Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - FIFTH THIRD BANCORP | d8k.htm |

Fifth Third Bank | All Rights Reserved

Investor Update

May 2011

Please refer to earnings release dated April 21, 2011 and

10-Q dated May 9, 2011 for further information

Exhibit 99.1 |

2

Fifth Third Bank | All Rights Reserved

A foundation of continued growth

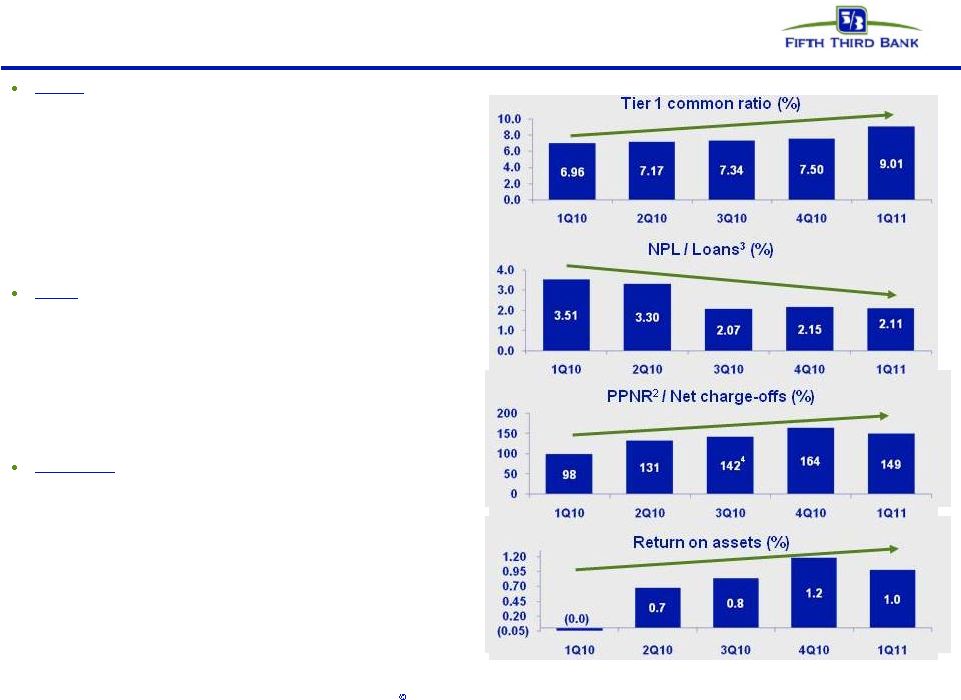

Capital

–

foundation for continued growth

—

Tier 1 common capital has increased 464bps or $4.0bn¹

—

9.0% Tier 1 common ratio is $1.0bn in excess of internal ~8.0%

target

—

Capital base transformed through series of capital actions

–

$1.7bn common equity offering; $1.0bn senior notes issued;

$3.408bn TARP redemption; $280mm warrant repurchase

—

Capital levels supplemented by strong reserve levels

–

Loan loss reserves 3.62% of loans and 170% of NPLs

Credit

–

ongoing discipline driving steady improvement

—

Broad-based improvements in problem loans

–

73% reduction in 90+ day delinquent loans since 3Q09

–

NCO ratio of 1.92%, down 51% (-191 bps) since 3Q09

–

149% PPNR²

/ NCOs in 1Q11

—

Balance sheet risk lowered through asset sales, resolutions

–

$1.3bn (44%) decline in NPLs since 4Q09

Profitability

–

recent results support positive momentum

—

PPNR²

remained stable throughout cycle

—

Profitability metrics have improved significantly from crisis-era

levels, with 4 consecutive profitable quarters

—

Return on assets at or above 1.0% for last two quarters and

exceeds most peers

1

Since December 31, 2008

2

Pre-provision net revenue (PPNR): net interest income plus noninterest income

minus noninterest expense

3

Nonperforming

loans

and

leases

as

a

percent

of

portfolio

loans,

leases

and

other

assets,

including other real estate owned (excludes nonaccrual loans

held-for-sale) 4

Excluding $510mm net charge-offs attributable to credit actions and $127mm in

net BOLI settlement gains |

3

Fifth Third Bank | All Rights Reserved

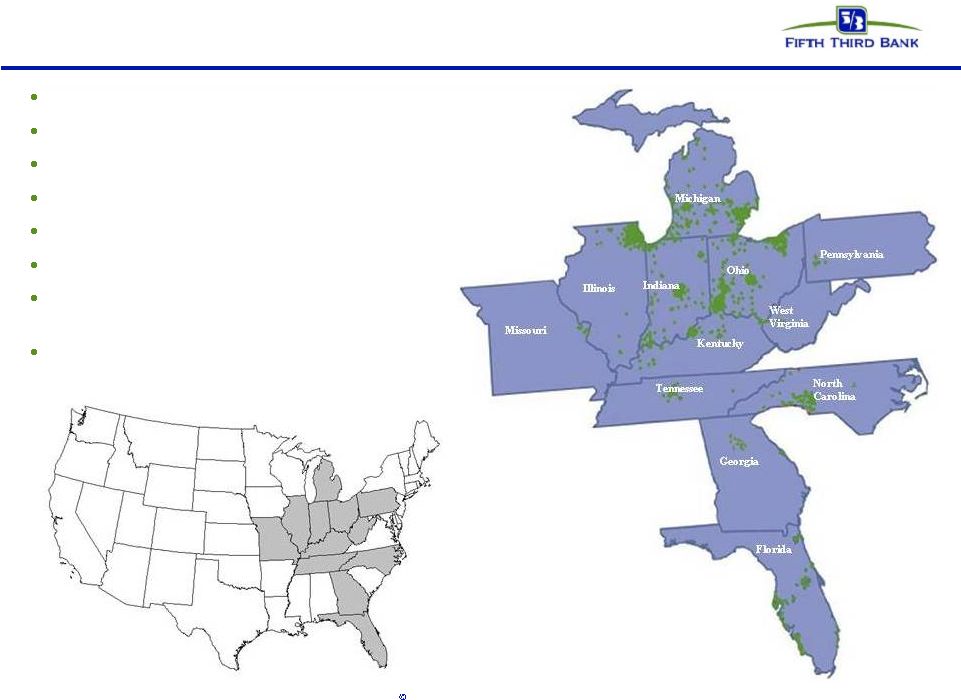

Fifth Third franchise

$110 billion assets

$84 billion deposits

$13 billion market cap

15 affiliates in 12 states

1,310 banking centers

2,453 ATMs

Leading market share in mature Midwest

market

Built strong presence in higher growth

Southeastern markets over past 5 years |

4

Fifth Third Bank | All Rights Reserved

1Q11 in review

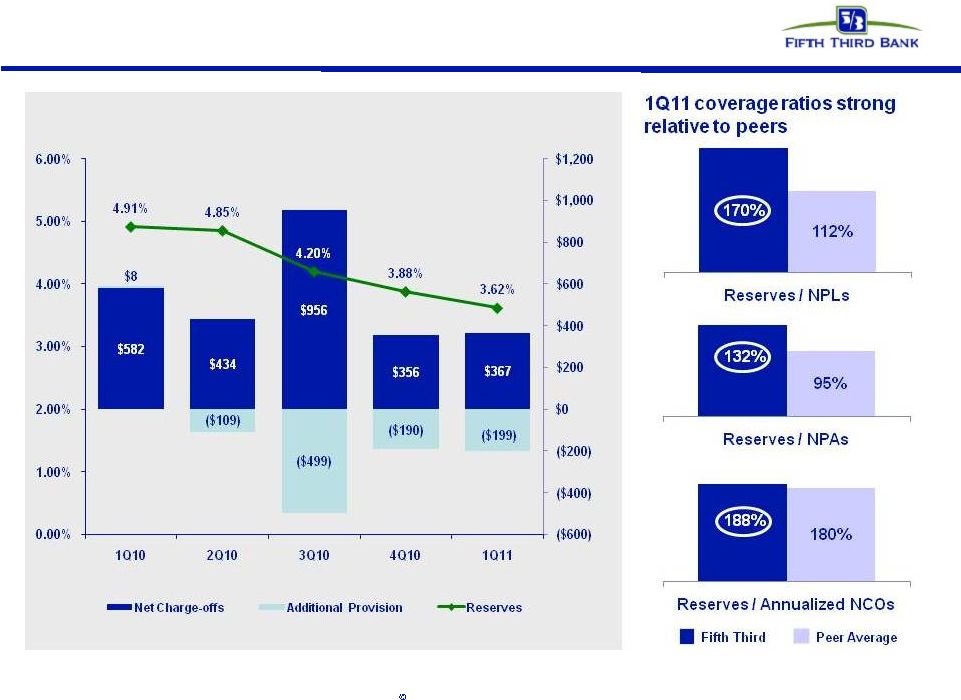

Credit continuing to improve

•

Net charge-offs of $367mm (1.92% of loans and leases) vs. 4Q10

NCOs of $356mm (1.86% of loans and leases)

