Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REGIONS FINANCIAL CORP | d8k.htm |

Exhibit 99.1

Exhibit 99.1

2011 Deutsche Bank

Financial Services Roundtable

June 8, 2011

David Turner

Chief Financial Officer

Why Regions?

Strong Southeastern United States footprint

Experienced management

Comprehensive line of product offerings

Exceptional service quality

Leading brand favorability

Strong capital, reserves and liquidity

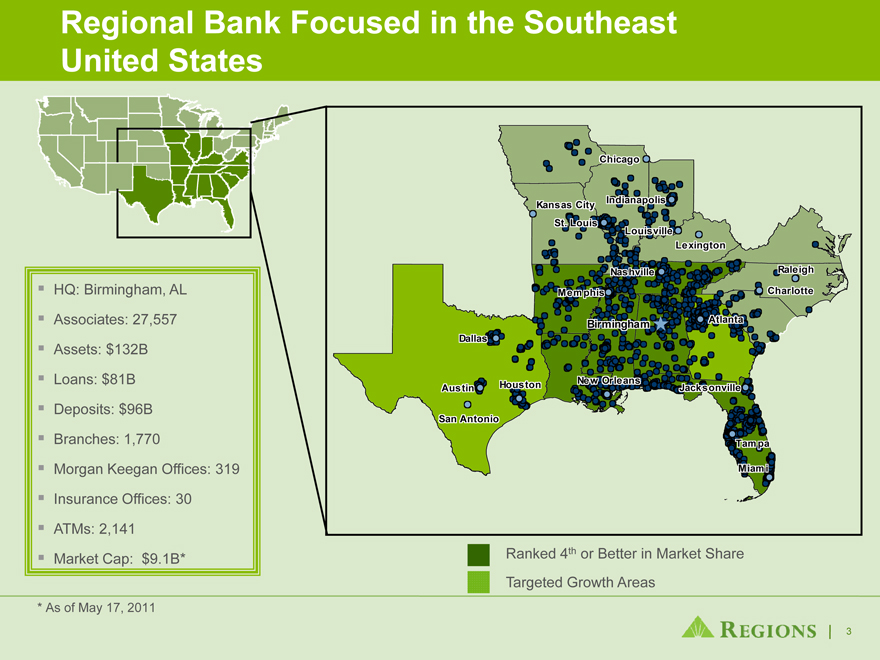

Regional Bank Focused in the Southeast United States

HQ: Birmingham, AL Associates: 27,557 Assets: $132B Loans: $81B Deposits: $96B Branches: 1,770 Morgan Keegan Offices: 319 Insurance Offices: 30 ATMs: 2,141 Market Cap: $9.1B*

Ranked 4th or Better in Market Share Targeted Growth Areas

As of May 17, 2011

Our primary focus is returning to sustainable profitability through disciplined execution of our strategic priorities

Focus on the Customer

Drive Financial Performance

Build for Our Future

Execute with Excellence

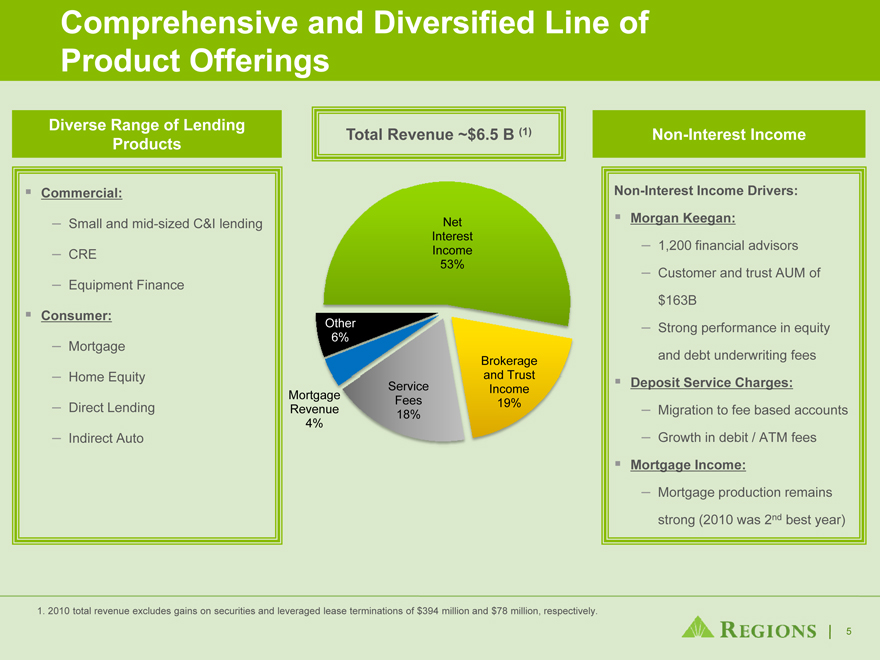

Comprehensive and Diversified Line of Product Offerings

Diverse Range of Lending Products

Total Revenue ~$6.5 B (1)

