Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BIOMIMETIC THERAPEUTICS, INC. | v225600_8k.htm |

Exhibit 99.1

Jefferies Global Healthcare Conference

June 9, 2011

Dr. Samuel Lynch

President and CEO

Forward Looking Statements

This presentation contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on the current intent and expectations of the management of BioMimetic. These statements are not guarantees of future performance and involve risks and uncertainties that are difficult to predict. There are many important factors that could cause actual results to differ materially from those indicated in the forward-looking statements. BioMimetic’s actual results and the timing and outcome of events may differ materially from those expressed in or implied by the forward-looking statements because of risks associated with the marketing of BioMimetic’s product and product candidates, unproven preclinical and clinical development activities, regulatory oversight, and other risks detailed in BioMimetic’s filings with the Securities and Exchange Commission. Except as required by law, BioMimetic undertakes no responsibility for updating the information contained in this presentation beyond the published date, whether as a result of new information, future events or otherwise, or for changes made to this document by wire services or Internet services.

BioMimetic Therapeutics Corporate Snapshot

• Fully integrated regenerative medicine company focused in orthopedics

• First product, GEM 21S®, FDA approved as a dental bone graft in 2005 with more than 200,000 patients treated to date

• Augment™ Bone Graft FDA received positive panel recommendation May 12, 2011 for orthopedic uses

• Augment will be first new pure rh protein therapeutic to come to market in nearly a decade, if approved by FDA

• GMP manufacturing facility under construction

• Cash ~ $84M (as of 3/31/11) 3

BioMimetic Therapeutics Investment Highlights

Novel orthopedic product that is the first and only cost effective fully synthetic replacement for autograft

$7 billion global market opportunity

Robust pipeline with multiple platform opportunities in bone grafting and soft tissue indications

Positive safety & efficacy profile with long-lived patent protection

Experienced senior management team with strong track record of value creation 4

Roughly a $7B Global Market Opportunity

Bone

Soft Tissue

• Foot & Ankle

• Trauma

• Spine

• Revision Joint Replacement

• Tendon-to-Bone

• Tendinosis

• Cartilage Repair

Market potential:

$2.5B +

Market potential:

$4B+

Source: IMS Healthcare, 2010 5

rhPDGF-BB: A Proven Therapeutic Platform

Why rhPDGF-BB?

• Essential component of the natural healing process

• Level 1 clinical data in multiple indications

• Positive regulatory track record

• Patented through 2025

rhPDGF-BB: A Proven Therapeutic Platform

FDA approved GEM 21S for periodontal indications in ’05

GEM 21S for Dental @ Augment for F&A

Footnotes:

GEM21S is FDA approved while Augment is still experimental and is subject to FDA approval.

