Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SELECTIVE INSURANCE GROUP INC | f8k_052311.htm |

EXHIBIT 99.1

INVESTOR PRESENTATION

MAY 2011

FINANCIAL STRENGTH

- SELECTIVE INSURANCE GROUP, INC. -

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Forward Looking Statement

Certain statements in this report, including information incorporated by reference, are “forward-

looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995

(“PSLRA”). The PSLRA provides a safe harbor under the Securities Act of 1933 and the Securities

Exchange Act of 1934 for forward-looking statements. These statements relate to our intentions,

beliefs, projections, estimations or forecasts of future events or our future financial performance

and involve known and unknown risks, uncertainties and other factors that may cause our or our

industry's actual results, levels of activity, or performance to be materially different from those

expressed or implied by the forward-looking statements. In some cases, you can identify forward-

looking statements by use of words such as "may," "will," "could," "would," "should," "expect,"

"plan," "anticipate," "target," "project," "intend," "believe," "estimate," "predict," "potential," "pro

forma," "seek," "likely" or "continue" or other comparable terminology. These statements are only

predictions, and we can give no assurance that such expectations will prove to be correct. We

undertake no obligation, other than as may be required under the federal securities laws, to

publicly update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

looking statements” as that term is defined in the Private Securities Litigation Reform Act of 1995

(“PSLRA”). The PSLRA provides a safe harbor under the Securities Act of 1933 and the Securities

Exchange Act of 1934 for forward-looking statements. These statements relate to our intentions,

beliefs, projections, estimations or forecasts of future events or our future financial performance

and involve known and unknown risks, uncertainties and other factors that may cause our or our

industry's actual results, levels of activity, or performance to be materially different from those

expressed or implied by the forward-looking statements. In some cases, you can identify forward-

looking statements by use of words such as "may," "will," "could," "would," "should," "expect,"

"plan," "anticipate," "target," "project," "intend," "believe," "estimate," "predict," "potential," "pro

forma," "seek," "likely" or "continue" or other comparable terminology. These statements are only

predictions, and we can give no assurance that such expectations will prove to be correct. We

undertake no obligation, other than as may be required under the federal securities laws, to

publicly update or revise any forward-looking statements, whether as a result of new information,

future events or otherwise.

Factors, that could cause our actual results to differ materially from those projected, forecasted or

estimated by us in forward-looking statements are discussed in further detail in Selective’s public

filings with the United States Securities and Exchange Commission. These risk factors may not be

exhaustive. We operate in a continually changing business environment, and new risk factors

emerge from time-to-time. We can neither predict such new risk factors nor can we assess the

impact, if any, of such new risk factors on our businesses or the extent to which any factor or

combination of factors may cause actual results to differ materially from those expressed or

implied in any forward-looking statements in this report. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed in this report might not occur.

estimated by us in forward-looking statements are discussed in further detail in Selective’s public

filings with the United States Securities and Exchange Commission. These risk factors may not be

exhaustive. We operate in a continually changing business environment, and new risk factors

emerge from time-to-time. We can neither predict such new risk factors nor can we assess the

impact, if any, of such new risk factors on our businesses or the extent to which any factor or

combination of factors may cause actual results to differ materially from those expressed or

implied in any forward-looking statements in this report. In light of these risks, uncertainties and

assumptions, the forward-looking events discussed in this report might not occur.

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

MN

IA

MO

WI

IL

IN

MI

MI

PA

NY

NJ

DE

CT

MA

TN

• 22-state super-regional

• 2010: $1.4B NPW

• 82% commercial lines

• 18% personal lines

• High tech, high touch business model

• Partner of choice - 980 independent

agents

• Focus on enterprise risk management

• Rated A+ by A.M. Best for 49 years

Who We Are

Financial

Strength

Strength

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

Focus on Enterprise Risk Management

• Historically strong capital position

• Business model generates more earnings stability

• Sophisticated underwriting and granular pricing

• Strong reserving practices

• Conservative reinsurance program

• Deep investment management talent

Financial

Strength

Strength

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

More Earnings Stability

Source: A.M. Best, III

Financial

Strength

Strength

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

More Earnings Stability

Note: National Peers include CNA, CB, HIG, TRV and WRB

Financial

Strength

Strength

Source: SNL Financial

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

More Earnings Stability

Source: SNL Financial

Note: Regional Peers include CINF, THG, HGIC, STFC and UFCS

(STD. DEV 4.3)

(STD. DEV 5.1)

