Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - OMNOVA SOLUTIONS INC | d8k.htm |

May

19, 2011 Exhibit 99 |

-

2 -

Cautionary

Cautionary

•

This

presentation

and

the

accompanying

oral

remarks

include

“forward-looking

statements,”

as

defined

by

federal

securities

laws.

These

statements,

as

well

as

any

verbal statements by the Company in connection with this presentation, are intended

to qualify for the protections afforded forward-looking statements under the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements reflect management’s current expectation, judgment, belief, assumption, estimate or

forecast about future events, circumstances or results and may address business

conditions and prospects, strategy, capital structure, sales, profits, earnings,

markets, products, technology, operations, customers, raw materials, financial

condition, and accounting policies among other matters. Words such as, but not

limited to, “will,”

“may,”

“should,”

“projects,”

“forecasts,”

“seeks,”

“believes,”

“expects,”

“anticipates,”

“estimates,”

“intends,”

“plans,”

“targets,”

“optimistic,”

“likely,”

“would,”

“could”

and similar expressions or phrases identify forward-looking statements.

•

All forward-looking statements involve risks and uncertainties. Many

risks and uncertainties are inherent in business generally and the markets in which the

Company operates or proposes to operate. Other risks and uncertainties are

more specific to the Company’s businesses, including businesses that the Company

acquires. The occurrence of such risks and uncertainties and the impact of

such occurrence is often not predictable or within the Company’s control. Such impacts

could adversely affect the Company’s results and, in some cases, such effect

could be material. •

All written and verbal forward-looking statements attributable to the Company

or any person acting on the Company’s behalf are expressly qualified in their entirety

by the risks, uncertainties and cautionary statements contained herein. Any

forward looking statement speaks only as of the date on which such statement is made,

and the Company undertakes no obligation, and specifically declines any obligation,

other than that imposed by law, to publicly update or revise any forward-looking

statements whether as a result of new information, future events

or otherwise.

•

Risks and uncertainties that may cause actual results to differ materially from

expected results include, among others: the Company’s ability to successfully integrate

ELIOKEM into its operations; the Company’s ability to achieve fully the

strategic and financial objectives related to the acquisition of ELIOKEM, including the

acquisition becoming accretive to the Company’s earnings; and unexpected costs

or liabilities that may arise from the acquisition, ownership or operation of

ELIOKEM.

•

Additional risk factors include: economic trends affecting the economy in

general and/or the Company’s end-use markets; prices and availability of raw materials

including styrene, butadiene, vinyl acetate monomer, polyvinyl chloride,

acrylonitrile, acrylics and textiles; ability to increase pricing to offset raw material cost

increases;

product

substitution

and/or

demand

destruction

due

to

product

technology,

performance

or

cost

disadvantages;

loss

of

a

significant

customer;

customer

and/or

competitor

consolidation;

customer

bankruptcy;

ability

to

successfully

develop

and

commercialize

new

products;

a

decrease

in

demand

for

domestically

manufactured products due to increased foreign competition and off-shoring of

production; ability to successfully implement productivity enhancement and cost

reduction initiatives; unplanned full or partial suspension of plant operations;

losses from the Company’s strategic alliance, joint venture, acquisition and integration

activities; loss or damage due to acts of war or terrorism, natural disasters or

accidents, including fires, floods, explosions and releases of hazardous substances;

ability to comply, and cost of compliance with, legislative and regulatory changes,

including changes impacting environmental, health and safety compliance and

changes which may restrict or prohibit certain products and raw materials; rapid

inflation in health care costs and assumptions used in determining health care cost

estimates; risks associated with foreign operations including political unrest and

fluctuations in exchange rates of foreign currencies; prolonged work stoppage

resulting from labor disputes with unionized workforce; changes in and compliance

with pension plan funding obligations; stock price volatility; infringement or loss of

the Company’s intellectual property; litigation and claims against the Company

related to products, services, contracts, employment, environmental, safety,

intellectual property and other matters; adverse litigation judgments or

settlements; absence of or inadequacy of insurance coverage for litigation judgments,

settlements or other losses; availability of financing at anticipated rates and

terms; and loan covenant default arising from substantial debt and leverage and the

inability to service that debt, including increases in applicable short-term or

long-term borrowing rates. •

For further information on risks and uncertainties, see the Company’s Form

10-K and Form 10-Q filings with the Securities and Exchange Commission.

Forward-Looking Statements

Non-GAAP Financial Measures

This presentation includes EBITDA, Adjusted EBITDA and Net Debt which are

non-GAAP financial measures as defined by the Securities and Exchange

Commission. For a reconciliation to the most directly comparable

GAAP financial measures, refer to the presentation Appendix.

