Attached files

Exhibit 10.1

Execution Version

LIMITED LIABILITY COMPANY AGREEMENT

OF

FMT SCOTTSDALE HOLDINGS, LLC

Dated as of June 9, 2011

TABLE OF CONTENTS

| Page | ||||||

| ARTICLE I DEFINED TERMS |

1 | |||||

| 1.01 |

Defined Terms |

1 | ||||

| 1.02 |

Other Defined Terms |

14 | ||||

| ARTICLE II ORGANIZATION AND STRUCTURE |

14 | |||||

| 2.01 |

Continuation |

14 | ||||

| 2.02 |

Name and Principal Place of Business |

14 | ||||

| 2.03 |

Term |

15 | ||||

| 2.04 |

Registered Agent and Registered Office |

15 | ||||

| 2.05 |

Purpose; Acquisition Vehicle; TRS Lease Structure |

15 | ||||

| 2.06 |

Walton Street Required Modifications to Structure |

16 | ||||

| ARTICLE III MEMBERS |

17 | |||||

| 3.01 |

Members |

17 | ||||

| 3.02 |

Limitation on Liability |

17 | ||||

| ARTICLE IV CAPITAL |

18 | |||||

| 4.01 |

Initial Capital Contributions |

18 | ||||

| 4.02 |

Additional Capital Contributions |

18 | ||||

| 4.03 |

Additional Capital Contribution Default; Remedies |

19 | ||||

| 4.04 |

Capital Accounts |

21 | ||||

| 4.05 |

No Further Capital Contributions |

22 | ||||

| ARTICLE V INTERESTS IN THE COMPANY |

23 | |||||

| 5.01 |

Percentage Interest |

23 | ||||

| 5.02 |

Return of Capital |

23 | ||||

| 5.03 |

Ownership |

23 | ||||

| 5.04 |

Waiver of Partition; Nature of Interests in the Company |

23 | ||||

| ARTICLE VI ALLOCATIONS AND DISTRIBUTIONS |

24 | |||||

| 6.01 |

Allocations |

24 | ||||

| 6.02 |

Allocations and Compliance with Section 704(b) |

25 | ||||

| 6.03 |

Distributions |

26 | ||||

| 6.04 |

Distributions in Liquidation |

27 | ||||

| 6.05 |

Tax Matters |

28 | ||||

i

| 6.06 |

Tax Matters Partner |

28 | ||||

| 6.07 |

Section 704(c) |

28 | ||||

| 6.08 |

Withholding |

29 | ||||

| 6.09 |

No Tax Confidentiality |

29 | ||||

| 6.10 |

Certain Transactions |

29 | ||||

| ARTICLE VII MANAGEMENT |

29 | |||||

| 7.01 |

Management |

29 | ||||

| 7.02 |

Asset Management Services; Enforcement of Asset Management Agreement and Purchase Agreement |

33 | ||||

| 7.03 |

Duties and Conflicts |

33 | ||||

| 7.04 |

Company Expenses |

34 | ||||

| 7.05 |

Member Meetings and Budget Process |

34 | ||||

| ARTICLE VIII BOOKS, RECORDS, REPORTS AND PROJECT PLANS |

35 | |||||

| 8.01 |

Books and Records |

35 | ||||

| 8.02 |

Accounting and Fiscal Year |

35 | ||||

| 8.03 |

Reports |

35 | ||||

| 8.04 |

The Company Accountant |

37 | ||||

| 8.05 |

Reserves |

37 | ||||

| 8.06 |

Budgets and Operating Plan |

37 | ||||

| 8.07 |

Accounts |

38 | ||||

| 8.08 |

REIT Status |

38 | ||||

| ARTICLE IX TRANSFER OF INTERESTS |

39 | |||||

| 9.01 |

No Transfer |

39 | ||||

| 9.02 |

Permitted Transfers |

39 | ||||

| 9.03 |

Transferees |

40 | ||||

| 9.04 |

Section 754 Election |

40 | ||||

| 9.05 |

Right of Sale |

41 | ||||

| ARTICLE X EXCULPATION AND INDEMNIFICATION |

43 | |||||

| 10.01 |

Exculpation |

43 | ||||

| 10.02 |

Indemnification |

44 | ||||

| ARTICLE XI DISSOLUTION AND TERMINATION |

45 | |||||

| 11.01 |

Dissolution |

45 | ||||

| 11.02 |

Termination |

46 | ||||

ii

| 11.03 |

Liquidating Member |

46 | ||||

| 11.04 |

Claims of the Members |

47 | ||||

| ARTICLE XII DEFAULT BY MEMBER |

47 | |||||

| 12.01 |

Events of Default |

47 | ||||

| 12.02 |

Effect of Event of Default |

48 | ||||

| ARTICLE XIII MISCELLANEOUS |

48 | |||||

| 13.01 |

Representations and Warranties of the Members |

48 | ||||

| 13.02 |

Further Assurances |

50 | ||||

| 13.03 |

Notices |

50 | ||||

| 13.04 |

Governing Law |

51 | ||||

| 13.05 |

Captions |

51 | ||||

| 13.06 |

Pronouns |

51 | ||||

| 13.07 |

Successors and Assigns |

51 | ||||

| 13.08 |

Extension Not a Waiver |

52 | ||||

| 13.09 |

Creditors Not Benefited |

52 | ||||

| 13.10 |

Recalculation of Interest |

52 | ||||

| 13.11 |

Severability |

52 | ||||

| 13.12 |

Entire Agreement |

52 | ||||

| 13.13 |

Publicity |

53 | ||||

| 13.14 |

Confidentiality |

53 | ||||

| 13.15 |

Venue |

54 | ||||

| 13.16 |

WAIVER OF JURY TRIAL |

54 | ||||

| 13.17 |

Limitation of Liability |

54 | ||||

| 13.18 |

Cooperation |

54 | ||||

| 13.19 |

Counterparts |

55 | ||||

| EXHIBIT A – INITIAL CAPITAL ACCOUNT BALANCES OF EACH MEMBER |

||||||

| EXHIBIT B – SCOPE OF CONSTRUCTION |

||||||

| EXHIBIT C – STRUCTURE CHART |

||||||

iii

LIMITED LIABILITY COMPANY AGREEMENT

OF

FMT SCOTTSDALE HOLDINGS, LLC

This LIMITED LIABILITY COMPANY AGREEMENT OF FMT SCOTTSDALE HOLDINGS, LLC, dated as of June 9, 2011 (the “Effective Date”), as amended, restated, replaced, supplemented or otherwise modified from time to time (this “Agreement”), is made by and between WALTON SCOTTSDALE INVESTORS VI, L.L.C., a Delaware limited liability company (together with its successors and permitted assigns, “Walton Street”) and SHR SCOTTSDALE INVESTOR, LLC, a Delaware limited liability company (together with its successors and permitted assigns, “SHR”).

RECITALS:

WHEREAS, the Company (as hereinafter defined) was formed as a limited liability company under the Delaware Act (as hereinafter defined) pursuant to a Certificate of Formation (the “Certificate of Formation”) filed with the Secretary of State of Delaware on May 24, 2011, as amended by the Certificate of Amended filed with the Secretary of State of Delaware on June 3, 2011; and

WHEREAS, Walton Street and SHR deem a limited liability company agreement to be necessary and advisable to set out their agreement as to the conduct of business and the affairs of the Company, and the parties desire to enter into this Agreement.

NOW, THEREFORE, in consideration of the mutual promises and agreements herein made and intending to be legally bound hereby, the parties hereto hereby agree as follows:

ARTICLE I

DEFINED TERMS

1.01 Defined Terms.

As used in this Agreement, the following terms have the meanings set forth below:

“Acquisition Vehicle” has the meaning set forth in Section 2.05(c).

“Additional Capital Contribution” has the meaning set forth in Section 4.02(a).

“Adjusted Capital Account Deficit” means, with respect to any Member for any taxable year or other period, the deficit balance, if any, in such Member’s Capital Account as of the end of such year or other period, after giving effect to the following adjustments:

(a) credit to such Capital Account any amounts that such Member is obligated to restore or is deemed obligated to restore as described in the penultimate sentence of Treasury Regulation Section 1.704-2(g)(1) and in Treasury Regulation Section 1.704-2(i); and

(b) debit to such Capital Account the items described in Treasury Regulation Sections 1.704-1(b)(2)(ii)(d)(4), (5) and (6).

“Adjustment Contribution” has the meaning set forth in Section 4.03(b).

“Affiliate” or “Affiliated” means, with respect to any Person, (a) any other Person directly or indirectly Controlling, Controlled by, or under common Control with such Person, or (b) any other Person owning or controlling fifty percent (50%) or more of the outstanding voting interests of such Person, or (c) any officer, director, general partner or managing member of such Person, or (d) any other Person which is an officer, director, general partner, managing member or holder of fifty percent (50%) or more of the voting interests of any other Person described in clauses (a) through (c) of this definition.

