Attached files

As filed with the Securities and Exchange Commission on May 25, 2011 Registration No. (333- )

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

CHINA FILMS TECHNOLOGY INC.

(Exact name of registrant as specified in its charter)

Nevada

(State or other jurisdiction of incorporation)

3081

(Primary Standard Industrial Classification Code Number)

90-0707608

(IRS Employer Identification No.)

Yunmeng Economic and Technological Development Zone

Firsta Road

Yunmeng County, Hubei Province

People’s Republic of China 432500

Telephone: 086 0712 4326146

Facsimile: 086 0712 4338866

(Address and telephone number of registrant’s principal executive offices)

__________________________

Peter J. Gennuso, Esq,

Gersten Savage, LLP

600 Lexington Avenue, 10th Floor

New York, NY 10022

Telephone (212) 752-9700

Facsimile (212)980-5192

(Name, address and telephone number of agent for service)

__________________________

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. [x]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

1

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act Registration Statement number of the earlier effective Registration Statement for the same offering. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company:

Large accelerated filer [ ] Accelerated Filer [ ] Non-accelerated filer [ ] Smaller reporting company [x]

|

CALCULATION OF REGISTRATION FEE

|

||||

|

Title of securities

|

Amount to be

|

Proposed maximum

|

Proposed maximum

|

Amount of

|

|

to be registered

|

Registered (1)

|

offering price per share (3)

|

aggregate offering price

|

registration fee

|

|

Common stock, par value $0.0001

|

300,000

Shares (2)

|

$1.00

|

$300,000

|

$58.05

|

|

(1)

|

In accordance with Rule 416(a), the registrant is also registering hereunder an indeterminate number of additional shares of common stock that may be issued and resold pursuant to stock splits, stock dividends, recapitalization and other similar transactions.

|

|

(2)

|

Direct Public Offering.

|

(3) There is no current market for the securities and the price at which the Shares are being offered has been arbitrarily determined by the Company and used for the purpose of computing the amount of the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended.

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell these securities and it is not a solicitation of an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted by the law of such state or jurisdiction. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities, or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

2

|

PRELIMINARY PROSPECTUS

|

Subject to Completion, Dated: May 25, 2011

|

China Films Technology Inc.

300,000 Shares of Common Stock

$1.00 per share

-----------------------------------------------------------------------------

This prospectus (“Prospectus”) relates to the offer and sale of 300,000 shares of common stock, $0.0001 par value per share, of China Films Technology Inc., a Nevada corporation (“China Films”, “we”, “us”, “our”, the “Company”). This is our initial public offering. There are no securities being sold by existing security holders.

No public market currently exists for our securities or the shares being offered. We are offering for sale a total of 300,000 shares of common stock on a "self-underwritten" basis, which means the shares will be offered and sold by our officers and directors, without any commissions being paid to them for any shares sold. We do not intend to engage the services of an underwriter to sell any of the shares and there is no guarantee we will be able to sell all of the shares being offered. The shares are being offered at a fixed price of $1.00 per share for a period not to exceed 180 days from the date of this Prospectus (“Expiration Date”). The offering will be an “all-or-none” offering, which means we will need to sell all of the shares before we can use any of the proceeds. We intend to establish a separate bank account, where all proceeds from sales of shares will be deposited until the offering is sold out and the total offering amount of $300,000 is raised, at which time the funds will be transferred to our business account for use in our business operations. In the event we do not sell all of the shares and raise all of the proceeds before the Expiration Date of the offering, all monies collected will be returned promptly to the subscribers, without deductions or interest of any kind.

China Films Technology Inc. is a leading flexible film producer and flexible packaging solutions provider in the People’s Republic of China (“PRC”). We are principally engaged in the research and development, product design, manufacture, quality assurance, sales and distribution of high quality plastic film products in China.

BEFORE INVESTING, YOU SHOULD CAREFULLY READ THIS PROSPECTUS AND, PARTICULARLY, THE RISK FACTORS SECTION, BEGINNING ON PAGE 8.

Neither the U.S. Securities and Exchange Commission (“SEC”) nor any state securities division has approved or disapproved these securities, or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

Offering Price Per Share

|

Total Amount of Offering

|

Underwriting Commissions

|

Proceeds to us

|

|

|

Common Stock

|

$1.00

|

$300,000

|

$0.00

|

$300,000

|

This is a “best efforts”, “all-or-none” offering and, as such, we will not be able to spend any of the proceeds unless and until all shares are sold and all proceeds are received. We intend to hold all monies collected for subscriptions in a separate bank account until the total amount of $300,000 has been received or until the 300,000 shares being offered have been sold. At that time, the funds will be transferred to our business account for use in the implementation of our business plans. In the event the offering is not sold out prior to the Expiration Date, all monies will be returned to investors, without interest or deduction.

Our securities are not currently listed on any exchange. Immediately following completion of this offering, we plan to contact a market maker to apply to have the shares quoted on the OTC Electronic Bulletin Board (OTCBB); however, we cannot guarantee that our application will be accepted or approved. As of the date of this filing, there have been no discussions or understandings between us, or anyone acting on our behalf, with any market maker regarding participation in a future listing of our securities.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, Dated ___________________, 2011

3

|

TABLE OF CONTENTS

|

|

|

Page No.

|

|

|

SUMMARY OF PROSPECTUS

|

5

|

|

General Information about Our Company

|

5

|

|

The Offering

|

7

|

|

RISK FACTORS

|

8

|

|

RISKS ASSOCIATED WITH OUR COMPANY

|

8

|

|

RISKS ASSOCIATED WITH DOING BUSINESS IN CHINA

|

15

|

|

RISKS ASSOCIATED WITH THIS OFFERING

|

19

|

|

USE OF PROCEEDS

|

23

|

|

DETERMINATION OF OFFERING PRICE

|

24

|

|

DILUTION OF THE PRICE YOU PAY FOR YOUR SHARES

|

24

|

| EXCHANGE RATE INFORMATION | 25 |

| SELLING SECURITY HOLDERS | 25 |

|

PLAN OF DISTRIBUTION

|

25

|

|

Offering will be Sold by Our Officers and Directors

|

25

|

|

Terms of the Offering

|

26

|

|

Deposit of Offering Proceeds

|

26

|

|

Procedures for and Requirements for Subscribing

|

26

|

|

DESCRIPTION OF SECURITIES

|

27

|

|

INTEREST OF NAMED EXPERTS AND COUNSEL

|

28

|

|

DESCRIPTION OF BUSINESS

|

29

|

|

DESCRIPTION OF PROPERTY

|

39

|

| INSURANCE | 39 |

|

LEGAL PROCEEDINGS

|

39

|

|

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

|

40

|

|

FINANCIAL STATEMENTS

|

42

|

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

42

|

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURES

|

55

|

|

DIRECTORS, EXECUTIVE OFFICERS, PROMOTERS AND CONTROL PERSONS

|

55

|

|

EXECUTIVE COMPENSATION

|

56

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

58

|

|

DISCLOSURE OF COMMISSION POSITION ON INDEMNIFICATION FOR SECURITIES LIABILITIES

|

59

|

|

AVAILABLE INFORMATION

|

59

|

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | 60 |

4

SUMMARY OF PROSPECTUS

Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read the more detailed information contained in this prospectus, including our financial statements and related notes. Our business involves significant risks. You should carefully consider the information under the heading "Risk Factors" beginning on page 8.