|

-

3 -

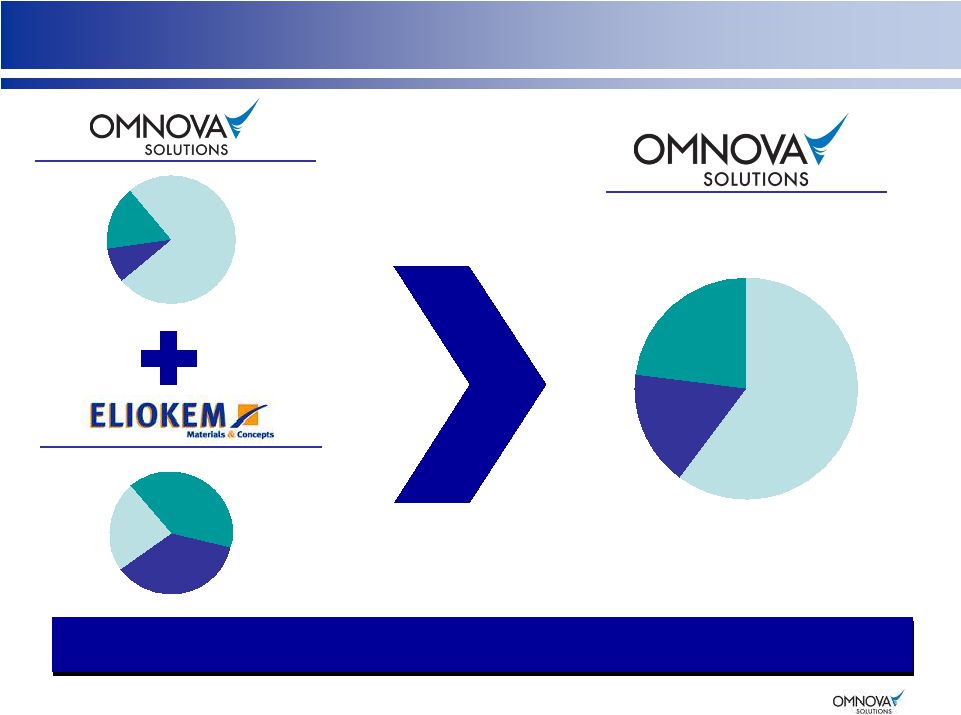

Creating Value Through A Global Enterprise

Creating Value Through A Global Enterprise

OMNOVA Solutions Today Is A Larger, More Diverse Global

Specialty Chemicals And Functional Surfaces Company With

Significant Potential To Create Shareholder Value

OMNOVA Solutions Today Is A Larger, More Diverse Global

Specialty Chemicals And Functional Surfaces Company With

Significant Potential To Create Shareholder Value

Technology

Innovation

Global

Capability

Frequently

Frequently

#1 or #2 in

#1 or #2 in

Consolidating

Consolidating

Niche Markets

Niche Markets

Leading Market

Positions |

-

4 -

OMNOVA Overview |

-

5 -

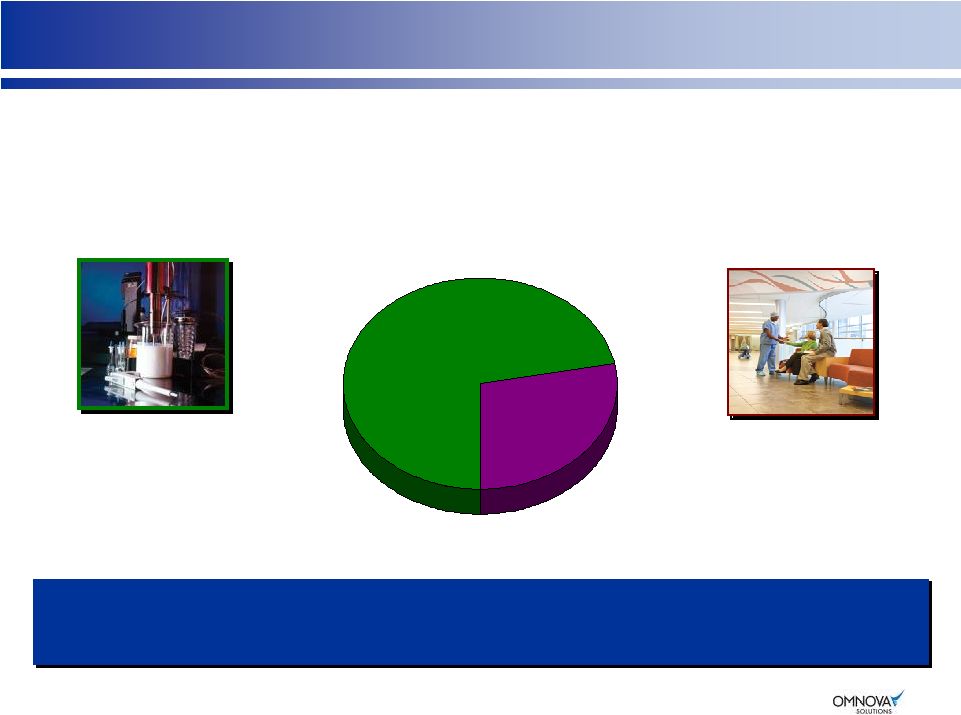

Business Segments At A Glance

Business Segments At A Glance

A Specialty Chemicals And Functional Surfaces

Company With Leadership Positions In Key Categories

A Specialty Chemicals And Functional Surfaces

Company With Leadership Positions In Key Categories

*

LTM:

Last

Twelve

Months

Through

February

28,

2011

including

ELIOKEM

on

a

Pro

Forma

Basis

for

2010;

Adjusted

EBITDA

–

see

Appendix 1

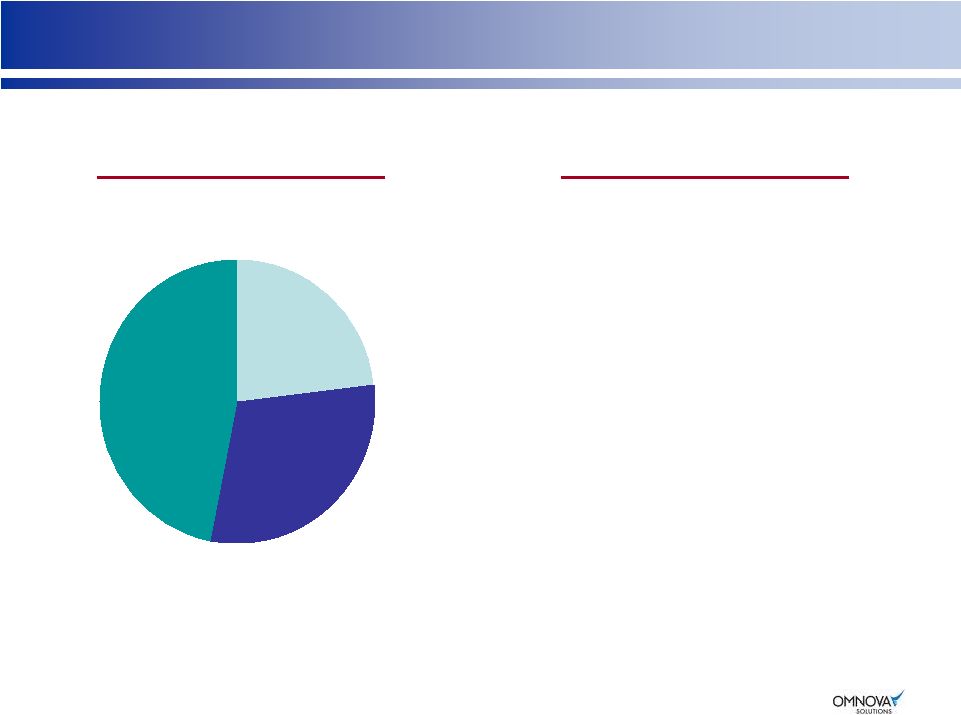

LTM Sales* = $1.2B

LTM Adj. EBITDA* = $121M

Adj. EBITDA Margin = 10.3%

Performance Chemicals

Decorative Products

Value-added emulsion

polymers used for

coatings, adhesives

and binders

Functional &

decorative surfaces

72%

28% |

-

6 -

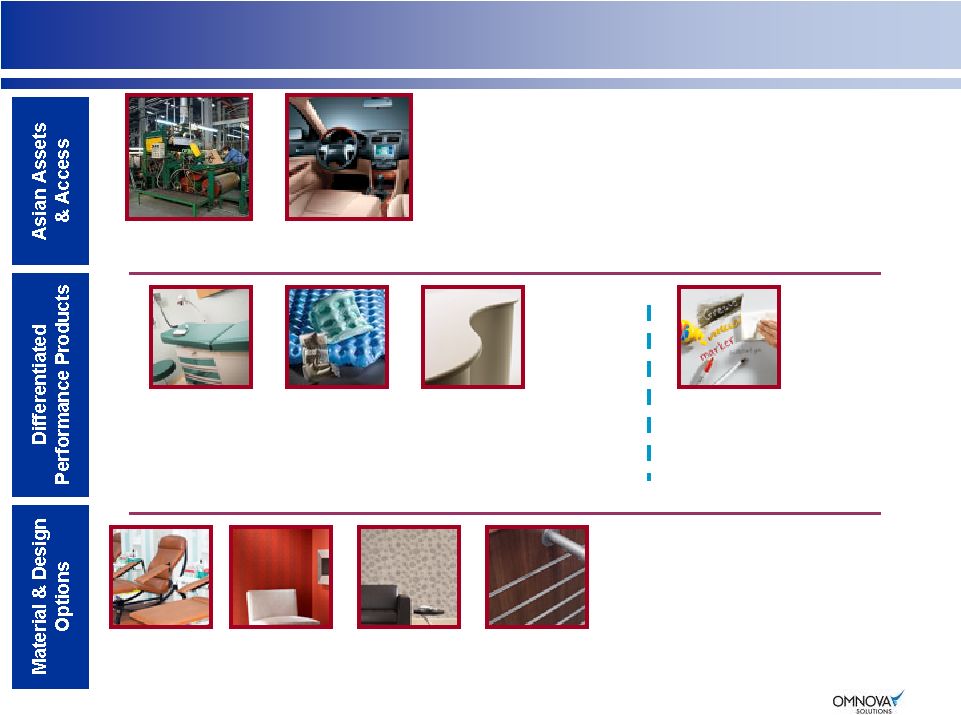

3-Part Strategy To Grow

3-Part Strategy To Grow

•

Technology-Driven Market Share Gains In Core Markets

•

Enter New, Related Markets / Applications

•

Globalization

•

A Culture of Safety

•

LEAN SixSigma

•

SAP Business System

•

Enhanced Global Purchasing/Logistics

•

Reducing OMNOVA’s Environmental Footprint

•

Providing Value-Added Environmentally Preferred

Products

Profitable

Growth

Operational

Excellence

Sustainability

Offer Customers A Distinctive Technology And Service Driven Value Proposition

To Drive Margin Expansion & Profitable Growth

Offer Customers A Distinctive Technology And Service Driven Value Proposition

To Drive Margin Expansion & Profitable Growth |

-

7 -

Fundamental, Structural Change In The OMNOVA Business Model

Fundamental, Structural Change In The OMNOVA Business Model

•

Introduced numerous industry-leading new products, driving share gain and

adjacent market penetration

–

Industry leading market position (#1 or #2) in many served markets

•

Rapid industry consolidation

–

6 Competitor chemical plants closed in 2008…major competitor sold

–

Exit of 7 decorative product competitors over last 5 years…more likely

–

2 Major competitors consolidated in Europe SB market with several plants closed in

last 3 years •

Implemented index pricing in Performance Chemicals

–

Significant margin improvement

–

Reduced earnings volatility

–

Successful in recent recessionary environment

•

Consolidated Strategic Decorative Products businesses in Asia

–

Purchased JV interest in 2008

–

Upgraded management

–

Unique capability to serve growing local markets and North American customers as

they migrate to Asia •

Productivity

/

cost

reductions

–

lowest

cost

structure

since

1999

spin-off

and

NOL’s

provide significant leverage for cash generation

•

Acquired ELIOKEM specialty chemicals company in December 2010

–

A game changer to accelerate globalization of our chemicals business, diversify

served markets and broaden technology offering

Business Model Changes, Productivity And New Products Driving

Sustainable Performance Improvement

Business Model Changes, Productivity And New Products Driving

Sustainable Performance Improvement |

-

8 -

ELIOKEM Acquisition Strategic Rationale

ELIOKEM Acquisition Strategic Rationale

1.

