UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A-1

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): March 15, 2011

PSM Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

333-151807

|

90-0332127

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

1112 N. Main Street, Roswell, NM

|

88201

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (575) 624-4170

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| [ ] | Written communications pursuant to Rule 425 under the Securities Act | |

| [ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act | |

| [ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act | |

| [ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Item 9.01 Financial Statements and Exhibits

On March 16, 2011, our acquisition of United Community Mortgage Corporation (“UCMC”), a New Jersey corporation, was completed. A report on Form 8-K disclosing the transaction was filed with the Commission on March 17, 2011. The following audited financial statements of UCMC and pro forma financial information required pursuant to this item for this transaction are included with this amended report:

(a) Financial statements of business acquired. (page 3)

Independent Auditor's Report - 2010 (page 3)

Balance Sheets at December 31, 2010 and 2009

Statements of Income for the Years Ended December 31, 2010 and 2009

Statements of Changes in Stockholders’ Equity for the Years Ended December 31, 2010 and 2009

Statements of Cash Flows for the Years Ended December 31, 2010 and 2009

Notes to Financial Statements for the Years Ended December 31, 2010 and 2009

Independent Auditor's Report - 2009 (page 14)

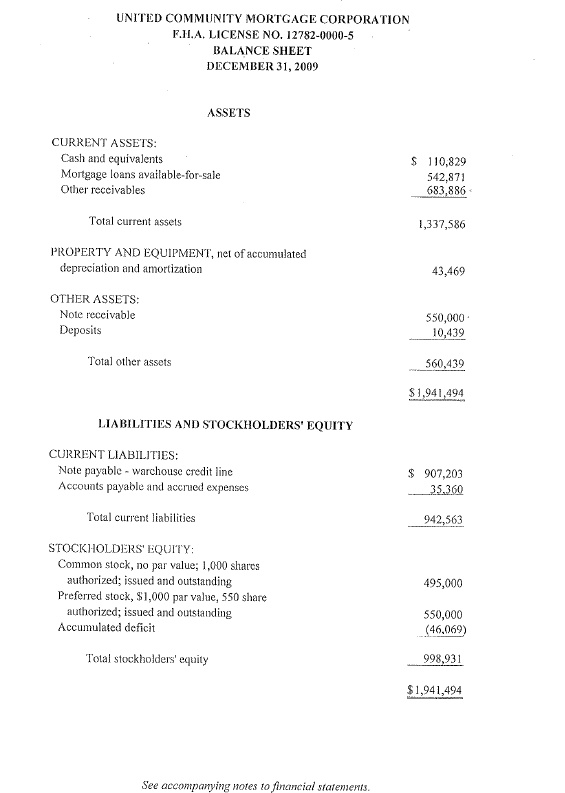

Balance Sheet at December 31, 2009

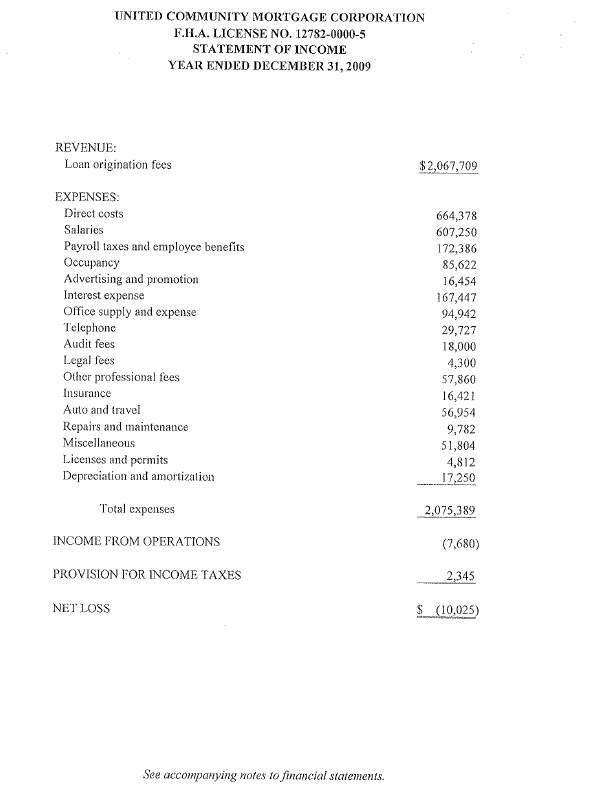

Statement of Income for the Year Ended December 31, 2009

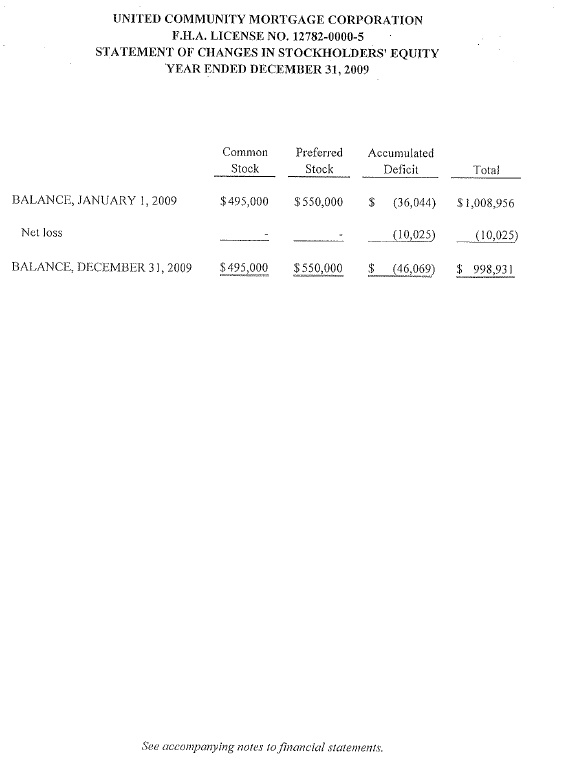

Statement of Changes in Stockholders’ Equity for the Year Ended December 31, 2009