In this prospectus, unless the context otherwise denotes, references to “we,” “us,” “our,” “CFTI” and the “Company” are to China Films Technology Inc. “China” or “PRC” refers to the People’s Republic of China. “RMB” or “Renminbi” refers to the legal currency of China and “$” or “U.S. Dollars” refers to the legal currency of the United States.

General Information about Our Company

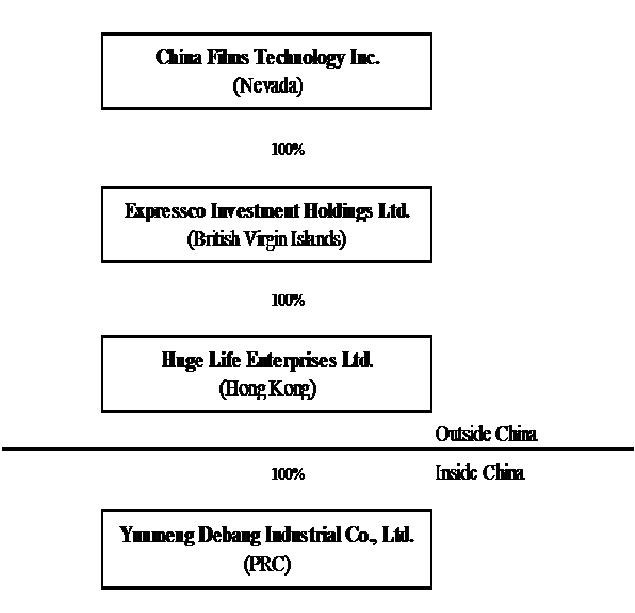

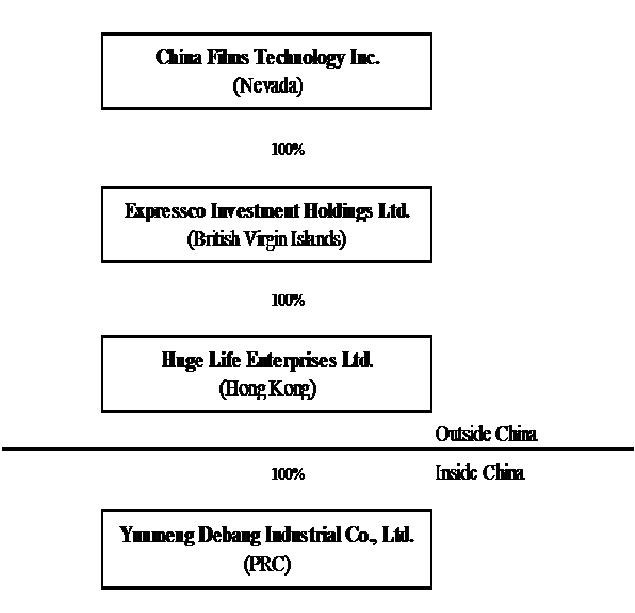

China Films Technology Inc. was incorporated in the State of Nevada on April 8, 2011. We are a holding company that conducts business operations in Hubei Province in the People’s Republic of China. On April 30, 2011, we entered into a stock exchange transaction with the shareholders of Expressco Investment Holdings Limited (“Expressco”), whereby we issued 58,400,000 shares of common stock in exchange for 100% of the ownership interest in Expressco, for the purpose of re-domiciling Expressco as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the share exchange transaction, Expressco became our wholly-owned operating subsidiary in the PRC. Unless otherwise indicated, all references to the Company throughout this prospectus include the operations of Expressco and its subsidiaries.

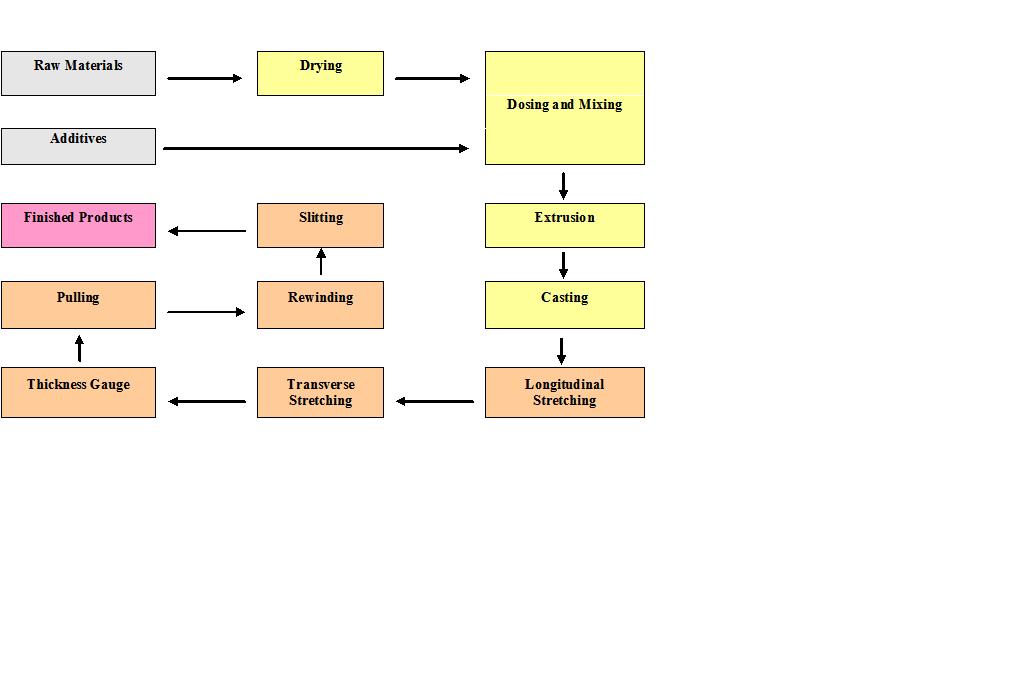

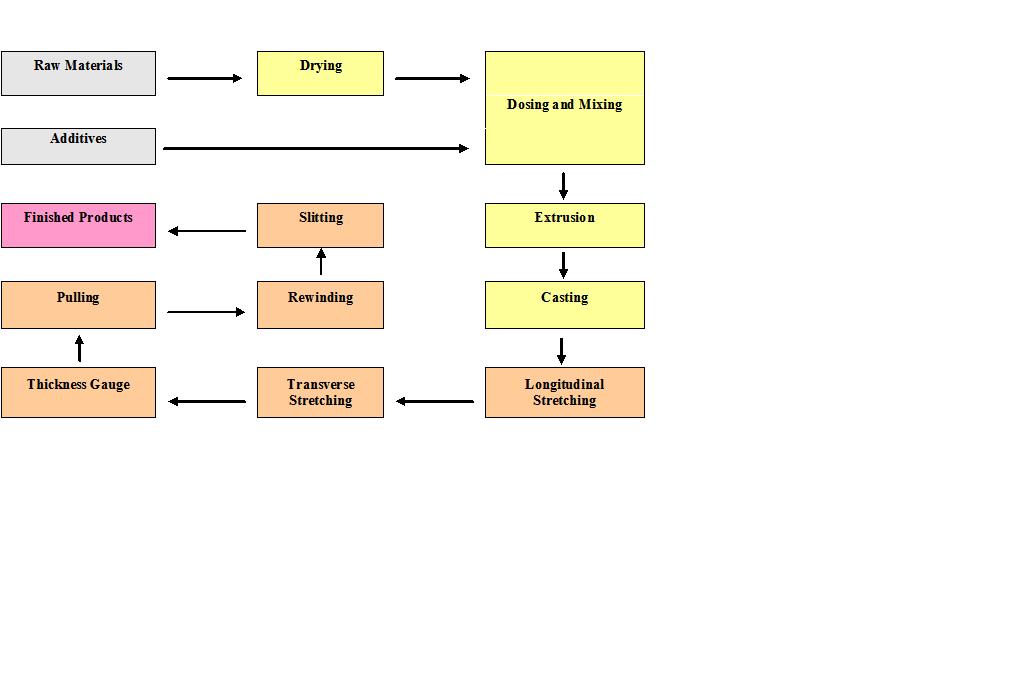

China Films Technology Inc. is a leading flexible film producer in the People’s Republic of China. Our product categories include packaging films, industrial films and specialty films. Our principal products include metallizable base films, transfer base films and specialty films which are widely used in consumer based packaging, imaging, electronics and electrical industries as well as magnetic products.

