Attached files

Exhibit 13

Providing personal, prompt, efficient service is the goal of Bank of Walterboro. We are committed to the concept of “Hometown Banking” and hope we can be of service to you. “Strong roots – strong branches.”

Contents:

| Shareholder Letter |

2 | |||

| Summary of Selected Financial Data |

3 | |||

| Financial Charts |

4-7 | |||

| Management’s Discussion and Analysis |

8-24 | |||

| Management’s Annual Report on Internal Control Over Financial Reporting |

25 | |||

| Report of Independent Registered Public Accounting Firms |

26-27 | |||

| Consolidated Balance Sheets |

28 | |||

| Consolidated Statements of Operations |

29 | |||

| Consolidated Statements of Changes in Shareholders’ Equity and Comprehensive Income |

30 | |||

| Consolidated Statements of Cash Flows |

31 | |||

| Notes to Consolidated Financial Statements |

32-52 | |||

| Directors, Officers and Staff |

53 | |||

| Corporate Data |

54 | |||

| Services |

55 |

Member FDIC

COMMUNITYCORP AND SUBSIDIARY

Dear Shareholder,

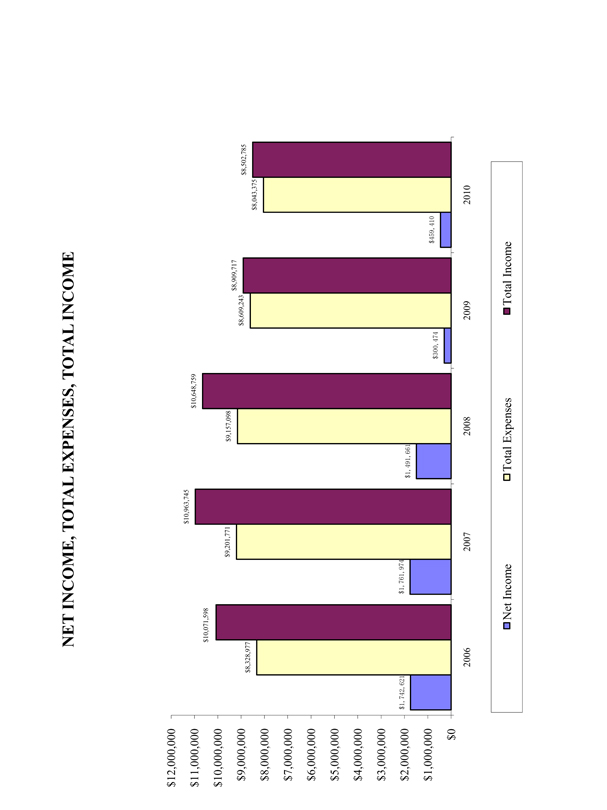

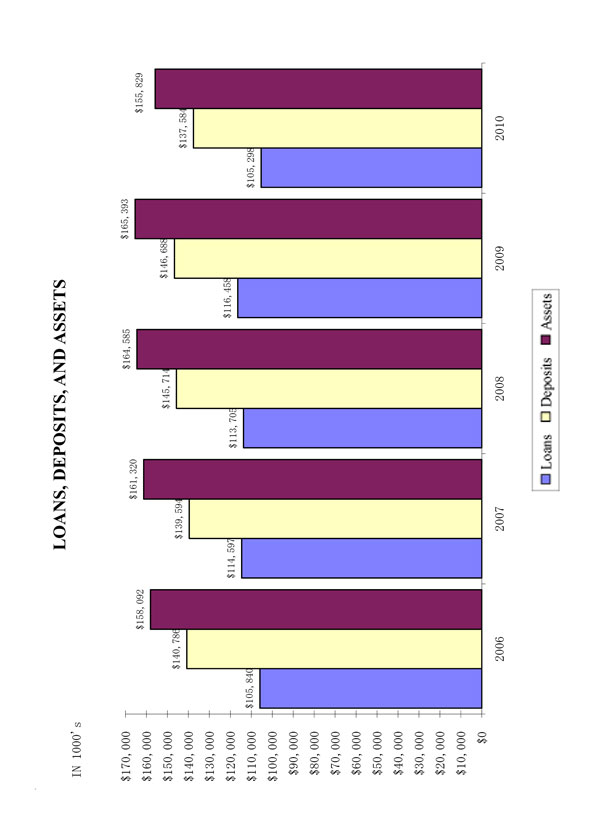

It is a pleasure to report the progress of Communitycorp and its subsidiary, the Bank of Walterboro, during 2010. As you are aware, our local and national economy has been significantly depressed over the past several years and it has been a challenging time for the banking industry. For 2010 and 2009, many South Carolina banks reported operating losses for the first time. In spite of the difficult challenges we faced during 2010, we were able to generate a net income of $459,410, or $1.97 per share for 2010, compared to a net income of $300,474, or a $1.28 per share for 2009. This represents an increase of $158,936, or 52.90%. Additionally, by decreasing our total assets and liabilities, we were able to increase our capital to asset ratio to 11.32% as of year-end 2010 from 10.73% as of year-end 2009.

Our total assets decreased from $165,393,055 to a December 31, 2010 total of $155,828,675, a decrease of $9,564,380, or 5.78%.

Net loans decreased from $114,405,140 to $103,278,187, a decrease of $11,126,953, or 9.73%. The allowance for loan losses was 1.92% and 1.76% of gross loans at December 31, 2010 and 2009, respectively.

Deposits at year-end 2010 were $137,583,821, compared to $146,687,996, for year-end 2009, representing a decrease of $9,104,175, or 6.21%, from 2009 year-end.

Our net interest margin decreased slightly from 3.67% in 2009 to 3.57% in 2010.

Please read the following financial information so you may become aware of your Company’s progress. We believe the information contained in this Annual Report shows that a local, well-managed independent bank can compete successfully in a deregulated market against national, regional, and state-wide banking institutions. Our success can be attributed to the teamwork of our shareholders, directors, officers, and employees. Most importantly, we want to thank our customers for allowing us to be of service to them.

The Board of Directors, officers, and employees thank you for your past support and solicit your ongoing support as we continue our efforts to provide prompt, efficient, and courteous service to our customers. We welcome any suggestions you may have.

We invite and encourage you to attend our Annual Meeting on Wednesday, April 27, 2011.

Very truly yours,

| /s/ W. Roger Crook |

/s/ Peden B. McLeod | |||

| W. Roger Crook |

Peden B. McLeod | |||

| President and CEO |

Chairman of the Board | |||

2

COMMUNITYCORP AND SUBSIDIARY

SELECTED FINANCIAL DATA

The following selected consolidated financial data for the five years ended December 31, 2010 are derived from our consolidated financial statements and other data. The selected consolidated financial data should be read in conjunction with our consolidated financial statements, including the accompanying notes, and Management’s Discussion and Analysis of Financial Condition and Results of Operations, included elsewhere herein.

| Year Ended December 31, |

2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| (Dollars in thousands, except per share) |

