Attached files

| file | filename |

|---|---|

| 10-K - FORM 10-K - OPNET TECHNOLOGIES INC | d10k.htm |

| EX-21 - EXHIBIT 21 - OPNET TECHNOLOGIES INC | dex21.htm |

| EX-23 - EXHIBIT 23 - OPNET TECHNOLOGIES INC | dex23.htm |

| EX-32.2 - EXHIBIT 32.2 - OPNET TECHNOLOGIES INC | dex322.htm |

| EX-31.1 - EXHIBIT 31.1 - OPNET TECHNOLOGIES INC | dex311.htm |

| EX-31.2 - EXHIBIT 31.2 - OPNET TECHNOLOGIES INC | dex312.htm |

| EX-32.1 - EXHIBIT 32.1 - OPNET TECHNOLOGIES INC | dex321.htm |

Exhibit 10.7

SECOND AMENDMENT TO OFFICE LEASE AGREEMENT

THIS SECOND AMENDMENT TO OFFICE LEASE AGREEMENT (“Amendment”) is made effective as of the January 31, 2011, by and between STREET RETAIL, INC., a Maryland corporation (“Landlord”), and OPNET TECHNOLOGIES, INC., a Delaware corporation (“Tenant”).

W I T N E S S E T H :

WHEREAS, Landlord and Tenant entered into that certain Office Lease Agreement dated on or about May 24, 2000 between Landlord and Tenant (the “Original Lease”), as amended by that certain First Amendment to Office Lease Agreement dated October 2, 2000 (the “First Amendment”), that certain letter agreement dated December 13, 2002 (the “Letter Agreement”), that certain Lease Modification Agreement dated January 24, 2006 (the “Modification Agreement”), and that certain Lease Modification and Settlement Agreement dated December 30, 2009 (the “Modification and Settlement Agreement”) (the Original Lease, the First Amendment, the Letter Agreement, the Modification Agreement and the Modification and Settlement Agreement shall collectively be referred to as the “Current Lease”), pursuant to which Tenant leased from Landlord approximately sixty-one thousand one hundred forty-one (61,141) square feet of space (the “Leased Premises”) comprised of (i) approximately sixty thousand four hundred sixty-six (60,466) square feet of rentable office space consisting of a portion of the second (2nd) floor and the entire rentable area on the third (3rd), fourth (4th) and fifth (5th) floors designated as Suites 250, 300, 400 and 500, respectively (the “Office Premises”), and (ii) approximately six hundred seventy-five (675) square feet of storage space (the “Storage Space”), in the building having an address of 7255 Woodmont Avenue, Bethesda, Maryland (the “Building”); and

WHEREAS, the Term is currently scheduled to expire on January 31, 2011, and Landlord and Tenant desire to extend the Term for an additional ten (10) years, all as more particularly provided herein.

NOW THEREFORE, in consideration of the foregoing and Ten Dollars ($10.00) and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and the mutual promises contained herein, the parties hereto, intending to be legally bound, agree as follows:

1. Incorporation of Recitals. The foregoing recitals are hereby incorporated in this Amendment and made a part hereof by this reference.

2. Definitions. All capitalized terms used herein shall have the meanings ascribed to them in the Lease, unless otherwise defined herein.

3. Term. The Term of the Lease shall hereby be extended for an additional period (the “Extension Period”) often (10) years commencing on February 1, 2011 (the “Extension Commencement Date”); and accordingly, the Term shall expire on, and the Termination Date shall be, January 31, 2021, unless earlier terminated in accordance with the terms of the Lease. The extension of the Term as provided above is effective as of the date hereof.

4. Minimum Rent.

(a) Until the Extension Commencement Date, Tenant shall pay to Landlord the Minimum Rent for the Office Premises in accordance with the provisions of the Current Lease. Commencing as of the Extension Commencement Date, the Minimum Rent payable by Tenant to Landlord for the Office Premises (consisting of 60,466 rentable square feet) shall be as follows:

| Period |

Rate per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| 02/01/11 – 01/31/12 |

$ | 39.75 | $ | 2,403,523.56 | $ | 200,293.63 | ||||||

| 02/01/12 – 01/31/13 |

$ | 41.24 | $ | 2,493,617.88 | $ | 207,801.49 | ||||||

| 02/01/13 – 01/31/14 |

$ | 42.79 | $ | 2,587,340.16 | $ | 215,611.68 | ||||||

| 02/01/14 – 01/31/15 |

$ | 44.39 | $ | 2,684,085.72 | $ | 223,673.81 | ||||||

| 02/01/15 – 01/31/16 |

$ | 46.06 | $ | 2,785,063.92 | $ | 232,088.66 | ||||||

| 02/01/16 – 01/31/17 |

$ | 47.78 | $ | 2,889,065.52 | $ | 240,755.46 | ||||||

| 02/01/17 – 01/31/18 |

$ | 49.58 | $ | 2,997,904.32 | $ | 249,825.36 | ||||||

| 02/01/18 – 01/31/19 |

$ | 51.43 | $ | 3,109,766.40 | $ | 259,147.20 | ||||||

| 02/01/19 – 01/31/20 |

$ | 53.36 | $ | 3,226,465.80 | $ | 268,872.15 | ||||||

| 02/01/20 – 01/31/21 |

$ | 55.36 | $ | 3,347,397.72 | $ | 278,949.81 | ||||||

(b) Until the Extension Commencement Date, Tenant shall pay to Landlord the Minimum Rent for the Storage Space in accordance with the provisions of the Current Lease. Commencing as of the Extension Commencement Date, the Minimum Rent payable by Tenant to Landlord for the Storage Space (consisting of 675 square feet) shall be as follows:

| Period |

Rate per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| 02/01/11 – 01/31/12 |