TCP particle in GEM21S is 300 um vs. 1000 um for Augment 7

rhPDGF-BB: A Proven Therapeutic Platform

GEM 21S global rights were sold to

Luitpold for ~$90MM in 2008

Orthobiologic Future

Value creation in our expanding pipeline

Dental History

value creation

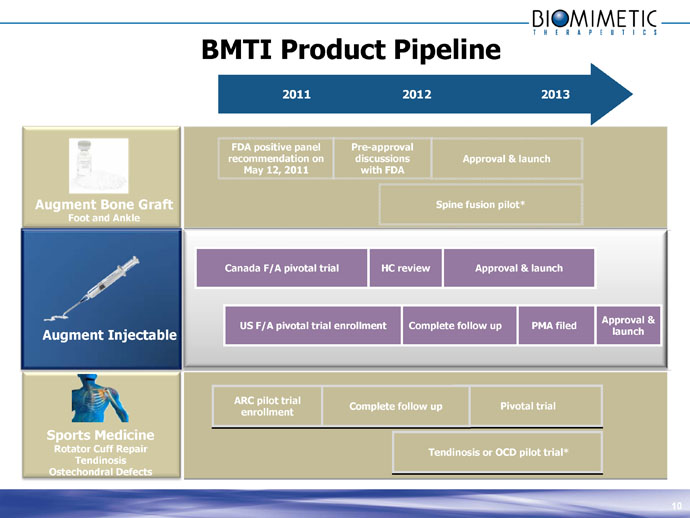

BMTI Product Pipeline

2011 2012 2013

Augment Bone Graft

Foot and Ankle

FDA positive panel recommendation on May 12, 2011

Pre-approval discussions with FDA

Approval & launch

Spine fusion pilot*

Augment Injectable

Canada F/A pivotal trial

HC review

Approval & launch

US F/A pivotal trial enrollment

Complete follow up

PMA filed

Approval & launch

Sports Medicine

Rotator Cuff Repair

Tendinosis

Ostechondral Defects

ARC pilot trial enrollment

Complete follow up

Pivotal trial

Tendinosis or OCD pilot trial* 9

BMTI Product Pipeline

2011 2012 2013

Augment Bone Graft

Foot and Ankle

FDA positive panel recommendation on May 12, 2011

Pre-approval discussions with FDA

Approval & launch

Spine fusion pilot*

Augment Injectable

Canada F/A pivotal trial

HC review

Approval & launch

US F/A pivotal trial enrollment

Complete follow up

PMA filed

Approval & launch

Sports Medicine

Rotator Cuff Repair

Tendinosis

Ostechondral Defects

ARC pilot trial enrollment

Complete follow up

Pivotal trial

Tendinosis or OCD pilot trial* 10

BMTI Product Pipeline

2011 2012 2013

Augment Bone Graft

Foot and Ankle

FDA positive panel recommendation on May 12, 2011

Pre-approval discussions with FDA

Approval & launch

Spine fusion pilot*

Augment Injectable

Canada F/A pivotal trial

HC review

Approval & launch

US F/A pivotal trial enrollment

Complete follow up

PMA filed

Approval & launch

Sports Medicine

Rotator Cuff Repair

Tendinosis

Ostechondral Defects

ARC Pilot trial enrollment

Complete follow up

Pivotal trial

Tendinosis or OCD pilot trial* 11

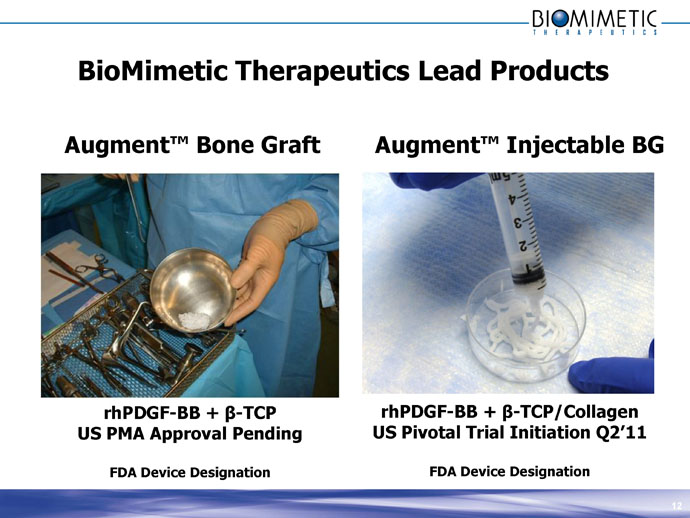

BioMimetic Therapeutics Lead Products

Augment™ Bone Graft

rhPDGF-BB + β-TCP

US PMA Approval Pending

FDA Device Designation

Augment™ Injectable BG

rhPDGF-BB + β-TCP/Collagen

US Pivotal Trial Initiation Q2’11

FDA Device Designation 12

Autograft: the Current Standard of Care

• Considered the “gold standard” for facilitating bony union, despite increased complication rates

• Invasive secondary surgical procedure - take bone from one site for use in the primary surgical site

