Attached files

| file | filename |

|---|---|

| EX-3.2 - CarePayment Technologies, Inc. | v218903_ex3-2.htm |

| EX-31.2 - CarePayment Technologies, Inc. | v218903_ex31-2.htm |

| EX-32.2 - CarePayment Technologies, Inc. | v218903_ex32-2.htm |

| EX-21.1 - CarePayment Technologies, Inc. | v218903_ex21-1.htm |

| EX-31.1 - CarePayment Technologies, Inc. | v218903_ex31-1.htm |

| EX-32.1 - CarePayment Technologies, Inc. | v218903_ex32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| x |

ANNUAL REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended December 31, 2010

| o |

TRANSITION REPORT UNDER SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from to

Commission file number: 001-16781

CarePayment Technologies, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Oregon

|

91-1758621

|

|

(State or Other Jurisdiction of Incorporation or Organization)

|

(I.R.S. Employer Identification No.)

|

|

5300 Meadows Road, Suite 400, Lake Oswego, Oregon

|

97035

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

(Issuer’s Telephone Number, Including Area Code): (503) 419-3505

Securities registered under Section 12(g) of the Exchange Act: None

Securities registered under Section 12(b) of the Exchange Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Yes x No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files).

Yes o No x

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained in this form, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K, or any amendments to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

|

Large accelerated filer o

|

Accelerated filer o

|

|

|

Non-accelerated filer o

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates, as of December 31, 2010, was approximately $296,913 based upon the last sale price reported for such date on the NASDAQ OTC Market.

There were 10,600,879 shares of the issuer’s Common Stock outstanding as of April 12, 2011.

Transitional Small Business Disclosure Format: Yes o No x

EXPLANATORY NOTE

CarePayment Technologies, Inc. is filing this Amendment No. 1 on Form 10-K/A (this “Amendment No. 1”) for the sole purposes of filing (i) Exhibits 3.2 and 21.1 to the Registrant's Annual Report on Form 10-K for the fiscal year ended December 31, 2010, as filed with the Securities and Exchange Commission on April 15, 2011 (the “Original Report”), each of which was referenced in the exhibit table in Item 15 of the Original Report but was erroneously omitted from the filing and (ii) including by reference and/or correcting reference to certain other exhibits in Item 15.

For convenience, this Amendment No. 1 sets forth the Original Report in its entirety. Other than the changes referenced above, no other changes have been made to the Original Report and this Amendment No. 1 does not reflect facts or events occurring after the date on which the Original Report was filed. As required by Rule 12b-15 of the Securities Exchange Act of 1934, as amended, certifications by the Registrant's principal executive officer and principal financial officer are also included as exhibits to this Amendment No. 1.

PART I

This Annual Report on Form 10-K contains forward-looking statements. Such statements reflect management’s current view and estimates of future economic and market circumstances, industry conditions, company performance and financial results. Words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates” and variations of such words and similar expressions are intended to identify such forward-looking statements. These statements are subject to risks and uncertainties that could cause our future results to differ materially from the results discussed herein. Factors that might cause such a difference include, but are not limited to, those discussed elsewhere in this Annual Report on Form 10-K. We do not intend, and undertake no obligation, to update any such forward-looking statements to reflect events or circumstances that occur after the date of this filing.

Overview

CarePayment Technologies, Inc. (“we”, “us”, “our” or the “Company”) was incorporated as an Oregon corporation in 1991. Unless otherwise indicated, all references in this Report to the Company includes our 99% owned subsidiary, CP Technologies, LLC (“CP Technologies”), which was organized as an Oregon limited liability company in 2009. The remaining 1% of CP Technologies is owned by Aequitas Capital Management, Inc. (“Aequitas”) and CarePayment, LLC, each of which are affiliates of ours. (For additional information, see “Formation of CP Technologies” below in this Item 1.)

Beginning in January 2010, we commenced operating a receivables servicing business through CP Technologies. Although we intend to grow our business to include servicing accounts receivable on behalf of other parties and in other industries, we currently service only healthcare accounts receivable and are dependent on a single customer, CarePayment, LLC.

CarePayment, LLC, or one of its affiliates, purchases from hospitals the portion of their accounts receivable that are due directly from patients. We then administer, service, and collect those accounts receivable on behalf of CarePayment, LLC for a fee. In 2010, we generated revenues of $5,867,717 in fees from our servicing activities on behalf of CarePayment, LLC.

The Healthcare Receivables Servicing Industry and Our Business

Generally, the majority of an account receivable that a hospital generates in connection with providing health care services is paid by private medical insurance, Medicare or Medicaid. The balance of an account receivable that is not paid by those sources is due directly from the patient. Often, hospitals do not prioritize collecting that balance as a result of the effort and expense required to collect directly from a patient.

Our affiliate, CarePayment, LLC, offers health care providers a receivables servicing alternative. CarePayment, LLC, either alone or through an affiliate, purchases from healthcare providers the balance of their accounts receivable that are due directly from patients. A patient whose healthcare receivable is acquired by CarePayment, LLC is offered the CarePayment program with a loyalty card and a line of credit and, if they accept the terms of the offer, becomes a CarePayment® customer. The patient’s CarePayment® card has an initial outstanding balance equal to the account receivable CarePayment, LLC purchased from the healthcare provider. Balances due on the CarePayment® card are generally payable over up to 25 months with no interest.

On December 31, 2009, CP Technologies entered into a Servicing Agreement (the “Servicing Agreement”) with CarePayment, LLC under which CP Technologies has the exclusive right to collect, administer and service all accounts receivable purchased or controlled by CarePayment, LLC or its affiliates. CarePayment, LLC also appointed CP Technologies as a non-exclusive originator of receivables purchased or controlled by CarePayment, LLC, including the right to negotiate with hospitals on behalf of CarePayment, LLC with respect to collecting, administering and servicing receivables purchased by CarePayment, LLC or its affiliates from hospitals. While CP Technologies services the accounts receivable, CarePayment, LLC retains ownership of them. In addition to servicing receivables on behalf of CarePayment, LLC, CP Technologies also analyzes potential receivable acquisitions for CarePayment, LLC and recommends a course of action when it determines that collection efforts for existing receivables are no longer effective.

In exchange for its services, CarePayment, LLC pays CP Technologies origination fees at the time CarePayment, LLC purchases and delivers receivables to CP Technologies for servicing, a monthly servicing fee based on the total principal amount of receivables that CP Technologies is servicing, and a quarterly fee based upon a percentage of CarePayment, LLC’s quarterly net income, adjusted for certain items. (See Item 13 of this Report for additional information regarding the Servicing Agreement.)

On July 30, 2010, we completed our acquisition of Vitality Financial, Inc., a Delaware corporation (“Vitality”), pursuant to an Agreement and Plan of Merger (the “Vitality Acquisition”). Vitality, headquartered in San Francisco, California, provides advanced payment and receivables management to a limited number of medical providers and patients.

In connection with the Vitality Acquisition, we issued 97,500 shares of our Series E Convertible Preferred Stock to certain of Vitality’s former stockholders as consideration for the Vitality Acquisition. CP Technologies entered into employment agreements with two former executives of Vitality.