Globalization: Manufacturing and sales in China, India and France

•

Enhanced growth opportunities for OMNOVA specialty chemical products in

Europe and in higher growth markets in Asia

•

Grow existing legacy OMNOVA $45M chemical export/toll business in Asia/Europe

•

40% of new Performance Chemicals business outside of North America

2.

Growth: Entry into higher growth products / markets; core market expansion

•

Specialty Coatings (intumescent paint, masonry coatings, stain blocking coatings);

Oil Field Chemicals; Elastomeric Modification

•

Key processes and factors for success similar to OMNOVA’s base business

3.

Diversification: Diversification of OMNOVA product offering

•

75% of ELIOKEM sales in new, complementary markets for OMNOVA

4.

Cost Synergy: Significant sourcing and supply chain, manufacturing and

SG&A cost savings opportunities by leveraging an integrated global team

Compelling Strategic Rationale; Exciting Opportunities

Compelling Strategic Rationale; Exciting Opportunities

|

-

9 -

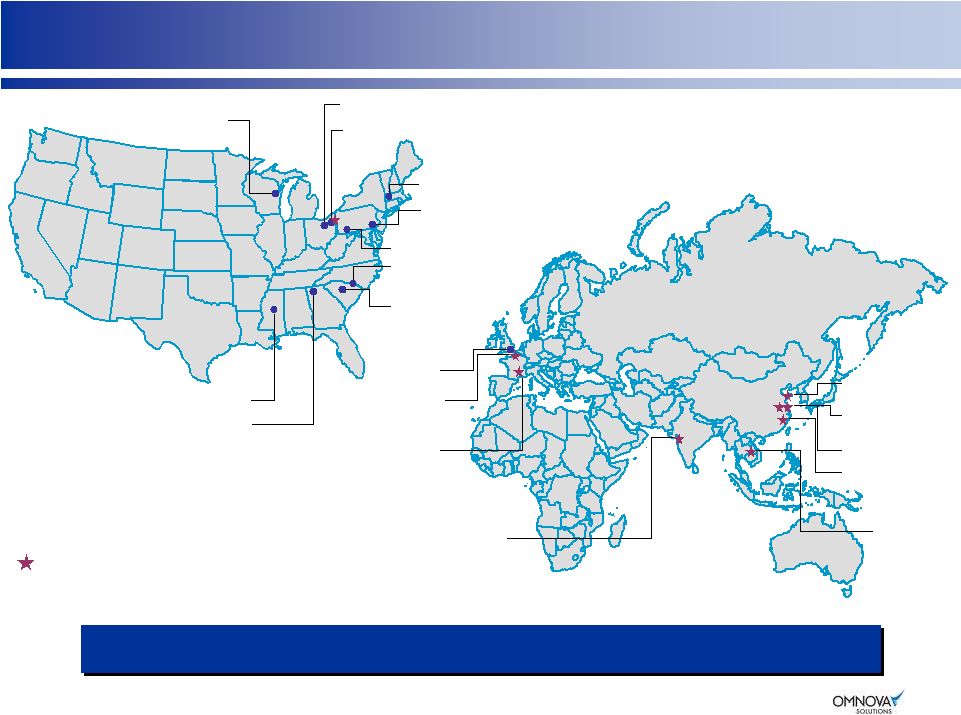

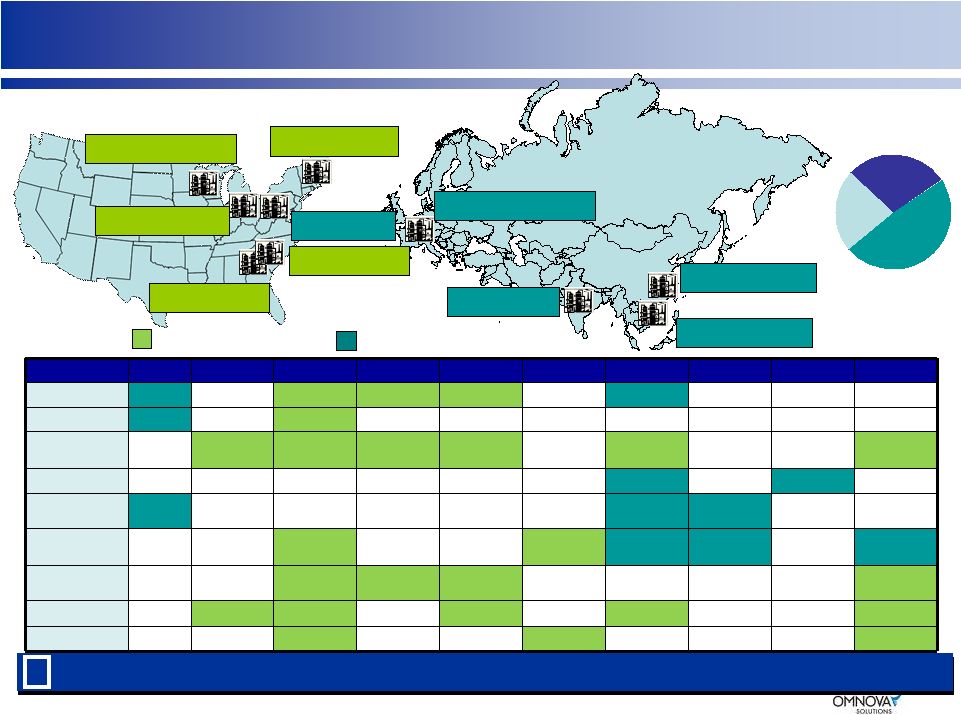

= Added in Last 5 Years

OMNOVA Locations

OMNOVA Locations

9 Global Locations Added In Last Five Years

9 Global Locations Added In Last Five Years

Monroe, NC

Chester, SC

Calhoun, GA

Columbus, MS

Shanghai/

Taicang, China

Rayong,

Thailand

Kent, U.K.

Fitchburg, MA

Auburn, PA

Jeannette, PA

Green Bay, WI

Fairlawn/Akron, OH (World Headquarters)

