Attached files

Exhibit 3.1 (a)

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

ENVIVIO, INC.

Envivio, Inc., a corporation duly organized and existing under the General Corporation Law of the State of Delaware (the “Corporation”), hereby certifies as follows:

1. The name of the Corporation is Envivio, Inc. Envivio, Inc. was originally incorporated under the name Envivio.com, Inc., and its original Certificate of Incorporation was filed with the Secretary of State of Delaware on January 5, 2000.

2. Pursuant to Sections 242 and 245 of the General Corporation Law of the State of Delaware, this Amended and Restated Certificate of Incorporation restates and integrates and further amends the provisions of the Amended and Restated Certificate of Incorporation of this Corporation.

3. The text of the Amended and Restated Certificate of Incorporation as heretofore amended or supplemented is hereby restated and further amended to read in its entirety as follows:

ARTICLE I

The name of the Corporation is Envivio, Inc.

ARTICLE II

The address of the Corporation’s registered office in the State of Delaware is 3500 S. DuPont Highway, in the City of Dover, County of Kent. The name of the Corporation’s registered agent at such address is Incorporating Services, Ltd.

ARTICLE III

The purpose of the Corporation shall be to engage in any lawful act or activity for which corporations may be organized and incorporated under the General Corporation Law of the State of Delaware.

ARTICLE IV

The total number of shares of all classes of stock which the Corporation is authorized to issue is 295,360,000 shares, consisting of 250,000,000 shares of common stock, with a par value of $0.001 per share (“Common Stock”) and 45,360,000 shares of preferred stock, with a par value of $0.001 per share (“Preferred Stock”). This corporation shall from time to time, in accordance with the laws of the State of Delaware, increase the authorized amount of its Common Stock if at any time the number of shares of Common Stock remaining unissued and available for issuance shall not be sufficient to permit conversion of the Preferred Stock. At the time this Amended and Restated Certificate of Incorporation shall become effective, every ten

(10) shares of Common Stock and of each series of Preferred Stock issued and outstanding at such time shall be, and hereby is, changed and reconstituted into one (1) fully paid and non-assessable share of Common Stock and of such series of Preferred Stock, respectively (the “Reverse Stock Split”). Each outstanding stock certificate of the Corporation which, immediately prior to the time this Amended and Restated Certificate of Incorporation is filed with the Secretary of State of the State of Delaware, represents shares of Common Stock or Preferred Stock shall thereafter be deemed to represent the appropriate number of shares of Common Stock or such series of Preferred Stock resulting from the Reverse Stock Split until such old stock certificate is exchanged for a new certificate reflecting the appropriate number of shares resulting from the Reverse Stock Split. Any fractional shares resulting from the Reverse Stock Split shall be eliminated by paying cash in lieu of issuing fractional shares (after aggregating shares of the same series held by a holder) in an amount equal to the fair market value of such fractional shares. All references in this Amended and Restated Certificate of Incorporation, including any share numbers and prices herein, reflect the Reverse Stock Split.

1. The Common Stock and Preferred Stock authorized by the Amended and Restated Certificate of Incorporation shall be issued as follows:

(a) The first series of Common Stock shall be designated Series 1 Common Stock (“Series 1 Common Stock”) and shall consist of 20,000,000 shares. The second series of Common Stock shall be designated Series 2 Common Stock (“Series 2 Common Stock”) and shall consist of 230,000,000 shares.

(b) The first series of Preferred Stock shall be designated Series G1 Preferred Stock (“Series G1 Preferred Stock”) and shall consist of 2,000,000 shares. The second series of Preferred Stock shall be designated Series G2 Preferred Stock (“Series G2 Preferred Stock”) and shall consist of 18,360,000 shares (collectively, Series G1 Preferred Stock and Series G2 Preferred Stock shall be referred to as “Series G Preferred Stock”). The third series of Preferred Stock shall be designated Series H1 Preferred Stock (“Series H1 Preferred Stock”) and shall consist of 1,000,000 shares. The fourth series of Preferred Stock shall be designated Series H2 Preferred Stock (“Series H2 Preferred Stock”) and shall consist of 24,000,000 shares. The shares of each series of Preferred Stock shall have the rights, preferences, privileges and restrictions set forth in Section 2 below.

2. The relative powers, preferences and rights, and relative participating, optional or other special rights, and the qualifications, limitations, or restrictions thereof, granted to or imposed on the respective classes and series of the shares of capital stock or the holders thereof are as follows:

(a) Definitions.

“Junior Shares” shall mean all Common Stock and any other shares of the Corporation other than the Preferred Stock.

“Primarily of a Financing Nature” shall mean any issuance of Additional Shares of Common Stock (as defined herein) to financial institutions, venture capital investors or other investors for such consideration, all or a part of which consists of cash, to be used by the

Corporation for working capital, acquisition consideration or any other purpose.

“Subsidiary” shall mean any corporation, at least fifty percent (50%) of whose outstanding voting shares shall at the time be owned, directly or indirectly, by the Corporation or by one or more of such subsidiaries.

(b) Liquidation Preference. In the event of any liquidation, dissolution, or winding up of the Corporation, either voluntary or involuntary, distributions to the stockholders of the Corporation shall be made in the following manner:

(i) The holders of the Series H Preferred Stock shall first receive, prior and in preference to any distribution of any of the assets of the Corporation to the holders of the Series G Preferred Stock and Junior Shares, by reason of their ownership of such stock, an amount (the “Series H Liquidation Amount”) equal to $3.351 per share of Series H Preferred Stock (the “Series H Original Issue Price”) (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, recapitalizations and the like) then held by them, plus any declared, but unpaid dividends. If the assets of the Corporation legally available for distribution shall be insufficient to permit the payment in full to such holders of the Series H Preferred Stock of the full aforesaid Series H Liquidation Amount, then the entire assets of the Corporation legally available for distribution shall be distributed ratably among the holders of the Series H Preferred Stock in accordance with the number of shares of Series H Preferred Stock held by each of them.