We also position ourselves as a flexible film solutions provider delivering customized packaging solutions to our clients using the high quality BOPET (biaxially oriented polyethylene terephthalate) film products. We provide integrated solutions throughout the entire product cycle, right from material chemistry research, technology development, product design, customized film production, quality assurance as well as sales and distribution.

At present, our revenues are derived from sale of packaging film products, industrial film products and specialty film products. In coming years, we expect to generate revenue from provision of flexible packaging solutions on a project-by-project basis.

Our production plant is located at the Yunmeng County Economic & Technological Development Zone of Hubei Province, the PRC with a total land area of 11,729.20 sq. meters and 145 employees. We currently operate one automated Brückner-made BOPET production line with a designed annual capacity of 15,000 tons to deliver differentiated product mix ranging from thickness of 8 microns to 75 microns. Brückner is one of the top manufacturers of world-advanced BOPET machines and equipment. We commenced our BOPET film production in May 2009.

Our Industry

According to an industry report published in 2009 by the U.S. Flexible Packaging Association, global packaging industry is estimated to be $505 billion, in which Western Europe and North America accounting for a majority of the world’s flexible packaging demand at 28% and 27%, respectively. Global flexible packaging market, being one of the fast-growing sectors, is estimated to be $52.2 billion with North America as the largest market, accounting for 32% of the market, followed by Europe (32%), Asia Pacific (28%), and Latin America (5%). The report also details that the two largest material segments of the global packaging industry are plastics (37%), and paper & board (36%). It is forecast that the U.S. flexible packaging industry will continue to produce outstanding packaging solutions for multiple products and uses and innovation will continue to drive the growth of the $25.9 billion flexible packaging industry.

5

Flexible packaging refers to bags, envelopes, pouches, sachets, wraps, etc., made of easily yielding materials such as film, foil, or paper sheeting which, when filled and sealed, acquires pliable shape. The flexible packaging industry experienced an estimated annual growth rate of 1.5% in 2007 and 2008, and has grown at a compound average growth rate (“CAGR”) of 3.4% from 1998 to 2008. Flexible packaging converters' expectations for the next three to five years are positive with revenue projected to increase slightly more than 3%, and volume to grow by approximately 3% per year. Flexible packaging industry in China has been developing rapidly in recent years for two major reasons. Firstly, the enormous consumer capacity, brought about by the fast-growing Chinese economy; and secondly, the great leaps in production technologies made by the industry players as a whole.

BOPET, PET and BOPP are the raw materials suitable for many forms of flexible packaging, printing, laminating, aluminum-plating and other applications. Improvement in production techniques in recent decade has widened the scope of applications for PET in areas like synthetic fibre, film, bottle, etc.. BOPET film is recyclable and environmental friendly, and is widely used in optical and packaging areas. With excellent physical and chemical characteristics and properties, demand for BOPET has been growing substantially over the past ten years.

According to a research report by PCI Films Consulting Ltd. (“PCI”), a consulting firm in the United Kingdom specialized in petrochemicals industry, world BOPET film demand has grown by an average annual rate of 7.2% since 2004 and reached an estimated 2.4 million tons in 2009. The Central and East Asian region, which includes South Korea, Japan and China, remains the world’s largest producer and consumer of BOPET films accounting for 51% of total demand. Flexible packaging applications for BOPET film now account for 51% of world demand. Bouncing back from recessionary downturns in the world market in 2008 / 2009, the thin film market is expected to grow at an average rate of 9.2% per annum, over the next five years. BOPET film producers have invested in capacity to keep pace with demand growth and increased by 53% the size of the industry since 2004. New applications for BOPET films have emerged in recent years and will continue to drive growth at above average rates for the market as a whole. According to the forecasts of PCI, world demand for BOPET films will continue to grow by an average of 8.6% per annum to reach 3.7 million tons by 2014. Growth in Asian demand is expected to account for almost 80% of world growth over the next five years. Capacity additions announced and expected, will expand the world BOPET film industry by another 38% over the next five years with Chinese producers accounting for one third of the expected increases but thin film supplies will still be short.

Our Competitive Strengths

We believe the following strengths have contributed to our success as a leading flexible film producer and flexible packaging solutions provider and differentiate us from our competitors:

|

l

|

We have an established brand name for quality film products in the PRC.

|

|

l

|

We have an experienced management team with extensive industry experience.

|

|

l

|

We are equipped with the R&D expertise in BOPET technologies.

|

|

l

|

We provide customized flexible packaging solutions to our clients.

|

Corporate History and Structure

China Films Technology Inc. was incorporated in the State of Nevada on April 8, 2011. On April 30, 2011, we entered into a stock exchange transaction with the shareholders of Expressco Investment Holdings Limited (“Expressco”), whereby we issued 58,400,000 shares of common stock in exchange for 100% of the ownership interest in Expressco, for the purpose of re-domiciling Expressco as a Nevada corporation in the United States. These shares were issued as restricted securities under SEC Rule 144. As a result of the merger, Expressco became our wholly-owned operating subsidiary in the PRC. Unless otherwise indicated, all references to the Company throughout this prospectus include the operations of Expressco and its subsidiaries.

Expressco was incorporated in the British Virgin Islands on January 4, 2010 as a limited liability company for the purpose of holding 100% equity interest in Huge Life Enterprises Limited (“HLEL”).

6

HLEL was incorporated in the Hong Kong Special Administrative Region (“Hong Kong”) on April 13, 2010 as a limited liability company. HLEL holds 100% equity interest in Yunmeng Debang Industrial Co., Ltd. (“YDIC”), which is a wholly foreign-owned enterprise under the laws of the People’s Republic of China and was incorporated on April 6, 2008. YDIC holds our licenses, intellectual properties and operations in the PRC.

The following diagram illustrates our current corporate structure:

Corporate Information

Our principal executive office is located at Yunmeng Economic and Technological Development Zone, Firsta Road, Yunmeng County, Hubei Province, PRC 432500. Our telephone number at this address is +86 0712-4326146. Investors should contact us for any inquiries through the address and telephone number of our principal executive offices. Our website is www.debangtech.com. The information contained on our website is not a part of this prospectus.

The Offering

Following is a brief summary of this offering. Please see the Plan of Distribution section for a more detailed description of the terms of the offering.

|

Securities Being Offered:

|

300,000 shares of common stock, par value $0.0001.

|

||

|

Offering Price per Share:

|

$1.00

|

||

|

Offering Period:

|

The shares are being offered for a period not to exceed 180 days.

|

||

|

Net Proceeds to Our Company:

|

$300,000

|

||

|

Use of Proceeds:

|

We intend to use the proceeds to expand our business operations.

|

||

|

Number of Shares Outstanding Before the Offering:

|

58,400,000

|

||

|

Number of Shares Outstanding After the Offering:

|

58,700,000

|

Our officers, directors, control persons and/or affiliates do not intend to purchase any shares in this offering.