“Agreement” has the meaning set forth in the introductory paragraph hereof.

“Applicable Rate” means the lesser of (a) seventeen percent (17%) per annum; and (b) the maximum interest that may be charged under any applicable usury law.

“Asset Management Agreement” means that certain Asset Management Agreement dated as of the Effective Date, between Asset Manager and the Company, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time as approved by the Members as a Major Decision, or upon the termination of such Asset Management Agreement pursuant to its terms, any replacement asset management agreement, as approved by the Members as a Major Decision.

“Asset Manager” means SHR Advisory, LLC, a Delaware limited liability company, or any replacement thereof, as approved by the Members as a Major Decision.

“Book Basis” means, with respect to any asset of the Company, the adjusted basis of such asset for federal income tax purposes; provided, however, that (a) if any asset is contributed to the Company, the initial Book Basis of such asset shall equal its fair market value on the date of contribution as determined by the Members as a Major Decision, and (b) the Book Basis of all Company assets shall be adjusted to equal their respective gross fair market values, as determined by the Members as a Major Decision, as of the following: (i) the acquisition of an additional Interest by any new or existing Member in exchange for more than a de minimis Capital Contribution; (ii) the distribution by the Company to a Member of more than a de minimis amount of property as consideration for an Interest; (iii) in connection with the liquidation of the Company within the meaning of Treasury Regulation Section 1.704-1(b)(2)(ii)(g); and (iv) in any other circumstances as permitted by the Code or Treasury Regulations; provided, further, that adjustments pursuant to clauses (i), (ii) and (iv) above shall be made only if the Members determine, as a Major Decision, that such adjustments are necessary or appropriate to reflect the relative economic interests of the Members in the Company after taking into account the intent expressed in Section 6.04(b). The Book Basis of all assets of the Company shall be adjusted thereafter by depreciation as provided in Treasury Regulation Section 1.704-1(b)(2)(iv)(g) and any other adjustment to the basis of such assets other than depreciation or amortization.

2

“Breaching Member” has the meaning set forth in Section 12.01.

“Budget” means the initial and each subsequent budget covering the Company’s and any Acquisition Vehicle’s anticipated operations and capital improvements, which shall be prepared by the Managing Member, as in effect from time to time pursuant to Section 8.06, as the same may be amended, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Business Day” means any day other than Saturday, Sunday, any day that is a legal holiday in the State of New York, or any other day on which banking institutions in New York are authorized to close.

“Capital Account” means the separate account maintained for each Member under Section 4.04.

“Capital Contribution” means, with respect to any Member, the aggregate amount of all Initial Capital Contributions, Additional Capital Contributions, Substitute Contributions, and Adjustment Contributions made (or deemed made) by such Member to the Company pursuant to this Agreement.

“Certificate of Formation” has the meaning set forth in the recital paragraphs to this Agreement.

“Closing Date” means the date of the “Closing” under the Purchase Agreement.

“Code” means the Internal Revenue Code of 1986, as amended.

“Company” means the limited liability company continued and governed by the terms of this Agreement.

“Company Accountant” has the meaning set forth in Section 8.04.

“Company Minimum Gain” means “partnership minimum gain” as defined in Treasury Regulation Section 1.704-2(d).

“Company Property” means, either individually or collectively as the context requires or otherwise indicates, any asset or other property (real, personal or mixed) owned by or leased to the Company, directly or indirectly through one or more Acquisition Vehicles (including, without limitation, FSP Hotel Owner, FSP Mezz and FSP Operating Lessee), which shall consist of the Initial Company Property as acquired by FSP Hotel Owner, FSP Mezz and FSP Operating Lessee on the Closing Date pursuant to the Purchase Agreement, and (ii) any and all other property directly or indirectly acquired by the Company from time to time in connection with the operation of the Hotel.

“Company Property Purchase Price” has the meaning set forth in Section 9.05(b).

“Confidential Information” has the meaning set forth in Section 13.14(a).

3

“Contributing Member” has the meaning set forth in Section 4.02(b).

“Control” means, when used with respect to any Person, the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities or other beneficial interests, by contract or otherwise, and the terms “Controlling”, “Controlled by” and “under common Control with” shall have the meanings correlative therewith.

“Conversion Date” has the meaning set forth in Section 4.03(b).

“Conversion Notice” has the meaning set forth in Section 4.03(b).

“Corporate Transaction Transfer” means with respect to any Member, (i) a direct or indirect Transfer of all or substantially all of such Member’s Interest in connection with a sale, merger, acquisition, consolidation, financing or public offering involving all or substantially all of the assets, properties, stock or other equity interests of the ultimate owner or general partner of such Member or the operating partnership of Strategic REIT (which, for the avoidance of doubt, shall include Strategic Hotel Funding, L.L.C.), and as a result of which (A) the Interest of such Member continues to be held by a Member who, directly or through Affiliates, owns or controls substantially all of the business and assets that were (immediately prior to such transaction) held by the transferring Member and its Affiliates, and (B) with respect to SHR, the new Member (directly or through Affiliates) has substantially similar rights and obligations (including control rights) with respect to the Asset Manager as the transferring Member had immediately prior to such transaction, or (ii) any change of control or similar transaction involving any publicly traded entity that is the ultimate parent of such Member or any operating partnership of Strategic REIT (which, for the avoidance of doubt, shall include Strategic Hotel Funding, L.L.C.).

“Defaulting Member” has the meaning set forth in Section 4.03(a).

“Deficiency” has the meaning set forth in Section 4.03(a).

“Deficiency Contribution” has the meaning set forth in Section 4.03(a).

“Deficiency Loan” has the meaning set forth in Section 4.03(b).

“Deficiency Notice” has the meaning set forth in Section 4.03(a).

“Delaware Act” means the Delaware Limited Liability Company Act, as amended from time to time.

“Effective Date” has the meaning set forth in the introductory paragraph hereof.

“Election Notice” has the meaning set forth in Section 4.03(a).

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time.

“Event of Default” has the meaning set forth in Section 12.01.

4

“Exchanging Member” has the meaning set forth in Section 13.18.

“Existing Senior Loan” means the mortgage loan in the aggregate amount of $140,000,000 entered into pursuant to the Loan and Security Agreement dated as of September 1, 2006 between SHR Scottsdale X, L.L.C. and SHR Scottsdale Y, L.L.C., as borrower and Citigroup Global Markets Realty Corp., as lender, as heretofore amended, including without limitation by the Amendment to Mortgage Loan and Security Agreement dated as of May 9, 2007 between SHR Scottsdale, L.L.C., as borrower and Citigroup Global Markets Realty Corp., as lender, as amended by that certain Restructuring Agreement dated as of June 9, 2011 and as assigned to FSP Hotel Owner and FSP Operating Lessee pursuant to that certain Assumption Agreement dated as of June 9, 2011.

“Expenses” means, for any period, the total gross expenditures of the Company reasonably relating to the operations of the Company and/or the acquisition, development, ownership, maintenance, management, operations, marketing, leasing, sale, financing or refinancing of the Company Property during such period contemplated by the then applicable Budget or otherwise approved (either prospectively or retroactively) in accordance with this Agreement from time to time, including (a) all cash operating expenses (including without limitation real estate taxes and assessments, personal property taxes, sales taxes, and all fees, commissions, expenses and allowances paid or reimbursed to any Member or any of its Affiliates pursuant to any property management agreement (including the Asset Management Agreement and fees payable to the Asset Manager thereunder) or otherwise as permitted hereunder), (b) all deposits of Revenues to the Company’s reserve accounts, (c) all debt service payments including debt service on loans made to the Company by the Members or any of their Affiliates, (d) all expenditures which are treated as capital expenditures (as distinguished from expense deductions included in clause (a) above) under GAAP, and (e) all expenditures related to any acquisition, sale, disposition, financing, refinancing or securitization of any Company Property; provided, however, that Expenses shall not include (i) any payment or expenditure to the extent (A) the sources of funds used for such payment or expenditure are not included in Revenues or (B) such payment or expenditure is paid out of any Company reserves, and (ii) any expenditure properly attributable to the liquidation of the Company.

“Fairmont” means Fairmont Hotels & Resorts (U.S.) Inc., a Delaware corporation, in its capacity as manager under the Hotel Management Agreement in effect on the Effective Date, together with its successors and permitted assigns thereunder.

“Fractions Percentage” means the percentage determined with regard to each Member or its applicable Affiliate in accordance with Treasury Regulation Section 1.514(c)-2(b).