(ii) After payment has been made to the holders of the Series H Preferred Stock of the full amounts to which they shall be entitled pursuant to Section 2(b)(i) above, the holders of Series G Preferred Stock shall receive, prior and in preference to any distribution of any of the assets of the Corporation to the holders of the Junior Shares, by reason of their ownership of such stock, an amount (the “Series G Liquidation Amount”) equal to $12.50 per share of Series G Preferred Stock (the “Series G Original Issue Price”) (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, recapitalizations and the like) then held by them, plus any declared, but unpaid dividends. If the assets of the Corporation legally available for distribution shall be insufficient to permit the payment in full to such holders of the Series G Preferred Stock of the full aforesaid Series G Liquidation Amount, then the entire assets of the Corporation legally available for distribution after payment of the full amounts to which holders of Series H Preferred Stock are entitled pursuant to Section 2(b)(i) above shall be distributed ratably among the holders of the Series G Preferred Stock in accordance with the number of shares of Series G Preferred Stock held by each of them.

(iii) After payment has been made to the holders of the Series H Preferred Stock and Series G Preferred Stock of the full amounts to which they shall be entitled pursuant to Sections 2(b)(i) and 2(b)(ii) above, the holders of the Preferred Stock and the holders of the Common Stock shall be entitled to share ratably in the remaining assets, based on the number of shares of Common Stock held by each of them (calculated assuming conversion of all of the shares of Preferred Stock into Common Stock).

(iv) For purposes of this Section 2(b), (A) a merger or consolidation of the Corporation (or a Subsidiary of the Corporation if the Corporation issues shares of its capital

stock pursuant to such transaction) with or into any other corporation or corporations in which the shares of capital stock of the Corporation do not continue to represent, and are not converted or exchanged into, more than fifty percent (50%) of the outstanding voting power of the surviving corporation, (B) a sale of at least 50% of the outstanding capital stock of the Corporation to a single purchaser or a group of affiliated purchasers, in each case that were not previously stockholders of the Corporation or (C) the sale, lease, license or transfer of all or substantially all of the assets of the Corporation (each a “Change of Control”) shall be treated as a liquidation, dissolution or winding up of the Corporation. All consideration payable to the stockholders of the Corporation (in the case of a Change of Control by a merger or consolidation), or all consideration payable to the Corporation, together with all other available assets of the Corporation (in the case of a sale of 50% of the capital stock of the Corporation or an asset sale), shall be distributed to the holders of capital stock of the Corporation in accordance with Sections 3(b)(i), (ii) and (iii) above.

(v) For purposes of this Section 2, if the distributions or consideration received by the stockholders of the Corporation is other than cash, its value will be deemed to be the fair market value as determined in good faith by the Board of Directors. Whenever the distribution provided for in this Section 2 shall be payable in securities, such securities shall be valued as follows:

(A) Securities not subject to investment letter or other similar restrictions on free marketability covered by (B) below:

(1) If traded on a securities exchange or through the Nasdaq National Market, the value shall be deemed to be the average of the closing prices of the securities on such exchange or system over the thirty (30) day period ending three (3) days prior to the closing;

(2) If actively traded over-the-counter, the value shall be deemed to be the average of the closing bid or sale prices (whichever is applicable) over the thirty (30) day period ending three (3) days prior to the closing; and

(3) If there is no active public market, the value shall be the fair market value thereof, as determined in good faith by the Board of Directors.

(B) The method of valuation of securities subject to investment letter or other restrictions on free marketability (other than restrictions arising solely by virtue of a stockholder’s status as an affiliate or former affiliate) shall be to make an appropriate discount from the market value determined as above in (A) (1), (2) or (3) to reflect the approximate fair market value thereof, as mutually determined by the Corporation and the holders of at least a majority of the voting power of all then outstanding shares of such Preferred Stock.

(vi) In the event the requirements of this Section 2(b) are not complied with, the Corporation shall forthwith either:

(A) cause the closing of any proposed Change of Control to be postponed until such time as the requirements of this Section 2 have been complied with; or

(B) cancel such Change of Control transaction, in which event the rights, preferences and privileges of the holders of Preferred Stock shall revert to and be the same as such rights, preferences and privileges existing immediately prior to the date of the first notice referred to in Section 2(b)(vii) hereof.

(vii) The Corporation shall give each holder of record of Preferred Stock written notice of an impending “Change of Control” transaction not later than twenty (20) days prior to the stockholders’ meeting called to approve such transaction, or twenty (20) days prior to the closing of such transaction, whichever is earlier, and shall also notify such holders in writing of the final approval of such transaction. The first of such notices shall describe the material terms and conditions of the impending “Change of Control” transaction and the provisions of this Section 2, and the Corporation shall thereafter give such holders prompt notice of any material changes. The transaction shall in no event take place sooner than twenty (20) days after the Corporation has given the first notice provided for herein or sooner than ten (10) days after the Corporation has given notice of any material changes provided for herein; provided, however, that any of such foregoing periods may be shortened upon the written consent of the holders of Preferred Stock that represent at least a majority of the voting power of all then outstanding shares of such Preferred Stock.

(c) Dividends.

(i) The holders of the Series H Preferred Stock shall first receive, out of any assets legally available therefor, prior and in preference to any declaration, payment or setting aside for payment of any dividend on the Series G Preferred Stock and the Junior Shares of the Corporation, cash dividends in the amount of $0.268080 per share per annum on each outstanding share of Series H Preferred Stock (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, reorganizations, recapitalizations and the like) if, when, and as declared by the Board of Directors, out of funds legally available therefor.

