Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STATE STREET CORP | d8k.htm |

| EX-99.2 - RECONCILIATIONS OF CONSOLIDATED REPORTED RESULTS OF OPERATION - STATE STREET CORP | dex992.htm |

Annual

Meeting of Shareholders 18 May 2011

Exhibit 99.1 |

Building from Strength

Joseph L. Hooley

Chairman, President and

Chief Executive Officer |

3

Reminder

This presentation contains “forward-looking statements” within the meaning of U.S.

securities laws, including statements about industry trends, management’s expectations about

our financial performance, market growth, acquisitions and divestitures, new technologies, services

and opportunities and earnings, management’s confidence in our strategies and other

matters that do not relate strictly to historical facts. Forward-looking statements are often identified by such forward-looking terminology as “expect,” “look,” “believe,”

“anticipate,” “estimate,” “seek,” “may,” “will,”

“trend,” “target” and “goal,” or similar statements or variations of such terms. Forward-looking statements are subject to various risks

and uncertainties, which change over time, are based on management’s expectations and assumptions

at the time the statements are made, and are not guarantees of future results.

Management’s expectations and assumptions, and the continued validity of the forward-looking statements, are subject to change due to a broad range of factors affecting

the national and global economies, the equity, debt, currency and other financial markets, as well as

factors specific to State Street and its subsidiaries, including State Street Bank. Therefore,

actual outcomes and results may differ materially from what is expressed in those statements, and those statements should not be relied upon as representing our

expectations or beliefs as of any date subsequent to May 18, 2011.

Important factors that could cause changes in the expectations or assumptions on which

forward-looking statements are based include, but are not limited to: the manner in which

the Federal Reserve and other regulators implement the Dodd-Frank Act and other regulatory

initiatives in the U.S. and internationally, including any increases in the minimum regulatory

capital ratios applicable to us and regulatory developments that result in changes to our operating model, or other changes to the provision of our services in order to

comply with or respond to such regulations; required regulatory capital ratios under Basel II and

Basel III, in each case as fully implemented by State Street and State Street Bank (and in the

case of Basel III, when finally adopted by the Federal Reserve), which may result in the need for substantial additional capital or increased levels of liquidity in the future;

changes in law or regulation that may adversely affect our, our clients’ or our

counterparties’ business activities and the products or services that we sell, including additional or

increased taxes or assessments thereon, capital adequacy requirements and changes that expose us to

risks related to compliance; financial market disruptions and the economic recession, whether

in the U.S. or internationally; the liquidity of the U.S. and international securities markets, particularly the markets for fixed-income securities, and the liquidity

requirements of our clients; increases in the volatility of, or declines in the levels of, our net

interest revenue, changes in the composition of the assets on our consolidated statement of

condition and the possibility that we may be required to change the manner in which we fund those assets; the financial strength and continuing viability of the

counterparties with which we or our clients do business and to which we have investment, credit or

financial exposure; the credit quality, credit agency ratings, and fair values of the

securities in our investment securities portfolio, a deterioration or downgrade of which could lead to

other-than-temporary impairment of the respective securities and the recognition of an

impairment loss in our consolidated statement of income; delays or difficulties in the execution of our previously announced global multi-year program designed to enhance

our operating model, which could lead to changes in our estimates of the charges, expenses or savings

associated with the planned program, resulting in increased volatility of our earnings; the

maintenance of credit agency ratings for our debt and depository obligations as well as the level of credibility of credit agency ratings; the risks that acquired

businesses will not be integrated successfully, or that the integration will take longer than

anticipated, that expected synergies will not be achieved or unexpected disynergies will be

experienced, that client and deposit retention goals will not be met, that other regulatory or

operational challenges will be experienced and that disruptions from the transaction will harm

relationships with clients, employees or regulators; the ability to complete acquisitions, divestitures and joint ventures, including the ability to obtain regulatory approvals, the

ability to arrange financing as required and the ability to satisfy closing conditions; the