Non-Interest Income

Commercial:

– Small and mid-sized C&I lending

– CRE

– Equipment Finance

Consumer:

– Mortgage

– Home Equity

– Direct Lending

– Indirect Auto

Non-Interest Income Drivers: ?Morgan Keegan:

– 1,200 financial advisors

– Customer and trust AUM of $163B

– Strong performance in equity and debt underwriting fees

?Deposit Service Charges:

– Migration to fee based accounts

– Growth in debit / ATM fees

?Mortgage Income:

– Mortgage production remains

strong (2010 was 2nd best year)

1. 2010 total revenue excludes gains on securities and leveraged lease terminations of $394 million and $78 million, respectively.

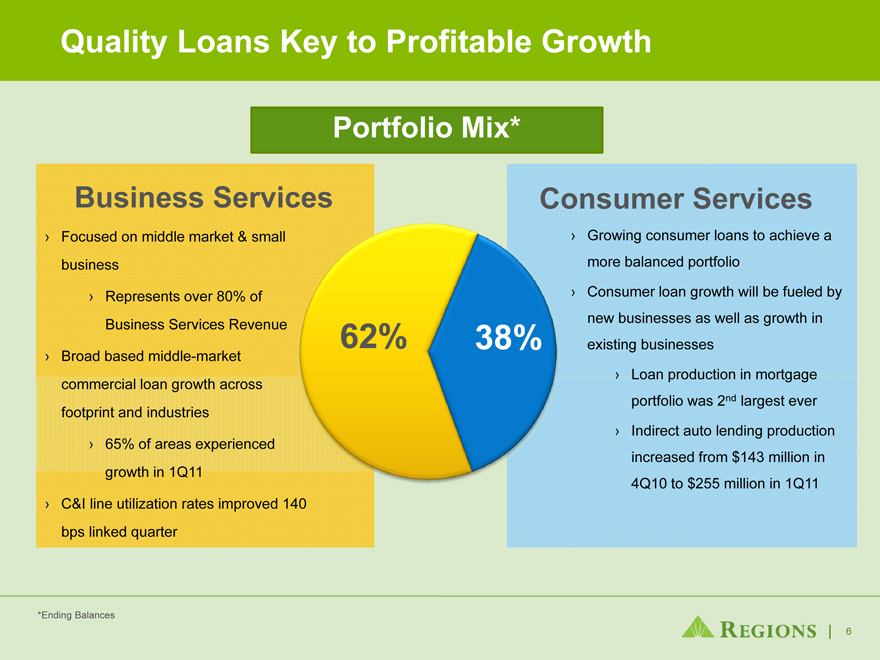

Quality Loans Key to Profitable Growth

Portfolio Mix*

Business Services

› Focused on middle market & small business

› Represents over 80% of Business Services Revenue

› Broad based middle-market commercial loan growth across footprint and industries

› 65% of areas experienced growth in 1Q11

› C&I line utilization rates improved 140 bps linked quarter

Consumer Services

› Growing consumer loans to achieve a more balanced portfolio

› Consumer loan growth will be fueled by new businesses as well as growth in existing businesses

› Loan production in mortgage portfolio was 2nd largest ever

› Indirect auto lending production increased from $143 million in 4Q10 to $255 million in 1Q11

*Ending Balances

Forward-Looking Statements

› aThis “safe presentation harbor” for may forward include -looking forward statements -looking which statements are identified which reflect as such Regions’ and are current accompanied views with by respect the identification to future of events important and financial factors that performance. could cause The actual Private results Securities to differ Litigation materially Reform from the Act forward of 1995- looking (“the Act”) statements. provides For operations, these statements, strategies, financial we, together results with or our other subsidiaries, developments. claim Forward the protection -looking afforded statements by the are

safe based harbor on management’s in the Act. Forward expectations -looking as statements well as certain are not assumptions based on and historical estimates information, made by, but and rather information are related available to future to, the management views, beliefs at the and time projections the statements expressed are made. in such Those statements. statements These are risks, based uncertainties on general and assumptions other factors and include, are subject but are to various not limited risks, to, uncertainties those described and below: other factors that may cause actual results to differ materially from