||||||||||||||||||||

| Results of Operations: |

||||||||||||||||||||

| Interest income |

$ | 7,661 | $ | 8,753 | $ | 9,958 | $ | 10,392 | $ | 9,358 | ||||||||||

| Interest expense |

2,148 | 3,290 | 4,213 | 4,767 | 3,871 | |||||||||||||||

| Net interest income |

5,513 | 5,463 | 5,745 | 5,625 | 5,487 | |||||||||||||||

| Provision for loan losses |

1,866 | 1,083 | 400 | 202 | 225 | |||||||||||||||

| Net interest income after provision for loan losses |

3,647 | 4,380 | 5,345 | 5,423 | 5,262 | |||||||||||||||

| Noninterest income |

841 | 157 | 691 | 666 | 713 | |||||||||||||||

| Noninterest expense |

3,977 | 4,067 | 3,845 | 3,533 | 3,411 | |||||||||||||||

| Income before income taxes |

512 | 469 | 2,191 | 2,556 | 2,565 | |||||||||||||||

| Income tax expense |

52 | 169 | 699 | 794 | 823 | |||||||||||||||

| Net income |

$ | 459 | $ | 300 | $ | 1,492 | $ | 1,762 | $ | 1,742 | ||||||||||

| Balance Sheet Data: |

||||||||||||||||||||

| Securities available-for-sale |

$ | 26,955 | $ | 24,620 | $ | 27,815 | $ | 34,585 | $ | 32,468 | ||||||||||

| Securities held-to-maturity |

300 | 565 | 1,320 | 1,819 | 1,574 | |||||||||||||||

| Allowance for loan losses |

2,019 | 2,053 | 1,982 | 1,929 | 1,857 | |||||||||||||||

| Net loans |

103,278 | 114,405 | 111,723 | 112,668 | 103,983 | |||||||||||||||

| Premises and equipment, net |

2,903 | 3,090 | 3,029 | 2,989 | 3,131 | |||||||||||||||

| Total assets |

155,829 | 165,393 | 164,585 | 161,320 | 158,092 | |||||||||||||||

| Noninterest-bearing deposits |

14,078 | 14,163 | 15,652 | 16,461 | 19,765 | |||||||||||||||

| Interest-bearing deposits |

123,506 | 132,525 | 130,062 | 123,133 | 121,021 | |||||||||||||||

| Total deposits |

137,584 | 146,688 | 145,714 | 139,594 | 140,786 | |||||||||||||||

| Short-term borrowings |

— | — | — | 3,068 | 250 | |||||||||||||||

| Total liabilities |

138,190 | 147,647 | 146,892 | 144,583 | 142,955 | |||||||||||||||

| Total shareholders’ equity |

17,639 | 17,746 | 17,693 | 16,736 | 15,137 | |||||||||||||||

| Per Share Data: |

||||||||||||||||||||

| Weighted-average common shares outstanding |

233,251 | 234,849 | 239,634 | 240,708 | 242,636 | |||||||||||||||

| Net income |

$ | 1.97 | $ | 1.28 | $ | 6.22 | $ | 7.32 | $ | 7.18 | ||||||||||

| Cash dividends paid |

$ | 0.50 | $ | 1.07 | $ | 1.05 | $ | 1.00 | $ | 0.90 | ||||||||||

| Period end book value |

$ | 75.70 | $ | 75.74 | $ | 74.69 | $ | 69.60 | $ | 62.62 | ||||||||||

| Equity and Assets Ratios: |

||||||||||||||||||||

| Return on average assets |

0.28 | % | 0.18 | % | 0.91 | % | 1.08 | % | 1.11 | % | ||||||||||

| Return on average equity |

2.58 | % | 1.68 | % | 8.70 | % | 11.24 | % | 12.35 | % | ||||||||||

| Equity to assets ratio |

11.32 | % | 10.73 | % | 10.75 | % | 10.37 | % | 9.58 | % | ||||||||||

| Dividend payout ratio |

25.47 | % | 84.10 | % | 16.93 | % | 13.65 | % | 12.57 | % | ||||||||||

3

4

5

6

7

COMMUNITYCORP AND SUBSIDIARY

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

GENERAL

Communitycorp is a South Carolina corporation organized on March 13, 1995 to be a bank holding company (the “Company”). The Company’s subsidiary, Bank of Walterboro, (the “Bank”) is a state-chartered commercial bank with four banking locations. The Bank’s main office and operations center is in Walterboro, South Carolina. In addition, the Bank has branches in Ravenel and Ridgeland, South Carolina. The Company’s primary market area includes Colleton, Jasper and Charleston Counties. Depository accounts are insured by the Federal Deposit Insurance Corporation up to the maximum amount permitted by law. The Bank, which received its charter on October 11, 1988, and opened for business on May 1, 1989, is dedicated to providing prompt, efficient, personal service to its customers. The Bank offers a full range of deposit services for individuals and businesses. Deposit products include checking accounts, savings accounts, certificates of deposit, money market accounts, and IRAs.

The Company primarily is engaged in the business of attracting deposits from the general public and using these deposits with other funds to make commercial, consumer, and real estate loans. The Company’s operating results depend to a substantial extent on the difference between interest and fees earned on loans, investments, and services and the Company’s interest expense, consisting principally of interest paid on deposits. Unlike most industrial companies, virtually all of the assets and liabilities of financial institutions are monetary. As a result, interest rates have a greater effect on the financial institution’s performance. In addition to competing with other traditional financial institutions, the Company also competes for savings dollars with nontraditional financial intermediaries such as mutual funds. This has resulted in a highly competitive market area, which demands the type of personal service and attention provided by the Bank.

The earnings and growth of the banking industry and the Company are and will be affected by general conditions of the economy and by the fiscal and monetary policies of the federal government and its agencies, including the Board of Governors of the Federal Reserve System (the “Board”). The Board regulates money and credit conditions and, as a result, has a strong influence on interest rates and on general economic conditions. The effect of such policies in the future on the business and earnings of the Company cannot be predicted with certainty.

As of December 31, 2010, the Company had forty-four full-time employees and two part-time employees.

This discussion and analysis is intended to assist the reader in understanding the financial condition and results of operations of the Company and its subsidiary, the Bank. This commentary should be read in conjunction with the consolidated financial statements and the related notes and the other statistical information in this report.

FORWARD-LOOKING STATEMENTS

Statements included in Management’s Discussion and Analysis which are not historical in nature are intended to be, and are hereby, identified as “forward-looking statements” for purposes of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance and underlying assumptions and other statements which are other than statements of historical fact. Such forward-looking statements may be identified, without limitation, by the use of the words “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” and similar expressions. The Company’s expectations, beliefs and projections are expressed in good faith and are believed by the Company to have a reasonable basis including, without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished. The Company cautions readers that forward-looking statements, including without limitation, those relating to future business prospects, revenues, working capital, liquidity, capital needs, interest costs, and income, are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements, due to several important factors herein identified, among others, and other risks and factors identified from time to time in the Company’s reports filed with the Securities and Exchange Commission.

8

RESULTS OF OPERATIONS

OVERVIEW

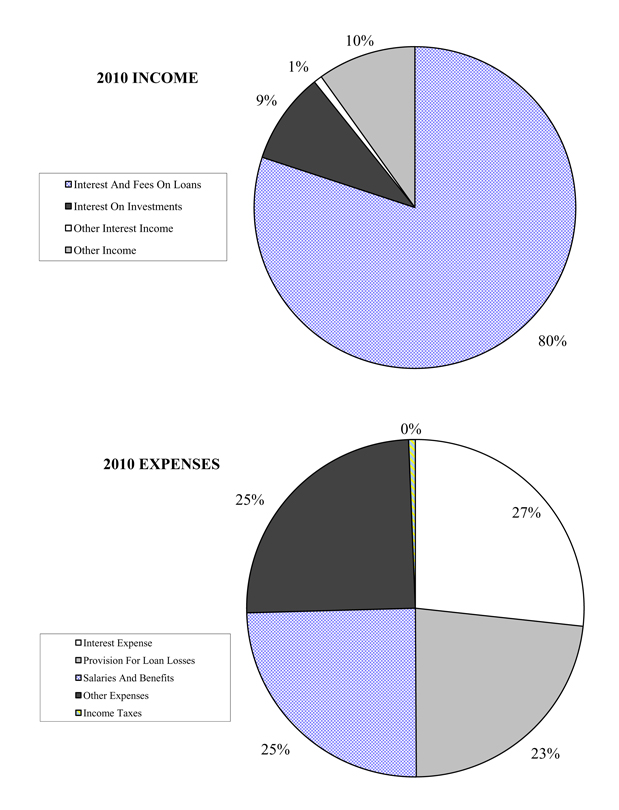

Net income for the year ended December 31, 2010 was $459,410, or $1.97 per share, compared to $300,474, or $1.28 per share, for the year ended December 31, 2009, resulting in an increase of $158,936, 52.90%.

Our 2010 operating results, compared to 2009, were favorably impacted by the increase in our noninterest income of $684,650 and the reduction of our total noninterest expenses of $207,205. However, for 2010 our earnings continued to be negatively impacted by borrowers defaulting on their loans. As a result of the significant increase in our charged-off loans during 2010, we recorded a provision for loan losses for 2010 that was $684,650 more than our 2009 provision.

NET INTEREST INCOME

General - The largest component of total income is net interest income, the difference between the income earned on assets and the interest accrued or paid on deposits and borrowings used to support such assets. The volume and mix of assets and liabilities and their sensitivity to interest rate movement determine changes in net interest income. Net interest margin is determined by dividing annualized net interest income by average earning assets. Net interest spread is derived from determining the weighted-average rate of interest paid on deposits and borrowings and subtracting it from the weighted-average yield on average assets.

Net interest income for 2010 was $5,512,853 compared to $5,462,772 for 2009, an increase of $50,081, or 0.92%.

This slight increase is attributable to the high volume of fixed rate loans that we have traditionally maintained in our loan portfolio. Fixed rate loans tend to minimize the negative effect of a falling interest rate market such as we experienced during 2010. The prevailing interest rates for 2010 were lower than for 2009.

For 2010, average earning assets totaled $154,385,250, with an annualized average yield of 4.96% compared to $148,954,149 and 5.88%, respectively, for 2009. Average interest-bearing liabilities totaled $129,279,114 with an annualized average cost of 1.66% for 2010 compared to $131,579,436 and 2.50%, respectively, for 2009.

Our net interest margin and net interest spread were 3.57% and 3.30%, respectively, for 2010 compared to 3.67% and 3.38%, respectively, for 2009.

Our annualized yield on average earning assets decreased 52 basis points for 2010 compared to 2009, while our annualized average cost of our interest-bearing liabilities decreased 76 basis points for 2010 compared to 2009. These decreases were reflective of the decreasing interest rate environment during 2010.

Details of certain components of our average assets and interest-bearing liabilities are discussed in the following paragraphs.

Because loans often provide a higher yield than other types of average assets, one of our goals is to maintain our loan portfolio as the largest component of total average assets. Loans comprised 72.41% and 77.65% of average earning assets for December 31, 2010 and 2009, respectively. Loan interest income for the years ended December 31, 2010 and 2009 was $6,806,911 and $7,668,804, respectively. The annualized average yield on loans was 6.09% and 6.63% for 2010 and 2009, respectively. Average balances of loans decreased to $111,796,785 during 2010, a decrease of $3,861,904 from the average of $115,658,689 during 2009. The decrease in the annualized yield on loans is mainly attributable to the decline in market interest rates, the significant increase in net loans charged off, and the significant increase in our nonaccruing loans. Fixed rate loans averaged approximately 98% and 97% of our loan portfolio during 2010 and 2009, respectively.