Financial

Strength

Strength

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

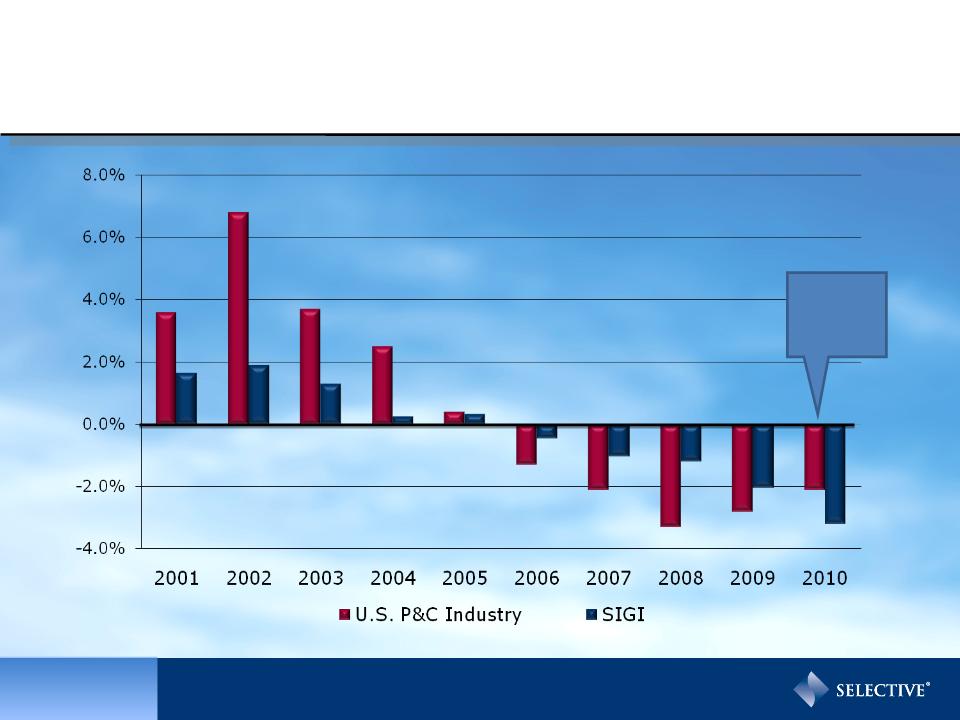

Source: AM Best, 2010 Estimate

Adverse/ (Favorable) Points of

Calendar Year Development

Calendar Year Development

Financial

Strength

Strength

AIG takes

$4B

charge

$4B

charge

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

Premium-to-Surplus

Financial

Strength

Strength

1 point of Combined Ratio = 1 point of ROE

Sources: ISO, AM Best, III; 2010 AM Best Estimate

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

High Quality Investment Portfolio

• Average “AA” bond quality

• Approximately 3.4 year

average duration, including

short-term & cash

• Laddered maturity schedule

– 34% matures within 3 years

– 68% matures within 5 years

• Outsourcing provides access

to broader market expertise

$4.0B Invested Assets

March 31, 2011

March 31, 2011

Financial

Strength

Strength

30 bps of Yield = 1 point of ROE

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Commercial

Lines

Lines

Commercial

Lines

Lines

Strong Natural Catastrophe

Reinsurance Program

Reinsurance Program

Percentages are net of tax, reinsurance and reinstatement premium.

Data as of 7/10; Equity data as of 3/31/11.

% of Equity at Risk (Near-term basis)

CAT cover: $435M in excess of $40M

Financial

Strength

Strength

RMS v9.0

RMS v11.0

AIR v12

RMS v9.0

RMS v11.0

AIR v12

1% Probability

0.4% Probability

Blended RMS v11.0 and AIR

1% Probability = 5%

0.4% Probability = 18%

PREPARED FOR TOMORROW

- SELECTIVE INSURANCE GROUP, INC. -

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Selective’s Commercial Lines

Renewal Pricing Success

Renewal Pricing Success

1Q:09

2Q:09

3Q:09

4Q:09

1Q:10

2Q:10

8 consecutive quarters of positive price

3Q:10

4Q:10

1Q:11

Pricing

Success

Success

Pricing

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Why Are We Successful?

• Agency relationships

• Field model

• Sophisticated underwriting tools and granular pricing

– Aggregate quality score by account

– Targeted pricing

– Agency profitability

– Segment performance

– Hazard grade

– System calculated pure price change

• The courage to walk away

Pricing

Success

Success

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Mix of Business

$1.4B Net Premium Written in 2010

Small Business

Personal Lines

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Middle Market

• Agency relationships

are key

• Agents act as risk

manager for insureds

• Safety Management

• Field underwriting and

claims model

Commercial

Lines

Lines

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Field Model

• Local knowledge of insureds

• Full claims/underwriting

authority

• Supported by sophisticated

underwriting tools

• Safety management services

lowers frequency and

increases retention

Over 300 Field Personnel

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Agency Focus

• 980 Agents

• 2,000 Storefronts

• Number 1, 2 or 3 in 60% of

agencies appointed for 5 or

more years

• Ease of doing business

• Online agency marketing

portal

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Middle Market Product Expansion

• Added 20 new and enhanced products in 2009

• Introduced another 11 in 2010

• New products

• Aging Services, Identity Theft, Cyber Security,

Technology

• Enhanced products

• Resort Endorsement, Contractors GL, Property

Coverage for Municipalities

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Small Business

• Less price sensitive

• Better profitability

• Stronger retention

• Straight through

processing

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Small Business Growth

$ thousands

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Small Business Product Expansion

