Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Comstock Holding Companies, Inc. | d8k.htm |

Investor Presentation

May 31, 2011

Exhibit 99.1

*

*

*

*

*

*

*

*

*

*

*

*

****************************** |

| Disclaimer

Certain

matters

discussed

throughout

all

of

this

presentation

constitute

forward-looking

statements

within

the

meaning

of

the

federal

securities

laws.

Generally,

our

use

of

words

such

as

“expect,”

“estimate,”“believe,”

“anticipate,”

“will,”

“forecast,”

“plan,”

“project,”

“assume”

or

similar

words

of

futurity

identify

statements

that

are

forward-looking

and

that

we

intend

to

be

included

within

the

Safe

Harbor

protections

provided

by

Section

27A

of

the

Securities

Act

and

Section

21E

of

the

Securities

Exchange

Act

of

1934.

Such

forward-looking

statements

are

based

on

management’s

current

beliefs,

assumptions

and

expectations

regarding

future

events,

which

in

turn

are

based

on

information

currently

available

to

management.

Such

statements

may

relate

to

projections

for

the

company’s

revenue,

earnings,

cash

flow

and

other

financial

and

operational

measures,

company

debt

levels,

and

future

operations.

We

caution

you

not

to

place

undue

reliance

on

any

forward-looking

statements,

which

are

made

as

of

the

date

of

this

presentation.

Forward-looking

statements

do

not

guarantee

future

performance

and

involve

known

and

unknown

risks,

uncertainties

and

other

factors.

Several

factors

could

cause

actual

results,

performance

or

achievements

of

the

company

to

differ

materially

from

those

expressed

in

or

contemplated

by

the

forward-looking

statements.

Such

risks

include,

but

are

not

limited

to,

changes

to

general,

domestic

and

foreign

economic

conditions

and

operating

risks

common

in

the

real

estate

and

homebuilding

industries.

These

and

other

risk

factors

are

discussed

in

detail

in

the

Risk

Factors

section

of

the

company’s

Form

10-K

for

the

year

ended

December

31,

2010,

filed

with

the

Securities

and

Exchange

Commission.

We

undertake

no

obligation

to

publicly

update

or

revise

any

forward-looking

statement,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

1 |

Investment

Thesis

–

Why

Comstock?

Unique “story”

in the publicly traded real estate space

Experienced

real

estate

management

team

operating

through

a

publicly

traded

business

platform

Deep knowledge of target Washington DC market; proprietary deal flow

No

significant

“legacy”

issues

as

is

common

in

the

industry

-

not

encumbered

by

large

land

holdings

or

unfinished communities

Restructured balance sheet

Rationalized cost structure

$12.5

million

pending

award

judgment,

when

collected,

will

provide

additional

growth

capital (assuming the

pending appeal of the award is concluded in a manner favorable to us)

$72

million

of

available

NOL’s

that may

potentially

offset

future

taxable

income

Significant

insider

ownership

and

sponsorship

2 |

Comstock Overview

We

are

a

multi-faceted

real

estate

development

and

services

company

with

substantial

experience

in

building

a

diverse

range

of

products

including

single-family

homes,

townhomes,

mid-rise

condominiums,

high-rise multi-

family

condominiums

and

mixed-use

(residential

and

commercial)

developments.

Since

our

founding

in

1985,

and

as

of

December

31,

2010,

we

have

built

and

delivered

more

than

5,200

homes

generating

revenue

in

excess

of

$1.3

billion.

In

December

2004,

we

completed

our

initial

public

offering

(NASDAQ:CHCI).

In

2005,

we

began

executing

expansion

plans

and

established

operations

in

key

markets

throughout

the

Southeast.

Notably,

during

2006

we

increased

revenues

to

$266

million.

However,

during

2007

it

became

clear

that

the

unprecedented

span

of

growth

in

the

housing

sector

was

quickly

ending.

Drawing

on

the

valuable

experience

our

management

team

had

gained

in

previous

downturns,

we

expeditiously

curtailed

expansion

plans

and

adopted

a

defensive

strategy

that

allowed

us

to

survive

the

housing

downturn.

