Attached files

| file | filename |

|---|---|

| EX-5.1 - FIRST CHINA PHARMACEUTICAL GROUP, INC. | v224118_ex5-1.htm |

| EX-23.1 - FIRST CHINA PHARMACEUTICAL GROUP, INC. | v224118_ex23-1.htm |

As filed with the Securities and Exchange Commission on May 25, 2011

Registration No. [ ]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

FIRST CHINA PHARMACEUTICAL GROUP, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

3663

|

74-3232809

|

||

|

(State or jurisdiction of

|

(Primary Standard Industrial

|

(I.R.S. Employer

|

||

|

incorporation or organization)

|

Classification Code Number)

|

Identification No.)

|

Number 504, West Ren Min Road,

Kunming City, Yunnan Province

People’s Republic of China, 650000

+852-2138-1668

(Address and telephone number of principal executive offices and principal place of business)

Business Filings Incorporated

311 S. Division St.

Carson City, NV 89703

(608) 827-5300

(Name, address and telephone number of agent for service)

Copies to:

Mark C. Lee, Esq.

Kamyar Daneshvar, Esq.

GREENBERG TRAURIG, LLP

1201 K Street, Suite 1100

Sacramento, California 95814

Telephone: (916) 442-1111

Facsimile: (916) 448-1709

Approximate date of proposed sale to the public:

From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. þ

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o

|

Accelerated filer o

|

Non-accelerated filer o

|

Smaller reporting company þ

|

|

(Do not check if a smaller reporting company)

|

|

Proposed

|

Proposed

|

|||||||||||||||

|

Amount of

|

maximum

|

maximum

|

Amount of

|

|||||||||||||

|

Title of each class of

|

shares to be

|

offering price

|

aggregate

|

Registration

|

||||||||||||

|

securities to be registered

|

Registered

|

per share

|

offering price

|

Fee

|

||||||||||||

|

Common Stock

|

7,464,480 | $ | 0.73 | (3) | $ | 5,449,070.40 | $ | 632.64 | ||||||||

|

Common Stock underlying Series A-1 Warrants

|

4,381,145 | (1) | $ | 1.25 | $ | 5,476,431.25 | $ | 635.81 | ||||||||

|

Common Stock underlying Series A-2 Warrants

|

4,381,145 | (2) | $ | 2.00 | $ | 8,762,290 | $ | 1,017.30 | ||||||||

|

Total

|

16,226,770 | - | $ | 19,687,791.65 | $ | 2,285.75 | ||||||||||

|

(1)

|

Represents the number of shares of common stock offered for resale following the exercise of the Series A-1 Warrants by the investors and the placement agents.

|

|

(2)

|

Represents the number of shares of common stock offered for resale following the exercise of the Series A-2 Warrants by the investors and the placement agents.

|

|

(3)

|

Calculated in accordance with Rule 457(c) of the Securities Act of 1933, as amended (“Securities Act”). Estimated for the sole purpose of calculating the registration fee and based upon the average bid and ask price per share of our common stock on May 20, 2011, as quoted on the Over-The-Counter Bulletin Board.

|

We hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until it shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

SUBJECT TO COMPLETION, DATED May 25, 2011

PROSPECTUS

16,226,770 Shares

FIRST CHINA PHARMACEUTICAL GROUP, INC.

Common Stock

This Prospectus relates to the resale of up to 16,226,770 shares of common stock, $.0001 par value, by the Selling Security Holders listed under “Selling Security Holders” on page 56 including the resale of 4,381,145 shares of our common stock by certain Selling Security Holders upon the exercise of outstanding Series A-1 warrants and the resale of 4,381,145 shares of our common stock by certain Selling Security Holders upon the exercise of outstanding Series A-2 warrants. We will not receive any proceeds from the resale of any common stock by the Selling Security Holders sold pursuant to this Prospectus. We may receive gross proceeds of $14,238,721.20 if all of the Series A-1 and Series A-2 warrants are exercised for cash by the Selling Security Holders.

Our common stock is traded on the OTC Bulletin Board under the Symbol “FCPG.OB.” On May 20, 2011, the last reported sale price of our common stock on the OTC Bulletin Board was $0.73 per share.

The Selling Security Holders may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of common stock registered under this Prospectus on any stock exchange, market or trading facility on which the shares are traded or in private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, or at negotiated prices. The Selling Security Holders may use any one or more of the following methods when selling shares: (i) ordinary brokerage transactions and transactions in which the broker-dealer solicits investors; (ii) block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; (iii) purchases by a broker-dealer as principal and resale by the broker-dealer for its account; (iv) at prevailing market prices or privately negotiated prices on the OTC Bulletin Board or other applicable exchange; (v) privately negotiated transactions; (vi) to cover short sales after the date the registration statement of which this Prospectus is a part is declared effective by the Securities and Exchange Commission; (vii) broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; (viii) a combination of any such methods of sale; and (ix) any other method permitted pursuant to applicable law.

INVESTING IN OUR COMMON STOCK INVOLVES A HIGH DEGREE OF RISK. SEE “RISK FACTORS” BEGINNING ON PAGE 2 OF THIS PROSPECTUS.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this Prospectus is not complete and may be changed. The Selling Security Holders may not sell these securities until the registration statement filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted or would be unlawful prior to registration or qualification under the securities laws of any such state.