$ | 12.00 | $ | 8,100.00 | $ | 675.00 | ||||||

| 02/01/12 – 01/31/13 |

$ | 12.30 | $ | 8,302.56 | $ | 691.88 | ||||||

| 02/01/13 – 01/31/14 |

$ | 12.61 | $ | 8,511.72 | $ | 709.31 | ||||||

| 02/01/14 – 01/31/15 |

$ | 12.92 | $ | 8,721.00 | $ | 726.75 | ||||||

| 02/01/15 – 01/31/16 |

$ | 13.25 | $ | 8,943.72 | $ | 745.31 | ||||||

| 02/01/16 – 01/31/17 |

$ | 13.58 | $ | 9,166.56 | $ | 763.88 | ||||||

| 02/01/17 – 01/31/18 |

$ | 13.92 | $ | 9,396.00 | $ | 783.00 | ||||||

| 02/01/18 – 01/31/19 |

$ | 14.26 | $ | 9,625.56 | $ | 802.13 | ||||||

| 02/01/19 – 01/31/20 |

$ | 14.62 | $ | 9,868.56 | $ | 822.38 | ||||||

| 02/01/20 – 01/31/21 |

$ | 14.99 | $ | 10,118.28 | $ | 843.19 | ||||||

(c) The monthly installments of Minimum Rent for the Office Premises and the Storage Space otherwise due and payable for the first three (3) months from and after the Extension Commencement Date (i.e., February, March and April, 2011) shall be abated (the “Rent Abatement”).

(d) Subject to application of the Rent Abatement, Tenant shall pay the Minimum Rent to Landlord in monthly installments in advance on the first day of each calendar month during the Term, without notice, in accordance with the terms and conditions of the Lease.

5. Additional Rent. Except as otherwise expressly set forth in this Paragraph 5, all Additional Rent shall continue to be paid by Tenant to Landlord in accordance with the provisions of the Current Lease. From and after the Extension Commencement Date, Tenant shall no longer be required to pay its share of Operating Costs or any additional charge for after hours HVAC usage, but shall be required to pay the entire cost of electricity consumption at the Leased Premises. Tenant shall also continue to be responsible for Tenant’s share of Taxes each Operating Year, but only for the amount that exceeds Taxes for calendar year 2011. Accordingly, from and after the Extension Commencement Date:

(i) Section 6.03 A shall be deleted in its entirety and replaced with the following:

“A. For each Operating Year, Tenant shall pay to Landlord, in the manner provided herein, Tenant’s share of Taxes (“Tenant’s Share of Taxes”), which shall be equal to the the product obtained by multiplying Tenant’s Tax Share times the amount, if any, by which Taxes for such Operating Year exceed the Base Taxes; provided, however, that for the Operating Year during which the Term ends, Tenant’s Share of Taxes shall be prorated based upon the actual number of days of the Term occurring during such Operating Year.”

(ii) The term “Tenant’s Share of Operating Costs and Taxes” in each instance that it occurs in the Current Lease shall be replaced with the term “Tenant’s Share of Taxes.”

(iii) The definition of Base Year, as set forth in Section 1.02 G of the Lease, shall mean the calendar year commencing January 1, 2011.

(iv) Section 6.03 C of the Lease shall be deleted in its entirety.

(v) The fourth (4th) sentence (commencing with “Such after-hours”) and the sixth (6th) sentence (commencing with “Tenant shall pay”) of Section 7.01.D shall be deleted in their entirety.

(vi) Tenant shall be responsible for the entire cost of electricity consumed at the Leased Premises. Landlord shall install separate meters (pursuant to Paragraph 7(a) hereof) for measuring electricity consumption at the Leased Premises. Tenant shall pay the charges for such electricity directly to the appropriate utility company. No base amount, base year or expense stop shall apply with respect to Tenant’s obligation to pay electricity costs. Landlord and Tenant acknowledge that such meters will not be installed as of the Extension Commencement Date. For the period from the Extension Commencement Date until that date the foregoing meters are installed, Tenant shall pay to Landlord the

2

entire cost of electricity consumed at the Leased Premises, based upon Landlord’s actual cost thereof and the readings of the submeters currently existing for the Leased Premises. Landlord shall have Energy Management Systems, Inc. (“EMS”) read the submeters at least monthly and Landlord or EMS shall notify, at least 24 hours in advance, Tenant by mail, e-mail or telephone of the date and time of such reading, provided that Tenant notifies Landlord in writing of the name, phone number and e-mail address of the person designated to receive such notice. Until Landlord is otherwise so notified, the name, phone number and e-mail address of the person designated to receive such notice is as follows: Michele Nevins, 240-497-3000 (telephone), meternotifications@opnet.com (Email). Such notice can be in the form of a schedule; provided that Landlord or EMS shall notify, at least 24 hours in advance, Tenant by mail, e-mail or telephone of any changes to such schedule. Tenant shall reimburse Landlord for any fee charged by EMS in connection with such meter reading. Tenant shall pay Landlord any amounts payable to Landlord pursuant to this Section 5(vi) within fifteen (15) days after Landlord delivers to Tenant an invoice therefor.