•

Total

NPAs

of

$2.3B

including

held-for-sale

declined

$126mm

or

5%

sequentially

to

lowest

level

since

2Q08

–

Total

delinquencies

down

12%

sequentially

(lowest

level

since 2006)

•

Provision expense of $168mm, reduction in allowance of $199mm

•

Loan loss allowance of 3.62%; coverage 132% of NPAs and 170% of

NPLs and 1.9x annualized first quarter net charge-offs

Actions driving progress

•

Focusing on credit quality, portfolio management, and loss mitigation

strategies

•

Executing on customer experience and employee engagement

initiatives

•

Enhancing breadth and profitability of offerings and relationships

•

Exit from all crisis-era government programs

Continued strong operating results

•

Net income available to common shareholders of $88mm, or $0.10 per

diluted share

–

Net income reduced by $153mm of discount accretion recorded

in preferred dividends accelerated by February repurchase of

$3.4B in TARP CPP Preferred Stock; $0.17 per share impact

•

Average loan and lease balances excluding held-for-sale up 2%

sequentially; period end loans and leases flat sequentially

•

Return on average assets of 1.0%

•

Strong capital ratios: Tier 1 common 9.0%, Tier 1 capital ratio 12.2%,

Total capital ratio 16.3% |

5

Fifth Third Bank | All Rights Reserved

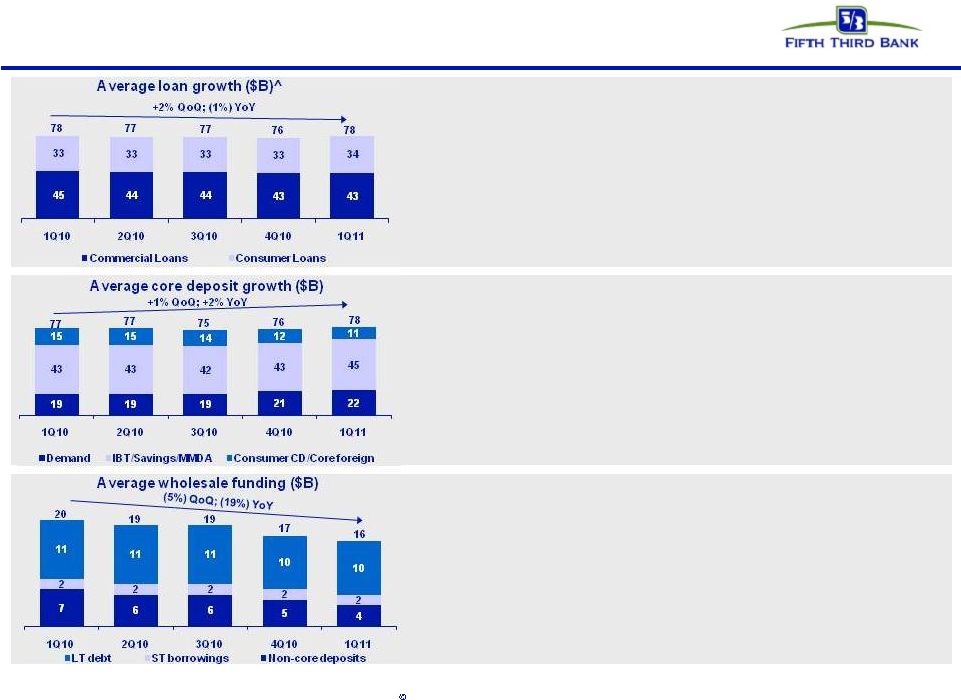

Balance sheet

•

C&I loans up 4% sequentially and 4% from the previous year

•

CRE loans down 3% sequentially and 17% from the previous year

•

Consumer loans up 2% sequentially and 3% from the previous year

•

Warehoused residential mortgage loans held-for-sale were $1.5B at

quarter end versus $2.3B at year-end

•

Core deposit to loan ratio of 100%, up from 97% in 1Q10

•

DDAs up 2% sequentially and 15% year-over-year

•

Retail average transaction deposits up 3% sequentially and 14% from

the previous year, driven by growth in demand deposit, savings, and

interest checking account balances

•

Commercial average transaction deposits up 3% sequentially, driven by

growth in demand deposit and interest checking account balances

–

Excluding public funds balances, commercial average transaction

deposits increased 1% sequentially and 17% over prior year

•

Reduced

wholesale

funding

by

$3.8

billion

from

the

first

quarter

of

2010

–

Non-core deposits down 13% sequentially and 40% from the

previous year

–

Short term borrowings down 8% sequentially and up 16% from the

previous year

–

Long-term debt flat sequentially and down 11% from the previous

year

^ Excludes loans held-for-sale

Note: Numbers may not sum due to rounding |

6

Fifth Third Bank | All Rights Reserved

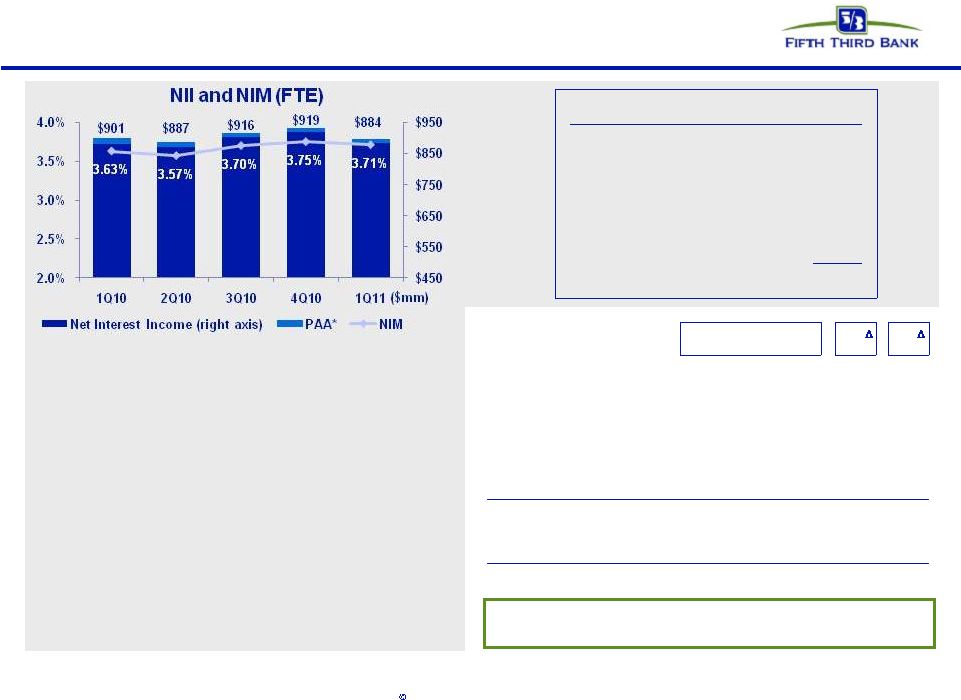

Net interest income

•

Sequential net interest income and net interest

margin (FTE) performance driven by lower

daycount, debt issuance for TARP repayment,

lower mortgage warehouse HFS balances, 4Q10

FTPS, LLC loan refinancing, and lower yields,

partially offset by deposit mix shift and pricing as

well as higher average total loan balances

–

NII down $35mm, or 4%, sequentially and

down $17mm, or 2%, year-over-year

–

NIM down 4 bps sequentially and up 8 bps

year-over-year

•

4Q10 FTPS, LLC loan refinancing represented

nearly half of decline in C&I loan yields

* Represents purchase accounting adjustments included in net interest income.