Expanded Special Contractors &

Merchants PRO BOP

Merchants PRO BOP

Special Contractors

Merchants PRO BOP

2000

2010

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Personal Lines

• Smoothes performance

over the long-term

• Significant source of

agent revenue

• Improving mix of business

and ability to get rate

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Personal Lines Rate Success

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Driving Down Cost of Goods Sold

• 3 point reduction in loss costs expected over 3 years

– Specialized claims handling model

– Improved workers compensation medical management

– Staff counsel expansion

– Vendor management

– Fraud analytics

– Recovery and subrogation

Anticipate $6M savings from 2011 initiatives

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Customer Focus to Improve Retention

• Continue to build relationships with end

customers

• 24/7 online access for customer service needs

• Improving customer experience through high

frequency touch points

• Online interactive safety training resources

• Safety management strengthens Selective

brand

Pricing

Success

Success

Pricing

Success

Success

Personal

Lines

Lines

Personal

Lines

Lines

Prepared for

Tomorrow

Tomorrow

Financial

Strength

Strength

Financial

Strength

Strength

Commercial

Lines

Lines

Commercial

Lines

Lines

Long-Term Shareholder Value Creation

Current Dividend Yield: 3.0%

*

*Annualized Indicated Dividend

Financial Highlights 2006 - Q1 2011

|

|

Q1:2011

|

2010

|

2009

|

2008

|

2007

|

2006

|

|

NPW Growth

|

(1.7)%

|

(2.3)%

|

(4.7)%

|

(4.5)%

|

1.4%

|

5.3%

|

|

Operating EPS

|

$0.32

|

$1.35

|

$1.39

|

$1.43

|

$2.16

|

$2.23

|

|

Net Income per Share

|

$0.39

|

$1.20

|

$0.68

|

$0.82

|

$2.59

|

$2.65

|

|

Dividend per Share

|

$0.13

|

$0.52

|

$0.52

|

$0.52

|

$0.49

|

$0.44

|

|

Book Value

|

$20.06

|

$19.95

|

$18.83

|

$16.84

|

$19.81

|

$18.81

|

|

Return on Equity

|

8.0%

|

6.3%

|

3.8%

|

4.5%

|

13.6%

|

15.9%

|

|

Operating Return on Equity

|

6.6%

|

7.1%

|

7.9%

|

7.8%

|

11.3%

|

13.3%

|

|

Statutory Combined Ratio -

Total |

102.6%

|

101.6%

|

100.5%

|

99.2%

|

97.5%

|

95.4%

|

|

- Commercial Lines

|

100.6%

|

100.8%

|

99.8%

|

98.5%

|

95.9%

|

95.0%

|

|

- Personal Lines

|

111.5%

|

106.4%

|

104.4%

|

103.7%

|

107.9%

|

98.2%

|

|

GAAP Combined Ratio - Total

|

103.2%

|

101.6%

|

99.8%

|

100.0%

|

98.0%

|

95.3%

|

|

- Commercial Lines

|

101.7%

|

100.1%

|

98.8%

|

99.2%

|

96.5%

|

94.9%

|

|

- Personal Lines

|

109.7%

|

108.5%

|

105.6%

|

105.1%

|

107.7%

|

97.8%

|

Net Operating Cash Flow

($ in millions)

YTD March 2011: $28M

26%

25%

16%

16%

11%

Cash Flow as % of NPW

Investment Income - After-tax

($ in millions)

YTD March 2011: $32M

Diversified Municipal Portfolio

• $1.4 billion portfolio

• Average “AA” rated

• 36% of portfolio matures

within 3 years

• Diversified among 291

issuers

• NY, CA, NJ, IL represent

$34M or 2.4% of portfolio

Reported Expense Ratio*

SIGI vs. National Peers

SIGI vs. National Peers

*Expense Ratio including Dividends

Note: National Peers include CNA, CB, HIG, TRV and WRB

Source: SNL Financial

Reported Expense Ratio*

SIGI vs. Regional Peers

SIGI vs. Regional Peers

*Expense Ratio including Dividends

Source: SNL Financial

Note: Regional Peers include CINF, THG, HGIC, STFC and UFCS

Insurance Operations Productivity

($ in 000s)

%

%

100.6

104.5

102.2

100.9

Impact of Catastrophe

Combined Ratio excluding Cats

95.4

Statutory Combined Ratios

93.6

95.0

95.9

98.5

99.8

100.8

Commercial Lines Profitability

Granular Pricing Capabilities

4 & 5

Diamond

3

Diamond

1 & 2

Diamond

Quarterly Pricing by Diamond

Higher

Lower

Quality

For lines < $50,000

Percent of Total New Premium Diamond Distribution

WC, BOP, CPP, CA

Commercial Lines New Business Quality

Improvement

Improvement

Higher

Lower

Quality

Retaining our Best Commercial

Business

Business

1 & 2 Diamond

3 Diamond

4 & 5 Diamond

Retention at point of renewal as of March 31, 2011

Higher

Lower

Quality

Commercial Lines Premium by Line of

Business

2010 Statutory Net Premium Written

Business

2010 Statutory Net Premium Written

Premium by Strategic Business Unit

2010 Direct Premium Written

2010 Direct Premium Written