• Complications include donor site pain, blood loss, infection and fractures

hip

shin

heel

Typical Bone Grafting Sites 13

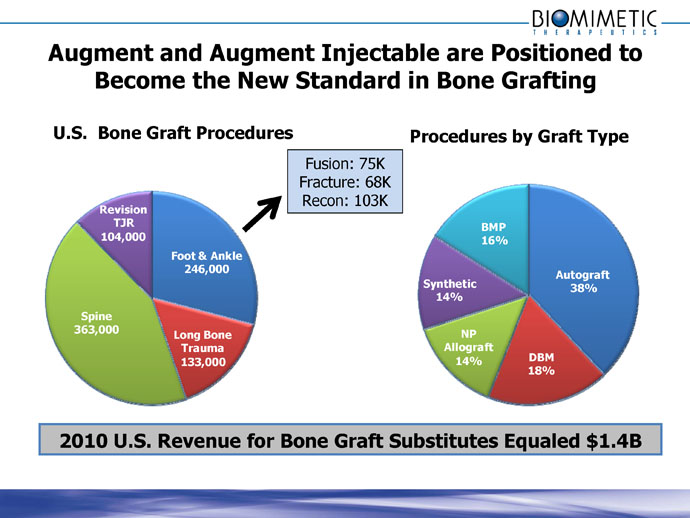

Augment and Augment Injectable are Positioned to

Become the New Standard in Bone Grafting

U.S. Bone Graft Procedures

Foot & Ankle

246,000

Long Bone

Trauma

133,000

Spine

363,000

Revision

TJR

104,000

Fusion: 75K

Fracture: 68K

Recon: 103K

Procedures by Graft Type

Autograft

38%

DBM

18%

NP

Allograft

14%

Synthetic

14%

BMP

16%

2010 U.S. Revenue for Bone Graft Substitutes Equaled $1.4B

Augment Bone Graft

Value Proposition

Upon approval, Augment will be the first and only cost effective fully synthetic replacement for autograft with level 1 data supporting its safety and efficacy. 15

Augment Bone Graft

Proven Track Record of Safety & Efficacy

Augment Clinical Trials:

• Positive N.A. Phase III Pivotal Trial for F&A Fusion - n : 414*

• Positive U.S. Pilot Study for F&A Fusion - n : 20

• Positive Canadian Open Label Study for F&A Fusion - n : 60

• Positive European Registry Study for Distal Radius Fracture - n : 20

• Positive EU Open Label F&A Fusion Study - n : 108

TOTAL: 622

*treated patients 16

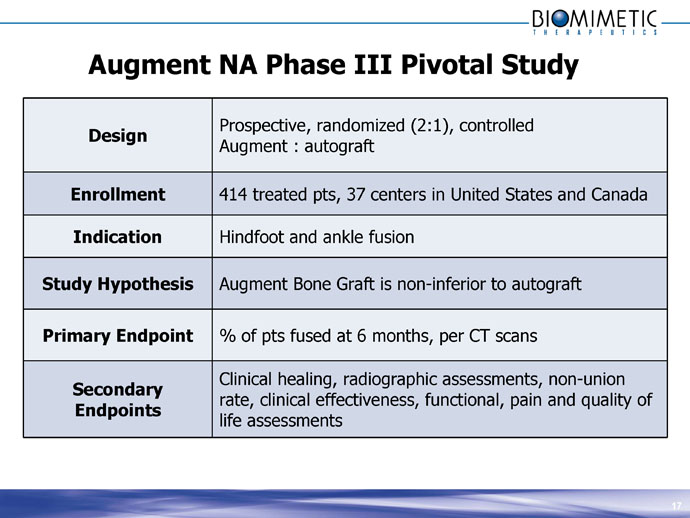

Augment NA Phase III Pivotal Study

Design

Prospective, randomized (2:1), controlled Augment : autograft

Enrollment 414 treated pts, 37 centers in United States and Canada

Indication Hindfoot and ankle fusion

Study Hypothesis Augment Bone Graft is non-inferior to autograft

Primary Endpoint % of pts fused at 6 months, per CT scans

Secondary Endpoints

Clinical healing, radiographic assessments, non-union rate, clinical effectiveness, functional, pain and quality of life assessments 17

PMA patient populations

Randomized Population (ITT)

n = 434

Augment (285) / Autograft (149)

Not defined in IDE

Not treated

n = 20

Augment (13) / Autograft (7)

Treated Population (Safety)

n = 414

Augment (272) / Autograft (142)

Defined in IDE as ITT

Major Protocol Violations

n = 17

Augment (12) / Autograft (5)

Primary Analysis Population (mITT)

n=397

Augment (260) / Autograft (137)

Defined in IDE as Per Protocol

Prospectively determined by blinded review

Augment U.S. Pivotal trial:

Summary of mITT (397 patients / 597 joints)

Primary endpoint is measured at 24 weeks

Endpoint

Non-inferiority established

24 Weeks 36 Weeks 52 Weeks

CT Fusion (full complement) Yes (p=0.038) No (p=0.202) N/A

CT Fusion (all joints) Yes (p<0.001) No (p=0.103) N/A

Clinical Healing (patient) Yes (p=0.010) Yes (p=0.038) Yes (p=0.003)