› The banking Dodd regulators -Frank Wall continue Street to Reform implement, and Consumer but are also Protection beginning Act to became wind down, law on a number July 21, of 2010, programs and a to number address of capital legislative, and liquidity regulatory in the and banking tax proposals system. remain Proposed pending. rules, Additionally, including those the U. that S. Treasury are part of and the federal Basel III determined process, could at this require time. banking institutions to increase levels of capital. All of the foregoing may have significant effects on Regions and the financial services industry, the exact nature of which cannot be › restrictions The impact on of compensation Regions’ ability and to attract other restrictions and retain talented imposed executives under the Troubled and associates. Asset Relief Program (“TARP”) until Regions repays the outstanding preferred stock and warrant issued under the TARP, including

› Possible additional loan losses, impairment of goodwill and other intangibles, and adjustment of valuation allowances on deferred tax assets and the impact on earnings and capital.

› Possible customers changes whose terms in interest include rates a variable may increase interest funding rate, which costs may and reduce negatively earning impact asset the yields, ability of thus borrowers reducing to margins. pay as contractually Increases in obligated. benchmark interest rates would also increase debt service requirements for

› Possible economic changes conditions, in general including economic unemployment and business levels. conditions in the United States in general and in the communities Regions serves in particular, including any prolonging or worsening of the current unfavorable

› Possible changes in the creditworthiness of customers and the possible impairment of the collectability of loans.

› Possible changes in trade, monetary and fiscal policies, laws and regulations and other activities of governments, agencies, and similar organizations, may have an adverse effect on business.

› The current stresses in the financial and real estate markets, including possible continued deterioration in property values.

› Regions’ ability to manage fluctuations in the value of assets and liabilities and off-balance sheet exposure so as to maintain sufficient capital and liquidity to support Regions’ business.

› Regions’ ability to expand into new markets and to maintain profit margins in the face of competitive pressures.

› Regions’ ability to develop competitive new products and services in a timely manner and the acceptance of such products and services by Regions’ customers and potential customers.

› Regions’ ability to keep pace with technological changes.

› Regions’ ability to effectively manage credit risk, interest rate risk, market risk, operational risk, legal risk, liquidity risk, and regulatory and compliance risk.

› Regions’ ability to ensure adequate capitalization which is impacted by inherent uncertainties in forecasting credit losses.

› The cost and other effects of material contingencies, including litigation contingencies, and any adverse judicial, administrative or arbitral rulings or proceedings.

› The effects of increased competition from both banks and non-banks.

› The effects of geopolitical instability and risks such as terrorist attacks.

› Possible changes in consumer and business spending and saving habits could affect Regions’ ability to increase assets and to attract deposits.

› The effects of weather and natural disasters such as floods, droughts , wind, tornadoes and hurricanes, and the effects of man-made disasters.

› Possible downgrades in ratings issued by rating agencies.

› Potential dilution of holders of shares of Regions’ common stock resulting from the U.S. Treasury’s investment in TARP.

› Possible changes in the speed of loan prepayments by Regions’ customers and loan origination or sales volumes.

› Possible acceleration of prepayments on mortgage-backed securities due to low interest rates and the related acceleration of premium amortization on those securities.

› The effects of problems encountered by larger or similar financial institutions that adversely affect Regions or the banking industry generally.

› Regions’ ability to receive dividends from its subsidiaries.

› The effects of the failure of any component of Regions’ business infrastructure which is provided by a third party.

› Changes in accounting policies or procedures as may be required by the Financial Accounting Standards Board or other regulatory agencies.

› The effects of any damage to Regions’ reputation resulting from developments related to any of the items identified above.

Regions’ ›The foregoing Annual list Report of factors on Form is not 10 exhaustive. -K for the year For discussion ended December of these 31, and 2010 other and factors Quarterly that Report may cause on Form actual 10 results -Q for the to differ quarter from ended expectations, March 31, look 2011, under as the on file captions with the “Forward Securities -Looking and Exchange Statements” Commission. and “Risk Factors” in made. ›.The words We assume “believe,” no “expect,” obligation “anticipate,” to update or “project,” revise any and forward similar -looking expressions statements often signify that are forward made -from looking time statements. to time. You should not place undue reliance on any forward-looking statements, which speak only as of the date