Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 28, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to __________

Commission file number 0-14749

Rocky Mountain Chocolate Factory, Inc.

(Exact name of registrant as specified in its charter)

|

Colorado

|

84-0910696

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification No.)

|

265 Turner Drive, Durango, CO 81303

(Address of principal executive offices)

(970) 259-0554

(Registrant’s telephone number, including area code)

Securities Registered Pursuant To Section 12(b) Of The Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock $.03 Par Value per Share | The NASDAQ Stock Market LLC |

| Preferred Stock Purchase Rights | The NASDAQ Stock Market LLC |

Securities Registered Pursuant To Section 12(g) Of The Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

On April 30, 2011, there were 6,073,976 shares of Common Stock outstanding. The aggregate market value of the Common Stock (based on the closing price as quoted on the Nasdaq Market on August 31, 2010) held by non-affiliates was $36,036,701. For purposes of this calculation, shares of common stock held by each executive officer and director and by holders of more than 5% of the outstanding common stock have been excluded since those persons may under certain circumstances be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement furnished to stockholders in connection with the 2011 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference in Part III of this Report. The Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the close of the registrant’s fiscal year ended February 28, 2011.

2

ROCKY MOUNTAIN CHOCOLATE FACTORY, INC.

FORM 10-K

TABLE OF CONTENTS

|

Page No.

|

||

|

PART I.

|

||

|

Item 1

Item 1A

Item 1B

|

Business

Risk Factors

Unresolved Staff Comments

|

4

14

17

|

|

Item 2

|

Properties

|

17

|

|

Item 3

|

Legal Proceedings

|

17

|

|

Item 4

|

(Removed and Reserved)

|

17

|

|

PART II.

|

||

|

Item 5

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

18

|

|

Item 6

|

Selected Financial Data

|

20

|

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

Item 7A

|

Quantitative and Qualitative Disclosures About Market Risk

|

27

|

|

Item 8

|

Financial Statements and Supplementary Data

|

28

|

|

Item 9

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

44

|

|

Item 9A

|

Controls and Procedures

|

44

|

|

Item 9B

|

Other Information

|

45

|

|

PART III.

|

||

|

Item 10

|

Directors, Executive Officers and Corporate Governance

|

45

|

|

Item 11

|

Executive Compensation

|

45

|

|

Item 12

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

45

|

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence

|

46

|

|

Item 14

|

Principal Accountant Fees and Services

|

46

|

|

PART IV.

|

||

|

Item 15

|

Exhibits and Financial Statement Schedules

|

47

|

3

Cautionary Note Regarding Forward Looking Statements

This report includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The nature of our operations and the environment in which we operate subject us to changing economic, competitive, regulatory and technological conditions, risks and uncertainties. The statements, other than statements of historical fact, included in this report are forward-looking statements. Many of the forward-looking statements contained in this document may be identified by the use of forward-looking words such as "will," "intend," "believe," "expect," "anticipate," "should," "plan," "estimate" and "potential," or similar expressions. Factors which could cause results to differ include, but are not limited to: changes in the confectionery business environment, seasonality, consumer interest in our products, general economic conditions, consumer trends, costs and availability of raw materials, competition, the success of our co-branding strategy and the effect of government regulations. Government regulations which we and our franchisees either are or may be subject to and which could cause results to differ from forward-looking statements include, but are not limited to: local, state and federal laws regarding health, sanitation, safety, building and fire codes, franchising, employment, manufacturing, packaging and distribution of food products and motor carriers. For a detailed discussion of the risks and uncertainties that may cause our actual results to differ from the forward-looking statements contained herein, please see the “Risk Factors” contained in this report in Item 1A. These forward-looking statements apply only as of the date of this report. As such they should not be unduly relied upon for more current circumstances. Except as required by law, we are not obligated to release publicly any revisions to these forward-looking statements that might reflect events or circumstances occurring after the date of this report or those that might reflect the occurrence of unanticipated events.

PART I.

ITEM 1. BUSINESS

General

Founded in 1981 and incorporated in Colorado in 1982, Rocky Mountain Chocolate Factory, Inc. (the “Company”, and sometimes referred to herein with the pronouns “we,” “us,” or “our”) is an international franchisor and confectionery manufacturer. We are headquartered in Durango, Colorado and manufacture an extensive line of premium chocolate candies and other confectionery products. As of March 31, 2011, there were 12 Company-owned, 42 licensee-owned and 302 franchised Rocky Mountain Chocolate Factory stores operating in 37 states, Canada, and the United Arab Emirates.

Aspen Leaf Yogurt, LLC (“ALY”), a wholly-owned subsidiary of the Company, was incorporated in Colorado as Aspen Leaf Yogurt, Inc. on September 30, 2010 and reorganized as Aspen Leaf Yogurt, LLC on October 14, 2010 with the Company as the sole founding member. ALY is a franchisor and retail operator of self serve frozen yogurt retail locations. Since its inception, ALY has been developing franchise-related documents, negotiating leases for retail locations, developing vendor relationships and other organizational activities. As of February 28, 2011 there was one ALY Company-owned location, as of March 31, 2011, there were three Company-owned Aspen Leaf Yogurt stores operating in three states.

Approximately 55% of the products sold at Rocky Mountain Chocolate Factory stores are prepared on the premises. We believe this in-store preparation creates a special store ambiance, and the aroma and sight of products being made attracts foot traffic and assures customers that products are fresh.

Our principal competitive strengths lie in our brand name recognition, our reputation for the quality, variety and taste of our products, the special ambiance of our stores, our knowledge and experience in applying criteria for selection of new store locations, our expertise in the manufacture of chocolate candy products and the merchandising and marketing of chocolate and other candy products, and the control and training infrastructures we have implemented to assure consistent customer service and execution of successful practices and techniques at our stores.

4

We believe our manufacturing expertise and reputation for quality has facilitated the sale of selected products through specialty markets. We are currently selling our products in a select number of specialty markets including wholesaling, fundraising, corporate sales, mail order and internet sales.

Our revenues are currently derived from three principal sources: (i) sales to franchisees and other third parties of chocolates and other confectionery products manufactured by us (69-71-72%); (ii) sales at Company-owned stores of chocolates and other confectionery products (including products manufactured by us) (12-10-7%) and (iii) the collection of initial franchise fees and royalties from franchisees (19-19-21%). Our revenues are derived from domestic (97-97-97%) and international (3-3-3%) sources. The figures in parentheses show the percentage of total revenues attributable to each source for fiscal years ended February 28, 2011, 2010 and 2009, respectively.

According to the National Confectioners Association, the total U.S. candy market approximated $29.3 billion of retail sales in 2009 with chocolate generating sales of approximately $16.9 billion. According to the Department of Commerce, per capita consumption of chocolate in 2009 was approximately 14 pounds per year nationally and was approximately unchanged when compared to 2008

Business Strategy

Our objective is to build on our position as a leading international franchisor and manufacturer of high quality chocolate and other confectionery products. We continually seek opportunities to profitably expand our business. To accomplish this objective, we employ a business strategy that includes the following elements:

Product Quality and Variety

We maintain gourmet taste and quality of our chocolate candies by using only the finest chocolate and other wholesome ingredients. We use our own proprietary recipes, primarily developed by our master candy makers. A typical Rocky Mountain Chocolate Factory store offers up to 100 of our chocolate candies throughout the year and as many as 200, including many packaged candies, during the holiday seasons. Individual stores also offer numerous varieties of premium fudge and gourmet caramel apples, as well as other products prepared in the store from Company recipes.