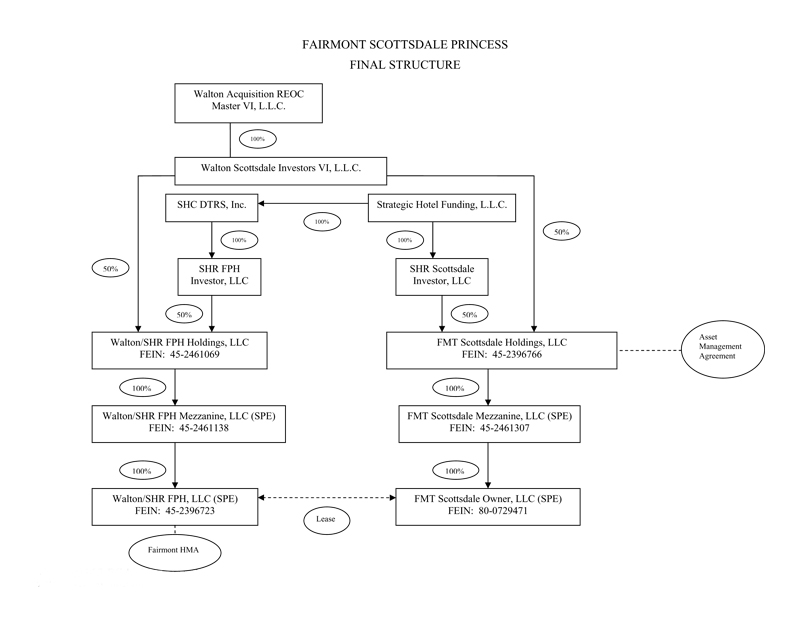

“FSP Hotel Owner” means FMT Scottsdale Owner, LLC, a Delaware limited liability company, the sole member of which is FMT Mezz, together with its successors and permitted assigns in such capacity.

“FSP Mezz” means FMT Scottsdale Mezzanine, LLC, a Delaware limited liability company, the sole member of which is the Company, together with its successors and permitted assigns in such capacity.

5

“FSP Operating Lessee” means Walton/SHR, LLC, a Delaware limited liability company, the sole member of which is Walton/SHR FPH Mezzanine, LLC, a Delaware limited liability company, the sole member of which is Walton/SHR FPH Holdings, LLC, a Delaware limited liability company, the sole members of which are Walton Street and SHR FPH Investor, LLC, a Delaware limited liability company.

“GAAP” means United States generally accepted accounting principles consistently applied.

“Ground Lease” means that certain lease comprised of the following agreements: (A) Ground Lease, dated as of December 30, 1985, by and between City of Scottsdale, a municipal corporation, and Scottsdale Princess Partnership, an Arizona partnership; (B) First Amendment to Ground Lease, dated as of November 17, 1986, by and between the City of Scottsdale, a municipal corporation, and Scottsdale Princess Partnership, an Arizona partnership as reflected in a Memorandum of Ground Lease and Right of First Refusal dated as of November 21, 1986; (C) Second Amendment to Ground Lease, dated as of April 4, 1995, by and between the City of Scottsdale, a municipal corporation, and Scottsdale Princess Partnership, an Arizona partnership; and (D) Wall and Sign Agreement and Third Amendment to Ground Lease, dated as of December 23, 2002, by and between the City of Scottsdale, a municipal corporation, and Scottsdale Princess Partnership, an Arizona partnership (including both a Third Amendment and a Wall and Sign Agreement, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time as approved by the Members as a Major Decision).

“Hotel” means, collectively, the real property, improvements and personal property currently owned and leased by Seller pursuant to the Ground Lease located at 7575 East Princess Drive, Scottsdale, Arizona, currently known as “The Scottsdale Fairmont Princess Resort”, as more particularly described as the “Hotel” in the Purchase Agreement, including, without limitation, all right, title and interest of Seller in the Ground Lease and any and all other “Property” as defined and described in the Purchase Agreement.

“Hotel Management Agreement” means that certain Hotel Management Agreement dated as of September 1, 2006, between DTRS Scottsdale, LLC and Fairmont, as manager, as amended by a First Amendment to Hotel Management Agreement made as of [sic], 2007, a Second Amendment to Hotel Management Agreement dated as of January 1, 2010, and a letter agreement dated as of the Effective Date, together with any subsequent replacement property and/or hotel management agreement entered into thereafter by FSP Operating Lessee with respect to all or any portion of the Company Property, in each case as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time as approved by the Members as a Major Decision.

“Impositions” has the meaning set forth in Section 2.06.

“Indemnitees” has the meaning set forth in Section 10.02.

“Initial Budget and Operating Plan” has the meaning set forth in Section 8.06(a).

6

“Initial Capital Contribution” means, with respect to any Member, any Capital Contribution made (or deemed made) by such Member pursuant to Section 4.01 hereof.

“Initial Company Property” means the Hotel and the Vacant Land to be acquired by the Company through Acquisition Vehicles on the Closing Date pursuant to the Purchase Agreement.

“Interest” means, with respect to any Member at any time, the interest of such Member in the Company at such time, including the right of such Member to any and all of the benefits to which such Member may be entitled as provided in this Agreement, together with the obligations of such Member to comply with all of the terms and provisions of this Agreement.

“Internal Rate of Return” means, as of the date calculated, that discount rate expressed as an annual percentage rate (compounded quarterly) which, when applied to the present value of the Walton Distributed Cash, causes the present value of the Walton Distributed Cash to equal the sum of the present value of all Capital Contributions made by Walton Street to the Company. Calculations shall be made using the X-IRR function of Microsoft Excel, 2003. In determining the Internal Rate of Return, the following shall apply:

(a) all calculations are to be made as of the day on which a distribution is made;

(b) all contributions shall be treated as having been contributed to the Company on the day on which funds were actually delivered to the Company or expended on behalf of the Company;

(c) all distributions shall be treated as if received on the day on which the distribution was made;

(d) all distribution amounts shall be based on the amount of the distribution prior to the application of any federal, state or local taxation to the Members (including any withholding or deduction requirements); and

(e) all amounts shall be calculated on a compounded quarterly basis, and on the basis of a 365-day year.

“Liquidating Member” means the Managing Member.

“Loan” means, either individually or collectively as the context requires or otherwise indicates, the Existing Senior Loan, as amended, supplemented, modified, extended or restated from time to time, including as contemplated in the Restructuring Agreement, or any other loan obtained by the Company or any Acquisition Vehicle, not including any Deficiency Loans or any loan made by the Company or any Acquisition Vehicle.

“Loan Documents” means, collectively, any loan agreement, promissory notes, mortgages and/or other security instrument, guaranties, indemnities and all other agreements, certificates, instruments and documents evidencing or securing the Loan or otherwise entered into and/or delivered by or on behalf of the Company, any Acquisition Vehicle, any Member

7

and/or their respective Affiliates in accordance with this Agreement in connection with any Loan and the transactions contemplated thereby, in each case as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Loss” means, for each taxable year or other period, an amount equal to the Company’s items of taxable deduction and loss for such year or other period, determined in accordance with Section 703(a) of the Code (including all items of loss or deduction required to be stated separately under Section 703(a)(1) of the Code), with the following adjustments:

(a) any expenditures of the Company described in Section 705(a)(2)(B) of the Code or treated as Section 705(a)(2)(B) expenditures under Treasury Regulation Section 1.704-1(b)(2)(iv)(i), and not otherwise taken into account in computing Loss, will be considered an item of Loss;

(b) Loss resulting from any disposition of Company Property with respect to which gain or loss is recognized for federal income tax purposes will be computed by reference to the Book Basis of such property, notwithstanding that the adjusted tax basis of such property may differ from its Book Basis;

(c) in lieu of depreciation, amortization and other cost recovery deductions taken into account in computing taxable income or loss, there will be taken into account depreciation for the taxable year or other period as determined in accordance with Treasury Regulation Section 1.704-1(b)(2)(iv)(g);

(d) any items of deduction and loss specially allocated pursuant to Section 6.02 shall not be considered in determining Loss; and

(e) any decrease to Capital Accounts as a result of any adjustment to the Book Basis of Company assets pursuant to Treasury Regulation Section 1.704-1(b)(2) (iv)(f) or (g) shall constitute an item of Loss.

“Major Decision” has the meaning set forth in Section 7.01(b).

“Managing Member” means SHR or an Affiliate of SHR, together with its successors and permitted assigns in such capacity.

“Mandatory Additional Capital Contributions” has the meaning set forth in Section 4.02(b).

“Member” means, on the Effective Date, one or more of Walton Street and SHR and, from and after the Effective Date, any Person who is admitted as a member of the Company in accordance with this Agreement and applicable law.

“Member Minimum Gain” means the Company’s “partner nonrecourse debt minimum gain” as defined in Treasury Regulation Section 1.704-2(i)(2).