Investment securities averaged $23,329,772, or 15.11% of average earning assets, for December 31, 2010, compared to $27,322,011, or 18.34% of average earning assets, for 2009. Interest earned on investment securities amounted to $782,633 for the year ended December 31, 2010, compared to $1,012,570 for the same period last year. Investment securities yielded 3.35% and 3.71% for the period ended December 31, 2010 and 2009, respectively.

9

Practically the only interest expense we have is interest on deposit accounts. Interest expense on deposit accounts was $2,148,411 and $3,290,068, for the years ended December 31, 2010 and 2009, respectively. The average balance of interest-bearing deposits decreased to $129,279,114 for 2010 from $131,578,477 during the same period last year. The annualized average cost of deposits was 1.66% for the year ended December 31, 2010, compared to 2.50% for the same period in 2009. The decline in the annualized cost of deposits is due to our decision to lower the rates we paid for deposit accounts. Previously, we were paying competitive rates in our market area.

Average Balances, Income, Expenses, Yields, and Rates - The following table sets forth, for the periods indicated, the weighted average yields earned, the weighted average rates paid, the net interest spread, and the net interest margin on average assets. The table also indicates the average balance during the year and the interest income or expense by specific categories.

Average Balances, Income, Expenses, and Rates

| 2010 | 2009 | |||||||||||||||||||||||

| Average Balance |

Income/ Expense |

Yield/ Rate |

Average Balance |

Income/ Expense |

Yield/ Rate |

|||||||||||||||||||

| Assets: |

||||||||||||||||||||||||

| Average earning assets: |

||||||||||||||||||||||||

| Loans (2) |

$ | 111,796,785 | $ | 6,806,911 | 6.09 | % | $ | 115,658,689 | $ | 7,668,804 | 6.63 | % | ||||||||||||

| Securities, taxable (1) |

10,708,457 | 330,358 | 3.09 | 14,589,666 | 549,383 | 3.77 | ||||||||||||||||||

| Securities, tax-exempt (1) |

12,324,879 | 451,266 | 3.66 | 12,370,484 | 462,881 | 3.74 | ||||||||||||||||||

| Nonmarketable equity securities |

296,436 | 1,009 | 0.34 | 361,861 | 306 | 0.08 | ||||||||||||||||||

| Other |

19,258,693 | 71,721 | 0.37 | 5,973,449 | 71,473 | 0.13 | ||||||||||||||||||

| Total average earning assets |

154,385,250 | 7,661,265 | 4.96 | 148,954,149 | 8,752,847 | 5.88 | ||||||||||||||||||

| Cash and due from banks |

4,139,960 | 12,828,752 | ||||||||||||||||||||||

| Allowance for loan losses |

(2,089,796 | ) | (2,025,013 | ) | ||||||||||||||||||||

| Premises and equipment |

3,005,074 | 3,028,163 | ||||||||||||||||||||||

| Other real estate owned |

919,435 | 104,176 | ||||||||||||||||||||||

| Accrued interest |

686,231 | 1,137,478 | ||||||||||||||||||||||

| Other assets |

1,440,787 | 1,052,138 | ||||||||||||||||||||||

| Total average assets |

$ | 162,486,941 | $ | 164,975,667 | ||||||||||||||||||||

| Liabilities and Shareholders’ Equity: |

||||||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||||||

| Interest-bearing deposits |

$ | 129,279,114 | 2,148,411 | 1.66 | % | 131,578,477 | $ | 3,290,068 | 2.50 | % | ||||||||||||||

| Short-term borrowings |

1 | 959 | 7 | 0.73 | ||||||||||||||||||||

| Total interest-bearing liabilities |

129,279,114 | 2,148,412 | 1.66 | 131,579,436 | 3,290,075 | 2.50 | ||||||||||||||||||

| Noninterest-bearing deposits |

14,718,863 | 14,225,344 | ||||||||||||||||||||||

| Accrued interest |

592,311 | 915,074 | ||||||||||||||||||||||

| Other liabilities |

79,489 | 372,698 | ||||||||||||||||||||||

| Shareholders’ equity |

17,817,164 | 17,883,115 | ||||||||||||||||||||||

| Total liabilities and shareholders’ equity |

$ | 162,486,941 | $ | 164,975,667 | ||||||||||||||||||||

| Net interest spread |

3.30 | % | 3.38 | % | ||||||||||||||||||||

| Net interest income |

$ | 5,512,853 | $ | 5,462,772 | ||||||||||||||||||||

| Net interest margin |

3.57 | % | 3.67 | % | ||||||||||||||||||||

| (1) |

Averages for securities are stated at their carrying amount. |

| (2) |

The effect of loans in nonaccrual status and fees collected is not significant to the computations. All loans and deposits are |

domestic.

10

Analysis of Changes in Net Interest Income—Net interest income can also be analyzed in terms of the impact of changing rates and changing volume. The following table describes the extent to which changes in interest rates and changes in the volume of average assets and interest-bearing liabilities have affected the Company’s interest income and interest expense during the periods indicated. Information on changes in each category attributable to (i) changes due to volume (change in volume multiplied by prior period rate), (ii) changes due to rates (changes in rates multiplied by prior period volume) and (iii) changes in rate and volume (change in rate multiplied by the change in volume) is provided as follows:

Analysis of Changes in Net Interest Income

| 2010 Compared With 2009 | 2009 Compared With 2008 | |||||||||||||||||||||||||||||||

| Variance Due to Changes in | Variance Due to Changes in | |||||||||||||||||||||||||||||||

| (Dollars in thousands) |

Volume | Rate | Volume/ Rate |

Total | Volume | Rate | Volume/ Rate |

Total | ||||||||||||||||||||||||

| Earning assets |

||||||||||||||||||||||||||||||||

| Loans |

$ | (256 | ) | $ | (627 | ) | $ | 21 | $ | (862 | ) | $ | 226 | $ | (857 | ) | $ | (23 | ) | $ | (654 | ) | ||||||||||

| Securities, taxable |

(146 | ) | (99 | ) | 26 | (219 | ) | (425 | ) | (188 | ) | 76 | (537 | ) | ||||||||||||||||||

| Securities, tax-exempt |

(2 | ) | (10 | ) | 0 | (12 | ) | 117 | (5 | ) | (2 | ) | 110 | |||||||||||||||||||

| Nonmarketable equity securities |

0 | 1 | 0 | 1 | (8 | ) | 5 | (1 | ) | (4 | ) | |||||||||||||||||||||

| Other |

32 | (22 | ) | (10 | ) | 0 | 49 | (1 | ) | (10 | ) | 38 | ||||||||||||||||||||

| Total interest income |

(372 | ) | (757 | ) | 38 | (1,092 | ) | (125 | ) | (1,198 | ) | 117 | (1,206 | ) | ||||||||||||||||||

| Interest-Bearing Liabilities |

||||||||||||||||||||||||||||||||

| Interest-bearing deposits |

(57 | ) | (1,103 | ) | 18 | (1,142 | ) | 88 | (985 | ) | (21 | ) | (918 | ) | ||||||||||||||||||

| Short-term borrowings |

0 | 0 | 0 | 0 | (6 | ) | (4 | ) | 4 | (6 | ) | |||||||||||||||||||||

| Total interest expense |

(57 | ) | (1,103 | ) | 18 | (1,142 | ) | 82 | (989 | ) | (17 | ) | (924 | ) | ||||||||||||||||||

| Net interest income |

$ | (315 | ) | $ | 346 | $ | 19 | $ | 50 | $ | (207 | ) | $ | (209 | ) | $ | 134 | $ | (282 | ) | ||||||||||||

Interest Sensitivity - The Company monitors and manages the pricing and maturity of its assets and liabilities in order to diminish the potential adverse impact that changes in interest rates could have on its net interest income. The principal monitoring technique employed by the Company is the measurement of the Company’s interest sensitivity “gap,” which is the positive or negative dollar difference between assets and liabilities that are subject to interest rate repricing within a given period of time. Interest rate sensitivity can be managed by repricing assets or liabilities, selling securities available-for-sale, replacing an asset or liability at maturity, or adjusting the interest rate during the life of an asset or liability. Managing the amount of assets and liabilities repricing in this same time interval helps to manage the risk and minimize the impact on net interest income of rising or falling interest rates.

The following table presents the Company’s rate sensitivity at each of the time intervals indicated as of December 31, 2010. The table may not be indicative of the Company’s rate sensitivity position at other points in time.