Store Atmosphere and Ambiance

We seek to establish an enjoyable and inviting atmosphere in each of our stores. Each store prepares numerous products, including fudge, barks and caramel apples, in the store. In-store preparation is designed both to be fun and entertaining for customers and to convey an image of freshness and homemade quality. Our design staff has developed easily replicable designs and specifications to ensure that the Rocky Mountain Chocolate Factory concept is consistently implemented at each store.

We have evaluated and updated our store design from our original Victorian concept to a more contemporary design, through our own testing and the input of a nationally recognized design firm. The objective of store design is threefold: (1) increase average revenue per unit thereby opening untapped real estate environments; (2) further emphasize the entertainment and freshness value of our in-store confectionery factory; and (3) improve operational efficiency through optimal store layout. Nearly all domestic stores in operation incorporate elements of the new design.

Site Selection

Careful selection of a site is critical to the success of our stores. We consider many factors in identifying suitable sites, including tenant mix, visibility, attractiveness, accessibility, level of foot traffic and occupancy costs. Final site selection occurs only after our senior management has approved the site. We believe that the experience of our management team in evaluating a potential site is one of our competitive strengths.

Customer Service Commitment

We emphasize excellence in customer service and seek to employ and to sell franchises to motivated and energetic people. We also foster enthusiasm for our customer service philosophy and the Rocky Mountain Chocolate Factory concept through our bi-annual franchisee convention, regional meetings and other frequent contacts with our franchisees.

5

Increase Same Store Retail Sales at Existing Locations

We seek to increase profitability of our store system through increasing sales at existing store locations. Changes in system wide domestic same store retail sales are as follows:

|

2007

|

0.3 | % | |||

|

2008

|

(0.9 | %) | |||

|

2009

|

(5.4 | %) | |||

|

2010

|

(2.9 | %) | |||

|

2011

|

0.6 | % |

We believe that the negative trend in FY 2008, FY 2009 and FY 2010 was due to the global economic recession that significantly impacted retailing, in general, and regional shopping mall customer traffic, in particular, throughout the United States during all of 2008, 2009 and the first three quarters of FY 2010 resulting in the worst economic and retail environment in our history. We experienced a decrease in same store sales of (6.7%) in our fiscal first quarter of 2010 followed by decreases in same store sales of (4.6%) and (3.2%) in our fiscal second and third quarters and an increase of 1.4% in our fiscal fourth quarter of 2010 compared with the same periods in FY 2009. The negative trend reversed slightly in FY 2011 and we experienced a 0.6% increase in same store sales though we still believe that the retail environment will continue to be challenging and has not significantly recovered from the effects of the economic environment.

We have designed a contemporary and coordinated line of packaged products that capture and convey the freshness, fun and excitement of the Rocky Mountain Chocolate Factory retail store experience. We also believe that the successful launch of new packaging has had a positive impact on same store sales.

Increase Same Store Pounds Purchased by Existing Locations

In FY 2011, same store pounds purchased by franchisees decreased 0.6% compared to the prior fiscal year. We continue to add new products and focus our existing product lines in an effort to increase same store pounds purchased by existing locations. We believe the decrease in same store pounds purchased was due in part to a product mix shift from factory-made products to products made in the store such as caramel apples and we believe the decline in same store pounds purchased contrary to the slight increase in same store sales is primarily a result of the United States recession and the resulting financial pressure the recession has created for our system of franchise-owned stores.

Enhanced Operating Efficiencies

We seek to improve our profitability by controlling costs and increasing the efficiency of our operations. Efforts in the last several years include: the purchase of additional automated factory equipment, implementation of a comprehensive Advanced Planning and Scheduling (APS) system, implementation of alternative manufacturing strategies and installation of enhanced Point-of-Sale (POS) systems in all of our Company-owned and 166 of our franchised stores through March 31, 2011. These measures have significantly improved our ability to deliver our products to our stores safely, quickly and cost-effectively and impact store operations.

Expansion Strategy

We are continually exploring opportunities to grow our brand and expand our business. Key elements of our expansion strategy include:

Unit Growth

The cornerstone of our growth strategy is to aggressively pursue unit growth opportunities in locations where we have traditionally been successful, to pursue new and developing real estate environments for franchisees which appear promising based on early sales results, and to improve and expand the retail store concept, such that previously untapped and unfeasible environments (such as most regional centers) generate sufficient revenue to support a successful Rocky Mountain Chocolate Factory location.

High Traffic Environments

We currently establish franchised stores in the following environments: outlet centers, tourist environments, regional centers, street fronts, airports and other entertainment-oriented environments. Over the last several years, we have had a particular focus on regional center locations. We are optimistic that our exciting store design will allow us to

6

continue targeting the over 1,400 regional centers in the United States. We have established a business relationship with most of the major developers in the United States and believe that these relationships provide us with the opportunity to take advantage of attractive sites in new and existing real estate environments.

Name Recognition and New Market Penetration

We believe the visibility of our stores and the high foot traffic at many of our locations has generated strong name recognition of Rocky Mountain Chocolate Factory and demand for our franchises. The Rocky Mountain Chocolate Factory system has historically been concentrated in the western and Rocky Mountain region of the United States, but recent growth has generated a gradual easterly momentum as new stores have been opened in the eastern half of the country. This growth has further increased our name recognition and demand for our franchises. Distribution of Rocky Mountain Chocolate Factory products through specialty markets also increases name recognition and brand awareness in areas of the country in which we have not previously had a significant presence. We believe that by distributing selected Rocky Mountain Chocolate Factory products through specialty markets increases our name brand recognition and will improve and benefit our entire store system.

We seek to establish a fun and inviting atmosphere in our Rocky Mountain Chocolate Factory store locations. Unlike most other confectionery stores, each Rocky Mountain Chocolate Factory store prepares certain products, including fudge and caramel apples, in the store. Customers can observe store personnel making fudge from start to finish, including the mixing of ingredients in old-fashioned copper kettles and the cooling of the fudge on large granite or marble tables, and are often invited to sample the store's products. An average of approximately 55% of the revenues of franchised stores is generated by sales of products prepared on the premises. We believe the in-store preparation and aroma of our products enhance the ambiance at Rocky Mountain Chocolate Factory stores, are fun and entertaining for our customers and convey an image of freshness and homemade quality.

To ensure that all stores conform to the Rocky Mountain Chocolate Factory image, our design staff provides working drawings and specifications and approves the construction plans for each new store. We also control the signage and building materials that may be used in the stores.

In FY 2002, we launched our revised store design concept intended specifically for high foot traffic regional shopping centers. The revised store design concept is modern with crisp and clean site lines and an even stronger emphasis on our unique upscale kitchen. We are requiring that all new Rocky Mountain Chocolate Factory stores incorporate the revised store design concept. We also require that key elements of the revised store design concept be incorporated into existing store design upon renewal of the Franchise Agreement, or transfer in store ownership.

The average store size is approximately 1,000 square feet, approximately 650 square feet of which is selling space. Most stores are open seven days a week. Typical hours are 10 a.m. to 9 p.m., Monday through Saturday, and 12 noon to 6 p.m. on Sundays. Store hours in tourist areas may vary depending upon the tourist season.