7

RISK FACTORS

An investment in these securities involves an exceptionally high degree of risk and is extremely speculative in nature. Following are what we believe are all of the material risks involved if you decide to purchase shares in this offering.

RISKS ASSOCIATED WITH OUR COMPANY:

An increase in the prices of raw materials will lead to increased costs and may adversely affect our profit margins if we are unable to pass on such increases in costs to our customers

The main raw materials used in our production of BOPET film are polyethylene terephthalate (or PET) resin and additives, which respectively made up approximately 86.8% and 13.2% of our total cost of raw materials.

The PET resin is currently used as a raw material in China’s textile industry, and the market prices of PET resin may fluctuate due to changes in supply and demand conditions in that industry. Any sudden shortage of supply, or significant increase in demand, of PET resin and additives may result in higher market prices and thereby increase our cost of sales. The prices of PET resin and additives are, to a certain extent, affected by the price movement of crude oil.

However, the price of our major raw materials, PET resin, which are widely used in the textile industry in China, has not increased in line with the rising crude oil prices due to the dampened demand for PET resin from textile manufacturers in China as a result of the anti-dumping policy exerted by the US and European countries. There has been virtually no warning of these significant price spikes, and our ability to hedge against these fluctuations by either entering into long-term supply contracts or otherwise offsetting our exposure to these commodity price variations has been extremely limited. We currently have no hedging transactions in place with respect to PET resin or any other petroleum product.

If there is a significant increase in the cost of our raw materials and we are unable to pass on such increase to our customers on a timely basis or at all, our profit margins and results of operations will be adversely affected.

Rising Competition may materially affect our operation and financial conditions

We operate in a highly competitive and rapidly evolving field, and new developments are expected to continue at a rapid pace. Competitors may succeed by expanding their capacity or succeed in developing products that are more efficient, easier to use or less expensive than those which have been or are being developed by us that would render our technology and products obsolete and non-competitive. Any of these actions by our competitors could adversely affect our sales.

Additionally, several companies are developing similar and substitute products to address the same packaging field that we are targeting. These competitors may have greater financial and technical resources, productivity and marketing capabilities and facilities, and human resources, or they may have a better quality of products, service, and production cycle. The competition from these competitors may adversely affect our business.

An increase in competition could result in material selling price reductions or loss of our market share, which could have an adverse material impact on our operation and financial conditions.

Entry of new BOPET producers in the PRC may increase the supply of, and decrease the prices of, BOPET film in the industry, and hence lead to a decline in our profit margins

We believe that we are currently one of the few producers of BOPET film in the PRC with research and development capability and our past financial performance is attributable to our market position in the industry. Over time, there may be new entrants into our industry, whether as a result of increased access to the production technology of BOPET film or otherwise. Accordingly, we may experience increased competition and the entry of new BOPET producers will also lead to an increase in the industry supply of BOPET film resulting in more competitive pricing. We believe that our major competitors in the BOPET manufacturing market in the PRC are Dupont Hongji Films Foshan Co., Ltd, Zhejiang Ouya Film Co., Ltd, Fuwei (Shandong) Film Co., Ltd. and Yihua Toray Polyester Film Co., Ltd. We may have to price our products in response to competitive market conditions and this may lead to a decline in our profit margins. In the event that we are unable to compete successfully or retain effective control over the pricing of our products, our profit margins will decrease and, our revenues and net income may also decrease.

8

In addition, China has gradually lifted its import restrictions, lowered import tariffs and relaxed foreign investment restrictions after its entry into the World Trade Organization in December 2001. This can lead to increased competition from foreign companies in our industry, some of which are significantly larger and financially stronger than us. If we fail to compete effectively with these companies in the future, our current business and future growth potential would be adversely affected.

A significant portion of our revenue is derived from the flexible packaging industry in the PRC relating to the packaging of products in different industries

A significant portion of our revenue is currently derived from the production and sale of BOPET films. Our film products are largely used for the packaging in different industries like tobacco, cosmetics and pharmaceuticals, etc.. The demand for our film products is therefore indirectly affected by the demand in these industries.

Any decrease in the demand for our BOPET film will significantly affect our financial performance. Although demand for our BOPET film for packaging of pharmaceutical products, cosmetics, tobacco and alcohol has gradually been increasing, any unexpected decrease in demand of these products could result in a decline in the sales of our products and adversely impact our financial condition, business and operation.

We rely on key managerial and technical personnel and failure to attract or retain such personnel may compromise our ability to develop new products and to effectively carry on our research and development and other efforts

Our success to date has been largely attributable to the contributions of key management and experienced personnel, particularly Yongsheng Yang, our Chairman and Chief Executive Officer and Keng Swee Goh, our Chief Financial Officer. The loss of the services of Mr. Yang or Mr. Goh might impede the achievements of our development objectives and might damage the close business relationship we currently enjoy with some of our larger customers. We do not currently have any employment agreements with our Chief Executive Officer or our Chief Financial Officer. Our continued success is dependent, to a large extent, on our ability to attract or retain the services of these key personnel. We do not currently maintain key man insurance for any of our directors or officers.

Marketability of any of our new products is uncertain and low acceptance levels of any of our new products will adversely affect our revenue and profitability

The development of our products is based upon a complex technology, and requires significant time and expertise in order to meet industry standards and customers’ specifications. Although we have developed products that meet customers’ requirements in the past, there is no assurance that any of our research and development efforts will necessarily lead to any new or enhanced products or generate sufficient market share to justify commercialization. We must continually improve our current products and develop and introduce new or enhanced products that address the requirements of our customers and are competitive in terms of functionality, performance, quality and price in order to maintain and increase our market share. If our new products are unable to gain market acceptance, we would be forced to write-off the related inventory and would not be able to generate future revenue from our investment in research and development. In such event, we would be unable to increase our market share and achieve and sustain profitability. Our failure to further refine our technology and develop and introduce new products attractive to the market could cause our products to become uncompetitive or obsolete, which could reduce our market share and cause our sales to decline.

Our anti-counterfeit technology may not satisfy the changing needs of our customers.

With any anti-counterfeit product authentication technology, including the technology of our current and proposed products, there are risks that the technology may not successfully address all of our customers’ needs.

9

While we have already established successful relationships with Chinese customers with regard to our products, our customers’ ultimate needs may change or vary, thus introducing variables which may affect the ability of our proposed products to address all of our customers’ ultimate technology needs in an economically feasible manner.

Our growth strategy and future success depends upon commercial acceptance of products incorporating technologies we have developed and are continuing to develop. Technological trends have had and will continue to have a significant impact on our business. Our results of operations and ability to remain competitive are largely based upon our ability to accurately anticipate customer and market requirements. Our success in developing, introducing and selling new and enhanced products depends upon a variety of factors, including:

|

·

|

accurate technology and product selection;

|

|

·

|

timely and efficient completion of product design and treatment;

|

|

·

|

timely and efficient implementation of manufacturing processes;

|

|

·

|

product performance; and

|

|

·

|

product support and effective sales and marketing.

|

We may not be able to accurately forecast or respond to commercial and technological trends in the industries in which we operate.

We may not be able to keep pace with rapid technological changes in the anti-counterfeit product industry.