Interest Sensitivity Analysis

| (Dollars in thousands) |

Within Three Months |

After Three Through Twelve Months |

After One Through Five Years |

Greater Than Five Years |

Total | |||||||||||||||

| Assets |

||||||||||||||||||||

| Earning assets: |

||||||||||||||||||||

| Federal funds sold |

$ | 2,004 | $ | — | $ | — | $ | — | $ | 2,004 | ||||||||||

| Interest bearing deposits |

9,967 | 9,967 | ||||||||||||||||||

| Time deposits in other banks |

750 | 250 | — | 1,000 | ||||||||||||||||

| Investment securities |

302 | 402 | 2,628 | 24,225 | 27,557 | |||||||||||||||

| Loans (1) |

9,098 | 27,293 | 54,962 | 9,140 | 100,493 | |||||||||||||||

| Total earning assets |

12,154 | 27,945 | 57,590 | 33,365 | 131,054 | |||||||||||||||

11

| (Dollars in thousands) |

Within Three Months |

After Three Through Twelve Months |

After One Through Five Years |

Greater Than Five Years |

Total | |||||||||||||||

| Liabilities |

||||||||||||||||||||

| Interest-bearing liabilities: |

||||||||||||||||||||

| Interest-bearing deposits: |

||||||||||||||||||||

| Demand |

$ | 21,295 | $ | — | $ | — | $ | — | $ | 21,295 | ||||||||||

| Savings and money market |

18,569 | — | — | — | 18,569 | |||||||||||||||

| Time |

24,537 | 48,715 | 10,390 | — | 83,642 | |||||||||||||||

| Total interest-bearing deposits and |

64,401 | 48,715 | 10,390 | — | 123,506 | |||||||||||||||

| Period gap |

$ | (52,247 | ) | $ | (20,770 | ) | $ | 47,200 | $ | 33,365 | ||||||||||

| Cumulative gap |

$ | (52,247 | ) | $ | (73,017 | ) | $ | (25,817 | ) | $ | 7,548 | |||||||||

| Ratio of cumulative gap to total earning assets |

(39.87 | )% | (55.72 | )% | (19.70 | )% | 5.76 | % | ||||||||||||

| (1) |

Excludes nonaccrual loans. |

The above table reflects the balances of average assets and interest-bearing liabilities at the earlier of their repricing or maturity dates. Interest-bearing deposits and overnight federal funds are reflected at the earliest pricing interval due to the immediately available nature of these instruments. Time deposits in other banks are reflected at their contractual maturity date. Scheduled payment amounts of fixed rate amortizing loans are reflected at each scheduled payment date. Scheduled payment amounts of variable rate amortizing loans are reflected at each scheduled payment date until the loan may be repriced contractually; the unamortized balance is reflected at that point. Interest-bearing liabilities with no contractual maturity, such as savings deposits and interest-bearing transaction accounts, are reflected in the earliest repricing period due to contractual arrangements which give us the opportunity to vary the rates paid on those deposits within a thirty-day or shorter period. Fixed rate time deposits, principally certificates of deposit, are reflected at their contractual maturity date. Short-term borrowings are reflected in the earliest repricing period since these borrowings mature daily.

We would generally benefit from increasing market rates of interest when it has an asset-sensitive gap and generally would benefit from decreasing market rates of interest when it is liability sensitive. We are currently liability-sensitive over periods with maturity dates of less than twelve months. However, our gap analysis is not a precise indicator of its interest sensitive position. The analysis presents a static view of the timing of maturities and repricing opportunities, without taking into consideration that changes in interest rates do not affect all assets and liabilities equally. Net interest income is also impacted by other significant factors, including changes in the volume and mix of average assets and interest-bearing liabilities.

PROVISION AND ALLOWANCE FOR LOAN LOSSES

We have developed policies and procedures for evaluating the overall quality of our credit portfolio and the timely identification of potential problem credits. On a quarterly basis, our Board of Directors reviews and approves the appropriate level for the allowance for loan losses based upon management’s recommendations, the results of our internal monitoring and reporting system, and an analysis of economic conditions in our market. The objective of management has been to fund the allowance for loan losses at a level greater than or equal to our internal risk measurement system for loan risk.

Additions to the allowance for loan losses, which are expensed as the provision for loan losses on our statement of operations, are made periodically to maintain the allowance at an appropriate level based on management’s analysis of the potential risk in the loan portfolio. Loan losses and recoveries are charged or credited directly to the allowance. The amount of the provision is a function of the level of loans outstanding, the level of nonperforming

12

loans, historical loan loss experience, the amount of loan losses actually charged against the reserve during a given period, and current and anticipated economic conditions.

The allowance represents an amount which management believes will be adequate to absorb inherent losses on existing loans that may become uncollectible. Our judgment as to the adequacy of the allowance for loan losses is based on a number of assumptions about future events, which we believe to be reasonable, but which may or may not prove to be accurate. Our determination of the allowance for loan losses is based on regular evaluations of the collectability of loans, including consideration of factors such as the balance of impaired loans, the quality, mix, and size of our overall loan portfolio, economic conditions that may affect the borrower’s ability to repay, the amount and quality of collateral securing the loans, our historical loan loss experience, and a review of specific problem loans. We also consider subjective issues such as changes in our lending policies and procedures, changes in the local and national economy, changes in volume or type of credits, changes in the volume or severity of problem loans, quality of loan review and board of director oversight, concentrations of credit, and peer group comparisons.

More specifically, in determining our allowance for loan losses, we regularly review loans for specific and impaired reserves based on the appropriate impairment assessment methodology. Pooled reserves are determined using historical loss trends measured over a five-year average, adjusted for environmental risk, which is then applied to risk rated loans grouped by Federal Financial Examination Council (“FFIEC”) call code and segmented by impairment status. The pooled reserves are calculated by applying the appropriate historical loss ratio to the loan categories. Impaired loans greater than a minimum threshold established by management are excluded from this analysis. The sum of all such amounts determines our pooled reserves.

We track our portfolio and analyze loans grouped by FFIEC call code categories. The first step in this process is to risk grade each and every loan in the portfolio based on one common set of parameters. These parameters include items like debt-to-worth ratio, liquidity of the borrower, net worth, experience in a particular field and other factors such as underwriting exceptions. Weight is also given to the relative strength of any guarantors on the loan.

After risk grading each loan, we then segment the portfolio by FFIEC call code groupings, separating out substandard or impaired loans. The remaining loans are grouped into “performing loan pools.” The loss history for each performing loan pool is measured over a specific period of time to create a loss factor. The relevant look back period is determined by the Bank, regulatory guidance, and current market events. The loss factor is then applied to the pool balance and the reserve per pool calculated. Loans deemed to be substandard but not impaired are segregated and a loss factor is applied to this pool as well. Finally, impaired loans are segmented based upon size; smaller impaired loans are pooled and a loss factor applied, while larger impaired loans are assessed individually using the appropriate impairment measuring methodology. Finally, certain qualitative factors are utilized to assess economic and other trends not currently reflected in the loss history. These factors include concentration of credit across the portfolio, the experience level of management and staff, effects of changes in risk selection and underwriting practice, industry conditions and the current economic and business environment. A quantitative value is assigned to each of the factors, which is then applied to the performing loan pools. Negative trends in the loan portfolio increase the quantitative values assigned to each of the qualitative factors and, therefore, increase the reserve. For example, as general economic and business conditions decline, this qualitative factor’s quantitative value will increase, which will increase reserve requirement for this factor. Similarly, positive trends in the loan portfolio, such as improvement in general economic and business conditions, will decrease the quantitative value assigned to this qualitative factor, thereby decreasing the reserve requirement for this factor. These factors are reviewed and updated by our risk management committee on a regular basis to arrive at a consensus for our qualitative adjustments.

Periodically, we adjust the amount of the allowance based on changing circumstances. We recognize loan losses to the allowance and add subsequent recoveries back to the allowance for loan losses. In addition, on a quarterly basis we informally compare our allowance for loan losses to various peer institutions; however, we recognize that allowances will vary as financial institutions are unique in the make-up of their loan portfolios and customers, which necessarily creates different risk profiles for the institutions. If our allowance was significantly different from our peer group, we would carefully review our assessment procedures again to ensure that all procedures were completed accurately and all environmental risk factors were thoroughly considered. There can be no assurance that charge-offs of loans in future periods will not exceed the allowance for loan losses as estimated at any point in time

13

or that provisions for loan losses will not be significant to a particular accounting period, especially considering the overall weakness in the economic environment in our market areas.

Various regulatory agencies review our allowance for loan losses through their periodic examinations, and they may require additions to the allowance for loan losses based on their judgment about information available to them at the time of their examinations. Our losses will undoubtedly vary from our estimates, and it is possible that charge-offs in future periods will exceed the allowance for loan losses as estimated at any point in time.

As of December 31, 2010 and 2009, the allowance for loan losses was $2,019,497 and $2,053,340, respectively, a decrease of $33,843, or 1.65%, from the 2009 allowance. However, as a percentage of total loans, the allowance for loan losses was 1.92% and 1.76% at December 31, 2010 and 2009, respectively. The decrease in the dollar amount of our allowance for loan losses was driven by the significant reduction of our loan portfolio, while we continue to charge off loan losses once they are identified.

For the years 2010 and 2009, the provision for loan losses was $1,866,000 and $1,083,000, respectively. This represents an increase of $783,000, or 72.30%, which is primarily attributable to the increase in the number of our borrowers defaulting on their loans due to the current depressed economy of our local market.

We believe the allowance for loan losses at December 31, 2010, is adequate to meet potential loan losses inherent in the loan portfolio, and, as described earlier, maintain the flexibility to adjust the allowance should our local economy and loan portfolio either improve or decline in the future.

The following table sets forth certain information with respect to the Company’s allowance for loan losses and the composition of charge-offs and recoveries for the years ended December 31, 2010 and 2009.