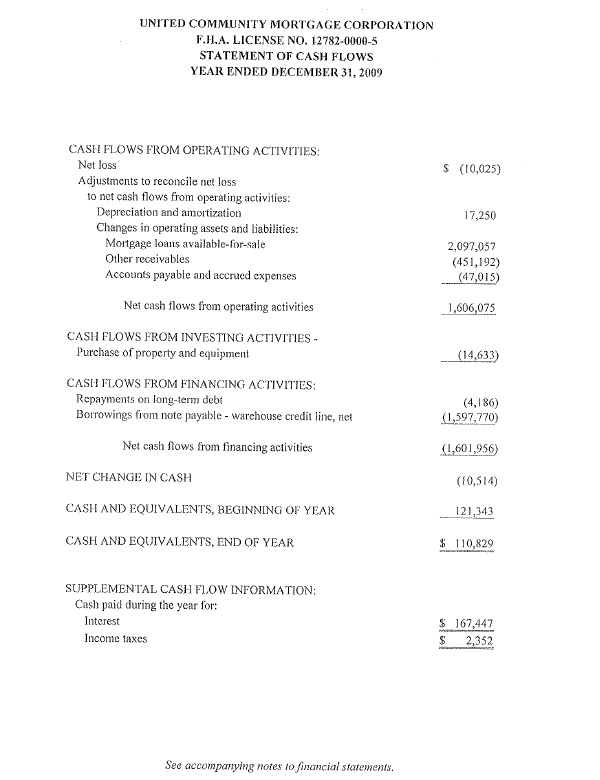

Statement of Cash Flows for the Year Ended December 31, 2009

Notes to Financial Statements for the Year Ended December 31, 2009

(b) Pro forma financial information. (page 24)

Pro forma financial information required by this item is included in this amended report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this amended report to be signed on its behalf by the undersigned hereunto duly authorized.

|

PSM Holdings, Inc.

|

|||

|

Date: May 31, 2011

|

By:

|

/s/ Ron Hanna | |

| Ron Hanna, President | |||

2

(a) Financial statements of business acquired.

UNITED COMMUNITY MORTGAGE CORPORATION

FINANCIAL REPORT

DECEMBER 31, 2010 AND 2009

3

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

CONTENTS

|

PAGE

|

|||||||||

|

INDEPENDENT AUDITOR'S REPORT - 2010

|

5

|

||||||||

|

FINANCIAL STATEMENTS:

|

|||||||||

|

Balance Sheets

|

6

|

||||||||

|

Statements of Income

|

7

|

||||||||

|

Statements of Changes in Stockholders' Equity

|

8

|

||||||||

|

Statements of Cash Flows

|

9

|

||||||||

|

Notes to Financial Statements

|

10-13

|

||||||||

4

INDEPENDENT AUDITOR’S REPORT

To the Stockholders of

United Community Mortgage Corporation

Keyport, New Jersey

I have audited the accompanying balance sheet of the United Community Mortgage Corporation as of December 31, 2010 and the related statements of income, changes in stockholders’ equity, and cash flows for the year then ended. The financial statements are the responsibility of the Company’s management. My responsibility is to express an opinion on these financial statements based on my audit. The financial statements of United Community Mortgage Corporation as of December 31, 2009, were audited by other auditors whose report dated March 27, 2010,expressed an unqualified opinion on those statements.

I conducted my audit in accordance with auditing standards generally accepted in the United States of America. Those standards require that I plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes consideration of internal control over financial reporting as a basis for designing procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting. An audit also includes examining, on a test basis, evidence supporting the amount and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. I believe that my audit provide a reasonable basis for my opinion.

In my opinion, the 2010 financial statements referred to above present fairly, in all material respects, the financial position of the United Community Mortgage Corporation as of December 31, 2010, and the results of its operations, changes in stockholders’ equity, and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

Matawan, New Jersey

April 12, 2011

5

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

BALANCE SHEETS

DECEMBER 31, 2010 AND 2009

|

ASSETS

|

||||||||

|

2010

|

2009

|

|||||||

|

CURRENT ASSETS

|

||||||||

|

Cash and equivalents

|

$ | 228,469 | $ | 110,829 | ||||

|

Other receivables

|

856,213 | 683,886 | ||||||

|

Mortgage loans available-for-sale

|

- | 542,871 | ||||||

|

Total current assets

|

1,084,682 | 1,337,586 | ||||||

|

PROPERTY AND EQUIPMENT, Net of accumulated depreciation and amortization

|

19,219 | 43,469 | ||||||

|

OTHER ASSETS

|

||||||||

|

Note receivable

|

- | 550,000 | ||||||

|

Security deposits

|

8,375 | 10,439 | ||||||

|

Total other assets

|

8,375 | 560,439 | ||||||

|

TOTAL ASSETS

|

$ | 1,112,276 | $ | 1,941,494 | ||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

||||||||

|

CURRENT LIABILITIES

|

||||||||

|

Accounts payable and accrued expenses

|

$ | 18,141 | $ | 35,360 | ||||

|

Note payable - warehouse credit line

|

- | 907,203 | ||||||

|

Total current liabilities

|

18,141 | 942,563 | ||||||

|

STOCKHOLDERS' EQUITY

|

||||||||

|

Common stock, no par value; 1,000 share authorized; issued and outstanding

|

495,000 | 495,000 | ||||||

|

Preferred stock, $1,000 par value; 571.2 and 550 shares authorized; 2009 and 2010, respectively issued and outstanding

|

571,200 | 550,000 | ||||||

|

Retained earnings

|

27,935 | (46,069 | ) | |||||

|

Total stockholders' equity

|

1,094,135 | 998,931 | ||||||

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

$ | 1,112,276 | $ | 1,941,494 | ||||

The accompanying notes are an integral part of these financial statements.