Mogadore/Akron, OH

Le Havre, France

Villejust, France

Valia, India

Caojing, China

Ningbo, China

Black Text = OMNOVA Manufacturing Sites

Green Text = Headquarters Facilities

Shanghai, China |

-

10 -

Accelerates OMNOVA’s Global Reach On A Pro Forma Basis

Accelerates OMNOVA’s Global Reach On A Pro Forma Basis

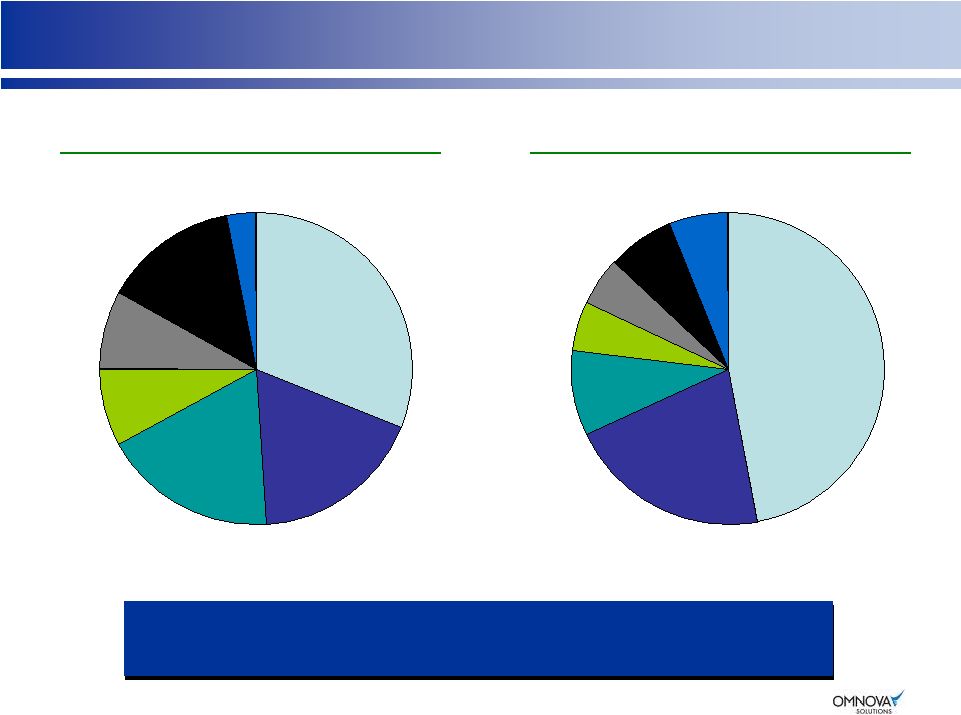

Europe &

Africa

17%

Asia &

Middle East

23%

USA

60%

Europe

9%

USA

75%

Asia

16%

LTM Sales $1.2 Billion*

Positioned For Strong Growth Potential In Asia And Europe

Positioned For Strong Growth Potential In Asia And Europe

Pro Forma Consolidated

* LTM: Last Twelve Months Through February 28, 2011 including ELIOKEM on a Pro

Forma Basis for 2010 Americas

24%

Asia & Middle

East

40%

Europe &

Africa

36% |

-

11 -

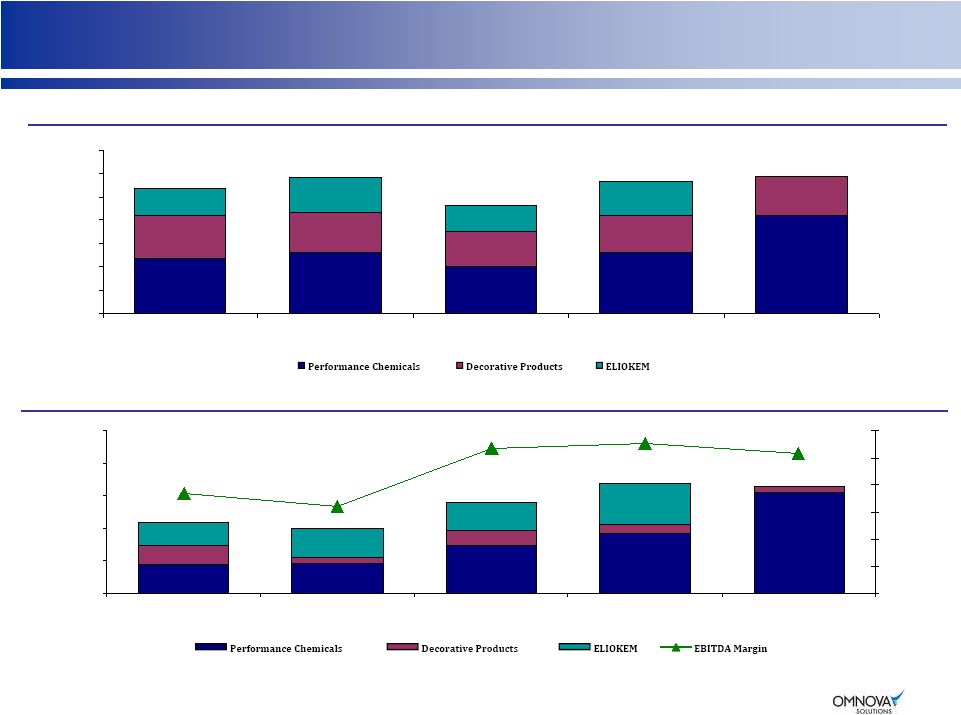

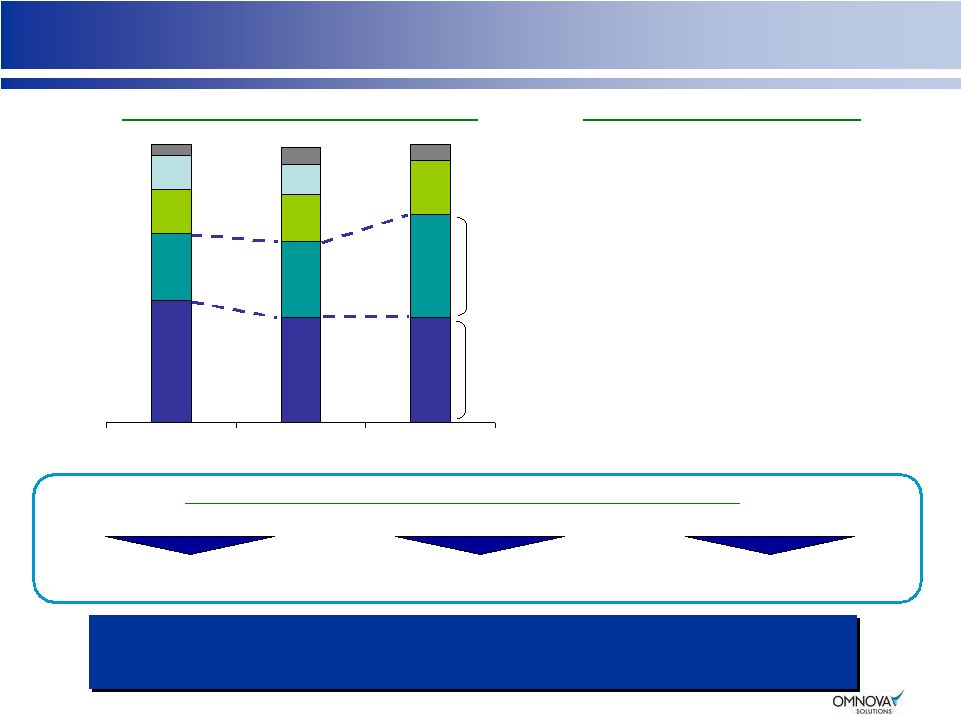

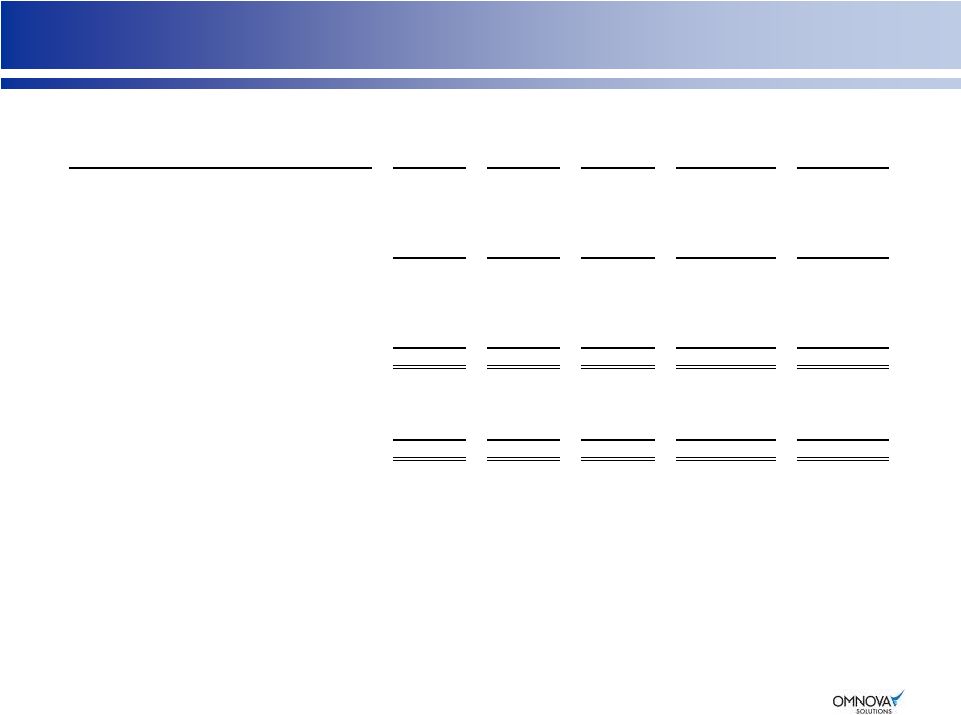

Pro Forma Historical Annual Financials

Pro Forma Historical Annual Financials

Annual Historical Revenue*

Annual Historical Adjusted EBITDA*

*

LTM:

Last

Twelve

Months

Through

February

28,

2011

including

ELIOKEM

on

a

Pro

Forma

Basis

for

2010;

Adjusted

EBITDA

-

see

Appendices

1,

3,

4,

and

5;

Total

Adjusted

EBITDA

includes

OMNOVA

Corporate

Expense

of

$8.9M,

$5.6M,

$12.2M,

$10.3M

and

$10.9M

for

2007,

2008,

2009,

2010

and

2011

LTM,

respectively.

