordingly, an aggregate of 19,602,000 shares of our common stock were issued to the Empire Shareholders.

On October 8, 2010, we entered into an Agreement of Conveyance, Transfer of Assets and Assumption of Obligations (the “Conveyance Agreement”) with our wholly-owned subsidiary, Excel Global Holdings, Inc. (“SplitCo”). Pursuant to the Conveyance Agreement, we transferred all of the assets and liabilities associated with our web-based consulting services business to SplitCo. We also entered into a stock purchase agreement (the “Purchase Agreement”) pursuant to which we sold all of the outstanding capital stock of SplitCo to certain purchasers (the “Split-Off”) in exchange for 17,596,603 shares of our common stock held by the purchasers which were thereafter cancelled (the “Share Cancellation”).

The foregoing description of certain changes to our Certificate of Incorporation, the Share Exchange and related transactions does not purport to be complete and is qualified in its entirety by reference to the complete text of (i) the Amended and Restated Certificate of Incorporation, which was filed as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on October 4, 2010, (ii) the Share Exchange Agreement, which was filed as Exhibit 2.1 to our Current Report on Form 8-K filed with the SEC on October 5, 2010, (iii) the Conveyance Agreement, which was filed as Exhibit 10.1 to our Current Report on Form 8-K filed with the SEC on October 12, 2010, and (iv) the Stock Purchase Agreement, which was filed with the SEC as Exhibit 10.2 to our Current Report on Form 8-K filed on October 12, 2010, each of which is incorporated herein by reference.

Following the closing of the Share Exchange and the Share Cancellation there were 22,135,805 shares of common stock issued and outstanding, which excludes 2,800,000 shares of common stock reserved for issuance under our 2010 Equity Incentive Plan and 250,000 shares of our common stock issuable upon exercise of options issued to one of our executive officers.

On May 16, 2011, we filed a Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of Nevada in order to change our name to “Sagebrush Gold Ltd.” from “The Empire Sports & Entertainment Holdings Co.” The name change became effective and a new symbol was issued by FINRA for the Company’s common stock on June 1, 2011.

On May 24, 2011, we entered into four limited liability company membership interests purchase agreements (the “Agreements”) with the owners of Arttor Gold. Each of the owners of Arttor Gold (the “Members”), sold their interests in Arttor Gold in privately negotiated sales resulting in the Company acquiring one hundred percent (100%) of Arttor Gold. Prior to the sale our President, David Rector, owned approximately 9.5% of Arttor Gold. 2,000,000 shares of our Common Stock were issued to Mr. Rector. Arthur Leger, who the Company intends to engage as its chief geologist, also received 2,000,000 shares of Common Stock in exchange for his approximate 9.5% membership interest in Arttor Gold. Arttor Gold leases from Mr. Leger certain claims in the State of Nevada which the Company intends to explore, and Arttor Gold also holds approximately $2,000,000 of cash acquired by the Company at closing.

6

Pursuant to the Agreements, in addition to 2,000,000 shares of Common Stock issued to each of Mr. Rector and Mr. Leger (4,000,000 total), the Company issued an additional 8,000,000 shares of a class of preferred stock, designated Series B Convertible Preferred Stock, par value $0.0001 per share, (the “Series B Preferred Stock”) and 9,000,000 shares of Common Stock (including 7,000,000 shares of Common Stock to its principal investor Frost Gamma Investments Trust (“FGIT”)). After giving effect to the foregoing, and assuming the conversion into Common Stock of the Series B Preferred Stock, the Company will have an additional 21,000,000 shares of its Common Stock, on a fully-diluted basis, outstanding following the transaction.

Each share of Series B Preferred Stock is convertible into one share of Common Stock, and has a liquidation preference equal to $0.0001 per share. Shares of Common Stock issued pursuant to the Agreements are subject to lockup agreements which restrict certain sales, transfers and assignments for a period of 24 months unless there has occurred a change of control of the Company, the Board of Directors (the “Board”) terminates the lockup provisions or a minimum of 1,000,000 ounces of gold deposits are removed from the Arttor lease properties. The lockup agreements do not apply to shares of Common Stock underlying the Series B Preferred Stock. Upon termination of the lockup period with respect to the Arttor Gold Agreements, similar prior lockup agreements with other shareholders of the Company in effect on the closing date are also required to be terminated.

On May 24, 2011, the Company entered into an agreement with FGIT pursuant to which the Company agreed that in connection with any private offering completed within six months, the Company shall make available to FGIT the same terms (including terms related to anti-dilution price protection, registration rights, dividends and similar terms and provisions) provided to investors in such private placement with respect to the 7,000,000 shares of Common Stock of the Company issued to FGIT.

Also on May 24, 2011 and prior to the closing of the limited liability company membership interests purchase agreements, the Members adopted the Amended and Restated Operating Agreement of Arttor Gold (the “Operating Agreement”). The Operating Agreement provides that Arttor Gold be managed by the Members and that the Members may appoint an officer or officers to manage the business of Arttor Gold. No Member may transfer any portion of his or its interest in Arttor Gold without the unanimous written consent of all of the Members, provided, however, that any Member may transfer all or any portion of his or its membership interest to any other Member. The owners of the majority of the membership interests shall determine the timing, form and amount of distributions, which shall be made to the Members pro rata in accordance with their respective ownership interests.

On June 3, 2011 David Rector was appointed sole manager of Arttor Gold.

