Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ADA-ES INC | d8k.htm |

Creating a

Future with Creating a Future with

Cleaner Coal

Cleaner Coal

Annual Shareholders Meeting

June 7, 2011

NASDAQ:ADES

Exhibit 99.1 |

Please

note

that

this

presentation

contains

forward-looking

statements

within

the

meaning

of

Section

21E

of

the

Securities

Exchange

Act

of

1934,

which

provides

a

"safe

harbor"

for

such

statements

in

certain

circumstances.

The

forward-looking

statements

include,

but

will

not

necessarily

be

limited

to,

statements

or

expectations

regarding

the

growth

in

markets

for

our

products

and

services;

amount

and

timing

of

future

tax

credits,

revenues,

operating

income,

cash

flows,

legal

expenses

and

other

financial

measures;

timelines

for

our

projects;

scope,

timing

and

impact

of

current

and

anticipated

regulations

and

legislation;

future

supply

and

demand;

resolution

of

the

Norit

arbitration

and

indemnity

obligations

and

its

effects;

and

related

matters.

These

statements

are

based

on

current

expectations,

estimates,

projections,

beliefs

and

assumptions

of

our

management.

Such

statements

involve

significant

risks

and

uncertainties.

Actual

events

or

results

could

differ

materially

from

those

discussed

in

the

forward-looking

statements

as

a

result

of

various

factors,

including

but

not

limited

to,

our

inability

to

satisfactorily

resolve

the

Norit

arbitration

and

related

indemnity

obligations;

adverse

outcomes

in

future

legal

proceedings;

lack

of

working

capital

to

timely

fulfill

our

obligations;

changes

in

laws

and

regulations,

government

funding,

prices,

economic

conditions

and

market

demand;

timing

of

regulations

and

any

legal

challenges

to

them;

impact

of

competition;

availability,

cost

of

and

demand

for

alternative

energy

sources

and

other

technologies;

technical,

start-up

and

operational

difficulties;

inability

to

commercialize

our

technologies

on

favorable

terms;

additional

risks

related

to

ADA

Carbon

Solutions

including

lack

of

continued

funding

and

failure

to

raise

additional

financing,

demand

of

payment

on

loans

and

other

obligations,

inability

to

obtain

permits,

our

lack

of

control

and

further

dilution

of

our

interest,

changes

in

the

costs

and

timing

of

full

commercial

operations;

additional

risks

related

to

Clean

Coal

Solutions,

LLC

including

failure

of

its

leased

facilities

to

continue

to

produce

coal

which

qualifies

for

IRS

Section

45

tax

credits,

termination

of

the

leases

for

such

facilities,

decreases

in

the

production

of

refined

coal

by

the

lessee,

seasonality

and

failure

to

build

or

monetize

new

facilities

to

meet

the

recently

extended

Section

45

tax

credit

placed-in-service

date;

availability

of

raw

materials

and

equipment

for

our

businesses;

loss

of

key

personnel;

and

other

factors

discussed

in

greater

detail

in

our

filings

with

the

Securities

and

Exchange

Commission

(SEC).

You

are

cautioned

not

to

place

undue

reliance

on

such

statements

and

to

consult

our

SEC

filings

for

additional

risks

and

uncertainties

that

may

apply

to

our

business

and

the

ownership

of

our

securities.

Our forward-

looking

statements

are

presented

as

of

the

date

made,

and

we

disclaim

any

duty

to

update

such

statements

unless

required

by

law

to

do

so.

Disclaimer

-2- |

Leader in Clean

Coal Technology Investment Overview

Primary Market: 1,100+ coal-fired utility boilers in the U.S.

–

Coal provides 50% of electricity in the U.S.

On March 16, 2011 EPA’s Mercury and Air Toxics Standards draft was issued

requiring reduction of Hazardous Air Pollutants (“HAPs”) from new and

existing electricity generating units in the U.S.