8

“Member Nonrecourse Deductions” means “partner nonrecourse deductions” as defined in Treasury Regulation Section 1.704-2(i)(2).

“Mezzanine Debt” means that certain mezzanine indebtedness described and evidenced by that certain Mezzanine Loan and Security Agreement dated as of May 9, 2007 between SHR Scottsdale Mezzanine, L.L.C. and Pacific Life Insurance Company, as successor in interest.

“Monetary Default” has the meaning set forth in Section 12.01(b).

“Necessary Expenses” means expenses in respect of the following: the Planned Renovation, debt service on the Company’s (or any Acquisition Vehicle’s) financing (including the expense of curing any defaults thereunder), utilities, real estate taxes and assessments, insurance and emergency repairs or other expenditures which a Member determines are necessary for the continued ordinary operation of the Company Property, including without limitation uninsured losses or deductibles, operating shortfalls, repairs, additions or modifications to comply with applicable laws or insurance requirements, insurance premiums for insurance policies approved by the Members, any final orders, judgments, or other proceedings and all costs and expenses related thereto, and any amounts necessary to cure defaults under the Transaction Documents (excluding voluntary prepayment of the principal balance of a Loan prior to its maturity), regardless of whether the Budget has been approved or whether such expenditures exceed the amounts provided for in the applicable Budget.

“Net Cash Flow” means, for any period, the excess of (i) Revenues for such period, over (ii) Expenses for such period.

“Net Loss” means, for any period, the excess of (i) Losses for such period, over (ii) Profits, if applicable, for such period determined without regard to any Profits or Losses allocated pursuant to Section 6.02.

“Net Profit” means, for any period, the excess of (i) Profits for such period, over (ii) Losses, if applicable, for such period determined without regard to any Profits or Losses allocated pursuant to Section 6.02.

“Non-Contributing Member” has the meaning set forth in Section 4.02(b).

“Non-Defaulting Member” has the meaning set forth in Section 4.03(a).

“Non-Selling Member” has the meaning set forth in Section 9.05(b).

“Non-Selling Member Option” has the meaning set forth in Section 9.05(b).

“Nonrecourse Deductions” has the meaning set forth in Treasury Regulation Section 1.704-2(b)(1).

“Notices” has the meaning set forth in Section 13.03.

“OFAC” means the United States Office of Foreign Assets Control, Department of the Treasury, any successor governmental or similar authority thereto.

9

“Operating Lease” means that certain Lease Agreement dated as of the Closing Date, as the same may be amended, supplemented or modified from time to time.

“Operating Plan” means the initial and each subsequent strategic and comprehensive operating plan covering the Company’s and any Acquisition Vehicle’s anticipated operations of Company Property, which shall be prepared by the Managing Member, as in effect from time to time pursuant to Section 8.06, as the same may be amended, supplemented or otherwise modified from time to time in accordance with this Agreement.

“Partially Adjusted Capital Account” means, with respect to any Member for any taxable year or other period of the Company, the Capital Account balance of such Member at the beginning of such year or period, adjusted for all contributions and distributions made or deemed made to or by such Member during such year or period and all special allocations to such Member pursuant to Section 6.02 with respect to such year or period, or to be made to such Member pursuant to Section 6.02(a), but before giving effect to any allocations of Net Profit or Net Loss to such Member pursuant to Section 6.01 with respect to such year or period.

“Participation Notice” has the meaning set forth in Section 4.02(a).

“Percentage Interest” means (a) subject to any adjustments set forth in Section 4.03(b) with regard to any Adjustment Contributions, with regard to each Member on a particular date, the quotient obtained by dividing (i) the Capital Contributions made by such Member as of such date by (ii) the Capital Contributions made by all Members in the aggregate as of such date, which quotient shall be multiplied by 100 and expressed as a percentage, and (b) on the Effective Date, the percentage set forth below opposite such Member’s name:

| Member |

Percentage Interest | |||

| Walton Street |

50 | % | ||

| SHR |

50 | % | ||

“Person” means any individual, partnership, corporation, limited liability company, limited liability partnership, trust or other entity.

“Plan Asset Rules” has the meaning set forth in Section 2.06.

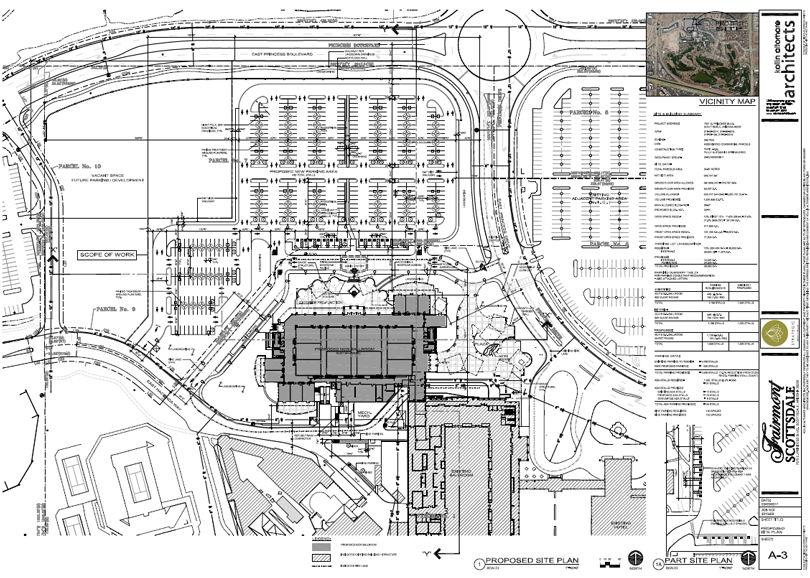

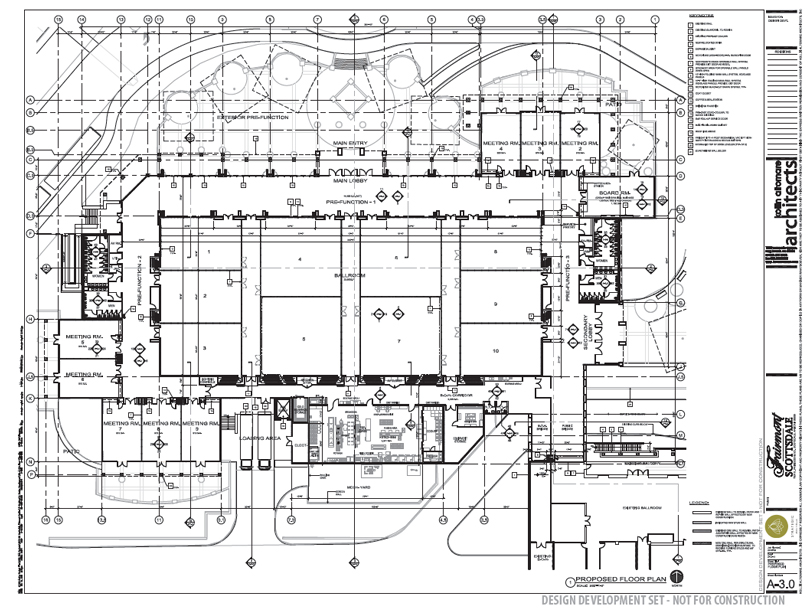

“Planned Renovation” means the construction of a ballroom and ancillary facilities as more particularly set forth in the scope of construction attached hereto as Exhibit B and in the Initial Budget and Operating Plan.

“Profit” means, for each taxable year or other period, an amount equal to the Company’s items of taxable income and gain for such year or other period, determined in accordance with Section 703(a) of the Code (including all items of income and gain required to be stated separately under Section 703(a)(1) of the Code), with the following adjustments:

(i) any income of the Company that is exempt from federal income tax and not otherwise taken into account in computing Profit will be added to Profit;

10

(ii) any gain resulting from any disposition of Company Property with respect to which gain or loss is recognized for federal income tax purposes will be computed by reference to the Book Basis of such property, notwithstanding that the adjusted tax basis of such property may differ from its Book Basis; and

(iii) any items specially allocated pursuant to Section 6.02 shall not be considered in determining Profit; and

(iv) any increase to Capital Accounts as a result of any adjustment to the Book Basis of Company assets pursuant to Treasury Regulation Section 1.704-1(b)(2)(iv)(f) or (g) shall constitute an item of Profit.

“Prohibited Person” means a Person with whom a U.S. Person is prohibited from transacting business of the type contemplated by this Agreement or any other Transaction Document, whether such prohibition arises under United States law, regulation, executive orders and lists published by OFAC, including those executive orders and lists published by OFAC with respect to Persons that have been designated by executive order or by the sanction regulations of OFAC as Persons with whom U.S. Persons may not transact business or must limit their interactions to types approved by OFAC or otherwise.

“Prohibited Result” has the meaning set forth in Section 8.08(b).