Principal Executive Offices

Our principal executive offices have changed and are located at 1640 Terrace Way, Walnut Creek, California 94597 and our telephone number has changed to (925) 930-6338 . We maintain a website at www.theempirese.com and at www.sagebrushgold.com . The information on our website is not incorporated into this prospectus.

The Offering

|

Securities offered by us

|

[_____________]

|

|

|

Common stock outstanding before the offering

|

44,945,808 shares . (1)

|

|

|

Common stock to be outstanding after the offering

|

[__________] shares. (2)

|

|

|

Use of proceeds

|

We will not receive any proceeds from the sale of the common stock by the selling stockholders. We intend to use the proceeds from the sale of the securities by the Company as described in “Use of Proceeds”.

|

|

|

OTB Bulletin Board Symbol

|

SAGE.OB

|

|

|

Risk Factors

|

|

You should carefully consider the information set forth in this prospectus and, in particular, the specific factors set forth in the “Risk Factors” section beginning on page 9 of this prospectus before deciding whether or not to invest in our common stock.

|

|

(1)

|

Represents the number of shares of our common stock outstanding as of June 15, 2011, and includes 21,000,000 shares issued in connection with the acquisition of Arttor Gold . Excludes (i) 2,800,000 shares of our common stock issuable upon exercise of options reserved under the 2010 Equity Incentive Plan, and (ii) 250,000 share of common stock issuable upon exercise of options issued to one of our executive officers.

|

|

(2)

|

Excludes (i) 2,800,000 shares of our common stock issuable upon exercise of options reserved under the 2010 Equity Incentive Plan, and (ii) 250,000 share of common stock issuable upon exercise of options issued to one of our executive officers.

|

7

This prospectus contains forward-looking statements. Such statements include statements regarding our expectations, hopes, beliefs or intentions regarding the future, including but not limited to statements regarding our market, strategy, competition, development plans (including acquisitions and expansion), financing, revenues, operations, and compliance with applicable laws. Forward-looking statements involve certain risks and uncertainties, and actual results may differ materially from those discussed in any such statement. Factors that could cause actual results to differ materially from such forward-looking statements include the risks described in greater detail in the following paragraphs. All forward-looking statements in this document are made as of the date hereof, based on information available to us as of the date hereof, and we assume no obligation to update any forward-looking statement. Market data used throughout this prospectus is based on published third party reports or the good faith estimates of management, which estimates are based upon their review of internal surveys, independent industry publications and other publicly available information.

8

The following tables set forth our summary statement of operations data for the period from November 30, 2009 (inception) to December 31, 2009, and for the period from February 10, 2010 (inception) to December 31, 2010, and for the three months ended March 31, 2011 , and our summary balance sheet data as of December 31, 2009 and 2010 and as of March 31, 2011 . Our statement of operations data for the period from November 30, 2009 (inception) to December 31, 2009, and for the period from February 10, 2010 (inception) to December 31, 2010 and our balance sheets dated as of December 31, 2009 and 2010 is derived from our audited consolidated financial statements included elsewhere in this prospectus. Our statement of operations data for the three months ended March 31, 2011 is derived from our unaudited interim consolidated financial statements included elsewhere in this prospectus.

The results indicated below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our audited condensed consolidated financial statements and related notes included elsewhere in this prospectus.

Statement of Operations Data:

|

For the period from November 30, 2009 (inception) to December 31, 2009 (1)

|

For the period from February 10, 2010 (Inception) to December 31, 2010

|

|||||||

|

Net revenues

|

$

|

-

|

$

|

906,639

|

||||

|

Operating expenses

|

53,051

|

2,918,416

|

||||||

|

Loss from operations

|

(53,051

|

)

|

(2,011,777

|

)

|

||||

|

Interest expense and other financial costs, net

|

-

|

(10,720

|

)

|

|||||

|

Net loss

|

(53,051

|

)

|

(2,022,497

|

)

|

||||

Balance Sheet Data:

|

December 31, 2009 (1)

|

December 31, 2010

|

||||||||

|

Working capital (deficit)

|

$

|

(30,551

|

)

|

$

|

2,055,157

|

||||

|

Total assets

|

15,386

|

2,777,672

|

|||||||

|

Total liabilities

|

45,937

|

101,329

|

|||||||

|

Accumulated deficit

|

(53,051

|

)

|

(2,075,548

|

)

|

|||||

|

Total stockholders’ equity

|

(30,551

|

)

|

2,676,343

|

||||||

|

(1)

|

Represents financial statement data of Golden Empire, LLC, the predecessor of The Empire Sports & Entertainment, Co.

|

||||||||

The results indicated below and elsewhere in this prospectus are not necessarily indicative of our future performance. You should read this information together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our unaudited condensed consolidated financial statements and related notes included elsewhere in this prospectus.

9

Statement of Operations Data:

|

For the Three Months Ended March 31, 2011

|

|||||

|

Net revenues

|

$

|

291,200

|

|||

|

Operating expenses

|

1,178,136

|

||||

|

Loss from operations

|

(886,936

|

)

|

|||

| Interest expense and other financial costs, net |

(401,426)

|

||||

|

Net loss

|

(1,288,362

|

)

|

|||

Balance Sheet Data:

|

March 31, 2011

|

|||||

|

Working capital

|

$

|

4,690,484

|

|||

|

Total assets

|

8,387,834

|

||||

|

Total liabilities

|

3,153,305

|

||||

|

Accumulated deficit

|

(3,423,522

|

)

|

|||

|

Total stockholders’ equity

|

5,234,529

|

||||

RISKS RELATING TO OUR ENTERTAINMENT BUSINESS AND INDUSTRY

Our business is highly sensitive to public tastes and dependent on our ability to secure popular artists and athletes and other events. We may be unable to anticipate or respond to changes in consumer preferences, which may result in decreased demand for our services.