–

Rule scheduled to become final November 2011

–

Compliance required in 36 months

Mercury: 80-90% reduction in mercury

–

Refined Coal through JV Clean Coal Solutions

–

Enhanced Coal, licensed for production to Arch Coal

–

Activated Carbon Injection (“ACI”) Equipment

Dry

Sorbent

Injection

(DSI)

systems

for

control

of

acid

gases,

HCl

and

SO

2

7.6 mm shares outstanding

-3- |

ADA’s

Emissions Solutions for the Existing Fleet

Supply emission control technologies based upon

minimal capital cost for new equipment

–

Doesn’t require 10-20 years of extended plant life to justify large

equipment costs

Low CAPEX alternatives trade variable operating

expenses for fixed capital costs

–

Allows continued operation of the plants to take advantage of

additional economic life

–

Provides continuous revenues for ADA vs. one time equipment sales

Examples for a 250 MW Plant:

–

ACI: $1 mm capital

–

Refined Coal: Controls mercury at no cost to utility

–

Enhanced Coal: No capital equipment; $2-$4 mm per year in

increased fuel costs to the power producer

-4- |

-5-

ACI System

for Mercury

ADA’s Low CAPEX Approach to Emissions

Control Technology

Emission Control Equipment

(NO

x

, SO

2

, Particulate) |

Refined Coal

Reduces Mercury Clean Coal Solutions: ADA JV with NexGen Refined Coal LLC

CyClean –

patented technology enhances combustion of PRB

coals in cyclone boilers and reduces mercury and NOx

emissions

Two systems installed at two power plants June, 2010

producing 6+ mm tons of Refined Coal per year

–

Received $9 mm in prepaid rent from monetizer

–

Generated >$16 mm in revenues to ADA in first 3 Quarters of

Operation

–

Expected to produce ~$1.00/share in earnings per year for ADA for the

next nine years (based on 7.6 mm shares)

-6- |

Refined Coal

Growth Opportunity In December 2010 Congress extended deadline to install new Refined

Coal facilities until the end of 2011.

–

New Air Toxics Rule creating additional demand for Refined Coal.

Currently fabricating 12 additional Refined Coal facilities

–

First 5 facilities scheduled for on-site tests in June through August treating a total of

15 mm tons per year

–

JV has $10 mm line of credit to finance new units

–

Advance payments for pre-paid rent are expected once the facilities are operational

-7- |

Refined Coal

Growth Opportunity CURRENT PROJECTIONS

(based on 2 existing facilities @ 6 million tons)

POTENTIAL OPPORTUNITY

(based on 20 million tons)

$ in millions

Estimated revenues Estimated

operating income

-8- |

Refined Coal

JV Equity Sale to a

Goldman Sachs Affiliate (“GS”)

Clean Coal Solutions JV sold 15% equity interest to GS for

$60 million cash

–

Implies a $400 million value for the JV

–

ADA received approx. $32 million cash from GS and NexGen

GS has rights to monetize next 12 million tons of RC

–

Monetization rates more economically favorable than lease

transactions on first two units

–

Increased pre-paid rent terms will bring in earlier and increased

cash flows for new systems

–

Eliminates ROFR from prior GS Lease Agreement

Cash infusion enhances our balance sheet and our ability

to meet our obligations and grow the business |

-10-

Mercury Control:

License to Arch Coal

Designed to enable Arch’s PRB coals to burn

with lower emissions of mercury and other

metals

$2.00-4.00/ton in benefits to customer

Royalty agreement –

payments to ADA of up

to $1.00/ton based on premium of Enhanced

Coal sales

Air Toxics Rule could create a market for

>100 mm tons/yr of Enhanced PRB

Full-scale tests proving effectiveness |

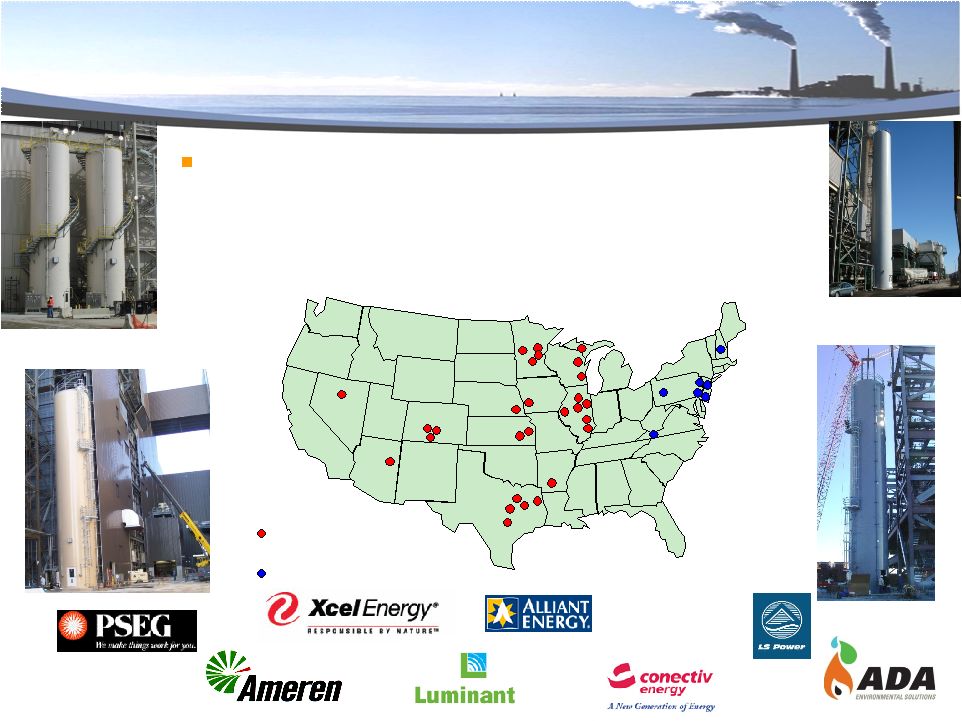

ADA Commercial

ACI Systems > 20 GW Sold for Mercury Control

Plant burns PRB coal or

lignite

Plant burns bituminous coal

-11-

Installed/installing 47 ACI systems at coal-

fired power plants

–

Over 30% market share of 150 systems sold

for mercury control from power plants |

Emission

Control: Growth Expected in ACI

Equipment

-12-

Expect contracts to begin once the Air Toxics Rule is

finalized in November 2011

E |

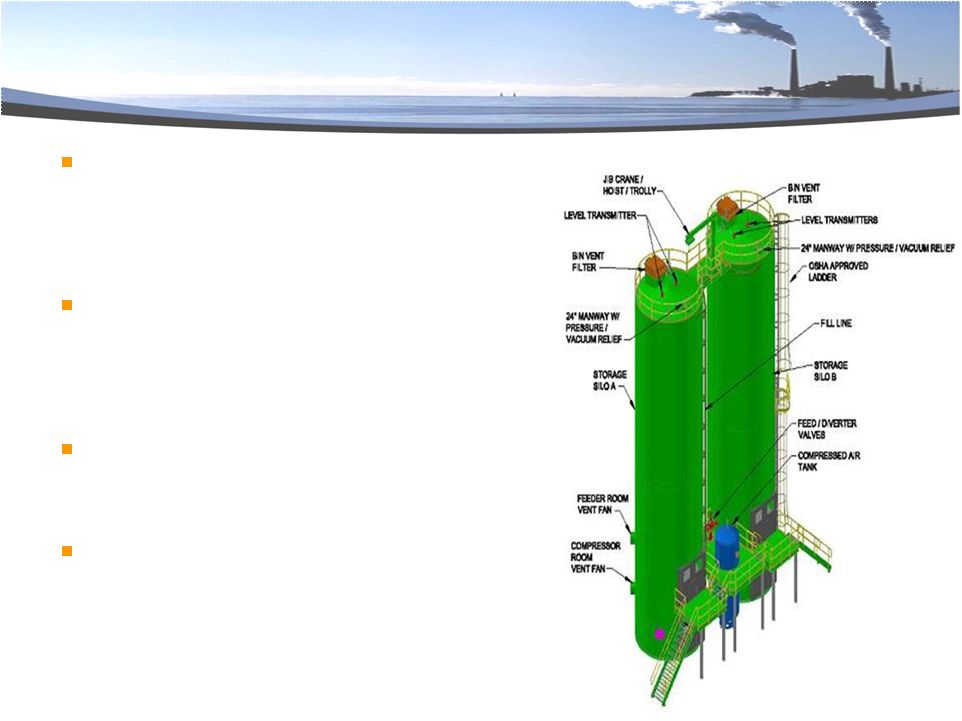

Control of

Acid Gases HCl, SO

2

, SO

3

Air Toxics Rule identifies HCI

and SO

2

as surrogates for acid

gases

ADA provides dry sorbent

injection (DSI) systems as a low-

cost option to wet scrubbers

Equipment costs $2-3 mm for

average size plants

EPA predicts over 200 systems

will be needed by 2015

-13- |

CO

2

Capture

Developing solid sorbent capture technology to capture

CO

2

from flue gas in conventional coal-fired boilers

DOE and industry funding:

–

Phase I -

$3.8 mm R&D program awarded in Nov. 2008 to

develop technology; successful field tests at 1 KW pilot plant

–

Phase II -

$19 mm, 51-month contract awarded Oct. 2010 to

scale-up technology to 1 MW; key step toward

commercialization

Advantages over competing technologies:

–

For customer: lower cost and less parasitic energy

–

For ADA: continuous revenues from sale of proprietary chemical

sorbents

-14- |

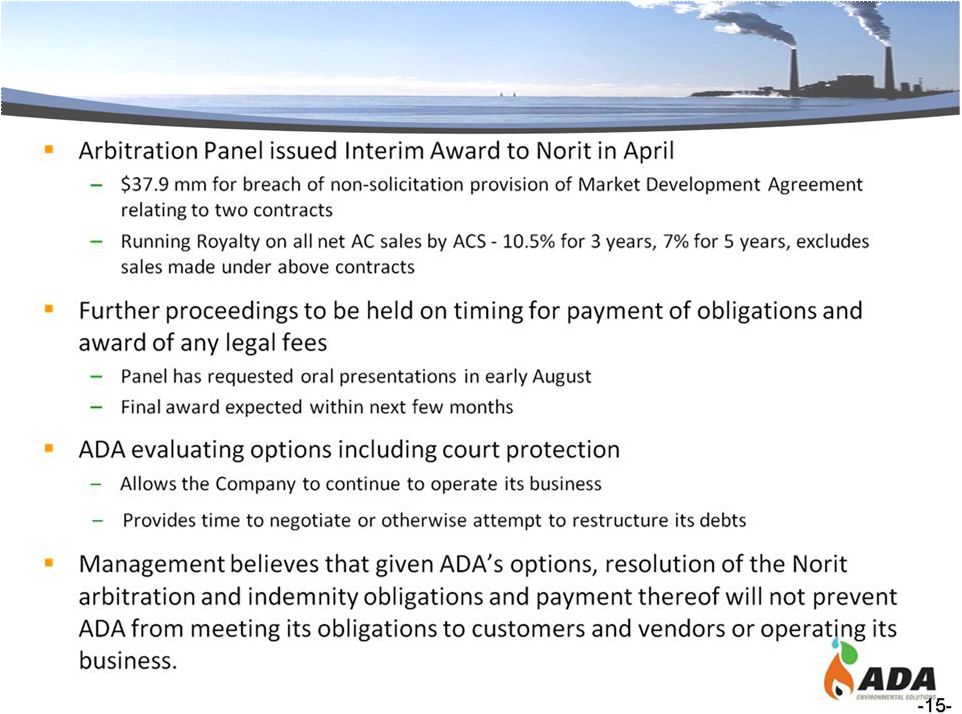

Norit

Arbitration -15- |

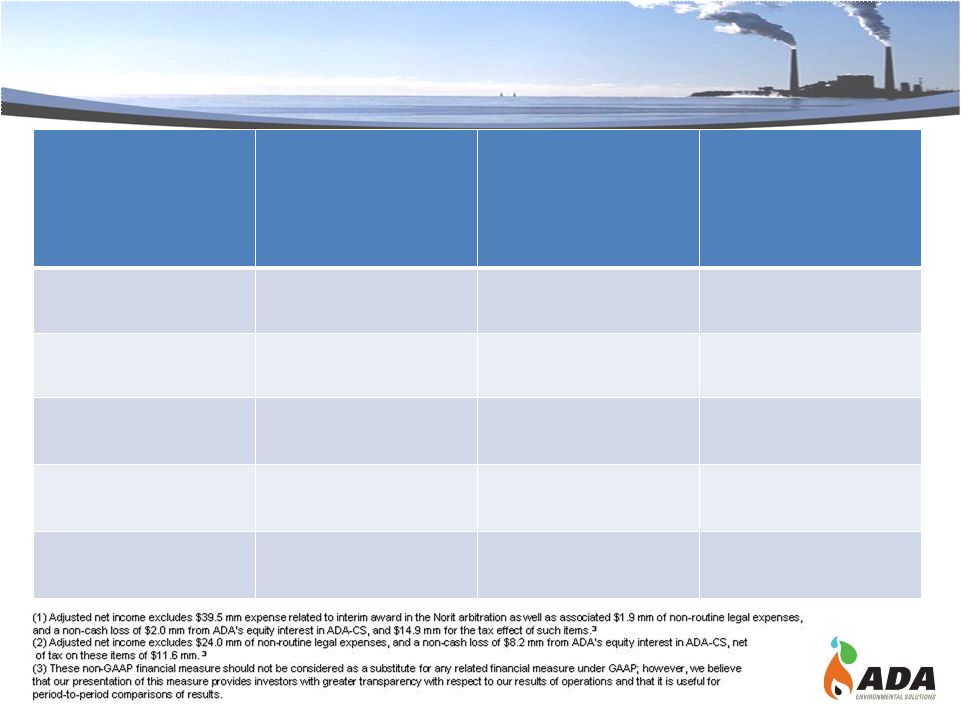

Summary of

Recent Financial Results Three Months

ended

03/31/11

(1)