“Property Sale Terms” has the meaning set forth in Section 9.05(a).

“Proposed Sale Notice” has the meaning set forth in Section 9.05(a).

“Purchase Agreement” means that certain Purchase and Sale Agreement, dated as of the Effective Date, between Seller and certain of its Affiliates, as sellers, and FSP Hotel Owner and Walton/SHR FPH, LLC, as purchasers, and certain other signatories thereto, as the same may be further amended, restated, replaced, supplemented, assigned or otherwise modified from time to time as approved by the Members as a Major Decision, pursuant to which the Company (directly or through one or more Acquisition Vehicles) shall purchase the Initial Company Property for a purchase price and upon the other terms set forth therein.

“Reasonable Period” means, with respect to any defaulting member, a period of thirty (30) days after such defaulting Member receives written notice of its default from a non–defaulting Member; provided, however, that if such breach can be cured but cannot reasonably be cured within such thirty (30) day period, the period shall continue, if such defaulting Member commences to cure the breach within such thirty (30) day period, for so long as such defaulting Member diligently prosecutes the cure to completion up to a maximum of the lesser of (i) an additional ninety (90) days following the expiration of such thirty (30) day period, or (ii) the period of time allowed for such performance under the Loan Documents.

“Regulatory Allocations” has the meaning set forth in Section 6.02(g).

“Reimbursement Agreement” means that certain Reimbursement and Indemnity Agreement, dated as of the Effective Date, among the Members and/or certain of their Affiliates,

11

as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time.

“Restructuring Agreement” means that certain Restructuring Agreement dated as of June 9, 2011 between SHR Scottsdale, L.L.C., a Delaware limited liability company, as borrower, and Bank of America, National Association, successor by merger to LaSalle Bank National Association, as Trustee for the registered holders of the Citigroup Commercial Mortgage Trust 2007-FL3, Commercial Mortgage Pass-Through Certificates, Series 2007-FL3.

“Revenues” means, for any period, the total gross cash receipts received by the Company during such period, including all cash receipts of the Company from (a) rent, cost, expense and other recoveries and all additional rent paid to the Company (including for parking facilities), (b) concessions to the Company which are in the nature of revenues, (c) rent or business interruption insurance, and casualty and liability insurance, if any, (d) funds made available to the extent such funds are withdrawn from the Company’s or a third party’s reserve account and deposited into the Company’s operating accounts, (e) proceeds from the sale or other disposition of any Company Property, (f) proceeds from the financing, refinancing or securitization of any Company Property, and (g) other revenues and receipts realized by the Company, including, without limitation, excess cash from any reserve established by or on behalf of the Company or from any Capital Contribution if and to the extent the same were not used for the purpose of funding any Shortfall.

“Sale of Company Property” means any sale, exchange, transfer, assignment or other disposition by the Company (or applicable Acquisition Vehicle) of Company Property, in each case together with any of the Company’s (or applicable Acquisition Vehicle’s) then existing rights, title and interests relating thereto, either in one transaction or a series of transactions.

“Sale Deposit” has the meaning set forth in Section 9.05(c).

“Sale Election Notice” has the meaning set forth in Section 9.05(a).

“Seller” means SHR Scottsdale, LLC, a Delaware limited liability company, as the seller under the Purchase Agreement, together with its successors and permitted assigns in any such capacity.

“Selling Member” has the meaning set forth in Section 9.05(b).

“Selling Member Interest Price” has the meaning set forth in Section 9.05(b).

“Shortfall” has the meaning set forth in Section 4.02(a).

“SHR” has the meaning set forth in the introductory paragraph hereof.

“Strategic REIT” means Strategic Hotels & Resorts, Inc., together with any successors thereto.

“Subsidiary(ies)” means each of the Persons that are direct or indirect subsidiaries of the Company as of the Closing Date as set forth on the structure chart attached hereto as Exhibit C

12

and such other Persons formed as Subsidiaries after the Closing Date in connection with the business of the Company.

“Substitute Contribution” has the meaning set forth in Section 4.02(b).

“Target Account” means, with respect to any Member for any taxable year of the Company or other period, the excess of (a) an amount equal to the hypothetical distribution such Member would receive if all assets of the Company, including cash, were sold for cash equal to their Book Basis (taking into account any adjustments to Book Basis for such year or other period but not adjustments caused by any such hypothetical distributions pursuant to this definition), all liabilities allocable to such assets were then due and were satisfied according to their terms (limited, with respect to each nonrecourse liability, to the Book Basis of the assets securing such liability) and all remaining proceeds from such sale were distributed pursuant to Section 6.03 over (b) the amount of Company Minimum Gain and Member Minimum Gain that would be charged back to such Member as determined pursuant to Treasury Regulation Section 1.704-2 immediately prior to such sale.

“Tenant” means, either individually or collectively as the context requires or otherwise indicates, each tenant and/or other occupant (other than FSP Operating Lessee, and short term guests of the Hotel) of any portion of the Company Property, either pursuant to a Tenant Lease or otherwise (other than pursuant to the Operating Lease).

“Tenant Lease” means each lease, sublease, license or other occupancy agreement with any Tenant with respect to any portion of space in any Company Property, other than the Operating Lease.

“Transaction Documents” means, collectively, this Agreement, the limited liability company operating agreement or other organizational documents of each Acquisition Vehicle, the Purchase Agreement, the Asset Management Agreement, the Reimbursement Agreement and the Loan Documents, together with any other agreement, document or instrument executed and/or delivered pursuant to the provisions of any of the foregoing or in connection with the transactions contemplated thereby, as the same may be amended, restated, replaced, supplemented or otherwise modified from time to time in accordance with the terms thereof as approved by the Members as a Major Decision.

“Transfer” has the meaning set forth in Section 9.01.

“Treasury Regulation” or “Regulation” means, with respect to any referenced provision, such provision of the regulations of the United States Department of the Treasury or any successor provision.

“UBTI” means “unrelated business taxable income” as defined in Code Sections 512 through 514.

“U.S. Person” means a United States citizen, a permanent resident of the United States, an entity organized under the laws of the United States or any of its territories or having its principal place of business within the United States or any of its territories, or any other Person

13

that is a “United States person” as described in, or for the purposes of, Executive Order 13224 of September 23, 2001 or any amendment, replacement or other modification thereto.

“Vacant Land” has the meaning set forth in the Purchase Agreement.

“Voluntary Additional Capital Contributions” has the meaning set forth in Section 4.02(b).

“Walton Distributed Cash” means cash distributed to Walton Street pursuant to Sections 6.03(a)(i), (a)(ii), (a)(iii), 6.03(b) and 6.04.

“Walton Street” has the meaning set forth in the introductory paragraph hereof.

1.02 Other Defined Terms.

As used in this Agreement, unless otherwise specified, (i) all references to Sections, Articles or Exhibits are to Sections, Articles or Exhibits of this Agreement, and (ii) each accounting term has the meaning assigned to it in accordance with GAAP.

ARTICLE II

ORGANIZATION AND STRUCTURE

2.01 Continuation.

The Company was formed as a limited liability company under the Delaware Act by the filing of the Certificate of Formation. The Members hereby agree to continue the Company as a limited liability company under the Delaware Act, upon the terms and subject to the conditions set forth in this Agreement. The Managing Member is hereby authorized to file and record any amendments to the Certificate of Formation and such other documents as may be reasonably required or appropriate under the Delaware Act or the laws of any other jurisdiction in which the Company may conduct business or own property.

2.02 Name and Principal Place of Business.

(a) The name of the Company is set forth on the cover page to this Agreement. The Managing Member may change the name of the Company or adopt such trade or fictitious names for use by the Company as the Managing Member may from time to time determine. All business of the Company shall be conducted under such name, and title to all Company Property shall be held in such name.

(b) The principal place of business and office of the Company shall be located c/o Strategic Hotels & Resorts, Inc., 200 West Madison, Suite 1700, Chicago, Illinois 60606, or at such other place or places as the Managing Member may from time to time designate. The Managing Member shall notify the other Members of any change of principal place of business and office.

14

2.03 Term.

The term of the Company commenced on May 24, 2011, the date of the filing of the Certificate of Formation pursuant to the Delaware Act and shall continue in existence until dissolution pursuant the provisions of this Agreement.

2.04 Registered Agent and Registered Office.

The name of the Company’s registered agent for service of process shall be the Corporation Trust Company, and the address of the Company’s registered agent and the address of the Company’s registered office in the State of Delaware shall be 1209 Orange Street, Wilmington, Delaware 19801. Such agent and such office may be changed from time to time by the Managing Member with written notice to all Members.