We

quickly

sold

certain

assets

and

worked

closely

with

our

existing

lenders

to

amicably

renegotiate

the

terms

of

project

related

and

corporate

borrowings,

which

had

peaked

at

$340

million

as

of

September

30,

2006.

In

2009,

we

established

our

Strategic

Realignment

Plan

(the

“Strategic

Realignment

Plan”).

The

Strategic

Realignment

Plan

was

designed

to

eliminate

debt,

further

reduce

expenses,

enhance

our

balance

sheet,

conserve

cash,

and

protect

key

Washington,

D.C.

market

assets.

By

the

end

of

2009,

we

had

successfully

renegotiated

substantially

all

of

our

secured

debt

obligations

and

reduced

total

debt

to

$68

million

($

28.4

million

as

of

December

31,

2010).

We

believe

that

having

achieved

the

major

objectives

of

the

Strategic

Realignment

Plan

(which

eliminated

or

reduced

corporate

and

project

related

debt

while

disposing

of

noncore

assets

where

market

values

had

deteriorated)

ultimately

allowed

for

the

retention

of

core

assets

in

the

Washington,

D.C.

market.

3 |

Our

Operating Market – Washington, DC

We

are

exclusively

focused

on

the

Washington,

D.C.

market

which

is

the

eighth

largest

metropolitan

statistical

area

in

the

United

States.

Our

expertise

in

developing

traditional

and

non-traditional

housing

products

enables

us

to

focus

on

a

wide

range

of

opportunities

within

our

core

market.

We

have

built

homes

and

apartment

buildings

in

suburban

communities,

where

we

focus

on

low

density

products

such

as

single

family

detached

homes,

and

in

urban

areas,

where

we

focus

on

high

density

multi-family

and

mixed

use

products.

For

our

homebuilding

operations,

we

develop

properties

with

the

intent

that

they

be

sold

either

as

fee-simple

properties

or

condominiums

to

individual

unit

buyers

or

as

investment

properties

sold

to

private

or

institutional

investors.

Our

apartment

buildings

are

developed

as

rental

properties

to

be

held

and

operated

for

our

own

purposes,

converted

at

some

point

to

for-sale

condominium

units

or

sold

on

a

merchant

build

basis.

We

target

first-time,

early

move-up,

and

secondary

move-up

buyers

with

our

homebuilding

product.

We

focus

on

products

that

we

are

able

to

offer

for

sale

in

the

middle

price

points

within

the

markets

where

we

operate,

avoiding

the

very

low-end

and

high-end

products.

We

believe

our

middle

market

strategy

positions

our

products

such

that

they

are

affordable

to

a

significant

segment

of

potential

home

buyers

in

our

market.

We

believe

that

our

significant

experience

over

the

past

25

years,

combined

with

our

ability

to

navigate

through

two

major

housing

downturns

(early

1990’s

and

late

2000’s)

have

provided

us

the

experience

necessary

to

capitalize

on

attractive

opportunities

in

our

core

market

of

Washington,

D.C.

and

to

rebuild

shareholder

value.

We

believe

that

our

focus

on

the

Washington,

D.C.

market,

which

has

historically

been

characterized

by

economic

conditions

less

volatile

than

many

other

major

homebuilding

markets,

will

provide

an

opportunity

to

generate

attractive

returns

on

investment

and

for

growth.

4 |

| Comstock’s Business Plan

*

*

*

*

*

*

*

*

*

*

* |

Our

Business Strategy Our

business

strategy

is

designed

to

leverage

our

extensive

capabilities

and

market

knowledge

to

maximize

returns

on

invested

capital

on

our

various

real

estate

related

activities.

We

execute

our

strategy

through

three

related

business

units:

•

Homebuilding

–

We

target

new

home

building

opportunities

where

our

building

experience

and

ability

to

manage

highly

complex

entitlement,

development

and

distressed

assets

provides

us

with

a

competitive

advantage.

•

Apartments

–

We

seek

opportunities

in

the

multi-family

rental

market

where

our

experience

and

core

capabilities

can

be

leveraged.

