Attached files

| file | filename |

|---|---|

| EX-3.2 - BYLAWS - GWG Holdings, Inc. | dex32.htm |

| EX-21 - LIST OF SUBSIDIARIES - GWG Holdings, Inc. | dex21.htm |

| EX-3.1 - ARTICLES OF INCORPORATION - GWG Holdings, Inc. | dex31.htm |

| EX-23.1 - CONSENT OF MAYER HOFFMAN MCCANN P.C. - GWG Holdings, Inc. | dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on June 14, 2011

Reg. No. 333-

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

GWG HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-2222607 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) |

| 220 South Sixth Street, Suite 1200 Minneapolis, Minnesota 55402 (612) 746-1944 Fax: (612) 746-0445 |

Jon R. Sabes Chief Executive Officer 220 South Sixth Street, Suite 1200 Minneapolis, Minnesota 55402 (612) 746-1944 |

With a copy to: Paul D. Chestovich, Esq. Martin R. Rosenbaum, Esq. Maslon Edelman Borman & Brand, LLP 3300 Wells Fargo Center Minneapolis, Minnesota 55402 Telephone: (612) 672-8200 Fax: (612) 672-8397 | ||

| (Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices) | (Name, address, including zip code, and telephone number, including area code, of agent for service) |

Approximate date of commencement of proposed sale to the public: as soon as practicable after the effective date.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

| Non-accelerated filer ¨ | Smaller reporting company x | |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Unit |

Proposed Maximum Aggregate Offering |

Amount of Registration Fee | ||||

| Secured Debentures |

$250,000,000 | (1) | $ 250,000,000 | $ 29,025.00 | ||||

| (1) | The Secured Debentures will be issued in minimum denominations of $25,000 and in $1,000 increments in excess of such minimum amount. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

A Registration Statement relating to these securities has been filed with the Securities and Exchange Commission but has not yet become effective. Information contained herein is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted prior to the time the Registration Statement becomes effective.

SUBJECT TO COMPLETION, DATED JUNE 14, 2011

Offering Amount $250,000,000

GWG HOLDINGS, INC.

a Delaware corporation

Secured Debentures

GWG Holdings, Inc., through its subsidiaries, purchases life insurance policies sold in the secondary marketplace. Our objective is to earn returns from the purchased life insurance policies that are greater than the costs necessary to purchase, finance and service those policies to their maturity.

We are offering up to $250,000,000 in Secured Debentures (the “debentures”) in this offering. This is a continuous offering and there is no minimum amount of debentures that must be sold before we can use any of the proceeds. The proceeds from the sale of the debentures will be paid directly to us following each sale and will not be placed in an escrow account. We will use the net proceeds from the offering of the debentures primarily to purchase and finance additional life insurance policies, and to service and retire other outstanding debt obligations. The minimum investment in debentures is $25,000. Investments in excess of such minimum amount may be made in $1,000 increments. The debentures will be sold with varying maturity terms, interest rates and frequency of interest payments, all as set forth in this prospectus and in supplements published from time to time. Depending on our capital needs and the amount of your investment, debentures with certain terms may not always be available. Although we will periodically establish and change interest rates on unsold debentures offered pursuant to this prospectus, once a debenture is sold, its interest rate will not change during its term (subject, however, to the extension and renewal provisions contained in such debenture).

The debentures are secured by the assets of GWG Holdings, Inc., and a pledge of all of the common stock by our largest shareholders. Obligations under the debentures will also be guaranteed by our subsidiary GWG Life Settlements, LLC, which guarantee will involve the grant of a security interest in all of the assets of such subsidiary. The majority of our life insurance policy assets are held in our subsidiary GWG DLP Funding II, LLC (which is a direct subsidiary of GWG Life Settlements). The policies held by GWG DLP Funding II will not be collateral for obligations under the debentures although the guarantee and collateral provided by GWG Life Settlements will include that company’s ownership interest in GWG DLP Funding II. The security offered for the debentures will provide rights as to collateral that are pari passu with the holders of other secured debt previously issued by GWG Life Settlements.

We may prepay the outstanding principal balance and accrued and unpaid interest of any or all of the debentures, in whole or in part, at any time without penalty or premium. Debenture holders will have no right to require us to prepay any debenture prior to the due date unless the request is due to death, bankruptcy or total disability. In the event we agree to prepay a debenture upon the request of a debenture holder (other than after death, bankruptcy or total disability), we will impose a prepayment fee of 6% against the outstanding principal balance of the redeemed debenture. This prepayment fee will be subtracted from the amount paid.

We do not intend to list our debentures on any securities exchange during the offering period, and we do not expect a secondary market in the debentures to develop. As a result, you should not expect to be able to resell your debentures regardless of how we perform. Accordingly, an investment in our debentures is not suitable for investors that require liquidity in advance of their debenture’s maturity date.

Investing in our debentures may be considered speculative and involves a high degree of risk, including the risk of losing your entire investment. See “Risk Factors” beginning on page 14 to read about the risks you should consider before buying our debentures. You should carefully consider the risk factors set forth in this prospectus. An investment in our debentures is not suitable for all investors. The debentures are only suitable for persons with substantial financial resources and with no need for liquidity in this investment. See “Suitability Standards” for information on the suitability standards that investors must meet in order to purchase the debentures.

Please read this prospectus before investing and keep it for future reference. We file annual, quarterly and current reports, proxy statements and other information about us with the SEC. This information will be available free of charge by contacting us at 220 South Sixth Street, Suite 1200, Minneapolis, Minnesota 55402 or by phone at (612) 746-1944 or on our website at www.gwglife.com. The SEC also maintains a website at www.sec.gov that contains such information.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2011

Table of Contents

The debentures will be offered and sold on a best-efforts basis by our selling group consisting of broker-dealers registered with the Financial Industry Regulatory Authority (“FINRA”). Arque Capital, Ltd., a member of FINRA, will act as managing broker-dealer, or the “dealer manager.” The dealer manager will enter into agreements with participating members of the selling group and will receive a managing broker-dealer fee ranging from 0.25% to 1.30% of the principal amount of debentures sold, depending on the debentures’ maturity date. The remaining members of the selling group, including wholesale brokers, will receive selling commissions ranging from 0.50% to 10.95% of the principal amount of the debentures sold, and a non-accountable marketing and due-diligence allowance of up to 1.25% of the principal amount of the debentures sold, depending on the debentures’ maturity date. Certain of our employees who are also registered representatives of Arque Capital may receive selling commissions for selling debentures as a member of the selling group. The total amount of the managing broker-dealer fee, selling commission, and non-accountable expense allowance paid to the dealer manager and selling group on each debenture will not exceed 13.50% of the principal amount of the debenture sold. In addition, we may issue warrants for our equity securities to selling group members and the dealer manager. See “Plan of Distribution” and “Use of Proceeds” for further information.

