Attached files

| file | filename |

|---|---|

| 8-K - NTS, INC. | xfone8k.htm |

XFONE, Inc.

Rating Action | May 2011

Author:

Pavel Ioffe, Team Leader

pavel@midroog.co.il

Contacts:

Avital Bar-Dayan, Senior VP

bardayan@midroog.co.il

-1-

XFONE, Inc.

|

Series Rating

|

Baa3

|

Outlook: Negative

|

Midroog announces that it is assigning a Baa3 rating/negative outlook to a new bond series1 (Series B) of up to NIS 60 million par value, which Xfone, Inc. ("Xfone", the "Company") intends to issue (the "issuance"). Midroog is also assigning a negative outlook to the Baa3 bond series rating.

NIS 40 million of the issuance proceeds will be deposited in a local bank and will be earmarked for repaying the Company's bonds (principal and interest). The balance of the issuance proceeds will be used for ongoing activity, including investments in communication infrastructure. It should be clarified that if the issuance proceeds are less than NIS 40 million, all the proceeds will be placed in the special deposit.

Bond series rated by Midroog:

|

Series

|

Stock No.

|

Issue Date

|

Coupon

|

Linkage

|

Par Value (NIS K)

|

Bond Repayment Years

|

|

A

|

1112721

|

December 2007

|

8.00%

|

CPI

|

62,739

|

2008-2015

|

Change in rating outlook from stable to negative reflects an increase in the Company's debt and current financing expenses due to the issuance of the new series (Series B).

The Company's rating reflects a weak financial profile coupled with investments in expanding operations in the fiber optic telecommunications field. The rating is supported by the payment load2 being pushed back from 2012 to 2013, which will give the Company more maneuvering room until the expansion of operations will start to yield financial results. Progress on the Levelland project (the first of four projects backed by the U.S. government which the Company was awarded) may be a good indication that the Company will be awarded other projects as part of the U.S. Government's program for fiber optic networking of outlying regions of the country. Having said that, Midroog believes there still is a significant level of uncertainty. Midroog anticipates that the discontinuation of operations in Israel and the UK will help to cut costs, although still not expressed in the Xfone's financial results.

Xfone: Key Financial Data (USD in thousand):

|

Consolidated Balance Sheet

|

December 31, 2010

|

December 31, 2009

|

||||||

|

Total Current Assets

|

8,200 | 12,677 | ||||||

|

Fixed assets, net

|

58,545 | 51,547 | ||||||

|

Assets from discontinued activity (UK and Israel)

|

- | 8,730 | ||||||

|

Total Assets

|

73,644 | 78,475 | ||||||

|

Current liabilities (without credit and maturities)

|

11,576 | 11,043 | ||||||

|

Debt(1)

|

36,642 | 34,042 | ||||||

|

Equity

|

22,506 | 21,683 | ||||||

|

Statement of Income

|

2010 | 2009 | ||||||

|

Revenues(2)

|

58,944 | 61,410 | ||||||

|

EBIT(3)

|

2,128 | -19,373 | ||||||

|

Net profit (loss)(4)

|

-4,473 | -22,159 | ||||||

|

Cash flow

|

2010 | 2009 | ||||||

|

FFO

|

2,769 | 4,024 | ||||||

|

EBITDA

|

7,200 | 6,400 | ||||||

|

FFO-CAPEX

|

-103 | 692 | ||||||

|

EBITDA-CAPEX

|

4,327 | 3,068 | ||||||

-2-

|

(1)

|

Includes US Government loans of about $9.5 million, which are non-recourse to the Company.

|

|

(2)

|

Does not include revenues from the operations of subsidiaries in Israel and the UK, sold in 2010, of about $14 million and $24 million in 2010 and 2009, respectively.

|

|

(3)

|

In 2009 the Company posted a $21 million goodwill write-down for the acquisition of assets pertaining to activity on traditional copper cable networks.

|

|

(4)

|

In 2010 the Company posted a loss of about $2 million from discontinued operations.

|

Key Business Developments

In 2010 the Company sold its operations in Israel and the UK.

Today, the Company is focusing its operations in the U.S. on two core fields of business:

(1) Through its subsidiaries (NTS Communications, Xfone USA), the Company provides telecommunication services (telephony, Internet and television) in several states in the U.S. Up to 2010, inclusive, these operations were the source of most of the Company's business results.