We

will

either

position

the

assets

for

sale

to

institutional

buyers

when

completed

or

operate

the

asset

within

our

own

portfolio.

Operating

the

asset

for

our

own

account

affords

us

the

flexibility

of

converting

the

units

to

condominiums

in

the

future.

•

Real

Estate

Services

–

Our

management

team

has

significant

experience

in

all

aspects

of

real

estate

including

strategic

planning,

land

development,

entitlement,

property

management,

sales

and

marketing,

workout

and

turnaround

strategies

and

general

construction.

We

provide

a

wide

range

of

construction

management

and

general

contracting

services

to

other

property

owners.

This

business

line

not

only

allows

us

to

generate

positive

fee

income

from

our

highly

qualified

personnel

but

also

serves

as

a

potential

catalyst

for

joint

venture

and

acquisition

opportunities.

These

business

units

work

in

concert

and

leverage

the

collective

skill

sets

of

our

organization.

The

talent

and

experience

of

our

personnel

allows

workflow

flexibility

and

a

multitasking

approach

to

managing

various

projects.

In

a

capital

constrained

environment,

we

use

creative

problem

solving

and

financing

approaches

by

working

closely

with

banks,

borrowers

and

other

parties

in

an

effort

to

generate

value

for

all

constituents.

We

believe

that

our

business

network

within

the

Washington,

D.C.

real

estate

market

provides

us

a

competitive

advantage

in

sourcing

and

executing

investment

opportunities.