The anti-counterfeit product authentication industry is a relatively new industry and market, especially in China and other parts of Asia, and continues to evolve in terms of customer/market needs, applications, and technology. We believe we have hired or engaged personnel and outside consultants who have experience and are recognized within the industry to be experts in the anti-counterfeit product authentication industry. With respect to technology, while we continue to seek out and develop “next generation” technology through acquisition, strategic partnerships, and our own R&D, there is no guarantee that we will be able to keep pace with technological developments and market demands in this evolving industry and market. Technological changes, process improvements, or operating improvements that could adversely affect us include:

|

·

|

development of new technologies by our competitors or counterfeiters;

|

|

·

|

changes in product requirements of our customers; and

|

|

·

|

improvements in the alternatives to our technologies.

|

We may not have sufficient funds to devote to R&D, or our R&D efforts may not be successful in developing products in the time, or with the characteristics, necessary to meet customer needs. If we do not adapt to such changes or improvements, our competitive position, operations and prospects would be materially affected.

We have, in the past, experienced and may, from time to time, experience negative working capital and we face risks associated with debt financing (including exposure to variation in interest rates)

We have a negative working capital of $8,415,953 as at March 31, 2011. Our total short-term bank borrowing as of March 31, 2011 was $10,045,509 , which excludes $5,935,983 as current portion of long-term bank borrowings. In the event that we default on all expired indebtedness, our lenders could foreclose on our assets. In the event that our assets are foreclosed upon, we will not be able to continue to operate our business. Our obligations under our existing loans have been mainly met through the cash flow from our operations and our financing activities. We are subject to risks normally associated with debt financing, including the risk of significant increases in interest rates and the risk that our cash flow will be insufficient to meet required payment of principal and interest. In the past, cash flows from operations have been sufficient to meet payment obligations. There is however, no assurance that we will be able to continue to do so in the future. We may also underestimate our capital requirements and other expenditures or overestimate our future cash flows. In such

10

event, we may consider additional bank loans, issuing bonds, or other forms of financing to satisfy our capital requirements. If any of the aforesaid events occur and we are unable for any reason to raise additional capital, debt or other financing to meet our working capital requirements, our business, operating results, liquidity and financial position will be adversely affected. For example, if we fail to get appropriate financing, it will negatively impact the investment in and the production of our new production line. In addition, if we do not obtain financing or have negative working capital, there is a possibility that we may not be able to perform our contracts with our suppliers as a result of our inability to pay them back. The foregoing factors may have an adverse effect on our operation.

We may lose our competitive advantage and our operations may suffer if we fail to prevent the loss or misappropriation of, or disputes over, our intellectual property

We have applied for patents in respect of some of our processes, technologies and systems used in our business and these are pending approvals from the relevant PRC authorities. We may not be able to successfully obtain the approvals of the PRC authorities for our patent applications. Furthermore, third parties may assert claims to our proprietary processes, technologies and systems. These proprietary processes, technologies and systems are important to our business as they allow us to maintain our competitive edge over our competitors.

Our ability to compete in our markets and to achieve future revenue growth will depend, in significant part, on our ability to protect our proprietary technology and operate without infringing upon the intellectual property rights of others. The legal regime in China for the protection of intellectual property rights is still at its early stage of development. Intellectual property protection became a national effort in China in 1979 when China adopted its first statute on the protection of trademarks. Since then, China has adopted its Patent Law, Trademark Law and Copyright Law and promulgated related regulations such as Regulation on Computer Software Protection, Regulation on the Protection of Layout Designs of Integrated Circuits and Regulation on Internet Domain Names. China has also acceded to various international treaties and conventions in this area, such as the Paris Convention for the Protection of Industrial Property, Patent Cooperation Treaty, Madrid Agreement and its Protocol Concerning the International Registration of Marks. In addition, when China became a party to the World Trade Organization in 2001, China amended many of its laws and regulations to comply with the Agreement on Trade-Related Aspects of Intellectual Property Rights. Despite many laws and regulations promulgated and other efforts made by China over the years with a view to tightening up its regulation and protection of intellectual property rights, private parties may not enjoy intellectual property rights in China to the same extent as they would in many Western countries, including the United States, and enforcement of such laws and regulations in China have not achieved the levels reached in those countries. Both the administrative agencies and the court system in China are not well-equipped to deal with violations or handle the nuances and complexities between compliant technological innovation and non-compliant infringement.

We rely on trade secrets and registered patents and trademarks to protect our intellectual property. We have also entered into confidentiality agreements with our management and employees relating to our confidential proprietary information. However, the protection of our intellectual properties may be compromised as a result of:

|

·

|

departure of any of our management members or employees in possession of our confidential proprietary information;

|

|

·

|

breach by such departing management member or employee of his or her confidentiality and non-disclosure undertaking to us;

|

|

·

|

expiration of the protection period of our registered patents or trademarks;

|

|

·

|

infringement by others of our proprietary technology and intellectual property rights; or

|

|

·

|

refusal by relevant regulatory authorities to approve our patent or trademark applications.

|

Any of these events or occurrences may reduce or eliminate any competitive advantage we have developed, causing us to lose sales or otherwise harm our business. The measures that we have put in place to protect our

11

intellectual property rights will be sufficient. As the number of patents, trademarks, copyrights and other intellectual property rights in our industry increases, and as the coverage of these rights and the functionality of the products in the market further overlap, business entities in our industry may face more frequent infringement claims. Litigation to enforce our intellectual property rights could result in substantial costs and may not be successful. If we are unable to successfully defend our intellectual property rights, we may lose rights to technology that we need to conduct and develop our business. This will seriously harm our business, operating results and financial condition, and enable our competitors to use our intellectual property to compete against us.

Furthermore, if third parties claim that our products infringe their patents or other intellectual property rights, we may be required to devote substantial resources to defending against such claims. If we are unsuccessful in defending against such infringement claims, we may be required to pay damages, modify our products or suspend the production and sale of such products. There is a risk that we are unable to modify our products on commercially reasonable terms.

We may incur capital expenditures in the future in connection with our growth plans and therefore may require additional financing

To expand our business, we will need to increase our production capacities which will require substantial capital expenditures. Such expenditures are likely to be incurred in advance of any increase in sales. We cannot assure you that our revenue will increase after such capital expenditures are incurred as this will depend on, among other factors, our ability to maintain or achieve high capacity utilization rates. Any failure to increase our revenue after incurring capital expenditures to expand production capacity will reduce our profitability.

In addition, we may need to obtain additional debt or equity financing to fund our capital expenditures. Additional equity financing may result in dilution to our shareholders. Additional debt financing may be required which, if obtained, may:

|

·

|

limit our ability to pay dividends or require us to seek consents for the payment of dividends;

|

|

·

|

increase our vulnerability to general adverse economic and industry conditions;

|

|

·

|

limit our ability to pursue our growth plan;

|

|

·

|

require us to dedicate a substantial portion of our cash flow from operations as payment for our debt, thereby reducing availability of our cash flow to fund capital expenditures, working capital and other general corporate purposes; and/or

|

|

·

|

limit our flexibility in planning for, or reacting to, changes in our business and our industry.

|

We cannot assure you that we will be able to obtain the additional financing on terms that are acceptable to us, if at all.

A disruption in the supply of utilities, fire or other calamity at our manufacturing plant would disrupt production of our products and adversely affect our sales

Our BOPET film products are manufactured solely at our production facility located in Yunmeng County Economic and Technological Development Zone in the PRC. While we have not in the past experienced any calamities which disrupted production, any disruption in the supply of utilities, in particular, electricity or power supply or any outbreak of fire, flood or other calamity resulting in significant damage at our facilities would severely affect our production of BOPET film. Though our building, machinery and raw materials are currently insured, we could still incur liabilities that could reduce or eliminate the funds available for product development, or result in a loss of equipment and properties due to any possible calamity incurred.