Yield Analysis

Interest-earning assets

1Q10

4Q10

1Q11

Seq.

(bps)

YoY

(bps)

Commercial and industrial loans

4.61%

4.64%

4.45%

(19)

(16)

Commercial mortgage loans

4.20%

4.17%

4.11%

(6)

(9)

Commercial construction loans

2.92%

2.90%

3.15%

25

23

Commercial leases

4.54%

4.21%

4.17%

(4)

(37)

Residential mortgage loans

5.18%

4.64%

4.67%

3

(51)

Home equity

4.02%

3.98%

3.96%

(2)

(6)

Automobile loans

6.24%

5.41%

5.10%

(31)

(114)

Credit card

10.76%

10.55%

10.43%

(12)

(33)

Other consumer loans and leases

11.87%

18.68%

18.54%

(14)

667

Total loans and leases

4.87%

4.78%

4.67%

(11)

(20)

Taxable securities

4.28%

3.88%

3.96%

8

(32)

Tax exempt securities

3.65%

4.27%

4.77%

50

112

Other short-term investments

0.18%

0.25%

0.25%

-

7

Total interest-earning assets

4.62%

4.52%

4.47%

(5)

(15)

•

Yield on interest-earning assets declined 5 bps

sequentially and 15 bps year-over-year

Net Interest Income Reconciliation

($ in millions)

4Q10 NII (FTE)

$919

Daycount

(12)

FTPS loan restructuring

(8)

Lower mortgage warehouse

(8)

$1B debt issuance

(7)

1Q11 NII (FTE)

$884 |

7

Fifth Third Bank | All Rights Reserved

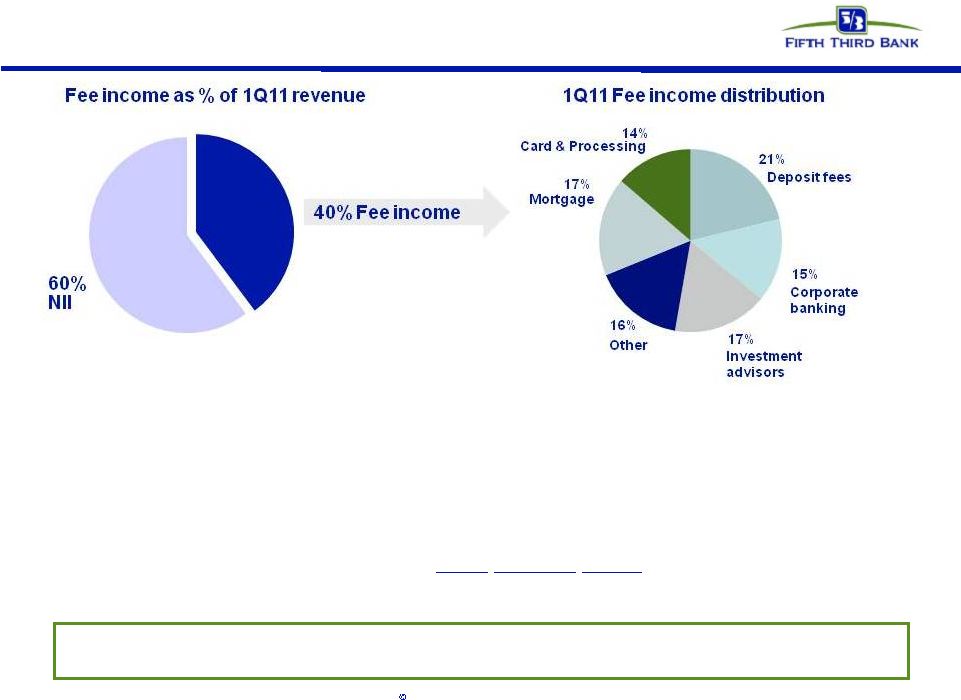

Diverse revenue stream

•

Improving economy supportive of underlying revenue growth from loan growth and

business fee income –

Higher market interest rates in future should add further benefit

•

Negative impact of Reg E fully absorbed into results in 4Q10

•

Timing and initial impact of debit interchange legislation currently unknown

–

Legislative changes possible

–

Timing

of

implementation

2H11,

unless

timeline

altered

–

~3%

of

revenue

at

risk

from

initial

impact

before

mitigating

actions

–

Valuable

product

and

service;

expect

to

mitigate

through

adjustments

to

product

and

service

offerings

Economic trends should support long-term improvement in results through

balance sheet growth and higher business activity |

8

Fifth Third Bank | All Rights Reserved

Strong relative credit trends

Peer average includes: BBT, CMA, HBAN, KEY, MTB, MI, PNC, RF,STI, USB, WFC, and

ZION Source: SNL Financial and company filings. NPA and NCO ratios exclude

loans held-for-sale and covered assets for peers where appropriate.

*

4Q08

NCOs

included

$800mm

in

NCOs

related

to

commercial

loans

moved

to

held-for-sale;

3Q10

NCOs

included

$510mm

in

NCOs

related

to

loans

sold

or

moved

to

held-for-sale

FITB credit metrics are now generally better than peers

|

9

Fifth Third Bank | All Rights Reserved

Industry leading reserve levels

Source: SNL and company reports. NPAs/NPLs exclude held-for-sale portion

for all banks as well as covered assets for BBT, USB, and ZION. |

10

Fifth Third Bank | All Rights Reserved

Strong capital position

Source: SNL Financial and Company reports. HFI NPAs exclude loans

held-for-sale and also exclude covered assets for BBT, USB, and ZION

Capital ratios strong and reflect TARP CPP redemption |

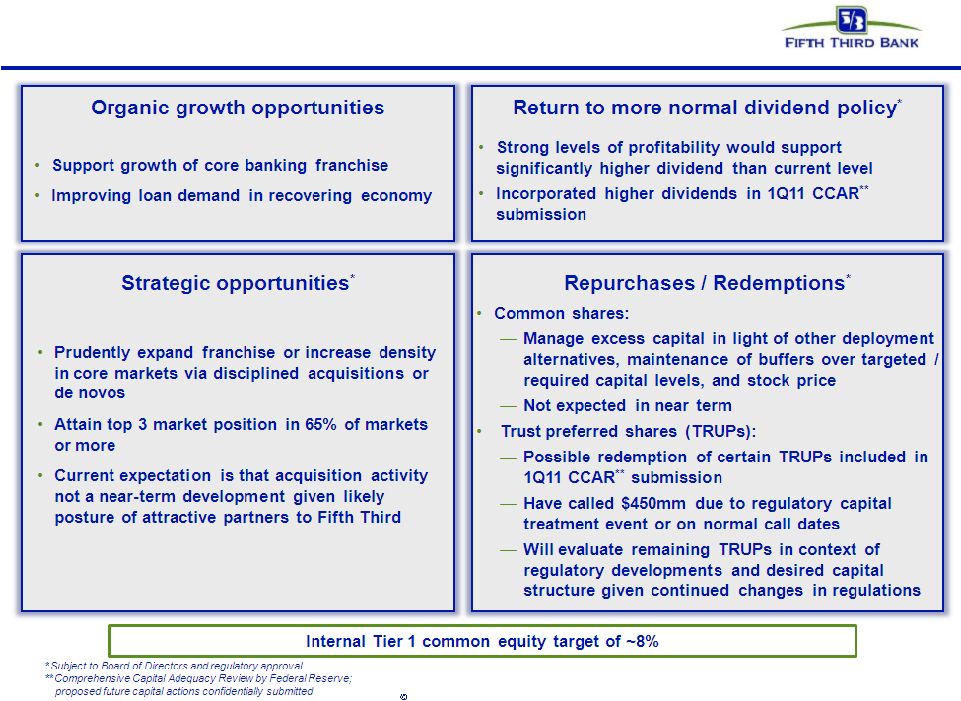

Capital management philosophy

11

FifthThird Bank | All Rights Reserved |

12

Fifth Third Bank | All Rights Reserved

Customer-centric traditional banking model:

well-positioned for changed financial landscape

Fifth Third’s business model is driven by traditional banking activities

—

Largest bank headquartered within Fifth Third’s core Midwest footprint

—

Focus on expansion and development of businesses where regional leadership

matters –

Retail, small business, and mid-market commercial

–

Select national lines where the bank has a distinctive element (i.e., Fifth Third

Processing Solutions, Indirect Auto, Healthcare)

No significant business at Fifth Third impaired during crisis; traditional banking

focus consistent with direction of financial reform

—

Didn’t / don’t originate or sell CDOs or securitize loans on behalf of

others; no mortgage securitizations outstanding (except ~$100mm HELOC from

2003) —

Didn’t / don’t originate or sell subprime mortgages or Option ARMs

—

Low level of financial system “interconnectedness”

(e.g., Fifth Third loss in Lehman

bankruptcy should be less than $2mm)

—

Little to no impact from Volcker rule (de minimis market maker in derivatives,

proprietary trading);

—

Daily VaR less than $500 thousand

–

Small private equity portfolio ~$100mm (holding company subsidiary)

Fifth Third’s businesses have performed well through the crisis -

expect reintermediation

and the landscape to evolve further toward our traditional strengths

|

13

Fifth Third Bank | All Rights Reserved

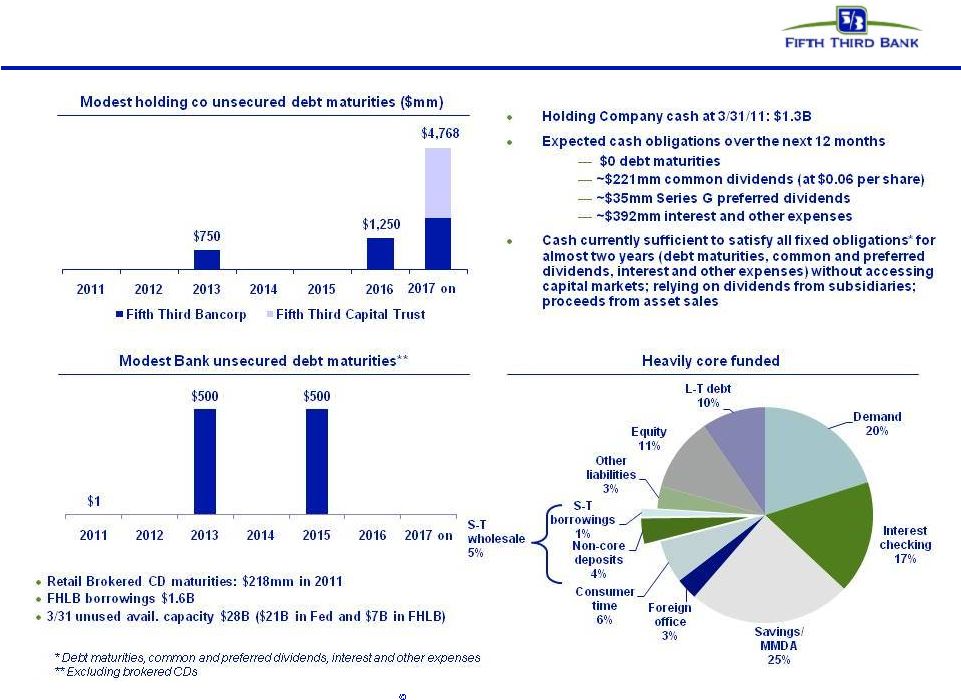

Well-positioned for the future

•

Holding company cash currently sufficient for approximately 2 years of obligations;

no holding company or Bank debt maturities until 2013

•

Fifth Third has completely exited all crisis-era government support

programs –

Fifth Third is one of the few large banks that have no TLGP-guaranteed

debt Superior capital and liquidity position

•

NCOs below 2%; 1.9x reserves / annualized NCOs

•

$1.2B problem assets addressed through loan sales and transfer to HFS in 3Q10

•

Substantial reduction in exposure to CRE since 1Q09; relatively low CRE exposure

versus peers Proactive approach to risk management

•

Traditional commercial banking franchise built on customer-oriented localized

operating model •

Strong market share in key markets with focus on further improving density

•

Fee income ~40% of total revenues

Diversified traditional banking platform

•

PPNR has remained strong throughout the credit cycle

•

PPNR substantially exceeds annual net charge-offs (149% PPNR / NCOs in

1Q11) •

1.0% ROAA in 1Q11

Strong industry leader in earnings power |

14

Fifth Third Bank | All Rights Reserved

Cautionary statement

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated

thereunder. These statements relate to our financial condition, results of operations, plans,

objectives, future performance or business. They usually can be identified by the use of

forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “estimate,” “forecast,”

“projected,” “intends to,” or may include other similar words or phrases such as

“believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar

expressions, or future or conditional verbs such as “will,” “would,”

“should,” “could,” “might,” “can,” or similar verbs. You should not place undue

reliance on these statements, as they are subject to risks and uncertainties, including but not

limited to the risk factors set forth in our most recent Annual Report on Form 10-K. When

considering these forward-looking statements, you should keep in mind these risks and uncertainties, as well as

any cautionary statements we may make. Moreover, you should treat these statements as speaking only as

of the date they are made and based only on information then actually known to us.

There are a number of important factors that could cause future results to differ materially

from historical performance and these forward-looking statements. Factors that might cause

such a difference include, but are not limited to: (1) general economic conditions and weakening in the

economy, specifically the real estate market, either nationally or in the states in which Fifth Third,

one or more acquired entities and/or the combined company do business, are less favorable than

expected; (2) deteriorating credit quality; (3) political developments, wars or other hostilities may

disrupt or increase volatility in securities markets or other economic conditions; (4) changes in the

interest rate environment reduce interest margins; (5) prepayment speeds, loan origination and

sale volumes, charge-offs and loan loss provisions; (6) Fifth Third’s ability to maintain required capital

levels and adequate sources of funding and liquidity; (7) maintaining capital requirements may limit

Fifth Third’s operations and potential growth; (8) changes and trends in capital markets;

(9) problems encountered by larger or similar financial institutions may adversely affect the banking industry

and/or Fifth Third (10) competitive pressures among depository institutions increase significantly;

(11) effects of critical accounting policies and judgments; (12) changes in accounting policies

or procedures as may be required by the Financial Accounting Standards Board (FASB) or other

regulatory agencies; (13) legislative or regulatory changes or actions, or significant litigation,

adversely affect Fifth Third, one or more acquired entities and/or the combined company or the

businesses in which Fifth Third, one or more acquired entities and/or the combined company are

engaged, including the recently enacted Dodd-Frank Wall Street Reform and Consumer Protection Act;

(14) ability to maintain favorable ratings from rating agencies; (15) fluctuation of Fifth

Third’s stock price; (16) ability to attract and retain key personnel; (17) ability to receive dividends from its

subsidiaries; (18) potentially dilutive effect of future acquisitions on current shareholders’

ownership of Fifth Third; (19) effects of accounting or financial results of one or more

acquired entities; (20) difficulties in separating Fifth Third Processing Solutions from Fifth Third; (21) loss of income

from any sale or potential sale of businesses that could have an adverse effect on Fifth Third’s

earnings and future growth;(22) ability to secure confidential information through the use of

computer systems and telecommunications networks; and (23) the impact of reputational risk created by

these developments on such matters as business generation and retention, funding and liquidity.