6 |

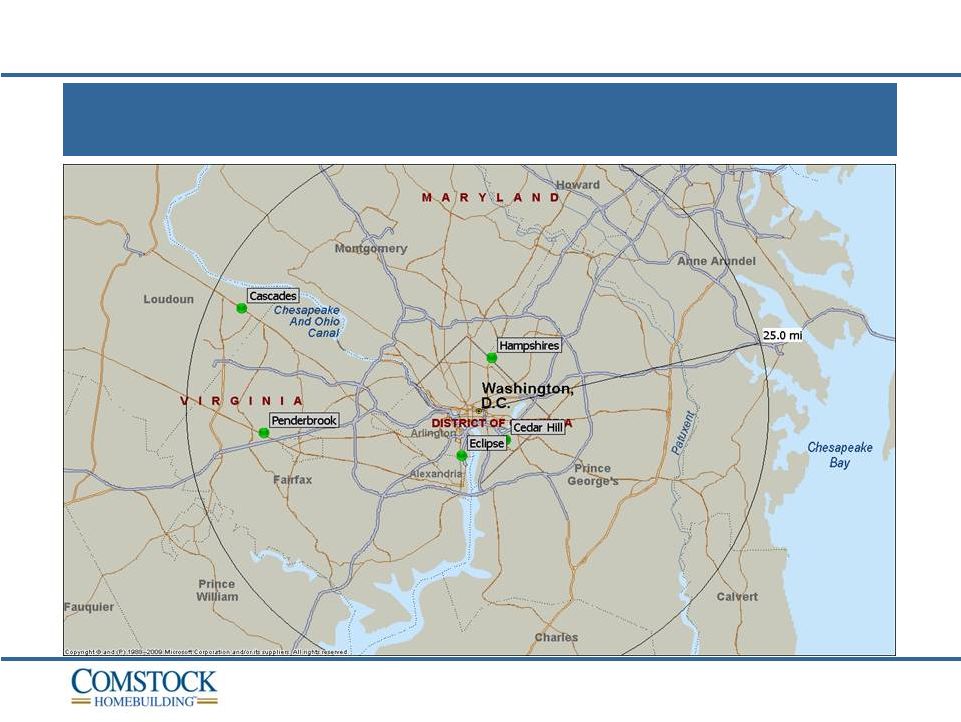

7

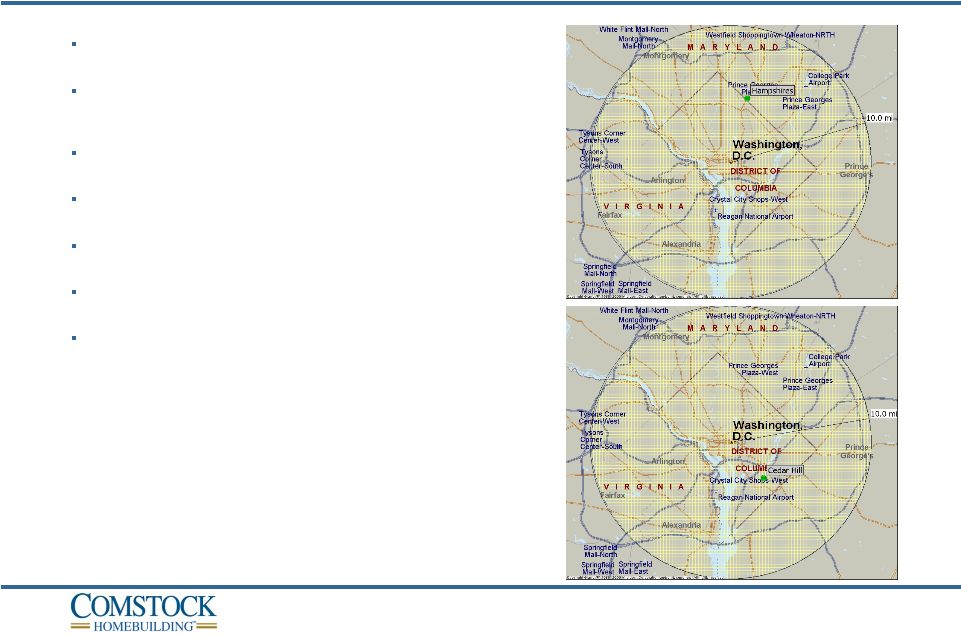

Comstock Concentrated Approach

Three Business Lines Concentrated In One Favorable Market

Washington,

D.C.

Metropolitan

Area

–

Among

Best

Performing

Real

Estate

Markets |

| Current

Projects *

*

*

*

*

*

*

*

*

*

*

* |

9

Comstock Communities

The strength of the Washington, DC economy, increased demand for rental housing and

stabilizing conditions in the new home market provides an attractive opportunity to