Our ability to generate revenue from music and sports operations is highly sensitive to rapidly changing public tastes and dependent on the availability of popular artists, athletes and events. Declines in general economic conditions could result in our fans or potential fans having less discretionary income to spend on our live and televised entertainment and branded merchandise, which could have an adverse effect on our business and/or prospects. Our success depends in part on our ability to anticipate the tastes of consumers and to offer events that appeal to them. Since we rely on unrelated parties to create and perform live content, any unwillingness to tour or lack of availability of popular artists or athletes could limit our ability to generate revenue. In particular, there are a limited number of artists and athletes that can headline a North American or global tour or event who can sell out larger venues, including many of our anticipated amphitheaters. If those key artists do not continue to tour, or athletes are not willing or able to obtain successful matches, or if we are unable to secure the rights to their future tours or matches, then our business would be adversely affected.

10

In addition, live music is typically booked for music tours from one to four months in advance of the beginning of the tour and often an agreement to pay an artist a fixed guaranteed amount is required prior to our receiving any operating income. Therefore, if the public is not receptive to the tour, or we or a performer cancel the tour, we may incur a loss for the tour depending on the amount of the fixed guarantee or incurred costs relative to any revenue earned, as well as foregone revenue we could have earned at booked venues. We may be able to secure cancellation insurance policies but such policies to cover a portion of our losses if a performer cancels a tour may not be sufficient, we may choose not to procure such policies, and they are subject to deductibles. Furthermore, consumer preferences change, from time to time, and our failure to anticipate, identify or react to these changes could result in reduced demand for our services, which would adversely affect our operating results and profitability.

Our entertainment operations are seasonal and may be affected by declines in general economic conditions.

Our financial results and cash needs will vary from quarter to quarter and year to year depending on, among other things, the timing of tours and events, cancellations, capital expenditures, seasonal and other fluctuations in our operating results, the timing of guaranteed payments and receipt of ticket sales, financing activities, acquisitions and investments and receivables management. Because our results will vary significantly from quarter to quarter and year to year, our financial results for one quarter or year cannot necessarily be compared to another quarter or year and may not be indicative of our future financial performance in subsequent quarters or years. Typically, the financial performance for live entertainment is in the first and fourth quarters of the calendar year as outdoor venues are primarily used, and festivals primarily occur, during May through September. In addition, the timing of tours of top grossing acts can impact comparability of quarterly results year over year and potentially annual results.

We have incurred net losses and may experience future net losses.

Our operating results from continuing operations have been adversely affected by, among other things, event profitability and overhead costs. For the period February 10, 2010 to December 31, 2010, we recorded a net loss of $2,022,497. We expect to continue to incur net losses for the foreseeable future. We may face reduced demand for our events and other factors that could adversely affect our results of operations in the future. We cannot predict whether we will achieve profitability in future periods or at all.

We may be adversely affected by the current, or any future, general deterioration in economic conditions, which could affect consumer and corporate spending and, therefore, significantly adversely impact our entertainment-related operating results.

A decline in attendance at or reduction in the number of live events may have an adverse effect on our revenue and operating income. In addition, during past economic slowdowns and recessions, many consumers reduced their discretionary spending and advertisers reduced their advertising expenditures. The impact of slowdowns on our business is difficult to predict, but they may result in reductions in ticket sales, sponsorship opportunities and our ability to generate revenue. The risks associated with our businesses may become more acute in periods of a slowing economy or recession, which may be accompanied by a decrease in attendance at live events.

Our entertainment business depends on discretionary consumer and corporate spending. Many factors related to corporate spending and discretionary consumer spending, including economic conditions affecting disposable consumer income such as employment, fuel prices, interest and tax rates and inflation which can significantly impact our operating results. Business conditions, as well as various industry conditions, including corporate marketing and promotional spending and interest levels, can also significantly impact our operating results. These factors can affect attendance at our events, premium seat sales, sponsorship, advertising and hospitality spending, concession and souvenir sales, as well as the changes in our industry. Negative factors such as challenging economic conditions, public concerns over terrorism and security incidents, particularly when combined, can impact corporate and consumer spending, and one negative factor can impact our results more than another. There can be no assurance that consumer and corporate spending will not be adversely impacted by current economic conditions, or by any further or future deterioration in economic conditions, thereby possibly impacting our operating results and growth.

Loss of our management and other personnel could result in the loss of key events and negatively impact our entertainment business.

The event business is uniquely dependent upon personal relationships, as promoters and executives within the company leverage their existing network of relationships with artists, athletes, agents and managers in order to secure the rights to the live tours and events which are critical to our success. Due to the importance of those industry contacts to our business, the loss of any of our officers or other key personnel could adversely affect our operations.