1

Government Regulation

Through CP Technologies, we contract with various vendors to issue the CarePayment® customer cards, send customer statements, accept payments and transmit transaction history back to us. Since CP Technologies is responsible for the CarePayment® compliance with various laws and regulations relating to consumer credit, these vendors are selected for their specific expertise in such areas.

Federal, state and local statutes establish specific guidelines and procedures that we must follow when collecting health care accounts receivable. It is our policy to comply with the provisions of all applicable federal, state and local laws in all of our servicing activities. Failure to comply with these laws could lead to fines, suits and disruption of our business that could have a material adverse effect on us.

Federal, state and local consumer protection, privacy and related laws extensively regulate the relationship between debt collectors and debtors. Significant federal laws and regulations applicable to our business may include the following:

|

●

|

Dodd-Frank Wall Street Reform and Consumer Protection Act. This act authorized the creation of the Consumer Financial Protection Bureau (“CFPB”). The CFPB will have authority to regulate and examine the Company. While the CFPB will have wide ranging authority over the Company, it is not yet possible to know what its specific impact will be as it has not yet implemented any rules or regulations governing our business.

|

|

●

|

The Equal Credit Opportunity Act. This act prohibits creditors from discriminating against credit applicants and customers on a variety of factors, including race, color, sex, age, or marital status. Pursuant to the Equal Credit Opportunity Act, creditors are required to make certain disclosures regarding consumer rights and advise consumers whose credit applications are not approved of the reasons for being denied. In addition, any of the credit scoring systems we use during the application process or other processes must comply with the requirements for such systems under the Equal Credit Opportunity Act.

|

|

●

|

The Financial Privacy Rule. Promulgated under the Gramm-Leach-Bliley Act, this rule requires that financial institutions, including collection agencies, develop policies to protect the privacy of consumers’ private financial information and provide notices to consumers advising them of their privacy policies. This rule is enforced by the Federal Trade Commission, which has retained exclusive jurisdiction over enforcement of it. Consumers do not have a private cause of action for violations of the Gramm-Leach-Bliley Act.

|

|

●

|

Electronic Funds Transfer Act. This act regulates the use of the Automated Clearing House (“ACH”) system to make electronic funds transfers. All ACH transactions must comply with Federal Reserve Regulation E and the rules of the Electronic Payments Association, formerly the National Automated Check Clearing House Association (“NACHA”). This act, Regulation E and the NACHA regulations give the consumer, among other things, certain privacy rights with respect to the transactions, the right to stop payments on a pre-approved fund transfer, and the right to receive certain documentation of the transaction.

|

The Bank Secrecy Act and the US Patriot Act may also apply to our business. Additionally, there are state and local statutes and regulations comparable to the above federal laws that affect our operations and court rulings in various jurisdictions also may impact our ability to collect receivables.

Although we are not a credit originator, the following laws, which typically apply to credit originators, may occasionally affect our operations because receivables we service through CP Technologies were originated through credit transactions:

| ● | Truth in Lending Act | |

| ● | Fair Credit Billing Act | |

| ● | Retail Installment Sales Act | |

| ● | Credit Card Accountability Responsibility and Disclosure Act of 2009 |

Patents and Intellectual Property

CP Technologies owns the CarePayment® proprietary accounting software system (the “Software”), which facilitates the efficient servicing of accounts receivable by merging transactions from various sources into a master database that is used to manage the servicing of accounts receivable. CP Technologies also owns the trademarks “CarePayment®” and “CarePayment.com”, and the Internet domain name “CarePayment.com.” We had no patents or patent applications pending as of the date of this Report.

2

We rely upon a combination of trademark, copyright and trade secret laws and contractual terms and conditions to protect our intellectual property rights. We also seek to control access to and distribution of our technology, documentation and other proprietary information.

Competition

The consumer debt collection industry is highly competitive and fragmented, and the market for servicing hospital patient receivables is particularly competitive. Currently, we only service receivables for an affiliated company. However, in our future efforts to service receivables for additional customers, we will face competition from a wide range of collection companies, financial service companies and technology companies that operate within the revenue and payment cycle markets. We may also compete with traditional contingency collection agencies and in-house recovery departments. Barriers to entry into the consumer debt collection industry are low and many of our potential competitors are significantly larger than us and have greater financial resources than we do.

Employees

As of March 31, 2011, we had 28 full-time employees and no part-time employees in the United States. Of these 28 employees, 16 engage in collection activities as part of the CP Technologies’ servicing department, 6 engage in sales and marketing activities for CP Technologies, and two provides various administrative support services. The remaining four employees are executives who provide management-level services to us.

We outsource certain administrative support services to Aequitas pursuant to the terms of an Administrative Services Agreement dated December 31, 2009 (the “Administrative Services Agreement”). Under the Administrative Services Agreement, Aequitas provides us with management and other support services, including accounting, treasury, budgeting and other financial services, financial reporting and tax planning services, human resources services and information technology infrastructure services. (See Item 13 of this Report for additional information regarding the Administrative Services Agreement.)

History, Formation of CP Technologies and Corporate Structure

History

We were incorporated as an Oregon corporation in 1991 under the name microHelix, Inc. From our inception until September 28, 2007, we manufactured custom cable assemblies and mechanical assemblies for the medical and commercial original equipment manufacturer (OEM) markets. We were experiencing considerable competition by late 2006 as our customers aggressively outsourced competing products from offshore suppliers. In the first quarter of 2007, a customer that accounted for over 30% of our revenues experienced a recall of one of its major products by the U.S. Food and Drug Administration. As a result, the customer cancelled its orders with us, leaving us with large amounts of inventory on hand and significantly reduced revenue.

On May 31, 2007 we informed our three secured creditors, BFI Business Finance, VenCore Solution, LLC and MH Financial Associates, LLC (“MH Financial”), that we were unable to continue business operations due to continuing operating losses and a lack of working capital. At that time, we voluntarily surrendered our assets to these secured creditors, following which we and our wholly owned subsidiary, Moore Electronics, Inc. (“Moore”), operated for the benefit of the secured creditors until September 2007, when we ceased manufacturing operations and became a shell company. MH Financial was at that time an affiliate of ours due to its ownership of shares of our capital stock.

From September 2007 until December 31, 2009, we had no operations. Our Board of Directors, however, decided to maintain us as a shell company to seek opportunities to acquire a business or assets sufficient to operate a business. To help facilitate our search for suitable business acquisition opportunities, among other goals, on June 27, 2008 we entered into an Advisory Services Agreement with Aequitas pursuant to which Aequitas provided us with strategy development, strategic planning, marketing, corporate development and other advisory services. (For additional information regarding the Advisory Services Agreement, see Item 13 of this Report.)

At the end of December 2009, we acquired the assets and rights that enabled us to begin building our current business. Before we acquired those assets and rights, they were owned by various entities affiliated with Aequitas. Aequitas, which is an investment management company, was performing the servicing function on behalf of CarePayment, LLC as an administrative process without dedicated management. We (including through our subsidiary, CP Technologies) have hired management with the necessary operational expertise in our current business to develop a strategic plan to effectively utilize the acquired assets, develop processes, and provide supervision and staff training.

