Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Axos Financial, Inc. | d8k.htm |

B. Riley & Co.

12th Annual Investor

Conference

May 24, 2011

Greg Garrabrants

President &

Chief Executive Officer

Exhibit 99.1 |

1

Safe Harbor

This presentation contains forward-looking

statements within the meaning of the Private

Securities Litigation Reform Act of 1995 (the

“Reform Act”). The words “believe,” “expect,”

“anticipate,” “estimate,” “project,” or the

negation thereof or similar expressions

constitute forward-looking statements within

the meaning of the Reform Act. These

statements may include, but are not limited to,

projections of revenues, income or loss,

estimates of capital expenditures, plans for

future operations, products or services, and

financing needs or plans, as well as

assumptions relating to these matters. Such

statements involve risks, uncertainties and

other factors that may cause actual results, performance or achievements of the Company and its

subsidiaries to be materially different from any future results, performance or achievements expressed

or implied by such forward-looking statements. For a discussion of these factors, we

refer you to the Company's reports filed with the Securities and Exchange Commission, including

its Annual Report on Form 10-K for the year ended June 30, 2010 and its Earnings Report on

Form 10-Q for the quarter ended March 31, 2011. In light of the significant

uncertainties inherent in the forward-looking statements included herein, the inclusion of

such information should not be regarded as a representation by the Company or by any other

person or entity that the objectives and plans of the Company will be achieved. For all

forward-looking statements, the Company claims the protection of the safe-harbor for

forward-looking statements contained in the Reform Act.

|

2

Key Accomplishments

Common stock currently trading at: 125.0%

of book; 9.15x TTM P/E

Return on equity of 15.0% (YTD 3/11)

Efficiency ratio of 39.3% (YTD 3/11)

5-year asset growth of 18.4% (CAGR) 6/30/2010

5-year deposit growth of 21.8% (CAGR) 6/30/2010

Third highest ranking on SNL list of top performing thrifts (March 2010)

Bank Tier 1 Capital Ratio 8.11% / Tier 1 Risk-based Capital Ratio 12.97% at

3/31/11; Pro-forma Tier 1 Capital Ratio of 8.51%

/ Tier 1 Risk-based Capital Ratio of 13.62%

BofI joins the Russell 3000 index on June 25, 2010

1

2

3

4

5

6

7

2

2

1. Assumes pushdown of existing cash of $7M from Holding company to Bank.

2. As of 5/02/11 closing price of $16.56 per share.

1

1 |

3

Corporate Profile

1. Quarter ended March 31, 2011 2. As of 5/02/11 closing

price of $16.56 per share $1.7 billion asset savings and loan

holding company

1

10 years operating history, publicly

traded on NASDAQ(BOFI) since 2005

Headquartered in single branch location

in San Diego, CA

35,000 deposit and loan

customers

1

170 employees ($10 million in assets

per

employee)

1

Market Capitalization

of

$171

million

2

Price/Tangible Book

Value

=

125.0%

2 |

The

Best of the Biggest – The 100 Largest

Public Thrifts by Asset Size

BofI Holding, Inc. (BOFI)

3

5

CA

89.40

1,401.1

1.16

15.87

13.14

32.23

1.21

0.80

4 |

5

Primary Business –

Deposits

Deposit products

•

Deposit base: ~$1,191M

•

Full-featured products

•

Self-service operations

•

Highly efficient operations

(9 CSRs; 31,000

accounts)

•

Deposit base: ~$75M

•

Strong start in first full

year of operations

•

One dedicated employee

•

Significant expansion

opportunities

1. Bank as of 3/31/2011

1

1 |

6

Primary Businesses –

Lending

Lending

Single family

Multifamily

Capital

Markets

Gain-on-sale

Mortgage

Banking

Wholesale

Jumbo

Retail

Wholesale

Loan

purchases

Special

situations

•

Internet-focused lend sources

•

Self-service operation

•

Low-fixed costs

•

High-end portfolio lender

–

“Common Sense”

underwriting

–

Quarter to date average LTV

of 52.9%

•

15 high quality originators with

average experience of 15+ years

•

Highly ranked website-

apartmentbank.com

•

10-year history as portfolio bank

•

High credit quality

•

Quarter to date average LTV of

58.0% and DSCR of 1.48%

•

Wide network of relationships

•

Significant due diligence experience

•

Over $1bn of closed transactions

•

Complex transaction structure

assistance

•

Highly creative and opportunistic |

7

Loan Origination Group Production

Single Family –

Jumbo Portfolio

Multifamily –

Portfolio

73.6

78.7

Total

$175.6

138.7

107.8

$269.7

Single Family –

Gain on Sale

$23.3

$23.2

(In millions)

1. Applications in as of 3/31/2011

Pipeline

Q3-2011

Production

1 |

8

Multi Family and Single Family Production are a

Reliable Asset Generation Platform for the Bank

($ Million)

($ Million)

Multifamily Loan Production

Single Family Jumbo |

9

Our Business Model is More Profitable

Because Our Costs are Lower

Salaries and benefits

Premises and equipment

0.77

0.13

Other non-interest

expense

0.41

Total non-interest

expense

1.31

Core business margin

2.09

1.35

0.37

1.55

3.27

0.22

Net interest income

3.40

3.49

As % of average assets

BofI

1

(%)

Banks

$1-$10bn

2

(%)

1. Bank of Internet USA only for three months ended 12/31/10 - the most recent data on FDIC

website “Statistics on Depository Institutions Report. ”Excludes BofI Holding

company to compare to FDIC data.