(2) Projects for laying down telecommunication infrastructure in rural U.S. with the backing of the U.S. Government and the provision of telecommunication services through them. Laying down the infrastructure in the first project (Levelland) has been completed, and the Company continues to expand its customer base for broadband telecommunication services.

Xfone Inc. has also been awarded three more projects which are currently in various stages of planning and execution. The Company has invested a total of about $110 million in these projects, including Levelland, about 40% of which it received in grants and low interest government loans (long-term repayment schedule). The loans are for closed projects, where the Company does not have a right of recourse, and were put up against a lien on the projects' assets. Unlike the Levelland project, this activity has a neutral impact on the rating, since in Midroog's assessment it does not stand to contribute significant cash flows to the Company within the rating horizon.

Rating Outlook

Factors likely to upgrade the rating:

|

·

|

Significant improvement in cash flow which will be reflected, among other things, in a surplus cash flow after debt payment.

|

Factors liable to downgrade the rating:

|

·

|

No improvement in free cash flow in the next two-three quarters while meeting the Company's forecasts.

|

|

·

|

Failure to maintain ample liquidity for debt service payments.

|

|

·

|

Deterioration in the Company's business environment that could threaten the volume of activity and long-term profitability.

|

-3-

About the Company

Xfone is a U.S. provider of telecommunication services, including local, long distance and international telephony services, Internet services and broadband video services in the U.S. through its main subsidiaries, Xfone USA and NTS Communications. NTS was acquired by the Company in February 2008, and this acquisition boosted the Company's volume of operations substantially. After selling off its operations in Israel and the UK, the Company chose to focus on its US operations, which made up the bulk of its activity in the past as well. The Company's U.S. operations focus on the provision of telecommunication services to the business sector - small and medium-sized companies, primarily in certain regions of Texas, Mississippi and Louisiana. The Company's headquarters are based in Lubbock, Texas. The Company's shares of common stock are traded on the NYSE Amex exchange in the U.S. as well as on the Tel-Aviv Stock Exchange (in a "dual listing"). The bond is traded on the Tel-Aviv Stock Exchange only.

Major shareholders are Gagnon Securities LLC (Neil Gagnon), Richard L. Scott, LLC, Burlingame (Blair E. Sanford) and Windcrest Microcap (James H. Gellert), Mr. Abraham Keinan and Mr. Guy Nissenson.

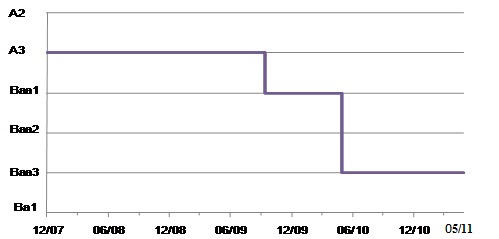

Rating History

Key Financial Terms

|

Interest

|

Net financing expenses from Income Statement

|

|

Cash interest

|

Financing expenses from income statement after adjustments for non-cash flow expenditures from statement of cash flows.

|

|

Operating Profit – EBIT

|

Pre-tax profit + financing + non-recurring expenses/profits.

|

|

Operating profit before amortizations – EBITA

|

EBIT + amortization of intangible assets.

|

|

Operating profit before depreciation and amortizations - EBITDA

|

EBIT + depreciation + amortization of intangible assets.

|

|

Operating profit before depreciation, amortization and rent/leasing - EBITDAR

|

EBIT + depreciation + amortization of intangible assets + rent + operational leasing.

|

|

Assets

|

Company's total balance sheet assets.

|

|

Debt

|

Short term debt + current maturities of long-term loans + long-term debt + liabilities on operational leasing.

|

|

Net debt

|

Debt - cash and cash equivalent – long-term investments

|

|

Capital base - Capitalization (CAP)

|

Debt + total shareholders' equity (including minority interest) + long-term deferred taxes in balance sheet.

|

|

Capital Expenditures (Capex)

|

Gross investments in equipment, machinery and intangible assets

|

|

Funds from Operations (FFO)*

|

Cash flow from operations before changes in working capital and before changes in other asset and liabilities items

|

|

Cash Flow from Operations (CFO)*

|

Cash flow from operating activity according to consolidated cash flow statements

|

|

Retained Cash Flow (RCF)*

|

Funds from operations (FFO) less dividend paid to shareholders.

|

|

Free Cash Flow (FCF)*

|

Cash flow from operating activity (CFO) - CAPEX – dividends.

|

* It should be noted that in IFRS reports, interest payments and receipts, tax and dividends from investees will be included in the calculation of the operating cash flows, even if they are not entered in cash flow from operating activity.