The offering expenses and other expenses incurred in connection with this offering are not expected to exceed $500,000. Such expenses will be charged against initial proceeds.

| Price to Investors |

Dealer Manager Fee, Selling Commissions, and Allowance (1)(2) |

Proceeds

to the Company (3) |

||||||||||

| Minimum Investment |

$ | 25,000 | $ | 1,750 | $ | 23,250 | ||||||

| Offering |

$ | 250,000,000 | $ | 17,500,000 | $ | 232,500,000 | ||||||

| (1) | Assumes an average sales commission of 5.00%, average non-accountable marketing and due-diligence expenses of 1.00%, and an average dealer manager fee of 1.00%. As indicated above, actual sales commissions, non-accountable marketing and due-diligence allowances, and dealer manager fees will vary based on a range that relates to the maturity of the debentures sold. The total amount of non-accountable expense allowance, commissions and fees to the dealer manager and the selling group paid on each debenture will not exceed 13.50% of the principal amount of the debenture sold. |

| (2) | The dealer manager has agreed to offer the debentures on an agency and “best efforts” basis. The dealer manager may also sell debentures as part of the selling group, thereby becoming entitled to selling commissions. |

| (3) | Proceeds we receive are calculated after deducting the dealer manager fee, assumed average selling commissions, fees and allowance, but before deducting offering expenses and other expenses incurred in connection with the offering. If the maximum offering were sold and the maximum allowance, commissions and fees were paid, the proceeds to us would be $215,750,000, less the amount of offering expenses and other expenses incurred in connection with the offering. |

We will issue the debentures in book-entry or uncertificated form. Subject to certain limited exceptions, you will not receive a certificated security or negotiable instrument that is or represents your debentures. Instead, we will deliver written confirmation to purchasers of debentures. Bank of Utah, National Association, will act as trustee for the debentures.

i

Table of Contents

ABOUT THIS PROSPECTUS

We have prepared this prospectus as part of a registration statement that we filed with the SEC, using a continuous offering process. Periodically, as we make material investments or have other material developments, we will provide a prospectus supplement that may add, update or change information contained in this prospectus. We will endeavor to avoid interruptions in the continuous offering of our debentures, including, to the extent permitted under the rules and regulations of the SEC, by filing an amendment to the registration statement with the SEC. There can be no assurance, however, that our continuous offering will not be suspended while the SEC reviews such amendment, until it is declared effective.

Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement made by us in a subsequent prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement, together with additional information described below under “Available Information.” In this prospectus, we use the term “day” to refer to a calendar day, and we use the term “business day” to refer to any day other than Saturday, Sunday, a legal holiday or a day on which banks in New York City are authorized or required to close.

You should rely only on the information contained in this prospectus. Neither we, nor the dealer manager have authorized any other person to provide you with different information from that contained in this prospectus or information furnished by us upon request as described herein. The information contained in this prospectus is complete and accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or sale of our debentures. This prospectus contains summaries of certain other documents, which summaries are believed to be accurate, but reference is hereby made to the full text of the actual documents for complete information concerning the rights and obligations of the parties thereto. Such information necessarily incorporates significant assumptions, as well as factual matters. All documents relating to this offering and related documents and agreements, if readily available to us, will be made available to a prospective investor or its representatives upon request. During the course of this offering and prior to sale, each prospective debenture holder is invited to ask questions of and obtain additional information from us concerning the terms and conditions of this offering, our company, the debentures and any other relevant matters, including but not limited to additional information necessary or desirable to verify the accuracy of the information set forth in this prospectus. We will provide the information to the extent it possesses such information or can obtain it without unreasonable effort or expense. If there is a material change in the affairs of our company, we will amend or supplement this prospectus.

Neither the information contained herein, nor any prior, contemporaneous or subsequent communication should be construed by the prospective investor as legal or tax advice. Each prospective investor should consult its, his or her own legal, tax and financial advisors to ascertain the merits and risks of the transactions described herein prior to purchasing the debentures. This written communication is not intended to be issued as a “reliance opinion” or a “marketed opinion,” as defined under Section 10.35 of Circular 230 published by the U.S. Treasury Department, so as to avoid any penalties that could be assessed under the Internal Revenue Code of 1986, as amended (the “Code”) or its applicable Treasury Regulations. Accordingly, (a) any information contained in this written communication is not intended to be used, and cannot be used or relied upon for purposes of avoiding any penalties that may be imposed on a prospective investor by the Code or applicable Treasury Regulations; (b) this written communication has been written to support the promotion or marketing of the transactions or matters addressed by this written communication; and (c) each prospective investor should seek advice based on the prospective investor’s particular circumstances from an independent tax advisor.

The debentures will be issued under an indenture. This prospectus is qualified in its entirety by the terms of that indenture filed with SEC as an exhibit to the registration statement of which this prospectus is a part. To the extent there is any inconsistency between this prospectus and the indenture, the indenture shall prevail. You may obtain a copy of the indenture upon written request to us or online at www.sec.gov.

The indenture trustee did not participate in the preparation of this prospectus and makes no representations concerning the debentures, the collateral, or any other matter stated in this prospectus. The indenture trustee has no duty or obligation to pay the debentures from their funds, assets or capital or to make inquiry regarding, or investigate the use of, amounts disbursed from any account.

ii

Table of Contents

| Page | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 12 | ||||

| 14 | ||||

| 25 | ||||

| 27 | ||||

| 28 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

29 | |||

| 39 | ||||

| 55 | ||||

| 59 | ||||

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS |

62 | |||

| 64 | ||||

| 79 | ||||

| 80 | ||||

| 84 | ||||

| 85 | ||||

| 86 | ||||

| 86 | ||||

| 87 | ||||

| F-1 | ||||

GWG Holdings, Inc.

220 South Sixth Street, Suite 1200

Minneapolis, MN 55402

(612) 746-1944

(612) 746-0445 fax

iii

Table of Contents

The following are our suitability standards for investors that are required by the Omnibus Guidelines published by the North American Securities Administrators Association in connection with our continuous offering of debentures under this registration statement.

Pursuant to applicable state securities laws, debentures offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. There is not expected to be any public market for the debentures, which means that it may be difficult or impossible for you to resell the debentures. As a result, we have established suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $250,000. Our suitability standards also require that a potential investor (1) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (2) is able to bear the economic risk of the investment based on the prospective debenture holder’s overall financial situation; and (3) has apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the lack of liquidity of the debentures, (d) the qualifications of any advisor in our selling group who is recommending an investment in the debentures, and (e) the tax consequences of the investment.

The minimum purchase for our debentures is $25,000. To satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement accounts, or IRAs, provided that each such contribution is made in increments of $500. You should note that an investment in our debentures will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Code. If you wish to purchase debentures in excess of the $25,000 minimum, any additional purchase must be in amounts of at least $1,000.