Allowance for Loan Losses

| Year ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| Total loans outstanding at end of year |

$ | 105,297,684 | $ | 116,458,480 | ||||

| Average loans outstanding |

$ | 111,796,785 | $ | 115,658,689 | ||||

| Balance of allowance for loan losses at beginning of |

$ | 2,053,340 | $ | 1,981,637 | ||||

| Loan losses: |

||||||||

| Real estate - construction |

24,867 | 104,327 | ||||||

| Real estate - mortgage |

57,334 | 48,043 | ||||||

| Commercial and industrial |

1,772,072 | 791,786 | ||||||

| Consumer |

57,502 | 108,907 | ||||||

| Total loan losses |

1,911,775 | 1,053,063 | ||||||

| Recoveries of previous loan losses: |

||||||||

| Real estate - construction |

— | — | ||||||

| Real estate - mortgage |

— | — | ||||||

| Commercial and industrial |

3,753 | 17,048 | ||||||

| Consumer |

8,179 | 24,718 | ||||||

| Total recoveries |

11,932 | 41,766 | ||||||

| Net charge-offs |

(1,899,843 | ) | (1,011,297 | ) | ||||

| Provision charged to operations |

1,866,000 | 1,083,000 | ||||||

| Balance of allowance for loan losses at end of year |

$ | 2,019,497 | $ | 2,053,340 | ||||

| Ratios: |

||||||||

| Net charge-offs to average loans outstanding |

1.70 | % | 0.87 | % | ||||

| Net charge-offs to loans at end of year |

1.80 | % | 0.87 | % | ||||

| Allowance for loan losses to average loans |

1.81 | % | 1.78 | % | ||||

| Allowance for loan losses to loans at end of year |

1.92 | % | 1.76 | % | ||||

| Net charge-offs to allowance for loan losses |

94.08 | % | 49.25 | % | ||||

| Net charge-offs to provisions for loan losses |

101.81 | % | 93.38 | % | ||||

14

NONPERFORMING ASSETS

Nonperforming Assets - At December 31, 2010 and 2009, loans totaling $4,805,658 and $2,710,494, respectively, were in nonaccrual status and total loans of $0 and $2,480, respectively, were ninety days or more overdue and still accruing interest.

The following table shows the nonperforming assets, percentages of net charge-offs, and the related percentage of allowance for loan losses for the years ended December 31, 2010 and 2009.

| 2010 | 2009 | |||||||

| Nonaccrual loans |

$ | 4,805,658 | $ | 2,710,494 | ||||

| Total loans impaired not in nonaccrual |

2,897,583 | 6,047,778 | ||||||

| Total impaired loans |

7,703,241 | 8,758,272 | ||||||

| Loans 90 days or more past due and still accruing interest |

— | 2,480 | ||||||

| Total impaired and nonperforming loans |

7,703,241 | 8,760,752 | ||||||

| Other real estate owned |

2,764,189 | 340,000 | ||||||

| Total impaired and nonperforming assets |

$ | 10,467,430 | $ | 9,100,752 | ||||

| Percentage of nonperforming loans to total loans |

7.32 | % | 7.52 | % | ||||

| Allowance for loan losses as a percentage of impaired and nonperforming loans |

26.22 | % | 23.44 | % | ||||

| Percentage of nonperforming assets to total assets |

6.72 | % | 5.50 | % | ||||

Generally, loans are placed on nonaccrual status if principal or interest payments become 90 days past due and/or we deem the collectibility of the principal and/or interest to be doubtful. Once a loan is placed in nonaccrual status, all previously accrued and uncollected interest is reversed against interest income. Interest income on nonaccrual loans is recognized on a cash basis when the ultimate collectability is no longer considered doubtful. Loans are returned to accrual status when the principal and interest amounts contractually due are brought current and future payments are reasonably assured. During 2010 and 2009, interest income recognized on nonaccrual loans was $30,654 and $18,687, respectively. If the nonaccrual loans had been accruing interest at their original contracted rates, related income would have been $275,415 and $167,968 for 2010 and 2009, respectively. All nonaccruing loans at December 31, 2010 and 2009 were included in our classification of impaired loans at those dates.

We consider a loan to be impaired when, based upon current information and events, we believe it is probable that we will be unable to collect all amounts due according to the contractual terms of the loan agreement. Our impaired loans include loans identified as impaired through review of the nonhomogeneous portfolio and troubled debt restructurings. Specific allowances are established on impaired loans, if deemed necessary, for the difference between the loan amount and the fair market value less estimated selling costs. Impaired loans may be left on accrual status during the period we are pursuing repayment of the loan. Impairment losses are recognized through an increase in the allowance for loan losses and a corresponding charge to the provision for loan losses. Adjustments to impairment losses due to changes in the fair market value of the collateral properties for impaired loans are also recognized through an increase in the allowance for loan losses and a corresponding charge to the provision for loan losses. When an impaired loan is sold, transferred to other real estate owned, or written-down, the loan is removed from the portfolio through a charge-off to the allowance for loan losses.

On a quarterly basis, we analyze each loan that is classified as impaired to determine the potential for possible loan losses. This analysis is focused upon determining the then current estimated value of the collateral, local market condition, and estimated costs to foreclose, repair and resell the property. The net realizable value of the property is then computed and compared to the loan balance to determine the appropriate amount of specific reserve for each loan.

The following tables summarize information on our impaired loans at and for the years ended December 31, 2010 and 2009.

15

| 2010 | 2009 | |||||||

| Impaired loans with specific allowance |

$ | 2,134,648 | $ | 2,426,363 | ||||

| Impaired loans with no specific allowance |

5,568,593 | 6,331,909 | ||||||

| Total impaired loans |

$ | 7,703,241 | $ | 8,041,962 | ||||

| Related specific allowance |

$ | 373,484 | $ | 760,103 | ||||

| Average recorded investment in impaired loans |

$ | 8,512,074 | $ | 6,475,817 | ||||

At December 31, 2010 real estate or other collateral secured practically all of the loans that were considered impaired. The depressed economy of our local market has resulted in an increase in loan delinquencies, defaults and foreclosures. In some cases, this depression has resulted in a significant impairment to the value of our collateral and ability to sell the collateral upon foreclosure at its appraised value. If collateral values further decline, it is also more likely that we would be required to increase our allowance for loan losses.

Included in the impaired loans at December 31, 2010, were 10 borrowers that accounted for 69% of the total amount of the impaired loans at that date.

The results of our internal review process and applying the allowance model methodology are the primary determining factors in management’s assessment of the adequacy of the allowance for loan losses.

NONINTEREST INCOME AND EXPENSE

Noninterest Income - Noninterest income for 2010 was $841,520 compared to $156,870 for 2009. The increase of $684,650 is mostly attributable to the $461,935 write down of certain investment securities for being other than temporarily impaired during 2009 and to the $262,011 gain realized on the sale of available-for-sale securities during 2010.

Noninterest Expense - Total noninterest expense for 2010 and 2009 was $3,976,833 and $4,067,863, respectively. This represented a decrease of $91,030, or 2.24%. Salaries and employee benefits increased $72,219, or 3.78%, from $1,910,476 for 2010 compared to $1,982,695 for 2009. Net occupancy and equipment expense was $7,044 higher for 2010 compared to 2009. These increases in expenses were offset by the $170,293 reduction in our other operating expenses for 2010 compared to 2009. This reduction is mainly due to the decrease of $103,370 in our federal deposit insurance premiums and to the decrease of $51,674 in our professional fees. During 2010, like all federally insured banks, the Federal Deposit Insurance Corporation levied a special premium assessment for our deposit insurance in 2009, while lowering the premium rates for 2010. The increase in our professional fees is due the cost of having consultants train our staff in how to use the new software and computer equipment we installed during 2010. Finally, our ATM surcharges decreased by $50,695 as a result of receiving an abatement for being over charged for ATM surcharges over the last five years.

Income Taxes - Our income tax expense for 2010 was $52,130, a decrease of $116,175 from the 2009 income tax expense of $168,305. The effective tax rates for the years ended December 31, 2010 and 2009 were 10.19% and 35.90%, respectively. The decrease in the effective rates is due mainly to the establishment of a valuation allowance for our deferred tax asset relating to the capital loss incurred during 2009 and the relationship of the 2010 tax exempt income to our pre-tax income.

EARNING ASSETS

Loans - Loans are the largest category of average assets and typically provide higher yields than other types of average assets. Associated with the higher loan yields are the inherent credit and liquidity risks which management attempts to control and counterbalance. Loans averaged $111,796,785 in 2010 compared to $115,658,689 in 2009, a decrease of $3,861,904, or 3.34%. Total loans were $105,297,684 and $116,458,480 at December 31, 2010 and 2009, respectively, a decrease of $11,160,796, 9.58%. Fixed rate loans comprised 98% and 97% of our loan portfolio at December 31, 2010 and 2009, respectively.

16

Our ratio of loans to deposits was 76.53% at December 31, 2010 as compared to 79.39% at December 31, 2010. The loan to deposit ratio is used to monitor a financial institution’s potential profitability and efficiency of asset distribution and utilization. Generally, a higher loan to deposit ratio is indicative of higher interest income since loans yield a higher return than alternative investment vehicles. We have concentrated on maintaining quality in the loan portfolio while continuing to increase the deposit base.