Clinical Healing (all joints) Yes (p<0.001) Yes (p<0.001) Yes (p<0.001)

Clinical Success No (p=0.071) Yes (p=0.041) Yes (p=0.022)

Non-Union/Therapeutic Failure Yes (p<0.001) Yes (p<0.001) Yes (p<0.001)

Persistent Donor Site Pain Yes (p<0.001) Yes (p<0.001) Yes (p<0.001)

Augment statistically significant in primary and key secondary endpoints

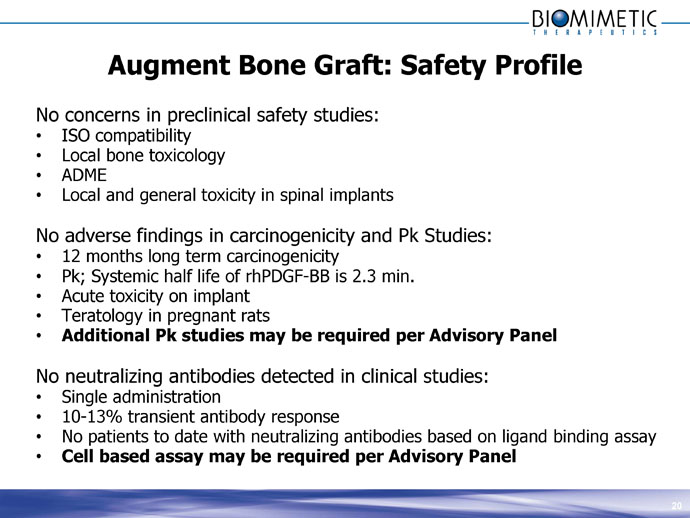

Augment Bone Graft: Safety Profile

No concerns in preclinical safety studies:

• ISO compatibility

• Local bone toxicology

• ADME

• Local and general toxicity in spinal implants

No adverse findings in carcinogenicity and Pk Studies:

• 12 months long term carcinogenicity

• Pk; Systemic half life of rhPDGF-BB is 2.3 min.

• Acute toxicity on implant

• Teratology in pregnant rats

• Additional Pk studies may be required per Advisory Panel

No neutralizing antibodies detected in clinical studies:

• Single administration

• 10-13% transient antibody response

• No patients to date with neutralizing antibodies based on ligand binding assay

• Cell based assay may be required per Advisory Panel 20

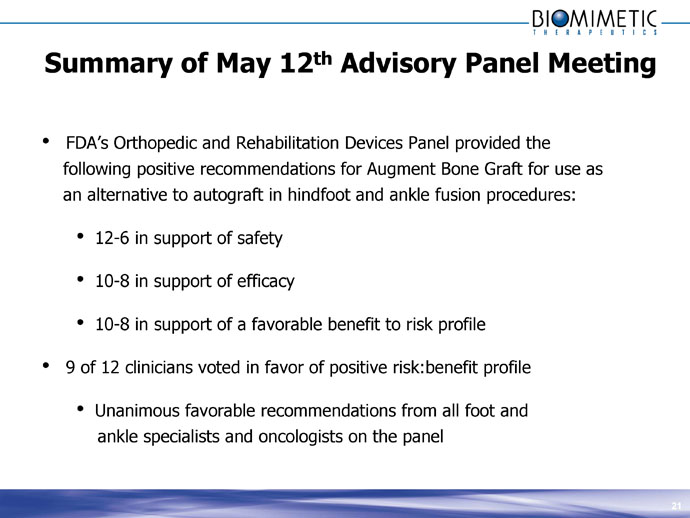

Summary of May 12th Advisory Panel Meeting

• FDA’s Orthopedic and Rehabilitation Devices Panel provided the following positive recommendations for Augment Bone Graft for use as an alternative to autograft in hindfoot and ankle fusion procedures:

• 12-6 in support of safety

• 10-8 in support of efficacy

• 10-8 in support of a favorable benefit to risk profile

• 9 of 12 clinicians voted in favor of positive risk:benefit profile

• Unanimous favorable recommendations from all foot and ankle specialists and oncologists on the panel 21