(ii) After payment has been made to the holders of the Series H Preferred Stock of the full amounts to which they shall be entitled, the holders of the Series G Preferred Stock shall receive, out of any assets legally available therefor, prior and in preference to any declaration, payment or setting aside for payment of any dividend on the Junior Shares of the Corporation, cash dividends in the amount of $1.00 per share per annum on each outstanding share of Series G Preferred Stock (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, reorganizations, recapitalizations and the like) if, when, and as declared by the Board of Directors, out of funds legally available therefor.

(iii) The right to such dividends on the Series G Preferred Stock and Series H Preferred Stock shall not be cumulative, and no right shall accrue to holders of the Series G Preferred Stock and Series H Preferred Stock if dividends on such shares are not declared or paid in any prior year. Dividends and distributions may be paid (or declared and set aside for payment) upon shares of Common Stock in any calendar year only if dividends shall have been paid (or declared and set aside for payment) on account of all shares of Series G Preferred Stock and Series H Preferred Stock then issued and outstanding, at the aforesaid rates.

(iv) In the event that the Corporation shall have declared and unpaid dividends outstanding immediately prior to, and in the event of, a conversion of the Preferred Stock (as provided in Section 2(f) hereof), the Corporation shall pay to the holder(s) of the Series G Preferred Stock and Series H Preferred Stock, subject to such conversion, the full amount of any such dividends to the extent that assets are legally available therefor either in cash or in Common Stock (as determined by the Corporation’s Board of Directors and valued at the fair market value on the date of payment as determined by the Board of Directors). Any amounts for which such assets are not legally available shall be paid promptly as assets become legally available therefor.

(d) Voting Rights. Except as otherwise expressly provided herein or as required by law, the holders of the shares of Common Stock and Preferred Stock shall vote together as a single class on all matters, voting on an as-converted basis as set forth in this Section 2(d).

(i) Common Stock. Subject to Section 2(e) below and as otherwise required by law, the holder of each share of Series 2 Common Stock issued and outstanding shall have one vote and shall be entitled to notice of any stockholders’ meeting in accordance with the By-laws of the Corporation. Except as required by law, the Series 1 Common Stock shall have no voting rights. Any action requiring the approval of the Common Stock shall require the approval of the holders of only the Series 2 Common Stock.

(ii) Preferred Stock. Subject to Section 2(e) below and as otherwise required by law, the holder of each share of Preferred Stock (except Series G1 Preferred Stock and Series H1 Preferred Stock) issued and outstanding shall have that number of votes per share as is equal to the number of shares of Common Stock into which each such share of Preferred Stock held by such holder is convertible determined as of the record date for the determination of stockholders entitled to vote on such matters, or if no such record date is established, as of the date of such vote. Except as required by law, the Series G1 Preferred Stock and Series H1 Preferred Stock shall have no voting rights. Any action requiring the approval of the holders of the Series G Preferred Stock shall require the approval of the holders of only the Series G2 Preferred Stock. Any action requiring the approval of the holders of the Series H Preferred Stock shall require the approval of the holders of only the Series H2 Preferred Stock.

(iii) Directors. The number of directors on the Corporation’s Board of Directors shall consist of eight (8) members. The holders of the Series 2 Common Stock, voting as a separate class, shall be entitled to elect one (1) member of the Board of Directors. The holders of Series G2 Preferred Stock, voting as a separate class and on an as-converted basis, shall be entitled to elect three (3) members of the Board of Directors. The holders of Series H2 Preferred Stock, voting as a separate class, shall be entitled to elect one (1) member of the Board of Directors. The holders of Preferred Stock (excluding Series G1 Preferred and Series H1 Preferred) and Series 2 Common Stock, voting together as a separate class and on an as-converted basis, shall be entitled to elect any remaining members of the Board of Directors. Any director who shall have been elected by the holders of a class of stock may be removed during the aforesaid term of office, either with or without cause by, and only by, the affirmative vote of the holders of the shares of the class of stock who elected such director or directors, given either at a special meeting of such stockholders (provided a quorum of such holders is present) duly called for that purpose or pursuant to a written consent of stockholders, and any vacancy thereby created may be filled by the holders of that class of stock represented at such meeting (provided

a quorum of such holders is present) or pursuant to such written consent. In the event of a vacancy in the office of any director elected by the holders of any class, a successor shall be elected to hold office for the unexpired term of such director by the holders of shares of such class.

(e) Protection Provisions.

(i) In addition to any other rights provided by law, the Corporation shall not (directly or indirectly, by amendment, merger, consolidation or otherwise), without first obtaining the affirmative vote or written consent of the holders of at least two-thirds of the shares of all of the Series G2 Preferred Stock and Series H2 Preferred Stock then outstanding (voting together as a single class and on an as-converted basis):

(A) amend or repeal any provision of the Corporation’s Amended and Restated Certificate of Incorporation or By-laws in a manner which adversely alter or change the rights, preferences, or privileges of the Series G Preferred Stock, Series H Preferred Stock or the holders thereof;

(B) authorize or issue any additional shares of any class or series of stock of the Corporation having any preference or priority equal to or superior to the Series G Preferred Stock or Series H Preferred Stock with respect to dividends, redemptions or payments made in liquidation, or authorize or issue any bonds, debentures, notes or other obligations convertible into or exchangeable for, or having option rights to purchase, any class or series of stock having any preference or priority equal to or superior to the Series G Preferred Stock or Series H Preferred Stock with respect to dividends, redemptions or payments made in liquidation;

(C) increase or decrease the authorized number of shares of Series G Preferred Stock or Series H Preferred Stock;

(D) reclassify any shares of Common Stock or any other capital stock of the Corporation;

(E) declare or pay dividends on any class of capital stock;

(F) effect (A) a Change of Control or (B) a liquidation, winding up, dissolution, or adoption of any plan for the same;