We extend credit primarily to consumers and small businesses in Walterboro, Ravenel and Ridgeland, South Carolina, and to customers in surrounding areas. Our service area is mixed in nature. Walterboro is a regional business center whose economy contains elements of medium and light manufacturing, higher education, regional health care, and distribution facilities. Outside the incorporated city limits of Walterboro, the economy includes manufacturing, agriculture, timber, and recreational activities. Loan growth in the Ravenel and Ridgeland area is expected to come primarily from consumer loans and small businesses in neighboring Charleston and Jasper Counties. No particular category or segment of the economies previously described is expected to grow or contract disproportionately in 2011. We believe that the loan portfolio is adequately diversified. There are no significant concentrations of loans in any particular individuals, industry, or group of related individuals or industries. We expect the area to remain stable; however due to the currently depressed markets, we do not expect any material growth in the near future.

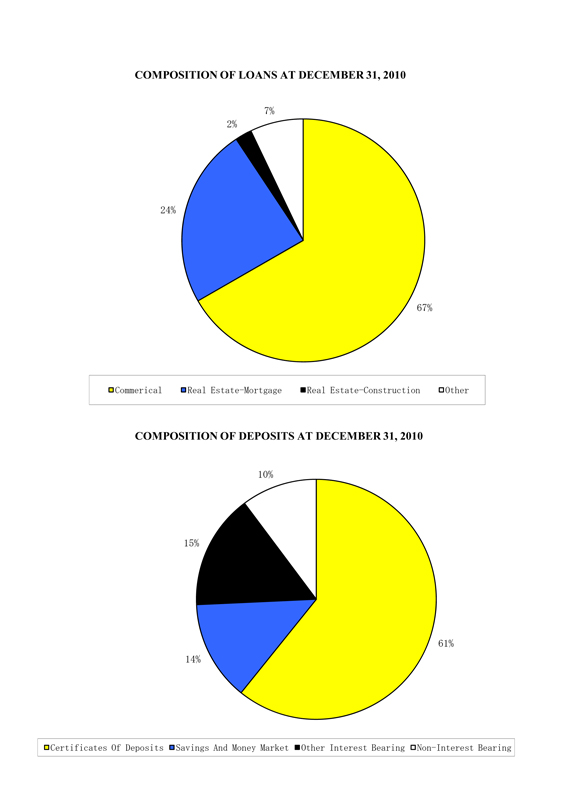

The following table sets forth the composition of the loan portfolio by category at December 31, 2010 and 2009 and highlights our general emphasis on commercial and mortgage lending.

Loan Portfolio Composition

| 2010 | 2009 | |||||||||||||||

| Amount | Percent of Total |

Amount | Percent of Total |

|||||||||||||

| Commercial and industrial |

$ | 70,230,829 | 66.70 | % | $ | 71,750,588 | 61.60 | % | ||||||||

| Real estate |

||||||||||||||||

| Construction |

2,326,588 | 2.21 | 3,256,857 | 2.80 | ||||||||||||

| Mortgage |

25,251,991 | 23.98 | 31,601,663 | 27.14 | ||||||||||||

| Consumer and other loans |

7,488,276 | 7.11 | 9,849,372 | 8.46 | ||||||||||||

| Total loans |

105,297,684 | 100.00 | % | 116,458,480 | 100.00 | % | ||||||||||

| Allowance for loan losses |

(2,019,497 | ) | (2,053,340 | ) | ||||||||||||

| Net loans |

$ | 103,278,187 | $ | 114,405,140 | ||||||||||||

Commercial and industrial loans decreased $1,519,759, or 2.12%, to $70,230,829 at December 31, 2010, from $71,750,588 at December 31, 2009. The decrease is mainly due to the economic downturn in our markets that caused the demand for these types of loans to decrease. At December 31, 2010 and 2009, commercial and industrial loans represented 66.70% and 61.60%, respectively, of the total loan portfolio.

Real estate mortgage loans totaled $25,251,991 at December 31, 2010, and represented 23.98% of the total loan portfolio, compared to $31,601,663 and 27.14%, respectively, at December 31, 2009. Real estate mortgage loans consist of first and second mortgages on single or multi-family residential dwellings and nonresidential mortgage loans, which include commercial loans and other loans secured by multi-family properties and farmland. Real estate construction loans were $2,326,588 and $3,256,857 at December 31, 2010 and 2009, respectively, and represented 2.21% and 2.80% of the total loan portfolio, respectively. Comparing 2010 with 2009, our real estate mortgage and construction loans declined by $6,349,672, or 20.09% and $930,269, or 28.56%, respectively. Currently, the demand for all types of real estate loans in our market area is very weak because of the economic downturn in our markets.

Consumer and other loans decreased $2,361,096, or 23.97%, to $7,488,276 at December 31, 2010, from $9,849,372 at December 31, 2009. At December 31, 2010 and 2009, consumer and other loans represented 7.11% and 8.46%, respectively, of the total loan portfolio. The decrease in the volume in consumer loans is due to the sharp decline in our consumers’ spending during 2010 due to the economic downturn in our markets

17

Maturities and Sensitivity of Loans to Changes in Interest Rates

The following table summarizes the loan maturity distribution, by type, at December 31, 2010 and related interest rate characteristics:

| One Year or Less |

Over One Year Through Five Years |

Over Five Years |

Total | |||||||||||||

| Real estate - construction |

$ | 1,535,555 | $ | 348,956 | $ | 442,076 | $ | 2,326,588 | ||||||||

| Real estate – mortgage |

4,766,841 | 17,394,969 | 3,090,180 | 25,251,991 | ||||||||||||

| Commercial and industrial |

29,519,311 | 35,227,934 | 5,483,584 | 70,230,829 | ||||||||||||

| Consumer and other |

2,308,875 | 4,618,184 | 561,217 | 7,488,276 | ||||||||||||

| $ | 38,130,583 | $ | 57,590,043 | $ | 9,577,058 | $ | 105,297,684 | |||||||||

| Loans maturing after one year with: |

||||||||||||||||

| Fixed interest rates |

$ | 66,207,249 | ||||||||||||||

| Floating interest rates |

959,851 | |||||||||||||||

| $ | 67,167,101 | |||||||||||||||

The information presented in the above table is based on the contractual maturities of the individual loans, including loans that may be subject to renewal at their contractual maturity. Renewal of such loans is subject to review and credit approval as well as modification of terms upon their maturity. Consequently, management believes the treatment shown in the above table presents fairly the maturity and repricing structure of the loan portfolio.

Investment Securities - The investment securities portfolio is a significant component of the Company’s total average assets. Total investment securities, stated at carrying amount, averaged $23,329,772 in 2010, compared to $27,322,011 in 2009. At December 31, 2010, the carrying value of the securities portfolio was $27,557,535. Securities designated as available-for-sale totaled $26,955,350 and were recorded at estimated fair value. Securities designated as held-to-maturity totaled $299,885 and were recorded at amortized cost. Securities designated as nonmarketable equity securities totaled $302,300 and were recorded at cost. Our investment objectives include maintaining and investing in a portfolio of high quality and highly liquid investments with competitive returns. Based on these objectives, our investments primarily consist of obligations of government-sponsored enterprises and obligations of states and local governments.

Investment Securities Portfolio Composition

The following tables summarize the carrying value of investment securities at December 31, 2010 and 2009 and the weighted average yields of those securities at December 31, 2010.

| 2010 | 2009 | |||||||

| Available-for-Sale (at estimated fair value) |

||||||||

| Government-sponsored enterprises |

$ | 13,591,442 | $ | 4,947,534 | ||||

| Obligations of states and local governments |

11,312,642 | 12,653,121 | ||||||

| Other |

200,000 | 200,000 | ||||||

| 25,104,084 | 17,800,655 | |||||||

| Mortgage-backed securities |

1,851,266 | 6,819,521 | ||||||

| Total available-for-sale securities |

$ | 26,955,350 | $ | 24,620,177 | ||||

| Held-to-Maturity (at amortized cost) |

||||||||

| Obligations of states and local governments |

$ | 299,885 | $ | 564,821 | ||||

18

| Nonmarketable Equity Securities (at cost) |

||||||||

| Federal Home Loan Bank |

$ | 296,300 | $ | 296,300 | ||||

| Investments in Community Banks |

6,000 | 6,000 | ||||||

| Total |

$ | 302,300 | $ | 302,300 | ||||

The stocks are carried at cost because they have no quoted market value and no ready market exists; however, redemption of this stock has historically been at par value. Investment in Federal Home Loan Bank stock is a condition of borrowing from the Federal Home Loan Bank, and the stock is pledged to collateralize the borrowings.