$1,068

$1,159

$926

$1,135

$78.5

$73.7

$99.5

$125.2

$1,170

$120.6

$475.3

$521.6

$396.8

$527.9

$846.8

$364.6

$347.8

$299.6

$318.3

$323.1

$228.1

$289.5

$229.5

$288.4

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2007

2008

2009

2010

LTM 02/28/11*

$35.1

$37.5

$59.7

$74.8

123.9

$23.8

$7.2

$28.5

$34.6

$35.1

$16.9

$7.6

$9.8

$50.9

7.4%

6.4%

10.7%

11.0%

10.3%

$0.0

$40.0

$80.0

$120.0

$160.0

$200.0

2007

2008

2009

2010

LTM 02/28/11*

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0% |

-

12 -

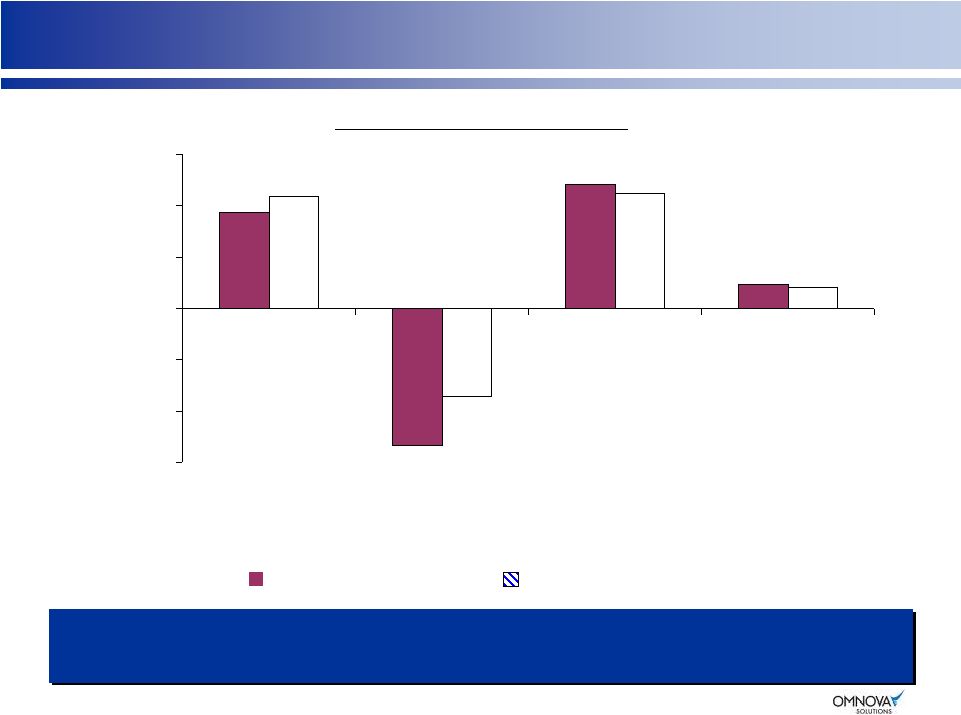

Raw Material Inflation / OMNOVA Pricing Dynamics

Raw Material Inflation / OMNOVA Pricing Dynamics

Success Historically In Recovering Raw Material Costs –

Even With Record RM Inflation In 2008 And 2010

Success Historically In Recovering Raw Material Costs –

Even With Record RM Inflation In 2008 And 2010

($ Millions)

Raw Material Inflation

OMNOVA Pricing Realization

OMNOVA Legacy Operations

87

90

17

19

97

(107)

75

(69)

-$120

-$80

-$40

$0

$40

$80

$120

2008

2009

2010

2011 Q1 |

-

13 -

Decorative Products |

-

14 -

Decorative Products –

Segment Overview

Decorative Products –

Segment Overview

* LTM:

Last

Twelve

Months

Through

February

28,

2011;

Adjusted

EBITDA

see

Appendix

4

Coated Fabrics Products

Laminates & Films Products

Commercial Wallcovering Products

End Markets

End Markets

End Markets

•

Vinyl and urethane fabrics

•

Performance fabrics

•

Vinyl, paper and acrylic laminates

•

Performance films

•

Vinyl wallcoverings

•

Customized wall murals

•

Transportation, marine

•

Health care

•

Furniture and furnishings

•

Kitchen and bath cabinets

•

RV / manufactured housing

•

Furniture

•

Retail store fixtures

•

Healthcare

•

Pool Liner

•

Corporate

•

Hospitality

•

Healthcare

•

Retail

LTM Sales* = $323M

LTM Adj. EBITDA* = $8M

Adj. EBITDA Margin* = 2.4%

A Broad-Based Functional And Decorative Surfaces Business

A Broad-Based Functional And Decorative Surfaces Business

|

-

15 -

•

Pricing discipline to offset raw material

inflation and expand margins

•

Reduce operating costs

•

Leverage scale in a highly fragmented

but consolidating industry

–

Several recent competitor exits

•

Grow at above-market rates as industry

recovers from cyclical decline

–

Leverage innovation in existing and

adjacent markets

•

Profitably serve global customers with

strategically located global assets

Decorative Products –

Segment Overview

(cont.)

Decorative Products –

Segment Overview

(cont.)

* LTM: Last Twelve Months Through February 28, 2011

Decorative Products

Sales Breakdown*

Commercial

Wallcovering

23%

Laminates

and Films

30%

Coated Fabrics

47%

Strategy |

-

16 -

Decorative Products –

Globalization & Innovation

Decorative Products –

Globalization & Innovation

•

Solely-owned plants in China and

Thailand provide strategic advantage

most competitors can’t match

•

A leading position in rapidly growing

Chinese automotive OEM market

•

Environmentally preferred

constructions

•

High performance, cost effective

alternatives to traditional materials

and processes

PreFixx®

Protective

Finish

High performance

barrier coatings resist

stains, abrasions and

scuffing

3 Asian Plants

Automotive

Upholstery

Healthcare / Medical Devices Market

•

Can cover broad array of surfaces

•

Durability, cleanability and design major differentiators

•

3-D Laminates reduce cracks where germs may develop

Increased Designer Choice:

Pinnacle™

Performance

Fabrics

duraMAX™

Flat Laminates

RECORE

®

Recycled Wall

Technology

ECORE

®

Advanced Wall

Technology |

-

17 -

Performance Chemicals |

-

18 -

New Performance Chemicals –

Segment Overview

New Performance Chemicals –

Segment Overview

*

LTM:

Last

Twelve

Months

Through

February

28,

2011

including

ELIOKEM

on

a

Pro

Forma

Basis

for

2010;

Adjusted

EBITDA

-

see

Appendix 3

Paper and Carpet Chemicals (LTM Sales = $346M)

Specialty Chemicals (LTM Sales = $501M)

End Markets

End Markets

•

Specialty / architectural

coatings

•

Nonwovens –

consumable

and durable

•

Construction

•

Tires and rubber goods

LTM Sales* = $847M

LTM Adj. EBITDA* = $124M

Adj. EBITDA Margin* = 14.6%

•

Magazines, brochures

•

Catalogs

•

Packaging, paperboard

ELIOKEM Accelerates Globalization Of Our Specialty Chemical Products

ELIOKEM Accelerates Globalization Of Our Specialty Chemical Products

•

Labels, specialty papers

•

Residential and commercial

carpet backing

•

Tapes and release coatings

•

Oil / gas drilling

•

Elastomeric modification

•

Floor care |

-

19 -

Performance Chemicals

Performance Chemicals

Served Markets*

Chemistries*

Paper and

Packaging

31%

Refurbishment /

Construction

18%

Tire & Rubber

18%

Nonwovens

8%

Specialty /

Architectural

Coatings

8%

Other

Specialty

14%

Oil Field

3%

SB Latex

47%

Acrylics

21%

Vinyl Pyridine

Latex

9%

Nitrile Rubber

Latex

5%

Elastomeric

Modifiers

7%

Antioxidants

6%

ELIOKEM Provides Diversification

Of Markets And Chemistries

ELIOKEM Provides Diversification

Of Markets And Chemistries

High Styrene

Latex

5%

* Sales % for quarter ended February 28, 2011 |

-

20 -

Leading SB Latex Producer In Disciplined N. American Industry

Leading SB Latex Producer In Disciplined N. American Industry

OMNOVA

BASF

Reichhold

SB Latex N. American Volumes

’02-’10

OMNOVA

+13 pts.