(vii) Tenant shall enter into annual service contracts with a reputable HVAC maintenance firm for the inspection, maintenance and repair of any supplemental HVAC system serving the Leased Premises, and Tenant shall provide to Landlord such service contract and evidence that it is in full force and effect at Landlord’s request.

6. “As-ls” Condition; Refurbishment Allowance.

(a) Tenant hereby expressly acknowledges and agrees that (i) Landlord will not make or pay for, and has no obligation to make or pay for, any alterations, decorations, additions or improvements in or to the Leased Premises from its “as is” condition in connection with this Amendment, except for the Landlord Work set forth in Paragraph 7 hereof, and (ii) Landlord has no obligation to provide Tenant with any allowance in connection with this Amendment, except the Refurbishment Allowance set forth in Paragraph 6(c) hereof.

(b) Tenant currently intends to undertake certain refurbishments to the Leased Premises (the “Refurbishment Work”), the cost of which shall be borne by Tenant, subject to the application of the Refurbishment Allowance (hereinafter defined). The Refurbishment Work shall be deemed an “Alteration” under the Lease and shall be subject to all the terms and conditions in the Lease concerning Alterations, including without limitation the provisions of Article IX of the Lease (but expressly excluding the Work Agreement, which shall no longer be applicable). In connection with the Refurbishment Work and any other Alterations undertaken by Tenant, Tenant shall cause each contractor, subcontractor or vendor to observe all reasonable rules and regulations promulgated by Landlord in connection with the performance of work in the Building, including those attached to the Lease as Exhibit D.

(c) Landlord agrees to provide Tenant with an allowance (“Refurbishment Allowance”) in the amount of Twenty-five Dollars ($25.00) per square foot of rentable area in the Office Premises, to be applied against the actual out-of-pocket third party costs and expenses incurred (i) in connection with the Refurbishment Work, including for customary hard and soft construction costs, project management services and architectural and engineering fees incurred in connection with constructing and designing the Refurbishment Work, (ii) for acquisition and installation of telecommunications and computer networking equipment and cabling for the Office Premises; (iii) for acquisition and installation of an uninterrupted power source (“UPS”) and emergency generator and all applicable electrical improvements necessary to install such UPS and generator for the Office Premises (collectively referred to as “Emergency Power Infrastructure”). Such costs against which the Refurbishment Allowance may be applied shall be referred to herein as “Allowable Refurbishment Costs.” The Refurbishment Allowance shall not be applied to the costs of any furniture, equipment, personal property, or for any other costs other than Allowable Refurbishment Costs. After Tenant has incurred costs against which the Refurbishment Allowance may be applied, Tenant may deliver to Landlord a written request for partial payment of the Refurbishment Allowance and evidence of satisfaction of the following conditions (an “Allowance Request”): (a) receipt by Landlord of a signed statement from Tenant and Tenant’s architect certifying that Tenant has incurred out-of-pocket Allowable Refurbishment Costs (for which Tenant has not previously been reimbursed) against which the Refurbishment Allowance may be applied in the amount requested to be paid from the Refurbishment Allowance; (b) receipt by Landlord of appropriate paid receipts or invoices approved by Tenant and lien waivers in a form satisfactory to Landlord from the contractors and subcontractors performing the Refurbishment Work, which lien waivers must cover the work then provided by such contractors; and (c) Tenant shall not be in default of any term, condition or provision of this Lease. If a complete Allowance Request (complying with the foregoing requirements) is received by Landlord from

3

Tenant, Landlord shall use reasonable efforts to pay to Tenant the amount covered by the Allowance Request, within fifteen (15) days after receipt of the Allowance Request (and satisfaction of the foregoing conditions). Landlord shall be required to hold back five percent (5%) of the Refurbishment Allowance until the conditions required in connection with the Final Allowance Request (hereinafter defined) have been satisfied. Tenant shall not submit more than one Allowance Request in any month and shall not submit more than two (2) Allowance Requests and one (1) Final Allowance Request. Promptly after Tenant has completed the Refurbishment Work, Tenant may provide a final Allowance Request (the “Final Allowance Request”). In addition to satisfaction of the conditions of an Allowance Request, Tenant shall also be required to deliver as a part of the Final Allowance Request (i) a signed statement from Tenant and Tenant’s architect certifying that Tenant has completed the Refurbishment Work in accordance with the plans for the Refurbishment Work approved by Landlord, and (ii) lien waivers from all contractor and subcontractors performing any Refurbishment Work in a form satisfactory to Landlord. If the full amount of the Refurbishment Allowance has not been used in accordance with the foregoing as of earlier of <i) the date the Refurbishment Work is complete, or (ii) the date that is the last day of the thirtieth (30th) month after the Extension Commencement Date, then the balance thereof, but no more than an amount equal to two (2) monthly installments of Minimum Rent, may be applied against the next two (2) monthly installments of Minimum Rent coming due. Any remaining balance shall be retained by Landlord, and Tenant shall have no rights whatsoever with respect thereto. Notwithstanding the foregoing, Landlord shall have the right, without the obligation, to apply all or any portion of the undisbursed Refurbishment Allowance to remedy any default by Tenant (that remains uncured after any notice and the cure period expressly set forth in the Lease) occurring hereunder; provided, however, it is expressly covenanted and agreed that such remedy by Landlord shall not be deemed to waive, or release, the default of Tenant. Notwithstanding anything contained in this Paragraph 6 to the contrary, Tenant shall not be required to obtain a lien waiver from any contractor or subcontractor to the extent the total cost of the work in, to or for the Leased Premises provided by such contractor or subcontractor is less than Five Thousand Dollars ($5,000.00).