TABLE OF CONTENTS

|

Page

|

||||

| PART I - INFORMATION REQUIRED IN PROSPECTUS | ||||

|

PROSPECTUS SUMMARY

|

1 | |||

|

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

|

2 | |||

|

RISK FACTORS

|

2 | |||

|

RISKS RELATED TO OUR BUSINESS AND INDUSTRY

|

2 | |||

|

RISKS RELATED TO OUR CORPORATE STRUCTURE

|

11 | |||

|

RISKS RELATED TO DOING BUSINESS IN CHINA

|

11 | |||

|

RISKS RELATED TO OUR SECURITIES AND OUR STATUS AS A PUBLIC COMPANY

|

15 | |||

|

USE OF PROCEEDS

|

17 | |||

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDERS MATTERS

|

17 | |||

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

|

18 | |||

|

OVERVIEW

|

18 | |||

|

CRITICAL ACCOUNTING POLICIES AND ESTIMATES

|

18 | |||

|

RESULTS OF OPERATIONS

|

19 | |||

|

LIQUIDITY AND CAPITAL RESOURCES

|

25 | |||

|

OFF-BALANCE SHEET ARRANGEMENTS

|

26 | |||

|

DESCRIPTION OF BUSINESS

|

28 | |||

|

DESCRIPTION OF PROPERTY

|

47 | |||

|

LEGAL PROCEEDINGS

|

47 | |||

|

DIRECTORS AND EXECUTIVE OFFICERS

|

47 | |||

|

EXECUTIVE COMPENSATION

|

50 | |||

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE

|

52 | |||

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

54 | |||

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

55 | |||

|

RECENT SALES OF UNREGISTERED SECURITIES

|

55 | |||

|

SELLING SECURITY HOLDERS

|

56 | |||

|

PLAN OF DISTRIBUTION

|

63 | |||

|

DESCRIPTION OF SECURITIES

|

65 | |||

|

DISCLOSURE OF COMMISSION POSITION OF INDEMNIFICATION FOR SECURITIES ACT LIABILITIES

|

67 | |||

|

LEGAL MATTERS

|

67 | |||

|

EXPERTS

|

67 | |||

|

TRANSFER AGENT AND REGISTRAR

|

67 | |||

|

WHERE YOU CAN FIND MORE INFORMATION

|

67 | |||

|

FINANCIAL STATEMENTS

|

67 | |||

|

PART II - INFORMATION NOT REQUIRED IN PROSPECTUS

|

||||

|

Other Expenses of Issuance and Distribution

|

68 | |||

|

Indemnification of Directors and Officers

|

68 | |||

|

Recent Sales of Unregistered Securities

|

70 | |||

|

Exhibit Index

|

71 | |||

|

Undertakings

|

74 | |||

|

Signatures

|

77 | |||

You should rely only on the information contained in this Prospectus. We have not authorized anyone to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted.

PROSPECTUS SUMMARY

You should read the following summary together with the more detailed information and the financial statements appearing elsewhere in this Prospectus. This Prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under “Risk Factors” and elsewhere in this Prospectus. Unless the context indicates or suggests otherwise, references to “we,” “our,” “us,” the “Company,” “FCPG” or the “Registrant” refer to First China Pharmaceutical Group, Inc., a Nevada corporation and its wholly owned subsidiaries, First China Pharmaceutical Group Limited, a Hong Kong company, and Kun Ming Xin Yuan Tang Pharmacies Co. Ltd., a company organized under the laws of the People’s Republic of China.

The Offering

|

Issuer

|

First China Pharmaceutical Group, Inc.

|

|

|

Securities Offered for Resale

|

Up to 16,226,770 shares of our common stock.

|

|

|

Common Stock to be Outstanding After the Offering

|

59,464,480 shares (1)

|

|

|

Use of Proceeds

|

Other than the proceeds we may receive in the event the warrants are exercised for cash by the Selling Security Holders, we will not receive any proceeds from the resale of any of the shares offered hereby.

|

|

|

Trading

|

Our common stock is quoted on the OTC Bulletin Board under the symbol “FCPG.OB”

|

|

|

Risk Factors

|

You should carefully consider the information set forth in the section entitled “Risk Factors” beginning on page 2 of this prospectus in deciding whether or not to invest in our common stock

|

|

(1)

|

Unless the context indicates otherwise, all share and per-share information in this prospectus is based on 59,464,480 shares of our common stock outstanding as of May 20, 2011.

|

Our Business

First China Pharmaceutical Group, Inc. (“FCPG” or the “Company”), formerly known as E-Dispatch Inc., was incorporated under the laws of the State of Nevada on July 31, 2007. On September 15, 2010, we closed a voluntary share exchange transaction pursuant to a Share Exchange Agreement, dated August 23, 2010 (the “Exchange Transaction”), by and among FCPG, First China Pharmaceutical Group Limited, a Hong Kong company (“FCPG HK”), and Kun Ming Xin Yuan Tang Pharmacies Co. Ltd., a company organized under the laws of the People’s Republic of China (“PRC”) and wholly owned subsidiary of FCPG HK (“XYT”). Prior to the Exchange Transaction, we were a development stage company engaged in developing a cell phone-based taxi dispatch system, and a public reporting “shell company,” as defined in Rule 12b-2 of the Securities Exchange Act of 1934, as amended. As a result of the Exchange Transaction, the FCPG HK stockholder acquired approximately 25% of our issued and outstanding common stock, FCPG HK and XYT became our wholly-owned subsidiaries, and we acquired the business and operations of FCPG HK and XYT.

Through our wholly-owned subsidiary, XYT, we are now engaged in drug logistics and distribution in Yunnan Province, China through drug stores, medical clinics and hospitals, as well as the wholesale distribution of medicine products, chemical agents, antibiotics, biochemistry drugs and biological preparations to hospitals and the XYT store located at the Company’s distribution facility in Kunming. XYT was founded in November 2002 and is a provincial pharmaceutical distributor that offers approximately 5,000 drugs, of which approximately 1,000 are over-the-counter drugs, approximately 1,000 are prescription drugs, approximately 2,000 are prepared Chinese medicines and approximately 1,000 are supplements. Currently, we have approximately 4,700 customers and supply approximately 10% of such customers’ inventories with a sales network that covers the entire Yunnan Province of China.

1

Our continuing strategy is to build a nationwide pharmaceutical distribution network throughout China. We plan to expand our customer base through the use of the following tactics: broadening of our current product line to attract larger customers that currently do not utilize us and benefit from internet ordering and the lower prices that we offer; providing computers to customers to attract new customers as our management is unaware of any other pharmaceutical distribution company providing this benefit; and increasing our current sales force to directly target hospitals, medical clinics and pharmacies.

Corporate Information

Our principal executive offices are located at FCPG HK’s and XYT’s headquarters located at Number 504, West Ren Min Road, Kunming City, Yunnan Province, People’s Republic of China, 650000, which is also our mailing address. Our telephone number is 852-2138-1668.

Transfer Agent

Our transfer agent is Routh Stock Transfer Inc., and is located at 6860 N. Dallas Parkway, Suite 200, Plano, Texas, 75024. Their telephone number is (972) 381-2782.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

Except for statements of historical facts, this Prospectus contains forward-looking statements involving risks and uncertainties. The words “anticipate,” “believe,” “estimate,” “expect,” “future,” “intend,” “plan” or the negative of these terms and similar expressions or variations thereof are intended to forward looking statements. Such statements reflect the current view of the Registrant with respect to future events and are subject to risks, uncertainties, assumptions and other factors (including the risks contained in the section of this report on Form S-1 entitled “Risk Factors”) relating to the Registrant’s industry, the Registrant’s operations and results of operations and any businesses that may be acquired by the Registrant. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although the Registrant believes that the expectations reflected in the forward looking statements are reasonable, the Registrant cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, the Registrant does not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with the Registrant’s financial statements and the related notes included in this report on Form S-1.