(G) sell or otherwise dispose of any shares of capital stock of any Subsidiary except a sale or disposition to the Corporation or another Subsidiary, or permit any Subsidiary to (or to obligate itself to) issue, sell or otherwise dispose of any shares of the capital stock of the Corporation or of any other Subsidiary, except to the Corporation or another Subsidiary;

(H) permit any Subsidiary to issue or sell, or obligate itself to issue or sell, except to the Corporation or any wholly-owned Subsidiary, any equity security of such Subsidiary;

(I) amend Section 2(e) of the Amended and Restated Certificate of Incorporation; or

(J) except for any repurchase of capital stock arising out of any agreement which permits the Corporation to repurchase shares of Common Stock upon termination of services with the Corporation or any repurchase for the repricing of Common Stock held by current or former employees as approved by the Company’s Board of Directors at cost or in exercise of the Corporation’s right of first refusal, redeem any other capital stock of the Corporation prior to the redemption of all of the outstanding Series G Preferred Stock and Series H Preferred Stock;

(ii) In addition to the foregoing protective provisions and any other rights provided by law, the Corporation shall not (directly or indirectly, by amendment, merger, consolidation or otherwise), without first obtaining the affirmative vote or written consent of the holders at least seventy percent of the shares of all of the Series H2 Preferred Stock then outstanding:

(A) amend or repeal any provision of the Corporation’s Amended and Restated Certificate of Incorporation or By-laws in a manner which adversely alters or changes the rights, preferences, or privileges of the Series H Preferred Stock or the holders thereof;

(B) increase or decrease the authorized number of shares of the Series H Preferred Stock (whether by merger, consolidation, or otherwise);

(C) reclassify any shares of Common Stock or any other capital stock of the Corporation in a manner which adversely alters or changes the rights, preferences, or privileges of, or change the liquidation preference, of the Series H Preferred Stock or the holders thereof (whether by merger, consolidation, or otherwise); or

(D) amend Section 2(e)(ii) of the Amended and Restated Certificate of Incorporation.

Notwithstanding the foregoing, nothing in this Section 2(e)(ii) shall be interpreted to require the affirmative vote or written consent of the holders at least seventy percent of the shares of all of the Series H2 Preferred Stock then outstanding to effect a (i) a reorganization, recapitalization, reclassification, consolidation; or a Change of Control; (ii) a liquidation, winding up, dissolution, or adoption of any plan for the same; or (iii) a transaction which is “Primarily of a Financing Nature” or similar transactions provided that the holders of the Series H Preferred Stock would receive their Series H Liquidation Amount in such transactions.

(iii) In addition to the foregoing protective provisions and any other rights provided by law, the Corporation shall not (directly or indirectly, by amendment, merger, consolidation or otherwise), without first obtaining the affirmative vote or written consent of the holders at least seventy percent of the shares of all of the Series G2 Preferred Stock then outstanding:

(A) amend or repeal any provision of the Corporation’s Amended and Restated Certificate of Incorporation or By-laws in a manner which adversely alters or changes the rights, preferences, or privileges of the Series G Preferred Stock or the holders thereof;

(B) increase or decrease the authorized number of shares of the Series G Preferred Stock (whether by merger, consolidation, or otherwise);

(C) reclassify any shares of Common Stock or any other capital stock of the Corporation in a manner which adversely alters or changes the rights, preferences, or privileges of, or change the liquidation preference, of the Series G Preferred Stock or the holders thereof (whether by merger, consolidation, or otherwise); or

(D) amend Section 2(e)(iii) of the Amended and Restated Certificate of Incorporation.

Notwithstanding the foregoing, nothing in this Section 2(e)(iii) shall be interpreted to require the affirmative vote or written consent of the holders at least seventy percent of the shares of all of the Series G2 Preferred Stock then outstanding to effect a (i) a reorganization, recapitalization, reclassification, consolidation; or a Change of Control; (ii) a liquidation, winding up, dissolution, or adoption of any plan for the same; or (iii) a transaction which is “Primarily of a Financing Nature” or similar transactions provided that the holders of the Series G Preferred Stock would receive their Series G Liquidation Amount in such transactions.

(f) Conversion of Preferred. The holders of Preferred Stock shall have conversion rights as follows (the “Conversion Rights”):

(i) Right to Convert. Each share of Series G1 Preferred Stock and Series H1 Preferred Stock shall be convertible, without the payment of any additional consideration by the holder thereof, at the option of the holder thereof, at the office of the Corporation or any transfer agent for the Preferred Stock, into such number of fully paid and nonassessable shares of Series 1 Common Stock as is determined (i) in the case of the Series G1 Preferred Stock, by dividing $12.50 by the Series G Conversion Price (as defined below) in effect at the time of the conversion; and (ii) in the case of the Series H1 Preferred Stock, by dividing $3.351 by the Series H Conversion Price (as defined below) in effect at the time of the conversion. Each share of Series G2 Preferred Stock and Series H2 Preferred Stock shall be convertible, without the payment of any additional consideration by the holder thereof, at the option of the holder thereof, at the office of the Corporation or any transfer agent for the Preferred Stock, into such number of fully paid and nonassessable shares of Series 2 Common Stock as is determined (i) in the case of the Series G2 Preferred Stock, by dividing $12.50 by the Series G Conversion Price in effect at the time of the conversion; and (ii) in the case of the Series H2 Preferred Stock, by dividing $3.351 by the Series H Conversion Price in effect at the time of the conversion. The initial “Series G Conversion Price” shall be $12.50 per share and the initial “Series H Conversion Price” shall be $3.351 per share. Each of the Series G Conversion Price and Series H Conversion Price is referred to herein as “Conversion Price.” Such initial Conversion Price shall be subject to adjustment for stock splits, stock combinations, stock dividends, combinations, consolidations, recapitalizations and the like as hereinafter provided.