Others

Dow/

Styron

Source: OMNOVA

~

30%

of

North

American

Capacity

Shut

Down

in

2008

Dow-Reichhold Exit

Dow / Styron Closures

Lubrizol Exit

Closed 2 Plants

Closed 1 Plant

4 Plants (3 in N.A.)

Dow / Styron

recently

sold to

Bain Capital

4%

12%

16%

24%

44%

•

Differentiated products

•

Highly customized with high

switching cost

•

Low risk of Asian imports due to high

shipping cost

•

60-70% contracted with index raw

material price escalations

•

OMNOVA manufacturing strategically

located to serve core markets

OMN Share Gain Drivers

OMNOVA Growing Leadership Position

In Consolidating SB Latex Industry

OMNOVA Growing Leadership Position

In Consolidating SB Latex Industry

2002

2005

2010 |

-

21 -

Fit With

OMNOVA

ELIOKEM

OMNOVA

•

Global niche specialty chemicals company owned by AXA Private

Equity (formerly Goodyear Specialty Chemicals)

•

Focused on emulsion polymerization chemistry

•

#1 and #2 market leading positions in targeted specialty segments

•

Strong customer relationships with deep application expertise

•

Manufacturing footprint in China, India, France and USA

•

Headquarters in Villejust, France

–

630 employees worldwide

–

Regional sales teams supported by 85 distributors and agents

in 90 countries

•

$294M in LTM sales* and $50M in LTM EBITDA

ELIOKEM Acquisition –

A Strong Fit

ELIOKEM Acquisition –

A Strong Fit

* LTM: Last Twelve Months Through February 28, 2011

Paper

Carpet

Construction

Tape

Personal Hygiene

Floor Care

Exterior Masonry

Paint

Intumescent

(Fire

Resistant)

Paint

Stain Blocking

Primers

ABS Stabilization

Elastomeric

Modification

Antioxidants

Tires and Rubber

Goods

Oil and Gas

Drilling |

-

22 -

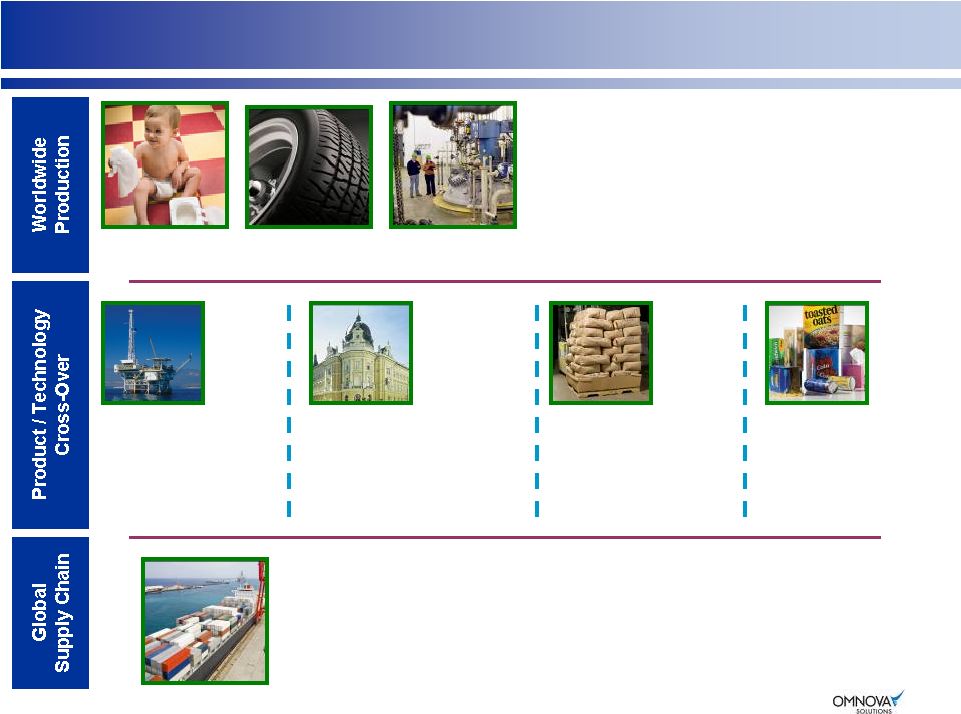

Examples Of Exciting Synergy Potential

Examples Of Exciting Synergy Potential

•

Manufacturing on 3 continents

to serve customers anywhere

in the world

•

Flexibility to manufacture

where profitability can be

maximized

•

Major raw materials are same for both ELIOKEM

and OMNOVA

•

Leverage purchasing and logistics with increased

options and scale

Oil Field

Architectural

Coatings

Powder

Polymers

Hollow

Plastic

Pigment

ELIOKEM products

for oil/synthetic

based drilling fluids

complement

OMNOVA’s for water-

based applications

OMNOVA has new

solutions for advanced

applications in this

ELIOKEM served

market

New capability to

deliver dry polymer

resins for easier

handling / new

applications

(e.g. oil field)

Paper coating

technology acquired

from Dow in 2010 has

broad potential

across several other

served markets

Nonwovens

Tire Cord

SB and

Acrylic Latex |

-

23 -

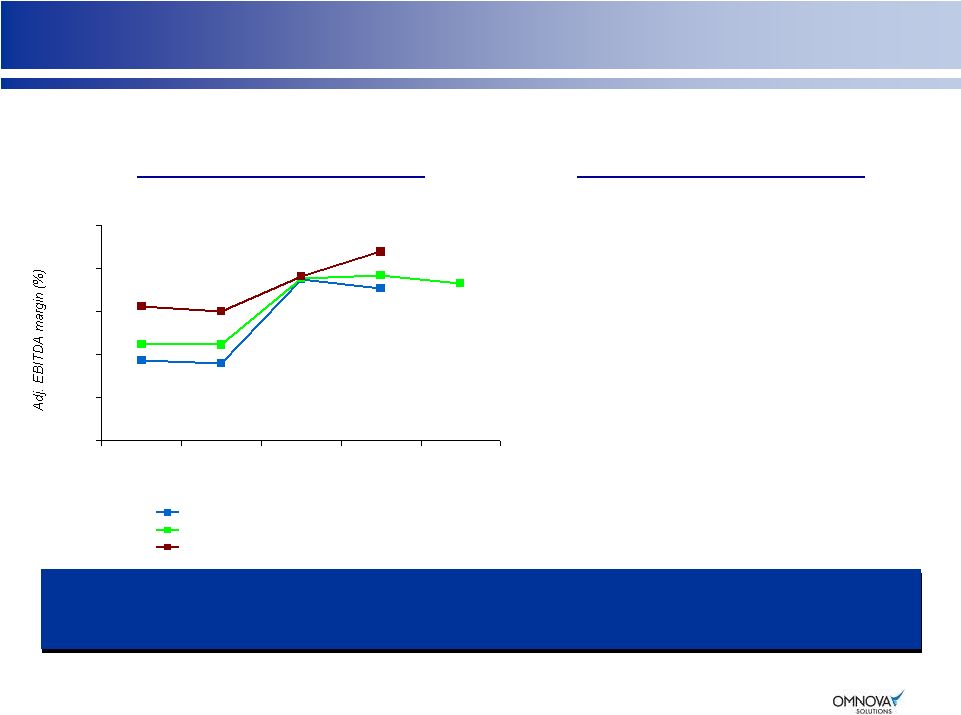

Enhances Performance Chemicals Profitability Profile

Enhances Performance Chemicals Profitability Profile

•

Innovative new products

•

Cost restructuring

•

Volume improvement

•

Increased average unit selling price

Improves Operating Profile Through

Niche / Specialty, High Margin Products

Improves Operating Profile Through

Niche / Specialty, High Margin Products

ELIOKEM’s Drivers of

Profit Improvement

Adj. EBITDA Margins**

Over Time

* LTM: Last Twelve Months Through February 28, 2011 including ELIOKEM on a Pro

Forma Basis for 2010. 2011 LTM margin decline related primarily to index

pricing mechanics (no margin on raw material pass-through). **

Adjusted

EBITDA

Margins

–

see

Appendices

3

and

5

14.6%

7.4%

7.2%

15.0%

14.2%

15.4%

9.0%

8.9%

15.1%

17.6%

15.3%

12.0%

12.5%

0%

4%

8%

12%

16%

20%

2007

2008

2009

2010

2011

LTM*

OMNOVA Performance Chemicals

Pro Forma OMNOVA Performance Chemicals

Eliokem |

-

24 -

OMNOVA Solutions –

Key Investment Highlights

OMNOVA Solutions –

Key Investment Highlights

30% of SB latex capacity in North America shutdown in 2008

In Europe, BASF acquired Ciba and restructured assets in 2010; Yule Cato acquiring

PolymerLatex

Low risk of imports due to high shipping costs

Leading market positions across many business lines (#1 or #2)

Industry recognized brands, with customer co-branding

OMNOVA has over 1,000 products sold to over 1,500 customers in more than 90

countries 75% of ELIOKEM’s sales to adjacent markets not currently served

by OMNOVA Geographically

diversified

asset

base,

with

significant

emerging

market

presence

Significantly improved Adjusted EBITDA since 2008

~10% Adjusted EBITDA margins (up from ~6% in 2008)

Ability

to

pass

through

raw

material

changes

(indexed

contracts,

disciplined

industry)

Generated $37 million of free cash flow in 2010

Modest capex requirements (maintenance capex <1.5% of revenues)