RISK FACTORS

You should carefully consider the risks described below together with all of the other information included in our public filings before making an investment decision with regard to our securities. The statements contained in or incorporated into this report on Form S-1 that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. While the risks described below are the ones we believe are most important for you to consider, these risks are not the only ones that we face. If any of the following events described in these risk factors actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Business and Industry

Our operating results are difficult to predict, and we may experience significant fluctuations in our operating results.

Our operating results may fluctuate significantly. As a result, you may not be able to rely on period to period comparisons of our operating results as an indication of our future performance. Factors causing these fluctuations include, among others:

|

|

·

|

our ability to maintain and increase sales to existing customers, attract new customers and satisfy our customers’ demands;

|

|

|

·

|

the frequency of customer visits to pharmacies and drugstores and the quantity and mix of products our customers purchase;

|

|

|

·

|

the price we charge for our products or changes in our pricing strategies or the pricing strategies of our competitors;

|

|

|

·

|

timing and costs of marketing and promotional programs organized by us and/or our suppliers, including the extent to which we or our suppliers offer promotional discounts to our customers;

|

2

|

|

·

|

our ability to acquire merchandise, manage inventory and fulfill orders;

|

|

|

·

|

technical difficulties, system downtime or interruptions of our computer system, which we use for product selection, procurement, pricing, distribution and retail management processes;

|

|

|

·

|

the introduction by our competitors of new products;

|

|

|

·

|

the effects of strategic alliances, potential acquisitions and other business combinations, and our ability to successfully and timely integrate them into our business;

|

|

|

·

|

changes in government regulations with respect to pharmaceutical and retail industries; and

|

|

|

·

|

economic and geopolitical conditions in China and elsewhere.

|

In addition, a significant percentage of our operating expenses are fixed in the short term. As a result, a delay in generating or recognizing revenue for any reason could result in substantial operating losses.

Moreover, our business is subject to seasonal variations in demand. In particular, traditional retail seasonality affects the sales of certain pharmaceuticals and other non-pharmaceutical products. Sales of our pharmaceutical products benefit in the fourth quarter from the winter cold and flu season, and are lower in the first quarter of each year because Chinese New Year falls into the first quarter of each year and our customers generally pay fewer visits to drugstores during this period. In addition, sales of some health products are driven, to some extent, by seasonal purchasing patterns and seasonal product changes. Failure to manage the increased sales effectively in the high sale season, and increases in inventory in anticipation of sales increase could have a material adverse effect on our financial condition, results of operations and cash flow.

The commercial success of our products depends upon the degree of their market acceptance among the medical community. If our products do not attain market acceptance among the medical community, our operations and profitability would be adversely affected.

The commercial success of our products depends, in large part, upon the degree of market acceptance they achieve among the medical community, particularly among physicians, pharmacists, administrators of hospitals, clinics and other health care institutions. Physicians may not prescribe or recommend our products to patients and pharmacies, procurement departments of hospitals, clinics and other health care institutions may not purchase our products if physicians or pharmacists do not find our products attractive. The acceptance and use of our products among the medical community will depend upon a number of factors including:

|

|

·

|

perceptions by physicians, pharmacists, patients and others in the medical community about the safety and effectiveness of our products;

|

|

|

·

|

the prevalence and severity of any side effects;

|

|

|

·

|

pharmacological benefit of our products relative to competing products and products under development;

|

|

|

·

|

the efficacy and potential advantages relative to competing products and products under development;

|

|

|

·

|

relative convenience and ease of administration;

|

|

|

·

|

effectiveness of our education, marketing and distribution efforts;

|

|

|

·

|

publicity concerning our products or competing products and treatments; and

|

|

|

·

|

the price for our products and competing products.

|

If our products fail to attain market acceptance among the medical community, or if our currently marketed products cannot maintain market acceptance, our results of operations and profitability would be adversely affected.

Our success is dependent upon our ability to maintain our relationships with hospitals, clinics, pharmacies, drugstores and other health care institutions, to expand such relationships and develop new relationships.

Our business depends significantly on our relationships with hospitals, clinics, pharmacies, drugstores and other health care institutions. No assurance can be given that any such distribution channels will continue their relationships with us, and the loss of one or more of these distribution channel partners could have a material adverse effect on our business, results of operations and financial condition. Our ability to grow our business will therefore depend to a significant degree upon our ability to develop new relationships with such distribution channel partners and to expand existing relationships. No assurance can be given that new partners will be found, that any such new relationships will be successful when they are in place, or that business with current distribution channel partners will increase. Failure to develop and expand such relationships could have a material adverse effect on our business, results of operations and financial condition.

3

We may not be able to timely identify or otherwise effectively respond to changing customer preferences, and we may fail to optimize our product offering and inventory position.

The pharmaceutical industry in China is rapidly evolving and is subject to rapidly changing customer preferences that are difficult to predict. We believe that our success depends on our ability to anticipate and identify customer preferences and adapt our product selection to these preferences. In particular, we believe that we must optimize our product selection and inventory positions based on sales trends. No assurances can be given that our product selection, especially our selections of nutritional supplements and food products, will accurately reflect customer preferences at any given time. If we fail to anticipate accurately either the market for our products or customers’ purchasing habits or fail to respond to customers’ changing preferences promptly and effectively, we may not be able to adapt our product selection to customer preferences or make appropriate adjustments to our inventory positions, which could significantly reduce our revenue and have a material adverse effect on our business, financial condition and results of operations.

We face significant competition, and if we do not compete successfully against existing and new competitors, our revenue and profitability would be materially and adversely affected.

The pharmaceutical industry in China is highly competitive, and we expect competition to intensify. In addition there is a trend towards consolidation of the pharmaceutical industry in the future. Our primary competitors are other provincial pharmaceutical distributors. We compete for customers and revenue primarily on the basis of product selection, price, and timely delivery of products. Moreover, we may be subject to additional competition from new entrants to the drugstore industry in China. If the PRC government removes the barriers for foreign companies to operate majority-owned pharmaceutical distributors in China, we could face increased competition from foreign companies. Some of our larger competitors may enjoy competitive advantages, such as:

|

|

·

|

greater financial and other resources;

|

|

|

·

|

larger variety of products;

|

|

|

·

|

more extensive and advanced supply chain management systems;

|

|

|

·

|

greater pricing flexibility;

|

|

|

·

|

larger economies of scale and purchasing power;

|

|

|

·

|

more extensive advertising and marketing efforts;

|

|

|

·

|

greater knowledge of local market conditions;

|

|

|

·

|

larger sales and distribution networks.

|

As a result, we may be unable to offer products similar to, or more desirable than, those offered by our competitors, market our products as effectively as our competitors or otherwise respond successfully to competitive pressures. In addition, our competitors may be able to offer larger discounts on the same or competing products, and we may not be able to profitably match those discounts. Furthermore, our competitors may offer products that are more attractive to our customers or that render our products uncompetitive. Our failure to compete successfully could materially and adversely affect our business, financial condition, results of operation and prospects.