2.05 Purpose; Acquisition Vehicle; TRS Lease Structure.

(a) The purpose of the Company shall be to:

(i) perform its obligations and exercise its rights under the Purchase Agreement, the other Transaction Documents and any other agreements or contracts contemplated by the foregoing, and to carry out the terms of and engage in the transactions contemplated by the Purchase Agreement and the other Transaction Documents;

(ii) directly or indirectly acquire, own, manage, operate, improve, finance, refinance, develop, redevelop, construct, renovate, market, lease, sell and otherwise deal with and dispose of the Company Property; and

(iii) conduct all other activities reasonably necessary or desirable to accomplish the foregoing purposes.

(b) It is acknowledged that, subject to any other applicable or relevant provisions of this Agreement:

(i) on or prior to the Closing Date, the Company shall cause the formation of FSP Hotel Owner and FSP Mezz;

(ii) on the Closing Date, FSP Hotel Owner shall assume the Existing Senior Loan and the Ground Lease, and FSP Operating Lessee shall assume the Hotel Management Agreement;

(iii) on the Closing Date, (x) the Company shall purchase the Mezzanine Debt from mezzanine lender, (y) the existing mezzanine borrower shall assign and FSP Mezz shall assume the Mezzanine Debt, and (z) the Company shall contribute the Mezzanine Debt to the capital of FSP Mezz (whereupon the Mezzanine Debt will automatically be cancelled and extinguished).

15

(iv) on the Closing Date, pursuant to the terms of the Purchase Agreement, the Initial Company Property shall be acquired by FSP Hotel Owner; and

(v) on the Closing Date, FSP Hotel Owner and FSP Operating Lessee shall enter into the Operating Lease.

(c) Notwithstanding anything to the contrary contained in this Agreement, the Company shall cause the formation of (i) FSP Hotel Owner and FSP Mezz, directly or indirectly wholly owned or Controlled by the Company, and (ii) FSP Operating Lessee, owned indirectly by SHR FPH Investor, LLC and Walton Street, in the same proportion as their (or their Affiliates’ in the case of SHR) respective interests in the Company, in each case to acquire or lease all or any portion of the Company Property (each such newly formed entity being referred to as an “Acquisition Vehicle”). It is expressly understood that the Company will conduct all of its business directly or indirectly through one or more Acquisition Vehicles; provided that it is the intent of the Members that the organizational documents relating to the formation of any Acquisition Vehicle shall be interpreted together with the provisions of this Agreement to have substantially the same effect as would be the case if all the interests therein were held or all such business were conducted by the Company pursuant to the terms of this Agreement.

(d) Notwithstanding anything to the contrary in this Agreement, the Members acknowledge and agree that, for so long as any Member holds, directly or through Affiliates, an Interest in the Company or an interest in FSP Operating Lessee through one or more entities that qualifies as a “real estate investment trust” for U.S. federal income tax purposes: (i) the Hotel must at all times be leased to FSP Operating Lessee (or a successor or assign thereof), (ii) SHR or its Affiliate may at any time, without approval of any other Member, require FSP Hotel Owner and FSP Operating Lessee (or a successor or assign thereof) to amend, modify or renew the Operating Lease (including any increase, decrease or other changes to the rent stated therein), and/or enter into any new lease agreement with respect to the lease of the Hotel to the Operating Lessee, in each case in a manner consistent with customary REIT practices, and (iii) all actions, amendments or agreements contemplated in this paragraph shall be binding and in full force and effect without any execution or acknowledgment by Walton Street or any of its Affiliates; provided, however, that no actions, amendments or agreements contemplated in this paragraph shall be made, implemented, approved or authorized to the extent they adversely affect the economic interests or other rights of the Members under this Agreement. Each Member agrees to cooperate with the SHR and to execute, acknowledge, deliver, file, record and publish all such reasonable and necessary documents, agreements and instruments and to take any other actions as SHR reasonably determines are necessary to implement the foregoing, subject to the limitations set forth in this Section 2.05.

2.06 Walton Street Required Modifications to Structure.

In order to qualify and/or preserve the status of Walton Street, any direct or indirect member or partner with an interest in Walton Street, or any other Person in which the Members and/or the Company owns an interest and which owns any portion of the Company Property as an “operating company” under the plan asset rules of ERISA at 29 C.F.R. Section 2510.3–101 (the “Plan Asset Rules”), to avoid the imposition of a corporate tax on any income of the Company, or to minimize the effects of any UBTI on Walton Street, its Affiliates and/or their respective

16

direct or indirect partners, members, shareholders and other Affiliates (collectively, the “Impositions”), the Members agree to consent to modifications proposed by Walton Street in good faith to the structure of the Company and/or the structure of the Company’s investments in and ownership of the Company Property and/or to the terms of this Agreement including, without limitation, the capital contribution and allocation and distribution provisions set forth in Articles IV and VI, if in any such case the modifications are necessary, advisable or otherwise helpful in achieving or maintaining the foregoing. Any such modification may include, without limitation, the formation by the Members of other limited liability companies, partnerships, corporations or other entities (including without limitation, corporations and trusts that qualify as real estate investment trusts under Section 856 of the Code) to be owned by the Company, the Members or their Affiliates and which will own a portion of the Company Property. Each Member agrees to cooperate with Walton Street and to execute, acknowledge, deliver, file, record and publish all such reasonable and necessary documents, agreements and instruments and to take any other actions as Walton Street reasonably determines are necessary to implement the foregoing, subject to the limitations set forth in this Section 2.06. The Members agree to amend this Agreement in a manner reasonably proposed by Walton Street in order to structure their contributions in a manner that will avoid the Impositions. Notwithstanding the foregoing, no actions, amendments or agreements contemplated in this Section 2.06 shall be made, implemented, approved or authorized to the extent they adversely affect the economic interests or other rights of the Members under this Agreement or jeopardize Strategic REIT’s status as a real estate investment trust for U.S. federal income tax purposes.

ARTICLE III

MEMBERS

3.01 Members.

Effective as of the Effective Date, the Members of the Company shall be Walton Street and SHR. Except as expressly permitted by this Agreement, no other Person shall be admitted as a member of the Company and no additional Interest shall be issued, without the approval of all of the Members.

3.02 Limitation on Liability.

Except as otherwise provided in the Delaware Act, (i) the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and no Member shall be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a member of the Company, (ii) the liability of each Member to contribute capital to the Company shall be limited to the amount of Capital Contributions required to be made by such Member in accordance with the provisions of this Agreement, but only when and to the extent the same shall become due pursuant to the provisions of this Agreement, and (iii) the liability and obligations of each Member under this Agreement shall be limited to such Member’s Interest in the Company and no recourse shall be permitted to any property, assets or other interests of such Member other than to (A) such Member’s Interest hereunder, (B) such Member’s share of any distributions of Net Cash Flow, the proceeds of liquidation or any other amounts that would otherwise be distributable or payable to such Member with respect to its Interest, (C) the amount of Capital Contributions required to

17

be made by such Member in accordance with the provisions of this Agreement, and (D) the amount of any distributions or other amounts wrongfully distributed or paid to such Member.

ARTICLE IV

CAPITAL

4.01 Initial Capital Contributions.

As of the Effective Date, (a) Walton Street contributed (or was deemed to contribute) the sum of $35,559,220.81 to the Company in exchange for its Interests therein, and (b) SHR contributed (or was deemed to contribute) the sum of $35,559,220.81 to the Company in exchange for its Interests therein.

4.02 Additional Capital Contributions.

(a) If at any time or from time to time after all of the Initial Capital Contributions have been contributed, the Managing Member determines that additional funds (a “Shortfall”) are reasonably required (i) to meet the ongoing obligations, liabilities, expenses or other reasonable business needs of the Company in accordance with the then applicable Budget or Operating Plan, including in connection with the Planned Renovation, or (ii) for any other purpose as reasonably determined by the Managing Member relating to the Company and/or the ownership, operation, development and/or management of any portion of the Company Property or for any other purpose which is not adverse or contrary to the then applicable Budget or Operating Plan, and the Managing Member has determined to request additional capital to fund such Shortfall, then the Managing Member shall deliver notice (a “Participation Notice”) to each of the Members offering each Member the right to contribute (subject to the consequences specified herein) its pro rata share (based upon the Percentage Interests of the Members at the time of such request) of such Shortfall (such pro rata share, an “Additional Capital Contribution”). If so requested by the Managing Member, each Member who elects to fund any Additional Capital Contribution shall do so within fifteen (15) Business Days after receipt of a Participation Notice. In addition to any Additional Capital Contributions made under this Agreement, the Members acknowledge and agree that any amounts paid by the Members or their respective Affiliates pursuant to the terms of the Reimbursement Agreement shall be deemed Additional Capital Contributions. Notwithstanding the foregoing or anything to the contrary herein: (A) the Members shall be required to make all Additional Capital Contributions required to fund the Planned Renovation, and (B) if the Managing Member does not call capital in an amount sufficient to fund the Planned Renovation, the Budget or Operating Plan or any other Necessary Expenses of the Company, then Walton Street shall have the right to make such capital call without any approval of the Managing Member and shall have all of the rights of the Managing Member under this Article IV or otherwise with respect to such capital call and any failure by the Managing Member to fund its pro rata portion thereof.