11

Our future success depends, to a significant extent, on the continued services of our senior management, particularly Sheldon Finkel, our Chief Executive Officer. Moreover, we do not have key-man insurance on Mr. Finkel. The loss of Mr. Finkel or certain other employees, would have a material and adverse effect on our business. Competition for talented personnel throughout our industry is intense and we may be unable to retain our current key employees or attract, integrate or retain other highly qualified employees in the future. We have in the past experienced, and we expect to continue to experience, difficulty in hiring and retaining highly skilled employees with appropriate qualifications. If we do not succeed in attracting new personnel or retaining and motivating our current personnel, our business could be adversely affected.

We face intense competition in live music and entertainment, ticketing and artist/athlete services industries, and we may not be able to maintain or increase our current revenue, which could adversely affect our financial performance.

The industry in which we compete is a rapidly evolving, highly competitive and fragmented. We expect competition to intensify in the future. There can be no assurance that we will be able to compete effectively. We believe that the main competitive factors in the sports, entertainment and media industries include personal and professional relationships, trust and access to capital in order to develop a roster of talent and media relationships that provide returns on the Company’s investments. Many of our competitors are established, profitable and have strong attributes in many, most or all of these areas. They may be able to leverage their existing relationships to offer alternative products or services at more attractive pricing or with better organizational or financial support. Other companies may also enter our markets with better athletes, greater financial and human resources and/or greater brand recognition. Competitors may continue to evolve and improve or expand current offerings and introduce new talent. We may be perceived as relatively too small, untested or possessing a poor track record inasmuch as similar business models developed in the past have failed to produce successful performance or returns to investors to succeed, which may be hurtful to our success relative to the competition. To be competitive, we will have to invest significant resources in business development, advertising and marketing. We may also have to rely on strategic partnerships for critical branding and relationship leverage, which partnerships may or may not be available or sufficient. There are no assurances that we will have sufficient resources to make these investments or that we will be able to make the advances necessary to be competitive. Increased competition may result in price inflation for talent, reduced gross margins from our media and other relationships and loss of market share. Failure to compete successfully against current or future competitors could have a material adverse effect on the Company’s business, operating results and financial condition.

We compete in the live music and sports industries and within these industries we compete with venues to book performers, athletes and events, and, in the markets in which we promote concerts and events, we face competition from other promoters and venue operators. Our competitors compete with us for key employees who have relationships with popular artists and athletes that have a history of being able to book such artists for concerts and tours or athletes for fights or other events. These competitors have already and may continue to engage in extensive development efforts, undertake more far-reaching marketing campaigns, adopt more aggressive pricing policies and make more attractive offers to existing and potential artists and athletes. Our competitors have already developed many of the elements that are important to our success, as we are a newcomer in the industry, and they may continue to develop services, advertising options or venues that are equal or superior to those we utilize or that achieve greater market acceptance and brand recognition than we achieve. It is possible that new competitors may emerge and rapidly acquire significant market share.

We do not presently have ticketing capabilities, but rely on others for ticketing services. Our ticketing vendors compete in the ticketing industry with other vendors and intense competition in the ticketing industry could cause the proceeds from our ticketing to decline, although immaterial at present. There can be no assurance that we will be able to compete successfully in the future with existing or potential competitors or that competition will not have an adverse effect on our business and financial condition. We may face direct competition in the live music industry with our prospective or current primary ticketing clients, who primarily include live event content providers (such as owners or operators of live event venues) and face similar competition in the sporting event industry. If we were to enter the ticketing business directly , direct competition with our prospective or current primary ticketing clients could result in a decline in the number of clients we may obtain and a decline in the volume of our ticketing services business, which could adversely affect our business and financial condition, although at the present, our direct ticketing business revenue is immaterial.

12

Other variables that could adversely affect our financial performance by, among other things, leading to decreases in overall revenue, the number of sponsors, event attendance, ticket prices or profit margins include:

|

•

|

an increased level of competition for advertising dollars, which may lead to lower sponsorships as we attempt to retain advertisers or which may cause us to lose advertisers to our competitors offering better programs that we are unable or unwilling to match;

|

|

|

•

|

unfavorable fluctuations in operating costs, including increased guarantees to performers and athletes, which we may be unwilling or unable to pass through to our customers via ticket prices;

|

|

|

•

|

our competitors may offer more favorable terms than we do in order to obtain agreements for new venues or to obtain events for the venues they operate;

|

|

|

•

|

technological changes and innovations that we are unable to adopt or are late in adopting that offer more attractive entertainment alternatives than we currently offer, which may lead to reduction in attendance at live events, a loss of ticket sales or to lower ticket prices;

|

|

|

•

|

other entertainment options available to our audiences that we do not offer;

|

|

|

•

|

unfavorable changes in labor conditions which may require us to spend more to retain and attract key employees; and

|

|

|

•

|

unfavorable shifts in population and other demographics which may cause us to lose audiences as people migrate to markets where we have a smaller presence, or which may cause sponsors to be unwilling to pay for sponsorship and advertising opportunities if the general population shifts into a less desirable age or geographical demographic from an advertising perspective.

|

We believe that barriers to entry into the live music and into the sports promotion business are low and that local promoters, Internet based businesses and others are increasingly expanding the scope of their operations.

The speculative nature of the entertainment industry may result in our inability to develop performers or athletes that receive sufficient market acceptance for us to be successful.

Certain segments of the entertainment industry are highly speculative and historically have involved a substantial degree of risk. If we are unable to produce products or services that receive sufficient market acceptance we may not generate sufficient revenues to maintain our operations and our business will be unsuccessful.