Our reliance on third-party manufacturers to supply our products may result in disruptions to our distribution network.

We rely on third-party manufactures to supply our products. Reliance on such third-party manufacturers involves a number of risks, including a lack of control over the manufacturing process and the potential absence or unavailability of adequate capacity. If any of our third-party manufacturers cannot or will not manufacture our products in required volumes in compliance with applicable regulations, on a cost-effective basis, in a timely manner, or at all, we will have to secure alternative manufacturers. Maintaining relationships with existing manufacturers and replacing such manufacturers may be difficult and time consuming. Any disruption of our network of manufacturers, including failure to renew existing distribution agreements with desired manufacturers, could negatively affect our product selection and our ability to effectively sell our products and could materially and adversely affect our business, financial condition and results of operations.

4

Failure to maintain optimal inventory levels could increase our inventory holding costs or cause us to lose sales, either of which could have a material adverse effect on our business, financial condition and results of operations.

We need to maintain sufficient inventory levels to operate our business successfully as well as meet our customers’ expectations. However, we must also prevent accumulating excess inventory. We are exposed to increased inventory risks due to our increased offering of private label products, rapid changes in product life cycles, changing consumer preferences, uncertainty of success of product launches, seasonality, and manufacturer backorders and other vendor-related problems. No assurances can be given that we can accurately predict these trends and events and avoid over-stocking or under-stocking products. In addition, demand for products could change significantly between the time product inventory is ordered and the time it is available for sale. When we begin selling a new product, it is particularly difficult to forecast product demand accurately. The purchase of certain types of inventory may require significant lead-time. As we carry a broad selection of products and maintain significant inventory levels for a substantial portion of our merchandise, we may be unable to sell such inventory in sufficient quantities or during the relevant selling seasons. Carrying too much inventory would increase our inventory holding costs, and failure to have inventory in stock when orders are received could cause us to lose such orders or customers, either of which could have a material adverse effect on our business, financial condition and results of operations.

The retail prices of some of our products are subject to control, including periodic downward adjustment, by PRC governmental authorities which may have an adverse effect on our profitability.

An increasing percentage of our products, primarily those included in the national and provincial Medical Insurance Catalogues, are subject to price controls in the form of fixed retail prices or retail price ceilings. In addition, the retail prices of these products are also subject to periodic downward adjustments as the PRC governmental authorities seek to make pharmaceutical products more affordable to the general public. Any future price controls or government mandated price reductions may have a material adverse affect on our financial condition and results of operations, including significantly reducing our revenue, margins and profitability.

Reimbursement may not be available for our products, which could diminish our sales or affect our ability to sell our products profitably.

Market acceptance and sales of our products also depend to a large extent on the reimbursement policies of the PRC government. The Ministry of Labor and Social Security of the PRC or provincial or local labor and social security authorities, together with other government authorities, review the inclusion or removal of drugs from the national Medical Insurance Catalog or provincial or local medical insurance catalogs for the National Medical Insurance Program every other year, and the tier under which a drug will be classified, both of which affect the amounts reimbursable to program participants for their purchases of those medicines. These determinations are made based on a number of factors, including price and efficacy. Depending on the tier under which a drug is classified in the provincial medicine catalog, a National Medical Insurance Program participant residing in that province can be reimbursed for the full cost of Tier 1 medicine and for 80% to 90% of the cost of a Tier 2 medicine. Decisions by the relevant government authorities not to include our products in the medicine catalogs may reduce the affordability of our products relative to other products included in the medicine catalogs and negatively affect the public perception regarding our products which in turn would adversely affect the sales of these products and reduce our net revenue.

Adverse publicity associated with our company or our products or similar products manufactured by our competitors could have a material adverse effect on our results of operations.

We are highly dependent upon market perceptions of the safety and quality of our products. Concerns over the safety of pharmaceutical products manufactured in China could have an adverse effect on the sale of such products, including products distributed by us. We could be adversely affected if any of our products or any similar products distributed by other companies prove to be, or are alleged to be, harmful to patients. Any negative publicity associated with severe adverse reactions or other adverse effects resulting from patients’ use or misuse of our products or any similar products manufactured by other companies could also have a material adverse impact on our results of operations. If in the future we become involved in incidents of the type described above, such problems could severely and adversely impact our product sales and reputation.

5

The continued penetration of counterfeit products into the retail market in China may damage our brand and reputation and have a material adverse effect on our business, financial condition, results of operations and prospects.

There has been continued penetration of counterfeit products into the pharmaceutical retail market in China. Counterfeit products are generally sold at lower prices than the authentic products due to their low production costs, and in some cases are very similar in appearance to the authentic products. Counterfeit pharmaceuticals may or may not have the same chemical content as their authentic counterparts, and are typically manufactured without proper licenses or approvals as well as fraudulently mislabeled with respect to their content and/or manufacturer. Although the PRC government has been increasingly active in combating counterfeit pharmaceutical and other products, there is not yet an effective counterfeit pharmaceutical product regulation control and enforcement system in China. Although we have implemented a series of quality control procedures in our procurement process, no assurances can be given that we would not be selling counterfeit pharmaceutical products inadvertently. Any unintentional sale of counterfeit products may subject us to negative publicities, fines and other administrative penalties or even result in litigation against us. Moreover, the continued proliferation of counterfeit products and other products in recent years may reinforce the negative image of retailers among consumers in China, and may severely harm the reputation and brand name of companies like us. The continued proliferation of counterfeit products in China could have a material adverse effect on our business, financial condition, results of operations and prospects.

Our geographic concentration in Yunnan Province presents certain risks that could adversely affect us.

We conduct our logistics and distribution business in Yunnan Province, China. Therefore, we are subject to risks specifically related to such region, including adverse economic effects on this region, natural disasters, local laws and regulations, including the discretion of provincial and regional price control authorities to authorize price adjustments for our products. Because of our geographic concentration, these risks could have a material adverse effect on our business and could result in significant disruptions to our business or increased operating expenses. In addition, we rely on our warehouse located in Kunming, City, Yunnan Province, to ship our products to our customers. If our warehouse was destroyed or shut down for any reason, we would incur significantly higher costs and delays associated with distribution of products during the time it takes us to reopen or replace our warehouse.