Stable, Disciplined,

Consolidated Industry

Leading Market

Positions

Diverse Business Model

Strong And Stable

Margins

Strong Free Cash Flow

OMNOVA Is Creating Value Through A Global Enterprise

OMNOVA Is Creating Value Through A Global Enterprise |

-

25 -

Appendix |

-

26 -

Global Footprint In Performance Chemicals

Global Footprint In Performance Chemicals

Product Focus

Akron

Green Bay

Mogadore

Fitchburg

Chester

Calhoun

Le Havre

Valia

Ningbo

Caojing

Coatings

Oil Field

Nonwovens/

Textiles

X

X

Antioxidants

Elastomers/

Reinforcing

Specialty

Rubbers/Latex

Tape &

Releases

X

Paper

X

X

Carpet

X

Valia, India

Ningbo, China

Caojing, China

Le Havre, France

Fitchburg, MA

Green Bay, WI

Akron, OH

Mogadore, OH

Chester, SC

Calhoun, GA

OMNOVA

ELIOKEM

Leveraging ELIOKEM Manufacturing Infrastructure With OMNOVA

Technology

Leveraging ELIOKEM Manufacturing Infrastructure With OMNOVA

Technology

ELIOKEM Production Capacity

X = Additional

Growth

Opportunities

X

Europe &

Africa

29%

Americas

23%

Asia

48% |

-

27 -

Appendix –

Non-GAAP Financial Measures

Appendix –

Non-GAAP Financial Measures

This presentation includes EBITDA, Adjusted EBITDA and Net Debt which are

Non-GAAP financial measures as defined by the Securities and Exchange

Commission. OMNOVA’s EBITDA is calculated as income (loss) from continuing

operations less interest expense, amortization of deferred financing costs,

income taxes and depreciation and amortization expense. OMNOVA’s Adjusted EBITDA is

calculated as OMNOVA’s EBITDA less restructuring and severance expenses, asset

impairments, non-cash stock compensation and other items. Segment

EBITDA is calculated as segment operating income (loss) less interest expense,

amortization of deferred financing costs, income taxes and depreciation and amortization expense.

Segment Adjusted EBITDA is calculated as Segment EBITDA less restructuring and

severance expenses, asset impairments, non-cash stock compensation and

other items. For purposes of this presentation, Net Debt is calculated

as total debt less cash. ELIOKEM’s EBITDA is calculated as net

income less interest expense, amortization of deferred financing costs, income

taxes and depreciation and amortization expense. ELIOKEM’s Adjusted EBITDA is calculated as ELIOKEM’s

EBITDA less restructuring and severance expenses, asset impairments and other

items. EBITDA, Adjusted EBITDA and Net Debt are not measures of

financial performance under GAAP. EBITDA, Adjusted EBITDA and Net Debt

are not calculated in the same manner by all companies and, accordingly, are

not necessarily comparable to similarly titled measures of other companies and

may not be appropriate measures for comparing performance relative to other

companies. EBITDA, Adjusted EBITDA and Net Debt should not be construed as

indicators of the Company’s operating performance or liquidity and should not be

considered in isolation from or as a substitute for net income (loss), cash

flows from operations or cash flow data, which are all prepared in accordance

with GAAP. EBITDA, Adjusted EBITDA and Net Debt are not intended to represent, and should not be

considered more meaningful than or as an alternative to, measures of operating

performance as determined in accordance with GAAP. Management believes

that presenting this information is useful to investors because these measures

are commonly used as analytical indicators to evaluate performance and by management to allocate

resources. Set forth below are the reconciliations of these non-GAAP

measures to their most directly comparable GAAP financial measure.

|

-

28 -

Appendix 1 –

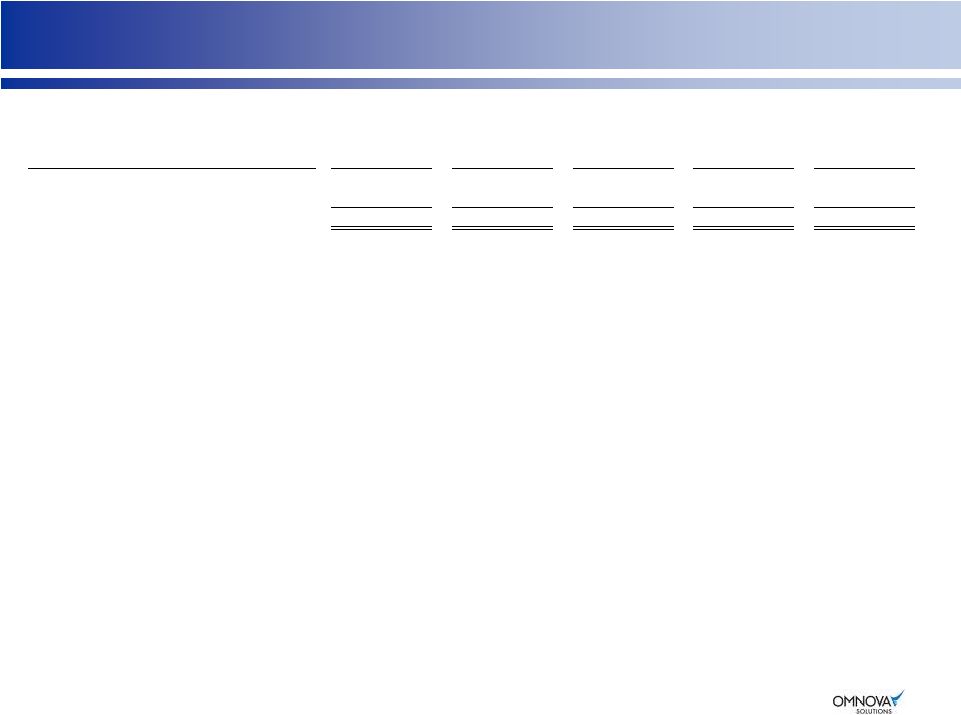

Adjusted EBITDA

Appendix 1 –

Adjusted EBITDA

($ Millions)

LTM

OMNOVA Solutions Consolidated

2007*

2008

2009

2010

Feb 28, 2011

Income (loss) from continuing operations

$

(4.9)

$

(2.2)

$

26.2

$

107.9

$

104.1

Interest expense

15.7

12.3

7.5

8.0

26.6

Amortization of deferred financing costs

0.8

0.7

0.6

0.7

1.6

Income tax

0.1

0.2

1.7

(89.4)

(82.8)

Depreciation & amortization

23.1

23.9

22.9

20.6

33.1

EBITDA

$

34.8

$

34.9

$

58.9

$

47.8

$

82.6

Restructuring & severance

1.0

0.6

2.1

0.6

1.1

Asset impairments

-

-

1.1

6.2

6.2

Non-cash stock compensation

2.9

2.4

2.8

3.5

3.5

Other

11.3

1.2

(0.5)

16.2

27.2

Adjusted EBITDA

$

50.0

$

39.1

$

64.4

$

74.3

$

120.6

OMNOVA Solutions Adjusted EBITDA

$

50.0

$

39.1

$

64.4

$

74.3

$

120.6

Eliokem International Adjusted EBITDA

28.5

34.6

35.1

50.9

Combined Adjusted EBITDA

$

78.5

$

73.7

$

99.5

$

125.2

$

120.6

Combined Sales

$

1,068.0

$

1,158.9

$

925.9

$

1,134.6

$

1,169.9

Percentage of Adjusted EBITDA to Sales

7.4%

6.4%

10.7%

11.0%

10.3%

LTM: Last Twelve Months through February 28, 2011 including ELIOKEM on a Pro Forma

Basis for 2010 * NOTE: 2007 Sales and Adjusted EBITDA have been adjusted by

$94.4 million and $4.8 million, respectively. Pro forma 2007 reflects the

full year results of the Asian businesses acquired during December 2007 as if

the acquisition took place December 1, 2006. |

-

29 -

Appendix 2 –

Net Debt / Adjusted EBITDA

Appendix 2 –

Net Debt / Adjusted EBITDA

($ Millions)

LTM

OMNOVA Solutions Consolidated

2007

2008

2009

2010*

Feb 28, 2011

Total Debt

$ 149.9

$ 188.3

$ 144.1

$ 394.2

$ 454.7

Less Cash

(12.6)

(17.4)

(41.5)

(328.7)

(74.0)

Net Debt

137.3

$

170.9

$

102.6

$

65.5

$

380.7

$

Adjusted EBITDA (Appendix 1)

$ 50.0

$ 39.1

$ 64.4

$ 74.3

$ 120.6

Net Debt / Adjusted EBITDA

2.7

x

4.4

x

1.6

x

0.9

x

3.2

x

LTM: Last Twelve Months through February 28, 2011 including ELIOKEM on a Pro Forma

