Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Sunset Suits Holdings, Inc. | exhibit32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Sunset Suits Holdings, Inc. | exhibit31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Sunset Suits Holdings, Inc. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Sunset Suits Holdings, Inc. | exhibit31-2.htm |

UNITED

STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO

SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal

year ended: December 31, 2010

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________to

_____________

Commission File No. 000-28543

SUNSET SUITS HOLDINGS,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 26-1516905 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

ul. Starołecka 18

61-361

Poznań, Poland

(Address of principal executive

offices)

+48 (61) 642 40 04

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Exchange Act: Common Stock, par value $0.001 per share Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files)

Yes [ ] No [X]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer [ ] | Accelerated Filer [ ] |

| Non-Accelerated Filer [ ] | Smaller reporting company [X] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act)

Yes [ ] No [X]

The common stock of the registrant was not listed on any principal market or quoted on any securities quotation system on June 30, 2010. Accordingly, as of June 30, 2010 (the last business day of the registrant’s most recently completed second fiscal quarter), there was no market for the registrant's common stock and the aggregate market value of the shares of the registrant’s common stock held by non-affiliates at such time is not determinable. There were a total of 12,499,645 shares of the registrant’s common stock outstanding as of April 30, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

None.

SUNSET SUITS HOLDINGS, INC.

Annual

Report on FORM 10-K

For the Fiscal Year Ended December 31,

2010

TABLE OF CONTENTS

| PART I | 1 | |

| ITEM 1. | BUSINESS. | 1 |

| ITEM 1A. | RISK FACTORS. | 9 |

| ITEM 1B. | UNRESOLVED STAFF COMMENTS. | 13 |

| ITEM 2. | PROPERTIES. | 14 |

| ITEM 3. | LEGAL PROCEEDINGS. | 14 |

| ITEM 4. | (REMOVED AND RESERVED). | 14 |

| PART II | 15 | |

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES. | 15 |

| ITEM 6. | SELECTED FINANCIAL DATA. | 15 |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS. | 15 |

| Foreign Currency Translation | 30 | |

| Accounts Receivable | 31 | |

| Use of estimates | 33 | |

| ITEM 7A. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK. | 34 |

| ITEM 8. | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA. | 34 |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE. | 34 |

| ITEM 9A(T). | CONTROLS AND PROCEDURES. | 34 |

| ITEM 9B. | OTHER INFORMATION. | 35 |

| PART III | 35 | |

| ITEM 10. | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE. | 35 |

| Directors and Executive Officers | 35 | |

| ITEM 11. | EXECUTIVE COMPENSATION. | 36 |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS. | 37 |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE. | 38 |

| ITEM 14. | PRINCIPAL ACCOUNTING FEES AND SERVICES. | 39 |

| PART IV | 40 | |

| ITEM 15. | EXHIBITS, FINANCIAL STATEMENT SCHEDULES. | 40 |

Special Note Regarding Forward Looking Statements

In addition to historical information, this report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We use words such as “believe,” “expect,” “anticipate,” “project,” “target,” “plan,” “optimistic,” “intend,” “aim,” “will” or similar expressions which are intended to identify forward-looking statements. Such statements include, among others, those concerning market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in foreign countries, as well as all assumptions, expectations, predictions, intentions or beliefs about future events. You are cautioned that any such forward-looking statements are not guarantees of future performance and involve risks and uncertainties, including those identified in Item 1A, “Risk Factors” included herein, as well as assumptions, which, if they were to ever materialize or prove incorrect, could cause the results of the Company to differ materially from those expressed or implied by such forward-looking statements.

Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance, or achievements. Moreover, neither we nor any other person assumes responsibility for the accuracy or completeness of any of these forward-looking statements. You should not rely upon forward-looking statements as predictions of future events. We are under no duty to update any of these forward-looking statements after the date of this report to conform our prior statements to actual results or revised expectations.

Use of Terms

Except as otherwise indicated by the context, references in this report to (i) the “Company,” “we,” “us,” and “our” are to the combined business of Sunset Suits Holdings, Inc., a Nevada corporation, and its consolidated subsidiaries; (ii) “Sunset Suits” are to our wholly-owned subsidiary Sunset Suits S.A., a Polish company; (iii) “Fashion Service” are to our wholly-owned subsidiary Fashion Service Sp. z o.o., a Polish company; (iv) “Men's Fashion” are to the predecessor company to Sunset Suits, Sunset Suits Men's Fashion - Moda Meska; (v) “SEC” are to the United States Securities and Exchange Commission; (vi) “Securities Act” are to Securities Act of 1933, as amended; (vii) “Exchange Act” are to the Securities Exchange Act of 1934, as amended; (viii) “Poland,” “Polish” and “Pole” are to the Republic of Poland; (ix) “PLN” are to the legal currency of Poland, the Polish Zloty; (x) “EUR” or “Euro” are to the legal currency of the European Union; (xi) “U.S. dollars,” “dollars,” “USD” and “$” refer to the legal currency of the United States; (xii) “LIBOR” are to the London Interbank Offered Rate; and (xiii) “WIBOR” refers to the Warsaw Interbank Offered Rate.

PART I

ITEM 1. BUSINESS.

Business Overview

We are a retailer of high quality menswear based in Poland. Our merchandise includes suits, sport coats, slacks, dress shirts and ties. We offer an assortment of styles and maintain a broad selection of fabrics, colors and sizes. Prior to March 26, 2010, we manufactured the majority of our menswear through our subsidiary, Fashion Service, and purchased the remaining inventory from third party suppliers. On March 26, 2010, we sold 100% of our ownership interest in Fashion Service and currently purchase our merchandise through a supply chain in Asia.

We distribute our clothing primarily through our sales outlets, which we operate, and which are dedicated exclusively to the sale of our clothing. As of December 31, 2010, our operations included 59 domestic retail stores located in Poland with total retail space of approximately 6,800 square meters, 3 stores located in Latvia with total retail space of approximately 359 meters, 8 stores located in the Czech Republic with total retail space of approximately 766 meters, and 5 stores located in Lithuania with total retail space of approximately 654 square meters. Our sales outlets are located mainly in larger shopping centers in urban areas with populations in excess of 50,000 people.

We target our sales to men in the 18 to 35 year-old age group, one of the most rapidly developing demographics in our industry. Our products are targeted toward consumers of business attire, consumers who are purchasing attire for special events, and consumers who are shopping for “smart” casual attire.

1

Because we concentrate on men's business attire, which is characterized by infrequent and more predictable fashion changes, we believe that we are not as exposed to trends typical of more fashion-forward apparel retailers, where significant markdowns and promotional pricing are more common. In addition, because our inventory mix includes “business casual” merchandise, we are able to meet demand resulting from the trend over the past decade toward more relaxed dress codes in the workplace. We believe that the quality and selection we provide to our customers have been significant factors in enabling us to consistently gain market share in Poland.

We market our clothing principally through the direct efforts of our in-house sales staff. As of December 31, 2010, we had 409 sales personnel. We believe we provide a superior level of customer service relative to our competitors. Additionally, our in-store salespersons are trained as clothing consultants to provide customers with assistance and advice on their apparel needs, including product style, color coordination, fabric choice and garment fit. We encourage our sales staff to be friendly and knowledgeable.

We compete with several designers and manufacturers of apparel, domestic and foreign. Our ability to continuously evaluate and respond to changing consumer demands and tastes, across multiple markets, is critical to our success. We emphasize fashion, quality and service in engaging in the apparel business. Our business depends on our ability to shape, stimulate, and respond to changing consumer trends and demands by producing innovative, attractive and exciting clothing as well as on our ability to remain competitive in the areas of quality and price.