We rely on computer software and hardware systems in managing our operations, the capacity of which may restrict our growth and the failure of which could adversely affect our business, financial condition and results of operations.

We are dependent upon our integrated information management system to monitor daily operations of our drugstores and to maintain accurate and up-to-date operating and financial data for compilation of management information. In addition, we rely on our computer hardware and network for the storage, delivery and transmission of data. Any system failure which causes interruptions to the input, retrieval and transmission of data or increase in the service time could disrupt our normal operation. Although we believe that our disaster recovery plan is adequate in handling the failure of our computer software and hardware systems, no assurances can be given that we can effectively carry out this disaster recovery plan and that we will be able to restore our operation within a sufficiently short time frame to avoid our business being disrupted. Any failure in our computer software and/or hardware systems could have a material adverse effect on our business, financial condition and results of operations. In addition, if the capacity of our computer software and hardware systems fails to meet the increasing needs of our expanding operations, our ability to grow may be constrained.

Our dependence on the development and maintenance of the internet infrastructure could result in disruptions to our business.

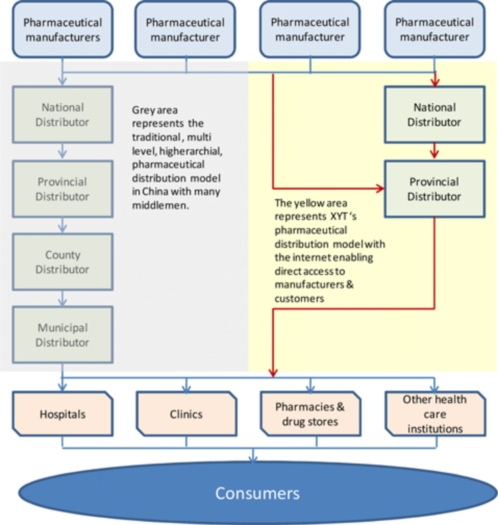

We believe that our ability to fill orders over the internet provides us a competitive advantage over certain other provincial distributors as we can order directly from some manufacturers as well as bypass several layers in the traditional Chinese pharmaceutical distribution model that utilizes county and municipal distributors and provide our product line directly to hospitals, clinics, pharmacies, drug stores and other health care institutions. Therefore, we believe the success our business will depend largely on the development and maintenance of the internet infrastructure. This includes maintenance of a reliable network backbone with the necessary speed, data capacity, and security, as well as timely development of complementary products, for providing reliable internet access and services. XYT’s Kunming headquarters are supplied high speed internet capacity by China Telecom and China Netcom. Hosting of the XYT website is provided by Jian Wang Technology Co. Ltd at a cost of $90.00 per year. To protect against XYT’s website going down, the corporate servers utilize dual line server connections to both China Telecom and China Netcom. However, the internet has experienced, and is likely to continue to experience, significant growth in the numbers of users and amount of traffic. The internet infrastructure may be unable to support such demands. In addition, increasing numbers of users, increasing bandwidth requirements, or problems caused by “viruses,” “worms,” and similar programs may harm the performance of the internet. The backbone computers of the internet have been the targets of such programs. The internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure, and it could face outages and delays in the future. These outages and delays could reduce the level of internet usage generally resulting in lower fulfillment of orders for our products over the internet, which may have a negative impact on our revenues.

Increasing government regulation of the internet could affect our business.

We are subject not only to regulations applicable to businesses generally but also to laws and regulations directly applicable to electronic commerce. The PRC government may adopt new laws and regulations applicable to electronic commerce. Any such legislation or regulation could dampen the growth of the internet and decrease its acceptance. If such a decline occurs, customers may decide in the future not to use the internet to fulfill their orders for our products. Any new laws or regulations in the following areas could affect our business:

6

|

|

·

|

user privacy;

|

|

|

·

|

the pricing and taxation of products offered over the internet;

|

|

|

·

|

the content of websites;

|

|

|

·

|

copyrights;

|

|

|

·

|

the online distribution of specific material or content over the internet; and

|

|

|

·

|

the characteristics and quality of services offered over the internet.

|

If we are unable to detect and prevent unauthorized use of confidential information, we could be subject to financial liability, our reputation could be harmed and customers may be reluctant to purchase products from us.

We rely to a large extent upon our information technology systems and infrastructure which are potentially vulnerable to breakdown, malicious intrusion and random attack. Likewise, data privacy breaches by employees and others with permitted access to our systems may pose a risk that sensitive data may be exposed to unauthorized persons or to the public. While we have taken measures for the protection of data and information technology, no assurances can be given that our efforts will prevent breakdowns or breaches in our systems that could adversely affect our business.

We expect to rely on encryption and authentication technology to provide secure transmission of confidential information over the internet, including confidential customer information. Advances in computer capabilities, new discoveries in the field of cryptography or other events or developments could result in a compromise or breach of the technologies used to protect sensitive transaction data. If any such compromise of our security, or the security of our customers, were to occur, it could result in misappropriation of proprietary information or interruptions in operations and have an adverse impact on our reputation and our business could suffer. Additionally, we might be required to expend significant capital and other resources to protect against security breaches or to rectify problems caused by any security breach.

Uninsured claims and litigation could adversely impact our operating results.

The distribution of drugs, including medicine products, chemical agents, antibiotics, biochemistry drugs and biological preparations entails an inherent risk of harm to the patient and, therefore, product liability. In extreme situations, pharmaceutical product manufacturers and distributors may be subject to criminal liability if their goods or services lead to the death or injuries of customers or other third parties. If a product liability claim is brought against us, it may, regardless of merit or eventual outcome, result in damage to our reputation, breach of contract with our customers, decreased demand for our products, costly litigation, product recalls, loss of revenue, and the inability to commercialize some products. Although we have general business insurance coverage, to the extent deemed prudent by our management and to the extent insurance is available, no assurances can be given that the nature and amount of the insurance coverage will be sufficient to fully indemnify us against liabilities arising out of pending and future claims and litigation. Our insurance coverage is subject to deductibles or self-insured retentions and contain certain coverage exclusions. The insurance does not cover damages from breach of contract by us, alleged fraud or deceptive trade practices. Insurance and customer agreements do not provide complete protection against losses and risks, and our results of operations could be adversely affected by unexpected claims not covered by insurance.

The decision of the Yunnan Food and Drug Administration to issue licenses to fill orders over the internet to our competitors would have an adverse effect on our business and diminish our competitive advantage over such competitors.