You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking statements. |

Fifth Third Bank | All Rights Reserved

Appendix |

16

Fifth Third Bank | All Rights Reserved

Financial summary

•

1Q11 earnings of $0.10 per diluted share reduced by $153mm ($0.17 per share) of

discount accretion recorded in preferred dividends accelerated by February

repurchase of $3.4B in TARP CPP Preferred Stock •

Return on average assets of 1.0%

•

Decline

in

net

interest

income

and

net

interest

margin

driven

by

two

fewer

days

in

quarter;

debt

issuance

for

TARP

repayment;

lower

mortgage

warehouse

HFS

balances;

and

4Q10

FTPS,

LLC

loan

refinancing

–

Average

core

deposits

up

1%

sequentially,

reflecting

higher

DDA

balances

and

decline

in

consumer

CDs

–

Average

loans

up

2%

sequentially,

reflecting

strength

in

C&I

and

auto

loans

Actual

Seq.

YOY

($ in millions)

1Q10

4Q10

1Q11

$

%

$

%

Average Balances

Commercial loans

$45,169

$42,808

$43,410

$602

1%

($1,759)

(4%)

Consumer loans

33,212

33,428

34,226

798

2%

1,014

3%

Total loans & leases (excl. held-for-sale)

$78,381

$76,236

$77,636

$1,400

2%

($745)

(1%)

Core deposits

$76,262

$76,454

$77,524

$1,070

1%

$1,262

2%

Income Statement Data

Net interest income (taxable equivalent)

$901

$919

$884

($35)

(4%)

($17)

(2%)

Provision for loan and lease losses

590

166

168

2

1%

(422)

(72%)

Noninterest income

627

656

584

(71)

(11%)

(43)

(7%)

Noninterest expense

956

987

918

(69)

(7%)

(38)

(4%)

Net Income (loss)

($10)

$334

$265

($69)

(20%)

$275

NM

Preferred dividends

(62)

(63)

(177)

114

181%

115

184%

Diluted earnings after preferred dividends

($72)

$270

$88

($182)

(67%)

$161

NM

Pre-provision net revenue

$568

$583

$545

($38)

(7%)

($23)

(4%)

Earnings per share, basic

($0.09)

$0.34

$0.10

($0.24)

(71%)

$0.19

NM

Earnings per share, diluted

($0.09)

$0.33

$0.10

($0.23)

(70%)

$0.19

NM

Net interest margin

3.63%

3.75%

3.71%

(4bps)

(1%)

8bps

2%

Return on average assets

(0.04%)

1.18%

0.97%

(21bps)

(18%)

101bps

NM |

17

Fifth Third Bank | All Rights Reserved

Potential impact of key elements of Dodd-Frank Act

and other recent financial legislation*

Scope of activity

Potential impact**

Volcker Rule /

Derivatives

•

Vast majority of derivatives activities are exempted

(FITB generally not a market maker)

•

Any proprietary trading de minimis

•

“P/E”

fund investments ~$100mm (<1% of Tier 1

capital)

•

Expect minimal financial impact from loss of existing

revenue

•

Potentially higher compliance costs despite small levels

of non-exempt activities

Debit

Interchange

(Durbin

Amendment)

•

1Q11 debit interchange revenue of $54mm

•

1Q11 debit interchange $ volume: $4.1B

–

Signature $3.3B, PIN $.8B

–

Signature 89mm, PIN 20mm

•

Fed has proposed limits on debt interchange; proposal

currently out for comment

•

Proposals would apply caps of $0.12 or $0.07 per transaction

(e.g., on volume which in 1Q11 was 109

million transactions)

•

If proposal implemented as written, we would expect

substantial mitigation of any reduction in revenue through

actions by FITB and competitors to recapture costs of providing

this service to customers and merchants

Deposit

Insurance

•

Current assessed base (Deposits): ~$78B

•

Proposed assessed base (Assets-TE): ~$96B

•

FITB rate under new industry assessment, based

upon large bank scorecard, less than rate under old

assessment

•

Lower due to reduced share of assessed base

Reg. E

•

Requires

customers

to

“opt-in”

to

allow

non-recurring

electronic overdrafts (e.g. debit, ATM) from accounts

•

Impact fully absorbed in run-rate

Potential impact of these and other elements of financial regulatory reform, such as

CFPA activities and many other aspects, are unknown at this time

TRUPs exclusion

(Collins

Amendment)

•

~280 bps of non-common Tier 1 capital in capital

structure

•

>300 bps of non-common Tier 1 currently

–

Expected to be more than needed post-Basel III

•

3-year transition period begins 2013

•

Will manage capital structure to desired composition

* Based on current understanding of legislation. ** Potential impact, as noted

above, is not intended to be inclusive of all potential impacts that may result from implementation

of legislation and does not include benefit of mitigation activities. Please refer

also to cautionary statement. •

1Q11 debit interchange transaction volume: 109mm |

18

Fifth Third Bank | All Rights Reserved

Liquidity position |

19

Fifth Third Bank | All Rights Reserved

Mortgage repurchase overview

Demand requests and repurchase losses remain volatile

and near-term repurchase losses are expected to remain

elevated

Virtually all sold loans and new claims relate to GSEs or

GNMA

—

98% of outstanding balance of loans sold

—

92% of outstanding claims

Losses remain focused in 2006 thru 2008 vintages.

Majority of outstanding balances of the serviced for others

portfolio relates to origination activity in 2009 and later

Claims and exposure related to whole loan sales (no

outstanding first mortgage securitizations)

Repurchase Reserves* ($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Beginning balance

$58

$84

$85

$103

$101

Net reserve additions

39

19

47

21

10

Repurchase losses

(13)

(18)

(29)

(23)

(23)

Ending balance

$84

$85

$103

$101

$88

Outstanding Counterparty Claims ($ in millions)

Outstanding Balance of Sold Loans ($ in millions)

2005 and prior

GSE

GNMA

Private

Total

$8,876

$325

$648

$9,850

2006

2,036

69

309

2,414

2007

3,331

101

272

3,705

2008

3,460

802

3

4,262

2009 and later

27,432

7,782

1

32,214

Total

$45,135

$9,079

$1,233

$55,447

*

Includes reps and warranty reserve ($73mm) and reserve for loans

sold with recourse ($14mm). |

20

Fifth Third Bank | All Rights Reserved

Troubled debt restructurings (TDR) overview

* Fifth Third data includes changes made to align with OCC/OTS methodology (i.e.

