Attached files

| file | filename |

|---|---|

| 8-K/A - MARIZYME INC | v225093_8ka.htm |

| EX-99.2 - MARIZYME INC | v225093_ex99-2.htm |

|

Disclaimer

|

This Presentation has been prepared by GBS Enterprises Incorporated the ‘Company ’) listed on the OTCBB under the stock symbol GBSX; who beneficially owns approximately 50.1% of GROUP Business Software AG, (‘GROUP ’), located in Frankfurt, Germany. This Presentation is being furnished through the GBSX’s management team, for informational purposes solely for use by prospective accredited investors in considering their interest in a possible transaction involving the Company. No part of these pages, either text or image maybe used for any purpose other than personal use. Therefore, reproduction, modification, storage in a retrieval system or retransmission, in any form or by any means, electronic, mechanical or otherwise, for reasons other than personal use, is strictly prohibited without prior written permission.

SAFE HARBOR LANGUAGE

This Presentation may include forward -looking statements related to the Company and GROUP that involve risks, including, but not limited to, product delivery, the management of growth, market acceptance of certain products of other risks. These forward -looking statements are made in reliance on the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. For further information about these factors that could affect the Company’s future results, please refer to the Company’s filings with the Securities and Exchange Commission. Prospective investors and shareholders are cautioned that any such forward -looking statements are not guarantees of future performance and involves risk and uncertainties, and that actual results may differ materially from those projected in the forward -looking statements as a result of various factors.

This information contained herein has been prepared to assist interested parties in making their own evaluation and does not purport to be all-inclusive or to contain all the information that a prospective buyer or investor may desire or that may be required in order to properly evaluate the opportunity discussed. In all cases, interested parties should conduct their own investigation and analysis of the data set forth in this Presentation. Industry data and statistics have been obtained or derived from the management team and published industry sources.

GBSX has not independently verified any of the information contained herein. GBSX nor their respective affiliates make any representation or warranty (expressed or implied) as to the accuracy or completeness of this Presentation or any statements, estimates or projections contained herein, and none of them will have any liability for the recipient ’s use of this Presentation or any other oral, written or other communications transmitted to the recipient in the course of its evaluation of GBSX and this opportunity. This Presentation includes certain statements, estimates and projections provided by, and with respect to the anticipated future performance of GBSX. Such statements, estimates and projections reflect various assumptions and elements of subjective judgment made by management concerning anticipated results , which are subject to business , economic contingencies , and competitive uncertainties and many of which are beyond the control of the Company and which may or may not prove to be correct. This Presentation contains certain projected financial information that reflects management ’s projections as to anticipated future results based upon assumptions that are inherently uncertain, including assumptions as to the size of the markets in which it expects to compete, GBSX’s market share, general industry conditions and other factors. The assumptions are based upon management ’s judgment. As a result, no representation or warranty is made as to the feasibility of the projected financial information included in this Presentation.

By accepting the Presentation, you acknowledge that: (1) the information will be used by you solely for the purpose of evaluating a transaction involving GBSX; (2) you will not reproduce the Presentation in whole or in part and will not distribute all or any portion of the Presentation to any person other than a limited number of your employees or representatives who have a need to know such information for the purpose set forth in (1) above and who are informed by you of the confidential nature of such information; and (3) if you do not wish to pursue a transaction you will destroy or return the Presentation to the “Ott team” together with any copies of the Presentation or other material relating to the properties discussed which you may have received from the management team.

|

CERTAIN OF THE INFORMATION CONTAINED HEREIN IS HIGHLY CONFIDENTIAL

|

Confidential

|

2

|

|

GBS Enterprises - The Basics

|

|

|

Strong profitable business for last 5 years

|

|

|

•

|

Diversified and Recurring Revenue Streams

|

|

|

•

|

Longstanding Relationships with Diverse, Global Customer Base

|

|

|

Core business focused on serving IBM’s Lotus Notes market

|

|

|

•

|

Business built from‘roll-up’ of the 24 Companies in Lotus market US & Europe

|

|

|

•

|

World’s largest provider of business applications for the Lotus market

|

|

|

•

|

More than 3,500 customers in 38 countries spanning 4 continents

|

|

|

High Growth Potential with ‘Market Changing’ Cloud Technologies

|

|

|

•

|

Agnostic PaaS Cloud Automation Platform

|

|

|

•

|

Application Transformer for IBM Lotus Notes market

|

|

|

•

|

Converts exiting Lotus applications to be ‘cloud ready’

|

|

|

•

|

Multiple partnerships with major OEM

|

|

|

•

|

Significant Industry Recognition and Awards

|

|

Confidential

|

3

|

|

GBS Enterprises, Inc (OTCBB: GBSX)

|

|

|

.