In the case of sales to fiduciary accounts, these suitability standards must be met by the person who directly or indirectly supplied the funds for the purchase of our debentures or by the beneficiary of the account. These suitability standards are intended to help ensure that, given the long-term nature of an investment in our debentures, our investment objectives and the relative illiquidity of our debentures, the debentures are an appropriate investment for prospective purchasers. Those selling debentures on our behalf must make every reasonable effort to determine that the purchase of our debentures is a suitable and appropriate investment for each debenture holder based on information known to selling group members and provided by the debenture holder in the subscription agreement. Each selected broker-dealer is required to maintain for six years records of the information used to determine that an investment in our debentures is suitable and appropriate for a debenture holder.

The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective debenture holders. However, satisfaction of these requirements will not necessarily mean that the debentures are a suitable investment for a prospective investor, or that we will accept the prospective investor’s subscription agreement. Furthermore, as appropriate, we may modify such requirements in our sole discretion, and such modifications may raise the suitability requirements for prospective debenture holders.

This prospectus constitutes an offer only to the offeree or to the representative to whom it has been presented. Furthermore, this prospectus does not constitute an offer or solicitation to anyone in any jurisdiction in which such an offer or solicitation is not authorized. This prospectus has been prepared solely for the benefit of persons interested in the proposed offering of the debentures offered hereby. Any reproduction or distribution of this prospectus, in whole or in part, or the disclosure of any of its contents without our prior written consent is expressly prohibited. The recipient, by accepting delivery of this prospectus, agrees to return this prospectus and all documents furnished herewith to us or our representatives immediately upon request if the recipient does not purchase any debentures, or if this offering is withdrawn or terminated.

1

Table of Contents

If you do not meet the requirements described above, do not read further and immediately return this prospectus. In the event you do not meet such requirements, this prospectus does not constitute an offer to sell debentures to you.

The industry, market and data used throughout this prospectus have been obtained from our own research, surveys or studies conducted by third parties and industry or general publications. Industry publications and surveys generally state that they have obtained information from sources believed to be reliable, but do not guarantee the accuracy and completeness of such information. Although we believe that each of these studies and publications is reliable, we have not independently verified such data and make no representations as to the accuracy of such information. Similarly, we believe our internal research is reliable but it has not been verified by any independent sources.

If, after carefully reading this entire prospectus, obtaining any other information requested and available and being fully satisfied with the results of pre-investment due-diligence activities, you would like to purchase debentures, you must complete, execute and return the Subscription Agreement to us (documents to be completed are in a separate subscription package) together with a certified check or personal check payable to the order of “GWG Holdings, Inc. – Indenture Account” (or wire sent to the Indenture Account) equal to the amount of debentures you wish to purchase. Instructions for subscribing for the debentures are included in the Subscription Agreement. The subscription materials and the certified check or personal check should be delivered to your broker-dealer, who will deliver it to us at the following address:

GWG Holdings, Inc.

220 South Sixth Street, Suite 1200

Minneapolis, MN 55402

Wire Instructions

GWG Holdings, Inc.—Indenture Account

Routing:

Bank Name:

You must meet the suitability requirements, and your purchase is subject to our acceptance. All information provided is confidential and will be disclosed only to our officers, affiliates, and legal counsel, and if required, to governmental authorities and self-regulatory organizations or as otherwise required by law.

Upon receipt of the signed Subscription Agreement, verification that the Subscription Agreement contains the appropriate representations and warranties respecting the investor’s investment qualifications, and our acceptance of your purchase (in our sole discretion), we will notify you of receipt and acceptance of your purchase. We may, in our sole discretion, accept or reject any purchase, in whole or in part, for a period of 15 days after receipt of the Subscription Agreement. Any purchase not expressly accepted within 15 days of receipt shall be deemed rejected. In the event we do not accept a your purchase of debentures for any reason, we will promptly return your payment. We may terminate or suspend this offering at any time, for any reason or no reason, in our sole discretion.

2

Table of Contents

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. To understand this offering fully, you should carefully read the entire prospectus, including the section entitled “Risk Factors,” before making a decision to invest in our debentures. Unless otherwise noted or unless the context otherwise requires, the terms “we,” “us,” “our,” the “Company” and “GWG” refers to GWG Holdings, Inc. together with its wholly owned subsidiaries.

Our Company

We are engaged in the emerging secondary market for life insurance policies. We acquire life insurance policies that are sold at a discount to the face value of the insurance benefit. Once we purchase a policy, we continue paying the policy premiums in order to ultimately collect the face value of the insurance benefit. We generally hold the individual policies to maturity in order to ultimately collect the policy’s face value upon the insured’s mortality. Our strategy is to continue to build a diversified and profitable portfolio of policies.

Life insurance companies earn substantial revenue windfalls due to the lapse and surrender behavior of individuals owning insurance policies. These revenue windfalls have enabled life insurance companies to issue policies with reduced premiums. These two business practices create a profit opportunity for participants in the life insurance secondary market. The profit opportunity is the difference, or “spread,” between (i) the cost of purchasing and maintaining a life insurance policy over the insured’s lifetime; and (ii) the policy’s benefit that will paid upon the insured’s mortality. The secondary market for life insurance policies has also been driven by the creation of life insurance policy pricing tools and actuarial modeling techniques developed by investors.

According to the American Council of Life Insurers Fact Book 2010 (ACLI), individuals owned over $10.3 trillion in face value of life insurance policies in the United States in 2009. This figure includes all types of policies, including term and permanent insurance known as whole life, universal life, variable life, and variable universal life. The secondary market for life insurance has developed around individuals aged 65 years or older owning either permanent insurance or term insurance convertible into permanent insurance. According to the ACLI, the average annual lapse rate and surrender rate of life insurance policies for the ten years ended 2009 was 7.3%, or over $750 billion in face value of policy benefits annually.

Owners of life insurance policies generally surrender the policies or allow them to lapse for a variety of reasons, including: (i) unrealistic original earnings assumptions made when the policy was purchased, combined with higher premium payments later in the term of the policy than initially forecasted; (ii) increasing premium payment obligations as the insured ages; (iii) changes in financial status or outlook which cause the insured to no longer require life insurance; (iv) other financial needs that make the insurance unaffordable; or (v) a desire to maximize the policy’s investment value.

The market opportunity for selling and purchasing life insurance policies in the secondary market is relatively new. According to Conning Research & Consulting, the secondary market for life insurance policies grew from $2 billion in 2002 to over $11 billion in face value of life insurance policy benefits being purchased in 2008. To participate in the market opportunity, we have spent significant resources: (i) developing a robust operational platform and systems for purchasing and servicing life insurance policies; (ii) obtaining requisite licensure to purchase life insurance in the secondary market; (iii) developing financing resources for purchasing and financing our life insurance policies; (iv) recruiting and developing a professional management team; (v) establishing origination relationships for purchasing life insurance policies in the secondary market; and (vi) obtaining financing to participate in the business sector.