3

Formation of CP Technologies

Together with Aequitas and CarePayment, LLC, we formed CP Technologies in December 2009 to service health care accounts receivable. In addition to the other agreements described in this Item 1, the agreements related to the creation of CP Technologies included the following:

|

●

|

Contribution Agreement (the “Aequitas Contribution Agreement”) dated December 30, 2009 between CP Technologies and Aequitas . Under the Aequitas Contribution Agreement, Aequitas, which controlled approximately 46% of our capital stock at the time, contributed the exclusive right to service and receive compensation and origination fees for all receivables owned and acquired in the future by CarePayment, LLC together with certain assets required to perform that service, including the Software. In exchange for that contribution, CP Technologies issued units representing a 28% ownership interest in CP Technologies to Aequitas.

|

|

●

|

Contribution Agreement (the “CarePayment Contribution Agreement”) dated December 30, 2009 between CP Technologies and CarePayment, LLC. Under the CarePayment Contribution Agreement, CarePayment, LLC contributed the service marks CarePayment® and CarePayment.com and the Internet domain name “CarePayment.com” to CP Technologies. In exchange for that contribution, CP Technologies issued units representing a 22% ownership interest in CP Technologies to CarePayment, LLC. CP Technologies uses the CarePayment brand in the ordinary course of our business and in connection with providing services to our customers.

|

|

●

|

Contribution Agreement (the “Company Contribution Agreement”) dated December 30, 2009 between CP Technologies and the Company. Under the Company Contribution Agreement, we contributed 1,000,000 shares of our Series D Preferred Stock (the “Series D Preferred”) and 10-year warrants to purchase 6,510,092 shares of our Class B Common Stock at an exercise price of $0.01 per share (the “Class B Warrants”) to CP Technologies. In exchange for that contribution, CP Technologies issued units representing a 50% ownership interest in CP Technologies to us. CP Technologies subsequently distributed the Series D Preferred and Class B Warrants to Aequitas and CarePayment, LLC in connection with redeeming all but one-half of one unit held by each of them in CP Technologies (see the descriptions of the Aequitas Redemption Agreement and the CarePayment Redemption Agreement below). As a result of those redemptions, we currently own 99% of CP Technologies and Aequitas and CarePayment, LLC each currently own 0.5% of CP Technologies. The Class B Warrants were exercised in full in April 2010.

|

|

●

|

Redemption Agreement dated December 31, 2009 between CP Technologies and Aequitas (the “Aequitas Redemption Agreement”). Under the Aequitas Redemption Agreement, CP Technologies redeemed all but half of one unit of CP Technologies held by Aequitas in CP Technologies in exchange for 600,000 shares of the Series D Preferred.

|

|

●

|

Redemption Agreement dated December 31, 2009 between CP Technologies and CarePayment (the “CarePayment Redemption Agreement”). Under the CarePayment Redemption Agreement, CP Technologies redeemed all but half of one unit of CP Technologies held by CarePayment, LLC in CP Technologies for 400,000 shares of the Series D Preferred and all of the Class B Warrants.

|

|

●

|

Royalty Agreement (“Royalty Agreement”) dated December 31, 2009 between CP Technologies and Aequitas. Under the Royalty Agreement, CP Technologies pays Aequitas a royalty based on new products (“Products”) developed by CP Technologies or co-developed by CP Technologies and Aequitas that are based on or use the Software. The royalty is calculated as either (i) 1.0% of the net revenue received by CP Technologies and generated by the Products that utilize funding provided by Aequitas or its affiliates or (ii) 7.0% of the face amount, or such other percentage as the parties may agree, of receivables serviced by CP Technologies that do not utilize such funding.

|

|

●

|

Trademark License Agreement (“Trademark License”) dated December 31, 2009 between CP Technologies and Aequitas Holdings, LLC (“Aequitas Holdings”). Under the Trademark License, CP Technologies granted the non-exclusive use of the CarePayment name and service mark to Aequitas Holdings and its affiliates. Aequitas Holdings may also sublicense the use of the CarePayment name and trademark to its business partners that are involved in the marketing and sale of Aequitas Holdings’ products or joint products with those business partners.

|

|

●

|

Investor Rights Agreement (“Investor Rights Agreement”) dated December 31, 2009 among the Company, Aequitas and CarePayment, LLC. Under the Investor Rights Agreement, we agreed that, as long as Aequitas and CarePayment, LLC (or their affiliates) own securities of the Company, we will pay all expenses incurred by Aequitas and CarePayment, LLC in connection with preparing and filing SEC reports or other documents related to us or any our securities that Aequitas and CarePayment, LLC own. In addition, if we fail to redeem the Series D Preferred by January 31, 2013 in accordance with Section 4.1(b) of the Certificate of Designation for the Series D Preferred, (i) Aequitas or its assignee will have the right to exchange all of its shares of Series D Preferred for 55.5 units of CP Technologies, and (ii) CarePayment, LLC or its assignee will have the right to exchange all of its shares of Series D Preferred for 42.5 units of CP Technologies, which could result in Aequitas and CarePayment, LLC (or their assignees) together owning 99% of CP Technologies.

|

4

Corporate Structure and Relationship with Affiliates

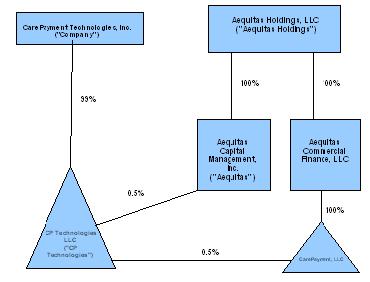

As of March 31, 2011, Aequitas Holdings and its affiliates beneficially owned 90.4% of our Class A common stock and controlled 97.0% of our voting rights on a fully diluted basis. Aequitas and CarePayment, LLC, the other members of CP Technologies, are affiliates of each other due to their common control by Aequitas Holdings. Aequitas is a wholly owned subsidiary of Aequitas Holdings. CarePayment, LLC is a wholly owned subsidiary of Aequitas Commercial Finance, LLC (“ACF”), which itself is a wholly owned subsidiary of Aequitas Holdings.

The following diagram depicts our current corporate structure and relationships with certain affiliates:

We also own Moore Electronics, Inc, a non-operating subsidiary, and Vitality.

Our two board members, James T. Quist and Brian Oliver, are affiliates of Aequitas.

Where You Can Find More Information

You may read and copy any document we file with the SEC at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549, on official business days from 10:00 a.m. to 3:00 p.m. You may obtain information on the operation of the SEC’s Public Reference Room by calling (800) SEC-0330. You may also purchase copies of our SEC filings by writing to the SEC, Public Reference Section, 100 F Street, N.W., Washington, D.C. 20549. Our SEC filings are also available on the SEC’s website at http://www.sec.gov. We currently do not have a website.

5

Item 1A. Risk Factors

The Company is subject to various risks that could have a material adverse effect on it, including without limitation the following:

We are dependent on the performance of a single subsidiary and line of business.

The Company’s only operating assets are held by its subsidiary CP Technologies, which itself has only one line of business. We have no significant assets or financial resources other than CP Technologies.

The Company has a limited operating history in its current business.

Prior to January 1, 2010, the Company had never operated a hospital receivables servicing business. Our business plan must be considered in light of the risks, expenses and problems frequently encountered by companies in their early stages of development. Specifically, such risks include a failure to anticipate and adapt to a developing market and an inability to attract, retain and motivate qualified personnel. There can be no assurance that the Company will be successful in addressing such risks. To the extent that we are not successful in addressing these risks, our business, results of operations and financial condition will be materially and adversely affected. There can be no assurance that the Company will ever achieve or sustain profitability.