performance of and demand for the products and services we offer, including the level and

timing of redemptions and withdrawals from our collateral pools and other collective investment

products; the possibility that our clients will incur substantial losses in investment pools

where we act as agent, and the possibility of significant reductions in the valuation of assets; our ability to attract deposits and other low-cost, short-term funding; potential

changes to the competitive environment, including changes due to the effects of consolidation, and

perceptions of State Street as a suitable service provider or counterparty; the level and

volatility of interest rates and the performance and volatility of securities, credit, currency and other markets in the U.S. and internationally; our ability to measure the fair

value of the investment securities on our consolidated statement of condition; the results of

litigation, government investigations and similar disputes or proceedings; our ability to

control operating risks, information technology systems risks and outsourcing risks, and our ability

to protect our intellectual property rights, the possibility of errors in the quantitative

models we use to manage our business and the possibility that our controls will prove insufficient, fail or be circumvented; adverse publicity or other reputational harm;

our ability to grow revenue, attract and/or retain and compensate highly skilled people, control

expenses and attract the capital necessary to achieve our business goals and comply with

regulatory requirements; the potential for new products and services to impose additional costs on us and expose us to increased operational risk; changes in accounting

standards and practices; and changes in tax legislation and in the interpretation of existing tax laws

by U.S. and non-U.S. tax authorities that affect the amount of taxes due. Other important factors that could cause actual results to differ materially from those

indicated by any forward-looking statements are set forth in our 2010 Annual Report on Form

10-K and our subsequent SEC filings. We encourage investors to read these filings,

particularly the sections on risk factors, for additional information with respect to any forward-

looking statements and prior to making any investment decision. The forward-looking statements

contained in this presentation speak only as of the date hereof, May 18, 2011, and we do not

undertake efforts to revise those forward-looking statements to reflect events after that date. |

4

Building from Strength

2010: A Year of Transition

Strategic Direction

Investing in Communities and Corporate Social Responsibility

2011: Progress

Agenda |

5

2010: A Year of Transition |

6

Building from Strength

2010: A Year of Transition

INCREASED CAPITAL

FLEXIBILITY

•

Repositioned investment portfolio to lay the foundation to

restore the dividend and prepare for Basel III ahead of

implementation dates

•

90% of investment portfolio assets rated AAA / AA*

ADDRESSED ISSUES FROM

FINANCIAL CRISIS

•

Reached settlement with SEC on fixed-income issues

•

Implemented solution to provide clients in securities

lending program with improved access to liquidity

•

Strengthened risk infrastructure

DEEPENED CLIENT

RELATIONSHIPS

•

Added $1.4T in assets to be serviced

•

Added $160B in gross new asset management business

•

Launched new products and services

EXPANDED MARKET SHARE

•

Strategic acquisitions advanced State Street’s market share

in Europe and key client segments

INITIATED OPS AND IT

TRANSFORMATION PROGRAM

•

Multi-year strategic transformational plan in place

•

Broad-based organizational focus

*

As of March 31, 2011. |

7

Building from Strength

State Street Corporation

“Well

Capitalized”

1

3/31/11

12/31/10

12/31/09

Tier 1 Leverage

5.0%

2

8.7%

8.2%

8.5%

Tier 1 Capital

6.0%

19.6%

20.5%

17.7%

Tier 1 Common Ratio

3

----

17.5%

18.1%

15.6%

Total Capital

10.0%

21.6%

22.0%

19.1%

Tangible Common Equity

4

----

7.4%

7.6%

6.6%

CAPITAL RATIOS

2010: A Year of Transition –

Increased Capital Flexibility

Capital Ratios Exceed Regulatory “Well Capitalized”

Requirements

1 Except as noted in note 4 below, minimum “Well Capitalized” as defined by Federal

regulators under Basel I. 2 Minimum “Well Capitalized,” as defined by Federal

regulators, applies to State Street Bank and Trust only and therefore stated only as a reference point.