We were formed in 2006. Since then, we have acquired over $1.4 billion in face value of life insurance policy benefits and have become an active purchaser and financier of life insurance policies in the secondary

3

Table of Contents

market. As of March 31, 2011, we owned approximately $417 million in face value of life insurance policy benefits with an aggregate cost basis of approximately $95 million. To date, we have financed the acquisition of this portfolio through the issuance of secured notes by our direct wholly owned subsidiary GWG Life Settlements, LLC, and the use of a senior revolving credit facility, our “revolving credit facility,” benefitting our indirect wholly owned subsidiary GWG DLP Funding II, LLC, which subsidiary owns title to the majority of our life insurance policy assets. For more information on our corporate structure, please refer to the caption “— Corporate Organization” below.

A summary of our portfolio of life insurance policies as of March 31, 2011 is set forth in the table below:

Life Insurance Portfolio Summary (as of March 31, 2011)

| Total portfolio face value of policy benefits |

$417,643,414 | |

| Average face value per policy * |

$ 2,694,474 | |

| Average face value per insured life * |

$ 2,880,299 | |

| Average age of insured (yrs) |

80.37 | |

| Average life expectancy estimate (yrs) * |

8.33 | |

| Total number of policies |

155 | |

| Demographics |

56.7% Males; 43.3% Females | |

| Number of smokers |

No insureds are smokers | |

| Largest policy as % of total portfolio |

2.39% | |

| Average policy as % of total portfolio |

0.65% |

| * | Averages presented in the table are weighted averages. |

We generally purchase life insurance policies through secondary market transactions directly from the policy owner who originally purchased the life insurance in the primary market. We purchase policies in the secondary market through a network of life insurance agents, life insurance brokers, and licensed providers who assist policy owners in accessing the secondary market. Before we purchase a life insurance policy, we conduct a rigorous underwriting review that includes obtaining two life expectancy estimates on each insured from third party medical actuarial firms. We base our life expectancy estimates on the average of those two estimates. The policies we purchase are universal life insurance policies issued by rated life insurance companies. The price we are willing to pay for the policy in the secondary market is primarily a function of: (i) the policy’s face value; (ii) the expected actuarial mortality of the insured; (iii) the premiums expected to be paid over the life of the insured; and (iv) market competition from other purchasers.

We seek to earn profits by purchasing policies at discounts to the face value of the insurance benefit. The discounts at which we purchase are expected to exceed the costs necessary to pay premiums and financing and servicing costs through the date of the insured’s mortality. We rely on the actuarial life expectancy assumptions provided to us by third-party medical actuary underwriters to estimate the expected mortality of the insured. We seek to finance our life insurance policy purchases and payment of premiums and financing costs, until we receive policy benefits, through the sale of the debentures and the use of our revolving line of credit. In the past, we have also relied on the sale of subsidiary secured notes.

We believe that our business model provides significant advantages to potential investors. First, our earnings from life insurance policies are non-correlated to traditional external market influences such as real estate, equity markets, fixed income markets, currency, and commodities. Second, life insurance policy benefits are the most senior in rank within an insurance company’s capital structure, senior even to secured debt holders, with some amounts further protected under state guaranteed funds (typically limited to $200,000). Third, our assets provide diversification from many other investment opportunities. In addition, the policies within the life insurance portfolio are diversified as well, with no single insurance company making up more than 20% of the total face value of insurance policy benefits.

4

Table of Contents

Our objective is to earn returns from the life insurance policies we purchase in the secondary market which are greater than the costs necessary to purchase and finance those policies to their maturity. We expect to accomplish our objective by:

| • | purchasing life insurance policies with expected internal rates of returns in excess of our cost of capital; |

| • | paying the premiums and costs associated with the life insurance policy until the insured’s mortality; |

| • | obtaining a large and diverse portfolio to mitigate actuarial risk; |

| • | maintaining diversified funding sources to reduce our overall cost of financing; |

| • | engaging in hedging strategies that reduce potential volatility to our cost of financing; and |

| • | maintaining rigorous portfolio monitoring and servicing. |

We have built our business with what we believe to be the following competitive strengths:

| • | Industry Experience: We have actively participated in the development of the secondary market of life insurance as a principal purchaser and financier since 2006. Our position within the marketplace has allowed us to evaluate over 30,000 life insurance policies for possible purchase, thereby gaining a deep understanding of the variety of issues involved when purchasing life insurance policies in the secondary market. We have participated in the leadership of various industry associations and forums, including the Life Insurance Settlement Association and the Insurance Studies Institute. Our experience gives us the confidence in building a portfolio of life insurance policies that will perform to our expectations. |

| • | Operational Platform: We have built an operational platform and systems for efficiently tracking, processing, and servicing life insurance policies that we believe provide competitive advantages when purchasing policies in the secondary marketplace, and servicing the policies once acquired. |

| • | Origination and Underwriting Practices: We purchase life insurance policies that meet published guidelines on what policies would be accepted in a rated securitization. We purchase only permanent life insurance policies we consider to be non-contestable and that meet stringent underwriting criteria and reviews. |

| • | Origination Relationships: We have established origination relationships with over 300 life insurance policy brokers and insurance agents who submit policies for our purchase or financing. Our referral base knows our underwriting standards for purchasing life insurance policies in the secondary market, which provides confidence in our bidding and closing process and streamlines our own due-diligence process. |

| • | Life Expectancy Methodology: We rely on at least two life expectancy reports from independent third-party medical actuary underwriting firms such as 21st Services, AVS Underwriting, Fasano Associates, and ISC Services to develop our life expectancy estimate. |

| • | Pricing Software and Methodology: We use actuarial pricing methodologies and software tools that are built and supported by leading independent actuarial service firms such as Milliman USA and Modeling Actuarial Pricing Systems, Inc. (“MAPS”) for calculating our expected returns. |

| • | Diversified Funding: We have actively developed diversified sources for accessing capital markets in support of our buy and hold strategy for our portfolio of life insurance policies, ranging from institutional bank financing and global capital markets, to a network of broker-dealers registered with the Financial Industry Regulatory Authority (“FINRA”) who have participated in our subsidiary secured notes financing. |

Corporate Organization

Our business was organized in February 2006. Our principal executive offices are located at 220 South Sixth Street, Suite 1200, Minneapolis, Minnesota 55402 and our telephone number is (612) 746-1944. Our website address is www.gwglife.com. The information on or accessible through our website is not part of this prospectus.