We may not be able to successfully implement our business model which is subject to inherent uncertainties.

Our business is predicated on our ability to attract athletes and artists, advertisers and persons willing to pay subscriptions in order to view our events in the appropriate medium. We cannot assure that there will be a large enough audience for our programs or that prospective fans or participants will agree to pay the prices that we propose to charge. In the event our customers resist paying the prices we set for our programs, our business, financial condition, and results of operations will be materially and adversely affected.

We must respond to and capitalize on rapid changes in consumer behavior resulting from new technologies and distribute programs and media content in order to become and remain competitive and exploit new opportunities.

Technology in the entertainment and sports arenas is changing rapidly and Internet and mobile viewership is still relatively new and untested. If we are unable to adapt to advances in technologies, distribution outlets and content transfer and storage (legally or illegally) to ensure that our programs remain desirable and widely available to our audiences while protecting our intellectual property interests our revenues and results of operations will be negatively impacted . The ability to anticipate and take advantage of new and future sources of revenue from these technological developments will affect our ability to secure revenue and expand our business. If we cannot ensure that our content is responsive to the lifestyles of our target audiences and capitalize on technological advances, our revenues will decline which may cause us to curtail operations or be unable to take advantage of opportunities.

13

The processing, storage, use and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements or differing views of personal privacy rights.

In the processing of consumer transactions, we may receive, transmit and store personally identifiable information and other user data. The sharing, use, disclosure and protection of this information are subject to privacy and data security expectations , laws and regulations, which are evolving . We do not have any procedures in place or policies for handling personally identifiable information other than as are generally available to vendors from transaction processing companies. Federal, state and international laws regarding privacy and the storing, sharing, use, disclosure and protection of personally identifiable information and user data may be asserted by individuals or groups that may claim we are responsible for security lapses or breaches. Personally identifiable information is increasingly subject to legislation and regulations in numerous jurisdictions around the world, the intent of which is to protect the privacy of personal information that is collected, processed and transmitted. We could be adversely affected if legislation or regulations are expanded to require changes in business practices or privacy policies, or if governing jurisdictions interpret or implement their legislation or regulations in ways that negatively affect our business, financial condition and results of operations.

We may also become exposed to potential liabilities as a result of differing views on the privacy of the consumer and other user data collected by our business. The failure of us and/or the various third-party vendors and service providers with which we do business, to comply with applicable privacy policies or federal, state or similar international laws and regulations or any compromise of security that results in the unauthorized release of personally identifiable information or other user data could damage the reputation of our business, discourage potential users from trying the products and services that we offer and/or result in fines and/or proceedings by governmental agencies and/or consumers, one or all of which could adversely affect our business, financial condition and results of operations.

Poor weather may adversely affect attendance at our events, which could negatively impact our financial performance and entertainment business.

We expect to promote many outdoor events. Weather conditions surrounding these events affect sales of tickets, concessions and merchandise, among other things. Poor weather conditions can have a material effect on our results of operations particularly because we expect to promote a finite number of events. Due to weather conditions, we may be required to reschedule an event to another available day or a different venue, which would increase our costs for the event and could negatively impact the attendance at the event, as well as food, beverage and merchandise sales. Poor weather can affect current periods as well as successive events in future periods. If we are unable to reschedule events due to poor weather, we may be forced to issue refunds for those events.

Our entertainment businesses may be adversely affected by the occurrence of extraordinary events.

The occurrence and threat of extraordinary events, such as terrorist attacks, intentional or unintentional mass-casualty incidents, natural disasters or similar events, may substantially decrease the use of and demand for our services and the attendance at events, which may decrease our revenue or expose us to substantial liability. The terrorism and security incidents in the past, military actions in foreign locations, and periodic elevated terrorism alerts can be expected to negatively impact us, including public concerns regarding air travel, military actions and additional national or local catastrophic incidents, causing a nationwide disruption of commercial and leisure activities.

Following past extraordinary events, some performers and athletes refused to travel or book tours or events, which if it were to occur to our performers or athletes, could adversely affect our business. The occurrence or threat of future terrorist attacks, military actions by the United States, contagious disease outbreaks, natural disasters such as earthquakes and severe floods or similar events cannot be predicted, and their occurrence can be expected to negatively affect the economies of the United States and other foreign countries where we expect to do business.

14

Costs associated with, and our ability to obtain adequate insurance could adversely affect our profitability and financial condition.

We may experience increased difficulty obtaining insurance coverage at all or at reasonable costs, including coverage for acts of terrorism. We may have a material investment in property and equipment that may be located at venues, which are generally located near major cities and which hold events typically attended by a large number of fans.

These operational, geographical and situational factors, among others, may result in significant increases in insurance premium costs and difficulties obtaining sufficiently high policy limits with deductibles that we believe to be reasonable. We cannot assure that future increases in insurance costs and difficulties obtaining high policy limits will not adversely impact our profitability, thereby possibly impacting our operating results and growth.

In addition, we enter into various agreements with artists and athletes from time to time, including artists and athletes . The profitability of those arrangements depends upon those artists’ willingness and ability to continue performing, and we may not be able to obtain sufficient insurance coverage at reasonable costs to adequately protect us against the death, disability or other failure to continue engaging in revenue-generating activities under those agreements.