(ii) Automatic Conversion. Each share of Series G1 Preferred Stock, Series G2 Preferred Stock, Series H1 Preferred Stock and Series H2 Preferred Stock shall be automatically converted into shares of Series 2 Common Stock at the then effective Conversion Price applicable to such series of Preferred Stock and each share of Series 1 Common Stock shall be automatically converted into one share of Series 2 Common Stock immediately prior to and contingent upon the closing of a firm commitment underwritten public offering of the Corporation’s Common Stock pursuant to a registration statement declared effective by the SEC resulting in aggregate proceeds (net of underwriting discounts and commissions) to the Corporation as seller of not less than $30,000,000 and at a public offering price of no less than $6.70 per share (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, recapitalizations and the like). The Series 2 Common Stock shall be designated “Common Stock” immediately prior to the closing of such a firm commitment underwritten public offering.

(iii) Mechanics of Conversion. No fractional shares of Common Stock shall be issued upon conversion of any share of Preferred Stock. All shares held by the holder to be converted shall be aggregated prior to determination of any fractional share to which such holder would otherwise be entitled. In lieu of any such fractional share, the Corporation shall pay cash equal to such fraction multiplied by the then effective Conversion Price for such series. Except in the case of a conversion pursuant to Section 2(f)(ii), before any holder of Preferred Stock shall be entitled to convert the same into full shares of Common Stock, such holder shall surrender the certificate or certificates therefor, duly endorsed, at the office of the Corporation or of any transfer agent for the Preferred Stock, and shall give written notice to the Corporation at such office that such holder elects to convert the same. Upon the date of a conversion pursuant to Section 2(f)(ii), any party entitled to receive the shares of Common Stock issuable upon such conversion shall be treated for all purposes as the record holder of such shares of Common Stock on such date, whether or not such holder has surrendered the certificate or certificates for such holder’s shares of Preferred Stock. A holder surrendering a certificate or certificates for conversion shall notify the Corporation of the name in which such holder wishes the certificate or certificates for shares of Common Stock to be issued. If the person or persons in whose name any certificate for shares of Common Stock issuable upon such conversion shall be other than the registered holder or holders of the Preferred Stock being converted, the Corporation’s obligation under this Section 2(f)(iii) shall be subject to the payment and satisfaction by such registered holder or holders of any and all transfer taxes in connection with the conversion and issuance of such Common Stock and the requirement that such registered holder deliver an opinion of legal counsel, reasonably satisfactory to the Corporation, that the transfer of such shares is exempt from the registration requirements of the Securities Act of 1933, as amended, unless the transfer is pursuant to Rule 144, in which case no such opinion shall be required. The Corporation shall, as soon as practicable thereafter (and, in any event, within ten (10) days of such surrender), issue and deliver at such office to such holder of Preferred Stock, or to such holder’s nominee or nominees, a certificate or certificates for the number of shares of Common Stock to which such holder shall be entitled as aforesaid, together with cash in lieu of any fraction of a share. Except in the case of a conversion pursuant to Section 2(f)(ii), such conversion shall be deemed to have been made immediately prior to the close of business on the date of such surrender of the shares of Preferred Stock to be converted, and the party or parties entitled to receive the shares of Common Stock issuable upon conversion shall be treated for all purposes as the record holder or

holders of such shares of Common Stock on such date. Shares of Preferred Stock converted pursuant to this Section 2(f) shall be immediately canceled and shall not be reissued.

(iv) Adjustments to Conversion Price for Diluting Issues.

(A) Special Definitions. For purposes of this Section 2(f)(iv), the following definitions shall apply:

(1) “Option” shall mean options, warrants or other rights to subscribe for, purchase or otherwise acquire either Common Stock or Convertible Securities.

(2) “Convertible Securities” shall mean any evidences of indebtedness, shares (other than Common Stock) of capital stock or other securities directly or indirectly convertible into or exchangeable for Common Stock.

(3) “Additional Shares of Common Stock” shall mean any or all shares of Common Stock issued (or, pursuant to Section 2(f)(iv)(C) below, deemed to be issued) by the Corporation after the date of this Amended and Restated Certificate of Incorporation, other than shares of Common Stock:

(a) issued or issuable upon conversion of shares of Series G Preferred Stock or Series H Preferred Stock (including Preferred Stock issued upon the exercise of warrants (as amended) outstanding as of this Amended and Restated Certificate of Incorporation);

(b) up to an aggregate of 3,925,000 shares (as adjusted to reflect stock splits, stock dividends, combinations, consolidations, recapitalizations and the like) issued or issuable to employees, officers, consultants, directors, or advisors of the Corporation pursuant to a stock option plan or other equity incentive program approved by a majority of the Board of Directors, but including additional shares under outstanding options which may expire or not be exercised or outstanding shares which are repurchased;

(c) issued or issuable pursuant to an acquisition of another company approved by a majority of the Board of Directors;

(d) issued or issuable pursuant to leasing or bank financing arrangements approved by a majority of the Board of Directors;

(e) issued or issuable pursuant to technology licensing transactions approved by a majority of the Board of Directors;

(f) issued or issuable to suppliers, customers, licensors, or licensees in connection with strategic relationships or joint ventures approved by a majority of the Board of Directors; or

(g) issued or deemed issued as a dividend or distribution on the Preferred Stock.

(B) No Adjustment of Conversion Price. Subject to the provisions of Section 2(f)(iv)(C) and Section 2(f)(iv)(D) below, no adjustment in the number of shares of Common Stock into which any series of the Preferred Stock is convertible shall be made, by adjustment in the Conversion Price of the Preferred Stock in respect of the issuance of Additional Shares of Common Stock or otherwise, unless the consideration per share for an Additional Share of Common Stock issued or deemed to be issued by the Corporation is less than the Conversion Price for such series in effect on the date of, and immediately prior to, the issue of such Additional Share of Common Stock.