5

Table of Contents

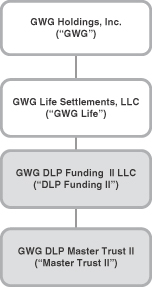

On June 10, 2011, GWG Holdings converted from a Delaware limited liability company to a Delaware corporation through the filing of statutory articles of conversion. In connection with the conversion, each class of limited liability company membership interests in GWG Holdings, LLC was converted into shares of common stock of GWG Holdings, Inc. Our corporate structure, including our principal subsidiaries, is as follows:

GWG Life Settlements, LLC (Delaware limited liability company), or GWG Life, is a licensed life/viatical settlement provider. GWG Life has fully and unconditionally guaranteed payment of our secured debentures offered by this prospectus. GWG DLP Funding II, LLC (Delaware limited liability company), or DLP Funding II, is a wholly owned special purpose subsidiary owning life insurance policies and is the borrower under the revolving line of credit from Autobahn/DZ Bank. The life insurance policy assets owned by DLP Funding II are held in the GWG DLP Master Trust II. The trust exists solely to hold the collateral security granted to Autobahn/DZ Bank under the revolving line of credit, and DLP Funding II is the beneficiary under the trust. Neither DLP Funding II nor Master Trust II have guaranteed the secured debentures offered hereby. Further, none of the assets of DLP Funding II nor Master Trust II are collateral for the secured debentures, although GWG Life has pledged the equity in DLP Funding II as collateral.

6

Table of Contents

The Offering

| Issuer |

GWG Holdings, Inc. |

| Indenture Trustee |

Bank of Utah, National Association |

| Paying Agent |

Bank of Utah, National Association |

| Securities Offered |

We are offering up to $250,000,000 in principal amount of our Secured Debentures, or the “debentures.” The debentures are being sold on a continuous basis. |

| Method of Purchase |

Prior to your purchase of debentures, you will be required to complete a Subscription Agreement setting forth the principal amount of your purchase, the term of the debentures, the interest payment frequency and certain other information regarding your ownership of the debentures, and tender the purchase price for the debentures. The form of Subscription Agreement is filed as an exhibit to the registration statement of which this prospectus is a part. We will mail you written confirmation that your subscription has been accepted. For more information, see “Plan of Distribution.” |

| Denomination |

The minimum purchase of debentures is $25,000 in principal amount. Additional debentures in excess of $25,000 may be purchased in increments of $1,000. |

| Offering Price |

100% of the principal of the debenture. |

| Limited Rescission Right |

If your Subscription Agreement is accepted at a time when we have determined that a post-effective amendment to the registration statement of which this prospectus is a part must be filed with the SEC, but such post-effective amendment has not yet been declared effective, you will have a limited time within which to rescind your investment subject to the conditions set forth in this prospectus. See “Description of the Debentures—Limited Rescission Right” for additional information. |

| Maturity |

You may generally choose maturities for your debentures of 6 months or 1, 2, 3, 4, 5, 7 or 10 years. Nevertheless, depending on our capital requirements, we may not offer and sell debentures of all maturities at all times during this offering. |

| Interest Rates |

The interest rate of the debentures will be established at the time of your purchase, or at the time of renewal, based upon the rates we are offering in this prospectus or our latest interest rate supplement to this prospectus (i.e., any prospectus supplement containing interest rate information for debentures of different maturities), and will remain fixed throughout the term of the debenture. We may offer higher rates of interest to investors with larger aggregate debenture portfolios, as set forth in the then-current interest rate supplement. |

7

Table of Contents

| Interest Payments |

We will pay interest on the debentures based on the terms you choose, which may be monthly, annually or at maturity. Interest will accrue from the effective date of the debenture. Interest payments will generally be made on the tenth day immediately following the last day of the month to the debenture holder of record as of the last day of that month. Interest will be paid without any compounding, unless you choose to be paid interest at maturity, or reinvest your interest for another term. Your first payment of interest will include interest for the partial month in which the purchase occurred. |

| Principal Payments |

The maturity date for the debentures will be the last day of the month during which the debenture matures. We are obligated to pay the principal on the debenture on the last day of the month next following its maturity (or the first business day following the end of the month). |

| Payment Method |

Principal and interest payments will be made by direct deposit to the account you designate in your Subscription Agreement |

| Renewal or Redemption at Maturity |

Upon maturity, the debentures will be automatically renewed for the same term at the interest rate we are offering at that time to other investors with similar aggregate debenture portfolios for debentures of the same maturity, unless repaid upon maturity at our or your election. In this regard, we will notify you at least 30 days prior to the maturity date of your debentures. In the notice, we will advise you if we intend to repay the debentures or else remind you that your debentures will be automatically renewed unless you exercise your option, within 15 days, to elect to have your debentures repaid. |

| If we determine that a post-effective amendment to the registration statement covering the offer and sale of debentures must be filed during your 15-day repayment election period, we will extend your election period until the amendment we file becomes effective. If debentures with similar terms are not being offered at the time of renewal, the interest rate upon renewal will be (a) the rate specified by us in writing on or before the maturity date or (b) if no such rate is specified, the rate of your existing debentures. Accordingly, you should understand that the interest rate offered upon renewal may differ from the interest rate applicable to your debentures prior to maturity. See “Description of the Debentures—Renewal or Redemption on Maturity.” |

| Prepayment or Early Redemption |

We may prepay the outstanding principal balance and accrued and unpaid interest of any or all of the debentures, in whole or in part, at any time without penalty or premium. Debenture holders will have no right to require us to prepay any debenture prior to maturity date unless the request is due to your death, bankruptcy, or total disability. In our sole discretion, we may nonetheless accommodate requests to prepay or redeem any debenture prior to its maturity. In the event we agree to prepay a debenture upon the request of a debenture holder, we will impose a prepayment fee of 6% against the outstanding principal balance of the debenture redeemed. This prepayment fee will be subtracted from the amount paid to you. |

8

Table of Contents

| Ranking |

The secured debentures will constitute the senior secured debt of GWG Holdings. The payment of principal and interest on the debentures will be: |

| • | pari passu with respect to collateral securing the approximately $55.7 million in principal amount of subsidiary secured notes previously issued by our subsidiary GWG Life (see the caption “—Collateral Security” below); |

| • | structurally junior to the present and future obligations owed by our subsidiary DLP Funding II under the revolving credit facility with Autobahn/DZ Bank (including the approximately $42 million presently outstanding under such facility); and |

| • | structurally junior to the present and future claims of other creditors of our subsidiaries, other than GWG Life, including trade creditors. |

| See “Description of the Debentures—Ranking” for further information. |

| Guarantee |

The payment of principal and interest on the debentures is fully and unconditionally guaranteed by GWG Life. This guarantee (and accompanying grant of a security interest in all of the assets of GWG Life) makes the debentures pari passu, with respect to collateral, with the approximately $55.7 million of subsidiary secured notes previously issued by GWG Life. |

| Collateral Security |

The debentures are secured by the assets of GWG Holdings, Inc. We will grant a security interest in all of our assets to the indenture trustee for the benefit of the debenture holders. Our assets consist primarily of any cash proceeds we receive from life insurance policy assets of our subsidiaries, and all other cash and investments we hold in various accounts. |