We cannot guarantee that our insurance policy coverage limits, including insurance coverage for property, casualty, liability, artists and business interruption losses and acts of terrorism, would be adequate under the circumstances should one or multiple events occur at or near any of our events, or that our insurers would have adequate financial resources to sufficiently or fully pay our related claims or damages. We cannot guarantee that adequate coverage limits will be available, offered at reasonable costs, or offered by insurers with sufficient financial soundness. The occurrence of such an incident or incidents affecting any one or more venues, even if such an incident did not involve any events put on by us , could have a material adverse effect on our financial position and future results of operations. If asset damage and/or company liability were to exceed insurance coverage limits or if an insurer were unable to sufficiently or fully pay our related claims or damages we could be forced to issue compensation on an uninsured basis.

There is the risk of personal injuries and accidents in connection with events, which could subject us to personal injury or other claims and increase our expenses, as well as reduce attendance at events, causing a decrease in our revenue.

There are inherent risks involved with producing live events. As a result, personal injuries and accidents have, and may, occur from time to time, which could subject us to claims and liabilities for personal injuries. Incidents in connection with our live events at any venue or venues that we rent could also result in claims, reducing operating income or reducing attendance at our events, causing a decrease in our revenue. We may maintain insurance policies that provide coverage within limits that are sufficient, in management’s judgment, however there can be no assurance that we will have or maintain adequate insurance or any insurance .

We are subject to extensive governmental regulation, and our failure to comply with these regulations could adversely affect our entertainment business, results of operations and financial condition.

Our live music operations are subject to federal, state and local laws, both domestically and internationally, governing matters such as construction, renovation and operation, as well as:

|

•

|

licensing, permitting and zoning, including noise ordinances;

|

|

|

•

|

human health, safety and sanitation requirements;

|

|

|

•

|

requirements with respect to the service of food and alcoholic beverages;

|

|

|

•

|

working conditions, labor, minimum wage and hour, citizenship and employment laws;

|

|

|

•

|

compliance with the ADA and the DDA;

|

|

|

•

|

sales and other taxes and withholding of taxes;

|

|

|

•

|

privacy laws and protection of personally identifiable information;

|

|

|

•

|

historic landmark rules; and

|

|

|

•

|

environmental protection laws.

|

15

We cannot predict the extent to which any future laws or regulations will impact our operations. The regulations relating to food service in venues are many and complex. Although we generally contract with a third-party vendor for these services, we cannot assure that we or our third-party vendors are in compliance with all applicable laws and regulations at all times or that we or our third-party vendors will be able to comply with any future laws and regulations or that we will not be held liable for violations by third-party vendors. Furthermore, additional or amended regulations in this area may significantly increase the cost of compliance.

Alcoholic beverages will be served at many of venues during live events and must comply with applicable licensing laws, as well as state and local service laws, commonly called dram shop statutes. Dram shop statutes generally prohibit serving alcoholic beverages to certain persons such as an individual who is intoxicated or a minor. If we violate dram shop laws, we may be liable to third parties for the acts of the customer. Although we generally hire outside vendors to provide these services at venues and regularly sponsor training programs designed to minimize the likelihood of such a situation, we cannot guarantee that intoxicated or minor customers will not be served or that liability for their acts will not be imposed on us. We cannot assure that additional regulation in this area would not limit our activities in the future or significantly increase the cost of regulatory compliance. We must also obtain and comply with the terms of licenses in order to sell alcoholic beverages in the states in which we serve alcoholic beverages.

From time to time, governmental bodies have proposed legislation that could have an effect on our business. For example, some legislatures have proposed laws in the past that would impose potential liability on us and other promoters and producers of live events for entertainment taxes and for incidents that occur at our events, particularly relating to drugs and alcohol.

We and the venues are subject to extensive environmental laws and regulations relating to the use, storage, disposal, emission and release of hazardous and non-hazardous substances, as well as zoning and noise level restrictions which may affect, among other things, the hours of operations of the venues. Additionally, certain laws and regulations could provide strict, joint and several responsibility for the remediation of hazardous substance contamination at facilities or at third-party waste disposal sites, which could hold us responsible for any personal or property damage related to any contamination.

We depend upon unionized labor for the provision of some services and any work stoppages or labor disturbances could disrupt our business.

The stagehands at some venues and other employees are subject to collective bargaining agreements. Union agreements regularly expire and require negotiation. Whether or not our employees become subject to collective bargaining agreements or employees of third parties are subject to collective bargaining agreements, our operations may be interrupted as a result of labor disputes or difficulties and delays in the process of renegotiating collective bargaining agreements. In addition, our business operations at one or more of our facilities may also be interrupted as a result of labor disputes by outside unions attempting to unionize. A work stoppage at one or more venues or at our promoted events could have a material adverse effect on our business, results of operations and financial condition. We cannot predict the effect that a potential work stoppage will have.

Our entertainment business is dependent upon venues, and if we are unable to secure access to venues on acceptable terms, or at all, our results of operations could be adversely affected.

We require access to venues to generate revenue. We expect to operate in a number of venues under various agreements which include leases with third parties or equity or booking agreements, which are agreements where we contract to book events at a venue for a specific period of time. Our long-term success will depend in part on the availability of venues, our ability to lease venues and our ability to enter into booking agreements. As many of these agreements are with third parties over whom we have little or no control, we may be unable to renew agreements or enter into new agreements on acceptable terms or at all, and may be unable to obtain favorable agreements with venues. Our ability to renew agreements or obtain new agreements on favorable terms depends on a number of other factors, many of which are also beyond our control, such as national and local business conditions and competition from other promoters. If the cost of renewing agreements is too high or the terms of any new agreement with a new venue are unacceptable or incompatible with our existing operations, we may decide to forego these opportunities. There can be no assurance that we will be able to renew agreements on acceptable terms or at all, or that we will be able to obtain attractive agreements with substitute venues, which could have a material adverse effect on our results of operations.