-4-

Rating Scale

|

Investment grade

|

Aaa

|

Obligations rated Aaa are those which, according to Midroog's judgment, are of the highest quality and involve minimal credit risk.

|

|

Aa

|

Obligations rated Aa are those which, according to Midroog’s judgment, are of high quality, and involve very low credit risk.

|

|

|

A

|

Obligations rated A are considered by Midroog in the upper-end of the middle rating, and involve low credit risk.

|

|

|

Baa

|

Obligations rated Baa are those which, according to Midroog's judgment, involve moderate credit risk. They are considered middle-level rated liabilities and as those that could have speculative characteristics.

|

|

|

Speculative

|

Ba

|

Obligations rated Ba include which according to Midroog's judgment have speculative elements and involve significant credit risk.

|

|

investment

|

B

|

Obligations rated B are those which, Midroog's judgment, are speculative and involve a high degree of credit risk.

|

|

Caa

|

Obligations rated Caa are those which, according to Midroog's judgment, have weak standing and involve very high credit risk.

|

|

|

Ca

|

Obligations rated Ca are very speculative investments and could be in a situation of insolvency or close to insolvency, with some prospect that principal and interest will be repaid.

|

|

|

C

|

Obligations rated C are rated in the lowest rating and are generally in a situation of insolvency with remote prospects of repayment of principal and interest.

|

Midroog uses the variables 1, 2 and 3 in each of the rating categories, from Aa to Caa. The variable “1” means that the bond is at the upper end of the rating category to which it has been assigned, cited in letters. The variable “2” means that it is in the middle of the rating category; whereas the variable “3” means that the bond is at the lower end of its rating category, as cited in letters.

Report No: CCX030511060M

Midroog Ltd.., Millennium 17 Ha’Arba'a Street, Tel-Aviv 64739

Tel: 03-6844700, Fax: 03-6855002, www.midroog.co.il

© Copyright 2011, Midroog Ltd. (“Midroog”). All rights reserved.

This document, including this paragraph, is the sole property of Midroog and is protected by copyright and intellectual property laws. No information contained herein may be copied, photocopied, modified, transferred, disseminated, duplicated or used for any commercial purpose without Midroog's prior written consent.

All information contained herein on which Midroog relied was submitted to it by sources it believes to be reliable and accurate. Midroog does not independently check the correctness, completeness, compliance, accuracy or reliability of the information (hereinafter: the "Information") submitted to it, and it relies on the Information submitted to it by the rated Company for assigning the rating.

The rating is subject to change as a result of changes in the Information obtained or for any other reason, and therefore it is recommended to monitor its revision or modification on Midroog's website www.midroog.co.il. The ratings assigned by Midroog must be construed as a subjective opinion, and not a recommendation to buy or not buy bonds or other rated instruments. Midroog's ratings should not be construed as a confirmation of data or a statement of opinion or as attempts to independently assess the financial situation of any Company or to attest to it, nor should it be construed as an opinion on the attractiveness of their price or the return of bonds or other rated instruments. Midroog's ratings relate directly only to credit risks and not to any other risk, such as the risk that the market value of the rated debt will drop due to changes in interest rates or due to other factors impacting the capital market. Each rating or other opinion must be weighed solely as one factor in any investment decision made by or on behalf of any user of the Information contained in this document. Accordingly, anyone using the Information contained in this document must conduct his own study and evaluation of each issuer, guarantor, bond or other rated instrument that he may consider holding, buying or selling. Midroog's rating is not tailored to the needs of a certain investor, and each investor must seek professional consulting regarding investments, the law or any other professional matter. Midroog hereby declares that the issuers of bonds or of other rated instruments or in connection with the issue thereof the rating is being assigned, have, prior to assignment of any rating, agreed to pay Midroog for appraisal and rating services rendered by Midroog.

Midroog is a subsidiary of Moody's Investors Service Inc. (Moody's Investors Service Ltd. (hereinafter: "Moody's") which owns 51% of Midroog. Notwithstanding, Midroog's rating proceedings are independent and separate from Moody's, and are not subject to Moody's approval. While Midroog's methodologies are based on those of Moody's, Midroog has its own policies and procedures and independent rating committees.

For further information on the rating procedures of Midroog or of its rating committee, please refer to the relevant pages on Midroog's website

-5-