(b) Notwithstanding anything to the contrary contained herein, a failure by any Member to make any Additional Capital Contribution to the extent required or requested hereunder shall not constitute an Event of Default by such Member and (i) the sole consequence

18

of a failure by any Member to make any Additional Capital Contribution required to fund the Planned Renovation shall be as set forth in Section 4.03 (such Additional Capital Contributions being referred to as “Mandatory Additional Capital Contributions”), and (ii) the sole consequence of a failure by any Member to fund any Additional Capital Contributions other than Mandatory Capital Contributions shall be as set forth below in this Section 4.02(b) (such Additional Capital Contributions being referred to as “Voluntary Additional Capital Contributions”). If any Member (the “Non-Contributing Member”) fails to timely make a Voluntary Additional Capital Contribution when due, then the other Member (the “Contributing Member”) may elect any time thereafter, in its sole and absolute discretion, to make such Additional Capital Contribution (any such Capital Contribution by a Contributing Member, a “Substitute Contribution”), and the Percentage Interest of each Member shall be adjusted accordingly (in the manner set forth in the definition of Percentage Interest) to take into account the Additional Capital Contributions and Substitute Contributions made in connection with such required or requested Additional Capital Contribution.

4.03 Additional Capital Contribution Default; Remedies.

(a) Upon the failure of any Member (the “Defaulting Member”) to make any Mandatory Additional Capital Contribution (the portion thereof not contributed by such Defaulting Member being referred to herein as the “Deficiency”), the Managing Member shall inform the other Member (the “Non-Defaulting Member”) in writing of such Deficiency (a “Deficiency Notice”) within five (5) days after the date on which the contribution was required to be made. Within ten (10) days after the date of delivery of a Deficiency Notice, the Non-Defaulting Member shall deliver written notice (an “Election Notice”) to the Defaulting Member, stating that it elects, in its sole and absolute discretion, to do one of the following in connection with such Deficiency: (i) withdraw the corresponding required contribution that was made by it in connection with such Deficiency; (ii) not withdraw its own contribution and contribute an amount equal to the Deficiency (such contributed amount, a “Deficiency Contribution”), which contribution shall be treated as provided in Section 4.03(b) below as the Non-Defaulting Member may elect in its sole and absolute discretion; or (iii) neither withdraw its contribution nor make a Deficiency Contribution. In the event that the Non-Defaulting Member withdraws the corresponding required contribution that was made by it in connection with such Deficiency or neither withdraws its corresponding required contribution nor makes a Deficiency Contribution, such Non-Defaulting Member shall have no liability for failure to make its required contribution (as applicable) or any Deficiency Contribution. If the election under clause (ii) above is made within the required time period, then the Non-Defaulting Member shall have an additional thirty (30) days after the date the Deficiency was originally required to be contributed to make the Deficiency Contribution. If the Non-Defaulting Member shall fail to deliver a timely Election Notice, it shall be deemed to have delivered an Election Notice making the election described in clause (iii) above.

(b) A Non-Defaulting Member who makes the election under clause (a)(ii) or (a)(iii) above shall have the following options:

19

(I) it may elect to have the entire amount contributed by it (including both such Non-Defaulting Member’s share of the Additional Capital Contribution and any portion of the Deficiency Contribution it may make) be treated as a contribution (“Adjustment Contribution”) governed by clause (i) below;

(II) it may elect to have any portion of its share of such Additional Capital Contribution and any share of the Deficiency Contribution it makes be treated as an Adjustment Contribution governed by clause (i) below and the remaining portion of such total amount be treated as a loan to the Company (“Deficiency Loan”) governed by clause (ii) below; or

(III) it may elect to have the entire amount contributed by it (including both such Non-Defaulting Member’s share of the Additional Capital Contribution and any portion of the Deficiency Contribution it may make) be treated as a Deficiency Loan governed by clause (ii) below.

Such election shall be made by written notice to the other Member within thirty (30) days after the earlier of (x) delivery of an Election Notice, or (y) expiration of the period for delivery of an Election Notice. If such Non-Defaulting Member fails to deliver such notice within such 30-day period, then such Non-Defaulting Member shall be deemed to have elected to have the entire amount contributed by it in connection with a particular Additional Capital Contribution (including both the Non-Defaulting Member’s share of the Additional Capital Contribution and any portion of the Deficiency Contribution it makes) be treated as a Deficiency Loan under clause (III) above. In addition to the foregoing options, after a Member has elected (or is deemed to have elected) to have an amount advanced by it be treated as a Deficiency Loan, it may thereafter elect to have the outstanding balance of such Deficiency Loan, together with all interest accrued and unpaid thereon through the Conversion Date, be converted to an Adjustment Contribution by delivering written notice (“Conversion Notice”) of such election to the other Member no later than ninety (90) days after the origination of the Deficiency Loan. Such conversion shall take effect on the date (“Conversion Date”) which is thirty (30) days following such Member’s delivery of the Conversion Notice to the other Member. On the Conversion Date, (A) the Deficiency Loan so converted shall be deemed to have been repaid to such Member, and (B) such Non-Defaulting Member shall be deemed to have made an Adjustment Contribution equal to the then outstanding balance of such Deficiency Loan, plus the interest accrued and unpaid thereon. The terms of each Adjustment Contribution and each Deficiency Loan shall be governed by the following provisions:

(i) If a Non-Defaulting Member makes an Adjustment Contribution or timely elects to have a Deficiency Loan converted to an Adjustment Contribution, then the Members’ Percentage Interests shall be recalculated by the Managing Member in good faith subject to review and approval by Walton Street, effective as of the date the Deficiency was required to have been contributed by the Defaulting Member (or, in the case of a Deficiency Loan which is converted to an Adjustment Contribution, on the Conversion Date) as follows: (A) the amount of Capital Contributions made by the Non-Defaulting Member as of such date shall be deemed increased by the amount of any Deficiency Contribution and Deficiency Loan (but only to the extent that such Deficiency Loan is then being converted to an Adjustment

20

Contribution) made by the Non-Defaulting Member as of such date; and (B) the amount of Capital Contributions made by all Members as of such date shall be deemed increased by the amount of any Deficiency Contribution and Deficiency Loan (but only to the extent that such Deficiency Loan is then being converted to an Adjustment Contribution) made by the Non-Defaulting Member as of such date. Upon the written request of any Member after completion of an adjustment to the Percentage Interest of each Member as provided above, the Managing Member shall confirm such adjustment in writing.

(ii) The terms of each Deficiency Loan shall be as follows: (A) interest shall accrue on the outstanding balance of such Deficiency Loan at the Applicable Rate per annum, compounded quarterly; (B) such Deficiency Loan shall be a loan and not a contribution; (C) no Member shall be entitled to any distributions under Article VI unless and until such Deficiency Loan and all accrued and unpaid interest thereon has been paid in full to the Member making the same, and all such distributions which otherwise would be made under Article IV shall instead be paid directly to the Member making Deficiency Loans that remain outstanding until the Deficiency Loans and all accrued and unpaid interest thereon have been paid in full (any such payments shall first be applied to unpaid interest accruing thereon, and then to principal); (D) the Deficiency Loan shall be due and payable in full upon the earlier of the tenth (10th) anniversary of the origination of the Deficiency Loan or the liquidation of the Company (without any prepayment premium or penalty); (E) the Deficiency Loan shall provide that it may not be accelerated prior to maturity for any reason (other than in connection with a liquidation of the Company), including non-payment, and shall have no financial or other covenants; (F) the Deficiency Loan shall be unsecured; and (G) neither the Company nor any Member shall have any personal liability for the payment of any Deficiency Loan or any interest accrued thereon. In the event that more than one Deficiency Loan remains outstanding, the same shall be paid on a pro rata basis, based on the relative proportions of the outstanding balances of principal and interest with respect thereto. In any instance in which a Member may make a Deficiency Loan, such Member may, at its option, cause an Affiliate of such Member to make such loan on the same terms and conditions as the Member; provided, however, that any such Affiliate shall not have the right to convert such Deficiency Loan to an Adjustment Contribution. Notwithstanding the foregoing, the Member associated with such Affiliate may elect to have such Deficiency Loan converted to an Adjustment Contribution by timely delivering a Conversion Notice in the manner set forth above. In such event, (x) such Member shall be deemed to have converted the balance of such Deficiency Loan (including all accrued and unpaid interest) into an Adjustment Contribution for the benefit of such Member, and (y) the Deficiency Loan so converted shall be deemed to have been repaid.