For the fiscal year ended December 31, 2010, we had net sales of $19.5 million, compared to net sales of $26.6 million for the fiscal year ended December 31, 2009, a decrease of 27%. The decrease in our sales was largely in response to the lack of liquidity supply and the reduction in number of Polish sales outlets from 88 to 59.

The address of our principal executive office in Poland is ul. Starołecka 18, 61- 361 Poznań, Poland and our telephone number is +48 (61) 642 40 04. We maintain a website at www.sunsetsuits.pl that contains information about our Company, but that information is not part of this report.

Our Corporate Structure and History

Prior Operations and Bankruptcy

We were initially incorporated under the laws of the State of Texas as SMSA III Acquisition Corp. as part of the implementation of the Chapter 11 reorganization plan of Senior Management Services of America III, Inc. and its affiliated companies, or the SMS Companies.

On January 17, 2007, the SMS Companies filed a petition for reorganization under Chapter 11 of the United States Bankruptcy Code. On August 1, 2007, the United States Bankruptcy Court for the Northern District of Texas confirmed the First Amended, Modified Chapter 11 Plan, or the Plan, as presented by the SMS Companies and their creditors.

During the three years prior to filing the reorganization petition, the SMS Companies operated a chain of skilled nursing homes in Texas, which had consisted of 14 nursing facilities, ranging in size from approximately 114 beds to 325 beds. In the aggregate, the SMS Companies provided care to approximately 1,600 resident patients and employed over 1,400 employees. A significant portion of the SMS Companies cash flow was provided by patients covered by Medicare and Medicaid. The SMS Companies facilities provided around-the-clock care for the health, well being, safety and medical needs of the SMS Companies' patients. The administrative and operational oversight of the nursing facilities was provided by an affiliated management company located in Arlington, Texas. In 2005 the SMS Companies obtained a secured credit facility from a financial institution. The credit facility eventually was comprised of an $8.3 million term loan and a revolving loan of up to $15 million that was used for working capital and to finance the purchase of the real property on which two of the SMS Companies' nursing care facilities operated. By late 2006, the SMS Companies were in an “over advance” position, whereby the amount of funds extended by the lender exceeded the amount of collateral eligible to be borrowed under the credit facility. Beginning in September 2006, the SMS Companies entered into a series of forbearance agreements whereby the lender agreed to forebear from declaring the financing in default as long as the SMS Companies obtained a commitment from a new lender to refinance and restructure the credit facility. The SMS Companies were unsuccessful in obtaining a commitment from a new lender, and on January 5, 2007, the lender declared the SMS Companies in default and commenced foreclosure and collection proceedings. On January 9, 2007, the lender agreed to provide an additional $1.7 million to fund payroll and permit a controlled transaction to bankruptcy. Subsequently, on January 17, 2007, the SMS Companies filed a petition for reorganization under Chapter 11 of the Bankruptcy Code.

2

Plan of Reorganization

Halter Financial Group, or HFG, participated with the SMS Companies and their creditors in structuring the Plan. As part of the Plan, HFG provided $115,000 to be used to pay professional fees associated with the Plan confirmation process. HFG was granted an option to be repaid through the issuance of equity securities in 23 of the SMS Companies, including Senior Management Services of El Paso Sunset, Inc.

HFG exercised the option and, as provided in the Plan, 80% of our outstanding common stock, or 1,000,000 shares, was issued to HFG in satisfaction of HFG's administrative claims. The remaining 20% of our outstanding common stock, or 250,178 shares, was issued to 455 holders of unsecured debt. The 1,250,178 shares, or Plan Shares, were issued pursuant to Section 1145 of the Bankruptcy Code. As further consideration for the issuance of the 1,000,000 Plan Shares to HFG, the Plan required HFG to assist us in identifying a potential merger or acquisition candidate.

We remained subject to the jurisdiction of the bankruptcy court until we acquired Sunset Suits. On May 9, 2008, we filed a certificate of compliance with the bankruptcy court which stated that the requirements of the Plan had been met, resulting in the discharge to be deemed granted. Thereafter, the post-discharge injunction provisions set forth in the Plan and the confirmation order became effective.

From August 1, 2007 (the date of the confirmation of the Plan) until May 21, 2008, when we acquired Sunset Suits, we had virtually no operations, assets or liabilities.

On September 26, 2007, we consummated a merger to reincorporate in the State of Nevada.

Immediately prior to our acquisition of Sunset Suits as described below, our corporate structure was as follows:

Acquisition of Sunset Suits and Related Financing

On May 21, 2008, we acquired all of the business operations of Sunset Suits in a share exchange transaction pursuant to which all of the issued and outstanding shares of Sunset Suits were exchanged for 6,121,250 shares of our common stock. As a result of this transaction and following the private placement described below, the former stockholders of Sunset Suits acquired 49% of our common stock and Sunset Suits became our wholly-owned subsidiary. Additionally, Fashion Service, through which we conducted our manufacturing operations until March 26, 2010, became our indirect wholly-owned subsidiary. For accounting purposes, the share exchange transaction was treated as a reverse acquisition with Sunset Suits as the acquirer and Sunset Suits Holdings, Inc. as the acquired party. On May 27, 2008, we changed our name to Sunset Suits Holdings, Inc. to more accurately reflect our new business.

Men's Fashion was started in Poland in 1987 by Mirosław Kranik as a sole proprietorship. On July 19, 2006, Sunset Suits was established as a Polish joint stock company. On February 3, 2007, through an in-kind contribution by Mirosław Kranik in exchange for a new issuance of shares in Sunset Suits, certain assets of Men's Fashion, including rights under lease contracts to 74 shops, the Sunset Suits trademark, know-how and fixed shop-related assets, were acquired by Sunset Suits. The registration of the share capital increase through an in-kind contribution took place at the National Court Register in Poznań on March 23, 2007.

Fashion Service was originally incorporated in Poland as a limited liability company on November 29, 2007. At the time of its incorporation, all of the shares of Fashion Service were owned by Mirosław Kranik and his wife Ewelina Ligocka-Kranik. Mirosław Kranik received his shares of Fashion Service in exchange for an in-kind contribution of certain assets of Men's Fashion, including land, buildings, technical appliances and machinery, transportation means, other fixed assets, intangible good and legal rights, fixed assets in construction, inventory and legal obligations. The registration of the company took place at the National Court Register in Poznań on December 10, 2007. On January 28, 2008, pursuant to a share sale agreement, Mr. Kranik sold his shares of Fashion Service to Sunset Suits. As a result of these transactions, Fashion Service became a subsidiary of Sunset Suits, in which Sunset Suits holds 2,000 shares of Fashion Service and Ewelina Ligocka-Kranik holds two shares. Subsequently on March 10, 2008, Ewelina Ligocka-Kranik transferred the two shares held by her to Sunset Suits. Fashion Service was the primary source of clothing and accessories sold in Sunset Suits shops, both in Poland and internationally through March 2010.

3

Immediately following the acquisition of Sunset Suits, we completed a private placement in which we sold 5,128,217 new shares of our common stock to 71 accredited investors. As a result of this private placement, we raised approximately $16 million in gross proceeds, which left us with $11,225,000 in net proceeds after the deduction of offering expenses in the amount of approximately $4,775,000. In connection with this private placement, we paid the placement agent, Wentworth Securities, Inc., a placement agency fee of $1,440,000.