6

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

STATEMENTS OF INCOME

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

2010

|

2009

|

|||||||

|

REVENUE

|

||||||||

|

Loan origination fees

|

$ | 851,657 | $ | 2,067,709 | ||||

|

Loss on sale of fixed asset

|

(7,000 | ) | - | |||||

|

Total revenue

|

844,657 | 2,067,709 | ||||||

|

EXPENSES

|

||||||||

|

Direct costs

|

95,558 | 664,378 | ||||||

|

Salaries

|

257,858 | 607,250 | ||||||

|

Payroll taxes and employee benefits

|

71,412 | 172,386 | ||||||

|

Occupancy

|

54,623 | 85,622 | ||||||

|

Advertising and promotion

|

8,096 | 16,454 | ||||||

|

Interest expense

|

48,285 | 167,447 | ||||||

|

Office supplies and expense

|

51,112 | 94,942 | ||||||

|

Telephone

|

18,745 | 29,727 | ||||||

|

Audit fees

|

11,100 | 18,000 | ||||||

|

Legal fees

|

9,410 | 4,300 | ||||||

|

Other professional fees

|

33,433 | 57,860 | ||||||

|

Insurance

|

9,027 | 16,421 | ||||||

|

Auto and travel

|

57,624 | 56,954 | ||||||

|

Repairs and maintenance

|

15,097 | 9,782 | ||||||

|

Miscellaneous

|

2,297 | 51,804 | ||||||

|

License and permits

|

7,392 | 4,812 | ||||||

|

Depreciation and amortization

|

17,250 | 17,250 | ||||||

|

Total expenses

|

768,319 | 2,075,389 | ||||||

|

INCOME (LOSS) FROM OPERATIONS

|

76,338 | (7,680 | ) | |||||

|

Provision for income taxes

|

2,334 | 2,345 | ||||||

|

NET INCOME (LOSS)

|

$ | 74,004 | $ | (10,025 | ) | |||

The accompanying notes are an integral part of these financial statements.

7

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

STATEMENTS OF CHANGES IN STOCKHOLDER' EQUITY

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

Common

|

Preferred

|

Retained

|

||||||||||||||

|

Stock

|

Stock

|

Earnings

|

Total

|

|||||||||||||

|

BALANCE, JANUARY 1, 2009

|

$ | 495,000 | $ | 550,000 | $ | (36,044 | ) | $ | 1,008,956 | |||||||

|

Net loss

|

- | - | (10,025 | ) | (10,025 | ) | ||||||||||

|

BALANCE, JANUARY 1, 2010

|

495,000 | 550,000 | (46,069 | ) | 998,931 | |||||||||||

|

Issuance of Perferred Stock

|

- | 21,200 | - | 21,200 | ||||||||||||

|

Net income

|

- | - | 74,004 | 74,004 | ||||||||||||

|

BALANCE, DECEMBER 31, 2010

|

$ | 495,000 | $ | 571,200 | $ | 27,935 | $ | 1,094,135 | ||||||||

The accompanying notes are an integral part of these financial statements.

8

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

STATEMENTS OF CHANGES IN CASH FLOWS

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

2010

|

2009

|

|||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||

|

Net income

|

$ | 74,004 | $ | (10,025 | ) | |||

|

Adjustments to reconcile net income (loss) to net cash provided by operating activities:

|

||||||||

|

Loss on sale of fixed asset

|

7,000 | - | ||||||

|

Depreciation and amortization

|

17,250 | 17,250 | ||||||

|

Changes in operating assets and liabilities:

|

||||||||

|

Mortgage loans available-for-sale

|

542,871 | 2,097,057 | ||||||

|

Other receivables

|

377,673 | (451,192 | ) | |||||

|

Security deposits

|

2,064 | - | ||||||

|

Accounts payable and accrued expenses

|

(17,219 | ) | (47,015 | ) | ||||

|

NET CASH PROVIDED BY OPERATING ACTIVITIES

|

1,003,643 | 1,606,075 | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||

|

Purchase of property and equipment

|

- | (14,633 | ) | |||||

|

NET CASH PROVIDED BY INVESTING ACTIVITIES

|

- | (14,633 | ) | |||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||

|

Payments on note payable - warehouse credit line, net

|

(907,203 | ) | (1,597,770 | ) | ||||

|

Shareholder contribution

|

21,200 | - | ||||||

|

Repayment on long-term debt

|

- | (4,186 | ) | |||||

|

NET CASH USED IN FINANCING ACTIVITIES

|

(886,003 | ) | (1,601,956 | ) | ||||

|

NET INCREASE (DECREASE) IN CASH

|

117,640 | (10,514 | ) | |||||

|

CASH, beginning of year

|

110,829 | 121,343 | ||||||

|

CASH, end of year

|

$ | 228,469 | $ | 110,829 | ||||

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

||||||||

|

Cash paid during the year for:

|

||||||||

|

Interest

|

$ | 48,285 | $ | 167,447 | ||||

|

Income taxes

|

$ | 1,560 | $ | 2,352 | ||||

The accompanying notes are an integral part of these financial statements.