maximize the value of each Comstock development

|

10

Penderbook (Penderbrook Square) |

11

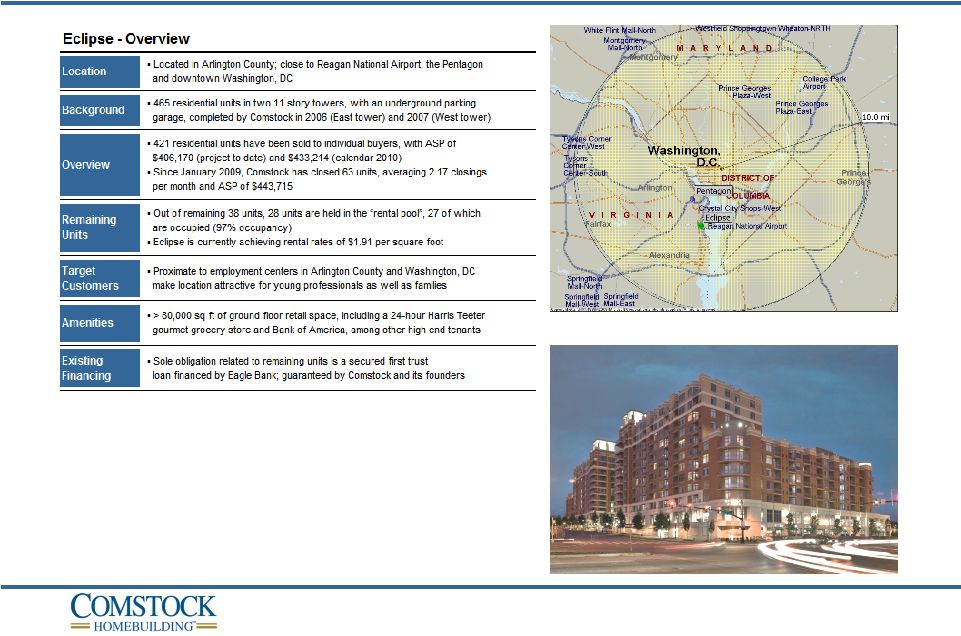

Eclipse (The Eclipse on Center Park at Potomac Yard) |

12

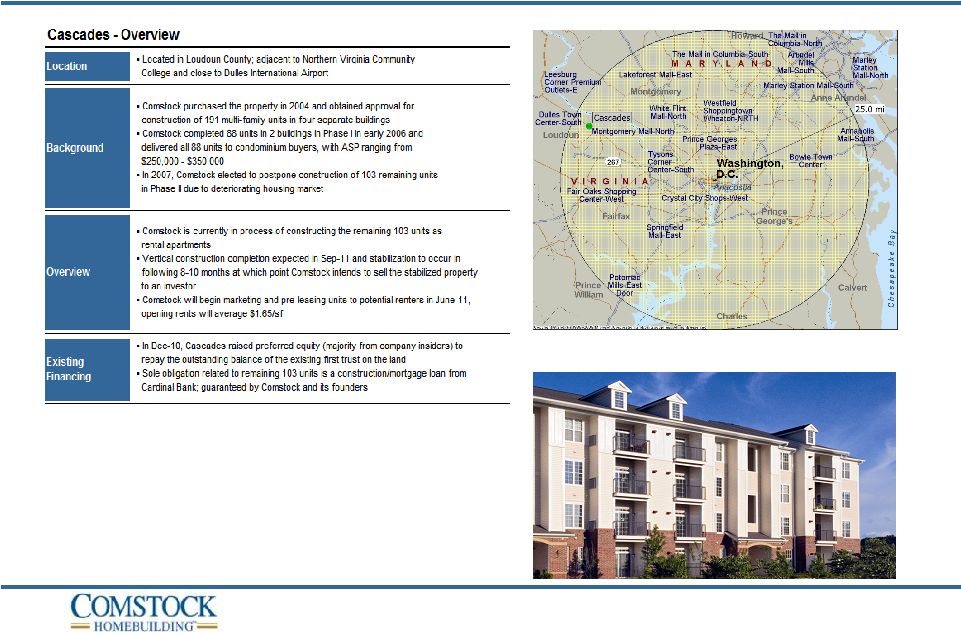

Cascades (The Commons on Potomac Square) |

13

Hampshires and Cedar Hill

The

Hampshires

and

Cedar

Hill

will

be

developed

as

a

result

of

a

joint

venture

between

Comstock

and

Four

Points,

LLC

Four

Points,

LLC

is

contributing

the

land

and

Comstock

will

manage

the

onsite

development,

construction

and

marketing

of

the

projects,

as

well

as

project

financing

The

Hampshires

is

located

in

close

proximity

to

2

Metro

stations

in

Northeast

Washington,

DC

Cedar

Hill

is

located

in

the

southeast

Washington,

DC,

near

the

home

of

the

Washington

Nationals

baseball

team

Comstock

plans

to

commence

site

improvements

and

construction

on

both

communities

as

soon

as

final

permits

are

obtained,

expected

in

2011

The

Hampshires

will

include

37

single

family

detached

homes

and

73

townhomes

Cedar

Hill

will

include

a

40

units,

including

1

single

family,

7

townhomes

and

32

townhome

style

condominiums |

Improved Financial Position |

Financial Restructuring –

Significant Improvement in Overall Financial Position

Comstock has restructured its balance sheet

Reduced debt load from a peak of over $340 million to less than $30 million in

2011 Only maturity in 2011 is $6.2 million Penderbrook secured loan which we

believe we have the ability to refinance

Eclipse secured $12 million loan was successfully refinanced Eclipse in February

2011 New lending relationship created with closing of $11 million

construction/permanent loan for the Cascades 103 unit apartment development

in February 2011 Management routinely explores additional debt and equity

financing opportunities that could enhance Comstock’s ability to

enhance results and shareholder value Comstock has restructured its

operations Significant reductions in overhead: streamlined operations

Selling, general and administrative expenses down from $37.5 million in 2006 to

$5.6 million in 2010 Experienced real estate management team remains with

diverse financial and operating backgrounds Management has reinvested in the

business Senior management has significant capital invested in the business,

including recent investments Recent capital raise for newly constructed

Cascades apartment project has significant inside equity ownership

15 |

Well

Positioned For Return To Profitability Focused

on

Washington,

DC

market,

widely

regarded

as

best

real

estate

market

in

nation

Experienced

management

team

with

unique

operating

model,

ability

to

develop

wide

range

of

housing

products,

including

single

family

homes

in

suburban

areas

to

mixed-use

and

high

density

products

in

urban

areas

where

high

density

products

are

favored

Positioned

to

quickly

and

effectively

identify,

pursue

and

execute

against

strategic

opportunities

Key

assets

(Eclipse

and

Penderbrook)

provide

cash

flow