In connection with the private placement on May 21, 2008, Mirosław Kranik, our largest stockholder, entered into an escrow agreement, or Escrow Agreement, with us, Wentworth Securities, Inc. and Securities Transfer Corporation, the escrow agent. Pursuant to the Escrow Agreement, Mr. Kranik agreed to place an aggregate of 3,125,000 shares of our common stock owned by him (to be equitably adjusted for stock splits, stock dividends and similar adjustments) into escrow with Securities Transfer Corporation. In the Escrow Agreement, the parties established minimum after tax net income thresholds of $3,377,000 for the fiscal year ending December 31, 2008 and $9,948,000 for the fiscal year ending December 31, 2009. In the event that the minimum after tax net income thresholds for fiscal year 2008 or fiscal year 2009 are not achieved, then the investors would be entitled to receive up to 100% of the shares in escrow for each applicable year based upon a pre-defined formula agreed to among the parties to the Escrow Agreement. However, in the event that the release of such shares of common stock to the investors, Mr. Kranik or any other party is deemed to be an expense, charge or deduction from the revenue reflected on our financial statements for the applicable year, as required under U.S. generally accepted accounting principles, such expense or deduction will be excluded for purposes of determining whether or not the minimum after tax income thresholds for fiscal year 2008 and fiscal year 2009 are achieved.

We did not achieve the minimum after tax net income threshold for fiscal year ended December 31, 2008, and pursuant to the Escrow Agreement, the investors received an aggregate of 1,514,006 shares of our common stock from Mr. Kranik.

On May 21, 2009 an amendment to Escrow Agreement was signed under which:

Sunset Suits no longer would be obliged to achieve an after tax income of $9,948,000 for the year 2009 Sunset Suits would be obliged to achieve an after tax income of $2,037,000 for the year 2010 Sunset Suits would be obliged to achieve an after tax income of $3,422,000 for the year 2011

Mirosław Kranik would personally pledge 625,000 shares of the Company’s common stock (in addition to the 1,610,994 shares of the company remaining in escrow following the distribution of 1,514,006 shares to investors) to guarantee that the Company would achieve the financial targets for 2010 and 2011

We did not meet the after tax net income threshold of $2,037,000 for the fiscal year 2010. Pursuant to the Escrow Agreement, the investors are entitled to receive 2,235,994 additional shares from Mr. Kranik.

Sale of Production and Distribution Operations

On March 26, 2010, Sunset Suits S.A., our wholly owned subsidiary, entered into a purchase agreement (the “Agreement”) with XCRITO Ltd. (an unrelated third party), a corporation headquartered in Limassol, Cyprus (“XCRITO”), pursuant to which we sold to XCRITO 100% of our equity interest in our wholly-owned subsidiary Fashion Service. Pursuant to the Agreement, XCRITO agreed to pay to the Company $16,000, and in turn will acquire all of the assets and liabilities of Fashion Service, except for liabilities resulting from long term debt (including current amounts owed on such debt), equal to approximately $6,767,000, which will be assumed pursuant to the Agreement by Sunset Suits S.A.

In connection with the Agreement, Mirosław Kranik, our President and Chief Executive Officer, agreed to continue to manage the operations of Fashion Service for up to 90 days from the closing of the transaction. In addition, the Company has agreed to rent office space from Fashion Service in Krzyżanowo, Poland for a period of 6 months following the closing of the transaction.

The sale of Fashion Service was part of a restructuring plan intended to improve our operating margin. The size of our current retail operations was not sufficient to fully utilize the manufacturing capacity of Fashion Service. In order to do so, we would have been required to engage in wholesale distribution to large distributers or retail clients. We recognized lower gross margins from our manufacturing business segment as compared to its retail segment, which therefore lowered the gross margin of the Company as a whole. In addition, the manufacturing plant would have required major upgrades in order to satisfy our needs. Accordingly, our management decided that it was more cost effective and in the best interests of the Company and our shareholders to increase its sourcing of merchandise through a supply chain in Asia instead of maintaining its own production lines.

4

Acquisition of Alza Sp. z o.o.

On March 8, 2010 Sunset Suits Holdings, Inc. purchased 100% shares in the company Alza Sp. z o.o., based in Warsaw, ul. Plac Defilad 1 at the price of $ 2,530. The net equity of acquired entity was $843. At the time of acquisition and as of 31 December 2010 Alza Sp. Z o.o. had no material impact on the Group’s operations, its assets and liabilities did not represent material values. Therefore, Alza Sp. z o.o. was not included in the consolidation. Management intends the company Alza Sp. z o.o. to deal with import and distribution of merchandises within the Group.

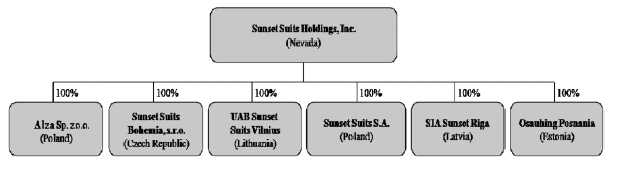

Our Corporate Structure

All of our business operations are conducted through our subsidiaries. The chart below presents our corporate structure as of April 30, 2010.

Our Industry and Principal Market

Overview of the European Clothing Market

Sales of menswear are spread relatively equally over Europe, USA and the Asia Pacific Region. According to SMI-ATI, clothing sales in Europe represent approximately 28.4% of global sales. Approximately 90% of European sales are from countries other than Hungary, the Czech Republic, Poland and Russia.

Sales of menswear in Poland are the highest in Central Europe, constituting 2.1% of total European sales. Sales of menswear in the Czech Republic and Hungary are much lower, constituting only 0.8% and 0.7%, respectively, of total European sales. According to Datamonitor, Russia, which covers a much greater geographic area than Poland, generates only about 6.6% of total European sales (about 3 times more sales than Poland notwithstanding its significantly greater geographic size). According to SMI-ATI, Eastern European markets (e.g., Ukraine, Russia) will represent an increasingly larger segment of the European menswear market over the next several years, both in terms of production and distribution of menswear products.

Based on various reports, mostly PMR Publications "Clothing and

footwear retail market in Poland 2010" clothing market in the European Union is

estimated at €470 billion. In this pool men's clothing market value is 16%, or

€75billion. The menswear market structure is as follows:

- 50% sportswear

- 30% casual clothing

- 20% formal clothing

Overview of the Polish Clothing Market

Polish clothing and footwear market is estimated for approximately 27 billion PLN or €6.8 billion. Contrary to earlier estimates, this market didn’t shrunk last year. According to the Polish Central Statistical Office data on retail sales in Poland, clothing and footwear segment was one of the fastest growing. Retail sale of textile, clothing and footwear rose in 2010 over the previous year by 14.3% .

5

The formal clothing market in Poland is estimated at 1 billion PLN, or more than €250 million. In 2009-2010 this market has shrunk by about 1-2%.

Our main local competitors: Wolczanka Group Vistula, Bytom, Próchnik aspire to a higher segment, but they are too poor quality and brand to compete with companies such as Boss, Ermenegildo Zegna which operate in the segment of boutique shops.

Sunset Suits operates in the segment close to the "low cost ", which is the substitution of a higher segment formal clothing, so-called “youth brands” (for example ZARA). Unfortunately, Sunset Suits is too formal, as for the prospect of development of the age group 18-35, and there are not frequent exchanges of collection (short series), (for example ZARA, which exchanges its collection every two weeks) - Sunset Suits launches new collection lately every 30 days, last year every 60 days.