The provision of hospital receivables servicing is a new business for the Company. We have no experience in such a business. Although we hired certain employees from Aequitas who have previously provided such services to CarePayment, LLC, there is no assurance that we will be able to provide satisfactory services to CarePayment, LLC through such employees, or such other employees or contractors as we may retain.

Our activities for the foreseeable future will be limited to servicing hospital receivables, CarePayment, LLC being our only direct customer. Our inability to diversify our activities into a number of areas may subject us to economic fluctuations related to the business of CarePayment, LLC and therefore increase the risks associated with our operations. CarePayment, LLC’s ability to acquire receivables for us to service depends on its ability to acquire adequate funding sources. The inability of CarePayment, LLC to acquire a sufficient amount of receivables for us to service would have a material adverse effect on us.

A deterioration in the economic or inflationary environment in the United States may have a material adverse effect on us.

The Company’s performance may be affected by economic or inflationary conditions in the United States. If the United States economy deteriorates or if there is a significant rise in inflation, personal bankruptcy filings may increase, and the ability of hospital customers to pay their debts could be adversely affected. This may in turn adversely impact our financial condition, results of operations, revenue and stock price.

The recent financial turmoil affecting the banking system and financial markets and the possibility that financial institutions may consolidate, go out of business or be taken over by the federal government have resulted in a tightening in credit markets. These and other economic factors could have a material adverse effect on us.

Adequate financing may not be available when needed.

Additional sources of funding will be required for us to continue operations. There is no assurance that the Company can raise working capital or that any capital will be available to the Company at all. Failure to obtain financing when needed could result in curtailing operations, acquisitions or mergers and investors could lose some or all of their investment.

We may be unable to manage growth adequately.

The implementation of our business plan requires an effective planning and management process. We anticipate significant growth and will need to continually improve our financial and management controls, reporting systems and procedures on a timely basis and expand, train and manage our personnel. There can be no assurance that our systems, procedures or controls will be adequate to support our operations or that our management will be able to achieve the rapid execution necessary to successfully implement our business plan.

The Company has many conflicts of interest.

Most of the Company’s agreements are with affiliates. Although we believe that the terms and conditions of the agreements with such parties are fair and reasonable to the Company, such terms and conditions may not be as favorable to us as those that could be obtained from independent third parties. In addition, the Company’s officers and directors participate in other competing business ventures.

6

There is no public market for our securities.

There is currently no active public market for the Company’s securities. No predictions can be made as to whether a trading market will ever develop for any of the Company’s securities. The sale of Company securities is not being registered under the Securities Act of 1933, as amended (the “Securities Act”), or any state securities laws, and such securities may not be resold or otherwise transferred unless they are subsequently registered under the Securities Act and applicable state laws, or unless exemptions from registration are available. Accordingly, investors may not be able to liquidate their investment in any of the Company’s securities.

Rule 144 is not available for the resale of Company securities.

The Company has been a “shell company” as defined in the Securities Act. Therefore, Rule 144 will not be available for the resale of Company securities until the following conditions are met:

|

●

|

The Company must be subject to the reporting requirements of Section 13 or 15(d) of the Exchange Act.

|

|

●

|

The Company must have filed all reports and other materials required to be filed by Section 13 or 15(d) of the Exchange Act, as applicable, during the preceding 12 months, other than Form 8-K reports; and

|

|

●

|

One year must have elapsed since the Company has filed current “Form 10 information” with the Securities and Exchange Commission reflecting its status as an entity that is no longer a shell company.

|

The Company has not yet satisfied the above conditions, and there can be no assurance that the Company will ever satisfy the above conditions. The unavailability of Rule 144 may prevent an investor from liquidating its investment in the Company’s securities.

The Company does not intend to pay dividends in the foreseeable future.

For the foreseeable future, we intend to retain any earnings to finance the development and expansion of the Company, and we do not anticipate paying any cash dividends on any of our Common Stock or Preferred Stock. Any future determination to pay dividends will be at the discretion of the Board of Directors and will be dependent on then-existing conditions, including the Company’s financial condition and results of operations, capital requirements, contractual restrictions, business prospects and other factors that the Board of Directors considers relevant.

Disruptions in service or damages to our data center or operations center, or other software or systems failures, could adversely affect our business.

The Company’s data center and operations center are essential to our business. Our operations depend on our ability to maintain and protect our computer systems. We intend to conduct business continuity planning and maintain insurance against fires, floods, other natural disasters and general business interruptions to mitigate the adverse effects of a disruption, relocation or change in operating environment at our offices. However, our planning and insurance coverage may not be adequate in any particular case. The occurrence of any of these events could result in interruptions, could impair or prohibit our ability to provide services and materially adversely impact us.

In addition, despite the implementation of security measures, the Company’s infrastructure, data center and systems, including the internet and related systems, are vulnerable to physical break-ins, hackers, improper employee or contractor access, computer viruses, programming errors, denial-of-service attacks, terrorist attacks or other attacks by third parties or similar disruptive problems. Any of these can cause system failure, including network, software or hardware failure, which can result in service disruptions or increased response time for our products and services. As a result, the Company may be required to expend significant capital and other resources to protect against security breaches and hackers or to alleviate problems caused by such breaches.

We also rely on a limited number of suppliers to provide us with a variety of products and services, including telecommunications and data processing services necessary for operations and software developers for the development and maintenance of certain software products we use to provide solutions. If these suppliers do not fulfill their contractual obligations or choose to discontinue their products or services, our business and operations could be disrupted, our brand and reputation could be harmed and we could be materially and adversely affected.

We may be unable to protect our intellectual property.

We rely, and expect to continue to rely, on a combination of copyright, trademark and trade secret laws and contractual restrictions to establish and protect our technology. We do not currently have any issued patents or registered copyrights, and have only one registered trademark. There can be no assurance that the steps we have taken will be adequate to prevent misappropriation of our technology or other proprietary rights, or that our competitors will not independently develop technologies that are substantially equivalent or superior to our technology, which could prevent us from successfully growing our business. To the extent we become involved in litigation to enforce or defend our intellectual property rights, such litigation could be a lengthy and costly process and divert our effort and resources and the attention of management with no guarantee of success.

7

We face significant competition for our services.

The markets for our services are intensely competitive, continually evolving and, in some cases, subject to rapid technological change. We face competition from many servicing and collections companies and other technology companies within segments of the revenue and payment cycle markets. Most of our competitors are significantly larger and have greater financial resources than we do. We may not be able to compete successfully with these companies, and these or other competitors may commercialize products, services or technologies that render our services obsolete or less marketable.

Some hospitals perform the services we offer for themselves.

Some hospitals perform the services we offer for themselves, or plan to do so, or belong to alliances that perform such services, or plan to do so. The ability of hospitals to replicate our services may adversely affect the terms and conditions the Company is able to negotiate in agreements with hospitals, or may prevent the Company from negotiating any such agreements.

Recent and future developments in the healthcare industry could adversely affect our business.