On January 26, 2007, we began testing co-branded locations with a variety of strategic partners. Co-branding a location is a potential vehicle to possibly exploit retail environments that would not typically support a stand alone Rocky Mountain Chocolate Factory store. Co-branding can also be used to more efficiently manage rent structure, payroll and other operating costs in environments that have not historically supported stand alone Rocky Mountain Chocolate Factory stores. Our co-branded partner’s franchisees currently operate 49 locations.

We are still in the testing and evaluation stage of our co-branding strategy and believe that if this strategy proves financially viable it could represent a significant future growth opportunity for us.

Products and Packaging

We produce approximately 300 chocolate candies and other confectionery products, using proprietary recipes developed primarily by our master candy makers. These products include many varieties of clusters, caramels, creams, mints and truffles. We continue to engage in a major effort to expand our product line by developing additional exciting and attractive new products. During the Christmas, Easter and Valentine's Day holiday seasons, we may make as many as 100 additional items, including many candies offered in packages specially designed for the holidays. A typical Rocky Mountain Chocolate Factory store offers up to 100 of these candies throughout the year and up to an additional 100 during holiday seasons. Individual stores also offer more than 15 premium fudges and other products prepared in the store. On

7

average, approximately 40% of the revenues of Rocky Mountain Chocolate Factory stores are generated by products manufactured at our factory, 55% by products made in individual stores using our recipes and ingredients purchased from us or approved suppliers and the remaining 5% by products, such as ice cream, coffee and other sundries, purchased from approved suppliers.

We use only the finest chocolates, nut meats and other wholesome ingredients in our candies and continually strive to offer new confectionery items in order to maintain the excitement and appeal of our products. We develop special packaging for the Christmas, Valentine's Day and Easter holidays, and customers can have their purchases packaged in decorative boxes and fancy tins throughout the year.

Chocolate candies that we manufacture are sold at prices ranging from $16.50 to $30.00 per pound, with an average price of $19.43 per pound. Franchisees set their own retail prices, though we do recommend prices for all of our products.

Operating Environment

We currently establish Rocky Mountain Chocolate Factory stores in six primary environments: regional centers, tourist areas, outlet centers, street fronts, airports and other entertainment-oriented shopping centers. Each of these environments has a number of attractive features, including high levels of foot traffic. Rocky Mountain Chocolate Factory domestic franchise locations in operation as of February 28, 2011 include:

|

Regional Centers

|

25.4 | % | |||

|

Outlet Centers

|

23.0 | % | |||

|

Festival/Community Centers

|

19.4 | % | |||

|

Tourist Areas

|

15.7 | % | |||

|

Street Fronts

|

8.9 | % | |||

|

Airports

|

4.4 | % | |||

|

Other

|

3.2 | % |

Regional Centers

As of February 28, 2011, there were Rocky Mountain Chocolate Factory stores in approximately 63 regional centers, including a location in the Mall of America in Bloomington, Minnesota. Although often providing favorable levels of foot traffic, regional centers typically involve more expensive rent structures and competing food and beverage concepts. Our existing store concept is designed to unlock the potential of the regional center environment.

Outlet Centers

We have established business relationships with most of the major outlet center developers in the United States. Although not all factory outlet centers provide desirable locations for our stores, management believes that our relationships with these developers will provide us with the opportunity to take advantage of attractive sites in new and existing outlet centers.

Tourist Areas, Street Fronts and Other Entertainment-Oriented Shopping Centers

As of February 28, 2011, there were approximately 39 Rocky Mountain Chocolate Factory stores in locations considered to be tourist areas, including Fisherman's Wharf in San Francisco, California and the Riverwalk in San Antonio, Texas. Tourist areas are very attractive locations because they offer high levels of foot traffic and favorable customer spending characteristics, and greatly increase our visibility and name recognition. We believe significant opportunities exist to expand into additional tourist areas with high levels of foot traffic.

Other Environments

We believe there are a number of other environments that have the characteristics necessary for the successful operation of Rocky Mountain Chocolate Factory stores such as airports and sports arenas. Thirteen franchised Rocky Mountain Chocolate Factory stores exist at airport locations: two at Atlanta International (Hartsfield-Jackson), two at Denver International Airport, one at Charlotte International Airport, two at Chicago O’Hare International Airport; one at Houston George Bush Intercontinental Airport, one at Minneapolis International Airport, one at Salt Lake City International Airport, one at Dallas Fort Worth International Airport; one at Edmonton International Airport, and one at Toronto Pearson International Airport.

8

Franchising Program

General

Our franchising philosophy is one of service and commitment to our franchise system, and we continuously seek to improve our franchise support services. Our concept has consistently been rated as an outstanding franchise opportunity by publications and organizations rating such opportunities. In January 2011, Rocky Mountain Chocolate Factory was rated the number one franchise opportunity in the candy category by Entrepreneur Magazine. As of March 31, 2011, there were 302 franchised stores in the Rocky Mountain Chocolate Factory system.

Franchisee Sourcing and Selection

The majority of new franchises are awarded to persons referred by existing franchisees, to interested consumers who have visited Rocky Mountain Chocolate Factory stores and to existing franchisees. We also advertise for new franchisees in national and regional newspapers as suitable potential store locations come to our attention. Franchisees are approved by us on the basis of the applicant's net worth and liquidity, together with an assessment of work ethic and personality compatibility with our operating philosophy.

In FY 1992, we entered into a franchise development agreement covering Canada with Immaculate Confections, Ltd. of Vancouver, British Columbia. Pursuant to this agreement, Immaculate Confections purchased the exclusive right to franchise and operate Rocky Mountain Chocolate Factory stores in Canada. As of March 31, 2011, Immaculate Confections operated 52 stores under this agreement.

In FY 2000, we entered into a franchise development agreement covering the Gulf Cooperation Council States of United Arab Emirates, Qatar, Bahrain, Saudi Arabia, Kuwait and Oman with Al Muhairy Group of United Arab Emirates. Pursuant to this agreement, Al Muhairy Group purchased the exclusive right to franchise and operate Rocky Mountain Chocolate Factory stores in the Gulf Cooperation Council States. As of March 31, 2011, Al Muhairy Group operated 4 stores under this agreement.

On August 18, 2009, we entered into a definitive Master License Agreement with Kahala Franchise Corp. Under the terms of the agreement, select current and future Cold Stone Creamery franchise stores are anticipated to be co-branded with both the Rocky Mountain Chocolate Factory and the Cold Stone Creamery brands. Locations developed or modified under the agreement are subject to the approval of both parties. Locations developed or modified under the agreement will remain franchisees of Cold Stone Creamery and will be licensed to offer the Rocky Mountain Chocolate Factory brand. The agreement runs until the date upon which the last co-branded store ceases to be open for business or unless earlier terminated by an event of either party’s default. As of March 31, 2011, Cold Stone Creamery franchisees operated 42 stores under this agreement.

Training and Support

Each domestic franchisee owner/operator and each store manager for a domestic franchisee is required to complete a comprehensive training program in store operations and management. We have established a training center at our Durango headquarters in the form of a full-sized replica of a properly configured and merchandised Rocky Mountain Chocolate Factory store. Topics covered in the training course include our philosophy of store operation and management, customer service, merchandising, pricing, cooking, inventory and cost control, quality standards, record keeping, labor scheduling and personnel management. Training is based on standard operating policies and procedures contained in an operations manual provided to all franchisees, which the franchisee is required to follow by terms of the franchise agreement. Additionally, and importantly, trainees are provided with a complete orientation to our operations by working in key factory operational areas and by meeting with members of our senior management.