As is clear from the financial statements for the year 2010 leading companies in the sector of formal menswear they are experiencing difficulties which are resulted not only from demand but also the costs, in particular from exchange rates. The low value of the zloty against the dollar and the euro has substantially increased the cost of network operation clothing. Most of them have their branches in shopping malls, where rental prices are denominated in euro. In addition, the vast majority of clothing that can be found in Polish stores is not produced in the country. Often, imported directly from the Far East (prices in dollars) and from other European countries - in the case of Western brands (prices in euro).

| Company | Sales revenue in PLN | EBIT in thousand of PLN | EBIT as % of sales | |||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||

| Sunset Suits | 58,846 | 82,848 | (16,657 | ) | (12,208 | ) | (28% | ) | (15% | ) | ||||||||

| Vistula & Wólczanka as Vistula Group | 353,921 | 408,402 | 23,265 | 40,229 | 7% | 10% | ||||||||||||

| Bytom & Intermoda as Bytom Group | 18,535 | 22,466 | (9,205 | ) | (4,450 | ) | (50% | ) | (20% | ) | ||||||||

| Próchnik | 6,722 | 6,563 | 143 | -691 | 2% | (11% | ) | |||||||||||

Our Competitive Strengths

We believe that we have the following competitive strengths in our industry:

- Recognizable Brand in Our Markets. We believe that our brand has built a loyal following of fashion- conscious consumers who desire high-quality, well-designed apparel. We believe that brand recognition is critical in the apparel industry, where a strong brand name helps define consumer preferences. We are one of the most recognized brands in Poland, both in terms of overall brand recognition and in the category of elegant apparel.

- Distribution Through Our Specialty Retail Sales Outlets. Our sales outlets are located mainly in larger shopping centers located in urban areas. We believe our sales outlets set, reinforce and capitalize on the image and distinct sensibility of our brand.

- Design Expertise. Our design staff designs substantially all of our products using computer aided design stations, which provide timely translation of designs into sample depictions varying in color, cut and style. The use of these design tools provides our customers with products that meet current fashion trends. Since our design team is local, it is also more in tune with local tastes and trends.

- Experienced Management Team. Our management team has significant experience in the apparel industry and has extensive experience in growing brands and in the retail environment. Mirosław Kranik, our significant stockholder and Chief Executive Officer, has worked in the apparel industry for over 20 years.

6

Our Strategy

We are committed to enhancing profitability and cash flows through the following strategies:

- Increase of the rate of gross margin by reducing the cost of purchasing goods from 43% in relation to the sale to the level of 37% which is possible with the current organization of supplies from China

- Increase of scale of operations by increasing the number of stores through franchising, the target number of sales outlets is 120, including 60 own and 60 franchised

- Decrease of cost of rental and staffing costs by decreasing surface of the outlets to an average of 100-120 sq. m

- Renegotiate our delinquent tax and overdue accounts payable to obtain at least 3 year repayment period

Retail Sales Outlets

We distribute our clothing primarily through our sales outlets, which we operate, and which are dedicated exclusively to the sale of our clothing. As of December 31, 2010, our operations included 59 domestic retail stores located in Poland with total retail space of approximately 6,800 square meters, 3 stores located in Latvia with total retail space of approximately 359 meters, 8 stores located in the Czech Republic with total retail space of approximately 766 meters, and 5 stores located in Lithuania with total retail space of approximately 654 square meters. Our sales outlets are located mainly in larger shopping centers in urban areas with populations in excess of 50,000 people.

All of our Polish sales outlets are leased. Generally, our sales outlets are leased for initial periods ranging from 5 to 10 years with renewal options for an additional 5 years. The outlets range in size from 28 square meters to 200 square meters.

Sales and Marketing

The menswear market consists of the following sectors: formal, smart casual, mainstream, jeans, and sport. We are focused on two sectors: formal and smart casual. The menswear market sector is divided into five price levels (segments), ranging from lowest to highest, as follows: “budget”, “moderate”, “better,” “bridge” and “designer”. We operate in medium price sector that spans from “moderate” through “better.” We refer to this segment as the “lower-medium” segment.

Management believes that the Polish market for formal attire is

approximately a PLN 1 billion (approximately $300 million). We estimate the

following market share for us and main competitors:

- Sunset Suits

6%

- Vistula&Wólczanka 25%

- Bytom 2%

-

Próchnik 1%

To achieve increased sales growth, we decided to focus on relatively non-expensive formal attire and the smart casual, lower medium price segments of the market.

We target our sales to men in the 18 to 35 year-old age group, one of the most rapidly developing demographics in our industry. Our products are targeted toward consumers of business attire, consumers who are purchasing attire for special events, and consumers who are shopping for “smart” casual attire.

Because we concentrate on men's business attire, which is characterized by infrequent and more predictable fashion changes, we believe we are not as exposed to trends typical of more fashion-forward apparel retailers, where significant markdowns and promotional pricing are more common. In addition, because our inventory mix includes “business casual” merchandise, we are able to meet demand for such products resulting from the trend over the past decade toward more relaxed dress codes in the workplace. We believe that the quality and selection we provide to our customers have been significant factors in enabling us to consistently gain market share in Poland.

We market our clothing principally through the direct efforts of our in-house sales staff. We had 409 sales personnel as of December 31, 2010. We believe we provide a superior level of customer service relative to our competitors. Additionally, our in-store salespersons are trained as clothing consultants to provide customers with assistance and advice on their apparel needs, including product style, color coordination, fabric choice and garment fit. We encourage our sales staff to be friendly and knowledgeable.

7

Suppliers

Prior to March 26, 2010, we purchased raw materials, including fabric, yarn, buttons and other trim from domestic and foreign sources, and designed and manufactured most of our inventory through Fashion Service. As discussed above, our management determined that it was more cost effective to cease our manufacturing operations through Fashion Service and begin importing finished goods from Asia through Sunset Suits S.A. As of December 31, 2010 90% of our purchases are from suppliers located in Asia. We intend to continue the present organization of supplies in 2011.

Changing sourcing policies

Retailers and manufacturers commonly enter into informal partnerships ranging from trust-based commercial relationships to increase the stability and reliability of the production and purchase of goods, to a more extensive integration of information systems and operations and activities.

We are currently introducing changes in the organization and implementation of our purchasing activities, including streamlining our suppliers’ portfolios, internationally centralizing our procurement activities, maintaining a high rotation of buyers, and commencing online auctions. These changes are aimed at systematically reducing our purchasing costs. Supply relationships in the clothing industry between suppliers and manufacturers commonly range from the establishment of short to medium-term informal, and often non-binding supply agreements between the parties followed by a flow of individual orders.

Advertising

Our advertising initiatives have been developed to elevate trademark awareness and increase customer acquisition and retention. Our advertising initiatives are relatively limited. We do not place advertisements in fashion magazines, on television, in the newspaper, on radio or on the internet. We mainly place our advertisements in shopping centers using billboards and point-of-purchase displays.

Inventory

The cyclical nature of the retail business requires us to carry a significant amount of inventory in our sales outlets, especially prior to peak selling seasons when we and other retailers generally build up our inventory levels. We review our inventory levels in order to identify slow-moving merchandise and use markdowns to clear merchandise.