excludes government loans, closed loans and OREO from calculations) |

21

Fifth Third Bank | All Rights Reserved

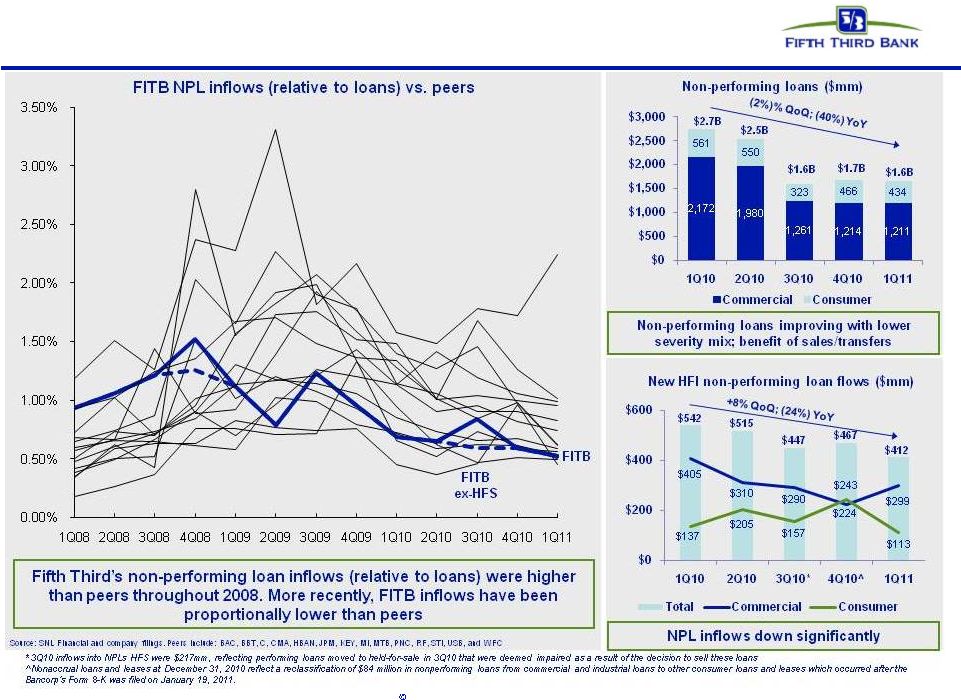

NPL HFI Rollforward

Commercial

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

Beginning NPL Amount

1,406

1,937

2,110

2,430

2,392

2,172

1,980

1,261

1,214

New nonaccrual loans

799

544

832

602

405

310

290

224

299

Paydowns, payoffs, sales and net other activity

(157)

(190)

(246)

(332)

(425)

(402)

(630)

(168)

(199)

Charge-offs

(111)

(181)

(266)

(308)

(200)

(100)

(379)

(103)

(103)

Ending Commercial NPL

1,937

2,110

2,430

2,392

2,172

1,980

1,261

1,214

1,211

Consumer

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

Beginning NPL Amount

457

459

477

517

555

561

550

323

466

New nonaccrual loans

157

125

160

152

137

205

157

243

113

Net other activity

(155)

(107)

(120)

(114)

(131)

(216)

(384)

(100)

(145)

Ending Consumer NPL

459

477

517

555

561

550

323

466

434

Total NPL

2,396

2,587

2,947

2,947

2,733

2,530

1,584

1,680

1,645

Total new nonaccrual loans - HFI

956

669

992

754

542

515

447

467

412

NPL Rollforward

Significant improvement in NPL inflows over past two years

Nonaccrual loans and leases at December 31, 2010 reflect a reclassification of $84

million in nonperforming loans from commercial and industrial loans to other consumer loans and leases

which occurred after the Bancorp's Form 8-K was filed on January 19, 2011.

|

22

Fifth Third Bank | All Rights Reserved

Non-performing loans |

23

Fifth Third Bank | All Rights Reserved

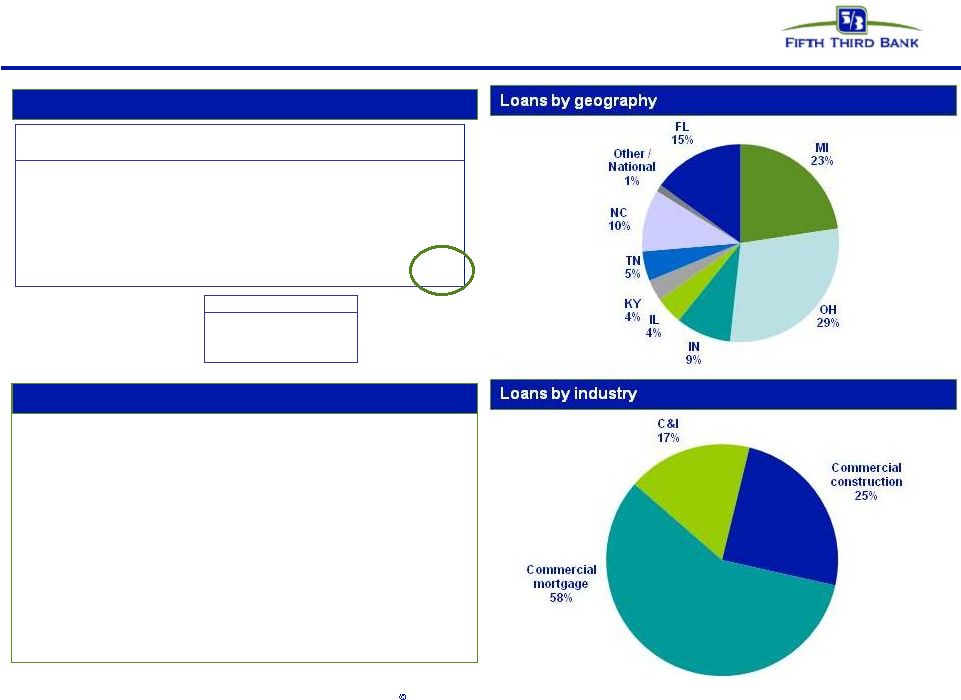

Commercial & industrial* |

24

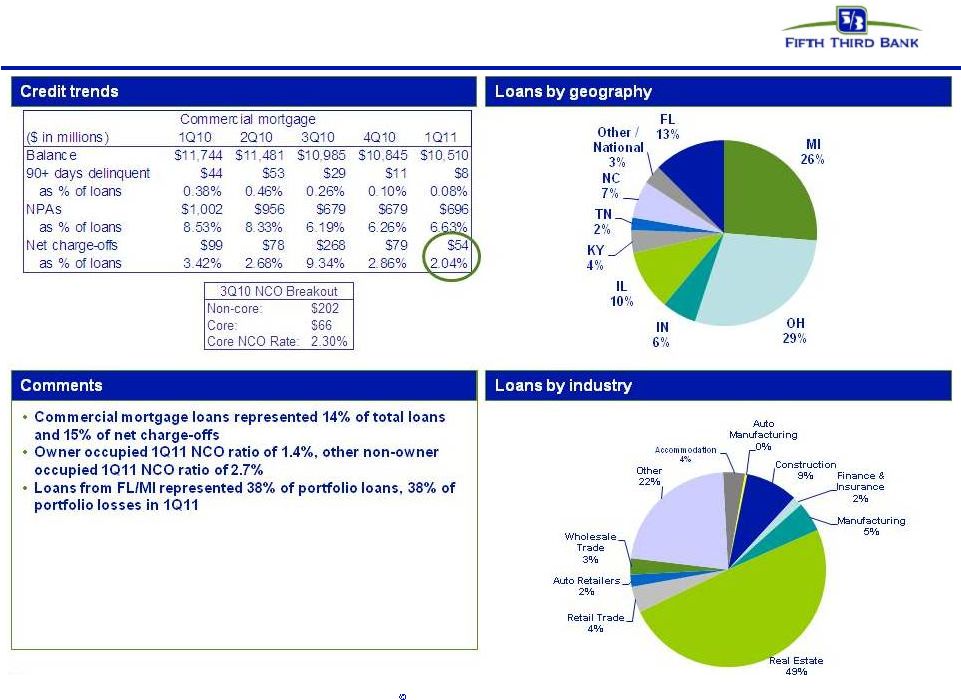

Fifth Third Bank | All Rights Reserved

Commercial mortgage*

* NPAs exclude loans held-for-sale.