9

|

UNITED COMMUNITY MORTGAGE CORPORATION

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

|

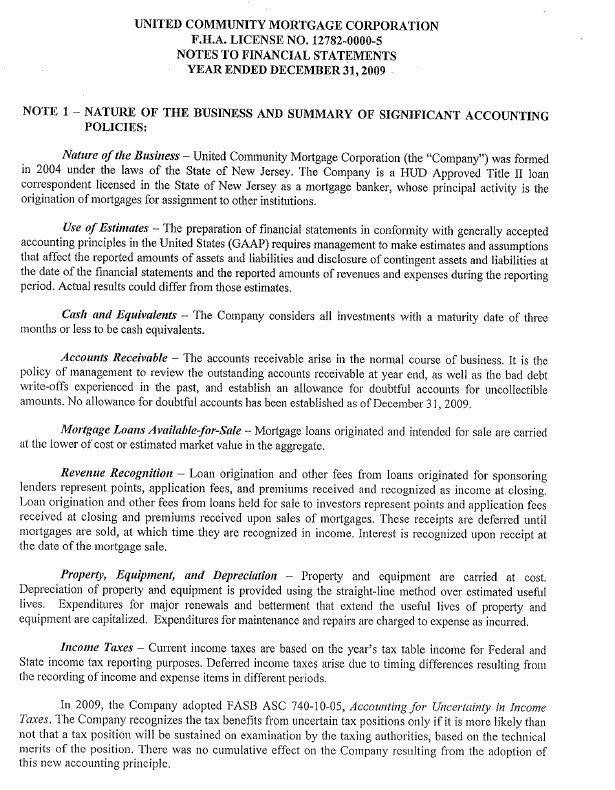

NOTE 1 - NATURE OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

|

Nature of the Business – United Community Mortgage Corporation (the “Corporation”) was formed under the laws of the State of New Jersey. The Corporation is a HUD Approved Title II loan correspondent licensed In the State of New Jersey as a mortgage banker, whose principle activity is the origination of mortgages for assignment to other institutions.

Use of Estimates - The preparation of financial statements in conformity with general accepted accounting principles in the United States (GAAP) requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reported period. Actual results could differ from those estimates.

Cash and Equivalents - The Corporation considers all investments with a maturity date of three months or less to be cash equivalents.

Other Receivables – The other receivables arise in the normal course of business. It is the policy of management to review the outstanding other receivables at year end, as well as the bad debt write-offs experienced in the past, and establish an allowance for doubtful accounts for uncollectible amounts. No allowance for doubtful accounts has been established as of December 31, 2010 and 2009.

Mortgage Loans Available-for-Sale – Mortgage loans originated and intended for sale are carried at the lower of cost or estimated market value in the aggregate.

Revenue Recognition – Loan origination and other fees from loans originated for sponsoring lenders represent points, application fees, and premiums and recognized as income at closing. Loan origination and other fees from loans held for sale to investors represent points and application fees received at closing and premiums received upon sales of mortgages. These receipts are deferred until mortgages are sold, at which time they are recognized in income. Interest is recognized upon receipt at the date of the mortgage sale.

Property, Equipment and Depreciation – Property and equipment are carried at cost less accumulated depreciation. Depreciation of property and equipment is provided using the straight-line method over estimated useful lives. Expenditures for major renewals and betterment that extend the useful lives of property and equipment are capitalized. Expenditures for maintenance and repairs are charged to expense as incurred.

10

|

UNITED COMMUNITY MORTGAGE CORPORATION

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

|

NOTE 1 - NATURE OF THE BUSINESS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (CONTINUED):

|

Income Taxes – Current income taxes are based on the year’s tax table for Federal and State income tax reporting purposes. Deferred income taxes arise due to timing differences resulting from the recording of income and expense items in different periods.

In 2009, the Corporation adopted FASB ASC 740-10-05, Accounting for Uncertainty in Income Taxes. The Corporation recognizes the tax benefits from uncertain tax positions only if it is more likely than not that a tax position will be sustained on examination by the taxing authorities, based on the technical merits of the position. There was no cumulative effect on the Corporation resulting from the adoption of this new accounting principle.

Management has determined that there are no unrecognized tax benefits that will significantly increase or decrease over the next twelve months, nor has the Corporation incurred any interest or penalties related to income tax expense during the years ended December 31, 2010 and 2009.

Advertising Costs – Advertising costs for the years ended December 31, 2010 and 2009 were $8,096 and $16,454, respectively, and are charged to operations as incurred, and are included under advertising and promotion on the accompanying financial statements.

Subsequent Events – The Corporation has evaluated subsequent events through March 30, 2010, which is the date the financial statements were available to be issued.

|

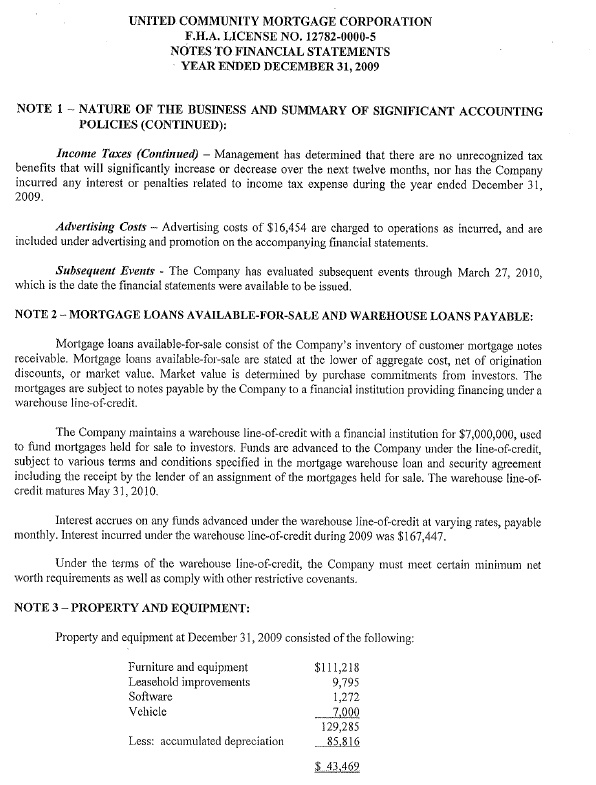

NOTE 2 – MORTGAGE LOANS AVAILABLE-FOR-SALE AND WAREHOUSE LOANS PAYABLE:

|

Mortgage loans available-for-sale consist of the Corporation’s inventory of customer mortgage notes receivable. Mortgage loans available-for-sale are stated at the lower of aggregate cost, net of origination discounts, or market value. Market value is determined by purchase commitments from investors. The mortgages are subject to notes payable by the Corporation to a financial institution providing financing under a warehouse line-of-credit.