Our Competition

Competition in our segment of the fashion industry is intense. We compete with several domestic and foreign designers and manufacturers of apparel, many of which are significantly larger and have substantially greater resources than us. Our ability to continuously evaluate and respond to changing consumer demands and tastes, across multiple markets, is critical to our success. We emphasize fashion, quality and service. Our business depends on our ability to shape, stimulate, and respond to changing consumer trends and demands by providing innovative, attractive and exciting clothing, as well as on our ability to remain competitive in the areas of quality and price.

Additionally, consumers have begun to migrate away from traditional department stores, turning instead to specialty retailers, national chains and off-price retailers. We have taken advantage of this trend through our sales outlets, which, we believe, set, reinforce and capitalize on the image and distinct sensibility of our trademark and provide a shopper-friendly environment.

Market shares of the largest clothing companies in Poland has similar over the last several years and according to our estimation are as follows: LPP – 5.2%, H&M – 2.8% ., NG2 – 2.7%, Deichmann – 2.1%, Vistula Group – 1.8%, Inditex – 1.7%, Our share in this market we estimate at 0.3%

Among all renowned brands, brand owners have focused on rejuvenating their clientele by offering modern, braver designs. This is especially apparent among traditional designer brands, which to-date have relied on classical, toned down cuts. This marketing approach has been pioneered by Vistula & Wólczanka, which is assessed by market players as exceptionally innovative. A similar strategy has been undertaken by Bytom, which earlier had been associated with suits for middle-aged men. Vistula, Bytom and Próchnik sell menswear from the middle and middle-upper price segments. Other than Vistula, Bytom, Próchnik, Ermenegildo Zegna (Warsaw and Poznań) and Armani (Warsaw), there are no other chains offering premium formal menswear in Poland, such as Ralph Lauren or Bugati.

8

We do not have any significant competitors in the lower-medium price segment of the Polish men's fashion industry.

Intellectual Property

We utilize the following primary trademarks in our business:

Our Sunset Suits trademark is registered with the Polish Patent Office under No. R-75309. An application dated January 24, 2008, was filed with the Polish Patent Office to update the register to reflect the transfer of the ownership of trademark from Mr. Mirosław Kranik to Sunset Suits. We regard our trademark and other proprietary rights as valuable assets that are critical in the marketing of our products, and therefore we vigorously protect our trademark against infringements.

Environmental Matters

Regulations relating to the protection of the environment have not had a significant effect on our capital expenditures, earnings or competitive position. Fashion Service’s production operations are not energy intensive, and we are not engaged in producing fibers or fabrics.

Regulation

Our current business operations are not subject to any material regulations.

Our Employees

As of December 31, 2010, we employed 443 employees. The following table sets forth the number of our employees by function as of December 31, 2010.

| Number of | |

| Functions | Employees |

| Sales | 409 |

| Acccounting, administration and other | 34 |

| TOTAL | 443 |

Compared to December 31, 2009 number of employees decreased by 336, of which 214 in connection with the sale Fashion Service and 122 in connection with the reorganization and reduction in the number of sales outlets.

Insurance

We maintain property insurance for our sales outlets and for the premises in Poznań , Poland, where our registered offices are located. We do not maintain business interruption insurance or key-man life insurance. We believe our insurance coverage is customary and standard for companies of comparable size in comparable industries in Poland.

ITEM 1A. RISK FACTORS.

The shares of our common stock are highly speculative in nature, involve a high degree of risk and should be purchased only by persons who can afford to lose the entire amount invested in the common stock. Before purchasing any shares of common stock, you should carefully consider the following factors relating to our business and prospects. You should pay particular attention to the fact that we conduct all of our operations in Poland and are governed by a legal and regulatory environment that in some respects differs significantly from the environment that may prevail in the U.S. and other countries. If any of the following risks actually occurs, our business, financial condition or operating results will suffer, the trading price of our common stock could decline, and you may lose all or part of your investment.

9

Risk of inability to continue business as a going concern

RISKS RELATED TO OUR BUSINESS

Risk of ability to continue as a going concern, loss of liquidity and ability to meet its commitments.

The company has experienced declines in revenue and continues to generate operating losses and negative cash flows from operations, has negative working capital and capital deficits, which raise doubt about the Company’s ability to continue as a going concern. In view of the negative working capital and negative equity there is a serious risk of loss of financial liquidity and ability to meet its commitments. Our substantial indebtedness could have important consequences, including:

limiting our ability to obtain additional financing to fund

capital expenditures and other general corporate requirements;

requiring us to dedicate a substantial portion of our cash flow from

operations to payments on our indebtedness,

limit the availability of

cash as a result of seizure of bank accounts by the bailiff,

lack of timely supply of goods as a result of overdue

payments

termination of leases by property owners, where are our

points of sales as a result of overdue payments,

the departure of

highly qualified personnel by the inability to pay adequate salaries

limiting our flexibility in planning for or reacting to changes in our

business and the industry in which we operate;

and placing us at a

competitive disadvantage compared to our less leveraged competitors

requiring the company to pay suspended interest totaling $3,079

thousand resulting from failure to pay interest on the Company’s existing bank

notes which may trigger a breach of previous bank settlement agreements which

allows the counterparty financial institutions to then claim the suspended

interest amount

We require additional capital and we may not be able to obtain it on acceptable terms or at all.

Due to reduction in sales and operating loss Sunset Suits does not have sufficient amounts of cash to pay its debts in a timely manner and to develop its business. Therefore, there is an urgent need for external financing. Because Sunset Suits is in poor financial situation, there is a risk that financing may not be available in amounts or on terms acceptable to us, if at all. The Company’s management is in talks with creditors aimed at spreading the overdue debt for at least 3 years with the possibility of conditional reductions. At present, the outcome of these talks is difficult to predict. Any failure by us to raise additional funds on terms favorable to us, or at all, could have a material adverse effect on our business.

Risk of subsequent closures of retail outlets due to overdue payments

The Group provides cash deposits to Landlords for rent facilities. These deposits are returned upon the end of lease period. The landlords require cash deposit being paid in advance as the substitute of bank guarantees. Therefore, according to its lease agreement the Group is required to make the whole payment of deposit before it starts to operate its retail outlet. Due to poor liquidity, the Group is unable to satisfy all of its agreements with landlords and did not provide for the whole deposits as it is required. As of December 31, 2010, there were $729 thousand of deposits that were not provided by Sunset Suits S.A. concerning 46 locations of stores. If not paid timely, landlords bear a right to dissolve the agreement with Sunset Suits S.A. As of April 30, 2011 18 of these locations were shut down due to lease agreements terminations. Currently Management is under discussion with landlords to delay the date the total deposit is paid.

10

Failure to comply with an agreement for deferred payment of delinquent taxes

According to decisions of Polish tax authorities issued on November 4, 2009 regarding deferral of delinquent tax obligations of Sunset Suits S.A. amounting to $1,232,642, Sunset Suits S.A. was obliged to pay delinquent tax obligations up to November 2010 with total balloon payments amounting to $1,047,088 on November 2, 2010. Due to inability to pay this amount on October 29, 2010 management submitted a request for further deferral of the balloon payments of delinquent up to November 2011. According to the decision of the tax office on December 2, 2010 the request was rejected due to formal defects. Management intends to resume negotiations with tax authority. Further non-payment of tax obligations could result in growing penalty interest and fines imposed on members of the board.

Mirosław Kranik, our significant stockholder, Chief Executive Officer and President, retained a portion of the delinquent tax and social security obligations of Men's Fashion. If Mr. Kranik fails to pay these delinquent tax and social security obligations in accordance with deferment agreements entered into with the applicable authorities, then such authorities may bring enforcement actions against Mr. Kranik, which could result in the imposition of fines or other penalties. Any such enforcement actions against Mr. Kranik could distract him from his duties as our Chief Executive Officer and President and negatively affect our ability to execute on our business plan.