7. Landlord Work. Landlord, at is sole cost shall performing the following repairs or work to the indicated items from the condition existing as of the date hereof (the “Landlord Work”). Such Landlord Work shall be made on or before February 1, 2012, unless another date for completion thereof is indicated below:

(a) Landlord shall perform all design, engineering and construction work (including all applicable labor and materials) required to install meter(s) to measure the electricity consumption at the Leased Premises. Landlord shall use commercially reasonable efforts to commence such work promptly after the date hereof, and once commenced, shall diligently pursue completion thereof. Landlord shall use good faith efforts to complete such metering work within six (6) months after the execution of this Amendment; provided, however, that Landlord shall have no liability on account of any failure of Landlord to complete such metering work within such six (6) month period.

(b) Landlord shall complete repairs, if any are required, to the base Building HVAC equipment, necessary to cause such HVAC equipment to perform to the level of the equipment’s design specifications, based on the current condition of the equipment, taking into consideration such factors as age and ordinary wear and tear.

(c) By no later than December 31, 2014, Landlord shall replace the currently existing roof surface with a roof surface that is comparable to such currently existing roof surface. Such roof shall have a commercially reasonable warranty of no less than ten (10) years.

(d) By no later than November 30, 2011, Landlord shall (i) make any necessary repairs to the garage and surface parking facilities to repair material cracks in the concrete and re-seal the affected area, it being understood that Landlord may, in its discretion, replace all or a portion of the concrete parking slab and related membrane on the surface parking area and make repairs to the structure of the garage facility, (ii) make commercially reasonable efforts to minimize the accumulation of standing water in the lower garage consistent with other garage facilities in buildings of similar quality, size, age and location in Montgomery County, Maryland, and (iii) re-stripe the parking facilities (the “Parking Area Work”). Landlord currently plans to commence such Parking Area Work at the beginning of April, 2011 and currently anticipates that the Parking Area Work will complete within ninety (90) to one hundred twenty (120) days after such work commences. Once Landlord commences the Parking Area Work, Landlord shall diligently pursue completing of such Parking Area Work. Tenant acknowledges and

4

agrees that, in the event Landlord elects to replace all or a portion of the concrete slab on the surface parking deck, such work will involve jackhammering of the concrete and other demolition activity during Building Hours that could result in substantial noise. Landlord shall have no liability, and Tenant shall have no claim against Landlord, as a result of such jackhammering or any other demolition or construction activity in connection with the Parking Area Work. Tenant acknowledges that there will be times during the course of the performance of the Parking Area Work when Landlord may remove from service some or all of the parking spaces in the parking area. If all or certain parking spaces are unusable as a result of the Parking Area Work and as a result thereof Tenant is not able to park the entire number of cars allotted to Tenant pursuant to the Lease in the parking area, then Landlord agrees to provide to Tenant a one day abatement of the monthly parking fee (calculated as (i) the monthly parking rate payable by Tenant for a parking space in the applicable parking area, divided by 30) for each day that any car within such allotted number cannot be parked in the parking area as a result of such Parking Area Work, and Landlord shall have no liability, and Tenant shall have no claim against Landlord, as a result thereof (except for the foregoing abatement). Tenant shall be responsible for finding alternative parking during such times that it is unable to park its entire parking allotment in the parking facility. During the period that the Parking Area Work is being performed and any of Tenant’s parking spaces are unavailable for its use, Landlord shall endeavor, at no cost to Landlord, to assist Tenant in identifying such alternative parking. Commencing April 1, 2011, the garage facility will be unavailable to Tenant and the abatement with respect to all of the parking spaces allotted to Tenant under the Lease shall commence. As the parking spaces in the parking area are returned to service, Landlord shall notify Tenant how many parking spaces are again usable, and the abatement will end with respect to such parking spaces as of the end of the month in which such parking spaces are again usable, as shall be set forth in a written notice from Landlord to Tenant; provided, however, (i) Landlord shall return to service parking spaces in increments of at least twenty-five (25) spaces at a time, except if the increment includes all of the lower level parking spaces then out of service or the increment is the last increment of parking spaces returned to service, and (ii) Tenant shall not actually be entitled to use such spaces until the day after the abatement with respect to such spaces expires (i.e., the first day of the month after the month in which such spaces are again usable). As parking spaces again become available for Tenant to use, Landlord shall use reasonable efforts to give Tenant at least thirty (30) days notice of the date that such spaces are anticipated to become available to use. In addition, during the period that the Parking Area Work is being performed and any of Tenant’s parking spaces are unavailable for use, Landlord shall mark as “Reserved for Opnet Executives” (or such other reserved designation as Tenant and Landlord shall mutual agree) three (3) of the parking spaces allotted to Tenant under that certain Office Lease Agreement between Landlord and Tenant for space at 7250 Woodmont Avenue, Bethesda Maryland (the “7250 Building”). Such parking spaces shall be in a location in the parking garage for the 7250 Building that is mutually agreed to by Landlord and Tenant and shall be restriped by Landlord. Landlord shall be entitled to require that Tenant vacate its storage area during all or any period that the Parking Area Work is being performed. During such time as Tenant is unable to access or use its storage space while Landlord is performing the Parking Area Work, Landlord shall abate all rent and other expenses for which Tenant is obligated to Landlord for such storage space.