The Corporation maintains a warehouse line-of-credit with a financial institution for $3,000,000, used to fund mortgages held for sale to investors. Funds are advanced to the Corporation under the line-of-credit, subject to various terms and conditions specified in the mortgage warehouse loan and security agreement including the receipt by the lender of an assignment of the mortgages held for sale. The warehouse line-of-credit matures May 31, 2011.

Interest accrues on any funds advanced under the warehouse line-of-credit at varying rates, payable monthly. Interest incurred under the warehouse line-of-credit during the years ended December 31, 2010 and 2009 were $29,921 and $167,447, respectively.

Under the terms of the warehouse line-of-credit, the Corporation must meet certain minimum net worth requirements as well as comply with other restrictive covenants.

11

|

UNITED COMMUNITY MORTGAGE CORPORATION

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

NOTE 3 – PROPERTY AND EQUIPMENT:

Property and equipment at December 31, 2010 and 2009 consist of the following:

|

2010

|

2009

|

|||||||

|

Furniture and equipment

|

$ | 111,218 | $ | 111,218 | ||||

|

Leasehold improvements

|

9,795 | 9,795 | ||||||

|

Software

|

1,272 | 1,272 | ||||||

|

Vehicle

|

- | 7,000 | ||||||

| 122,285 | 129,285 | |||||||

|

Less: Accumulated Depreciation

|

103,066 | 85,816 | ||||||

| $ | 19,219 | $ | 43,469 | |||||

|

NOTE 4 – CONCENTRATIONS OF CREDIT RISK:

|

The Corporation’s lending activities are concentrated in one-to-four family and home improvement loans that are secured by property located within the New Jersey area. HUD insured loans represented approximately for the years ended December 31, 2010 and 2009 73% and 1%, respectively, of the originated loans. All originated loans insured by HUD must be assigned to HUD approved sponsors.

The Corporation maintains cash with various financial institutions. The Federal Deposit Insurance Corporation insures accounts at each institution up to $250,000. At times, cash balances may exceed insured limits.

NOTE 5 – RELATED PARTY TRANSCATIONS:

The Corporation rents office space from an entity controlled by the stockholder. Rent paid to the related entity was $6,250 and $15,000 in 2010 and 2009, respectively.

NOTE 6 – REGULATORY MATTERS:

The corporation is subject to various regulatory capital requirements administered by HUD and various state agencies. Failure to meet minimum capital requirements can result in certain mandatory and discretionary actions from state regulators and HUD that, if undertaken, could have a direct material effect on the financial statements. The Corporation must maintain minimum net worth for New Jersey of $50,000 and $63,000 for HUD. As of December 31, 2010 and 2009, the Corporation was in compliance with these requirements.

12

|

UNITED COMMUNITY MORTGAGE CORPORATION

|

|

NOTES TO THE FINANCIAL STATEMENTS

|

|

YEARS ENDED DECEMBER 31, 2010 AND 2009

|

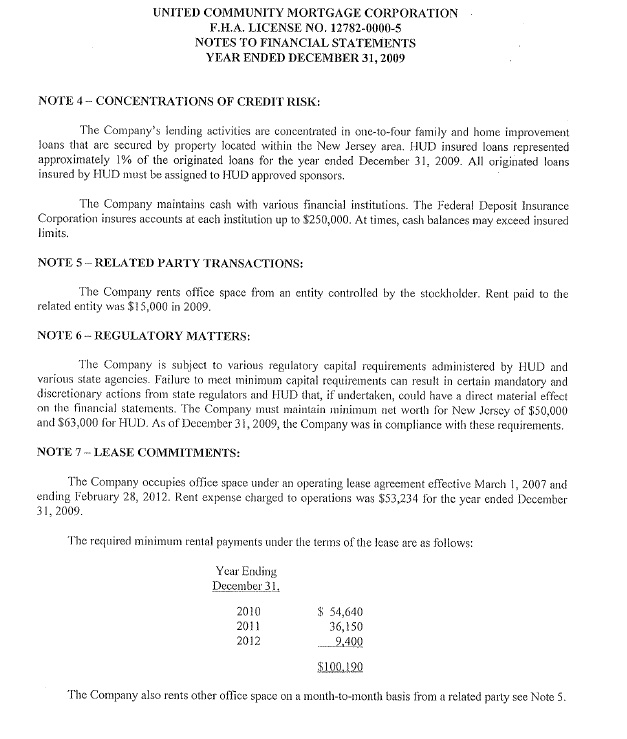

NOTE 7 – LEASE COMMITMENTS:

The Corporation occupies office space under an operating lease agreement effective March 1, 2007 and ending February 28, 2012. Rent expense charged to operations was $48,373 and $53,234 for the years ended December 31, 2010 and 2009, respectively.

The required minimum rental payments under the terms of the lease are as follows:

|

Year Ending December 31,

|

||||

|

2011

|

$ | 36,150 | ||

|

2012

|

9,400 | |||

| $ | 45,500 | |||

The Corporation also rents other office space on a month-to-month basis from a related party see Note 5.