16

Costs associated with capital improvements could adversely affect our profitability and liquidity.

Although we do not currently own any venues, growth or maintenance of our revenue may come to depend on consistent investment. Therefore, we may need to anticipate making capital improvements in venues to meet long-term demand, entertainment value and revenue. We may have a number of capital projects underway simultaneously. Numerous factors, many of which are beyond our control, may influence the ultimate costs and timing of various capital improvements at venues, including:

|

•

|

availability of financing on favorable terms;

|

|

|

•

|

unforeseen changes in design;

|

|

|

•

|

increases in the cost of construction materials and labor;

|

|

|

•

|

additional land acquisition costs;

|

|

|

•

|

fluctuations in foreign exchange rates;

|

|

|

•

|

litigation, accidents or natural disasters affecting the construction site;

|

|

|

•

|

national or regional economic changes;

|

|

|

•

|

environmental or hazardous conditions; and

|

|

|

•

|

undetected soil or land conditions.

|

The amount of capital expenditures can vary significantly. In addition, actual costs could vary materially from our estimates if the factors listed above and our assumptions about the quality of materials or workmanship required or the cost of financing such construction were to change. Construction is also subject to governmental permitting processes which, if changed, could materially affect the ultimate cost.

Entertainment revenues depend in part on the promotional success of marketing activities , and there can be no assurance that advertising , promotional and other marketing campaigns will be successful or will generate revenue or profits.

We plan to spend significant amounts on advertising, promotional and other marketing campaigns for events and other business activities. Such marketing activities include, among others, promotion of ticket sales, premium seat sales, hospitality and other services for events and venues and may include advertising associated with souvenir merchandise and apparel. There can be no assurance that our advertising, promotional and other marketing campaigns will be successful or will generate revenue or profits.

Promotion requires significant up front outlays that may not be capable of being recouped.

We intend to invest heavily in development and marketing which will require a significant expenditure of funds for rehearsal, practice, and for athletes, training, housing, and promotion. As a result, there can be no assurance that such investments will yield the anticipated returns.

Changes in technology may reduce the demand for the products or services traditionally associated with sports and entertainment programs and promotion.

Online digital media may present a challenge to our expected sources of revenue from pay per view and other media relations. Cable, satellite and broadcast television are substantially affected by rapid and significant changes in technology, including the increasing use and access to the Internet for media and entertainment, and the increasing use and access to technologies that may defeat copyright protections, reducing our income. These changes may reduce the demand for certain existing services and technologies used in these industries or render them obsolete. We cannot assure you that the technologies used by or relied upon or produced by our business. While many attempt to adapt and apply the services provided by the target business to newer technologies, we cannot assure you that we will have sufficient resources to fund these changes or that these changes will ultimately prove successful or produce revenue. If we are unable to respond quickly to changes in technology our business could fail.

17

A decline in media or advertising expenditures could cause our revenues and operating results to decline significantly in any given period or in specific markets.

We anticipate deriving a portion of our revenues from the sale of media content which is dependent on advertising. A decline in advertising expenditures generally or in specific markets could significantly adversely affect our revenues and operating results in any given period. Declines can be caused by the economic conditions and sentiment, prospects of advertisers or the economy in general could alter current or prospective media consumer or advertisers’ spending priorities. Disasters, acts of terrorism, political uncertainty or hostilities could lead to a reduction in media advertising expenditures as a result of economic uncertainty. Our advertising revenues may also be adversely affected by changes in audience traffic, which advertisers rely upon in making decisions to purchase advertising. A decrease in our media or in advertising revenues will adversely impact our results of operations.

If we are unable to obtain additional funding, our business operations will be harmed and if we do obtain additional financing, our then existing shareholders may suffer substantial dilution.

There is no assurance that we will not incur debt in the future, that we will have sufficient funds to repay any indebtedness or that we will not default on our debt obligations, jeopardizing our business viability. Furthermore, we may not be able to borrow or raise additional capital in the future to meet our needs or to otherwise provide the capital necessary to conduct our business. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. We estimate that based on current plans and assumptions, that our available cash will be sufficient to satisfy our cash requirements under our present operating expectations, without further financing for more than 12 months. If we are unable to obtain additional financing, we will likely be required to curtail our marketing and development plans and possibly cease our operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

We may incur liabilities that we might be unable to repay in the future.

We may incur liabilities with affiliated or unaffiliated lenders. These liabilities would represent fixed costs which would be required to be paid regardless of the level of our business or profitability. There is no assurance that we will be able to pay all of our liabilities. Furthermore, we are always subject to the risk of litigation from customers, suppliers, employees, and others because of the nature of our business, including but not limited to consumer lawsuits. Litigation can cause us to incur substantial expenses and, if cases are lost, judgments, and awards can add to our costs. An increase in our costs may cause us to increase the prices at which we charge our customers which may lead to our customers to seek alternatives to our products. In such event, our revenues will decrease and we may be forced to curtail our operations.