(e) Landlord shall perform the necessary work, if any, to cause the base Building fire/life safety equipment is operational and in compliance with the applicable legal requirements of the applicable building and life safety codes, including but not limited to sprinkler equipment, emergency lighting, and any enunciator panel.

(f) Landlord shall, as applicable, caulk and seal any windows and other areas of the facade as required to make the Building water tight.

(g) Landlord shall replace the external vent servicing the grease trap room in the Building with an internal vent.

(h) Landlord shall place walking stones on roof as necessary for Tenant to access any equipment it may have been permitted to install on the roof.

(i) Landlord shall install emergency power servicing the restroom toilets on the third (3rd) floor of the Building so that same will be operational during power outages.

Tenant shall, at no cost to Tenant, cooperate with Landlord in connection with Landlord undertaking the Landlord Work. In addition to the Landlord Work, Tenant shall be entitled to request that Landlord make certain improvements to the ventilation system servicing the area of the Building in which the grease trap

5

is located (“GT Ventilation Improvements”), the cost of which would be paid by Tenant to Landlord within fifteen (15) days after Landlord provides to Tenant an invoice therefor. Landlord will not unreasonably withhold its consent to such GT Ventilation Improvements, provided Landlord determines in its reasonable discretion that such GT Ventilation Improvements do not (i) adversely affect in any material respect the Building’s structure, safety or aesthetics or any electrical, plumbing or mechanical systems of the Building or the functioning thereof; or (ii) interfere in any material respect with the operation of the Building or the use of the Building by, or the provision of services or utilities to, any tenants in the Building. Landlord currently maintains, and shall continue to maintain, the grease trap for the Building in accordance with the maintenance specification attached hereto as Exhibit B. Tenant may request that Landlord increase the level of maintenance of such grease trap and Landlord will not unreasonably withhold its consent to such increased maintenance. The cost of any such increased maintenance shall be paid by Tenant to Landlord, from time to time, within fifteen (15) days after Landlord provides to Tenant an invoice therefor.

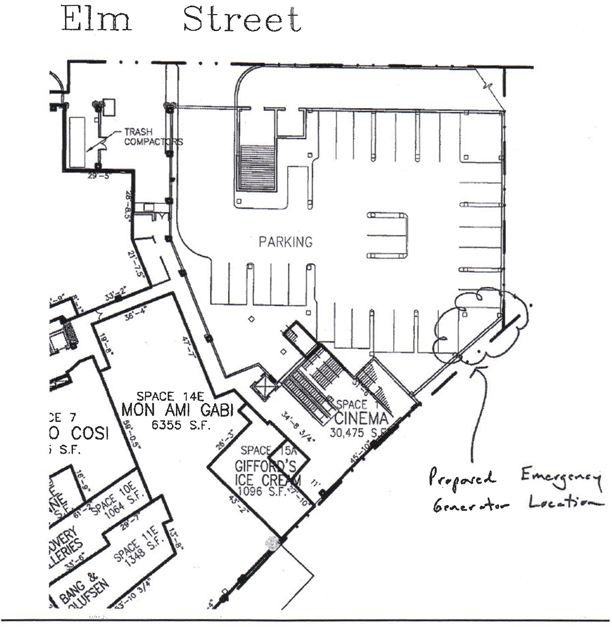

8. Emergency Power. Pursuant to Section 17.25 of the Current Lease, Landlord shall permit Tenant to install a Back-Up Generator in the location set forth in Exhibit A hereto, unless, prior to such installation, Landlord determines in good faith that such Back-Up Generator would cause unacceptable noise or vibrations or would interfere with the use of any parking spaces in the parking area; in which case, Landlord and Tenant shall reasonably agree on a mutually acceptable alternative location for such Back-Up Generator. If Landlord determines in good faith that such Back-Up Generator in the location set forth in Exhibit A would interfere with the use of any parking spaces in the parking area and Tenant agrees (a) to pay each month the prevailing monthly parking rate, from time to time, for such parking spaces, and (b) that such parking spaces shall be deemed to be taken from (and shall not be in addition to) Tenant’s allotted parking spaces, then Landlord will in good faith consider consenting to the installation of the Back-Up Generator in the location set forth in Exhibit A. The method of installation of the Back-Up Generator shall be subject to the reasonable approval of the Landlord, and all terms and conditions set forth in Section 17.25 of the Current Lease shall apply to such Back-up Generator. Tenant shall install a separate meter for measuring electricity consumption of the Back-up Generator, and shall pay the charges for such electricity directly to the appropriate utility company. Tenant shall be responsible for all costs and expenses associated with the design, permitting and installation of the Back-Up Generator, including, without limitation, any additional structural work made necessary by such installation. Tenant shall provide Landlord with plans and specifications for the proposed Back-up Generator prior to the date hereof, which approval shall not be unreasonably withheld, conditioned or delayed.