13

UNITED COMMUNITY MORTGAGE CORPORATION

FINANCIAL REPORT

DECEMBER 31, 2009

14

UNITED COMMUNITY MORTGAGE CORPORATION

F.H.A. LICENSE NO. 12782-0000-5

CONTENTS

|

PAGE

|

|||||||||

|

INDEPENDENT AUDITOR'S REPORT - 2009

|

16

|

||||||||

|

FINANCIAL STATEMENTS:

|

|||||||||

|

Balance Sheet

|

17

|

||||||||

|

Statement of Income

|

18

|

||||||||

|

Statement of Changes in Stockholders' Equity

|

19

|

||||||||

|

Statement of Cash Flows

|

20

|

||||||||

|

Notes to Financial Statements

|

21-23

|

||||||||

15

16

17

18

19

20

21

22

23

(b) Pro Forma financial information

PSM Holdings, Inc. and Subsidiaries

Unaudited Pro Forma Financial Information

The following presents our unaudited pro forma financial information. The pro forma statements of operations give effect to the business acquisition of United Community Mortgage Corp. (“UCMC”), a New Jersey corporation, as if the acquisition had occurred at July 1, 2009. The unaudited pro forma balance sheet as of December 31, 2010 has been prepared as if the acquisition occurred on that date. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable.

The unaudited pro forma financial information is for informational purposes only and does not purport to present what our results would actually have been had these transactions actually occurred on the dates presented or to project our results of operations or financial position for any future period. The information set forth below should be read together with the significant notes and assumptions to the pro forma statements, and the PSM Holdings, Inc. Annual Report on Form 10-K for the fiscal year ended June 30, 2010 and Quarterly Report on Form 10-Q for the quarter ended December 31, 2010 which are incorporated by reference in this Form 8-K/A, and the audited financial statements of UCMC for the years ended December 31, 2010 and 2009, including the notes thereto, included in this Form 8-K/A.

24

PSM HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA BALANCE SHEET

DECEMBER 31, 2010

|

Historical

|

|||||||||||||||||||||

|

Acquirer

|

Acquiree

|

Proforma Adjustments

|

|||||||||||||||||||

|

PSM Holdings

|

UCMC

|

Debit

|

Credit

|

Pro Forma

|

|||||||||||||||||

|

ASSETS

|

|||||||||||||||||||||

|

Current Assets:

|

|||||||||||||||||||||

|

Cash & cash equivalents

|

$ | 122,774 | $ | 228,469 | 13,664 | 1, 2, | 228,469 | $ | 118,438 | ||||||||||||

| 3 | 18,000 | ||||||||||||||||||||

|

Accounts receivable, net

|

65,208 | - | 65,208 | ||||||||||||||||||

|

Current portion of notes receivable

|

- | 189,654 | 189,654 | 1, 2 | 189,654 | 189,654 | |||||||||||||||

|

Other assets

|

636 | 4,763 | 250 | 1, 2 | 4,763 | 886 | |||||||||||||||

|

Total current assets

|

188,618 | 422,886 | 374,186 | ||||||||||||||||||

|

Property and equipment, net

|

13,568 | 19,219 | 15,625 | 1, 2 | 19,219 | 29,194 | |||||||||||||||

|

Goodwill

|

- | - | 1,087,432 | 2 | 1,087,432 | ||||||||||||||||

|

Loan receivable

|

90,891 | - | 90,891 | ||||||||||||||||||

|

Note Receivable

|

- | 675,000 | 360,000 | 1, 2 | 675,000 | 360,000 | |||||||||||||||

|

NWBO License, net

|

547,387 | - | 547,387 | ||||||||||||||||||

|

Security deposits

|

- | 8,375 | 8,375 | 1, 2 | 8,375 | 8,375 | |||||||||||||||

|

Total Assets

|

$ | 840,465 | $ | 1,125,480 | $ | 2,497,465 | |||||||||||||||

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|||||||||||||||||||||

|

Current Liabilities:

|

|||||||||||||||||||||

|

Accounts payable

|

$ | 160,578 | $ | 24,345 | 24,345 | 1, 2 | $ | 160,578 | |||||||||||||

|

Accrued liabilities

|

2,374 | 7,000 | 7,000 | 1, 2 | 2,374 | ||||||||||||||||

|

Total current liabilities

|

162,952 | 31,345 | 162,952 | ||||||||||||||||||

|

Long-term Liabilities:

|

|||||||||||||||||||||

|

Due to related party

|

100,000 | - | 100,000 | ||||||||||||||||||

|

Total long-term liabilities

|

100,000 | - | 100,000 | ||||||||||||||||||

|

Total Liabilities

|

262,952 | 31,345 | 262,952 | ||||||||||||||||||

|

Stockholders' Equity:

|

|||||||||||||||||||||

|

Common stock

|

14,195 | 260,000 | 260,000 | 1, 2 | 2,393 | 16,588 | |||||||||||||||

|

Preferred stock

|

- | 806,200 | 806,200 | 1, 2 | - | ||||||||||||||||

|

Treasury stock

|

(22,747 | ) | - | (22,747 | ) | ||||||||||||||||

|

Additional paid in capital

|

8,387,102 | - | 1,672,607 | 10,059,709 | |||||||||||||||||

|

Accumulated deficit

|

(7,801,038 | ) | 27,935 | 27,935 | 1, 2 | (7,819,038 | ) | ||||||||||||||

| 18,000 | 3 | ||||||||||||||||||||

|

Total stockholders' equity

|

577,513 | 1,094,135 | 2,234,514 | ||||||||||||||||||

|

Total Liabilities and Stockholders' Equity

|

$ | 840,465 | $ | 1,125,480 | $ | 2,818,480 | $ | 2,818,480 | $ | 2,497,465 | |||||||||||

See Unaudited Significant Notes and Assumptions to Pro Forma Financial Statements.