| The majority of our life insurance policy assets are held in our subsidiary DLP Funding II, LLC. The debentures’ security interest will be structurally subordinate to the security interest in favor of the lender under DLP Funding II’s revolving credit facility. The assets of GWG Life, including proceeds it receives as distributions from DLP Funding II and derived from the insurance policies owned by DLP Funding II, are collateral for GWG Life’s guarantee of the repayment of principal and interest on the debentures. This security interest will be pari passu to other debt issued and outstanding by GWG Life. The debentures are also secured by a pledge of a majority of our outstanding common stock from our largest stockholders, which pledge is pari passu with the pledge of the common stock to the holders of secured notes issued by GWG Life. |

| Indenture Covenants |

The indenture governing the debentures places restrictive covenants and affirmative obligations on us. For example: |

| • | our debt coverage ratio may not exceed 90%; and |

9

Table of Contents

| • | our subordination ratio may not exceed 50% for the first four years after our initial sale of debentures. |

| The indenture defines the debt coverage ratio as a percentage calculated by the ratio of (A) obligations owing by us and our subsidiaries on all outstanding debt for borrowed money (including the debentures), over (B) the net present asset value of all life insurance policy assets we own, directly or indirectly, plus any cash held in our accounts. For this purpose, the net present asset value of our life insurance assets is equal to the present value of the cash flows derived from the face value of policy benefit assets we own, discounted at a rate equal to the weighted average cost of capital for all our indebtedness for the prior month. |

| The indenture defines the subordination ratio as a percentage calculated as a ratio of (A) the principal amount owing by us or any of our subsidiaries that is either senior in rank to the debentures or secured by the life insurance policy assets owned by us or our subsidiaries, over (B) the net present asset value of all life insurance policy assets we own, directly or indirectly, plus any cash held in our accounts. For this purpose, the net present asset value of our life insurance assets is equal to the present value of the cash flows derived from the face value of policy benefit assets we own, discounted at a rate equal to the weighted-average cost of capital for all our indebtedness for the prior month. |

| We are required to notify the indenture trustee in the event that we violate one of these restrictive covenants. An “event of default” will exist under the indenture if a violation persists for a period of 30 calendar days after our initial notice to the trustee. |

| The indenture also places limitations on our ability to engage in a merger or sale of all of our assets. See “Description of the Indentures—Events of Default” and “—Consolidation Mergers or Sales” for more information. |

| Use of Proceeds |

If all the debentures are sold, we would expect to receive up to approximately $232 million of net proceeds from this offering after paying estimated offering and related expenses, expected average commissions, dealer manager fees and non-accountable expense allowances. If the maximum offering were sold and the maximum commissions, fees and allowances were paid, the proceeds to us would be approximately $215 million. There is no minimum amount of debentures that must be sold before we access investor funds. The exact amount of proceeds we receive may vary considerably depending on a variety of factors, including how long the debentures are offered. |

| We intend to use the net proceeds of this offering primarily for the purposes of purchasing and servicing life insurance policy and related assets (e.g., policy premiums, principal and interest on debt |

10

Table of Contents

| obligations, indenture trustee fees, and hedging instruments). We may use some of the net proceeds from this offering to repurchase some or all of the subsidiary secured notes previously issued by GWG Life, of which approximately $55.7 million in principal amount is currently outstanding, along with approximately $0.94 million in accrued but unpaid interest as of March 31, 2011. See “Use of Proceeds” for additional information. |

| No Market for Debentures and Restrictions on Transfers |

There is no existing market for the debentures and we do not anticipate that a secondary market for the debentures will develop. We do not intend to apply for listing of the debentures on any securities exchange or for quotation of the debentures in any automated dealer quotation system. You will be able to transfer or pledge the debentures only with our prior written consent. See “Description of the Debentures—Transfers.” |

| Book Entry |

The debentures will be issued in book entry or uncertificated form only. Except under limited circumstances, the debentures will not be evidenced by certificates or negotiable instruments. See “Description of the Debentures—Book Entry Registration and Exchange.” |

11

Table of Contents

RISK RELATING TO FORWARD-LOOKING STATEMENTS

Certain matters discussed in this prospectus are forward-looking statements. We have based these forward-looking statements on our current expectations and projections about future events. These forward-looking statements are subject to risks, uncertainties and assumptions about our operations and the investments we make, including, among other things, factors discussed under the heading “Risk Factors” in this prospectus and the following:

| • | changes in the secondary market for life insurance; |

| • | our limited operating history; |

| • | the valuation of assets reflected on our financial statements; |

| • | the reliability of assumptions relating to our actuarial models; |

| • | our reliance of debt financing; |

| • | risks relating to the validity and enforceability of the life insurance policies we purchase; |

| • | our reliance on information provided and obtained by third parties; |

| • | federal and state regulatory matters; |

| • | additional expenses, not reflected in our operating history, related to being a public reporting company; |

| • | competition in the secondary life insurance market; |

| • | the relative illiquidity of life insurance policies; |

| • | life insurance company credit exposure; |

| • | economic outlook; |

| • | performance of our investments in life insurance policies; |

| • | financing requirements; |

| • | litigation risks; and |

| • | restrictive covenants contained in borrowing agreements. |

Some of the statements in this prospectus that are not historical facts are “forward-looking” statements. Forward-looking statements can be identified by the use of words like “believes,” “could,” “possibly,” “probably,” “anticipates,” “estimates,” “projects,” “expects,” “may,” “will,” “should,” “seek,” “intend,” “plan,” “consider” or the negative of these expressions or other variations, or by discussions of strategy that involve risks and uncertainties. All forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual transactions, results, performance or achievements to be materially different from any future transactions, results, performance or achievements expressed or implied by such forward-looking statements. The cautionary statements set forth under the caption “Risk Factors” and elsewhere in this prospectus identify important factors with respect to such forward-looking statements due to the life insurance focus of our business.

We base these forward-looking statements on current expectations and projections about future events and the information currently available to us. Although we believe that the assumptions for these forward-looking statements are reasonable, any of the assumptions could prove to be inaccurate. Consequently, no representation or warranty can be given that the estimates, opinions, or assumptions made in or referenced by this prospectus will prove to be accurate. Some of the risks, uncertainties and assumptions are identified in the discussion entitled “Risk Factors” in this prospectus. We caution you that the forward-looking statements in this prospectus

12

Table of Contents

are only estimates and predictions. Actual results could differ materially from those anticipated in the forward-looking statements due to risks, uncertainties or actual events differing from the assumptions underlying these statements. These risks, uncertainties and assumptions include, but are not limited to, those discussed in this prospectus.

Although federal securities laws provide a safe harbor for forward-looking statements made by a public company that files reports under the federal securities laws, this safe harbor is not available to certain issuers, including issuers that do not have their equity traded on a recognized national exchange or the Nasdaq Capital Market. Our common stock does not trade on any recognized national exchange or the Nasdaq Capital Market. As a result, we will not have the benefit of this safe harbor protection in the event of any legal action based upon a claim that the material provided by us contained a material misstatement of fact or was misleading in any material respect because of our failure to include any statements necessary to make the statements not misleading.