(c) Each Member acknowledges and agrees that the other Members would not be entering into this Agreement were it not for (i) the Members agreeing to make the Capital Contributions provided for in Section 4.02, and (ii) the remedy provisions set forth above in this Section 4.03. Each Member acknowledges and agrees that the remedy provisions set forth in this Section 4.03 are fair, just and equitable in all respects.

4.04 Capital Accounts.

21

A separate Capital Account will be maintained for each Member in accordance with Treasury Regulation Section 1.704-1(b)(2)(iv). Consistent therewith, the Capital Account of each Member will be determined and adjusted as follows:

(a) Each Member’s Capital Account will be credited with:

(i) any contributions of cash made by such Member to the capital of the Company plus the fair market value of any property contributed by such Member to the capital of the Company (net of any liabilities to which such property is subject or which are assumed by the Company);

(ii) the Member’s distributive share of Net Profit and any items in the nature of income or gain specially allocated to such Member pursuant to Section 6.02; and

(iii) any other increases required by Treasury Regulation Section 1.704-1(b)(2)(iv), without duplication.

(b) Each Member’s Capital Account will be debited with:

(i) any distributions of cash made from the Company to such Member plus the fair market value of any property distributed in kind to such Member (net of any liabilities to which such property is subject or which are assumed by such Member);

(ii) the Member’s distributive share of Net Loss and any items in the nature of expenses or losses specially allocated to such Member pursuant to Section 6.02; and

(iii) any other decreases required by Treasury Regulation Section 1.704-1(b)(2)(iv), without duplication.

The initial Capital Account balance of each Member is set forth on Exhibit A attached hereto, which balances have been determined in accordance with the provisions of Treasury Regulation Section 1.704-1(b)(2)(iv)(f). Any expenses borne by a Member for its own account will not increase such Member’s Capital Account, nor affect its share of Profits or Losses. The provisions of this Section 4.04 and any other provisions of this Agreement relating to the maintenance of Capital Accounts have been included in this Agreement to comply with Section 704(b) of the Code and the Treasury Regulations promulgated thereunder and will be interpreted and applied in a manner consistent with those provisions.

4.05 No Further Capital Contributions.

Except as expressly provided in this Agreement or with the prior written consent of the Members, no Member shall be required or entitled to contribute any other or further capital to the Company, nor shall any Member be required or entitled to loan any funds to the Company. No Member will have any obligation to restore any negative balance in its Capital Account at any time including upon liquidation or dissolution of the Company.

22

ARTICLE V

INTERESTS IN THE COMPANY

5.01 Percentage Interest.

The Percentage Interests of the Members may be adjusted only as set forth in this Agreement.

5.02 Return of Capital.

No Member shall be liable for the return of the Capital Contributions (or any portion thereof) of any other Member, it being expressly understood that any such return shall be made solely from the assets of the Company. No Member shall be entitled to withdraw or receive a return of any part of its Capital Contributions or Capital Account, to receive interest on its Capital Contributions or Capital Account or to receive any distributions from the Company, except as expressly provided for in this Agreement or under applicable law. No Member shall have any obligation to restore any negative balance in its Capital Account.

5.03 Ownership.

All Company Property shall be owned by the Company, directly or indirectly through one or more Acquisition Vehicles, subject to the terms and provisions of this Agreement. Title to Company Property shall be held by the Company in the Company’s name or by an Acquisition Vehicle.

5.04 Waiver of Partition; Nature of Interests in the Company.

Except as otherwise expressly provided for in this Agreement, each of the Members hereby irrevocably waives any right or power that such Member might have to:

(i) cause the Company or any of its assets to be partitioned;

(ii) cause the appointment of a receiver for all or any portion of the assets of the Company;

(iii) compel any sale of all or any portion of the assets of the Company pursuant to any applicable law; or

(iv) file a complaint, or to institute any proceeding at law or in equity, to cause the termination, dissolution or liquidation of the Company.

Each of the Members has been induced to enter into this Agreement in reliance upon the waivers set forth in this Section 5.04, and without such waivers no member would have entered into this Agreement. No Member shall have any interest in any specific Company Property. The interests of all Members in this Company are personal property.

23

ARTICLE VI

ALLOCATIONS AND DISTRIBUTIONS

6.01 Allocations.

For each taxable year or portion thereof, Net Profit and Net Loss shall be allocated (after all allocations pursuant to Section 6.02 have been made) as follows:

(a) Net Loss shall be allocated among the Members so as to reduce, proportionately, the differences between their respective Partially Adjusted Capital Accounts and Target Accounts for such year; provided, however, that no portion of the Net Loss for any taxable year shall be allocated to a Member whose Target Account is greater than or equal to its Partially Adjusted Capital Account for such taxable year; and provided, further, that in no event shall an allocation under this Section 6.01(a) be made to Walton Street to the extent that it would cause Walton Street to be allocated a percentage of overall partnership loss within the meaning of Treasury Regulation Section 1.514(c)-2(c)(1) for the taxable year lower than its Fractions Percentage except to the extent that (i) such allocation is required to reverse a prior allocation of Net Profit to a Member in excess of such Member’s Percentage Interest, and is in the same proportion as such prior allocation, (ii) the result is to allocate losses or deductions to one or more Members who bear a disproportionately large share (relative to each Member’s Percentage Interest but in accordance with the distribution provisions of Section 6.03) of the economic burden of such losses or deduction if, taking into account all of the facts, circumstances and information (including bona fide financial projections), such losses or deductions had a low likelihood of occurring and such allocation otherwise satisfies the requirements of Treasury Regulation Section 1.514(c)-2(g), or (iii) such allocation otherwise is disregarded in determining whether Walton Street satisfies the “fractions rule” set forth in Treasury Regulation Section 1.514(c)-2(b)(1)(i) or otherwise does not cause the allocations set forth in this Agreement to fail to qualify as “permitted allocations” within the meaning of Section 514(c)(9)(E) of the Code and the regulations thereunder.

(b) Net Profit shall be allocated among the Members so as to reduce, proportionately, the differences between their respective Target Accounts and Partially Adjusted Capital Accounts for such year; provided, however, that no portion of the Net Profit for any taxable year shall be allocated to a Member whose Target Account is less than or equal to its Partially Adjusted Capital Account for such taxable year, and provided further that in no event shall an allocation under this Section 6.01(b) be made to Walton Street to the extent it would cause Walton Street to be allocated a percentage of overall partnership income within the meaning of Treasury Regulation Section 1.514(c)-2(c)(1) for the taxable year in excess of its Fractions Percentage except to the extent such allocation is disregarded in determining whether Walton Street satisfies the “fractions rule” set forth in Treasury Regulation Section 1.514(c)-2(b)(1)(i) or otherwise does not cause the allocations set forth in this Agreement to fail to qualify as “permitted allocations” within the meaning of Section 514(c)(9)(E) of the Code and the regulations thereunder.

(c) Notwithstanding anything in this Agreement to the contrary, no allocation of Net Profit shall be made to Walton Street in excess of its Fractions Percentage, and no allocation of Net Loss shall be made to the Members other than Walton Street in excess of its

24

respective Fractions Percentage, in either case, except as otherwise permitted in accordance with the “fractions rule” under Section 514(c)(9) of the Code and the Treasury Regulations thereunder, as determined by Walton Street.

6.02 Allocations and Compliance with Section 704(b).

The following special allocations shall, except as otherwise provided, be made in the following order:

(a) Notwithstanding anything to the contrary contained in this Article VI, if there is a net decrease in Company Minimum Gain or in any Member Minimum Gain during any taxable year or other period, prior to any other allocation pursuant hereto, such Member shall be specially allocated items of Profit for such year (and, if necessary, subsequent years) in an amount and manner required by Treasury Regulation Sections 1.704-2(f) or 1.704-2(i)(4). The items of Profit to be so allocated shall be determined in accordance with Treasury Regulation Section 1.704-2.

(b) Nonrecourse Deductions for any taxable year or other period shall be allocated (as nearly as possible) under Treasury Regulation Section 1.704-2 to the Members, pro rata in proportion to their respective Fractions Percentage.

(c) Any Member Nonrecourse Deductions for any taxable year or other period shall be allocated to the Member that made or guaranteed or is otherwise liable with respect to the loan to which such Member Nonrecourse Deductions are attributable in accordance with principles under Treasury Regulation Section 1.704-2(i).

(d) Any Member who unexpectedly receives an adjustment, allocation or distribution described in Treasury Regulation Section 1.704-1(b)(2)(ii)(d)(4), (5) or (6) which causes or increases a negative balance in his or its Capital Account shall be allocated items of Profit sufficient to eliminate such increase or negative balance caused thereby, as quickly as possible, to the extent required by such Treasury Regulation.