12

We have long accounts receivable cycles and our liquidity and cash flows from operations will deteriorate if our accounts receivable cycles or collection periods continue to lengthen

Our revenues primarily consist of the sale of our BOPET film products. We recognize revenues from the sale of our products when significant risks and rewards of ownership have been transferred to the buyer. No revenue is recognized if there are significant uncertainties regarding recovery of the consideration due, associated costs or the possible return of goods, or when the amount of revenue and costs incurred or to be incurred in respect of the transaction cannot be measured reliably.

However, we generally offer our customers in the PRC credit terms of up to 45 days. Our international sales are usually settled via letters of credit, which generally have payment terms of between 30 and 60 days.

While we permit our customers to pay in installments, our customers sometimes do not pay their installments as they come due and, in light of our need to maintain an ongoing relationship with these customers, it is difficult for us to improve their payment patterns.

We cannot assure you that our past allowance practice will not change in the future or that our allowance will be sufficient to cover defaults in our accounts receivable. Our liquidity and cash flows from operations will deteriorate if our accounts receivable cycles or collection periods continue to lengthen.

We are subject to the many risks of doing business internationally, including but not limited to the difficulty of enforcing liabilities in foreign jurisdictions.

We are a Nevada corporation and, as such, are subject to the jurisdiction of the State of Nevada and the United States courts for purposes of any lawsuit, action or proceeding by investors. An investor would have the ability to effect service of process in any action against the Company within the United States. In addition, we are registered as a foreign corporation doing business in Hubei Province, PRC, and as such, are subject to the local laws of Hubei Province governing an investors’ ability to bring actions in foreign courts and enforce liabilities against a foreign private issuer, or any person, based on U.S. federal securities laws. Generally, a final and conclusive judgment obtained by investors in U.S. courts would be recognized and enforceable against us in the Hubei Province courts having jurisdiction without re-examination of the merits of the case.

Investors may experience difficulties in effecting service of legal process, enforcing foreign judgments or bringing original actions in China based upon U.S. laws, including the federal securities laws or other foreign laws against us or our management.

All of our current operations are conducted in the PRC and all of our directors and officers are nationals and residents of China. All or substantially all of the assets of these persons are located outside the United States and in the PRC. As a result, it may not be possible to effect service of process within the United States or elsewhere outside China upon these persons. In addition, uncertainty exists as to whether the courts of China would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities laws of the United States or any state thereof, or be competent to hear original actions brought in China against us or such persons predicated upon the securities laws of the United States or any state thereof.

Because our assets are located overseas, shareholders may not receive distributions that they would otherwise be entitled to if we were declared bankrupt or insolvent.

Because all of our assets are located in the PRC, they may be outside of the jurisdiction of U.S. courts to administer if we become subject of an insolvency or bankruptcy proceeding. As a result, if we declared bankruptcy or insolvency, our shareholders may not receive the distributions on liquidation that they would otherwise be entitled to if our assets were to be located within the U.S., under U.S. Bankruptcy.

All of our assets are located in China and all of our revenues are derived from our operations in China. As a result, any changes in the political climate and/or economic policies of the PRC government could have a significant impact upon our current and proposed future business operations in the PRC and our results of operations and financial condition.

Our business operations may be adversely affected by the current and future political and economic environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since the late1970s. The government of the PRC has exercised and continues to

13

exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to successfully operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization; however, if the PRC significantly alters any of its current policies, with or without notice, it could have a substantial adverse effect on our results of operations and financial condition and could result in a total loss of any investment you make in our shares.

Our principal stockholder, who is also an officer and director of our Company, may have conflicts of interest which may not always be resolved favorably to our Company and our stockholders.

We operate our businesses in China through YDIC. Our chairman, CEO and principal shareholder, Mr. Yang, owns 3% of the equity interest in YDIC. Conflicts of interests between his duties to us and to YDIC may arise. We cannot assure you that if and when conflicts of interest arise, he will act in the best interests of our Company, or that any conflict of interest will be resolved in our favor. These conflicts may result in management decisions that could negatively affect our operations and potentially result in the loss of opportunities.

Failure to comply with the United States Foreign Corrupt Practices Act could subject us to penalties and other adverse consequences.

We are subject to the United States Foreign Corrupt Practices Act, which generally prohibits U.S. companies from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. In addition, we are required to maintain records that accurately and fairly represent our transactions and have an adequate system of internal accounting controls. Foreign companies, including some that may compete with us, are not subject to these prohibitions, and therefore may have a competitive advantage over us. Our executive officers and employees have not been subject to the United States Foreign Corrupt Practices Act prior to 2010. We have no control over whether our employees or other agents will or will not engage in such conduct for which we might be held responsible. If our employees or other agents are found to have engaged in such practices, we could suffer severe penalties and other consequences that may have a material adverse effect on our business, financial condition and results of operations.

The PRC laws and regulations governing our current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may have a material and adverse effect on our business.

The PRC’s legal system is a civil law system based on written statutes, in which system-decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing our business, or the enforcement and performance of our arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and/or criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties that are unclear at this time. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a “foreign persons” or “foreign funded” enterprise under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on our businesses. If the relevant authorities find us in violation of any PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

|

·

|

levying fines;

|

|

·

|

revoking our business and other licenses;

|

14

|

·

|

requiring that we restructure our ownership or operations; and/or

|

|

·

|

requiring that we discontinue any portion or all or our business operations in the PRC.

|

If we fail to maintain effective internal controls over financial reporting, the price of our common stock may be adversely affected.

PRC companies have historically not adopted a Western style of management and financial reporting concepts and practices, which includes strong corporate governance, internal controls and computer, financial and other control systems. In addition, we may have difficulty in hiring and retaining a sufficient number of qualified employees to work in the PRC. As a result of these factors, we may experience difficulty in establishing management, legal and financial controls, collecting financial data and preparing financial statements, books of account and corporate records and instituting business practices that meet Western standards for foreign subsidiaries. As a result, we may experience difficulties in implementing and maintaining adequate internal controls as required under Section 404 of the Sarbanes-Oxley Act of 2002. This could result in significant deficiencies or material weaknesses in our internal controls which could impact the reliability of our financial statements and prevent us from complying with SEC rules and regulations and the requirements of the Sarbanes-Oxley Act of 2002. Any actual or perceived weaknesses and conditions that need to be addressed in our internal control over financial reporting, disclosure of management’s assessment of our internal controls over financial reporting or disclosure of our public accounting firm’s attestation to or report on management’s assessment of our internal controls over financial reporting may have an adverse impact on the price of our common stock.

Changes in interest rates could negatively impact our results of operations, stockholders’ equity (deficit) and fair value of net assets.

Our investment activities and credit guarantee activities expose us to interest rate and other market risks. Changes in interest rates, up or down, could adversely affect our net interest yield. Although the yield we earn on our assets and our funding costs tend to move in the same direction in response to changes in interest rates, either can rise or fall faster than the other, causing our net interest yield to expand or compress. For example, due to the timing of maturities or rate reset dates on variable-rate instruments, when interest rates rise, our funding costs may rise faster than the yield we earn on our assets. This rate change could cause our net interest yield to compress until the effect of the increase is fully reflected in asset yields. Changes in the slope of the yield curve could also reduce our net interest yield.