As described in the immediately preceding risk factor, under deferment agreements entered into with Polish tax and social security authority, Mirosław Kranik is jointly and severally liable along with Fashion Services for delinquent tax and social security payments in an aggregate amount in excess of PLN 17,672,744 (approximately $6,200,310) and Men's Fashion is solely liable for PLN 9,130,774 (approximately $3,203,446) of the delinquent social security payments.

Since Men's Fashion was a sole proprietorship (i.e., just a name under which Mr. Kranik previously operated his clothing business and not a separate legal entity), these liabilities are personal to Mr. Kranik and put his personal assets at risk. Although Fashion Service has agreed to make all payments due to the tax and social security authorities as part of its acquisition of assets from Men's Fashion, if Fashion Service fails to make any such payments then Mr. Kranik would be obligated to make these payments. If payments under the deferment agreements are not made in accordance with the payment schedules provided for in those agreements, then such authorities may bring enforcement actions against Mr. Kranik personally, which could distract him from his duties as our Chief Executive Officer and President.

Economic risks associated with the size of consumer demand

The development of the Group directly depend on the size of consumer demand, which is shaped such by income and household debt, unemployment, interest rates, consumer sentiment indicator. In the case of a significant deterioration in the economic parameters will slow the development of the Group

Risk associated with increased competition

Risks associated with the activities of competitors notably the

following areas:

- competitive players from the Far East

- competition

from Far Eastern countries and other countries with low labor cost (Romania,

Ukraine), the throughput of market services,

- competition from new brands

entering the market in the western Polish,

- competitive brands currently

operating on the Polish market

Risks associated with the seasonal sales

Retail fashion sector is characterized by significant seasonality of sales. For the most favorable period clothing market from the point of view is generated as a result of the financial period of the Second and fourth quarter.

Foreign exchange risk

Group is exposed to currency risk in respect of the transactions. Such risk arises from making the operating unit sales or purchases in currencies other than the functional currency. The group also has signed leases commercial space, where both rents and other fees paid to the landlords are translated at the current rate PLN / EUR and PLN/ USD.

11

RISKS RELATED TO DOING BUSINESS IN POLAND

There are risks associated with investing in emerging markets such as Poland.

Poland has undergone significant political and economic change since 1989. These changes have thus far been largely beneficial for Polish businesses, but future political, economic, social and other developments could adversely affect our business. In particular, future changes in laws or regulations affecting Polish economic growth (or in the interpretation of existing laws or regulations), whether caused by changes in the government of Poland or otherwise, could have a material adverse effect on us and our ability to service our indebtedness. For example, while there is no limitation for most foreign exchange transactions conducted by businesses in Poland, we cannot assure you that foreign exchange control restrictions, taxes or limitations will not be imposed or increased in the future with regard to repatriation of earnings and investments from Poland.

Poland has been one of the fastest growing economies in Europe over the years that we have been in operation. There is no guarantee, however, that this growth will continue. Any significant slowdown in Poland's economic growth could adversely affect our business.

Poland is generally considered by international investors to be an emerging market. In general, investing in the securities of companies such as ours with substantial operations in markets such as Poland involves a higher degree of risk than investing in the securities of companies having substantial operations in the United States or other developed markets.

Since there is volatility in the Polish tax system, our cash flows and ability to service our debt may be adversely affected.

The Polish tax system is characterized by frequent changes in tax regulations, as a result of which many tax regulations are either not the subject of firmly established interpretations or are subject to frequently changing interpretation. The volatility of the Polish tax system makes tax planning difficult and results in an increased risk of tax non-compliance for Polish companies. Furthermore, changing interpretations of tax regulations by the tax authorities, extended time periods relating to overdue liabilities and the possible imposition of high penalties and other sanctions result in the tax risk for a Polish company being significantly higher than in countries with more stable tax systems.

RISKS RELATED TO THE MARKET FOR OUR STOCK GENERALLY

No market exists for the trading of our securities and no market may ever develop. Accordingly, you may not have any means of trading the shares you acquire.

A market does not presently exist for our securities and no assurance can be given that a market will ever develop. Consequently, you may not be able to liquidate your investment in our securities for an emergency or at any time, and the securities will not be readily acceptable as collateral for loans. Although we will endeavor to establish a trading market for our securities in the future, no assurance can be given as to the timing of this event or whether the market, if established, will be sufficiently liquid to enable an investor to liquidate his investment in us. Certain of our stockholders hold a significant percentage of our outstanding voting securities.

Ms. Mirosław Kranik, our Chief Executive Officer, is the beneficial owner of approximately 36% of our outstanding voting securities. As a result, he possesses significant influence and can elect a majority of our board of directors and authorize or prevent proposed significant corporate transactions. His ownership and control may also have the effect of delaying or preventing a future change in control, impeding a merger, consolidation, takeover or other business combination or discourage a potential acquirer from making a tender offer.

Certain provisions of our Articles of Incorporation and Bylaws, Nevada law and our Rights Plan may make it more difficult for a third party to effect a change-of-control.

Our Articles of Incorporation authorizes our board of directors to issue up to 10,000,000 shares of preferred stock. The preferred stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our board of directors without further action by our stockholders. These terms may include preferences as to dividends and liquidation, conversion rights, redemption rights and sinking fund provisions. The issuance of any preferred stock could diminish the rights of holders of our common stock, and therefore could reduce the value of such common stock. In addition, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell assets to, a third party. The ability of our board of directors to issue preferred stock could make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change-in-control, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.

12

In addition, Nevada corporate law and our Articles of Incorporation and Bylaws contain certain other provisions that could discourage, delay or prevent a change in control of our Company or changes in its management that our stockholders may deem advantageous. These provisions: Deny holders of our common stock cumulative voting rights in the election of directors, meaning that stockholders owning a majority of our outstanding shares of common stock will be able to elect all of our directors; require any stockholder wishing to properly bring a matter before a meeting of stockholders to comply with specified procedural and advance notice requirements; and allow any vacancy on the board of directors, however the vacancy occurs, to be filled by the directors.

On June 9, 2008, our board of directors enacted a shareholder rights plan, or Rights Plan, for the purpose of impeding any effort to acquire our Company on terms that are inconsistent with its underlying value and which would not therefore be in the best interests of our stockholders. The existence of the Rights Plan will make it more difficult, delay, discourage, prevent or make it more costly to acquire or effect a change-in-control that is not approved by our board of directors, which in turn could prevent our stockholders from recognizing a gain in the event that a favorable offer is extended and could materially and negatively affect the market price of our common stock.

We do not intend to pay dividends on shares of our common stock for the foreseeable future.

We have never declared or paid any cash dividends on shares of our common stock. We intend to retain any future earnings to fund the operation and expansion of our business and, therefore, we do not anticipate paying cash dividends on shares of our common stock in the foreseeable future.

We may be subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. If our common stock becomes a “penny stock”, we may become subject to Rule 15g-9 under the Exchange Act, or the “Penny Stock Rule”. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by Rule 15g-9, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser's written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock if the SEC finds that such a restriction would be in the public interest.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

Not Applicable.

ITEM 2. PROPERTIES.

As of December 31, 2010, we operated 59 retail sales outlets in Poland. The following table sets forth the location, by city, of these sales outlets.