Our operating objectives include providing knowledge and expertise in merchandising, marketing and customer service to all front-line store level employees to maximize their skills and ensure that they are fully versed in our proven techniques.

We provide ongoing support to franchisees through our field consultants, who maintain regular and frequent communication with the stores by phone and by site visits. The field consultants also review and discuss with the franchisee, store operating results and provide advice and guidance in improving store profitability and in developing and executing store marketing and merchandising programs. We have developed a handbook containing a "pre-packaged" local store marketing plan, which allows franchisees to implement cost-effective promotional programs that have proven successful in other Rocky Mountain Chocolate Factory stores.

9

Quality Standards and Control

The franchise agreement for Rocky Mountain Chocolate Factory franchisees requires compliance with our procedures of operation and food quality specifications and permits audits and inspections by us.

Operating standards for Rocky Mountain Chocolate Factory stores are set forth in operating manuals. These manuals cover general operations, factory ordering, merchandising, advertising and accounting procedures. Through their regular visits to franchised stores, our field consultants audit performance and adherence to our standards. We have the right to terminate any franchise agreement for non-compliance with our operating standards. Products sold at the stores and ingredients used in the preparation of products approved for on-site preparation must be purchased from us or from approved suppliers.

The Franchise Agreement: Terms and Conditions

The domestic offer and sale of Rocky Mountain Chocolate Factory franchises is made pursuant to the Franchise Disclosure Document prepared in accordance with federal and state laws and regulations. States that regulate the sale and operation of franchises require a franchiser to register or file certain notices with the state authorities prior to offering and selling franchises in those states.

Under the current form of domestic Rocky Mountain Chocolate Factory and Aspen Leaf Yogurt franchise agreements, franchisees pay us (i) an initial franchise fee for each store, (ii) royalties based on monthly gross sales, and (iii) a marketing fee based on monthly gross sales. Franchisees are generally granted exclusive territory with respect to the operation of Rocky Mountain Chocolate Factory or Aspen Leaf Yogurt stores only in the immediate vicinity of their stores. Chocolate and yogurt products not made on the premises by franchisees must be purchased from us or approved suppliers. The franchise agreements require franchisees to comply with our procedures of operation and food quality specifications, to permit inspections and audits by us and to remodel stores to conform with standards then in effect. We may terminate the franchise agreement upon the failure of the franchisee to comply with the conditions of the agreement and upon the occurrence of certain events, such as insolvency or bankruptcy of the franchisee or the commission by the franchisee of any unlawful or deceptive practice, which in our judgment is likely to adversely affect the Rocky Mountain Chocolate Factory system. Our ability to terminate franchise agreements pursuant to such provisions is subject to applicable bankruptcy and state laws and regulations. See "Business - Regulation."

The agreements prohibit the transfer or assignment of any interest in a franchise without our prior written consent. The agreements also give us a right of first refusal to purchase any interest in a franchise if a proposed transfer would result in a change of control of that franchise. The refusal right, if exercised, would allow us to purchase the interest proposed to be transferred under the same terms and conditions and for the same price as offered by the proposed transferee.

The term of each franchise agreement is ten years, and franchisees have the right to renew for one additional ten-year term.

Franchise Financing

We do not provide prospective franchisees with financing for their stores, but we have developed relationships with several sources of franchisee financing to whom we will refer franchisees. Typically, franchisees have obtained their own sources of such financing and have not required our assistance.

Licensee Financing

During FY 2011, we began a program to finance the remodel costs of a select number of co-branded licensed Cold Stone Creamery locations. The financing was provided to existing Cold Stone Creamery franchisees that were required to meet a number of financial qualifications prior to approval. At February 28, 2011, approximately $466,000 was included in notes receivable as a result of this program.

Company Store Program

As of March 31, 2011 there were 12 Company-owned Rocky Mountain Chocolate Factory stores and 3 Company-owned Aspen Leaf Yogurt stores. Company-owned stores provide a training ground for Company-owned store personnel and district managers and a controllable testing ground for new

10

products and promotions, operating and training methods and merchandising techniques, which may then be incorporated into the franchise store operations.

Managers of Company-owned stores are required to comply with all Company operating standards and undergo training and receive support from us similar to the training and support provided to franchisees. See "Franchising Program-Training and Support" and "Franchising Program-Quality Standards and Control."

Manufacturing Operations

General

We manufacture our chocolate candies at our factory in Durango, Colorado. All products are produced consistent with our philosophy of using only the finest, highest quality ingredients to achieve our marketing motto of "the Peak of Perfection in Handmade Chocolates®."

Our management has always believed that we should control the manufacturing of our own chocolate products. By controlling manufacturing, we can better maintain our high product quality standards, offer unique, proprietary products, manage costs, control production and shipment schedules and potentially pursue new or under-utilized distribution channels.

Manufacturing Processes

The manufacturing process primarily involves cooking or preparing candy centers, including nuts, caramel, peanut butter, creams and jellies, and then coating them with chocolate or other toppings. All of these processes are conducted in carefully controlled temperature ranges, and we employ strict quality control procedures at every stage of the manufacturing process. We use a combination of manual and automated processes at our factory. Although we believe that it is currently preferable to perform certain manufacturing processes, such as dipping of some large pieces by hand, automation increases the speed and efficiency of the manufacturing process. We have from time to time automated processes formerly performed by hand where it has become cost-effective for us to do so without compromising product quality or appearance.

We seek to ensure the freshness of products sold in Rocky Mountain Chocolate Factory stores with frequent shipments. Most Rocky Mountain Chocolate Factory stores do not have significant space for the storage of inventory, and we encourage franchisees and store managers to order only the quantities that they can reasonably expect to sell within approximately two to four weeks. For these reasons, we generally do not have a significant backlog of orders.

Ingredients

The principal ingredients used in our RMCF products are chocolate, nuts, sugar, corn syrup, cream and butter. The factory receives shipments of ingredients daily. To ensure the consistency of our products, we buy ingredients from a limited number of reliable suppliers. In order to assure a continuous supply of chocolate and certain nuts, we frequently enter into purchase contracts of between six to eighteen months for these products. Because prices for these products may fluctuate, we may benefit if prices rise during the terms of these contracts, but we may be required to pay above-market prices if prices fall. We have one or more alternative sources for all essential ingredients and therefore believe that the loss of any supplier would not have a material adverse effect on our results of operations. We currently purchase small amounts of finished candy from third parties on a private label basis for sale in Rocky Mountain Chocolate Factory stores.

Trucking Operations

We operate eight trucks and ship a substantial portion of our products from the factory on our own fleet. Our trucking operations enable us to deliver our products to the stores quickly and cost-effectively. In addition, we back-haul our own ingredients and supplies, as well as products from third parties, on return trips, which helps achieve even greater efficiencies and cost savings.

Marketing

We rely primarily on in-store promotion and point-of-purchase materials to promote the sale of our products. The monthly marketing fees collected from franchisees are used by us to develop new packaging and in-store promotion and point-of-purchase materials, and to create and update our local store marketing handbooks.

We focus on local store marketing efforts by providing customizable marketing materials, including advertisements, coupons, flyers and mail order catalogs generated by our in-house

11

Creative Services department. The department works directly with franchisees to implement local store marketing programs.

We aggressively seek low cost, high return publicity opportunities through participation in local and regional events, sponsorships and charitable causes. We have not historically and do not intend to engage in national advertising in the near future.