25

PSM HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED DECEMBER 31, 2010

|

Historical

|

|||||||||||||||||||||

|

Acquirer

|

Acquiree

|

Pro Forma Adjustments

|

|||||||||||||||||||

|

PSM Holdings

|

UCMC

|

Debit

|

Credit

|

Pro Forma

|

|||||||||||||||||

|

Revenues

|

$ | 2,414,314 | $ | 514,681 | $ | 2,928,996 | |||||||||||||||

|

Operating expenses

|

|||||||||||||||||||||

|

Selling, general & administrative

|

2,412,730 | 327,925 | 2,740,656 | ||||||||||||||||||

|

Depreciation and amortization

|

34,425 | 17,250 | 3,906 | 5 | 55,581 | ||||||||||||||||

|

Total operating expenses

|

2,447,155 | 345,175 | 2,796,237 | ||||||||||||||||||

|

Income (loss) from operations

|

(32,841 | ) | 169,506 | 132,759 | |||||||||||||||||

|

Non-operating income (expense):

|

|||||||||||||||||||||

|

Interest expense

|

(4,540 | ) | (9,172 | ) | (13,712 | ) | |||||||||||||||

|

Interest and dividend

|

1,324 | 13,353 | 14,677 | ||||||||||||||||||

|

Realized gain (loss) on sale of securities

|

5,057 | - | 5,057 | ||||||||||||||||||

|

Other Income (Expense)

|

13,174 | - | 13,174 | ||||||||||||||||||

|

Total non-operating income (expense)

|

15,016 | 4,181 | 19,197 | ||||||||||||||||||

|

Income (loss) from continuing operations before income tax

|

(17,825 | ) | 173,687 | 151,956 | |||||||||||||||||

|

Provision for income tax

|

- | 520 | 520 | ||||||||||||||||||

|

Net Income (loss)

|

(17,825 | ) | 174,207 | 152,476 | |||||||||||||||||

|

Other comprehensive income (loss):

|

|||||||||||||||||||||

|

Unrealized gain (loss) on marketable securities

|

(2,666 | ) | - | (2,666 | ) | ||||||||||||||||

|

Comprehensive income (loss)

|

$ | (20,491 | ) | $ | 174,207 | $ | 3,906 | $ | - | $ | 149,810 | ||||||||||

|

Net income (loss) per common share and equivalents -

|

|||||||||||||||||||||

|

basic and diluted loss from operations

|

$ | (0.00 | ) | $ | (0.00 | ) | |||||||||||||||

|

Weighted average shares of share capital outstanding

|

|||||||||||||||||||||

|

- basic & diluted

|

14,166,152 | 16,559,010 | |||||||||||||||||||

Weighted average number of shares used to compute basic and diluted loss per share for the six month periods ended December 31, 2010 is the same since the effect of dilutive securities is anti-dilutive.

See Unaudited Significant Notes and Assumptions to Pro Forma Financial Statements.

26

PSM HOLDINGS, INC. AND SUBSIDIARIES

UNAUDITED PRO FORMA STATEMENT OF OPERATIONS

FOR THE YEAR ENDED JUNE 30, 2010

|

Historical

|

|||||||||||||||||||||

|

Acquirer

|

Acquiree

|

Pro Forma Adjustments

|

|||||||||||||||||||

|

PSM Holdings

|

UCMC

|

Debit

|

Credit

|

Pro Forma

|

|||||||||||||||||

|

Revenues

|

$ | 3,832,902 | $ | 919,000 | $ | 4,751,901 | |||||||||||||||

|

Operating expenses

|

|||||||||||||||||||||

|

Selling, general & administrative

|

8,149,526 | 1,497,697 | 9,647,223 | ||||||||||||||||||

|

Depreciation and amortization

|

69,501 | 10,009 | 7,813 | 4 | 87,322 | ||||||||||||||||

|

Total operating expenses

|

8,219,027 | 1,507,706 | 9,734,546 | ||||||||||||||||||

|

Loss from operations

|

(4,386,125 | ) | (588,707 | ) | (4,982,645 | ) | |||||||||||||||

|

Non-operating income (expense):

|

|||||||||||||||||||||

|

Interest expense

|

(11,466 | ) | (18,718 | ) | (30,183 | ) | |||||||||||||||

|

Interest and dividend

|

12,690 | 107,221 | 119,911 | ||||||||||||||||||

|

Realized gain (loss) on sale of securities

|

(3,084 | ) | - | (3,084 | ) | ||||||||||||||||

|

Other Income (Expense)

|

23,056 | (26,990 | ) | (3,934 | ) | ||||||||||||||||

|

Total non-operating income (expense)

|

21,196 | 61,514 | 82,710 | ||||||||||||||||||

|

Loss from continuing operations before income tax

|

(4,364,929 | ) | (527,193 | ) | (4,899,935 | ) | |||||||||||||||

|

Provision for income tax

|

- | 1,345 | 1,345 | ||||||||||||||||||

|

Net loss

|

(4,364,929 | ) | (528,538 | ) | (4,901,280 | ) | |||||||||||||||

|

Other comprehensive income (loss):

|

|||||||||||||||||||||

|

Unrealized gain (loss) on marketable securities

|

12,436 | - | 12,436 | ||||||||||||||||||

|

Comprehensive income (loss)

|

$ | (4,352,493 | ) | $ | (528,538 | ) | $ | 7,813 | $ | - | $ | (4,888,843 | ) | ||||||||

|

Net loss per common share and equivalents -

|

|||||||||||||||||||||

|

basic and diluted loss from operations

|

$ | (0.33 | ) | $ | (0.31 | ) | |||||||||||||||

|

Weighted average shares of share capital outstanding

|

|||||||||||||||||||||

|

- basic & diluted

|

13,233,786 | 15,626,644 | |||||||||||||||||||

Weighted average number of shares used to compute basic and diluted loss per share for the six month periods ended December 31, 2010 is the same since the effect of dilutive securities is anti-dilutive.