13

| CITY | NUMBER OF

OUTLETS |

| Warszawa | 5 |

| Kraków | 5 |

| Wrocław | 3 |

| Łódź | 1 |

| Poznań | 2 |

| Gdańsk | 1 |

| Biała Podlaska | 1 |

| Białystok | 1 |

| Bielsko Biała | 2 |

| Bydgoszcz | 1 |

| Bytom | 1 |

| Chełm | 1 |

| Człestochowa | 1 |

| Gliwice | 2 |

| Gorzów | 1 |

| Iława | 1 |

| Jelenia Góra | 1 |

| Katowice | 1 |

| Kielce | 1 |

| Kluczbork | 1 |

| Kłodzko | 1 |

| Koszalin | 2 |

| Legnica | 1 |

| Lubin | 1 |

| Nowy Sącz | 1 |

| Opole | 2 |

| Piotrków Trybunalski | 1 |

| Płock | 2 |

| Racibórz | 1 |

| Radom | 1 |

| Rybnik | 2 |

| Rzeszów | 1 |

| Słubice | 1 |

| Sosnowiec | 3 |

| Szczecin | 1 |

| Tarnów | 1 |

| Toruń | 1 |

| Zabrze | 1 |

| Zgorzelec | 1 |

| Zielona Góra | 1 |

| Total | 59 |

All of our Polish sales outlets are leased. Generally our sales outlets are leased for initial periods ranging from 5 to 10 years with renewal options for an additional 5 years. The outlets range in size from 28 square meters to 200 square meters.

Sunset Suits has its Polish registered offices at ul. Starołecka 18, 61-361, Poznań, Poland. Sunset Suits leases its registered offices from Stomil-Poznań S.A. Sunset Suits pays a monthly rental rate of PLN 3,600 (approximately $1,200) for this space. This space consists of approximately 31.2 square meters and is the location where Sunset Suits maintains its corporate records.

ITEM 3. LEGAL PROCEEDINGS.

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse affect on our business, financial condition or operating results.

ITEM 4. (REMOVED AND RESERVED).

14

PART II Market Information

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Our shares are currently quoted on the Over the Counter Bulletin Board under the symbol "SNSX.OB". Approximate Number of Holders of Our Common Stock

As of April 30, 2011, there were approximately 530 holders of record of our common stock. This number excludes the shares of our common stock owned by stockholders holding stock under nominee security position listings. Dividends We have never declared or paid a cash dividend. Any future decisions regarding dividends will be made by our board of directors. We currently intend to retain and use any future earnings for the development and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Our board of directors has complete discretion on whether to pay dividends, subject to the approval of our stockholders. Even if our board of directors decides to pay dividends, the form, frequency and amount will depend upon our future operations and earnings, capital requirements and surplus, general financial condition, contractual restrictions and other factors that the board of directors may deem relevant.

Securities Authorized for Issuance under Equity Compensation Plans

See Item 12, “Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters — Securities Authorized for Issuance Under Equity Compensation Plans.” Recent Sales of Unregistered Securities We have not sold any equity securities during the fiscal year ended December 31, 2010 that were not previously disclosed in a quarterly report on Form 10-Q or a current report on Form 8-K that was filed during the 2010 fiscal year.

Purchases of Equity Securities

No repurchases of our common stock were made during the fourth quarter of 2010.

ITEM 6. SELECTED FINANCIAL DATA.

Not Applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

The following management’s discussion and analysis should be read in conjunction with our financial statements and the notes thereto and the other financial information appearing elsewhere in this report. In addition to historical information, the following discussion contains certain forward-looking information. See “Special Note Regarding Forward Looking Statements” above for certain information concerning those forward looking statements.

Overview

We are a distributer and retailer of high quality menswear, including suits, sport coats, slacks, dress shirts, ties and accessories in Poland, Latvia, Lithuania and the Czech Republic. We operate in the formal menswear market sector within its medium price segment, which represents, for example, suits priced in the range of 600 – 1,000 PLN ($180 – $300) and shirts in range of 100 – 180 PLN ($30 – $55), and we offer an assortment of styles and maintain a broad selection of fabrics, colors and sizes

We generate revenue through retail sales of our menswear, which we sell mainly through our retail sales outlets. For the twelve months ended December, 2010, we had net sales of $19.5 million, compared to net sales of $26.6 million for the twelve months ended December 31, 2009.

The drop in our revenue was caused by two major factors. First, our liquidity did not allow us to stock our shops with the level of inventory expected by our customers, which made our total sales less than if our inventory levels had been higher.

15

Second, we have reduced the number of the retail outlets since September 30, 2009. The lease agreements were dissolved due to outstanding lease payments or retail outlets were deemed unprofitable. The total number of retail outlets in operation as of December 31, 2010 was 59, 29 less than the total number of retail outlets in operation as of September 30, 2009.

The following table presents the movement in our retail outlets during the years 2010 and 2009:

| Beginning of | End of | |||

| the year, | the year, | |||

| Year | January 1, | New openings | Closures | December 31, |

| Number of retail outlets, 2010 | 88 | 2 | 31 | 59 |

| Number of retail outlets, 2009 | 90 | 16 | 18 | 88 |

As of April 30, 2011 18 of above locations were shut down due to lease agreements terminations.

The Group provides cash deposits to Landlords for rent facilities. These deposits are returned upon the end of lease period. The landlords require cash deposit being paid in advance as the substitute of bank guarantees. Therefore, according to its lease agreement the Group is required to make the whole payment of deposit before it starts to operate its retail outlet. Due to poor liquidity, the Group is unable to satisfy all of its agreements with landlords and did not provide for the whole deposits as it is required. As of December 31, 2010, there were $729 thousand of deposits that were not provided by Sunset Suits S.A. concerning 46 locations of stores. If not paid timely, landlords bear a right to dissolve the agreement with Sunset Suits S.A. As of April 30, 2011 18 of these locations were shut down due to lease agreements terminations. Currently Management is under discussion with landlords to delay the date the total deposit is paid.

We intend to continue to build upon our business strategy by maintaining only profitable outlets. We are monitoring the profitability of these stores. It is possible that we could decide to close some of these stores if we determine that they do not have the potential to be profitable.

Management is the opinion that the Group could effectively operate in Poland with the number of outlets reduced to about 30of the most profitable, if the operating expenses would be reduced appropriately.

However, by the end of 2011 Management intends to open 30 new franchise outlets.

Sunset Suits-branded retail stores are also operated internationally by local companies based in the Czech Republic, Lithuania, and Latvia. As of December 31, 2010 our distribution in these four countries is carried out through a network of 16 stores. This number remained constant throughout the year 2010.

In the period 2011-2013 we are planning to open 60 outlets under the terms of the franchise. With the existing number of our own outlets a total retail space will be 5,900 square feet. The average size of a single outlet should not exceed 100-120 square meters, which allow the optimization of the rental and staffing costs. Estimated outlays to open a new outlet is about $ 33,000, therefore the implementation of the new openings plan will require an additional $2,000,000.

Summary of Financial Performance

As of December 31, 2010, we had negative equity (liabilities in excess of assets) of $6.6 million and negative working capital (current liabilities in excess current assets less cash) of $10 million. Our net loss for the twelve months ended December 31, 2010 was $0.5 million. Our net loss from continuing operations for the twelve months ended December 31, 2010 was $6.8 million. Our net profit from discontinued operations for the twelve months ended December 31, 2010 was $6.3 million.