|

GBS Enterprises, Inc. listed on the OTCBB under the stock symbol GBSX; has acquired controlling interest (50.1%) of GROUP Business Software AG, (‘GROUP’), located in Frankfurt, Germany.

|

|

|

.

|

GBS Enterprises anticipates acquiring the remaining shares before end of 2011.

|

|

|

.

|

The CEO and EVO/CCDO of GBSX also serve in executive positions in GROUP Business Software, AG.

|

|

Confidential

|

4

|

|

GBS Enterprises, Inc - Management Team

|

|

Joerg Ott

|

Chairman and Chief Executive Officer

|

•

|

Founder OUTPUT! GmbH (sales training), GlobalWords (machine-translation based multilingual service), InterFair, TalkPower (call-centers)

|

20 + yrs.

|

||||

|

•

|

European Union Entrepreneur Forum expert for entrepreneurship and development of business plans for innovative ideas

|

|||||||

|

•

|

Earned his MBA at Passau University focusing on operations, research and finance; an OPM graduate and Harvard Alumnus since 2009

|

|||||||

|

•

|

Acquired and consolidated several industry leading companies in the Lotus Software market: GROUP, TJ, GEDYS, Relavis, IT Factory, Lotus911, Permessa, Salesplace

|

|||||||

|

•

|

Extensive industry expertise in M & A, including financial restructuring of publicly traded companies in Europe

|

|||||||

|

•

|

Responsibilities include setting strategy and vision, capital allocation, investor relations, corporate culture development and direct responsibility for nurturing, managing and integrating strategic business and technology acquisitions

|

|||||||

|

Gary MacDonald

|

Chief Corporate Development Officer

|

•

|

A broad background in engineering, marketing, sales, corporate development and general management. Extensive experience in both start-ups and enterprise level organizations such as Intel Corporation and successful high growth entrepreneurial companies such as Kingston Technology Company where he was Senior Vice President

|

30 + yrs.

|

||||

|

•

|

Founding CEO of PiNG PoNG Technologies, an artificial intelligence software company, and co-founder of Raydiance Incorporated, an award winning pioneer in advanced ultra short pulse laser technology

|

|||||||

|

•

|

Primary responsibilities at GROUP include corporate financial strategy, corporate development, investor relations, and M & A affairs

|

|||||||

|

Ron Everett

|

Chief Financial Officer (GBS Enterprises)

|

•

|

Founder and Director of Business Valuation Center, previously with a variety of financial services companies including Ernst & Young, Technology Ventures International, CBIZ Valuation Counselors, and Systems Architects

|

30 + yrs.

|

||||

|

|

|

•

|

|

Primary responsibilities include operational support and strategic guidance on all financial matters, supervises internal and external financial reporting, budget management, forecasting needs, and planning analysis relative to finance

|

|

|

Confidential

|

5

|

|

History

|

|

|

.

|

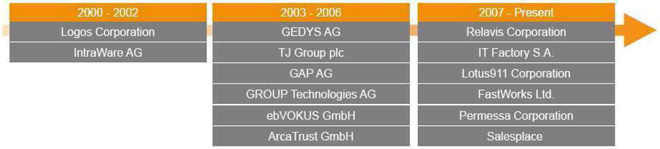

Company achieved significant growth by consolidating the fragmented Lotus Software market

|

|

|

.

|

Company performed over 24 merger & acquisitions with complementary product, technology or services offerings.

|

|

|

.

|

Company’s Cloud Automation Platform (CAP) will change the current Lotus Software & Domino Application Transformer markets (patents-pending)

|

|

|

.

|

CAP enables companies running on Lotus to easily deploy their entire environment including all applications in a private, public or hybrid cloud.