13

Table of Contents

An investment in the debentures involves a high degree of risk. Before purchasing debentures, you should carefully consider the following risk factors in conjunction with the other information contained in this prospectus. The risks discussed in this prospectus can materially harm our operations, operating results, financial condition or future results. If any of these risks materialize or occur, the value of our debentures could decline and could cause you to lose part or all of your investment. You should review the risks of this investment with your legal and financial advisors prior to purchasing debentures.

Risks Related to Our Business and Our Industry

Material changes in the life insurance secondary market, a relatively new and evolving market, may adversely affect our operating results, business prospects and our ability to repay our obligations under the debentures.

Our sole business is the purchase and ownership of life insurance policies acquired in the secondary market, which is a relatively new and evolving market. Our ability to repay the principal and interest on the debentures materially depends on the continued development of the secondary market for life insurance, including the solvency of life insurance companies to pay the face value of the life insurance benefits, both of which will critically impact the performance of the life insurance policies we own. We expect that the development of the secondary market will primarily be impacted by a variety of factors such as the interpretation of existing laws and regulations (including laws relating to insurable interests), the passage of new legislation and regulations, mortality improvement rates, and actuarial understandings and methodologies. Importantly, all of the factors that we believe will most significantly affect the development of the life insurance secondary market are beyond our control. Any material and adverse development in the life insurance secondary market could adversely affect our operating results, our access to capital, our business prospects and viability, and our ability to repay our obligations under the debentures. Because of this, an investment in the debentures generally involves greater risk as compared to investments offered by companies with more diversified business operations in more established markets.

We have a relatively limited history of operations and our earnings may be volatile, resulting in future losses and uncertainty about our ability to service and repay our debt when and as it comes due.

We are a company with a limited history, which makes it difficult to accurately forecast our earnings and cash flows. We have incurred losses in the past. In addition, our lack of a significant history and the evolving nature of our market make it likely that there are risks inherent in our business and the performance characteristics for portfolios of life insurance policies that are as yet recognized by us or others, or not fully appreciated, and that could result in earning less on our life insurance policies than we anticipate or even suffering further losses. As a result of the foregoing, an investment in our debentures necessarily involves uncertainty about the stability of our earnings, cash flows and, ultimately, our ability to service and repay our debt.

The valuation of our principal assets on our balance sheet requires us to make material assumptions that may ultimately prove to be incorrect. In such an event, we could suffer significant losses that could materially and adversely affect our results of operations and eventually cause us to be in default of restrictive covenants contained in our borrowing agreements.

Our principle assets are life insurance policies. Those assets are considered “Level 3” assets under ASU No. 2010-06, Fair Value Measurements and Disclosures, as there is currently no active market where we are able to observe quoted prices for identical assets. As a result, our valuation of those assets incorporates significant inputs that are not observable. Fair value is defined as an exit price representing the amount that would be received if assets were sold or that would be paid to transfer a liability in an orderly transaction between market participants at the measurement date. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability.

14

Table of Contents

The fair value measurement of Level 3 assets is inherently uncertain and creates additional volatility in our financial statements that are not necessarily related to the performance of the underlying assets. As of March 31, 2011, we estimate the fair value discount rate for our portfolio to be 13.31%. If we determine in the future that fair value requires a higher discount rate for a similarly situated portfolio of life insurance policies, we would experience significant losses materially affecting our results of operations. It is also possible that significant losses of this nature could at some point cause us to fall out of compliance with certain borrowing covenants contained in our revolving credit facility.

In an effort to present results of operations not subject to this volatility, we intend to provide additional non-GAAP financial disclosures, on a consistent basis, presenting the actuarial economic gain occurring within the portfolio of life insurance policies at the expected internal rate of return against the costs we incur over the same period. We report these very same non-GAAP financial measures to the lender under our revolving credit facility pursuant to financial covenants in the related borrowing documents. Nevertheless, our reported GAAP earnings may in the future be volatile for reasons that do not bear an immediate relationship to the cash flows we experience.

Our expected results from our life insurance portfolio may not match actual results, which could adversely affect our ability to service and grow our portfolio for diversification, and to service our debt.

Our business model relies on achieving actual results that are in line with the results we expect to attain from our investments in life insurance policy assets. In this regard, we believe that the larger portfolio we own, the greater likelihood we will achieve our expected results. To our knowledge, rating agencies generally suggest that portfolios of life insurance policies consist of at least 300 lives to be diversified enough to achieve actuarial stability in receiving expected cash flows from underlying mortality. As of March 31, 2011, we own approximately $417 million in face value of life insurance policies covering 155 lives. Accordingly, while there is risk with any portfolio of policies that our actual yield may be less than expected, we believe that the risk we face is presently more significant given the relative lack of diversification in our current portfolio as compared to rating agency recommendations.

Although we plan to expand of the number of life insurance policies we own using proceeds raised from the sale of debentures, we may be unable to meet this goal if we do not sell enough debentures and financing from other capital sources is available only on unfavorable or unacceptable terms. Furthermore, even if our portfolio reaches the size we desire, we still may experience differences between the actuarial models we use and actual mortalities.

Differences between our expectations and actuarial models and actual mortality results could have a materially adverse effect on our operating results and cash flow. In such a case, we may face liquidity problems, including difficulties servicing our remaining portfolio of policies and servicing our outstanding debt obligations owed under our revolving credit facility, subsidiary secured notes, and the debentures. Continued or material failures to meet our expected results could decrease the attractiveness of our debentures or other securities in the eyes of potential investors, making it even more difficult to obtain capital needed to both service our portfolio, grow the portfolio to obtain desired diversification, and service our existing debt.

We rely on debt financing for our business and in particular on our access to liquidity under a revolving credit facility. Any inability to borrow under the revolving credit facility could adversely affect our business operations and our ability to satisfy our obligations under the debentures.

To date, we have chosen to finance our business almost entirely through the issuance of debt, including debt incurred by our subsidiary DLP Funding II, LLC under a senior revolving credit facility provided by Autobahn/DZ Bank (which we refer to throughout this prospectus as our “revolving credit facility”). This revolving credit facility is secured by all of the assets of DLP Funding II, has a maximum amount of $100 million, and the outstanding balance at March 31, 2011 was approximately $42 million. Obligations under the revolving credit

15

Table of Contents

facility have a scheduled maturity date of July 15, 2013. Our business model expects that we will have continued access to financing in order to purchase a large and diversified portfolio of life insurance policies, pay the attendant premiums and costs of maintaining the portfolio, all while satisfying our current interest and principal repayment obligations under our revolving credit facility, our other indebtedness and the debentures. Accordingly, until we achieve cash flows derived from the portfolio of life insurance policy benefits, we expect to rely on debt to satisfy our ongoing financing and liquidity needs, including the costs associated with the offer and sale of the debentures. Nevertheless, continued access to financing and liquidity under the revolving credit facility is not guaranteed. If we are unable to borrow under the revolving credit facility for any reason, our business may be adversely impacted as well as our ability to repay our obligations under the debentures.