to

support

operating

activities

Creating

new

value

through

new

business

units

(rental

apartments

and

contracting/real

estate

services)

Eclipse

judgment

award

(approximately

$12.5

million),

when

collected,

will

provide

additional

growth

capital

(assuming the pending appeal of the award is concluded in a manner favorable to

us) Comstock

has

deferred

tax

asset

of

NOL’s

that

is

estimated

to

be

$72

million

gross

or

$27

million

of

tax

savings

(subject

to

IRC

sec.

382

limitations) which may be available to offset future taxable income

16 |

Conclusion |

Why

Comstock Is Positioned To Rebuild Its Business And Increase Shareholder Value

While

the

national

housing

recovery

continues

to

seek

solid

footing,

Comstock’s

focus

on

the

Washington,

DC

market

and

its

diverse

real

estate

development

platform

provides

opportunities

to

build

its

business,

increase

revenues,

and

return

to

profitability

Comstock’s

single

market

focus

is

on

the

strongest

real

estate

market

in

the

nation

Job

growth

in

the

Washington

region

continues

to

outpace

national

trends,

causing

unemployment

rate

to

be

among

the lowest

in

the nation

while

regional

per

capita

income

continues

to

be

among

highest

in

nation

Population

growth

follows

job

growth,

adding

stability

to

the

Washington,

DC

housing

market

Housing

demand

and

price

stability

in

the

Washington,

DC

area

continues

to

outpace

national

trends

Housing

affordability

is

high

due

to

low

mortgage

rates

and

reduced

prices,

but

mortgage

financing

is

challenging

for

many,

leading

to

increased

demand

for

quality

rental

housing,

occupancy

rates

among

highest

in

nation,

and

increasing

rental

rates

Recent

demographic

shifts

and

high

transportation

costs

are

increasing

demand

for

new

housing

in

close-

in,

urban

areas

where

mixed-use

and

high

density

housing

is

favored

Comstock’s

diverse

capabilities

and

“Real

Estate

Opportunity

Fund”

approach

enables

it

to

adapt

to

changing trends in housing and capitalize on attractive opportunities

Our

experience

successfully

navigating

two

major

housing

industry

downturns

(early

1990’s

&

late

2000’s)

provides

invaluable

insight

to

market

cycles

and

shifts

in

housing

demand

in

the

Washington,

DC

region

Our

experience

developing

a

diverse

range

of

housing

products

(from

suburban

single

family

homes

to

urban,

mixed-use

and

high

density

buildings)

provides

Comstock

significant

competitive

advantages

Our

new

community

development

strategy

ensures

Comstock

assets

are

positioned

to

capitalize

on

demand

for

rental

properties

and

for-sale

properties

Management

believes

it

will

succeed

in

rebuilding

shareholder

value

in

the

near

term utilizing limited

capital resources.

Given

our limited

share

universe,

our

cash

flow

“backlog”

and

tax

attributes

($72M+

NOL’s),

our

earnings

per share

are

highly

sensitive

to

relatively

small

EBITDA

increases.

18 |