(C) Deemed Issue of Additional Shares of Common Stock

(1) Options and Convertible Securities. In the event, at any time or from time to time after this Amended and Restated Certificate of Incorporation, the Corporation shall issue any Options or Convertible Securities or shall fix a record date for the determination of holders of any class of securities entitled to receive any such Options or Convertible Securities, then the maximum number of shares (as set forth in the instrument relating thereto without regard to any provisions contained therein for a subsequent adjustment of such number) of Common Stock issuable upon the exercise of such Options or, in the case of Convertible Securities and Options therefor, the conversion or exchange of such Convertible Securities, shall be deemed to be Additional Shares of Common Stock issued as of the time of such issue or, in case such a record date shall have been fixed, as of the close of business on such record date, provided that such Additional Shares of Common Stock shall not be deemed to have been issued unless the consideration per share (determined pursuant to Section 2(f)(iv)(E) hereof) of such Additional Shares of Common Stock would be less than the applicable Conversion Price in effect on the date of and immediately prior to such issue, or such record date, as the case may be, and provided further that in any such case in which Additional Shares of Common Stock are deemed to be issued:

(a) no further adjustment to the Conversion Price for any series of Preferred Stock shall be made upon the subsequent issue of Convertible Securities or shares of Common Stock upon the exercise of such Options or conversion or exchange of such Convertible Securities;

(b) if such Options or Convertible Securities by their terms provide, with the passage of time, pursuant to any provisions designed to protect against dilution, or otherwise, for any increase or decrease in the consideration payable to the Corporation, or increase or decrease in the number of shares of Common Stock issuable, upon the exercise, conversion or exchange thereof, the Conversion Price computed upon the original issue thereof (or upon the occurrence of a record date with respect thereto), and any subsequent adjustments based thereon, shall, upon any such increase or decrease becoming effective, be recomputed to reflect such increase or decrease insofar as it affects such Options or the rights of conversion or exchange under such Convertible Securities;

(c) upon the expiration or termination of any such Options or any rights of conversion or exchange under such Convertible Securities which shall not have been exercised, the Conversion Price computed upon the original issue thereof (or upon the occurrence of a record date with respect thereto), and any subsequent adjustments based thereon,

shall, upon such expiration, be recomputed as if such Options or Convertible Securities, as the case may be, were never issued;

(d) no readjustment pursuant to clause (b) or (c) above shall have the effect of increasing the Conversion Price to an amount which exceeds the lower of (i) the Conversion Price on the original date on which an adjustment was made pursuant to this Section 2(f)(iv)(F), or (ii) the Conversion Price that would have resulted from any issuance of Additional Shares of Common Stock between such original adjustment date and the date on which a readjustment is made pursuant to clause (b) or (c) above; provided, however, that if there is a consolidation or combination of the Common Stock into a smaller number of shares of Common Stock, the thresholds set forth in the foregoing subsection (D) shall be recalculated to give effect to such consolidation or combination;

(e) in the case of any Options which expire by their terms not more than thirty (30) days after the date of issue thereof, no adjustment of the Conversion Price shall be made until the expiration or exercise of all such Options, whereupon such adjustment shall be made in the same manner provided in clause (c) above; and

(f) if such record date shall have been fixed and such Options or Convertible Securities are not issued on the date fixed therefor, the adjustment previously made in the Conversion Price which became effective on such record date shall be canceled as of the close of business on such record date, and thereafter the Conversion Price for such series shall be adjusted pursuant to this Section 2(f)(iv)(C) as of the actual date of their issuance.

(2) Stock Dividends, Stock Distributions and Subdivisions. In the event the Corporation at any time or from time to time after this Amended and Restated Certificate of Incorporation shall declare or pay any dividend or make any other distribution on the Common Stock payable in Common Stock, or effect a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise than by payment of a dividend in Common Stock), then and in any such event, Additional Shares of Common Stock shall be deemed to have been issued:

(a) in the case of any such dividend or distribution, immediately after the close of business on the record date for the determination of holders of any class of securities entitled to receive such dividend or distribution, or

(b) in the case of any such subdivision, at the close of business on the date immediately prior to the date upon which such corporate action becomes effective.

If such record date shall have been fixed and such dividend shall not have been fully paid on the date fixed for the payment thereof, the adjustment previously made in the Conversion Price which became effective on such record date shall be canceled as of the close of business on such record date, and thereafter the Conversion Price shall be adjusted pursuant to this Section 2(f)(iv)(C) as of the time of actual payment of such dividend.

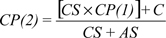

(D) Adjustment of Conversion Price Upon Issuance of Additional Shares of Common Stock. In the event, at any time or from time to time after this Amended and Restated Certificate of Incorporation, the Corporation shall issue Additional Shares of Common Stock (excluding Additional Shares of Common Stock deemed to be issued pursuant to Section 2(f)(iv)(C)(2), which event is dealt with in Section 2(f)(iv)(F) hereof) without consideration or for a consideration per share less than the Series G and/or H Conversion Price in effect on the date of, as applicable, and immediately prior to such issue, then, and in such event, the Series G and/or H Conversion Price, as applicable, shall be reduced, concurrently with such issue, to a price (calculated to the nearest cent) determined by the following formula:

where:

| CP(1) | = | the applicable Conversion Price in effect on the date of and immediately prior to such issue; | ||

| CP(2) | = | the applicable Conversion Price as so adjusted; | ||

| CS | = | the number of shares of Common Stock outstanding immediately prior to such issuance (including shares of Common Stock issuable upon conversion or exercise of any Convertible Securities, Options, and Preferred Stock, but not including those shares excluded from the definition of Additional Shares of Common Stock by Section 2(f)(iv)(A)(4) which are issued after the effective date of this Amended and Restated Certificate of Incorporation); | ||

| C | = | the minimum aggregate consideration, if any, received by the Corporation for the total number of Additional Shares of Common Stock so issued, provided that if the Additional Shares of Common Stock are issued without consideration then C shall be zero (0); and | ||

| AS | = | the number of such Additional Shares of Common Stock so issued. | ||

and provided further that, immediately after any Additional Shares of Common Stock are deemed issued pursuant to Section 2(f)(iv)(C) and an adjustment of the Conversion Price is made with respect thereto, such Additional Shares of Common Stock shall be deemed to be outstanding shares of Common Stock for the purposes of the foregoing formula as applied to future issuances.