|

|

($ in US thousands)

|

2006A

|

2007A

|

2008A

|

2009A

|

||||||||||||

|

Revenue

|

$ | 25,292 | $ | 29,543 | $ | 33,543 | $ | 33,433 | ||||||||

|

EBITDA

|

$ | 4,633 | $ | 5,265 | $ | 5,847 | $ | 4,421 | ||||||||

|

Confidential

|

6

|

|

Business Overview

|

|

GBS Enterprises / GROUP

|

||

|

Applications Business (Core Business)

|

•

|

Application portfolio for IBM’ Lotus Notes (Messaging, Analytics, Compliance, Archiving, Security, CRM, GRC, eBanking, …)

|

|

IBM Cloud Opportunities

Lotus Market

Domino Application

Transformer

|

||

|

•

|

GROUP’s “Evolution Transformer “ - a break through technology that converts existing Lotus applications to be ‘cloud-ready’

|

|

|

•

|

‘Market changing’ PaaS technology ‘Cloud Automation Platform ‘(CAP) serving public, hybrid and private cloud environments.

|

|

|

“GROUP Live”

|

||

|

( PaaS Turn-key Solution

|

•

|

Technology is AGNOSTIC.

|

|

for IBM Lotus Domino)

|

||

|

Cloud Automation Platform

|

•

|

Multiple partnering opportunities worldwide with such companies as IBM (Global Services and Lotus Software), with OEM and bundled solutions offerings sold through vendor sales channels.

|

|

($ in thousands)

|

2009A

|

2010P

|

2011P

|

2012P

|

||||||||||||

|

Revenue(1)

|

$ | 33,433 | $ | 33,231 | (2) | $ | 65,626 | $ | 116,666 | |||||||

|

EBITDA(1)

|

$ | 4,421 | $ | 4,000 | (2) | $ | 10,647 | $ | 35,858 | |||||||

|

(1)

|

Revenue and EBITDA projections assume no additional acquisitions

|

|

(2)

|

Revenue 2010 reflects sale of GEDYS business in 2/2010.

|

|

Confidential

|

7

|

|

Revenue Streams

|

||||

|

License (Apps)

|

Services

|

|||

|

Messaging, CRM, GRC & eBanking Apps

|

Implementation & Customization Services

|

|||

|

•

|

Over 3,500 customers in 38 countries on 4 continents

|

•

|

~70% of customers engage GROUP for implementation & customization services

|

|

|

Resale Licensing

|

Professional Consulting Services

|

|||

|

•

|

Accounts for sales associated with IBM Lotus and other third party software licenses

|

•

|

Consulting, custom application development, hosting and administration services

|

|

|

Maintenance

|

License & Subscription (Cloud Offerings)

|

|||

|

New contracts

|

Traditional License

|

|||

|

•

|

Over 98% of customers purchase maintenance contracts in the first year

|

•

|

License model option for ISVs, SIs, datacenters and customers

|

|

|

Renewals

|

Monthly Recurring

|

|||

|

•

|

GROUP products are often mission critical and embedded in the customer infrastructure, resulting a maintenance contract renewal rate of < 95%

|

•

|

Subscription model option

|

|

|

Confidential

|

8

|

|

Sample Customer Mix

|

|

Confidential

|

9

|

|

Cloud Computing

|

|

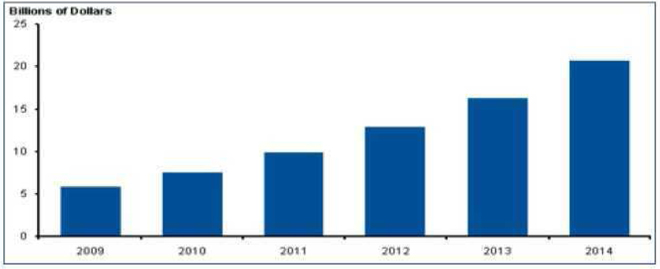

“The Next Generation of Outsourcing” (Gartner)

|

|

|

.

|

“We are in the midst of a fundamental shift as more enterprises start to use services enabled by cloud technologies.” Gartner, November 2010

|

|

|

.

|

18 million IBM Lotus Notes Applications at stake

|

Growth of Cloud-Based Applications (Gartner)

|

Confidential

|

10

|

|

Historical and Projected Income Statement

|

FYE 12/31

($ in thousands)

|

Actual

|

Projected

|

||||||||||||||||||||||||||||

|

Income Statement (summary)