9. Security Deposit. As of the date of this Amendment, Landlord is holding Tenant’s Security Deposit in the form of a Letter of Credit in the amount of $539,967.70. Within ten (10) days after Tenant’s request, Landlord shall execute and deliver to Tenant such reasonable amendment or consent documents requested by Tenant to reduce the Security Deposit to Four Hundred Seventy-one Thousand One Hundred Twenty-five and 01/100 Dollars ($471,125.01). There shall be no further reduction of the amount of the Security Deposit that Tenant is required to maintain with Landlord; and, accordingly, the provisions of Section 17.07(g) shall be deleted in their entirety.

10. Extension Option. Tenant acknowledges that Landlord (and/or an affiliate) may develop and construct an additional building and associated common areas on the existing parking facility (“New Building Construction”), which may result in substantial disruption and interference with Tenant conducting its business in the Leased Premises and require Tenant to obtain alternative parking during the New Building Construction. On or before January 31, 2019, Landlord will present to Tenant its then current re-development plan and schedule for the New Building Construction, provided Landlord then has such intentions to undertake any New Building Construction. Landlord, in its sole discretion, shall notify Tenant if Landlord desires to present Tenant with an opportunity to extend the term of the Lease (“Extension Notice”); provided, however that Landlord will provide Tenant with such opportunity to extend if Landlord does not then intend to commence any New Building Construction on or before January 31, 2023. Any Extension Notice shall contain various conditions to such extension as Landlord shall specify, including without limitation the right of Landlord to terminate the Lease if Landlord determines that it is desirable that the Leased Premises or portions thereof be vacant during any New Building Construction, waivers from Tenant relating to any disturbance that may result from any New Building Construction and other conditions relating to the New Building Construction. Without limiting the foregoing, neither Landlord, nor any of its affiliates, officers, directors, employees or agents, shall be liable to Tenant, and Tenant shall not be entitled to an abatement of any rent or any other remedy, as a

6

result of any interruption or disturbance of Tenant’s business resulting from the New Building Construction. If Tenant elects to proceed with any such opportunity presented to Tenant in the Extension Notice on the terms set forth therein (including without limitation, Tenant’s acceptance of the conditions of the Landlord’s redevelopment plan relating to the New Building Construction), Tenant shall notify Landlord thereof in writing (the “Extension Acceptance Notice”) on or before January 31, 2020, which Extension Acceptance Notice shall include an approval of Landlord’s overall development plan and conditions described in the Extension Notice and Tenant’s desired extension period, which shall not be less than 3.5 years nor longer than 10 years. If Tenant fails to timely provide to Landlord such Extension Acceptance Notice as provided above, Tenant shall have no further rights under this Paragraph 10. Landlord shall, within ninety (90) days of receipt of Tenant’s Extension Acceptance Notice, deliver to Tenant a proposed amendment or new lease reflecting the terms on which Landlord would be willing to continue to lease the Leased Premises to Tenant for the desired extension term reflected in the Extension Acceptance Notice; provided, however, that the Minimum Rent for such extension term shall be at the Market Rate for the extension period as determined pursuant to the provisions of Section 3.04 of the Lease. Tenant shall have thirty (30) days to execute and deliver to Landlord such amendment or lease proposed by Landlord; otherwise Tenant shall have no further rights under this Paragraph 10. The provisions of this Paragraph 10 shall be personal to OPNET Technologies, Inc., and no assignee (other than to a Qualified Tenant Affiliate in connection with an assignment of the Lease) or sublessee of Tenant shall have any extension rights hereunder. Except for the determination of Market Rate set forth in Section 3.04 of the Current Lease, the provisions of Section 3.04 shall be void and of no further force or effect and Tenant shall have no rights with respect to any renewal or extension of the Term of the Lease, except as set forth in this Paragraph 10. Notwithstanding anything contained herein or in the Lease to the contrary, the determination of the Market Rate shall not take into consideration the redevelopment of the Building or adjacent building or the New Building Construction or any disturbance to Tenant that may result therefrom. Time shall be of the essence with respect to Tenant’s obligations hereunder.

11. Short Term Extension Option. Landlord hereby grants Tenant the one time option (the “Short Term Extension Option”) to extend the Term for three (3) months (the “Short Term Extension Term”). Tenant shall have no right to an extension of the Term if at the time Tenant delivers the ST Extension Exercise Notice, or at the time the applicable Short Term Extension Term would have otherwise commenced, Tenant (i) has then assigned this Lease (other than to a Qualified Tenant Affiliate); (ii) is then in Default; or (iii) has delivered an Extension Acceptance Notice pursuant to Paragraph 10 hereof. To exercise the Short Term Extension Option, Tenant shall give notice (“ST Extension Exercise Notice”) of its exercise to Landlord not earlier than November 30, 2019 and not later than January 31, 2020. If Tenant is entitled to and gives Landlord the ST Extension Exercise Notice in accordance with the terms of this Paragraph 11, the Term shall be extended for the period of the Short Term Extension Term commencing on the day after expiration of the current Term, and except as set forth below the terms and condition of the Lease shall continue to apply during such Short Term Extension Term. Minimum Rent during the Short Term Extension Term shall be the Minimum Rent for the period immediately prior to the Short Term Extension Term increased by 3.75% for the Office Premises and 2.5% for the Storage Space. The provisions of this Paragraph 11 shall be personal to OPNET Technologies, Inc., and no assignee (other than to a Qualified Tenant Affiliate in connection with an assignment of this Lease) or sublessee of Tenant shall have any extension rights hereunder. Landlord will not make or pay for, and has no obligation to make or pay for, any alterations, decorations, additions or improvements in or to the Leased Premises from its then “as is” condition or provide any allowance in connection with Tenant exercise of the Short Term Extension Option.