Competition

The retailing of confectionery products is highly competitive. We and our franchisees compete with numerous businesses that offer confectionery products. Many of these competitors have greater name recognition and financial, marketing and other resources than us. In addition, there is intense competition among retailers for real estate sites, store personnel and qualified franchisees.

We believe that our principal competitive strengths lie in our name recognition and our reputation for the quality, value, variety and taste of our products and the special ambiance of our stores; our knowledge and experience in applying criteria for selection of new store locations; our expertise in merchandising and marketing of chocolate and other candy products; and the control and training infrastructures we have implemented to assure execution of successful practices and techniques at our store locations. In addition, by controlling the manufacturing of our own chocolate products, we can better maintain our high product quality standards for those products, offer proprietary products, manage costs, control production and shipment schedules and pursue new or under-utilized distribution channels.

Trade Name and Trademarks

The trade name "Rocky Mountain Chocolate FactoryÒ," the phrases, "The Peak of Perfection in Handmade ChocolatesÒ", "America's ChocolatierÒ”, “The World’s Chocolatierâ” as well as all other trademarks, service marks, symbols, slogans, emblems, logos and designs used in the Rocky Mountain Chocolate Factory system, are our proprietary rights. We believe that all of the foregoing are of material importance to our business. The registration for the trademark “Rocky Mountain Chocolate Factory” is registered in the United States and Canada. Applications have been filed to register the Rocky Mountain Chocolate Factory trademark and/or obtained in certain foreign countries. We have filed applications for similar rights for Aspen Leaf Yogurt and those applications are currently pending.

We have not attempted to obtain patent protection for the proprietary recipes developed by our master candy-maker and instead rely upon our ability to maintain the confidentiality of those recipes.

Employees

At February 28, 2011, we employed approximately 260 people. Most employees, with the exception of store management, factory management and corporate management, are paid on an hourly basis. We also employ some people on a temporary basis during peak periods of store and factory operations. We seek to assure that participatory management processes, mutual respect and professionalism and high performance expectations for the employee exist throughout the organization. We believe that we provide working conditions, wages and benefits that compare favorably with those of our competitors. Our employees are not covered by a collective bargaining agreement. We consider our employee relations to be good.

Executive Officers

The executive officers of the Company and their ages at April 30, 2011 are as follows:

|

Name

|

Age

|

Position

|

|

|

Franklin E. Crail

|

69

|

Chairman of the Board, President and Director

|

|

|

Bryan J. Merryman

|

50

|

Chief Operating Officer, Chief Financial Officer, Treasurer and Director

|

|

|

Gregory L. Pope

|

45

|

Sr. Vice President – Franchise Development and Operations

|

|

|

Edward L. Dudley

|

47

|

Sr. Vice President - Sales and Marketing

|

|

|

William K. Jobson

|

55

|

Chief Information Officer

|

|

|

Jay B. Haws

|

61

|

Vice President - Creative Services

|

|

|

Jeremy M. Kinney

|

34

|

Vice President - Finance

|

|

|

Donna L. Coupe

|

45

|

Vice President – Franchise Support and Training

|

|

|

Tracy D. Wojcik

|

48

|

Corporate Secretary

|

12

Mr. Crail co-founded the first Rocky Mountain Chocolate Factory store in May 1981. Since our incorporation in November 1982, he has served as our President and director. He was elected Chairman of the Board in March 1986. Prior to founding the Company, Mr. Crail was co-founder and president of CNI Data Processing, Inc., a software firm which developed automated billing systems for the cable television industry.

Mr. Merryman joined the Company in December 1997 as Vice President - Finance and Chief Financial Officer. Since April 1999, Mr. Merryman has also served as our Chief Operating Officer and as a director, and since January 2000, as our Treasurer. Prior to joining the Company, Mr. Merryman was a principal in Knightsbridge Holdings, Inc. (a leveraged buyout firm) from January 1997 to December 1997. Mr. Merryman also served as Chief Financial Officer of Super Shops, Inc., a retailer and manufacturer of aftermarket auto parts from July 1996 to November 1997, and was employed for more than eleven years by Deloitte and Touche LLP, an independent public accounting firm.

Mr. Pope became Sr. Vice President of Franchise Development and Operations in May 2004. Since joining the Company in October 1990, he has served in various positions including store manager, new store opener and franchise field consultant. In March 1996, he became Director of Franchise Development and Support. In June 2001, he became Vice President of Franchise Development, a position he held until he was promoted to his present position.

Mr. Dudley joined the Company in January 1997 to spearhead the Company’s newly formed Product Sales Development function as Vice President - Sales and Marketing. He was promoted to Senior Vice President in June 2001. During his 10 year career with Baxter Healthcare Corporation, Mr. Dudley served in a number of senior marketing and sales management capacities, including most recently that of Director, Distribution Services from March 1996 to January 1997.

Mr. Jobson joined the Company in July 1998 as Director of Information Technology. In June 2001, he was promoted to Chief Information Officer. From July 1995 to July 1998, Mr. Jobson worked for ADAC Laboratories in Durango, Colorado, a leading provider of diagnostic imaging and information systems solutions in the healthcare industry, as Manager of Technical Services and before that, Regional Manager.

Mr. Haws joined the Company in August 1991 as Vice President of Creative Services. Since 1981, Mr. Haws had been closely associated with us both as a franchisee and marketing/graphic design consultant. From 1986 to 1991, he operated two Rocky Mountain Chocolate Factory franchises located in San Francisco, California. From 1983 to 1989, he served as Vice President of Marketing for Image Group, Inc., a marketing communications firm based in Northern California. Concurrently, Mr. Haws was co-owner of two other Rocky Mountain Chocolate Factory franchises located in Sacramento, and Walnut Creek California. From 1973 to 1983, he was principal of Jay Haws and Associates, an advertising and graphic design agency.

Mr. Kinney became Vice President of Finance in May 2008. Since joining the Company in March 1999, he has served in various operational and financial positions including Director of Retail Operations and Operational Analysis. In May 2007, he became Corporate Controller, a position he held until he was promoted to his present position.

Ms. Coupe became Vice President of Franchise Support and Training in June 2008. From 1992 to 1997, she managed franchised stores in Northern California for absentee owners. Since joining the Company in October 1997, she has served in various positions including Field Consultant, Regional Manager and Director of Franchise Support.

Ms. Wojcik joined the Company in April 2011 as our Corporate Secretary. From 2007 until joining the Company, Ms. Wojcik was employed by us on a contractual basis, performing an annual assessment of the Company’s internal controls over financial reporting related to Sarbanes-Oxley compliance. From 2000 to 2006, Ms. Wojcik was employed by Ceridian as an Implementation Consultant for Human Resources software applications. Throughout her career, Ms. Wojcik has held various administrative and technical positions in Human Resources.

Seasonal Factors

Our sales and earnings are seasonal, with significantly higher sales and earnings occurring during the Christmas holiday and summer vacation seasons than at other times of the year, which causes fluctuations in our quarterly results of operations. In addition, quarterly results have been, and in the future are likely to be, affected by the timing of new store openings and the sale of franchises. Because of the seasonality of our business and the impact of new store openings and sales of franchises, results for any quarter are not necessarily indicative of the results that may be achieved in other quarters or for a full fiscal year.

13

Regulation

Each of the Company-owned and franchised stores is subject to licensing and regulation by the health, sanitation, safety, building and fire agencies in the state or municipality where located. Difficulties or failures in obtaining the required licensing or approvals could delay or prevent the opening of new stores. New stores must also comply with landlord and developer criteria.