3Q10 includes losses on loans transferred to held-for-sale

|

25

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Balance

$3,277

$2,965

$2,349

$2,048

$1,980

90+ days delinquent

$9

$37

$5

$3

$23

as % of loans

0.28%

1.24%

0.21%

0.13%

1.16%

NPAs

$569

$482

$291

$259

$248

as % of loans

17.36%

16.26%

12.40%

12.65%

12.53%

Net charge-offs

$78

$43

$121

$10

$26

as % of loans

8.57%

5.46%

16.58%

1.88%

5.24%

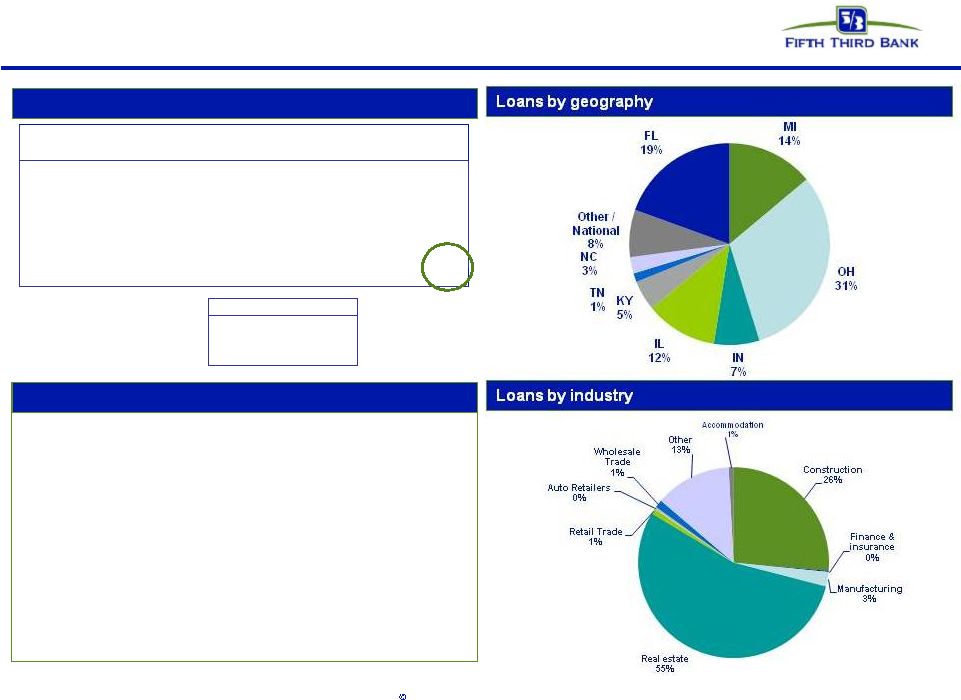

Commercial construction

Commercial construction*

Credit trends

Comments

* NPAs exclude loans held-for-sale.

3Q10 includes losses on loans transferred to held-for-sale

•

Commercial construction loans represented 3% of total loans

and 7% of net charge-offs

•

Loans from FL/MI represented 32% of portfolio loans, 17% of

portfolio losses in 1Q11

Non-core:

$77

Core:

$44

Core NCO Rate:

5.99%

3Q10 NCO Breakout |

26

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Balance

$1,324

$1,207

$824

$699

$651

90+ days delinquent

$6

$12

$3

$1

$1

as % of loans

0.43%

1.03%

0.37%

0.12%

0.16%

NPAs

$520

$431

$280

$259

$249

as % of loans

39.28%

35.68%

33.97%

37.12%

38.30%

Net charge-offs

$81

$48

$127

$19

$22

as % of loans

22.89%

15.01%

48.74%

10.08%

13.04%

Homebuilders/developers

Homebuilders/developers*

Credit trends

Comments

•

Originations of builder/developer loans suspended in 2007

•

Remaining portfolio balance of $651mm, down 80% from peak

of $3.3B in 2Q08; represents approximately 1% of total loans

and 1.5% of commercial loans

•

$22mm of NCOs (27% commercial mortgage, 67% commercial

construction, 6% C&I)

•

$249mm of NPAs (65% commercial mortgage, 30%

commercial construction, 5% C&I), down $10mm sequentially

* NPAs exclude loans held-for-sale.

3Q10 includes losses on loans transferred to held-for-sale

Non-core:

$95

Core:

$32

Core NCO Rate:

12.25%

3Q10 NCO Breakout |

27

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Balance

$7,918

$7,707

$7,975

$8,956

$9,530

90+ days delinquent

$157

$107

$111

$100

$98

as % of loans

1.98%

1.38%

1.39%

1.12%

1.03%

NPAs

$521

$549

$328

$368

$338

as % of loans

6.57%

7.12%

4.11%

4.11%

3.55%

Net charge-offs

$88

$85

$204

$62

$65

as % of loans

4.46%

4.35%

10.37%

2.93%

2.82%

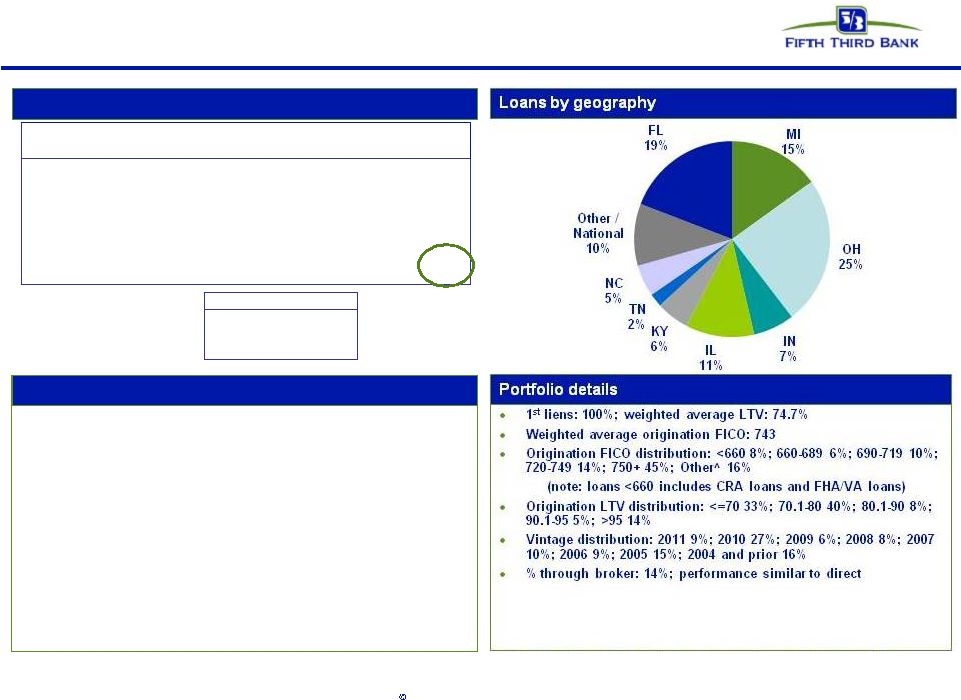

Residential mortgage

Residential mortgage

Credit trends

Comments

^ Includes acquired loans where FICO at origination is not available

3Q10 includes losses on loans sold

During 1Q09 the Bancorp modified its nonaccrual policy to exclude TDR loans less

than 90 days past due because they were performing in accordance with restructured terms. For

comparability purposes, prior periods were adjusted to reflect this

reclassification. •

Residential

mortgage

loans

represented

12%

of

total

loans

and

18% of net charge-offs

•

FL portfolio 19% of residential mortgage loans driving 57% of

portfolio losses

•

FL lots ($184mm) running at 32% annualized loss rate (YTD)

Non-core:

$123

Core:

$81

Core NCO Rate:

4.10%

3Q10 NCO Breakout |

28

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Balance

$10,280

$10,149

$10,004

$9,815

9,585

90+ days delinquent

$60

$61

$61

$59

$59

as % of loans

0.58%

0.60%

0.61%

0.60%

0.62%

Net charge-offs

$43

$37

$40

$40

$39

as % of loans

1.68%

1.45%

1.57%

1.61%

1.64%

Home equity - direct

($ in millions)

1Q10

2Q10

3Q10

4Q10

1Q11

Balance

$1,906

$1,838

$1,770

$1,698

1,637

90+ days delinquent

$29

$29

$26

$25

$25

as % of loans

1.53%

1.57%

1.46%

1.46%

1.51%

Net charge-offs

$30

$24

$26

$25

$24

as % of loans

6.45%

5.29%

5.87%

5.74%

5.88%

Home equity - brokered

Home equity

1

st

liens: 30%; 2

nd

liens: 70%

Weighted average origination FICO: 749

Origination FICO distribution^: <660 4%; 660-689 7%; 690-719 13%;