3 The tier 1 common ratio is not required by GAAP or on a recurring basis by bank

regulations. See State Street’s website (www.statestreet.com) for a description of this ratio and

related reconciliations.

4 As defined by State Street. The TCE ratio is not required by GAAP or by bank

regulations. See State Street’s website (www.statestreet.com) for a description of this ratio and

related reconciliations.

|

8

Building from Strength

2010: A Year of Transition –

Deepened Client Relationships

Growing Momentum in Core Businesses

2000

2010

Top 100 clients

11.4 products

13.2 products

Top 1,000 clients

7.1 products

7.9 products

Expanded Relationships

New Clients

INVESTMENT

SERVICING

•

Babson Capital Management

•

Charles Schwab

•

Legg Mason Global Asset Management

•

Martin Currie

•

Norges Bank

•

Guotai Nasdaq-100 Index Fund

•

Marshall Wace

•

National Employment Savings Trust

(NEST)

•

PineBridge Investments

•

REST Industry Super

INVESTMENT

MANAGEMENT

•

AT&T

•

Stichting Pensionefonds Ahold

•

Mass PRIM

•

AP7

•

NY State Teachers

•

Lincoln Financial Group

•

Previambiante

•

Pegaso Pension Fund

•

Qsuper

•

Alliance Bernstein

•

Illinois State Teachers

•

UAW |

9

Building from Strength

No. 2 Manager

of Worldwide

Institutional Assets

Pensions & Investments

2010 Money

Managers Survey

HF

Administrator

of

the

Year

and PE Fund Administrator

of the Year

International Custody and

Fund Administration

2010 Americas Service

Provider Awards

Transition Manager

of the Year

2010

Global Pensions

Awards

No. 1 Custodian for

Institutional Investors

Global Custodian

2010

Global Custody Survey

No. 1 Among Custodians*

Global Investor / isf

2010 Beneficial

Owners Survey

No. 1 Global Custodian

in Asia Pacific

Global Investor / isf

2010 Global Custody Survey

Equity Lender of the Year

Global Investor / isf

2010 Equity Lending Survey

Best Multi-Asset Class

Trading Platform

(FX Connect)

Profit & Loss

2010 Digital Markets Awards

Most Recognized

ETF Brand, Americas

exchangetradedfunds.com

2010 Global ETF Awards

2010: A Year of Transition –

Deepened Client Relationships

MARKET RECOGNITION

*

Weighted by lendable assets. |

10

INTESA SANPAOLO’S

SECURITIES SERVICES

•

State Street is now:

–

Leading asset servicer in Italy

–

No. 2 asset servicer of offshore funds in

Luxembourg

and

Ireland

1

•

Goal to retain 90% of revenue of ~€293M

•

Additional cross-sell opportunities

MOURANT INTERNATIONAL

FINANCE ADMINISTRATION

•

State Street is now No. 1 in Alternative Asset

Servicing

globally

2

:

–

Hedge funds

–

Private equity

–

Real estate assets

•

Annualized revenue of about $100 million

•

Additional cross-sell opportunities

BANK OF IRELAND

ASSET MANAGEMENT

•

Expected to deepen SSgA’s capabilities across key

investment strategies

Building from Strength

1 Fitzrovia 12/10.

2 ICFA Annual Fund Administration Survey, 2010; HFN Biannual Fund

Administration Survey 6/10. 2010: A Year of Transition –

Expanded Market Share |

11

Building from Strength

SUPPORTING GROWTH

•

Market expansion

•

Mergers and acquisitions

•

Geographic expansion

ENABLING PRODUCTIVITY

•

Business process excellence

•

Flexible global workforce

•

Global shared services

ACCELERATING INNOVATION

•

New product development

•

Technology leadership

•

Global solutions

BENEFITING THE CLIENT

•

Service excellence

•

Time to market

•

New products and services

2010: A Year of Transition –

Initiated Ops and IT Transformation Program

Expect to Save Between $575M and $625M by the End of 2014

|

12

Building from Strength

2010: A Year of Transition

$ in millions

12/31/10

1

12/31/09

1

% Change

Operating-basis revenue

$8,714

$8,138

+7.1%

Operating-basis expenses

$6,176

$5,667

+ 9.0%

Operating-basis EPS

$3.40

$3.32

+2.4%

Operating-basis ROE

10.4%

12.6%

-220 bps

FOR THE TWELVE MONTHS ENDED

•

Responded effectively to the global financial crisis

•

Strengthened capital position

•

Deepened client relationships

•

Expanded market share

•

Launched Ops and IT Transformational Program

1

Financial data presented on an operating or non-GAAP basis (which is adjusted

to exclude, among other things, discount accretion). For a description of GAAP to operating-basis

results,

and

related

reconciliations,

please

see

the

Appendix

on

State

Street’s

website

(www.statestreet.com)

or

State

Street‘s

current

Report

on

Form

8-K

filed

with

the

SEC

on

the date hereof. |

13

Strategic Direction |

14

Building from Strength

Strategic Direction

–

Secular Trends Support Growth

GLOBALIZATION

•

Asset managers increasingly invest beyond

their borders

•

Asset management industry globalizing product and

distribution strategies

RETIREMENT SAVINGS

•

Driven by demographics, especially in Europe and Asia

•

Evolution of retirement / savings schemes

OUTSOURCING

•

Growing global trend driven by complexity, cost and

risk management

•

Expanding into middle and front office

CONSOLIDATION

•

Non-core activity for universal banks

•

Increasing requirement for global capabilities |

15

Year ended

12/31/00

2

Year ended

12/31/10

% Change

Operating-basis revenue

$3.45B

$8.71B

+152%

Operating-basis non-US revenue

$0.94B

$3.18B

+238%

Employees

3

17,281

28,670

+66%

Non-US

employees

3

3,463

12,518

+261%

Building from Strength

1 Financial data presented on an operating-basis (which is adjusted to

exclude, among other things, discount accretion). For a description of operating-basis revenue and related

reconciliations,

see

State

Street’s

website

(www.statestreet.com)

or

State

Street’s

current

report

on

Form

8-K

filed

with

the

SEC

on

the

date

hereof.

2 Data exclude the revenue and employees associated with the Corporate Trust

and Private Asset Management businesses divested in 2002 and 2003, respectively.