Many states have laws regulating franchise operations, including registration and disclosure requirements in the offer and sale of franchises. We are also subject to the Federal Trade Commission regulations relating to disclosure requirements in the sale of franchises and ongoing disclosure obligations.

Additionally, certain states have enacted and others may enact laws and regulations governing the termination or non-renewal of franchises and other aspects of the franchise relationship that are intended to protect franchisees. Although these laws and regulations, and related court decisions, may limit our ability to terminate franchises and alter franchise agreements, we do not believe that such laws or decisions will have a material adverse effect on our franchise operations. However, the laws applicable to franchise operations and relationships continue to develop, and we are unable to predict the effect on our intended operations of additional requirements or restrictions that may be enacted or of court decisions that may be adverse to franchisers.

Federal and state environmental regulations have not had a material impact on our operations but more stringent and varied requirements of local governmental bodies with respect to zoning, land use and environmental factors could delay construction of new stores.

Companies engaged in the manufacturing, packaging and distribution of food products are subject to extensive regulation by various governmental agencies. A finding of a failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of all or a portion of our facilities for an indeterminate period of time. Our product labeling is subject to and complies with the Nutrition Labeling and Education Act of 1990 and the Food Allergen Labeling and Consumer Protection Act of 2004.

We provide a limited amount of trucking services to third parties, to fill available space on our trucks. Our trucking operations are subject to various federal and state regulations, including regulations of the Federal Highway Administration and other federal and state agencies applicable to motor carriers, safety requirements of the Department of Transportation relating to interstate transportation and federal, state and Canadian provincial regulations governing matters such as vehicle weight and dimensions.

We believe that we are operating in substantial compliance with all applicable laws and regulations.

Available Information

The Internet address of our website is www.rmcf.com.

We make available free of charge, through our Internet website, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15 (d) of the Exchange Act, as soon as reasonably practicable after we file such material with, or furnish it to, the Securities and Exchange Commission (the “SEC”). The contents of our website are not incorporated into, and should not be considered a part of, this report.

Item 1A. Risk Factors

General Economic Conditions Could Have A Material Adverse Effect on our Business, Results of Operations and Liquidity

Consumer purchases of discretionary items, including our products generally decline during weak economic periods and other periods where disposable income is adversely affected. Our performance is subject to factors that affect worldwide economic conditions including employment, consumer debt, reductions in net worth based on recent severe market declines, residential real estate and mortgage markets, taxation, fuel and energy prices, interest rates, consumer confidence, value of the U.S. dollar versus foreign currencies and other macroeconomic factors. Recently, these factors have caused consumer spending to deteriorate significantly and may cause levels of spending to remain depressed for the foreseeable

14

future. These factors may cause consumers to purchase products from lower priced competitors or to defer purchases of products altogether.

Continued economic weakness could have a material effect on our results of operations, liquidity and capital resources. It could also impact our ability to fund growth and/or result in us becoming more reliant on external financing, the availability and terms of which may be uncertain. In addition, a weak economic environment may exacerbate the risks noted below.

Comparable Store Sales Have Been Negatively Affected by the Economy and Will Continue to Fluctuate on a Regular Basis

Our comparable store sales defined as year-over-year sales for a store that has been open at least one year, have fluctuated significantly in the past on an annual and quarterly basis and are expected to continue to fluctuate in the future. During the past five fiscal years, comparable sales results have fluctuated as follows: (a) from (5.4%) to 0.6% for annual results; (b) from (10.0%) to 3.1% for quarterly results. Our comparable store sales were particularly adversely affected by the economy in the fourth quarter of FY 2009 and continued to be adversely affected through the first three quarters of FY 2010. Same store sales increased 1.4% in the fourth quarter of FY 2010. Sustained declines in comparable store sales or significant comparable store sales declines in any single period could have a material adverse effect on our results of operations.

Our Sales to Specialty Market Customers, Customers Outside Our System of Franchised Stores, Are Concentrated Among a Small Number of Customers

Revenue from one customer of the Company’s manufacturing segment represented approximately $3.4 million or 11% of the Company’s revenues during the year ended February 28, 2011. The Company’s future results may be adversely impacted by a change in the purchases of this customer.

The Availability and Price of Principal Ingredients Used in Our Products Are Subject to Factors Beyond Our Control

Several of the principal ingredients used in our products, including chocolate and nuts, are subject to significant price fluctuations. Although cocoa beans, the primary raw material used in the production of chocolate, are grown commercially in Africa, Brazil and several other countries around the world, cocoa beans are traded in the commodities market, and their supply and price are therefore subject to volatility. We believe our principal chocolate supplier purchases most of its beans at negotiated prices from African growers, often at a premium to commodity prices. The supply and price of cocoa beans, and in turn of chocolate, are affected by many factors, including monetary fluctuations and economic, political and weather conditions in countries in which cocoa beans are grown. We purchase most of our nut meats from domestic suppliers who procure their products from growers around the world. The price and supply of nuts are also affected by many factors, including weather conditions in the various regions in which the nuts we use are grown. Although we often enter into purchase contracts for these products, significant or prolonged increases in the prices of chocolate or of one or more types of nuts, or the unavailability of adequate supplies of chocolate or nuts of the quality sought by us, could have a material adverse effect on us and our results of operations.

Increases in Costs of Ingredients and Labor Could Adversely Effect Our Operations

Inflationary factors such as increases in the costs of ingredients, energy and labor directly affect our operations. Most of our leases provide for cost-of-living adjustments and require us to pay taxes, insurance and maintenance expenses, all of which are subject to inflation. Additionally, our future lease costs for new facilities may reflect potentially escalating costs of real estate and construction. There is no assurance that we will be able to pass on our increased costs to our customers.

The Seasonality of Our Sales Can Have a Significant Impact on Our Financial Results from Quarter to Quarter

Our sales and earnings are seasonal, with significantly higher sales and earnings occurring during the Christmas and summer vacation seasons than at other times of the year, which causes fluctuations in our quarterly results of operations. In addition, quarterly results have been, and in the future are likely to be, affected by the timing of new store openings and the sale of franchises. Because of the seasonality of our business and the impact of new store openings and sales of franchises, results for any quarter are not necessarily

15

indicative of the results that may be achieved in other quarters or for a full fiscal year. See "Management's Discussion and Analysis of Financial Condition and Results of Operations."

Our Expansion Plans Are Dependent on the Availability of Suitable Sites for Franchised Stores at Reasonable Occupancy Costs

Our expansion plans are critically dependent on our ability to obtain suitable sites at reasonable occupancy costs for our franchised stores in the regional center environment. There is no assurance that we will be able to obtain suitable locations for our franchised stores and kiosks in this environment at a cost that will allow such stores to be economically viable.

Our Growth is Dependent Upon Attracting and Retaining Qualified Franchisees and Their Ability to Operate Their Franchised Stores Successfully

Our continued growth and success is dependent in part upon our ability to attract, retain and contract with qualified franchisees. Our growth is dependent upon the ability of franchisees to operate their stores successfully, promote and develop our store concepts, and maintain our reputation for an enjoyable in-store experience and product quality. Although we have established criteria to evaluate prospective franchisees and have been successful in attracting franchisees, there can be no assurance that franchisees will be able to operate successfully in their franchise areas in a manner consistent with our concepts and standards.