National healthcare reform legislation was signed into law on March 23, 2010. This reform legislation attempts to address the issues of increasing access to and affordability of healthcare, increasing effectiveness of care, reducing inefficiencies and costs, emphasizing preventive care, and enhancing the fiscal sustainability of the federal healthcare programs. It is not yet clear how this reform legislation may affect the services we provide. In addition, there are currently numerous federal, state and private initiatives and studies seeking ways to increase the use of information technology in healthcare as a means of improving care and reducing costs. We cannot predict what healthcare initiatives, if any, will be enacted and implemented, or the effect any future legislation or regulation will have on us. These initiatives may result in additional or costly legal and regulatory requirements that are applicable to us and our customers, may encourage more companies to enter our markets, and may provide advantages to our competitors. Any such legislation or initiatives, whether private or governmental, may result in a reduction of expenditures by the customers or potential customers of the hospitals serviced by the Company, which could have a material adverse effect on our business.

Even if general expenditures by industry constituents remain the same or increase, other developments in the healthcare industry may result in reduced spending on the Company’s services or in some or all of the specific markets we serve or are planning to serve. In addition, expectations regarding pending or potential industry developments may also affect the budgeting processes of the hospitals serviced by the Company and spending plans with respect to the types of products and services the Company provides.

The healthcare industry is highly regulated and is subject ot changing political, legislative, regulatory and other influences. Many healthcare laws are complex and their application to specific services and relationships ,may not be clear. The healthcare industry has changed significantly in recent years, and the Company expects that significant changes will continue to occur. The timing and impact of developments in the healthcare industry are difficult to predict. There can be no assurance that the markets for the services provided by the Company will continue to exist at current levels or that we will have adequate technical, financial and marketing resources to react to changes in those markets.

We could face potential liability if health-related information is disclosed.

The Health Insurance Portability and Accountability Act of 1996 (“HIPAA”) required the United States Department of Health and Human Services to adopt standards to protect the privacy and security of individually identifiable health-related information. The department released final regulations containing privacy standards in December 2000 and published revisions to the final regulations in August 2002. The privacy regulations extensively regulate the use and disclosure of individually identifiable health-related information. The regulations also provide patients with significant new rights related to understanding and controlling how their health information is used or disclosed.

The Company may come into contact with protected health-related information. Although we will take measures to ensure that we comply with all applicable laws and regulations, including HIPAA, if there is a breach, we may be subject to various penalties and damages and may be required to incur costs to mitigate the impact of the breach on affected individuals.

We are subject to laws related to our handling and storage of personal consumer information violations of which could subject us to potential liability.

The privacy of consumers’ personal information is protected by various federal and state laws. Any penetration of our network security or other misappropriation of consumers’ personal information could subject us to liability. Other potential misuses of personal information, such as for unauthorized marketing purposes, could also result in claims against us. These claims could result in litigation. In addition, the Federal Trade Commission and several states have investigated the use by certain internet companies of personal information. We could incur unanticipated expenses, especially in connection with our settlement database, if and when new regulations regarding the use of personal information are enacted.

8

Changes in governmental laws and regulations could increase our costs and liabilities or impact our operations.

Changes in laws and regulations and the manner in which they are interpreted or applied may alter our business environment. This could affect our results of operations or increase our liabilities. These negative impacts could result from changes in collection laws, laws related to credit reporting or consumer bankruptcy, accounting standards, taxation requirements, employment laws and communications laws, among others. We may become subject to additional liabilities in the future resulting from changes in laws and regulations that could result in a material adverse effect on us.

We are subject to examinations and challenges by tax authorities.

Our industry is relatively new and unique and, as a result, there is not a set of well defined laws, regulations or case law for us to follow that match our particular facts and circumstances for some tax positions. Therefore, certain tax positions we take are based on industry practice, tax advice and drawing similarities of our facts and circumstances to those in case law relating to other industries. These tax positions may relate to tax compliance, sales and use, franchise, gross receipts, payroll, property and income tax issues, including tax base and apportionment. Challenges made by tax authorities to our application of tax rules may result in adjustments to the timing or amount of taxable income or deductions or the allocation of income among tax jurisdictions and in inconsistent positions between different jurisdictions on similar matters. If any such challenges are made and are not resolved in our favor, they could have a material adverse effect on us.

We are dependent on key personnel and the loss of one or more of our senior management team could have a material adverse effect on us.

Our business strongly depends upon the services and management experience of our senior management team. If any of our executive officers resigns or is otherwise unable to serve, our management expertise and our ability to effectively execute our business strategy could be diminished.

We may not be able to hire and retain enough sufficiently trained employees to support our operations, and/or we may experience high rates of personnel turnover.

Our industry is very labor-intensive, and companies in our industry typically experience a high rate of employee turnover. We will not be able to service our clients’ receivables effectively, continue our growth or operate profitably if we cannot hire and retain qualified personnel. Further, high turnover rates among our employees could increase our recruiting and training costs and may limit the number of experienced personnel available to service our receivables.

We may not be able to successfully anticipate, invest in or adopt technological advances within our industry.

The Company’s business relies on computer and telecommunications technologies, and our ability to integrate new technologies into our business is essential to our competitive position and our success. We may not be successful in anticipating, managing, or adopting technological changes on a timely basis. Computer and telecommunications technologies are evolving rapidly and are characterized by short product life cycles. While we believe that our existing information systems are sufficient to meet our current and foreseeable demands and continued expansion, our future growth may require additional investment in these systems. We depend on having the capital resources necessary to invest in new technologies to service receivables. There can be no assurance that we will have adequate capital resources available. We may not be able to anticipate, manage or adopt technological advances within our industry, which could result in our services becoming obsolete and no longer in demand.

A significant majority of our equity securities are beneficially owned by a group of related parties whose interests in our business may be different than yours.

Aequitas Holdings and its affiliates collectively beneficially own approximately 64% of our shares of Class A Common Stock outstanding as of March 31, 2011. These shareholders also own all of the issued and outstanding shares of our Class B Common Stock and Series D Convertible Preferred Stock, each share of which is convertible into Class A Common Stock. Additionally, each share of Class B Common Stock is entitled to 10 votes per share, which gives Aequitas Holdings control over approximately 97% of all votes eligible to be cast on most corporate matters. The concentration of voting power among our principal shareholders enables our principal shareholders to significantly influence all matters requiring approval by our shareholders, including the election of directors and the approval of mergers or other business combination transactions. Our principal shareholders may have strategic or other interests that conflict with the interests of our other shareholders. The Company is required to redeem the Series D Convertible Preferred Stock during January 2013. For more information about the redemption feature of the Series D Preferred Stock, see the discussion of the Investor Rights Agreement in Item 1 and Item 13 of this Report.

9

Provisions of our charter documents and Oregon law may have anti-takeover effects that could hinder a change in our corporate control.

Our Second Amended and Restated Articles of Incorporation and Amended and Restated Bylaws contain provisions that may make it more difficult or expensive for a third party to acquire control of us without the approval of our Board of Directors. These provisions may also delay, prevent or deter a merger, acquisition, tender offer, proxy contest or other transaction that might otherwise result in our shareholders receiving a premium over the market price for their Class A Common Stock. These provisions include, among others:

|

●

|

The ability of our Board of Directors to issue up to 10 million shares of preferred stock and to fix the rights, preferences, privileges and restrictions of those shares without any further vote or action by our shareholders;

|

|

●

|

The 10 vote-per-share feature of our Class B Common Stock and the ability of our Board of Directors to issue up to 10,000,000 shares of our Class B Common Stock (of which 8,010,092 shares were issued and outstanding as of March 31, 2011); and

|

|

●

|

Provisions that set forth advance notice procedures for shareholder nominations of directors and proposals for consideration at meetings of shareholders.

|

In addition, we are subject to the Oregon Control Share Act and business combination law, each of which could limit parties who acquire a significant amount of voting shares from exercising control over us for specific periods of time. These laws could lengthen the period for a proxy contest or for a shareholder to vote his, her or its shares to elect the majority of our Board of Directors and change management.