Interest rates can fluctuate for a number of reasons, including changes in the fiscal and monetary policies of the federal government and its agencies, such as the Federal Reserve. Federal Reserve policies directly and indirectly influence the yield on our interest-earning assets and the cost of our interest-bearing liabilities. The availability of derivative financial instruments (such as options and interest rate and foreign currency swaps) from acceptable counterparties of the types and in the quantities needed could also affect our ability to effectively manage the risks related to our investment funding. Our strategies and efforts to manage our exposures to these risks may not be effective in the future, which could negatively impact our results of operations and the price of our common stock.

RISKS ASSOCIATED WITH DOING BUSINESS IN CHINA:

Adverse changes in political and economic policies of the PRC government could impede the overall economic growth of China, which could reduce the demand for our products and damage our business.

We conduct substantially all of our operations and generate all of our revenues in China. Accordingly, our business, financial condition, results of operations and future revenue prospects are affected significantly by economic, political and legal developments in China. The PRC economy differs from the economies of most developed countries in many respects, including:

• the higher level of government involvement;

• the early stage of development of the market-oriented sector of the economy;

• the rapid growth rate;

• the higher level of control over foreign exchange; and

• the allocation of resources.

15

As the PRC economy has been transitioning from a planned economy to a more market-oriented economy, the PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. While these measures may benefit the overall PRC economy, they may also have a negative effect on us.

Although the PRC government has in recent years implemented measures emphasizing the utilization of market forces for economic reform, the PRC government continues to exercise significant control over economic growth in China through the allocation of resources, controlling payment of foreign currency-denominated obligations, setting monetary policy and imposing policies that impact particular industries or companies in different ways.

Any adverse change in the economic conditions or government policies in China could have a material adverse effect on the overall economic growth and the level of security and surveillance investments and expenditures in China, which in turn could lead to a reduction in demand for our products and consequently have a material adverse effect on our business and prospects.

The PRC government exerts substantial influence over the manner in which we conduct our business activities.

The PRC government has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy through regulation and state ownership. Our ability to operate in China may be harmed by changes in its laws and regulations, including those relating to taxation, import and export tariffs, environmental regulations, land use rights, property and any number of other unknown matters. The PRC central or local governments of the jurisdictions in which we operate may impose new, stricter regulations or different interpretations of existing regulations that would require additional expenditures and efforts on our part to ensure our compliance with such regulations or interpretations. Accordingly, government actions in the future, including any decision not to continue to support recent economic reforms and to return to a more centrally planned economy or regional or local variations in the implementation of economic policies, could have a significant effect on economic conditions in China, or particular regions in China, and could require us to divest ourselves of any interest we then hold in Chinese properties or joint ventures. Any of these actions by the PRC government would severely and negatively impact our business operations and resulting revenues, which could result in a total loss of any investment you make in our shares.

Future inflation in China may inhibit economic activity and adversely affect our operations.

The Chinese economy has experienced periods of rapid expansion in recent years which has led to high rates of inflation and deflation. This has caused the PRC government to, from time to time, enact various corrective measures designed to restrict the availability of credit or regulate growth and contain inflation. High inflation may in the future cause the PRC government to once again impose controls on credit and/or prices, or to take other action, which could inhibit economic activity in China. Any action on the part of the PRC government that seeks to control credit and/or prices may adversely affect our business operations.

Restrictions on currency exchange may limit our ability to receive and use our sales revenue effectively.

Most of our sales revenue and expenses are denominated in Renminbi. Under PRC law, the Renminbi is currently convertible under the "current account," which includes dividends and trade and service-related foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and loans. Currently, the PRC operating subsidiaries may purchase foreign currencies for settlement of current account transactions, including payments of dividends to us, without the approval of the State Administration of Foreign Exchange, or SAFE, by complying with certain procedural requirements. However, the relevant PRC governmental authorities may limit or eliminate our ability to purchase foreign currencies in the future. Since a significant amount of our future revenue will be denominated in Renminbi, any existing and future restrictions on currency exchange may limit our ability to utilize revenue generated in Renminbi to fund our business activities outside China that are denominated in foreign currencies.

Foreign exchange transactions by PRC operating subsidiaries under the capital account continue to be subject to significant foreign exchange controls and require the approval of or need to register with PRC government authorities, including SAFE. In particular, if our PRC operating subsidiaries borrow foreign currency through loans from us or other foreign lenders, these loans must be registered with SAFE, and if we finance the

16

subsidiaries by means of additional capital contributions, these capital contributions must be approved by certain government authorities, including the Ministry of Commerce, or their respective local counterparts. These limitations could affect the PRC operating subsidiaries’ ability to obtain foreign exchange through debt or equity financing, which could limit our business operations and impact our future revenues and financial condition.

Failure to comply with PRC regulations relating to the establishment of offshore special purpose companies by PRC residents may subject our PRC resident stockholders to personal liability, limit our ability to acquire PRC companies or to inject capital into the operating our PRC subsidiaries, limit our PRC subsidiaries’ ability to distribute profits to us or otherwise materially adversely affect us.

In October 2005, SAFE issued a public notice, the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE Notice, which requires PRC residents to register with the competent local SAFE branch before using onshore assets or equity interests held by them to establish offshore special purpose companies, or SPVs, for the purpose of overseas equity financing. Under the SAFE Notice, such PRC residents must also file amendments to their registration in connection with any increase or decrease of capital, transfer of shares, mergers and acquisitions, equity investment or creation of any security interest in any assets located in China to guarantee offshore obligations. Moreover, if the SPVs were established and owned the onshore assets or equity interests before the implementation date of the SAFE Notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC resident stockholder of any SPV fails to make the required SAFE registration and amended registration, the PRC subsidiaries of that SPV may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the SPV. Failure to comply with the SAFE registration and amendment requirements described above could also result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

Because of uncertainty over how the SAFE Notice will be interpreted and implemented, and how or whether SAFE will apply it to us, we cannot predict how it will affect our business operations or future strategies. For example, our present and prospective PRC subsidiaries’ ability to conduct foreign exchange activities, such as the remittance of dividends and foreign currency-denominated borrowings, may be subject to compliance with the SAFE Notice by our PRC resident beneficial holders. In addition, such PRC residents may not always be able to complete the necessary registration procedures required by the SAFE Notice. We also have little control over either our present or prospective direct or indirect stockholders or the outcome of such registration procedures. A failure by our PRC resident beneficial holders or future PRC resident stockholders to comply with the SAFE Notice, if SAFE requires it, could subject these PRC resident beneficial holders to fines or legal sanctions, restrict our overseas or cross-border investment activities, limit our subsidiaries’ ability to make distributions or pay dividends or affect our ownership structure, which could adversely affect our business and prospects.

We may be unable to complete a business combination transaction efficiently or on favorable terms due to complicated merger and acquisition regulations which became effective on September 8, 2006.

On August 8, 2006, six PRC regulatory agencies, including the China Securities Regulatory Commission or CSRC, promulgated the Regulation on Mergers and Acquisitions of Domestic Companies by Foreign Investors, which became effective on September 8, 2006. This new regulation, governs the approval process by which a PRC company may participate in an acquisition of assets or equity interests. Depending on the structure of the transaction, the new regulation will require the PRC parties to make a series of applications and supplemental applications to the government agencies. In some instances, the application process may require the presentation of economic data concerning a transaction, including appraisals of the target business and evaluations of the acquirer, which are designed to allow the government to assess the transaction. Government approvals will have expiration dates by which a transaction must be completed and reported to the government agencies. Compliance with the new regulations is likely to be more time consuming and expensive than in the past and the government can now exert more control over the combination of two businesses. Accordingly, due to the new regulation, our ability to engage in business combination transactions has become significantly more complicated, time consuming and expensive, and we may not be able to negotiate a transaction that is acceptable to our stockholders or sufficiently protect their interests in a transaction.