We have obtained government approval to fill orders over the internet in Yunnan Province, thereby bypassing municipal and county pharmaceutical distributors and provide products directly to retailers and in some cases, customers. We believe that our ability to fill orders over the internet provides us a competitive advantage over certain of our competitors. Bypassing the additional layers of distribution enables us to offer products to our customers at a significantly lower price than our major competitors while maintaining our margins. In 2010, the Yunnan Food and Drug Administration lifted a moratorium and began accepting new applications for these licenses. If the Yunnan Food and Drug Administration issues licenses to fill orders over the internet to our competitors, we would lose our competitive advantage resulting from our license to fill orders over the internet.

7

Our certificates, permits, and licenses related to our business are subject to governmental control and renewal and failure to obtain renewal will cause all or part of our operations to be terminated.

We are subject to various PRC laws and regulations pertaining to the pharmaceutical industry. We have attained certificates, permits, and licenses required for the operation of our business. Our distribution permit is valid for five years and renewal of such permit is subject to an inspection of our facilities, warehouse, hygienic environment, quality control systems, personnel and equipment. In addition, we possess an Internet Drug Information Service License in Yunnan Province issued by the Yunnan Food which enables us to provide internet drug transaction services. Such license is valid for five years and will expire in November 2014 and in order to renew the license, we must undergo reexamination. Additionally, as a distributor of nutritional supplements and other food products we must also have a food hygiene certificate from relevant provincial or local health regulatory authorities which is valid for four years. We have Good Supply Practice Standards certificates which currently have expiration dates of nearly five years. We intend to apply for renewal of our licenses, permits and certificates, but no assurances can be given that we will be successful in obtaining such renewals. In the event that trade protectionist policies are implemented by countries currently supplying Western drugs to China, such activities would adversely affect all pharmaceutical distribution companies in China, including XYT. In the event that we are not able to import Western drugs due to trade protection measures or to meet any new requirements imposed on our business by the appropriate regulatory authorities or are unable to renew our certificates, permits and licenses, all or part of our operations may be terminated. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of our operations, it may adversely affect our operation and profitability.

Our failure to retain and attract qualified personnel could harm our business.

We believe that our success depends in part on our ability to attract, train and retain qualified personnel, including sales personnel. Competition for qualified personnel is intense and we may not be able to hire sufficient personnel to achieve our goals or support the anticipated growth in our business. If we fail to attract and retain qualified personnel, our business will suffer.

If we are unable to protect our intellectual property from infringement, our business and prospects may be harmed.

As sales of our private label products increasingly account for a substantial portion of our revenue, we consider our brand name and trade names to be valuable assets. Although we currently have no trademarks, under PRC law, we would have the exclusive right to use a trademark for products for which such trademark has been registered with the PRC Trademark Office of State Administration for Industry and Commerce (“SAIC”). In addition, no assurances can be given that we will be able to obtain any trademarks for which we may apply in the future.

Moreover, we may be unable to prevent third parties from using our brand name without authorization and we may not have adequate remedies for such violations. Unauthorized use of our brand name by third parties may adversely affect our business and reputation, including the perceived quality and reliability of our products.

We also rely on trade secrets to protect our know-how and other proprietary information, including pricing, purchasing, promotional strategies, customer lists and/or suppliers lists. However, trade secrets are difficult to protect. While we use reasonable efforts to protect our trade secrets, our employees, consultants, contractors or advisors may unintentionally or willfully disclose our information to competitors. In addition, confidentiality agreements, if any, executed by the foregoing persons may not be enforceable or provide meaningful protection for our trade secrets or other proprietary information in the event of unauthorized use or disclosure. If we were to enforce a claim that a third party had illegally obtained and was using our trade secrets, our enforcement efforts could be expensive and time-consuming, and the outcome is unpredictable. In addition, if our competitors independently develop information that is equivalent to our trade secrets or other proprietary information, it will be even more difficult for us to enforce our rights and our business and prospects could be harmed.

Litigation may be necessary in the future to enforce our intellectual property rights or to determine the validity and scope of the intellectual property rights of others. However, because the validity, enforceability and scope of protection of intellectual property rights in the PRC are uncertain and still evolving, we may not be successful in prosecuting these cases. In addition, any litigation or proceeding or other efforts to protect our intellectual property rights could result in substantial costs and diversion of our resources and could seriously harm our business and operating results. Furthermore, the degree of future protection of our proprietary rights is uncertain and may not adequately protect our rights or permit us to gain or keep our competitive advantage. If we are unable to protect our trade names, trade secrets and other propriety information from infringement, our business, financial condition and results of operations may be materially and adversely affected.

8

We may be exposed to intellectual property infringement and other claims by third parties which, if successful, could disrupt our business and have a material adverse effect on our financial condition and results of operations.

Our success depends, in large part, on our ability to use our proprietary information and know-how without infringing third party intellectual property rights. As we increase our sales of private label products, and as litigation becomes more common in China, we face a higher risk of being the subject of claims for intellectual property infringement, invalidity or indemnification relating to other parties’ proprietary rights. Our current or potential competitors, many of which have substantial resources, may have or may obtain intellectual property protection that may prevent, limit or interfere with our ability to make, use or sell our products in China. Moreover, the defense of intellectual property suits, including trademark infringement suits, and related legal and administrative proceedings can be both costly and time consuming and may significantly divert the efforts and resources of our management personnel. Resolving intellectual property infringement claims may also require us to enter into license agreements. No assurances can be given that we would be able to obtain license agreements on commercially reasonable terms. A successful claim of intellectual property infringement could subject us to significant damages and may prevent us from manufacturing or selling the affected product. Any of these events could have a material adverse effect on our profitability and financial condition.

We depend substantially on the continuing efforts of our executive officers, and our business and prospects may be severely disrupted if we lose their services.

Our future success is dependent on the continued services of the key members of our management team, including Mr. Zhen Jiang Wang, our Chairman and Chief Executive Officer, Ms. Jing Gong, our President, Mr. Yong Kang Chen, our Senior Vice President, Quality Control and Ms. Yi Jia Li, our Chief Financial Officer. We do not maintain key man life insurance on any of our executive officers and directors. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Therefore, our business may be severely disrupted, and we may incur additional expenses to recruit and retain new management. The process of hiring suitably qualified personnel is also often lengthy. If our recruitment and retention efforts are unsuccessful in the future, it may be more difficult for us to execute our business strategy.

Changes in economic conditions and consumer confidence in China may influence the industry in which we operate, consumer preferences and spending patterns.