Investment Securities Maturity Distribution and Yields

Available-for-Sale

| December 31, 2010 |

Within One Year | After One But Within Five Years |

After Five But Within Ten Years |

Over Ten Years | ||||||||||||||||||||||||||||

| (Dollars in thousands) |

Amount | Yield | Amount | Yield | Amount | Yield | Amount | Yield | ||||||||||||||||||||||||

| Government-sponsored enterprises (1) |

$ | — | — | % | $ | 1,893 | 1.27 | % | $ | 6,456 | 2.16 | % | $ | 5,243 | 2.29 | % | ||||||||||||||||

| Obligations of states and local governments |

402 | 3.30 | % | 435 | 3.67 | % | 7,991 | 3.60 | % | 2,484 | 3.90 | % | ||||||||||||||||||||

| Other |

— | — | % | 200 | 6.25 | % | — | — | % | — | — | % | ||||||||||||||||||||

| Total available-for-sale securities |

$ | 402 | 3.30 | % | $ | 2,528 | 2,10 | % | $ | 14,447 | 2.97 | % | $ | 7,727 | 2.75 | % | ||||||||||||||||

| (1) |

Excludes mortgage-backed securities totaling $1,851,266 with a yield of 3.43%. |

Held-to-Maturity

| December 31, 2010 |

Within One Year | After One But Within Five Years |

After Five But Within Ten Years |

Over Ten Years | ||||||||||||||||||||||||||||

| (Dollars in thousands) |

Amount | Yield (1) | Amount | Yield (1) | Amount | Yield (1) | Amount | Yield (1) | ||||||||||||||||||||||||

| Obligations of states and local governments |

$ | — | — | % | $ | 100 | 4.45 | % | $ | 200 | 4.00 | % | $ | — | — | |||||||||||||||||

Federal Funds Sold - Federal funds sold averaged $2,521,088 in 2010, compared to $4,473,449 in 2009. At December 31, 2010 and 2009, federal funds sold were $2,004,000 and $2,030,000, respectively. These funds are a source of our liquidity and are generally invested in an earning capacity on an overnight basis.

DEPOSITS AND OTHER INTEREST-BEARING LIABILITIES

Deposits - Deposits account for practically all of our interest bearing liabilities. Total average deposits decreased from $145,803,821 in 2009 to $143,997,977 in 2010. This represents a decrease of $1,805,844, or 1.24% from the 2009 amount.

The following table summarizes our average deposits for the years ended December 31, 2010 and 2009.

| 2010 | 2009 | |||||||||||||||

| Amount | Percent of Deposits |

Amount | Percent of Deposits |

|||||||||||||

| Noninterest-bearing demand |

$ | 14,718,863 | 10.22 | % | $ | 14,225,344 | 9.75 | % | ||||||||

| Interest-bearing demand |

21,563,711 | 14.98 | 21,941,597 | 15.05 | ||||||||||||

| Savings accounts |

17,249,906 | 11.98 | 17,830,612 | 12.23 | ||||||||||||

| Time deposits |

90,465,497 | 62.82 | 91,806,268 | 62.97 | ||||||||||||

| Total deposits |

$ | 143,997,977 | 100.00 | % | $ | 145,803,821 | 100.00 | % | ||||||||

Our actual deposits at December 31, 2010 and 2009 were $137,583,821 and $146,687,996, respectively, representing a decrease of $9,104,175, or 6.21%.

19

Core deposits, which exclude certificates of deposit of $100,000 or more, provide a relatively stable funding source for our loan portfolio and other earning assets. Our core deposits were $91,441,658 and $95,566,620 at December 31, 2010 and 2009, respectively. A stable base of deposits is expected to be our primary source of funding to meet both our short-term and long-term liquidity needs in the future.

As our loan demand declined, we concurrently lowered our rates for all types of deposits, especially for time deposits. This is the primary reason why our total time deposits declined by $8,886,699, or 9.60%, from December 31, 2009 to December 31, 2010.

Deposits, and particularly core deposits, have been our primary source of funding and have enabled us to meet successfully both our short-term and long-term liquidity needs. We anticipate that such deposits will continue to be our primary source of funding in the future. Our loan-to-deposit ratio was 76.53% and 79.39% on December 31, 2010 and 2009, respectively.

Maturities of Certificates of Deposit of $100,000 or More

The maturity distribution of our time deposits of $100,000 or more at December 31, 2010, is shown in the following table.

| Within Three Months |

After Three Through Six Months |

After Six Through Twelve Months |

After Twelve Months |

Total | ||||||||||||||||

| Certificates of deposit of $100,000 or more |

$ | 13,744,335 | $ | 10,648,190 | $ | 15,546,554 | $ | 6,203,074 | $ | 46,142,153 | ||||||||||

Approximately 87.00% of our time deposits of $100,000 or more had scheduled maturities within one year. Large certificate of deposit customers tend to be extremely sensitive to interest rate levels, making these deposits less reliable sources of funding for liquidity planning purposes than core deposits. We expect most certificates of deposits with maturities less than one year to be renewed upon maturity. However, there is the possibility that some certificates may not be renewed. We believe that, should that occur, the impact would be minimal on our operations and liquidity due to the availability of other funding sources.

We had no broker deposits at December 31, 2010 or 2009.

Short-term Borrowings - We did not have any short-term borrowings at December 31, 2010. Since securities sold under agreements to repurchase, which are classified as secured borrowings and generally mature within a one to seven-day period. Either party may cancel the arrangement without penalty. Information concerning securities sold under agreements to repurchase for the year 2009 is summarized as follows:

| 2009 | ||||

| Average balance during the year |

$ | 308,449 | ||

| Average interest rate during the year |

1.81 | % | ||

| Maximum month-end balance during the year |

$ | 515,000 | ||

| End of period average interest rate |

0.25 | % | ||

CAPITAL

Total shareholders’ equity decreased by $106,816 from $17,745,653 at December 31, 2009 to $17,638,837 at December 31, 2010. The decrease is attributable to the purchase of treasury stock of $98,401, the decrease in other comprehensive income of $350,824 and the payment of dividends of $117,001. These decreases were offset by our net income of $459,410 for 2010.

20

The Bank is subject to various regulatory capital requirements administered by the federal banking agencies. Failure to meet minimum capital requirements can initiate certain mandatory and, possibly, additional discretionary actions by regulators that, if undertaken, could have a direct material effect on the Bank’s financial statements. Under capital adequacy guidelines and the regulatory framework for prompt corrective action, the Bank must meet specific capital guidelines that involve quantitative measures of the Bank’s assets, liabilities, and certain off-balance-sheet items as calculated under regulatory accounting practices. The Bank’s capital amounts and classification are also subject to qualitative judgments by the regulators about components, risk weightings, and other factors.

Quantitative measures established by regulation to ensure capital adequacy require the Bank to maintain minimum ratios of Tier 1 and total capital as a percentage of assets and off-balance-sheet exposures, adjusted for risk weights ranging from 0% to 100%. Tier 1 capital consists of common shareholders’ equity, excluding the unrealized gain or loss on securities available for sale, minus certain intangible assets. Tier 2 capital consists of the allowance for loan losses subject to certain limitations. Total capital for purposes of computing the capital ratios consists of the sum of Tier 1 and Tier 2 capital. Total regulatory minimum requirements are 4% for Tier 1 and 8% for total risk-based capital.

As of December 31, 2010, management believes that the Bank is well capitalized under the regulatory framework for prompt corrective action.

The following table summarizes the capital amounts and ratios of the Bank and the regulatory minimum requirements.

| Actual | For Capital Adequacy Purposes |

To Be Well- Capitalized Under Prompt Corrective Action Provisions |

||||||||||||||||||||||

| Amount | Ratio | Minimum | Minimum | |||||||||||||||||||||

| Amount | Ratio | Amount | Ratio | |||||||||||||||||||||

| December 31, 2010 |

||||||||||||||||||||||||

| Total capital (to risk-weighted assets) |

$ | 19,128,571 | 16.49 | % | $ | 9,283,040 | 8.00 | % | $ | 11,603,800 | 10.00 | % | ||||||||||||

| Tier 1 capital (to risk-weighted assets) |

17,678,096 | 15.23 | 4,641,520 | 4.00 | 6,962,280 | 6.00 | ||||||||||||||||||

| Tier 1 average ratio |

17,678,096 | 11.15 | 6,340,280 | 4.00 | 7,925,350 | 5.00 | ||||||||||||||||||

| December 31, 2009 |

||||||||||||||||||||||||

| Total capital (to risk-weighted assets) |

$ | 18,956,794 | 14.92 | % | $ | 10,165,600 | 8.00 | % | $ | 12,707,000 | 10.00 | % | ||||||||||||

| Tier 1 capital (to risk-weighted assets) |

17,368,419 | 13.67 | 5,082,800 | 4.00 | 7,624,200 | 6.00 | ||||||||||||||||||

| Tier 1 capital (to average assets) |

17,368,419 | 10.48 | 6,627,400 | 4.00 | 8,284,250 | 5.00 | ||||||||||||||||||

The Federal Reserve Board has similar requirements for bank holding companies. The Company is currently not subject to these requirements because the Federal Reserve guidelines contain an exemption for bank holding companies with less than $500,000,000 in consolidated assets.

LIQUIDITY MANAGEMENT

Liquidity is the ability to meet current and future obligations through liquidation or maturity of existing assets or the acquisition of additional liabilities. Adequate liquidity is necessary to meet the requirements of customers for loans and deposit withdrawals in the most timely and economical manner. Some liquidity is ensured by maintaining assets, which may be immediately converted into cash at minimal cost (amounts due from banks and federal funds sold). However, the most manageable sources of liquidity are composed of liabilities, with the primary focus of liquidity management being the ability to obtain deposits within our market area. Core deposits (total deposits, less time deposits of $100,000 and over) provide a relatively stable funding base. At December 31, 2010 and 2009 core deposits represented 66.46% and 65.15%, respectively of total deposits.