3 At period end.

Strategic

Direction

–

Globalization1 |

16

Building from Strength

Non-US Retirement Growth

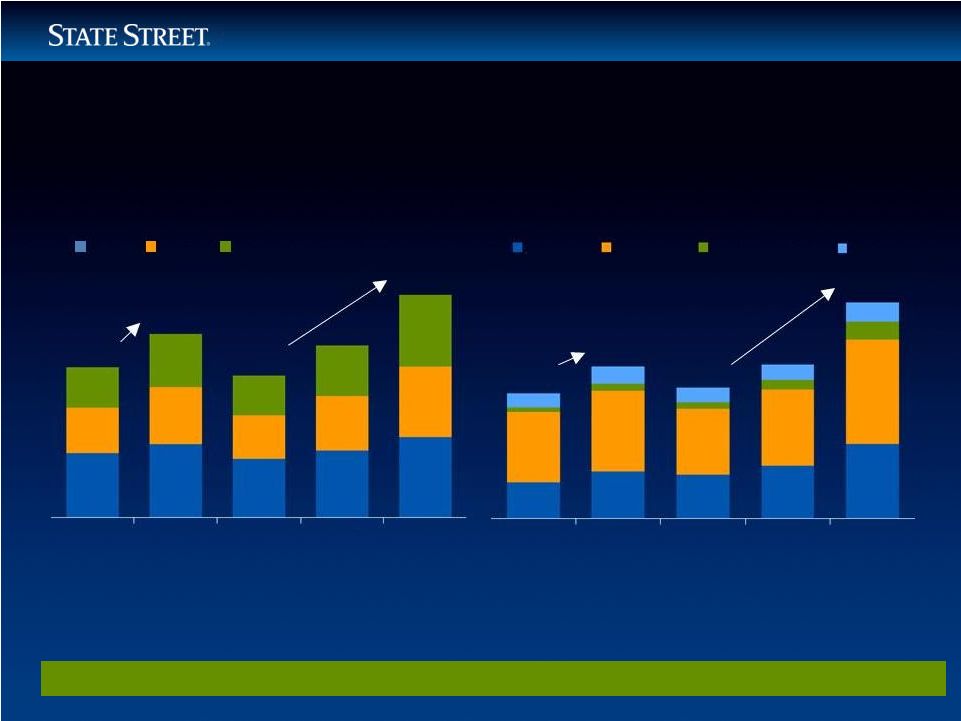

US Retirement Growth

$13.6T

$16.6T

$12.8T

$15.6T

$20.1T

10.5%

CAGR

7.8%

CAGR

$6.6T

$8.1T

$7.0T

$8.1T

$11.3T

10.8%

CAGR

8.3%

CAGR

Almost 50% of expected retirement asset

growth (2008 –

2014) will come from Europe

Strategic Direction –

Retirement Savings

Global Retirement Assets are Expected to Grow 32% ($7.7 Trillion) from 2010 through

2014 Source:

Cerulli

Associates

“Global

Markets

2010”

statistics

DC and IRA assets will lead US retirement

growth, with 8.6% and 10.1% expected

CAGRs (2008 –

2014)