10

Item 1B. Unresolved Staff Comments.

Not applicable.

Item 2. Properties

Our principal offices are located in office space at 5300 Meadows Road, Suite 400, Lake Oswego, Oregon, 97035 which is leased from Aequitas under a sublease dated December 31, 2009. (For additional information regarding that sublease, see Item 13 of this Report.) We also lease office space at 50 Osgood Place, San Francisco, California, 94133. We believe that these facilities are suitable for our operations the foreseeable future.

Item 3. Legal Proceedings

From time to time the Company may become involved in ordinary, routine or regulatory legal proceedings incidental to the Company’s business. On July 7, 2010, a former employee of Vitality filed a complaint in the Superior Court of California for Orange County, alleging breach of contract, breach of fiduciary duty, fraud, and negligent misrepresentation against Vitality and its officers. The plaintiff seeks damages relating to unexercised stock option grants and other matters related to the sale of Vitality to the Company. We believe the claim is without merit and do not believe that the claim will have a material impact on our financial position or results of operations. As of the date of this Report, we are not engaged in any other legal proceedings nor are we aware of any other pending or threatened legal proceedings that, singly or in the aggregate, could have a material adverse effect on the Company

Item 5. Market for Common Equity and Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities

There is no established public trading market for the Company’s securities. As of the date of this report the Company’s Class A Common Stock trades on the “pink sheets” under the symbol CPYT. The table below sets forth for the periods indicated the high and low bid prices for the Class A Common Stock as reported by NASDAQ from January 1, 2009 through December 31, 2010. The prices in the table are the high and low bid prices as reported by NASDAQ, adjusted to reflect the impact of the 1 for 10 reverse stock split approved by the Company’s shareholders at the annual meeting of the shareholders on March 31, 2010.

The prices shown represent interdealer prices without adjustments for retail mark-ups, mark-downs or commissions and consequently may not represent actual transactions.

Common Stock “CPYT”

|

2009 Fiscal Quarters

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

1.00

|

$

|

1.00

|

||||

|

Second Quarter

|

$

|

1.00

|

$

|

1.00

|

||||

|

Third Quarter

|

$

|

1.00

|

$

|

0.20

|

||||

|

Fourth Quarter

|

$

|

0.70

|

$

|

0.15

|

||||

|

2010 Fiscal Quarters

|

High

|

Low

|

||||||

|

First Quarter

|

$

|

4.00

|

$

|

0.17

|

||||

|

Second Quarter

|

$

|

8.00

|

$

|

0.14

|

||||

|

Third Quarter

|

$

|

3.00

|

$

|

0.14

|

||||

|

Fourth Quarter

|

$

|

4.00

|

$

|

1.55

|

||||

Dividends

Holders of shares of our Common Stock are entitled to receive such dividends, if any, as may be declared by our Board of Directors out of funds legally available therefor and, upon the Company’s liquidation, dissolution or winding up, are entitled to share ratably in all net assets available for distribution to such shareholders. The holders of the Company’s Series D Preferred Stock and Series E Preferred Stock have superior liquidation rights over the holders of our Common Stock. The Company has not, to date, declared or paid any cash dividends on its Common Stock or Preferred Stock and does not expect to pay any such dividends in the foreseeable future.

11

Recent Sales of Unregistered Securities

Other than as reported in our quarterly reports on Form 10-Q and current reports on Form 8-K, we did not sell any equity securities that were not registered under the Securities Act during the year ended December 31, 2010.

Shareholders of Record

As of December 31, 2010, there are approximately 87 shareholders of record of our Class A Common Stock, four shareholders of record of our Class B Common Stock, one shareholder of record of our Series D Convertible Preferred Stock and 23 shareholders of record of our Series E Convertible Preferred Stock.

Purchase of Equity Securities

We did not repurchase any of our securities during the fourth quarter of our fiscal year ended December 31, 2010.

Other

No class of our securities is registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we are not subject to the information requirements of the Exchange Act. We have no present intention of registering any of our securities under the Exchange Act, but we intend to continue voluntarily filing reports and information under the Exchange Act.

Item 6. Selected Financial Data

Not Applicable

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

All of the references to share and per share data below have been retroactively restated to reflect the reverse stock split for all periods presented due to the 1 for 10 reverse stock split approved by the Company’s shareholders at the annual meeting of the shareholders on March 31, 2010.

Overview

CarePayment Technologies, Inc. (“we,” “us,” “our,” “CarePayment” or the “Company”) was incorporated as an Oregon corporation in 1991. From inception until September 28, 2007, we manufactured custom cable assemblies and mechanical assemblies for the medical and commercial original equipment manufacturer (OEM) markets. We were experiencing considerable competition by late 2006 as our customers aggressively outsourced competing products from offshore suppliers. In the first quarter of 2007, a customer that accounted for over 30% of our revenues experienced a recall of one of its major products by the U.S. Food and Drug Administration. As a result the customer cancelled its orders with us, leaving us with large amounts of inventory on hand and significantly reduced revenue.

On May 31, 2007 we informed our three secured creditors, BFI Business Finance, VenCore Solution, LLC and MH Financial Associates, LLC (“MH Financial”), that we were unable to continue business operations due to continuing operating losses and a lack of working capital. At that time we voluntarily surrendered our assets to these secured creditors, following which we and our wholly owned subsidiary, Moore Electronics, Inc. (“Moore”), operated for the benefit of the secured creditors until September 2007, when we ceased manufacturing operations and became a shell company.

Following September 2007 and continuing until December 31, 2009, we had no operations. Our Board of Directors, however, determined to maintain us as a shell company to seek opportunities to acquire a business or assets sufficient to operate a business. To help facilitate our search for suitable business acquisition opportunities, among other goals, on June 27, 2008 we entered into an advisory services agreement with Aequitas Capital Management, Inc. (“Aequitas”) to provide us with strategy development, strategic planning, marketing, corporate development and other advisory services. In exchange for the services to be provided by Aequitas under that agreement, we issued to Aequitas warrants to purchase 106,667 shares of our Common Stock at an exercise price of $0.01 per share.

Effective at the end of December 2009, we acquired certain assets and rights that enabled us to begin building a business that services accounts receivable for other parties. The assets and rights we acquired had been previously developed by Aequitas and its affiliate, CarePayment, LLC (“CarePayment”), under the CarePayment® brand for servicing accounts receivable generated by hospitals in connection with providing health care services to their patients. The assets and rights we acquired included the exclusive right to administer, service and collect patient accounts receivables generated by hospitals and purchased by CarePayment or its affiliates, and a proprietary software product that is used to manage the servicing. Typically CarePayment or one of its affiliates purchase patient accounts receivable from hospitals and then we administer, service and collect them on behalf of CarePayment for a fee. Although we intend to grow our business to include servicing of accounts receivable on behalf of other parties, currently CarePayment is our only customer.