12. Holdover. The last sentence of Section 3.03 of the Lease shall be void and of no further force or effect.

13. Self-Help.

(a) In the event that for reasons, not caused by Tenant (or any of its employees or agents) or an event of Force Majeure, Landlord fails to provide any services or utility or perform any repairs or maintenance for the Leased Premises required of Landlord under the Lease (and such failure continues after Landlord has been provided notice thereof and a reasonable period within which to cure such failure) and such failure materially impairs Tenant’s use and occupancy of the Leased Premises (collectively, the “Cure Conditions”), then Tenant may deliver written notice (“Cure Notice”) to Landlord stating that Tenant intends to perform such repair or maintenance. Prior to Tenant undertaking any action to cure or remedy such condition, Tenant shall first allow Landlord and Landlord’s lender(s) thirty (30) days following receipt by Landlord of such Cure

7

Notice to cure or remedy the event or condition specified in Tenant’s notice; provided, however, if such default cannot be with reasonable diligence be cured within said thirty (30) day period, this period shall be extended for such longer period as may be reasonably required to effect such cure, provided that Landlord or Landlord’s lender commences to cure such default within such thirty (30) days and proceeds diligently thereafter to effect such cure (the “Final Cure Period”). If Landlord or Landlord’s lender(s) fails to cure or remedy such condition within such Final Cure Period, then Tenant, at Tenant’s option, may immediately commence to cure or remedy such condition (i.e., perform such repair or maintenance). Should Tenant take action to make such repairs or take such action as necessary to rectify such Cure Conditions when permitted to do so pursuant to the provisions hereof, then Tenant shall have the right to deliver an invoice to Landlord for the reasonable (and competitive) and actual out-of-pocket costs and expenses incurred by Tenant therefor (“Reimbursable Costs”); and Landlord shall pay to Tenant the amount of such invoice within thirty (30) days after delivery of such invoice by Tenant.

(b) In no event shall Tenant be entitled to exercise the cure rights set forth above with respect to any base Building systems or structural components, (except with respect to any base Building systems within the Leased Premises (provided that the work performed by Tenant within the Premises could not affect any other part of the Building or any services provided to any other part of the Building or occupant of the Building).

(c) In the event Tenant exercises its right hereunder to cure any Cure Conditions, Tenant shall (i) proceed in accordance with the applicable provisions of this Lease and all applicable legal requirements; (ii) use only qualified contractors duly licensed in the State of Maryland, which may include Landlord’s contractors, provided that Landlord provides to Tenant the names of such contractors within three (3) days after Landlord receives a written request therefor; (iii) upon commencing such repairs, complete the same within a reasonable period of time, (iv) effect such repairs in a good and workmanlike quality; (v) use new materials; (vi) minimize any interference or impact on any other tenants and occupants of the Building; and (vii) indemnify and hold Landlord and its lender(s) harmless from any and all liability, damage and expense arising from injury to persons or personal property arising out of or resulting from Tenant’s exercise of such rights.

(d) In the event that Landlord does not reimburse Tenant for Tenant’s Reimbursable Costs related to any and all work associated with rectifying the Cure Conditions, including the costs and expenses incurred and paid by Tenant for design, engineering, permitting, administration, management and construction of necessary work, within thirty (30) days of Tenant’s invoice, Tenant may deduct such amounts against the next due installments of Minimum Rent due under the Lease, provided, however, in no event shall Tenant offset more than thirty percent (30%) of any installment of Minimum Rent due for any month.

14. Surface Parking Lot. Notwithstanding anything contained in the Lease to the contrary and without limiting any other right of Landlord under the Lease, Landlord shall have the right to use any or all of the surface parking area serving the Building during non-Building Hours for special activities, including without limitation to permit the use thereof as a “farmer’s market” and for promotional and other similar activities; provided, however, that in the event Tenant has parked cars in the surface parking lot prior to the commencement of such activities, Tenant shall have no obligation to move its vehicles in order to accommodate such activities.

15. Landlord’s Insurance. Section 8.08 of the Current Lease shall be modified by deleting the phrase “at least eighty percent (80%)” and replacing it with the term “one hundred percent (100%).”

16 Permitted Occupants. During the term of the Lease (including any renewal or extension terms), Tenant shall have the right to permit the use of portions of the Leased Premises (not exceeding thirty percent (30%) in the aggregate of the total rentable square footage of the Leased Premises), without Landlord’s consent (but with at least 30 days prior notice), by persons or entities who are Permitted Occupants provided that Permitted Occupants (i) operate as an integrated whole with Tenant’s business in the Leased Premises with no separate entrances to the Leased Premises; (ii) do not display signs that are visible from the exterior of the Leased Premises, and (iii) use the space for general office use and operate in accordance with the terms and conditions of the Lease. “Permitted Occupants,” shall mean persons, entities, related corporations, consultants, business associates, business partners, clients or customers of Tenant, who are occupying space on a written contractual basis with Tenant and are either performing services for Tenant as subcontractors, contractors or vendors under Tenant’s contracts or are personnel employed by persons or entities for whom Tenant is performing services on a contractual basis. Any act, omission or default of any provision of the Lease caused by any such Permitted

8

Occupants shall be deemed an act, omission or default by Tenant. Nothing contained in the Lease (including the provisions of this Paragraph 16) or otherwise (including the provision of any services to the Leased Premises) shall be deemed to (a) create any landlord-tenant or other relationship between Landlord and any Permitted Occupant, or (b) create any liability or obligation on the part of Landlord to any Permitted Occupant.