Advisory Panel Positive Recommendation

Key Topics of Discussion

• AE reporting

• All AEs reported

• Rigorous FDA audit with no findings

• Carcinogenicity/tumor promotion

• Clinical data: 1.1% Augment vs. 1.4% autograft

• Pre clinical data clean

• Over 200,000 patients treated with GEM 21S with no cancer signal

• Regranex final analysis has no cancer signal

• Patient populations

• mITT and treated populations pre specified

• Majority of clinicians preferred mITT

• NAb and Pk studies

• Potential pre- or post-approval studies TBD 22

Next Steps Post Positive Panel

• Meetings with FDA management and reviewers

• Provide clarifications requested to FDA

• Discuss potential pre- and post-approval requirements with FDA

• First public announcement anticipated in September 23

Initial U.S. Market Opportunity:

Foot & Ankle Grafting Procedures

U.S. BONE GRAFT PROCEDURES: 2010

Foot & Ankle

246,000

Trauma

133,000

Spine

363,000

Revision TJR

104,000

Fusion: 75K

Fracture: 68K

Recon: 103K

Lumbar 228,000

Foot & Ankle

Market Characteristics

ü High growth: 8%+ procedure growth each year in F&A fusion

ü No active BGS alternative today: Autograft is used in the majority of procedures

ü Poor donor quality: An issue in Autograft harvesting given large diabetic & arthritic population

ü Highly concentrated: 2,000 foot and ankle surgeons, 4,500 surgical podiatrists in the U.S.

Foot & Ankle Fusion Market: $150M

Total Foot & Ankle Market: $453M

Source: IMS Healthcare, 2010 24

F/A Fusion Volume Distribution

• Based on coding data, F/A fusion procedures are performed at 2,468 unique institutions

• Top quartile: 50 institutions

• Top 50%: 188 institutions

• Top 75%: 537 institutions

• F/A fusion claims breakdown

• Foot/Ankle MDs (55.4%)

• DPMs (36.5%)

• Other MDs -trauma, general (8.1%)

• 20% of the F/A fusions are performed by 99 surgeons

• 88 MDs, 11 DPMs

Source: IMS Health/PearlDiver 25

Augment Sales and Marketing Strategy

U.S. Sales and Marketing

• Hybrid sales team and agency on boarding H2 2011

• Five new sales management employees hired

• 15 - 20 BMTI EEs total to include sales, technical and reimbursement support, marketing and sales management pre-approval

• Nearly 250 independent agents under contract currently

• Up to 400 independent agents expected on board at launch

• Commission based

• Focus on high volume surgeons

• Branding, collateral and marketing initiatives underway to support

Launch 26

Augment Reimbursement Strategy

U.S. Reimbursement

• Hired Director of Reimbursement Q4 2010

• Inpatient procedures covered under existing DRGs

• Pursuing Medicare outpatient hospital payment, and a unique HCPCS code

• Developing a comprehensive value dossier of the clinical and health economic value messages, data endpoints and supporting literature

• Establishing customer-focused reimbursement tools, services and resources 27

Augment International Commercialization Strategy

EU

• CE Mark dossier filed in Q2’11

• Distribution agreements and approvability decisions expected in 2012

Canada

• National Sales Manager has developed distributor network with nationwide coverage

• At YE ’10, thirty-three independent agents with 37 hospitals approved to use Augment

Australia

• Australian distribution agreement with Surgical Specialties

• Expect approval decisions in 2H’11

Reimbursement

• Market specific value dossiers, reimbursement calculators and submission preparations under development throughout 2011 28

BMTI Product Pipeline

2011 2012 2013

Augment Bone Graft

Foot and Ankle

Augment Injectable

Sports Medicine

Rotator Cuff Repair Tendinosis Ostechondral Defects

FDA positive panel recommendation on May 12, 2011

Pre-approval discussion with FDA

Approval & launch

Spine fusion pilot*

Canada F/A pivotal trial

HC review

Approval & launch

US F/A pivotal trial enrollment

Complete follow up

PMA filed

Approval & launch

ARC pilot clinical trial enrollment

Complete follow up

Pivotal trial

Tendinosis or OCD pilot trial* 29

AugmentTM Injectable Bone Graft

Orthopedic Clinical Trials

Study

# of

Patients Study Design Outcome

Wrist

Fracture

(EU)

21 RCT, External Fixation + AIBG vs. External Fixation alone

100% union in AIBG vs. 89% in control group; early bone fill observed in AIBG group