12

To facilitate building the business, on December 30, 2009, we, Aequitas and CarePayment, LLC formed an Oregon limited liability company, CP Technologies LLC (CP Technologies”). We contributed shares of our newly authorized Series D Convertible Preferred Stock (“Series D Preferred”) and warrants to purchase shares of our Class B Common Stock (the “Class B Warrants”) to CP Technologies. Aequitas and CarePayment contributed to CP Technologies the CarePayment® assets and rights described in the foregoing paragraph. CP Technologies then distributed the shares of Series D Preferred to Aequitas and CarePayment, and the Class B Warrants to CarePayment to redeem all but half of one membership unit (a “Unit”) held by each of them. Following these transactions, we own 99% of Cp Technologies, and Aequitas and CarePayment, LLC each own 0.5% of CP Technologies as of December 31, 2010.

See Item 1 of this Report for additional information regarding the Company’s business.

Critical Accounting Policies and Estimates

The discussion and analysis of the Company’s financial condition and results of operations is based upon the Company’s consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires the Company to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and related disclosure of contingent assets and liabilities The Company believes the following critical accounting policies and related judgments and estimates affect the preparation of the Company’s consolidated financial statements. See also Note 1 to the Consolidated Financial Statements.

Revenue recognition — The Company’s revenue is primarily related to a servicing agreement with CarePayment, LLC. Origination fee revenue is recognized at the time CarePayment, LLC funds its purchased receivables and the Company assumes responsibility for servicing these receivables; a servicing fee is recognized monthly based on the total funded receivables being serviced by the Company; and a percentage of CarePayment, LLC’s quarterly net income is accrued for the current quarter in accordance with the Servicing Agreement.

Warrants to purchase the Company’s stock — The fair value of warrants to purchase the Company’s stock issued for services or in exchange for assets is estimated at the issue date using the Black-Scholes model.

Results of Operations

Year ended December 31, 2010 compared with year ended December 31, 2009

The Company had no business activity during 2009. See Overview in this Item 7. Beginning in January 2010, we commenced operating a receivables servicing business. See Item 1 of this Report for additional information regarding the Company’s business.

Revenues:

The Company had no revenue in 2009. As of January 1, 2010, the Company began recognizing revenue in conjunction with a servicing agreement with its affiliate, CarePayment, LLC. CarePayment, LLC pays the Company a servicing fee equal to 5% annually of total funded receivables being serviced, an origination fee equal to 6% of the original balance of newly generated funded receivables, and a “back-end fee” based on 25% of CarePayment, LLC’s quarterly net income, adjusted for certain items. The Company recorded fee revenues in conjunction with the servicing agreement of $5,867,717 for the year ended December 31, 2010, which were comprised of $1,811,037 of servicing fees, $4,056,680 of origination fees and no “back end fees.” Additionally the Company recorded implementation revenue of $65,000 for implementation services provided to hospitals on behalf of CarePayment, LLC and $15,750 of interest revenue from loans receivable acquired in the acquisition of Vitality.

Cost of Revenues:

Cost of revenue is comprised primarily of compensation and benefit costs for servicing employees, costs associated with outsourcing billing, collection and payment processing servicers, and the amortization of the servicing rights and servicing software. For the year ended December 31, 2010, the total cost of revenues of $4,935,506 was comprised of compensation expense of $1,254,329, outsourced processing and collections services of $2,940,692, amortization expense of $556,173, and $184,312 of other expense. Outsourced services from four primary vendors include hosting and maintenance of cardholder accounts including all customer transaction processing, collection and mailing services, card processing and customer service administration.

13

Operating Expenses:

Operating expenses for the year ended December 31, 2010 were $4,098,960 as compared to $403,300 for the same period in 2009. The sales, general and administrative expenses for the year ended December 31, 2010 related to the servicing operations which began on January 1, 2010, while the expense for the same period in 2009 related to managing a shell company and preparing SEC filings.

Operating expenses for the year ended December 31, 2010 were comprised of the following: sales and marketing expense of approximately $974,000; legal, consulting and other professional fees of approximately $614,000; executive compensation of approximately $531,000; related party agreements with Aequitas for office and equipment lease expense of $224,000, accounting services of $781,000 and advisory services of $230,000; travel and entertainment of $383,000, information technology and non-capitalized software development costs of $148,000 and general office expense including insurance other administrative expense of approximately $214,000.

Other Income (Expense):

Loss reimbursement – The Company’s servicing agreement with CarePayment, LLC provides for CarePayment, LLC to pay additional compensation equal to the Company’s actual monthly losses for the first quarter of 2010 and an amount equal to 50% of actual monthly losses for the second quarter of 2010. This additional compensation was intended to reimburse the Company for transition costs that were not specifically identifiable. For the year ended December 31, 2010, the Company recorded a loss reimbursement of $1,241,912 as other income.

Interest expense – Interest expense of $454,041 for the year ended December 31, 2010 includes $299,302 of the accreted discount on the Series D Preferred. See Note 7 to the Consolidated Financial Statements contained in this Report. Interest expense of $513,620 for the year ended December 31, 2009 includes $261,944 of debt discount expense.

Net Loss:

Net loss for the year ended December 31, 2010 was $2,263,413. This loss is net of the $1,241,912 additional compensation received from CarePayment, LLC, whereby CarePayment, LLC reimbursed the Company for an amount equal to the Company’s actual monthly losses for the first quarter of 2010 and an amount equal to 50% of actual monthly losses for the second quarter of 2010 in accordance with the servicing agreement.

LIQUIDITY AND CAPITAL RESOURCES

As of December 31, 2010, the Company had $555,975 of cash and cash equivalents. For the year ended December 31, 2010, the Company used $920,547 of cash for operating activities compared to $241,010 for the year ended December 31, 2009. Cash used in operating activities during 2010 included a net loss of $2,263,413 offset by non-cash activity of $893,749, which included depreciation and amortization of $563,138, accretion of the discount on the Series D Preferred Stock of $299,302, and stock-based compensation expense of $31,309, and further offset by a net change in operating assets and liabilities of $449,177. The primary components of the change in operating assets and liabilities were an increase in accounts payable of $408,633 and accrued interest of $99,128.

For the year ended December 31, 2010, the Company provided $35,055 in cash from investing activities compared to $0 for the same period in 2009. The acquisition of Vitality provided $100,842 of cash; loan receivable activity provided net cash of $71,398, which was offset by the purchase of $137,185 of property and equipment. The total consideration for the acquisition of Vitality was Series E Preferred Stock; Vitality had $100,842 in cash at the acquisition date.

For the year ended December 31, 2010, the Company provided $1,372,370 in cash from financing activities as compared to $211,674 for 2009. During 2010, the Company sold 200,000 shares of Series D Preferred Stock to a single investor for $2,000,000 and received $66,560 of proceeds from the exercise of warrants. These proceeds were offset by the use of $694,190 to repay notes payable.

Substantially all of the Company’s revenue and cash receipts are generated from the servicing agreement with CarePayment, LLC. Origination and servicing revenues are generated based upon the volume of receivables that CarePayment, LLC or its affiliates purchase.