We Are Subject to Federal, State and Local Regulation

We are subject to regulation by the Federal Trade Commission and must comply with certain state laws governing the offer, sale and termination of franchises and the refusal to renew franchises. Many state laws also regulate substantive aspects of the franchisor-franchisee relationship by, for example, requiring the franchisor to deal with its franchisees in good faith, prohibiting interference with the right of free association among franchisees and regulating discrimination among franchisees in charges, royalties or fees. Franchise laws continue to develop and change, and changes in such laws could impose additional costs and burdens on franchisors. Our failure to obtain approvals to sell franchises and the adoption of new franchise laws, or changes in existing laws, could have a material adverse effect on us and our results of operations.

Each of our Company-owned and franchised stores is subject to licensing and regulation by the health, sanitation, safety, building and fire agencies in the state or municipality where located. Difficulties or failures in obtaining required licenses or approvals from such agencies could delay or prevent the opening of a new store. We and our franchisees are also subject to laws governing our relationships with employees, including minimum wage requirements, overtime, working and safety conditions and citizenship requirements. Because a significant number of our employees are paid at rates related to the federal minimum wage, increases in the minimum wage would increase our labor costs. The failure to obtain required licenses or approvals, or an increase in the minimum wage rate, employee benefits costs (including costs associated with mandated health insurance coverage) or other costs associated with employees, could have a material adverse effect on us and our results of operations.

Companies engaged in the manufacturing, packaging and distribution of food products are subject to extensive regulation by various governmental agencies. A finding of a failure to comply with one or more regulations could result in the imposition of sanctions, including the closing of all or a portion of our facilities for an indeterminate period of time, and could have a material adverse effect on us and our results of operations.

The Retailing of Confectionery and Yogurt Products is Highly Competitive and Many of Our Competitors Have Competitive Advantages Over Us.

The retailing of confectionery and yogurt products is highly competitive. We and our franchisees compete with numerous businesses that offer similar products. Many of these competitors have greater name recognition and financial, marketing and other resources than we do. In addition, there is intense competition among retailers for real estate sites, store personnel and qualified franchisees. Competitive market conditions could have a material adverse effect on us and our results of operations and our ability to expand successfully.

Changes in Consumer Tastes and Trends Could Have a Material Adverse Effect on Our Operations

The sale of our products is affected by changes in consumer tastes and eating habits, including views regarding consumption of chocolate. Numerous other factors that we cannot

16

control, such as economic conditions, demographic trends, traffic patterns and weather conditions, influence the sale of our products. Changes in any of these factors could have a material adverse effect on us and our results of operations.

A Significant Shift by Franchisees from Company-Manufactured Products to Products Produced By Third Parties Could Adversely Effect Our Operations

We believe approximately 40% of franchised stores' revenues are generated by sales of products manufactured by and purchased from us, 55% by sales of products made in the stores with ingredients purchased from us or approved suppliers and 5% by sales of products purchased from approved suppliers for resale in the stores. Franchisees' sales of products manufactured by us generate higher revenues to us than sales of store-made or other products. A significant decrease in the amount of products franchisees purchase from us, therefore, could adversely affect our total revenues and results of operations. Such a decrease could result from franchisees' decisions to sell more store-made products or products purchased from third party suppliers.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

Our manufacturing operations and corporate headquarters are located at a 53,000 square foot manufacturing facility, which we own, in Durango, Colorado. During FY 2011, our factory produced approximately 2.62 million pounds of chocolate candies, an increase of 12% from the approximately 2.33 million pounds produced in FY 2010. During FY 2008, we conducted a study of factory capacity. As a result of this study, we believe the factory has the capacity to produce approximately 5.3 million pounds per year. In January 1998, we acquired a two-acre parcel adjacent to our factory to ensure the availability of adequate space to expand the factory as volume demands.

As of March 31, 2011, 11 of the 12 Rocky Mountain Chocolate Factory Company-owned stores were occupied pursuant to non-cancelable leases of five to ten years having varying expiration dates from December 2011 to December 2019, some of which contain optional five-year renewal rights. As of March 31, 2011, four Aspen Leaf Yogurt Company-owned stores were occupied pursuant to non-cancelable leases of five years having varying expiration dates from December 2015 to January 2016, some of which contain optional five-year renewal rights. We do not deem any individual store lease to be significant in relation to our overall operations.

We act as primary lessee of some franchised store premises, which we then sublease to franchisees, but the majority of existing locations are leased by the franchisee directly. Our current policy is not to act as primary lessee on any further franchised locations. At March 31, 2011, we were the primary lessee at 2 of our 302 franchised stores. The subleases for such stores are on the same terms as the Company's leases of the premises. For information as to the amount of our rental obligations under leases on both Company-owned and franchised stores, see Note 5 of the notes to our consolidated financial statements included in Item 8 of this report.

ITEM 3. LEGAL PROCEEDINGS

The Company is not currently involved in any material legal proceedings other than ordinary routine litigation incidental to its business.

ITEM 4. (REMOVED AND RESERVED)

17

Part II.

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER

MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our Common Stock trades on the NASDAQ Global Market which is part of The NASDAQ Stock Market under the trading symbol “RMCF”. On February 17, 2010, our Board of Directors declared a fourth quarter cash dividend of $0.10 cents per common share outstanding. The cash dividend was paid March 12, 2010 to shareholders of record as of February 26, 2010. On February 15, 2011, the Board of Directors declared a fourth quarter cash dividend of $0.10 cents per common share outstanding. The cash dividend was paid March 11, 2011 to shareholders of record as of February 25, 2011.

The table below sets forth high and low price information and dividends declared for the Common Stock for each quarter of fiscal years 2011 and 2010.

|

Fiscal Year Ended February 28, 2011

|

HIGH

|

LOW

|

Dividends

declared

|

|||||||||

|

Fourth Quarter

|

$ | 10.50 | $ | 9.41 | .1000 | |||||||

|

Third Quarter

|

$ | 9.95 | $ | 9.20 | .1000 | |||||||

|

Second Quarter

|

$ | 10.08 | $ | 8.91 | .1000 | |||||||

|

First Quarter

|

$ | 10.26 | $ | 8.55 | .1000 | |||||||

|

Fiscal Year Ended February 28, 2010

|

HIGH

|

LOW

|

Dividends

declared

|

|||||||||

|

Fourth Quarter

|

$ | 8.93 | $ | 8.00 | .1000 | |||||||

|

Third Quarter

|

$ | 9.20 | $ | 7.85 | .1000 | |||||||

|

Second Quarter

|

$ | 8.65 | $ | 7.50 | .1000 | |||||||

|

First Quarter

|

$ | 9.19 | $ | 4.08 | .1000 | |||||||

On April 29, 2011 the closing price for the Common Stock was $10.54.

Holders

On April 30, 2011 there were approximately 400 record holders of the Company's Common Stock. The Company believes that there are more than 800 beneficial owners of its Common Stock.