Foot /

Ankle

Fusion

(CA)

10 Open label study using AIBG as an adjunct in fusions

100% fusion; results led to decision on AIBG pivotal trial

Foot /

Ankle

Fusion

(CA)

75 RCT, AIBG vs. autograft non-inferiority; primary endpoint is 6 month CT scan

Pivotal trial results 2H’11

Foot /

Ankle

Fusion

(U.S)

201 Pivotal RCT, AIBG vs. autograft non-inferiority; 6 month primary endpoint, 12 months for safety

Enrollment initiated; further discussions ongoing with FDA 30

Sports Medicine: Untapped Market for rhPDGF-BB

rhPDGF-BB stimulates repair of tendons, ligaments and cartilage in pre-clinical studies.

Tendinosis

Rotator cuff

Cartilage repair

• Resorbable Type I collagen mesh hydrated with rhPDGF-BB

• Interpositional graft between torn tendon & bone

Hydrated

Matrix

Rotator Cuff

Tendon

Suture

Fixation

• rhPDGF-BB solution for injection into tendons for treatment of tennis elbow

• Bi-phasic scaffold hydrated with rhPDGF-BB for the treatment of osteochondral defects 31

U.S. Market Opportunity: Sports Medicine

TARGET U.S. SPORTS MED PROCEDURES: 2014

Tendon to bone

(e.g., rotator cuff repair)

460K

Tendinosis 1.4M

540K

Cartilage repair

Sports Medicine

Market Characteristics

ü High Growth: 7-10%+ procedure growth each year in tendon, ligament and cartilage repair

ü Unmet Need / No Effective Regenerative Alternatives Today: Steroids or fixation are only “therapeutic” options

ü Large Opportunities: Significant procedure numbers in all target areas

ü May be Regulated as a Drug: Providing unique opportunities for additional barriers to entry, exclusivity and reimbursement opportunity

Tendon to Bone Market: $710M+

Cartilage Repair Market: $1.4B

Tendinosis Market: $2.2B

Source: IMS Healthcare, 2010 32

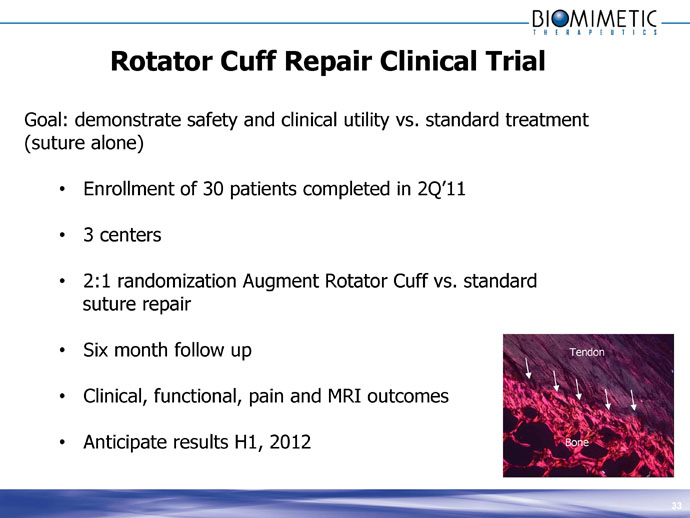

Rotator Cuff Repair Clinical Trial

Goal: demonstrate safety and clinical utility vs. standard treatment (suture alone)

• Enrollment of 30 patients completed in 2Q’11

• 3 centers

• 2:1 randomization Augment Rotator Cuff vs. standard suture repair

• Six month follow up

• Clinical, functional, pain and MRI outcomes

• Anticipate results H1, 2012

Tendon

Bone 33

Established Manufacturing and Distribution Capabilities

• ISO 9001:2008 and 13485 certifications

• Long-term exclusive supply and manufacturing agreements

• Scalable manufacturing

• Attractive gross margins 75% to 85%

• Experience manufacturing GEM 21S over 200k units sold to date 34

Conclusion

• Validated technology platform: GEM 21S PMA approval

• Favorable Augment panel recommendation on May 12, 2011

• $7B global market opportunity

• Robust pipeline with multiple platform opportunities in bone grafting and soft tissue indications

• Successful track record in value creation

Augment will be the first clinically proven and cost-effective protein therapeutic to market in nearly a decade 35

NASDAQ: BMTI

Thank you 36