During 2010, the Company added headcount, trained staff and hired a software development firm to develop additional systems to manage the servicing operation in preparation for the projected receivables volume increases. New volume from existing CarePayment, LLC’s customers has been on schedule, but servicing volumes from new CarePayment, LLC customers have been less than projected. The Company expects the first quarter 2011 volume of serviced receivables to be similar to the fourth quarter of 2010, which will result in a use of cash from operations during the first quarter of 2011.

14

On March 31, 2011, Holdings purchased an additional 1.5 million shares of Class B Common Stock for $1.00 per share to provide working capital for the Company until the third quarter when the Company forecasts positive cash flows from operations. Holdings owns 7,910,092 shares of Class B stock which equates to 94% of the voting shares of the Company. Should this $1.5 million of cash from the equity infusion be insufficient to meet liquidity needs over the next year or until such time as the Company has positive cash flow, Holdings has advised the Company that it is prepared to provide liquidity either in the form of equity infusion or a line of credit to the Company.

Off Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements.

Recent Accounting Developments

In January 2010, the Financial Accounting Standards Board (“FASB”) issued guidance to amend the disclosure requirements related to recurring and nonrecurring fair value measurements. The guidance requires additional disclosures of transfers of assets and liabilities between Level 1 and Level 2 of the fair value measurement hierarchy, including the reasons and the timing of the transfers and information on purchases, sales, issuance, and settlements on a gross basis in the reconciliation of the assets and liabilities measured under Level 3 of the fair value measurement hierarchy. This guidance is effective for the Company beginning January 1, 2011. As this guidance only requires expanded disclosures, the adoption did not and will not impact the Company’s consolidated financial position or results of operations.

In October 2009, the FASB issued new standards that revised the guidance for revenue recognition with multiple deliverables. These new standards impact the determination of when the individual deliverables included in a multiple-element arrangement may be treated as separate units of accounting. Additionally, these new standards modify the manner in which the transaction consideration is allocated across the separate identified deliverables by no longer permitting the residual method of allocating arrangement consideration. These new standards are effective for the Company beginning January 1, 2011. The Company does not expect the adoption will have a material impact on its consolidated financial position or results of operations.

15

Item 8. Financial Statements and Supplementary Data

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

|

Page

|

||

|

Report of Peterson Sullivan LLP - Independent Registered Public Accounting Firm

|

17

|

|

|

Consolidated Balance Sheets as of December 31, 2010 and 2009

|

18

|

|

|

Consolidated Statements of Operations for the Years Ended December 31, 2010 and 2009

|

19

|

|

|

Consolidated Statements of Shareholders’ Equity (Deficit) for the Years Ended December 31, 2010 and 2009

|

20

|

|

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2010 and 2009

|

21

|

|

|

Notes to Consolidated Financial Statements

|

22

|

16

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors

CarePayment Technologies, Inc.

Lake Oswego, Oregon

We have audited the accompanying consolidated balance sheets of CarePayment Technologies, Inc. and Subsidiaries, (“the Company”) as of December 31, 2010 and 2009, and the related consolidated statements of operations, shareholders’ equity (deficit), and cash flows for the years then ended. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company has determined that it is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of CarePayment Technologies, Inc. and Subsidiaries, as of December 31, 2010 and 2009, and the results of their operations and their cash flows for the years then ended in conformity with accounting principles generally accepted in the United States.

/S/ PETERSON SULLIVAN LLP

Seattle, Washington

April 15, 2011

17

CAREPAYMENT TECHNOLOGIES, INC.

CONSOLIDATED BALANCE SHEETS

December 31, 2010 and 2009

|

2010

|

2009

|

|||||||

|

Assets

|

|

|||||||

|

Current Assets:

|

|

|||||||

|

Cash and cash equivalents

|

$ | 555,975 | $ | 69,097 | ||||

|

Related party receivable

|

28,616 | — | ||||||

|

Prepaid expenses

|

40,215 | — | ||||||

|

Total current assets

|

624,806 | 69,097 | ||||||

|

Property and equipment, net

|

472,960 | 500,000 | ||||||

|

Intangible assets, net

|

9,227,637 | 9,550,000 | ||||||

|

Deposits

|

17,100 | — | ||||||

|

Goodwill

|

13,335 | — | ||||||

|

Total assets

|

$ | 10,355,838 | $ | 10,119,097 | ||||

|

Liabilities and Shareholders’ Equity (Deficit)

|

||||||||

|

Current Liabilities:

|

||||||||

|

Accounts payable

|

$ | 1,216,916 | $ | 808,283 | ||||

|

Accrued interest

|

423,210 | 324,082 | ||||||

|

Related party liabilities

|

67,429 | — | ||||||

|

Accrued liabilities

|

85,483 | — | ||||||

|

Current maturities of notes payable

|

577,743 | 294,190 | ||||||

|

Total current liabilities

|

2,370,781 | 1,426,555 | ||||||

|

Notes payable, net of current potion

|

— | 977,743 | ||||||

|

Mandatorily redeemable preferred stock, Series D, no par value: 1,200,000 shares authorized, 1,200,000 and 1,000,000 shares issued and outstanding at December 31, 2010 and 2009, respectively, net of discount of $10,966,545 and $1,194,860 at December 31, 2010 and 2009, respectively, liquidation preference of $12,000,000 at December 31, 2010

|

1,033,455 | 8,805,140 | ||||||

|

Total liabilities

|

3,404,236 | 11,209,438 | ||||||

|

Shareholders’ Equity (Deficit):

|

||||||||

|

CarePayment Technologies, Inc. shareholders’ equity (deficit):

|

||||||||

|

Preferred stock, Series E, no par value: 250,000 shares authorized, 97,500 shares issued and outstanding at December 31, 2010 and no shares issued or outstanding at December 31, 2009

|

136,500 | — | ||||||

|

Common stock, no par value: Class A, 65,000,000 shares authorized, 2,590,787 and 1,383,286 issued and outstanding at December 31, 2010 and December 31, 2009, respectively; Class B, 10,000,000 shares authorized, 6,510,092 shares issued and outstanding at December 31, 2010 and no shares issued or outstanding at December 31, 2009

|

18,089,151 | 18,022,591 | ||||||

|

Additional paid-in-capital

|

21,857,507 | 11,755,211 | ||||||

|

Accumulated deficit

|

(33,127,616 | ) | (30,868,143 | ) | ||||

|

Total CarePayment Technologies, Inc. shareholders’ equity (deficit)

|

6,955,542 | (1,090,341 | ) | |||||

|

Noncontrolling interest

|

(3,940 | ) | — | |||||

|

Total shareholders’ equity (deficit)

|

6,951,602 | (1,090,341 | ) | |||||

|

Total liabilities and shareholders’ equity (deficit)

|

$ | 10,355,838 | $ | 10,119,097 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

18

CAREPAYMENT TECHNOLOGIES, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

For the Years Ended

December 31

|

||||||||

|

2010

|

2009

|

|||||||

|

Service fees revenue

|

$ | 5,867,717 | $ | — | ||||

|

Interest on loans receivable

|

15,750 | |||||||

|

Other

|

65,000 | — | ||||||

|

Total revenue

|

5,948,467 | — | ||||||

|

Cost of revenue

|

4,935,506 | — | ||||||

|

Gross margin

|

1,012,961 | — | ||||||

|

Operating expenses:

|

||||||||

|

Sales, general and administrative

|

4,098,960 | 403,300 | ||||||