The new regulation allows PRC government agencies to assess the economic terms of a business combination transaction. Parties to a business combination transaction may have to submit to the Ministry of Commerce and other relevant government agencies an appraisal report, an evaluation report and the acquisition agreement, all of which form part of the application for approval, depending on the structure of the transaction. The regulations also prohibit a transaction at an acquisition price obviously lower than the appraised value of the PRC business

17

or assets and in certain transaction structures, require that consideration must be paid within defined periods, generally not in excess of a year. The regulation also limits our ability to negotiate various terms of the acquisition, including aspects of the initial consideration, contingent consideration, holdback provisions, indemnification provisions and provisions relating to the assumption and allocation of assets and liabilities. Transaction structures involving trusts, nominees and similar entities are prohibited. Therefore, such regulation may impede our ability to negotiate and complete a business combination transaction on financial terms that satisfy our investors and protect our stockholders’ economic interests.

In addition to the above risks, in many instances, we will seek to structure transactions in a manner that avoids the need to make applications or a series of applications with Chinese regulatory authorities under these new M&A regulations. If we fail to effectively structure an acquisition in a manner that avoids the need for such applications or if the Chinese government interprets the requirements of the new M&A regulations in a manner different from our understanding of such regulations, then acquisitions that we have effected may be unwound or subject to rescission. Also, if the Chinese government determines that our structure of any of our acquisitions does not comply with these new regulations, then we may also be subject to fines and penalties.

Under the New EIT Law, we may be classified as a “resident enterprise” of China. Such classification will likely result in unfavorable tax consequences to us and our non-PRC stockholders.

China enacted a new Enterprise Income Tax Law, or the New EIT Law, and its implementing rules, both of which became effective on January 1, 2008. Under the New EIT Law, an enterprise established outside of China with “de facto management bodies” within China is considered a “resident enterprise,” meaning that it can be treated in a manner similar to a Chinese enterprise for enterprise income tax purposes. The implementing rules of the New EIT Law define de facto management as “substantial and overall management and control over the production and operations, personnel, accounting, and properties” of the enterprise. Because the New EIT Law and its implementing rules are new, no official interpretation or application of this new “resident enterprise” classification is available. Therefore, it is unclear how tax authorities will determine tax residency based on the facts of each case.

If the PRC tax authorities determine that we are a “resident enterprise” for PRC enterprise income tax purposes, a number of unfavorable PRC tax consequences could follow. First, we may be subject to the enterprise income tax at a rate of 25% on our worldwide taxable income as well as PRC enterprise income tax reporting obligations. In our case, this would mean that income such as interest on offering proceeds and non-China source income would be subject to PRC enterprise income tax at a rate of 25%. Second, although under the New EIT Law and its implementing rules dividends paid to us from our PRC subsidiaries currently qualify as “tax-exempt income,” we cannot guarantee that such dividends will not be subject to a 10% withholding tax, as the PRC foreign exchange control authorities, which enforce the withholding tax, have not yet issued guidance with respect to the processing of outbound remittances to entities that are treated as resident enterprises for PRC enterprise income tax purposes. Finally, it is possible that future guidance issued with respect to the new “resident enterprise” classification could result in a situation in which a 10% withholding tax is imposed on dividends we pay to our non-PRC stockholders and with respect to gains derived by our non-PRC stockholders from transferring our shares. We are actively monitoring the possibility of “resident enterprise” treatment for the 2009 tax year and are evaluating appropriate organizational changes to avoid this treatment, to the extent possible. If we were treated as a “resident enterprise” by PRC tax authorities, we would be subject to taxation in both the U.S. and China, and our PRC tax may not be creditable against any U.S. taxes we may owe.

New labor laws in the PRC may adversely affect our results of operations.

On January 1, 2008, the PRC government promulgated the Labor Contract Law of the PRC, or the New Labor Contract Law. The New Labor Contract Law imposes greater liabilities on employers and significantly impacts the cost of an employer’s decision to reduce its workforce. Further, it requires certain terminations to be based upon seniority and not merit. In the event we decide to significantly change or decrease our workforce, the New Labor Contract Law could adversely affect our ability to enact such changes in a manner that is most advantageous to our business or in a timely and cost effective manner, thus materially and adversely affecting our financial condition and results of operations.

Non-compliance with the social insurance and housing fund contribution regulations in the PRC could lead to imposition of penalties or other liabilities.

The PRC governmental authorities have enacted a variety of laws and regulations regarding social insurance and housing fund, such as the Regulation of Insurance for Labor Injury, the Regulation of Insurance for

18

Unemployment, the Provisional Insurance Measures for Maternity of Employees, Interim Provisions on Registration of Social Insurance, Interim Regulation on the Collection and Payment of Social Insurance Premiums, Regulations on Management of Housing Fund and other related laws and regulations. Pursuant to these regulations, all our PRC subsidiaries and variable interest entities have to obtain and renew the social insurance registration certificate and the housing fund certificate and make enough contributions to the relevant local social insurance and housing fund authorities for our PRC employees. Failure to comply with such laws and regulations would subject our PRC subsidiaries and variable interest entities to various fines and legal sanctions and supplemental contributions to the local social insurance and housing fund authorities.

Fluctuations in exchange rates could adversely affect our business and the value of our securities.

The value of the RMB against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in China’s political and economic conditions and foreign exchange policies. On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the RMB to the U.S. dollar. Under the revised policy, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. Following the removal of the U.S. dollar peg, the RMB appreciated more than 20% against the U.S. dollar over the following three years. Since July 2008, however, the RMB has traded within a narrow range against the U.S. dollar. It is difficult to predict how long the current situation may last and when and how the RMB exchange rates may change going forward.

Our revenues and costs are mostly denominated in RMB, while a significant portion of our financial assets are denominated in U.S. dollars. At the holding company level, we rely entirely on dividends and other fees paid to us by our subsidiaries and consolidated affiliated entities in China. Any significant revaluation of RMB may materially and adversely affect our cash flows, revenues, earnings and financial position. For example, an appreciation of RMB against the U.S. dollar would make any new RMB denominated investments or expenditure more costly to us, to the extent that we need to convert U.S. dollars into RMB for such purposes. An appreciation of RMB against the U.S. dollar would also result in foreign currency translation losses for financial reporting purposes when we translate our U.S. dollar denominated financial assets into RMB, as RMB is our reporting currency. Conversely, a significant depreciation of the RMB against the U.S. dollar may significantly reduce the U.S. dollar equivalent of our earnings, which in turn could adversely affect the price of our common stock.

We are subject to environmental laws and regulations in the PRC

We are subject to environmental laws and regulations in the PRC. Our failure to fully comply with such laws and regulations will subject us to penalties and fines or damages. Although we are currently in compliance with the environmental regulations in all material respects, any change in the regulations may require us to acquire equipment or incur additional capital expenditure or costs in order to comply with such regulations. Our profits will be adversely affected if we are unable to pass on such additional costs to our customers.

RISKS ASSOCIATED WITH THIS OFFERING:

We may, in the future, issue additional Common Shares which would reduce investors’ percent of ownership and may dilute our share value.