Three Months

ended

03/31/10

Year Ended

12/31/10

(2)

Total Revenues

$8.5 mm

$3.9 mm

$22.3 mm

Gross Margin

85%

35%

61%

Operating Income

(Loss)

$1.9 mm

($3.6) mm

($21.0) mm

Net Loss

(per share)

($27.5) mm

($3.63)

($2.8) mm

($0.39)

($15.5) mm

($2.09)

Adjusted Net Income

per share

(3)

$1.0 mm

$0.14

N/A

$5.1 mm

$0.69

-16- |

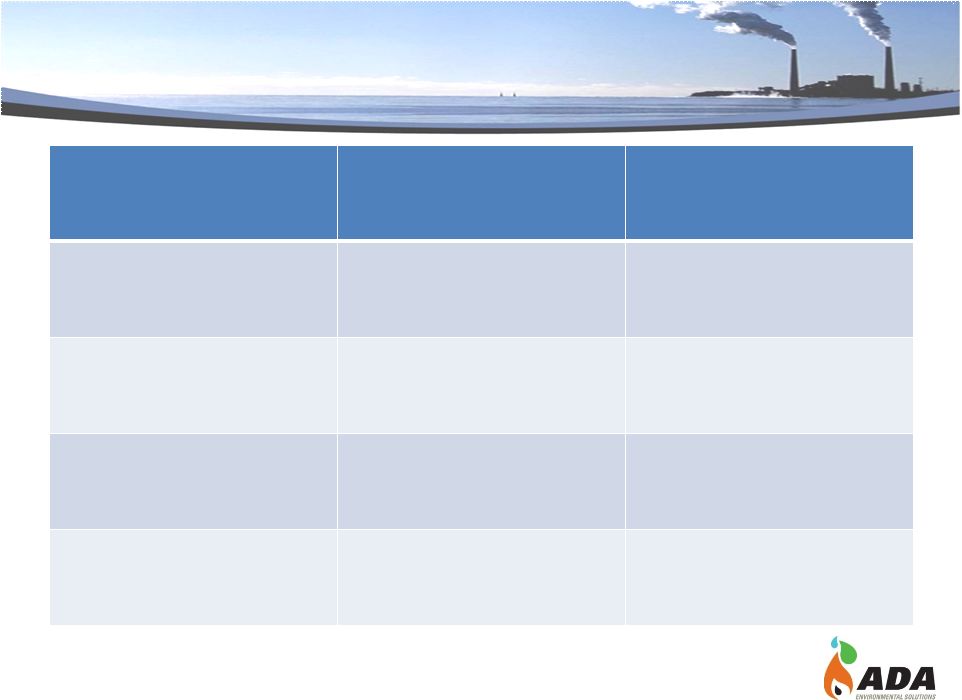

Balance Sheet

Highlights As of 3/31/11

(1)

As of 12/31/10

Cash & Cash Equivalents

$9.3 mm

$9.7 mm

Working Capital

$3.2 mm

$10.1 mm

Shareholders’

(Deficit)

Equity

($13.6) mm

$13.4 mm

Shares Outstanding

7.6 mm

7.6 mm

(1) As a result of the Interim Award to Norit, ADA accrued $33 mm in long-term

liabilities and $6.5 mm as a current liability.

-17- |

Other Data

As of 05/31/11:

–

Market cap: $86 mm

–

7.6 mm shares outstanding

–

50%+ held by institutions

–

~11% held by insiders and employees

–

Analyst coverage: JMP Securities, Johnson Rice, Lazard Capital

Markets, Pritchard Capital Partners, Wedbush Securities

Investor Contact:

-18-

ADA-ES, Inc.

Investor Relations Counsel

Michael D. Durham, Ph.D., MBA, President & CEO

The Equity Group, Inc.

Mark H. McKinnies, CFO

Melissa Dixon

(303) 734-1727

(212) 836-9613

www.adaes.com

Mdixon@equityny.com |

A Leader in

Clean Coal Technology ©

Copyright 2011 ADA-ES, Inc. All rights reserved.

NASDAQ:ADES |