DB

DC

IRA

2005

2007

2008

2010E

2014F

2005

2007

2008

2010E

2014F

APAC

Europe

Latin America

Other |

17

Building from Strength

INVESTMENT MANAGER

OPERATIONS OUTSOURCING

•

Leading provider with more than $7 trillion

of AUA

•

Market

sized

at

approximately

$53

trillion

1

HEDGE FUND SERVICING

•

Second

largest

servicer

in

the

world

2

with

about

$470

billion

3

of

AUA

in

hedge

fund

assets

•

Market sized at

$1.7 trillion

4

and growing at an

estimated

19%

CAGR

through

2013

5

INVESTMENT

MANAGEMENT SOLUTIONS

•

Customized strategic and tactical asset allocation

solutions through flexible and efficient portfolio

implementation across and within global asset

classes

Strategic Direction

–

Outsourcing

1 Pension & Investment,/Watson Wyatt World 500, 12/28/09.

2 ICFA Annual Fund Administration Survey, 2010.

3 As of March 31, 2011.

4 Hedge Fund Research, 3/31/10.

5 McKinsey, 7/09. |

18

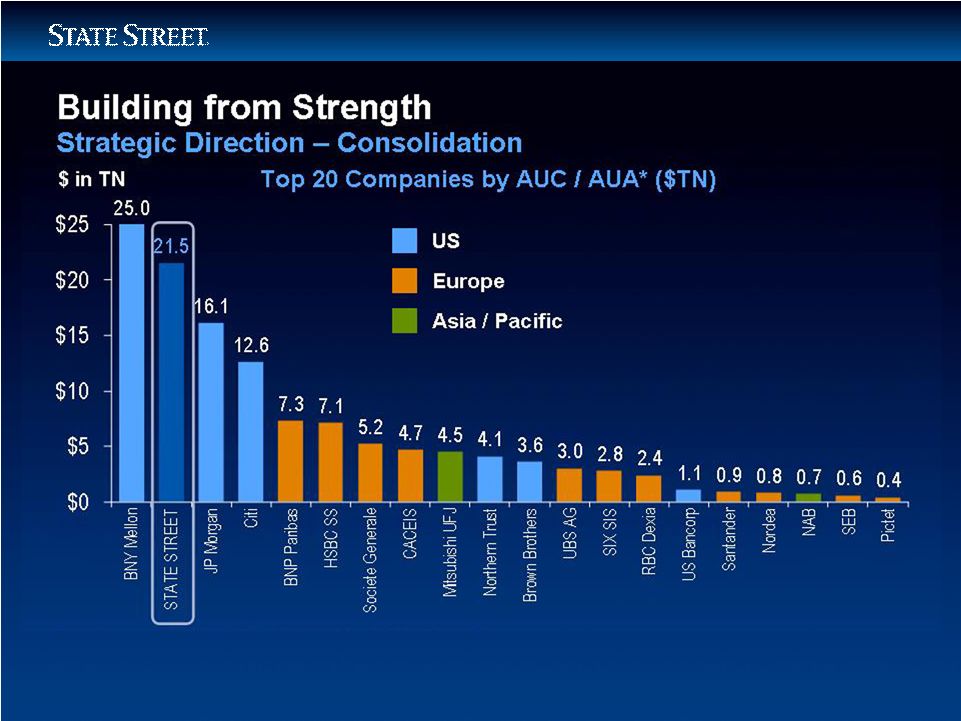

Source: Company reports, Global Custody.net, Institutional Investor

Global Custodian Survey. *

Data for BNY, State Street, & CACEIS reflect AUA as of 12/31/2010;

as of 9/30/10 for, BNP Paribas, Societe Generale, & Brown Brothers; as of 6/30/10 for RBC Dexia & HSBC ;

all

others

reflect

AUC

data:

JP

Morgan,

Citi,

&

Northern

Trust

as

of

12/31/10;

Nordea,

NAB,

&

SEB

as

of

9/30/10;

Pictet

as

of

6/30/10;

Mitsubishi,

UBS,

SIX

SIS,

&

Santander:

as of 3/31/10. |

19

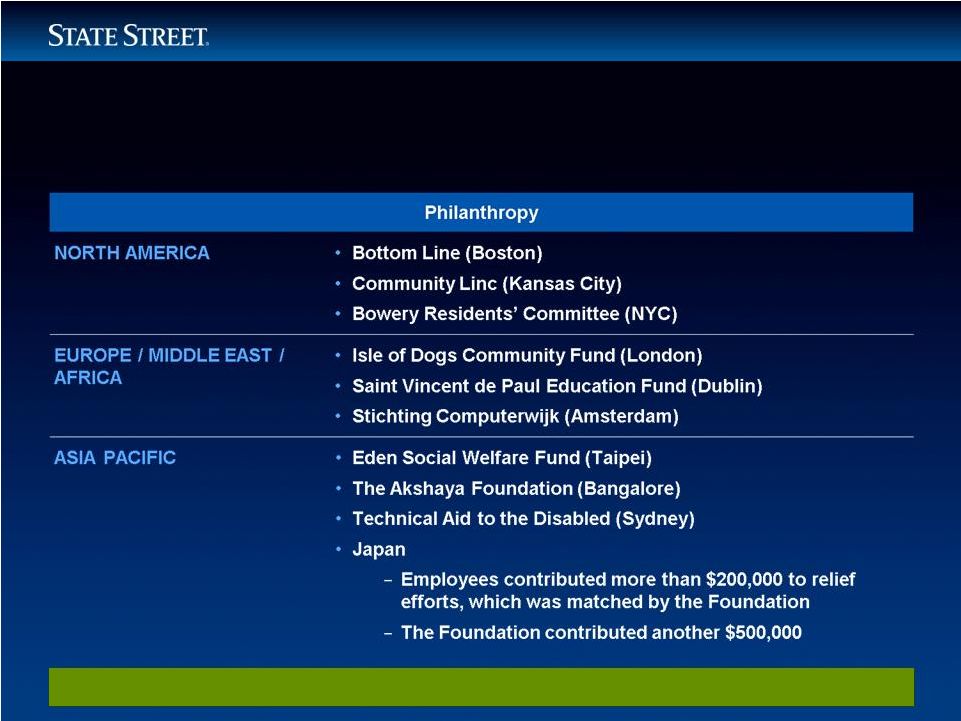

Investing in Communities and

Corporate Social Responsibility |

Building from Strength

Investing in Communities and Corporate Social Responsibility

Provided 619 Grants Worldwide

20 |

21

Building from Strength

Investing in Communities and Corporate Social Responsibility

Volunteerism

PROJECTS INCLUDED

•

Environmental cleanups

•

Food sorting and service

•

Distance and web-based volunteerism

•

Youth Mentoring

•

Support Pledge-a-thons

EXECUTIVES ACTIVE WITH

MANY NON-PROFIT

ORGANIZATIONS INCLUDING

•

Boys & Girls Club of Boston

•

Boston Partners in Education

•

Boston Symphony Orchestra

•

Earthwatch Institute

•

Women’s Lunch Place

•

Oxfam Hong Kong

•

Urban League of Eastern Massachusetts

78,000 Volunteer Hours Dedicated by State Street Employees and Alumni

|

22

Building from Strength

CORPORATE

RESPONSIBILITY

PRACTICES

Organization

Ranking

Newsweek

Magazine:

Greenest US Companies

No. 35 of Top 500

Carbon Disclosure Project

First time on S&P 500 Business Leadership Index

Dow Jones Sustainability World

and North America Indices

One of only three U.S. financial services companies

listed on both indices

CR

Magazine’s

100 Best Corporate Citizens

One of only three financial services

companies listed

•

Established new Executive Corporate Responsibility Committee

•

Recent accolades include:

Annual CSR Report One of the Only Independently Verified

Reports Among US-based Financial Services Firms

Investing in Communities and Corporate Social Responsibility

|

23

2011: Progress |

24

Building from Strength

2011: Progress –

Recent Update

CAPITAL DEPLOYMENT

DIVIDEND PAYOUT

•

Announced increase in quarterly dividend to $0.18 per

share at a 20% payout ratio

SHARE REPURCHASE

PROGRAM

•

Board approved up to $675M in share purchase

program for 2011

BUSINESS

INVESTMENTS

•

Fund organic growth

•

Continue to evaluate accretive acquisition

opportunities to expand our global footprint, accelerate

our growth, and extend our product capabilities |

25

Building from Strength

$ in millions, except per share data

Q1 2011

1

Q1 2010

1

Change

Operating-basis revenue

$2,330

$2,116

+10.1%

Operating-basis expenses

$1,683

$1,566

+7.5%

Operating-basis EPS

$0.88

$0.75

+17.3%

Operating-basis ROE

9.9%

10.0%

-10 bps

Positive operating leverage

2

260 bps

2011: Progress –

Recent Update

Q1 2011 COMPARED TO Q1 2010

1

Financial

data

presented

on

an

operating

basis

(which

is

adjusted

to

exclude,

among

other

things,

discount

accretion).

For

a

description

of

GAAP

to

operating-basis

results,

and

related reconciliations, please see the Appendix on State Street’s website

(www.statestreet.com) or State Street‘s current Report on Form 8-K filed with the SEC on the date

hereof.

2

Operating leverage represents the difference between the growth rate of total

revenue and the growth rate of total expenses, each determined on an operating basis. |

26

Building from Strength

STT

+15%

S & P

Fin. +8%

BK 0%

NTRS

-7%

Strong Annual Share Performance

Bank of New York Mellon Corp.

Northern Trust Corp.

S&P 500 / Financials

State Street Corp. |

27

Building from Strength

Delivering Long-Term

Shareholder Value

Summary

Successfully Transitioned

Through Crisis in 2010

Well-Positioned Against

Secular Growth Trends

Financial and Capital Strength

Executing our Strategic Plan |

28 |

29 |