16

The negative working capital and equity, along with our loss for the most recent twelve month period raise a substantial doubt about our ability to continue as a going concern. In addition to seeking new debt financing, which may not be possible, or which may come at a high cost, we are implementing various plans to increase profitability and cash flow in order to continue operations. In addition, our management also expects, if necessary to continue operations, that it can conserve cash by delaying the payment of certain of its liabilities and by decreasing inventory purchases. Some of the possible sources of improving profitability and cash flow through which we seek are as follows:

Increase of the rate of gross margin by reducing the cost of purchasing goods from 43% in relation to the sale to the level of 37% which is possible with the current organization of supplies from China

Increase of scale of operations by increasing the number of stores through franchising, the target number of sales outlets is 120, including 60 own and 60 franchised

Decrease of cost of rental and staffing costs by decreasing surface of the outlets to an average of 100-120 sq. m

Renegotiate our delinquent tax and overdue accounts payable to obtain at least 3 year repayment payment

Our ability to generate operating cash flow from increases in our net income is enhanced by the retail nature of our business because our immediate receipt of cash revenue means that we do not need working capital in the form of accounts receivable to generate sales. We will, however, need to finance additional accounts receivable for our new distribution channels. A significant portion of inventory, which is necessary for our retail operations, can be financed through accounts payable credit.

The Company’s management plans at the next meeting of shareholders to submit a draft of resolution to increase shareholders’ equity by the amount of $3,000,000 to $6,000,000.

We believe that in a normalized situation with no further decrease in sales, higher gross margin and reduced operating expenses, our operating cash flows would tend toward net income plus depreciation and amortization. Depreciation was $0.6 million during the twelve months ended December 31, 2010. With successful settlements to stretch our delinquent tax and overdue accounts payable we would be able to pay in time our current liabilities.

Principal Factors Affecting Our Financial Performance

We believe that the following factors will continue to affect our financial performance:

-

Economic growth in Poland. Growth in Poland’s GDP, employment rate and wages should result in increased demand for our products. According to the Polish Central Statistical Office, Poland’s economic growth in 2010 measured by the country’s GDP was 3.9% compared to 2009. The GDP for the fourth quarter of 2010 showed 4.4% increase over the fourth quarter of 2009 and 0.8% over the third quarter of 2010. Domestic demand in the fourth quarter of 2010, compared with the corresponding period of 2009 was higher by 5.6%. The International Monetary Fund forecasts that Polish GDP growth for 2011 will approximate 3.8% and 3.6% for 2012.

-

Clothing market development. Polish clothing market is estimated for approximately $ 9,000 million and statistical Pole spends for clothing $200 yearly. Contrary to earlier estimates, this market didn’t shrunk last year. According to the Polish Central Statistical Office data on retail sales in Poland, clothing and footwear segment was one of the fastest growing. Retail sale of textile, clothing and footwear rose in 2010 over the previous year by 14.3%.

-

Supply chain development. We will continue to seek high quality and cheaper sources of supply abroad, particularly raw materials and semi-finished and finished products. Increased liquidity has also allowed us to make larger and more systematic orders from our suppliers resulting in a decrease of the purchase prices. Lower purchase prices have decreased our cost of goods sold resulting in higher operating margins. We believe that our overall supply chain development process will continue to result in increased profit margins.

-

Increase in exports. We plan to expand sales of our products to foreign markets. This goal has been achieved through acquisitions of shares in local companies operating retail stores in Lithuania, Latvia, Estonia and the Czech Republic, as well as through further development of retail outlets in these countries. We believe that the overall increase in export sales through our network of acquired retail stores will result in increased sales of menswear and positively affect our overall sales.

17

Short-Term Financial Plan

Our short-term financial plan for 2011 includes various initiatives as discussed above, through which we hope to achieve positive net income for the year and positive cash flows from operations or cash flows. We believe that we will achieve this plan. If we are able to achieve positive cash flows from operations and extend the repayment of outstanding debts for at least 3 years, it would allow us to gradually pay down our current debts and overdue loans and tax payables . It would also allow us to have sufficient cash flows to operate normally in the year 2011.

Recent Events

Acquisition of Alza Sp. z o.o.

On March 8, 2010 Sunset Suits Holdings, Inc. purchased 100% shares in the company Alza Sp. z o.o., based in Warsaw, ul. Plac Defilad 1 at the price of $ 2,530. The net equity of acquired entity was $843. At the time of acquisition and as of 31 December 2010 Alza Sp. Z o.o. had no material assets and liabilities and as such was not included in the consolidation. Management intends the company Alza Sp. z o.o. to deal with import and distribution of merchandises within the Group.

Results of Operations

The following tables set forth key components of our results of operations for the periods indicated, in dollars and as a percentage of revenue.

Comparison of the Twelve Months Ended December 31, 2010 to December 31, 2009

(All amounts, other than percentages, in thousands of US dollars)

| Twelve Months Ended | Twelve Months Ended | ||||||||||||||

| December 31, 2010 | December 31, 2009 | Year to | |||||||||||||

| Percent of | Percent of | Year | |||||||||||||

| Amount | Revenue | Amount | Revenue | Change | |||||||||||

| Sales revenue | $ | 19,513 | 100% | $ | 26,586 | 100% | (27% | ) | |||||||

| Cost of sales | 8,392 | 43% | 11,319 | 43% | (26% | ) | |||||||||

| Gross profit | 11,121 | 57% | 15,267 | 57% | (27% | ) | |||||||||

| Administrative expenses | 1,382 | 7% | 2,075 | 8% | (33% | ) | |||||||||

| Selling expenses | 13,797 | 71% | 16,463 | 62% | (16% | ) | |||||||||

| Total Expenses | 15,180 | 78% | 18,538 | 70% | (18% | ) | |||||||||

| Gain (loss) on disposal of fixed assets, net | ($ 1,465 | ) | (8% | ) | ($ 647 | ) | (2% | ) | 127% | ||||||

| Interest income | 59 | % | 4 | % | 1,386% | ||||||||||

| Interest expense | 1,034 | 5% | 554 | 2% | 87% | ||||||||||

| Gain (loss) on transaction in foreign currency | (217 | ) | (1% | ) | (74 | ) | (%) | 193% | |||||||

| Income before income taxes | (6,716 | ) | (34% | ) | (4,542 | ) | (17% | ) | 48% | ||||||

| Income taxes | (86 | ) | (%) | 468 | 2% | (118% | ) | ||||||||

| Net income (loss) from Continuing Operations | (6,802 | ) | (35% | ) | (4,074 | ) | (15% | ) | 67% | ||||||

| Income (loss) from Discontinued Operations | 6,321 | 32% | (961 | ) | (4% | ) | (758% | ) | |||||||

| Net (Loss) Income | (481 | ) | (2% | ) | (5,034 | ) | (19% | ) | (90% | ) | |||||

18

(All amounts, other than percentages, in thousands of Polish zloty)

| Twelve Months Ended | Twelve Months Ended | ||||||||||||||

| December 31, 2010 | December 31, 2009 | Year to | |||||||||||||

| Percent of | Percent of | Year | |||||||||||||

| Amount | Revenue | Amount | Revenue | Change | |||||||||||

| Sales revenue | zl 58,846 | 100% | zl 82,848 | 100% | (29% | ) | |||||||||

| Cost of sales | 25,307 | 43% | 35,272 | 43% | (28% | ) | |||||||||

| Gross profit | 33,539 | 57% | 47,576 | 57% | (30% | ) | |||||||||

| Administrative expenses | 4,169 | 7% | 6,466 | 8% | (36% | ) | |||||||||