Basis for 2010 * 2010 Total Debt includes $250.0M of Senior Notes held in

escrow and 2010 cash includes restricted cash of $253.1M |

-

30 -

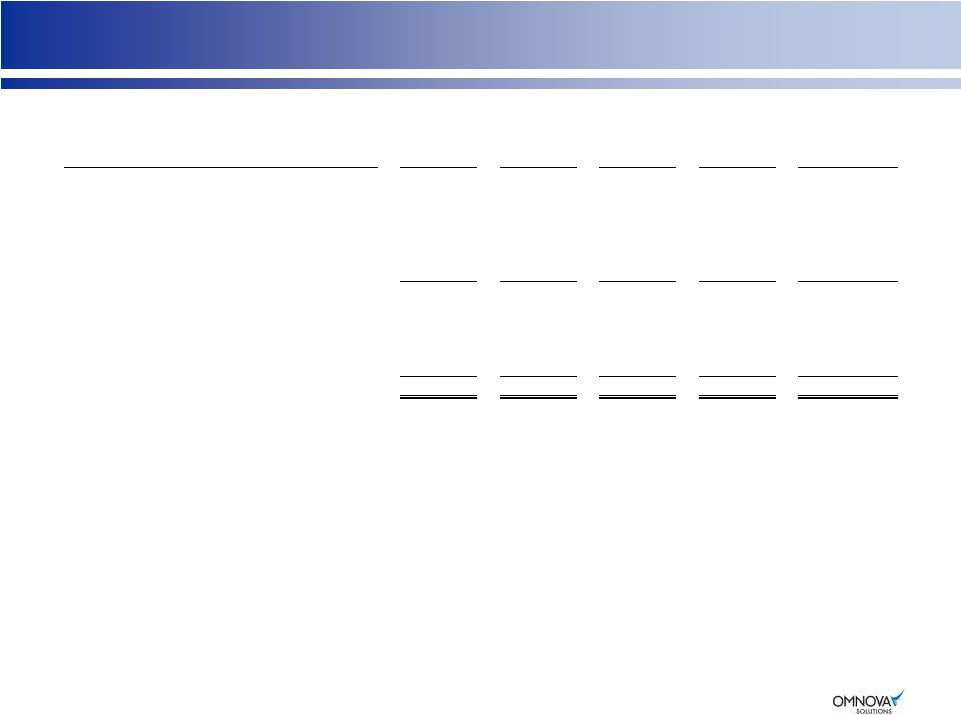

Appendix 3 –

Adjusted EBITDA

Appendix 3 –

Adjusted EBITDA

($ Millions)

LTM

Performance Chemicals Segment

2007

2008

2009

2010

Feb 28, 2011

Segment Operating Profit

$

23.7

$

25.2

$

47.9

$

73.3

$

83.7

Interest Expense

-

-

-

-

11.7

Amortization of deferred financing costs

-

-

-

-

0.3

Income Tax

-

-

-

-

5.1

Depreciation & amortization

11.1

11.0

9.9

9.3

22.6

EBITDA

$

34.8

$

36.2

$

57.8

$

82.6

$

123.4

Restructuring & severance

-

0.1

0.2

0.4

0.9

Asset Impairments

-

-

0.7

-

-

Non-cash stock compensation

1.0

1.1

0.8

1.2

1.2

Other

(0.7)

0.1

0.2

(9.4)

(1.6)

Adjusted EBITDA

$

35.1

$

37.5

$

59.7

$

74.8

$

123.9

Sales

$

475.3

$

521.6

$

396.8

$

527.9

$

846.8

Percentage of Adjusted EBITDA to Sales

7.4%

7.2%

15.0%

14.2%

14.6%

LTM: Last Twelve Months through February 28, 2011 including ELIOKEM on a Pro Forma

Basis for 2010 |

-

31 -

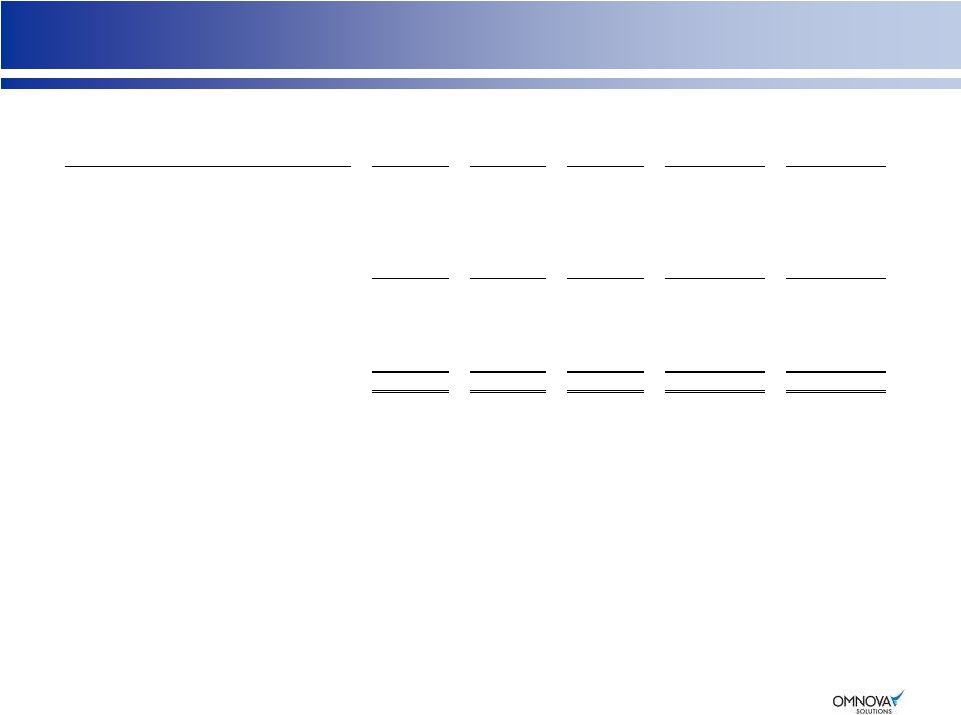

Appendix 4 –

Adjusted EBITDA

Appendix 4 –

Adjusted EBITDA

($ Millions)

LTM

Decorative Products Segment

2007*

2008

2009

2010

Feb 28, 2011

Segment Operating Profit

$

10.4

$

(6.7)

$

1.6

$

(18.0)

$

(19.7)

Interest Expense

-

-

-

-

-

Amortization of deferred financing costs

-

-

-

-

-

Income Tax

-

-

-

-

-

Depreciation & amortization

11.7

12.5

12.5

11.0

10.4

EBITDA

$

22.1

$

5.8

$

14.1

$

(7.0)

$

(9.3)

Restructuring & severance

0.7

0.5

1.8

0.1

0.1

Asset Impairments

-

-

0.6

6.2

6.2

Non-cash stock compensation

0.8

0.9

0.4

1.1

1.1

Other

0.2

-

-

9.4

9.5

Adjusted EBITDA

$

23.8

$

7.2

$

16.9

$

9.8

$

7.6

Sales

$

364.6

$

347.8

$

299.6

$

318.3

$

323.1

Percentage of Adjusted EBITDA to Sales

6.5%

2.1%

5.6%

3.1%

2.4%

LTM: Last Twelve Months through February 28, 2011

* NOTE: 2007 Sales and Adjusted EBITDA have been adjusted by $94.4 million and $4.8

million, respectively. Pro forma 2007 reflects the full year results of the

Asian businesses acquired during December 2007 as if the acquisition took

place December 1, 2006. |

-

32 -

Appendix 5 –

Adjusted EBITDA

Appendix 5 –

Adjusted EBITDA

($ Millions)

Eliokem International

2007

2008

2009

2010

Net income

$

5.8

$

(2.5)

$

1.2

$

0.4

Interest expense

15.0

17.5

16.8

16.0

Amortization of deferred financing costs

0.5

0.5

0.5

0.4

Income Tax

2.5

(3.3)

1.3

2.6

Depreciation & amortization

12.5

14.3

13.4

13.2

EBITDA

$

36.3

$

26.5

$

33.2

$

32.6

Restructuring & severance

1.1

1.1

3.9

1.1

Other

(8.9)

7.0

(2.0)

17.2

Adjusted EBITDA

$

28.5

$

34.6

$

35.1

$

50.9

Sales

$

228.1

$

289.5

$

229.5

$

288.4

Percentage of Adjusted EBITDA to Sales

12.5%

12.0%

15.3%

17.6%

Combined Adjusted EBITDA

2007

2008

2009

2010

Performance Chemicals Adjusted EBITDA

$

35.1

$

37.5

$

59.7

$

74.8

Eliokem International Adjusted EBITDA

28.5

34.6

35.1

50.9

Combined Adjusted EBITDA

$

63.6

$

72.1

$

94.8

$

125.7

Combined Sales

Performance Chemicals

$

475.3

$

521.6

$

396.8

$

527.9

Eliokem International

228.1

289.5

229.5

288.4

Combined Sales

$

703.4

$

811.1

$

626.3

$

816.3

Percentage of Adjusted EBITDA to Sales

9.0%

8.9%

15.1%

15.4% |

*

*

*

*

*

*

*

*

************

************

************

************

************

************ |