Our business and revenue growth primarily depend on the size of the retail market of pharmaceutical products in China. As a result, our revenue and profitability may be negatively affected by changes in national, regional or local economic conditions and consumer confidence in China. We are susceptible to changes in economic conditions, consumer confidence and customer preferences of the Chinese population. External factors beyond our control that affect consumer confidence include unemployment rates, levels of personal disposable income, national, regional or local economic conditions, natural disasters, extreme weather conditions, disease outbreaks and acts of war or terrorism. Changes in economic conditions and consumer confidence could adversely affect consumer preferences, purchasing power and spending patterns. In addition, natural disasters, extreme weather conditions, disease outbreaks and acts of war or terrorism may cause damage to our facilities, disrupt the supply of the products we offer or adversely impact consumer demand. Any of these factors could have a material adverse effect on our business, financial condition and results of operations.

We are subject to critical accounting policies and actual results may vary from our estimates.

We follow generally accepted accounting principles in the United States in preparing our financial statements. As part of the preparation of such financial reports, we must make many estimates and judgments concerning future events, which affect the value of the assets and liabilities, contingent assets and liabilities, and revenue and expenses reported in our financial statements. We believe that these estimates and judgments are reasonable, and we make them in accordance with our accounting policies based on information available at the time. However, actual results could differ from our estimates, and this could require us to record adjustments to expenses or revenues that could be material to our financial position and results of operations in the future.

9

We may not be able to manage our expansion of operations effectively and failure to do so could strain our management, operational and other resources, which could materially and adversely affect our business and growth potential.

We have grown rapidly since our inception and we anticipate continued expansion of our business to address growth in demand for our products, as well as to capture new market opportunities. The continued growth of our business has resulted in, and will continue to result in, substantial demands on our management, operational and other resources. In particular, we believe that the management of our growth will require, among other things:

|

|

·

|

our ability to expand our market reach in China beyond the Yunnan Province;

|

|

|

·

|

our ability to continue to identify new customers;

|

|

|

·

|

our ability to optimize product offerings and increase sales of private label products;

|

|

|

·

|

our ability to control procurement cost and optimize product pricing;

|

|

|

·

|

our ability to control operating expenses;

|

|

|

·

|

our ability to improve reporting systems and procedures;

|

|

|

·

|

information technology system enhancement;

|

|

|

·

|

strengthening of financial and management controls;

|

|

|

·

|

increased marketing, sales and sales support activities; and

|

|

|

·

|

hiring, training and managing of new personnel, including sales personnel.

|

If we are not able to manage our growth successfully, our business and prospects would be materially and adversely affected.

We may acquire other businesses, license rights to products or form alliances with third-parties, which could cause us to incur significant expenses and could negatively affect our profitability.

We may pursue acquisitions, licensing arrangements, and strategic alliances, as part of our business strategy. We may not complete these transactions in a timely manner, on a cost-effective basis, or at all, and may not realize the expected benefits. If we are successful in making an acquisition, the products that are acquired may not be successful or may require significantly greater resources and investments than originally anticipated. We may not be able to integrate acquisitions successfully into our existing business and could incur or assume significant debt and unknown or contingent liabilities. This may result in increased borrowing costs and interest expense.

We may need additional capital and may not be able to obtain it on acceptable terms or at all, which could adversely affect our liquidity and financial position; the issuance of additional equity would result in dilution to our shareholders.

We may need to raise additional capital if our expenditures exceed our current expectations due to changed business conditions or other future developments. Our future liquidity needs and other business reasons may require us to sell additional equity or debt securities or obtain a credit facility. The sale of additional equity securities or securities convertible or exchangeable to our equity securities would result in additional dilution to our stockholders. The incurrence of additional indebtedness would result in increased debt service obligations and could result in operating and financing covenants that restrict our operational flexibility. Our ability to raise additional funds in the future is subject to a variety of uncertainties, including:

|

|

·

|

our future financial condition, results of operations and cash flows;

|

|

|

·

|

general market conditions for capital-raising activities by pharmaceutical companies; and

|

|

|

·

|

economic, political and other conditions in China and elsewhere.

|

No assurances can be given that we will be able to obtain additional capital in a timely manner or on commercially acceptable terms or at all.

Future acquisitions are expected to be a part of our growth strategy, and could expose us to significant business risks.

One of our strategies is to grow our business through acquisition of other pharmaceutical distributor companies. However, no assurances can be given that we will be able to identify and secure suitable acquisition opportunities. Our ability to consummate and integrate effectively any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and, to the extent necessary, our ability to obtain financing on satisfactory terms for larger acquisitions, if at all.

10

Moreover, if an acquisition candidate is identified, the third parties with whom we seek to cooperate may not select us as a potential partner or we may not be able to enter into arrangements on commercially reasonable terms or at all. The negotiation and completion of potential acquisitions, whether or not ultimately consummated, could also require significant diversion of management’s time and resources and potential disruption of our existing business. Furthermore, no assurances can be given that the expected synergies from future acquisitions will actually materialize. In addition, future acquisitions could result in the incurrence of additional indebtedness, costs, and contingent liabilities. Future acquisitions may also expose us to potential risks, including risks associated with:

|

|

·

|

the integration of new operations, services and personnel;

|

|

|

·

|

unforeseen or hidden liabilities;

|

|

|

·

|

the diversion of financial or other resources from our existing businesses;

|

|

|

·

|

our inability to generate sufficient revenue to recover costs and expenses of the acquisitions; and

|

|

|

·

|

the potential loss of, or harm to, relationships with employees or customers.

|

Any of the above could significantly disrupt our ability to manage our business and materially and adversely affect our business, financial condition and results of operations.

Risks Related to Our Corporate Structure

Transactions among our affiliates are subject to scrutiny by the PRC tax authorities and a finding that we or any of our consolidated entities owe additional taxes could have a material adverse impact on our net income and the value of an investment in our common stock.

Under PRC law, arrangements and transactions among related parties may be subject to audit or challenge by the PRC tax authorities. If any of the transactions we have entered into among our consolidated entities are challenged by the PRC tax authorities to be not on an arm’s-length basis, or to result in an unreasonable reduction in our PRC tax obligations, the PRC tax authorities have the authority to disallow our tax deduction claims, adjust the profits and losses of our respective PRC consolidated entities and assess late payment fees and other penalties. Our net income may be materially reduced if our tax liabilities increase or if we are otherwise assessed late payment fees or other penalties.

Risks Related to Doing Business in China

Adverse changes in political and economic policies of the PRC government could have a material adverse effect on the overall economic growth of China, which could reduce the demand for our products and materially and adversely affect our competitive position.