2. Commercial banks by asset size. FDIC reported for three months ended 12/31/10. Total of 424

institutions $1-$10 billion. |

10

Our Efficiency Ratio Consistently is One

of the Industry's Lowest

Efficiency Ratio

(Bank of Internet USA, for the fiscal quarter ended)

63.24

34.49

30.67

31.39

29.21

0

20

40

60

80

(%)

Banks

Q2 ‘11

Q1 ‘11

Q4 ‘10

Q3 ’10

One of the lowest

rates in the

industry

1

1. Reported by FDIC – 424 commercial banks with $1-$10 billion in assets for the

quarter ended 12/31/10. Source: FDIC Statistics on Depository Institutions. All data excludes

holding companies for banks. |

11

Best in Class Asset Quality

0.83

0.27

0

1

2

3

(%)

BofI

Bank $1-10bn

2.66

1.01

0

1

2

3

(%)

BofI

Bank $1-10bn

1. Bank of Internet USA only at 12/31/10 (excludes BofI Holding, Inc. to

compare to FDIC data). 2. Commercial banks by asset size. FDIC reported at 12/31/10. Total of 424

institutions $1-$10 billion.

1

2

2

1

Assets 30-89 days delinquent

Assets in non-accrual |

12

Mortgage Loan Portfolio –

Years Seasoned

and Loan-to-Value

3/31/11

3.4

4.1

3.8

4.1

0

1

2

3

4

5

6

Single Family

Multifamily

Commercial

Home Equity

53

47

53

54

0

20

40

60

Percent

1. Based on current loan balance and collateral value at origination or

purchase. Weighted-average number of years since origination

Weighted-average loan-to-value

1 |

Loan

Diversity – March 31, 2011

Loan Portfolio

1

100% = $1,126 mm

1. Gross loans before premiums, discounts and allowances

Multifamily

SF residential

Home equity

Commercial

Consumer and other

36

3

49

3

9

13 |

14

Technology Improvements In Process

Completed Major Revisions to Online Banking

Key Features

Account Aggregation

Safe Interbank Transfers

Financial Management Reporting Tools

Expanded Cross-Sell Capabilities

Target Marketing (assuming consumer opt-in) |

A

Complete Financial Picture All From Our Website

View

accounts

across

16,000+

institutions

Spending

Reports

Simplified

budgeting

tool

Alerts and

reminders for Bill

Payment

15 |

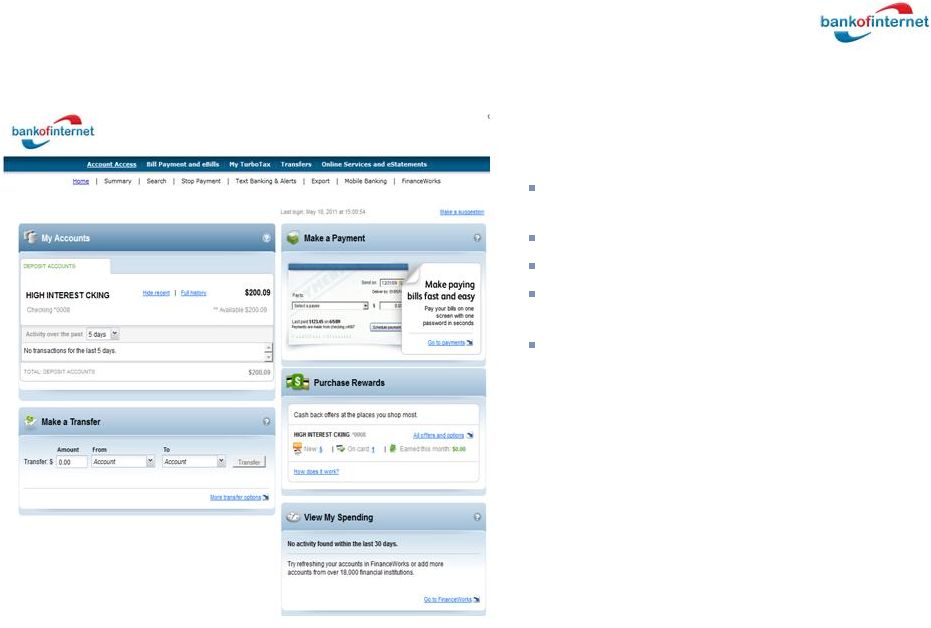

Home

Page with Purchase Rewards •

Solves the most critical money

management tasks on first page:

Check balances and review recent

transactions

Make transfers

Pay bills

Review new and activated offers through

Purchase Rewards

View your spending

•

Extended cross-sell capabilities

from the

page where end users will do the majority

of their banking

•

Compel more end users to use the online

channel with this easy-to-use home page

16 |

Mobile Banking

Enhanced Mobile Banking

Experience for Customers

Text Message Banking allows:

secure and convenient way to check account

balances

view latest transactions

receive low balance alerts

make fund transfers

Mobile Web provides:

secure access to account information and

recent transactions

the ability to conduct transactions and pay bills

through a mobile phone's web browser

17 |

18

Investment Considerations

High-quality consumer franchise

Attractive valuation

Scalability

Strong credit quality

Significant earnings upside potential |