Funding for events may not be available from independent third parties, or at all. As a result we may undertake funding for events with insiders and others affiliated with the Company which may not be on an arms-length basis. During February 2011 our subsidiary EXCX Funding Corp. secured a loan of $4.5 million (the “Loan”) from our Co-Chairman and a significant stockholder. The Loan is senior secured, bearing 6% interest and due on January 31, 2012. As additional collateral our Chief Executive Officer Sheldon Finkel pledged a $1 million letter of credit originally procured by the Company to secure the Company’s payment obligations to Mr. Finkel under his employment agreement. The loan was obtained in order to provide funding for a single event, the Capital Hoedown, to be performed in Ottawa, Canada, during August 2011. Under the terms of the loan any proceeds from the Capital Hoedown must be used to pay, in addition to principal, interest, fees and expenses of the loan, an override fee of 15% of the initial $4.5 million loan, of which Mr. Finkel shall receive a pro-rata portion (1/3). In addition to the risks appurtenant to such an event generally, the nature of the loan provides a further risk that even if the event is profitable, until the interest, principal, and override amount are repaid to our lenders, who are affiliates of the Company, there may not be sufficient proceeds for the Company to realize a profit from the event.

18

We have significantly increased our leverage as a result of the Loan.

In connection with the Loan, we incurred new indebtedness of $4.5 million. The degree to which we are leveraged could, among other things:

• make it difficult for us to make payments on the loans;

• make it difficult for us to obtain financing for working capital, acquisitions or other purposes on favorable terms, if at all;

• make us more vulnerable to industry downturns and competitive pressures; and

• limit our flexibility in planning for, or reacting to changes in, our business.

Our ability to meet our debt service obligations will depend upon our future performance, which will be subject to financial, business and other factors affecting our operations, many of which are beyond our control.

The security interest governing the Loan contains financial covenants and restrict the incurrence of debt by us or our subsidiaries and, as a result, neither the Company nor our subsidiaries can incur additional secured indebtedness, which would significantly affect the availability of future financing on favorable terms.

The security interests granted in connection with the Loan contain various financial covenants or restrictions prohibiting the incurrence of indebtedness, including additional indebtedness by us or the incurrence of any indebtedness by our subsidiary, EXCX. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail our marketing and development plans and possibly cease our operations. Any additional equity financing may involve substantial dilution to our then existing shareholders.

We may be unable to repay the Loan at maturity or prior to a change of control.

At maturity, January 31, 2012, of the Loan the entire outstanding principal and accrued interest on the Loan will become due and payable by us. Upon a change of control, as defined in the governing credit facility agreement, the entire outstanding principal and accrued interest on the Loan will become due and payable by us. We cannot assure you that we will have enough funds or be able to arrange for additional financing to pay the principal amount at maturity or upon such a change of control.

Our failure to repay the Notes at maturity or prior to a change of control would constitute an event of default under the agreement that governs the Loans and may also constitute an event of default under any other indenture or other agreement governing then-existing indebtedness, which could prevent us from paying the Loan. If a change of control occurred and accelerated any other then-existing indebtedness, there are no assurances that we would have sufficient financial resources, or be able to arrange for additional financing, to repay the principal amount at maturity or pay the repurchase price for the Notes and amounts due under any other indebtedness.

19

Provisions of the Loan and the agreements governing the Loan could discourage an acquisition of us by a third party.

Certain provisions of the Loan could make it more difficult or more expensive for a third party to acquire us. Upon the occurrence of certain transactions constituting a change of control, the lenders of the Loan will have the right, at their option, to require us to pay all or any portion of the Loan to be immediately due and payable. Furthermore the lenders of the Loan will have the immediate right, in addition to any legal and equitable rights and remedies available under law, to enforce and realize upon the first priority collateral security granted under any of the documents governing the Loan in any manner or in any order, which could result in the requirement to liquidate our assets.

We may incur unanticipated cost overruns which may significantly affect our operations.

We may incur substantial cost overruns in the acquisition, development and promotion of our talent. Management is not obligated to contribute capital to us and we do not maintain any credit facility which can finance events or artists and athletes . Unanticipated costs may force us to obtain additional capital or financing from other sources if we are unable to obtain the additional funds necessary to implement our business plan. There is no assurance that we will be able to obtain sufficient capital to implement our business plan successfully. If a greater investment is required in the business, our revenues and profitability may decline, although we have never turned a profit from our operations .

Our operating results are difficult to predict, so our operating results may fall below the expectations of securities analysts and investors.

Because our operating results are difficult to predict, our operating results may fall below the expectations of securities analysts and investors. We presently are not followed by any securities analysts . If this happens, the trading price of our common stock may fall significantly. Factors that affect our quarterly and annual operating results include, among other things, the following:

|

·

|

our ability to establish and strengthen brand awareness;

|

|

|

·

|

our success in promoting our performers and events;

|

|

|

·

|

the amount and timing of costs relating to our marketing efforts or other initiatives;

|

|

|

·

|

our ability to enter into favorable contracts with entertainers, athletes and venues, content distributors, developers, and other parties;

|

|

·

|

acquisition-related costs;

|

|

|

·

|

our ability to compete in a highly competitive market; and

|

|

|

·

|

economic trends specifically affecting the entertainment and sports business, as well as general economic conditions in the markets we serve.

|

If we do not manage our growth efficiently, we may not be able to operate our business effectively; we may abandon or reduce our entertainment business