18

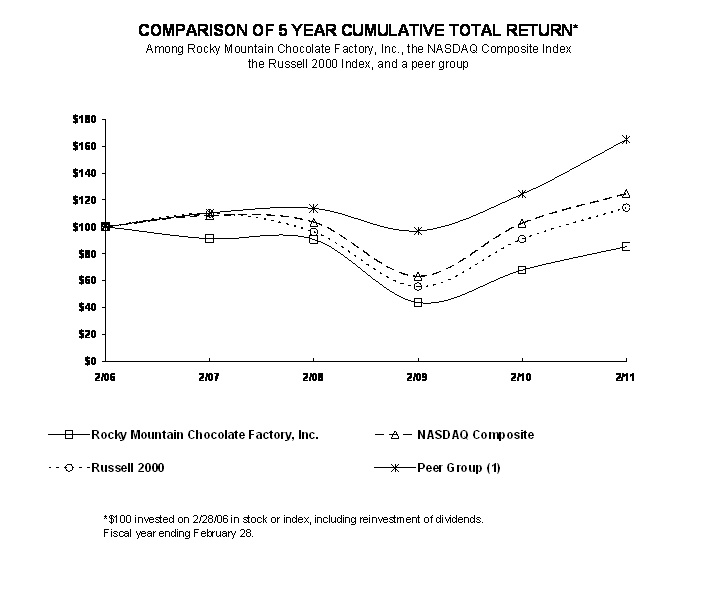

Comparison of Return on Equity

The following graph reflects the total return, which assumes reinvestment of dividends, of a $100 investment in the Company’s Common Stock, in the Nasdaq Index, in the Russell 2000 Index and in a Peer Group Index of companies in the confectionery industry, on February 28, 2006. The stock price performance included in this graph is not necessarily indicative of future stock price performance.

|

Return

|

Return

|

Return

|

Return

|

Return

|

Return

|

|||||||||||||||||||

|

Company/Index Name

|

2/2006 | 2/2007 | 2/2008 | 2/2009 | 2/2010 | 2/2011 | ||||||||||||||||||

|

Rocky Mountain Chocolate Factory, Inc.

|

100.00 | 91.10 | 90.60 | 43.73 | 67.85 | 85.26 | ||||||||||||||||||

|

NASDAQ Composite

|

100.00 | 108.42 | 103.52 | 63.19 | 102.68 | 124.77 | ||||||||||||||||||

|

Russell 2000

|

100.00 | 109.87 | 96.21 | 55.43 | 90.88 | 114.23 | ||||||||||||||||||

|

Peer Group (1)

|

100.00 | 110.25 | 113.75 | 96.98 | 124.43 | 164.78 | ||||||||||||||||||

|

(1)

|

Comprised of the following companies: The Hershey Company, Imperial Sugar Company, Paradise, Inc., Tootsie Roll Industries, Inc., and Valhi, Inc.

|

19

ITEM 6. SELECTED FINANCIAL DATA

The selected financial data presented below for the fiscal years ended February 28 or 29, 2007 through 2011, are derived from the Financial Statements of the Company, which have been audited by Ehrhardt Keefe Steiner & Hottman PC, independent registered public accounting firm. The selected financial data should be read in conjunction with the Financial Statements and related Notes thereto included elsewhere in this Report and "Management's Discussion and Analysis of Financial Condition and Results of Operations.”

(Amounts in thousands, except per share data)

|

YEARS ENDED FEBRUARY 28 or 29,

|

||||||||||||||||||||

|

Selected Statement of Operations Data

|

2011

|

2010

|

2009

|

2008

|

2007

|

|||||||||||||||

|

Total revenues

|

$ | 31,128 | $ | 28,437 | $ | 28,539 | $ | 31,878 | $ | 31,573 | ||||||||||

|

Operating income

|

5,950 | 5,671 | 5,819 | 7,914 | 7,561 | |||||||||||||||

|

Net income

|

$ | 3,911 | $ | 3,580 | $ | 3,719 | $ | 4,961 | $ | 4,745 | ||||||||||

|

Basic Earnings per Common Share

|

$ | .65 | $ | .60 | $ | .62 | $ | .78 | $ | .74 | ||||||||||

|

Diluted Earnings per Common Share

|

$ | .62 | $ | .58 | $ | .60 | $ | .76 | $ | .71 | ||||||||||

|

Weighted average common shares outstanding

|

6,051 | 6,013 | 5,985 | 6,341 | 6,432 | |||||||||||||||

|

Weighted average common shares outstanding, assuming dilution

|

6,290 | 6,210 | 6,157 | 6,501 | 6,659 | |||||||||||||||

|

Selected Balance Sheet Data

|

||||||||||||||||||||

|

Working capital

|

$ | 9,831 | $ | 8,930 | $ | 7,371 | $ | 5,152 | $ | 7,503 | ||||||||||

|

Total assets

|

21,439 | 18,920 | 16,841 | 16,147 | 18,456 | |||||||||||||||

|

Stockholders’ equity

|

16,654 | 14,731 | 13,242 | 11,655 | 14,515 | |||||||||||||||

|

Cash Dividend Declared per Common Share

|

$ | .400 | $ | .400 | $ | .400 | $ | .390 | $ | .324 | ||||||||||

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Current Trends and Outlook

The fourth quarter retail environment of FY 2009 proved to be the most challenging in our history. Global economic turmoil resulted in a swift and steep decline in consumer spending and a shopping landscape dominated by promotional activity.

We continued to experience this difficult environment throughout FY 2010 and FY 2011. As a result, we have and will continue to focus on managing the business in a seasoned, disciplined and controlled manner.

In managing the business in FY 2012, we are taking a conservative view of market conditions. We will continue to focus on our long-term objectives while seeking to maintain flexibility to respond to market conditions.

We are a product-based international franchisor. Our revenues and profitability are derived principally from its franchised system of retail stores that feature chocolate and other confectionery products. We also sell our candy in selected locations outside our system of retail stores to build brand awareness. We operate thirteen retail units as a laboratory to test marketing, design and operational initiatives.

We are subject to seasonal fluctuations in sales because of the location of our franchisees, which have traditionally been located in resort or tourist locations. As we expand our geographical diversity to include regional centers, it has seen some moderation to its seasonal sales mix. Seasonal fluctuation in sales causes fluctuations in quarterly results of operations. Historically, the strongest sales of our products have occurred during the Christmas holiday and summer vacation seasons. Additionally, quarterly results have been, and in the future are likely to be, affected by the timing of new store openings and sales of franchises. Because of the seasonality of our business and the impact of new store openings and sales of franchises, results for any quarter are not necessarily indicative of results that may be achieved in other quarters or for a full fiscal year.

20

The most important factors in continued growth in our earnings are ongoing unit growth, increased same store sales and increased same store pounds purchased from the factory. Historically, unit growth has more than offset decreases in same store sales and same store pounds purchased.

Our ability to successfully achieve expansion of our franchise systems depends on many factors not within our control including the availability of suitable sites for new store establishment and the availability of qualified franchisees to support such expansion.

Efforts to reverse the decline in same store pounds purchased from the factory by franchised stores and to increase total factory sales depend on many factors, including new store openings, competition, the receptivity of our franchise system to our product introductions and promotional programs. Same store pounds purchased from the factory by franchised stores increased approximately 0.5% in the first quarter, declined approximately 1.0% in the second quarter, increased approximately 2.3% in the third quarter, declined approximately 8.2% in the fourth quarter and declined approximately 0.6% overall in FY 2011 as compared to the same periods in FY 2010.

On May 11, 2009, we announced the expansion of the co-branding test relationship with Cold Stone Creamery. The Company and Cold Stone Creamery, Inc. have agreed to expand the co-branding relationship to several hundred potential locations, based upon the performance of several test locations, operating under the test agreement announced in October 2008. We believe that if this co-branding strategy proves financially viable it could represent a significant future growth opportunity. As of February 28, 2011, licensees operated 40 co-branded locations.