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

||||||||||||||||||||||

|

Revenue

|

|||||||||||||||||||||||||||||

|

Licence

|

8.878 | 11.502 | 12.061 | 11.307 | 11.485 | 29.603 | 45.771 | ||||||||||||||||||||||

|

Service

|

5.031 | 5.427 | 6.869 | 6.525 | 6.828 | 12.904 | 14.750 | ||||||||||||||||||||||

|

Maintenance

|

8.853 | 10.023 | 11.111 | 11.304 | 9.693 | 10.690 | 12.307 | ||||||||||||||||||||||

|

Subscription

|

- | - | - | - | .52 | 10.699 | 42.271 | ||||||||||||||||||||||

|

Other

|

2.530 | 2.591 | 3.501 | 4.297 | 4.705 | 1.730 | 1.568 | ||||||||||||||||||||||

|

Total Revenue

|

$ | 25.292 | $ | 29.543 | $ | 33.543 | $ | 33.433 | $ | 33.231 | $ | 65.626 | $ | 116.666 | |||||||||||||||

|

TCOGS

|

4.008 | 5.609 | 6.772 | 6.763 | 5.944 | 8.868 | 12.650 | ||||||||||||||||||||||

|

Gross Profit

|

$ | 21.284 | $ | 23.934 | $ | 26.770 | $ | 26.670 | $ | 27.287 | $ | 56.757 | $ | 104.016 | |||||||||||||||

|

SG&A

|

19.316 | 20.883 | 23.316 | 25.058 | 25.846 | 50.214 | 73.488 | ||||||||||||||||||||||

|

EBIT

|

$ | 1.967 | $ | 3.051 | $ | 3.454 | $ | 1.611 | $ | 1.441 | $ | 6.543 | $ | 30.528 | |||||||||||||||

|

Depreciation & Amortization

|

2.666 | 2.214 | 2.393 | 2.809 | 2.559 | 4.104 | 5.330 | ||||||||||||||||||||||

|

EBITDA

|

$ | 4.633 | $ | 5.265 | $ | 5.847 | $ | 4.421 | $ | 4.000 | $ | 10.647 | $ | 35.858 | |||||||||||||||

|

Licence, Service, Maintenance Growth

|

24 | % | 17 | % | 14 | % | 0 | % | 1 | % | 110 | % | 78 | % | |||||||||||||||

|

Subscription Growth

|

N/A | N/A | N/A | N/A | N/A | 20458 | % | 295 | % | ||||||||||||||||||||

|

Gross margin

|

84 | % | 81 | % | 80 | % | 80 | % | 81 | % | 86 | % | 89 | % | |||||||||||||||

|

SG&A / sales

|

76 | % | 71 | % | 70 | % | 75 | % | 83 | % | 77 | % | 63 | % | |||||||||||||||

|

EBITDA / sales

|

18 | % | 18 | % | 17 | % | 13 | % | 12 | % | 16 | % | 31 | % | |||||||||||||||

|

Confidential

|

11

|

|

Industry Recognition

|

40 Industry awards

Current Awards

|

|

.

|

2011 IBM Lotus Award Winner: Chief Technology Officer Innovation Award for GBS Transformer

|

|

|

.

|

2011 IBM Beacon Award Finalist: Cloud Computing Innovation - Cloud Builder Category for GROUP Live

|

|

|

.

|

2011 “IBM Bestseller Award” in the “Best Cloud Solution Partner” category

|

|

|

.

|

2011 ISM Top 15 CRM Software Award

|

|

|

.

|

2011 IBM Lotus Finalist: Best Cross industry Award

|

|

|

.

|

2010 IBM Lotus Award Winner: Chief Technology Officer Innovation Award for GROUP Live

|

|

|

.

|

2010 INNOVATIONSPREIS-IT 2010 Award for GROUP Live

|

|

|

.

|

2010 IBM Lotus Finalist: Best Industry Award for eb.Vokkus

|

|

|

.

|

2010 IBM Lotus Semi-Finalist: Best in Lotusphere Showcase Award

|

|

Confidential

|

12

|

|

Capitalization

|

|

|

.

|

GBS has 20.4 MM shares issued and outstanding; 5.8MM warrants

|

|

|

.

|

GBS trades on OTCBB: GBSX trades at $4.45 (as of 3/9/11)

|

|

|

.

|

GBS recently closed on $7MM financing

|

|

|

.

|

Raise consists of 4MM shares @ $1.25 per share and 4MM warrants exercisable @ $1.50.

|

|

|

.

|

Use of proceeds: Expansion of staff and continued technology investment for cloud automation business (the “CAP”) as well as other acquisitions.

|

For further information, please contact:

GarWood Securities LLC

Jackson Spears

Office: 414.289.7176 / Mobile: 847.899.3952

Email: jspears@garwoodsecurities .net

|

Confidential

|

13

|