The Bank had available at the end of 2010 unused short-term lines of credit to purchase up to $10,000,000 of federal funds from unrelated correspondent institutions. The Bank also has a credit availability agreement with the Federal Home Loan Bank totaling 15 percent of the Bank’s qualifying assets as of any quarter end. As of December 31,

21

2010, the available credit totaled $24,373,000 and there were no borrowings outstanding. Any borrowings from the FHLB will be secured by a blanket lien on all of the Bank’s 1-4 family residential first lien mortgage loans and or investment securities.

Asset liquidity is provided from several sources, including amounts due from banks and federal funds sold. Available-for- sale securities, particularly those maturing within one year, provide a secondary source of liquidity. In addition, funds from maturing loans are a source of liquidity.

Our ability to meet our cash obligations or to pay any possible future cash dividends to shareholders is dependent primarily on the successful operation of the Bank and its ability to pay cash dividends to us. Any of the Bank’s cash dividends in an amount exceeding current year-to-date earnings are subject to the prior approval of the South Carolina Commissioner of Banking and are generally allowable only from its undivided profits. In addition, dividends paid by the Bank to us would be prohibited if such payment would cause the Bank’s capital to be reduced below applicable minimum regulatory requirements. At December 31, 2010, the Bank’s available undivided profits totaled $14,446,388. Under Federal Reserve Board regulations, the amounts of loans or advances from the Bank to us are also restricted.

We believe that our overall liquidity sources for us and the Bank are adequate to meet our operating needs in the ordinary course of business.

IMPACT OF OFF-BALANCE-SHEET INSTRUMENTS

We are a party to financial instruments with off-balance-sheet risk in the normal course of business to meet the financing needs of our customers. These financial instruments consist of commitments to extend credit and standby letters of credit. Commitments to extend credit are legally binding agreements to lend to a customer at predetermined interest rates as long as there is no violation of any condition established in the contract. Commitments generally have fixed expiration dates or other termination clauses and may require payment of a fee. A commitment involves, to varying degrees, elements of credit and interest rate risk in excess of the amount recognized in the balance sheet. Our exposure to credit loss in the event of nonperformance by the other party to the instrument is represented by the contractual notional amount of the instrument. Since certain commitments are expected to expire without being drawn upon, the total commitment amounts do not necessarily represent future cash requirements. Letters of credit are conditional commitments issued to guarantee a customer’s performance to a third party and have essentially the same credit risk as other lending facilities. Standby letters of credit often expire without being used. We believe that through various sources of liquidity, they have the necessary resources to meet obligations arising from these financial instruments.

We use the same credit underwriting procedures for commitments to extend credit and standby letters of credit as we do for our on-balance-sheet instruments. The credit worthiness of each borrower is evaluated and the amount of collateral, if deemed necessary, is based on the credit evaluation. Collateral held for commitments to extend credit and standby letters of credit varies but may include accounts receivable, inventory, property, plant, equipment, and income-producing commercial properties.

There are no off-balance-sheet contractual relationships, other than those disclosed in this report, that could result in liquidity needs or other commitments or that could significantly impact earnings.

Through its operations, the Bank has made contractual commitments to extend credit in the ordinary course of its business activities. These commitments are legally binding agreements to lend money to the Bank’s customers at predetermined interest rates for a specified period of time. At December 31, 2010, the Bank had issued commitments to extend credit of $5,855,857 and standby letters of credit of $850,000 through various types of commercial lending arrangements. Approximately $99,000 of these commitments to extend credit had variable rates.

22

The following table sets forth the length of time until maturity for unused commitments to extend credit and standby letters of credit at December 31, 2010.

| Within One Month |

After One Through Three Months |

After Three Through Twelve Months |

Within One Year |

Greater Than One Year |

Total | |||||||||||||||||||

| Unused commitments to extend credit |

$ | 455,146 | $ | 1,438,046 | $ | 3,858,762 | $ | 5,751,954 | $ | 103,903 | $ | 5,855,857 | ||||||||||||

| Standby letters of credit |

— | 53,000 | 697,000 | 750,000 | 100,000 | 850,000 | ||||||||||||||||||

| Totals |

$ | 455,146 | $ | 1,491,046 | $ | 4,555,762 | $ | 6,501,954 | $ | 203,903 | $ | 6,705,857 | ||||||||||||

The Bank evaluates each customer’s credit worthiness on a case-by-case basis. The amount of collateral obtained, if deemed necessary by the Bank upon extension of credit, is based on its credit evaluation of the borrower. Collateral varies but may include accounts receivable, inventory, property, plant and equipment, commercial and residential real estate.

IMPACT OF INFLATION

The consolidated financial statements and related financial data presented herein have been prepared in accordance with accounting principles generally accepted in the United States of America which require the measurement of financial position and operating results in terms of historical dollars, without considering changes in relative purchasing power over time due to inflation. Unlike most industrial companies, virtually all of the assets and liabilities of a financial institution are monetary in nature. As a result, interest rates generally have a more significant impact on a financial institution’s performance than does the effect of inflation.

While the effect of inflation on a bank is normally not as significant as its influence on those businesses that have large investments in plant and inventories, it does have an effect. Interest rates generally increase as the rate of inflation increases, but the magnitude of the change in rates may not be the same. While interest rates have traditionally moved with inflation, the effect on income is diminished because both interest earned on assets and interest paid on liabilities, vary directly with each other. Also, increases in the price of goods and services will generally result in increased operating expenses.

ACCOUNTING AND FINANCIAL REPORTING ISSUES

We have adopted various accounting policies, which govern the application of accounting principles generally accepted in the United States in the preparation of its consolidated financial statements. The significant accounting policies are described in the footnotes to the financial statements at December 31, 2010. as filed in the Annual Report on Form 10-K. Certain accounting policies involve significant judgments and assumptions by management which have a material impact on the carrying value of certain assets and liabilities. We consider these accounting policies to be critical accounting policies. The judgments and assumptions used are based on historical experience and other factors, which management believes to be reasonable under the circumstances. Because of the nature of the judgments and assumptions made, actual results could differ from these judgments and estimates which could have a material impact on the carrying values of assets and liabilities and the results of operations.

Of these significant accounting policies, we consider that our policies regarding the allowance for loan losses (the “Allowance”) to be its most critical accounting policy due to the significant degree of our judgment involved in determining the amount of the Allowance. We have developed policies and procedures for assessing the adequacy of the Allowance, recognizing that this process requires a number of assumptions and estimates with respect to its loan portfolio. Our assessments may be impacted in future periods by changes in economic conditions, the impact of regulatory examinations, and the discovery of information with respect to borrowers, which is not known to management at the time of the issuance of the consolidated financial statements. Refer to the discussion under Provision and Allowance for Loan Losses for a detailed description of our estimation process and methodology related to the allowance for loan losses.

23

EFFECT OF GOVERNMENTAL POLICIES

We are affected by the policies of regulatory authorities, including the Federal Reserve Board and the FDIC. An important function of the Federal Reserve Board is to regulate the national money supply. Among the instruments of monetary policy used by the Federal Reserve Board are: purchase and sale of U.S. Government securities in the market place; changes in the discount rate, which is the rate any depository institution must pay to borrow funds from the Federal Reserve; and changes in the reserve requirements of depository institutions. These instruments are effective in influencing the economic and monetary growth, interest rate levels and inflation.

The monetary policies of the Federal Reserve Board and other governmental policies have had a significant effect on the operating results of commercial banks in the past and are expected to continue to do so in the future. Because of changing conditions in the national and international economy and in the money markets, as well as the result of actions by monetary and fiscal authorities, it is not possible to predict with certainty future changes in interest rates, deposit levels or loan demand or whether the changing economic conditions will have a positive or negative effect on operations and earnings.

Legislation from time to time is introduced into the United States Congress and the South Carolina Legislature and other state legislatures, and regulations are proposed by the regulatory agencies that could affect our business. It cannot be predicted whether or in what form any of these proposals will be adopted or the extent to which our business may be affected thereby.

24

MANAGEMENT’S ANNUAL REPORT ON INTERNAL

CONTROL OVER FINANCIAL REPORTING

Our Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Rules 13a-15(f) and 15d-15(f) under the Securities Exchange Act of 1934. Our internal control over financial reporting is a process designed to provide reasonable assurance that assets are safeguarded against loss from unauthorized use or disposition, transactions are executed in accordance with appropriate management authorization and accounting records are reliable for the preparation of financial statements in accordance with generally accepted accounting principles.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Management assessed the effectiveness of our internal control over financial reporting as of December 31, 2010. Management based this assessment on criteria for effective internal control over financial reporting described in “Internal Control - Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission.” Management’s assessment included an evaluation of the design of our internal control over financial reporting and testing of the operational effectiveness of its internal control over financial reporting. Management reviewed the results of its assessment with the Audit Committee of the Board of Directors. Based on this assessment, management believes that Communitycorp maintained effective internal control over financial reporting as of December 31, 2010.

This annual report does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by the Company’s independent registered public accounting firm pursuant to rules of the Securities and Exchange Commission that permit the Company to provide only management’s report in this annual report.

25

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and Board of Directors

Communitycorp and subsidiary

Walterboro, South Carolina