(E) Determination of Consideration. For purposes of this Section 2(f), the consideration received by the Corporation for the issue of any Additional Shares of Common Stock shall be computed as follows:

(1) Cash and Property: Such consideration shall:

(a) insofar as it consists of cash, be the aggregate amount of cash received by the Corporation excluding amounts paid or payable for accrued interest or

accrued dividends; and provided further that no deduction shall be made for any reasonable and customary commissions or expenses paid or incurred by the Corporation for any underwriting of the issue or otherwise in connection therewith;

(b) insofar as it consists of property other than cash, be computed at the fair market value thereof at the time of such issue, as determined in good faith by the Board of Directors;

(c) in the event Additional Shares of Common Stock are issued together with other shares of securities or other assets of the Corporation for a single undivided consideration, be computed as the portion of such consideration so received allocable to such Additional Shares of Common Stock, computed as provided in clauses (a) and (b) above, as determined in good faith by the Board of Directors.

(2) Options and Convertible Securities. The consideration per share received by the Corporation for Additional Shares of Common Stock deemed to have been issued pursuant to Section 2(f)(iv)(C), relating to Options and Convertible Securities shall be determined by dividing

(x) the total amount, if any, received or receivable by the Corporation as consideration for the issue of such Options or Convertible Securities, plus the minimum aggregate amount of additional consideration (as set forth in the instruments relating thereto, without regard to any provision contained therein for a subsequent adjustment of such consideration) payable to the Corporation upon the exercise of such Options or the conversion or exchange of such Convertible Securities, or in the case of Options for Convertible Securities, the exercise of such Options for Convertible Securities and the conversion or exchange of such Convertible Securities, by

(y) the maximum number of shares of Common Stock (as set forth in the instruments relating thereto, without regard to any provision contained therein for a subsequent adjustment of such number) issuable upon the exercise of such Options or the conversion or exchange of such Convertible Securities.

(F) Adjustment for Stock Dividends, Stock Distributions, Subdivisions, Combinations or Consolidations of Common Stock.

(1) Stock Dividends, Stock Distributions or Subdivisions. In the event the Corporation shall at any time after this Amended and Restated Certificate of Incorporation issue Additional Shares of Common Stock in a stock dividend, other stock distribution or subdivision, the Conversion Price in effect immediately prior to such stock dividend, stock distribution or subdivision shall, concurrently with the effectiveness of such stock dividend, stock distribution or subdivision, be proportionately decreased to adjust equitably for such dividend, distribution or subdivision.

(2) Combinations or Consolidations. In the event that the outstanding shares of Common Stock shall be combined or consolidated, by reclassification or otherwise, into a lesser number of shares of Common Stock, the Conversion Price in effect immediately prior to such combination or consolidation shall, concurrently with the effectiveness

of such combination or consolidation, be proportionately increased to adjust equitably for such combination or consolidation.

(G) Adjustment for Change of Control. Subject to the provisions of Section 2(b)(iv), if there shall occur any reorganization, recapitalization, reclassification, consolidation, or a Change of Control in which the Common Stock (but not the Preferred Stock) is converted into or exchanged for securities, cash or other property (except a transaction for which provision for adjustment is otherwise made in this Section 2(f)(iv)(G)), then following such reorganization, recapitalization, reclassification, consolidation, or Change of Control, each share of Preferred Stock shall thereafter be convertible into the number of shares of stock, securities, cash or property to which a holder of the number of shares of Common Stock of the Corporation deliverable upon conversion of such Preferred Stock would have been entitled upon such reorganization, recapitalization, reclassification, consolidation, or Change of Control; and, in any such case, appropriate adjustment (as determined by the Board of Directors) shall be made in the application of the provisions herein set forth with respect to the rights and interest thereafter of the holders of the Preferred Stock, to the end that the provisions set forth herein (including provisions with respect to changes in and other adjustments of the Conversion Price) shall thereafter be applicable, as nearly as reasonably may be, in relation to any shares of stock, securities or other property thereafter deliverable upon the conversion of Preferred Stock. The Corporation shall not effect any such reorganization, recapitalization, reclassification, consolidation, or Change of Control, unless prior to or simultaneously with the consummation thereof the successor corporation or purchaser, as the case may be, shall assume by written instrument the obligation to deliver to the holder of the Preferred Stock such shares of stock, securities, cash or property as, in accordance with the foregoing provisions, such holder is entitled to receive.

(v) No Impairment. The Corporation will not, by amendment of its Amended and Restated Certificate of Incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms to be observed or performed hereunder by the Corporation but will at all times in good faith assist in the carrying out of all the provisions of this Section 2(f) and in the taking of all such action as may be necessary or appropriate in order to protect the Conversion Rights of the holders of the Preferred Stock against impairment.

(vi) Certificate as to Adjustments. Upon the occurrence of each adjustment or readjustment of the Conversion Price pursuant to this Section 2(f), the Corporation at its expense shall promptly compute such adjustment or readjustment in accordance with the terms hereof and furnish to each holder of Preferred Stock a certificate executed by the Chief Executive Officer or Chief Financial Officer setting forth such adjustment or readjustment and showing in detail the facts upon which such adjustment or readjustment is based. The Corporation shall, upon the written request at any time of any holder of Preferred Stock, furnish or cause to be furnished to such holder a like certificate setting forth (a) all such adjustments and readjustments theretofore made, (b) the applicable Conversion Price at the time in effect, and (c) the number of shares of Common Stock and the amount, if any, of other property which at such time would be received upon the conversion of Preferred Stock.