Our investments in life insurance policies have inherent risks, including fraud and legal challenges to the validity of the policies, which we will be unable to eliminate and which may adversely affect our results of operations.

When we purchase a life insurance policy, we underwrite the purchase of the policy to mitigate risks associated with insurance fraud and other legal challenges to the validity of the life insurance policy. To the extent that the insured is not aware of the existence of the policy, the insured him or herself does not exist, or the insurance company does not recognize the policy, the insurance company may cancel or rescind the policy thereby causing the loss of an investment in a policy. In addition, if medical records have been altered in such a way as to shorten a related life expectancy report, this may cause us to overpay for the related policy. Finally, we may experience legal challenges from insurance companies that the insured failed to have an insurable interest at the time the policy was originally purchased, or from the beneficiaries of an insurance policy claiming the sale was invalid upon mortality of the insured. To mitigate these risks, we require a current verification of coverage from the insurance company, complete thorough due diligence on the insured and accompanying medical records, review the life insurance policy application, require a policy to have been in force for at least two years before purchasing, and require a legal review of any premium financing associated with the life insurance policy to insure insurable interest existed. Nevertheless, we do not expect that these steps will eliminate the risk of fraud or legal challenges to the life insurance policies we purchase. If a significant face amount of policies were invalidated for reasons of fraud or any other reason, our results of operations may be adversely affected.

Every acquisition of a life insurance policy necessarily requires us to materially rely on information provided or obtained by third parties. Any misinformation or negligence in the course of obtaining material information could materially and adversely affect the value of the policies we own.

The acquisition of each life insurance policy is negotiated based on variables that are particular facts unique to the life insurance policy itself and the health of the insured. The facts we obtain about the policies and the insured at the time at which the policy was applied for and obtained are based on factual representations made to the insurance company by the insured, and the facts the insurance company independently obtains in the course of its own due-diligence examination, such as facts concerning the health of the insured and whether or not there is an insurable interest present at the inception of each issued policy. It is nearly impossible for us to confirm many of the facts provided by the insured or obtained by the insurance company at the time a policy was issued. Any misinformation or negligence in the course of obtaining or supplying material information relating to the insurance policy or the insured could ultimately materially and adversely impact the value of the life insurance policies we own.

Our business is subject to state regulation and changes in state laws and regulations governing our business, or changes in the interpretation of such laws and regulations, could negatively affect our business.

When we purchase a life insurance policy, we are subject to state insurance regulations. Over the past three years, we have seen a dramatic increase in the number of states that have adopted legislation and regulations from a model law promulgated by either the National Association of Insurance Commissioners (NAIC) or by the National Conference of Insurance Legislators (NCOIL). These laws are essentially consumer protection statutes

16

Table of Contents

responding to abuses that arose early in the development of our industry. Today, almost every state has adopted some version of either the NAIC or NCOIL model laws, which generally require the licensing of purchasers of and brokers for life insurance policies, the filing and approval of purchase agreements, disclosure of transaction fees, require various periodic reporting requirements and prohibit certain business practices deemed to be abusive.

State statutes typically provide state regulatory agencies with significant powers to interpret, administer and enforce the laws relating to the purchase of life insurance policies. Under statutory authority, state regulators have broad discretionary power and may impose new licensing requirements, interpret or enforce existing regulatory requirements in different ways or issue new administrative rules, even if not contained in state statutes. State regulators may also impose rules that are generally adverse to our industry. Because the life insurance secondary market is relatively new and because of the history of certain abuses in the industry, we believe it is likely that state regulation will increase and grow more complex during the foreseeable future. We cannot, however, predict what any new regulation would specifically involve.

Any adverse change in present laws or regulations, or their interpretation, in one or more states in which we operate (or an aggregation of states in which we conduct a significant amount of business) could result in our curtailment or termination of operations in such jurisdictions, or cause us to modify our operations in a way that adversely affects our profitability. Any such action could have a corresponding material and negative impact on our results of operations and financial condition, primarily through a material decrease in revenues, and could also negatively affect our general business prospects.

If federal or state regulators or courts conclude that the purchase of life insurance in the secondary market constitutes, in all cases, a transaction in securities, we could be in violation of existing covenants under our revolving credit facility, which could result in significantly diminished access to capital. We could also face increased operational expenses. The materialization of any of these risks could adversely affect our operating results and possibly threaten the viability of our business.

Some states and the SEC have, on occasion, attempted to regulate the purchase of non-variable universal life insurance policies as transactions in securities under federal or state securities laws. In July 2010, the SEC issued a Staff Report of its Life Settlement Task Force. In that report, the Staff recommended that certain types of purchased life insurance policies be classified as securities. The SEC has not taken any position on the Staff Report, and there is no indication if the SEC will take or advocate for any action to implement the recommendations of the Staff Report. In addition, there have been several federal court cases in which transactions involving the purchase and fractionalization of life insurance contracts have been held to be transactions in securities under the federal Securities Act of 1933. We believe that the matters discussed in the Staff Report, and existing caselaw, do not impact our current business model since our purchases of life settlements are distinguishable from those cases that have been held by courts, and advocated by the Staff Report, to be transactions in securities. For example, we are not involved in fractionalization of any life insurance policies.

With respect to state securities laws, many of states currently treat the sale of a life insurance policy as a securities transaction under state laws, although most states exclude from the definition of security the original sale from the insured or the policy owner to the provider. To date, due to the manner in which we conduct and structure our activities and the availability, in certain instances, of exceptions and exemptions under securities laws, such laws have not adversely impacted our business model.

As a practical matter, the widespread application of securities laws to our purchases of life insurance policies, either through the expansion of the definition of what constitutes a security, the expansion of the types of transactions in life insurance policies that would constitute transactions in securities, or the elimination or limitation of available exemptions and exceptions (whether by statutory change, regulatory change, or administrative or court interpretation) could burden us as well as other companies operating in the life insurance secondary market through the imposition of additional processes in the purchase of life insurance policies or the

17

Table of Contents

imposition of additional corporate governance and operational requirements through the application of the federal Investment Company Act of 1940. Any such burdens could be material. Among the particular repercussions for us would be a violation of existing covenants under our revolving credit facility requiring us to not be an “investment company” under the Investment Company Act of 1940, which could in the short or long term affect our liquidity and increase our cost of capital and operational expenses, all of which would adversely affect our operating results. It is possible that such an outcome could threaten the viability of our business and our ability to satisfy our obligations as they come due, including obligations under our debentures.

Being a public company will result in additional expenses and divert management’s attention. Being a public company could also adversely affect our ability to attract and retain qualified directors.