All of our business operations are conducted in China and all of our sales are made in China. Accordingly, our business, financial condition, results of operations and prospects are affected significantly by economic, political and legal developments in China. The Chinese economy differs from the economies of most developed countries in many respects, including:

|

|

·

|

the degree of government involvement;

|

|

|

·

|

the level of development;

|

|

|

·

|

the growth rate;

|

|

|

·

|

the control of foreign exchange;

|

|

|

·

|

access to financing; and

|

|

|

·

|

the allocation of resources.

|

While the Chinese economy has grown significantly in the past 25 years, the growth has been uneven, both geographically and among various sectors of the economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some of these measures benefit the overall Chinese economy, but may also have a negative effect on us. The Chinese government may not continue to pursue these policies or may significantly alter them to our detriment from time to time with little, if any, prior notice. Changes in policies, laws and regulations or in their interpretation or the imposition of confiscatory taxation, restrictions on currency conversion, restrictions or prohibitions on dividend payments to stockholders, governmental control over capital investments or changes in tax regulations applicable to us, devaluations of currency or the nationalization or other expropriation of private enterprises could have a material adverse effect on our business.

11

The Chinese economy has been transitioning from a planned economy to a more market-oriented economy. Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the reduction of state ownership of productive assets and the establishment of sound corporate governance in business enterprises, a substantial portion of the productive assets in China is still owned by the PRC government. The continued control of these assets and other aspects of the national economy by the PRC government could materially and adversely affect our business. The PRC government also exercises significant control over China’s economic growth through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and providing preferential treatment to particular industries or companies. Since late 2003, the PRC government implemented a number of measures, such as raising bank reserves against deposit rates to place additional limitations on the ability of commercial banks to make loans and raise interest rates, in order to decrease the growth rate of specific segments of China’s economy which it believed to be overheating. These actions, as well as future actions and policies of the PRC government, could materially affect our liquidity and access to capital and our ability to operate our business. Nationalization or expropriation could even result in the total loss of our investment in China and in the total loss of our stockholders’ investment.

New labor laws in the PRC may adversely affect our results of operations.

On January 1, 2008, the PRC government promulgated the Labor Contract Law of the PRC, or the New Labor Contract Law. The New Labor Contract Law imposes greater liabilities on employers and significantly impacts the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

If political relations between the United States and China worsen, our stock price may decrease and we may have difficulty accessing U.S. capital markets.

At various times during recent years, the United States and China have had significant disagreements over political and economic issues. Controversies may arise in the future between these two countries. Any political or trade controversies between the United States and China, whether or not directly related to our business, could adversely affect the market price of our common stock and our ability to access U.S. capital markets.

Uncertainties with respect to the PRC legal system could limit the protections available to you and us.

The PRC legal system is a civil law system based on written statutes. Unlike the common law system in the United States, prior court decisions may be cited for reference but have limited precedential value. Since 1979, PRC legislation and regulations have significantly enhanced the protections afforded to various forms of foreign investments in China. We conduct all of our business through our subsidiary established in China. Thus we are generally subject to laws and regulations applicable to foreign investment in China and, in particular, laws applicable to wholly foreign-owned enterprises. However, since many laws, rules and regulations are relatively new and the PRC legal system continues to rapidly evolve, the interpretations of many laws, regulations and rules are not always uniform and enforcement of these laws, regulations and rules involve uncertainties, which may limit legal protections available to us. For example, we may have to resort to administrative and court proceedings to enforce the legal protection that we enjoy either by law or contract. However, since PRC administrative and court authorities have significant discretion in interpreting and implementing statutory and contractual terms, it may be more difficult to evaluate the outcome of Chinese administrative and court proceedings and the level of legal protection we enjoy in China than in more developed legal systems. These uncertainties may impede our ability to enforce the contracts we have entered into with our business partners, customers and suppliers. In addition, such uncertainties, including the inability to enforce our contracts, could materially and adversely affect our business and operations. Furthermore, intellectual property rights and confidentiality protections in China may not be as effective as in the United States or other countries. Accordingly, we cannot predict the effect of future developments in the PRC legal system, particularly with regard to the Chinese pharmaceutical industry and retail industry, including the promulgation of new laws, changes to existing laws or the interpretation or enforcement thereof, or the preemption of local regulations by national laws. These uncertainties could limit the legal protections available to us and our investors. In addition, any litigation in China may be protracted and result in substantial costs and diversion of our resources and management attention.

12

The fluctuation of foreign currency exchange rates could materially impact our financial results.

Since we conduct our operations in China, our business is subject to foreign currency risks, including currency exchange rates fluctuations and difficulties in converting Renminbis into U.S. dollars. The exchange rates between the Renminbi and the U.S. dollar, Euro and other foreign currencies is affected by, among other things, changes in China’s political and economic conditions. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of foreign currencies. There remains significant international pressure on the PRC government to adopt a more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. dollar. In addition, appreciation or depreciation in the value of the Renminbi relative to the U.S. dollar would affect our financial results reported in U.S. dollar terms without giving effect to any underlying change in our business, financial condition and results of operations.

Because our assets are located outside of the United States and all of our directors and officers reside outside of the United States, it may be difficult for investors to enforce their rights based on United States federal securities laws or any United States court judgments against us and our officers and directors.

Our operating company and all of our assets are located in the PRC. In addition, all of our directors and officers reside outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the United States federal securities laws against us in the courts of either the United States or PRC and, even if civil judgments are obtained in United States courts, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties, under the United States federal securities laws or other United States laws.

Restrictions under PRC law on our PRC operating subsidiary’s ability to make dividends and other distributions could materially and adversely affect our ability to grow, make investments or complete acquisitions that could benefit our business, pay dividends to, and otherwise fund and conduct our businesses.

Substantially all of our revenues are earned by our PRC operating subsidiary, XYT. However, PRC regulations restrict the ability of our PRC subsidiary to make dividends and other payments to its offshore parent company. PRC legal restrictions permit payments of dividend by our PRC subsidiary only out of its accumulated after-tax profits, if any, determined in accordance with PRC accounting standards and regulations. Our PRC subsidiary is also required under PRC laws and regulations to allocate at least 10% of our annual after-tax profits determined in accordance with PRC GAAP to a statutory general reserve fund until the amounts in said fund reaches 50% of our registered capital. Allocations to these statutory reserve funds can only be used for specific purposes and are not transferable to us in the form of loans, advances or cash dividends. Any limitations on the ability of our PRC subsidiary to transfer funds to us could materially and adversely limit our ability to grow, make investments or acquisitions that could be beneficial to our business, pay dividends and otherwise fund and conduct our business.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

All of XYT’s sales revenue and expenses are denominated in RMB. Under PRC law, the RMB is currently convertible under the “current account,” which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, our PRC operating subsidiary may purchase foreign currencies for settlement of current account transactions, including payments of dividends to the Company, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC government authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in RMB, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in RMB to fund our business activities outside China that are denominated in foreign currencies.