17. Broker. Landlord shall pay the commission payable to Jones Lang LaSalle (“Broker”) in connection with this Amendment pursuant to a separate agreement between the Broker and Landlord. Landlord and Tenant each represent and warrant one to the other that if either has engaged any broker or agent (other than the Broker) in carrying on the negotiations relating to this Amendment, then the party that has engaged such broker or agent will pay any brokerage commission payable to said broker or agent. Tenant shall and does hereby indemnify, hold harmless and defend Landlord from and against any and all claims, loss, damage, cost or expense (including, without limitation, reasonable attorneys’ fees and all court costs) arising out of any breach of the foregoing representation and warranty by Tenant or any purported or actual dealings by Tenant and any broker or agent other than the Broker. Landlord shall and does hereby indemnify, hold harmless and defend Tenant from and against any and all claims, loss, damage, cost or expense (including, without limitation, reasonable attorneys’ fees and all court costs) arising out of any breach of the foregoing representation and warranty by Landlord. Any representation or statement by a leasing company or other third party (or employee thereof) engaged by Landlord as an independent contractor which is made with regard to the Leased Premises or the rest of the Building or the Property shall not be binding upon Landlord nor serve as a modification of the Lease or this Amendment and Landlord shall have no liability therefor, except to the extent such representation is also contained in the Lease or herein.

18. Financial Statements. If Tenant is a corporation having its outstanding voting stock listed on a national securities exchange (as defined in the Securities Exchange Act of 1934), then the financial statements may be provided to Landlord by Tenant delivering to Landlord Tenant’s annual report within fifteen (15) days after Landlord’s written request therefor, unless such information is publicly available through EDGAR (or such other computer system for the Securities and Exchange Commission as is available) on the internet.

19. Replacement of Existing Signs. Tenant, at Tenant’s sole cost and expense, shall be entitled to replace the two (2) existing Opnet signs on the front of the Building with two (2) signs (the “Replacement Signs”) identifying “Opnet” that are similar in size and style to the Opnet sign currently on the 7250 Building, provided that such Replacement Signs are permitted under the laws, rules and regulations of the Montgomery County, Maryland and any other governmental authorities having appropriate jurisdiction over the Building and comply with the other requirements for Permitted Exterior Signage set forth in the Lease. The exact style, dimensions and location of the Replacement Signs shall be subject to Landlord’s prior review and written approval, which may be withheld in Landlord’s sole discretion. Such Replacement Signs governed by all the terms and conditions governing Permitted Exterior Signage. In addition, Tenant shall be entitled, at its sole cost and expense, to relocate one or both of the Opnet signs currently on the front facade of the Building to other locations on the front facade of the Building, provided that such location is approved by Landlord in its sole and absolute discretion. Landlord also reserves the right to approve in its sole discretion the manner in which any of the foregoing signs are affixed to the Building.

20. Ratification. Except as expressly amended by this Amendment, all other terms, conditions and provisions of the Lease are hereby ratified and confirmed and shall continue in full force and effect.

21. Representations. Tenant hereby represents and warrants to Landlord that Tenant (i) is not in default of any of its obligations under the Lease and that such Lease is valid, binding and enforceable in accordance with its terms, (ii) has full power and authority to execute and perform this Amendment, and (iii) has taken all action necessary to authorize the execution and performance of this Amendment.

22. Miscellaneous. This Amendment (i) shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns (subject to the restrictions on assignment set forth in the Lease), (ii) shall be governed by and construed in accordance with the laws of the State of Maryland, and (iii) may be executed in multiple counterparts, each of which shall constitute an original and all of which shall constitute one and the same agreement.

[signatures on following page]

9

IN WITNESS WHEREOF, the parties hereto have set their hands and seals the day and date set forth above.

| LANDLORD: | ||||||||

| WITNESS: | STREET RETAIL, INC., a Maryland corporation | |||||||

|

|

By: |

| ||||||

| Name: | Deborah A. Colson | |||||||

| Title: | Vice President-Legal Operations | |||||||

| WITNESS: | TENANT: | |||||||

| OPNET TECHNOLOGIES, INC., a Delaware corporation | ||||||||

| By: |

|

By: |

| |||||

| Name: Alberto Morales | Name: Alain J. Cohen | |||||||

| Title: Senior Vice President, Chief Information Officer | Title: President and Chief Technology Officer | |||||||

EXHBIT A

LOCATION OF BACK-UP GENERATOR

EXHIBIT B

GREASE TRAP MAINTENANCE SPECIFICATIONS

Both the grease trap and lift station are cleaned once every moth. Grease trap is pumped out and pressure washed every month. The outlet is jetted every month to the lift station to prevent any backups. Lift station is pumped and pressure washed out every month. Pump system is checked for proper operation once floats, pumps and the tank have been cleaned. Every quarter, enzymes are put into the lift station to solidify any unforeseen grease build up areas and help maintain the grease from clumping up.