(vii) Notices of Record Date. In the event of any taking by the Corporation of a record of the holders of any class of securities for the purpose of determining the holders thereof who are entitled to receive any dividend (other than a cash dividend which is in the same amount per share as cash dividends paid in previous quarters) or other distribution, the Corporation shall mail to each holder of Preferred Stock at least ten (10) days prior to the date thereof, a notice specifying the date on which any such record is to be taken for the purpose of such dividend or distribution.

(viii) Common Reserved. The Corporation shall reserve and at all times keep available out of its authorized but unissued Common Stock, free from preemptive or other preferential rights, restrictions, reservations, dedications, allocations, options, other warrants and other rights under any stock option, conversion option or similar agreement, such number of shares of Common Stock as shall from time to time be sufficient to effect conversion of the Preferred Stock. The number of authorized shares of Common Stock may be increased or decreased, but not below the number of shares of Common Stock then outstanding, by a vote of the holders of a majority of all stock of the Corporation irrespective of subsection 242(b)(2) of the General Corporation Law of the State of Delaware.

(ix) Issue Tax. The issuance of certificates for shares of Common Stock upon conversion of Preferred Stock shall be made without charge to the holders thereof for any issuance tax in respect thereof, provided that the Corporation shall not be required to pay any tax which may be payable in respect of any transfer involved in the issuance and delivery of any certificate in a name other than that of the holder of the Preferred Stock which is being converted.

ARTICLE V

Unless and except to the extent that the By-Laws of the Corporation shall so require, the election of directors of the Corporation need not be by written ballot.

ARTICLE VI

Except as otherwise provided in this Certificate of Incorporation, in furtherance and not in limitation of the powers conferred by law, the Board of Directors is expressly authorized and empowered to make, alter, repeal, amend and rescind any or all of the By-Laws of the Corporation by a majority vote at any regular or special meeting of the Board of Directors or by written consent, subject to the power of the stockholders of the Corporation to make, alter, repeal, amend and rescind any or all of the By-Laws made by the Board of Directors.

ARTICLE VII

Except as otherwise provided herein, the Corporation reserves the right at any time and from time to time to amend, amend and restate, alter, change or repeal any provision contained in this Amended and Restated Certificate of Incorporation, and any other provisions authorized by the laws of the State of Delaware at the time in force may be added or inserted, in the manner now or hereafter required by law; and all rights, preferences and privileges of whatsoever nature conferred upon stockholders, directors or any other persons whomsoever by and pursuant to this

Amended and Restated Certificate of Incorporation in its present form or as hereafter amended are granted subject to the right reserved in this Article VII.

ARTICLE VIII

1. Elimination of Certain Liability of Directors. To the fullest extent permitted by law, a director of the Corporation shall not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director. If the General Corporation Law or any other law of the State of Delaware is amended after approval by the stockholders of this Article VIII to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Corporation shall be eliminated or limited to the fullest extent permitted by the General Corporation Law as so amended.

2. Indemnification and Insurance.

(a) Right to Indemnification. Each person who was or is made a party or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (hereinafter, a “proceeding”), by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to any employee benefit plan, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Corporation to the fullest extent authorized by the General Corporation Law of the State of Delaware, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than said law permitted the Corporation to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid in settlement) reasonably incurred or suffered by such person in connection therewith, and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of such person’s heirs, executors and administrators; provided, however, that the Corporation shall indemnify any such person seeking indemnification in connection with a proceeding (or party thereof) initiated by such person only if such proceeding (or part thereof) was authorized by the Board of Directors. The right to the indemnification conferred in this Article VIII shall be a contract right and shall include the right to be paid by the Corporation the expenses incurred in defending any such proceeding in advance of its final disposition; provided, however, that if the General Corporation Law of the State of Delaware so requires, the payment of such expenses incurred by a director or officer in such person’s capacity as a director or officer (and not in any other capacity in which service was or is rendered by such person while a director or officer, including, without limitation, service to an employee benefit plan) in advance of the final disposition of a proceeding, shall be made only upon delivery to the Corporation of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to be indemnified under this Article VIII or otherwise. The Corporation may, by action of the Board of Directors,

provide indemnification to employees and agents of the Corporation with the same scope and effect as the foregoing indemnification of directors and officers.

(b) Non-Exclusivity of Rights. The right to indemnification and the payment of expenses incurred in defending a proceeding in advance of its final disposition conferred in this Article VIII shall not be exclusive of any other right which any person may have or hereafter acquire under any statute, provision of the Amended and Restated Certificate of Incorporation, By-Law agreement, vote of stockholders or disinterested directors or otherwise.

(c) Insurance. The Corporation may maintain insurance, at its expense, to protect itself and any director, officer, employee or agent of the Corporation or another corporation, partnership, joint venture, trust or other enterprise against any such expense, liability or loss whether or not the Corporation would have the power to indemnify such person against such expense, liability or loss under the General Corporation Law of the State of Delaware.

ARTICLE IX

In connection with repurchases by the Corporation of its Common Stock from employees, officers, directors, advisors, consultants or other persons performing services for the Corporation or any subsidiary pursuant to agreements under which the Corporation has the option to repurchase such shares at cost upon the occurrence of certain events, such as the termination of employment, Sections 502 and 503 of the California Corporations Code shall not apply in all or in part with respect to such repurchases.

The foregoing Amended and Restated Certificate of Incorporation has been duly approved by the required vote of stockholders in accordance with Section 228, 242 and 245 of the General Corporation Law of the state of Delaware, as amended.

IN WITNESS WHEREOF, the Corporation has caused this Amended and Restated Certificate of Incorporation to be signed by Julien Signes, its Chief Executive Officer, this 10th day of June, 2011.

| /s/ Julien Signes |

| Julien Signes, Chief Executive Officer |