See Unaudited Significant Notes and Assumptions to Pro Forma Financial Statements.

27

PSM Holdings, Inc. and Subsidiaries

Significant Notes and Assumptions to Pro-Forma Financial Statements

(Unaudited)

On March 15, 2011, we completed a business acquisition of United Community Mortgage Corp. The closing was held for the Agreement and Plan of Merger dated March 9, 2011, (the “Merger Agreement”) with United Community Mortgage Corp. (“UCMC”), a New Jersey corporation, and its sole shareholder, Edward Kenmure, Prime Source Mortgage, Inc. (“PSMI”), and PSM Acquisition, Inc., a newly created New Jersey corporation and wholly-owned subsidiary of PSMI (“Merger Sub”). On March 16, 2011, the closing became effective with the filing of the Articles of Merger in the State of New Jersey to complete the merger of the Merger Sub with and into UCMC. UCMC was the surviving corporation of the merger and has become a wholly-owned subsidiary of PSMI. Mr. Kenmure, as the sole shareholder of UCMC received 2,392,858 shares of PSM Holdings, Inc. (PSMH) in exchange for all of the outstanding equity securities of UCMC. As a result of the transaction, Mr. Kenmure owned approximately 14% of the outstanding common shares of PSMH. The common shares issued by us to Kenmure have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

The accompanying unaudited pro-forma financial information reflects the financial statements of PSM Holdings, Inc. and Subsidiary, and UCMC. The pro-forma adjustments to the balance sheet give effect to the acquisition as if it occurred on December 31, 2010. The pro-forma adjustments to the statements of operations give effect to the acquisition as it occurred on July 1, 2009.

Significant assumptions include:

The shares issued to Edward Kenmure, owner of UCMC were calculated contractually valued at $1,675,000 based on issuance of 2,392,858 shares of our common stock at $0.70 per share which was based on the closing price per share on the date of closing the Agreement.

We incurred a non-recurring $18,000 of professional fees for legal and accounting related to the acquisition which is reflected as adjustments to accumulated deficit at December 31, 2010.

The purchase price was allocated first to record identifiable assets and liabilities at fair value and the remainder to goodwill, pending completion of independent valuation at which time the goodwill amount may change and will be allocated to licenses and permits and other intangible assets. The purchase price was allocated as follows:

|

Cash and cash equivalents

|

$ | 13,664 | ||

|

Notes receivable

|

549,654 | |||

|

Other current assets

|

250 | |||

|

Property and equipment

|

15,625 | |||

|

Other assets

|

8,375 | |||

|

Total assets acquired

|

587,568 | |||

|

Liabilities assumed

|

- | |||

|

Net assets acquired

|

587,568 | |||

|

Goodwill

|

1,087,432 | |||

|

Total purchase price

|

$ | 1,675,000 |

Notes receivable consist of (a) Letter of Repayment with three employees in the amount of $189,654 for funds advanced to them as a loan. These loans are unsecured, non-interest bearing and due on demand, and (b) a Promissory Note with an unrelated third party for a principal sum of $360,000, principal and unpaid interest shall be due and payable in full on December 1, 2016. The Promissory Note is secured by real estate parcels.

Depreciation of property and equipment has been given effect to the acquisition as if it occurred on July 1, 2009.

28

The following reflect the pro forma adjustments as at December 31, 2010:

PSM HOLDINGS, INC. AND SUBSIDIARIES

Unaudited Pro Forma Adjustments

|

Debit

|

Credit

|

||||||||

|

1

|

Cash and cash equivalents

|

$ | 228,469 | ||||||

|

Current portion of notes receivable

|

189,654 | ||||||||

|

Other assets

|

4,763 | ||||||||

|

Property and equipment

|

19,219 | ||||||||

|

Note receivable

|

675,000 | ||||||||

|

Security deposits

|

8,375 | ||||||||

|

Accounts payable

|

$ | 24,345 | |||||||

|

Accrued liabilities

|

7,000 | ||||||||

|

Common stock

|

260,000 | ||||||||

|

Preferred stock

|

806,200 | ||||||||

|

Accumulated deficit

|

27,935 | ||||||||

|

To remove assets not acquired and liabilities not assumed.

|

|||||||||

|

2

|

Cash and cash equivalents

|

$ | 13,664 | ||||||

|

Current portion of notes receivable

|

189,654 | ||||||||

|

Other current assets

|

250 | ||||||||

|

Property and equipment

|

15,625 | ||||||||

|

Notes receivable

|

360,000 | ||||||||

|

Security deposits

|

8,375 | ||||||||

|

Goodwill

|

1,087,432 | ||||||||

|

Common stock

|

$ | 2,393 | |||||||

|

Additional paid in capital

|

1,672,607 | ||||||||

|

To record at fair market value assets acquired and liabilities assumed pursuant to the Stock Purchase Agreement.

|

|||||||||

|

3

|

Accumulated deficit

|

$ | 18,000 | ||||||

|

Cash

|

$ | 18,000 | |||||||

|

To record non-recurring professional fees (acquirer expense) incurred in the acquisition for the year ended June 30, 2010.

|

|||||||||

|

4

|

Depreciation expense

|

$ | 7,813 | ||||||

|

Accumulated deficit

|

$ | 7,813 | |||||||

|

To record annual amortization of tangible assets acquired for year ended June 30, 2010.

|

|||||||||

|

5

|

Depreciation expense

|

$ | 3,906 | ||||||

|

Accumulated deficit

|

$ | 3,906 | |||||||

| To record amortization of tangible assets acquired for the six months ended December 31, 2010. | |||||||||

| Total | $ | 2,830,200 | $ | 2,830,200 | |||||

29