720-749 17%; 750+ 50%; Other 9%

Average CLTV: 74% Origination CLTV distribution: <=70 39%; 70.1-80 22%;

80.1-90 18%; 90.1-95 7%; >95 14%

Vintage distribution: 2011 1%; 2010 3%; 2009 4%; 2008 11%; 2007 11%; 2006

15%; 2005 14%; 2004 and prior 40%

% through broker channels: 15% WA FICO: 735 brokered, 751 direct; WA

CLTV: 88% brokered; 72% direct

Portfolio details

Comments

Credit trends

Home equity loans represented 15% of total loans and 17% of net

charge-offs

Approximately 15% of portfolio in broker product driving 38% total

loss

Approximately

one

third

of

Fifth

Third

2

nd

liens

are

behind

Fifth

Third

1

st

liens

2005/2006 vintages represent approximately 30% of portfolio; account

for 52% of losses

Aggressive home equity line management strategies in place

Note: Brokered and direct home equity net charge-off ratios are calculated

based on end of period loan balances ^ Includes acquired loans where FICO at

origination is not available |

29

Fifth Third Bank | All Rights Reserved

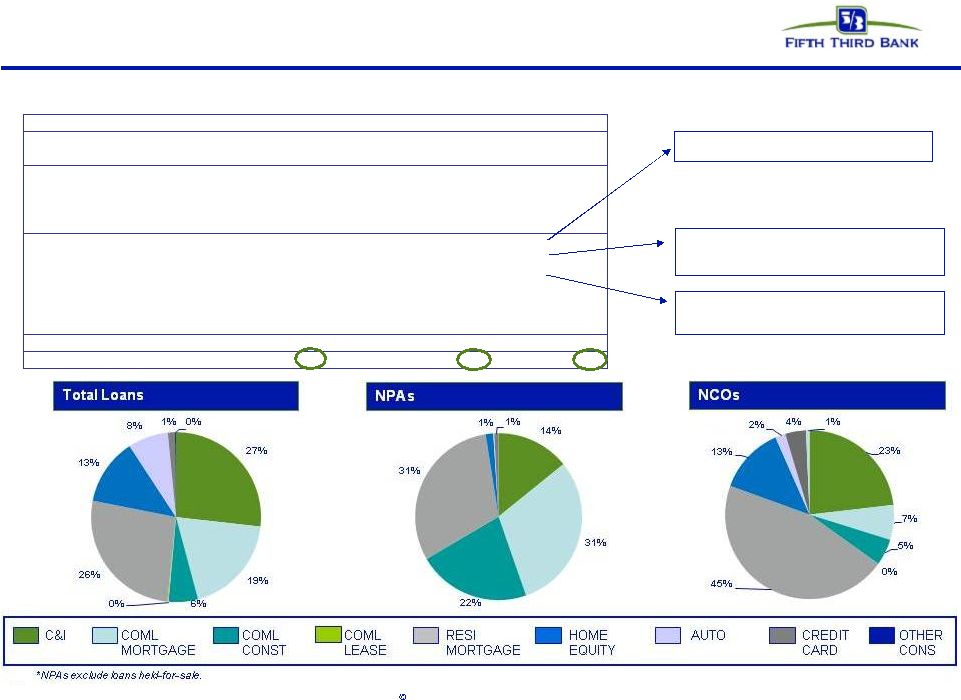

Loans ($B)

% of

FITB

NPAs ($M)

% of

FITB

NCOs

($M)

% of

FITB

Commercial loans

1.8

7%

73

12%

19

23%

Commercial mortgage

1.3

13%

157

22%

5

10%

Commercial construction

0.4

19%

112

45%

4

16%

Commercial lease

0.0

0%

0

0%

-

0%

Commercial

3.6

8%

342

21%

29

18%

Mortgage

1.8

19%

95

28%

37

58%

Home equity

0.9

8%

8

11%

11

17%

Auto

0.5

5%

1

7%

2

8%

Credit card

0.1

5%

4

8%

3

11%

Other consumer

0.0

2%

0

0%

1

2%

Consumer

3.3

10%

108

20%

53

26%

Total

6.9

9%

450

21%

82

22%

Florida

Florida market*

Deterioration in real estate values having effect on credit trends as evidenced by

increased NPA/NCOs in real estate related products Weak commercial real

estate market Losses due to significant declines in

valuations

Valuations; relatively small home

equity portfolio |

30

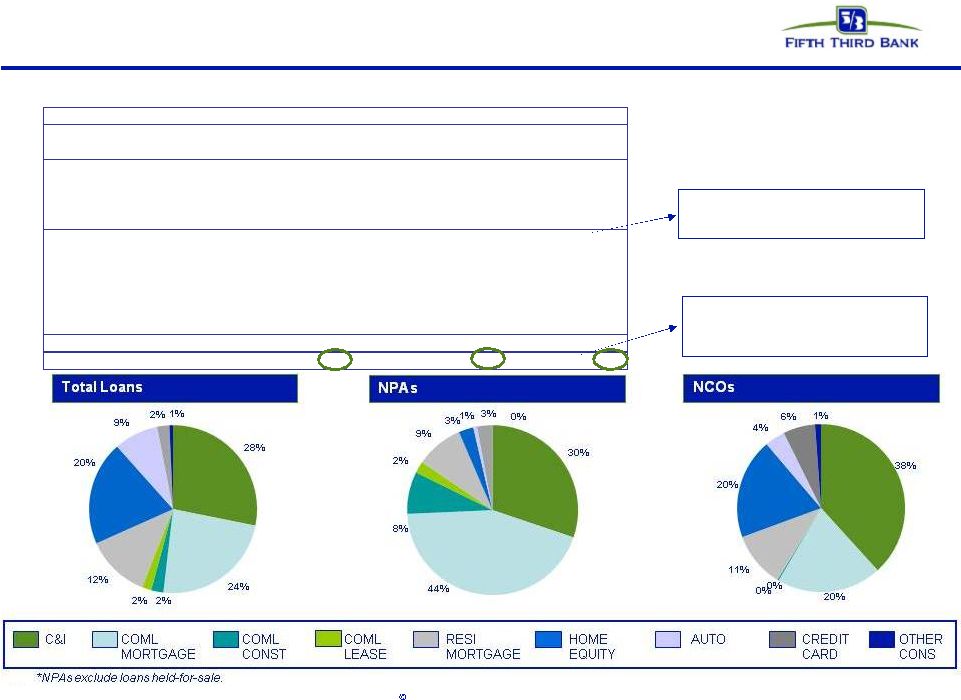

Fifth Third Bank | All Rights Reserved

Loans ($B)

% of

FITB

NPAs ($M)

% of

FITB

NCOs

($M)

% of

FITB

Commercial loans

3.3

12%

109

18%

28

34%

Commercial mortgage

2.8

26%

160

23%

15

28%

Commercial construction

0.3

14%

29

12%

0

1%

Commercial lease

0.2

6%

8

35%

0

0%

Commercial

6.5

15%

307

19%

44

27%

Mortgage

1.4

15%

33

10%

8

12%

Home equity

2.3

21%

10

14%

14

23%

Auto

1.0

9%

3

17%

3

14%

Credit card

0.3

15%

11

20%

5

15%

Other consumer

0.1

14%

0

0%

1

3%

Consumer

5.1

15%

56

10%

31

15%

Total

11.7

15%

363

17%

74

20%

Michigan

Michigan market*

Deterioration in home price values coupled with weak economy impacting credit trends

due to frequency of defaults and severity Negative impact from housing

valuations, economy,

unemployment

Economic weakness impacts

commercial real estate market |